6bf674c077387339e5aa37f11c2c6fc7.ppt

- Количество слайдов: 53

Part IV. Pricing strategies and market segmentation Chapter 10. Intertemporal price discrimination Slides Industrial Organization: Markets and Strategies Paul Belleflamme and Martin Peitz © Cambridge University Press 2009

Part IV. Pricing strategies and market segmentation Chapter 10. Intertemporal price discrimination Slides Industrial Organization: Markets and Strategies Paul Belleflamme and Martin Peitz © Cambridge University Press 2009

Chapter 10 - Objectives Chapter 10. Learning objectives • Understand the peculiarities of durable goods. • Analyze how a firm sets the price of a durable good at different periods of time. • Is intertemporal price discrimination profitable? • Be able to explain why the answer to the previous question crucially depends on the possibility to commit to future prices and on the number of consumers. • Understand the practice of behaviour-based price discrimination, and its implications for firms and consumers. © Cambridge University Press 2010 2

Chapter 10 - Objectives Chapter 10. Learning objectives • Understand the peculiarities of durable goods. • Analyze how a firm sets the price of a durable good at different periods of time. • Is intertemporal price discrimination profitable? • Be able to explain why the answer to the previous question crucially depends on the possibility to commit to future prices and on the number of consumers. • Understand the practice of behaviour-based price discrimination, and its implications for firms and consumers. © Cambridge University Press 2010 2

Chapter 10 - Durable goods • Main features • Firms offer the same product in different periods. • Consumers buy only 1 item over the whole horizon. • Benefits are derived over a number of periods. • Consumers can decide on the timing of their purchase. • car, washing machine, computer, software, . . . • By analogy, items that can be ordered in advance • holiday package, plane ticket, concert ticket, . . . • Main question • Selling at various points in time opens up the possibility of intertemporal price discrimination • Is it a profitable option for the firm? © Cambridge University Press 2010 3

Chapter 10 - Durable goods • Main features • Firms offer the same product in different periods. • Consumers buy only 1 item over the whole horizon. • Benefits are derived over a number of periods. • Consumers can decide on the timing of their purchase. • car, washing machine, computer, software, . . . • By analogy, items that can be ordered in advance • holiday package, plane ticket, concert ticket, . . . • Main question • Selling at various points in time opens up the possibility of intertemporal price discrimination • Is it a profitable option for the firm? © Cambridge University Press 2010 3

Chapter 10 - Durable good monopoly without commitment • Basic outline • Monopoly selling a durable good • No possibility to commit over future prices • The firm sets the period t price in that period, not earlier. • It has to take into account the consumers’ expectations over future prices. • Is intertemporal price discrimination profitable? • Rough answer: • Yes if small number of consumers • No if large number of consumers • To show this, we contrast 2 models • Small number of consumers 2 consumers • Large number of consumers continuum © Cambridge University Press 2010 4

Chapter 10 - Durable good monopoly without commitment • Basic outline • Monopoly selling a durable good • No possibility to commit over future prices • The firm sets the period t price in that period, not earlier. • It has to take into account the consumers’ expectations over future prices. • Is intertemporal price discrimination profitable? • Rough answer: • Yes if small number of consumers • No if large number of consumers • To show this, we contrast 2 models • Small number of consumers 2 consumers • Large number of consumers continuum © Cambridge University Press 2010 4

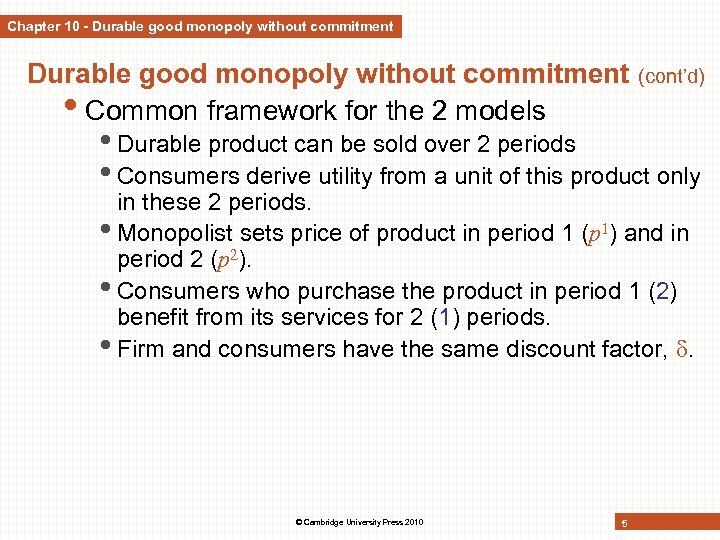

Chapter 10 - Durable good monopoly without commitment • Common framework for the 2 models (cont’d) • Durable product can be sold over 2 periods • Consumers derive utility from a unit of this product only in these 2 periods. • Monopolist sets price of product in period 1 (p 1) and in period 2 (p 2). • Consumers who purchase the product in period 1 (2) benefit from its services for 2 (1) periods. • Firm and consumers have the same discount factor, . © Cambridge University Press 2010 5

Chapter 10 - Durable good monopoly without commitment • Common framework for the 2 models (cont’d) • Durable product can be sold over 2 periods • Consumers derive utility from a unit of this product only in these 2 periods. • Monopolist sets price of product in period 1 (p 1) and in period 2 (p 2). • Consumers who purchase the product in period 1 (2) benefit from its services for 2 (1) periods. • Firm and consumers have the same discount factor, . © Cambridge University Press 2010 5

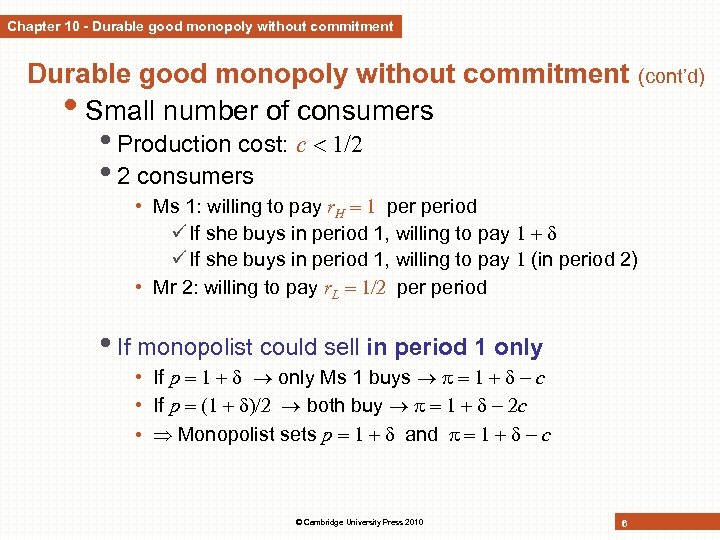

Chapter 10 - Durable good monopoly without commitment • Small number of consumers • Production cost: c • 2 consumers • Ms 1: willing to pay r. H period ü If she buys in period 1, willing to pay (in period 2) • Mr 2: willing to pay r. L period • If monopolist could sell in period 1 only • If p only Ms 1 buys c • If p both buy c • Monopolist sets p and c © Cambridge University Press 2010 6 (cont’d)

Chapter 10 - Durable good monopoly without commitment • Small number of consumers • Production cost: c • 2 consumers • Ms 1: willing to pay r. H period ü If she buys in period 1, willing to pay (in period 2) • Mr 2: willing to pay r. L period • If monopolist could sell in period 1 only • If p only Ms 1 buys c • If p both buy c • Monopolist sets p and c © Cambridge University Press 2010 6 (cont’d)

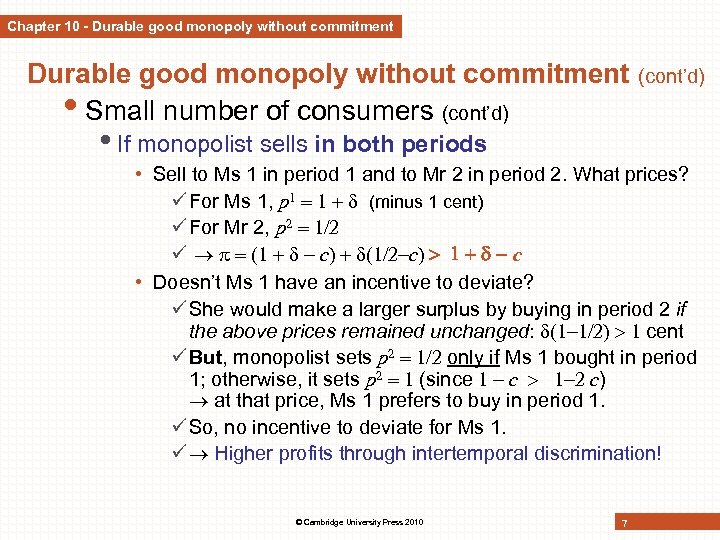

Chapter 10 - Durable good monopoly without commitment • Small number of consumers (cont’d) • If monopolist sells in both periods • Sell to Ms 1 in period 1 and to Mr 2 in period 2. What prices? ü For Ms 1, p 1 (minus 1 cent) ü For Mr 2, p 2 ü c c • Doesn’t Ms 1 have an incentive to deviate? ü She would make a larger surplus by buying in period 2 if the above prices remained unchanged: cent ü But, monopolist sets p 2 only if Ms 1 bought in period 1; otherwise, it sets p 2 (since c c) at that price, Ms 1 prefers to buy in period 1. ü So, no incentive to deviate for Ms 1. ü Higher profits through intertemporal discrimination! © Cambridge University Press 2010 7

Chapter 10 - Durable good monopoly without commitment • Small number of consumers (cont’d) • If monopolist sells in both periods • Sell to Ms 1 in period 1 and to Mr 2 in period 2. What prices? ü For Ms 1, p 1 (minus 1 cent) ü For Mr 2, p 2 ü c c • Doesn’t Ms 1 have an incentive to deviate? ü She would make a larger surplus by buying in period 2 if the above prices remained unchanged: cent ü But, monopolist sets p 2 only if Ms 1 bought in period 1; otherwise, it sets p 2 (since c c) at that price, Ms 1 prefers to buy in period 1. ü So, no incentive to deviate for Ms 1. ü Higher profits through intertemporal discrimination! © Cambridge University Press 2010 7

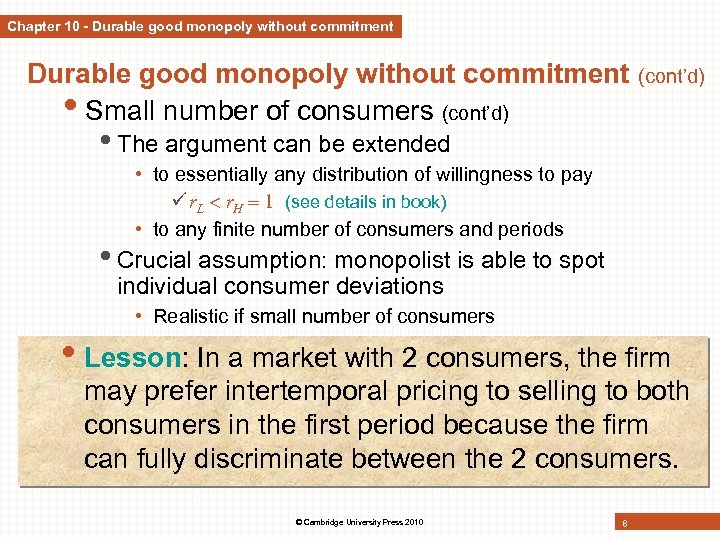

Chapter 10 - Durable good monopoly without commitment • Small number of consumers (cont’d) • The argument can be extended • to essentially any distribution of willingness to pay ü r. L r. H (see details in book) • to any finite number of consumers and periods • Crucial assumption: monopolist is able to spot individual consumer deviations • Realistic if small number of consumers • Lesson: In a market with 2 consumers, the firm may prefer intertemporal pricing to selling to both consumers in the first period because the firm can fully discriminate between the 2 consumers. © Cambridge University Press 2010 8

Chapter 10 - Durable good monopoly without commitment • Small number of consumers (cont’d) • The argument can be extended • to essentially any distribution of willingness to pay ü r. L r. H (see details in book) • to any finite number of consumers and periods • Crucial assumption: monopolist is able to spot individual consumer deviations • Realistic if small number of consumers • Lesson: In a market with 2 consumers, the firm may prefer intertemporal pricing to selling to both consumers in the first period because the firm can fully discriminate between the 2 consumers. © Cambridge University Press 2010 8

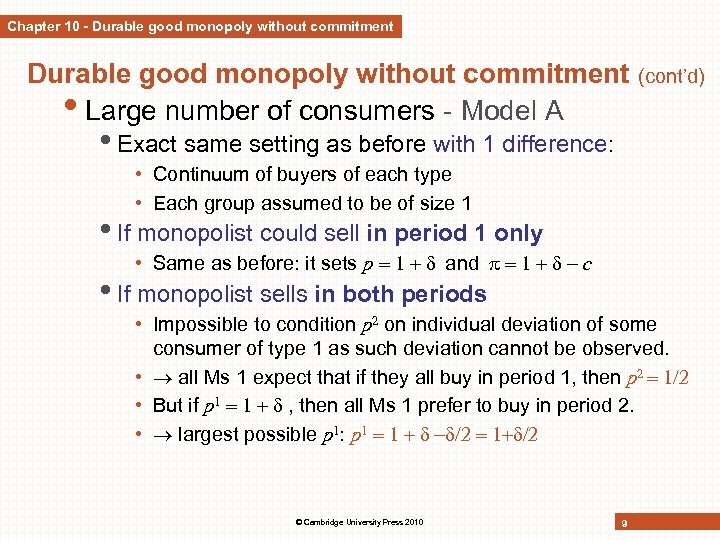

Chapter 10 - Durable good monopoly without commitment • Large number of consumers - Model A (cont’d) • Exact same setting as before with 1 difference: • Continuum of buyers of each type • Each group assumed to be of size 1 • If monopolist could sell in period 1 only • Same as before: it sets p and c • If monopolist sells in both periods • Impossible to condition p 2 on individual deviation of some consumer of type 1 as such deviation cannot be observed. • all Ms 1 expect that if they all buy in period 1, then p 2 • But if p 1 , then all Ms 1 prefer to buy in period 2. • largest possible p 1: p 1 © Cambridge University Press 2010 9

Chapter 10 - Durable good monopoly without commitment • Large number of consumers - Model A (cont’d) • Exact same setting as before with 1 difference: • Continuum of buyers of each type • Each group assumed to be of size 1 • If monopolist could sell in period 1 only • Same as before: it sets p and c • If monopolist sells in both periods • Impossible to condition p 2 on individual deviation of some consumer of type 1 as such deviation cannot be observed. • all Ms 1 expect that if they all buy in period 1, then p 2 • But if p 1 , then all Ms 1 prefer to buy in period 2. • largest possible p 1: p 1 © Cambridge University Press 2010 9

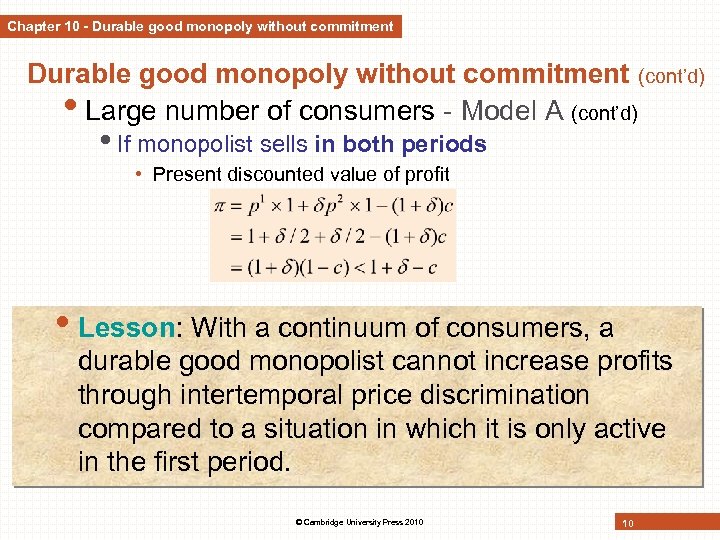

Chapter 10 - Durable good monopoly without commitment (cont’d) • Large number of consumers - Model A (cont’d) • If monopolist sells in both periods • Present discounted value of profit • Lesson: With a continuum of consumers, a durable good monopolist cannot increase profits through intertemporal price discrimination compared to a situation in which it is only active in the first period. © Cambridge University Press 2010 10

Chapter 10 - Durable good monopoly without commitment (cont’d) • Large number of consumers - Model A (cont’d) • If monopolist sells in both periods • Present discounted value of profit • Lesson: With a continuum of consumers, a durable good monopolist cannot increase profits through intertemporal price discrimination compared to a situation in which it is only active in the first period. © Cambridge University Press 2010 10

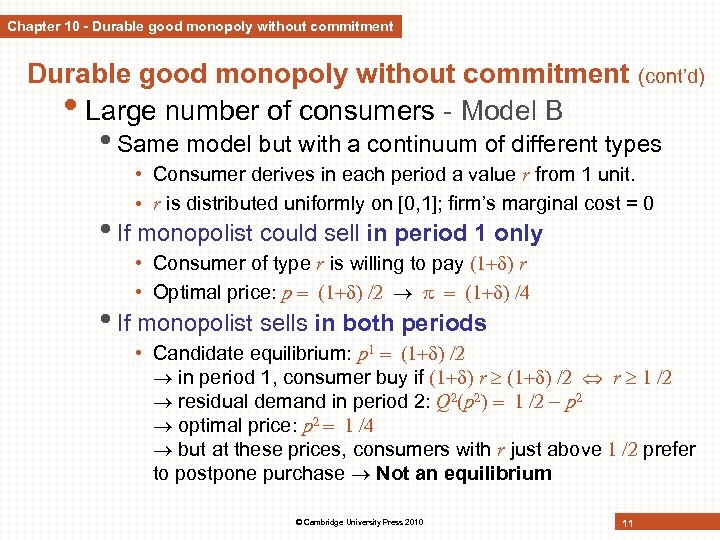

Chapter 10 - Durable good monopoly without commitment • Large number of consumers - Model B (cont’d) • Same model but with a continuum of different types • Consumer derives in each period a value r from 1 unit. • r is distributed uniformly on [0, 1]; firm’s marginal cost = 0 • If monopolist could sell in period 1 only • Consumer of type r is willing to pay r • Optimal price: p • If monopolist sells in both periods • Candidate equilibrium: p 1 in period 1, consumer buy if r residual demand in period 2: Q 2(p 2) p 2 optimal price: p 2 but at these prices, consumers with r just above prefer to postpone purchase Not an equilibrium © Cambridge University Press 2010 11

Chapter 10 - Durable good monopoly without commitment • Large number of consumers - Model B (cont’d) • Same model but with a continuum of different types • Consumer derives in each period a value r from 1 unit. • r is distributed uniformly on [0, 1]; firm’s marginal cost = 0 • If monopolist could sell in period 1 only • Consumer of type r is willing to pay r • Optimal price: p • If monopolist sells in both periods • Candidate equilibrium: p 1 in period 1, consumer buy if r residual demand in period 2: Q 2(p 2) p 2 optimal price: p 2 but at these prices, consumers with r just above prefer to postpone purchase Not an equilibrium © Cambridge University Press 2010 11

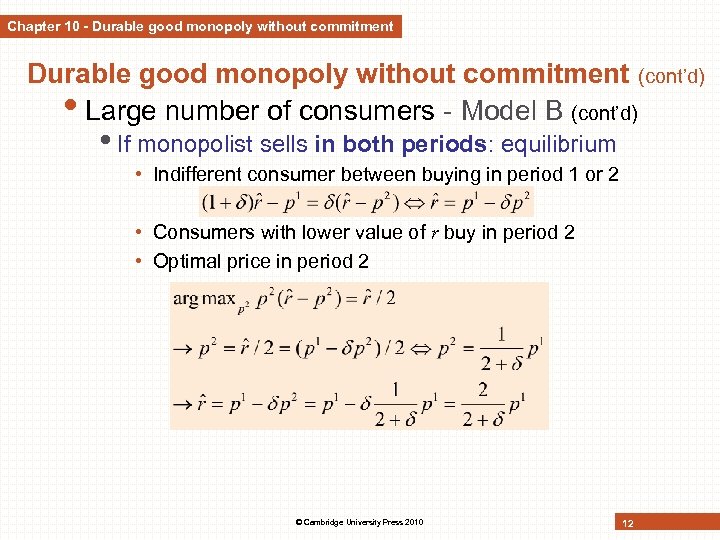

Chapter 10 - Durable good monopoly without commitment (cont’d) • Large number of consumers - Model B (cont’d) • If monopolist sells in both periods: equilibrium • Indifferent consumer between buying in period 1 or 2 • Consumers with lower value of r buy in period 2 • Optimal price in period 2 © Cambridge University Press 2010 12

Chapter 10 - Durable good monopoly without commitment (cont’d) • Large number of consumers - Model B (cont’d) • If monopolist sells in both periods: equilibrium • Indifferent consumer between buying in period 1 or 2 • Consumers with lower value of r buy in period 2 • Optimal price in period 2 © Cambridge University Press 2010 12

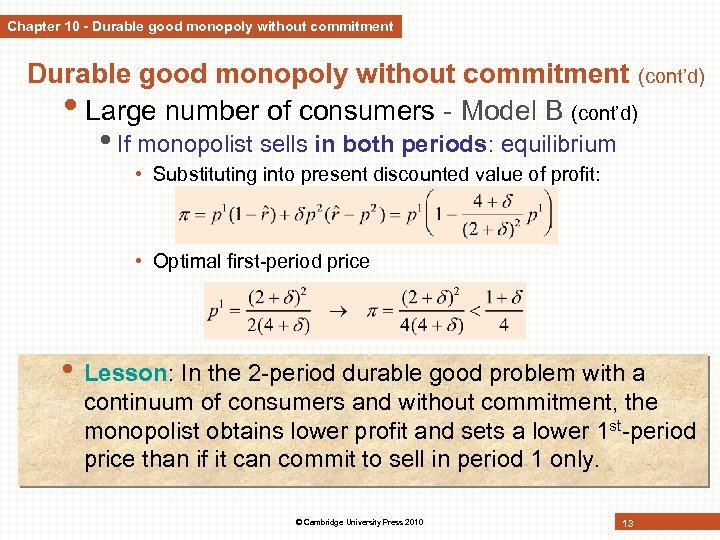

Chapter 10 - Durable good monopoly without commitment (cont’d) • Large number of consumers - Model B (cont’d) • If monopolist sells in both periods: equilibrium • Substituting into present discounted value of profit: • Optimal first-period price • Lesson: In the 2 -period durable good problem with a continuum of consumers and without commitment, the monopolist obtains lower profit and sets a lower 1 st-period price than if it can commit to sell in period 1 only. © Cambridge University Press 2010 13

Chapter 10 - Durable good monopoly without commitment (cont’d) • Large number of consumers - Model B (cont’d) • If monopolist sells in both periods: equilibrium • Substituting into present discounted value of profit: • Optimal first-period price • Lesson: In the 2 -period durable good problem with a continuum of consumers and without commitment, the monopolist obtains lower profit and sets a lower 1 st-period price than if it can commit to sell in period 1 only. © Cambridge University Press 2010 13

Chapter 10 - Durable good monopoly without commitment (cont’d) • Large number of consumers - Model B (cont’d) • Why is intertemporal price discrimination not profitable? • Monopolist faces competition from his own product in period 2 downward pressure on 1 st-period price lower profit • Argument can be extended to more than 2 periods. • When periods become sufficiently small Coase Conjecture: firm loses all price-setting power monopoly setting leads to outcome that converges to the perfectly competitive outcome • Small or large number of consumers? • Consumer goods continuous approximation seems more convincing • If buyers are retailers or intermediaries, model with small number of consumers could be relevant. © Cambridge University Press 2010 14

Chapter 10 - Durable good monopoly without commitment (cont’d) • Large number of consumers - Model B (cont’d) • Why is intertemporal price discrimination not profitable? • Monopolist faces competition from his own product in period 2 downward pressure on 1 st-period price lower profit • Argument can be extended to more than 2 periods. • When periods become sufficiently small Coase Conjecture: firm loses all price-setting power monopoly setting leads to outcome that converges to the perfectly competitive outcome • Small or large number of consumers? • Consumer goods continuous approximation seems more convincing • If buyers are retailers or intermediaries, model with small number of consumers could be relevant. © Cambridge University Press 2010 14

Chapter 10 - Durable good monopoly without commitment Case. The Microsoft case • 1998 • US Do. J accused Microsoft (MS) of antitrust violation • Motive: inclusion of web browser in operating system • Testimony of R. L. Schmalensee on behalf of MS • “Microsoft does not have monopoly power. . . ” • Argument: when assessing market power, one should look at dynamic competition • “Software products are durable goods, so the producer can make additional sales only as a result of selling to people who have not previously bought the product or by selling upgrades to previous customers. Selling upgrades to their installed base of users has historically been an important source of revenue for software firms. In the case of Microsoft, more than 35 percent of Office revenues comes from upgrades rather than new sales. ” © Cambridge University Press 2010 15

Chapter 10 - Durable good monopoly without commitment Case. The Microsoft case • 1998 • US Do. J accused Microsoft (MS) of antitrust violation • Motive: inclusion of web browser in operating system • Testimony of R. L. Schmalensee on behalf of MS • “Microsoft does not have monopoly power. . . ” • Argument: when assessing market power, one should look at dynamic competition • “Software products are durable goods, so the producer can make additional sales only as a result of selling to people who have not previously bought the product or by selling upgrades to previous customers. Selling upgrades to their installed base of users has historically been an important source of revenue for software firms. In the case of Microsoft, more than 35 percent of Office revenues comes from upgrades rather than new sales. ” © Cambridge University Press 2010 15

Chapter 10 - Durable good monopoly with commitment • How can firms commit to future prices? • Renting instead of selling. • Contracts return policies, money-back guarantees, repurchase agreements • Reputation • Technology planned obsolescence (software, textbooks), capacity restrictions • Is intertemporal price discrimination (through introductory offers or clearance sales) profitable? • YES if capacities are fixed (and limited • NO if capacities are flexible. © Cambridge University Press 2010 16

Chapter 10 - Durable good monopoly with commitment • How can firms commit to future prices? • Renting instead of selling. • Contracts return policies, money-back guarantees, repurchase agreements • Reputation • Technology planned obsolescence (software, textbooks), capacity restrictions • Is intertemporal price discrimination (through introductory offers or clearance sales) profitable? • YES if capacities are fixed (and limited • NO if capacities are flexible. © Cambridge University Press 2010 16

Chapter 10 - Durable good monopoly with commitment (cont’d) • Fixed capacity • Monopolist faces a binding capacity constraint. • Example: sale of tickets for a particular event • May use intertemporal price discrimination. • Introductory offer: a limited quantity is provided at a low price in advance. • Clearance sale: the firm initially sells at a high price and commits to sell the remaining units at a low price. • Lesson: Under fixed and limited capacity, and under demand certainty, both clearance sales and introductory offers allow the monopolist to ‘concavify’ its single-price revenue function and lead to the same revenue, which may be greater than with uniform pricing. © Cambridge University Press 2010 17

Chapter 10 - Durable good monopoly with commitment (cont’d) • Fixed capacity • Monopolist faces a binding capacity constraint. • Example: sale of tickets for a particular event • May use intertemporal price discrimination. • Introductory offer: a limited quantity is provided at a low price in advance. • Clearance sale: the firm initially sells at a high price and commits to sell the remaining units at a low price. • Lesson: Under fixed and limited capacity, and under demand certainty, both clearance sales and introductory offers allow the monopolist to ‘concavify’ its single-price revenue function and lead to the same revenue, which may be greater than with uniform pricing. © Cambridge University Press 2010 17

Chapter 10 - Durable good monopoly with commitment (cont’d) • Flexible capacity • Here: monopoly can adjust capacity at an initial stage without cost. • Lesson: If capacity can be adjusted without cost, there is no rationale to intertemporally price discriminate in markets in which demand is certain and in which consumers do not learn over time. • More generally: intertemporal price discrimination can only be optimal if • capacity costs are not linear • the single-price revenue function is not single-peaked. (See details in book. ) © Cambridge University Press 2010 18

Chapter 10 - Durable good monopoly with commitment (cont’d) • Flexible capacity • Here: monopoly can adjust capacity at an initial stage without cost. • Lesson: If capacity can be adjusted without cost, there is no rationale to intertemporally price discriminate in markets in which demand is certain and in which consumers do not learn over time. • More generally: intertemporal price discrimination can only be optimal if • capacity costs are not linear • the single-price revenue function is not single-peaked. (See details in book. ) © Cambridge University Press 2010 18

Chapter 10 - Durable good monopoly with commitment (cont’d) • Demand uncertainty • Attractiveness of intertemporal price discrimination • Aggregate demand uncertainty • Firm’s demand is subject to shocks. • Introductory offers and clearance sales can dominate uniform pricing even if there are no capacity costs ex ante. ü For clearance sales: must be able to commit to total capacity and a second-period price. ü For introductory offers: must be able to limit the supply of the product in the first period. • Lesson: Even if capacity can be adjusted ex ante without cost, intertemporal price discrimination can be profit maximizing under aggregate demand uncertainty. © Cambridge University Press 2010 19

Chapter 10 - Durable good monopoly with commitment (cont’d) • Demand uncertainty • Attractiveness of intertemporal price discrimination • Aggregate demand uncertainty • Firm’s demand is subject to shocks. • Introductory offers and clearance sales can dominate uniform pricing even if there are no capacity costs ex ante. ü For clearance sales: must be able to commit to total capacity and a second-period price. ü For introductory offers: must be able to limit the supply of the product in the first period. • Lesson: Even if capacity can be adjusted ex ante without cost, intertemporal price discrimination can be profit maximizing under aggregate demand uncertainty. © Cambridge University Press 2010 19

Chapter 10 - Durable good monopoly with commitment Case. Zara and the clothing industry • Demand uncertainty is high. • Demand for clothing varies with weather conditions and changes in tastes. • Capacity constraints • Retailers have to order stocks before new season. • Restocking during season used to be difficult. • Clearance or season sales are used to clear stocks before new collection arrives. • Recent advances • Flexible manufacturing & use of IT lead time. • Vertically integrated clothing companies, like Zara, are able to replenish stocks rapidly. • Zara uses clearance sales less frequently (as previous theory predicts). © Cambridge University Press 2010 20

Chapter 10 - Durable good monopoly with commitment Case. Zara and the clothing industry • Demand uncertainty is high. • Demand for clothing varies with weather conditions and changes in tastes. • Capacity constraints • Retailers have to order stocks before new season. • Restocking during season used to be difficult. • Clearance or season sales are used to clear stocks before new collection arrives. • Recent advances • Flexible manufacturing & use of IT lead time. • Vertically integrated clothing companies, like Zara, are able to replenish stocks rapidly. • Zara uses clearance sales less frequently (as previous theory predicts). © Cambridge University Press 2010 20

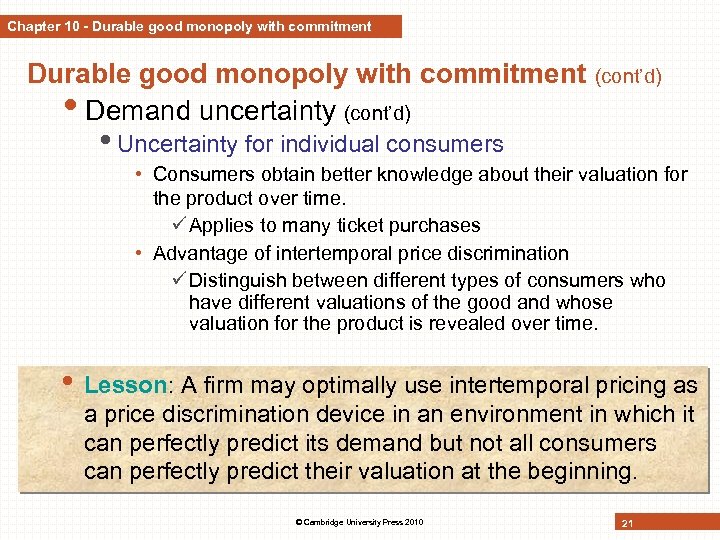

Chapter 10 - Durable good monopoly with commitment (cont’d) • Demand uncertainty (cont’d) • Uncertainty for individual consumers • Consumers obtain better knowledge about their valuation for the product over time. ü Applies to many ticket purchases • Advantage of intertemporal price discrimination ü Distinguish between different types of consumers who have different valuations of the good and whose valuation for the product is revealed over time. • Lesson: A firm may optimally use intertemporal pricing as a price discrimination device in an environment in which it can perfectly predict its demand but not all consumers can perfectly predict their valuation at the beginning. © Cambridge University Press 2010 21

Chapter 10 - Durable good monopoly with commitment (cont’d) • Demand uncertainty (cont’d) • Uncertainty for individual consumers • Consumers obtain better knowledge about their valuation for the product over time. ü Applies to many ticket purchases • Advantage of intertemporal price discrimination ü Distinguish between different types of consumers who have different valuations of the good and whose valuation for the product is revealed over time. • Lesson: A firm may optimally use intertemporal pricing as a price discrimination device in an environment in which it can perfectly predict its demand but not all consumers can perfectly predict their valuation at the beginning. © Cambridge University Press 2010 21

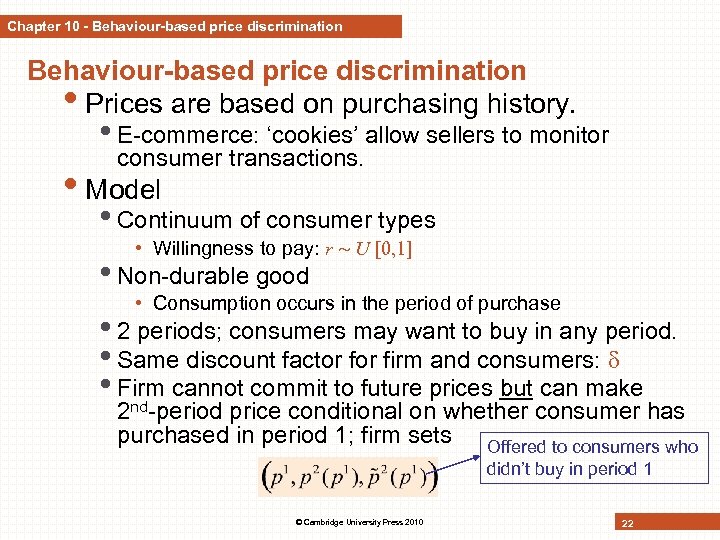

Chapter 10 - Behaviour-based price discrimination • Prices are based on purchasing history. • E-commerce: ‘cookies’ allow sellers to monitor consumer transactions. • Model • Continuum of consumer types • Willingness to pay: r U • Non-durable good • Consumption occurs in the period of purchase • 2 periods; consumers may want to buy in any period. • Same discount factor firm and consumers: • Firm cannot commit to future prices but can make nd 2 -period price conditional on whether consumer has purchased in period 1; firm sets Offered to consumers who didn’t buy in period 1 © Cambridge University Press 2010 22

Chapter 10 - Behaviour-based price discrimination • Prices are based on purchasing history. • E-commerce: ‘cookies’ allow sellers to monitor consumer transactions. • Model • Continuum of consumer types • Willingness to pay: r U • Non-durable good • Consumption occurs in the period of purchase • 2 periods; consumers may want to buy in any period. • Same discount factor firm and consumers: • Firm cannot commit to future prices but can make nd 2 -period price conditional on whether consumer has purchased in period 1; firm sets Offered to consumers who didn’t buy in period 1 © Cambridge University Press 2010 22

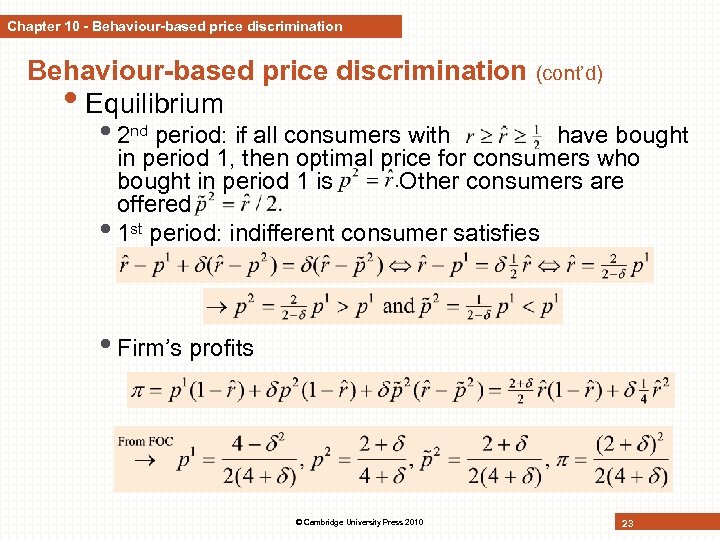

Chapter 10 - Behaviour-based price discrimination (cont’d) • Equilibrium • 2 nd period: if all consumers with have bought in period 1, then optimal price for consumers who bought in period 1 is Other consumers are offered • 1 st period: indifferent consumer satisfies • Firm’s profits © Cambridge University Press 2010 23

Chapter 10 - Behaviour-based price discrimination (cont’d) • Equilibrium • 2 nd period: if all consumers with have bought in period 1, then optimal price for consumers who bought in period 1 is Other consumers are offered • 1 st period: indifferent consumer satisfies • Firm’s profits © Cambridge University Press 2010 23

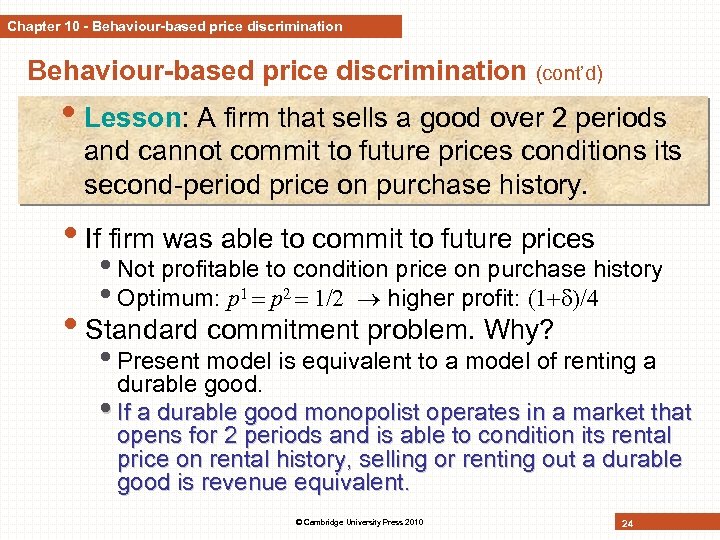

Chapter 10 - Behaviour-based price discrimination (cont’d) • Lesson: A firm that sells a good over 2 periods and cannot commit to future prices conditions its second-period price on purchase history. • If firm was able to commit to future prices • Not profitable to condition price on purchase history • Optimum: p 1 p 2 higher profit: • Standard commitment problem. Why? • Present model is equivalent to a model of renting a durable good. • If a durable good monopolist operates in a market that opens for 2 periods and is able to condition its rental price on rental history, selling or renting out a durable good is revenue equivalent. © Cambridge University Press 2010 24

Chapter 10 - Behaviour-based price discrimination (cont’d) • Lesson: A firm that sells a good over 2 periods and cannot commit to future prices conditions its second-period price on purchase history. • If firm was able to commit to future prices • Not profitable to condition price on purchase history • Optimum: p 1 p 2 higher profit: • Standard commitment problem. Why? • Present model is equivalent to a model of renting a durable good. • If a durable good monopolist operates in a market that opens for 2 periods and is able to condition its rental price on rental history, selling or renting out a durable good is revenue equivalent. © Cambridge University Press 2010 24

Chapter 10 - Review questions • If a durable good monopolist cannot commit to future prices, does the number of consumers matter? Explain. • Does a durable good monopolist have an incentive to set its prices flexibly in each period? Discuss. • Why would a monopolist deviate from uniform pricing and set non-constant prices? And what selling policies may it choose? • What happens if a firm can set individualized prices depending on previous purchases? © Cambridge University Press 2010 25

Chapter 10 - Review questions • If a durable good monopolist cannot commit to future prices, does the number of consumers matter? Explain. • Does a durable good monopolist have an incentive to set its prices flexibly in each period? Discuss. • Why would a monopolist deviate from uniform pricing and set non-constant prices? And what selling policies may it choose? • What happens if a firm can set individualized prices depending on previous purchases? © Cambridge University Press 2010 25

Part V. Product quality and information Chapter 12. Asymmetric information, price and advertising signals Slides Industrial Organization: Markets and Strategies Paul Belleflamme and Martin Peitz © Cambridge University Press 2009

Part V. Product quality and information Chapter 12. Asymmetric information, price and advertising signals Slides Industrial Organization: Markets and Strategies Paul Belleflamme and Martin Peitz © Cambridge University Press 2009

Chapter 12 - Objectives Chapter 12 Learning objectives • Become familiar with asymmetric information problems in the product market. • How do firms choose quality in the presence of asymmetric information? • How are pricing and advertising strategies affected by the presence of asymmetric information? • Application of signalling games to the study of firm strategy in experience goods markets © Cambridge University Press 2009 27

Chapter 12 - Objectives Chapter 12 Learning objectives • Become familiar with asymmetric information problems in the product market. • How do firms choose quality in the presence of asymmetric information? • How are pricing and advertising strategies affected by the presence of asymmetric information? • Application of signalling games to the study of firm strategy in experience goods markets © Cambridge University Press 2009 27

Introduction to Part V • Products and services with characteristics that can only be ascertained upon consumption = experience goods • Asymmetric information as consumers have less information than the producers about product quality • Firms operate in an environment in which consumers wonder whether products turned out to be of high quality (hidden information) or were chosen to be of high quality (hidden action) © Cambridge University Press 2009 28

Introduction to Part V • Products and services with characteristics that can only be ascertained upon consumption = experience goods • Asymmetric information as consumers have less information than the producers about product quality • Firms operate in an environment in which consumers wonder whether products turned out to be of high quality (hidden information) or were chosen to be of high quality (hidden action) © Cambridge University Press 2009 28

Chapter 12 – Asymmetric information problems Hidden information problem • Single seller • Product of two potential levels of quality • Quality s can take the value L or H • Seller’s opportunity cost cs, c. H > c. L • Buyers of unit mass • Valuation of each buyer rs • all consumers prefer high quality, r. H > r. L • Suppose that rs > cs • If there is full information about products quality • Seller can profitably sell the product to buyers whatever the actual quality of the product © Cambridge University Press 2009 29

Chapter 12 – Asymmetric information problems Hidden information problem • Single seller • Product of two potential levels of quality • Quality s can take the value L or H • Seller’s opportunity cost cs, c. H > c. L • Buyers of unit mass • Valuation of each buyer rs • all consumers prefer high quality, r. H > r. L • Suppose that rs > cs • If there is full information about products quality • Seller can profitably sell the product to buyers whatever the actual quality of the product © Cambridge University Press 2009 29

Chapter 12 – Asymmetric information problems Hidden information problem (cont’d) • Only seller observes its product quality • Buyers know with probability λ the product is of high quality • Expected utility for buyers is λr. H + (1 – λ)r. L provided that both seller types are active • Three-stage game • First stage: nature draws the seller’s product quality from some known distribution • Its realization is observed by the seller but not by buyers • Second stage: seller decides whether and which price to post • Third stage: consumers form beliefs about the firm’s product quality and make their purchasing decisions © Cambridge University Press 2009 30

Chapter 12 – Asymmetric information problems Hidden information problem (cont’d) • Only seller observes its product quality • Buyers know with probability λ the product is of high quality • Expected utility for buyers is λr. H + (1 – λ)r. L provided that both seller types are active • Three-stage game • First stage: nature draws the seller’s product quality from some known distribution • Its realization is observed by the seller but not by buyers • Second stage: seller decides whether and which price to post • Third stage: consumers form beliefs about the firm’s product quality and make their purchasing decisions © Cambridge University Press 2009 30

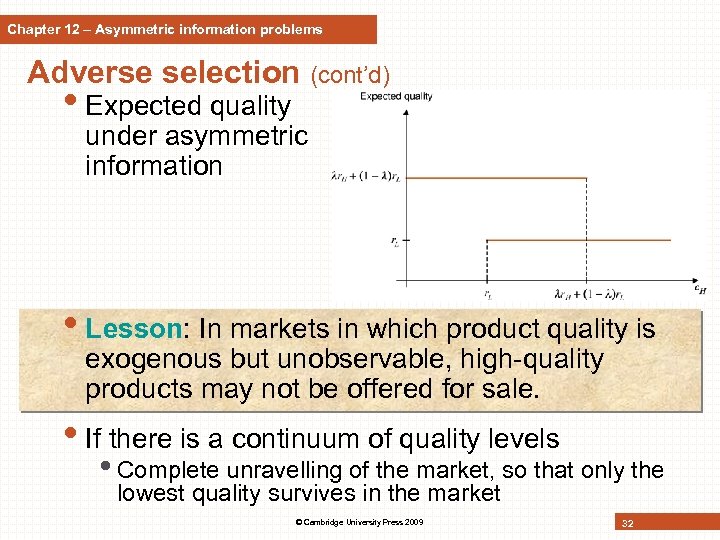

Chapter 12 – Asymmetric information problems Adverse selection • Since buyers are homogeneous, seller can extract the full expected surplus from buyers • If both firm types are active • p = λr. H + (1 – λ)r. L • All consumers buy • Uncertainty is not resolved: pooling equilibrium • All potential gains from trade are realized • p < c. H • High-quality firm cannot recover its opportunity cost and therefore does not participate • Consumers realize that a high-quality seller does not have an incentive to participate • In equilibrium • low-quality seller sets price p = r. L • The high-quality seller does not post a price • Only low quality survives: situation of adverse selection © Cambridge University Press 2009 31

Chapter 12 – Asymmetric information problems Adverse selection • Since buyers are homogeneous, seller can extract the full expected surplus from buyers • If both firm types are active • p = λr. H + (1 – λ)r. L • All consumers buy • Uncertainty is not resolved: pooling equilibrium • All potential gains from trade are realized • p < c. H • High-quality firm cannot recover its opportunity cost and therefore does not participate • Consumers realize that a high-quality seller does not have an incentive to participate • In equilibrium • low-quality seller sets price p = r. L • The high-quality seller does not post a price • Only low quality survives: situation of adverse selection © Cambridge University Press 2009 31

Chapter 12 – Asymmetric information problems Adverse selection (cont’d) • Expected quality under asymmetric information • Lesson: In markets in which product quality is exogenous but unobservable, high-quality products may not be offered for sale. • If there is a continuum of quality levels • Complete unravelling of the market, so that only the lowest quality survives in the market © Cambridge University Press 2009 32

Chapter 12 – Asymmetric information problems Adverse selection (cont’d) • Expected quality under asymmetric information • Lesson: In markets in which product quality is exogenous but unobservable, high-quality products may not be offered for sale. • If there is a continuum of quality levels • Complete unravelling of the market, so that only the lowest quality survives in the market © Cambridge University Press 2009 32

Chapter 12 – Asymmetric information problems Information revelation • Suppose firms can publicly reveal their quality. • If it is not costly to release information, all firms will do so in equilibrium. • Unravelling result: asymmetric information problem is solved. © Cambridge University Press 2009 33

Chapter 12 – Asymmetric information problems Information revelation • Suppose firms can publicly reveal their quality. • If it is not costly to release information, all firms will do so in equilibrium. • Unravelling result: asymmetric information problem is solved. © Cambridge University Press 2009 33

Chapter 12 – Asymmetric information problems Hidden action problem • Moral hazard • Setup as slides before except first stage • Firm itself that chooses its quality • Firm sets its price at stage 2 • Buyers form beliefs about product quality and make their purchasing decisions at stage 3 • Benchmark of full information • Firm chooses high quality if r. H – c. H > r. L – c. L • Implements the first-best allocation • If the quality choice is a hidden action, firms has no means to convince consumers that its product is of high quality Hidden action creates a moral hazard problem • • Lesson: In markets in which firms choose quality, firms tend to provide too low quality from a social point of view. © Cambridge University Press 2009 34

Chapter 12 – Asymmetric information problems Hidden action problem • Moral hazard • Setup as slides before except first stage • Firm itself that chooses its quality • Firm sets its price at stage 2 • Buyers form beliefs about product quality and make their purchasing decisions at stage 3 • Benchmark of full information • Firm chooses high quality if r. H – c. H > r. L – c. L • Implements the first-best allocation • If the quality choice is a hidden action, firms has no means to convince consumers that its product is of high quality Hidden action creates a moral hazard problem • • Lesson: In markets in which firms choose quality, firms tend to provide too low quality from a social point of view. © Cambridge University Press 2009 34

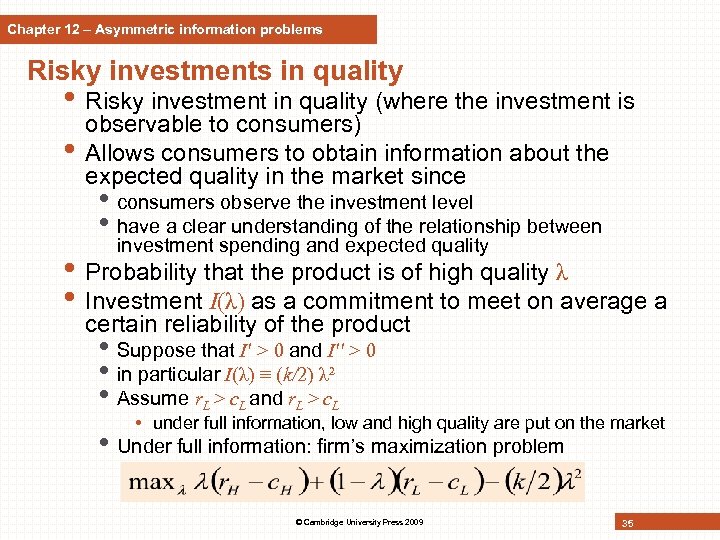

Chapter 12 – Asymmetric information problems Risky investments in quality • Risky investment in quality (where the investment is observable to consumers) • Allows consumers to obtain information about the expected quality in the market since • consumers observe the investment level • have a clear understanding of the relationship between investment spending and expected quality • Probability that the product is of high quality λ • Investment I(λ) as a commitment to meet on average a certain reliability of the product • Suppose that I' > 0 and I'' > 0 • in particular I(λ) ≡ (k/2) λ² • Assume r. L > c. L and r. L > c. L • under full information, low and high quality are put on the market • Under full information: firm’s maximization problem © Cambridge University Press 2009 35

Chapter 12 – Asymmetric information problems Risky investments in quality • Risky investment in quality (where the investment is observable to consumers) • Allows consumers to obtain information about the expected quality in the market since • consumers observe the investment level • have a clear understanding of the relationship between investment spending and expected quality • Probability that the product is of high quality λ • Investment I(λ) as a commitment to meet on average a certain reliability of the product • Suppose that I' > 0 and I'' > 0 • in particular I(λ) ≡ (k/2) λ² • Assume r. L > c. L and r. L > c. L • under full information, low and high quality are put on the market • Under full information: firm’s maximization problem © Cambridge University Press 2009 35

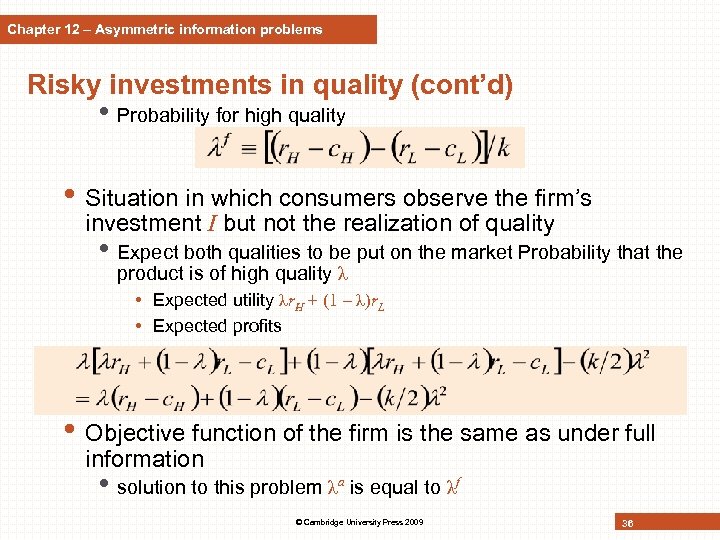

Chapter 12 – Asymmetric information problems Risky investments in quality (cont’d) • Probability for high quality • Situation in which consumers observe the firm’s investment I but not the realization of quality • Expect both qualities to be put on the market Probability that the product is of high quality λ • Expected utility λr. H + (1 – λ)r. L • Expected profits • Objective function of the firm is the same as under full information • solution to this problem λa is equal to λf © Cambridge University Press 2009 36

Chapter 12 – Asymmetric information problems Risky investments in quality (cont’d) • Probability for high quality • Situation in which consumers observe the firm’s investment I but not the realization of quality • Expect both qualities to be put on the market Probability that the product is of high quality λ • Expected utility λr. H + (1 – λ)r. L • Expected profits • Objective function of the firm is the same as under full information • solution to this problem λa is equal to λf © Cambridge University Press 2009 36

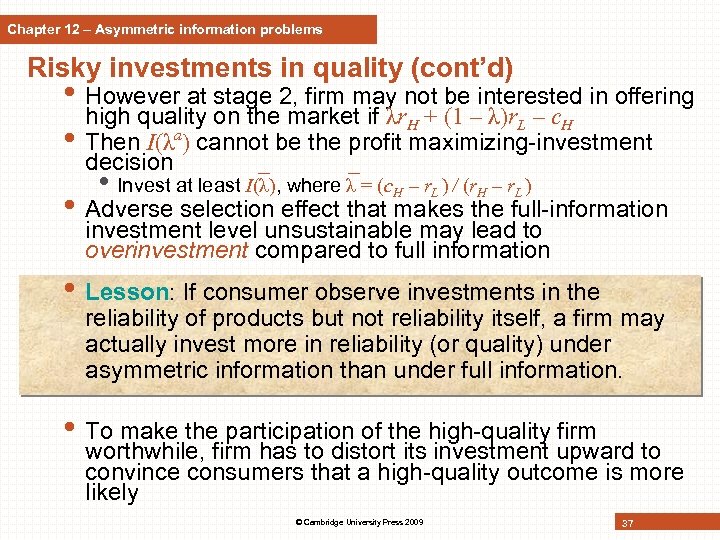

Chapter 12 – Asymmetric information problems Risky investments in quality (cont’d) • However at stage 2, firm may not be interested in offering high quality on the market if λr. H + (1 – λ)r. L – c. H • Then I(λa) cannot be the profit maximizing-investment decision • Invest at least I(λ), where λ = (c. H – r. L ) / (r. H – r. L ) • Adverse selection effect that makes the full-information investment level unsustainable may lead to overinvestment compared to full information • Lesson: If consumer observe investments in the reliability of products but not reliability itself, a firm may actually invest more in reliability (or quality) under asymmetric information than under full information. • To make the participation of the high-quality firm worthwhile, firm has to distort its investment upward to convince consumers that a high-quality outcome is more likely © Cambridge University Press 2009 37

Chapter 12 – Asymmetric information problems Risky investments in quality (cont’d) • However at stage 2, firm may not be interested in offering high quality on the market if λr. H + (1 – λ)r. L – c. H • Then I(λa) cannot be the profit maximizing-investment decision • Invest at least I(λ), where λ = (c. H – r. L ) / (r. H – r. L ) • Adverse selection effect that makes the full-information investment level unsustainable may lead to overinvestment compared to full information • Lesson: If consumer observe investments in the reliability of products but not reliability itself, a firm may actually invest more in reliability (or quality) under asymmetric information than under full information. • To make the participation of the high-quality firm worthwhile, firm has to distort its investment upward to convince consumers that a high-quality outcome is more likely © Cambridge University Press 2009 37

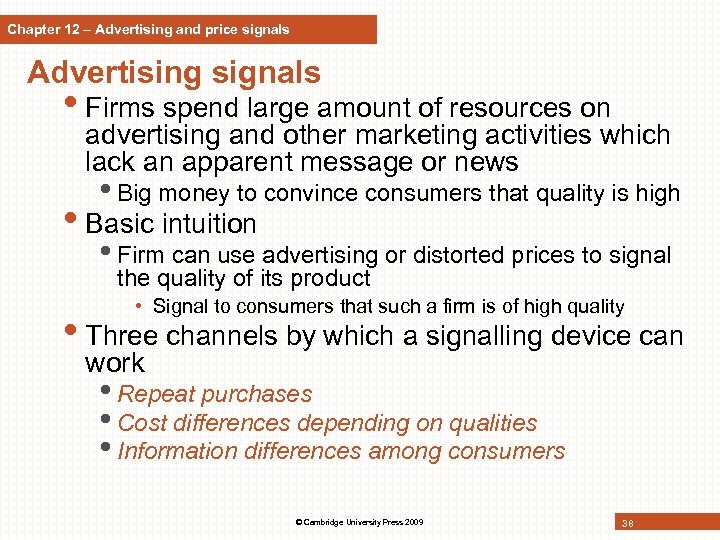

Chapter 12 – Advertising and price signals Advertising signals • Firms spend large amount of resources on advertising and other marketing activities which lack an apparent message or news • Big money to convince consumers that quality is high • Basic intuition • Firm can use advertising or distorted prices to signal the quality of its product • Signal to consumers that such a firm is of high quality • Three channels by which a signalling device can work • Repeat purchases • Cost differences depending on qualities • Information differences among consumers © Cambridge University Press 2009 38

Chapter 12 – Advertising and price signals Advertising signals • Firms spend large amount of resources on advertising and other marketing activities which lack an apparent message or news • Big money to convince consumers that quality is high • Basic intuition • Firm can use advertising or distorted prices to signal the quality of its product • Signal to consumers that such a firm is of high quality • Three channels by which a signalling device can work • Repeat purchases • Cost differences depending on qualities • Information differences among consumers © Cambridge University Press 2009 38

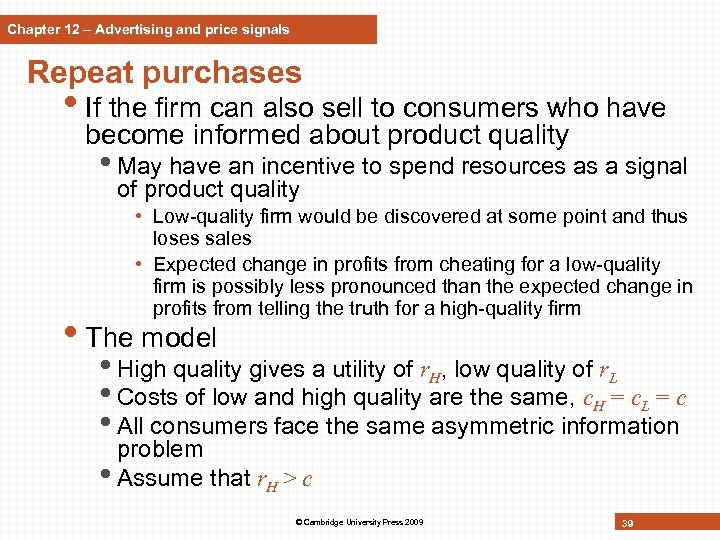

Chapter 12 – Advertising and price signals Repeat purchases • If the firm can also sell to consumers who have become informed about product quality • May have an incentive to spend resources as a signal of product quality • Low-quality firm would be discovered at some point and thus loses sales • Expected change in profits from cheating for a low-quality firm is possibly less pronounced than the expected change in profits from telling the truth for a high-quality firm • The model • High quality gives a utility of r. H, low quality of r. L • Costs of low and high quality are the same, c. H = c. L = c • All consumers face the same asymmetric information problem • Assume that r. H > c © Cambridge University Press 2009 39

Chapter 12 – Advertising and price signals Repeat purchases • If the firm can also sell to consumers who have become informed about product quality • May have an incentive to spend resources as a signal of product quality • Low-quality firm would be discovered at some point and thus loses sales • Expected change in profits from cheating for a low-quality firm is possibly less pronounced than the expected change in profits from telling the truth for a high-quality firm • The model • High quality gives a utility of r. H, low quality of r. L • Costs of low and high quality are the same, c. H = c. L = c • All consumers face the same asymmetric information problem • Assume that r. H > c © Cambridge University Press 2009 39

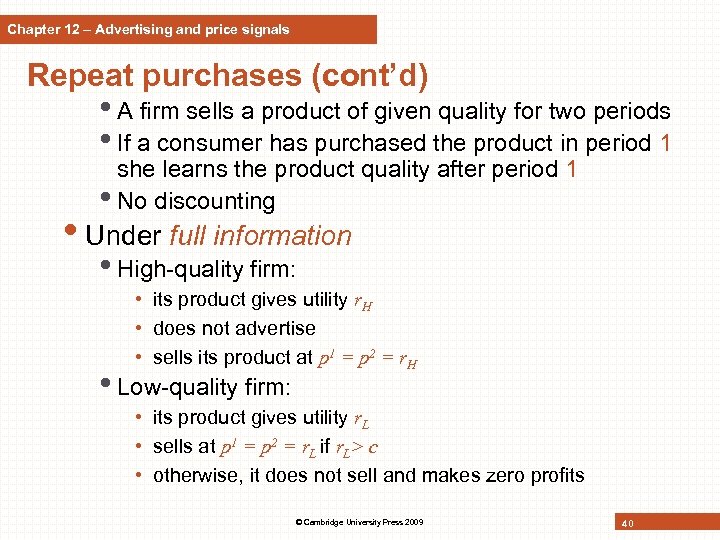

Chapter 12 – Advertising and price signals Repeat purchases (cont’d) • A firm sells a product of given quality for two periods • If a consumer has purchased the product in period 1 she learns the product quality after period 1 • No discounting • Under full information • High-quality firm: • its product gives utility r. H • does not advertise • sells its product at p 1 = p 2 = r. H • Low-quality firm: • its product gives utility r. L • sells at p 1 = p 2 = r. L if r. L> c • otherwise, it does not sell and makes zero profits © Cambridge University Press 2009 40

Chapter 12 – Advertising and price signals Repeat purchases (cont’d) • A firm sells a product of given quality for two periods • If a consumer has purchased the product in period 1 she learns the product quality after period 1 • No discounting • Under full information • High-quality firm: • its product gives utility r. H • does not advertise • sells its product at p 1 = p 2 = r. H • Low-quality firm: • its product gives utility r. L • sells at p 1 = p 2 = r. L if r. L> c • otherwise, it does not sell and makes zero profits © Cambridge University Press 2009 40

Chapter 12 – Advertising and price signals Repeat purchases (cont’d) • Under asymmetric information Period 1 • Firm learns its type but consumers do not • Then, the firm sets its first-period price and it possibly takes some action that can be publicly observed • Spends some amount of resources on advertising A • Consumers decide whether to buy • If a consumer buys, it observes the product quality Period 2 • The firm sets its second-period price and afterwards consumers buy • Since advertising expenditures cannot be rational in the second period, only need to consider advertising in the first period Analyse separating perfect Bayesian Nash equilibria • Restrict attention to belief systems in which only the advertising level but not the price can affect beliefs • Equilibrium actions p 1, p 2, and beliefs μ(A) © Cambridge University Press 2009 41

Chapter 12 – Advertising and price signals Repeat purchases (cont’d) • Under asymmetric information Period 1 • Firm learns its type but consumers do not • Then, the firm sets its first-period price and it possibly takes some action that can be publicly observed • Spends some amount of resources on advertising A • Consumers decide whether to buy • If a consumer buys, it observes the product quality Period 2 • The firm sets its second-period price and afterwards consumers buy • Since advertising expenditures cannot be rational in the second period, only need to consider advertising in the first period Analyse separating perfect Bayesian Nash equilibria • Restrict attention to belief systems in which only the advertising level but not the price can affect beliefs • Equilibrium actions p 1, p 2, and beliefs μ(A) © Cambridge University Press 2009 41

Chapter 12 – Advertising and price signals Repeat purchases (cont’d) • Case 1: the low quality is profitable • Two justifications as to why advertising can be a signal of product quality • Consumers may boycott a firm that they trusted in period 1 and that has failed them (not formalized here) • Repeat purchase effect • Case 2: the low quality is not profitable • Low quality will not be active in separating equilibrium • Equilibrium profits πH = 2 r. H – 2 c – A and πL = 0 • For A > r. H – c, the low-quality firm’s incentive constraint is satisfied • Second-period profits of the high-quality firm depend on its first-period action © Cambridge University Press 2009 42

Chapter 12 – Advertising and price signals Repeat purchases (cont’d) • Case 1: the low quality is profitable • Two justifications as to why advertising can be a signal of product quality • Consumers may boycott a firm that they trusted in period 1 and that has failed them (not formalized here) • Repeat purchase effect • Case 2: the low quality is not profitable • Low quality will not be active in separating equilibrium • Equilibrium profits πH = 2 r. H – 2 c – A and πL = 0 • For A > r. H – c, the low-quality firm’s incentive constraint is satisfied • Second-period profits of the high-quality firm depend on its first-period action © Cambridge University Press 2009 42

Chapter 12 – Advertising and price signals Repeat purchases (cont’d) • Lesson: Advertising and other strategies in which a firms publicly ‘burns money’ can be a credible means for a firm to communicate to consumers that it is of high quality. In particular, such a strategy can be successful if a repeat purchase effect is present. • Consumers may base their beliefs on price • Case that firms cannot advertise but in which the price may contain information about product quality • Any price below c would lead to losses for a low-quality firm • Beliefs that any price below c must come from a high-quality firm • Price below marginal costs: signal of high quality • Lesson: A price below marginal costs can be a credible strategy for a firm to communicate to consumers that it is of high quality because it allows the firm to benefit from repeat purchases. © Cambridge University Press 2009 43

Chapter 12 – Advertising and price signals Repeat purchases (cont’d) • Lesson: Advertising and other strategies in which a firms publicly ‘burns money’ can be a credible means for a firm to communicate to consumers that it is of high quality. In particular, such a strategy can be successful if a repeat purchase effect is present. • Consumers may base their beliefs on price • Case that firms cannot advertise but in which the price may contain information about product quality • Any price below c would lead to losses for a low-quality firm • Beliefs that any price below c must come from a high-quality firm • Price below marginal costs: signal of high quality • Lesson: A price below marginal costs can be a credible strategy for a firm to communicate to consumers that it is of high quality because it allows the firm to benefit from repeat purchases. © Cambridge University Press 2009 43

Chapter 12 – Advertising and price signals Price signals – differential information • single period • positive share of fully informed consumers • sufficiently large share: • Firm can separate with full information prices • smaller share: • • • Firm has to lower its price below the full information level Informed consumers generate an information spillover Uninformed consumers obtain information through the firm’s price because they know that some other consumers have better information and act according to this information • Lesson: If some consumers know the product quality, the high-quality firm can use its price to signal quality to the remaining share of uninformed consumers. As the share of informed consumers increases, the price of the high-quality firm reaches the corresponding fullinformation price. Above a critical size of informed consumers, signalling is feasible with full-information prices. © Cambridge University Press 2009 44

Chapter 12 – Advertising and price signals Price signals – differential information • single period • positive share of fully informed consumers • sufficiently large share: • Firm can separate with full information prices • smaller share: • • • Firm has to lower its price below the full information level Informed consumers generate an information spillover Uninformed consumers obtain information through the firm’s price because they know that some other consumers have better information and act according to this information • Lesson: If some consumers know the product quality, the high-quality firm can use its price to signal quality to the remaining share of uninformed consumers. As the share of informed consumers increases, the price of the high-quality firm reaches the corresponding fullinformation price. Above a critical size of informed consumers, signalling is feasible with full-information prices. © Cambridge University Press 2009 44

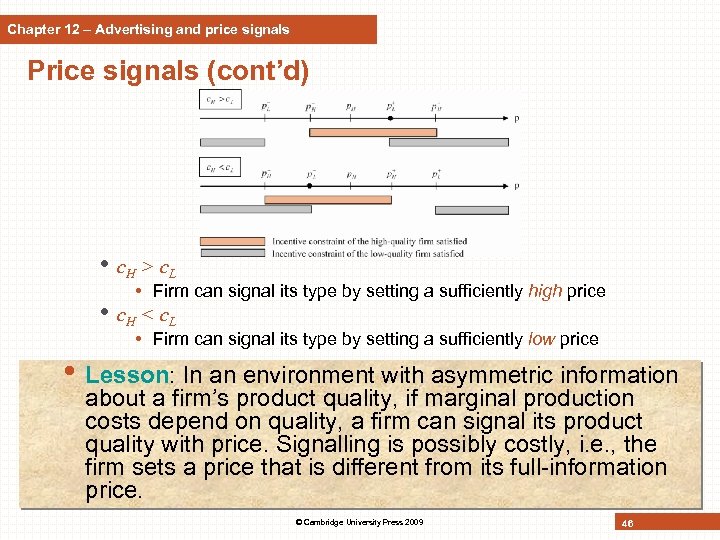

Chapter 12 – Advertising and price signals Price signals – cost differences • single period • cost differences between high and low quality • consumers have variable demand • Produce low quality at marginal cost c. L and high quality at c. H • Demand is independent of true quality since consumers purchase only once and no consumer has any private information on the product’s quality • Result: Price can be used as signal of product quality © Cambridge University Press 2009 45

Chapter 12 – Advertising and price signals Price signals – cost differences • single period • cost differences between high and low quality • consumers have variable demand • Produce low quality at marginal cost c. L and high quality at c. H • Demand is independent of true quality since consumers purchase only once and no consumer has any private information on the product’s quality • Result: Price can be used as signal of product quality © Cambridge University Press 2009 45

Chapter 12 – Advertising and price signals Price signals (cont’d) • c. H > c. L • Firm can signal its type by setting a sufficiently high price • c. H < c. L • Firm can signal its type by setting a sufficiently low price • Lesson: In an environment with asymmetric information about a firm’s product quality, if marginal production costs depend on quality, a firm can signal its product quality with price. Signalling is possibly costly, i. e. , the firm sets a price that is different from its full-information price. © Cambridge University Press 2009 46

Chapter 12 – Advertising and price signals Price signals (cont’d) • c. H > c. L • Firm can signal its type by setting a sufficiently high price • c. H < c. L • Firm can signal its type by setting a sufficiently low price • Lesson: In an environment with asymmetric information about a firm’s product quality, if marginal production costs depend on quality, a firm can signal its product quality with price. Signalling is possibly costly, i. e. , the firm sets a price that is different from its full-information price. © Cambridge University Press 2009 46

Chapter 12 – Advertising and price signals Joint price and advertising signals • Two-period model • Investigate whether a monopolist wants to use a two-dimensional signal in the form of price and advertising as a signal of product quality • First period: firm sets its price p 1 and an advertising expenditure A • Second period: price p 2 • Demand is now sensitive to price changes • Destroys the equivalence of price and advertising signals • Repeated purchases are more likely in the case of positive former experience (stemming from high quality) • Stimulating initial purchase is valuable especially for products with high quality • repeat-business effect: for any given beliefs fewer consumers buy in the second period if the first-period price rises • Lost consumers are more painful for producers of high quality © Cambridge University Press 2009 47

Chapter 12 – Advertising and price signals Joint price and advertising signals • Two-period model • Investigate whether a monopolist wants to use a two-dimensional signal in the form of price and advertising as a signal of product quality • First period: firm sets its price p 1 and an advertising expenditure A • Second period: price p 2 • Demand is now sensitive to price changes • Destroys the equivalence of price and advertising signals • Repeated purchases are more likely in the case of positive former experience (stemming from high quality) • Stimulating initial purchase is valuable especially for products with high quality • repeat-business effect: for any given beliefs fewer consumers buy in the second period if the first-period price rises • Lost consumers are more painful for producers of high quality © Cambridge University Press 2009 47

Chapter 12 – Advertising and price signals Joint price and advertising signals (cont’d) • c. H > c. L • Monopolist able to signal high quality through A > 0 and a distorted price • c. H ≤ c L • Advertising is not part of the signalling strategy • Lesson: With repeat purchases and variable demand, the monopolist can use advertising as part of his signalling strategy only if c. H > c. L. • An upward distortion of the first-period price above pm(s. H) reduces quantity sold and revenues • If c. H > c. L • distortion is less painful for a producer of high quality than for a producer of low quality • A price increases also decreases second-period revenue since there is a smaller number of consumers who were served in period 1 • More painful for a producer of high quality © Cambridge University Press 2009 48

Chapter 12 – Advertising and price signals Joint price and advertising signals (cont’d) • c. H > c. L • Monopolist able to signal high quality through A > 0 and a distorted price • c. H ≤ c L • Advertising is not part of the signalling strategy • Lesson: With repeat purchases and variable demand, the monopolist can use advertising as part of his signalling strategy only if c. H > c. L. • An upward distortion of the first-period price above pm(s. H) reduces quantity sold and revenues • If c. H > c. L • distortion is less painful for a producer of high quality than for a producer of low quality • A price increases also decreases second-period revenue since there is a smaller number of consumers who were served in period 1 • More painful for a producer of high quality © Cambridge University Press 2009 48

Chapter 12 – Price signalling under imperfect competition • Two firms compete in prices • want to use price as a signal of product quality • Firms have private information about their quality • Consumers can update their beliefs about quality because they observe prices • Competitor does not have this option available • Symmetric separating perfect Bayesian equilibria © Cambridge University Press 2009 49

Chapter 12 – Price signalling under imperfect competition • Two firms compete in prices • want to use price as a signal of product quality • Firms have private information about their quality • Consumers can update their beliefs about quality because they observe prices • Competitor does not have this option available • Symmetric separating perfect Bayesian equilibria © Cambridge University Press 2009 49

Chapter 12 – Price signalling under imperfect competition (cont’d) • Low-quality firm chooses its full-information best response • In monopoly model • Presence of asymmetric information does not change the outside option for consumers • Low-quality firm sets the same price under asymmetric information as under full information • Not the case under competition • Firm best responds to the competitor’s expected equilibrium price • Different from the full-information equilibrium price © Cambridge University Press 2009 50

Chapter 12 – Price signalling under imperfect competition (cont’d) • Low-quality firm chooses its full-information best response • In monopoly model • Presence of asymmetric information does not change the outside option for consumers • Low-quality firm sets the same price under asymmetric information as under full information • Not the case under competition • Firm best responds to the competitor’s expected equilibrium price • Different from the full-information equilibrium price © Cambridge University Press 2009 50

Chapter 12 – Price signalling under imperfect competition (cont’d) • If high quality is more costly than low quality • A high price can signal high quality also under imperfect competition • Separating prices are above full-information prices • Both for low-quality and high-quality firms • Suppose at an earlier stage (however, after they know their type), firms can decide whether to reveal information about product quality • There are parameter values for which both types of firm prefer not to reveal this information © Cambridge University Press 2009 51

Chapter 12 – Price signalling under imperfect competition (cont’d) • If high quality is more costly than low quality • A high price can signal high quality also under imperfect competition • Separating prices are above full-information prices • Both for low-quality and high-quality firms • Suppose at an earlier stage (however, after they know their type), firms can decide whether to reveal information about product quality • There are parameter values for which both types of firm prefer not to reveal this information © Cambridge University Press 2009 51

Chapter 12 – Price signalling under imperfect competition (cont’d) • Lesson: A high price can signal product quality also under competition. If high quality is costly, a high-quality firm distorts its price upward. Equilibrium prices are greater than prices under full information. Equilibrium profits may be greater than in the same market under full information for low-quality and high-quality firms. The asymmetric information problem may therefore persists even if firms can reveal their private information to consumers without costs. © Cambridge University Press 2009 52

Chapter 12 – Price signalling under imperfect competition (cont’d) • Lesson: A high price can signal product quality also under competition. If high quality is costly, a high-quality firm distorts its price upward. Equilibrium prices are greater than prices under full information. Equilibrium profits may be greater than in the same market under full information for low-quality and high-quality firms. The asymmetric information problem may therefore persists even if firms can reveal their private information to consumers without costs. © Cambridge University Press 2009 52

Chapter 12 - Review questions • If a firm faces asymmetric information and it has to invest in R&D to increase the probability of high quality, does this information lead to more or less investment? Discuss the effects that play a role. • What is the role of advertising spending in experience good markets? Are spending caps welfare increasing? • If a firm can choose price and advertising to convince consumers of high quality, do there exist circumstances under which the firm prefers not to use one of those two instruments? Discuss. • Consider a market in which product quality does not affect marginal costs. Do repeat purchases facilitate or hinder advertising signals? © Cambridge University Press 2009 53

Chapter 12 - Review questions • If a firm faces asymmetric information and it has to invest in R&D to increase the probability of high quality, does this information lead to more or less investment? Discuss the effects that play a role. • What is the role of advertising spending in experience good markets? Are spending caps welfare increasing? • If a firm can choose price and advertising to convince consumers of high quality, do there exist circumstances under which the firm prefers not to use one of those two instruments? Discuss. • Consider a market in which product quality does not affect marginal costs. Do repeat purchases facilitate or hinder advertising signals? © Cambridge University Press 2009 53