cce0e0d407a93ee22f7c6b6c143b4480.ppt

- Количество слайдов: 73

Part C Taxation for Companies

Part C Taxation for Companies

Chapter 1 Outline of Corporation Tax Administration Corporation tax is administratered by Her Majesty’ Revenue and Customs (HMRC). n Companies resident in the UK are chargeable to corporation tax on worldwide income and gains. Company residence A company is treated as resident in the UK if · it is incorporated in UK · its central management and control is exercised in UK n

Chapter 1 Outline of Corporation Tax Administration Corporation tax is administratered by Her Majesty’ Revenue and Customs (HMRC). n Companies resident in the UK are chargeable to corporation tax on worldwide income and gains. Company residence A company is treated as resident in the UK if · it is incorporated in UK · its central management and control is exercised in UK n

n Definition of terms 1. Period of account A period of account is any period for which a company prepares accounts. 2. Accounting period Corporation tax is charged in respect of accounting periods. Start of accounting period: · when a company commences to trade, or · immediately after the previous accounting period finishes

n Definition of terms 1. Period of account A period of account is any period for which a company prepares accounts. 2. Accounting period Corporation tax is charged in respect of accounting periods. Start of accounting period: · when a company commences to trade, or · immediately after the previous accounting period finishes

End of accounting period is the earliest of: · 12 months after start of period · end of company’s period of accounts · date company ceases to trade 3. Long period If a company has a period of account exceeding 12 months, it is split into two accounting periods: - the first 12 months - the reminder

End of accounting period is the earliest of: · 12 months after start of period · end of company’s period of accounts · date company ceases to trade 3. Long period If a company has a period of account exceeding 12 months, it is split into two accounting periods: - the first 12 months - the reminder

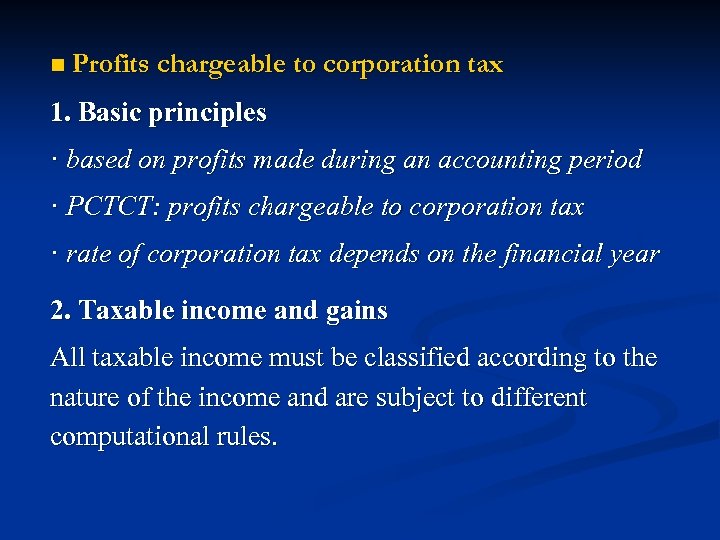

n Profits chargeable to corporation tax 1. Basic principles · based on profits made during an accounting period · PCTCT: profits chargeable to corporation tax · rate of corporation tax depends on the financial year 2. Taxable income and gains All taxable income must be classified according to the nature of the income and are subject to different computational rules.

n Profits chargeable to corporation tax 1. Basic principles · based on profits made during an accounting period · PCTCT: profits chargeable to corporation tax · rate of corporation tax depends on the financial year 2. Taxable income and gains All taxable income must be classified according to the nature of the income and are subject to different computational rules.

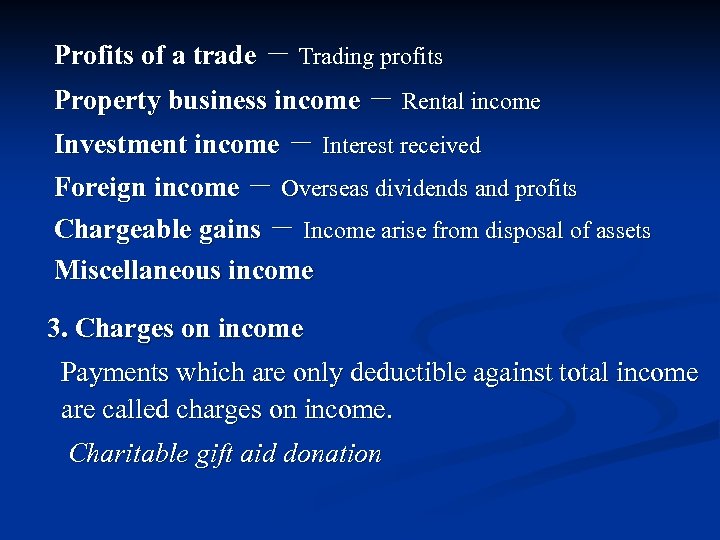

Profits of a trade - Trading profits Property business income - Rental income Investment income - Interest received Foreign income - Overseas dividends and profits Chargeable gains - Income arise from disposal of assets Miscellaneous income 3. Charges on income Payments which are only deductible against total income are called charges on income. Charitable gift aid donation

Profits of a trade - Trading profits Property business income - Rental income Investment income - Interest received Foreign income - Overseas dividends and profits Chargeable gains - Income arise from disposal of assets Miscellaneous income 3. Charges on income Payments which are only deductible against total income are called charges on income. Charitable gift aid donation

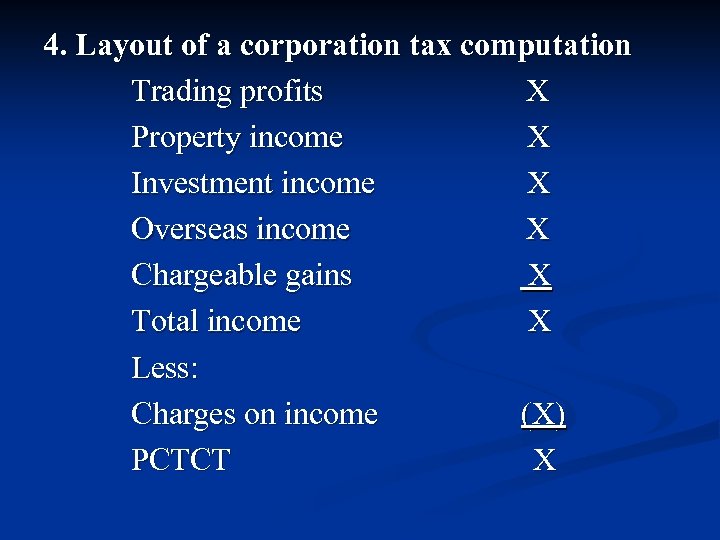

4. Layout of a corporation tax computation Trading profits X Property income X Investment income X Overseas income X Chargeable gains X Total income X Less: Charges on income (X) PCTCT X

4. Layout of a corporation tax computation Trading profits X Property income X Investment income X Overseas income X Chargeable gains X Total income X Less: Charges on income (X) PCTCT X

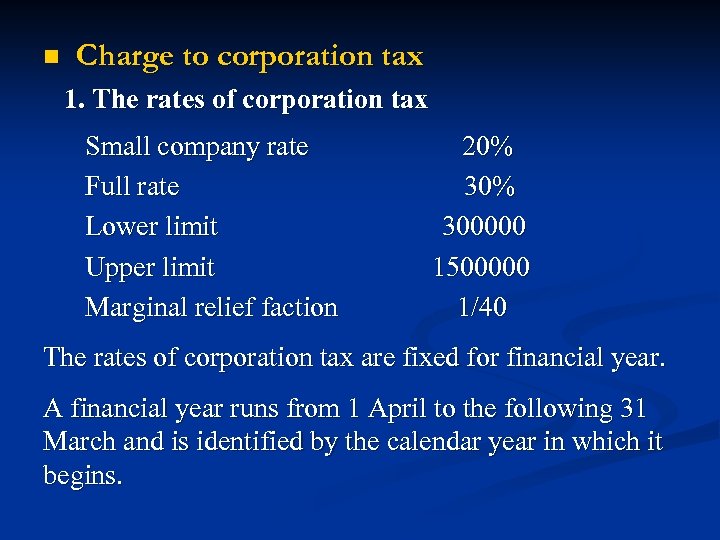

n Charge to corporation tax 1. The rates of corporation tax Small company rate Full rate Lower limit Upper limit Marginal relief faction 20% 300000 1500000 1/40 The rates of corporation tax are fixed for financial year. A financial year runs from 1 April to the following 31 March and is identified by the calendar year in which it begins.

n Charge to corporation tax 1. The rates of corporation tax Small company rate Full rate Lower limit Upper limit Marginal relief faction 20% 300000 1500000 1/40 The rates of corporation tax are fixed for financial year. A financial year runs from 1 April to the following 31 March and is identified by the calendar year in which it begins.

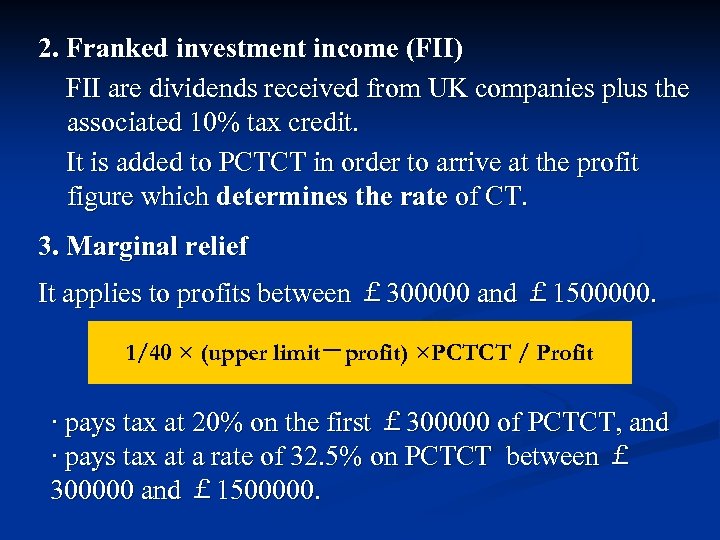

2. Franked investment income (FII) FII are dividends received from UK companies plus the associated 10% tax credit. It is added to PCTCT in order to arrive at the profit figure which determines the rate of CT. 3. Marginal relief It applies to profits between £ 300000 and £ 1500000. 1/40 × (upper limit-profit) ×PCTCT / Profit · pays tax at 20% on the first £ 300000 of PCTCT, and · pays tax at a rate of 32. 5% on PCTCT between £ 300000 and £ 1500000.

2. Franked investment income (FII) FII are dividends received from UK companies plus the associated 10% tax credit. It is added to PCTCT in order to arrive at the profit figure which determines the rate of CT. 3. Marginal relief It applies to profits between £ 300000 and £ 1500000. 1/40 × (upper limit-profit) ×PCTCT / Profit · pays tax at 20% on the first £ 300000 of PCTCT, and · pays tax at a rate of 32. 5% on PCTCT between £ 300000 and £ 1500000.

4. Short accounting period If an accounting period is for less than 12 months, the limits must be reduced proportionately. 5. Associated companies A company is associated with another company if either controls the other or if both are under the control of the same person or persons. If a company has any associated companies, then the limits are divided by the number of companies associated with each other. Dormant company is not accounted as associated company.

4. Short accounting period If an accounting period is for less than 12 months, the limits must be reduced proportionately. 5. Associated companies A company is associated with another company if either controls the other or if both are under the control of the same person or persons. If a company has any associated companies, then the limits are divided by the number of companies associated with each other. Dormant company is not accounted as associated company.

6. Accounting period straddling 31 March If either the corporation tax rate, the fraction, or the various limits have changed between the two years, calculate corporation tax liability in two parts.

6. Accounting period straddling 31 March If either the corporation tax rate, the fraction, or the various limits have changed between the two years, calculate corporation tax liability in two parts.

Chapter 2 Trading Profits n The adjustment of profits There are four types of adjustment that need to be made from accounting profit to taxable profit. ★ Add expenditure not allowable for taxation ★ Add income not included in the accounts but taxable as trading profits ★ Deduct expenditure not charged in the accounts but allowable for taxation ★ Deduct income not taxable as trading profits

Chapter 2 Trading Profits n The adjustment of profits There are four types of adjustment that need to be made from accounting profit to taxable profit. ★ Add expenditure not allowable for taxation ★ Add income not included in the accounts but taxable as trading profits ★ Deduct expenditure not charged in the accounts but allowable for taxation ★ Deduct income not taxable as trading profits

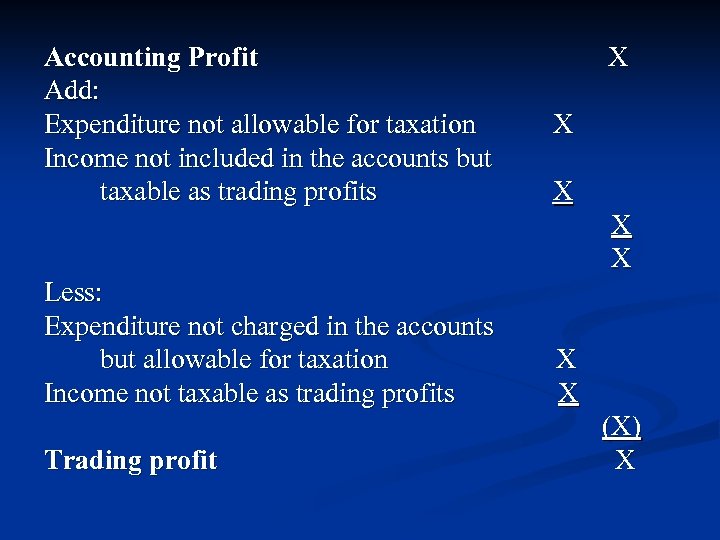

Accounting Profit Add: Expenditure not allowable for taxation Income not included in the accounts but taxable as trading profits X X X Less: Expenditure not charged in the accounts but allowable for taxation Income not taxable as trading profits Trading profit X X (X) X

Accounting Profit Add: Expenditure not allowable for taxation Income not included in the accounts but taxable as trading profits X X X Less: Expenditure not charged in the accounts but allowable for taxation Income not taxable as trading profits Trading profit X X (X) X

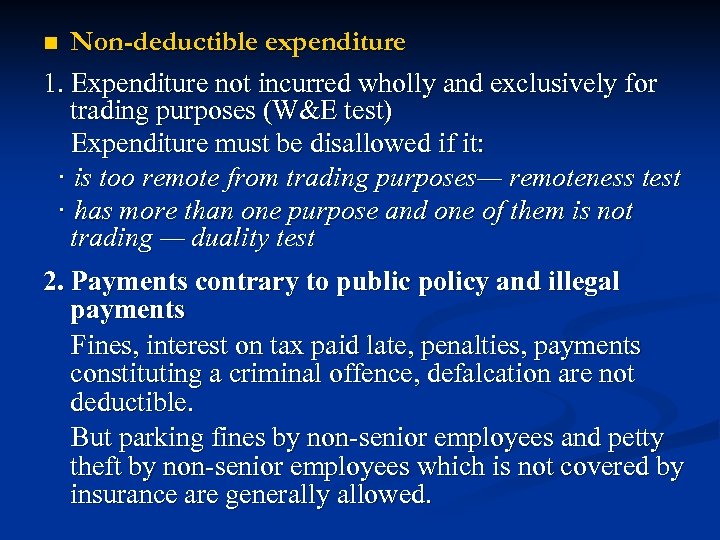

Non-deductible expenditure 1. Expenditure not incurred wholly and exclusively for trading purposes (W&E test) Expenditure must be disallowed if it: · is too remote from trading purposes— remoteness test · has more than one purpose and one of them is not trading — duality test n 2. Payments contrary to public policy and illegal payments Fines, interest on tax paid late, penalties, payments constituting a criminal offence, defalcation are not deductible. But parking fines by non-senior employees and petty theft by non-senior employees which is not covered by insurance are generally allowed.

Non-deductible expenditure 1. Expenditure not incurred wholly and exclusively for trading purposes (W&E test) Expenditure must be disallowed if it: · is too remote from trading purposes— remoteness test · has more than one purpose and one of them is not trading — duality test n 2. Payments contrary to public policy and illegal payments Fines, interest on tax paid late, penalties, payments constituting a criminal offence, defalcation are not deductible. But parking fines by non-senior employees and petty theft by non-senior employees which is not covered by insurance are generally allowed.

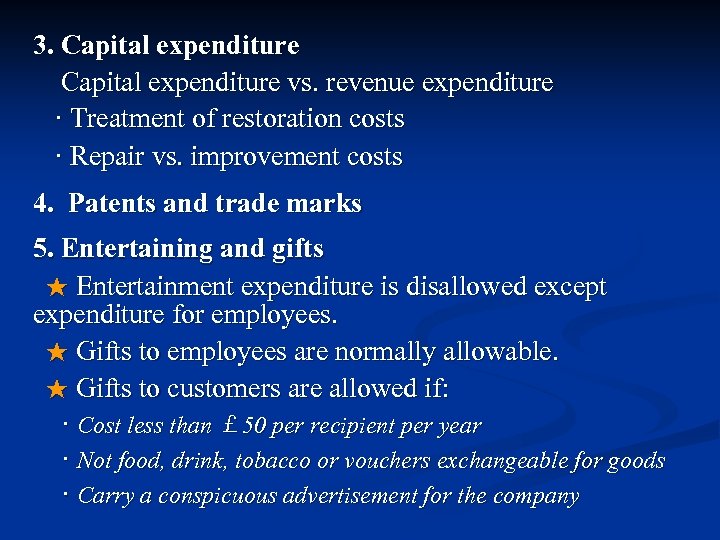

3. Capital expenditure vs. revenue expenditure · Treatment of restoration costs · Repair vs. improvement costs 4. Patents and trade marks 5. Entertaining and gifts ★ Entertainment expenditure is disallowed except expenditure for employees. ★ Gifts to employees are normally allowable. ★ Gifts to customers are allowed if: · Cost less than £ 50 per recipient per year · Not food, drink, tobacco or vouchers exchangeable for goods · Carry a conspicuous advertisement for the company

3. Capital expenditure vs. revenue expenditure · Treatment of restoration costs · Repair vs. improvement costs 4. Patents and trade marks 5. Entertaining and gifts ★ Entertainment expenditure is disallowed except expenditure for employees. ★ Gifts to employees are normally allowable. ★ Gifts to customers are allowed if: · Cost less than £ 50 per recipient per year · Not food, drink, tobacco or vouchers exchangeable for goods · Carry a conspicuous advertisement for the company

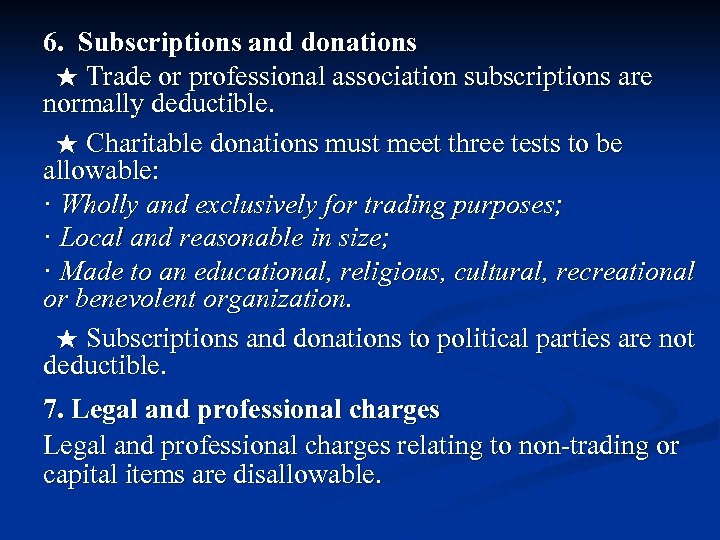

6. Subscriptions and donations ★ Trade or professional association subscriptions are normally deductible. ★ Charitable donations must meet three tests to be allowable: · Wholly and exclusively for trading purposes; · Local and reasonable in size; · Made to an educational, religious, cultural, recreational or benevolent organization. ★ Subscriptions and donations to political parties are not deductible. 7. Legal and professional charges relating to non-trading or capital items are disallowable.

6. Subscriptions and donations ★ Trade or professional association subscriptions are normally deductible. ★ Charitable donations must meet three tests to be allowable: · Wholly and exclusively for trading purposes; · Local and reasonable in size; · Made to an educational, religious, cultural, recreational or benevolent organization. ★ Subscriptions and donations to political parties are not deductible. 7. Legal and professional charges relating to non-trading or capital items are disallowable.

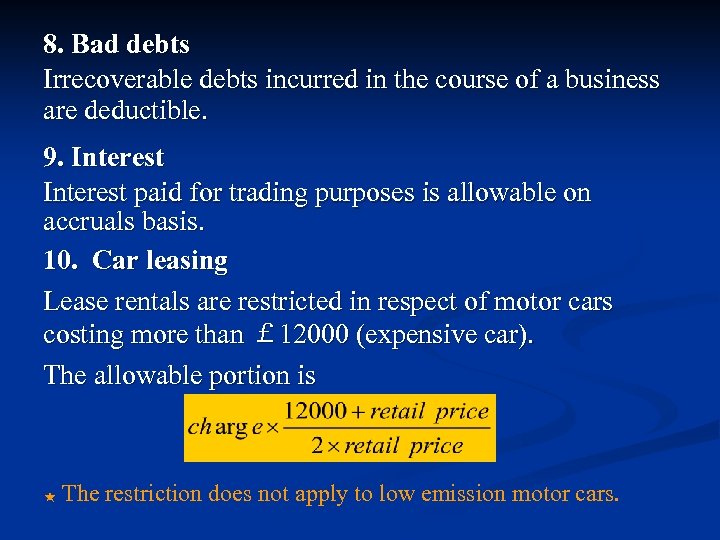

8. Bad debts Irrecoverable debts incurred in the course of a business are deductible. 9. Interest paid for trading purposes is allowable on accruals basis. 10. Car leasing Lease rentals are restricted in respect of motor cars costing more than £ 12000 (expensive car). The allowable portion is ★ The restriction does not apply to low emission motor cars.

8. Bad debts Irrecoverable debts incurred in the course of a business are deductible. 9. Interest paid for trading purposes is allowable on accruals basis. 10. Car leasing Lease rentals are restricted in respect of motor cars costing more than £ 12000 (expensive car). The allowable portion is ★ The restriction does not apply to low emission motor cars.

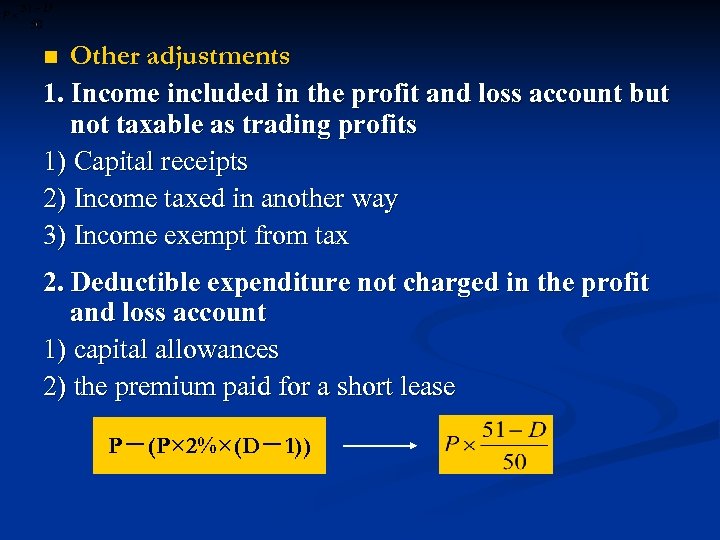

Other adjustments 1. Income included in the profit and loss account but not taxable as trading profits 1) Capital receipts 2) Income taxed in another way 3) Income exempt from tax n 2. Deductible expenditure not charged in the profit and loss account 1) capital allowances 2) the premium paid for a short lease P-(P× 2%×(D-1))

Other adjustments 1. Income included in the profit and loss account but not taxable as trading profits 1) Capital receipts 2) Income taxed in another way 3) Income exempt from tax n 2. Deductible expenditure not charged in the profit and loss account 1) capital allowances 2) the premium paid for a short lease P-(P× 2%×(D-1))

Relief for pre-trading expenditure Any allowable revenue expenditure incurred in the 7 years before a company commences to trade is treated as an expense incurred on the first day of trading. n

Relief for pre-trading expenditure Any allowable revenue expenditure incurred in the 7 years before a company commences to trade is treated as an expense incurred on the first day of trading. n

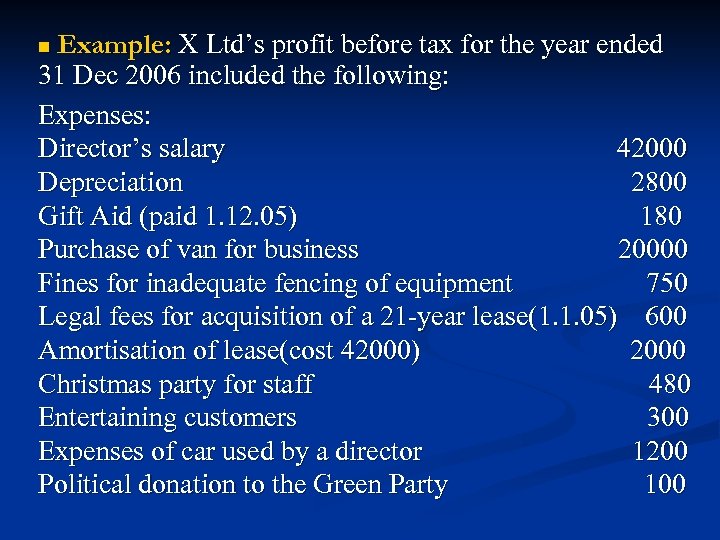

Example: X Ltd’s profit before tax for the year ended 31 Dec 2006 included the following: Expenses: Director’s salary 42000 Depreciation 2800 Gift Aid (paid 1. 12. 05) 180 Purchase of van for business 20000 Fines for inadequate fencing of equipment 750 Legal fees for acquisition of a 21 -year lease(1. 1. 05) 600 Amortisation of lease(cost 42000) 2000 Christmas party for staff 480 Entertaining customers 300 Expenses of car used by a director 1200 Political donation to the Green Party 100 n

Example: X Ltd’s profit before tax for the year ended 31 Dec 2006 included the following: Expenses: Director’s salary 42000 Depreciation 2800 Gift Aid (paid 1. 12. 05) 180 Purchase of van for business 20000 Fines for inadequate fencing of equipment 750 Legal fees for acquisition of a 21 -year lease(1. 1. 05) 600 Amortisation of lease(cost 42000) 2000 Christmas party for staff 480 Entertaining customers 300 Expenses of car used by a director 1200 Political donation to the Green Party 100 n

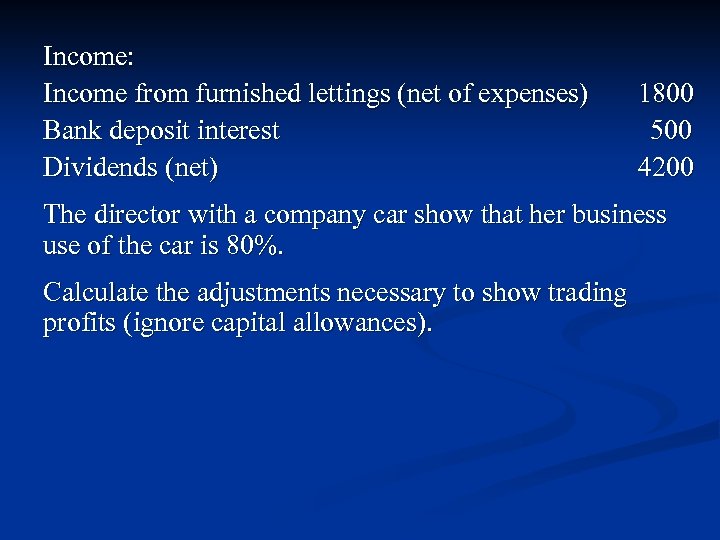

Income: Income from furnished lettings (net of expenses) Bank deposit interest Dividends (net) 1800 500 4200 The director with a company car show that her business use of the car is 80%. Calculate the adjustments necessary to show trading profits (ignore capital allowances).

Income: Income from furnished lettings (net of expenses) Bank deposit interest Dividends (net) 1800 500 4200 The director with a company car show that her business use of the car is 80%. Calculate the adjustments necessary to show trading profits (ignore capital allowances).

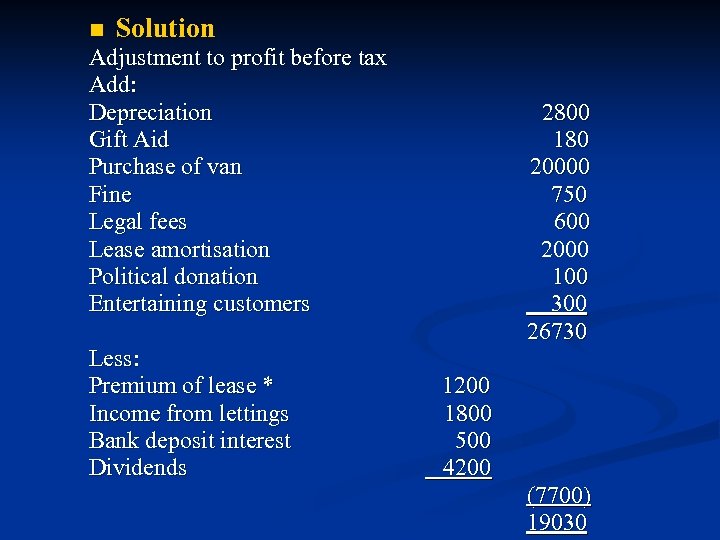

n Solution Adjustment to profit before tax Add: Depreciation Gift Aid Purchase of van Fine Legal fees Lease amortisation Political donation Entertaining customers Less: Premium of lease * Income from lettings Bank deposit interest Dividends 2800 180 20000 750 600 2000 100 300 26730 1200 1800 500 4200 (7700) 19030

n Solution Adjustment to profit before tax Add: Depreciation Gift Aid Purchase of van Fine Legal fees Lease amortisation Political donation Entertaining customers Less: Premium of lease * Income from lettings Bank deposit interest Dividends 2800 180 20000 750 600 2000 100 300 26730 1200 1800 500 4200 (7700) 19030

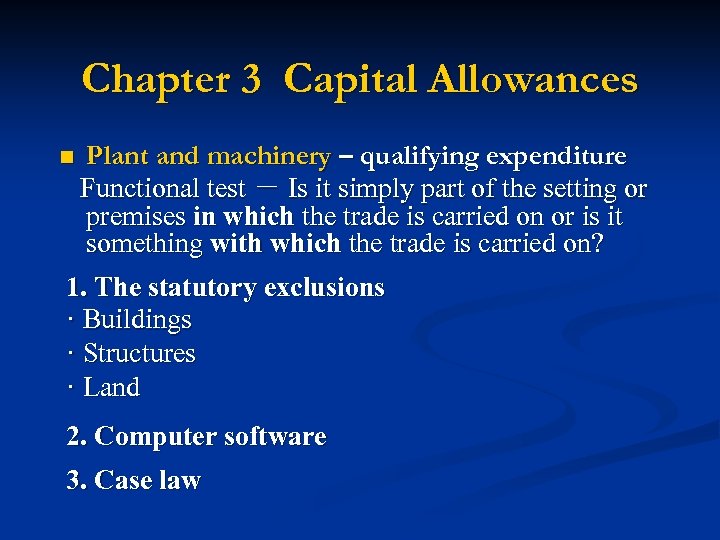

Chapter 3 Capital Allowances n Plant and machinery – qualifying expenditure Functional test - Is it simply part of the setting or premises in which the trade is carried on or is it something with which the trade is carried on? 1. The statutory exclusions · Buildings · Structures · Land 2. Computer software 3. Case law

Chapter 3 Capital Allowances n Plant and machinery – qualifying expenditure Functional test - Is it simply part of the setting or premises in which the trade is carried on or is it something with which the trade is carried on? 1. The statutory exclusions · Buildings · Structures · Land 2. Computer software 3. Case law

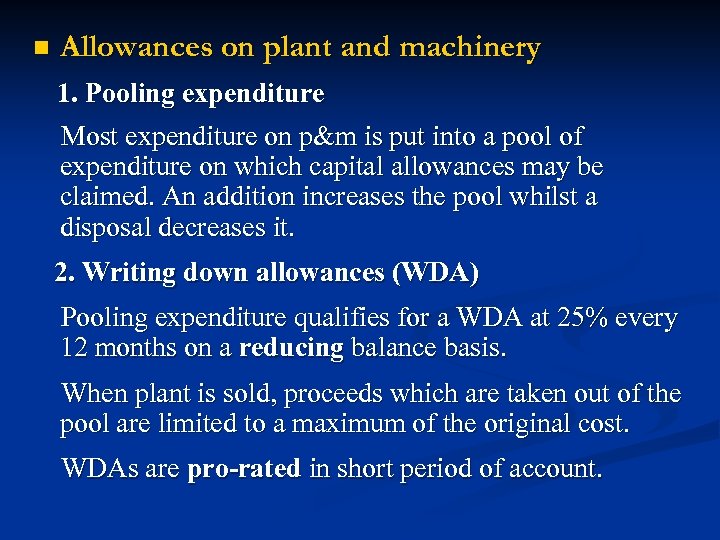

n Allowances on plant and machinery 1. Pooling expenditure Most expenditure on p&m is put into a pool of expenditure on which capital allowances may be claimed. An addition increases the pool whilst a disposal decreases it. 2. Writing down allowances (WDA) Pooling expenditure qualifies for a WDA at 25% every 12 months on a reducing balance basis. When plant is sold, proceeds which are taken out of the pool are limited to a maximum of the original cost. WDAs are pro-rated in short period of account.

n Allowances on plant and machinery 1. Pooling expenditure Most expenditure on p&m is put into a pool of expenditure on which capital allowances may be claimed. An addition increases the pool whilst a disposal decreases it. 2. Writing down allowances (WDA) Pooling expenditure qualifies for a WDA at 25% every 12 months on a reducing balance basis. When plant is sold, proceeds which are taken out of the pool are limited to a maximum of the original cost. WDAs are pro-rated in short period of account.

3. First year allowances (FYA) 1) Normal FYAs Normal FYA is available for expenditures of small and medium sized enterprises. Rates of FYAs - 40% ★ The rate is increased to 50% for small business for expenditure on or after 1 April 2006 for two years. FYAs are never pro-rated in short periods of account. 2) 100% FYAs - available to all businesses For low emission car: · emits CO 2 120 g/km or less · electrically propelled car ★ FYAs are not available on any other cars.

3. First year allowances (FYA) 1) Normal FYAs Normal FYA is available for expenditures of small and medium sized enterprises. Rates of FYAs - 40% ★ The rate is increased to 50% for small business for expenditure on or after 1 April 2006 for two years. FYAs are never pro-rated in short periods of account. 2) 100% FYAs - available to all businesses For low emission car: · emits CO 2 120 g/km or less · electrically propelled car ★ FYAs are not available on any other cars.

4. The disposal value of assets sale proceeds no more then original cost 5. Balancing charges and allowances Balancing charges — disposal value - residual Balancing allowances — residual - disposal value BC and BA arise when the trade ceases or disposal of not pooled assets. ★ When a business ceases to trade, no FYAs or WDAs are given in the final accounting period. 6. Expensive car Motor cars costing more than 12000 are not pooled. The restricted maximum WDA is 3000 a year which is pro-rated in short accounting period.

4. The disposal value of assets sale proceeds no more then original cost 5. Balancing charges and allowances Balancing charges — disposal value - residual Balancing allowances — residual - disposal value BC and BA arise when the trade ceases or disposal of not pooled assets. ★ When a business ceases to trade, no FYAs or WDAs are given in the final accounting period. 6. Expensive car Motor cars costing more than 12000 are not pooled. The restricted maximum WDA is 3000 a year which is pro-rated in short accounting period.

7. Short life assets Short life asset is the asset that is expected to be disposed of within 4 years. With a de-pooling election, a short life asset can be kept separately from the general pool. If the asset is not disposed of in the correct time period, its TWDV is transferred to the general pool. n Long life assets are assets with an expected working life of 25 years or more. It is also kept in a pool separate from the general pool. The writing down allowance available on such assets is 6% per annum on a reducing balance basis.

7. Short life assets Short life asset is the asset that is expected to be disposed of within 4 years. With a de-pooling election, a short life asset can be kept separately from the general pool. If the asset is not disposed of in the correct time period, its TWDV is transferred to the general pool. n Long life assets are assets with an expected working life of 25 years or more. It is also kept in a pool separate from the general pool. The writing down allowance available on such assets is 6% per annum on a reducing balance basis.

n Industrial buildings 1. Qualified buildings 1) General definition · All factories and ancillary premises used in a trade · Staff welfare buildings · Sports pavilions in any trade · Buildings in use for a transport undertaking, agriculture contracting, mining or fishing · Roads operated under highway concessions Dwelling houses, retail shops, showrooms and general offices are not industrial buildings. 2) Hotels

n Industrial buildings 1. Qualified buildings 1) General definition · All factories and ancillary premises used in a trade · Staff welfare buildings · Sports pavilions in any trade · Buildings in use for a transport undertaking, agriculture contracting, mining or fishing · Roads operated under highway concessions Dwelling houses, retail shops, showrooms and general offices are not industrial buildings. 2) Hotels

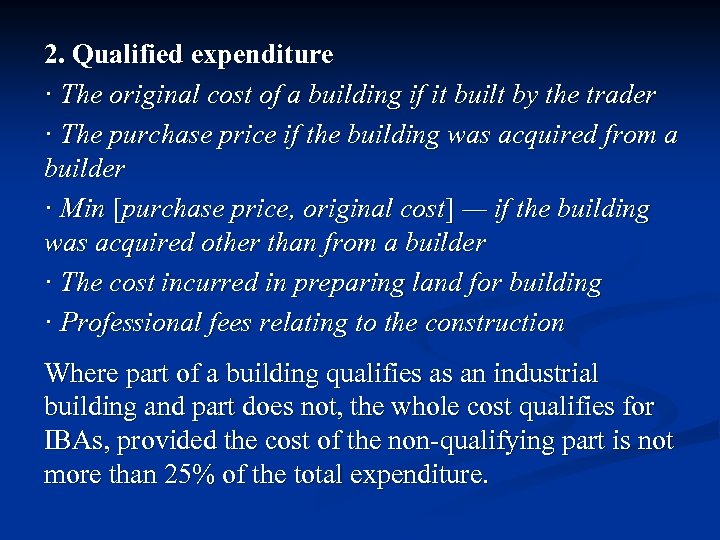

2. Qualified expenditure · The original cost of a building if it built by the trader · The purchase price if the building was acquired from a builder · Min [purchase price, original cost] — if the building was acquired other than from a builder · The cost incurred in preparing land for building · Professional fees relating to the construction Where part of a building qualifies as an industrial building and part does not, the whole cost qualifies for IBAs, provided the cost of the non-qualifying part is not more than 25% of the total expenditure.

2. Qualified expenditure · The original cost of a building if it built by the trader · The purchase price if the building was acquired from a builder · Min [purchase price, original cost] — if the building was acquired other than from a builder · The cost incurred in preparing land for building · Professional fees relating to the construction Where part of a building qualifies as an industrial building and part does not, the whole cost qualifies for IBAs, provided the cost of the non-qualifying part is not more than 25% of the total expenditure.

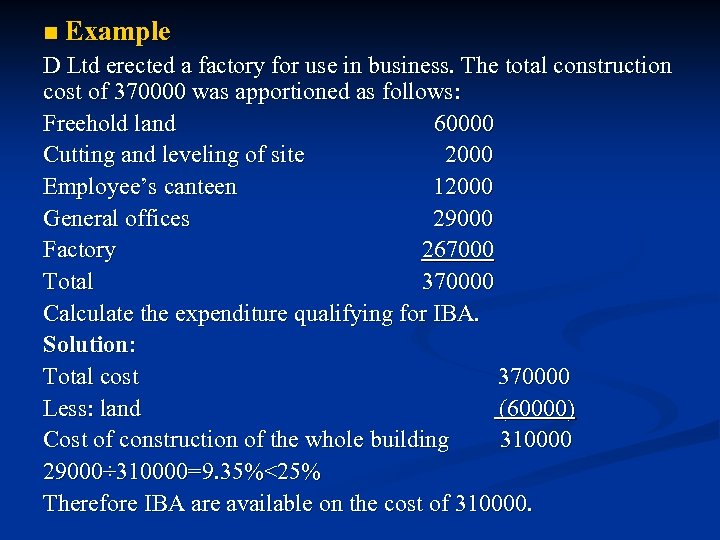

n Example D Ltd erected a factory for use in business. The total construction cost of 370000 was apportioned as follows: Freehold land 60000 Cutting and leveling of site 2000 Employee’s canteen 12000 General offices 29000 Factory 267000 Total 370000 Calculate the expenditure qualifying for IBA. Solution: Total cost 370000 Less: land (60000) Cost of construction of the whole building 310000 29000÷ 310000=9. 35%<25% Therefore IBA are available on the cost of 310000.

n Example D Ltd erected a factory for use in business. The total construction cost of 370000 was apportioned as follows: Freehold land 60000 Cutting and leveling of site 2000 Employee’s canteen 12000 General offices 29000 Factory 267000 Total 370000 Calculate the expenditure qualifying for IBA. Solution: Total cost 370000 Less: land (60000) Cost of construction of the whole building 310000 29000÷ 310000=9. 35%<25% Therefore IBA are available on the cost of 310000.

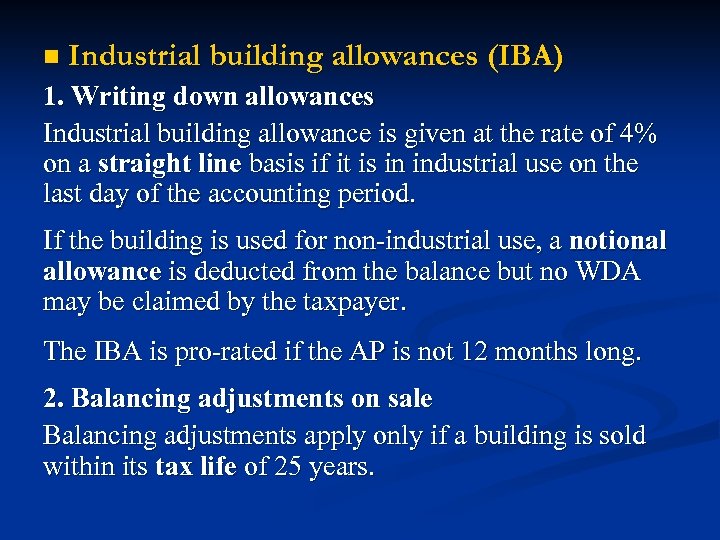

n Industrial building allowances (IBA) 1. Writing down allowances Industrial building allowance is given at the rate of 4% on a straight line basis if it is in industrial use on the last day of the accounting period. If the building is used for non-industrial use, a notional allowance is deducted from the balance but no WDA may be claimed by the taxpayer. The IBA is pro-rated if the AP is not 12 months long. 2. Balancing adjustments on sale Balancing adjustments apply only if a building is sold within its tax life of 25 years.

n Industrial building allowances (IBA) 1. Writing down allowances Industrial building allowance is given at the rate of 4% on a straight line basis if it is in industrial use on the last day of the accounting period. If the building is used for non-industrial use, a notional allowance is deducted from the balance but no WDA may be claimed by the taxpayer. The IBA is pro-rated if the AP is not 12 months long. 2. Balancing adjustments on sale Balancing adjustments apply only if a building is sold within its tax life of 25 years.

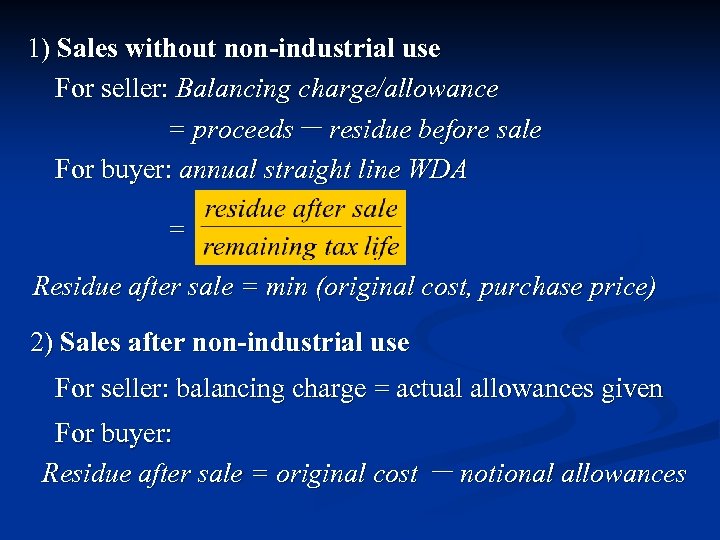

1) Sales without non-industrial use For seller: Balancing charge/allowance = proceeds- residue before sale For buyer: annual straight line WDA = Residue after sale = min (original cost, purchase price) 2) Sales after non-industrial use For seller: balancing charge = actual allowances given For buyer: Residue after sale = original cost - notional allowances

1) Sales without non-industrial use For seller: Balancing charge/allowance = proceeds- residue before sale For buyer: annual straight line WDA = Residue after sale = min (original cost, purchase price) 2) Sales after non-industrial use For seller: balancing charge = actual allowances given For buyer: Residue after sale = original cost - notional allowances

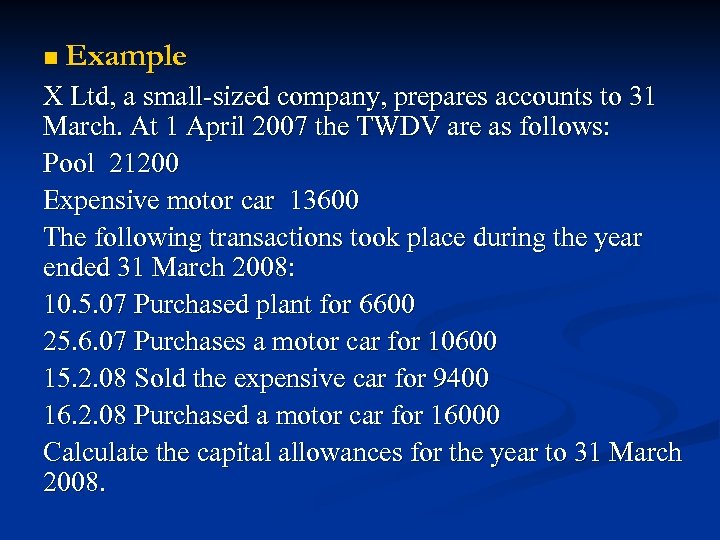

n Example X Ltd, a small-sized company, prepares accounts to 31 March. At 1 April 2007 the TWDV are as follows: Pool 21200 Expensive motor car 13600 The following transactions took place during the year ended 31 March 2008: 10. 5. 07 Purchased plant for 6600 25. 6. 07 Purchases a motor car for 10600 15. 2. 08 Sold the expensive car for 9400 16. 2. 08 Purchased a motor car for 16000 Calculate the capital allowances for the year to 31 March 2008.

n Example X Ltd, a small-sized company, prepares accounts to 31 March. At 1 April 2007 the TWDV are as follows: Pool 21200 Expensive motor car 13600 The following transactions took place during the year ended 31 March 2008: 10. 5. 07 Purchased plant for 6600 25. 6. 07 Purchases a motor car for 10600 15. 2. 08 Sold the expensive car for 9400 16. 2. 08 Purchased a motor car for 16000 Calculate the capital allowances for the year to 31 March 2008.

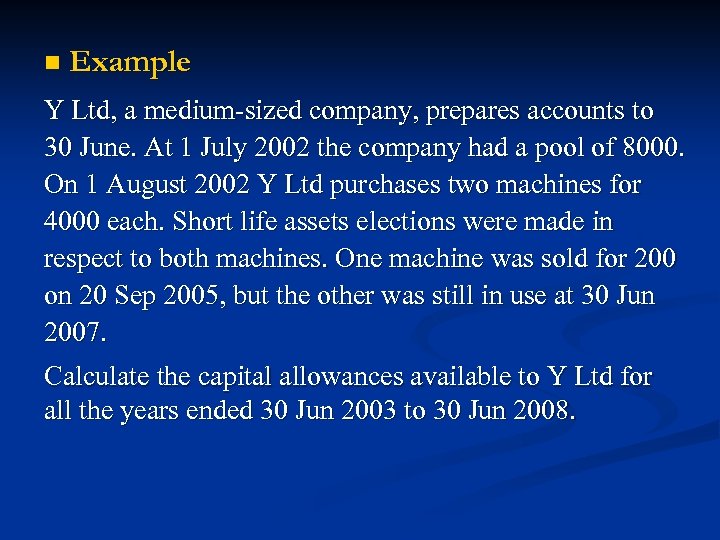

n Example Y Ltd, a medium-sized company, prepares accounts to 30 June. At 1 July 2002 the company had a pool of 8000. On 1 August 2002 Y Ltd purchases two machines for 4000 each. Short life assets elections were made in respect to both machines. One machine was sold for 200 on 20 Sep 2005, but the other was still in use at 30 Jun 2007. Calculate the capital allowances available to Y Ltd for all the years ended 30 Jun 2003 to 30 Jun 2008.

n Example Y Ltd, a medium-sized company, prepares accounts to 30 June. At 1 July 2002 the company had a pool of 8000. On 1 August 2002 Y Ltd purchases two machines for 4000 each. Short life assets elections were made in respect to both machines. One machine was sold for 200 on 20 Sep 2005, but the other was still in use at 30 Jun 2007. Calculate the capital allowances available to Y Ltd for all the years ended 30 Jun 2003 to 30 Jun 2008.

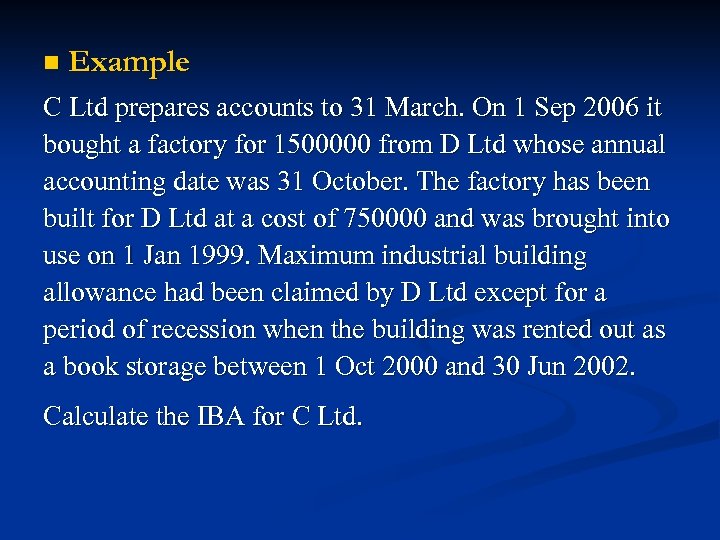

n Example C Ltd prepares accounts to 31 March. On 1 Sep 2006 it bought a factory for 1500000 from D Ltd whose annual accounting date was 31 October. The factory has been built for D Ltd at a cost of 750000 and was brought into use on 1 Jan 1999. Maximum industrial building allowance had been claimed by D Ltd except for a period of recession when the building was rented out as a book storage between 1 Oct 2000 and 30 Jun 2002. Calculate the IBA for C Ltd.

n Example C Ltd prepares accounts to 31 March. On 1 Sep 2006 it bought a factory for 1500000 from D Ltd whose annual accounting date was 31 October. The factory has been built for D Ltd at a cost of 750000 and was brought into use on 1 Jan 1999. Maximum industrial building allowance had been claimed by D Ltd except for a period of recession when the building was rented out as a book storage between 1 Oct 2000 and 30 Jun 2002. Calculate the IBA for C Ltd.

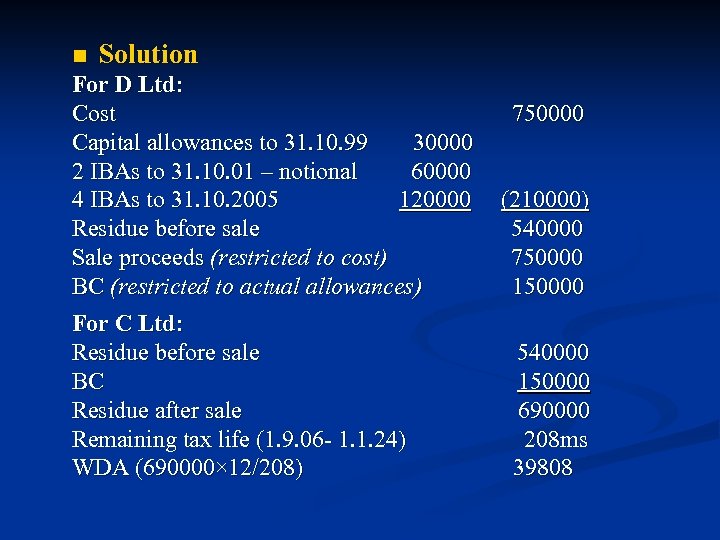

n Solution For D Ltd: Cost Capital allowances to 31. 10. 99 30000 2 IBAs to 31. 10. 01 – notional 60000 4 IBAs to 31. 10. 2005 120000 Residue before sale Sale proceeds (restricted to cost) BC (restricted to actual allowances) For C Ltd: Residue before sale BC Residue after sale Remaining tax life (1. 9. 06 - 1. 1. 24) WDA (690000× 12/208) 750000 (210000) 540000 750000 150000 540000 150000 690000 208 ms 39808

n Solution For D Ltd: Cost Capital allowances to 31. 10. 99 30000 2 IBAs to 31. 10. 01 – notional 60000 4 IBAs to 31. 10. 2005 120000 Residue before sale Sale proceeds (restricted to cost) BC (restricted to actual allowances) For C Ltd: Residue before sale BC Residue after sale Remaining tax life (1. 9. 06 - 1. 1. 24) WDA (690000× 12/208) 750000 (210000) 540000 750000 150000 540000 150000 690000 208 ms 39808

Chapter 4 Loan Relationships and Property Business Income n Loan relationships Any company that borrows or lends money has a loan relationship. creditor relationship ; debtor relationship 1. Treatment of trading loan relationships Where companies enter into loan relationships for trade purposes, any debits or credits are treated as expenses or receipts of the trade on accruals basis. 2. Treatment of non-trading loan relationships Interest arising on a non-trading loan relationship is taxable as investment income on accruals basis.

Chapter 4 Loan Relationships and Property Business Income n Loan relationships Any company that borrows or lends money has a loan relationship. creditor relationship ; debtor relationship 1. Treatment of trading loan relationships Where companies enter into loan relationships for trade purposes, any debits or credits are treated as expenses or receipts of the trade on accruals basis. 2. Treatment of non-trading loan relationships Interest arising on a non-trading loan relationship is taxable as investment income on accruals basis.

3. Accounting method - Accruals basis 4. Incidental costs of loan finance Expenses are allowed if incurred directly: · In bringing a loan relationship into existence · Entering into or giving effect to any related transactions · Making payment under a loan relationship or related transactions · Taking steps to ensure the receipt of payments under the loan relationship or related transaction 5. Other maters Interest paid or received between UK companies are paid or received gross. Interest on underpaid tax and interest on overpaid tax is treated as investment income.

3. Accounting method - Accruals basis 4. Incidental costs of loan finance Expenses are allowed if incurred directly: · In bringing a loan relationship into existence · Entering into or giving effect to any related transactions · Making payment under a loan relationship or related transactions · Taking steps to ensure the receipt of payments under the loan relationship or related transaction 5. Other maters Interest paid or received between UK companies are paid or received gross. Interest on underpaid tax and interest on overpaid tax is treated as investment income.

n Property business income 1. Income taxable · rents under any lease or tenancy agreement · premium received on the grant of a short lease Rental income is taxed as property business income in the same way as trading profits on accruals basis. 2. Allowable deductions · insurance · agents’ fees · management expenses · repairs and redecoration · specific bad debts · capital allowances · renewal cost or 10% wear and tear allowance

n Property business income 1. Income taxable · rents under any lease or tenancy agreement · premium received on the grant of a short lease Rental income is taxed as property business income in the same way as trading profits on accruals basis. 2. Allowable deductions · insurance · agents’ fees · management expenses · repairs and redecoration · specific bad debts · capital allowances · renewal cost or 10% wear and tear allowance

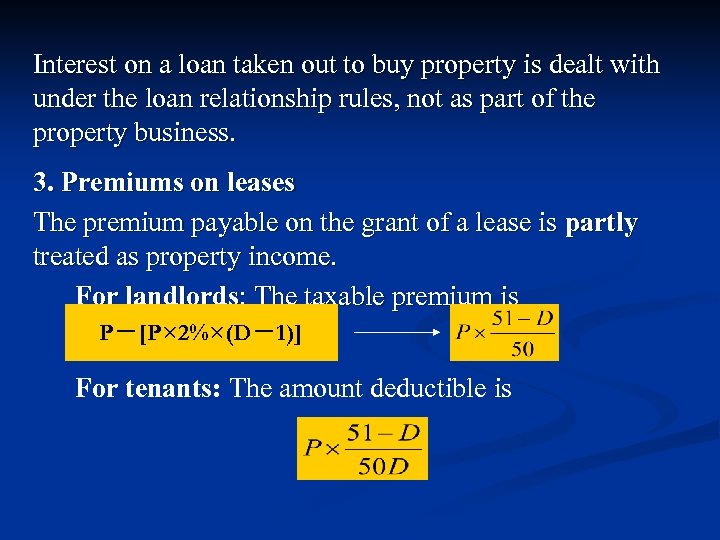

Interest on a loan taken out to buy property is dealt with under the loan relationship rules, not as part of the property business. 3. Premiums on leases The premium payable on the grant of a lease is partly treated as property income. For landlords: The taxable premium is P-[P× 2%×(D-1)] For tenants: The amount deductible is

Interest on a loan taken out to buy property is dealt with under the loan relationship rules, not as part of the property business. 3. Premiums on leases The premium payable on the grant of a lease is partly treated as property income. For landlords: The taxable premium is P-[P× 2%×(D-1)] For tenants: The amount deductible is

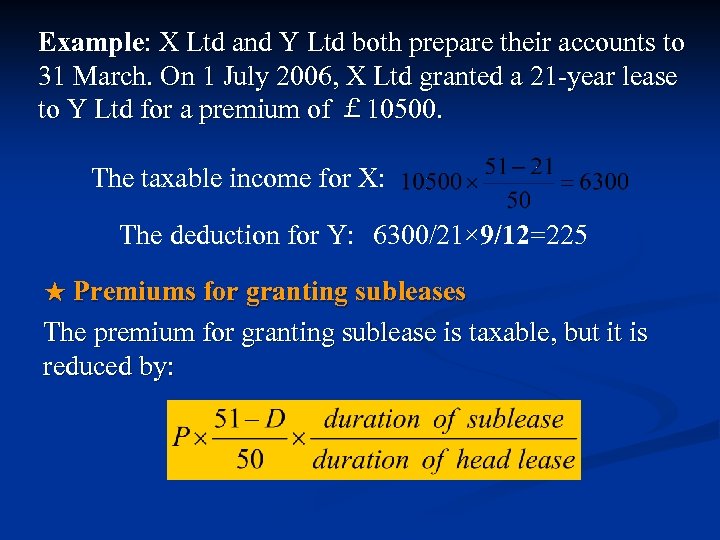

Example: X Ltd and Y Ltd both prepare their accounts to 31 March. On 1 July 2006, X Ltd granted a 21 -year lease to Y Ltd for a premium of £ 10500. The taxable income for X: The deduction for Y: 6300/21× 9/12=225 ★ Premiums for granting subleases The premium for granting sublease is taxable, but it is reduced by:

Example: X Ltd and Y Ltd both prepare their accounts to 31 March. On 1 July 2006, X Ltd granted a 21 -year lease to Y Ltd for a premium of £ 10500. The taxable income for X: The deduction for Y: 6300/21× 9/12=225 ★ Premiums for granting subleases The premium for granting sublease is taxable, but it is reduced by:

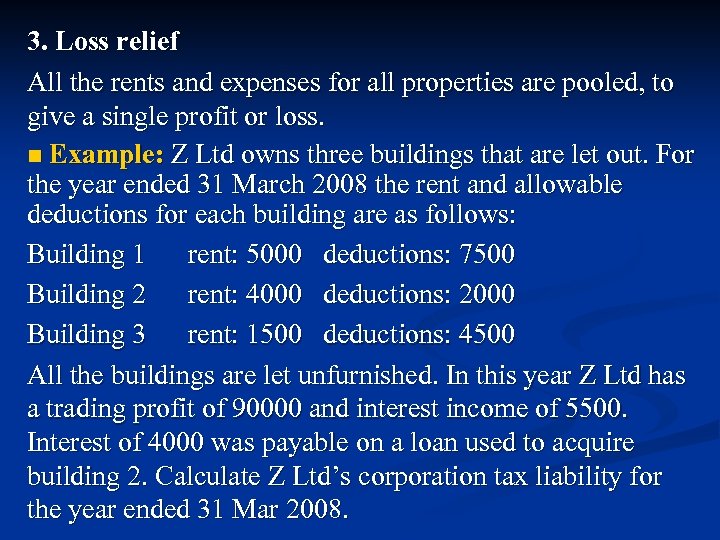

3. Loss relief All the rents and expenses for all properties are pooled, to give a single profit or loss. n Example: Z Ltd owns three buildings that are let out. For the year ended 31 March 2008 the rent and allowable deductions for each building are as follows: Building 1 rent: 5000 deductions: 7500 Building 2 rent: 4000 deductions: 2000 Building 3 rent: 1500 deductions: 4500 All the buildings are let unfurnished. In this year Z Ltd has a trading profit of 90000 and interest income of 5500. Interest of 4000 was payable on a loan used to acquire building 2. Calculate Z Ltd’s corporation tax liability for the year ended 31 Mar 2008.

3. Loss relief All the rents and expenses for all properties are pooled, to give a single profit or loss. n Example: Z Ltd owns three buildings that are let out. For the year ended 31 March 2008 the rent and allowable deductions for each building are as follows: Building 1 rent: 5000 deductions: 7500 Building 2 rent: 4000 deductions: 2000 Building 3 rent: 1500 deductions: 4500 All the buildings are let unfurnished. In this year Z Ltd has a trading profit of 90000 and interest income of 5500. Interest of 4000 was payable on a loan used to acquire building 2. Calculate Z Ltd’s corporation tax liability for the year ended 31 Mar 2008.

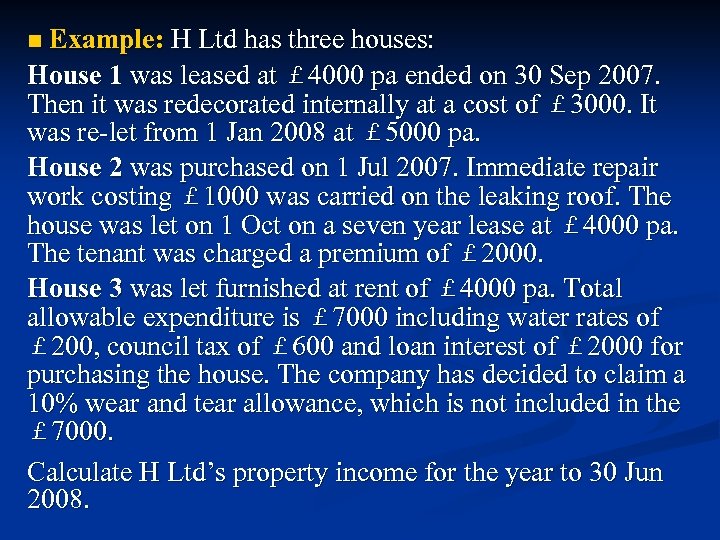

Example: H Ltd has three houses: House 1 was leased at £ 4000 pa ended on 30 Sep 2007. Then it was redecorated internally at a cost of £ 3000. It was re-let from 1 Jan 2008 at £ 5000 pa. House 2 was purchased on 1 Jul 2007. Immediate repair work costing £ 1000 was carried on the leaking roof. The house was let on 1 Oct on a seven year lease at £ 4000 pa. The tenant was charged a premium of £ 2000. House 3 was let furnished at rent of £ 4000 pa. Total allowable expenditure is £ 7000 including water rates of £ 200, council tax of £ 600 and loan interest of £ 2000 for purchasing the house. The company has decided to claim a 10% wear and tear allowance, which is not included in the £ 7000. Calculate H Ltd’s property income for the year to 30 Jun 2008. n

Example: H Ltd has three houses: House 1 was leased at £ 4000 pa ended on 30 Sep 2007. Then it was redecorated internally at a cost of £ 3000. It was re-let from 1 Jan 2008 at £ 5000 pa. House 2 was purchased on 1 Jul 2007. Immediate repair work costing £ 1000 was carried on the leaking roof. The house was let on 1 Oct on a seven year lease at £ 4000 pa. The tenant was charged a premium of £ 2000. House 3 was let furnished at rent of £ 4000 pa. Total allowable expenditure is £ 7000 including water rates of £ 200, council tax of £ 600 and loan interest of £ 2000 for purchasing the house. The company has decided to claim a 10% wear and tear allowance, which is not included in the £ 7000. Calculate H Ltd’s property income for the year to 30 Jun 2008. n

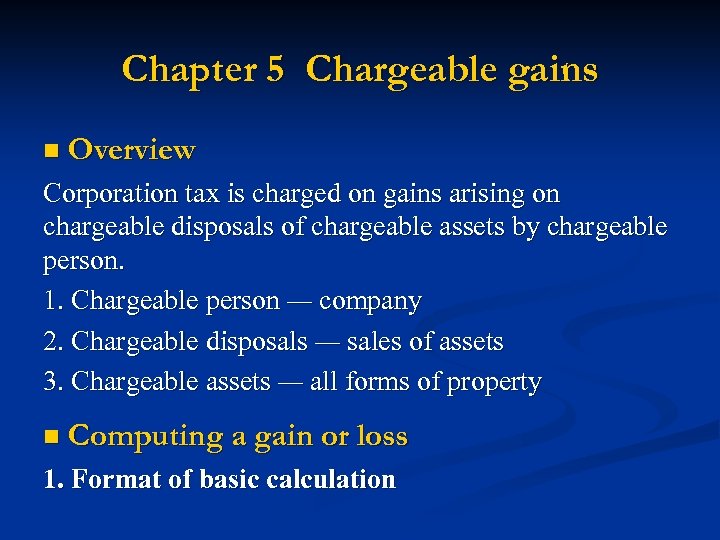

Chapter 5 Chargeable gains n Overview Corporation tax is charged on gains arising on chargeable disposals of chargeable assets by chargeable person. 1. Chargeable person — company 2. Chargeable disposals — sales of assets 3. Chargeable assets — all forms of property n Computing a gain or loss 1. Format of basic calculation

Chapter 5 Chargeable gains n Overview Corporation tax is charged on gains arising on chargeable disposals of chargeable assets by chargeable person. 1. Chargeable person — company 2. Chargeable disposals — sales of assets 3. Chargeable assets — all forms of property n Computing a gain or loss 1. Format of basic calculation

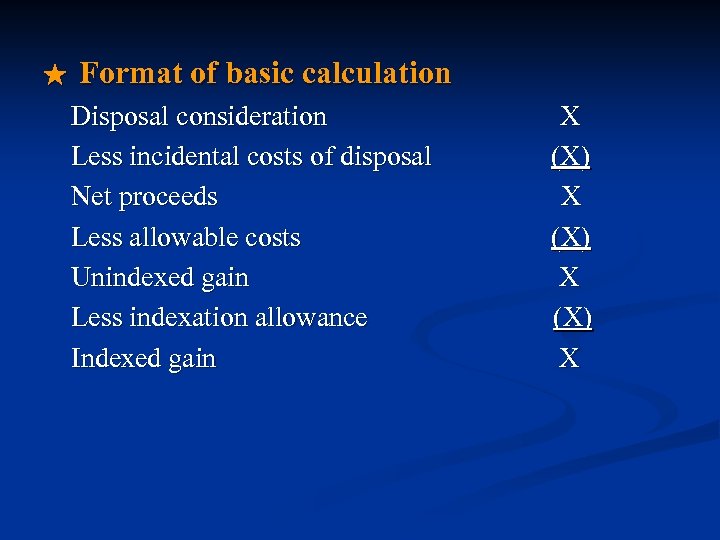

★ Format of basic calculation Disposal consideration Less incidental costs of disposal Net proceeds Less allowable costs Unindexed gain Less indexation allowance Indexed gain X (X) X

★ Format of basic calculation Disposal consideration Less incidental costs of disposal Net proceeds Less allowable costs Unindexed gain Less indexation allowance Indexed gain X (X) X

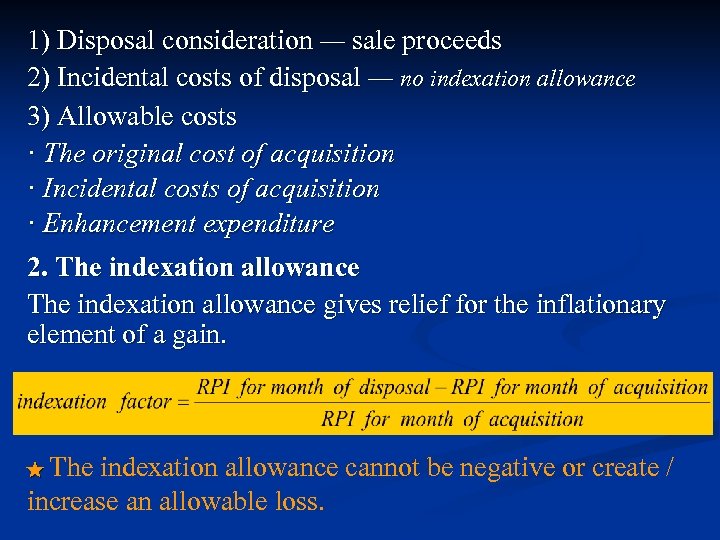

1) Disposal consideration — sale proceeds 2) Incidental costs of disposal — no indexation allowance 3) Allowable costs · The original cost of acquisition · Incidental costs of acquisition · Enhancement expenditure 2. The indexation allowance gives relief for the inflationary element of a gain. ★ The indexation allowance cannot be negative or create / increase an allowable loss.

1) Disposal consideration — sale proceeds 2) Incidental costs of disposal — no indexation allowance 3) Allowable costs · The original cost of acquisition · Incidental costs of acquisition · Enhancement expenditure 2. The indexation allowance gives relief for the inflationary element of a gain. ★ The indexation allowance cannot be negative or create / increase an allowable loss.

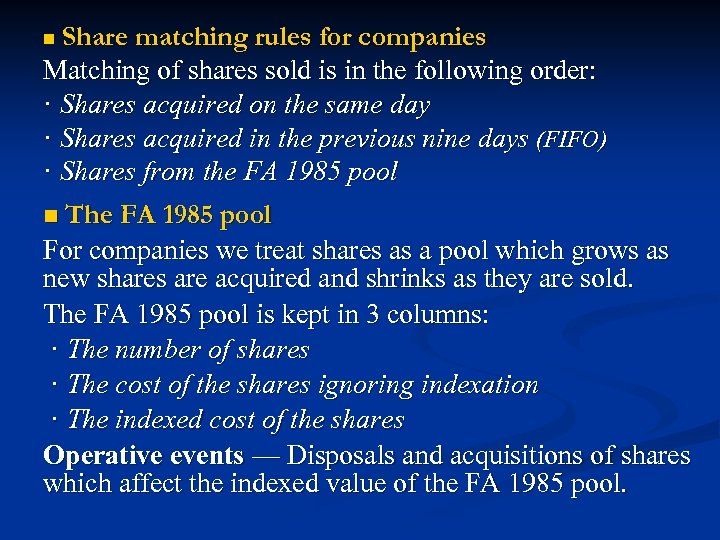

Share matching rules for companies Matching of shares sold is in the following order: · Shares acquired on the same day · Shares acquired in the previous nine days (FIFO) · Shares from the FA 1985 pool n The FA 1985 pool For companies we treat shares as a pool which grows as new shares are acquired and shrinks as they are sold. The FA 1985 pool is kept in 3 columns: · The number of shares · The cost of the shares ignoring indexation · The indexed cost of the shares Operative events — Disposals and acquisitions of shares which affect the indexed value of the FA 1985 pool. n

Share matching rules for companies Matching of shares sold is in the following order: · Shares acquired on the same day · Shares acquired in the previous nine days (FIFO) · Shares from the FA 1985 pool n The FA 1985 pool For companies we treat shares as a pool which grows as new shares are acquired and shrinks as they are sold. The FA 1985 pool is kept in 3 columns: · The number of shares · The cost of the shares ignoring indexation · The indexed cost of the shares Operative events — Disposals and acquisitions of shares which affect the indexed value of the FA 1985 pool. n

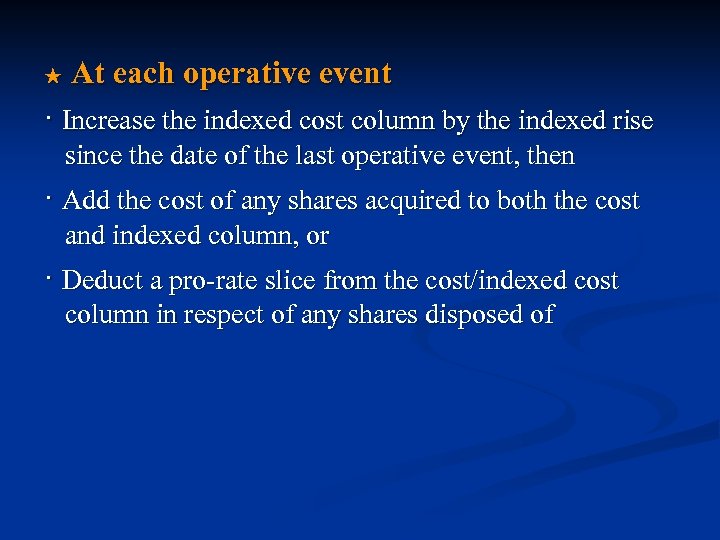

★ At each operative event · Increase the indexed cost column by the indexed rise since the date of the last operative event, then · Add the cost of any shares acquired to both the cost and indexed column, or · Deduct a pro-rate slice from the cost/indexed cost column in respect of any shares disposed of

★ At each operative event · Increase the indexed cost column by the indexed rise since the date of the last operative event, then · Add the cost of any shares acquired to both the cost and indexed column, or · Deduct a pro-rate slice from the cost/indexed cost column in respect of any shares disposed of

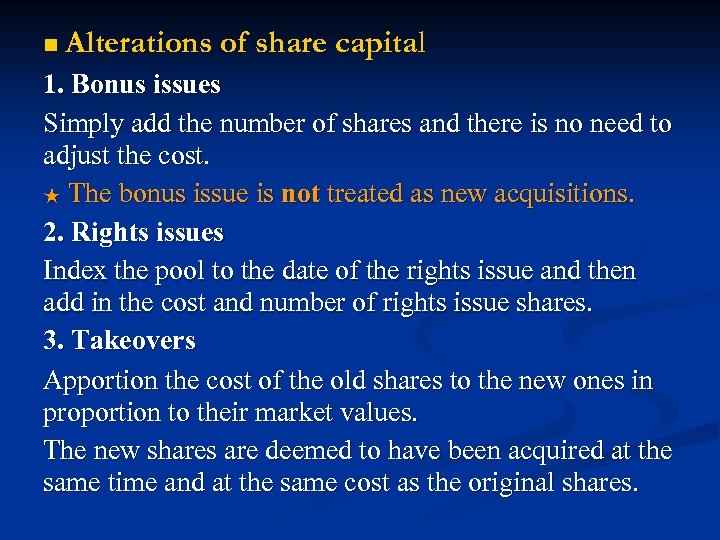

n Alterations of share capital 1. Bonus issues Simply add the number of shares and there is no need to adjust the cost. ★ The bonus issue is not treated as new acquisitions. 2. Rights issues Index the pool to the date of the rights issue and then add in the cost and number of rights issue shares. 3. Takeovers Apportion the cost of the old shares to the new ones in proportion to their market values. The new shares are deemed to have been acquired at the same time and at the same cost as the original shares.

n Alterations of share capital 1. Bonus issues Simply add the number of shares and there is no need to adjust the cost. ★ The bonus issue is not treated as new acquisitions. 2. Rights issues Index the pool to the date of the rights issue and then add in the cost and number of rights issue shares. 3. Takeovers Apportion the cost of the old shares to the new ones in proportion to their market values. The new shares are deemed to have been acquired at the same time and at the same cost as the original shares.

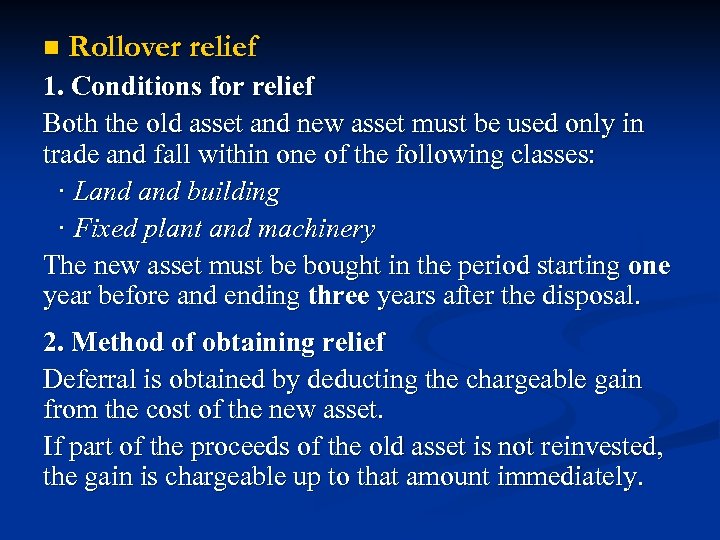

n Rollover relief 1. Conditions for relief Both the old asset and new asset must be used only in trade and fall within one of the following classes: · Land building · Fixed plant and machinery The new asset must be bought in the period starting one year before and ending three years after the disposal. 2. Method of obtaining relief Deferral is obtained by deducting the chargeable gain from the cost of the new asset. If part of the proceeds of the old asset is not reinvested, the gain is chargeable up to that amount immediately.

n Rollover relief 1. Conditions for relief Both the old asset and new asset must be used only in trade and fall within one of the following classes: · Land building · Fixed plant and machinery The new asset must be bought in the period starting one year before and ending three years after the disposal. 2. Method of obtaining relief Deferral is obtained by deducting the chargeable gain from the cost of the new asset. If part of the proceeds of the old asset is not reinvested, the gain is chargeable up to that amount immediately.

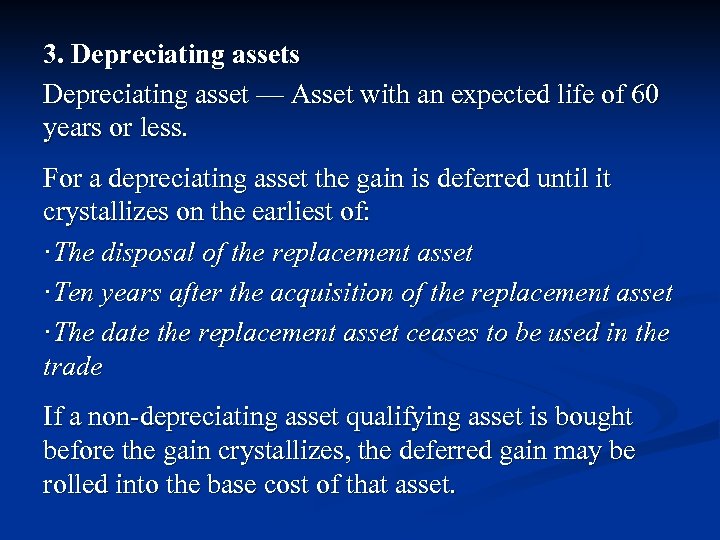

3. Depreciating assets Depreciating asset — Asset with an expected life of 60 years or less. For a depreciating asset the gain is deferred until it crystallizes on the earliest of: ·The disposal of the replacement asset ·Ten years after the acquisition of the replacement asset ·The date the replacement asset ceases to be used in the trade If a non-depreciating asset qualifying asset is bought before the gain crystallizes, the deferred gain may be rolled into the base cost of that asset.

3. Depreciating assets Depreciating asset — Asset with an expected life of 60 years or less. For a depreciating asset the gain is deferred until it crystallizes on the earliest of: ·The disposal of the replacement asset ·Ten years after the acquisition of the replacement asset ·The date the replacement asset ceases to be used in the trade If a non-depreciating asset qualifying asset is bought before the gain crystallizes, the deferred gain may be rolled into the base cost of that asset.

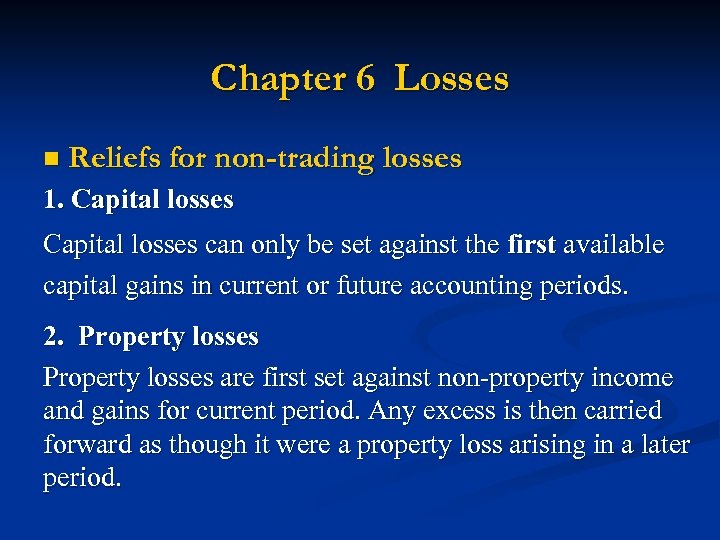

Chapter 6 Losses n Reliefs for non-trading losses 1. Capital losses can only be set against the first available capital gains in current or future accounting periods. 2. Property losses are first set against non-property income and gains for current period. Any excess is then carried forward as though it were a property loss arising in a later period.

Chapter 6 Losses n Reliefs for non-trading losses 1. Capital losses can only be set against the first available capital gains in current or future accounting periods. 2. Property losses are first set against non-property income and gains for current period. Any excess is then carried forward as though it were a property loss arising in a later period.

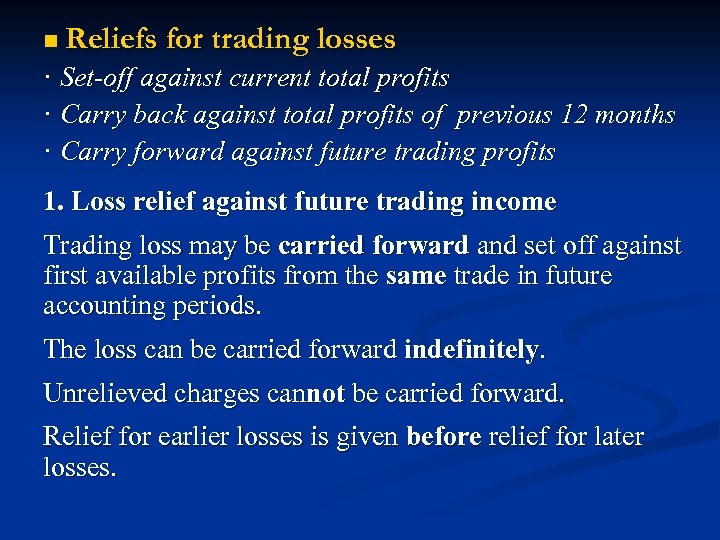

n Reliefs for trading losses · Set-off against current total profits · Carry back against total profits of previous 12 months · Carry forward against future trading profits 1. Loss relief against future trading income Trading loss may be carried forward and set off against first available profits from the same trade in future accounting periods. The loss can be carried forward indefinitely. Unrelieved charges cannot be carried forward. Relief for earlier losses is given before relief for later losses.

n Reliefs for trading losses · Set-off against current total profits · Carry back against total profits of previous 12 months · Carry forward against future trading profits 1. Loss relief against future trading income Trading loss may be carried forward and set off against first available profits from the same trade in future accounting periods. The loss can be carried forward indefinitely. Unrelieved charges cannot be carried forward. Relief for earlier losses is given before relief for later losses.

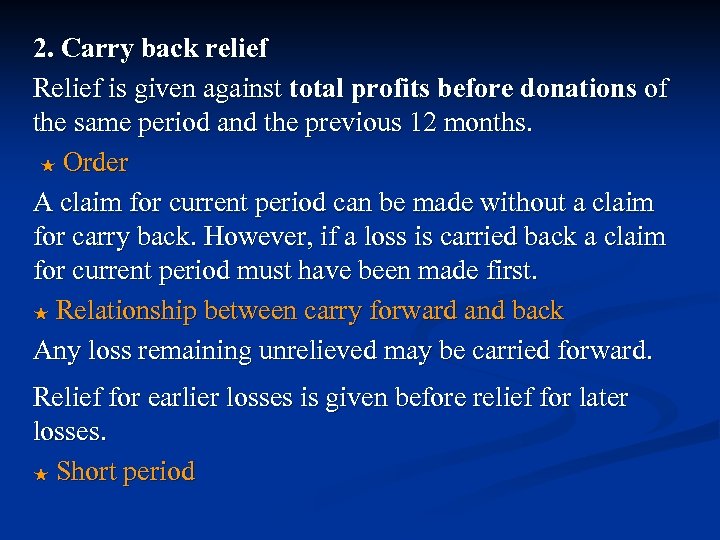

2. Carry back relief Relief is given against total profits before donations of the same period and the previous 12 months. ★ Order A claim for current period can be made without a claim for carry back. However, if a loss is carried back a claim for current period must have been made first. ★ Relationship between carry forward and back Any loss remaining unrelieved may be carried forward. Relief for earlier losses is given before relief for later losses. ★ Short period

2. Carry back relief Relief is given against total profits before donations of the same period and the previous 12 months. ★ Order A claim for current period can be made without a claim for carry back. However, if a loss is carried back a claim for current period must have been made first. ★ Relationship between carry forward and back Any loss remaining unrelieved may be carried forward. Relief for earlier losses is given before relief for later losses. ★ Short period

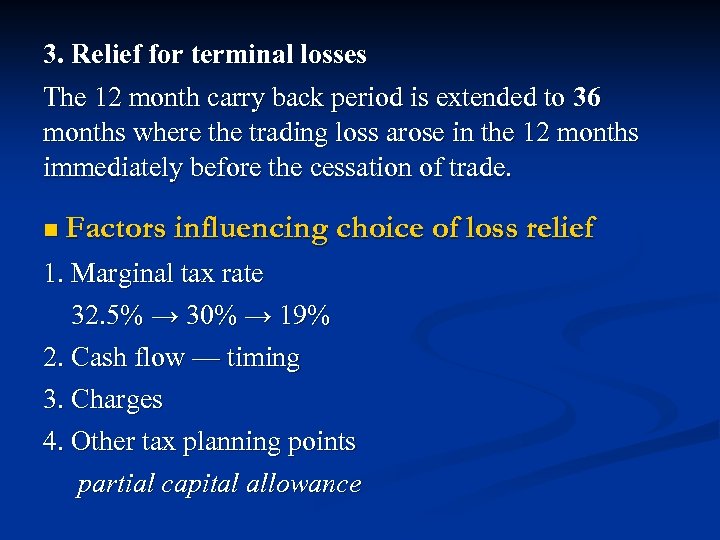

3. Relief for terminal losses The 12 month carry back period is extended to 36 months where the trading loss arose in the 12 months immediately before the cessation of trade. n Factors influencing choice of loss relief 1. Marginal tax rate 32. 5% → 30% → 19% 2. Cash flow — timing 3. Charges 4. Other tax planning points partial capital allowance

3. Relief for terminal losses The 12 month carry back period is extended to 36 months where the trading loss arose in the 12 months immediately before the cessation of trade. n Factors influencing choice of loss relief 1. Marginal tax rate 32. 5% → 30% → 19% 2. Cash flow — timing 3. Charges 4. Other tax planning points partial capital allowance

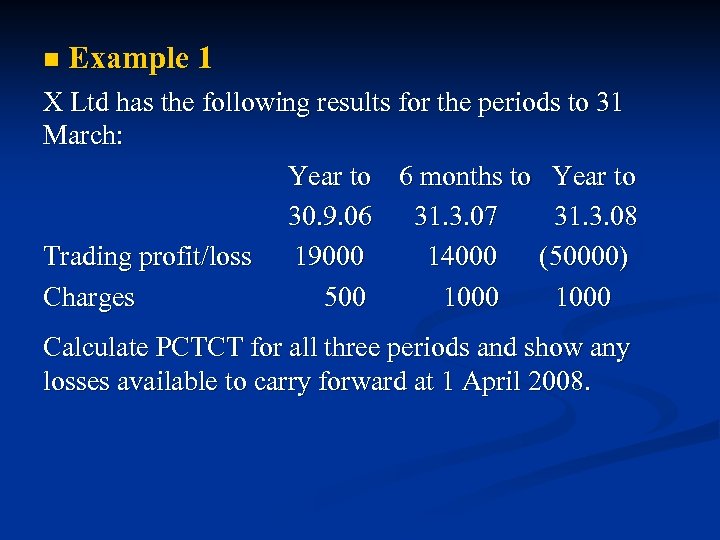

n Example 1 X Ltd has the following results for the periods to 31 March: Year to 6 months to Year to 30. 9. 06 31. 3. 07 31. 3. 08 Trading profit/loss 19000 14000 (50000) Charges 500 1000 Calculate PCTCT for all three periods and show any losses available to carry forward at 1 April 2008.

n Example 1 X Ltd has the following results for the periods to 31 March: Year to 6 months to Year to 30. 9. 06 31. 3. 07 31. 3. 08 Trading profit/loss 19000 14000 (50000) Charges 500 1000 Calculate PCTCT for all three periods and show any losses available to carry forward at 1 April 2008.

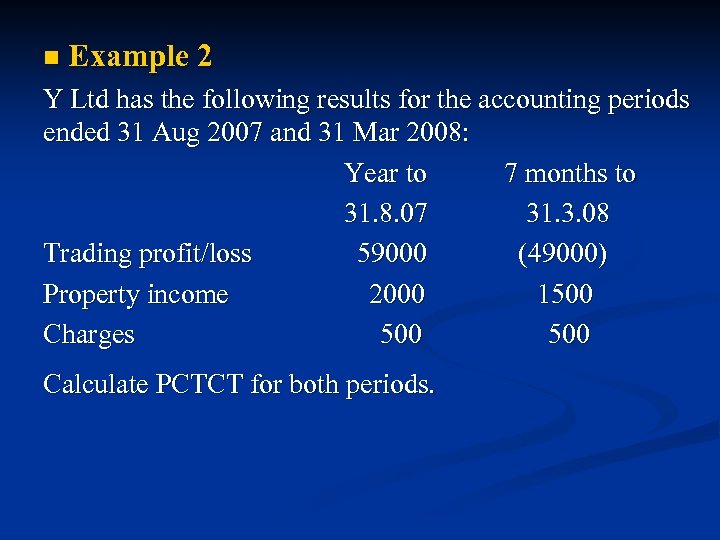

n Example 2 Y Ltd has the following results for the accounting periods ended 31 Aug 2007 and 31 Mar 2008: Year to 7 months to 31. 8. 07 31. 3. 08 Trading profit/loss 59000 (49000) Property income 2000 1500 Charges 500 Calculate PCTCT for both periods.

n Example 2 Y Ltd has the following results for the accounting periods ended 31 Aug 2007 and 31 Mar 2008: Year to 7 months to 31. 8. 07 31. 3. 08 Trading profit/loss 59000 (49000) Property income 2000 1500 Charges 500 Calculate PCTCT for both periods.

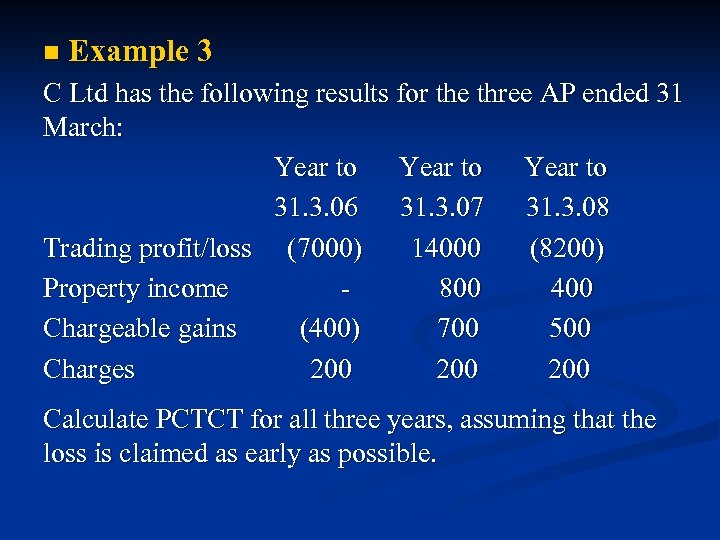

n Example 3 C Ltd has the following results for the three AP ended 31 March: Year to 31. 3. 06 31. 3. 07 31. 3. 08 Trading profit/loss (7000) 14000 (8200) Property income 800 400 Chargeable gains (400) 700 500 Charges 200 200 Calculate PCTCT for all three years, assuming that the loss is claimed as early as possible.

n Example 3 C Ltd has the following results for the three AP ended 31 March: Year to 31. 3. 06 31. 3. 07 31. 3. 08 Trading profit/loss (7000) 14000 (8200) Property income 800 400 Chargeable gains (400) 700 500 Charges 200 200 Calculate PCTCT for all three years, assuming that the loss is claimed as early as possible.

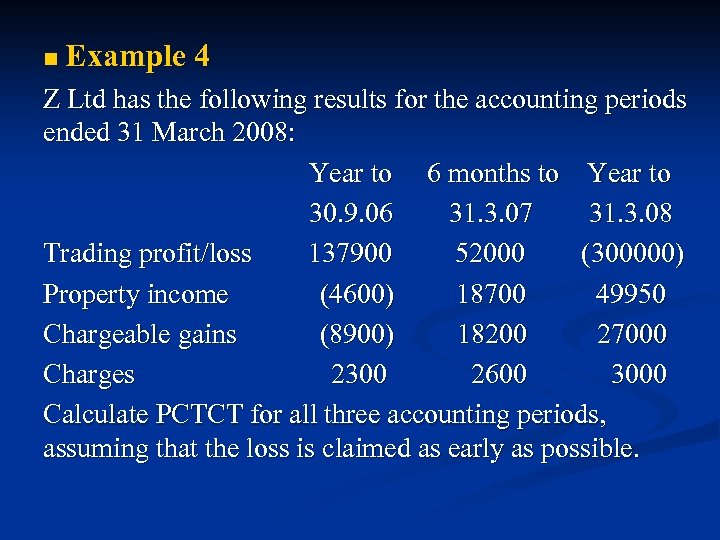

n Example 4 Z Ltd has the following results for the accounting periods ended 31 March 2008: Year to 6 months to Year to 30. 9. 06 31. 3. 07 31. 3. 08 Trading profit/loss 137900 52000 (300000) Property income (4600) 18700 49950 Chargeable gains (8900) 18200 27000 Charges 2300 2600 3000 Calculate PCTCT for all three accounting periods, assuming that the loss is claimed as early as possible.

n Example 4 Z Ltd has the following results for the accounting periods ended 31 March 2008: Year to 6 months to Year to 30. 9. 06 31. 3. 07 31. 3. 08 Trading profit/loss 137900 52000 (300000) Property income (4600) 18700 49950 Chargeable gains (8900) 18200 27000 Charges 2300 2600 3000 Calculate PCTCT for all three accounting periods, assuming that the loss is claimed as early as possible.

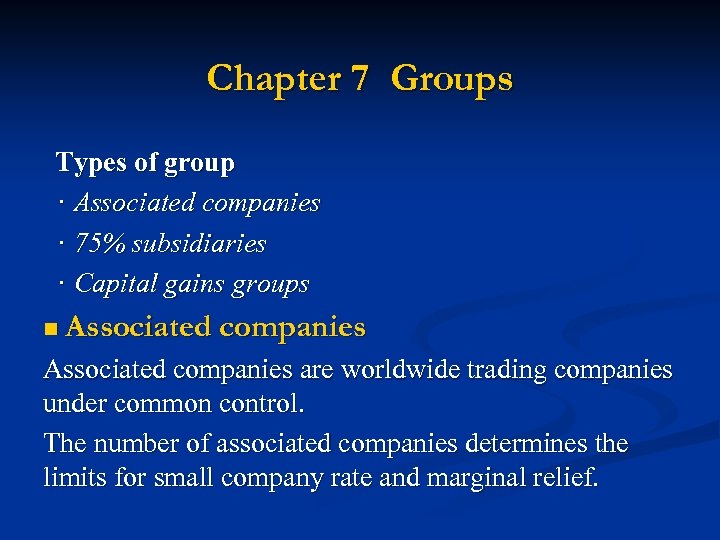

Chapter 7 Groups Types of group · Associated companies · 75% subsidiaries · Capital gains groups n Associated companies are worldwide trading companies under common control. The number of associated companies determines the limits for small company rate and marginal relief.

Chapter 7 Groups Types of group · Associated companies · 75% subsidiaries · Capital gains groups n Associated companies are worldwide trading companies under common control. The number of associated companies determines the limits for small company rate and marginal relief.

n Group relief 1. 75% group Two companies are in group only if there is a 75% effective interest. 2. The relief Within a 75% group, current period trading losses, excess property losses and excess charges can be surrendered between UK companies. ★ For surrendering company Only current year losses can be surrendered. Group relief can be claimed before s 393 A relief. It may specify any amount to be surrendered.

n Group relief 1. 75% group Two companies are in group only if there is a 75% effective interest. 2. The relief Within a 75% group, current period trading losses, excess property losses and excess charges can be surrendered between UK companies. ★ For surrendering company Only current year losses can be surrendered. Group relief can be claimed before s 393 A relief. It may specify any amount to be surrendered.

★ For claimant company It can claim group relief against profits after all other reliefs for the current period or brought forward from earlier periods, including charges. ★ Restrictions Only current period losses are available for group relief. Losses must be set against profits of a corresponding accounting period. 3. Tax planning ★ tax rate: 32. 75% → 30% → 19% ★ s 393 A relief vs. group relief ★ full vs. partial capital allowance

★ For claimant company It can claim group relief against profits after all other reliefs for the current period or brought forward from earlier periods, including charges. ★ Restrictions Only current period losses are available for group relief. Losses must be set against profits of a corresponding accounting period. 3. Tax planning ★ tax rate: 32. 75% → 30% → 19% ★ s 393 A relief vs. group relief ★ full vs. partial capital allowance

n Chargeable gains 1. Capital gains group Companies are in a capital gains group if: · At each level, there is a 75% holding, and · Top company has over 50% effective interest 2. Intra-group transfers Transfer assets between companies automatically at no gain/loss. 3. Matching group gains and losses Gains and losses can be matched within a group. 4. Rollover relief All companies are treated as one for rollover relief purposes.

n Chargeable gains 1. Capital gains group Companies are in a capital gains group if: · At each level, there is a 75% holding, and · Top company has over 50% effective interest 2. Intra-group transfers Transfer assets between companies automatically at no gain/loss. 3. Matching group gains and losses Gains and losses can be matched within a group. 4. Rollover relief All companies are treated as one for rollover relief purposes.

Chapter 8 Overseas aspects of corporate taxation n Branch or subsidiary abroad 1. Taxation of foreign income and gains A UK resident company is subject to CT on its worldwide profits. The taxable amount is the gross profits before deduction of any foreign taxes. 2. Taxation of foreign branches and subsidiaries An overseas branch of a UK company is effectively an extension of the UK trade, while a subsidiary is treated as a separate company.

Chapter 8 Overseas aspects of corporate taxation n Branch or subsidiary abroad 1. Taxation of foreign income and gains A UK resident company is subject to CT on its worldwide profits. The taxable amount is the gross profits before deduction of any foreign taxes. 2. Taxation of foreign branches and subsidiaries An overseas branch of a UK company is effectively an extension of the UK trade, while a subsidiary is treated as a separate company.

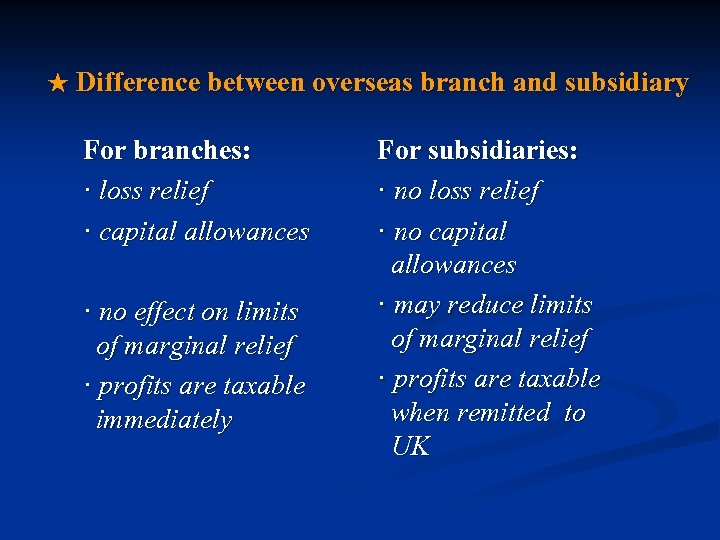

★ Difference between overseas branch and subsidiary For branches: · loss relief · capital allowances · no effect on limits of marginal relief · profits are taxable immediately For subsidiaries: · no loss relief · no capital allowances · may reduce limits of marginal relief · profits are taxable when remitted to UK

★ Difference between overseas branch and subsidiary For branches: · loss relief · capital allowances · no effect on limits of marginal relief · profits are taxable immediately For subsidiaries: · no loss relief · no capital allowances · may reduce limits of marginal relief · profits are taxable when remitted to UK

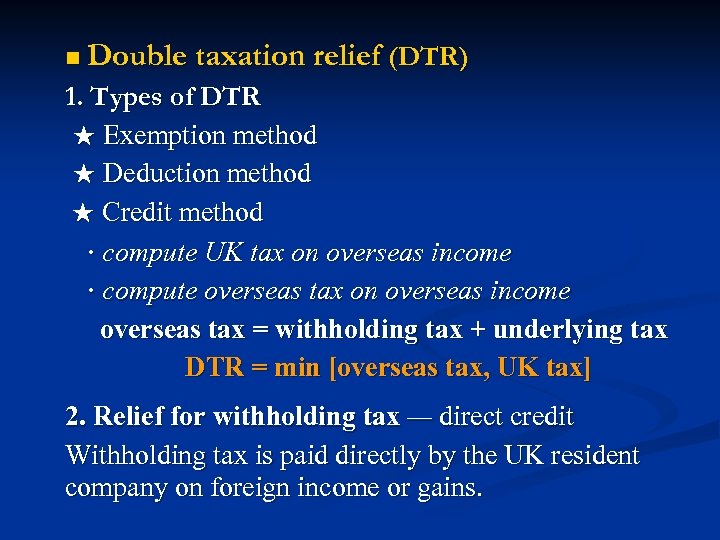

n Double taxation relief (DTR) 1. Types of DTR ★ Exemption method ★ Deduction method ★ Credit method · compute UK tax on overseas income · compute overseas tax on overseas income overseas tax = withholding tax + underlying tax DTR = min [overseas tax, UK tax] 2. Relief for withholding tax — direct credit Withholding tax is paid directly by the UK resident company on foreign income or gains.

n Double taxation relief (DTR) 1. Types of DTR ★ Exemption method ★ Deduction method ★ Credit method · compute UK tax on overseas income · compute overseas tax on overseas income overseas tax = withholding tax + underlying tax DTR = min [overseas tax, UK tax] 2. Relief for withholding tax — direct credit Withholding tax is paid directly by the UK resident company on foreign income or gains.

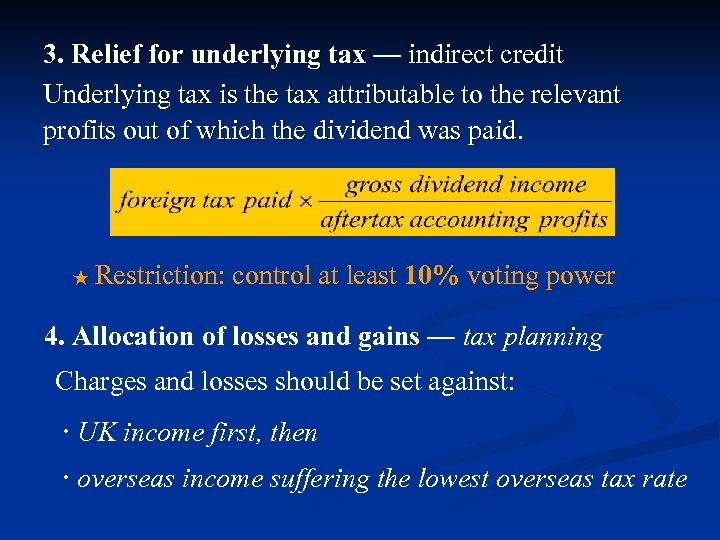

3. Relief for underlying tax — indirect credit Underlying tax is the tax attributable to the relevant profits out of which the dividend was paid. ★ Restriction: control at least 10% voting power 4. Allocation of losses and gains — tax planning Charges and losses should be set against: · UK income first, then · overseas income suffering the lowest overseas tax rate

3. Relief for underlying tax — indirect credit Underlying tax is the tax attributable to the relevant profits out of which the dividend was paid. ★ Restriction: control at least 10% voting power 4. Allocation of losses and gains — tax planning Charges and losses should be set against: · UK income first, then · overseas income suffering the lowest overseas tax rate

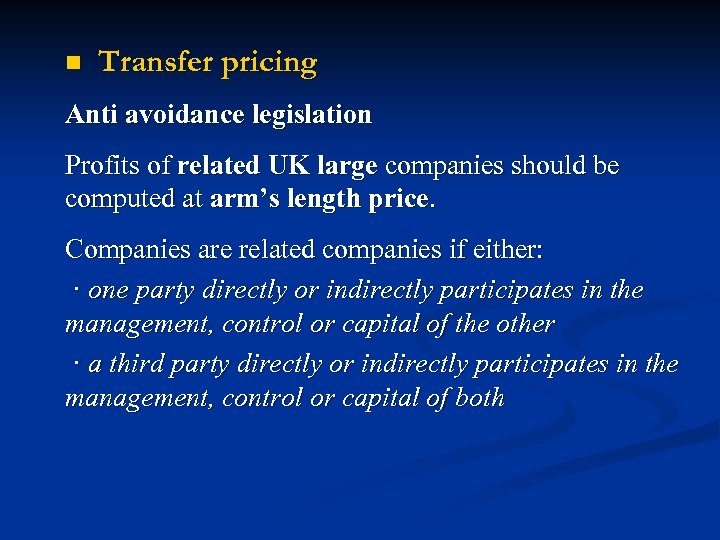

n Transfer pricing Anti avoidance legislation Profits of related UK large companies should be computed at arm’s length price. Companies are related companies if either: · one party directly or indirectly participates in the management, control or capital of the other · a third party directly or indirectly participates in the management, control or capital of both

n Transfer pricing Anti avoidance legislation Profits of related UK large companies should be computed at arm’s length price. Companies are related companies if either: · one party directly or indirectly participates in the management, control or capital of the other · a third party directly or indirectly participates in the management, control or capital of both

Chapter 9 Payment of Tax by Companies n Returns 1. Filing date A company must file its return by the later of: · 12 months after the end of the period to which the return relates · 3 months after a notice requiring the return was issued 2. Penalty for late filing (1) Fixed penalty (2) Tax geared penalty (3) Additional tax geared penalty

Chapter 9 Payment of Tax by Companies n Returns 1. Filing date A company must file its return by the later of: · 12 months after the end of the period to which the return relates · 3 months after a notice requiring the return was issued 2. Penalty for late filing (1) Fixed penalty (2) Tax geared penalty (3) Additional tax geared penalty

3. Amendment A company may amend a return within 12 months of the filing date. n Records must be kept until the latest of: · six years from the end of the accounting period concerned · the date any enquiries are completed · the date after which enquiries may not be commenced n Enquiries Notice to enquire into a return must be given by 12 months after the later of: ·The due filing date ·The 31 January, 30 April, 31 July or 31 October next following the actual filing date

3. Amendment A company may amend a return within 12 months of the filing date. n Records must be kept until the latest of: · six years from the end of the accounting period concerned · the date any enquiries are completed · the date after which enquiries may not be commenced n Enquiries Notice to enquire into a return must be given by 12 months after the later of: ·The due filing date ·The 31 January, 30 April, 31 July or 31 October next following the actual filing date

n Determinations and discovery assessments 1. Determinations The Revenue may issue a determination of the tax payable within the 5 years from the filing date. 2. Discovery assessment The Revenue can make a discovery assessment within 6 years from the end of the accounting period but this is extended to 21 years if there has been fraudulent or negligent conduct. n Claims A company make an error or mistake claim within 6 years from the end of the accounting period.

n Determinations and discovery assessments 1. Determinations The Revenue may issue a determination of the tax payable within the 5 years from the filing date. 2. Discovery assessment The Revenue can make a discovery assessment within 6 years from the end of the accounting period but this is extended to 21 years if there has been fraudulent or negligent conduct. n Claims A company make an error or mistake claim within 6 years from the end of the accounting period.

n Payment of corporation tax and interest 1. Payment date for small and medium companies Such companies must pay their CT liability 9 months after the end of the AP. 2. Payment date for large company A large company is a company that pays CT at full rate. Large company must pay their anticipated CT liability in quarterly installments. Amount of each installment is 3×CT/n.

n Payment of corporation tax and interest 1. Payment date for small and medium companies Such companies must pay their CT liability 9 months after the end of the AP. 2. Payment date for large company A large company is a company that pays CT at full rate. Large company must pay their anticipated CT liability in quarterly installments. Amount of each installment is 3×CT/n.

For a 12 months AP installments are due in: - months 7 and 10 of the period - months 1 and 4 of the following period For an AP of less than 12 months installments due: - months 7 of the AP - at subsequent quarterly intervals subject to the final installment being made in the 4 th month of the next period

For a 12 months AP installments are due in: - months 7 and 10 of the period - months 1 and 4 of the following period For an AP of less than 12 months installments due: - months 7 of the AP - at subsequent quarterly intervals subject to the final installment being made in the 4 th month of the next period