a5aa7d630cd5eda3909303c0e6d39dfd.ppt

- Количество слайдов: 31

Overview & Status of The U. S. Weight Loss Market Size, Segments, Emerging Trends & Forecasts September 27 -28, 2011 Silver Spring, MD John La. Rosa, President, Marketdata Enterprises

Overview & Status of The U. S. Weight Loss Market Size, Segments, Emerging Trends & Forecasts September 27 -28, 2011 Silver Spring, MD John La. Rosa, President, Marketdata Enterprises

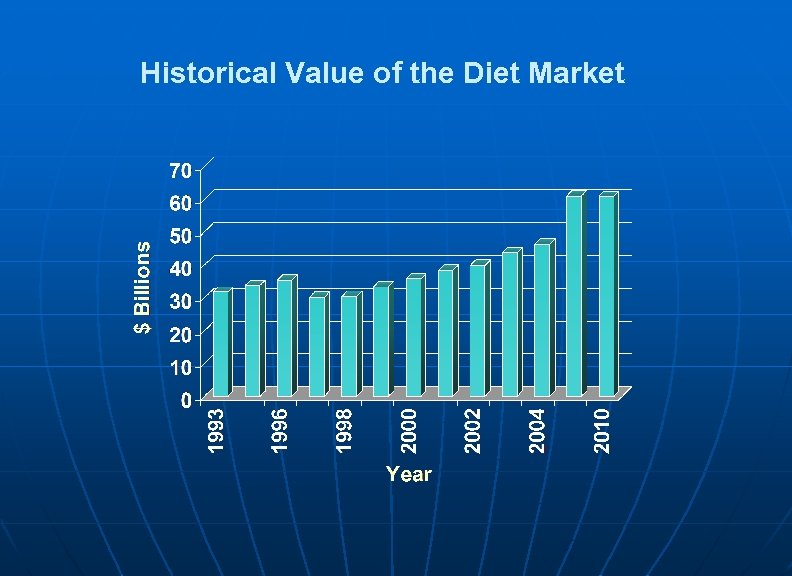

Historical Value of the Diet Market

Historical Value of the Diet Market

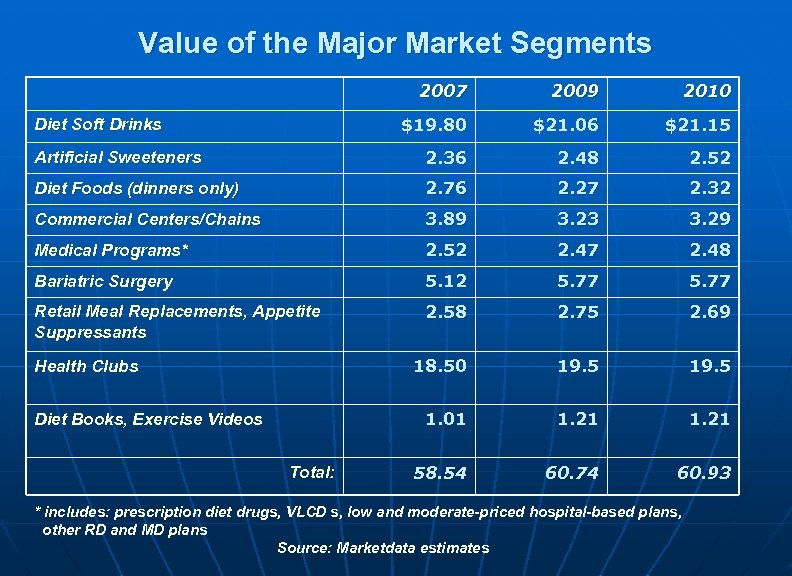

Value of the Major Market Segments 2007 2009 2010 $19. 80 $21. 06 $21. 15 Artificial Sweeteners 2. 36 2. 48 2. 52 Diet Foods (dinners only) 2. 76 2. 27 2. 32 Commercial Centers/Chains 3. 89 3. 23 3. 29 Medical Programs* 2. 52 2. 47 2. 48 Bariatric Surgery 5. 12 5. 77 Retail Meal Replacements, Appetite Suppressants 2. 58 2. 75 2. 69 18. 50 19. 5 1. 01 1. 21 58. 54 60. 74 60. 93 Diet Soft Drinks Health Clubs Diet Books, Exercise Videos Total: * includes: prescription diet drugs, VLCD s, low and moderate-priced hospital-based plans, other RD and MD plans Source: Marketdata estimates

Value of the Major Market Segments 2007 2009 2010 $19. 80 $21. 06 $21. 15 Artificial Sweeteners 2. 36 2. 48 2. 52 Diet Foods (dinners only) 2. 76 2. 27 2. 32 Commercial Centers/Chains 3. 89 3. 23 3. 29 Medical Programs* 2. 52 2. 47 2. 48 Bariatric Surgery 5. 12 5. 77 Retail Meal Replacements, Appetite Suppressants 2. 58 2. 75 2. 69 18. 50 19. 5 1. 01 1. 21 58. 54 60. 74 60. 93 Diet Soft Drinks Health Clubs Diet Books, Exercise Videos Total: * includes: prescription diet drugs, VLCD s, low and moderate-priced hospital-based plans, other RD and MD plans Source: Marketdata estimates

Major Market Developments q The “great recession” hampers consumer spending. q Dieters shift to low cost and free DIY programs (80%). q Diet food delivery services are hit hard (Nutri. System). q FDA rejects 5 new Rx diet drugs: Acomplia, Taranabant, Lorcaserin, Qnexa, Contrave – no new blockbusters. q OTC diet aids market hurt by Hydroxycut recall. q Small-mid-sized medical chains post good growth. q Diet websites estimated to be $842 mill. market in 2009.

Major Market Developments q The “great recession” hampers consumer spending. q Dieters shift to low cost and free DIY programs (80%). q Diet food delivery services are hit hard (Nutri. System). q FDA rejects 5 new Rx diet drugs: Acomplia, Taranabant, Lorcaserin, Qnexa, Contrave – no new blockbusters. q OTC diet aids market hurt by Hydroxycut recall. q Small-mid-sized medical chains post good growth. q Diet websites estimated to be $842 mill. market in 2009.

Major Market Developments (cont’d. ) q q Selling direct to consumer and MLM become more popular (Medifast, Herbalife, others). Weight Watchers has strongest 2011 diet season (WW. com paid subscribers reach 1. 7 million) Commercial weight loss centers used by less dieters, long-term share falls from 15% to 9 -10%. Recession forces competitors to cut prices, waive sign up fees, offer more discounts and special deals

Major Market Developments (cont’d. ) q q Selling direct to consumer and MLM become more popular (Medifast, Herbalife, others). Weight Watchers has strongest 2011 diet season (WW. com paid subscribers reach 1. 7 million) Commercial weight loss centers used by less dieters, long-term share falls from 15% to 9 -10%. Recession forces competitors to cut prices, waive sign up fees, offer more discounts and special deals

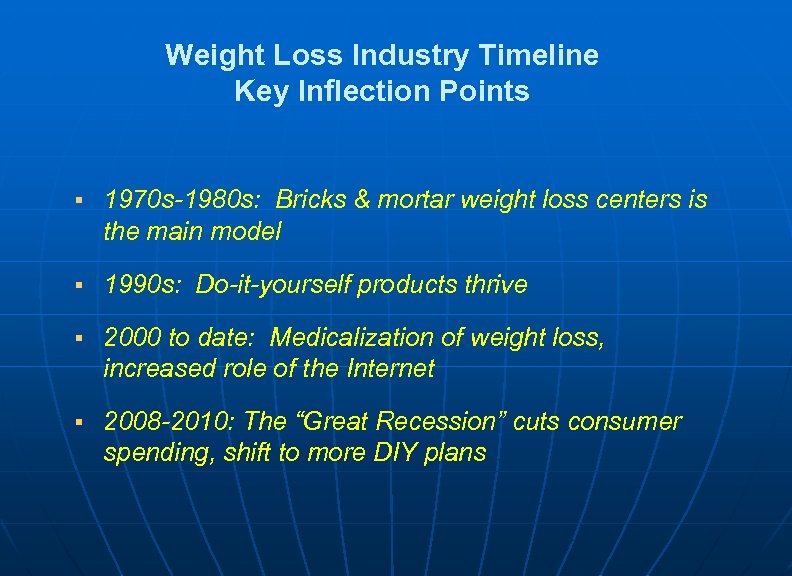

Weight Loss Industry Timeline Key Inflection Points § 1970 s-1980 s: Bricks & mortar weight loss centers is the main model § 1990 s: Do-it-yourself products thrive § 2000 to date: Medicalization of weight loss, increased role of the Internet § 2008 -2010: The “Great Recession” cuts consumer spending, shift to more DIY plans

Weight Loss Industry Timeline Key Inflection Points § 1970 s-1980 s: Bricks & mortar weight loss centers is the main model § 1990 s: Do-it-yourself products thrive § 2000 to date: Medicalization of weight loss, increased role of the Internet § 2008 -2010: The “Great Recession” cuts consumer spending, shift to more DIY plans

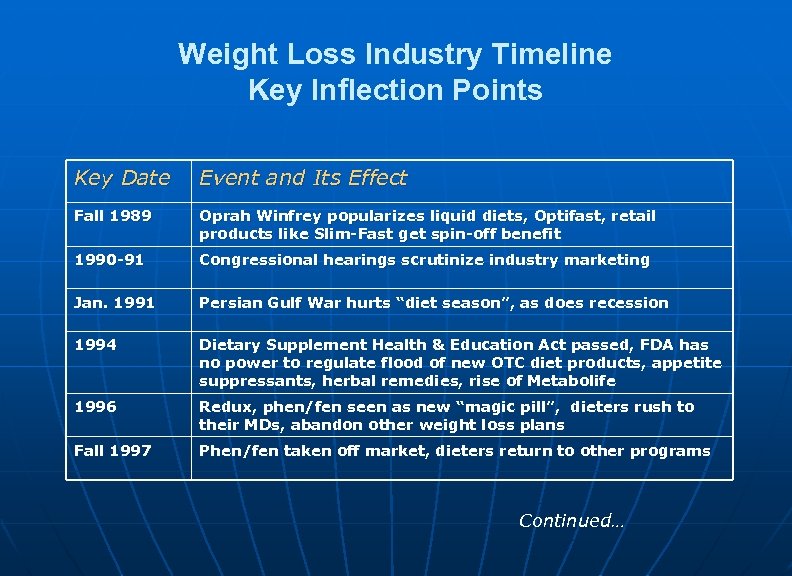

Weight Loss Industry Timeline Key Inflection Points Key Date Event and Its Effect Fall 1989 Oprah Winfrey popularizes liquid diets, Optifast, retail products like Slim-Fast get spin-off benefit 1990 -91 Congressional hearings scrutinize industry marketing Jan. 1991 Persian Gulf War hurts “diet season”, as does recession 1994 Dietary Supplement Health & Education Act passed, FDA has no power to regulate flood of new OTC diet products, appetite suppressants, herbal remedies, rise of Metabolife 1996 Redux, phen/fen seen as new “magic pill”, dieters rush to their MDs, abandon other weight loss plans Fall 1997 Phen/fen taken off market, dieters return to other programs Continued…

Weight Loss Industry Timeline Key Inflection Points Key Date Event and Its Effect Fall 1989 Oprah Winfrey popularizes liquid diets, Optifast, retail products like Slim-Fast get spin-off benefit 1990 -91 Congressional hearings scrutinize industry marketing Jan. 1991 Persian Gulf War hurts “diet season”, as does recession 1994 Dietary Supplement Health & Education Act passed, FDA has no power to regulate flood of new OTC diet products, appetite suppressants, herbal remedies, rise of Metabolife 1996 Redux, phen/fen seen as new “magic pill”, dieters rush to their MDs, abandon other weight loss plans Fall 1997 Phen/fen taken off market, dieters return to other programs Continued…

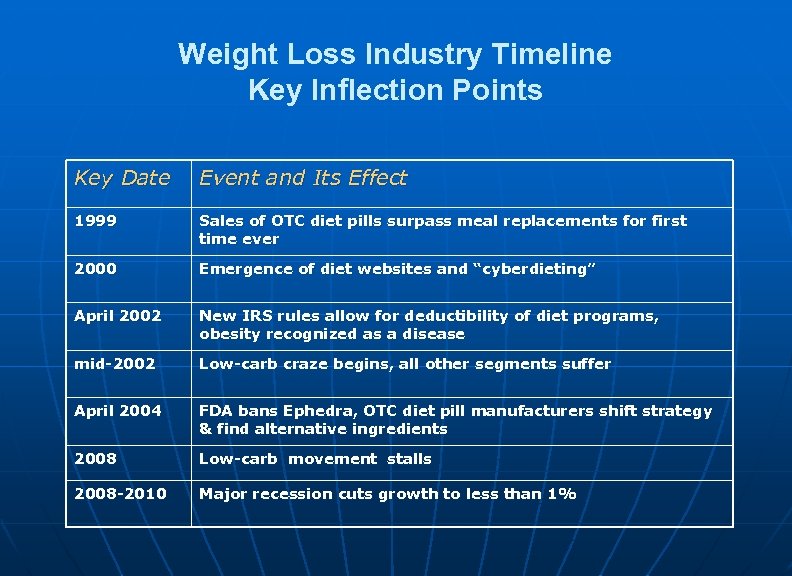

Weight Loss Industry Timeline Key Inflection Points Key Date Event and Its Effect 1999 Sales of OTC diet pills surpass meal replacements for first time ever 2000 Emergence of diet websites and “cyberdieting” April 2002 New IRS rules allow for deductibility of diet programs, obesity recognized as a disease mid-2002 Low-carb craze begins, all other segments suffer April 2004 FDA bans Ephedra, OTC diet pill manufacturers shift strategy & find alternative ingredients 2008 Low-carb movement stalls 2008 -2010 Major recession cuts growth to less than 1%

Weight Loss Industry Timeline Key Inflection Points Key Date Event and Its Effect 1999 Sales of OTC diet pills surpass meal replacements for first time ever 2000 Emergence of diet websites and “cyberdieting” April 2002 New IRS rules allow for deductibility of diet programs, obesity recognized as a disease mid-2002 Low-carb craze begins, all other segments suffer April 2004 FDA bans Ephedra, OTC diet pill manufacturers shift strategy & find alternative ingredients 2008 Low-carb movement stalls 2008 -2010 Major recession cuts growth to less than 1%

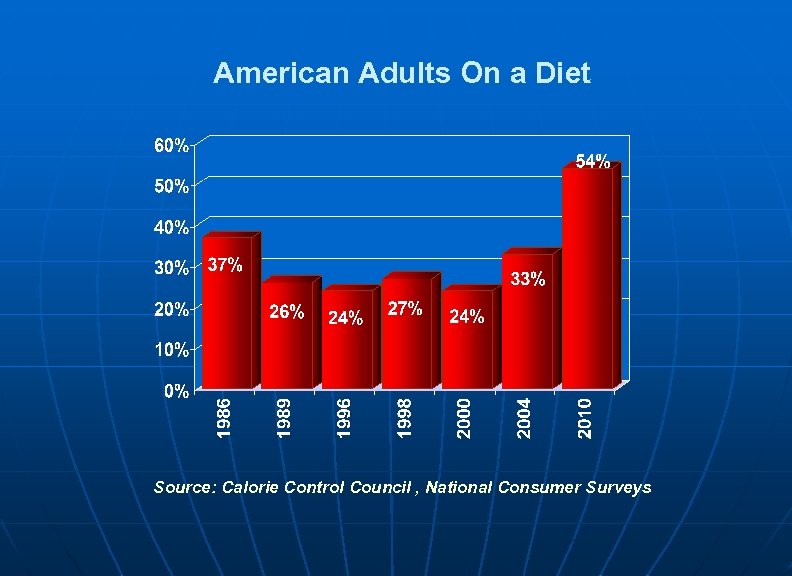

American Adults On a Diet Source: Calorie Control Council , National Consumer Surveys

American Adults On a Diet Source: Calorie Control Council , National Consumer Surveys

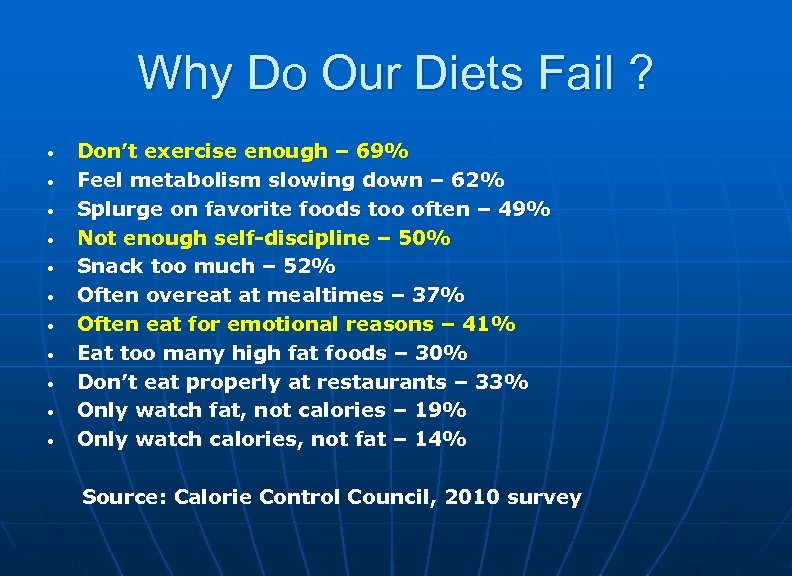

Why Do Our Diets Fail ? • • • Don’t exercise enough – 69% Feel metabolism slowing down – 62% Splurge on favorite foods too often – 49% Not enough self-discipline – 50% Snack too much – 52% Often overeat at mealtimes – 37% Often eat for emotional reasons – 41% Eat too many high fat foods – 30% Don’t eat properly at restaurants – 33% Only watch fat, not calories – 19% Only watch calories, not fat – 14% Source: Calorie Control Council, 2010 survey

Why Do Our Diets Fail ? • • • Don’t exercise enough – 69% Feel metabolism slowing down – 62% Splurge on favorite foods too often – 49% Not enough self-discipline – 50% Snack too much – 52% Often overeat at mealtimes – 37% Often eat for emotional reasons – 41% Eat too many high fat foods – 30% Don’t eat properly at restaurants – 33% Only watch fat, not calories – 19% Only watch calories, not fat – 14% Source: Calorie Control Council, 2010 survey

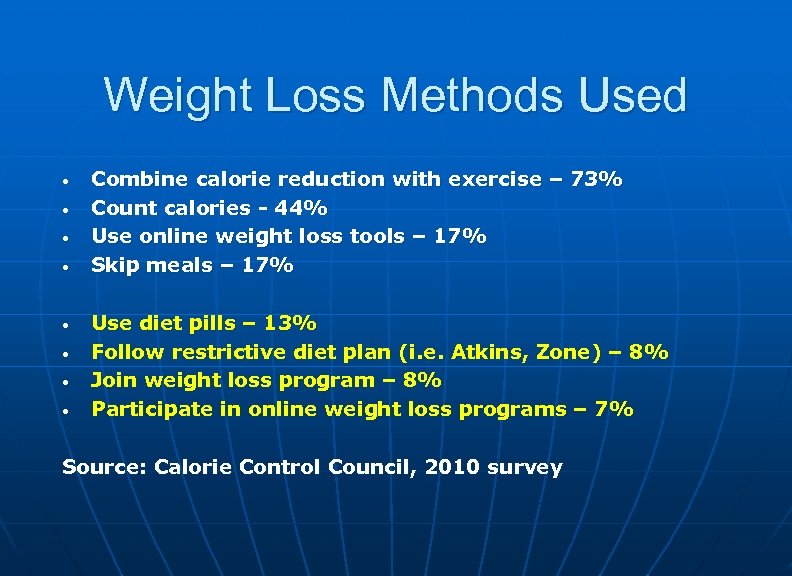

Weight Loss Methods Used • • Combine calorie reduction with exercise – 73% Count calories - 44% Use online weight loss tools – 17% Skip meals – 17% Use diet pills – 13% Follow restrictive diet plan (i. e. Atkins, Zone) – 8% Join weight loss program – 8% Participate in online weight loss programs – 7% Source: Calorie Control Council, 2010 survey

Weight Loss Methods Used • • Combine calorie reduction with exercise – 73% Count calories - 44% Use online weight loss tools – 17% Skip meals – 17% Use diet pills – 13% Follow restrictive diet plan (i. e. Atkins, Zone) – 8% Join weight loss program – 8% Participate in online weight loss programs – 7% Source: Calorie Control Council, 2010 survey

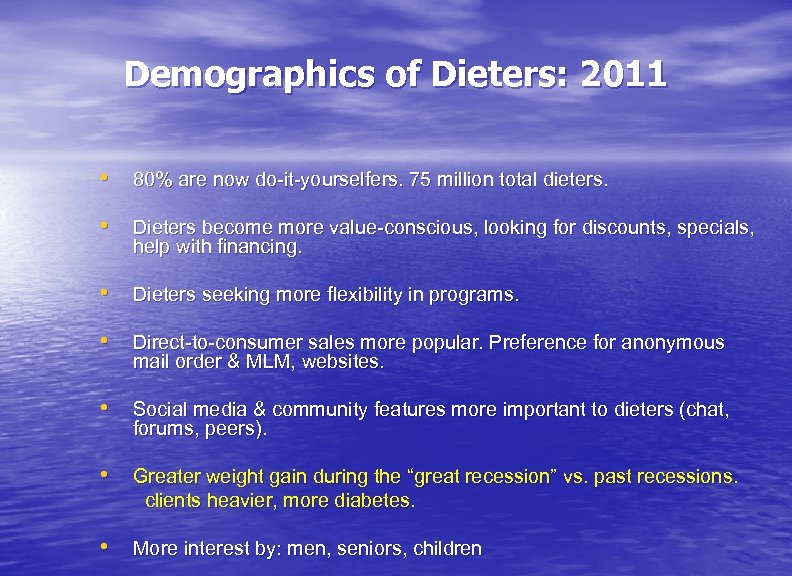

Demographics of Dieters: 2011 • 80% are now do-it-yourselfers. 75 million total dieters. • Dieters become more value-conscious, looking for discounts, specials, help with financing. • Dieters seeking more flexibility in programs. • Direct-to-consumer sales more popular. Preference for anonymous mail order & MLM, websites. • Social media & community features more important to dieters (chat, forums, peers). • Greater weight gain during the “great recession” vs. past recessions. clients heavier, more diabetes. • More interest by: men, seniors, children

Demographics of Dieters: 2011 • 80% are now do-it-yourselfers. 75 million total dieters. • Dieters become more value-conscious, looking for discounts, specials, help with financing. • Dieters seeking more flexibility in programs. • Direct-to-consumer sales more popular. Preference for anonymous mail order & MLM, websites. • Social media & community features more important to dieters (chat, forums, peers). • Greater weight gain during the “great recession” vs. past recessions. clients heavier, more diabetes. • More interest by: men, seniors, children

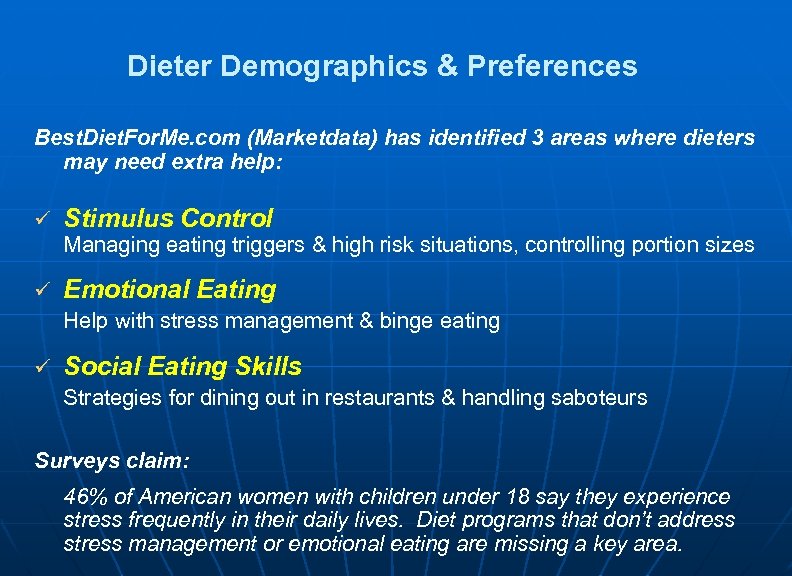

Dieter Demographics & Preferences Best. Diet. For. Me. com (Marketdata) has identified 3 areas where dieters may need extra help: ü Stimulus Control Managing eating triggers & high risk situations, controlling portion sizes ü Emotional Eating Help with stress management & binge eating ü Social Eating Skills Strategies for dining out in restaurants & handling saboteurs Surveys claim: 46% of American women with children under 18 say they experience stress frequently in their daily lives. Diet programs that don’t address stress management or emotional eating are missing a key area.

Dieter Demographics & Preferences Best. Diet. For. Me. com (Marketdata) has identified 3 areas where dieters may need extra help: ü Stimulus Control Managing eating triggers & high risk situations, controlling portion sizes ü Emotional Eating Help with stress management & binge eating ü Social Eating Skills Strategies for dining out in restaurants & handling saboteurs Surveys claim: 46% of American women with children under 18 say they experience stress frequently in their daily lives. Diet programs that don’t address stress management or emotional eating are missing a key area.

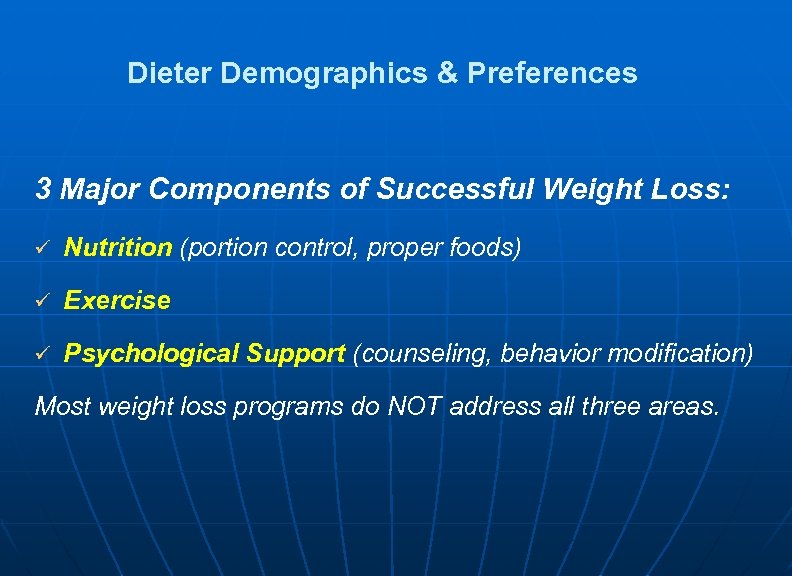

Dieter Demographics & Preferences 3 Major Components of Successful Weight Loss: ü Nutrition (portion control, proper foods) ü Exercise ü Psychological Support (counseling, behavior modification) Most weight loss programs do NOT address all three areas.

Dieter Demographics & Preferences 3 Major Components of Successful Weight Loss: ü Nutrition (portion control, proper foods) ü Exercise ü Psychological Support (counseling, behavior modification) Most weight loss programs do NOT address all three areas.

Best. Diet. For. Me. com Visitor Statistics • Of 16, 366 people completing the Best. Diet. For. Me. com online survey in 2010, 50% were triggered as needing SOME psychological support. • 74%, the greatest share, needs EMOTIONAL EATING support.

Best. Diet. For. Me. com Visitor Statistics • Of 16, 366 people completing the Best. Diet. For. Me. com online survey in 2010, 50% were triggered as needing SOME psychological support. • 74%, the greatest share, needs EMOTIONAL EATING support.

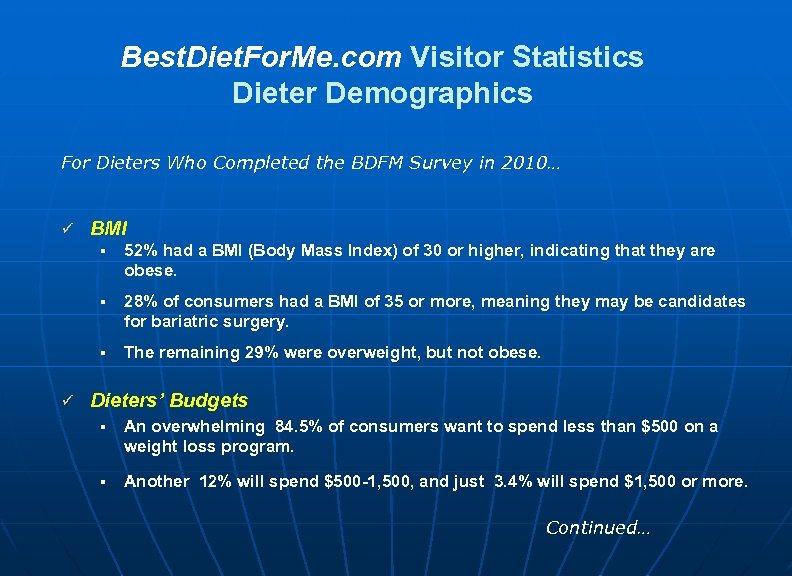

Best. Diet. For. Me. com Visitor Statistics Dieter Demographics For Dieters Who Completed the BDFM Survey in 2010… ü BMI § § 28% of consumers had a BMI of 35 or more, meaning they may be candidates for bariatric surgery. § ü 52% had a BMI (Body Mass Index) of 30 or higher, indicating that they are obese. The remaining 29% were overweight, but not obese. Dieters’ Budgets § An overwhelming 84. 5% of consumers want to spend less than $500 on a weight loss program. § Another 12% will spend $500 -1, 500, and just 3. 4% will spend $1, 500 or more. Continued…

Best. Diet. For. Me. com Visitor Statistics Dieter Demographics For Dieters Who Completed the BDFM Survey in 2010… ü BMI § § 28% of consumers had a BMI of 35 or more, meaning they may be candidates for bariatric surgery. § ü 52% had a BMI (Body Mass Index) of 30 or higher, indicating that they are obese. The remaining 29% were overweight, but not obese. Dieters’ Budgets § An overwhelming 84. 5% of consumers want to spend less than $500 on a weight loss program. § Another 12% will spend $500 -1, 500, and just 3. 4% will spend $1, 500 or more. Continued…

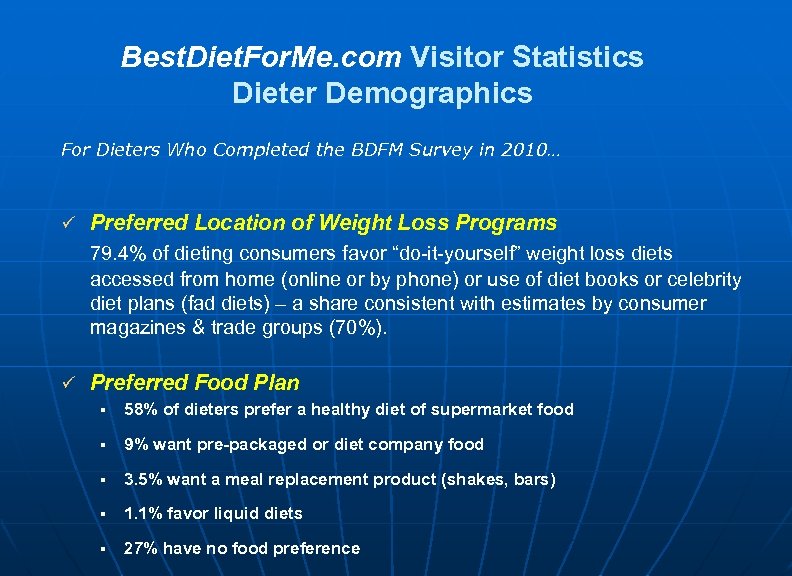

Best. Diet. For. Me. com Visitor Statistics Dieter Demographics For Dieters Who Completed the BDFM Survey in 2010… ü Preferred Location of Weight Loss Programs 79. 4% of dieting consumers favor “do-it-yourself” weight loss diets accessed from home (online or by phone) or use of diet books or celebrity diet plans (fad diets) – a share consistent with estimates by consumer magazines & trade groups (70%). ü Preferred Food Plan § 58% of dieters prefer a healthy diet of supermarket food § 9% want pre-packaged or diet company food § 3. 5% want a meal replacement product (shakes, bars) § 1. 1% favor liquid diets § 27% have no food preference

Best. Diet. For. Me. com Visitor Statistics Dieter Demographics For Dieters Who Completed the BDFM Survey in 2010… ü Preferred Location of Weight Loss Programs 79. 4% of dieting consumers favor “do-it-yourself” weight loss diets accessed from home (online or by phone) or use of diet books or celebrity diet plans (fad diets) – a share consistent with estimates by consumer magazines & trade groups (70%). ü Preferred Food Plan § 58% of dieters prefer a healthy diet of supermarket food § 9% want pre-packaged or diet company food § 3. 5% want a meal replacement product (shakes, bars) § 1. 1% favor liquid diets § 27% have no food preference

Health Clubs Industry - Trends & Status Report ü Historical sales growth rate of 6. 8% per year (2000 -2010) ü 2010 sales growth of zero ü Market value of $19. 5 billion in 2010 – 2 nd largest segment of U. S. weight loss market ü 29, 750 health clubs in the U. S. , and growing. 45 million paid members. ü 50% of customers drop out after 3 -6 months ü Clubs are growing source of sales for diet products mfrs. (supplements, nutrition bars). ü Estimated 55% of clubs have some type of weight loss program. ü Trend toward value- added wellness services, boot camp workouts, small group workouts, more focus on youths and seniors. ü Most health clubs do not have a specific weight loss program, usually an afterthought. Usually not part of membership and extra cost charged

Health Clubs Industry - Trends & Status Report ü Historical sales growth rate of 6. 8% per year (2000 -2010) ü 2010 sales growth of zero ü Market value of $19. 5 billion in 2010 – 2 nd largest segment of U. S. weight loss market ü 29, 750 health clubs in the U. S. , and growing. 45 million paid members. ü 50% of customers drop out after 3 -6 months ü Clubs are growing source of sales for diet products mfrs. (supplements, nutrition bars). ü Estimated 55% of clubs have some type of weight loss program. ü Trend toward value- added wellness services, boot camp workouts, small group workouts, more focus on youths and seniors. ü Most health clubs do not have a specific weight loss program, usually an afterthought. Usually not part of membership and extra cost charged

Commercial Weight Loss Centers – Trends & Status ü Historical sales growth rate of 3. 0% per year (1991 -2011) ü 2011 sales growth of 3. 5% ü 2014 forecast growth of 4. 5% yearly. ü Market value of $3. 23 billion in 2009, $3. 29 bill in 2010. ü Large chains (Weight Watchers, Jenny Craig) buying back franchises, converting them to corporate centers. ü Major revenue growth coming from Weight Watchers and Medifast. ü Sole proprietors/small chains disappearing – out of business or being acquired ü Obstacles to future growth include: new prescription drugs, DIY dieters, growth of medical chains and MDs adding diet programs.

Commercial Weight Loss Centers – Trends & Status ü Historical sales growth rate of 3. 0% per year (1991 -2011) ü 2011 sales growth of 3. 5% ü 2014 forecast growth of 4. 5% yearly. ü Market value of $3. 23 billion in 2009, $3. 29 bill in 2010. ü Large chains (Weight Watchers, Jenny Craig) buying back franchises, converting them to corporate centers. ü Major revenue growth coming from Weight Watchers and Medifast. ü Sole proprietors/small chains disappearing – out of business or being acquired ü Obstacles to future growth include: new prescription drugs, DIY dieters, growth of medical chains and MDs adding diet programs.

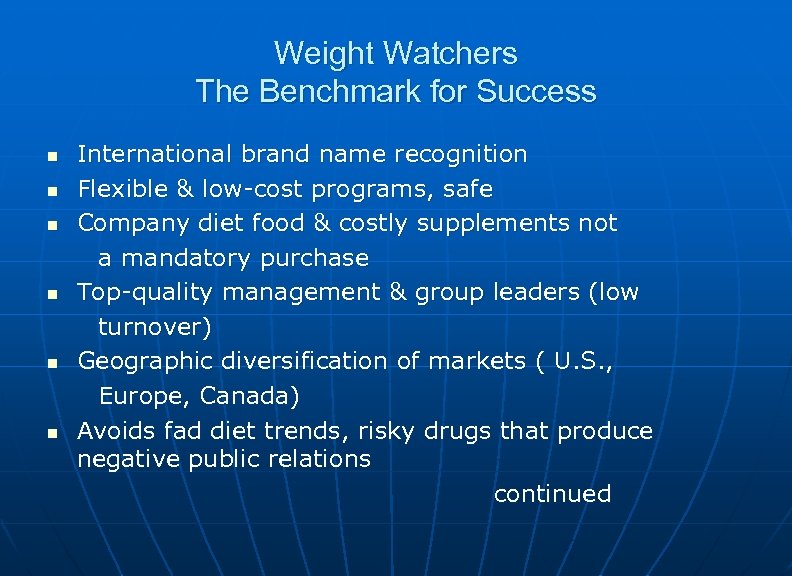

Weight Watchers The Benchmark for Success n n n International brand name recognition Flexible & low-cost programs, safe Company diet food & costly supplements not a mandatory purchase Top-quality management & group leaders (low turnover) Geographic diversification of markets ( U. S. , Europe, Canada) Avoids fad diet trends, risky drugs that produce negative public relations continued

Weight Watchers The Benchmark for Success n n n International brand name recognition Flexible & low-cost programs, safe Company diet food & costly supplements not a mandatory purchase Top-quality management & group leaders (low turnover) Geographic diversification of markets ( U. S. , Europe, Canada) Avoids fad diet trends, risky drugs that produce negative public relations continued

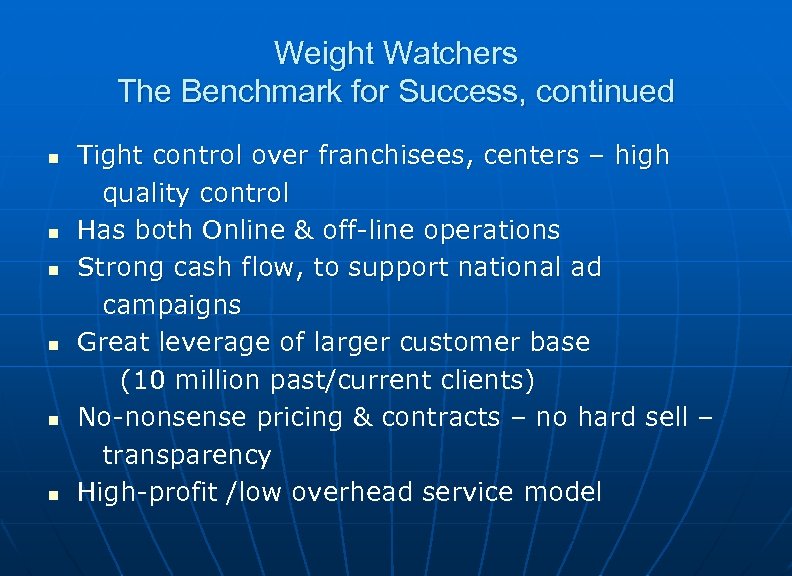

Weight Watchers The Benchmark for Success, continued n n n Tight control over franchisees, centers – high quality control Has both Online & off-line operations Strong cash flow, to support national ad campaigns Great leverage of larger customer base (10 million past/current clients) No-nonsense pricing & contracts – no hard sell – transparency High-profit /low overhead service model

Weight Watchers The Benchmark for Success, continued n n n Tight control over franchisees, centers – high quality control Has both Online & off-line operations Strong cash flow, to support national ad campaigns Great leverage of larger customer base (10 million past/current clients) No-nonsense pricing & contracts – no hard sell – transparency High-profit /low overhead service model

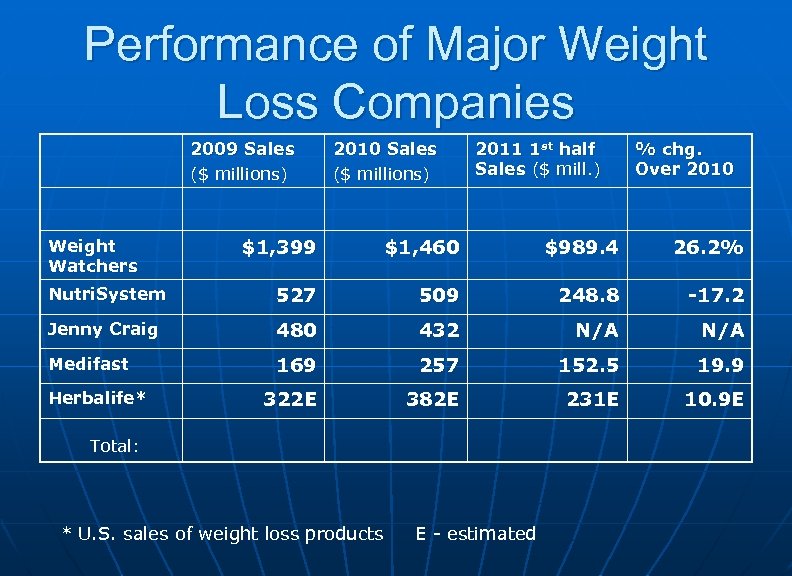

Performance of Major Weight Loss Companies 2009 Sales ($ millions) 2010 Sales ($ millions) 2011 1 st half Sales ($ mill. ) % chg. Over 2010 $1, 399 $1, 460 $989. 4 26. 2% Nutri. System 527 509 248. 8 -17. 2 Jenny Craig 480 432 N/A Medifast 169 257 152. 5 19. 9 322 E 382 E 231 E 10. 9 E Weight Watchers Herbalife* Total: * U. S. sales of weight loss products E - estimated

Performance of Major Weight Loss Companies 2009 Sales ($ millions) 2010 Sales ($ millions) 2011 1 st half Sales ($ mill. ) % chg. Over 2010 $1, 399 $1, 460 $989. 4 26. 2% Nutri. System 527 509 248. 8 -17. 2 Jenny Craig 480 432 N/A Medifast 169 257 152. 5 19. 9 322 E 382 E 231 E 10. 9 E Weight Watchers Herbalife* Total: * U. S. sales of weight loss products E - estimated

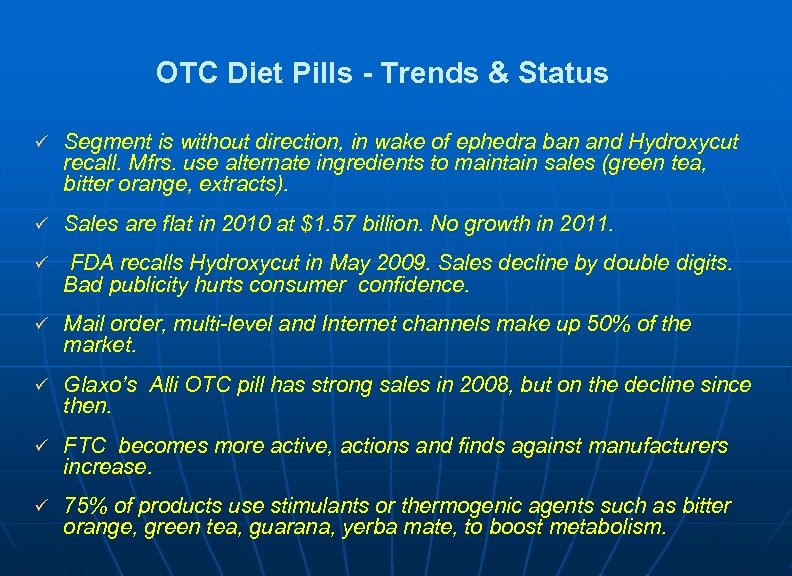

OTC Diet Pills - Trends & Status ü Segment is without direction, in wake of ephedra ban and Hydroxycut recall. Mfrs. use alternate ingredients to maintain sales (green tea, bitter orange, extracts). ü Sales are flat in 2010 at $1. 57 billion. No growth in 2011. ü FDA recalls Hydroxycut in May 2009. Sales decline by double digits. Bad publicity hurts consumer confidence. ü Mail order, multi-level and Internet channels make up 50% of the market. ü Glaxo’s Alli OTC pill has strong sales in 2008, but on the decline since then. ü FTC becomes more active, actions and finds against manufacturers increase. ü 75% of products use stimulants or thermogenic agents such as bitter orange, green tea, guarana, yerba mate, to boost metabolism.

OTC Diet Pills - Trends & Status ü Segment is without direction, in wake of ephedra ban and Hydroxycut recall. Mfrs. use alternate ingredients to maintain sales (green tea, bitter orange, extracts). ü Sales are flat in 2010 at $1. 57 billion. No growth in 2011. ü FDA recalls Hydroxycut in May 2009. Sales decline by double digits. Bad publicity hurts consumer confidence. ü Mail order, multi-level and Internet channels make up 50% of the market. ü Glaxo’s Alli OTC pill has strong sales in 2008, but on the decline since then. ü FTC becomes more active, actions and finds against manufacturers increase. ü 75% of products use stimulants or thermogenic agents such as bitter orange, green tea, guarana, yerba mate, to boost metabolism.

The Top OTC Diet Pills & Meal Replacements Brands: 2010 ($ millions) Slim-Fast (Unilever) Herbalife Zantrex, Relacore Hydroxycut (Iovate) Metabolife Stacker (NVE Pharm. ) Xenadrine (Cytodyne LLC) $180 382 160 220 80 40 40 Total: $1, 102

The Top OTC Diet Pills & Meal Replacements Brands: 2010 ($ millions) Slim-Fast (Unilever) Herbalife Zantrex, Relacore Hydroxycut (Iovate) Metabolife Stacker (NVE Pharm. ) Xenadrine (Cytodyne LLC) $180 382 160 220 80 40 40 Total: $1, 102

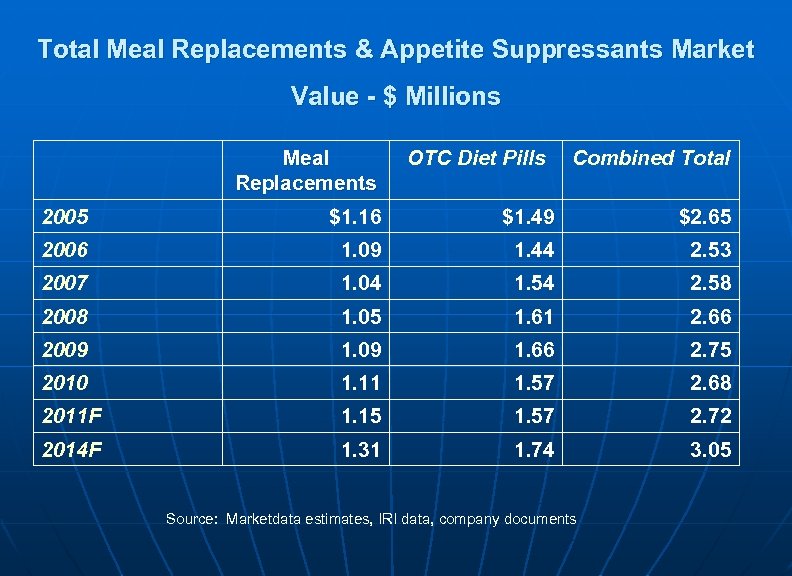

Total Meal Replacements & Appetite Suppressants Market Value - $ Millions Meal Replacements OTC Diet Pills Combined Total 2005 $1. 16 $1. 49 $2. 65 2006 1. 09 1. 44 2. 53 2007 1. 04 1. 54 2. 58 2008 1. 05 1. 61 2. 66 2009 1. 66 2. 75 2010 1. 11 1. 57 2. 68 2011 F 1. 15 1. 57 2. 72 2014 F 1. 31 1. 74 3. 05 Source: Marketdata estimates, IRI data, company documents

Total Meal Replacements & Appetite Suppressants Market Value - $ Millions Meal Replacements OTC Diet Pills Combined Total 2005 $1. 16 $1. 49 $2. 65 2006 1. 09 1. 44 2. 53 2007 1. 04 1. 54 2. 58 2008 1. 05 1. 61 2. 66 2009 1. 66 2. 75 2010 1. 11 1. 57 2. 68 2011 F 1. 15 1. 57 2. 72 2014 F 1. 31 1. 74 3. 05 Source: Marketdata estimates, IRI data, company documents

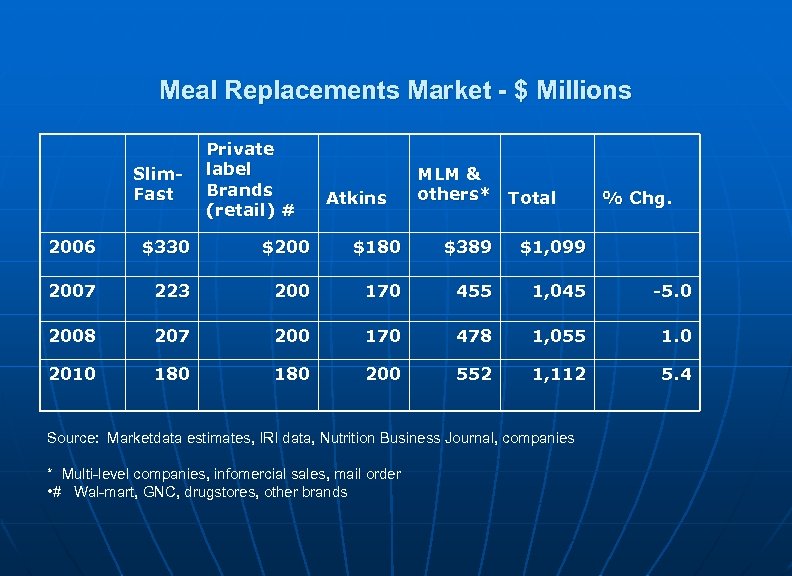

Meal Replacements Market - $ Millions Slim. Fast Private label Brands (retail) # Atkins MLM & others* Total % Chg. 2006 $330 $200 $180 $389 $1, 099 2007 223 200 170 455 1, 045 -5. 0 2008 207 200 170 478 1, 055 1. 0 2010 180 200 552 1, 112 5. 4 Source: Marketdata estimates, IRI data, Nutrition Business Journal, companies * Multi-level companies, infomercial sales, mail order • # Wal-mart, GNC, drugstores, other brands

Meal Replacements Market - $ Millions Slim. Fast Private label Brands (retail) # Atkins MLM & others* Total % Chg. 2006 $330 $200 $180 $389 $1, 099 2007 223 200 170 455 1, 045 -5. 0 2008 207 200 170 478 1, 055 1. 0 2010 180 200 552 1, 112 5. 4 Source: Marketdata estimates, IRI data, Nutrition Business Journal, companies * Multi-level companies, infomercial sales, mail order • # Wal-mart, GNC, drugstores, other brands

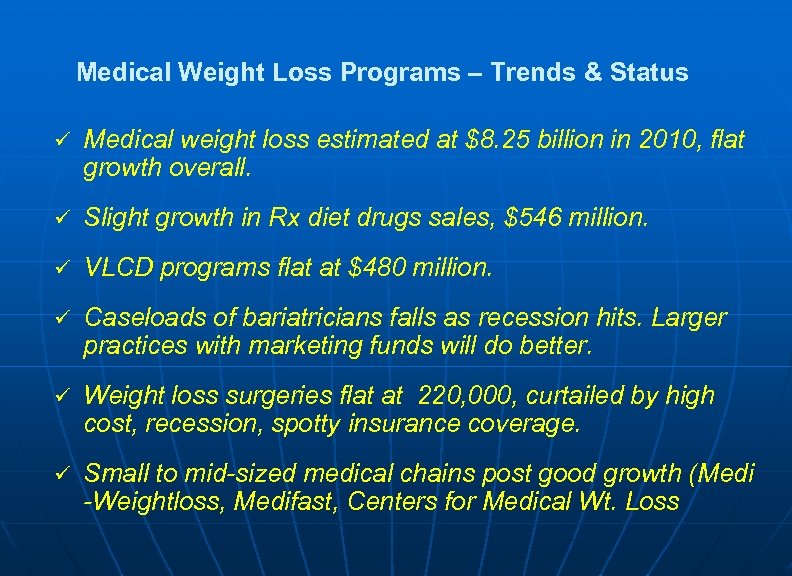

Medical Weight Loss Programs – Trends & Status ü Medical weight loss estimated at $8. 25 billion in 2010, flat growth overall. ü Slight growth in Rx diet drugs sales, $546 million. ü VLCD programs flat at $480 million. ü Caseloads of bariatricians falls as recession hits. Larger practices with marketing funds will do better. ü Weight loss surgeries flat at 220, 000, curtailed by high cost, recession, spotty insurance coverage. ü Small to mid-sized medical chains post good growth (Medi -Weightloss, Medifast, Centers for Medical Wt. Loss

Medical Weight Loss Programs – Trends & Status ü Medical weight loss estimated at $8. 25 billion in 2010, flat growth overall. ü Slight growth in Rx diet drugs sales, $546 million. ü VLCD programs flat at $480 million. ü Caseloads of bariatricians falls as recession hits. Larger practices with marketing funds will do better. ü Weight loss surgeries flat at 220, 000, curtailed by high cost, recession, spotty insurance coverage. ü Small to mid-sized medical chains post good growth (Medi -Weightloss, Medifast, Centers for Medical Wt. Loss

Untapped Market Niches n n n n Afro-American diet programs Hispanic diet programs Adolescents market China Centers with on-site exercise Partnerships with drugstore chain healthcare “mini-clinics” Upscale shopping mall locations OB/Gyn offices

Untapped Market Niches n n n n Afro-American diet programs Hispanic diet programs Adolescents market China Centers with on-site exercise Partnerships with drugstore chain healthcare “mini-clinics” Upscale shopping mall locations OB/Gyn offices

Marketdata’s 2011 Forecasts • Total market to grow only 2%, to $62 billion. • No new blockbuster prescription diet drug. • Free & low cost diet websites will gain (Weight Watchers. com, Sparkpeople, etc. ) • MLM channels will do well (Herbalife, Tale Shape for Life, Amway, Nu-Skin). • Return to regular food-based plans, less company diet foods & supplements. • 3. 5% growth for commercial chains. • Meal replacements grow faster than OTC diet pills

Marketdata’s 2011 Forecasts • Total market to grow only 2%, to $62 billion. • No new blockbuster prescription diet drug. • Free & low cost diet websites will gain (Weight Watchers. com, Sparkpeople, etc. ) • MLM channels will do well (Herbalife, Tale Shape for Life, Amway, Nu-Skin). • Return to regular food-based plans, less company diet foods & supplements. • 3. 5% growth for commercial chains. • Meal replacements grow faster than OTC diet pills

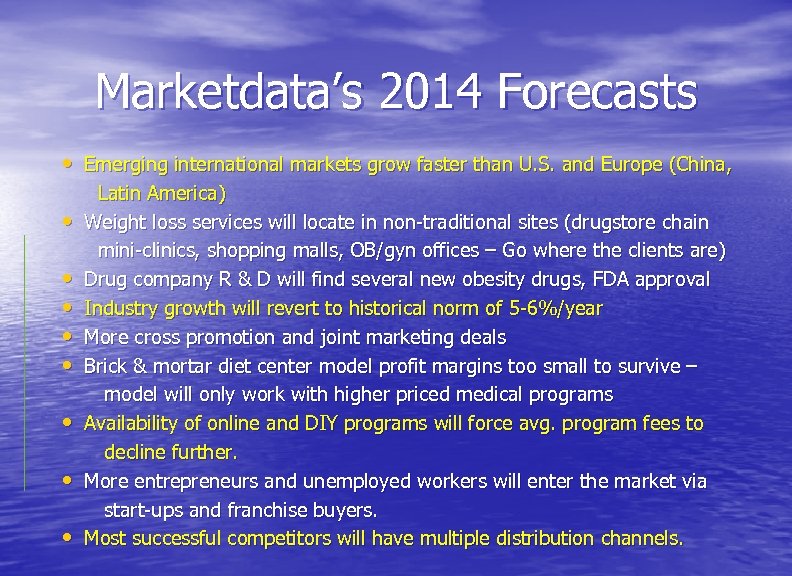

Marketdata’s 2014 Forecasts • Emerging international markets grow faster than U. S. and Europe (China, • • Latin America) Weight loss services will locate in non-traditional sites (drugstore chain mini-clinics, shopping malls, OB/gyn offices – Go where the clients are) Drug company R & D will find several new obesity drugs, FDA approval Industry growth will revert to historical norm of 5 -6%/year More cross promotion and joint marketing deals Brick & mortar diet center model profit margins too small to survive – model will only work with higher priced medical programs Availability of online and DIY programs will force avg. program fees to decline further. More entrepreneurs and unemployed workers will enter the market via start-ups and franchise buyers. Most successful competitors will have multiple distribution channels.

Marketdata’s 2014 Forecasts • Emerging international markets grow faster than U. S. and Europe (China, • • Latin America) Weight loss services will locate in non-traditional sites (drugstore chain mini-clinics, shopping malls, OB/gyn offices – Go where the clients are) Drug company R & D will find several new obesity drugs, FDA approval Industry growth will revert to historical norm of 5 -6%/year More cross promotion and joint marketing deals Brick & mortar diet center model profit margins too small to survive – model will only work with higher priced medical programs Availability of online and DIY programs will force avg. program fees to decline further. More entrepreneurs and unemployed workers will enter the market via start-ups and franchise buyers. Most successful competitors will have multiple distribution channels.

Thank You ! John La. Rosa, President Marketdata. Enterprises. com John@Marketdata. Enterprises. com Best. Diet. For. Me. com Diet. Business. Watch. com Phone: 813 -907 -9090 Fax: 813 -907 -3606

Thank You ! John La. Rosa, President Marketdata. Enterprises. com John@Marketdata. Enterprises. com Best. Diet. For. Me. com Diet. Business. Watch. com Phone: 813 -907 -9090 Fax: 813 -907 -3606