a67fe3ea85e49b7260a9f934d4e4efcb.ppt

- Количество слайдов: 25

Part II Foreign Exchange and Exchange Rate Determination Chapter 3 The Foreign Exchange and Eurocurrency Markets Chapter 4 The International Parity Conditions Chapter 5 The Nature of Currency Risk Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -1

Part II Foreign Exchange and Exchange Rate Determination Chapter 3 The Foreign Exchange and Eurocurrency Markets Chapter 4 The International Parity Conditions Chapter 5 The Nature of Currency Risk Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -1

…a peculiar currency of your own So much of barbarism, however, still remains in the transactions of most civilized nations, that almost all independent countries choose to assert their nationality by having, to their own inconvenience and that of their neighbors, a peculiar currency of their own. John Stuart Mill, 1894 Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -2

…a peculiar currency of your own So much of barbarism, however, still remains in the transactions of most civilized nations, that almost all independent countries choose to assert their nationality by having, to their own inconvenience and that of their neighbors, a peculiar currency of their own. John Stuart Mill, 1894 Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -2

Chapter 3 The Foreign Exchange and Eurocurrency Markets 3. 1 3. 2 3. 3 3. 4 3. 5 3. 6 3. 7 International Banking and Interbank Markets The Eurocurrency Markets The Foreign Exchange Markets Foreign Exchange Rates and Quotations Forward Premiums/Discounts and Changes in Spot Rates Hedging Currency Risk with Forward Contracts Summary Appendix 3 -A The Foreign Exchange Market Game Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -3

Chapter 3 The Foreign Exchange and Eurocurrency Markets 3. 1 3. 2 3. 3 3. 4 3. 5 3. 6 3. 7 International Banking and Interbank Markets The Eurocurrency Markets The Foreign Exchange Markets Foreign Exchange Rates and Quotations Forward Premiums/Discounts and Changes in Spot Rates Hedging Currency Risk with Forward Contracts Summary Appendix 3 -A The Foreign Exchange Market Game Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -3

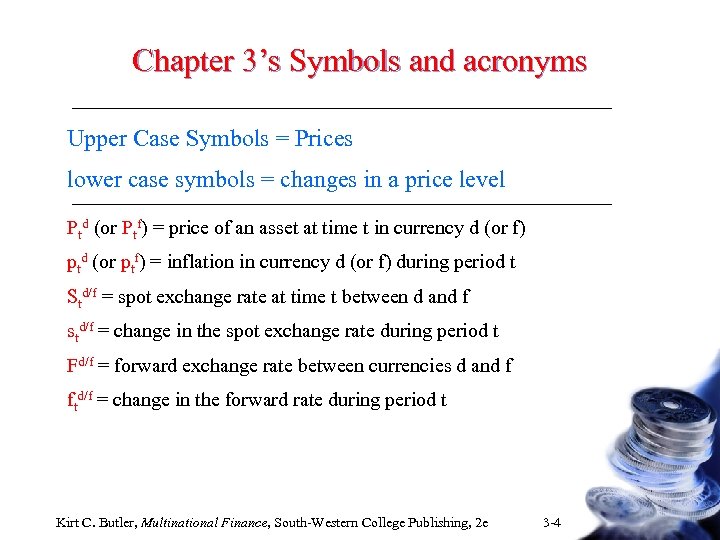

Chapter 3’s Symbols and acronyms Upper Case Symbols = Prices lower case symbols = changes in a price level Ptd (or Ptf) = price of an asset at time t in currency d (or f) ptd (or ptf) = inflation in currency d (or f) during period t Std/f = spot exchange rate at time t between d and f std/f = change in the spot exchange rate during period t Fd/f = forward exchange rate between currencies d and f ftd/f = change in the forward rate during period t Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -4

Chapter 3’s Symbols and acronyms Upper Case Symbols = Prices lower case symbols = changes in a price level Ptd (or Ptf) = price of an asset at time t in currency d (or f) ptd (or ptf) = inflation in currency d (or f) during period t Std/f = spot exchange rate at time t between d and f std/f = change in the spot exchange rate during period t Fd/f = forward exchange rate between currencies d and f ftd/f = change in the forward rate during period t Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -4

Foreign exchange (fx) markets F Markets » Spot market – trade in cash today with delivery in two business days » Forward market – trade at a pre-specified price and on a pre-specified future date F Volume » volume in April 1998 averaged $1. 5 trillion per day » about 75% in the interbank market F Operational efficiency » small retail transactions can be expensive » large interbank transactions have very low costs Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -5

Foreign exchange (fx) markets F Markets » Spot market – trade in cash today with delivery in two business days » Forward market – trade at a pre-specified price and on a pre-specified future date F Volume » volume in April 1998 averaged $1. 5 trillion per day » about 75% in the interbank market F Operational efficiency » small retail transactions can be expensive » large interbank transactions have very low costs Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -5

Alternative forms of market efficiency F Informational efficiency: » prices reflect all relevant information F Operational efficiency: » market frictions have little influence F Allocational efficiency: » market channels capital toward its most productive uses Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -6

Alternative forms of market efficiency F Informational efficiency: » prices reflect all relevant information F Operational efficiency: » market frictions have little influence F Allocational efficiency: » market channels capital toward its most productive uses Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -6

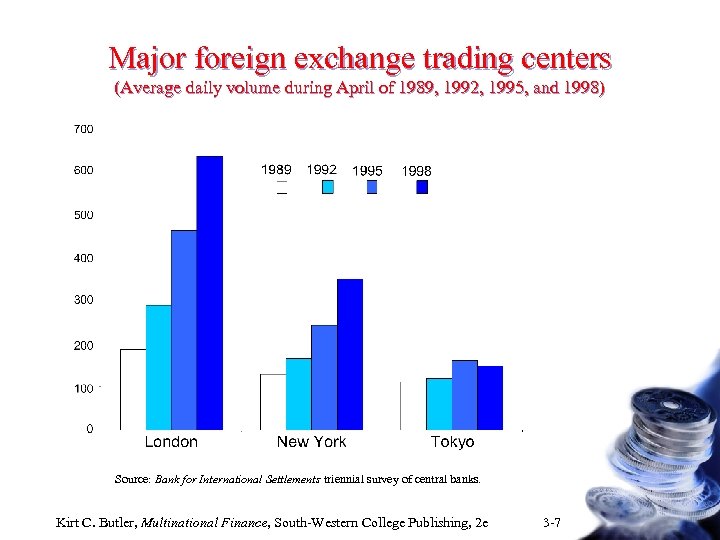

Major foreign exchange trading centers (Average daily volume during April of 1989, 1992, 1995, and 1998) Source: Bank for International Settlements triennial survey of central banks. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -7

Major foreign exchange trading centers (Average daily volume during April of 1989, 1992, 1995, and 1998) Source: Bank for International Settlements triennial survey of central banks. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -7

Rule #1 Keep track of your units. An example: S$/FF = $. 2500/FF Û SFF/$ = 1/ S$/FF = FF 4/$ Dollar value of a bottle of Georges de Bouef: Buy 1 bottle of wine PFF = FF 40/btl Spot exchange rate SFF/$ = FF 4/$ How much is this in dollars? P$ = PFF/SFF/$ = (FF 40/btl)/(FF 4. 00/$) = $10/btl = PFFS$/FF = (FF 40/btl)($. 2500/FF) = $10/btl Example of what can go wrong: P$ = PFFSFF/$ = (FF 40/btl)(FF 4/$) = FF 2 160/(btl-$)? No! Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -8

Rule #1 Keep track of your units. An example: S$/FF = $. 2500/FF Û SFF/$ = 1/ S$/FF = FF 4/$ Dollar value of a bottle of Georges de Bouef: Buy 1 bottle of wine PFF = FF 40/btl Spot exchange rate SFF/$ = FF 4/$ How much is this in dollars? P$ = PFF/SFF/$ = (FF 40/btl)/(FF 4. 00/$) = $10/btl = PFFS$/FF = (FF 40/btl)($. 2500/FF) = $10/btl Example of what can go wrong: P$ = PFFSFF/$ = (FF 40/btl)(FF 4/$) = FF 2 160/(btl-$)? No! Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -8

Rule #2: Always buy or sell the currency in the denominator of a foreign exchange quote. Example of buying low and selling high: Buy wine at FF 40/btl and sell at FF 50/btl Þ FF 10/btl Profit Buy FFs at $. 20/FF º Sell FFs at $. 25/FF º $. 05/FF Profit Sell $s at FF 5/$ Buy $s at FF 4/$ FF 1/$ Profit Example of what can go wrong: But. . . if you buy $s (and sell FFs) at $. 2000/FF = FF 5/$ and sell $s (and buy FFs) at $. 2500/FF = FF 4/$ you lose FF 1/$ !!! Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -9

Rule #2: Always buy or sell the currency in the denominator of a foreign exchange quote. Example of buying low and selling high: Buy wine at FF 40/btl and sell at FF 50/btl Þ FF 10/btl Profit Buy FFs at $. 20/FF º Sell FFs at $. 25/FF º $. 05/FF Profit Sell $s at FF 5/$ Buy $s at FF 4/$ FF 1/$ Profit Example of what can go wrong: But. . . if you buy $s (and sell FFs) at $. 2000/FF = FF 5/$ and sell $s (and buy FFs) at $. 2500/FF = FF 4/$ you lose FF 1/$ !!! Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -9

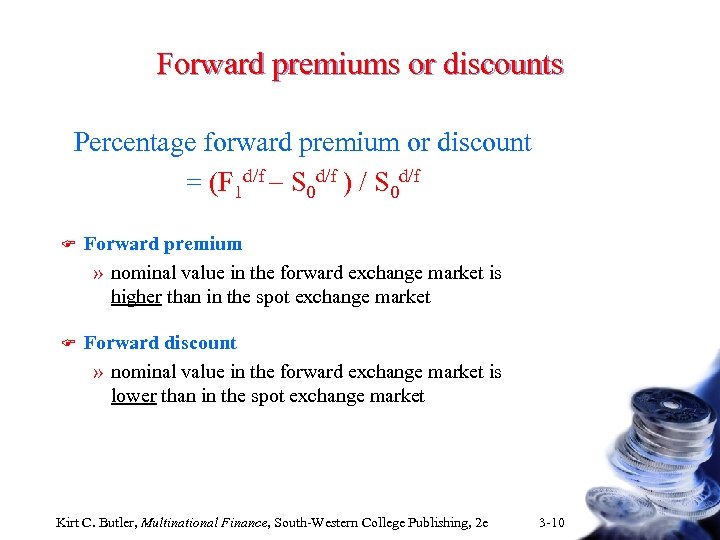

Forward premiums or discounts Percentage forward premium or discount = (F 1 d/f - S 0 d/f ) / S 0 d/f F Forward premium » nominal value in the forward exchange market is higher than in the spot exchange market F Forward discount » nominal value in the forward exchange market is lower than in the spot exchange market Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -10

Forward premiums or discounts Percentage forward premium or discount = (F 1 d/f - S 0 d/f ) / S 0 d/f F Forward premium » nominal value in the forward exchange market is higher than in the spot exchange market F Forward discount » nominal value in the forward exchange market is lower than in the spot exchange market Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -10

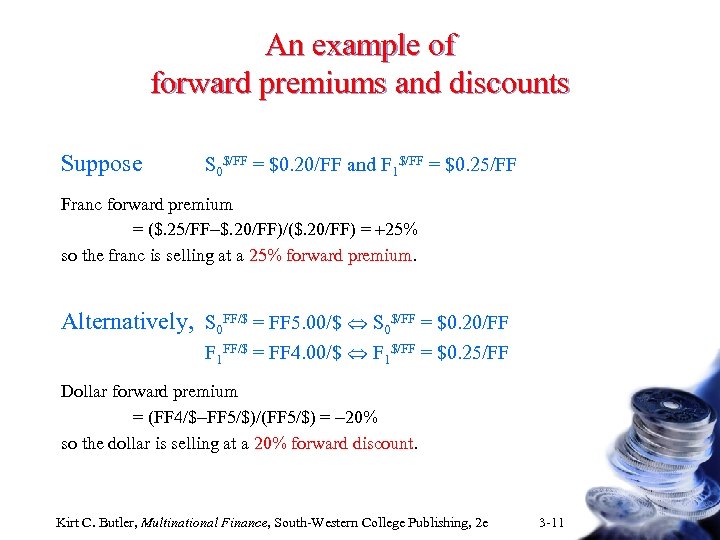

An example of forward premiums and discounts Suppose S 0$/FF = $0. 20/FF and F 1$/FF = $0. 25/FF Franc forward premium = ($. 25/FF-$. 20/FF)/($. 20/FF) = +25% so the franc is selling at a 25% forward premium. Alternatively, S 0 FF/$ = FF 5. 00/$ Û S 0$/FF = $0. 20/FF F 1 FF/$ = FF 4. 00/$ Û F 1$/FF = $0. 25/FF Dollar forward premium = (FF 4/$-FF 5/$)/(FF 5/$) = -20% so the dollar is selling at a 20% forward discount. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -11

An example of forward premiums and discounts Suppose S 0$/FF = $0. 20/FF and F 1$/FF = $0. 25/FF Franc forward premium = ($. 25/FF-$. 20/FF)/($. 20/FF) = +25% so the franc is selling at a 25% forward premium. Alternatively, S 0 FF/$ = FF 5. 00/$ Û S 0$/FF = $0. 20/FF F 1 FF/$ = FF 4. 00/$ Û F 1$/FF = $0. 25/FF Dollar forward premium = (FF 4/$-FF 5/$)/(FF 5/$) = -20% so the dollar is selling at a 20% forward discount. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -11

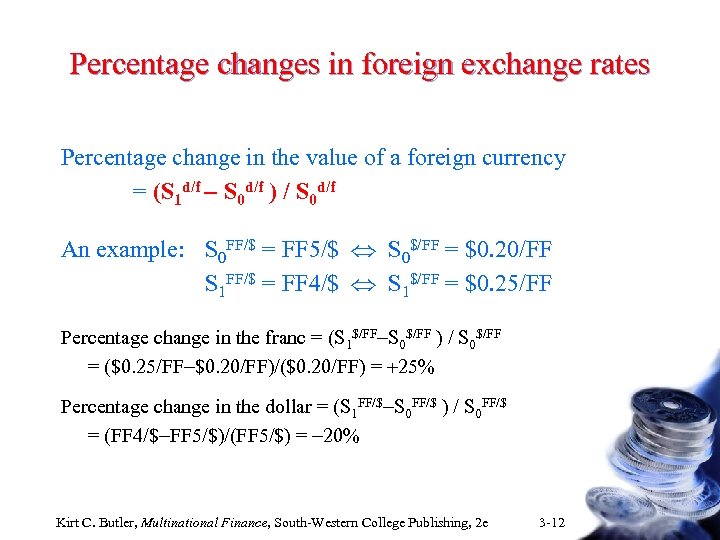

Percentage changes in foreign exchange rates Percentage change in the value of a foreign currency = (S 1 d/f - S 0 d/f ) / S 0 d/f An example: S 0 FF/$ = FF 5/$ Û S 0$/FF = $0. 20/FF S 1 FF/$ = FF 4/$ Û S 1$/FF = $0. 25/FF Percentage change in the franc = (S 1$/FF-S 0$/FF ) / S 0$/FF = ($0. 25/FF-$0. 20/FF)/($0. 20/FF) = +25% Percentage change in the dollar = (S 1 FF/$-S 0 FF/$ ) / S 0 FF/$ = (FF 4/$-FF 5/$)/(FF 5/$) = -20% Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -12

Percentage changes in foreign exchange rates Percentage change in the value of a foreign currency = (S 1 d/f - S 0 d/f ) / S 0 d/f An example: S 0 FF/$ = FF 5/$ Û S 0$/FF = $0. 20/FF S 1 FF/$ = FF 4/$ Û S 1$/FF = $0. 25/FF Percentage change in the franc = (S 1$/FF-S 0$/FF ) / S 0$/FF = ($0. 25/FF-$0. 20/FF)/($0. 20/FF) = +25% Percentage change in the dollar = (S 1 FF/$-S 0 FF/$ ) / S 0 FF/$ = (FF 4/$-FF 5/$)/(FF 5/$) = -20% Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -12

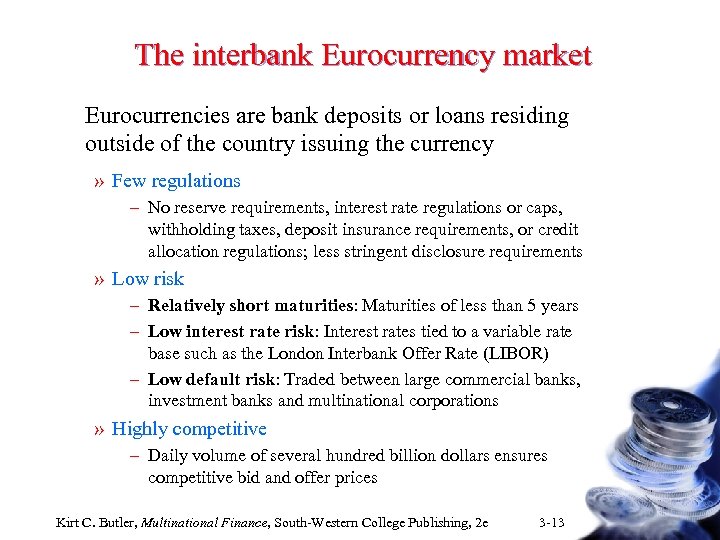

The interbank Eurocurrency market Eurocurrencies are bank deposits or loans residing outside of the country issuing the currency » Few regulations – No reserve requirements, interest rate regulations or caps, withholding taxes, deposit insurance requirements, or credit allocation regulations; less stringent disclosure requirements » Low risk – Relatively short maturities: Maturities of less than 5 years – Low interest rate risk: Interest rates tied to a variable rate base such as the London Interbank Offer Rate (LIBOR) – Low default risk: Traded between large commercial banks, investment banks and multinational corporations » Highly competitive – Daily volume of several hundred billion dollars ensures competitive bid and offer prices Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -13

The interbank Eurocurrency market Eurocurrencies are bank deposits or loans residing outside of the country issuing the currency » Few regulations – No reserve requirements, interest rate regulations or caps, withholding taxes, deposit insurance requirements, or credit allocation regulations; less stringent disclosure requirements » Low risk – Relatively short maturities: Maturities of less than 5 years – Low interest rate risk: Interest rates tied to a variable rate base such as the London Interbank Offer Rate (LIBOR) – Low default risk: Traded between large commercial banks, investment banks and multinational corporations » Highly competitive – Daily volume of several hundred billion dollars ensures competitive bid and offer prices Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -13

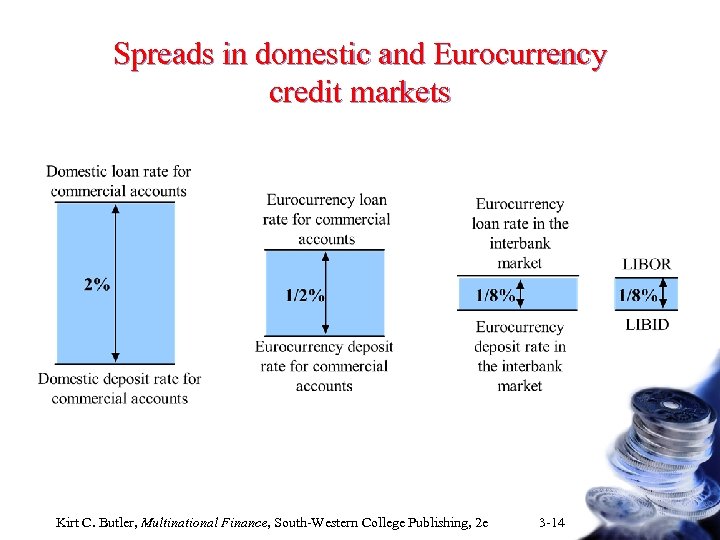

Spreads in domestic and Eurocurrency credit markets Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -14

Spreads in domestic and Eurocurrency credit markets Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -14

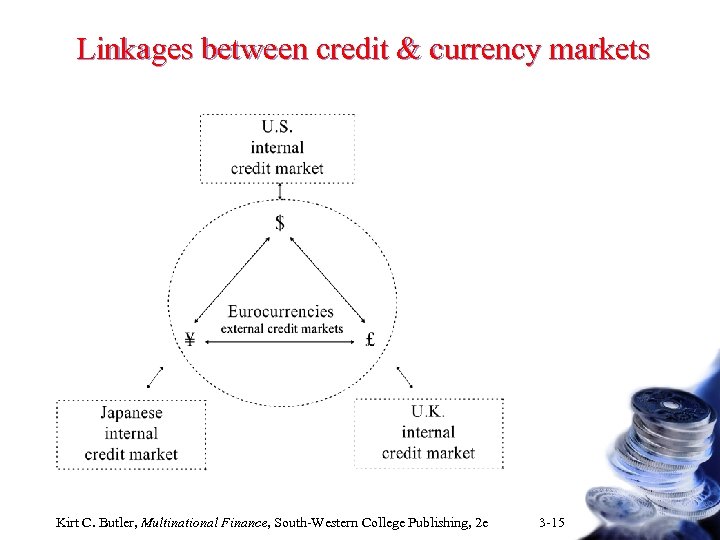

Linkages between credit & currency markets Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -15

Linkages between credit & currency markets Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -15

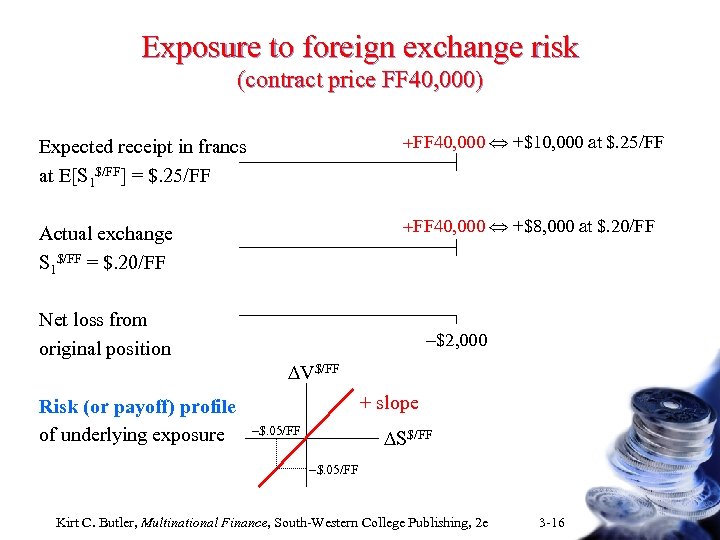

Exposure to foreign exchange risk (contract price FF 40, 000) Expected receipt in francs at E[S 1$/FF] = $. 25/FF +FF 40, 000 Û +$10, 000 at $. 25/FF Actual exchange S 1$/FF = $. 20/FF +FF 40, 000 Û +$8, 000 at $. 20/FF Net loss from original position Risk (or payoff) profile of underlying exposure -$2, 000 DV$/FF + slope -$. 05/FF DS$/FF -$. 05/FF Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -16

Exposure to foreign exchange risk (contract price FF 40, 000) Expected receipt in francs at E[S 1$/FF] = $. 25/FF +FF 40, 000 Û +$10, 000 at $. 25/FF Actual exchange S 1$/FF = $. 20/FF +FF 40, 000 Û +$8, 000 at $. 20/FF Net loss from original position Risk (or payoff) profile of underlying exposure -$2, 000 DV$/FF + slope -$. 05/FF DS$/FF -$. 05/FF Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -16

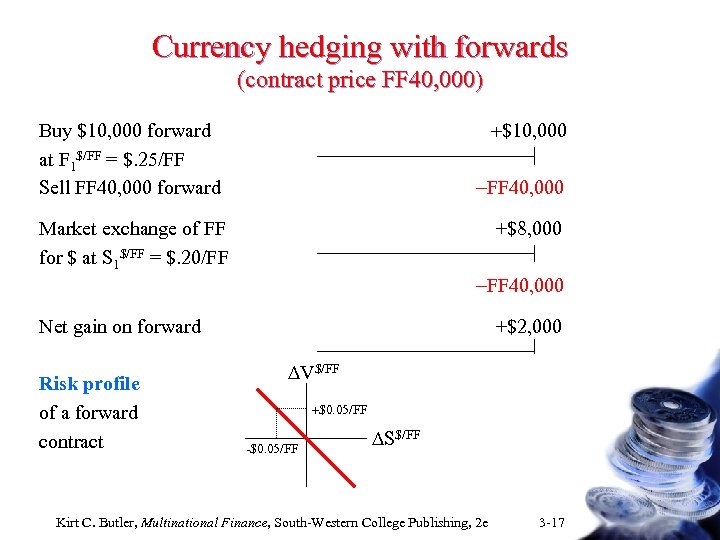

Currency hedging with forwards (contract price FF 40, 000) +$10, 000 Buy $10, 000 forward at F 1$/FF = $. 25/FF Sell FF 40, 000 forward -FF 40, 000 Market exchange of FF for $ at S 1$/FF = $. 20/FF +$8, 000 -FF 40, 000 Net gain on forward Risk profile of a forward contract +$2, 000 DV$/FF +$0. 05/FF -$0. 05/FF DS$/FF Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -17

Currency hedging with forwards (contract price FF 40, 000) +$10, 000 Buy $10, 000 forward at F 1$/FF = $. 25/FF Sell FF 40, 000 forward -FF 40, 000 Market exchange of FF for $ at S 1$/FF = $. 20/FF +$8, 000 -FF 40, 000 Net gain on forward Risk profile of a forward contract +$2, 000 DV$/FF +$0. 05/FF -$0. 05/FF DS$/FF Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -17

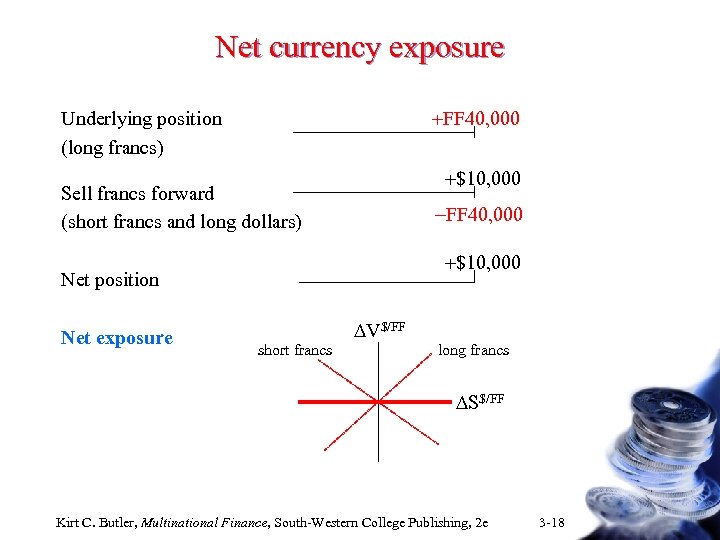

Net currency exposure +FF 40, 000 Underlying position (long francs) +$10, 000 Sell francs forward (short francs and long dollars) -FF 40, 000 +$10, 000 Net position Net exposure short francs DV$/FF long francs DS$/FF Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -18

Net currency exposure +FF 40, 000 Underlying position (long francs) +$10, 000 Sell francs forward (short francs and long dollars) -FF 40, 000 +$10, 000 Net position Net exposure short francs DV$/FF long francs DS$/FF Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -18

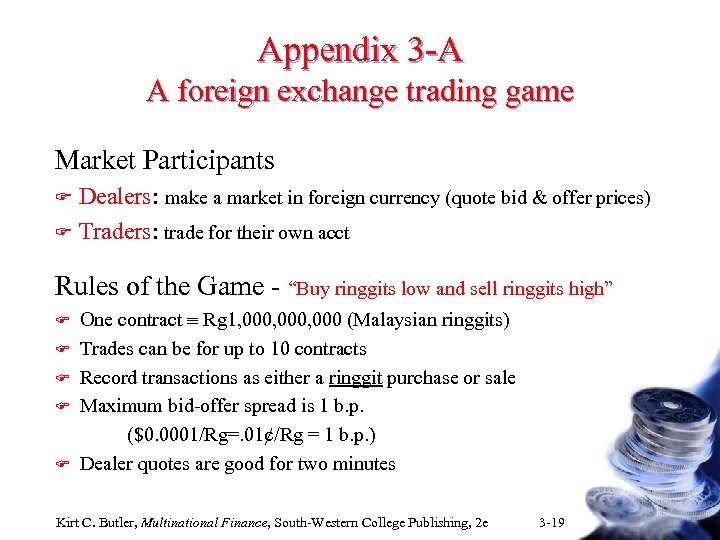

Appendix 3 -A A foreign exchange trading game Market Participants Dealers: make a market in foreign currency (quote bid & offer prices) F Traders: trade for their own acct F Rules of the Game - “Buy ringgits low and sell ringgits high” F F F One contract º Rg 1, 000, 000 (Malaysian ringgits) Trades can be for up to 10 contracts Record transactions as either a ringgit purchase or sale Maximum bid-offer spread is 1 b. p. ($0. 0001/Rg=. 01¢/Rg = 1 b. p. ) Dealer quotes are good for two minutes Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -19

Appendix 3 -A A foreign exchange trading game Market Participants Dealers: make a market in foreign currency (quote bid & offer prices) F Traders: trade for their own acct F Rules of the Game - “Buy ringgits low and sell ringgits high” F F F One contract º Rg 1, 000, 000 (Malaysian ringgits) Trades can be for up to 10 contracts Record transactions as either a ringgit purchase or sale Maximum bid-offer spread is 1 b. p. ($0. 0001/Rg=. 01¢/Rg = 1 b. p. ) Dealer quotes are good for two minutes Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -19

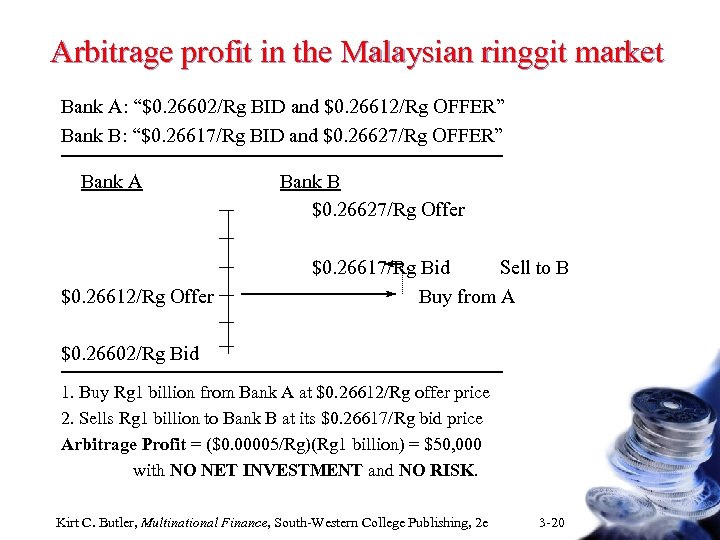

Arbitrage profit in the Malaysian ringgit market Bank A: “$0. 26602/Rg BID and $0. 26612/Rg OFFER” Bank B: “$0. 26617/Rg BID and $0. 26627/Rg OFFER” Bank A $0. 26612/Rg Offer Bank B $0. 26627/Rg Offer $0. 26617/Rg Bid Sell to B Buy from A $0. 26602/Rg Bid 1. Buy Rg 1 billion from Bank A at $0. 26612/Rg offer price 2. Sells Rg 1 billion to Bank B at its $0. 26617/Rg bid price Arbitrage Profit = ($0. 00005/Rg)(Rg 1 billion) = $50, 000 with NO NET INVESTMENT and NO RISK. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -20

Arbitrage profit in the Malaysian ringgit market Bank A: “$0. 26602/Rg BID and $0. 26612/Rg OFFER” Bank B: “$0. 26617/Rg BID and $0. 26627/Rg OFFER” Bank A $0. 26612/Rg Offer Bank B $0. 26627/Rg Offer $0. 26617/Rg Bid Sell to B Buy from A $0. 26602/Rg Bid 1. Buy Rg 1 billion from Bank A at $0. 26612/Rg offer price 2. Sells Rg 1 billion to Bank B at its $0. 26617/Rg bid price Arbitrage Profit = ($0. 00005/Rg)(Rg 1 billion) = $50, 000 with NO NET INVESTMENT and NO RISK. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -20

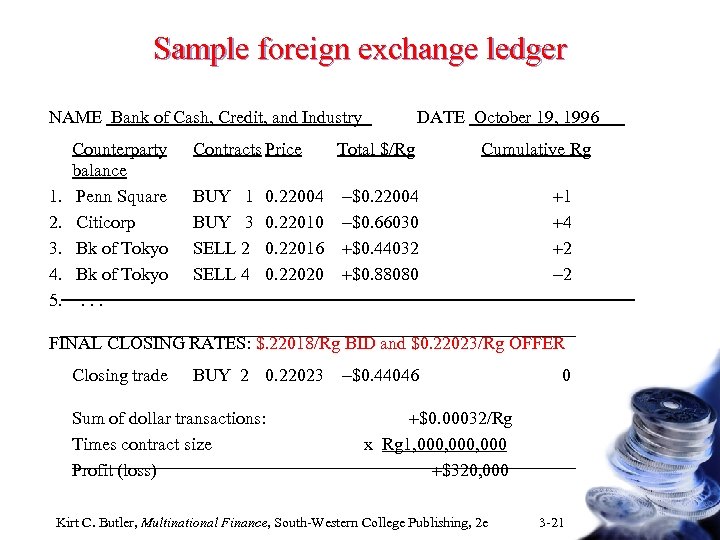

Sample foreign exchange ledger NAME Bank of Cash, Credit, and Industry 1. 2. 3. 4. 5. Counterparty balance Penn Square Citicorp Bk of Tokyo. . . DATE October 19, 1996 Contracts Price Total $/Rg BUY 1 BUY 3 SELL 2 SELL 4 -$0. 22004 -$0. 66030 +$0. 44032 +$0. 88080 0. 22004 0. 22010 0. 22016 0. 22020 Cumulative Rg +1 +4 +2 -2 FINAL CLOSING RATES: $. 22018/Rg BID and $0. 22023/Rg OFFER Closing trade BUY 2 0. 22023 Sum of dollar transactions: Times contract size Profit (loss) -$0. 44046 0 +$0. 00032/Rg x Rg 1, 000, 000 +$320, 000 Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -21

Sample foreign exchange ledger NAME Bank of Cash, Credit, and Industry 1. 2. 3. 4. 5. Counterparty balance Penn Square Citicorp Bk of Tokyo. . . DATE October 19, 1996 Contracts Price Total $/Rg BUY 1 BUY 3 SELL 2 SELL 4 -$0. 22004 -$0. 66030 +$0. 44032 +$0. 88080 0. 22004 0. 22010 0. 22016 0. 22020 Cumulative Rg +1 +4 +2 -2 FINAL CLOSING RATES: $. 22018/Rg BID and $0. 22023/Rg OFFER Closing trade BUY 2 0. 22023 Sum of dollar transactions: Times contract size Profit (loss) -$0. 44046 0 +$0. 00032/Rg x Rg 1, 000, 000 +$320, 000 Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -21

Opening prices: $0. 21945/Rg BID & $0. 21950/Rg OFFER News announcements: F F F The member nations of the G 7 have announced that they are buying dollars in an effort to stabilize the dollar. The U. S. Federal Reserve announces that in an effort to stimulate economic activity it is lowering the discount rate on overnight loans to commercial banks. The U. S. government reports that the U. S. money supply M 1 increased by $1 billion more than expected in the most recent quarter. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -22

Opening prices: $0. 21945/Rg BID & $0. 21950/Rg OFFER News announcements: F F F The member nations of the G 7 have announced that they are buying dollars in an effort to stabilize the dollar. The U. S. Federal Reserve announces that in an effort to stimulate economic activity it is lowering the discount rate on overnight loans to commercial banks. The U. S. government reports that the U. S. money supply M 1 increased by $1 billion more than expected in the most recent quarter. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -22

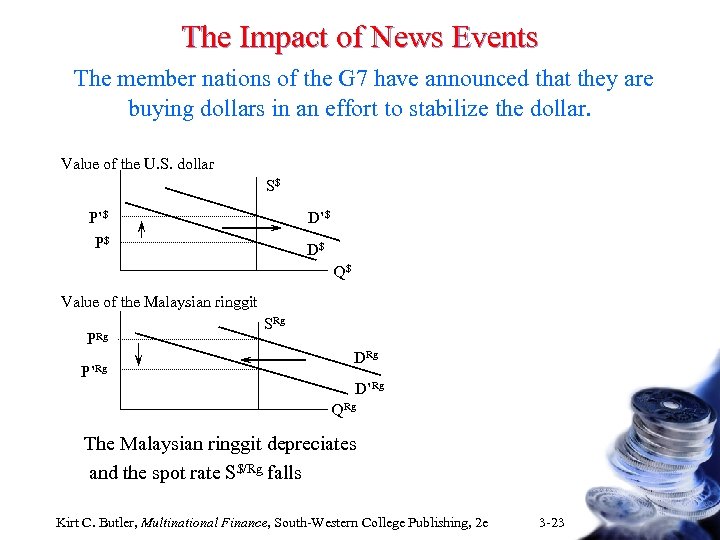

The Impact of News Events The member nations of the G 7 have announced that they are buying dollars in an effort to stabilize the dollar. Value of the U. S. dollar S$ P’$ D’$ P$ D$ Q$ Value of the Malaysian ringgit PRg P’Rg SRg D’Rg QRg The Malaysian ringgit depreciates and the spot rate S$/Rg falls Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -23

The Impact of News Events The member nations of the G 7 have announced that they are buying dollars in an effort to stabilize the dollar. Value of the U. S. dollar S$ P’$ D’$ P$ D$ Q$ Value of the Malaysian ringgit PRg P’Rg SRg D’Rg QRg The Malaysian ringgit depreciates and the spot rate S$/Rg falls Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -23

The Impact of News Events The U. S. Federal Reserve announces that in an effort to stimulate economic activity it is lowering the discount rate on overnight loans to commercial banks. This makes it easier for U. S. businesses to borrow and increases economic activity. If this also increases U. S. inflation, then the value of the U. S. dollar should fall. This will result in an appreciation of the ringgit against the dollar. Increases in the domestic discount rate usually, but not always, lead to increases in the value of the domestic currency. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -24

The Impact of News Events The U. S. Federal Reserve announces that in an effort to stimulate economic activity it is lowering the discount rate on overnight loans to commercial banks. This makes it easier for U. S. businesses to borrow and increases economic activity. If this also increases U. S. inflation, then the value of the U. S. dollar should fall. This will result in an appreciation of the ringgit against the dollar. Increases in the domestic discount rate usually, but not always, lead to increases in the value of the domestic currency. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -24

The Impact of News Events The U. S. government reports that U. S. money supply M 1 increased by $1 billion more than expected in the most recent quarter. While this would seem to result in a larger supply of dollars and hence a lower value for the dollar, the increase in the money supply has already occurred and hence should be reflected in the market price of the dollar. On the other hand, if the U. S. Federal Reserve is likely to react to this announcement by increasing the discount rate to slow down the economy, then the dollar may rise in anticipation of Fed policy. If the dollar rises against the ringgit, then the ringgit will fall against the dollar. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -25

The Impact of News Events The U. S. government reports that U. S. money supply M 1 increased by $1 billion more than expected in the most recent quarter. While this would seem to result in a larger supply of dollars and hence a lower value for the dollar, the increase in the money supply has already occurred and hence should be reflected in the market price of the dollar. On the other hand, if the U. S. Federal Reserve is likely to react to this announcement by increasing the discount rate to slow down the economy, then the dollar may rise in anticipation of Fed policy. If the dollar rises against the ringgit, then the ringgit will fall against the dollar. Kirt C. Butler, Multinational Finance, South-Western College Publishing, 2 e 3 -25