66eeca52243d4fc333c54aecf6d6a7a9.ppt

- Количество слайдов: 101

PART FIVE LAUNCH Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

PART FIVE LAUNCH Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

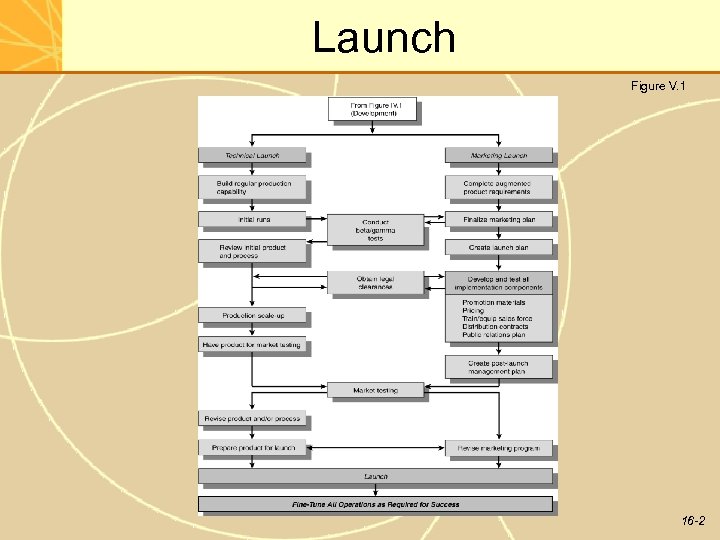

Launch Figure V. 1 16 -2

Launch Figure V. 1 16 -2

The Five Decision Sets that Lead to a Marketing Plan Figure V. 2 16 -3

The Five Decision Sets that Lead to a Marketing Plan Figure V. 2 16 -3

Common Myths About Marketing Planning for New Products Figure V. 3 • Marketing people make the decisions that constitute a marketing plan. • The technical work is complete when the new item hits the shipping dock. Marketing people take over. • The marketer’s task is to persuade the end user to use the new product. • The more sales potential there is in a market segment, the better that segment is as a target candidate. • The pioneer wins control of a new market. • As with Broadway shows, opening night is the culmination of everything we have been working for. 16 -4

Common Myths About Marketing Planning for New Products Figure V. 3 • Marketing people make the decisions that constitute a marketing plan. • The technical work is complete when the new item hits the shipping dock. Marketing people take over. • The marketer’s task is to persuade the end user to use the new product. • The more sales potential there is in a market segment, the better that segment is as a target candidate. • The pioneer wins control of a new market. • As with Broadway shows, opening night is the culmination of everything we have been working for. 16 -4

Chapter 16 Strategic Launch Planning 16 -5

Chapter 16 Strategic Launch Planning 16 -5

Strategic Givens Corporate, some team decisions made earlier. Often found in the PIC Guidelines. • A specified gross margin: affects funding. • Speed-to-market: affects promotional outlays and schedules. • Commitment to a given channel: affects distribution plan. • Advertising policy: affects promotion decisions. • Pricing policy: affects decision to use penetration or skimming pricing (slide down demand curve). 16 -6

Strategic Givens Corporate, some team decisions made earlier. Often found in the PIC Guidelines. • A specified gross margin: affects funding. • Speed-to-market: affects promotional outlays and schedules. • Commitment to a given channel: affects distribution plan. • Advertising policy: affects promotion decisions. • Pricing policy: affects decision to use penetration or skimming pricing (slide down demand curve). 16 -6

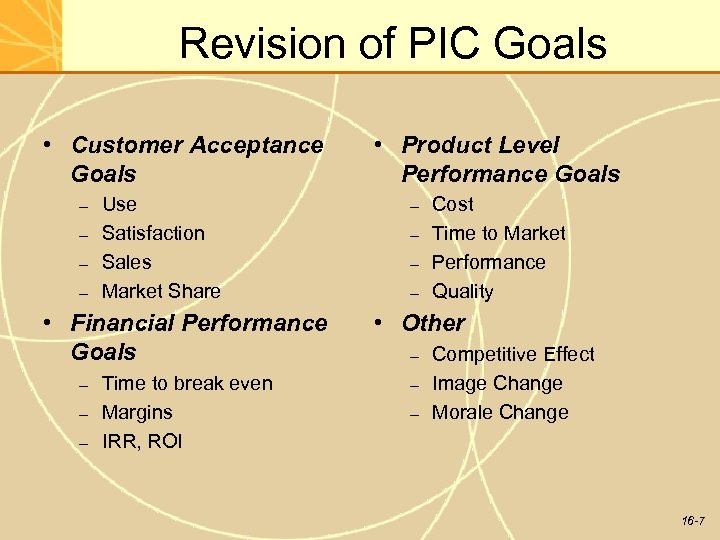

Revision of PIC Goals • Customer Acceptance Goals – – Use Satisfaction Sales Market Share • Financial Performance Goals – – – Time to break even Margins IRR, ROI • Product Level Performance Goals – – Cost Time to Market Performance Quality • Other – – – Competitive Effect Image Change Morale Change 16 -7

Revision of PIC Goals • Customer Acceptance Goals – – Use Satisfaction Sales Market Share • Financial Performance Goals – – – Time to break even Margins IRR, ROI • Product Level Performance Goals – – Cost Time to Market Performance Quality • Other – – – Competitive Effect Image Change Morale Change 16 -7

Strategic Platform Decisions • • Permanence Aggressiveness Type of Demand Sought Competitive Advantage Product Line Replacement Competitive Relationship Scope of Market Entry Image 16 -8

Strategic Platform Decisions • • Permanence Aggressiveness Type of Demand Sought Competitive Advantage Product Line Replacement Competitive Relationship Scope of Market Entry Image 16 -8

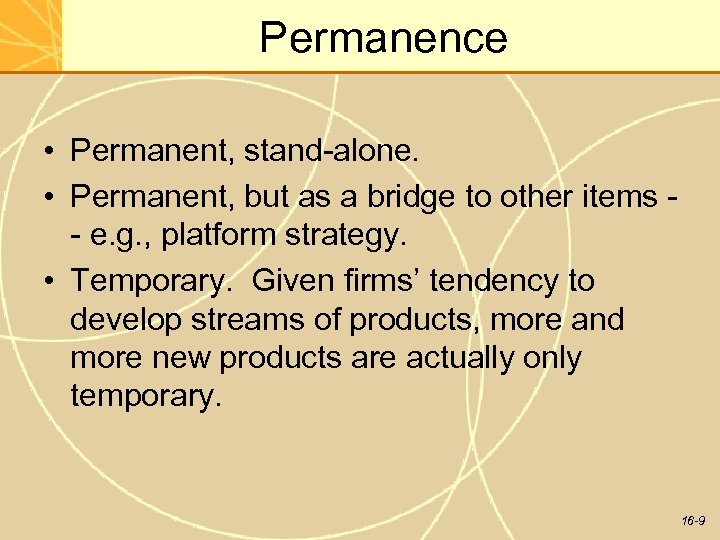

Permanence • Permanent, stand-alone. • Permanent, but as a bridge to other items - e. g. , platform strategy. • Temporary. Given firms’ tendency to develop streams of products, more and more new products are actually only temporary. 16 -9

Permanence • Permanent, stand-alone. • Permanent, but as a bridge to other items - e. g. , platform strategy. • Temporary. Given firms’ tendency to develop streams of products, more and more new products are actually only temporary. 16 -9

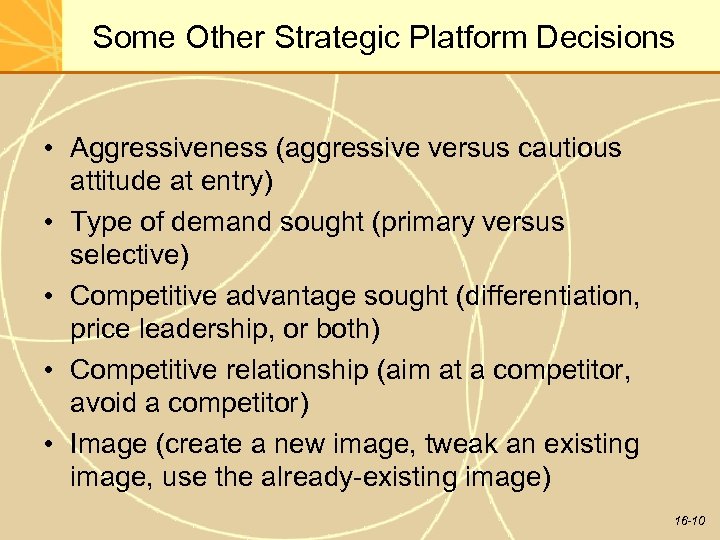

Some Other Strategic Platform Decisions • Aggressiveness (aggressive versus cautious attitude at entry) • Type of demand sought (primary versus selective) • Competitive advantage sought (differentiation, price leadership, or both) • Competitive relationship (aim at a competitor, avoid a competitor) • Image (create a new image, tweak an existing image, use the already-existing image) 16 -10

Some Other Strategic Platform Decisions • Aggressiveness (aggressive versus cautious attitude at entry) • Type of demand sought (primary versus selective) • Competitive advantage sought (differentiation, price leadership, or both) • Competitive relationship (aim at a competitor, avoid a competitor) • Image (create a new image, tweak an existing image, use the already-existing image) 16 -10

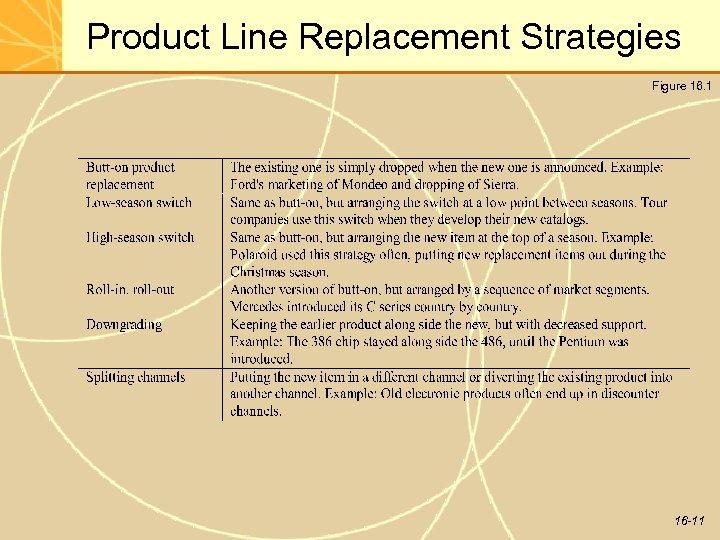

Product Line Replacement Strategies Figure 16. 1 16 -11

Product Line Replacement Strategies Figure 16. 1 16 -11

Scope of Market Entry This is not test marketing. This is launch. All forces in place and working. • Roll out slowly -- checking product, trade and service capabilities, manufacturing fulfillment, promotion communication, etc. • Roll out moderately, but go to full market as soon as volume success seems assured. • Roll out rapidly -- full commitment to total market, restricted only by capacity. 16 -12

Scope of Market Entry This is not test marketing. This is launch. All forces in place and working. • Roll out slowly -- checking product, trade and service capabilities, manufacturing fulfillment, promotion communication, etc. • Roll out moderately, but go to full market as soon as volume success seems assured. • Roll out rapidly -- full commitment to total market, restricted only by capacity. 16 -12

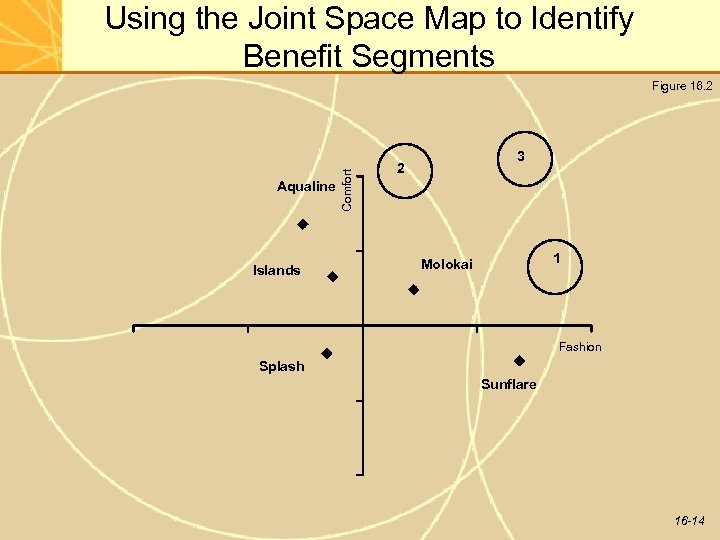

The Target Market Decision • Alternative ways to segment a market – end-use, geographic/demographic, behavioral/psychographic, benefit segmentation • Micromarketing and mass customization • Also consider the diffusion of innovation 16 -13

The Target Market Decision • Alternative ways to segment a market – end-use, geographic/demographic, behavioral/psychographic, benefit segmentation • Micromarketing and mass customization • Also consider the diffusion of innovation 16 -13

Using the Joint Space Map to Identify Benefit Segments Aqualine Islands Comfort Figure 16. 2 3 2 1 Molokai Fashion Splash Sunflare 16 -14

Using the Joint Space Map to Identify Benefit Segments Aqualine Islands Comfort Figure 16. 2 3 2 1 Molokai Fashion Splash Sunflare 16 -14

Factors Affecting Diffusion of Innovation • • • Relative Advantage Compatibility Complexity Divisibility Communicability 16 -15

Factors Affecting Diffusion of Innovation • • • Relative Advantage Compatibility Complexity Divisibility Communicability 16 -15

Product Positioning • • Who -- Why -- How To whom are we marketing? Why should they buy it? How do we best make the claim? 16 -16

Product Positioning • • Who -- Why -- How To whom are we marketing? Why should they buy it? How do we best make the claim? 16 -16

To Whom Are We Marketing? • Users vs. non-users (primary vs. selective demand) • Target market criteria (demographic, geographic, psychographic, benefit segmentation) • Everybody -- no narrowing down (mass customization, Post-It notes) The real issue here is commitment -- by all new product participants and by management 16 -17

To Whom Are We Marketing? • Users vs. non-users (primary vs. selective demand) • Target market criteria (demographic, geographic, psychographic, benefit segmentation) • Everybody -- no narrowing down (mass customization, Post-It notes) The real issue here is commitment -- by all new product participants and by management 16 -17

Why Should They Buy It? • This too we have been testing -- basic concept statement used for testing and for guiding technical (e. g. , QFD “Whats”), and the key reason on the “How likely would you be to buy this if we marketed it? ” (product use test) • Formatted in three ways: – Solves major problem current products do not. – Better meet needs and preferences. – Lower price than current items. 16 -18

Why Should They Buy It? • This too we have been testing -- basic concept statement used for testing and for guiding technical (e. g. , QFD “Whats”), and the key reason on the “How likely would you be to buy this if we marketed it? ” (product use test) • Formatted in three ways: – Solves major problem current products do not. – Better meet needs and preferences. – Lower price than current items. 16 -18

How Do We Make the Claim? • Product positioning statement is a strategic driver --a core item -- not a list of advantages. Some new products get one short sentence -technical items more. • Can be stated as one or more features (what it is). • Can be stated as a function (how it works). • Can be stated as one or more benefits (how the user gains). • Can be stated as a surrogate (no features, functions, benefits). 16 -19

How Do We Make the Claim? • Product positioning statement is a strategic driver --a core item -- not a list of advantages. Some new products get one short sentence -technical items more. • Can be stated as one or more features (what it is). • Can be stated as a function (how it works). • Can be stated as one or more benefits (how the user gains). • Can be stated as a surrogate (no features, functions, benefits). 16 -19

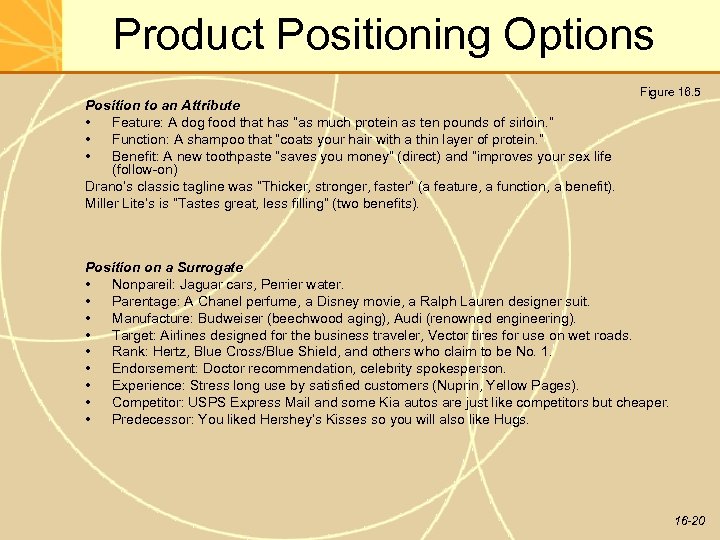

Product Positioning Options Position to an Attribute • Feature: A dog food that has “as much protein as ten pounds of sirloin. ” • Function: A shampoo that “coats your hair with a thin layer of protein. ” • Benefit: A new toothpaste “saves you money” (direct) and “improves your sex life (follow-on) Drano’s classic tagline was “Thicker, stronger, faster” (a feature, a function, a benefit). Miller Lite’s is “Tastes great, less filling” (two benefits). Figure 16. 5 Position on a Surrogate • Nonpareil: Jaguar cars, Perrier water. • Parentage: A Chanel perfume, a Disney movie, a Ralph Lauren designer suit. • Manufacture: Budweiser (beechwood aging), Audi (renowned engineering). • Target: Airlines designed for the business traveler, Vector tires for use on wet roads. • Rank: Hertz, Blue Cross/Blue Shield, and others who claim to be No. 1. • Endorsement: Doctor recommendation, celebrity spokesperson. • Experience: Stress long use by satisfied customers (Nuprin, Yellow Pages). • Competitor: USPS Express Mail and some Kia autos are just like competitors but cheaper. • Predecessor: You liked Hershey’s Kisses so you will also like Hugs. 16 -20

Product Positioning Options Position to an Attribute • Feature: A dog food that has “as much protein as ten pounds of sirloin. ” • Function: A shampoo that “coats your hair with a thin layer of protein. ” • Benefit: A new toothpaste “saves you money” (direct) and “improves your sex life (follow-on) Drano’s classic tagline was “Thicker, stronger, faster” (a feature, a function, a benefit). Miller Lite’s is “Tastes great, less filling” (two benefits). Figure 16. 5 Position on a Surrogate • Nonpareil: Jaguar cars, Perrier water. • Parentage: A Chanel perfume, a Disney movie, a Ralph Lauren designer suit. • Manufacture: Budweiser (beechwood aging), Audi (renowned engineering). • Target: Airlines designed for the business traveler, Vector tires for use on wet roads. • Rank: Hertz, Blue Cross/Blue Shield, and others who claim to be No. 1. • Endorsement: Doctor recommendation, celebrity spokesperson. • Experience: Stress long use by satisfied customers (Nuprin, Yellow Pages). • Competitor: USPS Express Mail and some Kia autos are just like competitors but cheaper. • Predecessor: You liked Hershey’s Kisses so you will also like Hugs. 16 -20

Branding Decisions • What is the brand’s role or purpose? • Are you planning a line of products? • Do you expect a long-term position in the market? • How good is your budget? • Physical/sensory qualities of brand considered? • Message clear and relevant? • Insulting or irritating to anyone? 16 -21

Branding Decisions • What is the brand’s role or purpose? • Are you planning a line of products? • Do you expect a long-term position in the market? • How good is your budget? • Physical/sensory qualities of brand considered? • Message clear and relevant? • Insulting or irritating to anyone? 16 -21

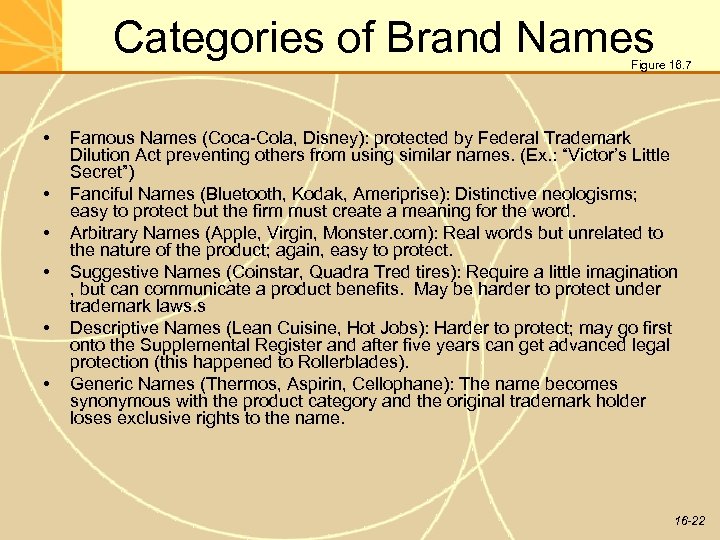

Categories of Brand Names Figure 16. 7 • • • Famous Names (Coca-Cola, Disney): protected by Federal Trademark Dilution Act preventing others from using similar names. (Ex. : “Victor’s Little Secret”) Fanciful Names (Bluetooth, Kodak, Ameriprise): Distinctive neologisms; easy to protect but the firm must create a meaning for the word. Arbitrary Names (Apple, Virgin, Monster. com): Real words but unrelated to the nature of the product; again, easy to protect. Suggestive Names (Coinstar, Quadra Tred tires): Require a little imagination , but can communicate a product benefits. May be harder to protect under trademark laws. s Descriptive Names (Lean Cuisine, Hot Jobs): Harder to protect; may go first onto the Supplemental Register and after five years can get advanced legal protection (this happened to Rollerblades). Generic Names (Thermos, Aspirin, Cellophane): The name becomes synonymous with the product category and the original trademark holder loses exclusive rights to the name. 16 -22

Categories of Brand Names Figure 16. 7 • • • Famous Names (Coca-Cola, Disney): protected by Federal Trademark Dilution Act preventing others from using similar names. (Ex. : “Victor’s Little Secret”) Fanciful Names (Bluetooth, Kodak, Ameriprise): Distinctive neologisms; easy to protect but the firm must create a meaning for the word. Arbitrary Names (Apple, Virgin, Monster. com): Real words but unrelated to the nature of the product; again, easy to protect. Suggestive Names (Coinstar, Quadra Tred tires): Require a little imagination , but can communicate a product benefits. May be harder to protect under trademark laws. s Descriptive Names (Lean Cuisine, Hot Jobs): Harder to protect; may go first onto the Supplemental Register and after five years can get advanced legal protection (this happened to Rollerblades). Generic Names (Thermos, Aspirin, Cellophane): The name becomes synonymous with the product category and the original trademark holder loses exclusive rights to the name. 16 -22

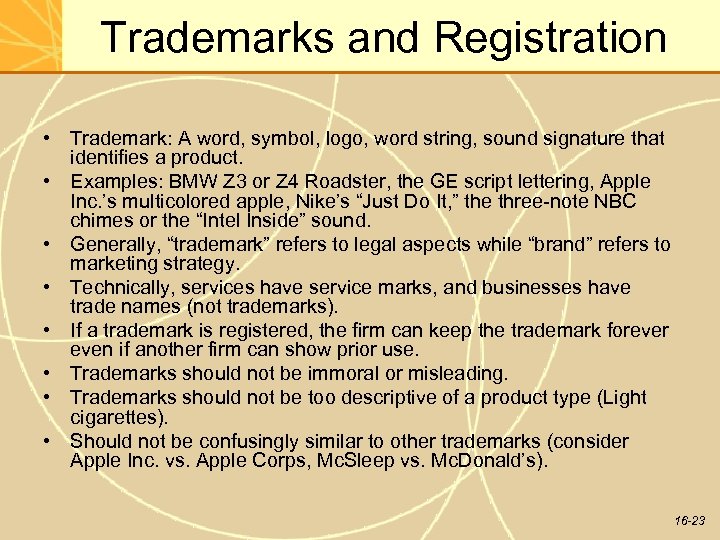

Trademarks and Registration • Trademark: A word, symbol, logo, word string, sound signature that identifies a product. • Examples: BMW Z 3 or Z 4 Roadster, the GE script lettering, Apple Inc. ’s multicolored apple, Nike’s “Just Do It, ” the three-note NBC chimes or the “Intel Inside” sound. • Generally, “trademark” refers to legal aspects while “brand” refers to marketing strategy. • Technically, services have service marks, and businesses have trade names (not trademarks). • If a trademark is registered, the firm can keep the trademark forever even if another firm can show prior use. • Trademarks should not be immoral or misleading. • Trademarks should not be too descriptive of a product type (Light cigarettes). • Should not be confusingly similar to other trademarks (consider Apple Inc. vs. Apple Corps, Mc. Sleep vs. Mc. Donald’s). 16 -23

Trademarks and Registration • Trademark: A word, symbol, logo, word string, sound signature that identifies a product. • Examples: BMW Z 3 or Z 4 Roadster, the GE script lettering, Apple Inc. ’s multicolored apple, Nike’s “Just Do It, ” the three-note NBC chimes or the “Intel Inside” sound. • Generally, “trademark” refers to legal aspects while “brand” refers to marketing strategy. • Technically, services have service marks, and businesses have trade names (not trademarks). • If a trademark is registered, the firm can keep the trademark forever even if another firm can show prior use. • Trademarks should not be immoral or misleading. • Trademarks should not be too descriptive of a product type (Light cigarettes). • Should not be confusingly similar to other trademarks (consider Apple Inc. vs. Apple Corps, Mc. Sleep vs. Mc. Donald’s). 16 -23

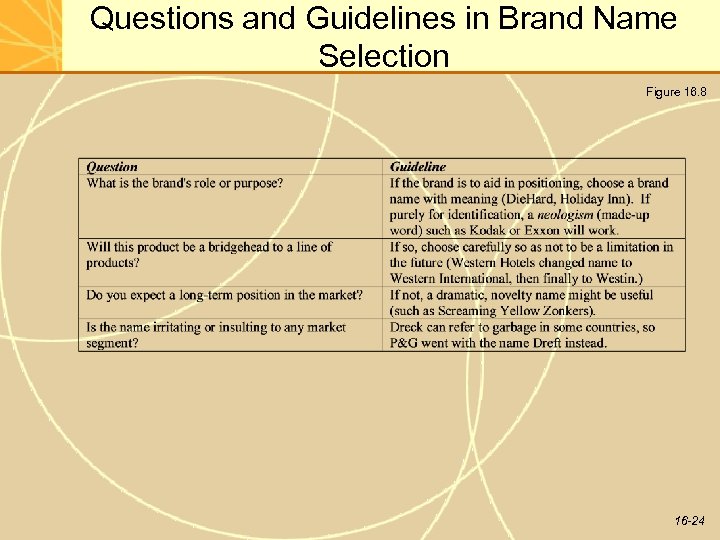

Questions and Guidelines in Brand Name Selection Figure 16. 8 16 -24

Questions and Guidelines in Brand Name Selection Figure 16. 8 16 -24

Brand Name Pitfalls To Avoid Figure 16 -9 • Not anticipating future uses of the name: too local, too “cute, ” may be misunderstood in some languages or dialects. • Not allocating enough time for the process (should be planned, not a rush job). • Choosing the wrong comfort level: some provocative names like Yahoo! might be better than comfortable but uninspiring names. • Having too many individuals involved: assign a team that understands brand naming and its importance. • Other pitfalls: not identifying the key decision makers, getting “stuck” on a name early without gathering objective feedback, not checking negative meanings in foreign markets, not hiring a good patent attorney! Source: Lee Schaeffer and Jim Twerdahl, “Giving Your Product the Right Name, ” in A. Griffin and S. M. Somermeyer, The PDMA Toolbook 3 for New Product Development, Wiley, 2007, Ch. 8. 16 -25

Brand Name Pitfalls To Avoid Figure 16 -9 • Not anticipating future uses of the name: too local, too “cute, ” may be misunderstood in some languages or dialects. • Not allocating enough time for the process (should be planned, not a rush job). • Choosing the wrong comfort level: some provocative names like Yahoo! might be better than comfortable but uninspiring names. • Having too many individuals involved: assign a team that understands brand naming and its importance. • Other pitfalls: not identifying the key decision makers, getting “stuck” on a name early without gathering objective feedback, not checking negative meanings in foreign markets, not hiring a good patent attorney! Source: Lee Schaeffer and Jim Twerdahl, “Giving Your Product the Right Name, ” in A. Griffin and S. M. Somermeyer, The PDMA Toolbook 3 for New Product Development, Wiley, 2007, Ch. 8. 16 -25

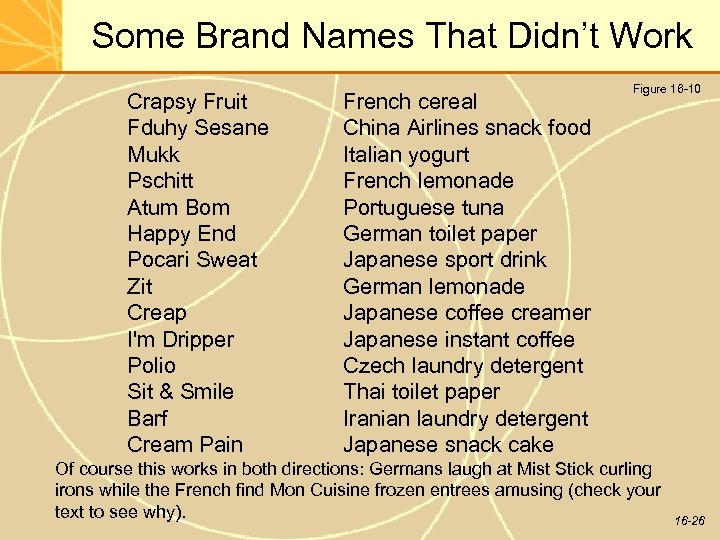

Some Brand Names That Didn’t Work Crapsy Fruit Fduhy Sesane Mukk Pschitt Atum Bom Happy End Pocari Sweat Zit Creap I'm Dripper Polio Sit & Smile Barf Cream Pain French cereal China Airlines snack food Italian yogurt French lemonade Portuguese tuna German toilet paper Japanese sport drink German lemonade Japanese coffee creamer Japanese instant coffee Czech laundry detergent Thai toilet paper Iranian laundry detergent Japanese snack cake Figure 16 -10 Of course this works in both directions: Germans laugh at Mist Stick curling irons while the French find Mon Cuisine frozen entrees amusing (check your text to see why). 16 -26

Some Brand Names That Didn’t Work Crapsy Fruit Fduhy Sesane Mukk Pschitt Atum Bom Happy End Pocari Sweat Zit Creap I'm Dripper Polio Sit & Smile Barf Cream Pain French cereal China Airlines snack food Italian yogurt French lemonade Portuguese tuna German toilet paper Japanese sport drink German lemonade Japanese coffee creamer Japanese instant coffee Czech laundry detergent Thai toilet paper Iranian laundry detergent Japanese snack cake Figure 16 -10 Of course this works in both directions: Germans laugh at Mist Stick curling irons while the French find Mon Cuisine frozen entrees amusing (check your text to see why). 16 -26

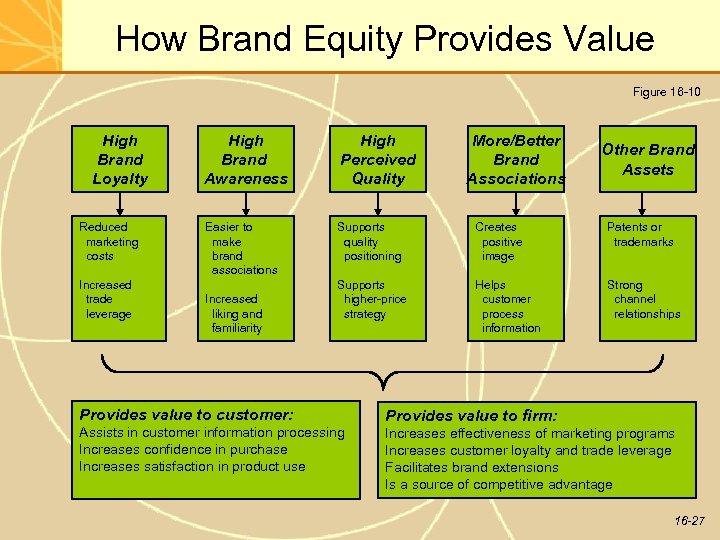

How Brand Equity Provides Value Figure 16 -10 High Brand Loyalty Reduced marketing costs Increased trade leverage High Brand Awareness High Perceived Quality Easier to make brand associations Supports quality positioning Creates positive image Patents or trademarks Supports higher-price strategy Helps customer process information Strong channel relationships Increased liking and familiarity More/Better Brand Associations Other Brand Assets Provides value to customer: Provides value to firm: Assists in customer information processing Increases confidence in purchase Increases satisfaction in product use Increases effectiveness of marketing programs Increases customer loyalty and trade leverage Facilitates brand extensions Is a source of competitive advantage 16 -27

How Brand Equity Provides Value Figure 16 -10 High Brand Loyalty Reduced marketing costs Increased trade leverage High Brand Awareness High Perceived Quality Easier to make brand associations Supports quality positioning Creates positive image Patents or trademarks Supports higher-price strategy Helps customer process information Strong channel relationships Increased liking and familiarity More/Better Brand Associations Other Brand Assets Provides value to customer: Provides value to firm: Assists in customer information processing Increases confidence in purchase Increases satisfaction in product use Increases effectiveness of marketing programs Increases customer loyalty and trade leverage Facilitates brand extensions Is a source of competitive advantage 16 -27

Building Brand Equity • Getting awareness of the brand the meaning. • Making brand associations -- even the factory location in Saturn’s case. • Building perceived quality • Loyalty in repurchase -- locking them in • Getting reseller support 16 -28

Building Brand Equity • Getting awareness of the brand the meaning. • Making brand associations -- even the factory location in Saturn’s case. • Building perceived quality • Loyalty in repurchase -- locking them in • Getting reseller support 16 -28

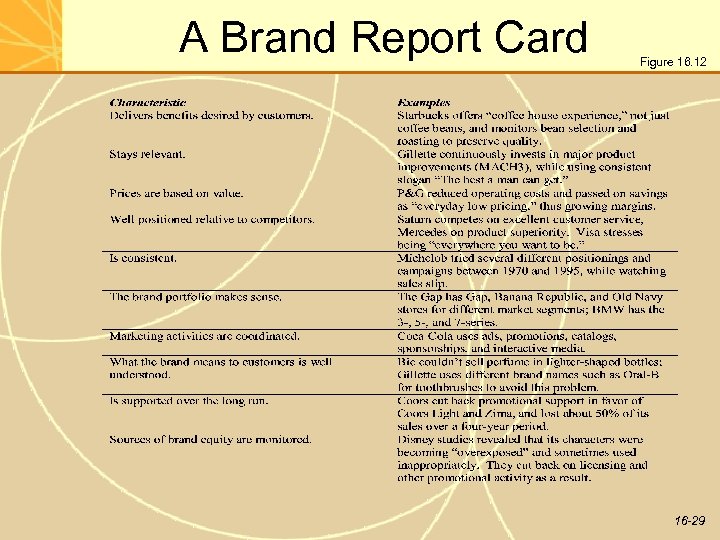

A Brand Report Card Figure 16. 12 16 -29

A Brand Report Card Figure 16. 12 16 -29

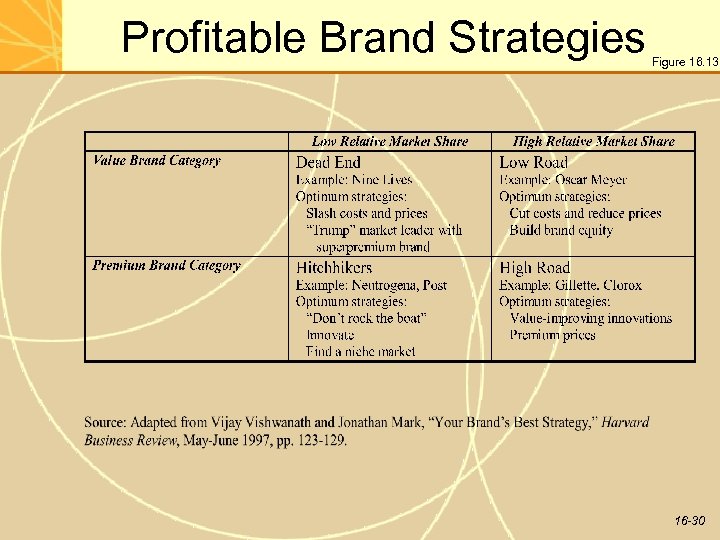

Profitable Brand Strategies Figure 16. 13 16 -30

Profitable Brand Strategies Figure 16. 13 16 -30

Chapter 17 Implementation of the Strategic Plan Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Chapter 17 Implementation of the Strategic Plan Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

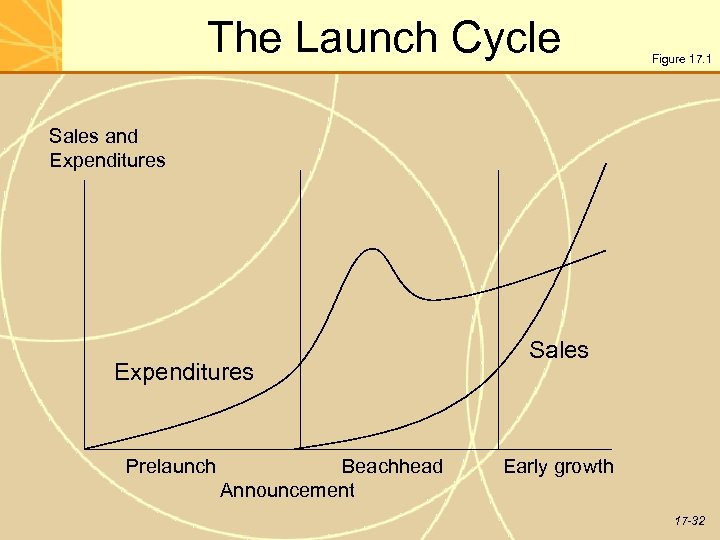

The Launch Cycle Figure 17. 1 Sales and Expenditures Prelaunch Beachhead Announcement Sales Early growth 17 -32

The Launch Cycle Figure 17. 1 Sales and Expenditures Prelaunch Beachhead Announcement Sales Early growth 17 -32

Tactical Launch Decisions and Actions, Showing Influences on Demand Figure 17. 2 17 -33

Tactical Launch Decisions and Actions, Showing Influences on Demand Figure 17. 2 17 -33

Preannouncement • Getting to be popular, and very creatively managed. • Far from the old days of “tease the public. ” • Preannouncement signaling may be used (“vaporware”). 17 -34

Preannouncement • Getting to be popular, and very creatively managed. • Far from the old days of “tease the public. ” • Preannouncement signaling may be used (“vaporware”). 17 -34

Beachhead • This refers to the heavy expenditure needed to overcome sales inertia (“getting the ball rolling”). • Steep rising expenditures curve during this period, up to point where sales are increasing at an increasing rate. • Begins with the announcement. • Key decision during beachhead: when do you end it? How do you know inertia has been overcome? 17 -35

Beachhead • This refers to the heavy expenditure needed to overcome sales inertia (“getting the ball rolling”). • Steep rising expenditures curve during this period, up to point where sales are increasing at an increasing rate. • Begins with the announcement. • Key decision during beachhead: when do you end it? How do you know inertia has been overcome? 17 -35

Copy Strategy Statement • Communications tools used at launch will have certain deliverables. • The way in which the firm communicates these deliverables to the advertising and promotion creative people is the copy strategy statement. • Typical contents: – The market segment targeted – The product positioning statement – The communications (promotion) mix – The major copy points to be communicated. 17 -36

Copy Strategy Statement • Communications tools used at launch will have certain deliverables. • The way in which the firm communicates these deliverables to the advertising and promotion creative people is the copy strategy statement. • Typical contents: – The market segment targeted – The product positioning statement – The communications (promotion) mix – The major copy points to be communicated. 17 -36

Typical Examples of Copy Points • “The provider of this insurance policy is the largest in the world. ” • “This cellular phone has no geographic limitation. ” • “Dockers are available at JCPenney. ” • “Future neurosurgeons benefit from the hand-to-eye skills of computer games like this one. ” There is no limit to the choices here, but there must be a focus. Only a few copy points are going to be accomplished at a time. 17 -37

Typical Examples of Copy Points • “The provider of this insurance policy is the largest in the world. ” • “This cellular phone has no geographic limitation. ” • “Dockers are available at JCPenney. ” • “Future neurosurgeons benefit from the hand-to-eye skills of computer games like this one. ” There is no limit to the choices here, but there must be a focus. Only a few copy points are going to be accomplished at a time. 17 -37

A-T-A-R Goals: The New Product Group’s Obligation • New product group must persuade itself and management that the plan can achieve the necessary awareness, availability, trial, and repeat purchase. . . • and that it can do so in sufficient quantity and at acceptable cost. 17 -38

A-T-A-R Goals: The New Product Group’s Obligation • New product group must persuade itself and management that the plan can achieve the necessary awareness, availability, trial, and repeat purchase. . . • and that it can do so in sufficient quantity and at acceptable cost. 17 -38

Motivating Distributors • • Figure 17. 3 Increase distributor’s unit volume. Increase distributor’s unit margin. Reduce distributor’s cost of doing business. Change distributor’s attitude toward the line. 17 -39

Motivating Distributors • • Figure 17. 3 Increase distributor’s unit volume. Increase distributor’s unit margin. Reduce distributor’s cost of doing business. Change distributor’s attitude toward the line. 17 -39

Barriers to Trial • Lack of interest in the claim. • Lack of belief in the claim. • Rejecting something negative about product. • Complacency. • Competitive ties. • Doubts about trial. • Lack of usage opportunity. • Cost. • Routines. • Risk of rejection. 17 -40

Barriers to Trial • Lack of interest in the claim. • Lack of belief in the claim. • Rejecting something negative about product. • Complacency. • Competitive ties. • Doubts about trial. • Lack of usage opportunity. • Cost. • Routines. • Risk of rejection. 17 -40

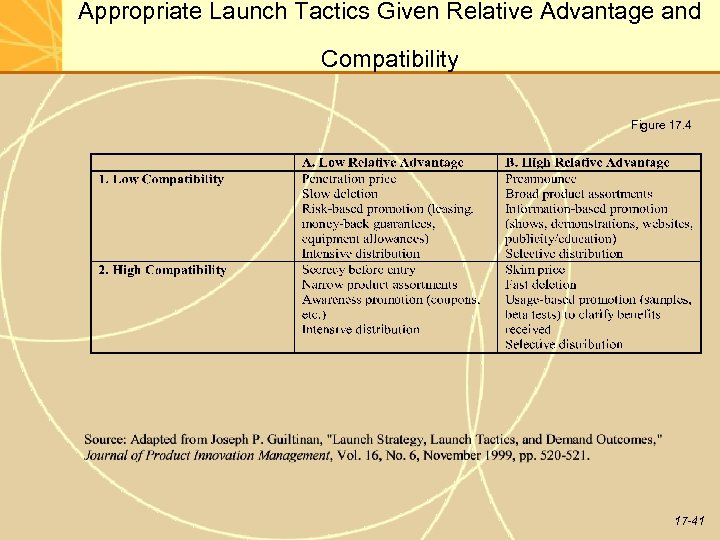

Appropriate Launch Tactics Given Relative Advantage and Compatibility Figure 17. 4 17 -41

Appropriate Launch Tactics Given Relative Advantage and Compatibility Figure 17. 4 17 -41

Chapter 18 Market Testing Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Chapter 18 Market Testing Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

What Is Market Testing? • Market testing is not test marketing! • Test marketing is one of many forms of market testing -- others include simulated test market, informal sale, minimarket, rollout. • Test marketing is also a much less common form now due to cost and time commitments and other drawbacks. 18 -43

What Is Market Testing? • Market testing is not test marketing! • Test marketing is one of many forms of market testing -- others include simulated test market, informal sale, minimarket, rollout. • Test marketing is also a much less common form now due to cost and time commitments and other drawbacks. 18 -43

Where We Are Today in Market Testing • Scanner systems allow for immediate collection of product sales data. • Mathematical sales forecasting models are readily available that can run on a relatively limited amount of data. • We are “building quality in, ” testing the marketing components of the product at early stages (ads, selling visuals, service contracts, package designs, etc. ) rather than testing the whole product at the end. • Increased competition puts greater pressure on managers to accelerate product cycle time. • Market testing is a team issue, not solely in the province of the market research department. 18 -44

Where We Are Today in Market Testing • Scanner systems allow for immediate collection of product sales data. • Mathematical sales forecasting models are readily available that can run on a relatively limited amount of data. • We are “building quality in, ” testing the marketing components of the product at early stages (ads, selling visuals, service contracts, package designs, etc. ) rather than testing the whole product at the end. • Increased competition puts greater pressure on managers to accelerate product cycle time. • Market testing is a team issue, not solely in the province of the market research department. 18 -44

Decision Matrix on When to Market Test Figure 18. 1 High Cost and Time Savings Low Scope of Learning and Accuracy Low High Stages of the product development cycle 18 -45

Decision Matrix on When to Market Test Figure 18. 1 High Cost and Time Savings Low Scope of Learning and Accuracy Low High Stages of the product development cycle 18 -45

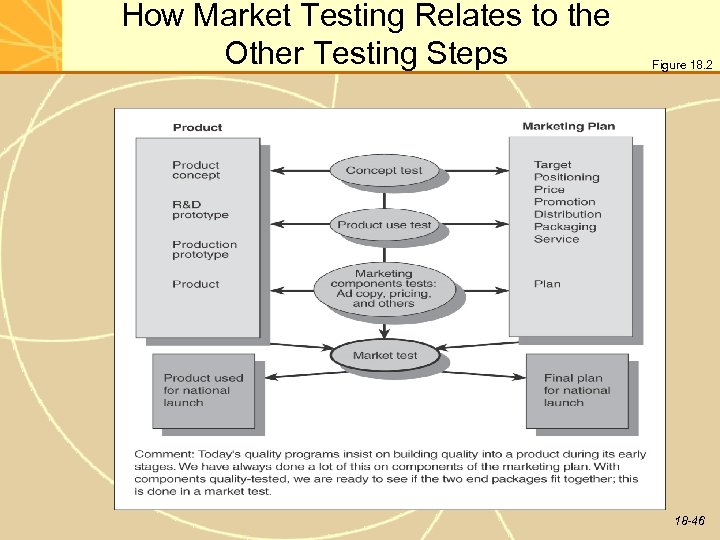

How Market Testing Relates to the Other Testing Steps Figure 18. 2 18 -46

How Market Testing Relates to the Other Testing Steps Figure 18. 2 18 -46

Two Key Values Obtained from Market Testing • Solid forecasts of dollar and unit sales volume. • Diagnostic information to allow for revising and refining any aspect of the launch. 18 -47

Two Key Values Obtained from Market Testing • Solid forecasts of dollar and unit sales volume. • Diagnostic information to allow for revising and refining any aspect of the launch. 18 -47

Deciding Whether to Market Test • Any special twists on the launch? (limited time or budget, need to make high volume quickly) • What information is needed? (expected sales volumes, unknowns in manufacturing process, etc. ) • Costs (direct cost of test, cost of launch, lost revenue that an immediate national launch would have brought) • Nature of marketplace (competitive retaliation, customer demand) • Capability of testing methodologies (do they fit the managerial situation at hand) 18 -48

Deciding Whether to Market Test • Any special twists on the launch? (limited time or budget, need to make high volume quickly) • What information is needed? (expected sales volumes, unknowns in manufacturing process, etc. ) • Costs (direct cost of test, cost of launch, lost revenue that an immediate national launch would have brought) • Nature of marketplace (competitive retaliation, customer demand) • Capability of testing methodologies (do they fit the managerial situation at hand) 18 -48

Types of Information That May Be Lacking • Manufacturing process: can we ramp-up from pilot production to full scale easily? • Vendors and resellers: will they do as they have promised in supporting the launch? • Servicing infrastructure: adequate? • Customers: will they buy and use the product as expected? • Cannibalization: what will be the extent? 18 -49

Types of Information That May Be Lacking • Manufacturing process: can we ramp-up from pilot production to full scale easily? • Vendors and resellers: will they do as they have promised in supporting the launch? • Servicing infrastructure: adequate? • Customers: will they buy and use the product as expected? • Cannibalization: what will be the extent? 18 -49

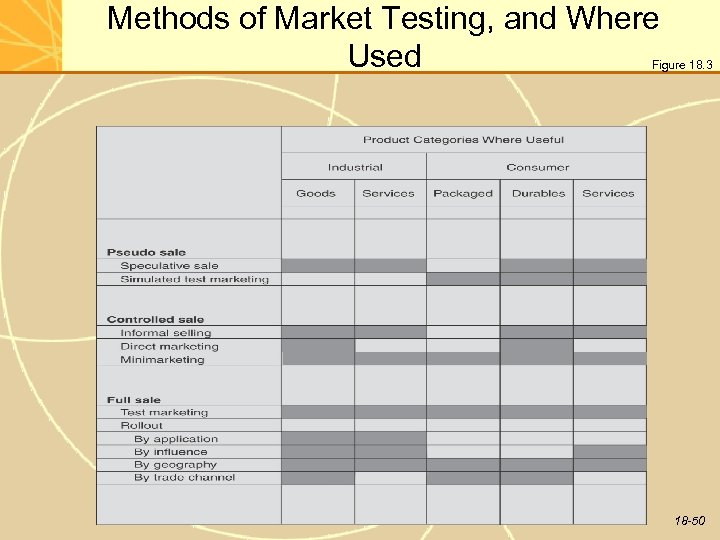

Methods of Market Testing, and Where Used Figure 18. 3 18 -50

Methods of Market Testing, and Where Used Figure 18. 3 18 -50

Speculative Sale • Often used in business-to-business and consumer durables, similar to concept and product use tests. • Give full pitch on product, answer questions, discuss pricing, and ask: – “If we make this product available as I have described it, would you buy it? ” • Often conducted by regular salespeople calling on real target customers. 18 -51

Speculative Sale • Often used in business-to-business and consumer durables, similar to concept and product use tests. • Give full pitch on product, answer questions, discuss pricing, and ask: – “If we make this product available as I have described it, would you buy it? ” • Often conducted by regular salespeople calling on real target customers. 18 -51

Conditions for Speculative Sale • Where industrial firms have very close downstream relationships with key buyers. • Where new product work is technical, entrenched within a firm's expertise, and only little reaction is needed from the marketplace. • Where the adventure has very little risk, and thus a costlier method is not defendable. • Where the item is new (say, a new material or a completely new product type) and key diagnostics are needed. For example, what set of alternatives does the potential buyer see, or what possible applications come to mind first. 18 -52

Conditions for Speculative Sale • Where industrial firms have very close downstream relationships with key buyers. • Where new product work is technical, entrenched within a firm's expertise, and only little reaction is needed from the marketplace. • Where the adventure has very little risk, and thus a costlier method is not defendable. • Where the item is new (say, a new material or a completely new product type) and key diagnostics are needed. For example, what set of alternatives does the potential buyer see, or what possible applications come to mind first. 18 -52

Simulated Test Market (STM) • Create a false buying situation and observe what the customer does. • Follow-up with customer later to assess likely repeat sales. • Often used for consumer nondurables. 18 -53

Simulated Test Market (STM) • Create a false buying situation and observe what the customer does. • Follow-up with customer later to assess likely repeat sales. • Often used for consumer nondurables. 18 -53

Simulated Test Market Procedure • • Mall intercept. Self-administered questionnaire. Advertising stimuli. Mini-store shopping experience. Post-exposure questionnaire. Receive trial package. Phone followup and offer to buy more. 18 -54

Simulated Test Market Procedure • • Mall intercept. Self-administered questionnaire. Advertising stimuli. Mini-store shopping experience. Post-exposure questionnaire. Receive trial package. Phone followup and offer to buy more. 18 -54

Possible Drawbacks to STMs • Mathematical complexity • False conditions • Possibly faulty assumptions on data, such as number of stores that will make the product available • May not be applicable to totally new-to-themarket products, since no prior data available. • Does not test channel member response to the new product, only the final consumer 18 -55

Possible Drawbacks to STMs • Mathematical complexity • False conditions • Possibly faulty assumptions on data, such as number of stores that will make the product available • May not be applicable to totally new-to-themarket products, since no prior data available. • Does not test channel member response to the new product, only the final consumer 18 -55

Controlled Sale by Informal Selling • Used for business-to-business products, also consumer products sold directly to end users. • Train salespeople, give them the product and the selling materials, and have them make calls (in the field, or at trade shows). • Real presentations, and real sales, take place. 18 -56

Controlled Sale by Informal Selling • Used for business-to-business products, also consumer products sold directly to end users. • Train salespeople, give them the product and the selling materials, and have them make calls (in the field, or at trade shows). • Real presentations, and real sales, take place. 18 -56

Controlled Sale by Direct Marketing · More secrecy than by any other controlled sale method. · The feedback is almost instant. · Positioning and image development are easier because more information can be sent and more variations can be tested easily. · It is cheaper than the other techniques. · The technique matches today's growing technologies of credit card financing, telephone ordering, and database compilation. 18 -57

Controlled Sale by Direct Marketing · More secrecy than by any other controlled sale method. · The feedback is almost instant. · Positioning and image development are easier because more information can be sent and more variations can be tested easily. · It is cheaper than the other techniques. · The technique matches today's growing technologies of credit card financing, telephone ordering, and database compilation. 18 -57

Controlled Sale by Minimarkets • Select a limited number of outlets -- each store is a minicity or “minimarket. ” • Do not use regular local TV or newspaper advertising, but chosen outlets can advertise it in its own flyers. • Can do shelf displays, demonstrations. • Use rebate, mail-in premium, or some other method to get names of purchasers for later follow-up. 18 -58

Controlled Sale by Minimarkets • Select a limited number of outlets -- each store is a minicity or “minimarket. ” • Do not use regular local TV or newspaper advertising, but chosen outlets can advertise it in its own flyers. • Can do shelf displays, demonstrations. • Use rebate, mail-in premium, or some other method to get names of purchasers for later follow-up. 18 -58

Controlled Sale by Scanner Market Testing • Audit sales from grocery stores with scanner systems -- over a few markets or national system. • Sample uses: – Can use the data as a mini-market test. – Can compare cities where differing levels of sales support are provided. – Can monitor a rollout from one region to the next. 18 -59

Controlled Sale by Scanner Market Testing • Audit sales from grocery stores with scanner systems -- over a few markets or national system. • Sample uses: – Can use the data as a mini-market test. – Can compare cities where differing levels of sales support are provided. – Can monitor a rollout from one region to the next. 18 -59

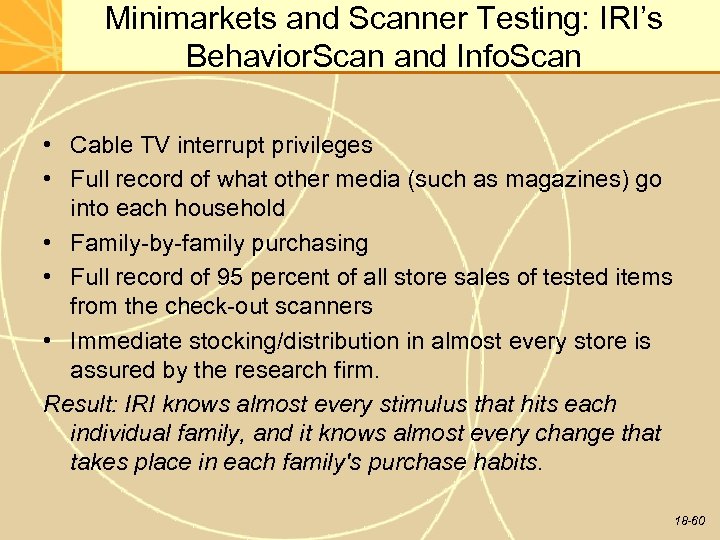

Minimarkets and Scanner Testing: IRI’s Behavior. Scan and Info. Scan • Cable TV interrupt privileges • Full record of what other media (such as magazines) go into each household • Family-by-family purchasing • Full record of 95 percent of all store sales of tested items from the check-out scanners • Immediate stocking/distribution in almost every store is assured by the research firm. Result: IRI knows almost every stimulus that hits each individual family, and it knows almost every change that takes place in each family's purchase habits. 18 -60

Minimarkets and Scanner Testing: IRI’s Behavior. Scan and Info. Scan • Cable TV interrupt privileges • Full record of what other media (such as magazines) go into each household • Family-by-family purchasing • Full record of 95 percent of all store sales of tested items from the check-out scanners • Immediate stocking/distribution in almost every store is assured by the research firm. Result: IRI knows almost every stimulus that hits each individual family, and it knows almost every change that takes place in each family's purchase habits. 18 -60

The Test Market • Several test market cities are selected. • Product is sold into those cities in the regular channels and advertised at representative levels in local media. • Once used to support the decision whether to launch a product, now more frequently used to determine how best to do so. 18 -61

The Test Market • Several test market cities are selected. • Product is sold into those cities in the regular channels and advertised at representative levels in local media. • Once used to support the decision whether to launch a product, now more frequently used to determine how best to do so. 18 -61

Pros and Cons of Test Marketing Advantages: • Risk Reduction – – – monetary risk channel relationships sales force morale • Strategic Improvement – – marketing mix production facilities Disadvantages: • Cost ($1 mill+) • Time (9 -12 months+) – – – hurt competitive advantage competitor may monitor test market competitor may go national • Competitor can disrupt test market 18 -62

Pros and Cons of Test Marketing Advantages: • Risk Reduction – – – monetary risk channel relationships sales force morale • Strategic Improvement – – marketing mix production facilities Disadvantages: • Cost ($1 mill+) • Time (9 -12 months+) – – – hurt competitive advantage competitor may monitor test market competitor may go national • Competitor can disrupt test market 18 -62

A Risk of Test Marketing: “Showing Your Hand” Figure 18. 5 • Kellogg tracked the sale of General Foods' Toast-Ems while they were in test market. Noting they were becoming popular, they went national quickly with Pop-Tarts before the General Foods' test market was over. • After having invented freeze-dried coffee, General Foods was testmarketing its own Maxim brand when Nestle bypassed them with Taster's Choice, which went on to be the leading brand. • While Procter & Gamble were busy test-marketing their soft chocolate chip cookies, both Nabisco and Keebler rolled out similar cookies nationwide. • The same thing happened with P&G’s Brigade toilet-bowl cleaner. It was in test marketing for three years, during which time both Vanish and Ty-D-Bol became established in the market. • General Foods' test market results for a new frozen baby food were very encouraging, until it was learned that most of the purchases were being made by competitors Gerber, Libby, and Heinz. 18 -63

A Risk of Test Marketing: “Showing Your Hand” Figure 18. 5 • Kellogg tracked the sale of General Foods' Toast-Ems while they were in test market. Noting they were becoming popular, they went national quickly with Pop-Tarts before the General Foods' test market was over. • After having invented freeze-dried coffee, General Foods was testmarketing its own Maxim brand when Nestle bypassed them with Taster's Choice, which went on to be the leading brand. • While Procter & Gamble were busy test-marketing their soft chocolate chip cookies, both Nabisco and Keebler rolled out similar cookies nationwide. • The same thing happened with P&G’s Brigade toilet-bowl cleaner. It was in test marketing for three years, during which time both Vanish and Ty-D-Bol became established in the market. • General Foods' test market results for a new frozen baby food were very encouraging, until it was learned that most of the purchases were being made by competitors Gerber, Libby, and Heinz. 18 -63

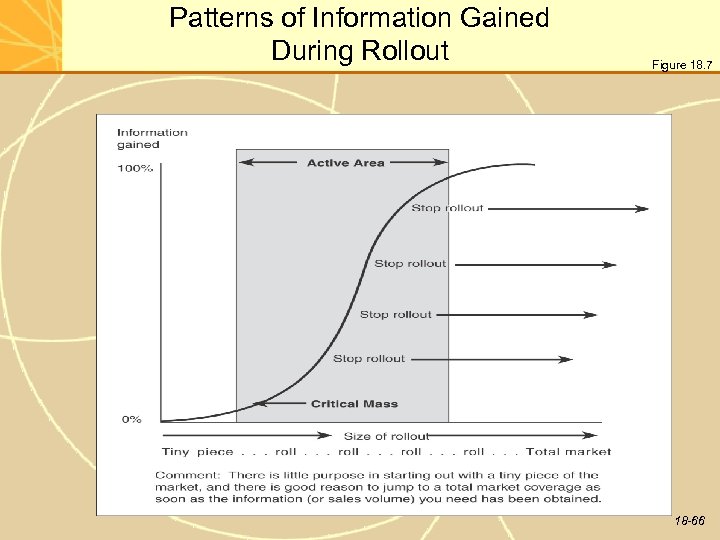

The Rollout • Select a limited area of the country (one or several cities or states, 25% of the market, etc. ) and monitor sales of product there. • Starting areas are not necessarily representative – The company may be able to get the ball rolling more easily there – The company may deliberately choose a hard area to sell in, to learn the pitfalls and what really drives success. • Decision point: when to switch to the full national launch. 18 -64

The Rollout • Select a limited area of the country (one or several cities or states, 25% of the market, etc. ) and monitor sales of product there. • Starting areas are not necessarily representative – The company may be able to get the ball rolling more easily there – The company may deliberately choose a hard area to sell in, to learn the pitfalls and what really drives success. • Decision point: when to switch to the full national launch. 18 -64

Types of Rollout • • By geography (including international) By application By influence By trade channel 18 -65

Types of Rollout • • By geography (including international) By application By influence By trade channel 18 -65

Patterns of Information Gained During Rollout Figure 18. 7 18 -66

Patterns of Information Gained During Rollout Figure 18. 7 18 -66

Risks of Rollout • May need to invest in full-scale production facility early. • Competitors may move fast enough to go national while the rollout is still underway. • Problems getting into the distribution channel. • Lacks national publicity that a full-scale launch may generate. 18 -67

Risks of Rollout • May need to invest in full-scale production facility early. • Competitors may move fast enough to go national while the rollout is still underway. • Problems getting into the distribution channel. • Lacks national publicity that a full-scale launch may generate. 18 -67

Probable Future for Market Testing Methods • Test marketing • Pseudo sale • Minimarket • Rollout (“dinosaur”) (incomplete) (flexibility & variety) (small, fast, flexible) 18 -68

Probable Future for Market Testing Methods • Test marketing • Pseudo sale • Minimarket • Rollout (“dinosaur”) (incomplete) (flexibility & variety) (small, fast, flexible) 18 -68

Chapter 19 Launch Management Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Chapter 19 Launch Management Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

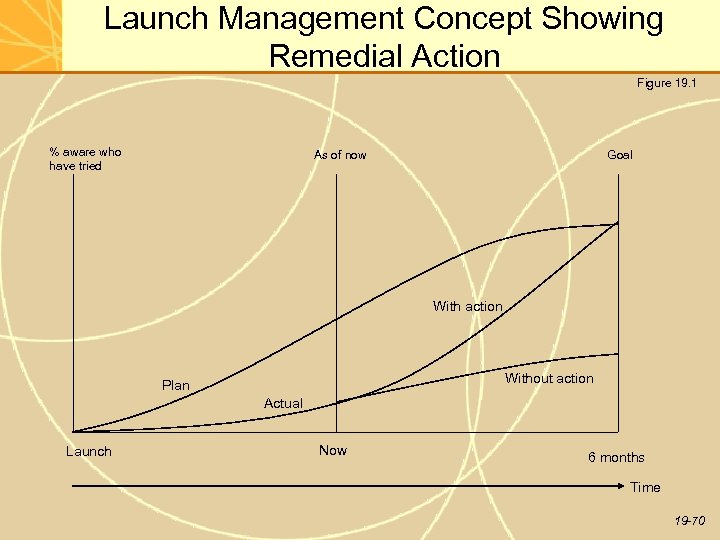

Launch Management Concept Showing Remedial Action Figure 19. 1 % aware who have tried As of now Goal With action Without action Plan Actual Launch Now 6 months Time 19 -70

Launch Management Concept Showing Remedial Action Figure 19. 1 % aware who have tried As of now Goal With action Without action Plan Actual Launch Now 6 months Time 19 -70

The Launch Management System • Spot potential problems. • Select those to control. – Consider expected impact/damage. • Develop contingency plans for the management of problems. • Design the tracking system. – Select variables. – Devise measuring system. – Select trigger points. Adage: in driving a car, it is the potholes you don’t know about (or forget about) that cause you damage. 19 -71

The Launch Management System • Spot potential problems. • Select those to control. – Consider expected impact/damage. • Develop contingency plans for the management of problems. • Design the tracking system. – Select variables. – Devise measuring system. – Select trigger points. Adage: in driving a car, it is the potholes you don’t know about (or forget about) that cause you damage. 19 -71

Spotting Potential Problems • Problems section from the situation analysis. • Role-play what competitors will do. • Look back over all the data in the new product's "file. " • Consider hierarchy of effects needed to result in a satisfied customer (A-T-A-R). 19 -72

Spotting Potential Problems • Problems section from the situation analysis. • Role-play what competitors will do. • Look back over all the data in the new product's "file. " • Consider hierarchy of effects needed to result in a satisfied customer (A-T-A-R). 19 -72

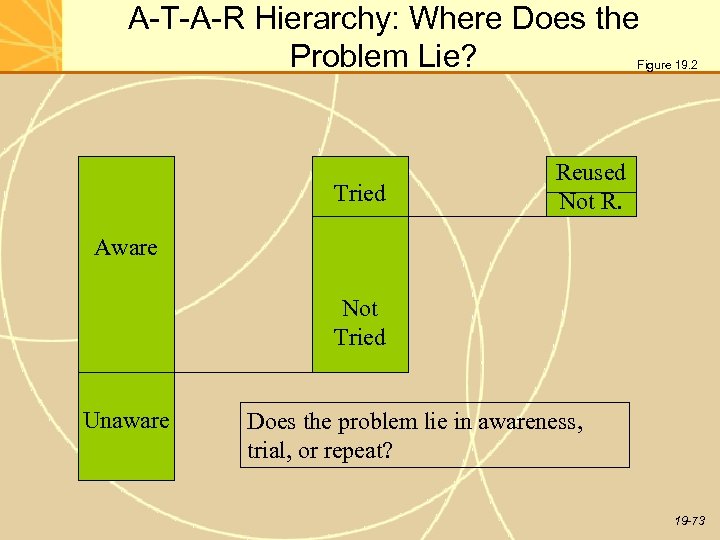

A-T-A-R Hierarchy: Where Does the Problem Lie? Figure 19. 2 Tried Reused Not R. Aware Not Tried Unaware Does the problem lie in awareness, trial, or repeat? 19 -73

A-T-A-R Hierarchy: Where Does the Problem Lie? Figure 19. 2 Tried Reused Not R. Aware Not Tried Unaware Does the problem lie in awareness, trial, or repeat? 19 -73

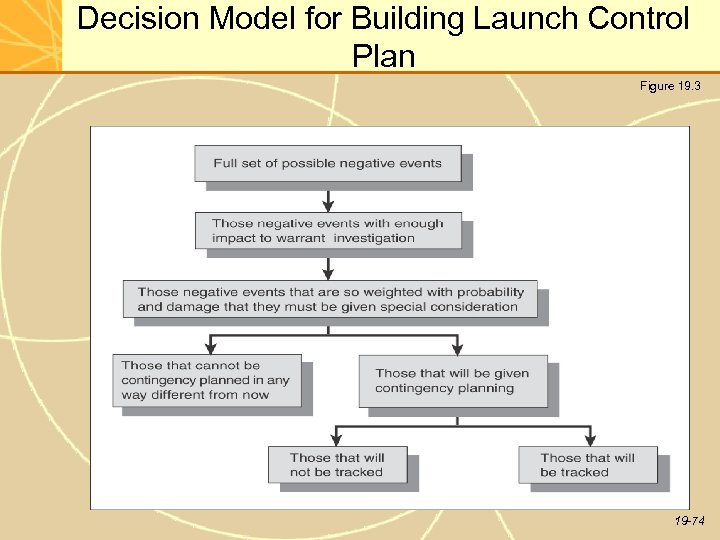

Decision Model for Building Launch Control Plan Figure 19. 3 19 -74

Decision Model for Building Launch Control Plan Figure 19. 3 19 -74

Select the Control Events Of all potential problems, • Which have enough impact to warrant investigation? • Which of these ought to be given special consideration? * • Which of these should be given contingency planning? • And which of these need to be tracked? *Basis: Consider potential damage and likelihood of occurrence. 19 -75

Select the Control Events Of all potential problems, • Which have enough impact to warrant investigation? • Which of these ought to be given special consideration? * • Which of these should be given contingency planning? • And which of these need to be tracked? *Basis: Consider potential damage and likelihood of occurrence. 19 -75

Develop Contingency Plans • "Is there anything we can do? " – E. g. : competitive price cut or product imitation. • Base contingency plan on type of problem: – 1. A company failure (e. g. , inadequate distribution) – 2. A consumer failure (e. g. , low awareness or trial) 19 -76

Develop Contingency Plans • "Is there anything we can do? " – E. g. : competitive price cut or product imitation. • Base contingency plan on type of problem: – 1. A company failure (e. g. , inadequate distribution) – 2. A consumer failure (e. g. , low awareness or trial) 19 -76

Designing the Tracking System • Select the tracking variables – Relevant, measurable, predictable • Select the trigger points • Consider the nontrackable problems 19 -77

Designing the Tracking System • Select the tracking variables – Relevant, measurable, predictable • Select the trigger points • Consider the nontrackable problems 19 -77

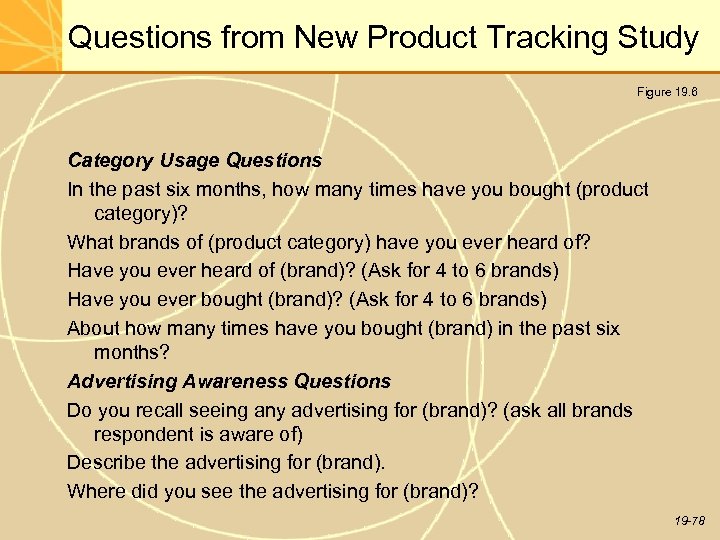

Questions from New Product Tracking Study Figure 19. 6 Category Usage Questions In the past six months, how many times have you bought (product category)? What brands of (product category) have you ever heard of? Have you ever heard of (brand)? (Ask for 4 to 6 brands) Have you ever bought (brand)? (Ask for 4 to 6 brands) About how many times have you bought (brand) in the past six months? Advertising Awareness Questions Do you recall seeing any advertising for (brand)? (ask all brands respondent is aware of) Describe the advertising for (brand). Where did you see the advertising for (brand)? 19 -78

Questions from New Product Tracking Study Figure 19. 6 Category Usage Questions In the past six months, how many times have you bought (product category)? What brands of (product category) have you ever heard of? Have you ever heard of (brand)? (Ask for 4 to 6 brands) Have you ever bought (brand)? (Ask for 4 to 6 brands) About how many times have you bought (brand) in the past six months? Advertising Awareness Questions Do you recall seeing any advertising for (brand)? (ask all brands respondent is aware of) Describe the advertising for (brand). Where did you see the advertising for (brand)? 19 -78

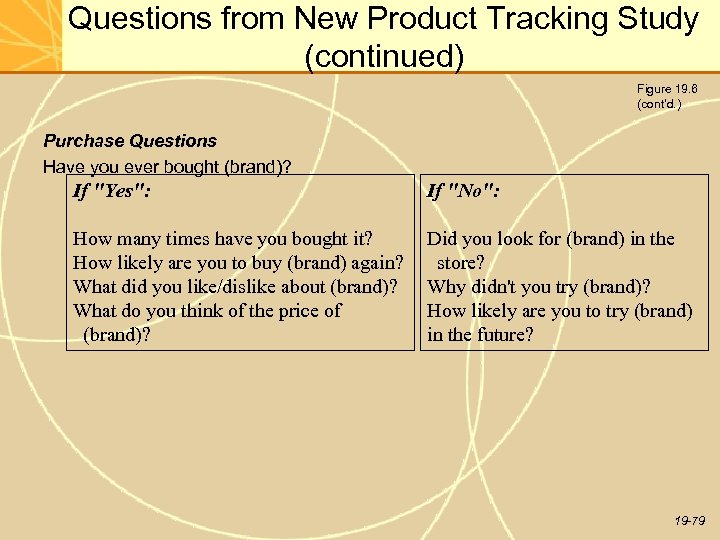

Questions from New Product Tracking Study (continued) Figure 19. 6 (cont’d. ) Purchase Questions Have you ever bought (brand)? If "Yes": If "No": How many times have you bought it? How likely are you to buy (brand) again? What did you like/dislike about (brand)? What do you think of the price of (brand)? Did you look for (brand) in the store? Why didn't you try (brand)? How likely are you to try (brand) in the future? 19 -79

Questions from New Product Tracking Study (continued) Figure 19. 6 (cont’d. ) Purchase Questions Have you ever bought (brand)? If "Yes": If "No": How many times have you bought it? How likely are you to buy (brand) again? What did you like/dislike about (brand)? What do you think of the price of (brand)? Did you look for (brand) in the store? Why didn't you try (brand)? How likely are you to try (brand) in the future? 19 -79

A Sample Launch Management Plan Figure 19. 7 Potential Problem Salespeople fail to contact general-purpose market at prescribed rate. Tracking Track weekly sales call reports (plan is for at least 10 general-purpose calls per week per rep). Contingency Plan If activity falls below this level for three weeks running, a remedial program of one-day district sales meetings will be held. 19 -80

A Sample Launch Management Plan Figure 19. 7 Potential Problem Salespeople fail to contact general-purpose market at prescribed rate. Tracking Track weekly sales call reports (plan is for at least 10 general-purpose calls per week per rep). Contingency Plan If activity falls below this level for three weeks running, a remedial program of one-day district sales meetings will be held. 19 -80

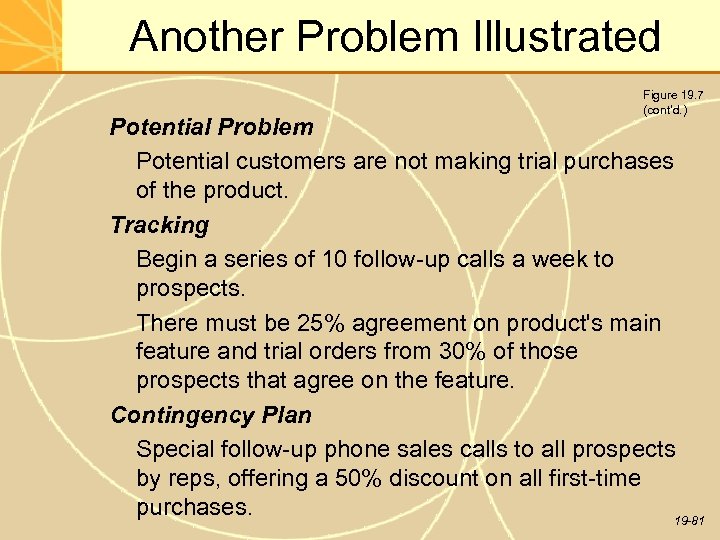

Another Problem Illustrated Figure 19. 7 (cont’d. ) Potential Problem Potential customers are not making trial purchases of the product. Tracking Begin a series of 10 follow-up calls a week to prospects. There must be 25% agreement on product's main feature and trial orders from 30% of those prospects that agree on the feature. Contingency Plan Special follow-up phone sales calls to all prospects by reps, offering a 50% discount on all first-time purchases. 19 -81

Another Problem Illustrated Figure 19. 7 (cont’d. ) Potential Problem Potential customers are not making trial purchases of the product. Tracking Begin a series of 10 follow-up calls a week to prospects. There must be 25% agreement on product's main feature and trial orders from 30% of those prospects that agree on the feature. Contingency Plan Special follow-up phone sales calls to all prospects by reps, offering a 50% discount on all first-time purchases. 19 -81

After Action Review • Designed to capture the events leading up to product launch. • Identify what went right (so it can be duplicated) and what went wrong (so it can be fixed in the future). • Contains planned versus actual results, what has been learned, and outline for next steps. 19 -82

After Action Review • Designed to capture the events leading up to product launch. • Identify what went right (so it can be duplicated) and what went wrong (so it can be fixed in the future). • Contains planned versus actual results, what has been learned, and outline for next steps. 19 -82

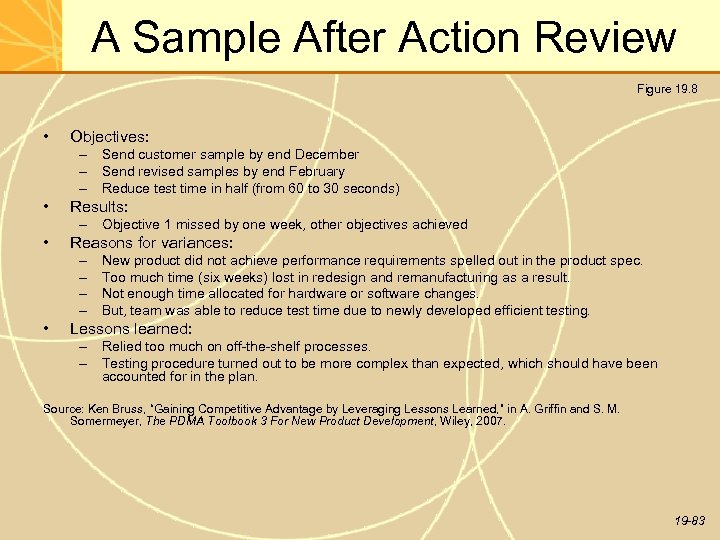

A Sample After Action Review Figure 19. 8 • Objectives: – Send customer sample by end December – Send revised samples by end February – Reduce test time in half (from 60 to 30 seconds) • Results: – Objective 1 missed by one week, other objectives achieved • Reasons for variances: – – • New product did not achieve performance requirements spelled out in the product spec. Too much time (six weeks) lost in redesign and remanufacturing as a result. Not enough time allocated for hardware or software changes. But, team was able to reduce test time due to newly developed efficient testing. Lessons learned: – Relied too much on off-the-shelf processes. – Testing procedure turned out to be more complex than expected, which should have been accounted for in the plan. Source: Ken Bruss, “Gaining Competitive Advantage by Leveraging Lessons Learned, ” in A. Griffin and S. M. Somermeyer, The PDMA Toolbook 3 For New Product Development, Wiley, 2007. 19 -83

A Sample After Action Review Figure 19. 8 • Objectives: – Send customer sample by end December – Send revised samples by end February – Reduce test time in half (from 60 to 30 seconds) • Results: – Objective 1 missed by one week, other objectives achieved • Reasons for variances: – – • New product did not achieve performance requirements spelled out in the product spec. Too much time (six weeks) lost in redesign and remanufacturing as a result. Not enough time allocated for hardware or software changes. But, team was able to reduce test time due to newly developed efficient testing. Lessons learned: – Relied too much on off-the-shelf processes. – Testing procedure turned out to be more complex than expected, which should have been accounted for in the plan. Source: Ken Bruss, “Gaining Competitive Advantage by Leveraging Lessons Learned, ” in A. Griffin and S. M. Somermeyer, The PDMA Toolbook 3 For New Product Development, Wiley, 2007. 19 -83

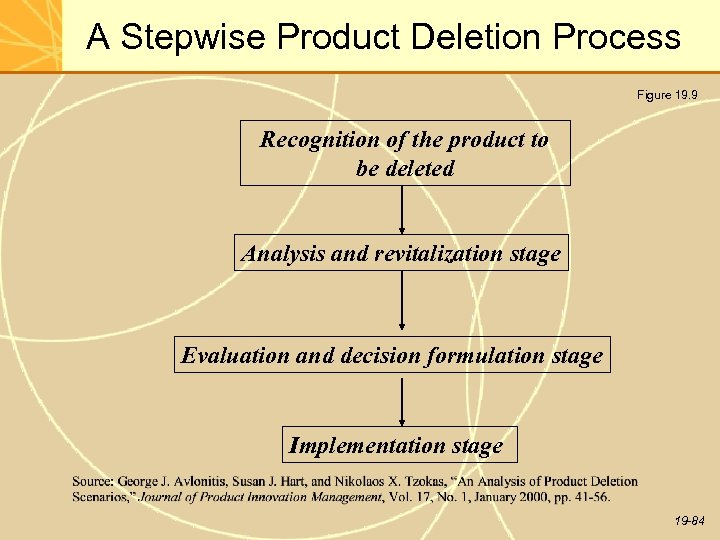

A Stepwise Product Deletion Process Figure 19. 9 Recognition of the product to be deleted Analysis and revitalization stage Evaluation and decision formulation stage Implementation stage 19 -84

A Stepwise Product Deletion Process Figure 19. 9 Recognition of the product to be deleted Analysis and revitalization stage Evaluation and decision formulation stage Implementation stage 19 -84

Chapter 20 Public Policy Issues Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Chapter 20 Public Policy Issues Mc. Graw-Hill/Irwin – Merle Crawford Anthony Di Benedetto 9 th Edition Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Public Policy Concerns • Product developers have to be aware of emerging public policy concerns and consider their impact on product development and launch. • How do the following affect product decision making? – Concern about the environment, global warming, carbon dioxide outputs, etc. – Concern about poor diets leading to heart disease, high cholesterol and diabetes, including among young people. 20 -86

Public Policy Concerns • Product developers have to be aware of emerging public policy concerns and consider their impact on product development and launch. • How do the following affect product decision making? – Concern about the environment, global warming, carbon dioxide outputs, etc. – Concern about poor diets leading to heart disease, high cholesterol and diabetes, including among young people. 20 -86

Life Cycle of a Public Concern Figure 20. 1 • Stirring • Trial Support • Political Arena • Regulatory Adjustment 20 -87

Life Cycle of a Public Concern Figure 20. 1 • Stirring • Trial Support • Political Arena • Regulatory Adjustment 20 -87

Product Liability: Typology of Injury Sources • Inherent Risk in Product • Design Defects – – – Dangerous Condition No Safety Device Inadequate Materials • Defects in Manufacture • Inadequate Instructions or Warnings • Dangers After Use 20 -88

Product Liability: Typology of Injury Sources • Inherent Risk in Product • Design Defects – – – Dangerous Condition No Safety Device Inadequate Materials • Defects in Manufacture • Inadequate Instructions or Warnings • Dangers After Use 20 -88

Four Legal Bases for Product Liability • Negligence – Manufacturer let the product be injurious • Warranty – – – A promise Express warranty: a statement of fact about a product Implied warranty: arises when product is made available for a given use 20 -89

Four Legal Bases for Product Liability • Negligence – Manufacturer let the product be injurious • Warranty – – – A promise Express warranty: a statement of fact about a product Implied warranty: arises when product is made available for a given use 20 -89

Four Legal Bases for Product Liability (continued) • Strict Liability – – Seller is responsible for not putting a defective product on the market Defenses: assumption of risk; unforeseeable misuse; not defective • Misrepresentation – Implied use of product, even if not defective Other Legislation Consumer Product Safety Act/Safety Commission 20 -90

Four Legal Bases for Product Liability (continued) • Strict Liability – – Seller is responsible for not putting a defective product on the market Defenses: assumption of risk; unforeseeable misuse; not defective • Misrepresentation – Implied use of product, even if not defective Other Legislation Consumer Product Safety Act/Safety Commission 20 -90

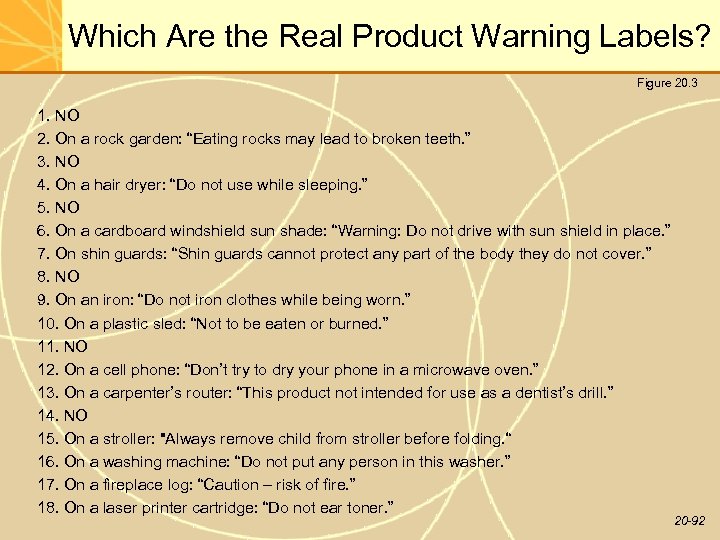

Which Are the Real Product Warning Labels? Figure 20. 3 1. On a disposable razor: “Do not use this product during an earthquake. ” 2. On a rock garden: “Eating rocks may lead to broken teeth. ” 3. On a roll of Life Savers: “Not for use as a flotation device. ” 4. On a hair dryer: “Do not use while sleeping. ” 5. On a piano: “Harmful or fatal if swallowed. ” 6. On a cardboard windshield sun shade: “Warning: Do not drive with sun shield in place. ” 7. On shin guards: “Shin guards cannot protect any part of the body they do not cover. ” 8. On syrup of ipecac: “Caution: may induce vomiting. ” 9. On an iron: “Do not iron clothes while being worn. ” 10. On a plastic sled: “Not to be eaten or burned. ” 11. On work gloves: “For best results, do not leave at crime scene. ” 12. On a cell phone: “Don’t try to dry your phone in a microwave oven. ” 13. On a carpenter’s router: “This product not intended for use as a dentist’s drill. ” 14. On a blender: “Not for use as an aquarium. ” 15. On a stroller: "Always remove child from stroller before folding. “ 16. On a washing machine: “Do not put any person in this washer. ” 17. On a fireplace log: “Caution – risk of fire. ” 18. On a laser printer cartridge: “Do not ear toner. ” 20 -91

Which Are the Real Product Warning Labels? Figure 20. 3 1. On a disposable razor: “Do not use this product during an earthquake. ” 2. On a rock garden: “Eating rocks may lead to broken teeth. ” 3. On a roll of Life Savers: “Not for use as a flotation device. ” 4. On a hair dryer: “Do not use while sleeping. ” 5. On a piano: “Harmful or fatal if swallowed. ” 6. On a cardboard windshield sun shade: “Warning: Do not drive with sun shield in place. ” 7. On shin guards: “Shin guards cannot protect any part of the body they do not cover. ” 8. On syrup of ipecac: “Caution: may induce vomiting. ” 9. On an iron: “Do not iron clothes while being worn. ” 10. On a plastic sled: “Not to be eaten or burned. ” 11. On work gloves: “For best results, do not leave at crime scene. ” 12. On a cell phone: “Don’t try to dry your phone in a microwave oven. ” 13. On a carpenter’s router: “This product not intended for use as a dentist’s drill. ” 14. On a blender: “Not for use as an aquarium. ” 15. On a stroller: "Always remove child from stroller before folding. “ 16. On a washing machine: “Do not put any person in this washer. ” 17. On a fireplace log: “Caution – risk of fire. ” 18. On a laser printer cartridge: “Do not ear toner. ” 20 -91

Which Are the Real Product Warning Labels? Figure 20. 3 1. NO 2. On a rock garden: “Eating rocks may lead to broken teeth. ” 3. NO 4. On a hair dryer: “Do not use while sleeping. ” 5. NO 6. On a cardboard windshield sun shade: “Warning: Do not drive with sun shield in place. ” 7. On shin guards: “Shin guards cannot protect any part of the body they do not cover. ” 8. NO 9. On an iron: “Do not iron clothes while being worn. ” 10. On a plastic sled: “Not to be eaten or burned. ” 11. NO 12. On a cell phone: “Don’t try to dry your phone in a microwave oven. ” 13. On a carpenter’s router: “This product not intended for use as a dentist’s drill. ” 14. NO 15. On a stroller: "Always remove child from stroller before folding. “ 16. On a washing machine: “Do not put any person in this washer. ” 17. On a fireplace log: “Caution – risk of fire. ” 18. On a laser printer cartridge: “Do not ear toner. ” 20 -92

Which Are the Real Product Warning Labels? Figure 20. 3 1. NO 2. On a rock garden: “Eating rocks may lead to broken teeth. ” 3. NO 4. On a hair dryer: “Do not use while sleeping. ” 5. NO 6. On a cardboard windshield sun shade: “Warning: Do not drive with sun shield in place. ” 7. On shin guards: “Shin guards cannot protect any part of the body they do not cover. ” 8. NO 9. On an iron: “Do not iron clothes while being worn. ” 10. On a plastic sled: “Not to be eaten or burned. ” 11. NO 12. On a cell phone: “Don’t try to dry your phone in a microwave oven. ” 13. On a carpenter’s router: “This product not intended for use as a dentist’s drill. ” 14. NO 15. On a stroller: "Always remove child from stroller before folding. “ 16. On a washing machine: “Do not put any person in this washer. ” 17. On a fireplace log: “Caution – risk of fire. ” 18. On a laser printer cartridge: “Do not ear toner. ” 20 -92

Preparing For the Product Recall • Prior to the Recall – Designate the recall program coordinator (spokesperson) – Develop channels for communicating with customers directly • During the Recall – Assess safety risk and take corrective action – Inform customers as well as intermediaries of the risks • After the Recall – Strive to restore company reputation – Monitor recall effectiveness 20 -93

Preparing For the Product Recall • Prior to the Recall – Designate the recall program coordinator (spokesperson) – Develop channels for communicating with customers directly • During the Recall – Assess safety risk and take corrective action – Inform customers as well as intermediaries of the risks • After the Recall – Strive to restore company reputation – Monitor recall effectiveness 20 -93

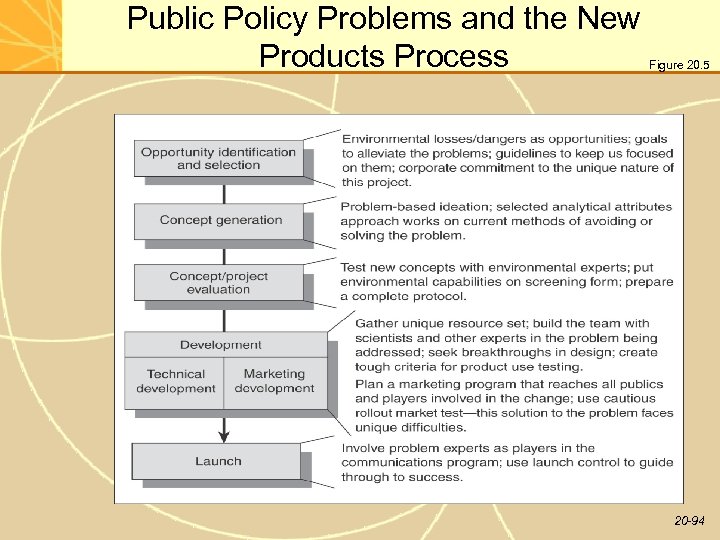

Public Policy Problems and the New Products Process Figure 20. 5 20 -94

Public Policy Problems and the New Products Process Figure 20. 5 20 -94

Other Areas of Public Policy Debate • • • Environmental Needs Product Piracy Worthy Products Morality Monopoly Personal Ethics (what would you do? ) 20 -95

Other Areas of Public Policy Debate • • • Environmental Needs Product Piracy Worthy Products Morality Monopoly Personal Ethics (what would you do? ) 20 -95

Environmental Needs • A new product is said to hurt the environment if: – Its raw materials are scarce or hard to get to. – Its design or manufacture causes pollution or excess power usage. – Its use causes pollution. – Its disposal cannot be handled by recycling. • Some companies test market their products in Germany and Scandinavia, because of the strict greenness tests there. 20 -96

Environmental Needs • A new product is said to hurt the environment if: – Its raw materials are scarce or hard to get to. – Its design or manufacture causes pollution or excess power usage. – Its use causes pollution. – Its disposal cannot be handled by recycling. • Some companies test market their products in Germany and Scandinavia, because of the strict greenness tests there. 20 -96

Product Piracy • Threatens brand equity and intellectual property of firms. • Categories of product piracy: – Counterfeiting: unauthorized production of goods – Brand Piracy: unauthorized use of copyrights or patented brands (the “$20 Rolex”) – Near Brand Usage: slightly different brand names (“Tonny Hilfiger” clothes) – Intellectual Property Copying: Unauthorized copying of CDs and DVDs, for example 20 -97

Product Piracy • Threatens brand equity and intellectual property of firms. • Categories of product piracy: – Counterfeiting: unauthorized production of goods – Brand Piracy: unauthorized use of copyrights or patented brands (the “$20 Rolex”) – Near Brand Usage: slightly different brand names (“Tonny Hilfiger” clothes) – Intellectual Property Copying: Unauthorized copying of CDs and DVDs, for example 20 -97

Protection Against Product Piracy Figure 20. 6 • • Communication Legal recourse Government Direct contact Labeling Strong proactive marketing Piracy as Promotion Source: Laurence Jacobs, A. Coksun Samli, and Tom Jedlik, “The Nightmare of International Product Piracy, ” Industrial Marketing Management 30, 2001, pp. 499 -509. 20 -98

Protection Against Product Piracy Figure 20. 6 • • Communication Legal recourse Government Direct contact Labeling Strong proactive marketing Piracy as Promotion Source: Laurence Jacobs, A. Coksun Samli, and Tom Jedlik, “The Nightmare of International Product Piracy, ” Industrial Marketing Management 30, 2001, pp. 499 -509. 20 -98

Worthy Products • Coffee manufacturers agreed to produce some brands containing no beans from El Salvador. • Manufacturers have been asked to produce special exercise equipment for the handicapped or modified products for the elderly. • Orphan drugs supported by the federal government; otherwise would not be commercially feasible due to few users. 20 -99

Worthy Products • Coffee manufacturers agreed to produce some brands containing no beans from El Salvador. • Manufacturers have been asked to produce special exercise equipment for the handicapped or modified products for the elderly. • Orphan drugs supported by the federal government; otherwise would not be commercially feasible due to few users. 20 -99

Personal Ethics – What Would You Do? 1. 2. 3. 4. 5. 6. You introduce a temporary product and are told not to let distributors or your sales force know it is only temporary and will soon be replaced. You are marketing a new seminar service to train bank personnel in investment counseling, but you don’t know they will really learn how to counsel. You are working on an item to be sold to virtually every K-12 school. You calculate gross margin at about 80%. The price could be cut in half and your company margin would still be 60%. Your database service collects patient records from physicians and offers a new service of information for pharmaceutical firms, including patients’ name, age, sex, and so on, as well as illnesses and treatments. Your company’s “educational” game cards are known to be bought by less sophisticated parents: there are several far better games on the market. Your brewing company markets a new beer containing legal (sterilized) hemp seeds, mostly as a gimmick. Nevertheless, your advertising contains obvious drug imagery. 20 -100

Personal Ethics – What Would You Do? 1. 2. 3. 4. 5. 6. You introduce a temporary product and are told not to let distributors or your sales force know it is only temporary and will soon be replaced. You are marketing a new seminar service to train bank personnel in investment counseling, but you don’t know they will really learn how to counsel. You are working on an item to be sold to virtually every K-12 school. You calculate gross margin at about 80%. The price could be cut in half and your company margin would still be 60%. Your database service collects patient records from physicians and offers a new service of information for pharmaceutical firms, including patients’ name, age, sex, and so on, as well as illnesses and treatments. Your company’s “educational” game cards are known to be bought by less sophisticated parents: there are several far better games on the market. Your brewing company markets a new beer containing legal (sterilized) hemp seeds, mostly as a gimmick. Nevertheless, your advertising contains obvious drug imagery. 20 -100

What Can the New Product Manager Do? • Include in Strategy and Policy – Consider public policy implications in PIC • Control Systems • Product Testing • Marketing Prepares Warnings/Labels • Adequate Market Testing (to identify miscommunications) • Education (to company personnel and customers) • External Affairs 20 -101

What Can the New Product Manager Do? • Include in Strategy and Policy – Consider public policy implications in PIC • Control Systems • Product Testing • Marketing Prepares Warnings/Labels • Adequate Market Testing (to identify miscommunications) • Education (to company personnel and customers) • External Affairs 20 -101