f18324c641c0473d7fbbf72fa26c9ff5.ppt

- Количество слайдов: 14

Part 1 Individuals 1

Part 1 Individuals 1

Two Cardinal Rules in Studying for the Enrolled Agents Exam n n Rule 1 – There absolutely NO shortcuts in studying for the EA Exam Rule 2 – Refer to Rule 1 2

Two Cardinal Rules in Studying for the Enrolled Agents Exam n n Rule 1 – There absolutely NO shortcuts in studying for the EA Exam Rule 2 – Refer to Rule 1 2

Pyramid Approach to Studying Final Review Cards Power. Point Webinar Presentation NSA EA Exam Review Course IRS Publications 3

Pyramid Approach to Studying Final Review Cards Power. Point Webinar Presentation NSA EA Exam Review Course IRS Publications 3

References Used in Slides n Color Code Description of Topic - Based on analysis of last 10 publicly-available exams: n n n Red [R] – Basic knowledge topic asked frequently Blue [B] – Complex topic asked fairly frequently Green [G] – Basic topic asked less frequently Yellow [Y] – Complex topic seldom tested * (asterisk) - Indicates at least 7 questions on the topic on last 10 publicly-available exams 4

References Used in Slides n Color Code Description of Topic - Based on analysis of last 10 publicly-available exams: n n n Red [R] – Basic knowledge topic asked frequently Blue [B] – Complex topic asked fairly frequently Green [G] – Basic topic asked less frequently Yellow [Y] – Complex topic seldom tested * (asterisk) - Indicates at least 7 questions on the topic on last 10 publicly-available exams 4

Topic 30 Capital Gain & Loss Netting of Individuals 5

Topic 30 Capital Gain & Loss Netting of Individuals 5

![*30 A Capital Gain and Loss Netting Process [R] n n 3 -Step Process *30 A Capital Gain and Loss Netting Process [R] n n 3 -Step Process](https://present5.com/presentation/f18324c641c0473d7fbbf72fa26c9ff5/image-6.jpg) *30 A Capital Gain and Loss Netting Process [R] n n 3 -Step Process – (1) Net all S/Ts, (2) Net all L/Ts, (3) if same sign, add separately to income; if opposite signs, add net difference to income (Note: LT > 1 yr) Final Result – 4 Basic Rules (for one transaction): n n n S/T Capital Gain – Treat as ordinary income S/T Capital Loss - $3, 000 offset against ordinary income L/T Capital Gain – 15% max. rate (0% if 10% or 15% ordinary income bracket, 20% if 39. 6% ordinary bracket) L/T Capital Loss - $3, 000 offset against ordinary income Figure 1 -8 Question 99 6

*30 A Capital Gain and Loss Netting Process [R] n n 3 -Step Process – (1) Net all S/Ts, (2) Net all L/Ts, (3) if same sign, add separately to income; if opposite signs, add net difference to income (Note: LT > 1 yr) Final Result – 4 Basic Rules (for one transaction): n n n S/T Capital Gain – Treat as ordinary income S/T Capital Loss - $3, 000 offset against ordinary income L/T Capital Gain – 15% max. rate (0% if 10% or 15% ordinary income bracket, 20% if 39. 6% ordinary bracket) L/T Capital Loss - $3, 000 offset against ordinary income Figure 1 -8 Question 99 6

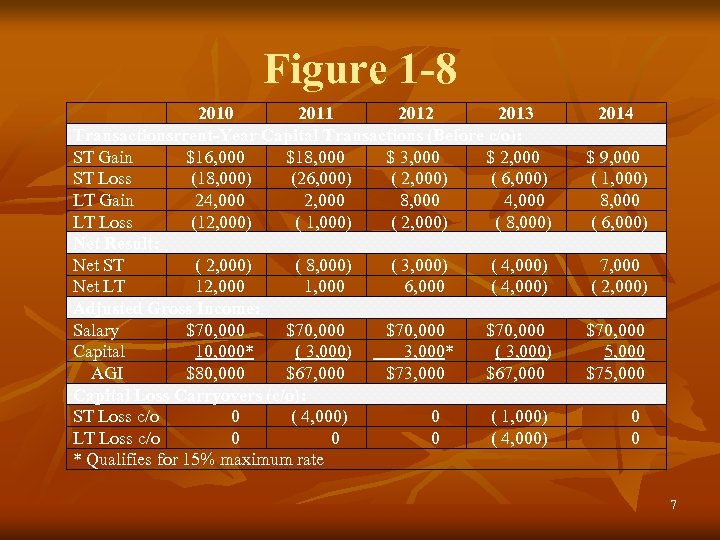

Figure 1 -8 2010 2011 2012 2013 Transactionsrrent-Year Capital Transactions (Before c/o): ST Gain $16, 000 $18, 000 $ 3, 000 $ 2, 000 ST Loss (18, 000) (26, 000) ( 2, 000) ( 6, 000) LT Gain 24, 000 2, 000 8, 000 4, 000 LT Loss (12, 000) ( 1, 000) ( 2, 000) ( 8, 000) Net Result: Net ST ( 2, 000) ( 8, 000) ( 3, 000) ( 4, 000) Net LT 12, 000 1, 000 6, 000 ( 4, 000) Adjusted Gross Income: Salary $70, 000 Capital 10, 000* ( 3, 000) 3, 000* ( 3, 000) AGI $80, 000 $67, 000 $73, 000 $67, 000 Capital Loss Carryovers (c/o): ST Loss c/o 0 ( 4, 000) 0 ( 1, 000) LT Loss c/o 0 ( 4, 000) * Qualifies for 15% maximum rate 2014 $ 9, 000 ( 1, 000) 8, 000 ( 6, 000) 7, 000 ( 2, 000) $70, 000 5, 000 $75, 000 0 7

Figure 1 -8 2010 2011 2012 2013 Transactionsrrent-Year Capital Transactions (Before c/o): ST Gain $16, 000 $18, 000 $ 3, 000 $ 2, 000 ST Loss (18, 000) (26, 000) ( 2, 000) ( 6, 000) LT Gain 24, 000 2, 000 8, 000 4, 000 LT Loss (12, 000) ( 1, 000) ( 2, 000) ( 8, 000) Net Result: Net ST ( 2, 000) ( 8, 000) ( 3, 000) ( 4, 000) Net LT 12, 000 1, 000 6, 000 ( 4, 000) Adjusted Gross Income: Salary $70, 000 Capital 10, 000* ( 3, 000) 3, 000* ( 3, 000) AGI $80, 000 $67, 000 $73, 000 $67, 000 Capital Loss Carryovers (c/o): ST Loss c/o 0 ( 4, 000) 0 ( 1, 000) LT Loss c/o 0 ( 4, 000) * Qualifies for 15% maximum rate 2014 $ 9, 000 ( 1, 000) 8, 000 ( 6, 000) 7, 000 ( 2, 000) $70, 000 5, 000 $75, 000 0 7

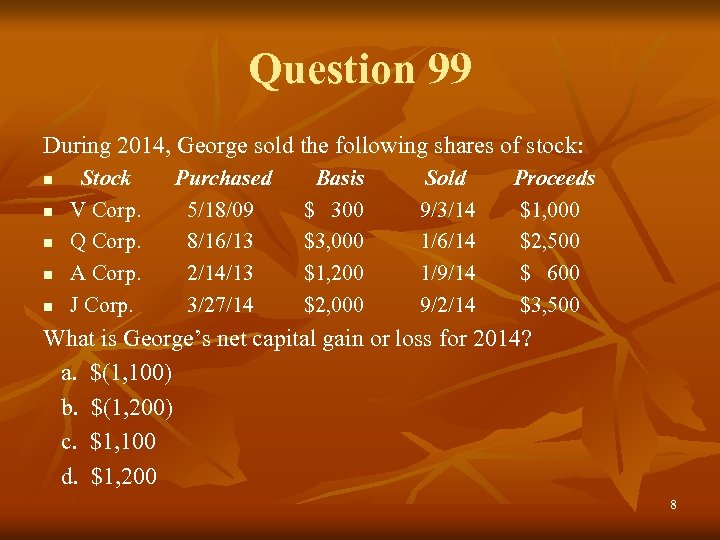

Question 99 During 2014, George sold the following shares of stock: n n n Stock V Corp. Q Corp. A Corp. J Corp. Purchased Basis 5/18/09 $ 300 8/16/13 $3, 000 2/14/13 $1, 200 3/27/14 $2, 000 Sold Proceeds 9/3/14 $1, 000 1/6/14 $2, 500 1/9/14 $ 600 9/2/14 $3, 500 What is George’s net capital gain or loss for 2014? a. $(1, 100) b. $(1, 200) c. $1, 100 d. $1, 200 8

Question 99 During 2014, George sold the following shares of stock: n n n Stock V Corp. Q Corp. A Corp. J Corp. Purchased Basis 5/18/09 $ 300 8/16/13 $3, 000 2/14/13 $1, 200 3/27/14 $2, 000 Sold Proceeds 9/3/14 $1, 000 1/6/14 $2, 500 1/9/14 $ 600 9/2/14 $3, 500 What is George’s net capital gain or loss for 2014? a. $(1, 100) b. $(1, 200) c. $1, 100 d. $1, 200 8

![30 B Preferential Tax Rates for Longterm Capital Gains [G] n n n If 30 B Preferential Tax Rates for Longterm Capital Gains [G] n n n If](https://present5.com/presentation/f18324c641c0473d7fbbf72fa26c9ff5/image-9.jpg) 30 B Preferential Tax Rates for Longterm Capital Gains [G] n n n If Net L/T Gain – Determine appropriate rates 15% (or 0%) - Basic rate for most L/T capital gains 25% - For “unrecaptured Sec. 1250 gain” on realty 28% - For collectibles, Sec. 1202 stock gain, & all c/o Step Netting Process – Four columns for 4 rates: 1. 2. 3. 4. n n If 15% Nets to a Loss – Net against 28% result first If S/Ts Net to a Loss – Net against 28% result first If 28% Nets to a Loss – Net against 25% result first If 25% Nets to a Loss – Net against 15% result Figure 1 -9 Question 100 9

30 B Preferential Tax Rates for Longterm Capital Gains [G] n n n If Net L/T Gain – Determine appropriate rates 15% (or 0%) - Basic rate for most L/T capital gains 25% - For “unrecaptured Sec. 1250 gain” on realty 28% - For collectibles, Sec. 1202 stock gain, & all c/o Step Netting Process – Four columns for 4 rates: 1. 2. 3. 4. n n If 15% Nets to a Loss – Net against 28% result first If S/Ts Net to a Loss – Net against 28% result first If 28% Nets to a Loss – Net against 25% result first If 25% Nets to a Loss – Net against 15% result Figure 1 -9 Question 100 9

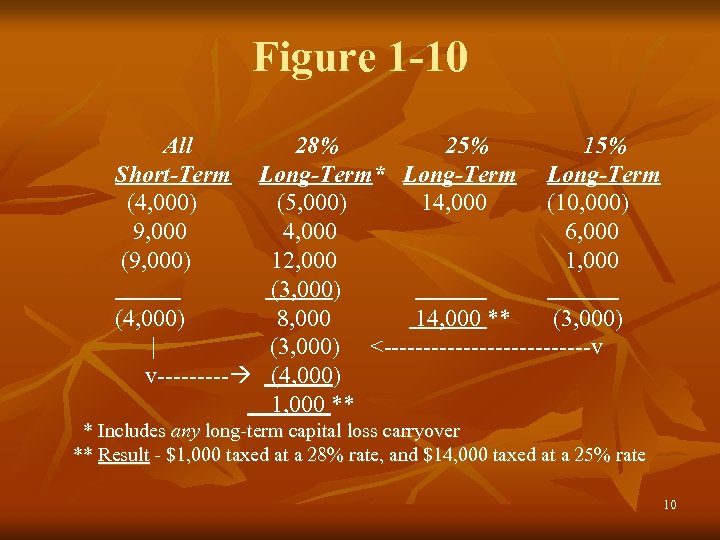

Figure 1 -10 All 28% 25% 15% Short-Term Long-Term* Long-Term (4, 000) (5, 000) 14, 000 (10, 000) 9, 000 4, 000 6, 000 (9, 000) 12, 000 1, 000 (3, 000) (4, 000) 8, 000 14, 000 ** (3, 000) | (3, 000) <-------------v v----- (4, 000) 1, 000 ** * Includes any long-term capital loss carryover ** Result - $1, 000 taxed at a 28% rate, and $14, 000 taxed at a 25% rate 10

Figure 1 -10 All 28% 25% 15% Short-Term Long-Term* Long-Term (4, 000) (5, 000) 14, 000 (10, 000) 9, 000 4, 000 6, 000 (9, 000) 12, 000 1, 000 (3, 000) (4, 000) 8, 000 14, 000 ** (3, 000) | (3, 000) <-------------v v----- (4, 000) 1, 000 ** * Includes any long-term capital loss carryover ** Result - $1, 000 taxed at a 28% rate, and $14, 000 taxed at a 25% rate 10

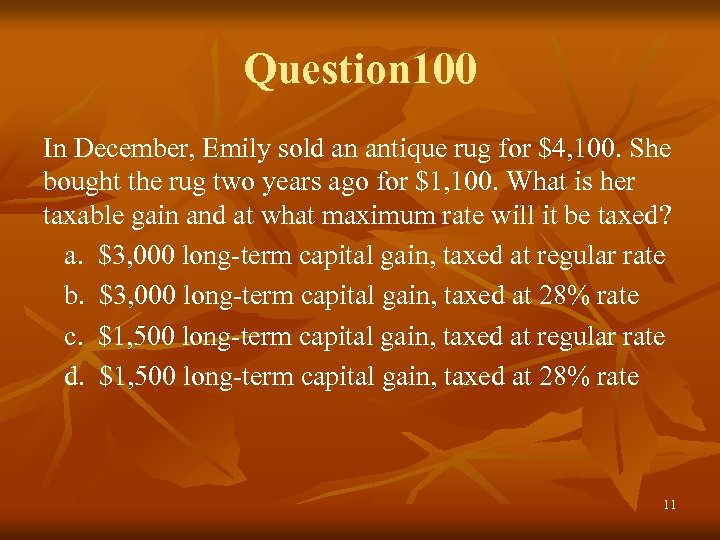

Question 100 In December, Emily sold an antique rug for $4, 100. She bought the rug two years ago for $1, 100. What is her taxable gain and at what maximum rate will it be taxed? a. $3, 000 long-term capital gain, taxed at regular rate b. $3, 000 long-term capital gain, taxed at 28% rate c. $1, 500 long-term capital gain, taxed at regular rate d. $1, 500 long-term capital gain, taxed at 28% rate 11

Question 100 In December, Emily sold an antique rug for $4, 100. She bought the rug two years ago for $1, 100. What is her taxable gain and at what maximum rate will it be taxed? a. $3, 000 long-term capital gain, taxed at regular rate b. $3, 000 long-term capital gain, taxed at 28% rate c. $1, 500 long-term capital gain, taxed at regular rate d. $1, 500 long-term capital gain, taxed at 28% rate 11

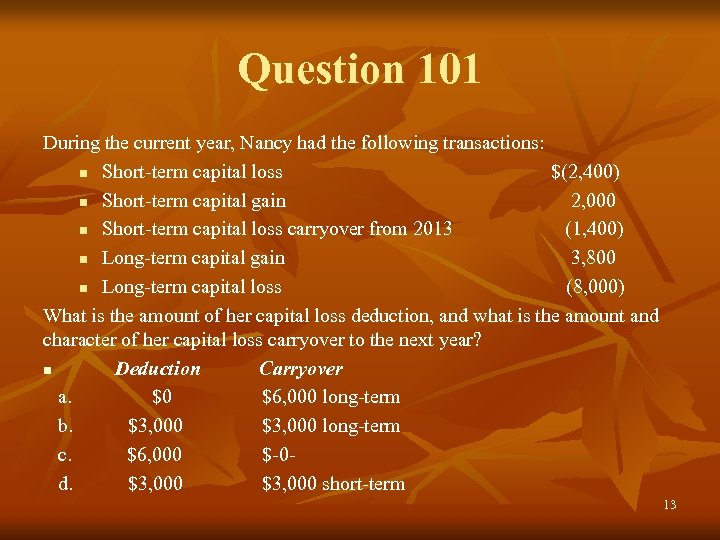

![*30 C Tax Treatment of Net Capital Losses [R] n n n $3, 000 *30 C Tax Treatment of Net Capital Losses [R] n n n $3, 000](https://present5.com/presentation/f18324c641c0473d7fbbf72fa26c9ff5/image-12.jpg) *30 C Tax Treatment of Net Capital Losses [R] n n n $3, 000 – Maximum combined ordinary income offset for net S/T and net L/T losses each yr. (use S/T first) $1, 500 – Married – filing separately limit If Taxable Income < Capital Loss – Full limit (up to $3, 000) still assumed utilized in computing carryover Capital Loss Carryover – Indefinite (retain character) Decedent’s Return – No carryovers possible Question 101 and Question 102 12

*30 C Tax Treatment of Net Capital Losses [R] n n n $3, 000 – Maximum combined ordinary income offset for net S/T and net L/T losses each yr. (use S/T first) $1, 500 – Married – filing separately limit If Taxable Income < Capital Loss – Full limit (up to $3, 000) still assumed utilized in computing carryover Capital Loss Carryover – Indefinite (retain character) Decedent’s Return – No carryovers possible Question 101 and Question 102 12

Question 101 During the current year, Nancy had the following transactions: n Short-term capital loss $(2, 400) n Short-term capital gain 2, 000 n Short-term capital loss carryover from 2013 (1, 400) n Long-term capital gain 3, 800 n Long-term capital loss (8, 000) What is the amount of her capital loss deduction, and what is the amount and character of her capital loss carryover to the next year? n Deduction Carryover a. $0 $6, 000 long-term b. $3, 000 long-term c. $6, 000 $-0 d. $3, 000 short-term 13

Question 101 During the current year, Nancy had the following transactions: n Short-term capital loss $(2, 400) n Short-term capital gain 2, 000 n Short-term capital loss carryover from 2013 (1, 400) n Long-term capital gain 3, 800 n Long-term capital loss (8, 000) What is the amount of her capital loss deduction, and what is the amount and character of her capital loss carryover to the next year? n Deduction Carryover a. $0 $6, 000 long-term b. $3, 000 long-term c. $6, 000 $-0 d. $3, 000 short-term 13

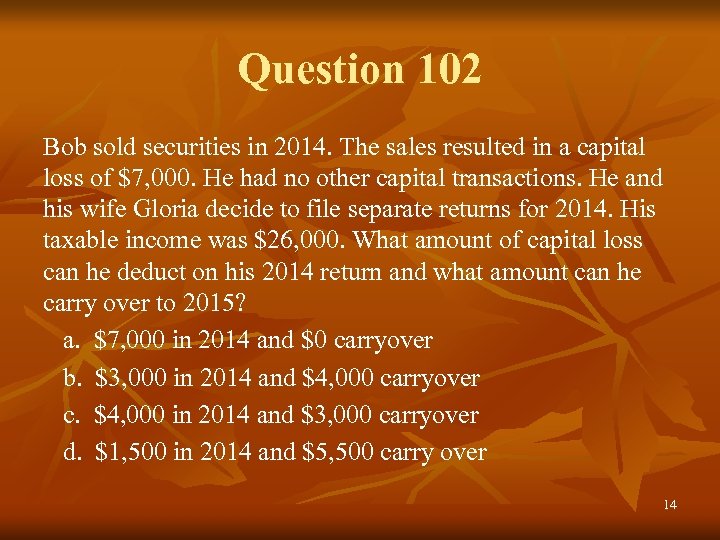

Question 102 Bob sold securities in 2014. The sales resulted in a capital loss of $7, 000. He had no other capital transactions. He and his wife Gloria decide to file separate returns for 2014. His taxable income was $26, 000. What amount of capital loss can he deduct on his 2014 return and what amount can he carry over to 2015? a. $7, 000 in 2014 and $0 carryover b. $3, 000 in 2014 and $4, 000 carryover c. $4, 000 in 2014 and $3, 000 carryover d. $1, 500 in 2014 and $5, 500 carry over 14

Question 102 Bob sold securities in 2014. The sales resulted in a capital loss of $7, 000. He had no other capital transactions. He and his wife Gloria decide to file separate returns for 2014. His taxable income was $26, 000. What amount of capital loss can he deduct on his 2014 return and what amount can he carry over to 2015? a. $7, 000 in 2014 and $0 carryover b. $3, 000 in 2014 and $4, 000 carryover c. $4, 000 in 2014 and $3, 000 carryover d. $1, 500 in 2014 and $5, 500 carry over 14