826e9f4275427623ec54f11f390bc06d.ppt

- Количество слайдов: 36

Part I. Principles A. B. C. D. E. Markets Market failure Discounting & PV Dynamic efficiency Pollution solutions

B. Market failure Chapter 2

From last time • MSC – marginal cost incurred by entire society, by the producer and by everyone else on whom the cost falls = MC + MEC • MSB – marginal benefit enjoyed by society, by the consumers and by everyone else who benefits from it = MB + MEB

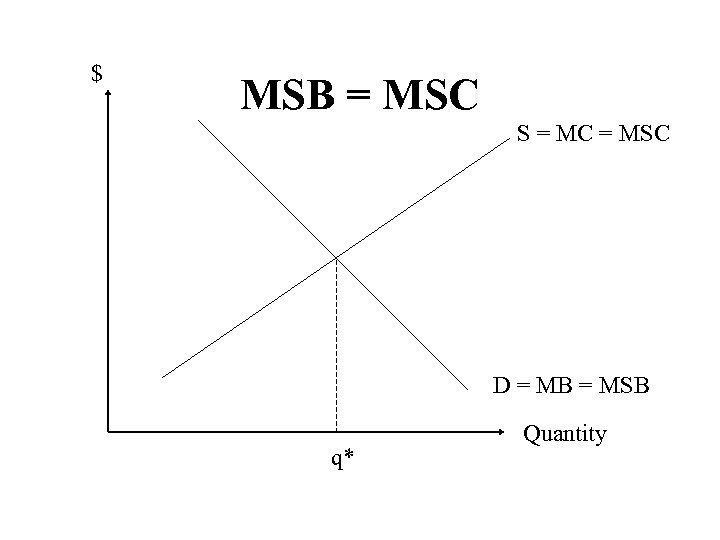

Maximizing Social Benefits • In order for social net benefits to be maximized, it is necessary that: MB = MSB & MC = MSC

$ MSB = MSC S = MC = MSC D = MB = MSB q* Quantity

Will MB = MSB, MC = MSC? • For many goods (sushi, surfboards), YES • For many environmental-related goods (paper produced by water polluting paper mill, snorkeling at Hanauma Bay), NO • MB ≠ MSB and/or MC ≠ MSC → market failure

Market Failure • Occurs when the market does not allocate resources efficiently. • 1 possible cause of market failure is a divergence between private and social costs (could also be between benefits). • Consider a steel producer.

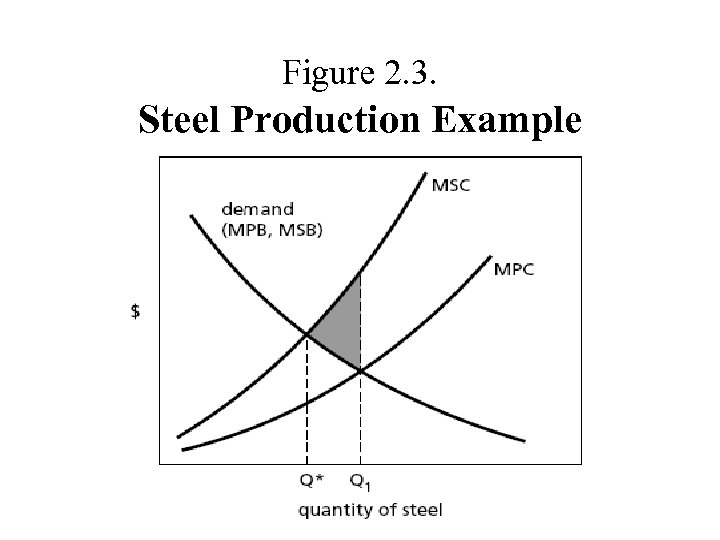

Production of steel • MC reflects all the private costs of production (labor, rent, materials) but does not reflect all the social costs associated with production (for example, air pollution). • Steel producers respond to private MC, steel consumers respond to private MB (here same as MSB) → equilibrium at Q 1

Figure 2. 3. Steel Production Example

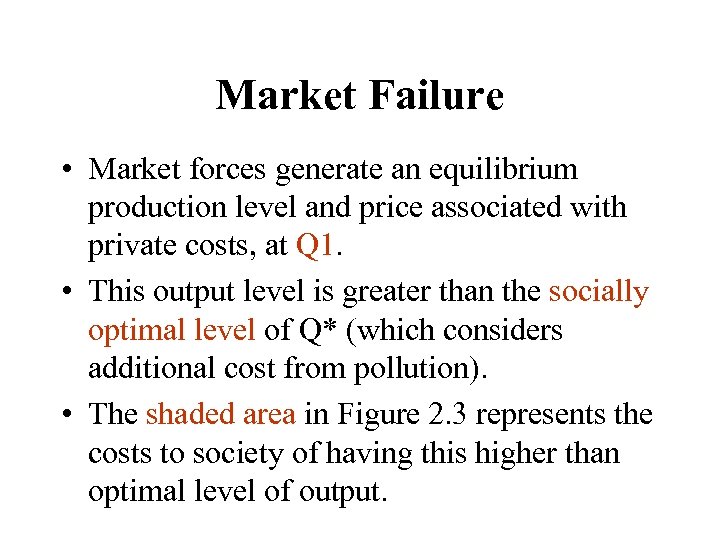

Market Failure • Market forces generate an equilibrium production level and price associated with private costs, at Q 1. • This output level is greater than the socially optimal level of Q* (which considers additional cost from pollution). • The shaded area in Figure 2. 3 represents the costs to society of having this higher than optimal level of output.

5 categories market failure 1. 2. 3. 4. 5. Imperfect competition Imperfect information Public goods Inappropriate government intervention Externalities

1. Imperfect competition – monopoly • Profit max: restrict output, raise price • Electricity, natural gas companies

2. Imperfect information • Consumers and/or producers do not know true costs and/or benefits associated with good or activity • Radon leaks into homes – if people don’t know health consequences, do not take proper mitigation measures • Deforestation – small farmers cutting and burning (better techniques, but don’t know them)

3. Public goods* • 2 characteristics distinguish from private goods: 1. Nonrival – 1 person’s consumption does not diminish amount available for others to consume 2. Nonexcludability – if 1 person can consume it, others can’t be excluded from consuming it

Pure public goods • 100% nonrival, 100% nonexcludable • Examples? • Climate – my consumption doesn’t decrease your consumption (nonrival); cannot exclude me from enjoying benefits (nonexcludable)

Pure or impure PG? • Beaches – nonrival, nonexcludable? • Rival – as more and more people use it, quality diminishes (congestion, environmental degradation) • Excludable – can charge user fees (as in NE, have to buy permits)

Pure or impure PG? • Spectator sport (baseball) – nonrival, nonexcludable? • 90% Nonrival – if I am watching, you can watch too, but congestion may diminish quality • Excludable – pay for admission, or pay for cable to watch on TV

Pure or impure PG? • Fish in a lake – nonrival, nonexcludable? • Rival – if I catch more fish, less left for you to catch • 90% nonexcludable – if I am fishing, you can fish too

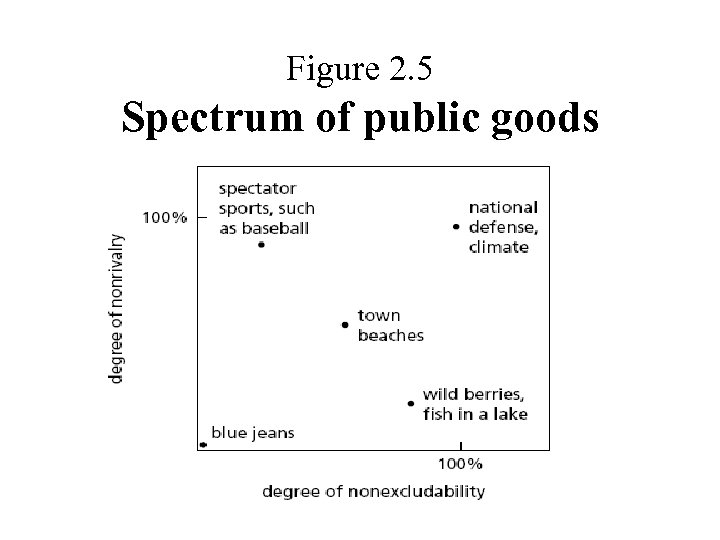

Figure 2. 5 Spectrum of public goods

Why market failure? • Free rider – person who enjoys benefits of good/service without paying for it • Clean air is public good – do you pay for it? • In general, public goods underprovided (since free riders) → market failure

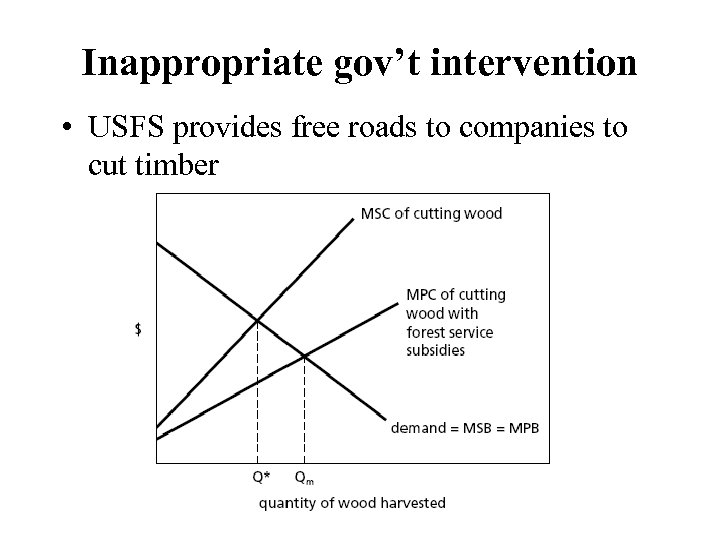

4. Inappropriate gov’t intervention • Gov’t intervention is a potential source of disparity between private and social values. • Often gov’t action to address an alternative issue creates this divergence. • Gov’t policy regarding timber leases has created a greater than socially optimal level of timber harvest.

USFS policy • Treats the forest as a private good – leases right to harvest to timber companies, ignoring other costs such as building roads, loss of ecosystem services, etc. • Harvester equates MC = MB • But forest has public goods characteristics – recreation, wildlife habitat, wilderness… • Therefore, too many trees cut as opposed to socially optimal level.

Inappropriate gov’t intervention • USFS provides free roads to companies to cut timber

5. Externalities* • Externalities are best described as “spillover costs or benefits”, unintended consequences or side effects, associated with market transactions. • These unintended costs or benefits will result in a divergence between private and social benefits and costs • Externalities are perhaps the most important class of market failures for the field of environmental and resource economics.

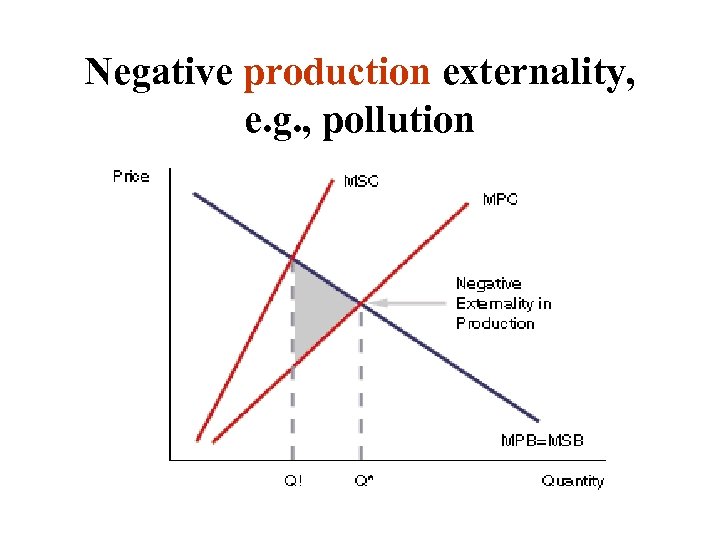

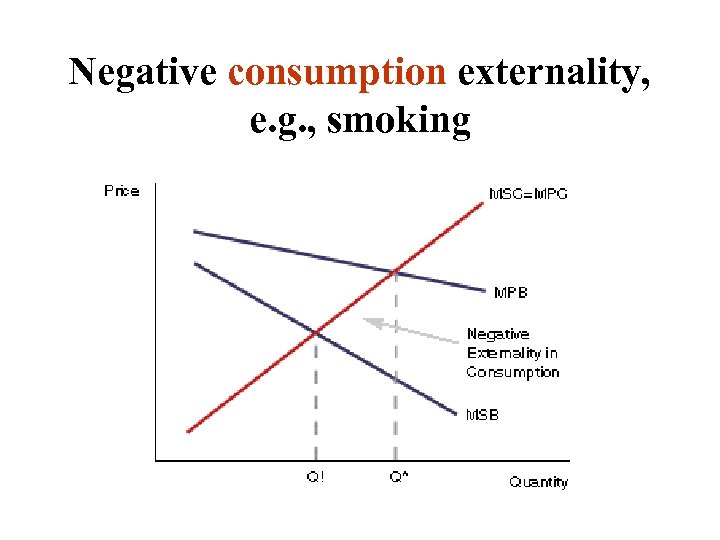

Negative Externalities • Can be generated by both producer and consumer side • Production – air pollution, noise • Consumption – smoking, traffic congestion

Negative production externality, e. g. , pollution

Negative consumption externality, e. g. , smoking

Positive Externalities • Can also be generated by both producer and consumer sides • Production – apples and honey, R&D • Consumption – gardens, education, vaccines

Pecuniary vs. technological • Pecuniary – price effect – unintended price change NOT an externality (demand for jeans ↑, price of cotton ↑, price of t-shirts ↑). Nothing has happened to ability to produce jeans/shirts, just price has changed. • Technological – air pollution – cannot grow as much cotton – price cotton ↑ – price of t-shirts ↑ – this is an EXTERNALITY

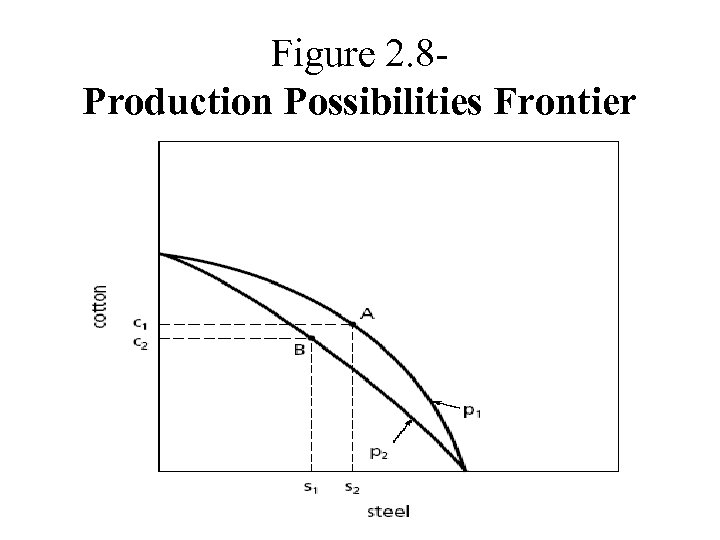

Figure 2. 8 Production Possibilities Frontier

Pecuniary vs. technological • Notice the lower curve in Figure 2. 8. • This represents a situation where the production of steel generates pollution (an externality). • Pollution reduces the yield per acre of cotton with the existing resource base.

Pecuniary vs. technological • A new lower PPF results from this externality. • Pecuniary externality would cause movement along same PPF, not shift of PPF. • Technical externality – reduces welfare. • Pecuniary shifts preferences.

Property Rights • Important reason market failure exists • Property rights for many environmental goods not well defined (clean air, water, etc. ) • Suffer from air pollution – who pays?

Open access externality • Lack of or inability to enforce property rights • E. g. , fisheries, grazing • Leads to overfishing, overgrazing • Even if rights exist, hard to enforce

Does efficiency = equity? • Market allocation of resources, absent of market failure, is efficient. • An efficient allocation maximizes the difference between social benefits and social costs. • An efficient allocation, however, does not imply equitable allocation. • The “best” distribution depends on what view of equity or fairness is held – return to this in Part II of class (criteria for environ. decision making)

Conclusion • This section focused on markets and how markets efficiently allocate goods and services. • When market failure occurs, MB MSB and/or MC MSC • Market failure can result from externalities, public goods, imperfect information, imperfect competition, and inappropriate government intervention.

826e9f4275427623ec54f11f390bc06d.ppt