5f4aa0548c4fb51fe60e880dea9d41bd.ppt

- Количество слайдов: 21

Overview of the FLEX LOAN PROGRAM

Overview of the FLEX LOAN PROGRAM

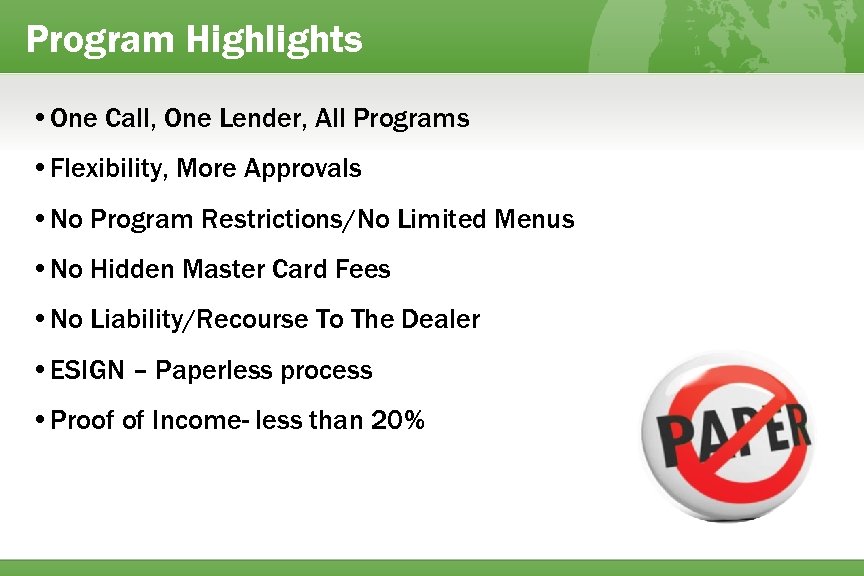

Program Highlights • One Call, One Lender, All Programs • Flexibility, More Approvals • No Program Restrictions/No Limited Menus • No Hidden Master Card Fees • No Liability/Recourse To The Dealer • ESIGN – Paperless process • Proof of Income- less than 20%

Program Highlights • One Call, One Lender, All Programs • Flexibility, More Approvals • No Program Restrictions/No Limited Menus • No Hidden Master Card Fees • No Liability/Recourse To The Dealer • ESIGN – Paperless process • Proof of Income- less than 20%

Program Examples

Program Examples

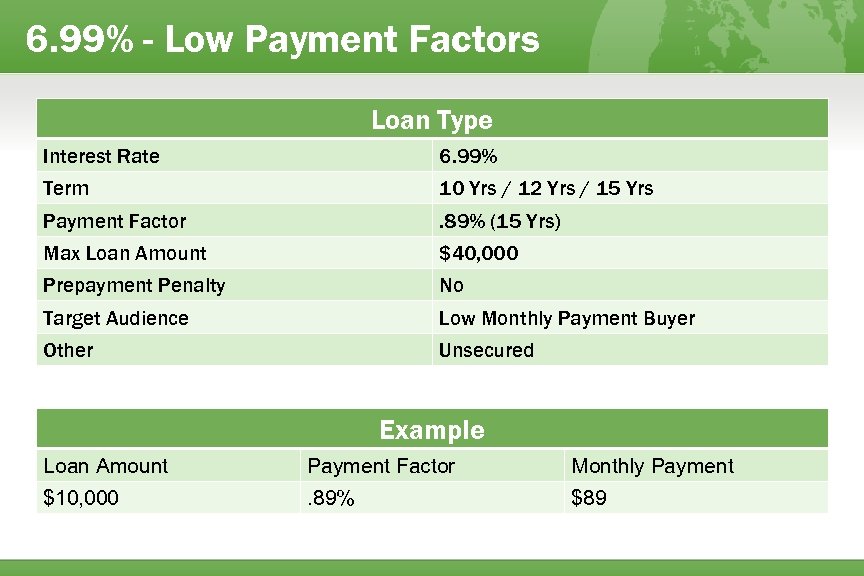

6. 99% - Low Payment Factors Loan Type Interest Rate 6. 99% Term 10 Yrs / 12 Yrs / 15 Yrs Payment Factor . 89% (15 Yrs) Max Loan Amount $40, 000 Prepayment Penalty No Target Audience Low Monthly Payment Buyer Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 . 89% $89

6. 99% - Low Payment Factors Loan Type Interest Rate 6. 99% Term 10 Yrs / 12 Yrs / 15 Yrs Payment Factor . 89% (15 Yrs) Max Loan Amount $40, 000 Prepayment Penalty No Target Audience Low Monthly Payment Buyer Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 . 89% $89

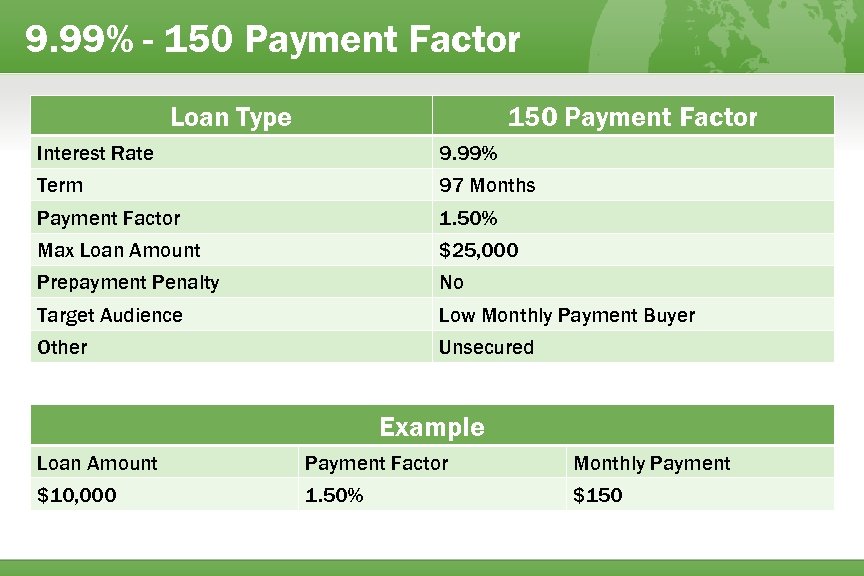

9. 99% - 150 Payment Factor Loan Type 150 Payment Factor Interest Rate 9. 99% Term 97 Months Payment Factor 1. 50% Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Low Monthly Payment Buyer Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 1. 50% $150

9. 99% - 150 Payment Factor Loan Type 150 Payment Factor Interest Rate 9. 99% Term 97 Months Payment Factor 1. 50% Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Low Monthly Payment Buyer Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 1. 50% $150

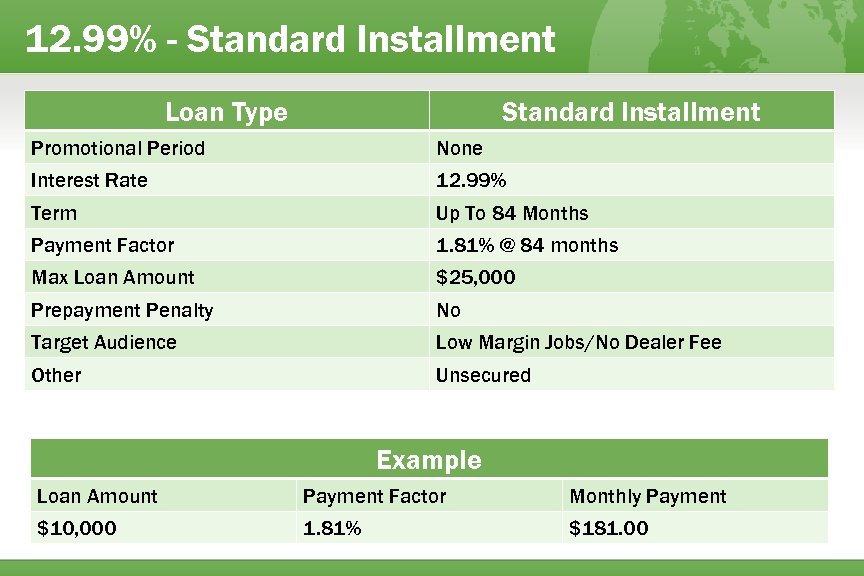

12. 99% - Standard Installment Loan Type Standard Installment Promotional Period None Interest Rate 12. 99% Term Up To 84 Months Payment Factor 1. 81% @ 84 months Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Low Margin Jobs/No Dealer Fee Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 1. 81% $181. 00

12. 99% - Standard Installment Loan Type Standard Installment Promotional Period None Interest Rate 12. 99% Term Up To 84 Months Payment Factor 1. 81% @ 84 months Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Low Margin Jobs/No Dealer Fee Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 1. 81% $181. 00

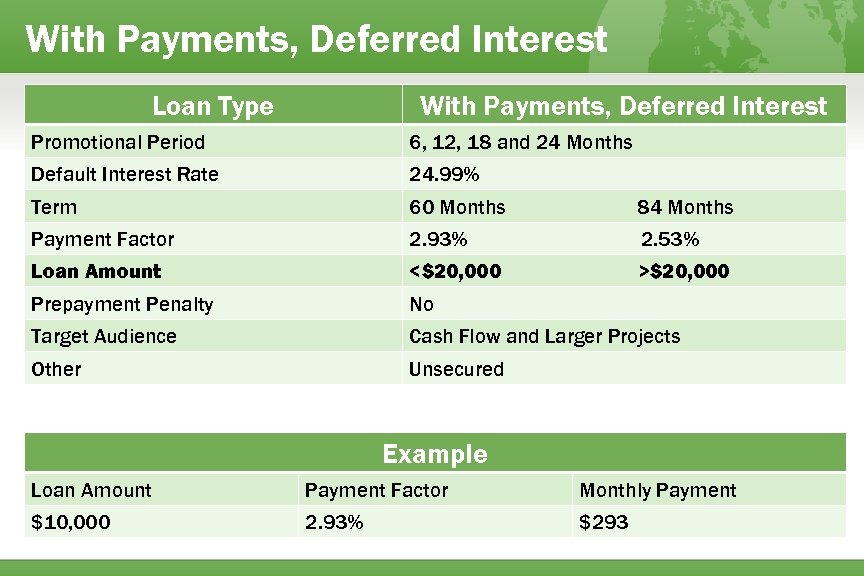

With Payments, Deferred Interest Loan Type With Payments, Deferred Interest Promotional Period 6, 12, 18 and 24 Months Default Interest Rate 24. 99% Term 60 Months 84 Months Payment Factor 2. 93% 2. 53% Loan Amount <$20, 000 >$20, 000 Prepayment Penalty No Target Audience Cash Flow and Larger Projects Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 2. 93% $293

With Payments, Deferred Interest Loan Type With Payments, Deferred Interest Promotional Period 6, 12, 18 and 24 Months Default Interest Rate 24. 99% Term 60 Months 84 Months Payment Factor 2. 93% 2. 53% Loan Amount <$20, 000 >$20, 000 Prepayment Penalty No Target Audience Cash Flow and Larger Projects Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 2. 93% $293

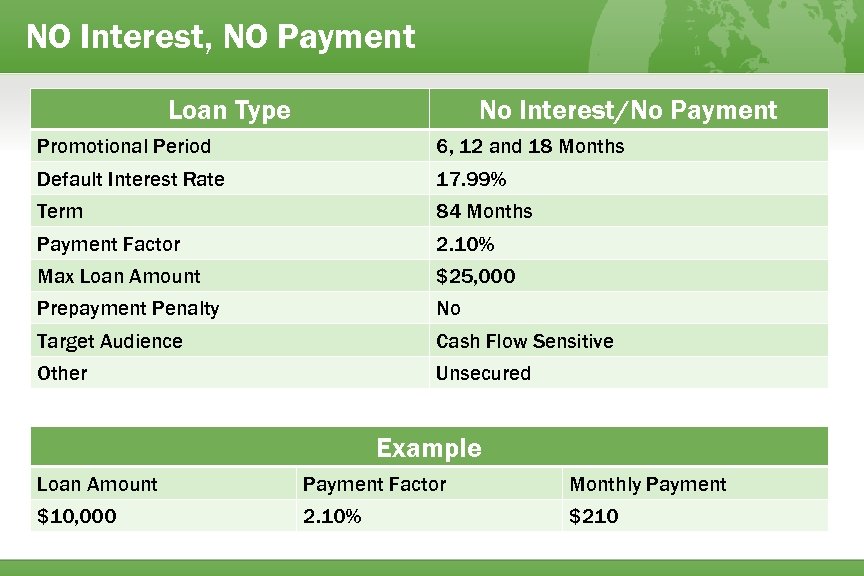

NO Interest, NO Payment Loan Type No Interest/No Payment Promotional Period 6, 12 and 18 Months Default Interest Rate 17. 99% Term 84 Months Payment Factor 2. 10% Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Cash Flow Sensitive Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 2. 10% $210

NO Interest, NO Payment Loan Type No Interest/No Payment Promotional Period 6, 12 and 18 Months Default Interest Rate 17. 99% Term 84 Months Payment Factor 2. 10% Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Cash Flow Sensitive Other Unsecured Example Loan Amount Payment Factor Monthly Payment $10, 000 2. 10% $210

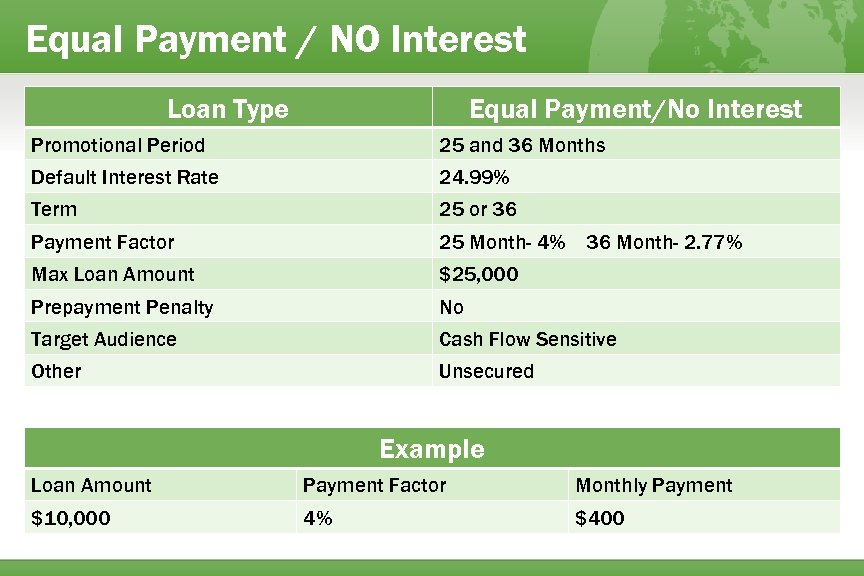

Equal Payment / NO Interest Loan Type Equal Payment/No Interest Promotional Period 25 and 36 Months Default Interest Rate 24. 99% Term 25 or 36 Payment Factor 25 Month- 4% Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Cash Flow Sensitive Other Unsecured 36 Month- 2. 77% Example Loan Amount Payment Factor Monthly Payment $10, 000 4% $400

Equal Payment / NO Interest Loan Type Equal Payment/No Interest Promotional Period 25 and 36 Months Default Interest Rate 24. 99% Term 25 or 36 Payment Factor 25 Month- 4% Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Cash Flow Sensitive Other Unsecured 36 Month- 2. 77% Example Loan Amount Payment Factor Monthly Payment $10, 000 4% $400

Buy Deeper (Second Look) Loan Type With Payments, Deferred Interest Second Look Buy Deeper Promotional Period 6 Months Default Interest Rate 17. 99 - 24. 99% Term 72 Months Payment Factor 2. 28% - 2. 69% Minimum Credit Score 580 Max Loan Amount $7, 500 Prepayment Penalty No Target Audience Challenged Credit/Cash Flow Other Unsecured Example Loan Amount Payment Factor Monthly Payment $7, 500 2. 69% $201. 75

Buy Deeper (Second Look) Loan Type With Payments, Deferred Interest Second Look Buy Deeper Promotional Period 6 Months Default Interest Rate 17. 99 - 24. 99% Term 72 Months Payment Factor 2. 28% - 2. 69% Minimum Credit Score 580 Max Loan Amount $7, 500 Prepayment Penalty No Target Audience Challenged Credit/Cash Flow Other Unsecured Example Loan Amount Payment Factor Monthly Payment $7, 500 2. 69% $201. 75

FHA Title I (Second Look) Loan Type Installment Second Look FHA Title I Promotional Period N/A Interest Rate 9. 99%-14. 99% Term Up to 20 Years Payment Factor As low as 1. 00% Minimum Credit Score 620 Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Challenged Credit/Cash Flow Other Unsecured/Secured Example Loan Amount Payment Factor Monthly Payment $10, 000 1. 00% $100

FHA Title I (Second Look) Loan Type Installment Second Look FHA Title I Promotional Period N/A Interest Rate 9. 99%-14. 99% Term Up to 20 Years Payment Factor As low as 1. 00% Minimum Credit Score 620 Max Loan Amount $25, 000 Prepayment Penalty No Target Audience Challenged Credit/Cash Flow Other Unsecured/Secured Example Loan Amount Payment Factor Monthly Payment $10, 000 1. 00% $100

Sample Solar Loan $40, 000 Solar Project Tax Rebate- 30% ($40, 000 x 30% = $12, 000) $12, 000 – 12 Month No Interest/No Payment- Tax Rebate $28, 000 – 6. 99% for 15 years Total Monthly Payment Only $249. 20 No Re-Amortization, Easy, and Straight Forward Sale.

Sample Solar Loan $40, 000 Solar Project Tax Rebate- 30% ($40, 000 x 30% = $12, 000) $12, 000 – 12 Month No Interest/No Payment- Tax Rebate $28, 000 – 6. 99% for 15 years Total Monthly Payment Only $249. 20 No Re-Amortization, Easy, and Straight Forward Sale.

Added Benefits Special Situations Rental Properties/Investment Properties Past Bankruptcies Mobile Homes Co-Signers (Do Not Have to Own the Home) NO Credit Applications Needed Income Verification (Less than 20%)

Added Benefits Special Situations Rental Properties/Investment Properties Past Bankruptcies Mobile Homes Co-Signers (Do Not Have to Own the Home) NO Credit Applications Needed Income Verification (Less than 20%)

Consumer Credit Center The Gateway to Improved Profitability For the Home Improvement Professional Mon – Fri 8 am – 12 pm EST Saturday 9 am – 8 pm EST Sunday – CLOSED

Consumer Credit Center The Gateway to Improved Profitability For the Home Improvement Professional Mon – Fri 8 am – 12 pm EST Saturday 9 am – 8 pm EST Sunday – CLOSED

How it Works (Loan Process) Step 1) Submit Application – 866 393 0033 Dealer #12345 2) Loan Approved If Declined 3) Email Work Order Action Credit Information Taken From Sales Rep or Customer Go To svcfin. com/ Customer Esigns Letter in 7 -10 Business Days stips@svcfin. com Or Upload it right to svcfin. com 4) Email or Fax Completion Certificate Loan # and Last Name on COC fund@svcfin. com Smith #1162345 Credit Center Hours: M-F 8 am-12 pm EST, Sat 9 am-8 pm EST

How it Works (Loan Process) Step 1) Submit Application – 866 393 0033 Dealer #12345 2) Loan Approved If Declined 3) Email Work Order Action Credit Information Taken From Sales Rep or Customer Go To svcfin. com/ Customer Esigns Letter in 7 -10 Business Days stips@svcfin. com Or Upload it right to svcfin. com 4) Email or Fax Completion Certificate Loan # and Last Name on COC fund@svcfin. com Smith #1162345 Credit Center Hours: M-F 8 am-12 pm EST, Sat 9 am-8 pm EST

Service Finance Company The ESIGN Process

Service Finance Company The ESIGN Process

Customer Logs Into Website Mr. Customer

Customer Logs Into Website Mr. Customer

Executed Loan Documents Emailed to Customer

Executed Loan Documents Emailed to Customer

Once the Job is Completed Customer logs on svcfin. com, accepts the loan and you get paid via ACH SFC Emails Dealer Loan Docs Received

Once the Job is Completed Customer logs on svcfin. com, accepts the loan and you get paid via ACH SFC Emails Dealer Loan Docs Received

Funding Dealer is funded via ACH

Funding Dealer is funded via ACH

Questions? Kevin Jurczyk Director of Business Development Kevinj@svcfin. com Office: 866 -928 -3719 Cell: 586 -549 -9337 Erin Mc. Collum Director of Programs and Trade Ally Services emccollum@egia. org Office: 916 -480 -7337

Questions? Kevin Jurczyk Director of Business Development Kevinj@svcfin. com Office: 866 -928 -3719 Cell: 586 -549 -9337 Erin Mc. Collum Director of Programs and Trade Ally Services emccollum@egia. org Office: 916 -480 -7337