ThumbsUp_P&G Case_Конечная.pptx

- Количество слайдов: 24

P&G Case Study Herbal Essences Thumbs. Up

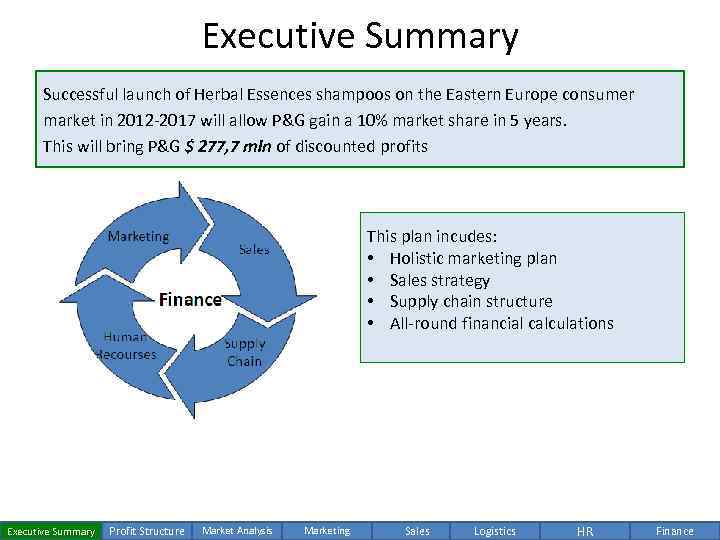

Executive Summary Successful launch of Herbal Essences shampoos on the Eastern Europe consumer market in 2012 -2017 will allow P&G gain a 10% market share in 5 years. This will bring P&G $ 277, 7 mln of discounted profits This plan incudes: • Holistic marketing plan • Sales strategy • Supply chain structure • All-round financial calculations Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

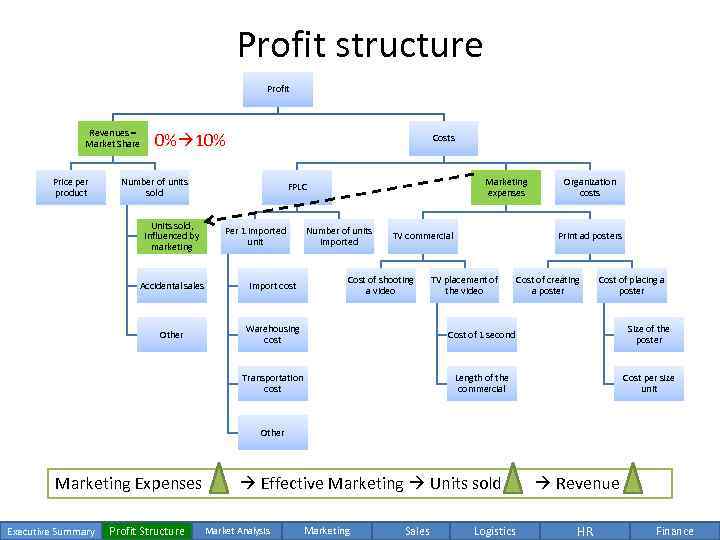

Profit structure Profit Revenues = Market Share Price per product 0% 10% Costs Number of units sold Units sold, influenced by marketing Marketing expenses FPLC Per 1 imported unit Number of units imported TV commercial Cost of shooting a video Organization costs Print ad posters TV placement of the video Cost of creating a poster Cost of placing a poster Accidental sales Import cost Other Warehousing cost Cost of 1 second Size of the poster Transportation cost Length of the commercial Cost per size unit Other Marketing Expenses Effective Marketing Units sold Revenue Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

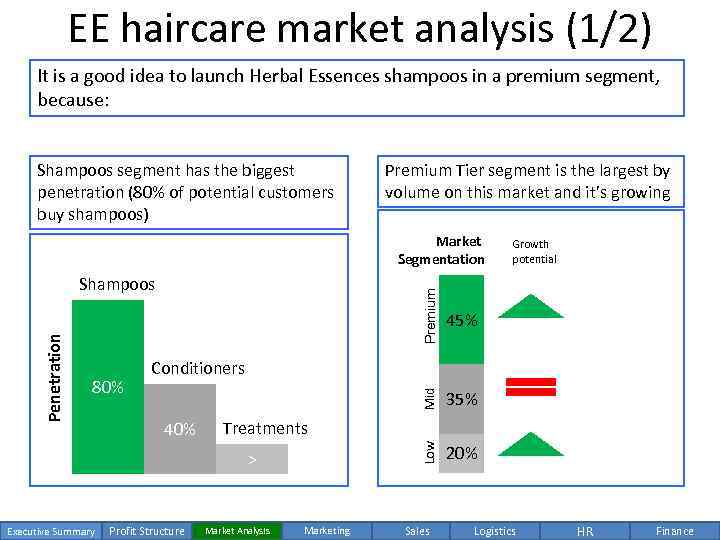

EE haircare market analysis (1/2) It is a good idea to launch Herbal Essences shampoos in a premium segment, because: Shampoos segment has the biggest penetration (80% of potential customers buy shampoos) Premium Tier segment is the largest by volume on this market and it’s growing Market Segmentation Premium Mid 80% 45% 35% Low Penetration Shampoos Growth potential 20% Conditioners 40% Treatments > Market Analysis Task Executive Summary Profit Structure Marketing expenses Profit Structure Marketing FPLC Sales Logistics HR Finance

EE haircare market analysis (2/2) Total market volume: 242 mln liters Volume Share 2% 4% 5% Consumer group Performance Seekers 45% 5% Value Driven 6% 6% 51% 8% 13% Moonstar Sunshine Twist Wella Eccol Superior Tomatoes Pantene Affordable brands Executive Summary Profit Structure Market Analysis Marketing • Value Driven consumers purchase Affordable Brands • Performance Seekers purchase Premium Tier brands (our clients) • P&G is not performed in Experiential sub-tier (there will be no cannibalization) We will be positioning Herbal Essences as an Experiential Premium shampoo Sales Logistics HR Finance

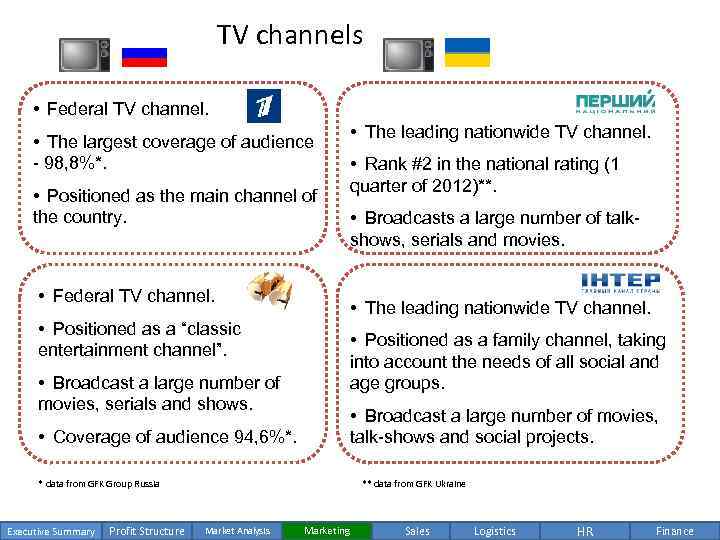

TV channels • Federal TV channel. • The largest coverage of audience - 98, 8%*. • Positioned as the main channel of the country. • Federal TV channel. • Broadcasts a large number of talkshows, serials and movies. • Positioned as a family channel, taking into account the needs of all social and age groups. • Broadcast a large number of movies, serials and shows. • Broadcast a large number of movies, talk-shows and social projects. • Coverage of audience 94, 6%*. * data from GFK Group Russia Profit Structure • Rank #2 in the national rating (1 quarter of 2012)**. • The leading nationwide TV channel. • Positioned as a “classic entertainment channel”. Executive Summary • The leading nationwide TV channel. ** data from GFK Ukraine Market Analysis Marketing Sales Logistics HR Finance

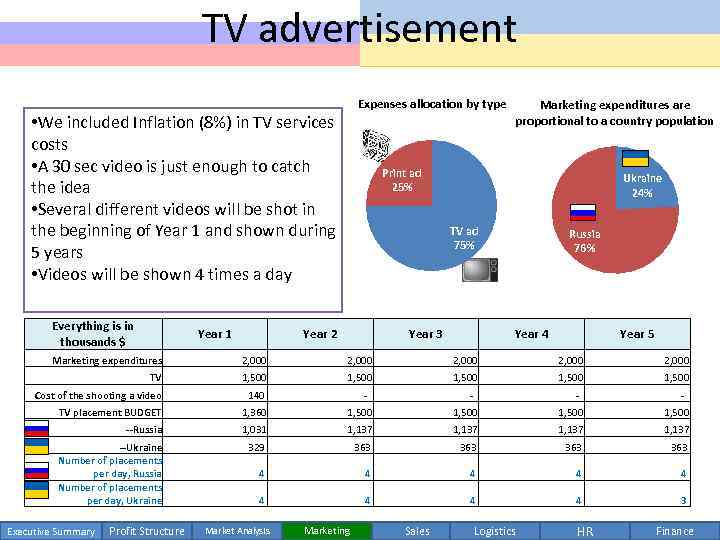

TV advertisement • We included Inflation (8%) in TV services costs • A 30 sec video is just enough to catch the idea • Several different videos will be shot in the beginning of Year 1 and shown during 5 years • Videos will be shown 4 times a day Everything is in thousands $ Year 1 Year 2 Expenses allocation by type Marketing expenditures are proportional to a country population Print ad 25% Ukraine 24% TV ad 75% Year 3 Russia 76% Year 4 Year 5 Marketing expenditures 2, 000 2, 000 TV 1, 500 1, 500 Cost of the shooting a video 140 - - TV placement BUDGET 1, 360 1, 500 --Russia 1, 031 1, 137 --Ukraine 329 363 Number of placements per day, Russia 4 4 Number of placements per day, Ukraine 4 3 Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

Magazines advertising ** * • The most popular magazine in Russia • Monthly audience – 6, 238, 900 • The most popular magazine in Ukraine • Average number of copies 870, 000 per month • Monthly audience – 305, 000 • Average number of copies 185, 000 per month • Monthly audience – 3, 181, 700 • Average number of copies 170, 000 per month • Wide variety of advertising facilities • Low cost per contact • Monthly audience - 858, 200 • Monthly audience - 3, 680, 600 • Average number of copies 330, 000 per month • Distribution: Moscow 55%, St. Petersburg 9%, The near abroad 36%. *data from TNS Gallup Media – Russia, Moscow Executive Summary Profit Structure Market Analysis • Wide variety of advertising facilities • Average number of copies in Europe – 6, 000 per month ** data from PMI 2011/12 Marketing Sales Logistics HR Finance

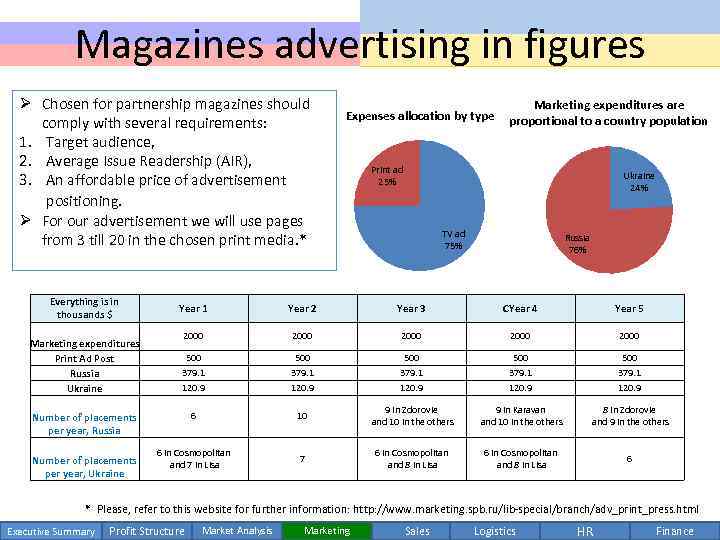

Magazines advertising in figures Ø Chosen for partnership magazines should comply with several requirements: 1. Target audience, 2. Average Issue Readership (AIR), 3. An affordable price of advertisement positioning. Ø For our advertisement we will use pages from 3 till 20 in the chosen print media. * Everything is in thousands $ Marketing expenditures Print Ad Post Russia Ukraine Print ad 25% Ukraine 24% TV ad 75% Russia 76% Year 1 Year 2 Year 3 CYear 4 Year 5 2000 2000 500 379. 1 120. 9 6 10 9 in Zdorovie and 10 in the others 9 in Karavan and 10 in the others 8 in Zdorovie and 9 in the others 6 in Cosmopolitan and 7 in Lisa 7 6 in Cosmopolitan and 8 in Lisa 6 Number of placements per year, Russia Number of placements per year, Ukraine Marketing expenditures are Expenses allocation by type proportional to a country population * Please, refer to this website for further information: http: //www. marketing. spb. ru/lib-special/branch/adv_print_press. html Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

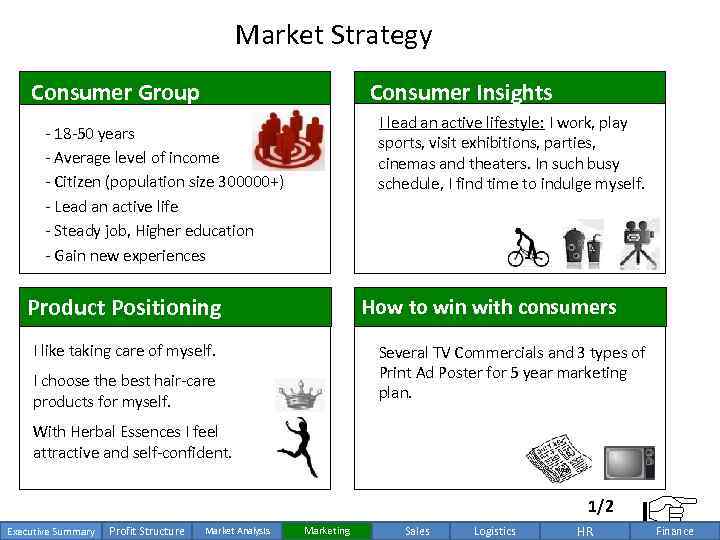

Market Strategy Consumer Group Consumer Insights I lead an active lifestyle: I work, play sports, visit exhibitions, parties, cinemas and theaters. In such busy schedule, I find time to indulge myself. - 18 -50 years - Average level of income - Citizen (population size 300000+) - Lead an active life - Steady job, Higher education - Gain new experiences Product Positioning How to win with consumers I like taking care of myself. Several TV Commercials and 3 types of Print Ad Poster for 5 year marketing plan. I choose the best hair-care products for myself. With Herbal Essences I feel attractive and self-confident. 1/2 Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

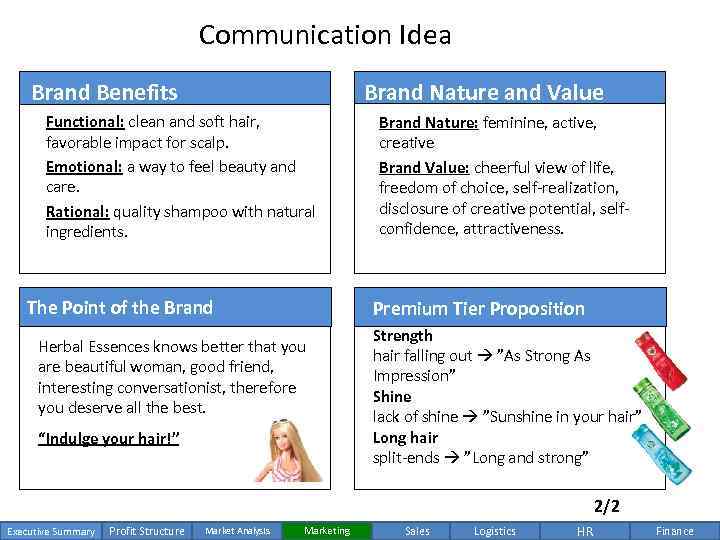

Communication Idea Brand Benefits Brand Nature and Value Functional: clean and soft hair, favorable impact for scalp. Emotional: a way to feel beauty and care. Rational: quality shampoo with natural ingredients. The Point of the Brand Nature: feminine, active, creative Brand Value: cheerful view of life, freedom of choice, self-realization, disclosure of creative potential, selfconfidence, attractiveness. Premium Tier Proposition Herbal Essences knows better that you are beautiful woman, good friend, interesting conversationist, therefore you deserve all the best. “Indulge your hair!” Strength hair falling out ”As Strong As Impression” Shine lack of shine ”Sunshine in your hair” Long hair split-ends ”Long and strong” 2/2 Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

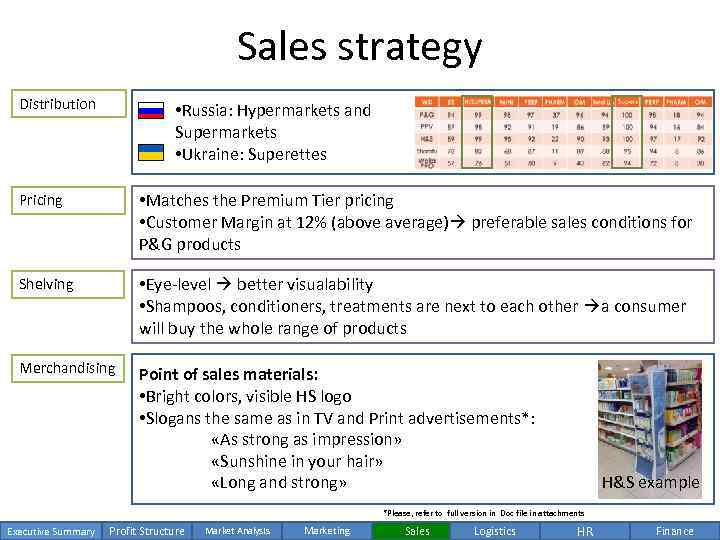

Sales strategy Distribution • Russia: Hypermarkets and Supermarkets • Ukraine: Superettes Pricing • Matches the Premium Tier pricing • Customer Margin at 12% (above average) preferable sales conditions for P&G products Shelving • Eye-level better visualability • Shampoos, conditioners, treatments are next to each other a consumer will buy the whole range of products Merchandising Point of sales materials: • Bright colors, visible HS logo • Slogans the same as in TV and Print advertisements*: «As strong as impression» «Sunshine in your hair» «Long and strong» H&S example *Please, refer to full version in Doc file in attachments Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

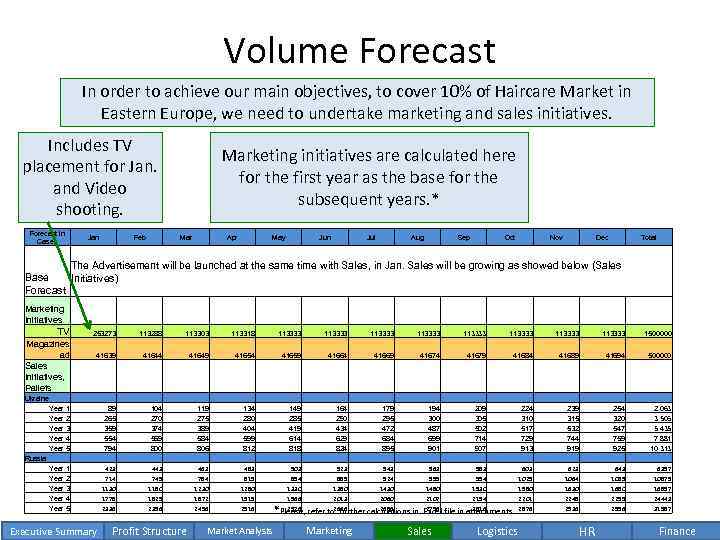

Volume Forecast In order to achieve our main objectives, to cover 10% of Haircare Market in Eastern Europe, we need to undertake marketing and sales initiatives. Includes TV placement for Jan. and Video shooting. Forecast in Cases Jan Marketing initiatives are calculated here for the first year as the base for the subsequent years. * Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total The Advertisement will be launched at the same time with Sales, in Jan. Sales will be growing as showed below (Sales Base Initiatives) Forecast Marketing Initiatives TV Magazines ad Sales Initiatives, Pallets Ukraine 113288 113303 113318 113333 113333 1500000 41639 41644 41649 41654 41659 41664 41669 41674 41679 41684 41689 41694 500000 Year 1 Year 2 Year 3 Year 4 Year 5 89 265 359 554 794 Russia 253273 104 270 374 569 800 119 275 389 584 806 134 280 404 599 812 149 285 419 614 818 Year 1 Year 2 Year 3 Year 4 423 714 1130 1778 443 749 1180 1825 463 784 1230 1872 483 819 1280 1919 Year 5 2336 2396 2456 2516 Executive Summary Profit Structure Market Analysis 164 290 434 629 824 503 854 1330 1966 179 295 472 684 895 523 889 1380 2013 194 300 487 699 901 209 305 502 714 907 563 959 1480 2107 224 310 517 729 913 239 315 532 744 919 254 320 547 759 925 2 063 3 506 5 435 7 881 10 313 623 1064 1630 2248 643 1099 1680 2295 6397 10875 16857 24443 2576 2636 2696 2756 2816 *Please, refer to further calculations in Excel file in attachments 2876 2936 2996 31987 Sales 583 994 1530 2154 603 1029 1580 2201 Marketing 543 924 1430 2060 Logistics HR Finance

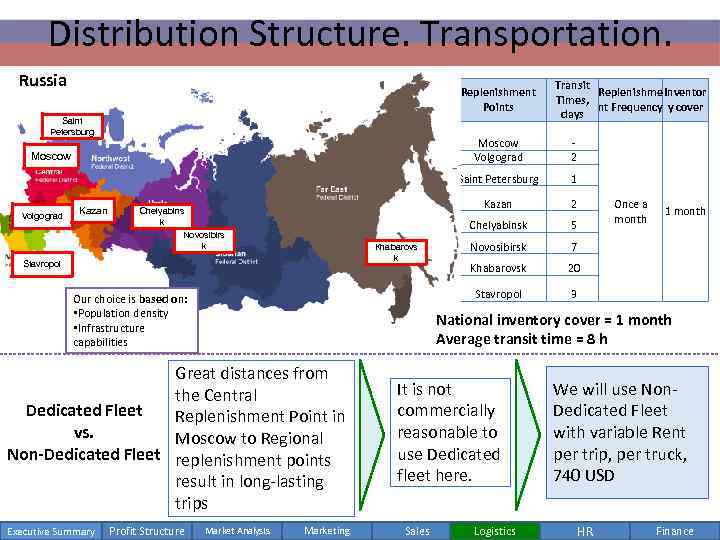

Distribution Structure. Transportation. Russia Replenishment Points Saint Petersburg Transit Replenishme Inventor Times, nt Frequency y cover days Moscow Volgograd Saint Petersburg Volgograd Kazan Stavropol Our choice is based on: • Population density • Infrastructure capabilities Novosibirsk 7 Khabarovsk 20 3 Once a month 1 month National inventory cover = 1 month Average transit time = 8 h Great distances from the Central Dedicated Fleet Replenishment Point in vs. Moscow to Regional Non-Dedicated Fleet replenishment points result in long-lasting trips Market Analysis Task Executive Summary Profit Structure Marketing expenses Profit Structure 5 Stavropol Khabarovs k 2 Chelyabinsk Chelyabins k Novosibirs k 1 Kazan Moscow - 2 Marketing FPLC It is not commercially reasonable to use Dedicated fleet here. Sales Logistics We will use Non. Dedicated Fleet with variable Rent per trip, per truck, 740 USD HR Finance

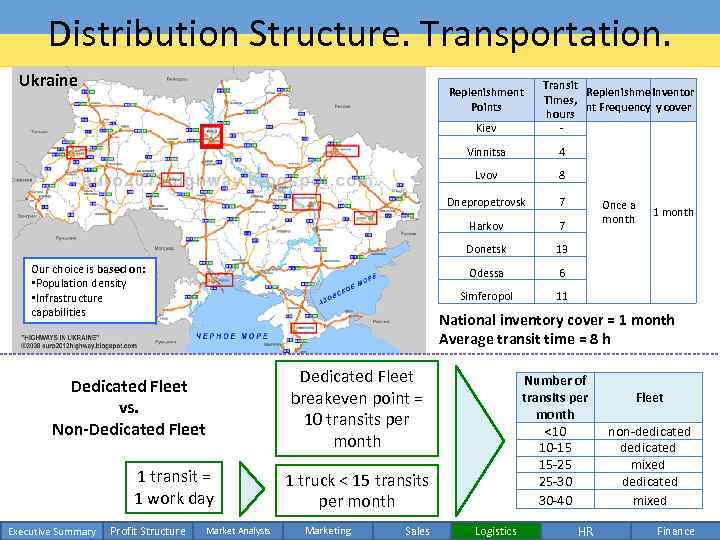

Distribution Structure. Transportation. Ukraine Replenishment Points Kiev Transit Replenishme Inventor Times, nt Frequency y cover hours - Vinnitsa Lvov Market Analysis Task Executive Summary Profit Structure Marketing expenses Profit Structure 7 Donetsk 1 transit = 1 work day 7 Harkov Dedicated Fleet vs. Non-Dedicated Fleet 8 Dnepropetrovsk 13 Odessa 6 Simferopol Our choice is based on: • Population density • Infrastructure capabilities 4 11 Once a month 1 month National inventory cover = 1 month Average transit time = 8 h Dedicated Fleet breakeven point = 10 transits per month Number of Fleet transits per month <10 non-dedicated 10 -15 dedicated 15 -25 mixed 25 -30 dedicated 30 -40 mixed 1 truck < 15 transits per month FPLC Marketing Sales Logistics HR Finance

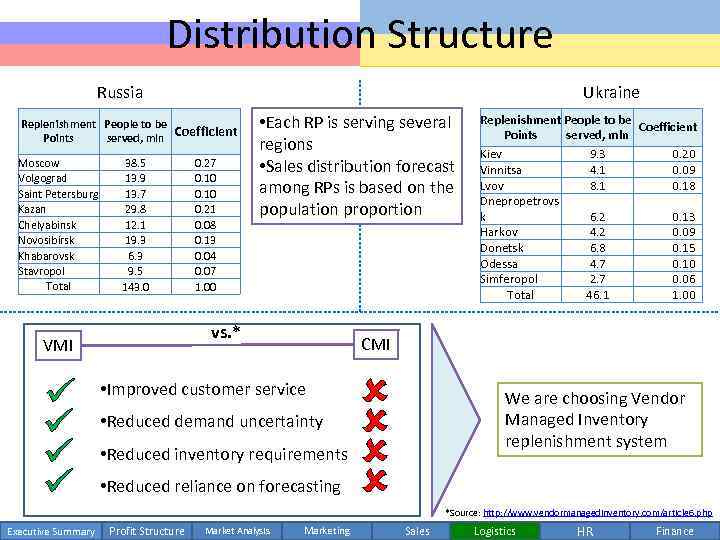

Distribution Structure Russia Ukraine Replenishment People to be Coefficient Points served, mln Moscow Volgograd Saint Petersburg Kazan Chelyabinsk Novosibirsk Khabarovsk Stavropol Total VMI 38. 5 13. 9 13. 7 29. 8 12. 1 19. 3 6. 3 9. 5 143. 0 0. 27 0. 10 0. 21 0. 08 0. 13 0. 04 0. 07 1. 00 • Each RP is serving several regions • Sales distribution forecast among RPs is based on the population proportion vs. * Replenishment People to be Points served, mln Kiev 9. 3 Vinnitsa 4. 1 Lvov 8. 1 Dnepropetrovs k 6. 2 Harkov 4. 2 Donetsk 6. 8 Odessa 4. 7 Simferopol 2. 7 Total 46. 1 Coefficient 0. 20 0. 09 0. 18 0. 13 0. 09 0. 15 0. 10 0. 06 1. 00 CMI • Improved customer service We are choosing Vendor Managed Inventory replenishment system • Reduced demand uncertainty • Reduced inventory requirements • Reduced reliance on forecasting *Source: http: //www. vendormanagedinventory. com/article 6. php Market Analysis Task Executive Summary Profit Structure Marketing expenses Profit Structure Marketing FPLC Sales Logistics HR Finance

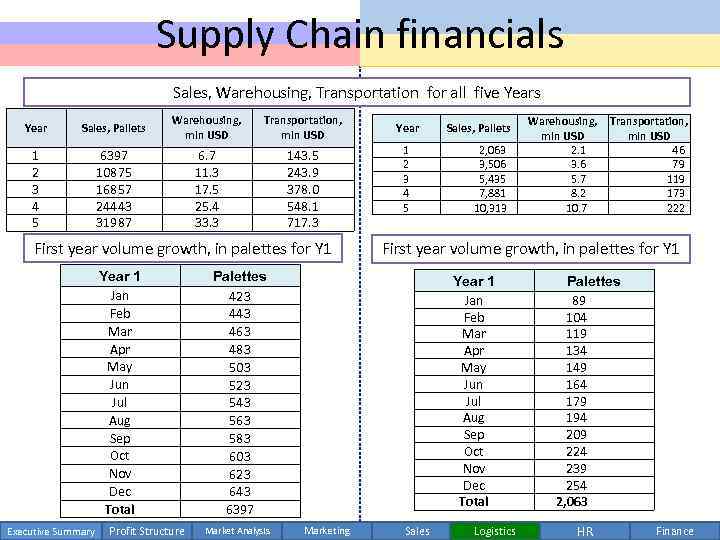

Supply Chain financials Sales, Warehousing, Transportation for all five Years Year Sales, Pallets Warehousing, mln USD Transportation, mln USD 1 2 3 4 5 6397 10875 16857 24443 31987 6. 7 11. 3 17. 5 25. 4 33. 3 143. 5 243. 9 378. 0 548. 1 717. 3 First year volume growth, in palettes for Y 1 Year 1 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total Executive Summary Profit Structure Year Sales, Pallets 1 2 3 4 5 2, 063 3, 506 5, 435 7, 881 10, 313 First year volume growth, in palettes for Y 1 Palettes 423 443 463 483 503 523 543 563 583 603 623 643 6397 Market Analysis Year 1 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total Marketing Warehousing, Transportation, mln USD 2. 1 46 3. 6 79 5. 7 119 8. 2 173 10. 7 222 Sales Logistics Palettes 89 104 119 134 149 164 179 194 209 224 239 254 2, 063 HR Finance

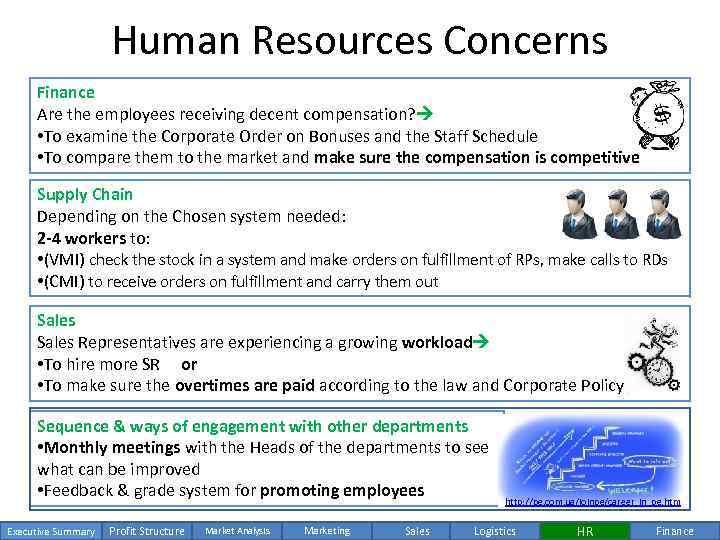

Human Resources Concerns Finance Are the employees receiving decent compensation? • To examine the Corporate Order on Bonuses and the Staff Schedule • To compare them to the market and make sure the compensation is competitive Supply Chain Depending on the Chosen system needed: 2 -4 workers to: • (VMI) check the stock in a system and make orders on fulfillment of RPs, make calls to RDs • (CMI) to receive orders on fulfillment and carry them out Sales Representatives are experiencing a growing workload • To hire more SR or • To make sure the overtimes are paid according to the law and Corporate Policy Sequence & ways of engagement with other departments • Monthly meetings with the Heads of the departments to see what can be improved • Feedback & grade system for promoting employees Market Analysis Task Executive Summary Profit Structure Marketing expenses Profit Structure Marketing FPLC Sales http: //pg. com. ua/joinpg/career_in_pg. htm Logistics HR Finance

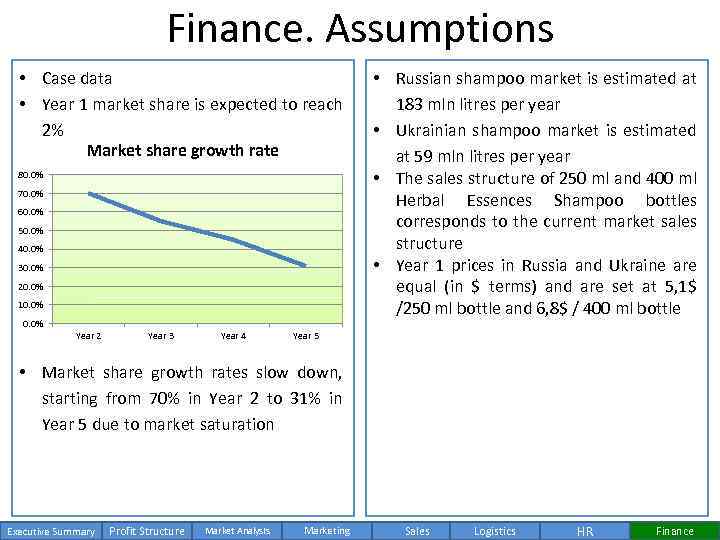

Finance. Assumptions • Case data • Year 1 market share is expected to reach 2% Market share growth rate 80. 0% 70. 0% 60. 0% 50. 0% 40. 0% 30. 0% 20. 0% 10. 0% Year 2 Year 3 Year 4 • Russian shampoo market is estimated at 183 mln litres per year • Ukrainian shampoo market is estimated at 59 mln litres per year • The sales structure of 250 ml and 400 ml Herbal Essences Shampoo bottles corresponds to the current market sales structure • Year 1 prices in Russia and Ukraine are equal (in $ terms) and are set at 5, 1$ /250 ml bottle and 6, 8$ / 400 ml bottle Year 5 • Market share growth rates slow down, starting from 70% in Year 2 to 31% in Year 5 due to market saturation Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

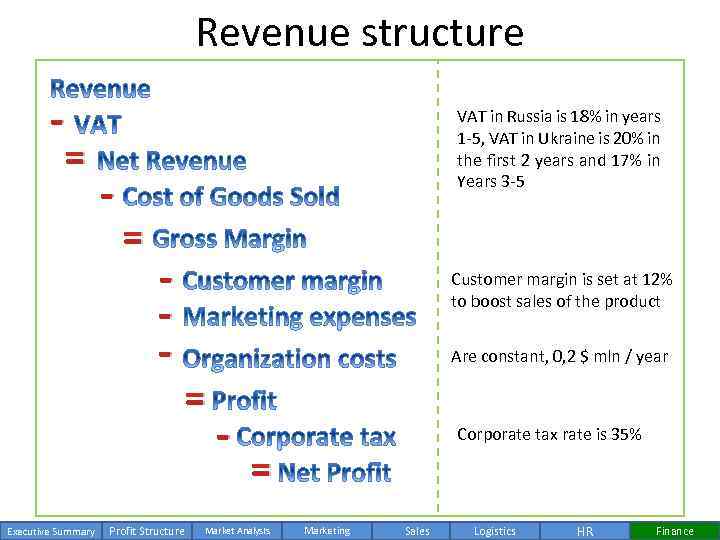

Revenue structure - = Executive Summary - VAT in Russia is 18% in years 1 -5, VAT in Ukraine is 20% in the first 2 years and 17% in Years 3 -5 = - Profit Structure Customer margin is set at 12% to boost sales of the product Are constant, 0, 2 $ mln / year = - Corporate tax rate is 35% = Market Analysis Marketing Sales Logistics HR Finance

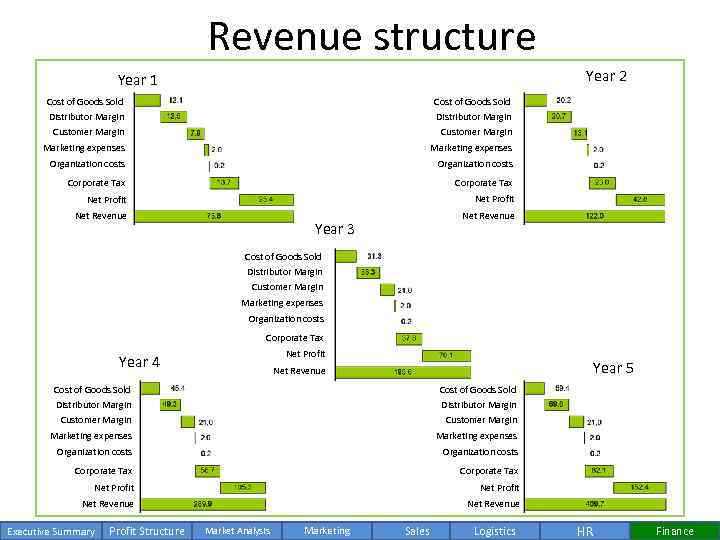

Revenue structure Year 2 Year 1 Cost of Goods Sold Distributor Margin Customer Margin Marketing expenses Organization costs Corporate Tax Net Profit Net Revenue Year 3 Cost of Goods Sold Distributor Margin Customer Margin Marketing expenses Organization costs Corporate Tax Net Profit Year 4 Year 5 Net Revenue Cost of Goods Sold Distributor Margin Customer Margin Marketing expenses Organization costs Corporate Tax Net Profit Net Revenue Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

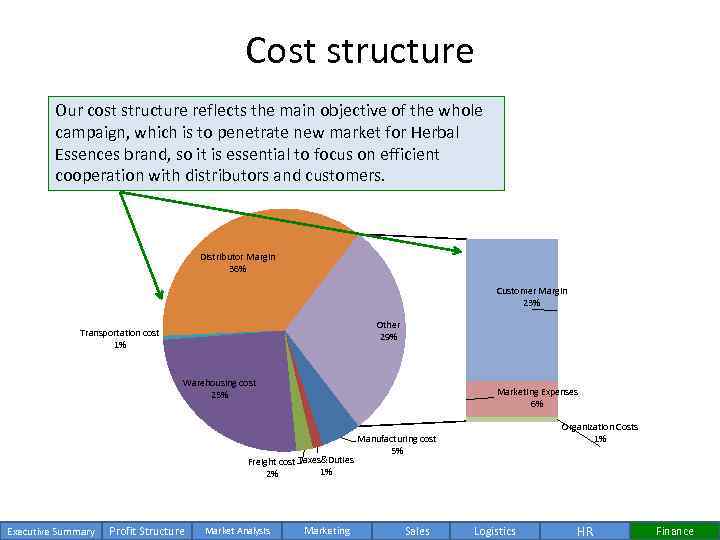

Cost structure Our cost structure reflects the main objective of the whole campaign, which is to penetrate new market for Herbal Essences brand, so it is essential to focus on efficient cooperation with distributors and customers. Distributor Margin 36% Customer Margin 23% Other 29% Transportation cost 1% Warehousing cost 25% Marketing Expenses 6% Freight cost Taxes&Duties 1% 2% Executive Summary Profit Structure Market Analysis Marketing Organization Costs 1% Manufacturing cost 5% Sales Logistics HR Finance

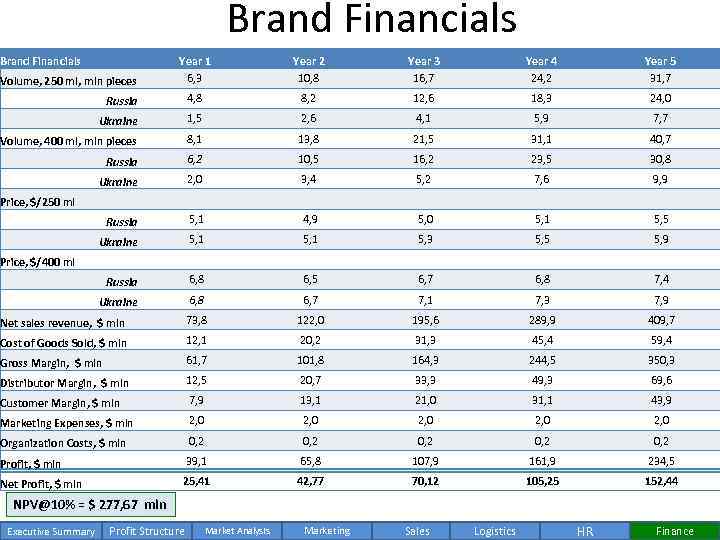

Brand Financials Year 1 6, 3 Year 2 10, 8 Year 3 16, 7 Year 4 24, 2 Year 5 31, 7 Russia 4, 8 8, 2 12, 6 18, 3 24, 0 Ukraine 1, 5 2, 6 4, 1 5, 9 7, 7 Volume, 400 ml, mln pieces 8, 1 13, 8 21, 5 31, 1 40, 7 Russia 6, 2 10, 5 16, 2 23, 5 30, 8 Ukraine 2, 0 3, 4 5, 2 7, 6 9, 9 Volume, 250 ml, mln pieces Price, $/250 ml Russia 5, 1 4, 9 5, 0 5, 1 5, 5 Ukraine 5, 1 5, 3 5, 5 5, 9 Price, $/400 ml 6, 8 Ukraine 6, 5 6, 7 6, 8 7, 4 6, 8 Russia 6, 7 7, 1 7, 3 7, 9 Net sales revenue, $ mln 73, 8 122, 0 195, 6 289, 9 409, 7 Cost of Goods Sold, $ mln 12, 1 20, 2 31, 3 45, 4 59, 4 Gross Margin, $ mln 61, 7 101, 8 164, 3 244, 5 350, 3 Distributor Margin, $ mln 12, 5 20, 7 33, 3 49, 3 69, 6 Customer Margin, $ mln 7, 9 13, 1 21, 0 31, 1 43, 9 Marketing Expenses, $ mln 2, 0 2, 0 Organization Costs, $ mln 0, 2 0, 2 Profit, $ mln 39, 1 65, 8 107, 9 161, 9 234, 5 Net Profit, $ mln 25, 41 42, 77 70, 12 105, 25 152, 44 NPV@10% = $ 277, 67 mln Executive Summary Profit Structure Market Analysis Marketing Sales Logistics HR Finance

Thank you for attention! Thumbs. Up Gulnara Imaeva Dilara Imaeva Eldar Asadullaev Varvara Solovyeva Advertising World Economy and International Politics Economics World Economy and International Politics NRU HSE`2013 gulnaraimayeva@mail. ru NRU HSE`2011 dilara. imaeva@gma il. com MSU`2013 eldar. asadullaev@gmail. com NRU HSE`2012 varvara. solovjova@g mail. com

ThumbsUp_P&G Case_Конечная.pptx