4fa4a8e2649309a9b0e1d854bfb1f52d.ppt

- Количество слайдов: 84

Overview

Overview

Section 382 General Rules

Section 382 General Rules

Section 382 Base Case

Section 382 Base Case

Section 382 Definition of “Ownership Change”

Section 382 Definition of “Ownership Change”

Section 382 Definition of “Ownership Change”

Section 382 Definition of “Ownership Change”

Section 382 Ownership Change – Example

Section 382 Ownership Change – Example

Section 382 Definition of “Ownership Change”

Section 382 Definition of “Ownership Change”

Section 382 Option – Example

Section 382 Option – Example

Section 382 Calculation of Limitation

Section 382 Calculation of Limitation

Section 382 Allocation of Income for Change Year

Section 382 Allocation of Income for Change Year

Section 382 Continuity of Business Enterprise

Section 382 Continuity of Business Enterprise

Section 382 Recognized Built-in Gains and Losses

Section 382 Recognized Built-in Gains and Losses

Section 382 NUBIL Example

Section 382 NUBIL Example

Section 382 Built-In Income and Deduction

Section 382 Built-In Income and Deduction

Section 382 Built-In Income and Deduction

Section 382 Built-In Income and Deduction

Section 1374 Approach

Section 1374 Approach

Section 338 Approach

Section 338 Approach

Section 338 Approach – Wasting or Consumption of Built-In Gain Assets

Section 338 Approach – Wasting or Consumption of Built-In Gain Assets

Section 338 Approach – Wasting or Consumption of Built-In Gain Assets

Section 338 Approach – Wasting or Consumption of Built-In Gain Assets

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Bankruptcy Rules

Section 382 Application to Consolidated Groups

Section 382 Application to Consolidated Groups

Section 382 Consolidated Ownership Change

Section 382 Consolidated Ownership Change

SRLY Rules Overview

SRLY Rules Overview

SRLY Rules Creeping Acquisition – Example

SRLY Rules Creeping Acquisition – Example

SRLY Rules Non-Applicability in Section 382 Overlap

SRLY Rules Non-Applicability in Section 382 Overlap

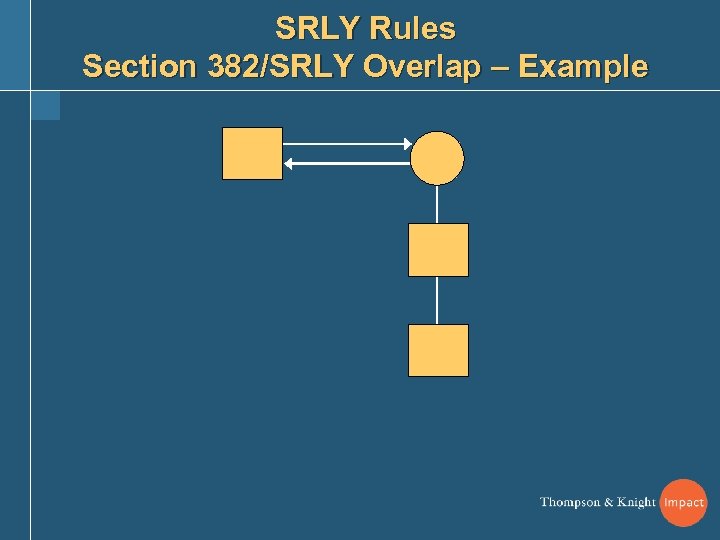

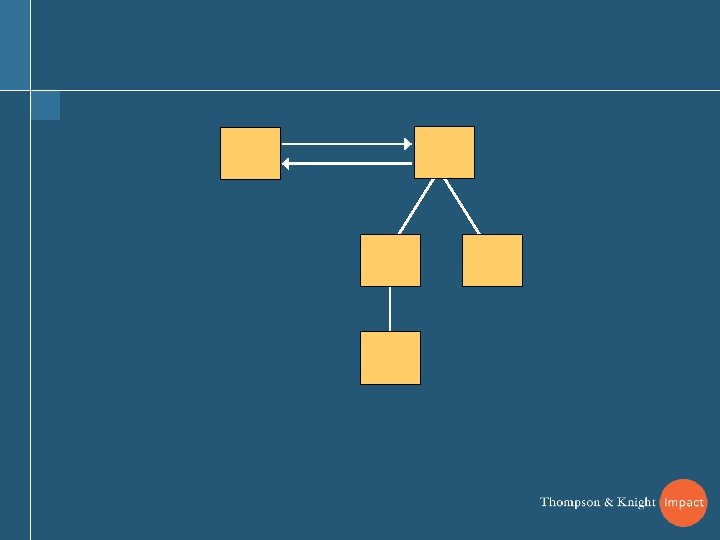

SRLY Rules Section 382/SRLY Overlap – Example

SRLY Rules Section 382/SRLY Overlap – Example

SRLY Rules Planning Opportunities

SRLY Rules Planning Opportunities

SRLY Rules Stuffing - Conduit Transactions

SRLY Rules Stuffing - Conduit Transactions

SRLY Rules Loss Waiver Election

SRLY Rules Loss Waiver Election

Insolvent Subsidiary – Liquidation

Insolvent Subsidiary – Liquidation

Tax Consequences of Insolvent Liquidation

Tax Consequences of Insolvent Liquidation

Check the Box Stock Worthlessness Rev. Rul. 2003 -125

Check the Box Stock Worthlessness Rev. Rul. 2003 -125

Tax-Free Reorganizations of Insolvent Corporations

Tax-Free Reorganizations of Insolvent Corporations

Loss Disallowance Rules Son of Mirror Example

Loss Disallowance Rules Son of Mirror Example

Computation of Allowed Loss Under Former Treas. Reg. § 1. 1502 -20

Computation of Allowed Loss Under Former Treas. Reg. § 1. 1502 -20

LDR – Base Case (Son of Mirror)

LDR – Base Case (Son of Mirror)

LDR – No Loss Case

LDR – No Loss Case

LDR – Offsetting Built-in Gains and Losses

LDR – Offsetting Built-in Gains and Losses

Difficulties in the Application of Treas. Reg. § 1. 337(d)-2 T

Difficulties in the Application of Treas. Reg. § 1. 337(d)-2 T

LDR – Built-in Income

LDR – Built-in Income

Notice 2004 -58

Notice 2004 -58

Basis Disconformity Calculation

Basis Disconformity Calculation

Tracing v. Basis Disconformity

Tracing v. Basis Disconformity

LDR – Offsetting Built-in Gains and Losses

LDR – Offsetting Built-in Gains and Losses

Tracing v. Basis Disconformity

Tracing v. Basis Disconformity

Overview of Treas. Reg. § 1. 1502 -35 T

Overview of Treas. Reg. § 1. 1502 -35 T

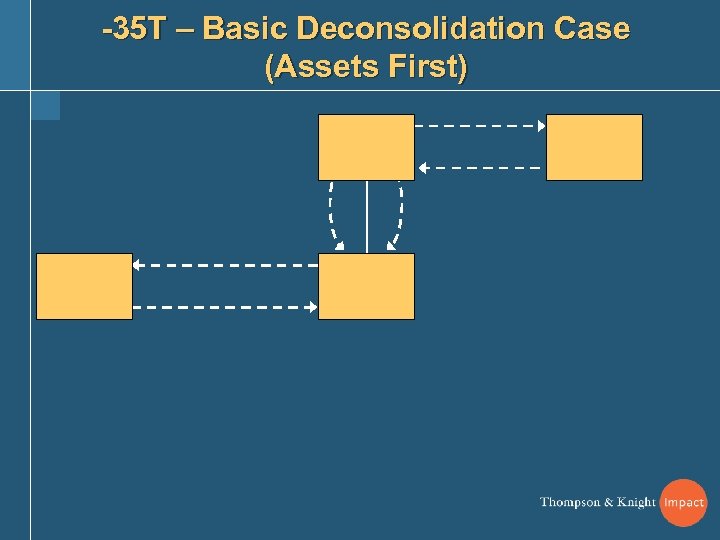

-35 T – Basic Deconsolidation Case (Assets First)

-35 T – Basic Deconsolidation Case (Assets First)

Basis Reallocation Rule

Basis Reallocation Rule

-35 T Loss Disallowance Rule

-35 T Loss Disallowance Rule

-35 T - Basic Consolidation Case (Assets First)

-35 T - Basic Consolidation Case (Assets First)

-35 T - Basic Consolidation Case (Stock First)

-35 T - Basic Consolidation Case (Stock First)