013ac7f89c6b1c72f918a9707aff5950.ppt

- Количество слайдов: 20

Overview of the Carbon Market Olga Gassan-zade Point Carbon UNFCCC Technical Workshop on JI February 14, Bonn Providing critical insights into energy and environmental markets www. pointcarbon. com

About Point Carbon • Founded in 2000 • Analysis, forecasting, consulting and news • Carbon, power and gas markets • Currently approx. 100 employees (16 Ph. Ds) • Oslo (HQ), London, Kiev, Hamburg, Tokyo, Brussels, Washington D. C • 15, 000 subscribers in 150 domains Providing critical insights into energy and environmental markets www. pointcarbon. com

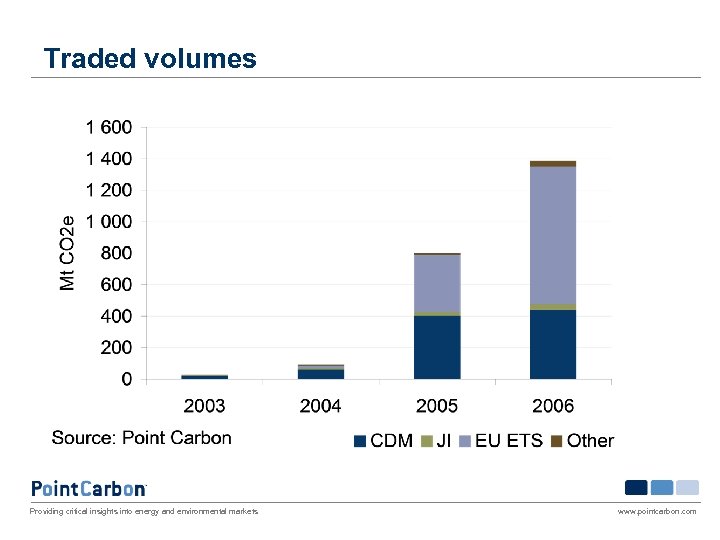

Traded volumes Providing critical insights into energy and environmental markets www. pointcarbon. com

Key price determinants Bullish/bearish? FUNDAMENTALS Bullish/bearish? POLICY Bullish/bearish? MARKET PSYCHOLOGY Bullish/bearish? OTHER Providing critical insights into energy and environmental markets www. pointcarbon. com

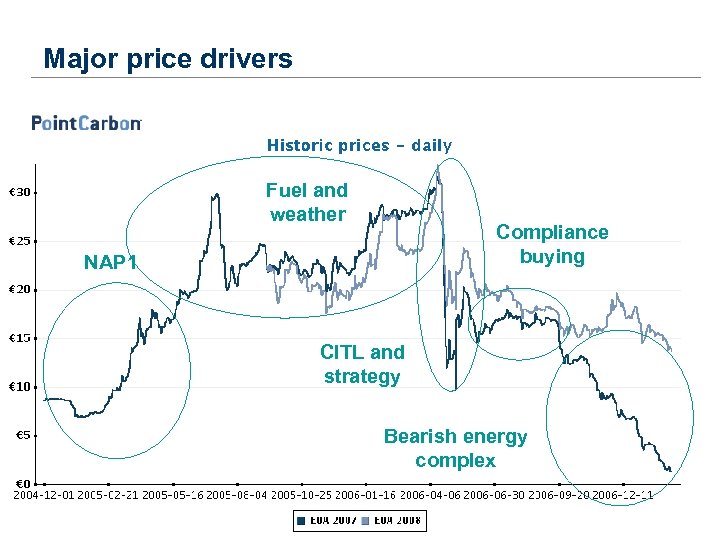

Major price drivers Fuel and weather Compliance buying NAP 1 CITL and strategy Bearish energy complex Providing critical insights into energy and environmental markets www. pointcarbon. com

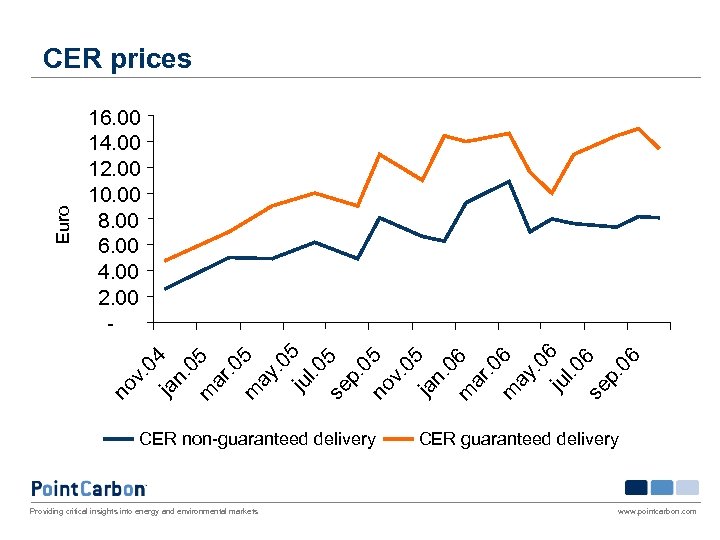

ja 4 n. 05 m ar. 0 m 5 ay. 0 ju 5 l. 0 se 5 p. 05 no v. 05 ja n. 06 m ar. 0 m 6 ay. 0 ju 6 l. 0 se 6 p. 06 16. 00 14. 00 12. 00 10. 00 8. 00 6. 00 4. 00 2. 00 no v. 0 Euro CER prices CER non-guaranteed delivery Providing critical insights into energy and environmental markets CER guaranteed delivery www. pointcarbon. com

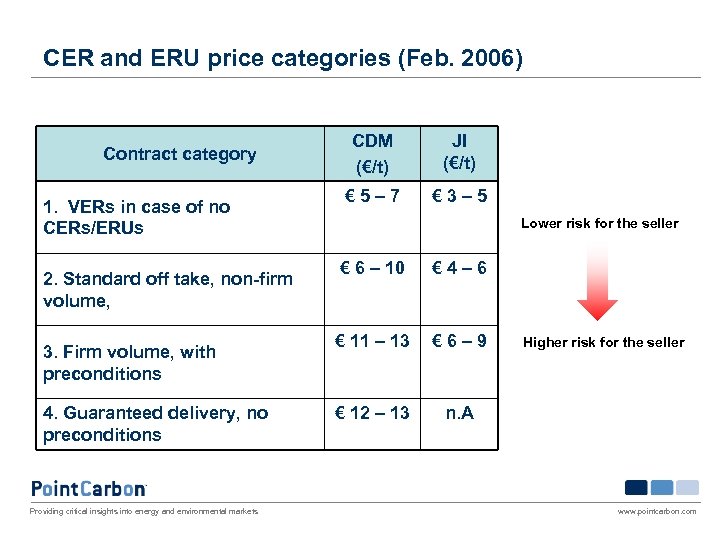

CER and ERU price categories (Feb. 2006) Contract category 1. VERs in case of no CERs/ERUs 2. Standard off take, non-firm volume, 3. Firm volume, with preconditions 4. Guaranteed delivery, no preconditions Providing critical insights into energy and environmental markets CDM (€/t) JI (€/t) € 5– 7 € 3– 5 Lower risk for the seller € 6 – 10 € 4– 6 € 11 – 13 € 6– 9 € 12 – 13 n. A Higher risk for the seller www. pointcarbon. com

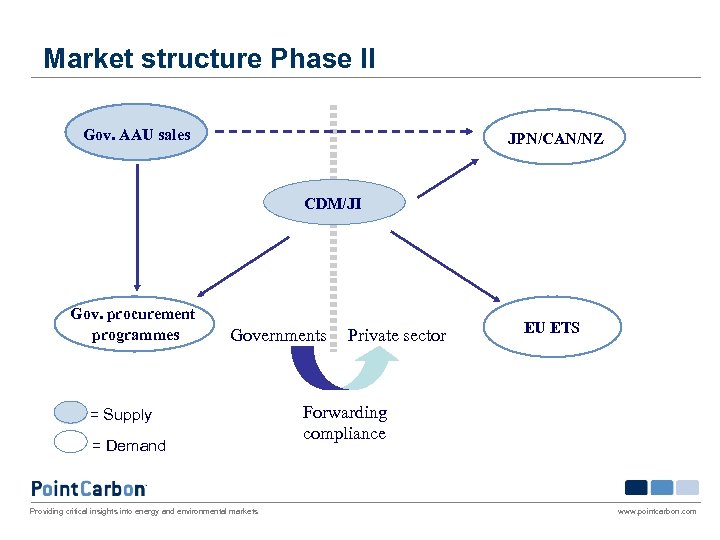

Market structure Phase II Gov. AAU sales JPN/CAN/NZ CDM/JI Gov. procurement programmes Governments = Supply = Demand Providing critical insights into energy and environmental markets Private sector EU ETS Forwarding compliance www. pointcarbon. com

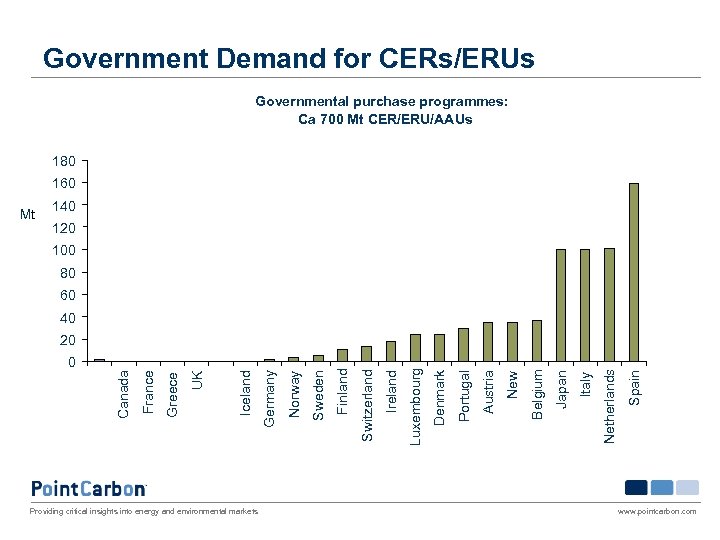

Government Demand for CERs/ERUs Governmental purchase programmes: Ca 700 Mt CER/ERU/AAUs 180 160 Mt 140 120 100 80 60 40 Providing critical insights into energy and environmental markets Spain Netherlands Italy Japan Belgium New Austria Portugal Denmark Luxembourg Ireland Switzerland Finland Sweden Norway Germany Iceland UK Greece France 0 Canada 20 www. pointcarbon. com

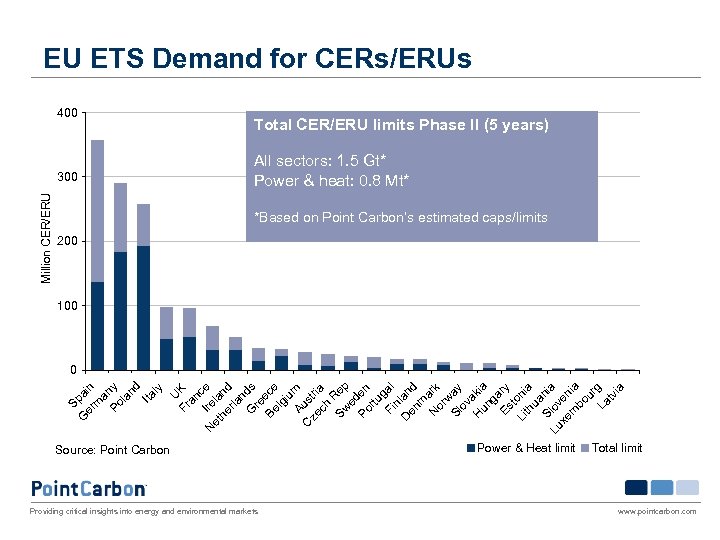

EU ETS Demand for CERs/ERUs 400 Million CER/ERU 300 Total CER/ERU limits Phase II (5 years) All sectors: 1. 5 Gt* Power & heat: 0. 8 Mt* *Based on Point Carbon’s estimated caps/limits 200 100 G Sp er ain m a Po ny la nd Ita ly U Fr K an Ire ce N et la he nd rla n G ds re Be ece lg iu Au m C st ze ri ch a R Sw ep ed Po en rtu g Fi al n D lan en d m N ark or w Sl ay ov H akia un ga Es ry t Li oni th a ua Sl nia Lu ov xe en m ia bo ur La g tv ia 0 Source: Point Carbon Providing critical insights into energy and environmental markets Power & Heat limit Total limit www. pointcarbon. com

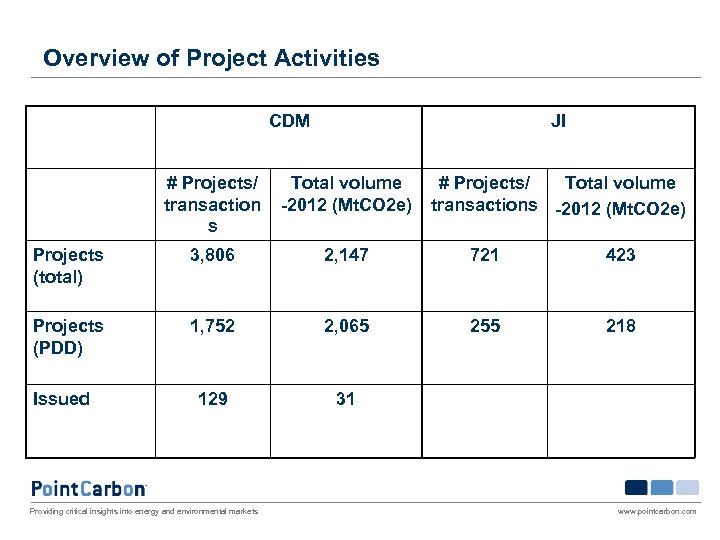

Overview of Project Activities CDM JI # Projects/ transaction s Total volume -2012 (Mt. CO 2 e) Projects (total) 3, 806 2, 147 721 423 Projects (PDD) 1, 752 2, 065 255 218 129 31 Issued Providing critical insights into energy and environmental markets # Projects/ Total volume transactions -2012 (Mt. CO 2 e) www. pointcarbon. com

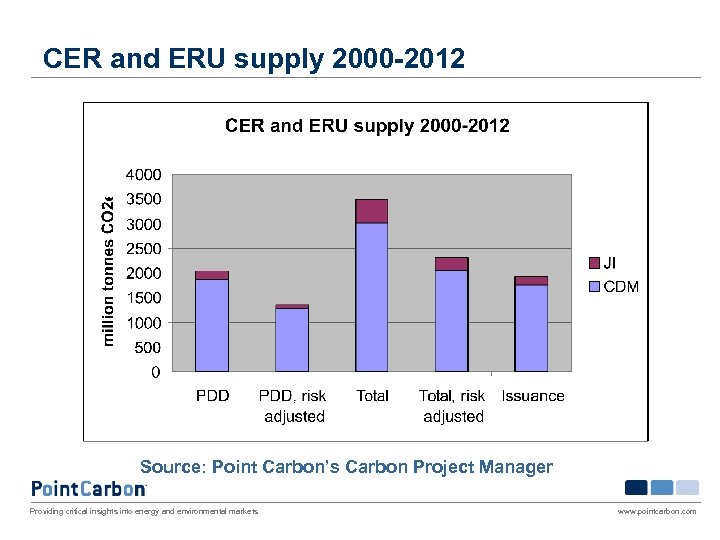

CER and ERU supply 2000 -2012 Source: Point Carbon’s Carbon Project Manager Providing critical insights into energy and environmental markets www. pointcarbon. com

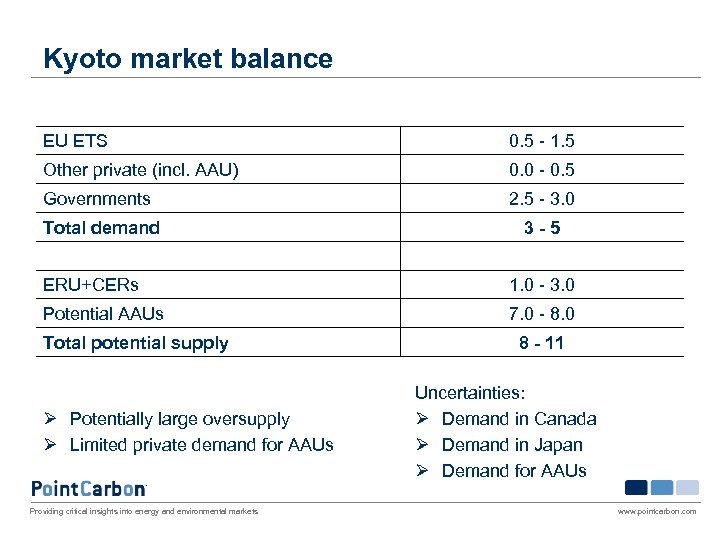

Kyoto market balance EU ETS 0. 5 - 1. 5 Other private (incl. AAU) 0. 0 - 0. 5 Governments 2. 5 - 3. 0 Total demand 3 -5 ERU+CERs 1. 0 - 3. 0 Potential AAUs 7. 0 - 8. 0 Total potential supply Ø Potentially large oversupply Ø Limited private demand for AAUs Providing critical insights into energy and environmental markets 8 - 11 Uncertainties: Ø Demand in Canada Ø Demand in Japan Ø Demand for AAUs www. pointcarbon. com

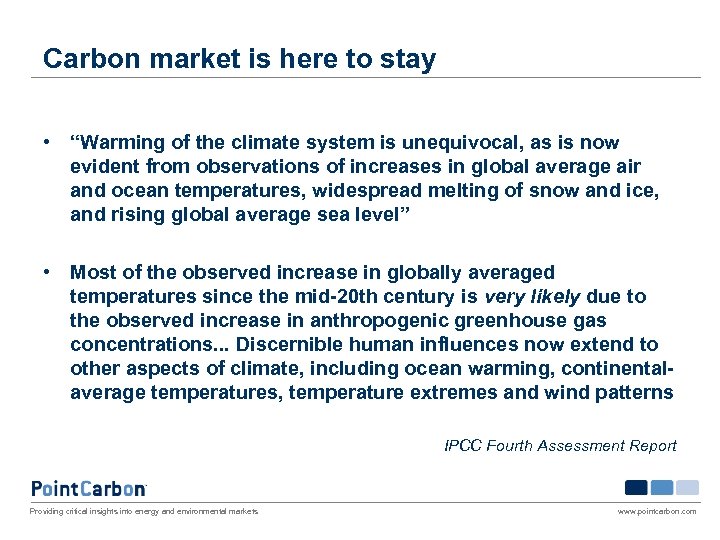

Carbon market is here to stay • “Warming of the climate system is unequivocal, as is now evident from observations of increases in global average air and ocean temperatures, widespread melting of snow and ice, and rising global average sea level” • Most of the observed increase in globally averaged temperatures since the mid-20 th century is very likely due to the observed increase in anthropogenic greenhouse gas concentrations. . . Discernible human influences now extend to other aspects of climate, including ocean warming, continentalaverage temperatures, temperature extremes and wind patterns IPCC Fourth Assessment Report Providing critical insights into energy and environmental markets www. pointcarbon. com

Time for a NAP? Providing critical insights into energy and environmental markets www. pointcarbon. com

US demand? Providing critical insights into energy and environmental markets www. pointcarbon. com

US to re-engage • Climate policy is speading up – – RGGI California Chicago Climate Exchange Other intiatives • It is 72% likely that the next US President will support strong climate policy. • Increases chances for post-2012 agreement • Parallel to international efforts in the 2013 -17 period • Likely domestic cap-and-trade • Full commitment only from 3 CP starting in 2018 • China to follow suit Providing critical insights into energy and environmental markets www. pointcarbon. com

Conclusions • Large and liquid global carbon market has emerged • Delivering unprecedented emissions reductions 5 things to watch for in the longer term • • • Post 2012 framework Role of China and Russia Programmatic CDM Green Investment Schemes US presidential elections Providing critical insights into energy and environmental markets www. pointcarbon. com

Thank you! Olga Gassan-zade Managing Director Point Carbon Kiev ogz@pointcarbon. com +380 50 38 38 968 www. pointcarbon. com www. pointcarbon. ru +380 44 278 33 56 Providing critical insights into energy and environmental markets www. pointcarbon. com

Price drivers for 2008 -12 • The European power sector is likely to continue to hedge dynamically – Much of the short term dynamic will be due to fuel prices and weather trends • Major shifts in price levels will be event-driven, like the oil market – – – NAP II, 2006 -2007 Generation of CDM projects, 2006 -2008 US Presidential election, 2008 Post-2012 framework, 2008 -2009 Strategies of govt. buyers, 2007 -13 Strategies of Russia and Ukraine, 2010 -13 Ø Similar to the current market, but more complicated Ø No single price for the period Providing critical insights into energy and environmental markets www. pointcarbon. com

013ac7f89c6b1c72f918a9707aff5950.ppt