f68dec461fe2817aa2c5f95ebb9ef274.ppt

- Количество слайдов: 29

PAN-AFRICAN PORT COOPERATION CONFERENCE DJIBOUTI 15 th - 18 th Dec 2008 PMAESA PORTS: CHALLENGES & OPPORTUNITIES Jerome Ntibarekerwa, Secretary General, PMAESA

Introduction Who we are? Port Management Association of Eastern & Southern Africa (PMAESA) is a regional grouping of ports in the eastern and southern Africa with membership composed of state representatives and private sector from: • Port Authorities • Maritime transport departments • Port Operators • Maritime regulators

PMAESA Member States

Introduction What we do Established in 1973 under the auspices of the UNECA with the following objectives among others: • Offer platform to exchange ideas and information where members can interface with one another in transport and trade facilitation • Assist port development by enhancing productivity and service delivery and trade facilitation; • Establish linking from ports to transport Corridors; • To assist our ports /maritime members to implement IMO conventions • Establish and maintain relations with other development partners and transport authorities for the study of matters beneficial to members

Ports are important • Ports in developing countries: – represent a key asset for economic development – serve landlocked countries – key components of regional trade corridors – play an important role as interface between sea and land transport systems • Inefficiencies impact trade competitiveness • Congestion at ports – an increasing problem – affects shipping schedules • contributes to further congestion • Constraints to capacity expansion: – Lack of scope to increase capacity – Weak inland transport links

Factors driving growth • External Factors: – Strong GDP expansion – Integration of regional economies with Asian suppliers – Political stability • Internal factors: – Privatization of ports sector - increased investment – Improved shipping links with Asia – Increased ship size and transshipment – Terminal productivity increases • Above factors are increasing pressure on port capacity

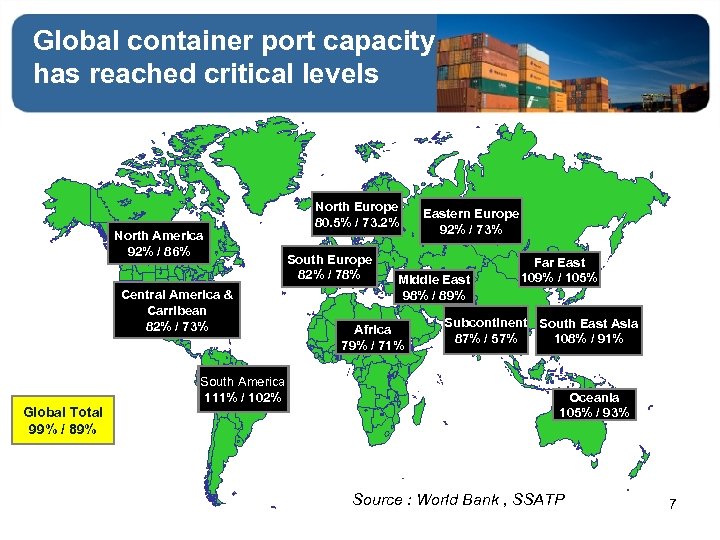

Global container port capacity has reached critical levels North America 92% / 86% Central America & Carribean 82% / 73% Global Total 99% / 89% South America 111% / 102% North Europe 80. 5% / 73. 2% South Europe 82% / 78% Eastern Europe 92% / 73% Middle East 98% / 89% Africa 79% / 71% Far East 109% / 105% Subcontinent South East Asia 87% / 57% 108% / 91% Oceania 105% / 93% Source : World Bank , SSATP 7

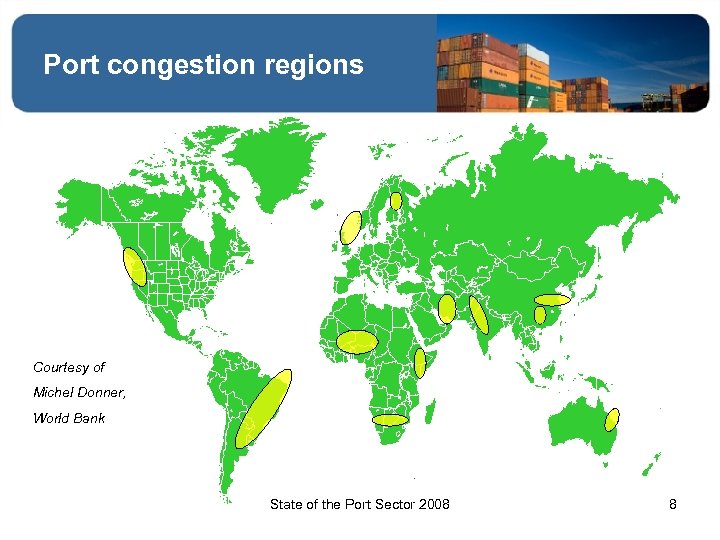

Port congestion regions Courtesy of Michel Donner, World Bank State of the Port Sector 2008 8

Measures to address port efficiency and productivity § § Acquiring more spaces for port activities Purchase of new equipment Using ICDs Developing IT systems and free port activities § Restructuring the management model § Improving safety, security and environment protection to meet international standards

OUR PORTS KEY CHALLENGES § Acquiring more spaces for port activities § Infrastructure development : Purchasing of new equipments § Using ICDs § Developing IT systems and free port activities § Restructuring the management model § Improving safety, security and environment protection to meet international standards

Challenges with Growing Demand Key ports in the Eastern and Southern Region: v Kenya Ports Authority v Tanzania Ports Authority v South Africa , Transet NPA v Djibouti port , DP World v Sudan port Cooperation v Mauritius Ports Authority v Seychelles Ports Authority

Challenges with Kenya Ports Authority – KPA § § The rapid increase of traffic is likely to continue The container Dwell time is yet to be reduced The hinterland rail connections remain inefficient More dependence on road mode of transport with 3 axle road rule constraint for hauliers § Long documentation procedures § Inadequate capacity to handle the forecasted cargo volumes.

Challenges with Kenya Ports Authority (Cont. . . ) § The exploration of Oil in Lamu District § The Regional Integration expectations : EAC/COMESA Customs Union expected positive results § The Transport Sector Reforms : Concession of RVR, Rehabilitation of major roads links to other countries

Challenges with Djibouti Ports • The throughput in TEU has grown by 31% in 2007 while the General Cargo grew by 44%; • The stripping operations by Freight Forwarders remain very slow; • The yard is occupied at 95%; • There is a high level of stacking ( up to 5 highs); • The number of full and empty containers is very high; • The port is facing many difficulties linked with Ethiopian bureaucracy as 85% of the total handled cargo is for Ethiopia ( Customs clearance taking more than 3 weeks, cargo financed by L/C).

Challenges with Tanzania Ports Authority- TPA- • The insufficient container storage space • The long container dwell time (has reached 25 days in Aug. 2008) • The rapid increase of container traffic and • The low performance of inland modes of transport especially the rail lines with very low availability of wagons and locomotives.

Challenges with Tanzania Ports Authority (Cont. ) § More investment to increase container terminals capacity and Inland Depot § Improve efficiency and productivity within the existing port infrastructure and equipment § Continue to involve private sector in port operations and concessioning which will improve port development

Challenges with Mauritius Ports Authority • The current port charges are high: there is need to assess adequacy of current charges to sustain Investments • The low level of connectivity of major shipping lines • The 15% corporate tax imposed on free port companies to be dropped at zero rate ( expected on 1 st July 2009) • Business environment yet to be friendly in regards with regulations, procedures …

Challenges in South Africa (TRANSNET NPA) Responding to the opportunities presented by : 1. Growth in global economic activity - increase inter/intra African trade – Link industrial and mining sector activity to markets – BRIC phenomena – Alternate logistic & hub – South S trade – Regional economic integration – Transport corridor development – Intermodal harmonisation to improve regional supply chain and reduce logistics costs Focus on Time, Cost & Skills

Challenges with Sea Port Corporation – Sudan § To cope with technological advances in maritime industries § To face the political and economical challenges internally and externally: Requirements of WTO, COMESA agenda § Exploration of Sudanese Oil, § To handle economic activities logistics after Peace Agreements in Sudan.

Comparative Review with key PMAESA Ports • In terms of : Ø Cargo handling performance Ø Container handling performance Ø Transit traffic Ø Transshipment traffic Ø Port regulation model Ø Other safety and security arrangements

Cargo handling performance (DWT “ 000”) 2002 2003 2004 2005 2006 AVG. GR OWTH RATE DJIBOUTI PAID 4, 409 5, 868 5, 594 5, 435 5, 489 6. 6% KENYA KPA 10, 564 11, 931 12, 921 13, 281 14, 402 8. 1% MAURITI US MPA 5, 552 5, 543 5, 816 5, 602 5, 686 0. 6% PORT REUNION 3, 195 3, 435 3, 891 3, 765 3, 947 5. 6% SOUTH AFRICA NPA 189, 155 171, 62 1 168, 751 173, 555 179, 984 -1. 1% SUDAN SPC 4, 388 5, 048 5, 575 7, 858 TANZANI A TPA 4, 724 5, 481 5, 416 6, 864 Port Authority 22. 1% 7, 291 7. 9%

Cargo handling • Ports in South Africa handle more cargo than other in the region • They are followed by Mombasa, DSM, Mauritius and Djibouti.

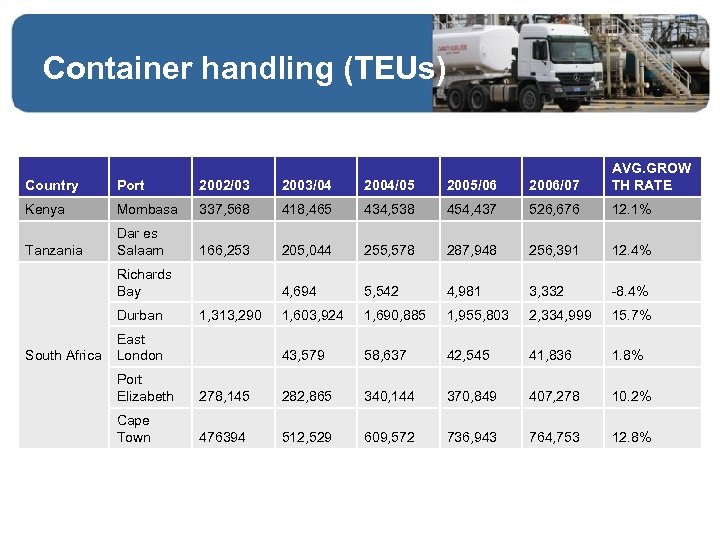

Container handling (TEUs) Country Port 2002/03 2003/04 2004/05 2005/06 2006/07 AVG. GROW TH RATE Kenya Mombasa 337, 568 418, 465 434, 538 454, 437 526, 676 12. 1% Tanzania Dar es Salaam 166, 253 205, 044 255, 578 287, 948 256, 391 12. 4% 4, 694 5, 542 4, 981 3, 332 -8. 4% 1, 603, 924 1, 690, 885 1, 955, 803 2, 334, 999 15. 7% 43, 579 58, 637 42, 545 41, 836 1. 8% Richards Bay Durban South Africa 1, 313, 290 East London Port Elizabeth 278, 145 282, 865 340, 144 370, 849 407, 278 10. 2% Cape Town 476394 512, 529 609, 572 736, 943 764, 753 12. 8%

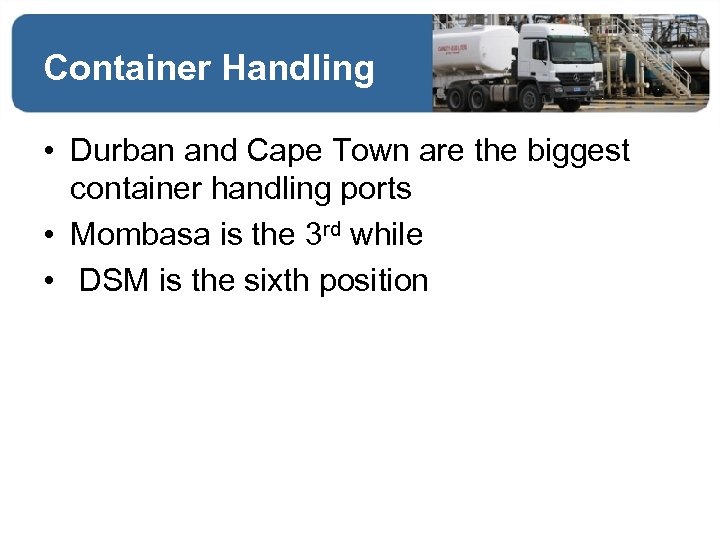

Container Handling • Durban and Cape Town are the biggest container handling ports • Mombasa is the 3 rd while • DSM is the sixth position

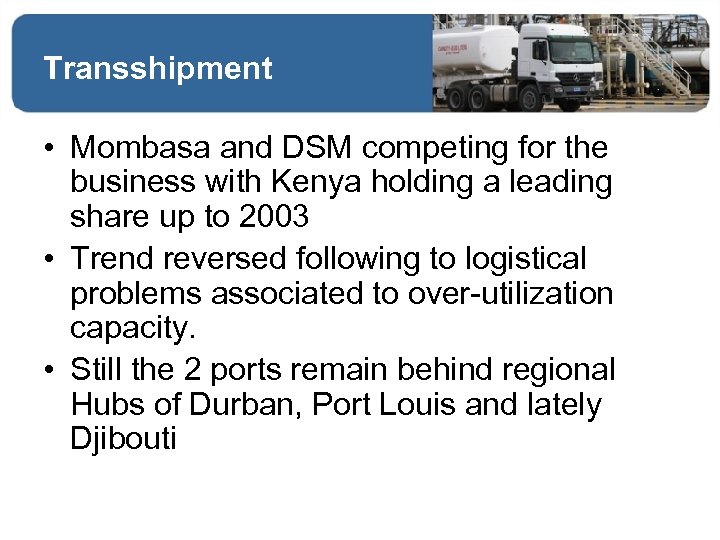

Transshipment • Mombasa and DSM competing for the business with Kenya holding a leading share up to 2003 • Trend reversed following to logistical problems associated to over-utilization capacity. • Still the 2 ports remain behind regional Hubs of Durban, Port Louis and lately Djibouti

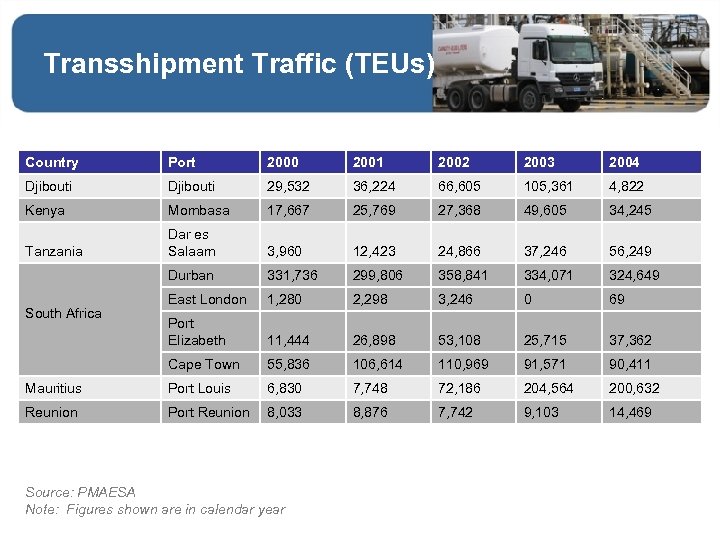

Transshipment Traffic (TEUs) Country Port 2000 2001 2002 2003 2004 Djibouti 29, 532 36, 224 66, 605 105, 361 4, 822 Kenya Mombasa 17, 667 25, 769 27, 368 49, 605 34, 245 Tanzania Dar es Salaam 3, 960 12, 423 24, 866 37, 246 56, 249 Durban 331, 736 299, 806 358, 841 334, 071 324, 649 East London 1, 280 2, 298 3, 246 0 69 Port Elizabeth 11, 444 26, 898 53, 108 25, 715 37, 362 Cape Town 55, 836 106, 614 110, 969 91, 571 90, 411 Mauritius Port Louis 6, 830 7, 748 72, 186 204, 564 200, 632 Reunion Port Reunion 8, 033 8, 876 7, 742 9, 103 14, 469 South Africa Source: PMAESA Note: Figures shown are in calendar year

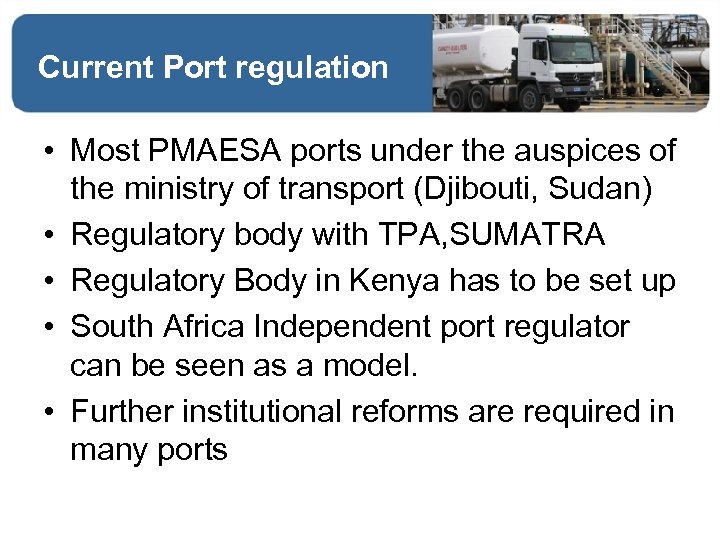

Current Port regulation • Most PMAESA ports under the auspices of the ministry of transport (Djibouti, Sudan) • Regulatory body with TPA, SUMATRA • Regulatory Body in Kenya has to be set up • South Africa Independent port regulator can be seen as a model. • Further institutional reforms are required in many ports

Safety and Security Arrangements • All PMAESA ports surveyed have achieved ISPS code approval • Closed Circuit Television( CCTV) • Container Scanning • Automated Port Access Are also reported

Thank you for your attention Do You Have Any Questions?

f68dec461fe2817aa2c5f95ebb9ef274.ppt