fc0c8e1631772eed59399b11e14dced0.ppt

- Количество слайдов: 13

Panama´s Opening Doors to Investment: Reverted Areas of the Panama Canal Zone Dulcidio De La Guardia Vice Minister of Finance Ministry of Economics and Finance London, September 2010

Panama´s Opening Doors to Investment: Reverted Areas of the Panama Canal Zone Dulcidio De La Guardia Vice Minister of Finance Ministry of Economics and Finance London, September 2010

Why are Multinational Companies driven to Panama? Major drivers for shifting operations to Panama include political stability, strategic location, sustained economic growth, investment grade rating, and great logistical connectivity Additional Benefits of Investing in Panama • Central location with modern infrastructure • Investment grade with dollarized economy • Efficient telecommunications infrastructure • Modern multimodal logistics platform that facilitates global commerce • Tax and importation incentives of law 41 • Immigration flexibility • Special economic and free trade zones • International financial center • No capital flow restrictions • Lower cost of living and security • “Panama ranked 53 rd and had the largest improvement in the region based on infrastructure quality and economic stability” Great connectivity with region • World Economic Forum Eco-tourism and biodiversity 2

Why are Multinational Companies driven to Panama? Major drivers for shifting operations to Panama include political stability, strategic location, sustained economic growth, investment grade rating, and great logistical connectivity Additional Benefits of Investing in Panama • Central location with modern infrastructure • Investment grade with dollarized economy • Efficient telecommunications infrastructure • Modern multimodal logistics platform that facilitates global commerce • Tax and importation incentives of law 41 • Immigration flexibility • Special economic and free trade zones • International financial center • No capital flow restrictions • Lower cost of living and security • “Panama ranked 53 rd and had the largest improvement in the region based on infrastructure quality and economic stability” Great connectivity with region • World Economic Forum Eco-tourism and biodiversity 2

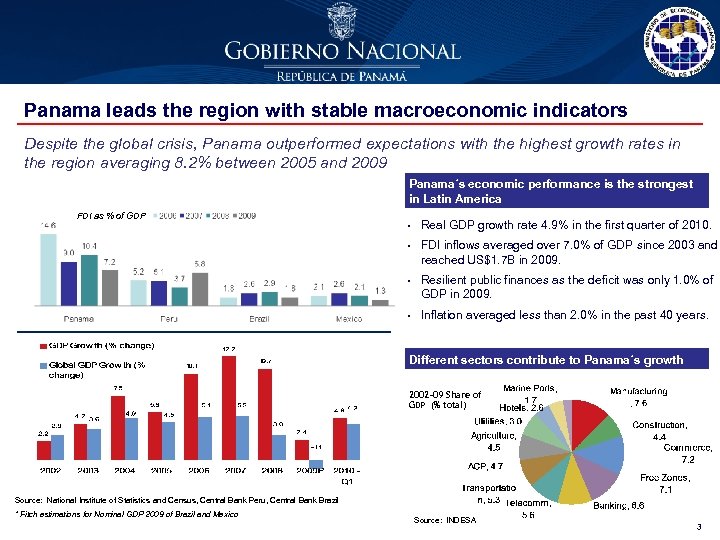

Panama leads the region with stable macroeconomic indicators Despite the global crisis, Panama outperformed expectations with the highest growth rates in the region averaging 8. 2% between 2005 and 2009 Panama´s economic performance is the strongest in Latin America FDI as % of GDP • Real GDP growth rate 4. 9% in the first quarter of 2010. • FDI inflows averaged over 7. 0% of GDP since 2003 and reached US$1. 7 B in 2009. • Resilient public finances as the deficit was only 1. 0% of GDP in 2009. • Inflation averaged less than 2. 0% in the past 40 years. Different sectors contribute to Panama´s growth 2002 -09 Share of GDP (% total) Source: National Institute of Statistics and Census, Central Bank Peru, Central Bank Brazil * Fitch estimations for Nominal GDP 2009 of Brazil and Mexico Source: INDESA 3

Panama leads the region with stable macroeconomic indicators Despite the global crisis, Panama outperformed expectations with the highest growth rates in the region averaging 8. 2% between 2005 and 2009 Panama´s economic performance is the strongest in Latin America FDI as % of GDP • Real GDP growth rate 4. 9% in the first quarter of 2010. • FDI inflows averaged over 7. 0% of GDP since 2003 and reached US$1. 7 B in 2009. • Resilient public finances as the deficit was only 1. 0% of GDP in 2009. • Inflation averaged less than 2. 0% in the past 40 years. Different sectors contribute to Panama´s growth 2002 -09 Share of GDP (% total) Source: National Institute of Statistics and Census, Central Bank Peru, Central Bank Brazil * Fitch estimations for Nominal GDP 2009 of Brazil and Mexico Source: INDESA 3

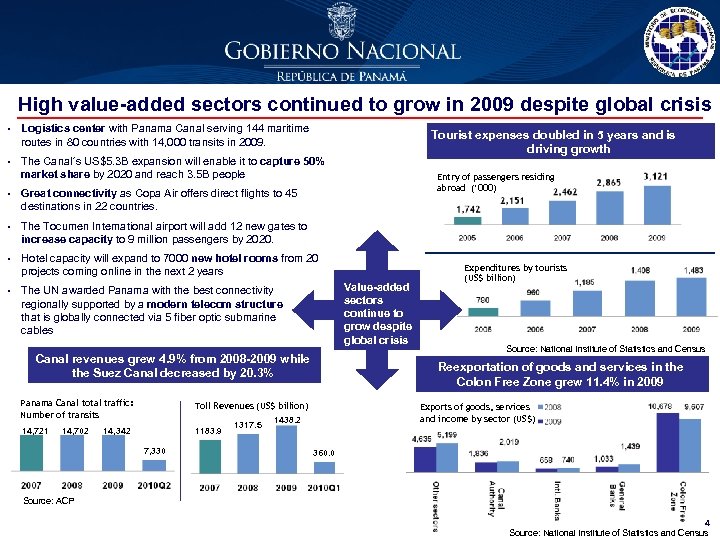

High value-added sectors continued to grow in 2009 despite global crisis • Logistics center with Panama Canal serving 144 maritime routes in 80 countries with 14, 000 transits in 2009. • The Canal´s US$5. 3 B expansion will enable it to capture 50% market share by 2020 and reach 3. 5 B people • The Tocumen International airport will add 12 new gates to increase capacity to 9 million passengers by 2020. • Hotel capacity will expand to 7000 new hotel rooms from 20 projects coming online in the next 2 years • The UN awarded Panama with the best connectivity regionally supported by a modern telecom structure that is globally connected via 5 fiber optic submarine cables Entry of passengers residing abroad (‘ 000) Great connectivity as Copa Air offers direct flights to 45 destinations in 22 countries. • Tourist expenses doubled in 5 years and is driving growth Value-added sectors continue to grow despite global crisis Canal revenues grew 4. 9% from 2008 -2009 while the Suez Canal decreased by 20. 3% Panama Canal total traffic: Number of transits 1183. 9 14, 702 14, 342 7, 330 1317. 5 Source: National Institute of Statistics and Census Reexportation of goods and services in the Colon Free Zone grew 11. 4% in 2009 Toll Revenues (US$ billion) 14, 721 Expenditures by tourists (US$ billion) Exports of goods, services and income by sector (US$) 1438. 2 360. 0 Source: ACP 4 Source: National Institute of Statistics and Census

High value-added sectors continued to grow in 2009 despite global crisis • Logistics center with Panama Canal serving 144 maritime routes in 80 countries with 14, 000 transits in 2009. • The Canal´s US$5. 3 B expansion will enable it to capture 50% market share by 2020 and reach 3. 5 B people • The Tocumen International airport will add 12 new gates to increase capacity to 9 million passengers by 2020. • Hotel capacity will expand to 7000 new hotel rooms from 20 projects coming online in the next 2 years • The UN awarded Panama with the best connectivity regionally supported by a modern telecom structure that is globally connected via 5 fiber optic submarine cables Entry of passengers residing abroad (‘ 000) Great connectivity as Copa Air offers direct flights to 45 destinations in 22 countries. • Tourist expenses doubled in 5 years and is driving growth Value-added sectors continue to grow despite global crisis Canal revenues grew 4. 9% from 2008 -2009 while the Suez Canal decreased by 20. 3% Panama Canal total traffic: Number of transits 1183. 9 14, 702 14, 342 7, 330 1317. 5 Source: National Institute of Statistics and Census Reexportation of goods and services in the Colon Free Zone grew 11. 4% in 2009 Toll Revenues (US$ billion) 14, 721 Expenditures by tourists (US$ billion) Exports of goods, services and income by sector (US$) 1438. 2 360. 0 Source: ACP 4 Source: National Institute of Statistics and Census

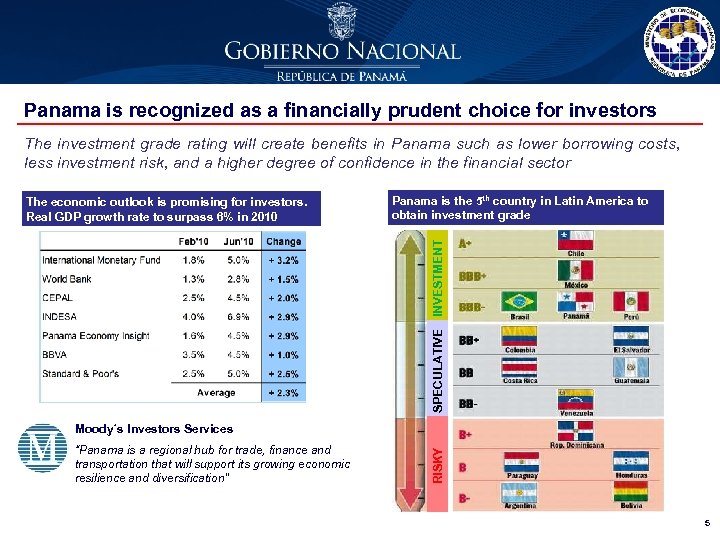

Panama is recognized as a financially prudent choice for investors The investment grade rating will create benefits in Panama such as lower borrowing costs, less investment risk, and a higher degree of confidence in the financial sector Panama is the 5 th country in Latin America to obtain investment grade SPECULATIVE INVESTMENT The economic outlook is promising for investors. Real GDP growth rate to surpass 6% in 2010 “Panama is a regional hub for trade, finance and transportation that will support its growing economic resilience and diversification” RISKY Moody´s Investors Services 5

Panama is recognized as a financially prudent choice for investors The investment grade rating will create benefits in Panama such as lower borrowing costs, less investment risk, and a higher degree of confidence in the financial sector Panama is the 5 th country in Latin America to obtain investment grade SPECULATIVE INVESTMENT The economic outlook is promising for investors. Real GDP growth rate to surpass 6% in 2010 “Panama is a regional hub for trade, finance and transportation that will support its growing economic resilience and diversification” RISKY Moody´s Investors Services 5

Panama is promoting new business development in the Reverted Areas Discover the potential of developing and investing in commercial activities strategically located in the Reverted Areas of the Panama Canal and in terminal areas of the Atlantic and Pacific The Reverted Areas offer an incredible range of incentives and opportunities for investment Supply Chain Mgt Insurance Services Tourism & Events Maritime Services Cluster Retail Sales Ship Yards Fishing Industry Nautical Training Telecom Port Development Airports Air, Land, & Sea Cargo Logistics Cluster Commercial Business Services Colon Free Zone Railroad Storage Yards Telecom 6

Panama is promoting new business development in the Reverted Areas Discover the potential of developing and investing in commercial activities strategically located in the Reverted Areas of the Panama Canal and in terminal areas of the Atlantic and Pacific The Reverted Areas offer an incredible range of incentives and opportunities for investment Supply Chain Mgt Insurance Services Tourism & Events Maritime Services Cluster Retail Sales Ship Yards Fishing Industry Nautical Training Telecom Port Development Airports Air, Land, & Sea Cargo Logistics Cluster Commercial Business Services Colon Free Zone Railroad Storage Yards Telecom 6

The reverted assets have a unique history and are strategically located The Reverted Areas will be developed to compliment the expansion of the canal and the modernization of ports Reverted Areas accessible to 3. 5 B billion potential customers at the crossroads of the world • The Canal Treaty of 1977 reverted the operation of the Canal along with 147, 386 hectares of land in the former canal zone back to Panama. • 5, 000 hectares of reverted land is available for private sector development and concessions. • The reverted assets along the Panama Canal and in the terminal areas of the Atlantic and Pacific will become a regional hub for commerce. Source: ACP Transit the Canal Feeder Services LAGO GATUN Canal Railroad/Fiberoptics Trans-isthmus highway Pan-American highway Ports Airports Panama City 7

The reverted assets have a unique history and are strategically located The Reverted Areas will be developed to compliment the expansion of the canal and the modernization of ports Reverted Areas accessible to 3. 5 B billion potential customers at the crossroads of the world • The Canal Treaty of 1977 reverted the operation of the Canal along with 147, 386 hectares of land in the former canal zone back to Panama. • 5, 000 hectares of reverted land is available for private sector development and concessions. • The reverted assets along the Panama Canal and in the terminal areas of the Atlantic and Pacific will become a regional hub for commerce. Source: ACP Transit the Canal Feeder Services LAGO GATUN Canal Railroad/Fiberoptics Trans-isthmus highway Pan-American highway Ports Airports Panama City 7

Atlantic coast opportunities for touristic and housing developments Valuable investment areas for hotels, university campuses, technology research centers, residential complexes, and commercial centers Sherman North 266. 5 Hectares Residential José Dominador Bazán (old Fort Davis) 380 hectares 8

Atlantic coast opportunities for touristic and housing developments Valuable investment areas for hotels, university campuses, technology research centers, residential complexes, and commercial centers Sherman North 266. 5 Hectares Residential José Dominador Bazán (old Fort Davis) 380 hectares 8

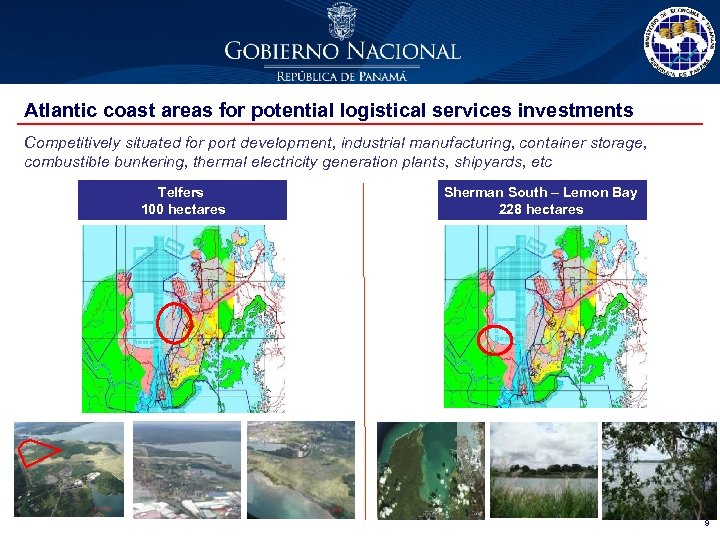

Atlantic coast areas for potential logistical services investments Competitively situated for port development, industrial manufacturing, container storage, combustible bunkering, thermal electricity generation plants, shipyards, etc Telfers 100 hectares Sherman South – Lemon Bay 228 hectares 9

Atlantic coast areas for potential logistical services investments Competitively situated for port development, industrial manufacturing, container storage, combustible bunkering, thermal electricity generation plants, shipyards, etc Telfers 100 hectares Sherman South – Lemon Bay 228 hectares 9

Pacific coast areas for tourism and housing development opportunities Prime investment areas for hotels, universities, technology research centers, residential complexes, and commercial centers Altos de Batele 160 hectares Clayton Veracruz 380 hectares Ciudad de Panamá Clayton Amador Howard Veracruz Altos de Batele 10

Pacific coast areas for tourism and housing development opportunities Prime investment areas for hotels, universities, technology research centers, residential complexes, and commercial centers Altos de Batele 160 hectares Clayton Veracruz 380 hectares Ciudad de Panamá Clayton Amador Howard Veracruz Altos de Batele 10

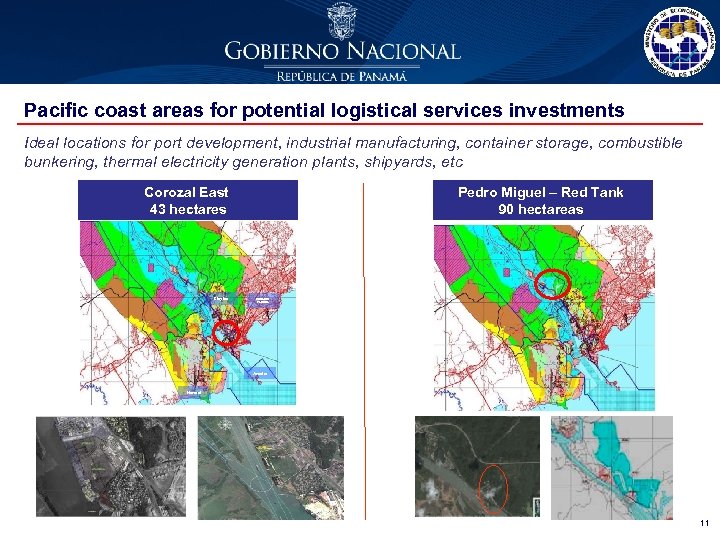

Pacific coast areas for potential logistical services investments Ideal locations for port development, industrial manufacturing, container storage, combustible bunkering, thermal electricity generation plants, shipyards, etc Corozal East 43 hectares Clayton Pedro Miguel – Red Tank 90 hectareas Ciudad de Panamá Amador Howard 11

Pacific coast areas for potential logistical services investments Ideal locations for port development, industrial manufacturing, container storage, combustible bunkering, thermal electricity generation plants, shipyards, etc Corozal East 43 hectares Clayton Pedro Miguel – Red Tank 90 hectareas Ciudad de Panamá Amador Howard 11

Conclusions: Bright outlook for investing in Panama is a destination foreign investment with the strongest economic performance of emerging markets regionally Panama offers a positive outlook for future investment with many competitive advantages: • Strong economic growth and political stability. • Investment grade based on sound fiscal disciplinary measures. • Regional connectivity to open new long term business opportunities. • Major fiscal and immigration incentives designed for Multinational Companies. • Exciting new opportunites for private sector development of over 5, 000 hectares of reverted assets for logistical, manufacturing, R&D, touristic and residential housing projects. • The government is marketing reverted areas that would be ideal for the logistical development of ports, transport services and telecom, such as Telfers in the Atlantic and Corazal West in the Pacific • In addition, the areas of Sherman and Altos de Batel could become luxury tourist destinations. 12

Conclusions: Bright outlook for investing in Panama is a destination foreign investment with the strongest economic performance of emerging markets regionally Panama offers a positive outlook for future investment with many competitive advantages: • Strong economic growth and political stability. • Investment grade based on sound fiscal disciplinary measures. • Regional connectivity to open new long term business opportunities. • Major fiscal and immigration incentives designed for Multinational Companies. • Exciting new opportunites for private sector development of over 5, 000 hectares of reverted assets for logistical, manufacturing, R&D, touristic and residential housing projects. • The government is marketing reverted areas that would be ideal for the logistical development of ports, transport services and telecom, such as Telfers in the Atlantic and Corazal West in the Pacific • In addition, the areas of Sherman and Altos de Batel could become luxury tourist destinations. 12

Thank You Reverted Assets Management Unit Ministry of Economics and Finance www. mef. gob. pa/uabr

Thank You Reverted Assets Management Unit Ministry of Economics and Finance www. mef. gob. pa/uabr