P R E S E N T A T I O N MBIA Insurance Corporation April 2005 MBIA’s results through 12/31/04 Capital Strength. Triple-A Performance.

P R E S E N T A T I O N MBIA Insurance Corporation April 2005 MBIA’s results through 12/31/04 Capital Strength. Triple-A Performance.

Foundation Principles · Build the strongest team · No-loss underwriting · Triple-A ratings · Build shareholder value -1 - Capital Strength. Triple-A Performance.

Foundation Principles · Build the strongest team · No-loss underwriting · Triple-A ratings · Build shareholder value -1 - Capital Strength. Triple-A Performance.

MBIA & The Financial Guarantee Product · MBIA is a “monoline” insurance company · Irrevocable & unconditional guarantee of scheduled debt service when due · The securities we guarantee are rated Triple-A by Standard & Poor's, Moody's and Fitch · We guarantee a wide range of debt obligations Benefits to Investors · Eliminates credit losses and downgrade risk; and significantly reduces “headline risk” · Greatly improves liquidity and price stability · Long-term “buy & hold” investor in credit risk · Active surveillance; interests aligned with investor’s · Diversification of portfolio -2 - Capital Strength. Triple-A Performance.

MBIA & The Financial Guarantee Product · MBIA is a “monoline” insurance company · Irrevocable & unconditional guarantee of scheduled debt service when due · The securities we guarantee are rated Triple-A by Standard & Poor's, Moody's and Fitch · We guarantee a wide range of debt obligations Benefits to Investors · Eliminates credit losses and downgrade risk; and significantly reduces “headline risk” · Greatly improves liquidity and price stability · Long-term “buy & hold” investor in credit risk · Active surveillance; interests aligned with investor’s · Diversification of portfolio -2 - Capital Strength. Triple-A Performance.

Rating Agency Rationale For Triple-A Financial Strength Rating · Conservative credit standards · Strong capitalization levels · Diversified insured portfolio · High quality investments · Stable profitability · Highly experienced management -3 - Capital Strength. Triple-A Performance.

Rating Agency Rationale For Triple-A Financial Strength Rating · Conservative credit standards · Strong capitalization levels · Diversified insured portfolio · High quality investments · Stable profitability · Highly experienced management -3 - Capital Strength. Triple-A Performance.

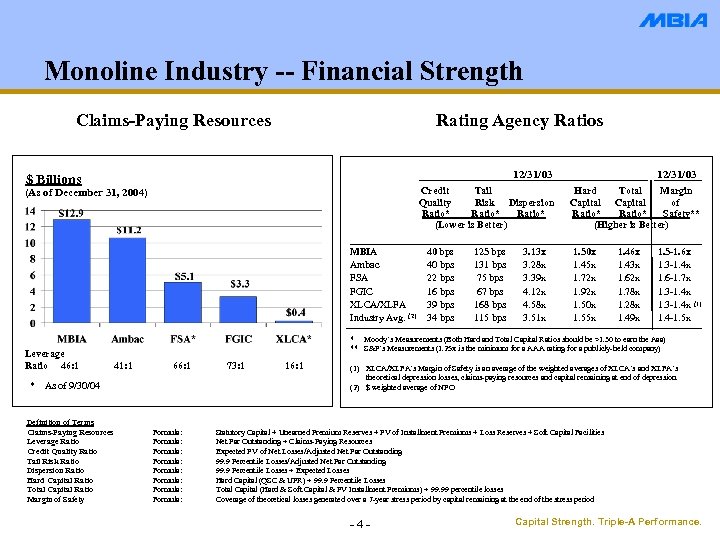

Monoline Industry -- Financial Strength Claims-Paying Resources Rating Agency Ratios 12/31/03 $ Billions Credit Tail Quality Risk Dispersion Ratio* (Lower is Better) (As of December 31, 2004) MBIA Ambac FSA FGIC XLCA/XLFA Industry Avg. (2) Leverage Ratio 46: 1 * 125 bps 131 bps 75 bps 67 bps 168 bps 115 bps 3. 13 x 3. 28 x 3. 39 x 4. 12 x 4. 58 x 3. 51 x Hard Total Margin Capital of Ratio* Safety** (Higher is Better) 1. 50 x 1. 45 x 1. 72 x 1. 92 x 1. 50 x 1. 55 x 1. 46 x 1. 43 x 1. 62 x 1. 78 x 1. 28 x 1. 49 x 1. 5 -1. 6 x 1. 3 -1. 4 x 1. 6 -1. 7 x 1. 3 -1. 4 x 1. 4 -1. 5 x (1) * Moody’s Measurements (Both Hard and Total Capital Ratios should be >1. 30 to earn the Aaa) ** S&P’s Measurements (1. 25 x is the minimum for a AAA rating for a publicly-held company) 41: 1 66: 1 As of 9/30/04 Definition of Terms Claims-Paying Resources Leverage Ratio Credit Quality Ratio Tail Risk Ratio Dispersion Ratio Hard Capital Ratio Total Capital Ratio Margin of Safety 40 bps 22 bps 16 bps 39 bps 34 bps 12/31/03 Formula: Formula: 73: 1 16: 1 (1) XLCA/XLFA’s Margin of Safety is an average of the weighted averages of XLCA’s and XLFA’s theoretical depression losses, claims-paying resources and capital remaining at end of depression. (2) $ weighted average of NPO Statutory Capital + Unearned Premium Reserves + PV of Installment Premiums + Loss Reserves + Soft Capital Facilities Net Par Outstanding ÷ Claims-Paying Resources Expected PV of Net Losses/Adjusted Net Par Outstanding 99. 9 Percentile Losses ÷ Expected Losses Hard Capital (QSC & UPR) ÷ 99. 9 Percentile Losses Total Capital (Hard & Soft Capital & PV Installment Premiums) ÷ 99. 99 percentile losses Coverage of theoretical losses generated over a 7 -year stress period by capital remaining at the end of the stress period -4 - Capital Strength. Triple-A Performance.

Monoline Industry -- Financial Strength Claims-Paying Resources Rating Agency Ratios 12/31/03 $ Billions Credit Tail Quality Risk Dispersion Ratio* (Lower is Better) (As of December 31, 2004) MBIA Ambac FSA FGIC XLCA/XLFA Industry Avg. (2) Leverage Ratio 46: 1 * 125 bps 131 bps 75 bps 67 bps 168 bps 115 bps 3. 13 x 3. 28 x 3. 39 x 4. 12 x 4. 58 x 3. 51 x Hard Total Margin Capital of Ratio* Safety** (Higher is Better) 1. 50 x 1. 45 x 1. 72 x 1. 92 x 1. 50 x 1. 55 x 1. 46 x 1. 43 x 1. 62 x 1. 78 x 1. 28 x 1. 49 x 1. 5 -1. 6 x 1. 3 -1. 4 x 1. 6 -1. 7 x 1. 3 -1. 4 x 1. 4 -1. 5 x (1) * Moody’s Measurements (Both Hard and Total Capital Ratios should be >1. 30 to earn the Aaa) ** S&P’s Measurements (1. 25 x is the minimum for a AAA rating for a publicly-held company) 41: 1 66: 1 As of 9/30/04 Definition of Terms Claims-Paying Resources Leverage Ratio Credit Quality Ratio Tail Risk Ratio Dispersion Ratio Hard Capital Ratio Total Capital Ratio Margin of Safety 40 bps 22 bps 16 bps 39 bps 34 bps 12/31/03 Formula: Formula: 73: 1 16: 1 (1) XLCA/XLFA’s Margin of Safety is an average of the weighted averages of XLCA’s and XLFA’s theoretical depression losses, claims-paying resources and capital remaining at end of depression. (2) $ weighted average of NPO Statutory Capital + Unearned Premium Reserves + PV of Installment Premiums + Loss Reserves + Soft Capital Facilities Net Par Outstanding ÷ Claims-Paying Resources Expected PV of Net Losses/Adjusted Net Par Outstanding 99. 9 Percentile Losses ÷ Expected Losses Hard Capital (QSC & UPR) ÷ 99. 9 Percentile Losses Total Capital (Hard & Soft Capital & PV Installment Premiums) ÷ 99. 99 percentile losses Coverage of theoretical losses generated over a 7 -year stress period by capital remaining at the end of the stress period -4 - Capital Strength. Triple-A Performance.

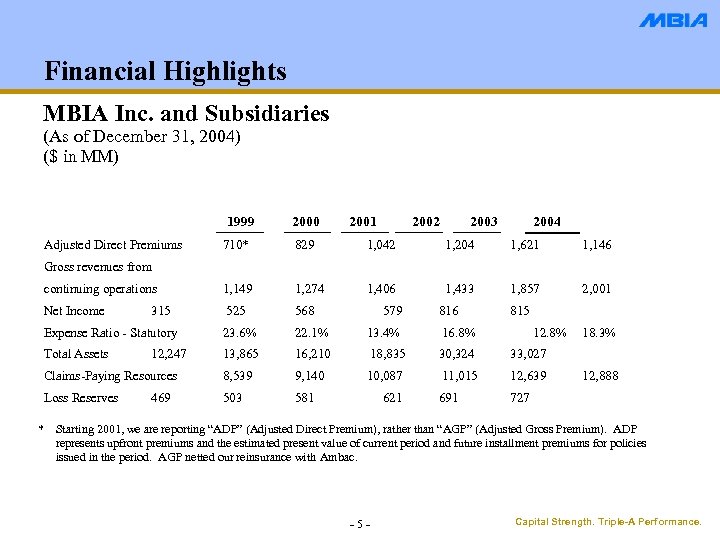

Financial Highlights MBIA Inc. and Subsidiaries (As of December 31, 2004) ($ in MM) 1999 Adjusted Direct Premiums 2000 2001 2002 2003 2004 710* 829 1, 042 1, 204 1, 621 1, 146 continuing operations 1, 149 1, 274 1, 406 1, 433 1, 857 2, 001 Net Income 525 568 Expense Ratio - Statutory 23. 6% 22. 1% 13. 4% 16. 8% Total Assets 13, 865 16, 210 18, 835 30, 324 33, 027 Claims-Paying Resources 8, 539 9, 140 10, 087 11, 015 12, 639 Loss Reserves 503 581 691 727 Gross revenues from * 315 12, 247 469 579 621 816 815 12. 8% 18. 3% 12, 888 Starting 2001, we are reporting “ADP” (Adjusted Direct Premium), rather than “AGP” (Adjusted Gross Premium). ADP represents upfront premiums and the estimated present value of current period and future installment premiums for policies issued in the period. AGP netted our reinsurance with Ambac. -5 - Capital Strength. Triple-A Performance.

Financial Highlights MBIA Inc. and Subsidiaries (As of December 31, 2004) ($ in MM) 1999 Adjusted Direct Premiums 2000 2001 2002 2003 2004 710* 829 1, 042 1, 204 1, 621 1, 146 continuing operations 1, 149 1, 274 1, 406 1, 433 1, 857 2, 001 Net Income 525 568 Expense Ratio - Statutory 23. 6% 22. 1% 13. 4% 16. 8% Total Assets 13, 865 16, 210 18, 835 30, 324 33, 027 Claims-Paying Resources 8, 539 9, 140 10, 087 11, 015 12, 639 Loss Reserves 503 581 691 727 Gross revenues from * 315 12, 247 469 579 621 816 815 12. 8% 18. 3% 12, 888 Starting 2001, we are reporting “ADP” (Adjusted Direct Premium), rather than “AGP” (Adjusted Gross Premium). ADP represents upfront premiums and the estimated present value of current period and future installment premiums for policies issued in the period. AGP netted our reinsurance with Ambac. -5 - Capital Strength. Triple-A Performance.

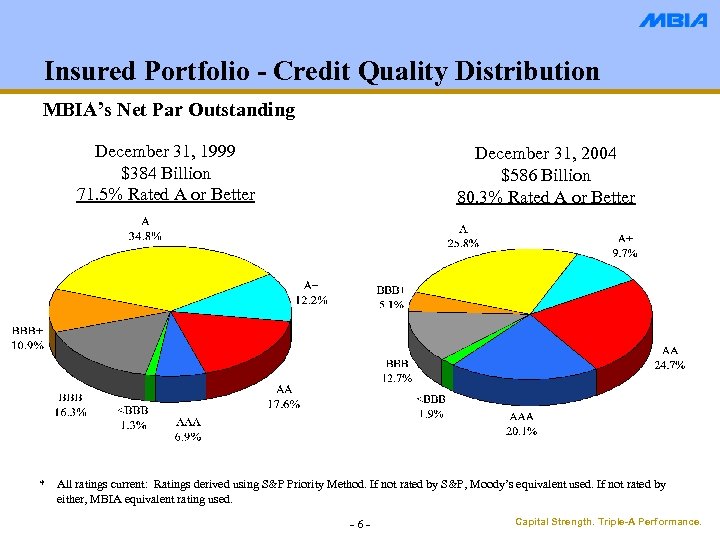

Insured Portfolio - Credit Quality Distribution MBIA’s Net Par Outstanding December 31, 1999 $384 Billion 71. 5% Rated A or Better * December 31, 2004 $586 Billion 80. 3% Rated A or Better All ratings current: Ratings derived using S&P Priority Method. If not rated by S&P, Moody’s equivalent used. If not rated by either, MBIA equivalent rating used. -6 - Capital Strength. Triple-A Performance.

Insured Portfolio - Credit Quality Distribution MBIA’s Net Par Outstanding December 31, 1999 $384 Billion 71. 5% Rated A or Better * December 31, 2004 $586 Billion 80. 3% Rated A or Better All ratings current: Ratings derived using S&P Priority Method. If not rated by S&P, Moody’s equivalent used. If not rated by either, MBIA equivalent rating used. -6 - Capital Strength. Triple-A Performance.

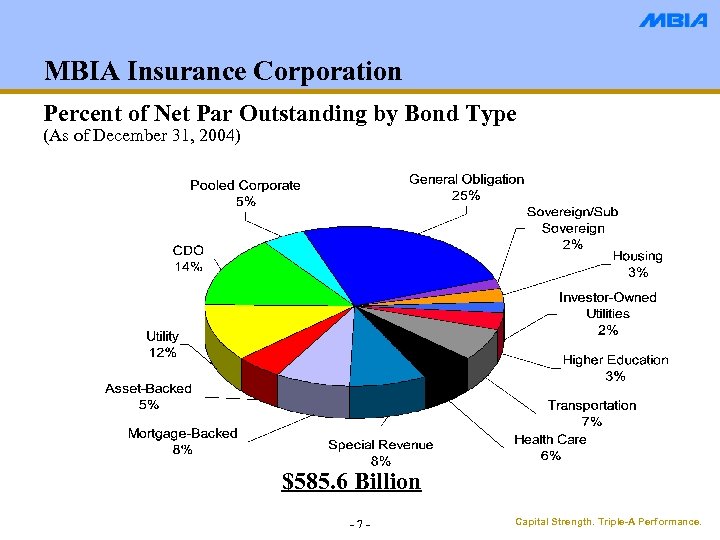

MBIA Insurance Corporation Percent of Net Par Outstanding by Bond Type (As of December 31, 2004) $585. 6 Billion -7 - Capital Strength. Triple-A Performance.

MBIA Insurance Corporation Percent of Net Par Outstanding by Bond Type (As of December 31, 2004) $585. 6 Billion -7 - Capital Strength. Triple-A Performance.

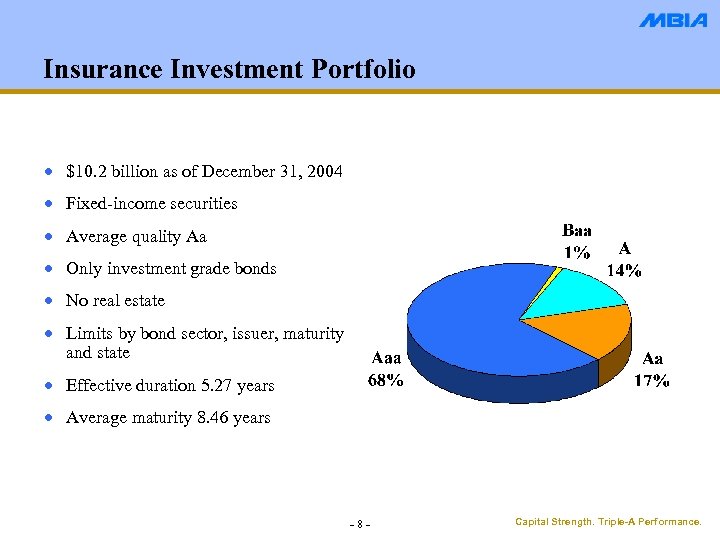

Insurance Investment Portfolio · $10. 2 billion as of December 31, 2004 · Fixed-income securities · Average quality Aa · Only investment grade bonds · No real estate · Limits by bond sector, issuer, maturity and state · Effective duration 5. 27 years · Average maturity 8. 46 years -8 - Capital Strength. Triple-A Performance.

Insurance Investment Portfolio · $10. 2 billion as of December 31, 2004 · Fixed-income securities · Average quality Aa · Only investment grade bonds · No real estate · Limits by bond sector, issuer, maturity and state · Effective duration 5. 27 years · Average maturity 8. 46 years -8 - Capital Strength. Triple-A Performance.

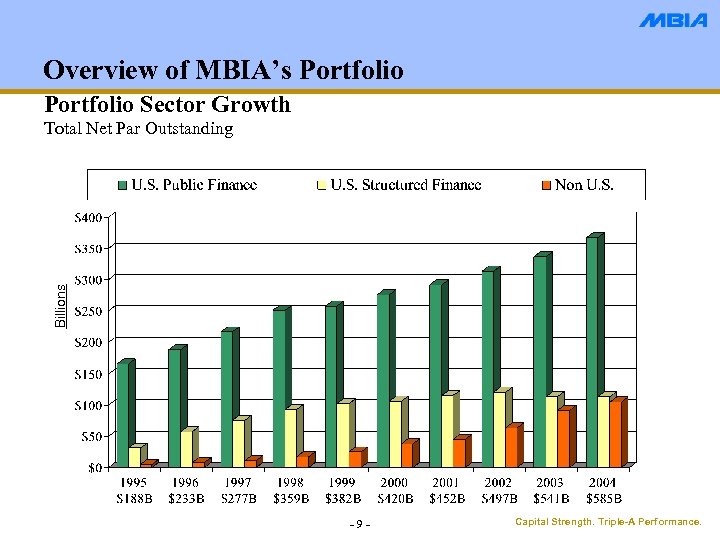

Overview of MBIA’s Portfolio Sector Growth Billions Total Net Par Outstanding -9 - Capital Strength. Triple-A Performance.

Overview of MBIA’s Portfolio Sector Growth Billions Total Net Par Outstanding -9 - Capital Strength. Triple-A Performance.

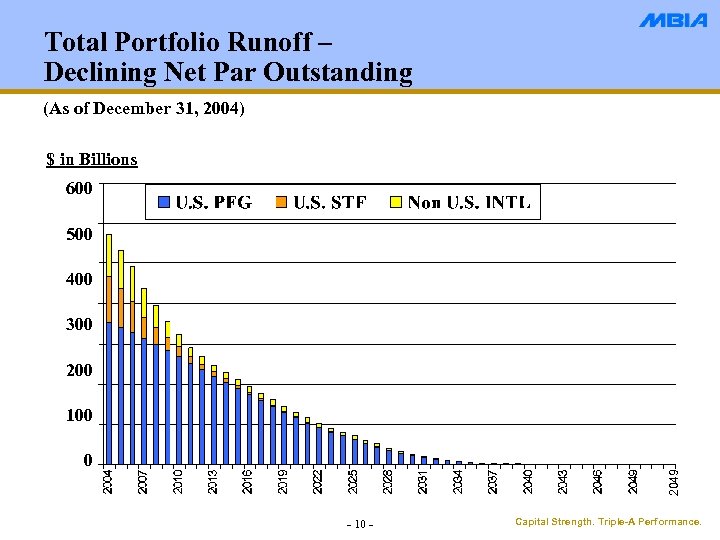

Total Portfolio Runoff – Declining Net Par Outstanding (As of December 31, 2004) $ in Billions 600 500 400 300 200 100 2049 0 - 10 - Capital Strength. Triple-A Performance.

Total Portfolio Runoff – Declining Net Par Outstanding (As of December 31, 2004) $ in Billions 600 500 400 300 200 100 2049 0 - 10 - Capital Strength. Triple-A Performance.

Risk Management Key Characteristics · State of the art analytic and modeling tools · Coordinate human capital · Rigorous approval process · Ongoing refinement via feedback mechanisms · Two levels of underwriting committees - Underwriting Committee - Executive Risk Committee - 11 - Capital Strength. Triple-A Performance.

Risk Management Key Characteristics · State of the art analytic and modeling tools · Coordinate human capital · Rigorous approval process · Ongoing refinement via feedback mechanisms · Two levels of underwriting committees - Underwriting Committee - Executive Risk Committee - 11 - Capital Strength. Triple-A Performance.

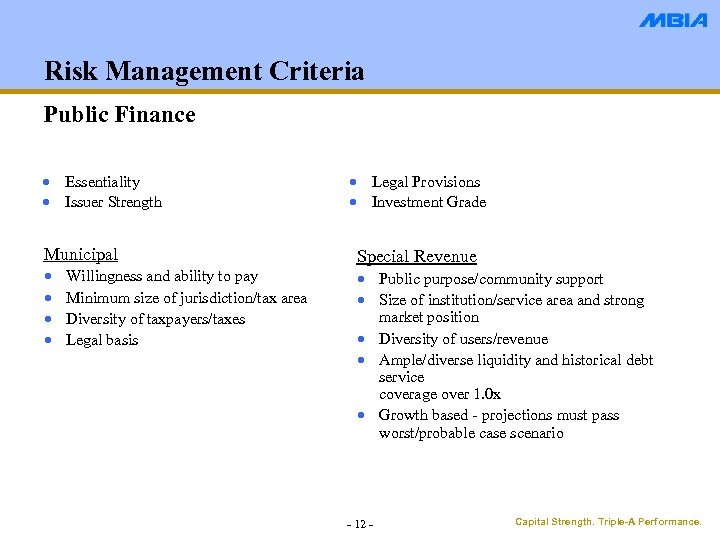

Risk Management Criteria Public Finance · Essentiality · Issuer Strength Municipal · · Willingness and ability to pay Minimum size of jurisdiction/tax area Diversity of taxpayers/taxes Legal basis · Legal Provisions · Investment Grade Special Revenue · Public purpose/community support · Size of institution/service area and strong market position · Diversity of users/revenue · Ample/diverse liquidity and historical debt service coverage over 1. 0 x · Growth based - projections must pass worst/probable case scenario - 12 - Capital Strength. Triple-A Performance.

Risk Management Criteria Public Finance · Essentiality · Issuer Strength Municipal · · Willingness and ability to pay Minimum size of jurisdiction/tax area Diversity of taxpayers/taxes Legal basis · Legal Provisions · Investment Grade Special Revenue · Public purpose/community support · Size of institution/service area and strong market position · Diversity of users/revenue · Ample/diverse liquidity and historical debt service coverage over 1. 0 x · Growth based - projections must pass worst/probable case scenario - 12 - Capital Strength. Triple-A Performance.

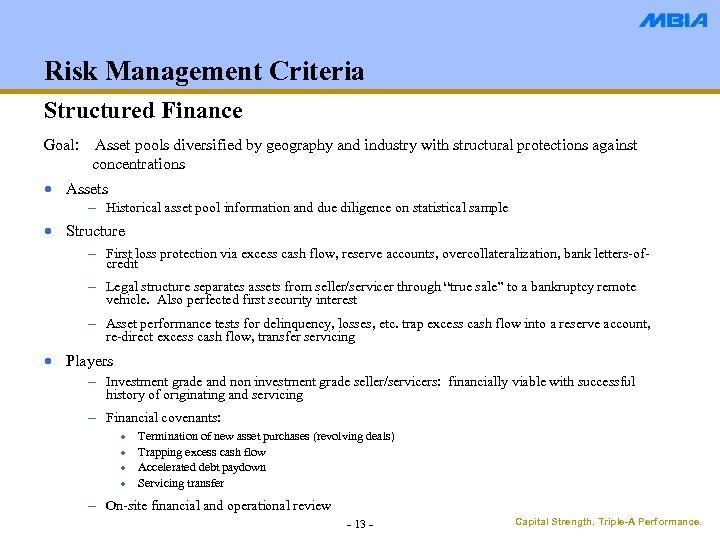

Risk Management Criteria Structured Finance Goal: Asset pools diversified by geography and industry with structural protections against concentrations · Assets - Historical asset pool information and due diligence on statistical sample · Structure - First loss protection via excess cash flow, reserve accounts, overcollateralization, bank letters-ofcredit - Legal structure separates assets from seller/servicer through “true sale” to a bankruptcy remote vehicle. Also perfected first security interest - Asset performance tests for delinquency, losses, etc. trap excess cash flow into a reserve account, re-direct excess cash flow, transfer servicing · Players - Investment grade and non investment grade seller/servicers: financially viable with successful history of originating and servicing - Financial covenants: · · Termination of new asset purchases (revolving deals) Trapping excess cash flow Accelerated debt paydown Servicing transfer - On-site financial and operational review - 13 - Capital Strength. Triple-A Performance.

Risk Management Criteria Structured Finance Goal: Asset pools diversified by geography and industry with structural protections against concentrations · Assets - Historical asset pool information and due diligence on statistical sample · Structure - First loss protection via excess cash flow, reserve accounts, overcollateralization, bank letters-ofcredit - Legal structure separates assets from seller/servicer through “true sale” to a bankruptcy remote vehicle. Also perfected first security interest - Asset performance tests for delinquency, losses, etc. trap excess cash flow into a reserve account, re-direct excess cash flow, transfer servicing · Players - Investment grade and non investment grade seller/servicers: financially viable with successful history of originating and servicing - Financial covenants: · · Termination of new asset purchases (revolving deals) Trapping excess cash flow Accelerated debt paydown Servicing transfer - On-site financial and operational review - 13 - Capital Strength. Triple-A Performance.

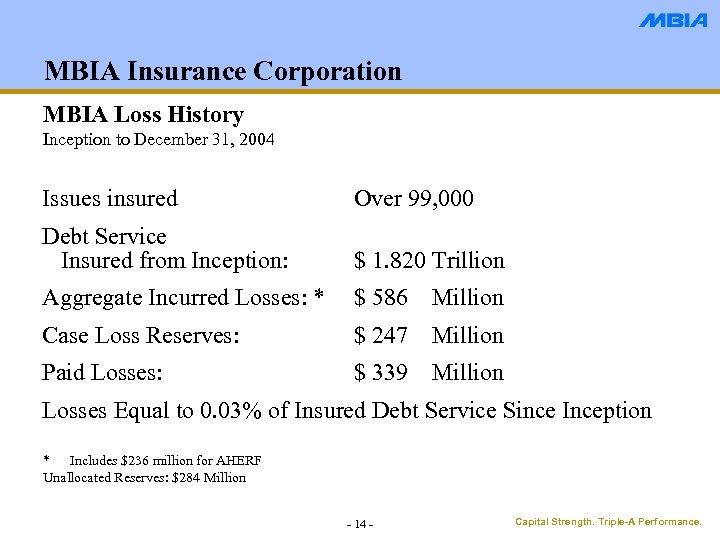

MBIA Insurance Corporation MBIA Loss History Inception to December 31, 2004 Issues insured Over 99, 000 Debt Service Insured from Inception: $ 1. 820 Trillion Aggregate Incurred Losses: * $ 586 Million Case Loss Reserves: $ 247 Million Paid Losses: $ 339 Million Losses Equal to 0. 03% of Insured Debt Service Since Inception * Includes $236 million for AHERF Unallocated Reserves: $284 Million - 14 - Capital Strength. Triple-A Performance.

MBIA Insurance Corporation MBIA Loss History Inception to December 31, 2004 Issues insured Over 99, 000 Debt Service Insured from Inception: $ 1. 820 Trillion Aggregate Incurred Losses: * $ 586 Million Case Loss Reserves: $ 247 Million Paid Losses: $ 339 Million Losses Equal to 0. 03% of Insured Debt Service Since Inception * Includes $236 million for AHERF Unallocated Reserves: $284 Million - 14 - Capital Strength. Triple-A Performance.

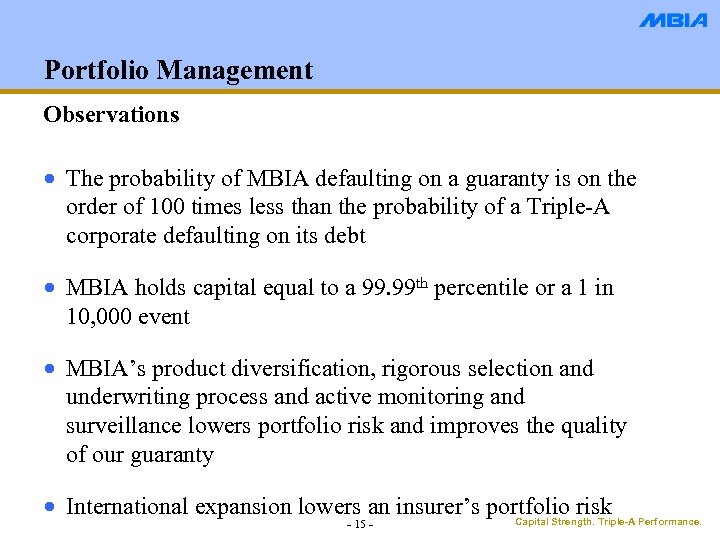

Portfolio Management Observations · The probability of MBIA defaulting on a guaranty is on the order of 100 times less than the probability of a Triple-A corporate defaulting on its debt · MBIA holds capital equal to a 99. 99 th percentile or a 1 in 10, 000 event · MBIA’s product diversification, rigorous selection and underwriting process and active monitoring and surveillance lowers portfolio risk and improves the quality of our guaranty · International expansion lowers an insurer’s portfolio risk Performance. Capital Strength. Triple-A - 15 -

Portfolio Management Observations · The probability of MBIA defaulting on a guaranty is on the order of 100 times less than the probability of a Triple-A corporate defaulting on its debt · MBIA holds capital equal to a 99. 99 th percentile or a 1 in 10, 000 event · MBIA’s product diversification, rigorous selection and underwriting process and active monitoring and surveillance lowers portfolio risk and improves the quality of our guaranty · International expansion lowers an insurer’s portfolio risk Performance. Capital Strength. Triple-A - 15 -

International Overview and MBIA Profile (as of June 30, 2004) · Substantial growth potential - 20%+ CAGR · Globalization and convergence of capital markets · Privatization · Decentralization · International offices - London, Paris, Madrid, Milan, Sydney, Tokyo and Singapore. · Depth of analytical talent in Armonk supports our global effort - Product specialists in Armonk work jointly with analysts located in overseas offices. - Same underwriting process and committees as in U. S. · International Net Par Outstanding represents 18% of the 12/31/04 book. International ADP YTD 2004 represents 35% of the company’s total. - 16 - Capital Strength. Triple-A Performance.

International Overview and MBIA Profile (as of June 30, 2004) · Substantial growth potential - 20%+ CAGR · Globalization and convergence of capital markets · Privatization · Decentralization · International offices - London, Paris, Madrid, Milan, Sydney, Tokyo and Singapore. · Depth of analytical talent in Armonk supports our global effort - Product specialists in Armonk work jointly with analysts located in overseas offices. - Same underwriting process and committees as in U. S. · International Net Par Outstanding represents 18% of the 12/31/04 book. International ADP YTD 2004 represents 35% of the company’s total. - 16 - Capital Strength. Triple-A Performance.

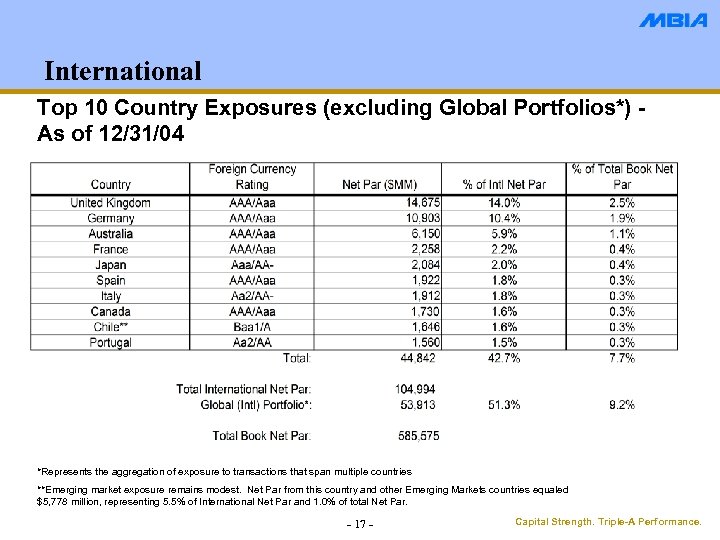

International Top 10 Country Exposures (excluding Global Portfolios*) As of 12/31/04 *Represents the aggregation of exposure to transactions that span multiple countries **Emerging market exposure remains modest. Net Par from this country and other Emerging Markets countries equaled $5, 778 million, representing 5. 5% of International Net Par and 1. 0% of total Net Par. - 17 - Capital Strength. Triple-A Performance.

International Top 10 Country Exposures (excluding Global Portfolios*) As of 12/31/04 *Represents the aggregation of exposure to transactions that span multiple countries **Emerging market exposure remains modest. Net Par from this country and other Emerging Markets countries equaled $5, 778 million, representing 5. 5% of International Net Par and 1. 0% of total Net Par. - 17 - Capital Strength. Triple-A Performance.

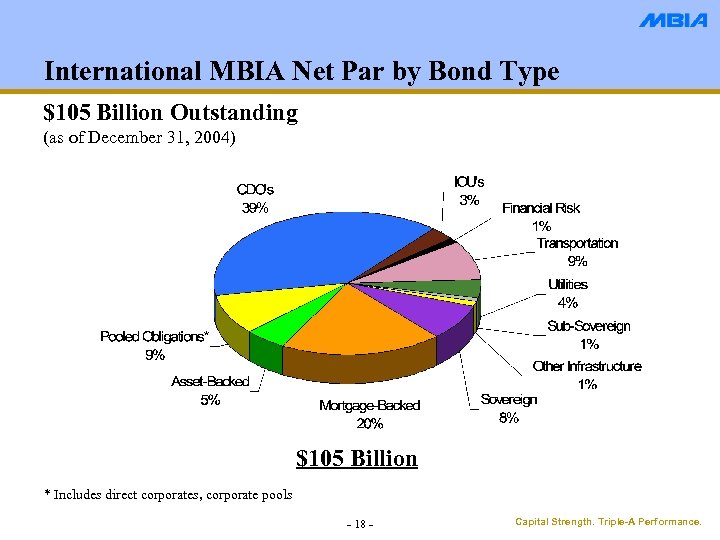

International MBIA Net Par by Bond Type $105 Billion Outstanding (as of December 31, 2004) $105 Billion * Includes direct corporates, corporate pools - 18 - Capital Strength. Triple-A Performance.

International MBIA Net Par by Bond Type $105 Billion Outstanding (as of December 31, 2004) $105 Billion * Includes direct corporates, corporate pools - 18 - Capital Strength. Triple-A Performance.

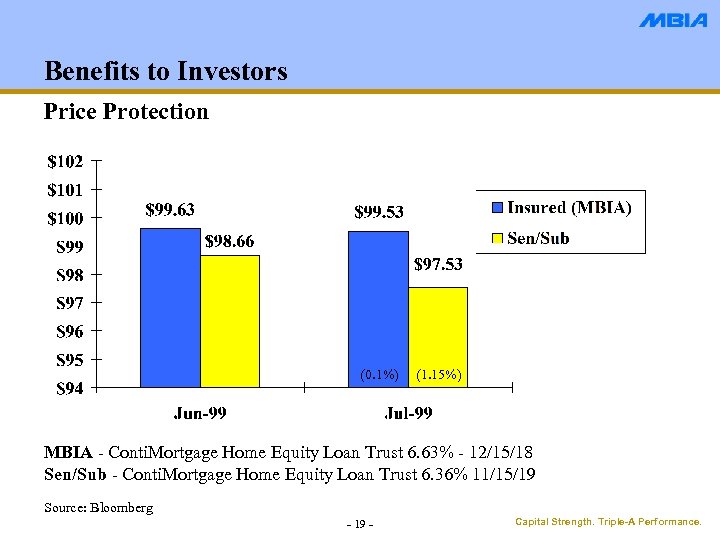

Benefits to Investors Price Protection (0. 1%) (1. 15%) MBIA - Conti. Mortgage Home Equity Loan Trust 6. 63% - 12/15/18 Sen/Sub - Conti. Mortgage Home Equity Loan Trust 6. 36% 11/15/19 Source: Bloomberg - 19 - Capital Strength. Triple-A Performance.

Benefits to Investors Price Protection (0. 1%) (1. 15%) MBIA - Conti. Mortgage Home Equity Loan Trust 6. 63% - 12/15/18 Sen/Sub - Conti. Mortgage Home Equity Loan Trust 6. 36% 11/15/19 Source: Bloomberg - 19 - Capital Strength. Triple-A Performance.

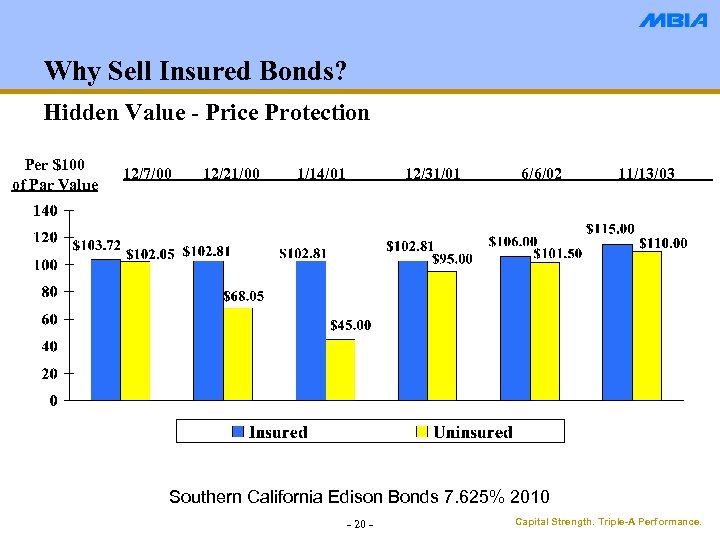

Why Sell Insured Bonds? Hidden Value - Price Protection Per $100 of Par Value 12/7/00 12/21/00 1/14/01 12/31/01 6/6/02 11/13/03 Southern California Edison Bonds 7. 625% 2010 - 20 - Capital Strength. Triple-A Performance.

Why Sell Insured Bonds? Hidden Value - Price Protection Per $100 of Par Value 12/7/00 12/21/00 1/14/01 12/31/01 6/6/02 11/13/03 Southern California Edison Bonds 7. 625% 2010 - 20 - Capital Strength. Triple-A Performance.

Exposure to MBIA How to Measure Exposure to MBIA · Joint Default Probability Approach: use joint default probabilities to “gross-up” standard limit · Tenor Approach: vary exposure by tenor of underlying transaction · Risk Based Capital Charge Approach: calculate the amount of incremental risk covered by MBIA as demonstrated by the S&P capital charge · BIS Risk Weighted Approach: Use the BIS guidelines to calculate the amount of exposure in a deal which is attributable to MBIA - 21 - Capital Strength. Triple-A Performance.

Exposure to MBIA How to Measure Exposure to MBIA · Joint Default Probability Approach: use joint default probabilities to “gross-up” standard limit · Tenor Approach: vary exposure by tenor of underlying transaction · Risk Based Capital Charge Approach: calculate the amount of incremental risk covered by MBIA as demonstrated by the S&P capital charge · BIS Risk Weighted Approach: Use the BIS guidelines to calculate the amount of exposure in a deal which is attributable to MBIA - 21 - Capital Strength. Triple-A Performance.

Benefits to Investors Joint Default Probability Approach · Default probability of MBIA wrapped assets far lower than default probability of unwrapped, Triple-A rated assets: - Default probability of Aaa rated corporate -- 0. 79%* - Default probability of A 2 rated ABS (1/3)/munis(2/3) -- 0. 95%** - Default probability of A 2 rated corporates/munis wrapped by MBIA -. 0079 X. 0095 =. 000075*** · Conclusion: The joint default probability of an average MBIA-wrapped security is less than 1% of an unwrapped Triple-A corporate (. 000075/. 0079 =. 00949). · In terms of default probability, $10 million of exposure to unwrapped, Triple-A rated corporates is equivalent credit risk to $1. 05 billion of exposure to MBIA wrapped obligations Source: Moody’s Feb 2002 Corporate Bond Default Study (10 year average cumulative default rates by ratings over 1970 -2000 period) & Moody’s Portfolio Risk Model for Financial Guarantors, July 2000. * This does not take into account that MBIA is less likely to default than a Triple-A rated corporate. ** Assumes that ABS defaults at the same rate as corporates, which is not true; ABS default less frequently. *** Does not take into account correlation risk. - 22 - Capital Strength. Triple-A Performance.

Benefits to Investors Joint Default Probability Approach · Default probability of MBIA wrapped assets far lower than default probability of unwrapped, Triple-A rated assets: - Default probability of Aaa rated corporate -- 0. 79%* - Default probability of A 2 rated ABS (1/3)/munis(2/3) -- 0. 95%** - Default probability of A 2 rated corporates/munis wrapped by MBIA -. 0079 X. 0095 =. 000075*** · Conclusion: The joint default probability of an average MBIA-wrapped security is less than 1% of an unwrapped Triple-A corporate (. 000075/. 0079 =. 00949). · In terms of default probability, $10 million of exposure to unwrapped, Triple-A rated corporates is equivalent credit risk to $1. 05 billion of exposure to MBIA wrapped obligations Source: Moody’s Feb 2002 Corporate Bond Default Study (10 year average cumulative default rates by ratings over 1970 -2000 period) & Moody’s Portfolio Risk Model for Financial Guarantors, July 2000. * This does not take into account that MBIA is less likely to default than a Triple-A rated corporate. ** Assumes that ABS defaults at the same rate as corporates, which is not true; ABS default less frequently. *** Does not take into account correlation risk. - 22 - Capital Strength. Triple-A Performance.

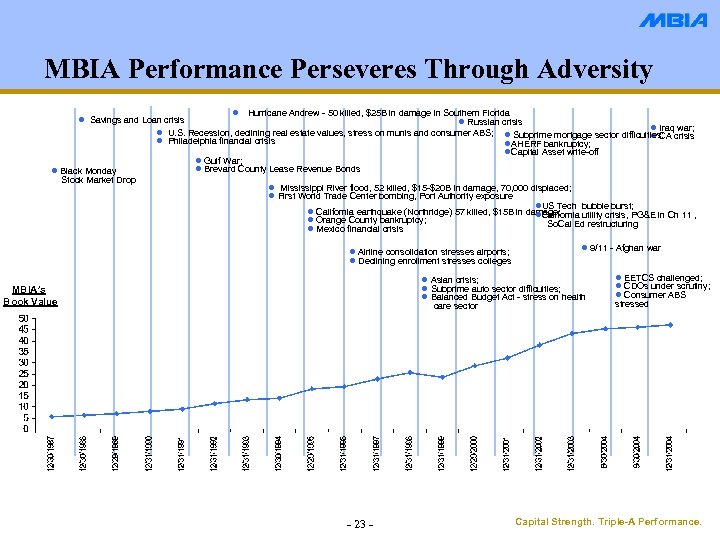

MBIA Performance Perseveres Through Adversity l Hurricane Andrew - 50 killed, $25 B in damage in Southern Florida l Savings and Loan crisis l Russian crisis l Iraq war; l U. S. Recession, declining real estate values, stress on munis and consumer ABS; l Subprime mortgage sector difficulties; crisis l CA l Philadelphia financial crisis l. AHERF bankruptcy; l. Capital Asset write-off l Gulf War; l Brevard County Lease Revenue Bonds l Black Monday Stock Market Drop l Mississippi River flood, 52 killed, $15 -$20 B in damage, 70, 000 displaced; l First World Trade Center bombing, Port Authority exposure l. US Tech bubble burst; l California earthquake (Northridge) 57 killed, $15 B in damage; l. California utility crisis, PG&E in Ch 11 , l Orange County bankruptcy; So. Cal Ed restructuring l Mexico financial crisis l Airline consolidation stresses airports; l Declining enrollment stresses colleges l 9/11 - Afghan war l Asian crisis; l Subprime auto sector difficulties; l Balanced Budget Act - stress on health care sector MBIA’s Book Value - 23 - l EETCS challenged; l CDOs under scrutiny; l Consumer ABS stressed Capital Strength. Triple-A Performance.

MBIA Performance Perseveres Through Adversity l Hurricane Andrew - 50 killed, $25 B in damage in Southern Florida l Savings and Loan crisis l Russian crisis l Iraq war; l U. S. Recession, declining real estate values, stress on munis and consumer ABS; l Subprime mortgage sector difficulties; crisis l CA l Philadelphia financial crisis l. AHERF bankruptcy; l. Capital Asset write-off l Gulf War; l Brevard County Lease Revenue Bonds l Black Monday Stock Market Drop l Mississippi River flood, 52 killed, $15 -$20 B in damage, 70, 000 displaced; l First World Trade Center bombing, Port Authority exposure l. US Tech bubble burst; l California earthquake (Northridge) 57 killed, $15 B in damage; l. California utility crisis, PG&E in Ch 11 , l Orange County bankruptcy; So. Cal Ed restructuring l Mexico financial crisis l Airline consolidation stresses airports; l Declining enrollment stresses colleges l 9/11 - Afghan war l Asian crisis; l Subprime auto sector difficulties; l Balanced Budget Act - stress on health care sector MBIA’s Book Value - 23 - l EETCS challenged; l CDOs under scrutiny; l Consumer ABS stressed Capital Strength. Triple-A Performance.

Conclusion MBIA Strengths · Rated Triple-A by Moody's, Standard and Poor's, and Fitch · Leading financial guarantee insurance company · Excellent credit quality and diversification of insured portfolio · Strong financial position · Highly rated and liquid investment portfolio · Conservative underwriting and monitoring standards · Strong management team - 24 - Capital Strength. Triple-A Performance.

Conclusion MBIA Strengths · Rated Triple-A by Moody's, Standard and Poor's, and Fitch · Leading financial guarantee insurance company · Excellent credit quality and diversification of insured portfolio · Strong financial position · Highly rated and liquid investment portfolio · Conservative underwriting and monitoring standards · Strong management team - 24 - Capital Strength. Triple-A Performance.

Contacts For more information about MBIA Insurance Corporation please contact us: Contact Phone E-mail Italy and Greece: Luis Cuttica +39 02 86 337 627 luis. cuttica@mbia. com European Infrastructure: Paul David +44 20 7920 6360 paul. david@mbia. com Fixed Income Investor Relations: Charlie Williams +1 -914 -765 -3481 charlie. williams@mbia. com Chip Reilly +1 -914 -765 -3227 charles. reilly@mbia. com Stephanie Dougherty +1 -914 -765 -3631 stephanie. dougherty@mbia. com Equity Investor Relations: Willard Hill +1 -914 -765 -3860 willard. hill@mbia. com Website: www. mbia. com/investor/index. html - 25 - Capital Strength. Triple-A Performance.

Contacts For more information about MBIA Insurance Corporation please contact us: Contact Phone E-mail Italy and Greece: Luis Cuttica +39 02 86 337 627 luis. cuttica@mbia. com European Infrastructure: Paul David +44 20 7920 6360 paul. david@mbia. com Fixed Income Investor Relations: Charlie Williams +1 -914 -765 -3481 charlie. williams@mbia. com Chip Reilly +1 -914 -765 -3227 charles. reilly@mbia. com Stephanie Dougherty +1 -914 -765 -3631 stephanie. dougherty@mbia. com Equity Investor Relations: Willard Hill +1 -914 -765 -3860 willard. hill@mbia. com Website: www. mbia. com/investor/index. html - 25 - Capital Strength. Triple-A Performance.