8d6d5c0247c950ca61098846f3ef5b16.ppt

- Количество слайдов: 16

Overview of the SAPP and the Energy Network in Southern Africa www. sapp. co. zw By Eng. Musara Beta Chief Market Analyst SAPP Coordination Centre 1 Carbon Capture & Storage Workshop: Perspectives for the Southern Africa Region Holiday Inn, Sandton, Johannesburg, SOUTH AFRICA 31 May 2011 SOUTHERN AFRICAN POWER POOL

Overview of the SAPP and the Energy Network in Southern Africa www. sapp. co. zw By Eng. Musara Beta Chief Market Analyst SAPP Coordination Centre 1 Carbon Capture & Storage Workshop: Perspectives for the Southern Africa Region Holiday Inn, Sandton, Johannesburg, SOUTH AFRICA 31 May 2011 SOUTHERN AFRICAN POWER POOL

CONTENTS 1. INTRODUCTION TO SAPP 2. SAPP DEMAND & SUPPLY BALANCE 3. SAPP GENERATION MIX 4. TRANSMISSION NETWORK DEVELOPMENT 5. DEMAND SIDE MANAGEMENT 6. SAPP COMPETITIVE MARKET 7. CONCLUSION 2 SOUTHERN AFRICAN POWER POOL

CONTENTS 1. INTRODUCTION TO SAPP 2. SAPP DEMAND & SUPPLY BALANCE 3. SAPP GENERATION MIX 4. TRANSMISSION NETWORK DEVELOPMENT 5. DEMAND SIDE MANAGEMENT 6. SAPP COMPETITIVE MARKET 7. CONCLUSION 2 SOUTHERN AFRICAN POWER POOL

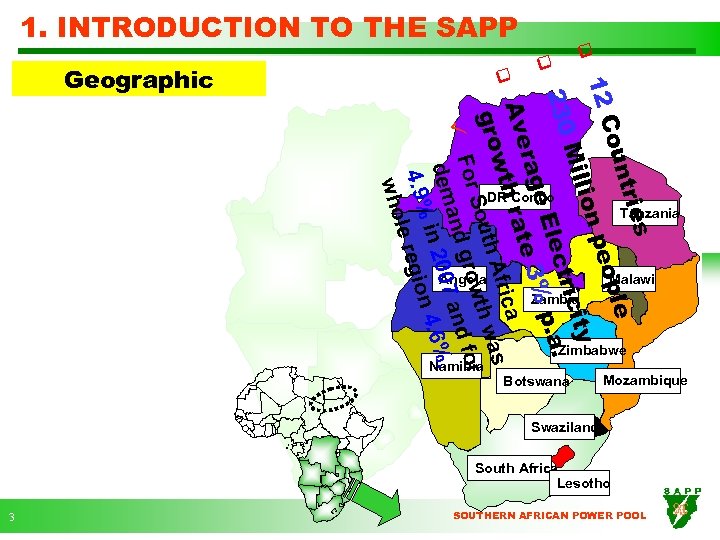

q Geographic s trie oun ple peo 12 C q ion ty Mill rici 230 lect. a. q ge E e 3% p t 1. INTRODUCTION TO THE SAPP era ra Av ca wth Afri as gro th w outh or S grow nd for a ü F and dem in 2007 4. 6%. 4. 9% e region l who DR Congo Angola Tanzania Malawi Zambia Namibia Zimbabwe Botswana Mozambique Swaziland South Africa Lesotho 3 SOUTHERN AFRICAN POWER POOL

q Geographic s trie oun ple peo 12 C q ion ty Mill rici 230 lect. a. q ge E e 3% p t 1. INTRODUCTION TO THE SAPP era ra Av ca wth Afri as gro th w outh or S grow nd for a ü F and dem in 2007 4. 6%. 4. 9% e region l who DR Congo Angola Tanzania Malawi Zambia Namibia Zimbabwe Botswana Mozambique Swaziland South Africa Lesotho 3 SOUTHERN AFRICAN POWER POOL

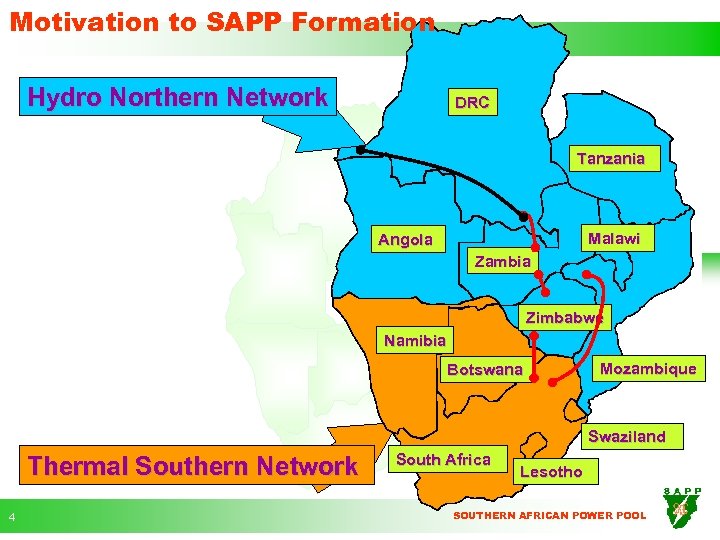

Motivation to SAPP Formation Hydro Northern Network DRC Tanzania Malawi Angola Zambia Zimbabwe Namibia Botswana Mozambique Swaziland Thermal Southern Network 4 South Africa Lesotho SOUTHERN AFRICAN POWER POOL

Motivation to SAPP Formation Hydro Northern Network DRC Tanzania Malawi Angola Zambia Zimbabwe Namibia Botswana Mozambique Swaziland Thermal Southern Network 4 South Africa Lesotho SOUTHERN AFRICAN POWER POOL

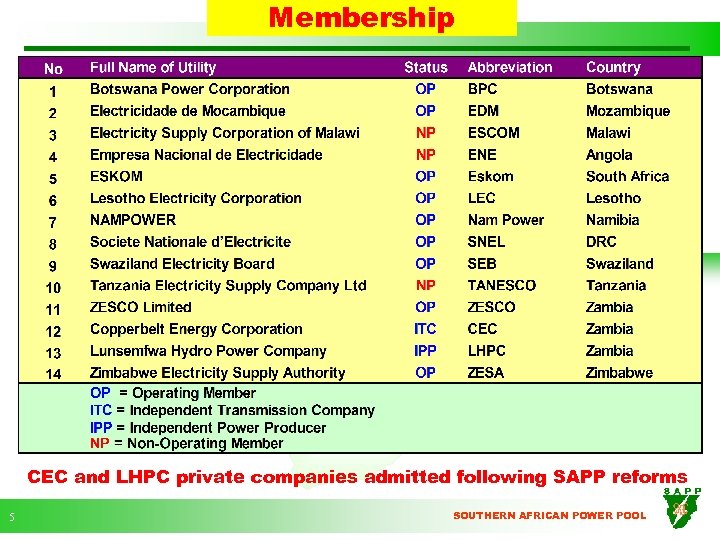

Membership CEC and LHPC private companies admitted following SAPP reforms 5 SOUTHERN AFRICAN POWER POOL

Membership CEC and LHPC private companies admitted following SAPP reforms 5 SOUTHERN AFRICAN POWER POOL

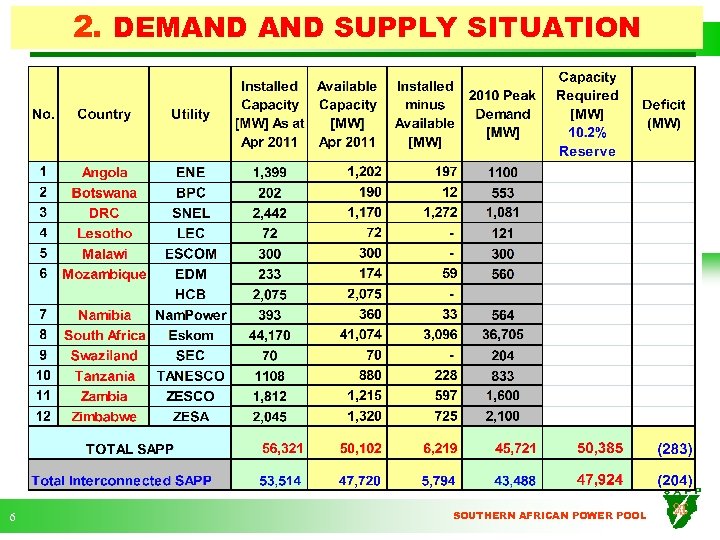

2. DEMAND SUPPLY SITUATION 6 SOUTHERN AFRICAN POWER POOL

2. DEMAND SUPPLY SITUATION 6 SOUTHERN AFRICAN POWER POOL

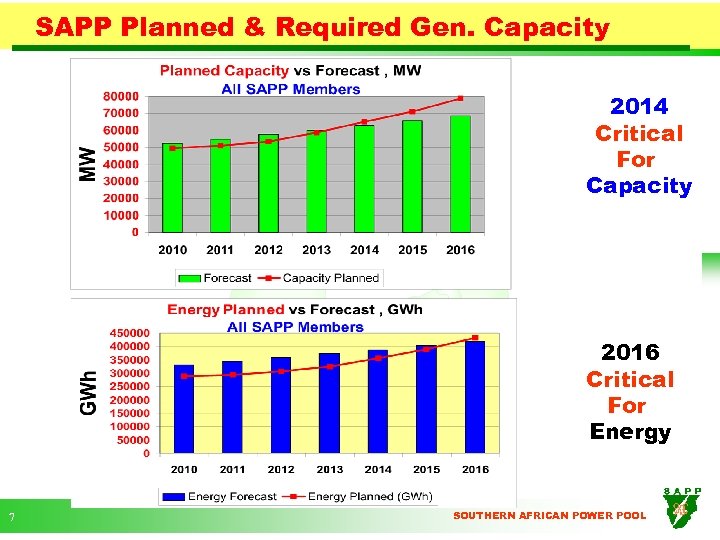

SAPP Planned & Required Gen. Capacity 2014 Critical For Capacity 2016 Critical For Energy 7 SOUTHERN AFRICAN POWER POOL

SAPP Planned & Required Gen. Capacity 2014 Critical For Capacity 2016 Critical For Energy 7 SOUTHERN AFRICAN POWER POOL

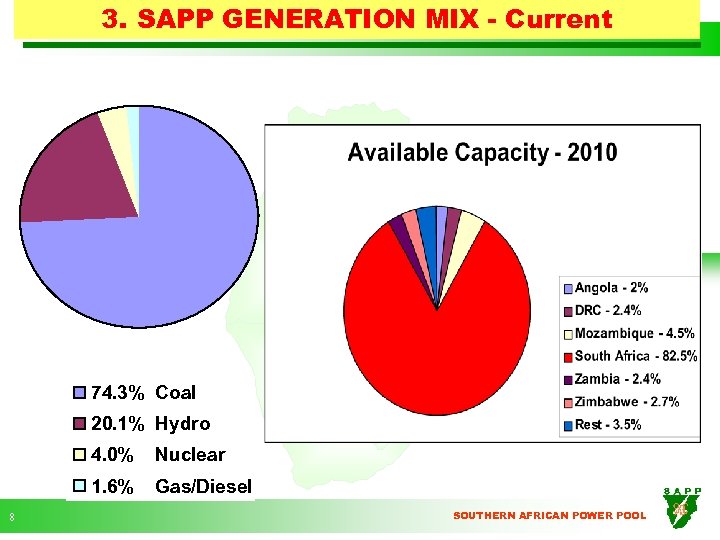

3. SAPP GENERATION MIX - Current 74. 3% Coal 20. 1% Hydro 4. 0% 1. 6% 8 Nuclear Gas/Diesel SOUTHERN AFRICAN POWER POOL

3. SAPP GENERATION MIX - Current 74. 3% Coal 20. 1% Hydro 4. 0% 1. 6% 8 Nuclear Gas/Diesel SOUTHERN AFRICAN POWER POOL

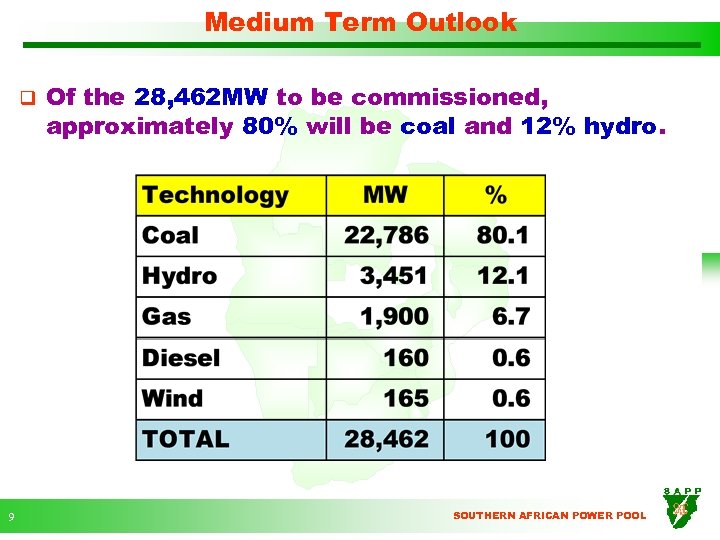

Medium Term Outlook q 9 Of the 28, 462 MW to be commissioned, approximately 80% will be coal and 12% hydro. SOUTHERN AFRICAN POWER POOL

Medium Term Outlook q 9 Of the 28, 462 MW to be commissioned, approximately 80% will be coal and 12% hydro. SOUTHERN AFRICAN POWER POOL

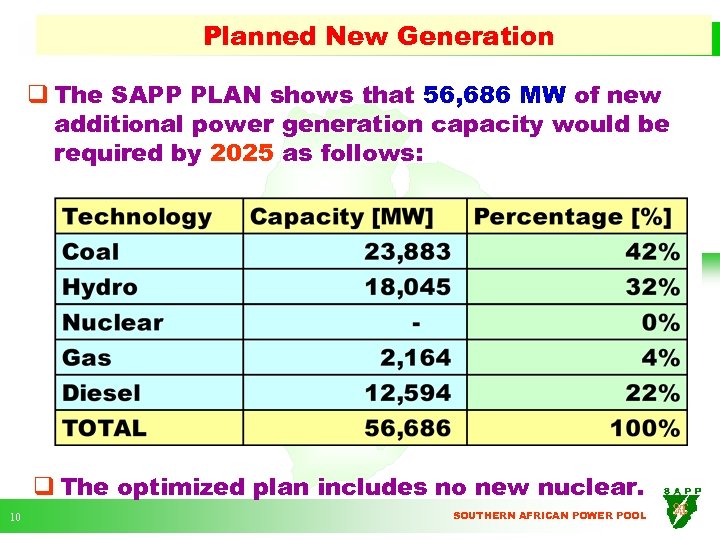

Planned New Generation q The SAPP PLAN shows that 56, 686 MW of new additional power generation capacity would be required by 2025 as follows: q The optimized plan includes no new nuclear. 10 SOUTHERN AFRICAN POWER POOL

Planned New Generation q The SAPP PLAN shows that 56, 686 MW of new additional power generation capacity would be required by 2025 as follows: q The optimized plan includes no new nuclear. 10 SOUTHERN AFRICAN POWER POOL

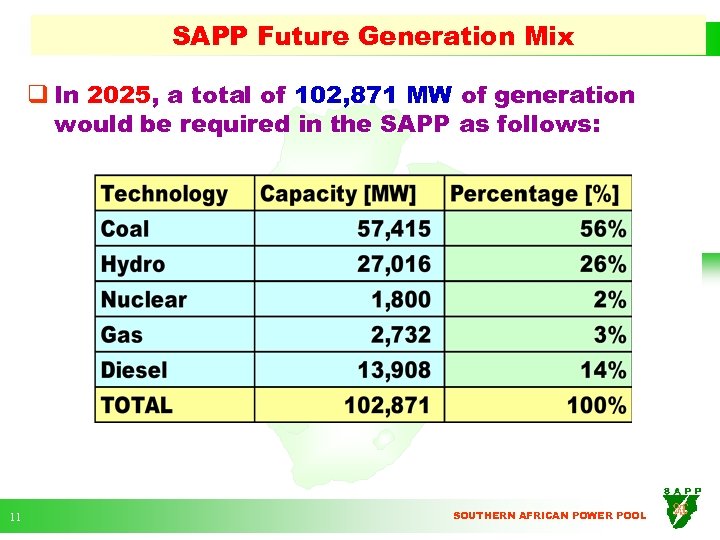

SAPP Future Generation Mix q In 2025, a total of 102, 871 MW of generation would be required in the SAPP as follows: 11 SOUTHERN AFRICAN POWER POOL

SAPP Future Generation Mix q In 2025, a total of 102, 871 MW of generation would be required in the SAPP as follows: 11 SOUTHERN AFRICAN POWER POOL

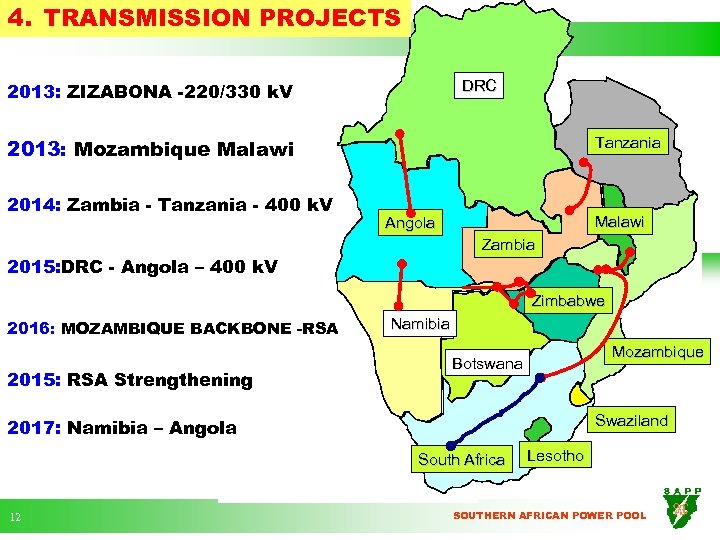

4. TRANSMISSION PROJECTS DRC 2013: ZIZABONA -220/330 k. V Tanzania 2013: Mozambique Malawi 2014: Zambia - Tanzania - 400 k. V Malawi Angola Zambia 2015: DRC - Angola – 400 k. V Zimbabwe 2016: MOZAMBIQUE BACKBONE -RSA 2015: RSA Strengthening Namibia Mozambique Botswana Swaziland 2017: Namibia – Angola South Africa 12 Lesotho SOUTHERN AFRICAN POWER POOL

4. TRANSMISSION PROJECTS DRC 2013: ZIZABONA -220/330 k. V Tanzania 2013: Mozambique Malawi 2014: Zambia - Tanzania - 400 k. V Malawi Angola Zambia 2015: DRC - Angola – 400 k. V Zimbabwe 2016: MOZAMBIQUE BACKBONE -RSA 2015: RSA Strengthening Namibia Mozambique Botswana Swaziland 2017: Namibia – Angola South Africa 12 Lesotho SOUTHERN AFRICAN POWER POOL

![5. DEMAND SIDE MANAGEMENT 5, 000. 00 Demand Reduction [MW] HWLC 4, 000. 00 5. DEMAND SIDE MANAGEMENT 5, 000. 00 Demand Reduction [MW] HWLC 4, 000. 00](https://present5.com/presentation/8d6d5c0247c950ca61098846f3ef5b16/image-13.jpg) 5. DEMAND SIDE MANAGEMENT 5, 000. 00 Demand Reduction [MW] HWLC 4, 000. 00 Commercial Lighting SWH CFLs 3, 000. 00 2, 000. 00 1, 000. 00 2009 2010 2011 2012 2013 2014 2015 Year q 13 Four technologies were planned: i. Compact florescent lamps (CFLs) ii. Solar Water Heaters (SWH) iii. Hot Water Load Control (HWLC), and iv. Commercial Lighting In 2010, 750 MW of savings were realised with CFL programme against a target of 1400 MW SOUTHERN AFRICAN POWER POOL

5. DEMAND SIDE MANAGEMENT 5, 000. 00 Demand Reduction [MW] HWLC 4, 000. 00 Commercial Lighting SWH CFLs 3, 000. 00 2, 000. 00 1, 000. 00 2009 2010 2011 2012 2013 2014 2015 Year q 13 Four technologies were planned: i. Compact florescent lamps (CFLs) ii. Solar Water Heaters (SWH) iii. Hot Water Load Control (HWLC), and iv. Commercial Lighting In 2010, 750 MW of savings were realised with CFL programme against a target of 1400 MW SOUTHERN AFRICAN POWER POOL

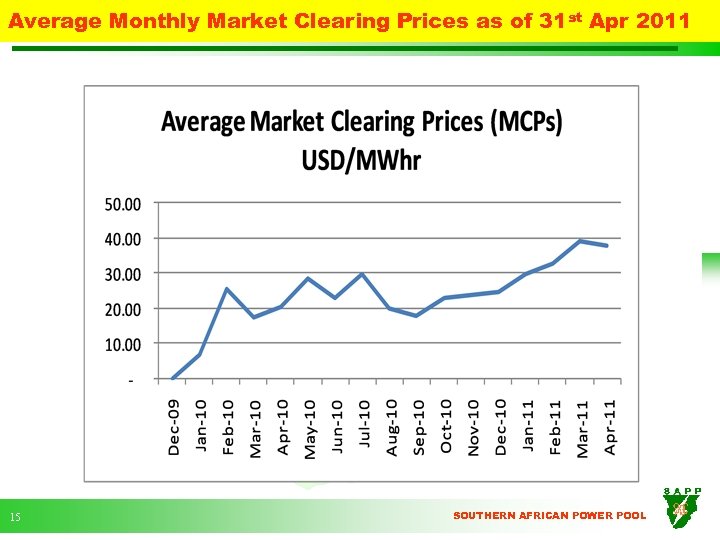

6. SAPP COMPETITIVE MARKET OVERVIEW q SAPP DAM Market opened for live trading on 15 December 2009 q Market performance highlights as of 31 st April 2011 ü ü 42, 000 MWh was matched on the DAM trading platform ü However only 29, 000 MWh was traded or approximately 1% market share ü 14 437, 000 MWh Sale and 338, 000 MWh Buy bids received The remainder could not be traded due to transmission constraints SOUTHERN AFRICAN POWER POOL

6. SAPP COMPETITIVE MARKET OVERVIEW q SAPP DAM Market opened for live trading on 15 December 2009 q Market performance highlights as of 31 st April 2011 ü ü 42, 000 MWh was matched on the DAM trading platform ü However only 29, 000 MWh was traded or approximately 1% market share ü 14 437, 000 MWh Sale and 338, 000 MWh Buy bids received The remainder could not be traded due to transmission constraints SOUTHERN AFRICAN POWER POOL

Average Monthly Market Clearing Prices as of 31 st Apr 2011 15 SOUTHERN AFRICAN POWER POOL

Average Monthly Market Clearing Prices as of 31 st Apr 2011 15 SOUTHERN AFRICAN POWER POOL

7. CONCLUSION q SAPP is making efforts to reduce carbon emissions Ø In the long-term, high cost coal will be displaced by cleaner energy sources such as hydro, wind and solar ü Coal % to be reduced from 74% to 56%. ü Hydro % to be increased from 20% to 26% ü Wind and solar % to be increased from 0% to approx. 0. 5% q SAPP has reformed in line with world wide trends in the electricity sector ü To date SAPP has introduced a competitive power market in the form of a Day Ahead Market ü Intends to introduce other markets incl. Carbon markets 16 SOUTHERN AFRICAN POWER POOL

7. CONCLUSION q SAPP is making efforts to reduce carbon emissions Ø In the long-term, high cost coal will be displaced by cleaner energy sources such as hydro, wind and solar ü Coal % to be reduced from 74% to 56%. ü Hydro % to be increased from 20% to 26% ü Wind and solar % to be increased from 0% to approx. 0. 5% q SAPP has reformed in line with world wide trends in the electricity sector ü To date SAPP has introduced a competitive power market in the form of a Day Ahead Market ü Intends to introduce other markets incl. Carbon markets 16 SOUTHERN AFRICAN POWER POOL