46308579895c01ef15e5fb8356912941.ppt

- Количество слайдов: 28

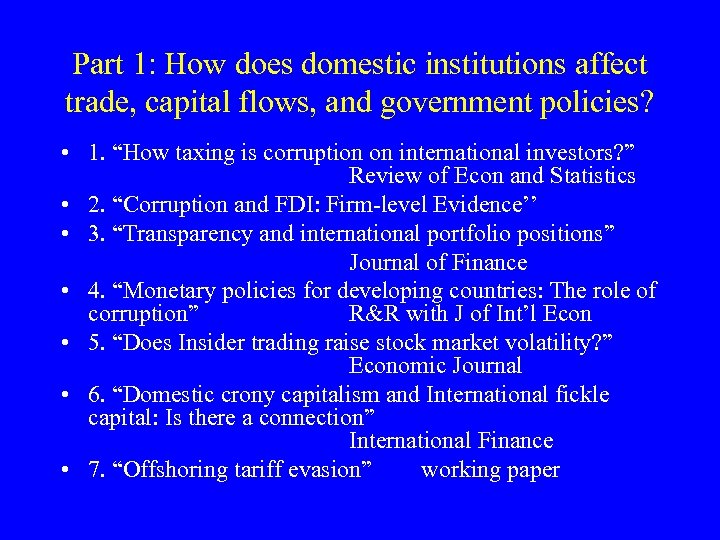

Part 1: How does domestic institutions affect trade, capital flows, and government policies? • 1. “How taxing is corruption on international investors? ” Review of Econ and Statistics • 2. “Corruption and FDI: Firm-level Evidence’’ • 3. “Transparency and international portfolio positions” Journal of Finance • 4. “Monetary policies for developing countries: The role of corruption” R&R with J of Int’l Econ • 5. “Does Insider trading raise stock market volatility? ” Economic Journal • 6. “Domestic crony capitalism and International fickle capital: Is there a connection” International Finance • 7. “Offshoring tariff evasion” working paper

Part 1: How does domestic institutions affect trade, capital flows, and government policies? • 1. “How taxing is corruption on international investors? ” Review of Econ and Statistics • 2. “Corruption and FDI: Firm-level Evidence’’ • 3. “Transparency and international portfolio positions” Journal of Finance • 4. “Monetary policies for developing countries: The role of corruption” R&R with J of Int’l Econ • 5. “Does Insider trading raise stock market volatility? ” Economic Journal • 6. “Domestic crony capitalism and International fickle capital: Is there a connection” International Finance • 7. “Offshoring tariff evasion” working paper

Part 2: Explaining institutional quality • 1. “Natural openness and good government” • 2. “Do externally imposed reforms work? ” • 3. “Tax rates and tax evasion: evidence from ‘missing trade’ in China” Journal of Political Economy

Part 2: Explaining institutional quality • 1. “Natural openness and good government” • 2. “Do externally imposed reforms work? ” • 3. “Tax rates and tax evasion: evidence from ‘missing trade’ in China” Journal of Political Economy

Outsourcing Tariff Evasion: Evidence From Hong Kong As Entrepôt Trader Raymond Fisman Peter Moustakerski and Shang-Jin Wei

Outsourcing Tariff Evasion: Evidence From Hong Kong As Entrepôt Trader Raymond Fisman Peter Moustakerski and Shang-Jin Wei

Outsourcing Corruption • • Hong Kong & Entrepôt Trade Data Results Conclusions

Outsourcing Corruption • • Hong Kong & Entrepôt Trade Data Results Conclusions

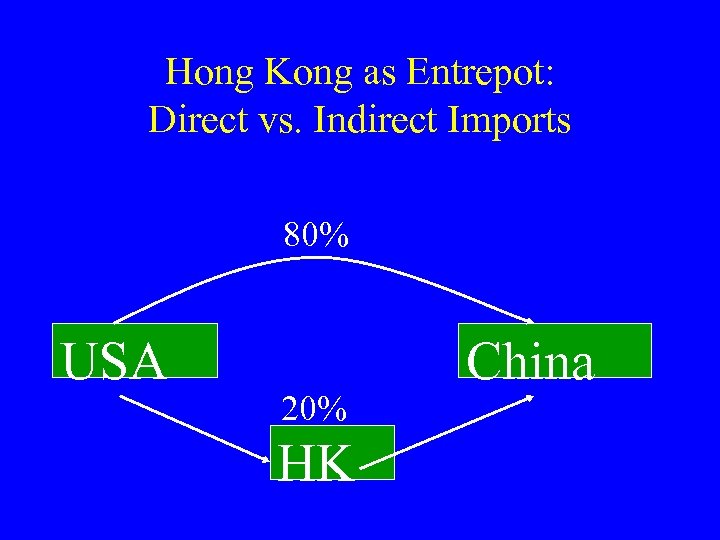

Hong Kong as Entrepot: Direct vs. Indirect Imports 80% USA 20% HK China

Hong Kong as Entrepot: Direct vs. Indirect Imports 80% USA 20% HK China

Indirect trade is prominent in world commerce • 30+ countries do a significant amt of indirect trade including: • HK, Macao, Cyprus, Fiji, Senegal, Jordan, Armenia, Seychelles, Honduras, Benin, Montserrat, St. Lucia, and Singapore

Indirect trade is prominent in world commerce • 30+ countries do a significant amt of indirect trade including: • HK, Macao, Cyprus, Fiji, Senegal, Jordan, Armenia, Seychelles, Honduras, Benin, Montserrat, St. Lucia, and Singapore

Why Indirect Trade? • Middlemen have a comparative advantage in matching buyers and sellers. • What is the nature of the comparative advantage? – Better information – Better contract enforcement • Our alternative explanation – outsourcing evasion

Why Indirect Trade? • Middlemen have a comparative advantage in matching buyers and sellers. • What is the nature of the comparative advantage? – Better information – Better contract enforcement • Our alternative explanation – outsourcing evasion

HK: Anecdotal evidence • “Using unofficial channels, to bring in a 40 foot container of imported fresh fruit from Hong Kong to one of the cities in the Pearl River Delta costs approximately $4, 000 to $6, 000. . This amount is usually much less than the price paid when using official channels. ” (USDA, 1997)

HK: Anecdotal evidence • “Using unofficial channels, to bring in a 40 foot container of imported fresh fruit from Hong Kong to one of the cities in the Pearl River Delta costs approximately $4, 000 to $6, 000. . This amount is usually much less than the price paid when using official channels. ” (USDA, 1997)

Fisman and Wei (JPE 2004) • Use reporting gap to measure tax evasion – Report gap = evasion + noise • Study the responsiveness of evasion to tax rate • Finiding: one percentage point rise in tax rate -> 3% increase in evasion

Fisman and Wei (JPE 2004) • Use reporting gap to measure tax evasion – Report gap = evasion + noise • Study the responsiveness of evasion to tax rate • Finiding: one percentage point rise in tax rate -> 3% increase in evasion

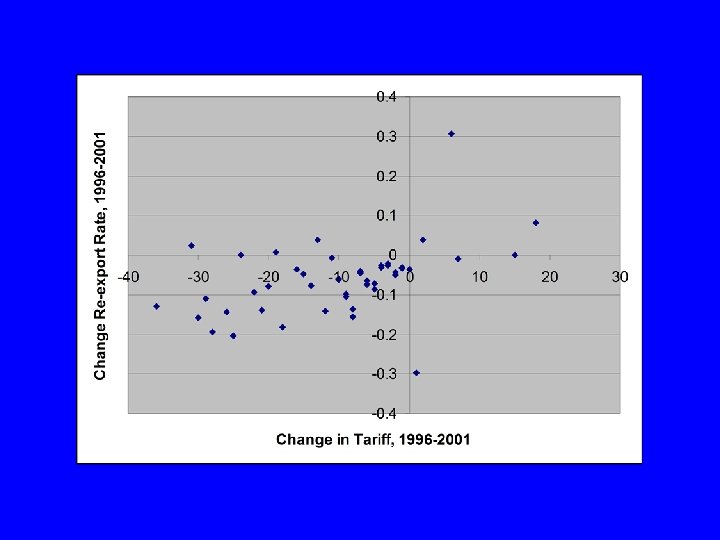

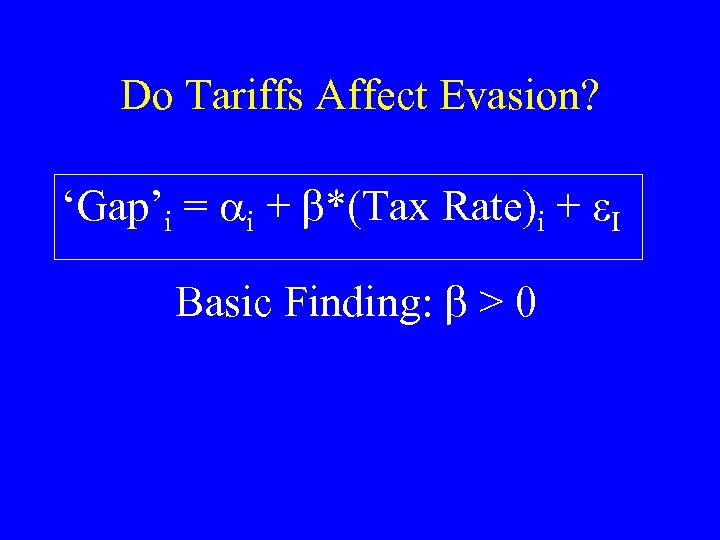

Do Tariffs Affect Evasion? ‘Gap’i = i + *(Tax Rate)i + I Basic Finding: > 0

Do Tariffs Affect Evasion? ‘Gap’i = i + *(Tax Rate)i + I Basic Finding: > 0

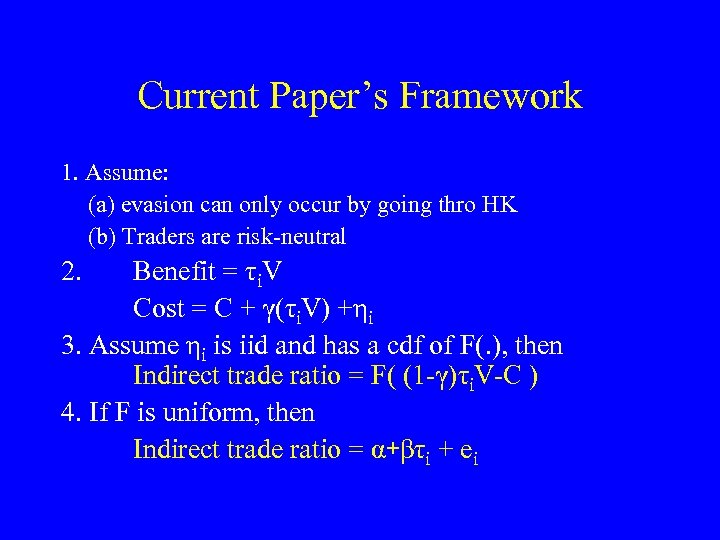

Current Paper’s Framework 1. Assume: (a) evasion can only occur by going thro HK (b) Traders are risk-neutral 2. Benefit = τi. V Cost = C + γ(τi. V) +ηi 3. Assume ηi is iid and has a cdf of F(. ), then Indirect trade ratio = F( (1 -γ)τi. V-C ) 4. If F is uniform, then Indirect trade ratio = α+βτi + ei

Current Paper’s Framework 1. Assume: (a) evasion can only occur by going thro HK (b) Traders are risk-neutral 2. Benefit = τi. V Cost = C + γ(τi. V) +ηi 3. Assume ηi is iid and has a cdf of F(. ), then Indirect trade ratio = F( (1 -γ)τi. V-C ) 4. If F is uniform, then Indirect trade ratio = α+βτi + ei

Data – sources • • Tariffs (tariffiy): WITS/UNCTAD Direct Exports (TRAINS): dir_exiyc Indirect Exports (Smartal): re_exiyc Additional Data – Information on tax exempt status of goods (Chinese Customs statistics, only for 1998) – Data on Singapore re-exports

Data – sources • • Tariffs (tariffiy): WITS/UNCTAD Direct Exports (TRAINS): dir_exiyc Indirect Exports (Smartal): re_exiyc Additional Data – Information on tax exempt status of goods (Chinese Customs statistics, only for 1998) – Data on Singapore re-exports

Data Coverage • Years = 1996 – 2001

Data Coverage • Years = 1996 – 2001

Singapore Ratio Rate Indirect Export Ratios and Tariff Rates, by Ratio year, 1996 -2001 (in percent) 1996 23. 6 1997 22. 9 22. 1 1998 23. 9 17. 5 1999 22. 5 17. 1 2000 5. 2 21. 8 16. 9 5. 3

Singapore Ratio Rate Indirect Export Ratios and Tariff Rates, by Ratio year, 1996 -2001 (in percent) 1996 23. 6 1997 22. 9 22. 1 1998 23. 9 17. 5 1999 22. 5 17. 1 2000 5. 2 21. 8 16. 9 5. 3

List of Exporting Countries Country Argentina Australia Annual Observations 356 1, 250 Austria Canada Czech Republic 645 Denmark 797 Finland France Germany 2, 890 Great Britain 1, 789 1, 089 961 2, 209 Country Japan Korea Mexico Netherlands New Zealand Norway Poland Portugal Slovenia Spain Sweden Switzerland Turkey United States Annual Observations 3, 649 3, 363 257 1, 453 426 564 107 335 1, 279 1, 390 1, 791 467 3, 569

List of Exporting Countries Country Argentina Australia Annual Observations 356 1, 250 Austria Canada Czech Republic 645 Denmark 797 Finland France Germany 2, 890 Great Britain 1, 789 1, 089 961 2, 209 Country Japan Korea Mexico Netherlands New Zealand Norway Poland Portugal Slovenia Spain Sweden Switzerland Turkey United States Annual Observations 3, 649 3, 363 257 1, 453 426 564 107 335 1, 279 1, 390 1, 791 467 3, 569

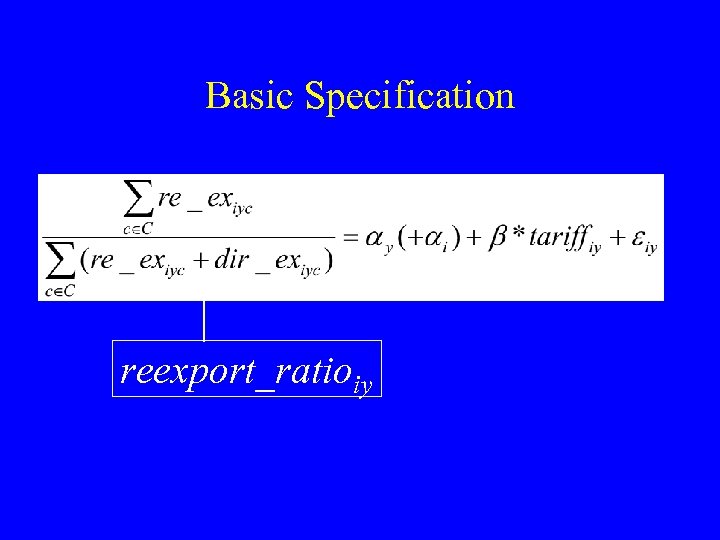

Basic Specification reexport_ratioiy

Basic Specification reexport_ratioiy

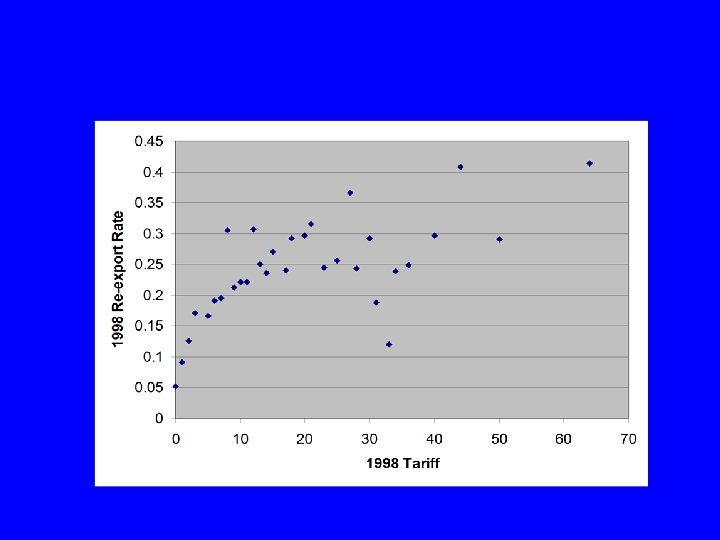

Basic Specification (Dependent Variable = Indirect-export_ratio) Tariff 0. 250 0. 286 0. 113 (0. 027) (0. 044) (0. 040) Time fixed effects Exporter fixed effects Industry fixed effects Observations R-squared Yes No 27577 0. 02 Yes 3 -digit 27577 0. 17 Yes 6 -digit 27577 0. 71

Basic Specification (Dependent Variable = Indirect-export_ratio) Tariff 0. 250 0. 286 0. 113 (0. 027) (0. 044) (0. 040) Time fixed effects Exporter fixed effects Industry fixed effects Observations R-squared Yes No 27577 0. 02 Yes 3 -digit 27577 0. 17 Yes 6 -digit 27577 0. 71

Magnitude of the effect: • Increase in tariff from 0% to 18% (mean tariff rate) results in higher indirect trade ratio of 5% (relative to the mean of 12%, sd of 0. 23) • Amount of evasion facilitated through re-exports: Evasion = Σ 0. 25*Tariff*Re-exports • Deflating by total imports: Evasion Rate ≈ 0. 02

Magnitude of the effect: • Increase in tariff from 0% to 18% (mean tariff rate) results in higher indirect trade ratio of 5% (relative to the mean of 12%, sd of 0. 23) • Amount of evasion facilitated through re-exports: Evasion = Σ 0. 25*Tariff*Re-exports • Deflating by total imports: Evasion Rate ≈ 0. 02

Can we rule out plausible alternatives? 1. Does it survive a differenced specification? 2. Does it hold for homogeneous products? 3. Does it hold better for non-exempted products than exempted ones? 4. Does it hold better for HK than for Singapore?

Can we rule out plausible alternatives? 1. Does it survive a differenced specification? 2. Does it hold for homogeneous products? 3. Does it hold better for non-exempted products than exempted ones? 4. Does it hold better for HK than for Singapore?

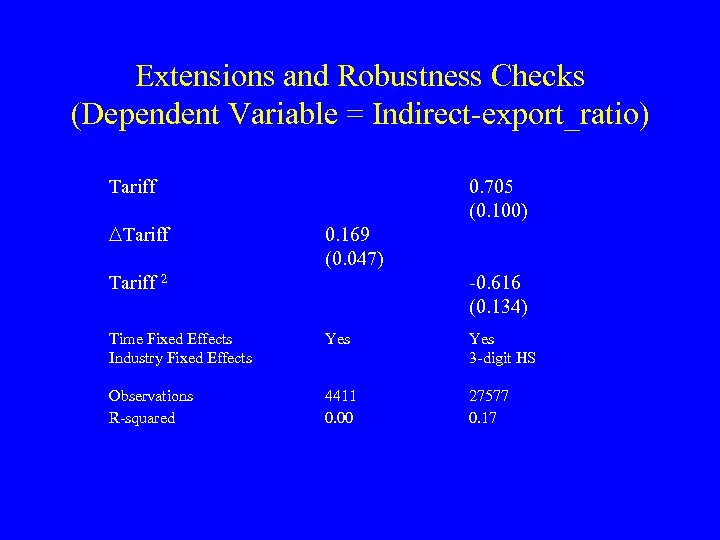

Extensions and Robustness Checks (Dependent Variable = Indirect-export_ratio) Tariff ∆Tariff 0. 705 (0. 100) 0. 169 (0. 047) Tariff 2 -0. 616 (0. 134) Time Fixed Effects Industry Fixed Effects Yes 3 -digit HS Observations R-squared 4411 0. 00 27577 0. 17

Extensions and Robustness Checks (Dependent Variable = Indirect-export_ratio) Tariff ∆Tariff 0. 705 (0. 100) 0. 169 (0. 047) Tariff 2 -0. 616 (0. 134) Time Fixed Effects Industry Fixed Effects Yes 3 -digit HS Observations R-squared 4411 0. 00 27577 0. 17

Coincidence of Product Characteristics • H 1: Indirect trade is driven by product characteristics, not by evasion. In particularly, there may be a coincidental correlation b/n product characteristics that render them to be intermediated and their tariff rates. • H 2: Indirect trade is driven by evasion Test 1: product fixed effects Test 2: first difference Test 3: separate homogeneous vs differentiated products

Coincidence of Product Characteristics • H 1: Indirect trade is driven by product characteristics, not by evasion. In particularly, there may be a coincidental correlation b/n product characteristics that render them to be intermediated and their tariff rates. • H 2: Indirect trade is driven by evasion Test 1: product fixed effects Test 2: first difference Test 3: separate homogeneous vs differentiated products

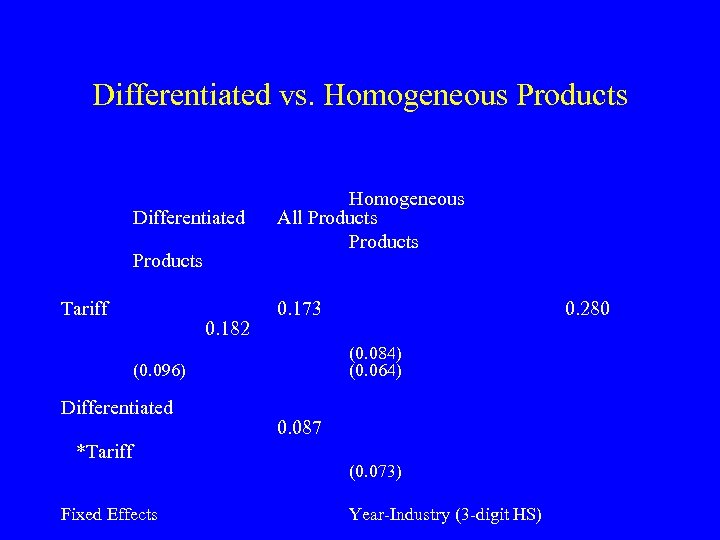

Differentiated vs. Homogeneous Products Differentiated Products Tariff 0. 182 Homogeneous All Products 0. 173 (0. 084) (0. 064) (0. 096) Differentiated *Tariff Fixed Effects 0. 280 0. 087 (0. 073) Year-Industry (3 -digit HS)

Differentiated vs. Homogeneous Products Differentiated Products Tariff 0. 182 Homogeneous All Products 0. 173 (0. 084) (0. 064) (0. 096) Differentiated *Tariff Fixed Effects 0. 280 0. 087 (0. 073) Year-Industry (3 -digit HS)

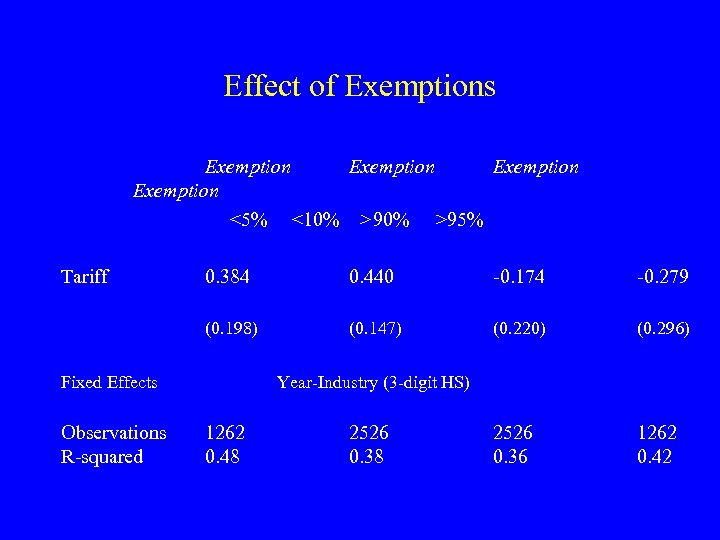

Tariff-driven legal avoidance • Ha: HK middlemen may be good at obtaining legal tariff exemptions, not illegal tariff evasion • Test: Separate products into a highlyexempted group vs a non-exempted group

Tariff-driven legal avoidance • Ha: HK middlemen may be good at obtaining legal tariff exemptions, not illegal tariff evasion • Test: Separate products into a highlyexempted group vs a non-exempted group

Effect of Exemptions Exemption <5% <10% >95% Tariff 0. 384 0. 440 -0. 174 -0. 279 (0. 198) (0. 147) (0. 220) (0. 296) 2526 0. 36 1262 0. 42 Fixed Effects Observations R-squared Year-Industry (3 -digit HS) 1262 0. 48 2526 0. 38

Effect of Exemptions Exemption <5% <10% >95% Tariff 0. 384 0. 440 -0. 174 -0. 279 (0. 198) (0. 147) (0. 220) (0. 296) 2526 0. 36 1262 0. 42 Fixed Effects Observations R-squared Year-Industry (3 -digit HS) 1262 0. 48 2526 0. 38

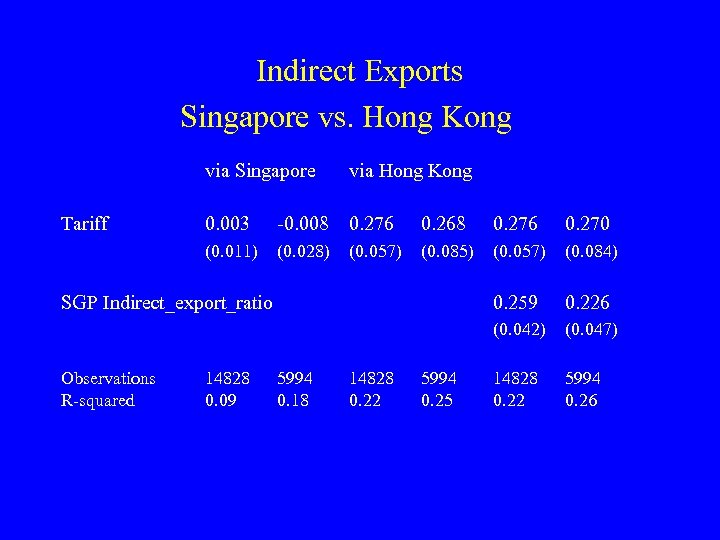

Indirect Exports Singapore vs. Hong Kong via Singapore 0. 003 -0. 008 0. 276 0. 268 0. 276 0. 270 (0. 011) Tariff via Hong Kong (0. 028) (0. 057) (0. 085) (0. 057) (0. 084) 0. 259 0. 226 (0. 042) (0. 047) 14828 0. 22 5994 0. 26 SGP Indirect_export_ratio Observations R-squared 14828 0. 09 5994 0. 18 14828 0. 22 5994 0. 25

Indirect Exports Singapore vs. Hong Kong via Singapore 0. 003 -0. 008 0. 276 0. 268 0. 276 0. 270 (0. 011) Tariff via Hong Kong (0. 028) (0. 057) (0. 085) (0. 057) (0. 084) 0. 259 0. 226 (0. 042) (0. 047) 14828 0. 22 5994 0. 26 SGP Indirect_export_ratio Observations R-squared 14828 0. 09 5994 0. 18 14828 0. 22 5994 0. 25

Conclusion • Tariff evasion is an important motivation for indirect trade in world commerce

Conclusion • Tariff evasion is an important motivation for indirect trade in world commerce