7e996ae67b1b0deee8e2fb04e0f8d4f4.ppt

- Количество слайдов: 13

Overview of US Health Care Reform Presented by: Anova Benefits Management

Health Care Reform The Following is a basic summary of Health Care Reform and how it affects you. Table of Contents: I. What is Health Care Reform II. Why Health Care Reform III. Notice Pertaining to Following Slides IV. Part A: In Effect Now V. Part B: Future VI. Controversies VII. Summary

I. What is Health Care Reform is an effort by the Obama Administration to increase the affordability and access of Health Insurance under the Patient Protection and Affordable Care Act. It is a Two Part Document with Part A going into effect immediately and Part B going into effect in by 2014. The goal of the Patient Protection and Affordability Act is to ensure more than 32 million Americans.

II. Why Health Care Reform Currently in Texas, there are more than 4 million adults (age 19 -64) that are uninsured. 1 The cost of insurance is rising with the average annual family premiums costing around $16, 000. 2 With the increasing cost of health care and increasing US population more and more people are uninsured and unable to cover their medical costs. References: . 1) Kaiser Family Foundation, statehealthfacts. org. Urban Institute and Kaiser Commission on Medicaid and the Uninsured estimates based on the Census Bureau's March 2009 and 2010 Current Population Survey (CPS: Annual Social and Economic Supplements). Retrieved from http: //www. statehealthfacts. org/profileind. jsp? ind=130&cat=3&rgn=45. Accessed: 12/19/2011. 2)Kaiser Family Foundation. Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999 -2011. Retrieved from http: //facts. kff. org/chart. aspx? ch=2281. Accessed: 12/19/2011.

III. Pertaining to the Following Slides Plans before September 23, 2010 are grandfathered and may not be subject to all the provisions. The following slides are a rough summary of the schedule of provisions for the Patient Protection and Affordable Care Act. These Provisions may not be permanent due to future legislation and rulings and not all of the future provisions are guaranteed to go into effect at the dates listed. A general outline is as follows with appropriate references at the end.

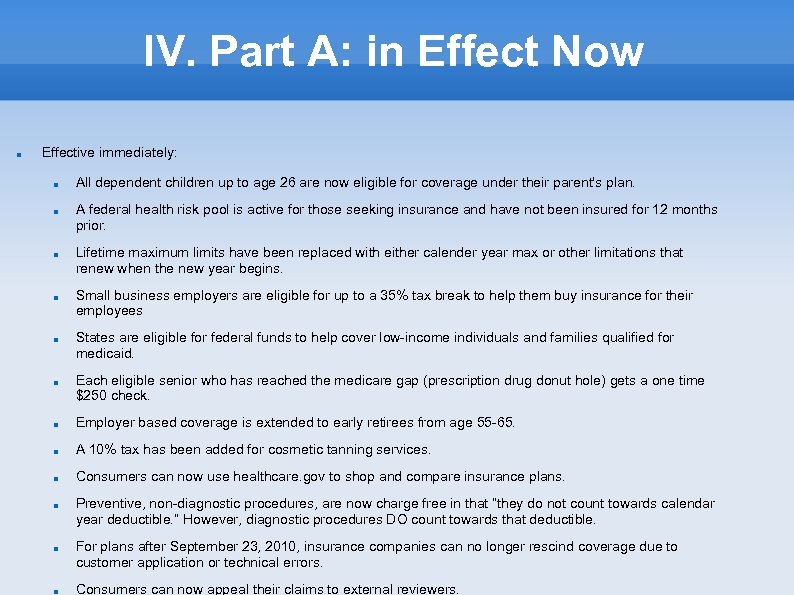

IV. Part A: in Effect Now Effective immediately: All dependent children up to age 26 are now eligible for coverage under their parent's plan. A federal health risk pool is active for those seeking insurance and have not been insured for 12 months prior. Lifetime maximum limits have been replaced with either calender year max or other limitations that renew when the new year begins. Small business employers are eligible for up to a 35% tax break to help them buy insurance for their employees States are eligible for federal funds to help cover low-income individuals and families qualified for medicaid. Each eligible senior who has reached the medicare gap (prescription drug donut hole) gets a one time $250 check. Employer based coverage is extended to early retirees from age 55 -65. A 10% tax has been added for cosmetic tanning services. Consumers can now use healthcare. gov to shop and compare insurance plans. Preventive, non-diagnostic procedures, are now charge free in that ”they do not count towards calendar year deductible. ” However, diagnostic procedures DO count towards that deductible. For plans after September 23, 2010, insurance companies can no longer rescind coverage due to customer application or technical errors. Consumers can now appeal their claims to external reviewers.

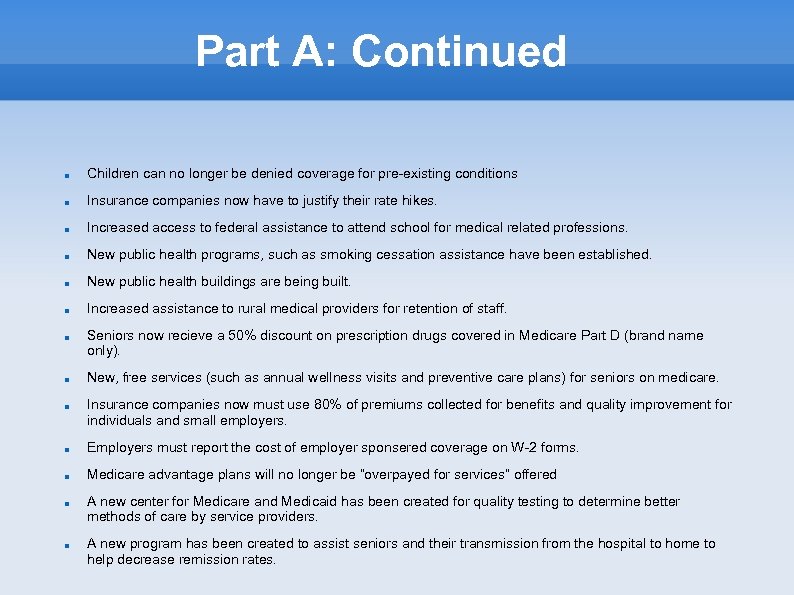

Part A: Continued Children can no longer be denied coverage for pre-existing conditions Insurance companies now have to justify their rate hikes. Increased access to federal assistance to attend school for medical related professions. New public health programs, such as smoking cessation assistance have been established. New public health buildings are being built. Increased assistance to rural medical providers for retention of staff. Seniors now recieve a 50% discount on prescription drugs covered in Medicare Part D (brand name only). New, free services (such as annual wellness visits and preventive care plans) for seniors on medicare. Insurance companies now must use 80% of premiums collected for benefits and quality improvement for individuals and small employers. Employers must report the cost of employer sponsered coverage on W-2 forms. Medicare advantage plans will no longer be ”overpayed for services” offered A new center for Medicare and Medicaid has been created for quality testing to determine better methods of care by service providers. A new program has been created to assist seniors and their transmission from the hospital to home to help decrease remission rates.

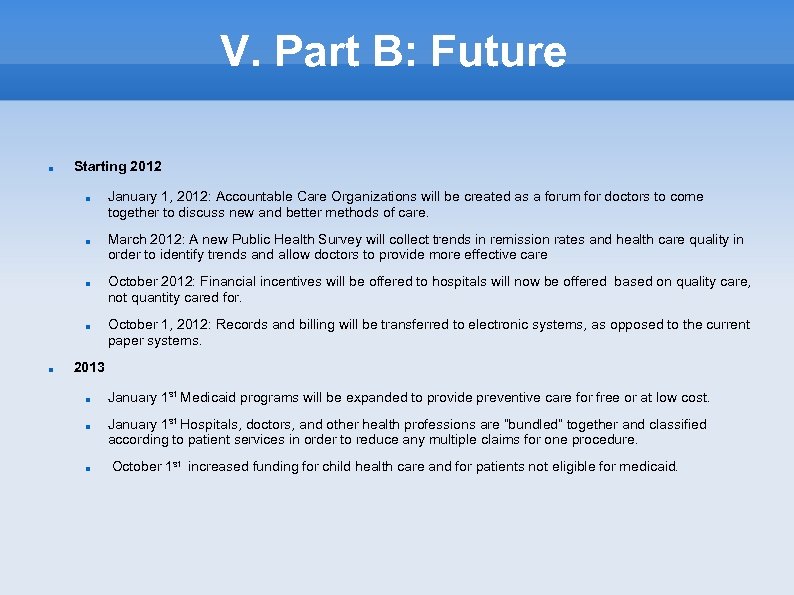

V. Part B: Future Starting 2012 January 1, 2012: Accountable Care Organizations will be created as a forum for doctors to come together to discuss new and better methods of care. March 2012: A new Public Health Survey will collect trends in remission rates and health care quality in order to identify trends and allow doctors to provide more effective care October 2012: Financial incentives will be offered to hospitals will now be offered based on quality care, not quantity cared for. October 1, 2012: Records and billing will be transferred to electronic systems, as opposed to the current paper systems. 2013 January 1 st Medicaid programs will be expanded to provide preventive care for free or at low cost. January 1 st Hospitals, doctors, and other health professions are ”bundled” together and classified according to patient services in order to reduce any multiple claims for one procedure. October 1 st increased funding for child health care and for patients not eligible for medicaid.

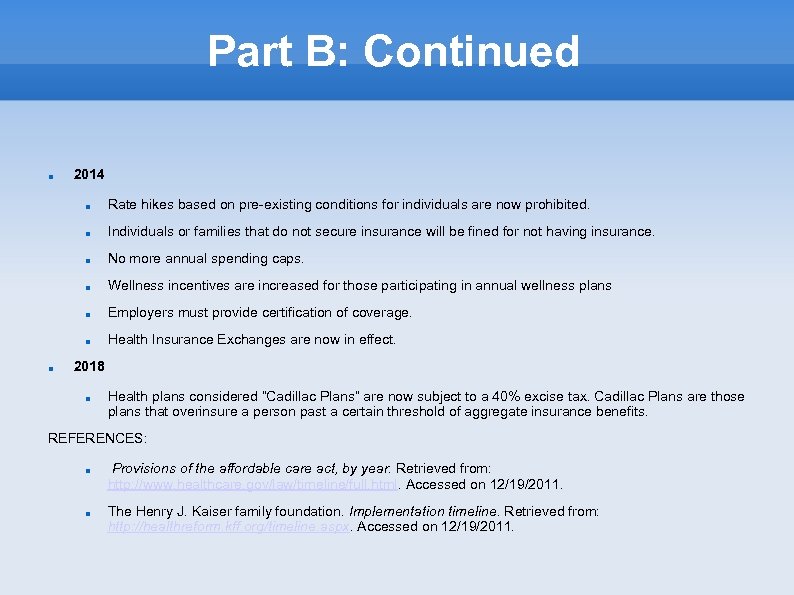

Part B: Continued 2014 Individuals or families that do not secure insurance will be fined for not having insurance. No more annual spending caps. Wellness incentives are increased for those participating in annual wellness plans Employers must provide certification of coverage. Rate hikes based on pre-existing conditions for individuals are now prohibited. Health Insurance Exchanges are now in effect. 2018 Health plans considered ”Cadillac Plans” are now subject to a 40% excise tax. Cadillac Plans are those plans that overinsure a person past a certain threshold of aggregate insurance benefits. REFERENCES: Provisions of the affordable care act, by year. Retrieved from: http: //www. healthcare. gov/law/timeline/full. html. Accessed on 12/19/2011. The Henry J. Kaiser family foundation. Implementation timeline. Retrieved from: http: //healthreform. kff. org/timeline. aspx. Accessed on 12/19/2011.

VI. How will we afford this? The Patient Protection and Affordable Care act is designed to pay for itself through full participation and implementation of it's policies. The plan increases taxes on those making more than $250, 000 per year and fines those that decide to opt out the plan. 1 1) The Henry J. Kaiser Family Foundation. Movie Reform Script. Retrieved from: http: //healthreform. kff. org/~/media/Files/KHS/Source%20 general/movie_reform_script_textonly_9_14 FINAL. pdf. Accessed on 12/19/2011

VII. Why the Controversy? Can't force people to buy broccoli: 1 For the PPAA to fully fund itself, it requires full participation and implementation. Many healthy people that do not need insurance are forced into paying premiums that they will not use. The issue at hand is whether or not Congress has the authority to require people to buy insurance. With more people insured, there will be longer wait times for certain surgeries and we may see a decrease in quality of care. The PPAA is extremely complicated and long. One of the major criticisms is that many Congressional leaders have not even read the plan, or had not the time to thoroughly review it before passing it. It requires FULL participation to work. Very few Government programs ever have FULL participation. 1. Liptak, adam. Health law puts focus on limits of federal power. The new york times. Published November 13, 2011. Accessed here: http: //www. nytimes. com/2011/11/14/us/politics/health-law-debate -puts-focus-on-limit-of-federal-power. html Retrieved on December 22, 2011.

VIII. Summary Many of the PPAA provisions are currently in effect with more being scheduled to roll out between now and 2014. Many of these provisions may change with various legislative efforts on behalf of the states and other political groups. Insurance Carriers have raised premiums to offset the costs that the PPAA is requiring them to cover. This increase in premiums has many large and small businesses reviewing their healthcare options.

IX. References and Helpful Links References: Kaiser Family Foundation, statehealthfacts. org. Urban Institute and Kaiser Commission on Medicaid and the Uninsured estimates based on the Census Bureau's March 2009 and 2010 Current Population Survey (CPS: Annual Social and Economic Supplements). Retrieved from http: //www. statehealthfacts. org/profileind. jsp? ind=130&cat=3&rgn=45. Accessed: 12/19/2011. US Department of Health and Human Services. What's Changing and When. Retrieved from: http: //www. healthcare. gov/law/timeline/index. html. Accessed: December 22, 2011. Grossman, Edward G. ; Sterkx, Craig A. ; Blount, Elonda C. ; Volberding, Emily M. Patient protection and affordable care act health related portions of the health care and reconciliation act of 2010. Retrieved from: http: //www. healthcare. gov/law/timeline/index. html. Accessed on: December 22, 2011. Helpful Resources: Kaiser Family Foundation's Powerpoint: http: //www. kaiseredu. org/Tutorials-and-Presentations/Health-Reform. Overview. aspx Criticisms regarding Public Health Care in Canada: http: //en. wikipedia. org/wiki/Health_care_in_Canada#Criticisms Wiki article on Health Care Reform: http: //en. wikipedia. org/wiki/Health_care_reform_in_the_United_States Kaiser Family Foundation info on Health refomr: http: //healthreform. kff. org/ Healthcare. gov: http: //www. healthcare. gov/index. html Aflcio: http: //www. aflcio. org/issues/healthcare/resources/

7e996ae67b1b0deee8e2fb04e0f8d4f4.ppt