9a6b87173f52a40c7a771aa01a233450.ppt

- Количество слайдов: 147

PART 1

n COURSE SYLLABUS/OUTLINE

Introduction to Marketing Research Dr. Doherty Tobin College of Business St. John’s University

MARKETING CASE REPORT FORMAT A. Executive Summary: Self. Contained Document, one to two pages • Statement of Purpose and Issues to be Addressed • Research Method Used to Address Issues • Salient Findings (Appears before Table of Contents)

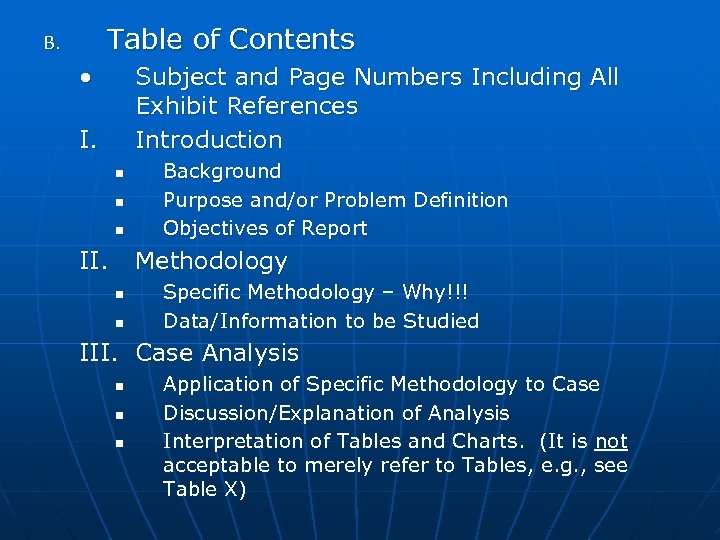

Table of Contents B. • Subject and Page Numbers Including All Exhibit References Introduction I. n n n II. Background Purpose and/or Problem Definition Objectives of Report Methodology n n Specific Methodology – Why!!! Data/Information to be Studied III. Case Analysis n n n Application of Specific Methodology to Case Discussion/Explanation of Analysis Interpretation of Tables and Charts. (It is not acceptable to merely refer to Tables, e. g. , see Table X)

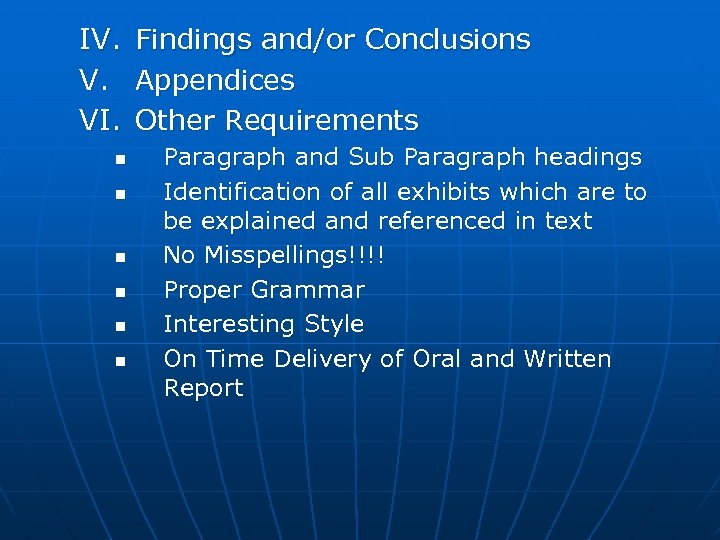

IV. Findings and/or Conclusions V. Appendices VI. Other Requirements n n n Paragraph and Sub Paragraph headings Identification of all exhibits which are to be explained and referenced in text No Misspellings!!!! Proper Grammar Interesting Style On Time Delivery of Oral and Written Report

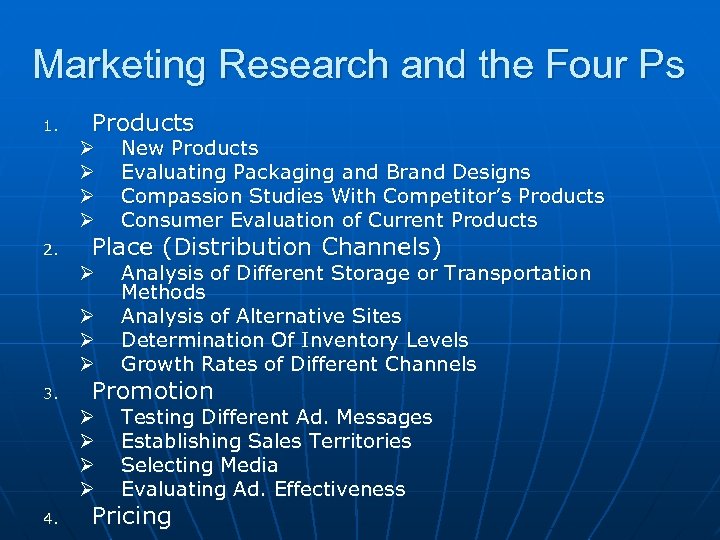

Marketing Research and the Four Ps 1. Products Ø Ø Ø Ø 3. 4. Analysis of Different Storage or Transportation Methods Analysis of Alternative Sites Determination Of Inventory Levels Growth Rates of Different Channels Ø Ø 2. New Products Evaluating Packaging and Brand Designs Compassion Studies With Competitor’s Products Consumer Evaluation of Current Products Testing Different Ad. Messages Establishing Sales Territories Selecting Media Evaluating Ad. Effectiveness Place (Distribution Channels) Promotion Pricing

Research on Markets ØForecasting Demand ØProviding Information of General Trends ØProviding Information For Segmenting Markets ØDeveloping Customer Profiles ØIdentifying New Markets For Existing Products ØIdentifying New Product Needs ØForeign Markets

Elements Of The Marketing Mix That Compose A Cohesive Marketing Program Marketing Manager Product Features Brand name Packaging Service Warranty Place Outlets Channels Coverage Transportation Stock level Price Promotion Advertising Personal selling Sales promotion Publicity Place Product Promotion Price List price Discounts Allowances Credit terms Payment period

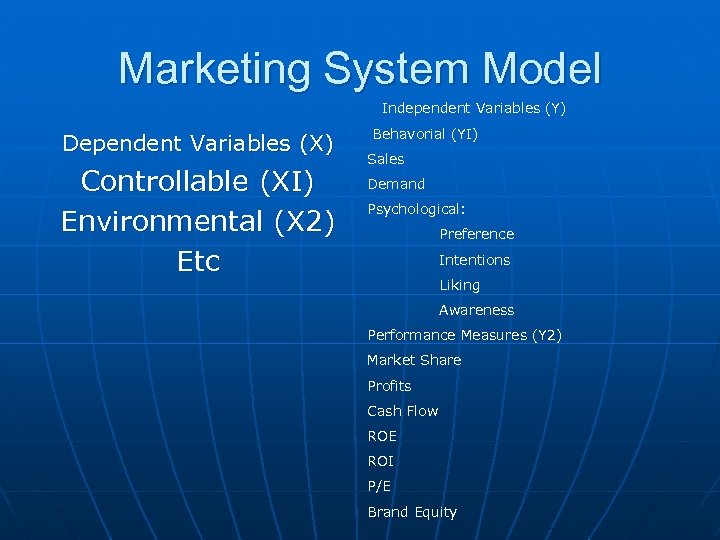

Marketing System Model Independent Variables (Y) Dependent Variables (X) Controllable (XI) Environmental (X 2) Etc Behavorial (YI) Sales Demand Psychological: Preference Intentions Liking Awareness Performance Measures (Y 2) Market Share Profits Cash Flow ROE ROI P/E Brand Equity

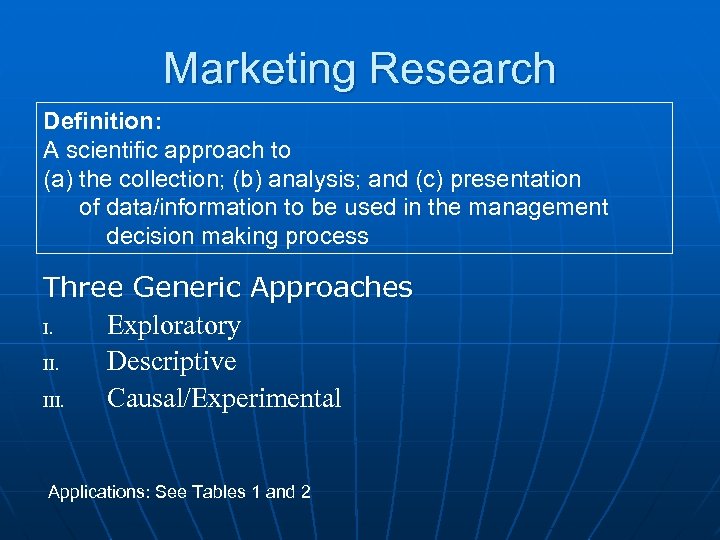

Marketing Research Definition: A scientific approach to (a) the collection; (b) analysis; and (c) presentation of data/information to be used in the management decision making process Three Generic Approaches I. Exploratory II. Descriptive III. Causal/Experimental Applications: See Tables 1 and 2

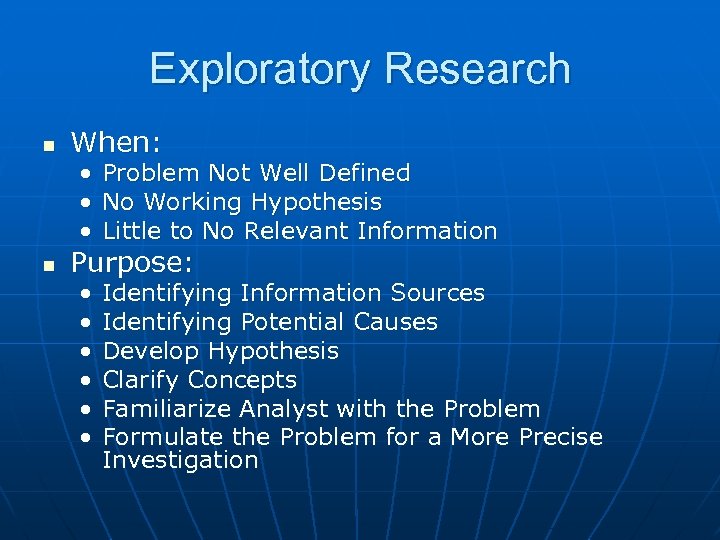

Exploratory Research n When: • Problem Not Well Defined • No Working Hypothesis • Little to No Relevant Information n Purpose: • • • Identifying Information Sources Identifying Potential Causes Develop Hypothesis Clarify Concepts Familiarize Analyst with the Problem Formulate the Problem for a More Precise Investigation

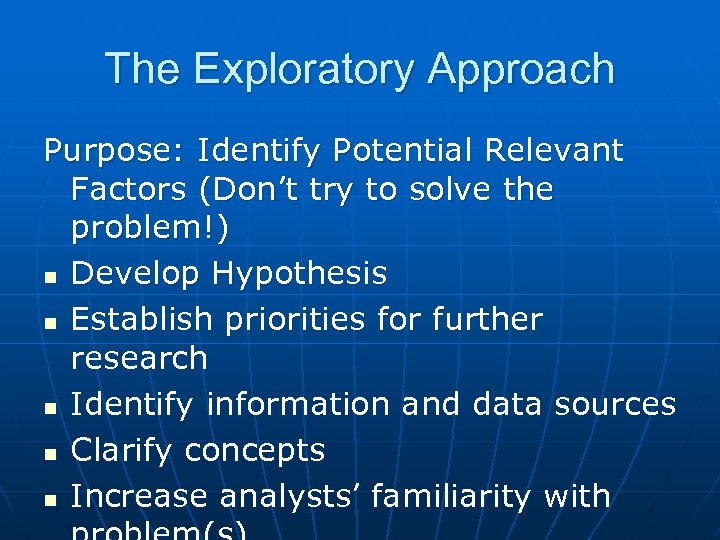

The Exploratory Approach Purpose: Identify Potential Relevant Factors (Don’t try to solve the problem!) n Develop Hypothesis n Establish priorities for further research n Identify information and data sources n Clarify concepts n Increase analysts’ familiarity with

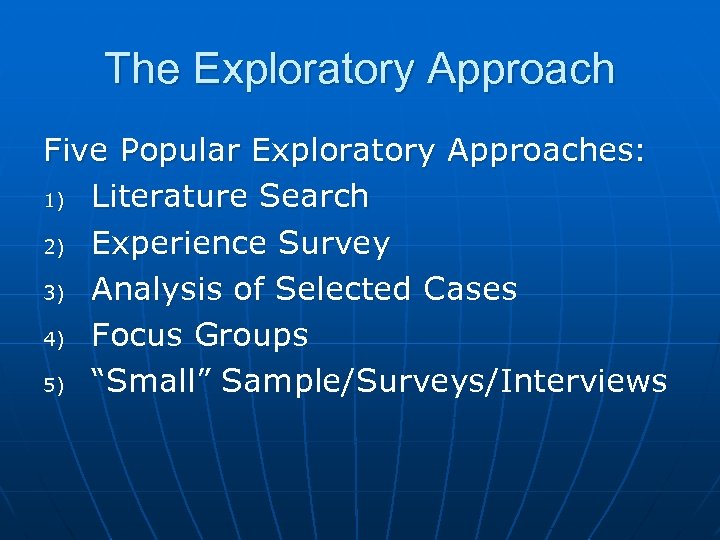

The Exploratory Approach Five Popular Exploratory Approaches: 1) Literature Search 2) Experience Survey 3) Analysis of Selected Cases 4) Focus Groups 5) “Small” Sample/Surveys/Interviews

The Descriptive Approach Purpose: Test Hypothesis n Analyze Data n Develop Findings/Conclusions Two Types (Depending on Type of Data) A. Longitudinal (Time Series) Ø Ø B. True Panel Omnibus Panel Cross Sectional Ø Field Survey Ø Field Study

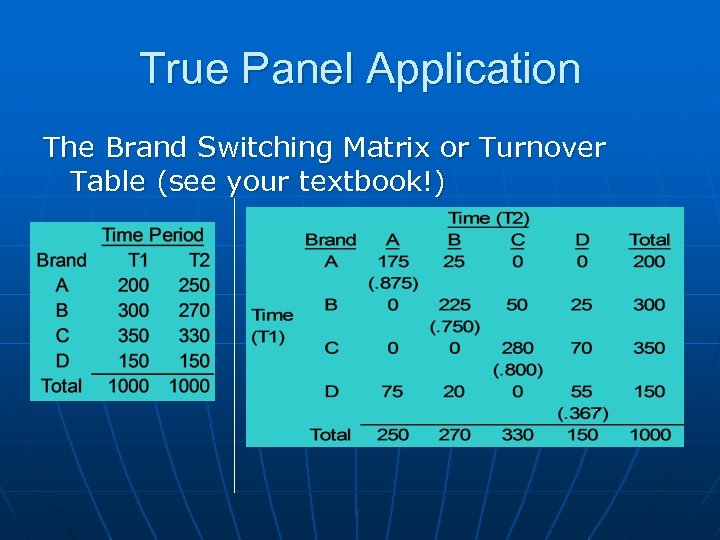

True Panel Application The Brand Switching Matrix or Turnover Table (see your textbook!)

Applications of Turnover Table Evaluating: a) b) c) d) e) Price Changes Promotional Campaigns New Packaging New Products Results can be integrated with other databases to determine customer profiles and media habits

Causal/Experimental Research Design 1. Scientific Criteria • • 2. 3. Concomitant Variation Time Sequence Elimination of Other Causes Reflects 1. Lab vs. Field Validation Two Groups: Experimental and Control • • • Experiment : Process Treatments : Alternatives Test Units : Entities Dependent Variables : Measures Extraneous Variables Controlled Experiment Basic Concepts Defined n n Hold Constant Randomize Assignment of Treatments Specific Design ANCOVA

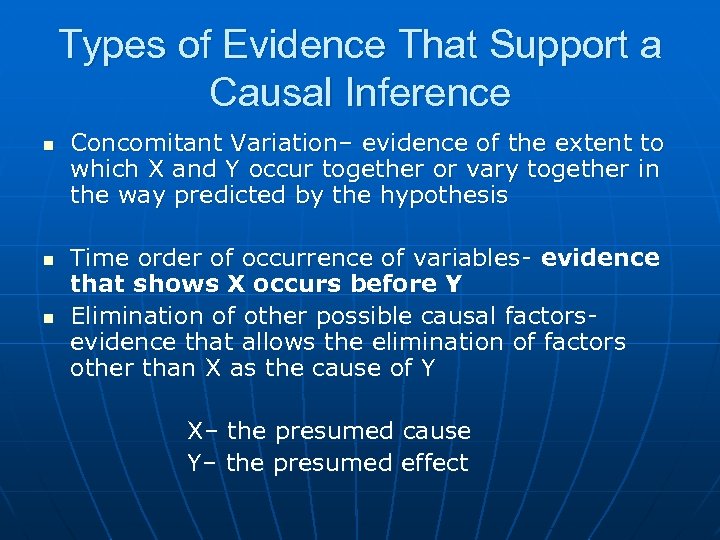

Types of Evidence That Support a Causal Inference n n n Concomitant Variation– evidence of the extent to which X and Y occur together or vary together in the way predicted by the hypothesis Time order of occurrence of variables- evidence that shows X occurs before Y Elimination of other possible causal factorsevidence that allows the elimination of factors other than X as the cause of Y X– the presumed cause Y– the presumed effect

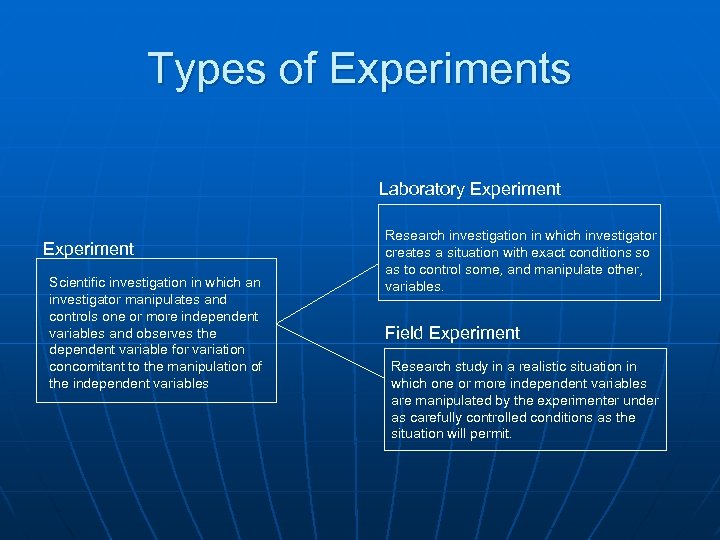

Types of Experiments Laboratory Experiment Scientific investigation in which an investigator manipulates and controls one or more independent variables and observes the dependent variable for variation concomitant to the manipulation of the independent variables Research investigation in which investigator creates a situation with exact conditions so as to control some, and manipulate other, variables. Field Experiment Research study in a realistic situation in which one or more independent variables are manipulated by the experimenter under as carefully controlled conditions as the situation will permit.

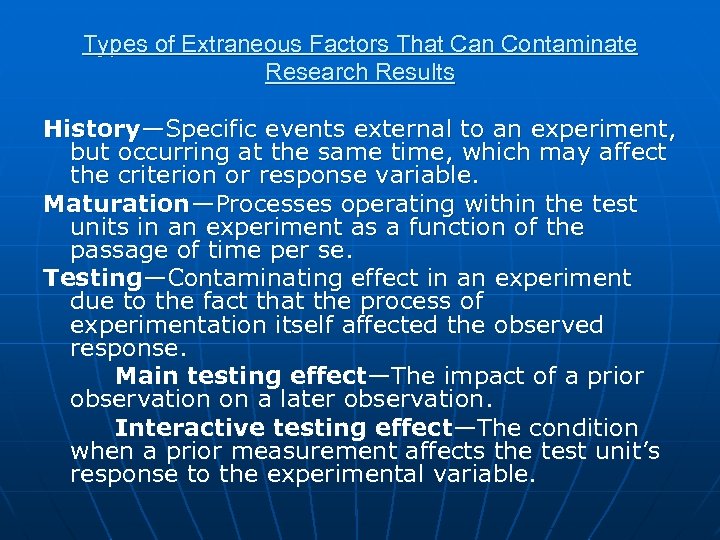

Types of Extraneous Factors That Can Contaminate Research Results History—Specific events external to an experiment, but occurring at the same time, which may affect the criterion or response variable. Maturation—Processes operating within the test units in an experiment as a function of the passage of time per se. Testing—Contaminating effect in an experiment due to the fact that the process of experimentation itself affected the observed response. Main testing effect—The impact of a prior observation on a later observation. Interactive testing effect—The condition when a prior measurement affects the test unit’s response to the experimental variable.

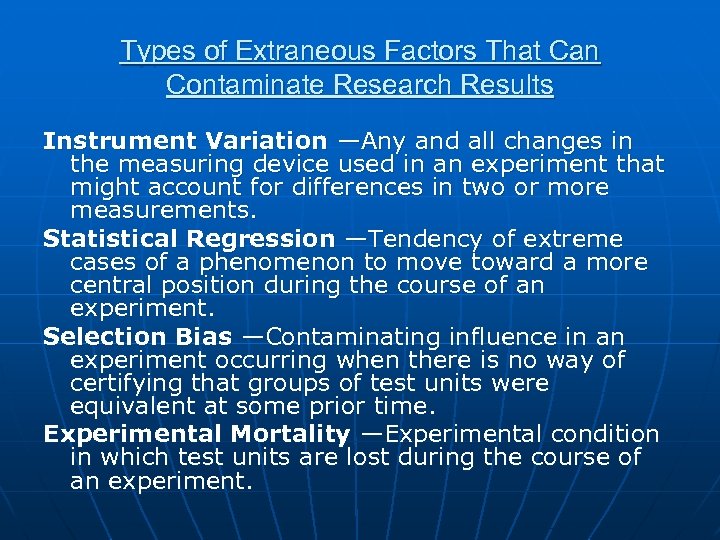

Types of Extraneous Factors That Can Contaminate Research Results Instrument Variation —Any and all changes in the measuring device used in an experiment that might account for differences in two or more measurements. Statistical Regression —Tendency of extreme cases of a phenomenon to move toward a more central position during the course of an experiment. Selection Bias —Contaminating influence in an experiment occurring when there is no way of certifying that groups of test units were equivalent at some prior time. Experimental Mortality —Experimental condition in which test units are lost during the course of an experiment.

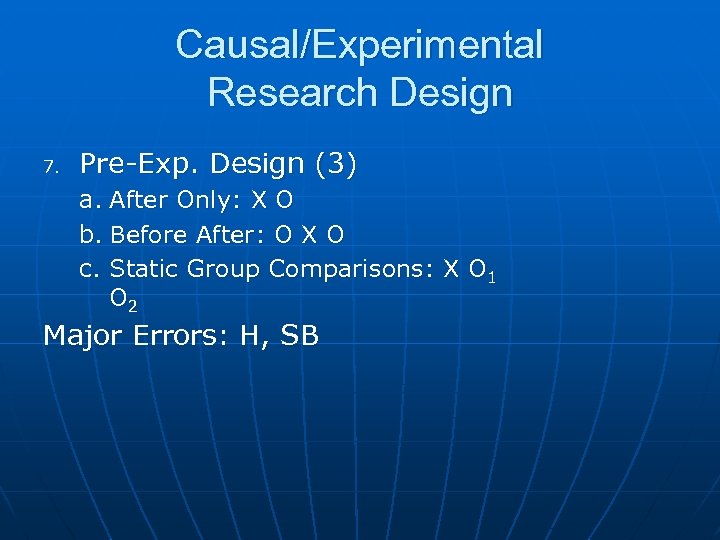

Causal/Experimental Research Design 7. Pre-Exp. Design (3) a. After Only: X O b. Before After: O X O c. Static Group Comparisons: X O 1 O 2 Major Errors: H, SB

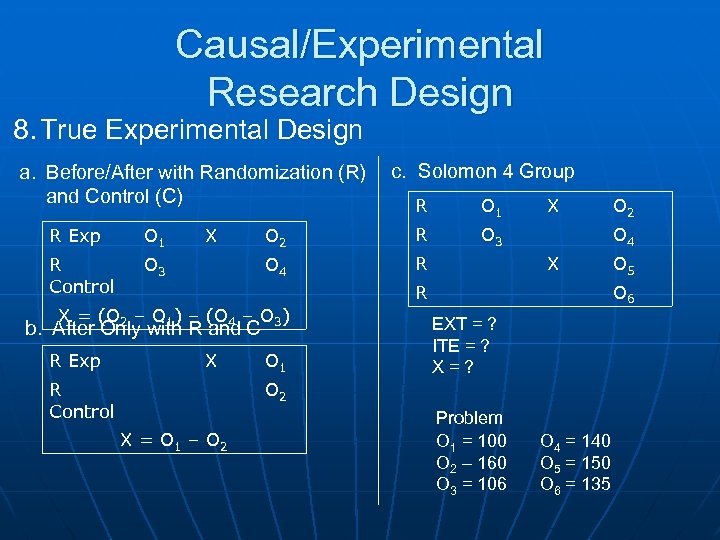

Causal/Experimental Research Design 8. True Experimental Design a. Before/After with Randomization (R) and Control (C) R Exp O 1 R Control X R O 1 O 2 R O 3 O 4 O 3 R X X = (O – O ) – (O – O 3) X R Control O 1 X O 5 O 6 EXT = ? ITE = ? X=? O 2 X = O 1 – O 2 O 4 R 2 1 4 b. After Only with R and C R Exp c. Solomon 4 Group Problem O 1 = 100 O 2 – 160 O 3 = 106 O 4 = 140 O 5 = 150 O 6 = 135

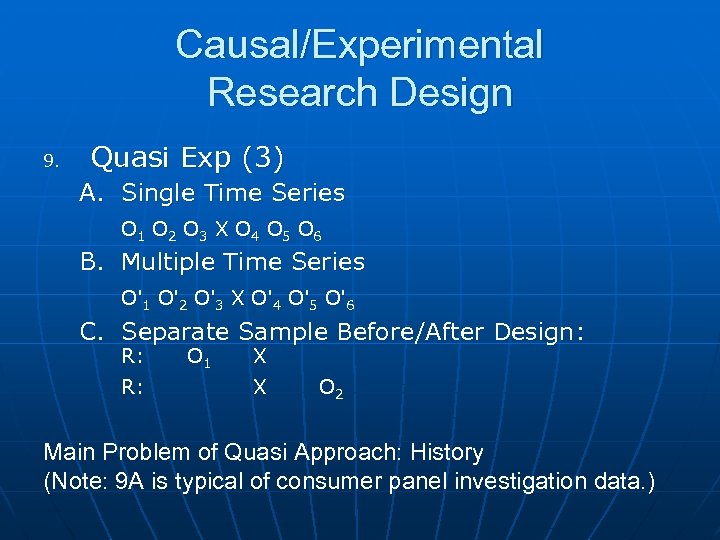

Causal/Experimental Research Design 9. Quasi Exp (3) A. Single Time Series O 1 O 2 O 3 X O 4 O 5 O 6 B. Multiple Time Series O'1 O'2 O'3 X O'4 O'5 O'6 C. Separate Sample Before/After Design: R: R: O 1 X X O 2 Main Problem of Quasi Approach: History (Note: 9 A is typical of consumer panel investigation data. )

Causal/Experimental Research Design 10. Advanced Statistical Design (4) A. B. C. D. CRD RBD LSD Factorial

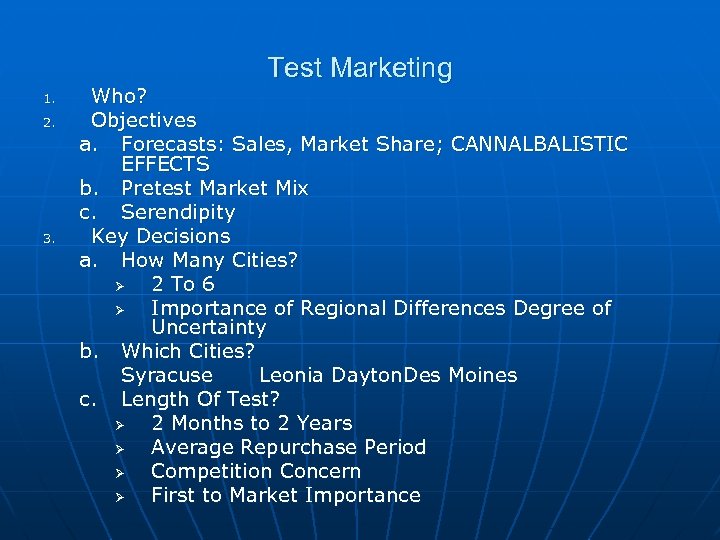

Test Marketing 1. 2. 3. Who? Objectives a. Forecasts: Sales, Market Share; CANNALBALISTIC EFFECTS b. Pretest Market Mix c. Serendipity Key Decisions a. How Many Cities? Ø 2 To 6 Ø Importance of Regional Differences Degree of Uncertainty b. Which Cities? Syracuse Leonia Dayton. Des Moines c. Length Of Test? Ø 2 Months to 2 Years Ø Average Repurchase Period Ø Competition Concern Ø First to Market Importance

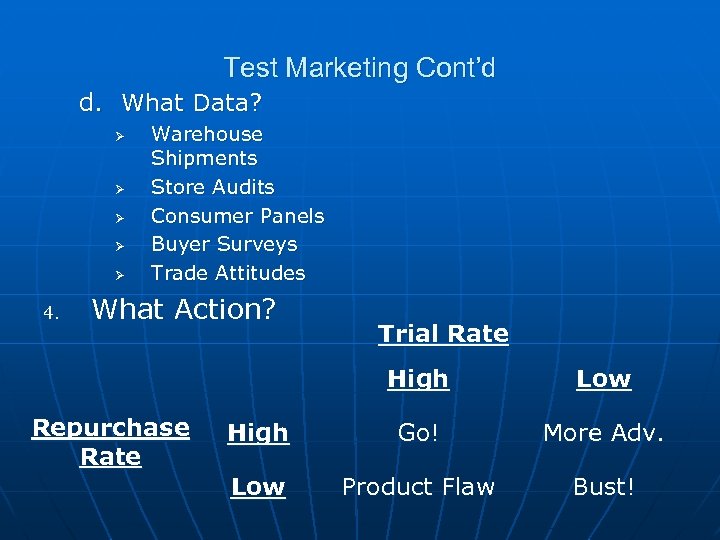

Test Marketing Cont’d d. What Data? Ø Ø Ø 4. Warehouse Shipments Store Audits Consumer Panels Buyer Surveys Trade Attitudes What Action? Trial Rate High Repurchase Rate Low High Go! More Adv. Low Product Flaw Bust!

PART 2

Part 2 A Decision Making Under Uncertainty Criteria for Selecting the Best Option • • • MAX/MIN MAX/MAX MIN/MAX-REGRET • EXPECTED VALUE

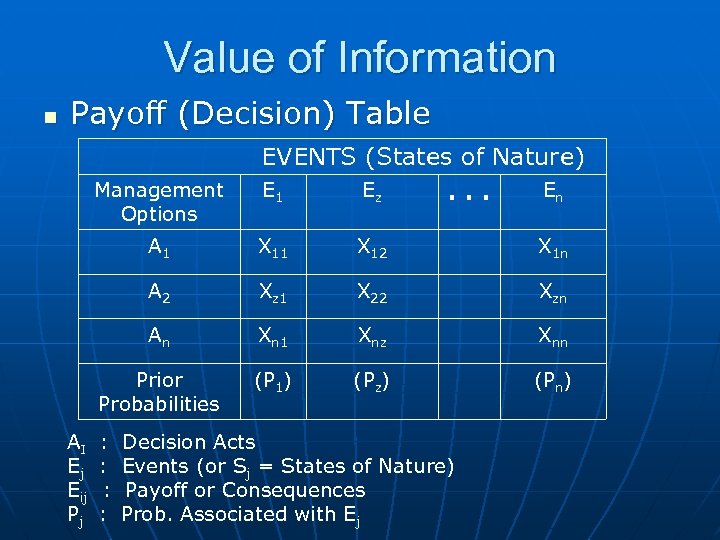

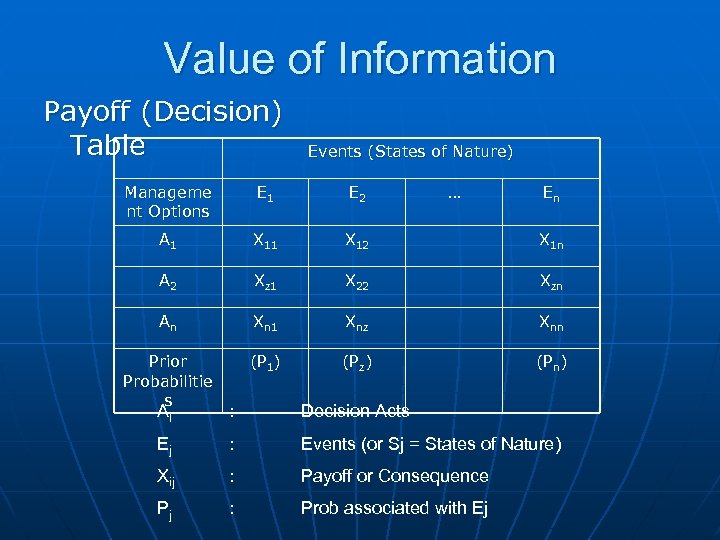

Value of Information n Payoff (Decision) Table Management Options EVENTS (States of Nature) E 1 Ez En. . . A 1 X 12 X 1 n A 2 Xz 1 X 22 Xzn An Xn 1 Xnz Xnn Prior Probabilities AI Ej Eij Pj X 11 (P 1) (Pz) (Pn) : : Decision Acts Events (or Sj = States of Nature) Payoff or Consequences Prob. Associated with Ej

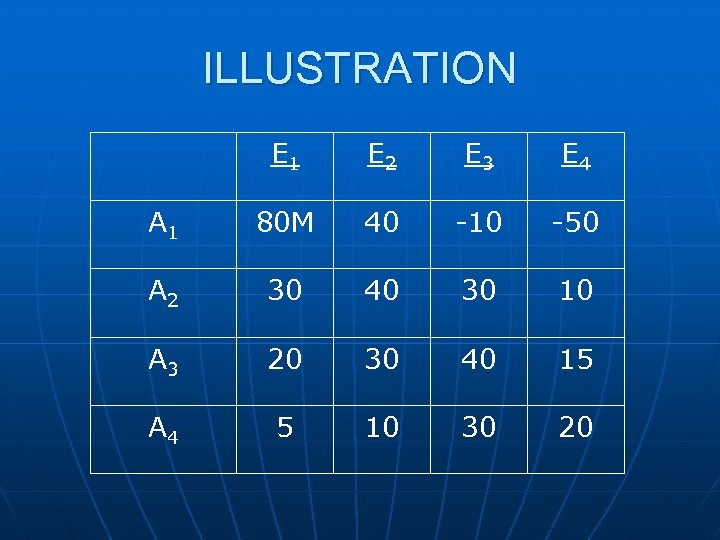

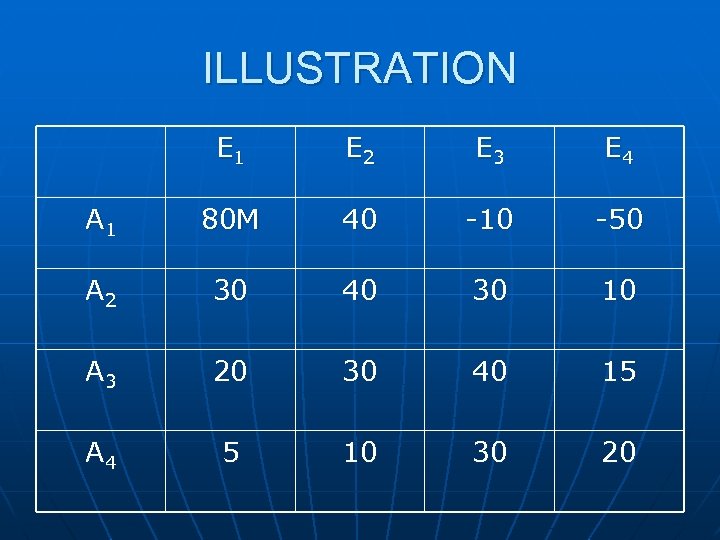

ILLUSTRATION E 1 E 2 E 3 E 4 A 1 80 M 40 -10 -50 A 2 30 40 30 10 A 3 20 30 40 15 A 4 5 10 30 20

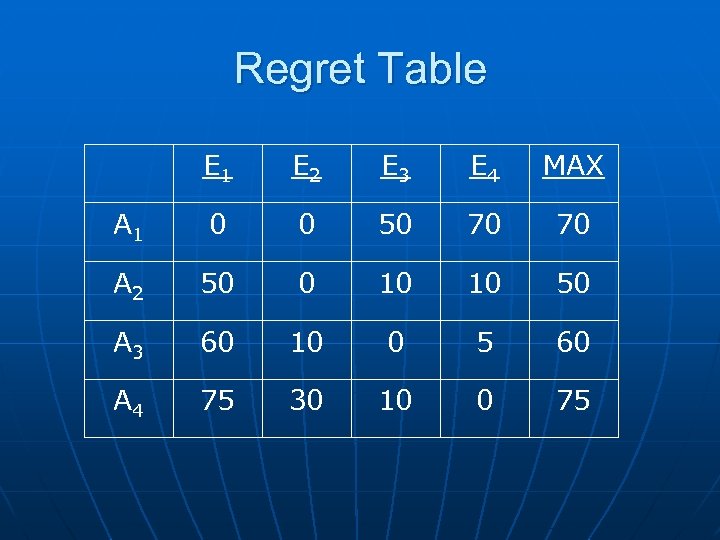

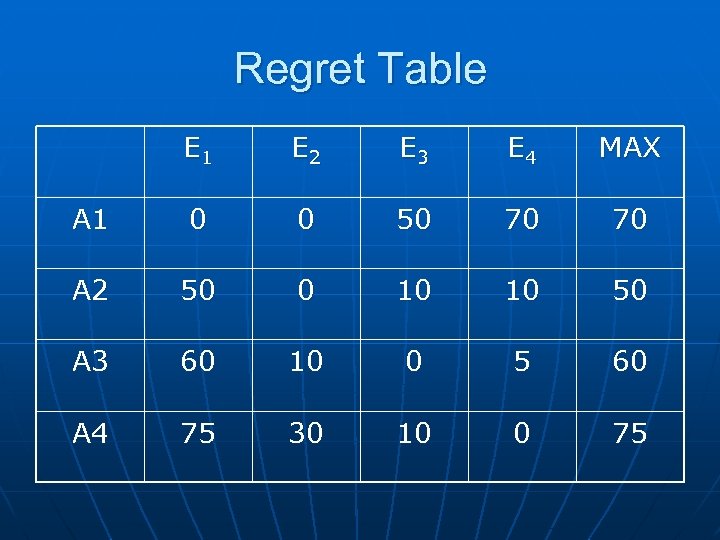

Regret Table E 1 E 2 E 3 E 4 MAX A 1 0 0 50 70 70 A 2 50 0 10 10 50 A 3 60 10 0 5 60 A 4 75 30 10 0 75

Part 2 B Marketing Research Case Study Bayesian Analysis

Value of Information Payoff (Decision) Table Events (States of Nature) Manageme nt Options E 1 E 2 … En A 1 X 12 X 1 n A 2 Xz 1 X 22 Xzn An Xn 1 Xnz Xnn Prior Probabilitie s (P 1) (Pz) (Pn) AI : Decision Acts Ej : Events (or Sj = States of Nature) Xij : Payoff or Consequence Pj : Prob associated with Ej

ILLUSTRATION E 1 E 2 E 3 E 4 A 1 80 M 40 -10 -50 A 2 30 40 30 10 A 3 20 30 40 15 A 4 5 10 30 20

Regret Table E 1 E 2 E 3 E 4 MAX A 1 0 0 50 70 70 A 2 50 0 10 10 50 A 3 60 10 0 5 60 A 4 75 30 10 0 75

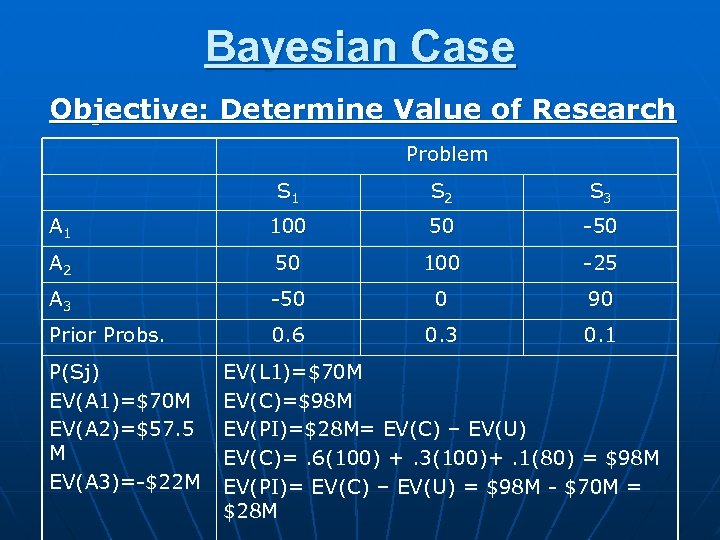

Bayesian Case Objective: Determine Value of Research Problem S 1 S 2 S 3 A 1 100 50 -50 A 2 50 100 -25 A 3 -50 0 90 Prior Probs. 0. 6 0. 3 0. 1 P(Sj) EV(A 1)=$70 M EV(A 2)=$57. 5 M EV(A 3)=-$22 M EV(L 1)=$70 M EV(C)=$98 M EV(PI)=$28 M= EV(C) – EV(U) EV(C)=. 6(100) +. 3(100)+. 1(80) = $98 M EV(PI)= EV(C) – EV(U) = $98 M - $70 M = $28 M

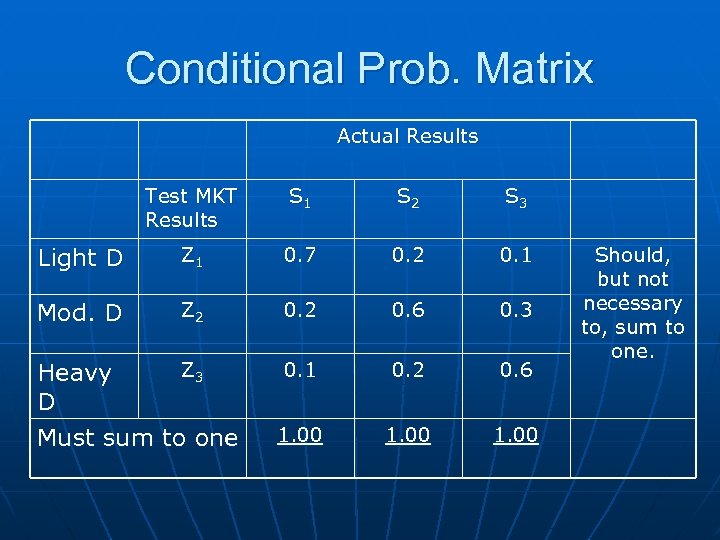

Conditional Prob. Matrix Actual Results Test MKT Results S 1 S 2 S 3 Light D Z 1 0. 7 0. 2 0. 1 Mod. D Z 2 0. 6 0. 3 0. 1 0. 2 0. 6 1. 00 Z 3 Heavy D Must sum to one Should, but not necessary to, sum to one.

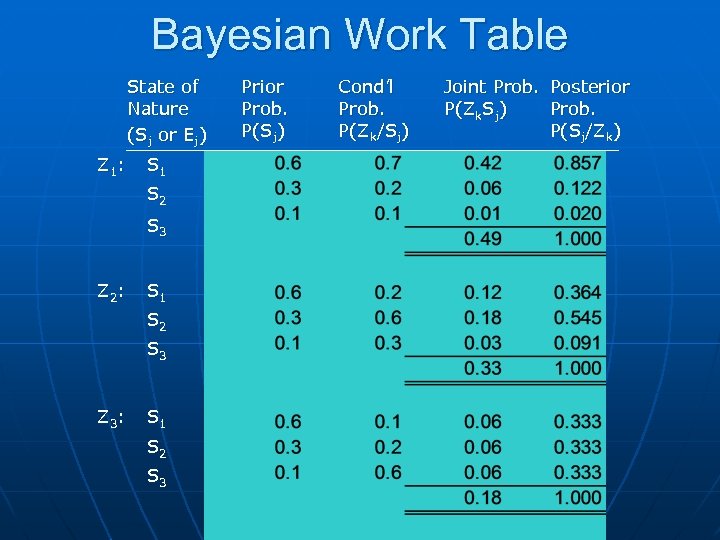

Bayesian Work Table State of Nature (Sj or Ej) Z 1: S 1 S 2 S 3 Z 2: S 1 S 2 S 3 Z 3: S 1 S 2 S 3 Prior Prob. P(Sj) Cond’l Prob. P(Zk/Sj) Joint Prob. Posterior P(Zk. Sj) Prob. P(Sj/Zk)

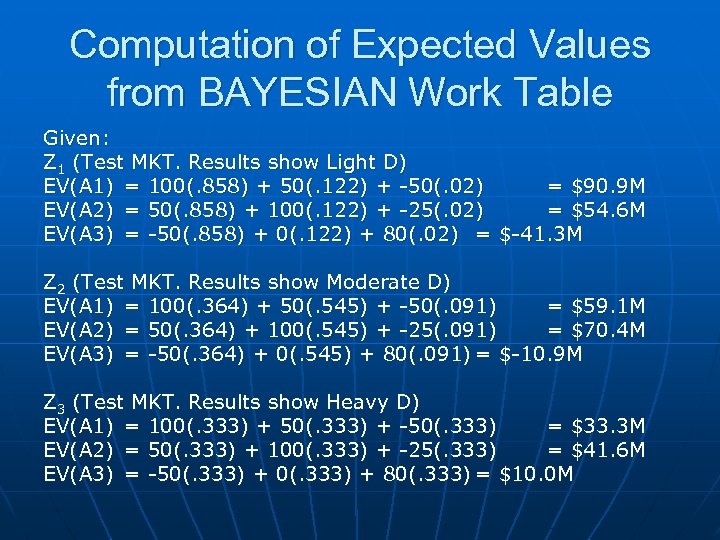

Computation of Expected Values from BAYESIAN Work Table Given: Z 1 (Test MKT. Results show Light D) EV(A 1) = 100(. 858) + 50(. 122) + -50(. 02) = $90. 9 M EV(A 2) = 50(. 858) + 100(. 122) + -25(. 02) = $54. 6 M EV(A 3) = -50(. 858) + 0(. 122) + 80(. 02) = $-41. 3 M Z 2 (Test MKT. Results show Moderate D) EV(A 1) = 100(. 364) + 50(. 545) + -50(. 091) = $59. 1 M EV(A 2) = 50(. 364) + 100(. 545) + -25(. 091) = $70. 4 M EV(A 3) = -50(. 364) + 0(. 545) + 80(. 091) = $-10. 9 M Z 3 (Test MKT. Results show Heavy D) EV(A 1) = 100(. 333) + 50(. 333) + -50(. 333) = $33. 3 M EV(A 2) = 50(. 333) + 100(. 333) + -25(. 333) = $41. 6 M EV(A 3) = -50(. 333) + 80(. 333) = $10. 0 M

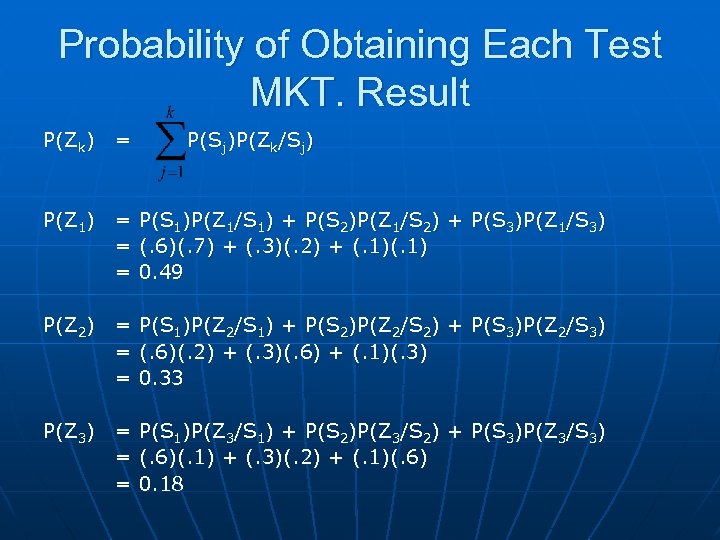

Probability of Obtaining Each Test MKT. Result P(Zk) = P(Z 1) = = = P(Sj)P(Zk/Sj) P(S 1)P(Z 1/S 1) + P(S 2)P(Z 1/S 2) + P(S 3)P(Z 1/S 3) (. 6)(. 7) + (. 3)(. 2) + (. 1) 0. 49 P(Z 2) = P(S 1)P(Z 2/S 1) + P(S 2)P(Z 2/S 2) + P(S 3)P(Z 2/S 3) = (. 6)(. 2) + (. 3)(. 6) + (. 1)(. 3) = 0. 33 P(Z 3) = P(S 1)P(Z 3/S 1) + P(S 2)P(Z 3/S 2) + P(S 3)P(Z 3/S 3) = (. 6)(. 1) + (. 3)(. 2) + (. 1)(. 6) = 0. 18

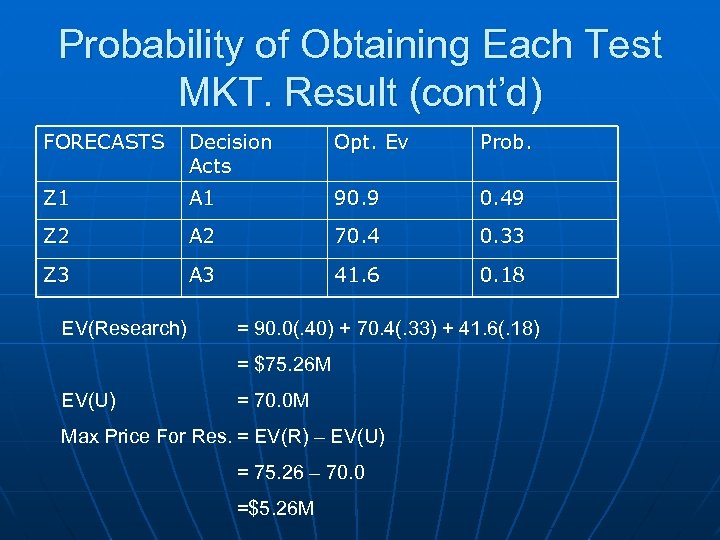

Probability of Obtaining Each Test MKT. Result (cont’d) FORECASTS Decision Acts Opt. Ev Prob. Z 1 A 1 90. 9 0. 49 Z 2 A 2 70. 4 0. 33 Z 3 A 3 41. 6 0. 18 EV(Research) = 90. 0(. 40) + 70. 4(. 33) + 41. 6(. 18) = $75. 26 M EV(U) = 70. 0 M Max Price For Res. = EV(R) – EV(U) = 75. 26 – 70. 0 =$5. 26 M

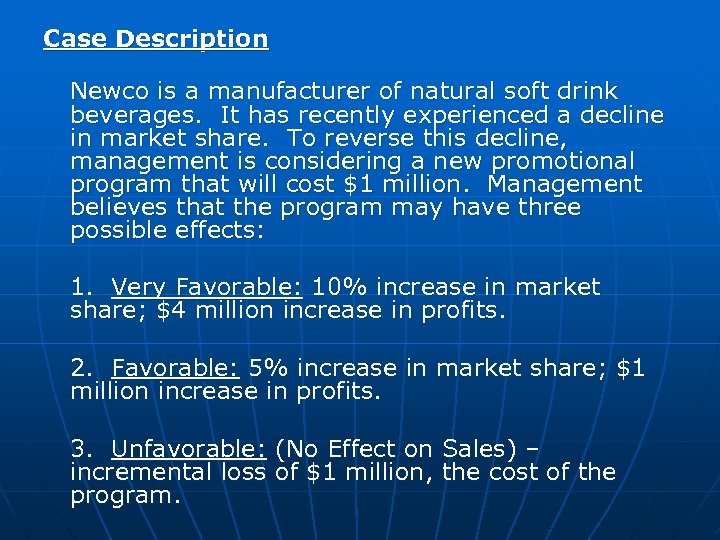

Case Description Newco is a manufacturer of natural soft drink beverages. It has recently experienced a decline in market share. To reverse this decline, management is considering a new promotional program that will cost $1 million. Management believes that the program may have three possible effects: 1. Very Favorable: 10% increase in market share; $4 million increase in profits. 2. Favorable: 5% increase in market share; $1 million increase in profits. 3. Unfavorable: (No Effect on Sales) – incremental loss of $1 million, the cost of the program.

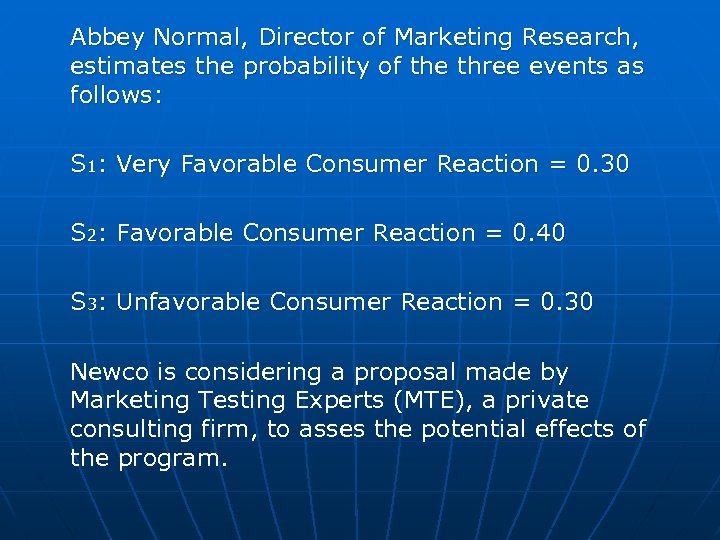

Abbey Normal, Director of Marketing Research, estimates the probability of the three events as follows: S 1: Very Favorable Consumer Reaction = 0. 30 S 2: Favorable Consumer Reaction = 0. 40 S 3: Unfavorable Consumer Reaction = 0. 30 Newco is considering a proposal made by Marketing Testing Experts (MTE), a private consulting firm, to asses the potential effects of the program.

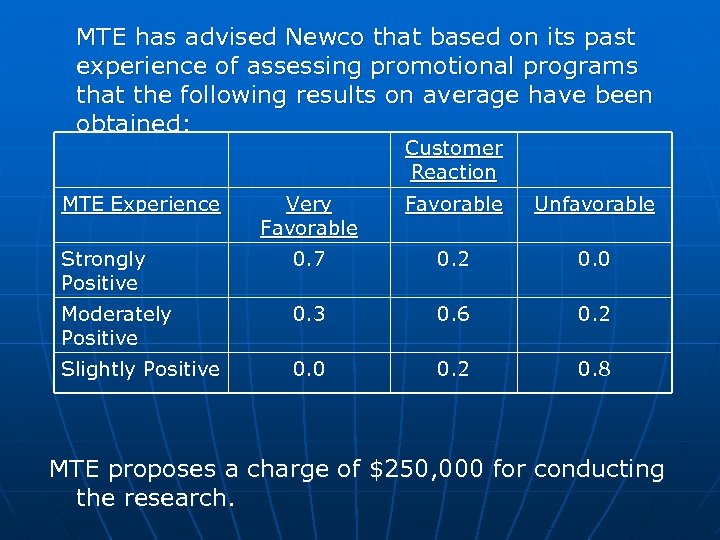

MTE has advised Newco that based on its past experience of assessing promotional programs that the following results on average have been obtained: Customer Reaction MTE Experience Very Favorable Unfavorable Strongly Positive 0. 7 0. 2 0. 0 Moderately Positive 0. 3 0. 6 0. 2 Slightly Positive 0. 0 0. 2 0. 8 MTE proposes a charge of $250, 000 for conducting the research.

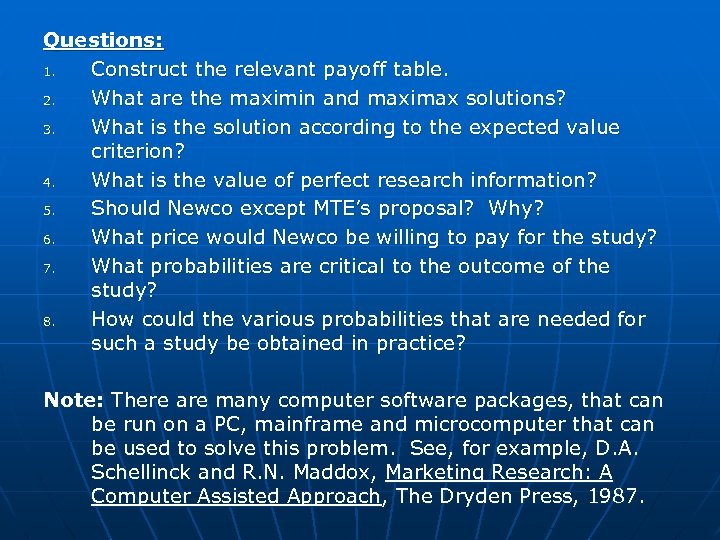

Questions: 1. Construct the relevant payoff table. 2. What are the maximin and maximax solutions? 3. What is the solution according to the expected value criterion? 4. What is the value of perfect research information? 5. Should Newco except MTE’s proposal? Why? 6. What price would Newco be willing to pay for the study? 7. What probabilities are critical to the outcome of the study? 8. How could the various probabilities that are needed for such a study be obtained in practice? Note: There are many computer software packages, that can be run on a PC, mainframe and microcomputer that can be used to solve this problem. See, for example, D. A. Schellinck and R. N. Maddox, Marketing Research: A Computer Assisted Approach, The Dryden Press, 1987.

PART 3

SECONDARY SOURCES OF DATA FIVEFOLD (5) CLASSIFICATION

1. INTERNAL • • P&L Balance Sheet Sales Figure Sales-Call Reports Invoices Inventory Records Prior Research Studies

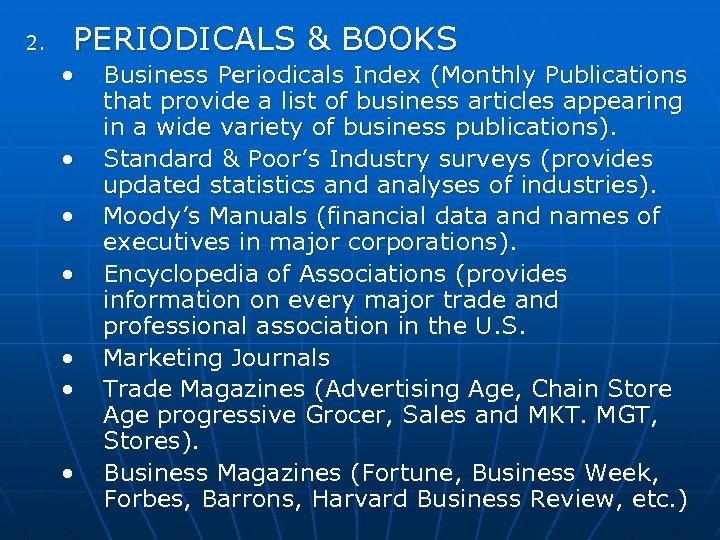

2. PERIODICALS & BOOKS • • Business Periodicals Index (Monthly Publications that provide a list of business articles appearing in a wide variety of business publications). Standard & Poor’s Industry surveys (provides updated statistics and analyses of industries). Moody’s Manuals (financial data and names of executives in major corporations). Encyclopedia of Associations (provides information on every major trade and professional association in the U. S. Marketing Journals Trade Magazines (Advertising Age, Chain Store Age progressive Grocer, Sales and MKT. MGT, Stores). Business Magazines (Fortune, Business Week, Forbes, Barrons, Harvard Business Review, etc. )

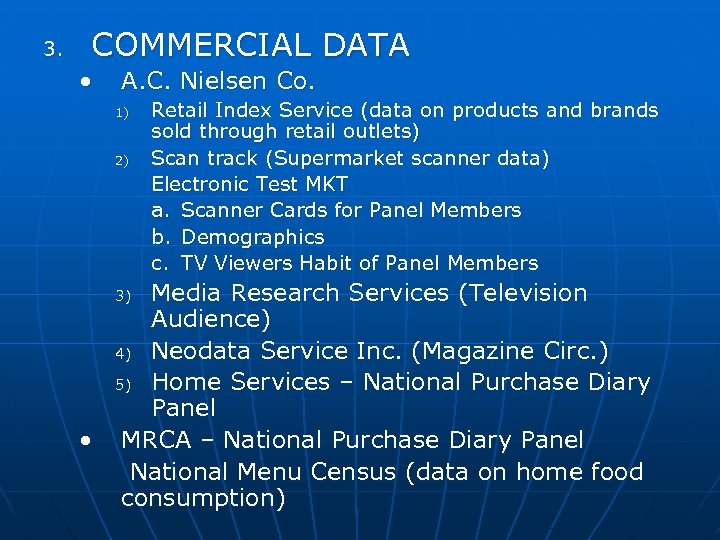

3. COMMERCIAL DATA • A. C. Nielsen Co. 1) 2) Retail Index Service (data on products and brands sold through retail outlets) Scan track (Supermarket scanner data) Electronic Test MKT a. Scanner Cards for Panel Members b. Demographics c. TV Viewers Habit of Panel Members Media Research Services (Television Audience) 4) Neodata Service Inc. (Magazine Circ. ) 5) Home Services – National Purchase Diary Panel • MRCA – National Purchase Diary Panel National Menu Census (data on home food consumption) 3)

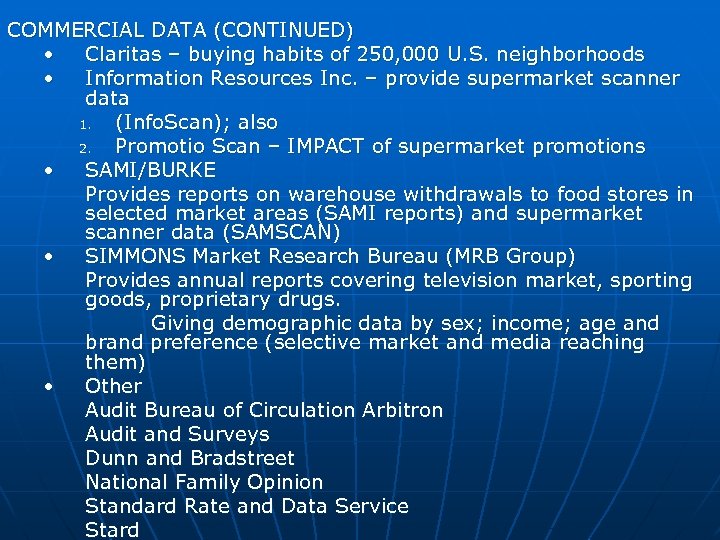

COMMERCIAL DATA (CONTINUED) • Claritas – buying habits of 250, 000 U. S. neighborhoods • Information Resources Inc. – provide supermarket scanner data 1. (Info. Scan); also 2. Promotio Scan – IMPACT of supermarket promotions • SAMI/BURKE Provides reports on warehouse withdrawals to food stores in selected market areas (SAMI reports) and supermarket scanner data (SAMSCAN) • SIMMONS Market Research Bureau (MRB Group) Provides annual reports covering television market, sporting goods, proprietary drugs. Giving demographic data by sex; income; age and brand preference (selective market and media reaching them) • Other Audit Bureau of Circulation Arbitron Audit and Surveys Dunn and Bradstreet National Family Opinion Standard Rate and Data Service Stard

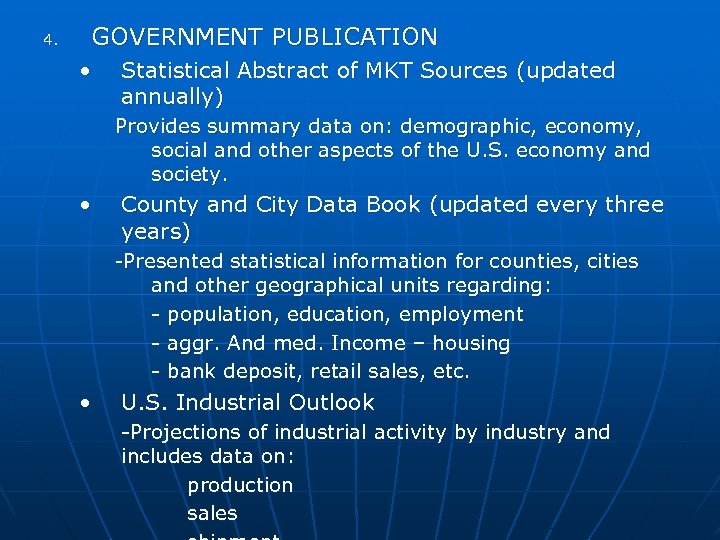

4. GOVERNMENT PUBLICATION • Statistical Abstract of MKT Sources (updated annually) Provides summary data on: demographic, economy, social and other aspects of the U. S. economy and society. • County and City Data Book (updated every three years) -Presented statistical information for counties, cities and other geographical units regarding: - population, education, employment - aggr. And med. Income – housing - bank deposit, retail sales, etc. • U. S. Industrial Outlook -Projections of industrial activity by industry and includes data on: production sales

• Marketing Information Guide Provides a monthly annotated bibliography of marketing information. • Other - Annual Survey of Manufacturers - Business Statistics - Census of Manufacturers - Census of Retail Trade, Wholesale Trade and Selected Service Industries - Census of Transportation - Federal Reserve Bulleting - Monthly Labor Review - Survey of Current Business - Vital Statistics Report

5. COMPUTERIZED DATA BASE Definition: A collection of numeric data and/or textual information that is available on computer readable form. e. g. : Bibliographic ABI/INFORM Predicast Numeric 1. 2000/2010 Census Data Donnelly MKT DRI 2. Nielsen Retail Product Movement SAMI 3. SPI (Strategic Planning Institute) 250 Companies PIMS

Work Index: Sponsored by Cornell University’s School of Industrial Labor Relations and Human Resource Executive magazine, this site provides links to resources on labor relations, benefits, training, technology, staffing, recruiting, leadership, legal issues and related topics. Marketing Advertising World Links to resources in selected areas of marketing and advertising. American Association of Advertising Agencies Provides membership information, recent bulletins, and links to related resources. American Marketing Association Provides information on membership, publications, and conferences. Guerrilla Marketing Online Provides access to recent articles in marketing and links to relevant sites.

Marketing Cont’d Institute for the Study of Business Markets (ISBM) Features current information about seminars and research projects. Includes marketing links. John W. Hartman Center for Sales, Advertising & Marketing History (Duke University Libraries) Center promotes study of sales, marketing, and advertising history. Features “Ad*Access, ” an image database of over 7, 000 advertisements printed in U. S. and Canadian newspapers between 1911 and 1955. Database allows keyword searching. Yahoo – Business and Economy: Marketing Provides links to marketing web sites Marketing Information: A Bibliography

Statistical Sources Business Resources on the Web: Economic Statistics, Government Statistics, and Business Law Maintained by Boise State University’s Albertsons Library, contains extensive links to statistics sources for the economy, population, international trade, statistics by state, etc. Primarily dedicated to statistics sources, but also contains a business law component Fisher College of Business Financial Data Finder Links to financial and economic data on the web and elsewhere.

Profiling Customers Dr. Doherty Tobin College of Business St. John’s University

Industrial n Dun’s Market Identifiers (DMI) • D&B’s market information service. A record of over 7 million establishments updated monthly n Enhanced DMI extends 4 digit S/C codes to 6 and 8 digits to allow clients to target specific customer groups

Consumer n Geodemographers • R. L. Pole Product for Retailers: Vehicle Origin Survey Samples cars parked in retailer parking lots and identifies (from the Vehicle Registration Database) their home location. Can also match location with Census data and via their TIGER files provide a demographic profile of customers • Claritas Uses 500+ demographic variables in its Prigm (Potential Ratings for Zip markets) database to classify 250, 000 neighborhoods 40 types based on consumer behavior and lifestyle (shotguns, pickups, patios and pools, etc. )

Consumer n Diary Panels • NPD (13, 000 HHs) 30 Product Categories • 29 Miniature Panels • Quota Sampling • Applications n Brand Shares n Brand Switching Behavior n Frequency of Purchase and Amounts n Evaluation of Price and Promotions n Changes in Channels and Distribution n Size of Market

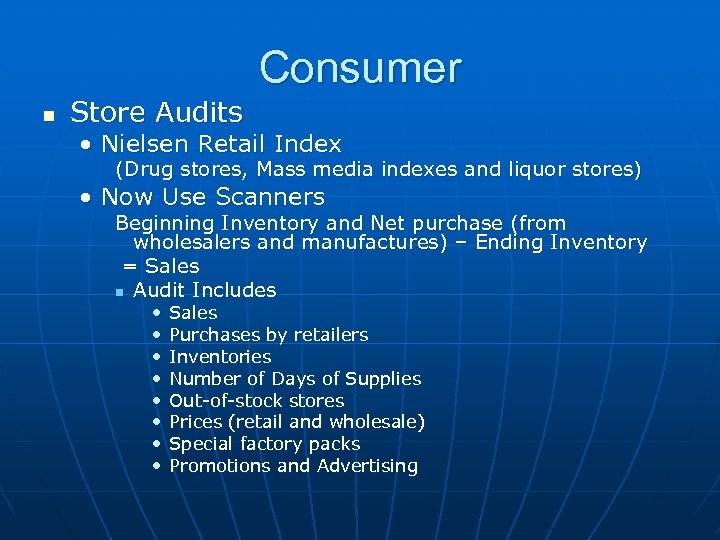

Consumer n Store Audits • Nielsen Retail Index (Drug stores, Mass media indexes and liquor stores) • Now Use Scanners Beginning Inventory and Net purchase (from wholesalers and manufactures) – Ending Inventory = Sales n Audit Includes • • Sales Purchases by retailers Inventories Number of Days of Supplies Out-of-stock stores Prices (retail and wholesale) Special factory packs Promotions and Advertising

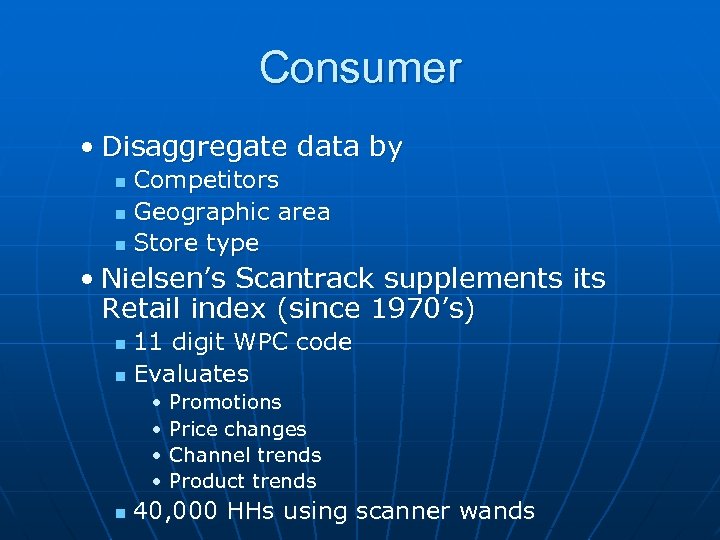

Consumer • Disaggregate data by Competitors n Geographic area n Store type n • Nielsen’s Scantrack supplements its Retail index (since 1970’s) 11 digit WPC code n Evaluates n • Promotions • Price changes • Channel trends • Product trends n 40, 000 HHs using scanner wands

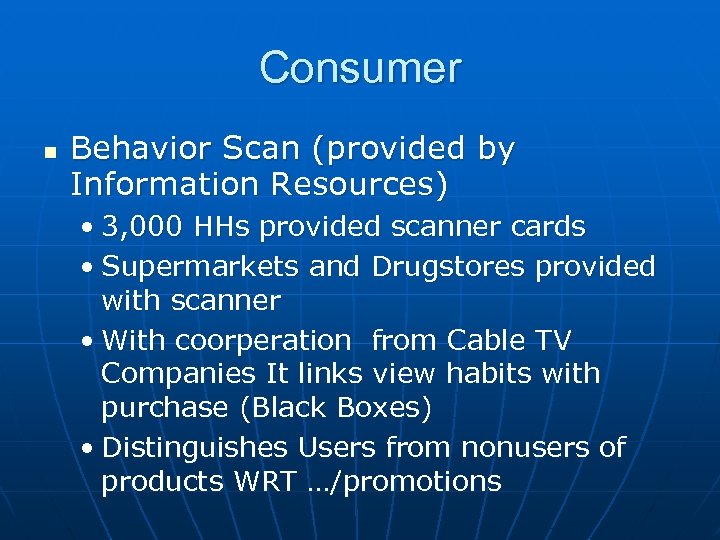

Consumer n Behavior Scan (provided by Information Resources) • 3, 000 HHs provided scanner cards • Supermarkets and Drugstores provided with scanner • With coorperation from Cable TV Companies It links view habits with purchase (Black Boxes) • Distinguishes Users from nonusers of products WRT …/promotions

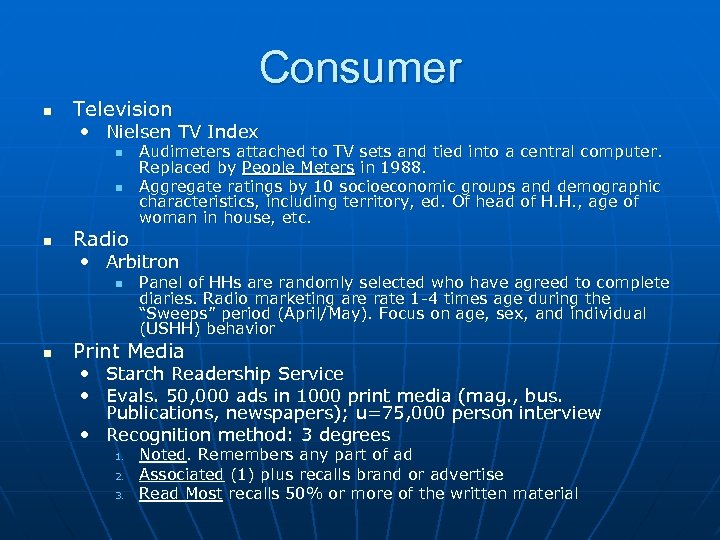

Consumer n Television • Nielsen TV Index n n n Radio Audimeters attached to TV sets and tied into a central computer. Replaced by People Meters in 1988. Aggregate ratings by 10 socioeconomic groups and demographic characteristics, including territory, ed. Of head of H. H. , age of woman in house, etc. • Arbitron n n Panel of HHs are randomly selected who have agreed to complete diaries. Radio marketing are rate 1 -4 times age during the “Sweeps” period (April/May). Focus on age, sex, and individual (USHH) behavior Print Media • Starch Readership Service • Evals. 50, 000 ads in 1000 print media (mag. , bus. Publications, newspapers); u=75, 000 person interview • Recognition method: 3 degrees 1. 2. 3. Noted. Remembers any part of ad Associated (1) plus recalls brand or advertise Read Most recalls 50% or more of the written material

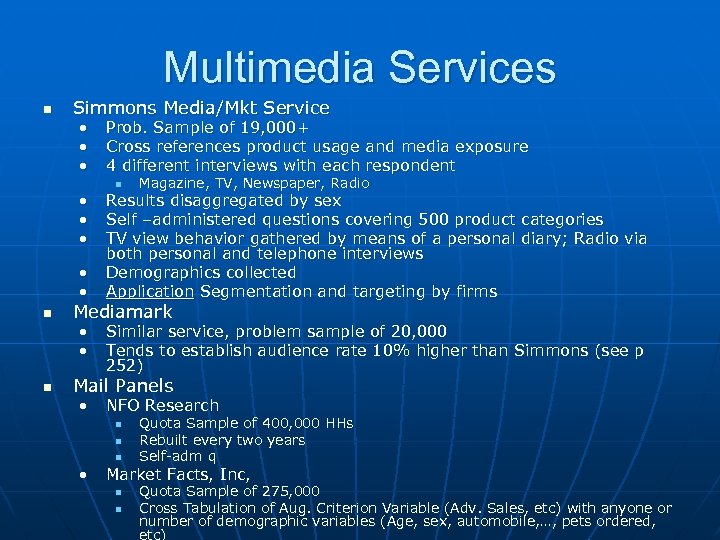

Multimedia Services n Simmons Media/Mkt Service • • n n Prob. Sample of 19, 000+ Cross references product usage and media exposure 4 different interviews with each respondent n Magazine, TV, Newspaper, Radio Results disaggregated by sex Self –administered questions covering 500 product categories TV view behavior gathered by means of a personal diary; Radio via both personal and telephone interviews Demographics collected Application Segmentation and targeting by firms Mediamark • • Similar service, problem sample of 20, 000 Tends to establish audience rate 10% higher than Simmons (see p 252) Mail Panels • NFO Research n n • n Quota Sample of 400, 000 HHs Rebuilt every two years Self-adm q Market Facts, Inc, n n Quota Sample of 275, 000 Cross Tabulation of Aug. Criterion Variable (Adv. Sales, etc) with anyone or number of demographic variables (Age, sex, automobile, …, pets ordered, etc)

PART 3 B

Determining Market Potential Dr. Doherty Tobin College of Business St. John’s University

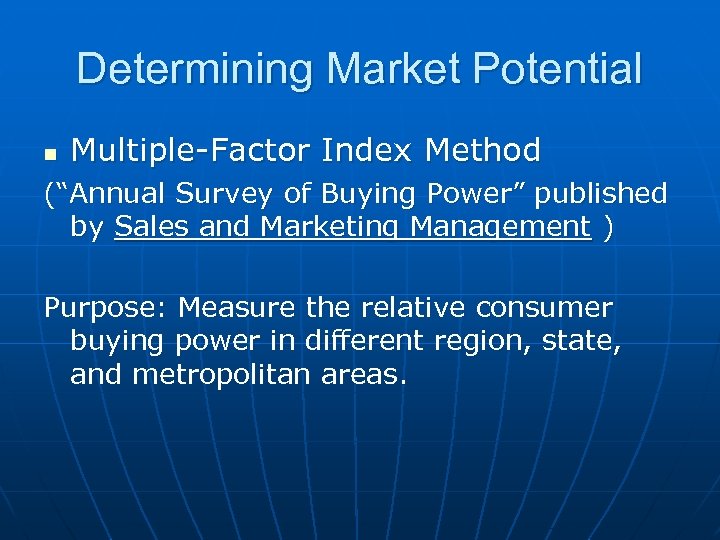

Determining Market Potential n Multiple-Factor Index Method (“Annual Survey of Buying Power” published by Sales and Marketing Management ) Purpose: Measure the relative consumer buying power in different region, state, and metropolitan areas.

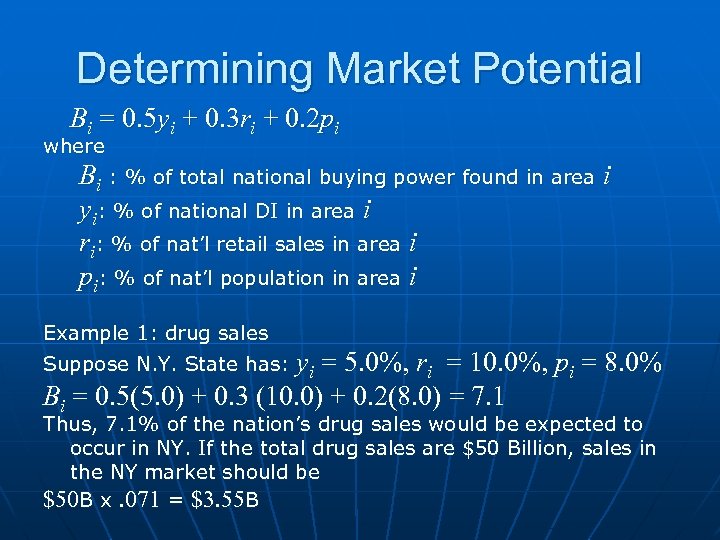

Determining Market Potential Bi = 0. 5 yi + 0. 3 ri + 0. 2 pi where Bi : % of total national buying power found in area i yi: % of national DI in area i ri: % of nat’l retail sales in area i pi: % of nat’l population in area i Example 1: drug sales Suppose N. Y. State has: yi = 5. 0%, ri = 10. 0%, pi = 8. 0% Bi = 0. 5(5. 0) + 0. 3 (10. 0) + 0. 2(8. 0) = 7. 1 Thus, 7. 1% of the nation’s drug sales would be expected to occur in NY. If the total drug sales are $50 Billion, sales in the NY market should be $50 B x. 071 = $3. 55 B

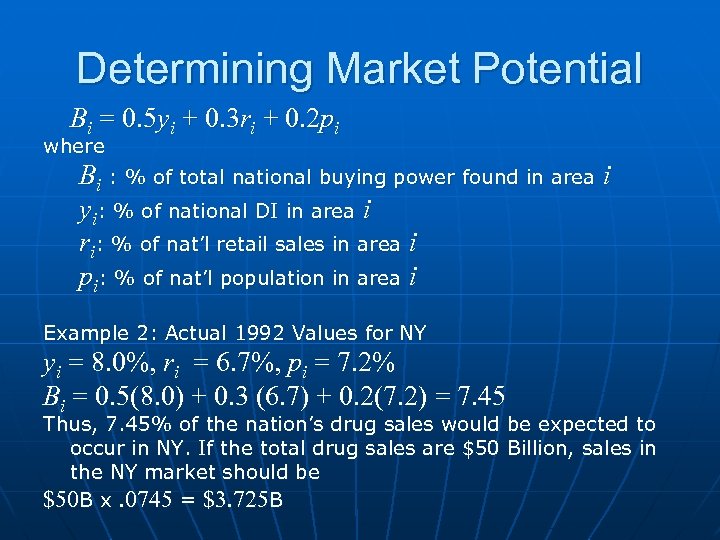

Determining Market Potential Bi = 0. 5 yi + 0. 3 ri + 0. 2 pi where Bi : % of total national buying power found in area i yi: % of national DI in area i ri: % of nat’l retail sales in area i pi: % of nat’l population in area i Example 2: Actual 1992 Values for NY yi = 8. 0%, ri = 6. 7%, pi = 7. 2% Bi = 0. 5(8. 0) + 0. 3 (6. 7) + 0. 2(7. 2) = 7. 45 Thus, 7. 45% of the nation’s drug sales would be expected to occur in NY. If the total drug sales are $50 Billion, sales in the NY market should be $50 B x. 0745 = $3. 725 B

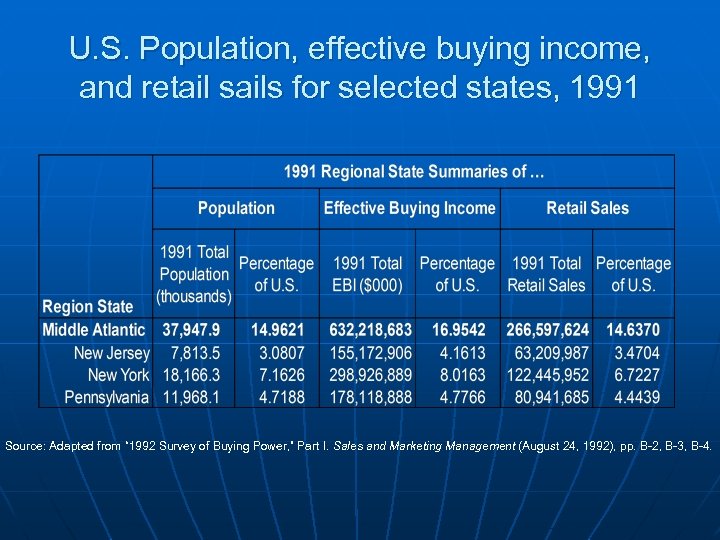

U. S. Population, effective buying income, and retail sails for selected states, 1991 Source: Adapted from “ 1992 Survey of Buying Power, ” Part I. Sales and Marketing Management (August 24, 1992), pp. B-2, B-3, B-4.

PART 4

Measuring Attitude: Five Approaches Dr. Doherty

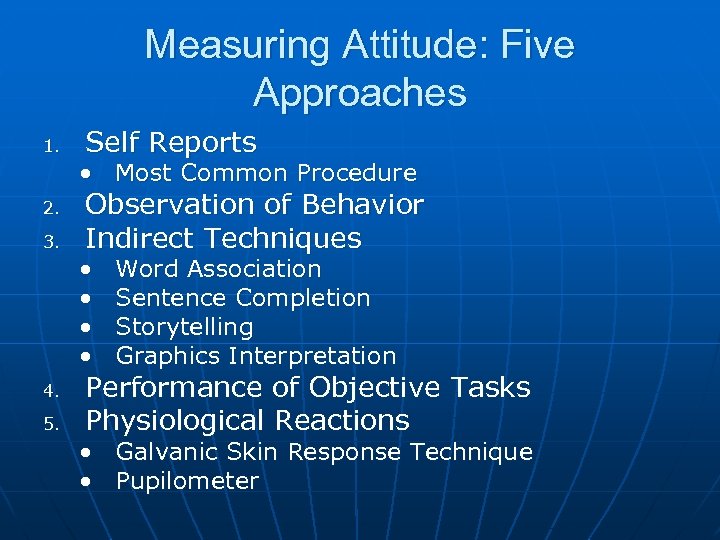

Measuring Attitude: Five Approaches 1. Self Reports • Most Common Procedure 2. 3. Observation of Behavior Indirect Techniques • • 4. 5. Word Association Sentence Completion Storytelling Graphics Interpretation Performance of Objective Tasks Physiological Reactions • Galvanic Skin Response Technique • Pupilometer

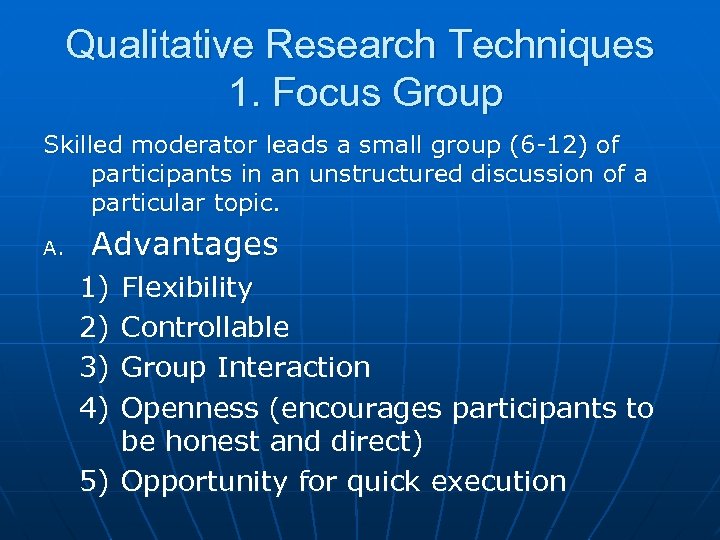

Qualitative Research Techniques 1. Focus Group Skilled moderator leads a small group (6 -12) of participants in an unstructured discussion of a particular topic. A. Advantages 1) 2) 3) 4) Flexibility Controllable Group Interaction Openness (encourages participants to be honest and direct) 5) Opportunity for quick execution

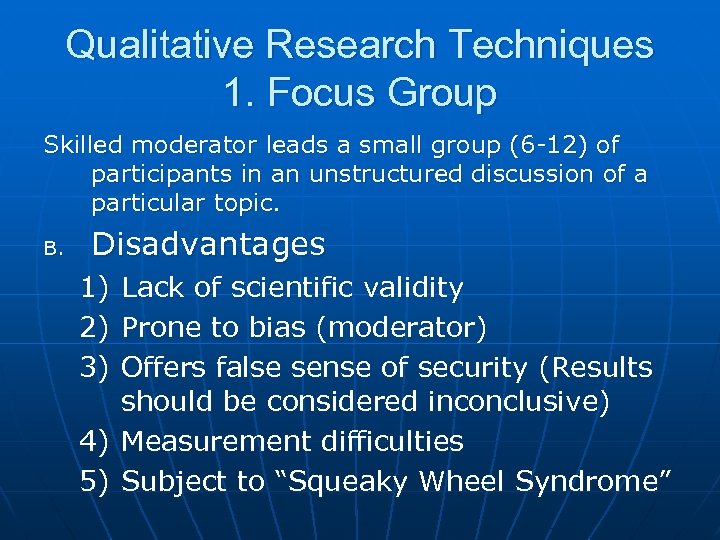

Qualitative Research Techniques 1. Focus Group Skilled moderator leads a small group (6 -12) of participants in an unstructured discussion of a particular topic. B. Disadvantages 1) Lack of scientific validity 2) Prone to bias (moderator) 3) Offers false sense of security (Results should be considered inconclusive) 4) Measurement difficulties 5) Subject to “Squeaky Wheel Syndrome”

Qualitative Research Techniques 2. Depth Interviews Structured or Unstructured, one-on-one interview. A. Advantages 1) Offers greater comfortability for sensitive topics 2) More detailed and revealing 3) Easier to schedule 4) Can handle more complex topics (e. g. Interviewing financial experts)

Qualitative Research Techniques 2. Depth Interviews Structured or Unstructured, one-on-one interview. B. Disadvantages 1) No interaction effects 2) Expensive 3) Inconsistency among interviewers and levels of energy (Diminishing Returns) 4) Interpretational errors produce inconsistency and unreliability 5) Lack statistical validity

Qualitative Research Techniques 3. Projective Techniques Based on theory that people may not be aware of their innermost attitudes and/or may not wish to express certain attitudes.

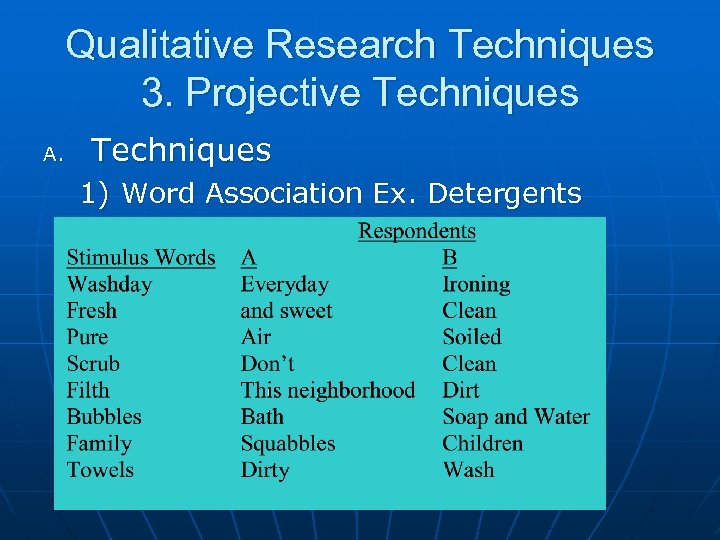

Qualitative Research Techniques 3. Projective Techniques A. Techniques 1) Word Association Ex. Detergents

Qualitative Research Techniques 3. Projective Techniques A. Techniques 2) Picture Interpretation n Thematic Apperception Test (TAT) Respondent is shown abstract visual and describes what is going on in pictures and what will happen stimuli the

Qualitative Research Techniques 3. Projective Techniques A. Techniques 3) Sentence Completion Ex. Toothpaste n I brush my teeth because _____. n I use my brand of toothpaste because _____. n My toothpaste tastes like _____. n When I brush my teeth, I _____.

Qualitative Research Techniques 3. Projective Techniques A. Techniques 4) Third-person technique and role playing 5) Cartoons n n Blank bubbles appear above the cartoon characters Ex. New car models

Qualitative Research Techniques 3. Projective Techniques B. Disadvantages of Projective Techniques 1) Subjectivity of scoring procedures low reliability 2) Low validity 3) Absence of substantial evidence of “Basic Assumption, ” namely, that respondents project their true feelings on ambiguous stimuli 4) Small samples and unstructured formats limit generalization

Basic Measurement/Scale Concepts Measure: Assignment of numbers to characteristics of objects Object: A material or physical configuration. Can be seen and/or touched Characteristics: Qualities associated with objects that give such objects identifying traits Measurement Scale: A plan that is used to assign numbers to characteristics of objects Construct: The “something” that is being measured

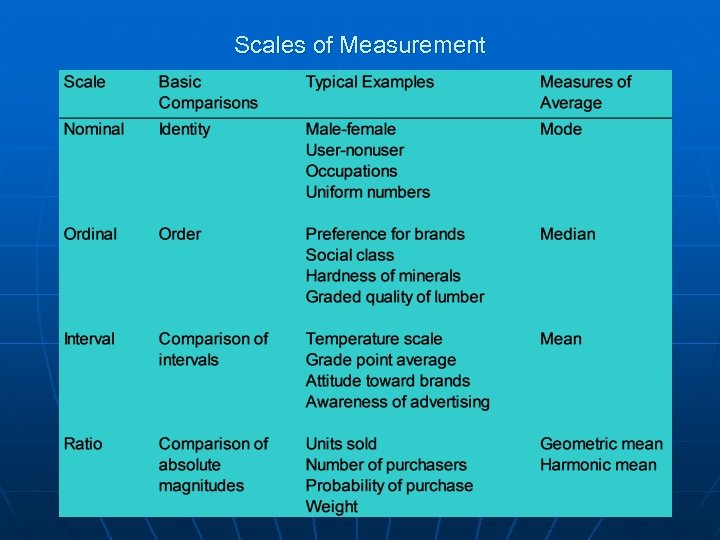

Scales of Measurement

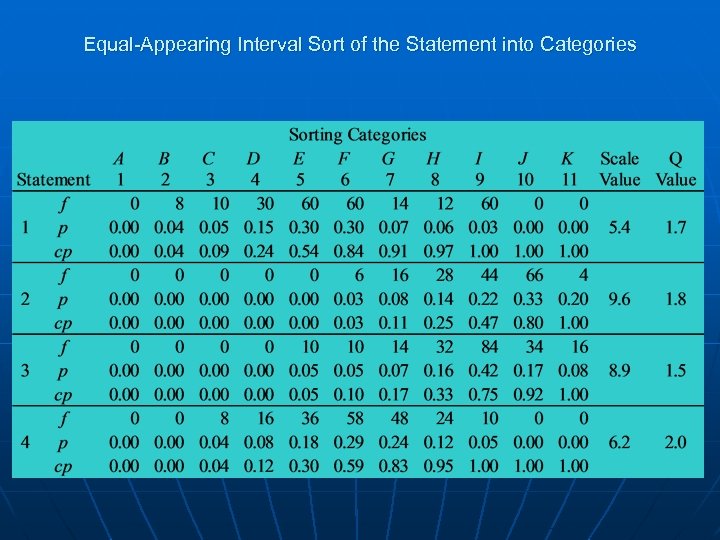

Equal-Appearing Interval Sort of the Statement into Categories

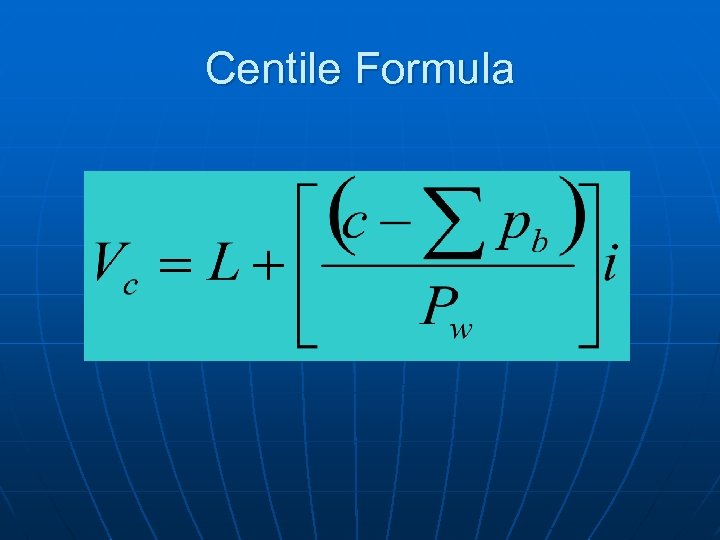

Centile Formula

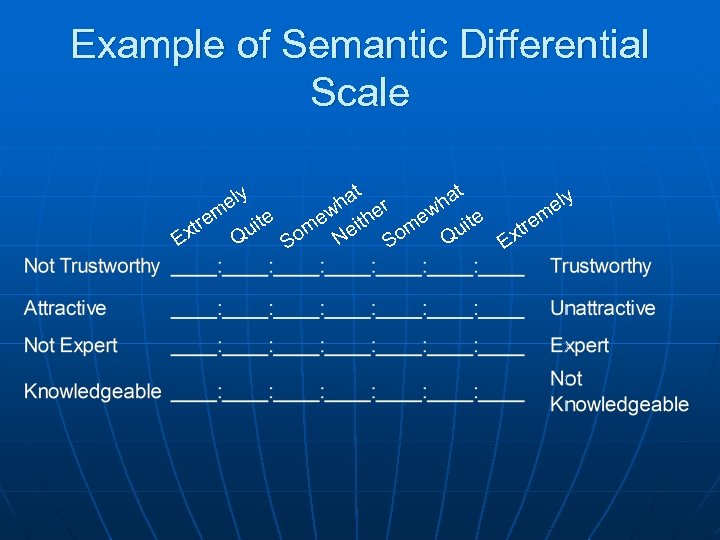

Semantic Differential Scale 1. 2. Origin: Research designed to investigate the underlying structure of words used to describe objects, events, processes, attitude, etc. Rational: Three independent (orthogonal) dimensions can be used to describe an object using a bipolar adjective scale.

Semantic Differential Scale 3. Three Uncorrelated Dimensions 1) Potency Strong - Weak Shallow - Deep Powerful - Powerless 2) Evaluation Good – Bad Sour – Sweet Informative – Uninformative Helpful – Unhelpful Useless – Useful 3) Activity: Dynamic – Static Orderly – Chaotic Aggressive – Non aggressive Dead – Alive Slow - Fast

Semantic Differential Scale 4. Marketing Application • Develop profiles for products, firms, markets or whatever is being measured • Studies often use adjective that are not anonyms or single words and use phrases to anchor scales • 7 -Point Scale is common

Semantic Differential Scale 5. Marketing Application • Purification Stage (often times skipped) • Item Analysis. Product Moment Formula is used to compare score of each item with total score. Or, • T-test of significance between mean scores of “low” and “high” total scores groups on an item-by-item basis.

Example of Semantic Differential Scale e xtr E t t ha ha er ely m ew ite ew ith ite re m m t Qu Qu So Ne So Ex ely m

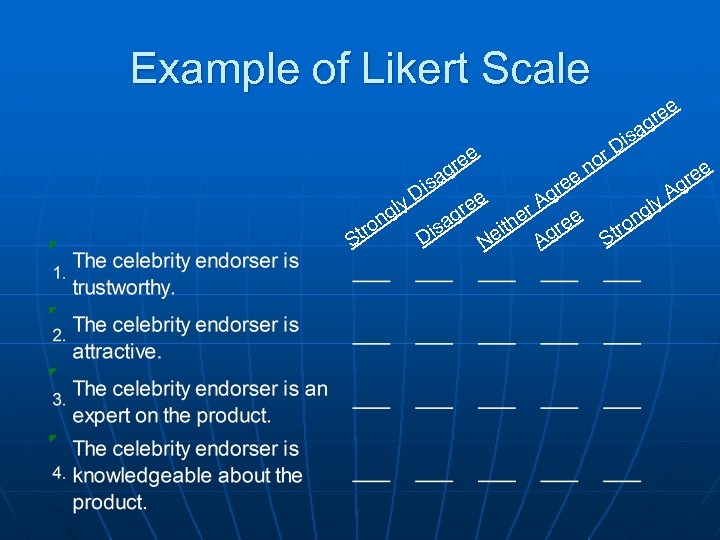

Likert Scale n n Allows an expression of intensity of feeling Purification Stage (same as SD scale) • Representative Sample of Target Population n Final Selection of Questions • Same as SD Scale n n Generally a 5 -Point Scale Mixes Statements as to Positive or Negative Expression

Example of Likert Scale e re ag s Di r e re g y. D gl S n ro t isa D isa e re g no e e e r Ne e ith gr A e gr tro S n gly A e gr

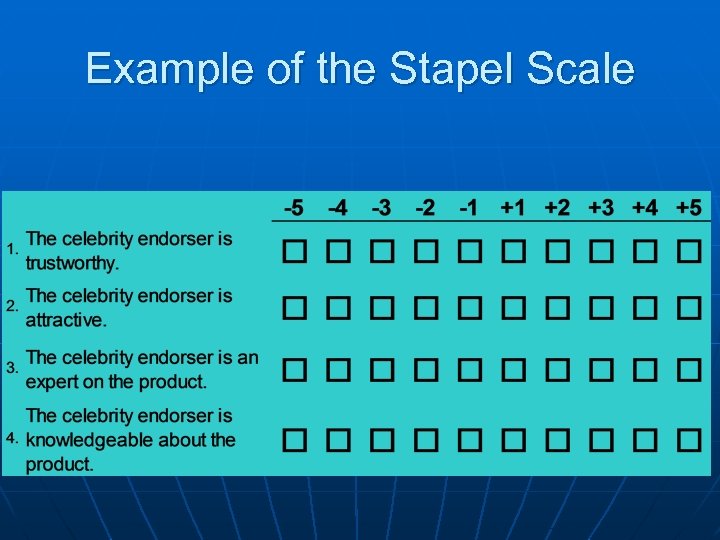

Stapel Scale n n n Adjectives or descriptive phrases are tested rather than bipolar adjective pairs. Generally, a 10 point scale is used. Points, on scale are identified by number. Results my differ according to the manner in which statement is phrased.

Example of the Stapel Scale

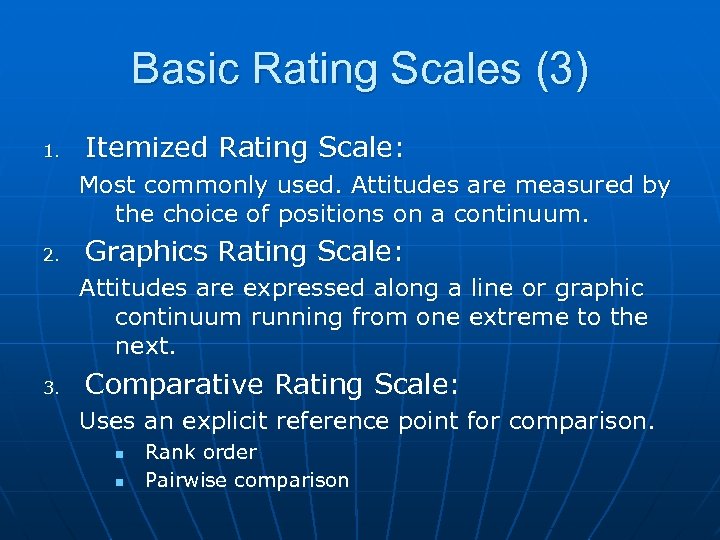

Basic Rating Scales (3) 1. Itemized Rating Scale: Most commonly used. Attitudes are measured by the choice of positions on a continuum. 2. Graphics Rating Scale: Attitudes are expressed along a line or graphic continuum running from one extreme to the next. 3. Comparative Rating Scale: Uses an explicit reference point for comparison. n n Rank order Pairwise comparison

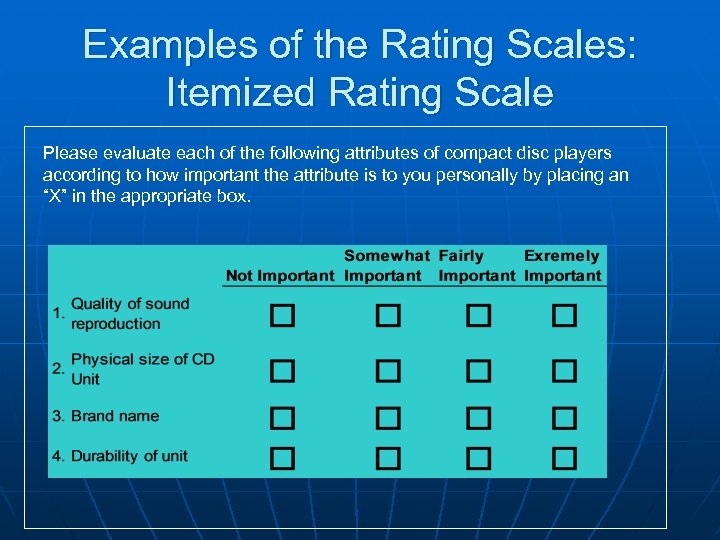

Examples of the Rating Scales: Itemized Rating Scale Please evaluate each of the following attributes of compact disc players according to how important the attribute is to you personally by placing an “X” in the appropriate box.

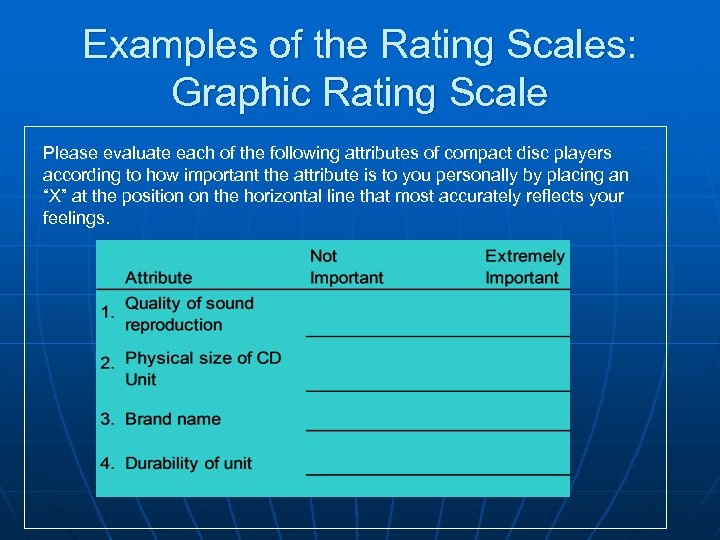

Examples of the Rating Scales: Graphic Rating Scale Please evaluate each of the following attributes of compact disc players according to how important the attribute is to you personally by placing an “X” at the position on the horizontal line that most accurately reflects your feelings.

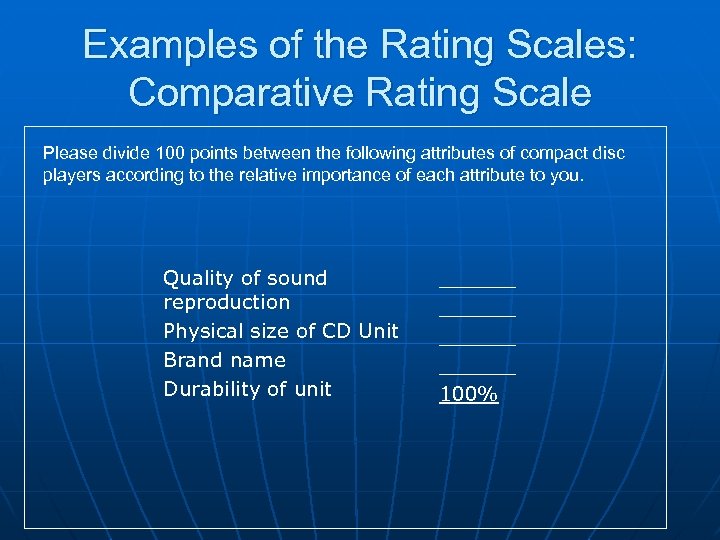

Examples of the Rating Scales: Comparative Rating Scale Please divide 100 points between the following attributes of compact disc players according to the relative importance of each attribute to you. Quality of sound reproduction Physical size of CD Unit Brand name Durability of unit ______ 100%

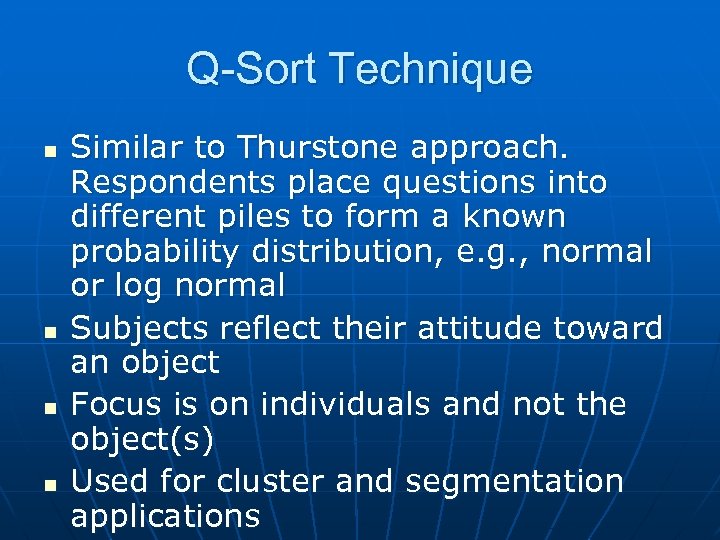

Q-Sort Technique n n Similar to Thurstone approach. Respondents place questions into different piles to form a known probability distribution, e. g. , normal or log normal Subjects reflect their attitude toward an object Focus is on individuals and not the object(s) Used for cluster and segmentation applications

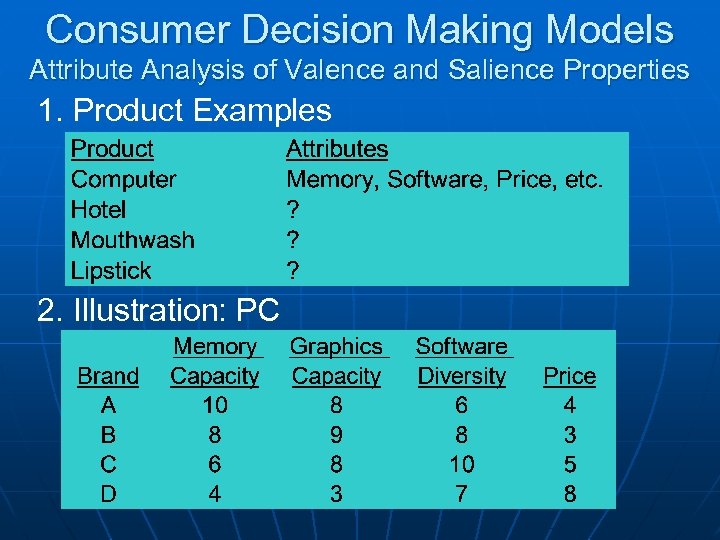

Consumer Decision Making Models Attribute Analysis of Valence and Salience Properties 1. Product Examples 2. Illustration: PC

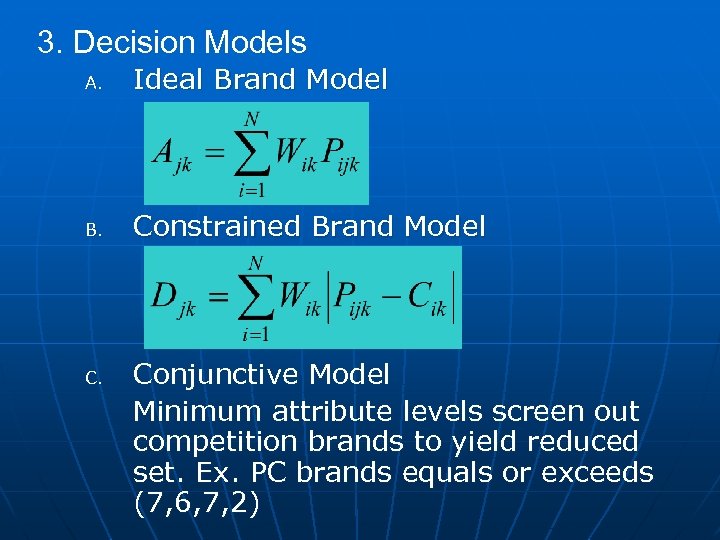

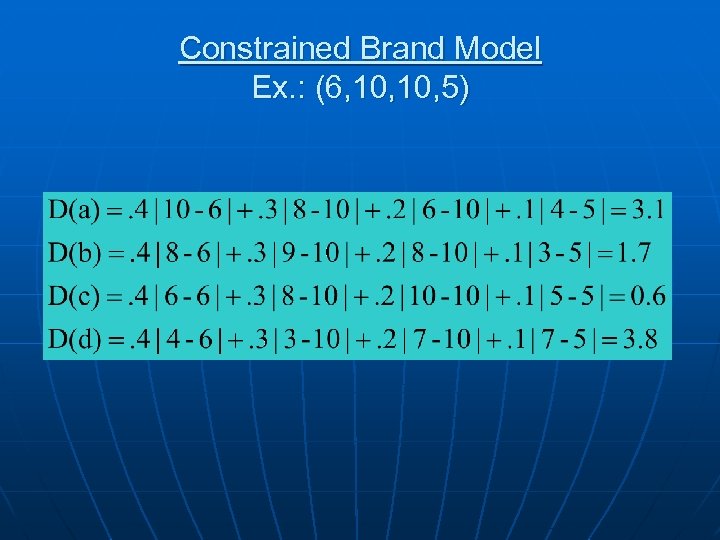

3. Decision Models A. Ideal Brand Model B. Constrained Brand Model C. Conjunctive Model Minimum attribute levels screen out competition brands to yield reduced set. Ex. PC brands equals or exceeds (7, 6, 7, 2)

Constrained Brand Model Ex. : (6, 10, 5)

PART 5

Questionnaire: Anatomy Dr. Doherty Tobin College of Business St. John’s University

Questionnaire: Anatomy Definition: A formalized schedule (document) that is designed to achieve three purposes: 1. 2. 3. Obtain Relevant Information; Direct the Questioning Process; and Set the format for recording and evaluating data.

Eight Step Process Step 1: Define Marketing Problem 1) 2) 3) 4) 5) 6) Write a paragraph List data to be collected Anticipate use of data State objectives Develop a Plan of Analysis Client “Sign Off”

Eight Step Process Step 2: Interviewing Process 1) Personal – – Structured vs. Unstructured Interviewer Administered vs. Self Administered 2) Telephone 3) Mail 4) Internet

Eight Step Process Step 3: Evaluate Question Content Four Rules: 1) Will the Respondent understand the question? 2) Will the Respondent have the information? 3) Will the Respondent provide information? 4) Will the Analyst understand the Respondent’s response?

Eight Step Process Step 4: Q/A Format 1) Open Ended a. b. c. Free Response Probing Projective (e. g. association, construction, sentence completion) 2) Close Ended a. b. c. d. e. Dichotomous Multichotomous Scales Ranking Check List

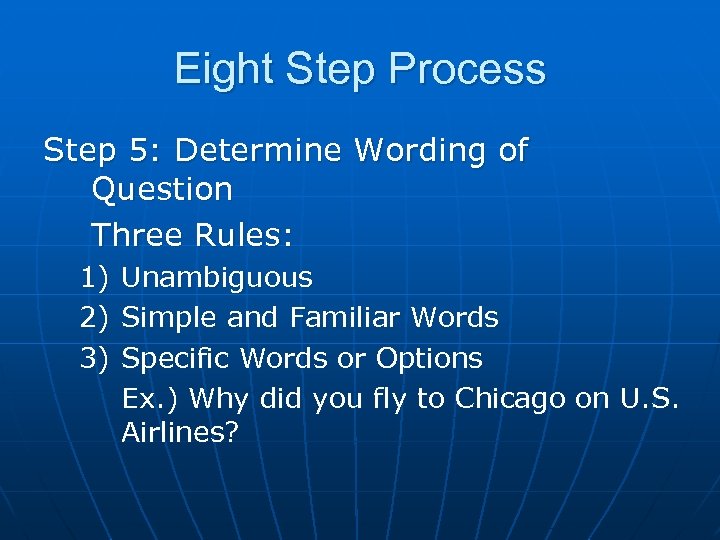

Eight Step Process Step 5: Determine Wording of Question Three Rules: 1) 2) 3) Unambiguous Simple and Familiar Words Specific Words or Options Ex. ) Why did you fly to Chicago on U. S. Airlines?

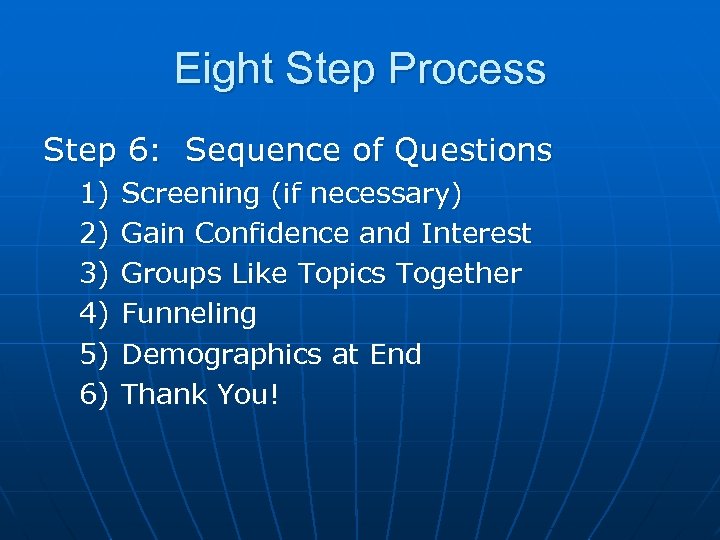

Eight Step Process Step 6: Sequence of Questions 1) 2) 3) 4) 5) 6) Screening (if necessary) Gain Confidence and Interest Groups Like Topics Together Funneling Demographics at End Thank You!

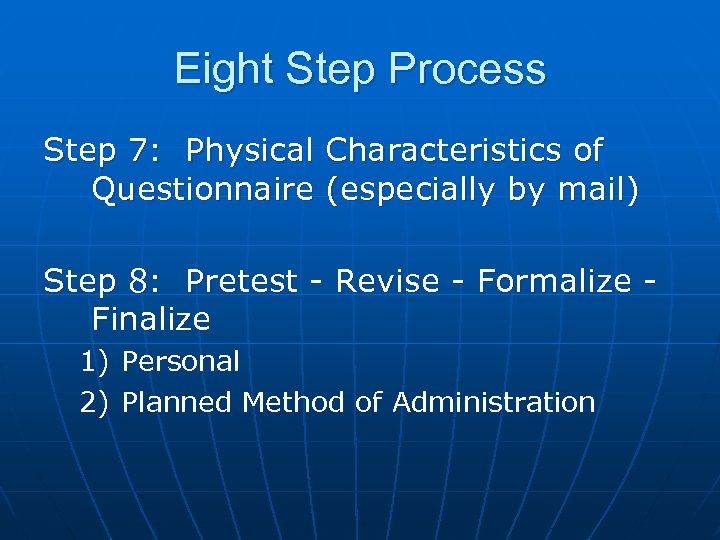

Eight Step Process Step 7: Physical Characteristics of Questionnaire (especially by mail) Step 8: Pretest - Revise - Formalize Finalize 1) 2) Personal Planned Method of Administration

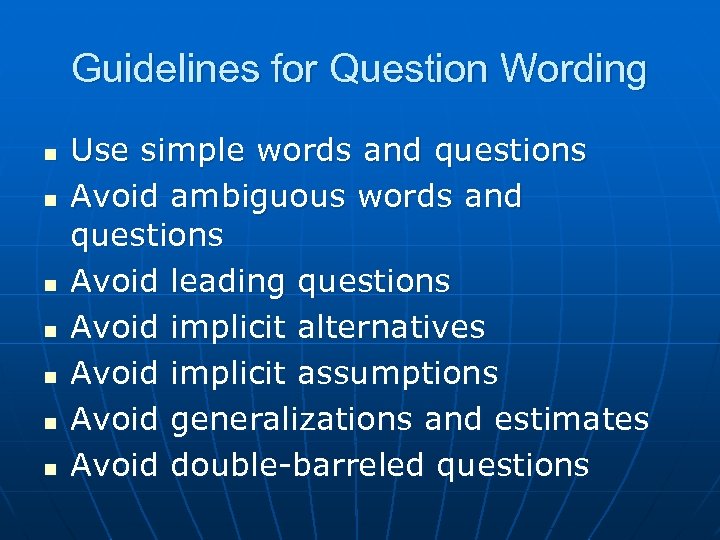

Guidelines for Question Wording n n n n Use simple words and questions Avoid ambiguous words and questions Avoid leading questions Avoid implicit alternatives Avoid implicit assumptions Avoid generalizations and estimates Avoid double-barreled questions

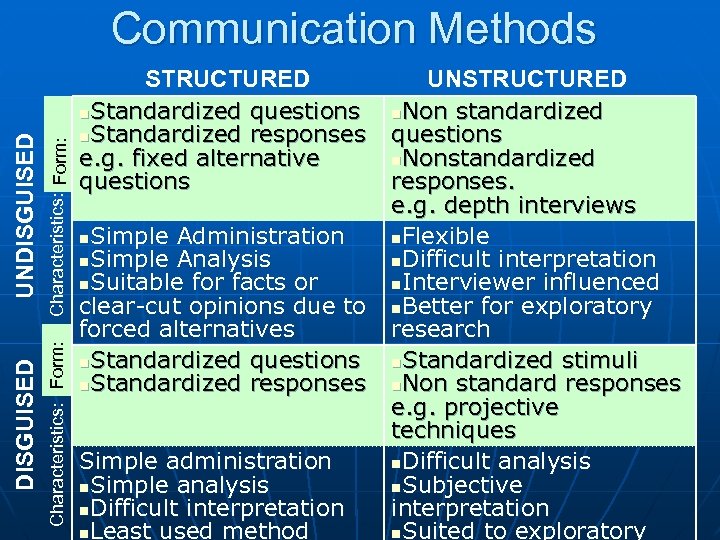

Characteristics: Form: DISGUISED UNDISGUISED Communication Methods STRUCTURED n. Standardized questions n. Standardized responses e. g. fixed alternative questions UNSTRUCTURED n. Non standardized questions n. Nonstandardized responses. e. g. depth interviews n. Simple Administration n. Flexible n. Simple Analysis n. Difficult interpretation n. Suitable for facts or n. Interviewer influenced clear-cut opinions due to n. Better for exploratory forced alternatives research n. Standardized questions n. Standardized stimuli n. Standardized responses n. Non standard responses e. g. projective techniques Simple administration n. Difficult analysis n. Simple analysis n. Subjective n. Difficult interpretation n. Least used method n. Suited to exploratory

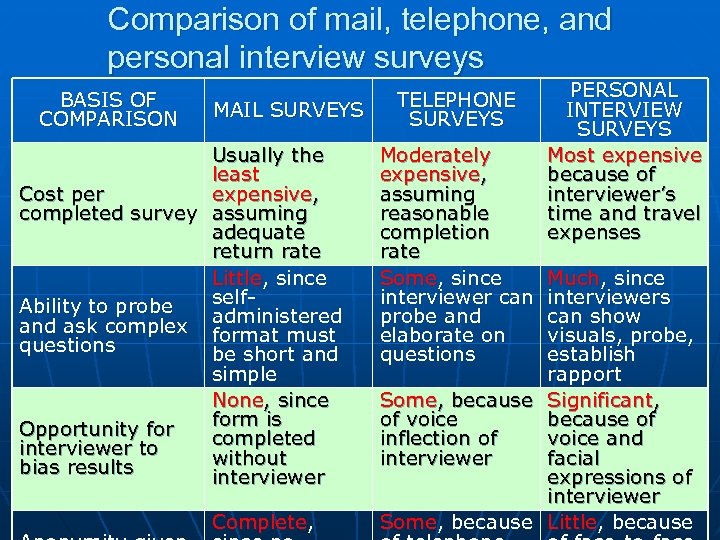

Comparison of mail, telephone, and personal interview surveys BASIS OF COMPARISON MAIL SURVEYS Usually the least Cost per expensive, completed survey assuming adequate return rate Little, since self. Ability to probe and ask complex administered format must questions be short and simple None, since form is Opportunity for completed interviewer to without bias results interviewer Complete, TELEPHONE SURVEYS Moderately expensive, assuming reasonable completion rate Some, since interviewer can probe and elaborate on questions PERSONAL INTERVIEW SURVEYS Most expensive because of interviewer’s time and travel expenses Much, since interviewers can show visuals, probe, establish rapport Some, because Significant, of voice because of inflection of voice and interviewer facial expressions of interviewer Some, because Little, because

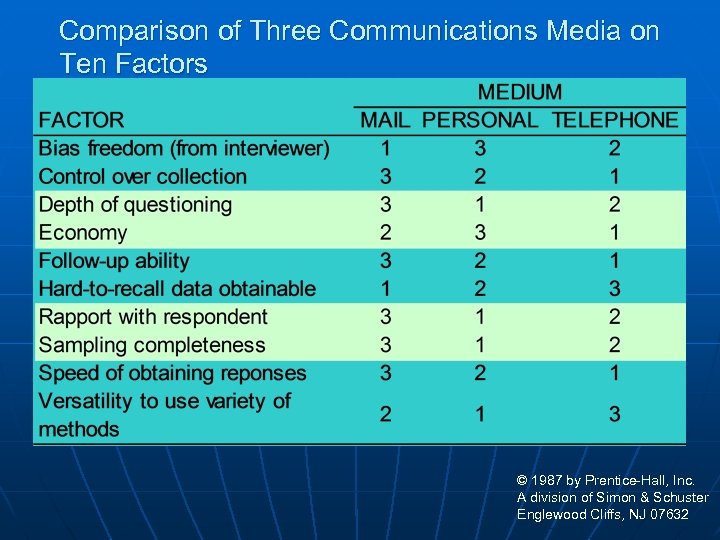

Comparison of Three Communications Media on Ten Factors © 1987 by Prentice-Hall, Inc. A division of Simon & Schuster Englewood Cliffs, NJ 07632

PART 6 STATISTICAL ANALYSIS

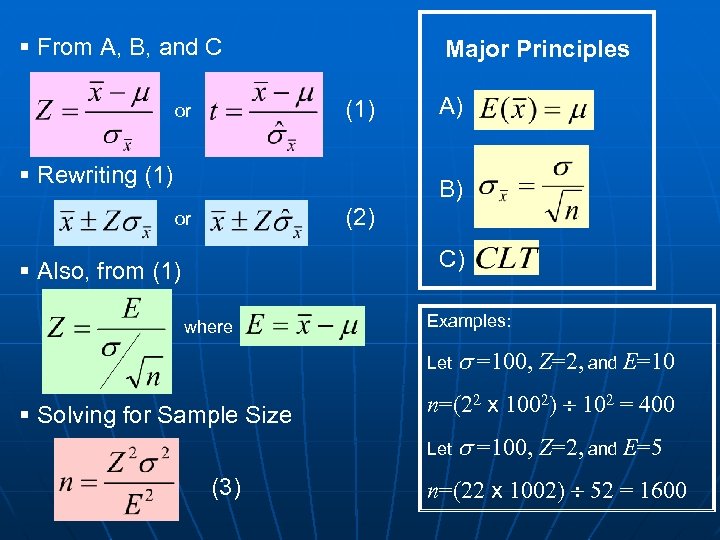

§ From A, B, and C Major Principles (1) or § Rewriting (1) A) B) (2) or C) § Also, from (1) where Examples: Let § Solving for Sample Size n=(22 x 1002) 102 = 400 Let (3) =100, Z=2, and E=10 =100, Z=2, and E=5 n=(22 x 1002) 52 = 1600

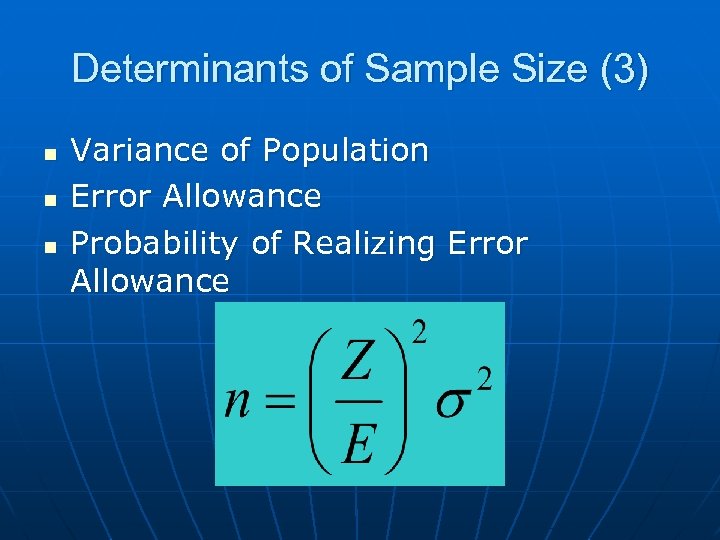

Determinants of Sample Size (3) n n n Variance of Population Error Allowance Probability of Realizing Error Allowance

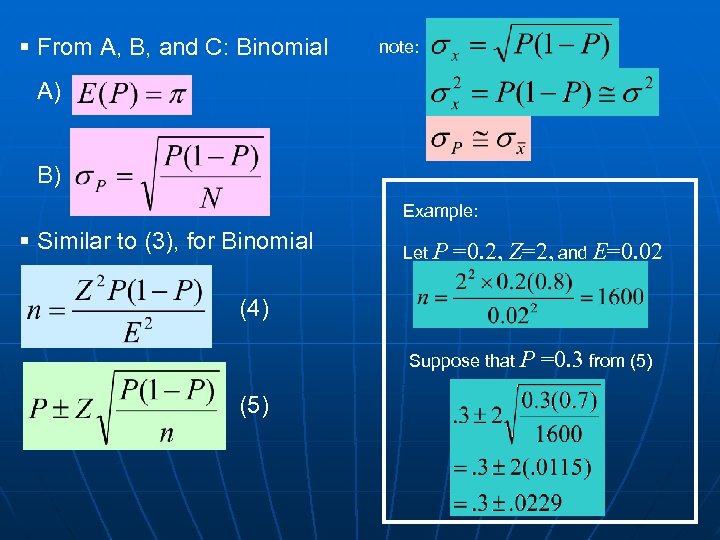

§ From A, B, and C: Binomial note: A) B) Example: § Similar to (3), for Binomial Let P =0. 2, Z=2, and E=0. 02 (4) Suppose that P (5) =0. 3 from (5)

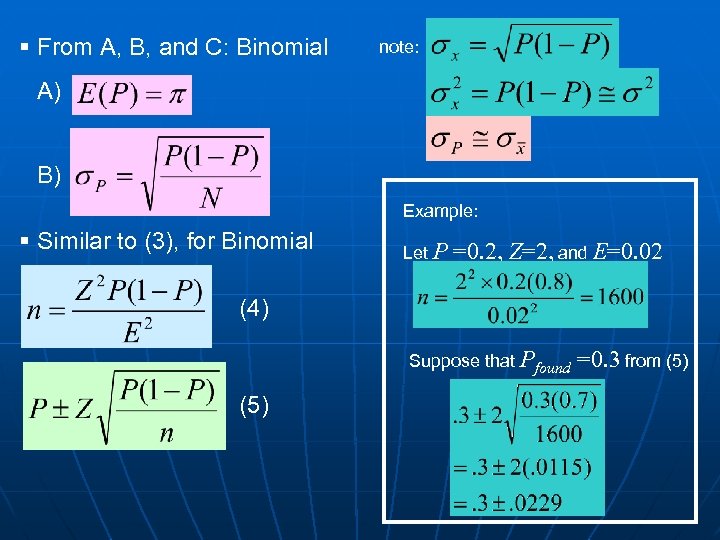

§ From A, B, and C: Binomial note: A) B) Example: § Similar to (3), for Binomial Let P =0. 2, Z=2, and E=0. 02 (4) Suppose that Pfound (5) =0. 3 from (5)

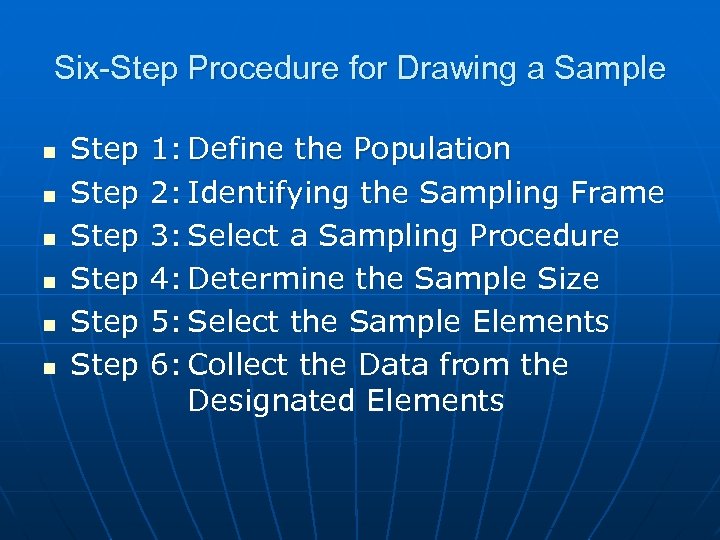

Six-Step Procedure for Drawing a Sample n n n Step Step 1: Define the Population 2: Identifying the Sampling Frame 3: Select a Sampling Procedure 4: Determine the Sample Size 5: Select the Sample Elements 6: Collect the Data from the Designated Elements

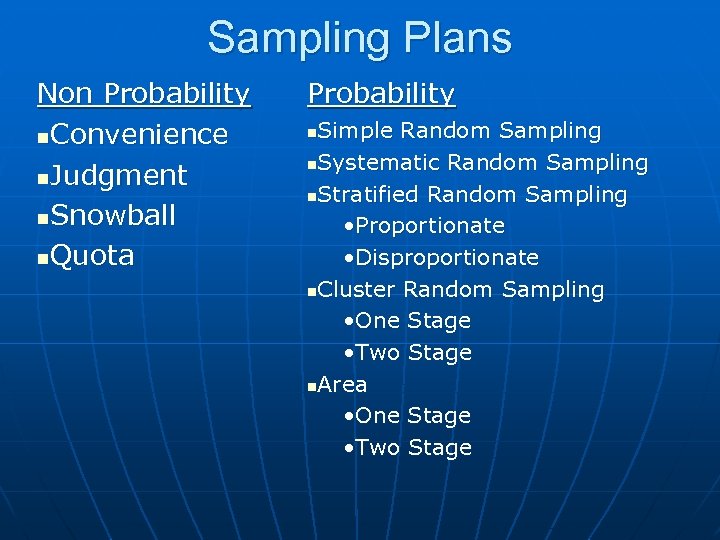

Sampling Plans Non Probability n. Convenience n. Judgment n. Snowball n. Quota Probability Simple Random Sampling n. Systematic Random Sampling n. Stratified Random Sampling • Proportionate • Disproportionate n. Cluster Random Sampling • One Stage • Two Stage n. Area • One Stage • Two Stage n

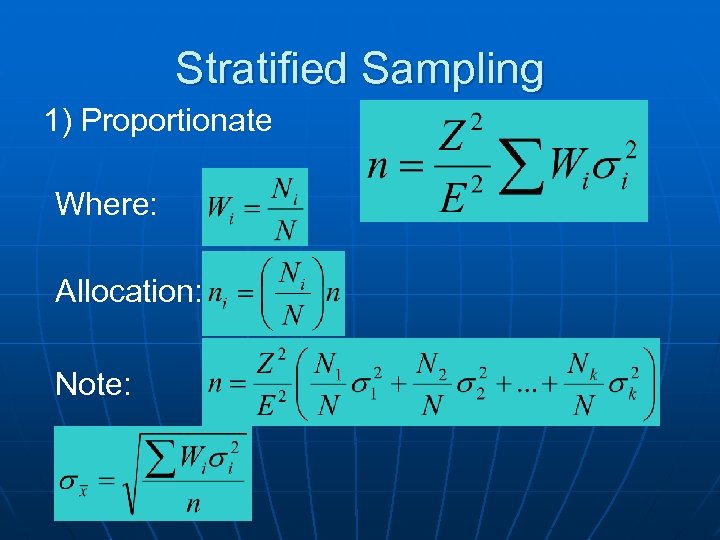

Stratified Sampling 1) Proportionate Where: Allocation: Note:

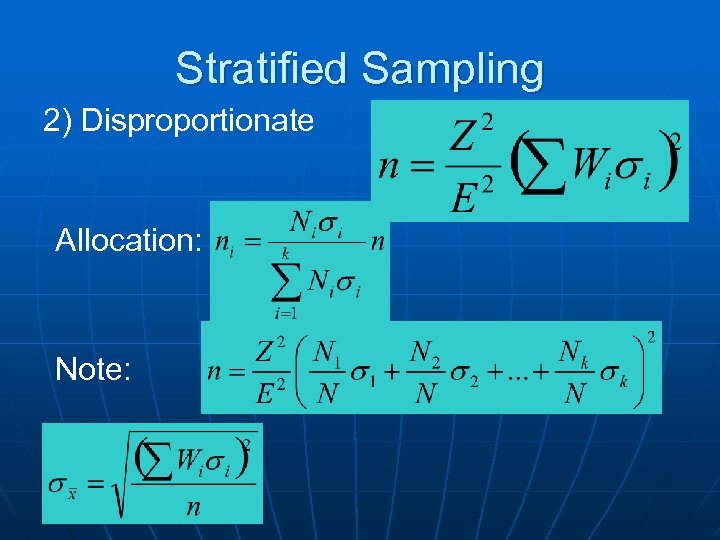

Stratified Sampling 2) Disproportionate Allocation: Note:

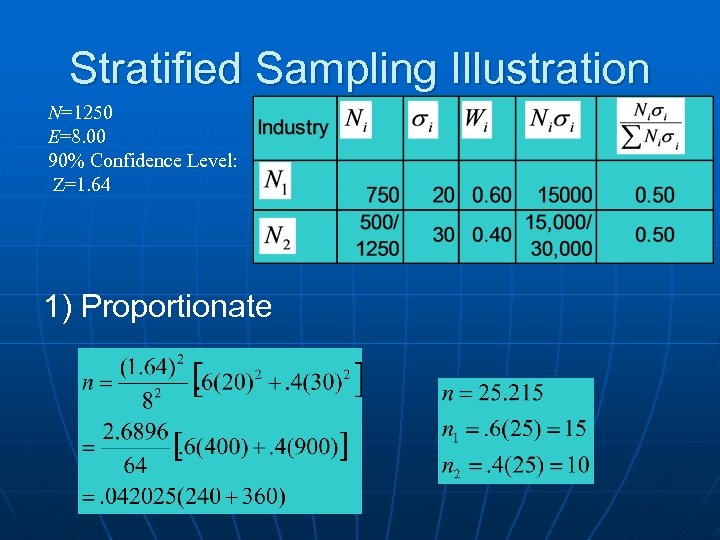

Stratified Sampling Illustration N=1250 E=8. 00 90% Confidence Level: Z=1. 64 1) Proportionate

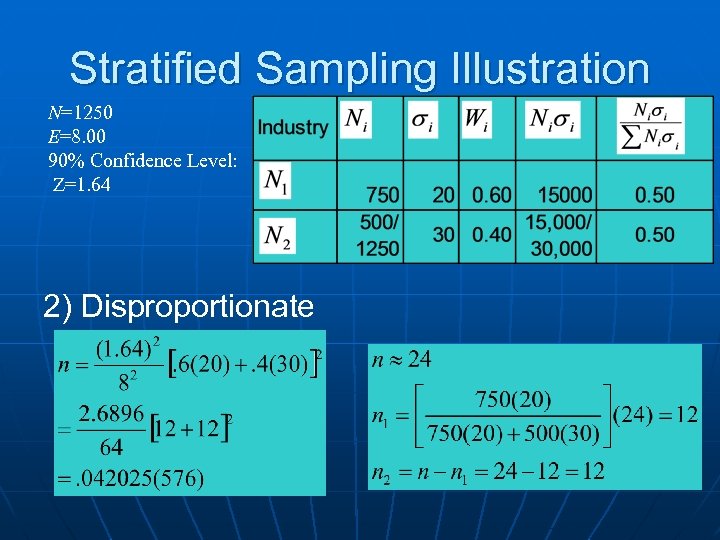

Stratified Sampling Illustration N=1250 E=8. 00 90% Confidence Level: Z=1. 64 2) Disproportionate

PART 7 STATISTICAL DISTRIBUTIONS

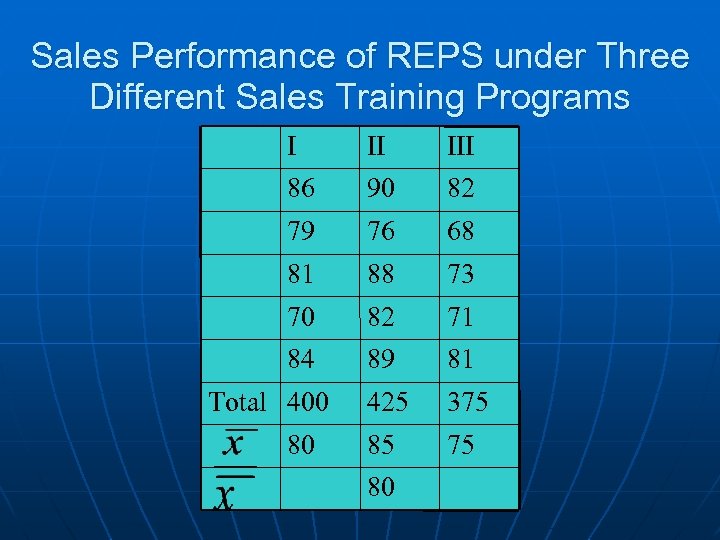

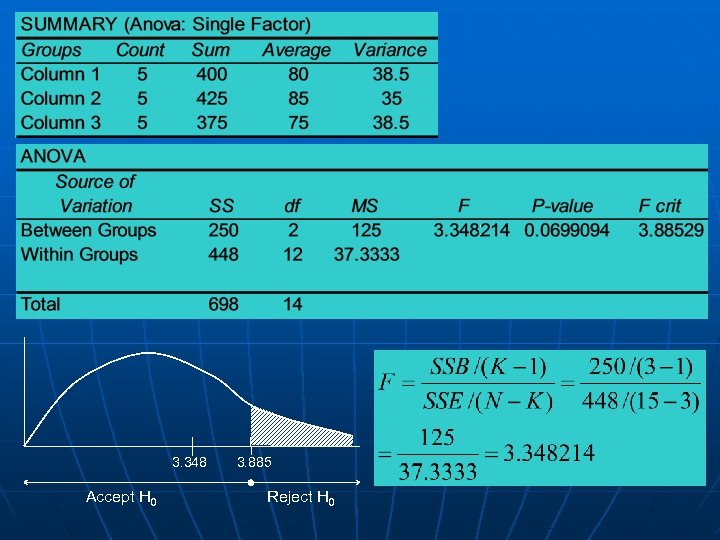

Sales Performance of REPS under Three Different Sales Training Programs I II III 86 90 82 79 76 68 81 88 73 70 82 71 84 89 81 425 375 85 75 Total 400 80 80

3. 348 Accept H 0 3. 885 Reject H 0

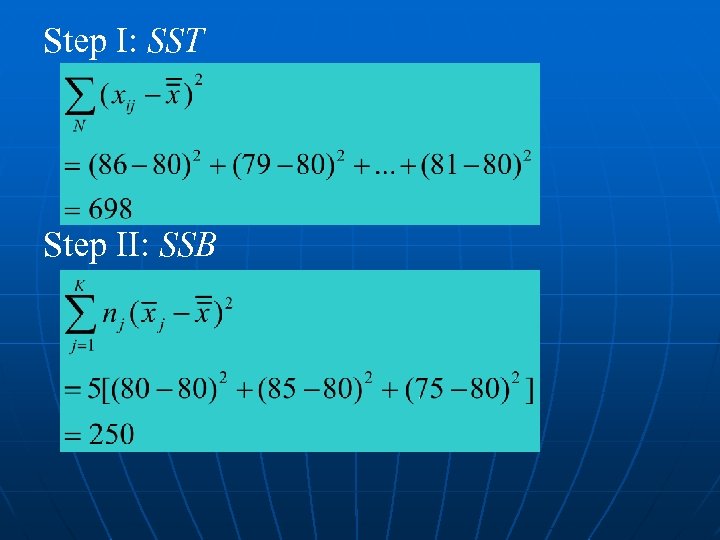

Step I: SST Step II: SSB

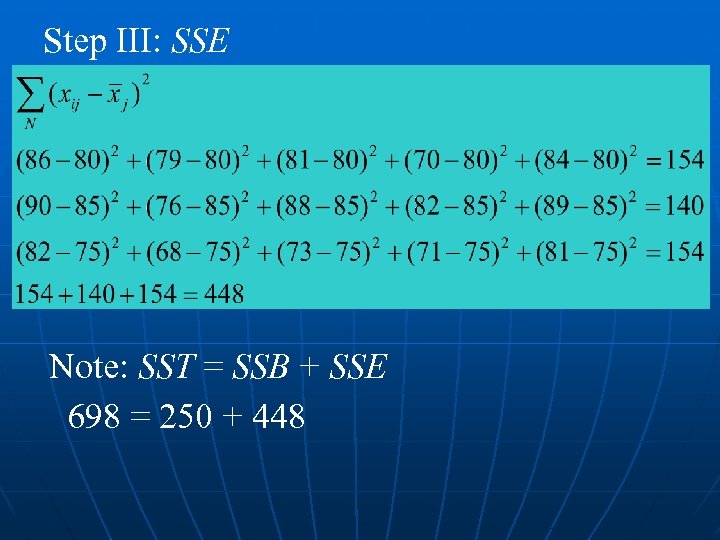

Step III: SSE Note: SST = SSB + SSE 698 = 250 + 448

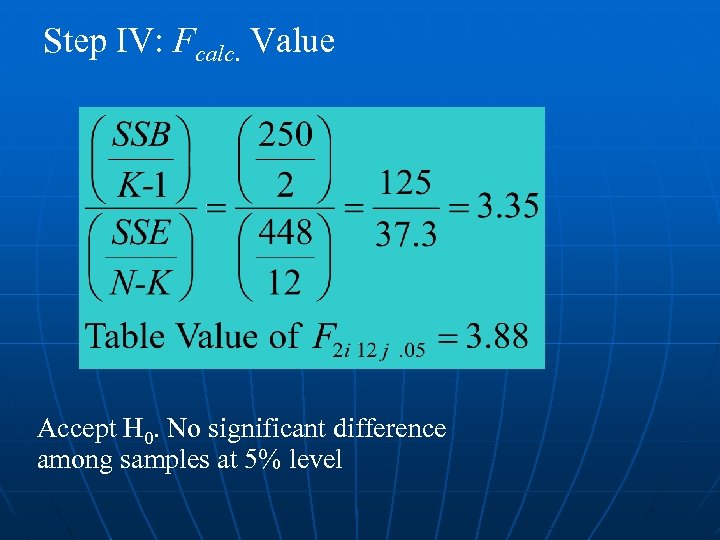

Step IV: Fcalc. Value Accept H 0. No significant difference among samples at 5% level

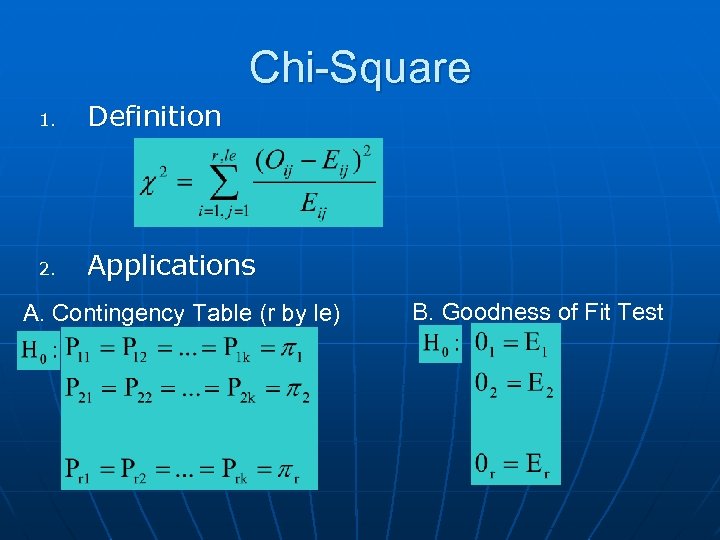

Chi-Square 1. Definition 2. Applications A. Contingency Table (r by le) B. Goodness of Fit Test

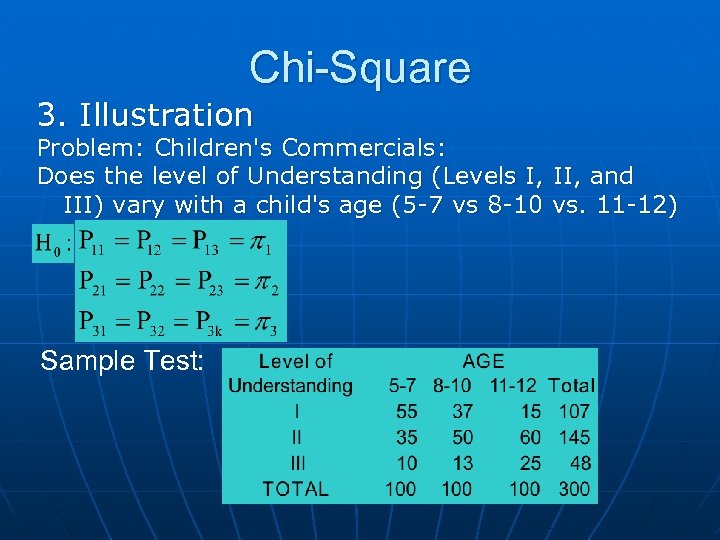

Chi-Square 3. Illustration Problem: Children's Commercials: Does the level of Understanding (Levels I, II, and III) vary with a child's age (5 -7 vs 8 -10 vs. 11 -12) Sample Test:

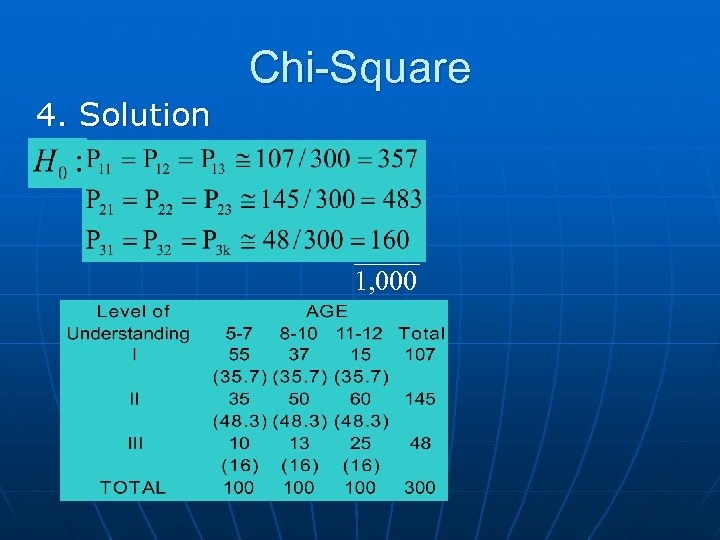

Chi-Square 4. Solution 1, 000

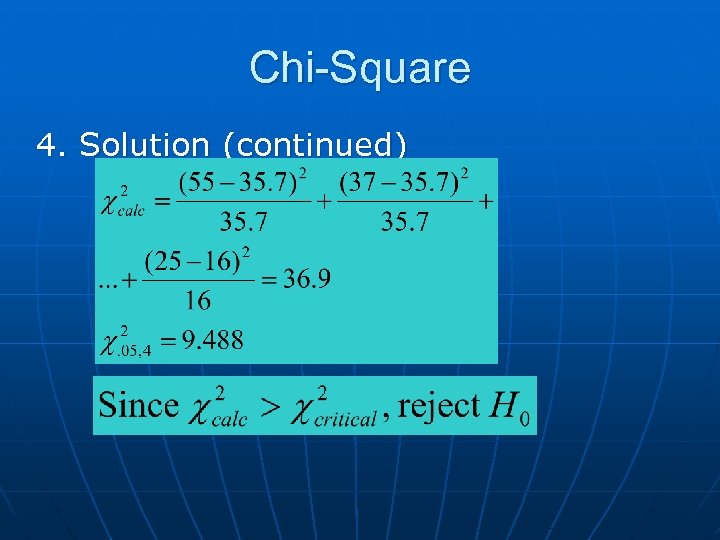

Chi-Square 4. Solution (continued)

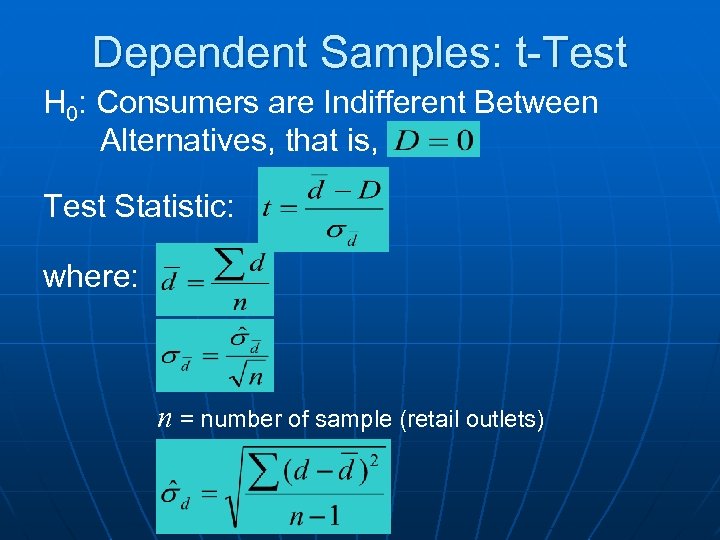

Dependent Samples: t-Test H 0: Consumers are Indifferent Between Alternatives, that is, Test Statistic: where: n = number of sample (retail outlets)

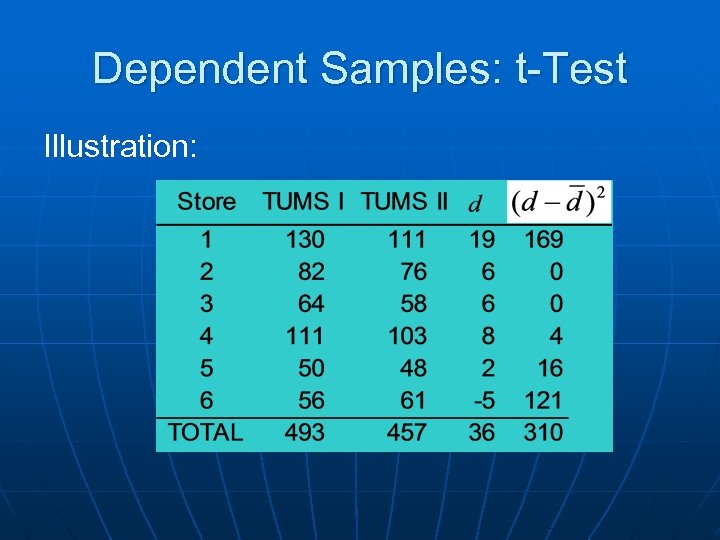

Dependent Samples: t-Test Illustration:

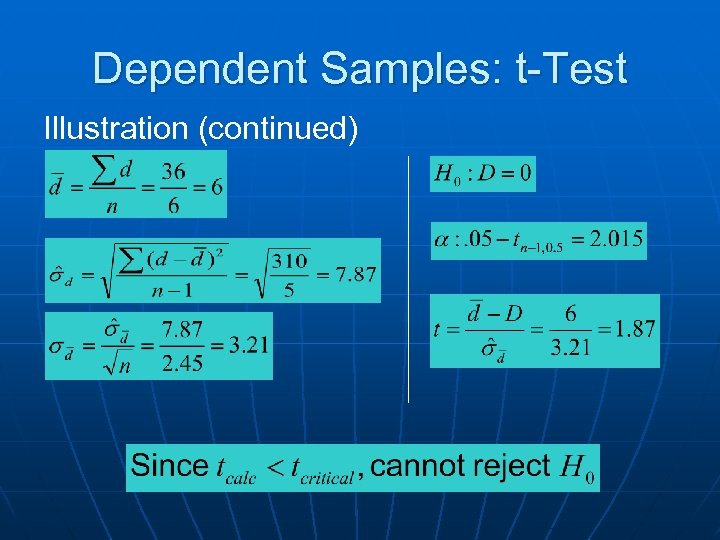

Dependent Samples: t-Test Illustration (continued)

END

9a6b87173f52a40c7a771aa01a233450.ppt