3b11aab37cf3fbb7a1e9a0e0ecbbb024.ppt

- Количество слайдов: 18

• Parliamentary Portfolio Committee Briefing • 06 September 2006 Pricing and availability of liquefied petroleum gas

DME Team • Nhlanhla Gumede – Acting DDG Hydrocarbons & Energy Planning • Muzi Mkhize – Director Petroleum & Gas Operations

Introduction • International experience in developing countries is that LPG is the main domestic thermal fuel – Cheaper and more efficient than electricity in thermal applications – Lower upfront capital costs – Clean and odourless fuel – It is much “safer” than paraffin & coal – It is easily transported and distributed – It stops deforestation caused by wood fuel

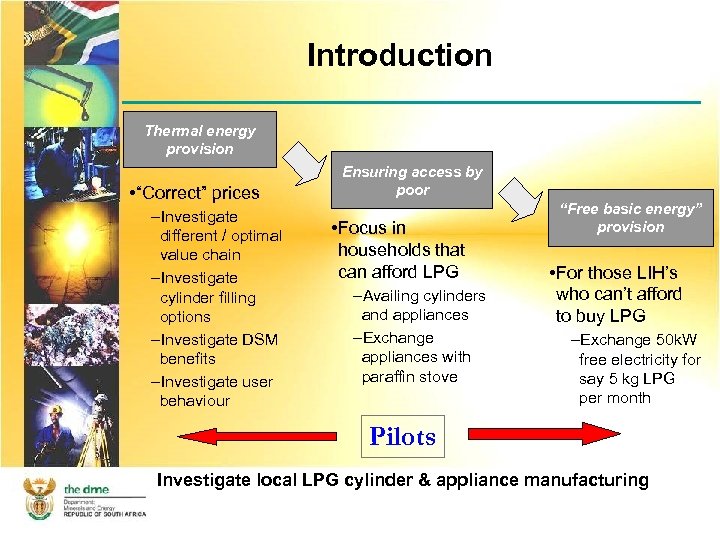

Introduction Thermal energy provision • “Correct” prices –Investigate different / optimal value chain –Investigate cylinder filling options –Investigate DSM benefits –Investigate user behaviour Ensuring access by poor • Focus in households that can afford LPG –Availing cylinders and appliances –Exchange appliances with paraffin stove “Free basic energy” provision • For those LIH’s who can’t afford to buy LPG –Exchange 50 k. W free electricity for say 5 kg LPG per month Pilots Investigate local LPG cylinder & appliance manufacturing

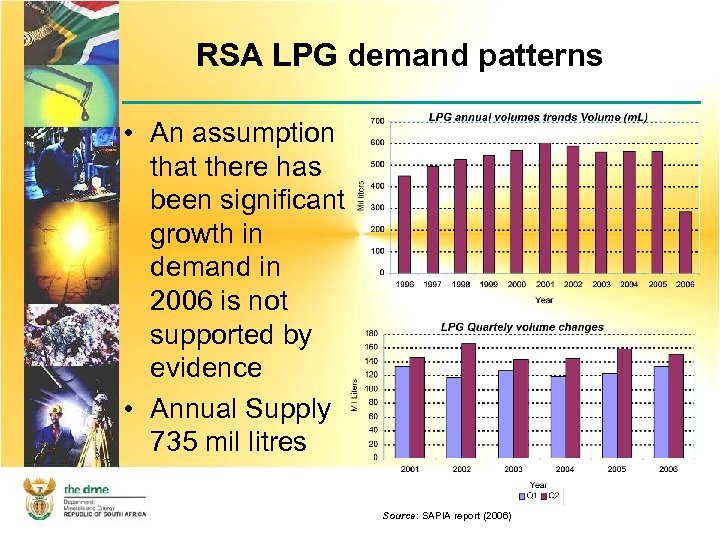

RSA LPG demand patterns • An assumption that there has been significant growth in demand in 2006 is not supported by evidence • Annual Supply 735 mil litres Source: SAPIA report (2006)

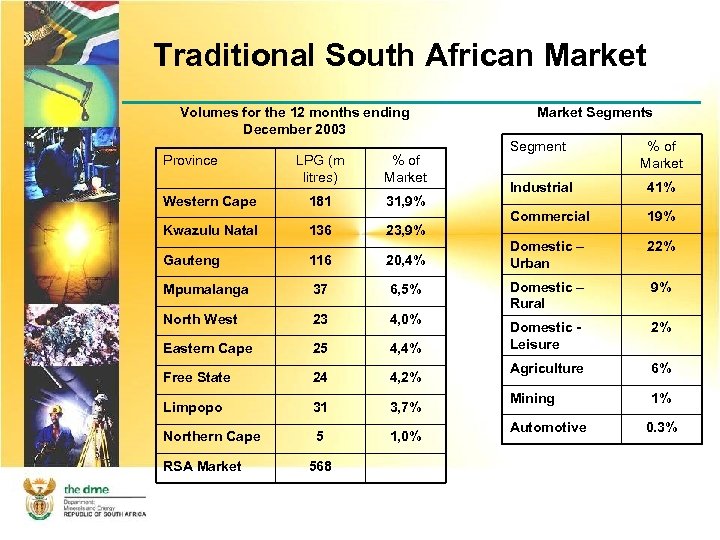

Traditional South African Market Volumes for the 12 months ending December 2003 Province LPG (m litres) % of Market Western Cape 181 31, 9% Kwazulu Natal 136 23, 9% Market Segments Segment % of Market Industrial 41% Commercial 19% 22% Gauteng 116 20, 4% Domestic – Urban Mpumalanga 37 6, 5% 9% North West 23 4, 0% Domestic – Rural 2% Eastern Cape 25 4, 4% Domestic Leisure Free State 24 4, 2% Agriculture 6% Limpopo 31 3, 7% Mining 1% Northern Cape 5 1, 0% RSA Market 568 Automotive 0. 3%

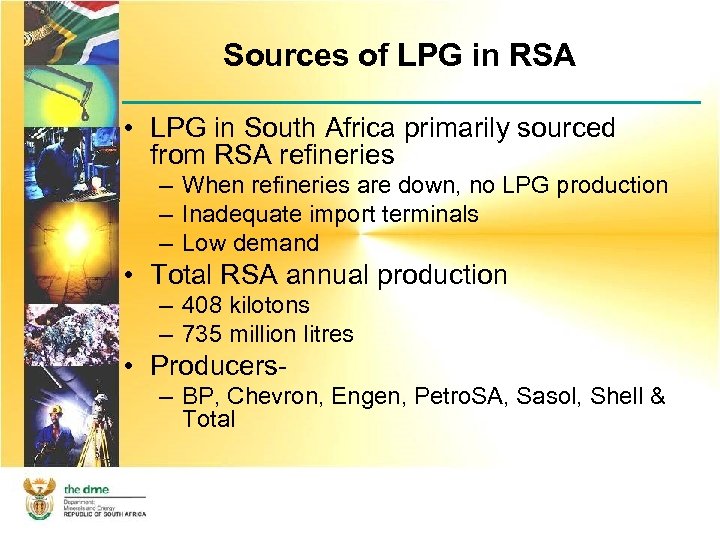

Sources of LPG in RSA • LPG in South Africa primarily sourced from RSA refineries – When refineries are down, no LPG production – Inadequate import terminals – Low demand • Total RSA annual production – 408 kilotons – 735 million litres • Producers– BP, Chevron, Engen, Petro. SA, Sasol, Shell & Total

World’s largest LPG traders (2000) Producers Million tons Exporters Million tons Importers Million tons 1 USA 47. 2 Saudi Arabia 12. 9 Japan 14. 8 2 Saudi Arabia 17. 8 Algeria 7. 2 China 5. 0 3 Canada 9. 8 Abu Dhabi 5. 0 Korea 4. 8 4 Algeria 8. 6 Norway 3. 4 Turkey 3. 7 5 China 7. 9 UK 3. 3 Brazil 2. 4 6 Mexico 7. 2 Kuwait 2. 8 France 1. 7 7 Russia 7. 1 Indonesia 1. 6 Mexico 1. 6 8 UK 6. 1 Australia 1. 5 Italy 1. 6 9 India 5. 6 Venezuela 1. 4 USA 1. 4 10 Abu Dhabi 5. 1 Nigeria 1. 3 Netherlands 1. 2 Source: Sasol’s presentation to SAPIA (2004)

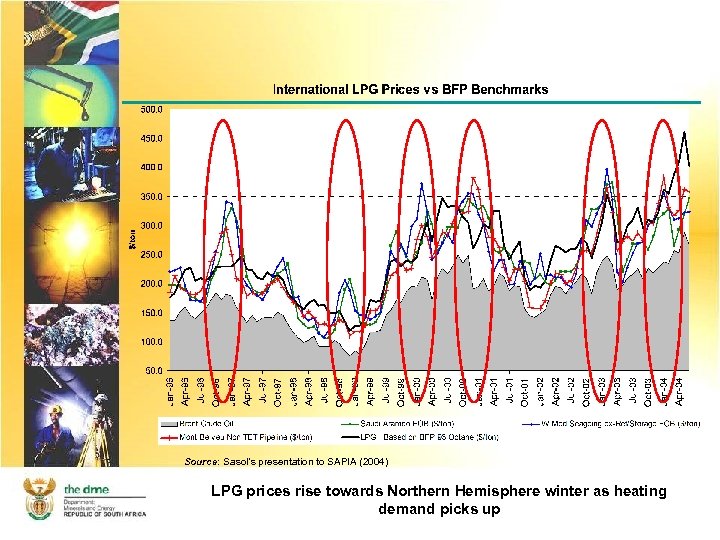

Source: Sasol’s presentation to SAPIA (2004) LPG prices rise towards Northern Hemisphere winter as heating demand picks up

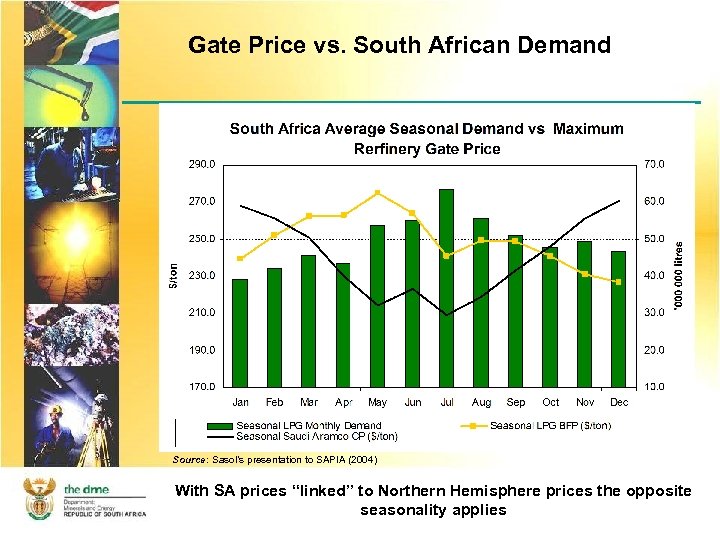

Gate Price vs. South African Demand Source: Sasol’s presentation to SAPIA (2004) With SA prices “linked” to Northern Hemisphere prices the opposite seasonality applies

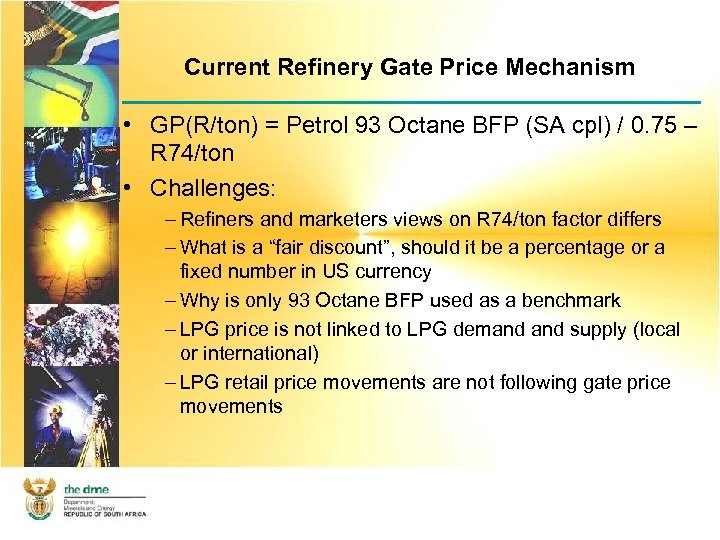

Current Refinery Gate Price Mechanism • GP(R/ton) = Petrol 93 Octane BFP (SA cpl) / 0. 75 – R 74/ton • Challenges: – Refiners and marketers views on R 74/ton factor differs – What is a “fair discount”, should it be a percentage or a fixed number in US currency – Why is only 93 Octane BFP used as a benchmark – LPG price is not linked to LPG demand supply (local or international) – LPG retail price movements are not following gate price movements

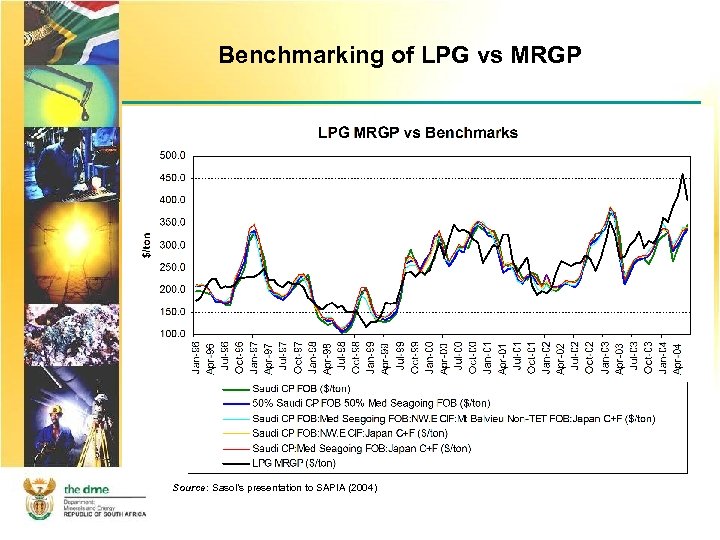

Benchmarking of LPG vs MRGP Source: Sasol’s presentation to SAPIA (2004)

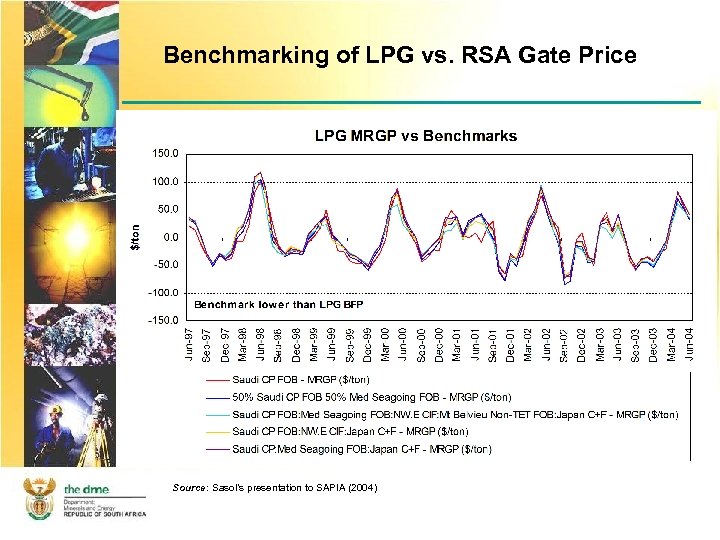

Benchmarking of LPG vs. RSA Gate Price Source: Sasol’s presentation to SAPIA (2004)

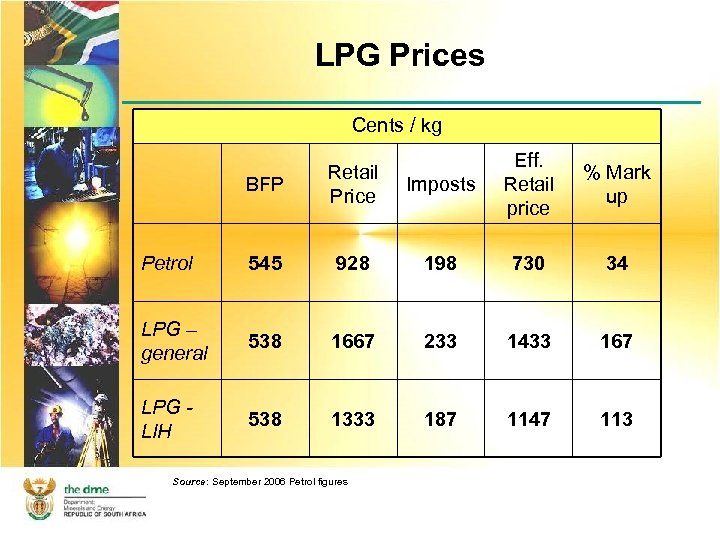

LPG Prices Cents / kg Imposts Eff. Retail price % Mark up 928 198 730 34 538 1667 233 1433 167 538 1333 187 1147 113 BFP Retail Price Petrol 545 LPG – general LPG LIH Source: September 2006 Petrol figures

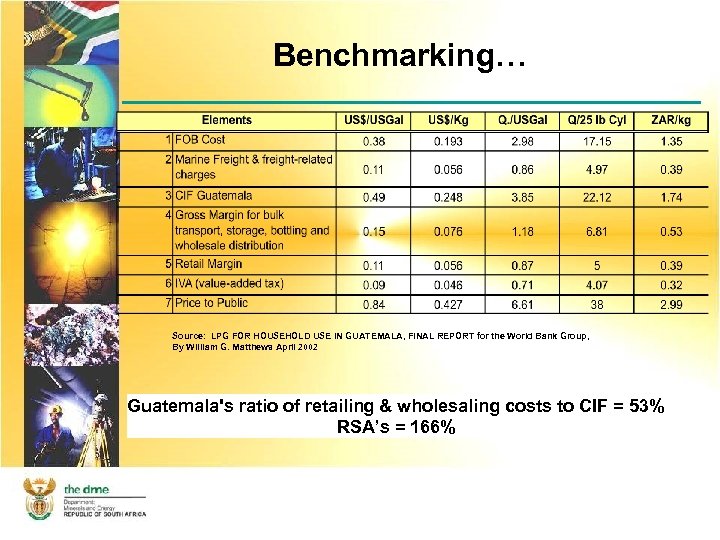

Benchmarking… Source: LPG FOR HOUSEHOLD USE IN GUATEMALA, FINAL REPORT for the World Bank Group, By William G. Matthews April 2002 Guatemala's ratio of retailing & wholesaling costs to CIF = 53% RSA’s = 166%

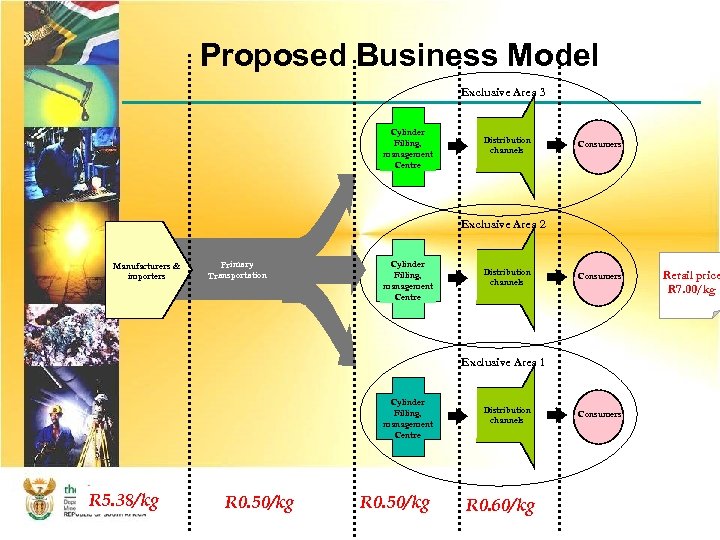

Proposed Business Model Exclusive Area 3 Cylinder Filling, management Centre Distribution channels Consumers Exclusive Area 2 Manufacturers & importers Primary Transportation Cylinder Filling, management Centre Distribution channels Consumers Exclusive Area 1 Cylinder Filling, management Centre R 5. 38/kg R 0. 50/kg Distribution channels R 0. 60/kg Consumers Retail price R 7. 00/kg

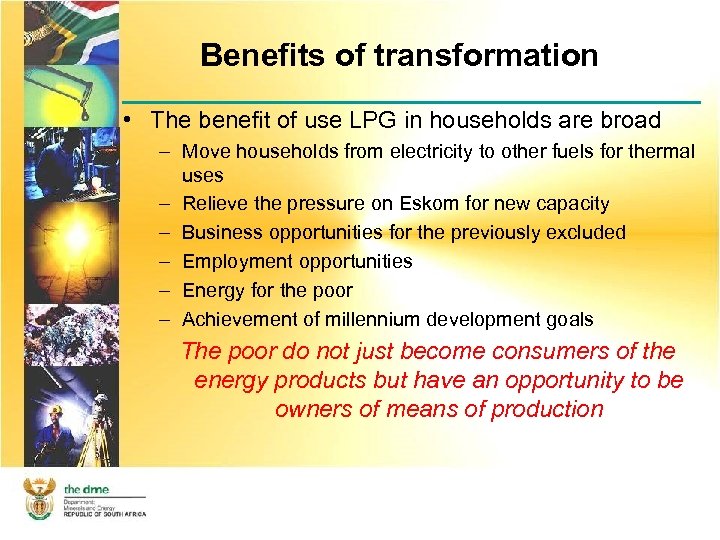

Benefits of transformation • The benefit of use LPG in households are broad – Move households from electricity to other fuels for thermal uses – Relieve the pressure on Eskom for new capacity – Business opportunities for the previously excluded – Employment opportunities – Energy for the poor – Achievement of millennium development goals The poor do not just become consumers of the energy products but have an opportunity to be owners of means of production

Pilot program - Attridgeville • The expected results of the project will inform DME on the way to go – Formulation of LPG supply policy – Determination of an appropriate price structure for LPG – Structuring of the future LPG national rollout strategy – Proven load shift from electricity usage as a result of LPG usage

3b11aab37cf3fbb7a1e9a0e0ecbbb024.ppt