cf57516d1d638512f401ce2d1e122b6e.ppt

- Количество слайдов: 19

Parliamentary Standing Committee on Finance Informal Hearings 22 June 2011 J-P Fourie and Mark Linington SAVCA www. savca. co. za

Parliamentary Standing Committee on Finance Informal Hearings 22 June 2011 J-P Fourie and Mark Linington SAVCA www. savca. co. za

Presentation objectives § Overview of our industry in South Africa § Facts and figures of the industry and the economic impact thereof § Discuss the impacts of the suspension of Section 45

Presentation objectives § Overview of our industry in South Africa § Facts and figures of the industry and the economic impact thereof § Discuss the impacts of the suspension of Section 45

What is private equity? § Typically transformational and value-adding strategies. § Specialised skills and experience. § Reasons for private equity financing § increasing its working capital base; § business expansion and development; § developing new technologies and products in order to grow and/or remain competitive; § to finance acquisitions of other businesses; § to buy out certain shareholders in order to restructure the ownership and management of the business; and § introduction of BEE.

What is private equity? § Typically transformational and value-adding strategies. § Specialised skills and experience. § Reasons for private equity financing § increasing its working capital base; § business expansion and development; § developing new technologies and products in order to grow and/or remain competitive; § to finance acquisitions of other businesses; § to buy out certain shareholders in order to restructure the ownership and management of the business; and § introduction of BEE.

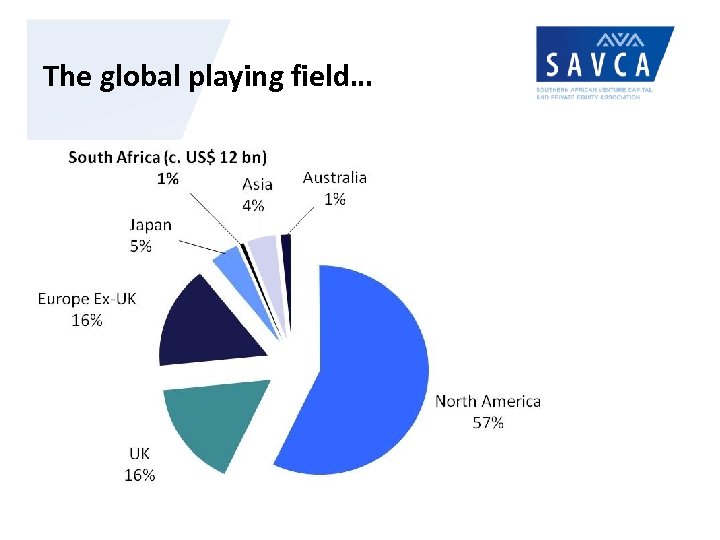

The global playing field…

The global playing field…

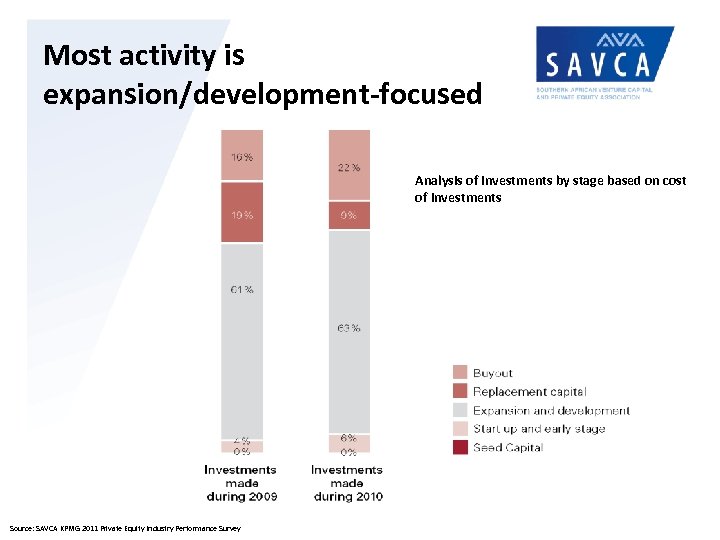

Most activity is expansion/development-focused Analysis of investments by stage based on cost of investments Source: SAVCA KPMG 2011 Private Equity Industry Performance Survey

Most activity is expansion/development-focused Analysis of investments by stage based on cost of investments Source: SAVCA KPMG 2011 Private Equity Industry Performance Survey

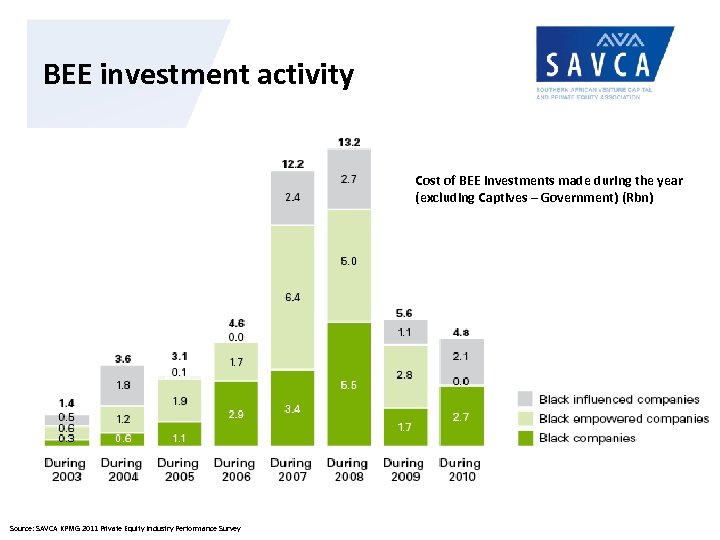

BEE investment activity Cost of BEE investments made during the year (excluding Captives – Government) (Rbn) Source: SAVCA KPMG 2011 Private Equity Industry Performance Survey

BEE investment activity Cost of BEE investments made during the year (excluding Captives – Government) (Rbn) Source: SAVCA KPMG 2011 Private Equity Industry Performance Survey

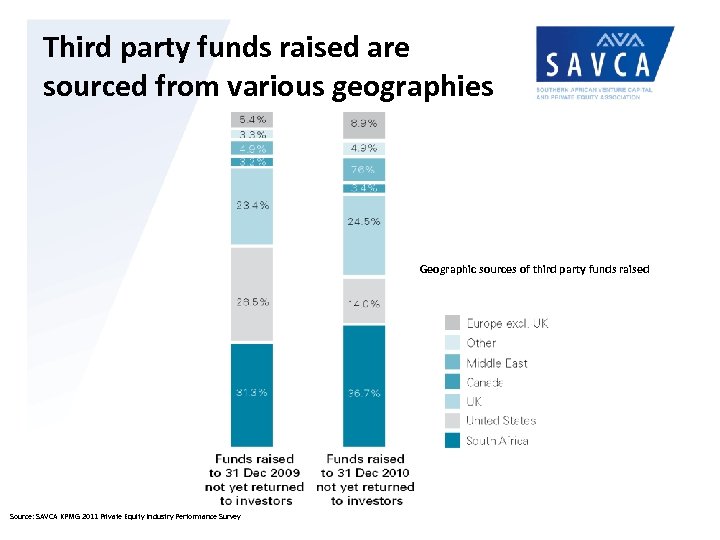

Third party funds raised are sourced from various geographies Geographic sources of third party funds raised Source: SAVCA KPMG 2011 Private Equity Industry Performance Survey

Third party funds raised are sourced from various geographies Geographic sources of third party funds raised Source: SAVCA KPMG 2011 Private Equity Industry Performance Survey

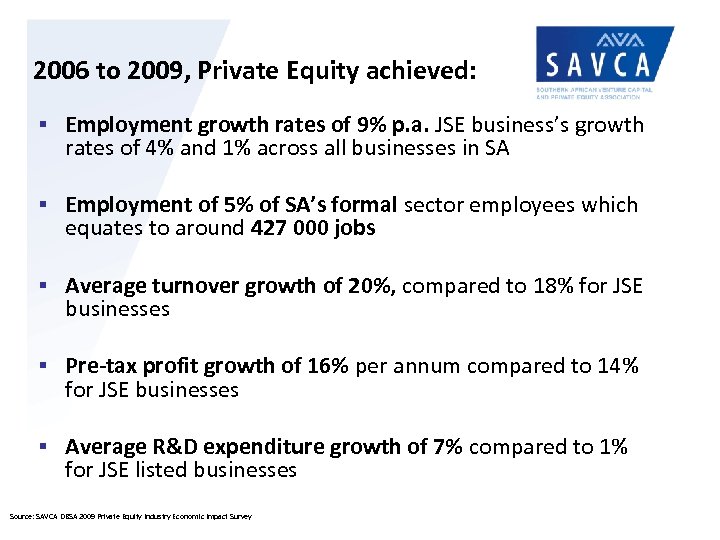

2006 to 2009, Private Equity achieved: § Employment growth rates of 9% p. a. JSE business’s growth rates of 4% and 1% across all businesses in SA § Employment of 5% of SA’s formal sector employees which equates to around 427 000 jobs § Average turnover growth of 20%, compared to 18% for JSE businesses § Pre-tax profit growth of 16% per annum compared to 14% for JSE businesses § Average R&D expenditure growth of 7% compared to 1% for JSE listed businesses Source: SAVCA DBSA 2009 Private Equity Industry Economic Impact Survey

2006 to 2009, Private Equity achieved: § Employment growth rates of 9% p. a. JSE business’s growth rates of 4% and 1% across all businesses in SA § Employment of 5% of SA’s formal sector employees which equates to around 427 000 jobs § Average turnover growth of 20%, compared to 18% for JSE businesses § Pre-tax profit growth of 16% per annum compared to 14% for JSE businesses § Average R&D expenditure growth of 7% compared to 1% for JSE listed businesses Source: SAVCA DBSA 2009 Private Equity Industry Economic Impact Survey

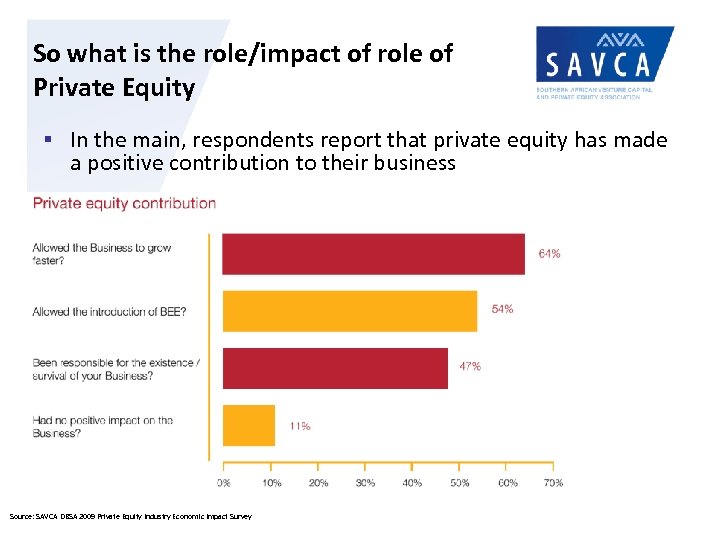

So what is the role/impact of role of Private Equity § In the main, respondents report that private equity has made a positive contribution to their business Source: SAVCA DBSA 2009 Private Equity Industry Economic Impact Survey

So what is the role/impact of role of Private Equity § In the main, respondents report that private equity has made a positive contribution to their business Source: SAVCA DBSA 2009 Private Equity Industry Economic Impact Survey

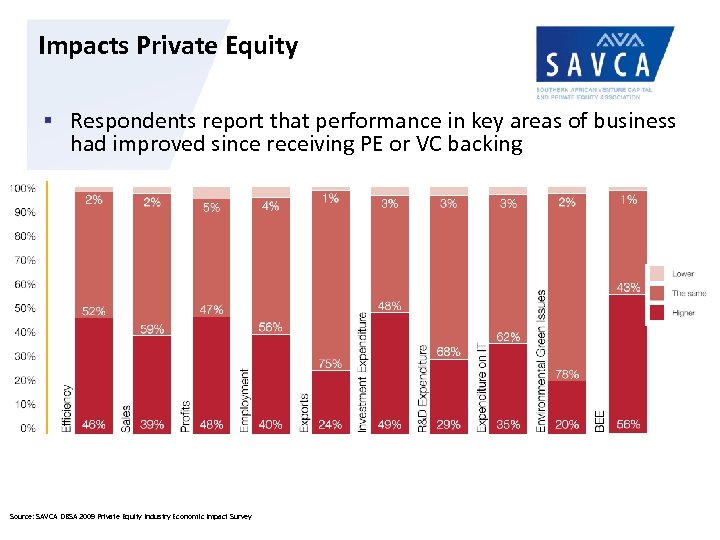

Impacts Private Equity § Respondents report that performance in key areas of business had improved since receiving PE or VC backing Source: SAVCA DBSA 2009 Private Equity Industry Economic Impact Survey

Impacts Private Equity § Respondents report that performance in key areas of business had improved since receiving PE or VC backing Source: SAVCA DBSA 2009 Private Equity Industry Economic Impact Survey

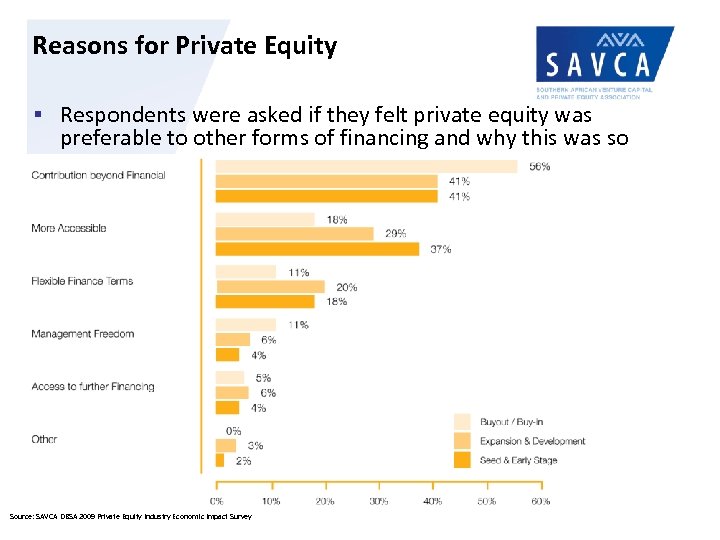

Reasons for Private Equity § Respondents were asked if they felt private equity was preferable to other forms of financing and why this was so Source: SAVCA DBSA 2009 Private Equity Industry Economic Impact Survey

Reasons for Private Equity § Respondents were asked if they felt private equity was preferable to other forms of financing and why this was so Source: SAVCA DBSA 2009 Private Equity Industry Economic Impact Survey

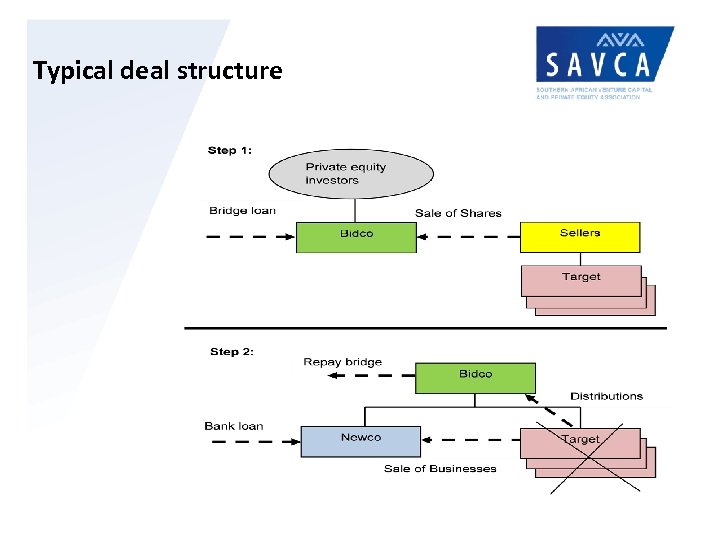

Typical deal structure

Typical deal structure

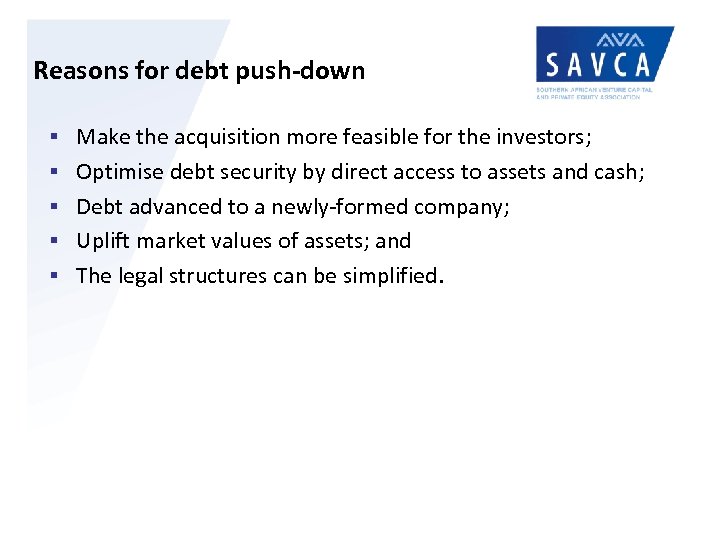

Reasons for debt push-down § Make the acquisition more feasible for the investors; § Optimise debt security by direct access to assets and cash; § Debt advanced to a newly-formed company; § Uplift market values of assets; and § The legal structures can be simplified.

Reasons for debt push-down § Make the acquisition more feasible for the investors; § Optimise debt security by direct access to assets and cash; § Debt advanced to a newly-formed company; § Uplift market values of assets; and § The legal structures can be simplified.

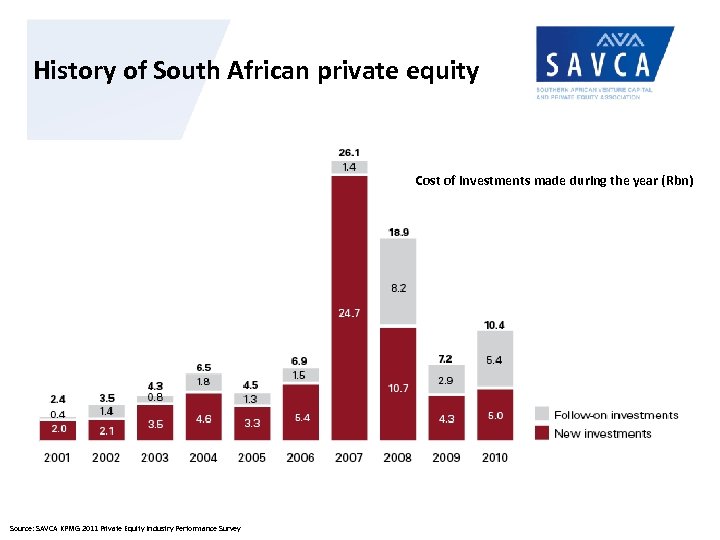

History of South African private equity Cost of investments made during the year (Rbn) Source: SAVCA KPMG 2011 Private Equity Industry Performance Survey

History of South African private equity Cost of investments made during the year (Rbn) Source: SAVCA KPMG 2011 Private Equity Industry Performance Survey

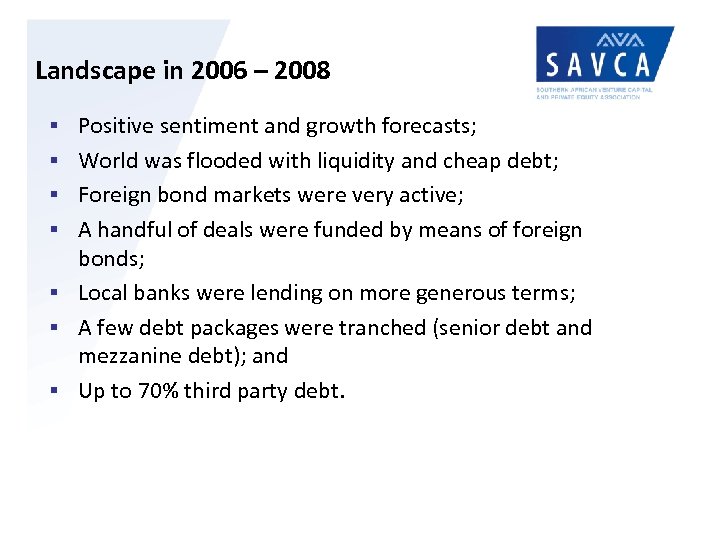

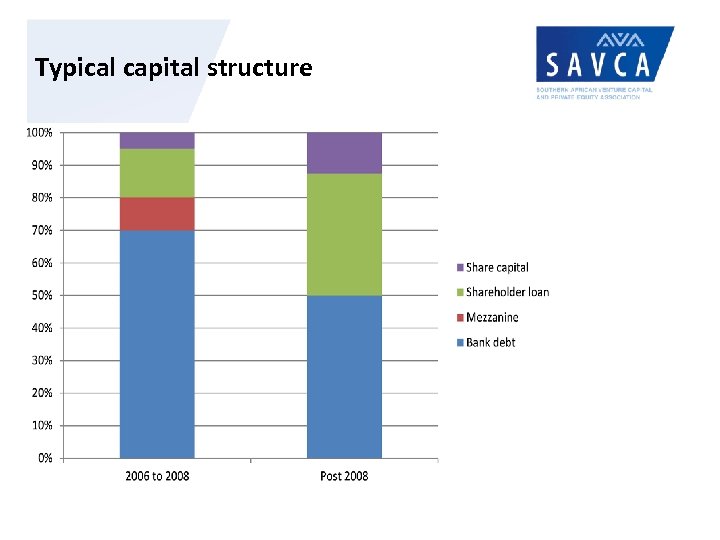

Landscape in 2006 – 2008 § Positive sentiment and growth forecasts; § World was flooded with liquidity and cheap debt; § Foreign bond markets were very active; § A handful of deals were funded by means of foreign bonds; § Local banks were lending on more generous terms; § A few debt packages were tranched (senior debt and mezzanine debt); and § Up to 70% third party debt.

Landscape in 2006 – 2008 § Positive sentiment and growth forecasts; § World was flooded with liquidity and cheap debt; § Foreign bond markets were very active; § A handful of deals were funded by means of foreign bonds; § Local banks were lending on more generous terms; § A few debt packages were tranched (senior debt and mezzanine debt); and § Up to 70% third party debt.

Landscape post 2008 § No new foreign bond issues; § Mezzanine funding for the big deals has dried up; § Local banks have remained very cautious in providing the debt; § 50% of local bank debt only in a deal; and § Interest rates are in the range of Jibar plus 2% to 4% therefore not excessive.

Landscape post 2008 § No new foreign bond issues; § Mezzanine funding for the big deals has dried up; § Local banks have remained very cautious in providing the debt; § 50% of local bank debt only in a deal; and § Interest rates are in the range of Jibar plus 2% to 4% therefore not excessive.

Typical capital structure

Typical capital structure

“Much of which carries a subordinated or junior ranking” § In 2006 -2008 some deals included mezzanine debt (10% - 15% of capital structure); § Not a feature of capital structures post; § Shareholder loans are the only subordinated debt; and § Exchange control limits the interest rate to prime. SARS toolkit § Shareholder loans are limited to a 3: 1 ratio; § New thin capitalisation rules from October 2011; and § Withholding tax on interest from 2013.

“Much of which carries a subordinated or junior ranking” § In 2006 -2008 some deals included mezzanine debt (10% - 15% of capital structure); § Not a feature of capital structures post; § Shareholder loans are the only subordinated debt; and § Exchange control limits the interest rate to prime. SARS toolkit § Shareholder loans are limited to a 3: 1 ratio; § New thin capitalisation rules from October 2011; and § Withholding tax on interest from 2013.

Suspension of section 45 § § § § Erodes confidence in South Africa; Foreign investment will go elsewhere; National Treasury and SARS have always been aware of debt push-down – SAVCA engagements in 2006/7; Deals are being abandoned; 18 months will be a significant setback for the industry; No consultation or warning; and Need to restore certainty – SAVCA would like to urgently engage with National Treasury (as per 2007)

Suspension of section 45 § § § § Erodes confidence in South Africa; Foreign investment will go elsewhere; National Treasury and SARS have always been aware of debt push-down – SAVCA engagements in 2006/7; Deals are being abandoned; 18 months will be a significant setback for the industry; No consultation or warning; and Need to restore certainty – SAVCA would like to urgently engage with National Treasury (as per 2007)