393ce0aa0d826286bc2042f93068d510.ppt

- Количество слайдов: 12

Pacifi. Corp and CAISO Expanding Regional Energy Partnerships Pat Reiten President and CEO, Pacifi. Corp Transmission May 19, 2015

Pacifi. Corp and CAISO Expanding Regional Energy Partnerships Pat Reiten President and CEO, Pacifi. Corp Transmission May 19, 2015

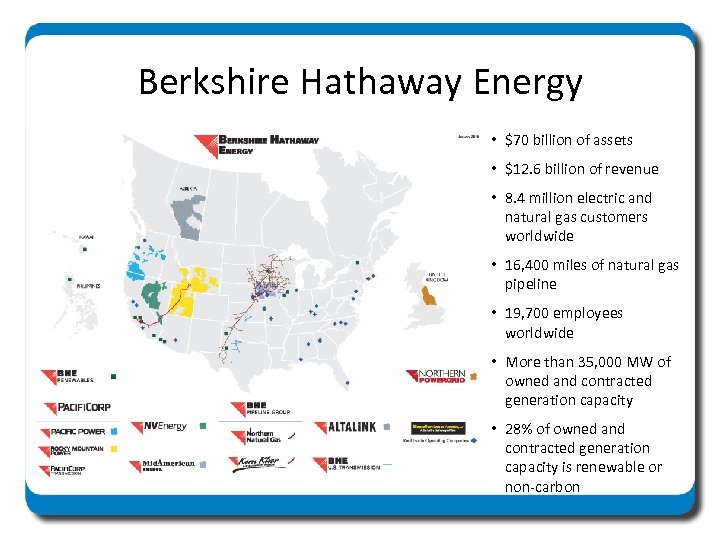

Berkshire Hathaway Energy • $70 billion of assets • $12. 6 billion of revenue • 8. 4 million electric and natural gas customers worldwide • 16, 400 miles of natural gas pipeline • 19, 700 employees worldwide • More than 35, 000 MW of owned and contracted generation capacity • 28% of owned and contracted generation capacity is renewable or non-carbon

Berkshire Hathaway Energy • $70 billion of assets • $12. 6 billion of revenue • 8. 4 million electric and natural gas customers worldwide • 16, 400 miles of natural gas pipeline • 19, 700 employees worldwide • More than 35, 000 MW of owned and contracted generation capacity • 28% of owned and contracted generation capacity is renewable or non-carbon

Pacifi. Corp/CAISO Announcement • April 2015 – Pacifi. Corp and the California Independent System Operator (ISO) announce agreement to explore Pacifi. Corp joining ISO as a Participating Transmission Owner • Study of feasibility and benefits of Pacifi. Corp joining ISO underway and will be complete this summer

Pacifi. Corp/CAISO Announcement • April 2015 – Pacifi. Corp and the California Independent System Operator (ISO) announce agreement to explore Pacifi. Corp joining ISO as a Participating Transmission Owner • Study of feasibility and benefits of Pacifi. Corp joining ISO underway and will be complete this summer

Pacifi. Corp and CAISO – At a Glance • Pacifi. Corp Serves: 1. 8 million customers in six Western states (OR, WA, CA, UT, ID and WY) Employees: 6, 000 Generation Capacity: 10, 595 MW Transmission: Over 16, 300 miles of transmission lines Over 62, 930 of distribution lines • California ISO Serves: 30+ million customers in California and a small portion of Nevada Employees: 580 Generation Capacity: 65, 000 MW Transmission: Controls more than 26, 000 miles of high-voltage transmission lines

Pacifi. Corp and CAISO – At a Glance • Pacifi. Corp Serves: 1. 8 million customers in six Western states (OR, WA, CA, UT, ID and WY) Employees: 6, 000 Generation Capacity: 10, 595 MW Transmission: Over 16, 300 miles of transmission lines Over 62, 930 of distribution lines • California ISO Serves: 30+ million customers in California and a small portion of Nevada Employees: 580 Generation Capacity: 65, 000 MW Transmission: Controls more than 26, 000 miles of high-voltage transmission lines

Pacifi. Corp/ISO Partnership Background • November 2014 – Pacifi. Corp and the ISO launch the Energy Imbalance Market to allow Pacifi. Corp participation in ISO’s 5 minute and 15 -minute markets – EIM generated more than $11 million in gross benefits during first five months of operation, consistent with pre-launch projections – NV Energy and Puget Sound Energy plan to start EIM participation in the fall of 2015 and 2016 – Greater participation will increase EIM benefits • April 2015 – Agreement to explore joining the ISO would extend Pacifi. Corp participation to day-ahead market and fully coordinated planning and operation of region’s two largest high-voltage transmission grids

Pacifi. Corp/ISO Partnership Background • November 2014 – Pacifi. Corp and the ISO launch the Energy Imbalance Market to allow Pacifi. Corp participation in ISO’s 5 minute and 15 -minute markets – EIM generated more than $11 million in gross benefits during first five months of operation, consistent with pre-launch projections – NV Energy and Puget Sound Energy plan to start EIM participation in the fall of 2015 and 2016 – Greater participation will increase EIM benefits • April 2015 – Agreement to explore joining the ISO would extend Pacifi. Corp participation to day-ahead market and fully coordinated planning and operation of region’s two largest high-voltage transmission grids

Need for Increased Coordination in West • Currently 38 separate BAAs in Western U. S. each responsible for balancing energy supply and demand at all times – Rely on own power plants or bilateral transactions – Outside of ISO, most transactions restricted to on-the-hour and initiated with manual processes • Results of “balkanized” grid – Imprecision and higher costs for balancing reserves – Frequent curtailment of renewable energy when supply > demand in an area at a given time – Transmission bottlenecks and issues connected to limited coordination across grids

Need for Increased Coordination in West • Currently 38 separate BAAs in Western U. S. each responsible for balancing energy supply and demand at all times – Rely on own power plants or bilateral transactions – Outside of ISO, most transactions restricted to on-the-hour and initiated with manual processes • Results of “balkanized” grid – Imprecision and higher costs for balancing reserves – Frequent curtailment of renewable energy when supply > demand in an area at a given time – Transmission bottlenecks and issues connected to limited coordination across grids

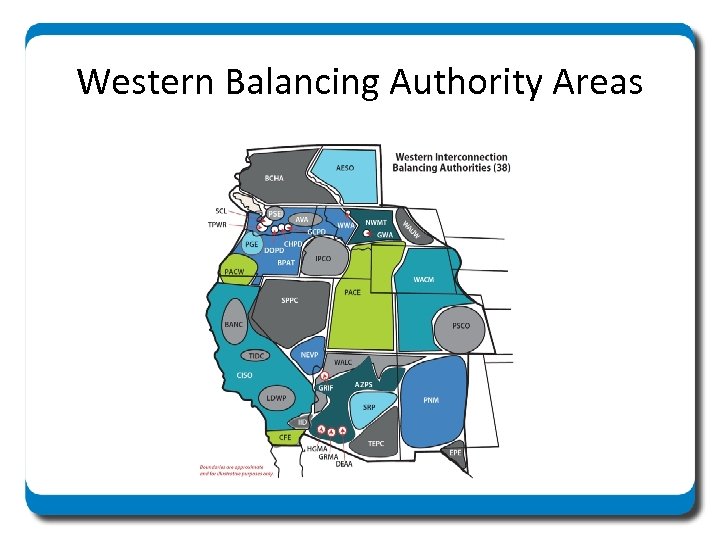

Western Balancing Authority Areas

Western Balancing Authority Areas

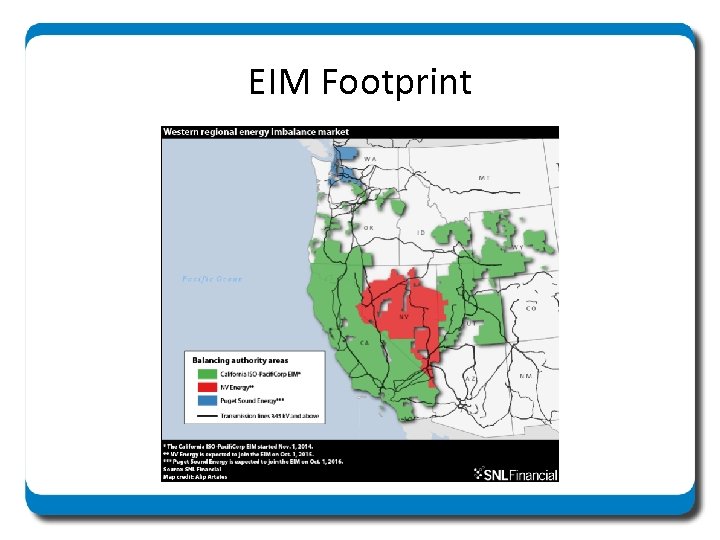

EIM Footprint

EIM Footprint

Benefits of Potential ISO Expansion • EIM provides automated dispatch of least-cost resource across entire EIM footprint to meet short-term balancing needs • ISO expansion could further – Reduce costs – more resources in day-ahead market; sharing of reserves; better use of transmission system – Lower cost emission reductions – fully coordinated planning of renewables in day-ahead market; excess solar in California can displace Pacifi. Corp coal and gas; excess wind and hydro in Pacifi. Corp system can serve load in California. – Enhance reliability – broader visibility and management of congestion across grids

Benefits of Potential ISO Expansion • EIM provides automated dispatch of least-cost resource across entire EIM footprint to meet short-term balancing needs • ISO expansion could further – Reduce costs – more resources in day-ahead market; sharing of reserves; better use of transmission system – Lower cost emission reductions – fully coordinated planning of renewables in day-ahead market; excess solar in California can displace Pacifi. Corp coal and gas; excess wind and hydro in Pacifi. Corp system can serve load in California. – Enhance reliability – broader visibility and management of congestion across grids

Benefits of Potential Expansion, cont. • Meeting clean energy requirements – Expanded access to renewables from across the West in day-ahead market will make California RPS compliance less costly – Replacing fossil fuel generation with renewables during oversupply situations will reduce emissions and make federal pollution control compliance less costly • EIM not impacted – Pacifi. Corp joining EIM does not impact benefits of EIM, or future EIM participants

Benefits of Potential Expansion, cont. • Meeting clean energy requirements – Expanded access to renewables from across the West in day-ahead market will make California RPS compliance less costly – Replacing fossil fuel generation with renewables during oversupply situations will reduce emissions and make federal pollution control compliance less costly • EIM not impacted – Pacifi. Corp joining EIM does not impact benefits of EIM, or future EIM participants

Next Steps Toward Full Market Integration • Benefits study underway • If decision is made to proceed – full stakeholder and regulatory review and input process • FERC and state regulatory filings • Engagement over governance of a regional organization

Next Steps Toward Full Market Integration • Benefits study underway • If decision is made to proceed – full stakeholder and regulatory review and input process • FERC and state regulatory filings • Engagement over governance of a regional organization

Questions?

Questions?