77598299a2455336369deae41b76275d.ppt

- Количество слайдов: 48

Overview of the Banking Bureau, Financial Supervisory Commission December 2011

Table of Contents I. About Us II. Overview of Financial Supervision III. Supervisory Focus VI. Future Plan 2

I. About Us 1. Brief History (1) Early Years of the ROC The Monetary Dept of the MOF- first financial supervisory authority in the ROC Renamed to Currency Department by Interim President Yuan, Shih. Kai Currency Department established after several reorganizations and renames Since Relocation to Taiwan: (2) Year 1981 Department of Monetary Affairs of MOF Year 1991 Bureau of Monetary Affairs led by Director General Mu-Tsai Chen Year 2004 - Transformed to FSC and renamed to Banking Bureau, led by Mr. Gary K. L. Tseng Now led by Director General Mr. Hsien-Nung Kuei 3

2. Our Staff (1) Authorized Complement: 240 (2) Budgeted Staff: 209 (3) Current Staff: 209 (4) Manpower by Education: Over 55% staff with Masters or higher degree 4

3. Responsibilities and Divisions Banking Bureau, the supervisory authority of Taiwan’s financial institutions, is responsible for maintaining financial stability and financial development. (1) Organizational Chart Director General Deputy Director General Chief Secretary Legal Affairs Trust and Bills Finance Co. IT Office Accounting Office Domestic Banks Foreign Banks Secretary Office Statistics Office Credit Cooperatives Financial Holding Co. Personnel Office Ethics Office

3. Responsibilities and Divisions( Cont’d. ) Legal Affairs Division Financial Regulatory and Supervisory Framework Financial Activities across the Strait Risk management, accounting and disclosure rules for banks and financial holding companies Prevention of Financial Crimes 6

3. Responsibilities and Divisions (Cont’d. ) Domestic Banks Division Supervision of Domestic Banks and Auxiliary Institutions Laws And Regulations of Domestic Banks Policies And Projects 7

3. Responsibilities and Divisions (Cont’d. ) Credit Cooperatives Division Consumer Protection ‧ Deposit Insurance ‧Supervision of commercial banks reorganized from credit cooperatives Supervision of the credit cooperatives 8

3. Responsibilities and Divisions (Cont’d. ) Trust and Bills Finance Companies Division Supervision of Bills Business Administration Policy and Supervision of Trust and Securitization Business Administration Policy and Supervision of Industrial Banks ‧Credit Cards ‧Electronic Stored Value Cards ‧Debt Negotiation 9

3. Responsibilities and Divisions (Cont’d. ) Foreign Banks Division Supervision of Foreign Banks Supervision of Mainland Banks Laws and Regulations Regarding OBUs and Financial Derivatives Financial Supervisory Cooperation 10

3. Responsibilities and Divisions (Cont’d. ) Financial Holding Companies Division Supervision of FHCs and Subordinated Bank and Bills Finance Subsidiaries FHC Related Rules And Regulations 11

II. Overview of Financial Supervision 1. Laws And Regulations Drafting and implementation of laws and regulations . . pieces of laws including the Banking Act 19 . pieces of by-acts 123 2. Financial Institutions Under Supervision . domestic banks 37 . Financial holding companies 16 . Foreign bank branches 28 . Credit Cooperatives 25 . Bills finance companies 8 . Chunghwa Post company . Total assets reached NTD 44 trillion at 2011 year end 12

Financial Data of the Financial Institutions Supervised by the Bureau (FHCs not Included) Credit Cooperatives Bills Finance Companies The Postal Savings System 6, 864 5, 466 - … 345, 812 29, 206 5, 929 7, 906 48, 888 24, 901 21, 990 713 387 1, 081 730 2011 2, 411. 6 2, 000. 1 168. 1 17. 8 115. 3 110. 3 % 2011 … 0. 59 0. 63 0. 30 1. 49 … ROE % 2011 … 9. 33 24. 43 4. 52 10. 56 … BIS Ratio % Sept. 2011 … 11. 71 … … 14. 59 … NPL Ratio % Dec. 2011 0. 42 (Average ) 0. 43 0. 13 0. 41 0. 02 (NPL %) … Coverage Ratio % Dec. 2011 262. 83 (Average ) 251. 83 959. 64 378. 64 8, 615. 93 … Index Total Domestic Banks Profitability Period Deposits Basic Data Unit NTD 100 Million Dec. 2011 288, 607 276, 276 Total Assets NTD 100 Million Dec. 2011 437, 741 Net Worth NTD 100 Million Dec. 2011 Pre-Tax Income NTD 100 Million ROA Foreign Bank Branches Asset Quality 13

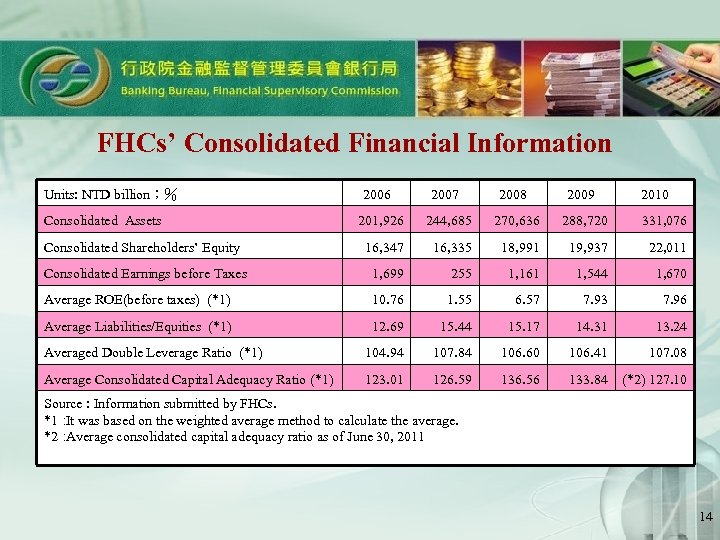

FHCs’ Consolidated Financial Information Units: NTD billion;% Consolidated Assets 2006 2007 2008 2009 2010 201, 926 244, 685 270, 636 288, 720 331, 076 Consolidated Shareholders’ Equity 16, 347 16, 335 18, 991 19, 937 22, 011 Consolidated Earnings before Taxes 1, 699 255 1, 161 1, 544 1, 670 Average ROE(before taxes) (*1) 10. 76 1. 55 6. 57 7. 93 7. 96 Average Liabilities/Equities (*1) 12. 69 15. 44 15. 17 14. 31 13. 24 Averaged Double Leverage Ratio (*1) 104. 94 107. 84 106. 60 106. 41 107. 08 Average Consolidated Capital Adequacy Ratio (*1) 123. 01 126. 59 136. 56 133. 84 (*2) 127. 10 Source : Information submitted by FHCs. *1: was based on the weighted average method to calculate the average. It *2: Average consolidated capital adequacy ratio as of June 30, 2011 14

III. Supervisory Focus Maintaining Financial Stability Major Tasks Sound Supervision of Financial Business Enhancing Protection and Education of Consumers/Investors Financial Interaction Across the Strait 15

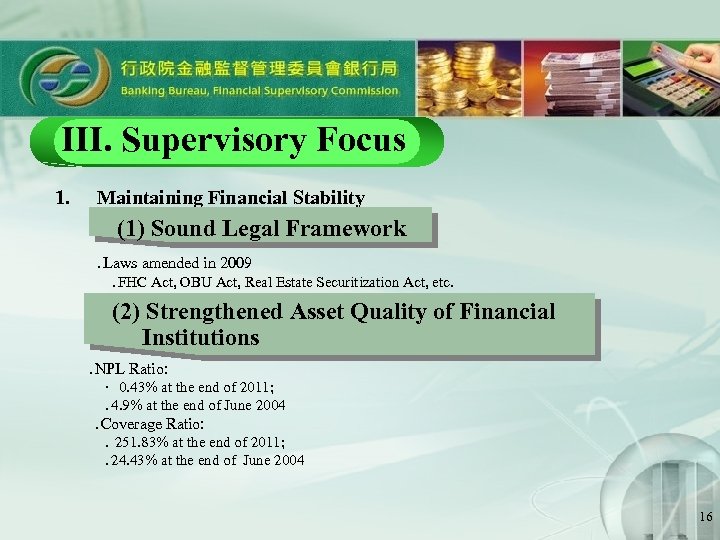

III. Supervisory Focus 1. Maintaining Financial Stability (1) Sound Legal Framework . Laws amended in 2009 . FHC Act, OBU Act, Real Estate Securitization Act, etc. (2) Strengthened Asset Quality of Financial Institutions . NPL Ratio: . 0. 43% at the end of 2011; . 4. 9% at the end of June 2004 . Coverage Ratio: .251. 83% at the end of 2011; . 24. 43% at the end of June 2004 16

NPL Ratio Coverage Ratio 17

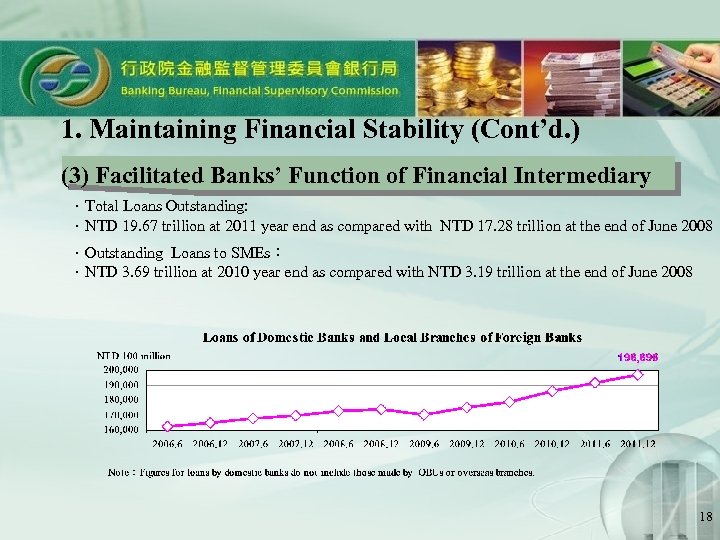

1. Maintaining Financial Stability (Cont’d. ) (3) Facilitated Banks’ Function of Financial Intermediary .Total Loans Outstanding: .NTD 19. 67 trillion at 2011 year end as compared with NTD 17. 28 trillion at the end of June 2008 .Outstanding Loans to SMEs: .NTD 3. 69 trillion at 2010 year end as compared with NTD 3. 19 trillion at the end of June 2008 18

1. Maintaining Financial Stability (Cont’d. ) (4) Blanket Deposit Guarantee in Response to Global Financial Crisis . restore market confidence and protect depositors interests To . Mechanism announced in October 2008 .Extend the deadline to the end of 2010 in October 2009 ~ 2008 Oct. 2008 ~ Dec. 2010 Jan. 2011 ~ (Ordinary Time) Limited Coverage Deposit Insurance (Systemic Crisis Period) Blanket Government Guarantee (End of Systemic Crisis) Limited Coverage Deposit Insurance 19

1. Maintaining Financial Stability (Cont’d. ) (5) Return to normal deposit insurance mechanism from January 1, 2011. measures to foster a smooth exit from blanket deposit insurance : 1. The upper limit amount of deposit insurance coverage raises to NT$3 million from 1 January 2011. 2. Amended the article 12 and article 13 of the Deposit Insurance Act to expand the scope of items under the deposit insurance scheme through including foreign currency deposit and the interest accrued from insured deposits. 3. An interagency task force has been formed to enhance banking supervisory activities and cooperation between different agencies. 4. Increasing the deposit insurance premium rate to speed up the accumulation of the deposit insurance fund. 5. Holding propagandas to strengthen public confidence. 20

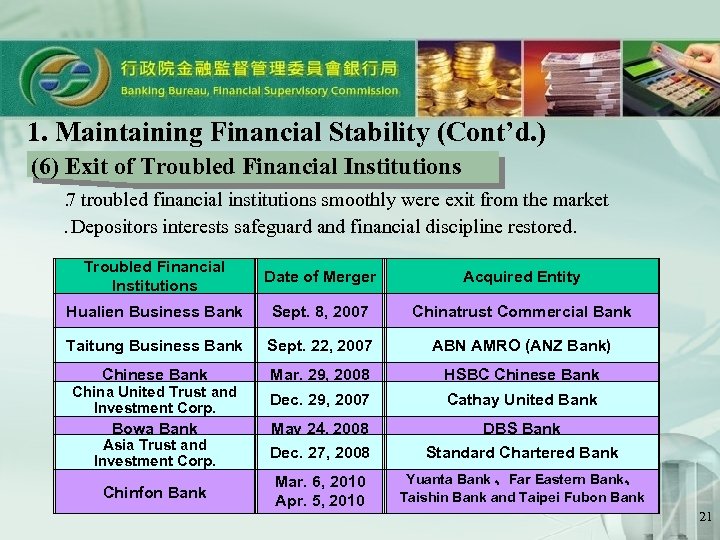

1. Maintaining Financial Stability (Cont’d. ) (6) Exit of Troubled Financial Institutions . troubled financial institutions smoothly were exit from the market 7 . Depositors interests safeguard and financial discipline restored. Troubled Financial Institutions Date of Merger Acquired Entity Hualien Business Bank Sept. 8, 2007 Chinatrust Commercial Bank Taitung Business Bank Sept. 22, 2007 ABN AMRO (ANZ Bank) Chinese Bank China United Trust and Investment Corp. Mar. 29, 2008 HSBC Chinese Bank Dec. 29, 2007 Cathay United Bank Bowa Bank Asia Trust and Investment Corp. May 24, 2008 DBS Bank Dec. 27, 2008 Standard Chartered Bank Chinfon Bank Mar. 6, 2010 Apr. 5, 2010 Yuanta Bank 、Far Eastern Bank、 Taishin Bank and Taipei Fubon Bank 21

1. Maintaining Financial Stability (Cont’d) (7) Enhanced Corporate Governance of FHCs and Banks . corporate governance guidelines amended in 2009. Two . FHCs and banks are required to . up compensation committees Set . Assign independent directors as conveners of the committee . up remuneration policy Set . Dislose members, responsibilities and operating status of the Committee, compensation policy of board of directors and senior management team, and rewards for individual directors and supervisors 22

1. Maintaining Financial Stability (Cont’d) (8) Financial assistance measures to support Government’s Economy Program . issued the “Temporary Supplemental Principles for Banking Industry to deal with the Stock-secured Loans in incorporated with Government Economy Program” .issued the “Bankers Association Self-regulatory Rules for Debt Workouts and Workout Enforcement of enterprises for the cases transferred by Ministry of Economic” .issued the “Guidelines for Rescheduling the Repayment of Principal by Involuntarily Unemployed Occupants of Owner-occupied Homes” 23

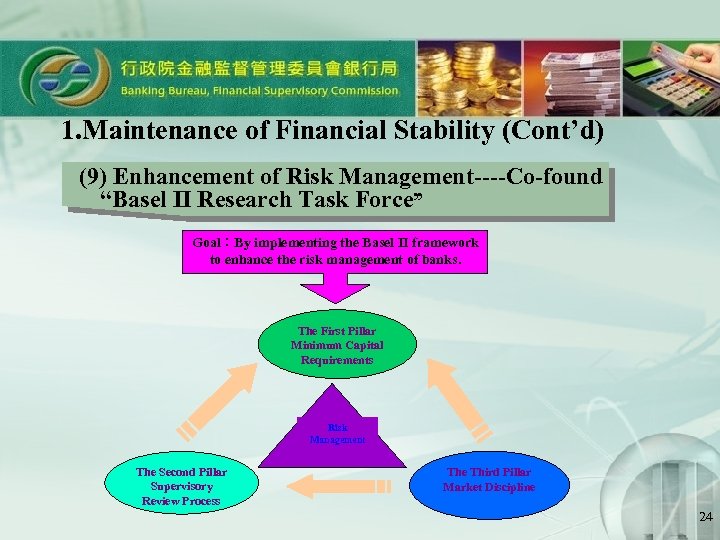

1. Maintenance of Financial Stability (Cont’d) (9) Enhancement of Risk Management----Co-found “Basel II Research Task Force” Goal:By implementing the Basel II framework to enhance the risk management of banks. The First Pillar Minimum Capital Requirements Risk Management The Second Pillar Supervisory Review Process The Third Pillar Market Discipline 24

2. Enhancing Protection and Education of Consumers and Investors (1) Promoting Financial Education . School and Community Financial Literacy Campaign . The Campaign launched since Feb. 2006 has benefited 519, 032 participants. (2) Standardized Principles of Bank Fees Charged for the Consumer Credit Loans. 25

2. Enhancing Protection and Education of Consumers and Investors (Cont’d) (3) Strengthened Supervision of Banks Engaged in Investment Product Business s Amendment of “Regulations Governing the Scope of Business, Restrictions on Transfer of Beneficiary Rights, Risk Disclosure, Marketing, and Conclusion of Contract by Trust Enterprises” and “Regulations Governing Required Qualifications for Responsible Persons and Required Trust Expertise or Experience for Operating and Managerial Personnel of Trust Enterprises “ s Amendment to the Regulations Governing Banks Engaging in Financial Derivatives s Adoption of Regulations on Credit Default Swap and Credit Default Option conducted by OBU 26

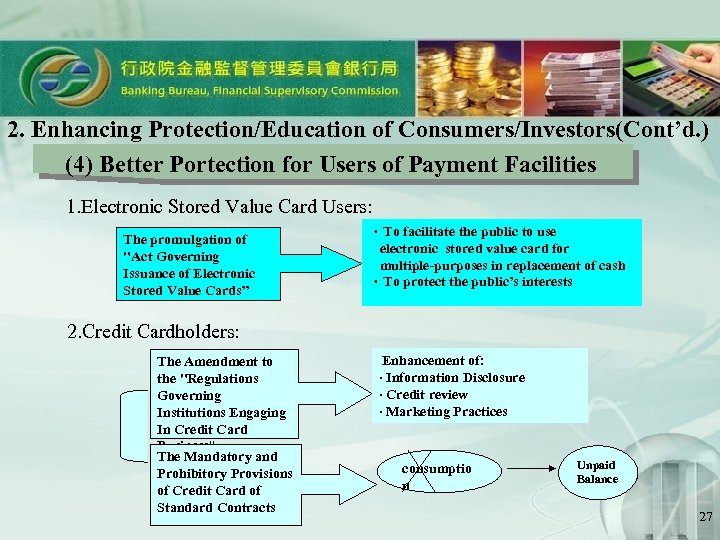

2. Enhancing Protection/Education of Consumers/Investors(Cont’d. ) (4) Better Portection for Users of Payment Facilities 1. Electronic Stored Value Card Users: The promulgation of "Act Governing Issuance of Electronic Stored Value Cards” .To facilitate the public to use electronic stored value card for multiple-purposes in replacement of cash .To protect the public’s interests 2. Credit Cardholders: The Amendment to the "Regulations Governing Institutions Engaging In Credit Card Business" The Mandatory and Prohibitory Provisions of Credit Card of Standard Contracts Enhancement of: ‧ Information Disclosure ‧ Credit review ‧ Marketing Practices consumptio n Unpaid Balance 27

2. Enhancing Protection/Education of Consumers/Investors(Cont’d. ) (5) Keep Reviewing of Standard Contract Template The “mandatory provisions of Standard Contract for ATM Card Accessory to Demand (Savings) Deposit Contract” have been announced that it would be implemented from Jan. 24, 2012. 定 型 化 契 約 範 本 Standard Contract Templates Deposit---Debit Card Pertaining to Savings Account standard contract Loan---Home and Auto Loan standard contract Online Banking---Personal Internet Banking Services Standard Contract Safe Deposit Box ---Financial Institution’s Safe Deposit box Leasing Standard Contract Credit Card---Credit Card Standard Contract Electronic Stored Value Card---Electronic Stored Value Card Standard Contract 28

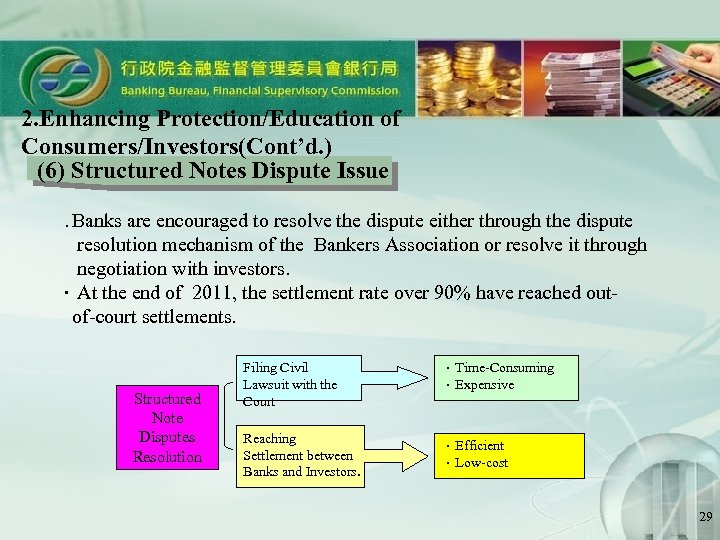

2. Enhancing Protection/Education of Consumers/Investors(Cont’d. ) (6) Structured Notes Dispute Issue . Banks are encouraged to resolve the dispute either through the dispute resolution mechanism of the Bankers Association or resolve it through negotiation with investors. .At the end of 2011, the settlement rate over 90% have reached outof-court settlements. Structured Note Disputes Resolution Filing Civil Lawsuit with the Court Reaching Settlement between Banks and Investors. .Time-Consuming .Expensive .Efficient .Low-cost 29

2. Enhancing Protection/Education of Consumers/Investors(Cont’d. ) (7) Abolishment of the Domestic Use of Magnetic Stripe ATM Cards Banks and Credit Cooperatives are requested to abolish the use of magnetic stripe cards in the domestic transactions by June 30, 2011. (8) Daily Limit On The ATM Cardless Transfer In Order To Prevent Fraud As of March 1, 2011, the amount of ATM cardless transfer to a nonpreregistered account is limited up to NT$30, 000 per day. (9) Adoption of the Voice-Activated ATM Machines For The Visually Impaired There have been 11 voice-activated ATM machines for the visually impaired set up by nine financial institutions till the end of 2011。 . 30

3. Financial Interactions Across the Strait Recognizing that---. Maintaining financial stability as government’s first priority . Financial activities as part of economic and trade policy across the Strait Therefore----financial interactions across the Strait will be progressed in an orderly manner Before MOU Remittance and Related Business across Strait Facilitating Financing Needs of Taiwanese Enterprises in Mainland China Setting Up Branches across the Strait After MOU Opening of Financial Markets across the Strait 31

(1) Remittance and Related Business across the Strait The total amount of remittance and foreign . exchange services across the Strait conducted by domestic banks (including designated FX banks and OBUs) reached USD 552. 249 billion in 2011. . amount of using Union. Pay in Taiwan has exceeded The TWD 33. 2 billion by the end of 2011. 32

3. Financial Interactions Across the Strait (Cont’d) (2) Facilitating the Financial Needs of Taiwanese Enterprises in Mainland China Allowed . OBUs and overseas branches to extend loans and conduct factoring business with Taiwanese enterprises in Mainland China in August 2002. Foreign enterprises are able to obtain loans from OBUs and overseas . branches of domestic banks in March 2008. . the end of 2011, the outstanding amount of loans extended to By Taiwanese enterprises in Mainland China by OBUs and overseas branches exceeded USD 17. 933 billion. . Promulgated the Regulations governing the conduct of RMB business for the OBUs and overseas branches of Taiwan's domestic banks in conjunction with Central Bank on 21 July 2011. 33

3. Financial Activities Across the Strait (Cont’d) (3) Opening Financial Market across the Strait . The 3 MOUs in the fields of banking, securities and insurance has taken effect on 16 January 2010. . Under the Economic Cooperation Framework Agreement (ECFA), finished Early Harvest negotiations on financial services with mainland China. 34

3. Financial Activities Across the Strait (Cont’d) (3) Opening Financial Market across the Strait (Cont’d) . Promulgated the amendment to the Regulations Governing the Banking Activity and the Establishment and the Investment by Financial Institution Between the Taiwan Area and the Mainland Area on September 7, 2011. The amendments of the regulation include the following: (1) to adjust types of entering Mainland market for Taiwan's domestic banks; (2) to strengthen risk management mechanism of the banks; and (3) to broaden the scope of banking activities cross the strait moderately. These changes are designed to enhance the competitiveness of Taiwan's banks. . the end of December 2011, Taiwanese banks have set up 6 By branches and 8 representative offices in mainland China. 35

3. Financial Activities Across the Strait (Cont’d) (4) The Cross-Strait Banking Supervisory Cooperation Platform . The FSC and the China Banking Regulatory Commission (CBRC) jointly held the first meeting of the Cross-Strait Banking Supervisory Cooperation Platform on April 25 th, 2011, in Taipei. The main propose of the meeting is to confirm the specific contents and operating mechanisms of the supervisory cooperation platform. . The FSC and the CBRC jointly held the second conference on the Cross-Strait Banking Supervisory Cooperation Platform on November 23 rd, 2011, in Beijing. The two sides engaged in substantive discussions on issues related to: (1) a proposal currently under consideration to allow banking institutions to establish commercial presences on the other side of the strait; and (2) implementation of commitments made pursuant to the ECFA early harvest provisions. 36

4. Sound Supervision of Financial Business (1) Amendments to the Corporate Governance Best. Practice Guidelines . Criteria for assessing managers’ and salespersons’ performance and remuneration .Reinforce the guidelines on compensation structure and schemes for directors and supervisors. Promoting the Development of the Real Estate (2) Securitization Market .The Real Estate Securitization Act was amended on Jan. 21, 2009 .Boradened securitized assets to include real estate rights under development .Opportuinites for private participation in infrastructure projects .Expanding REIT funds by follow-on offerings or private placement. .Better safeguard of investors interests. 37

4. Sound Supervision of Financial Business (Cont’d) (3) Strengthened Supervision of Foreign Banks in Taiwan . Enhanced supervision as foreign banks deepen roots in the local market both in terms of assets and diversified business scale (4) Refining Regulatory Environment for Consolidation and Mergers to Enhance Efficiency of FHCs . Amendment of rules and regulations regarding investment, fundraising, M&A activities, cross-selling of FHCs 38

4. Sound Supervision of Financial Business (Cont’d) (5) Strengthen Financial Regulations to Combat Financial Fraud .Anti-Money Laundering .Mainly responsible for oversight of compliance of AML/CFT of the financial sector . Took part in the last two APG mutual evaluations held in 2001 and 2007 respectively and will participate in the next round in 2013. . Prevention of Financial Crime Continue to cooperate with the National Police Agency and . Investigation Bureau to adopt anti-fraud measures. 39

4. Sound Supervision of Financial Business (Cont’d) (6)Strengthen the Bank’s risk management of the residential mortgage loan • FSC has announced a new policy that the new residential mortgage loan can apply current risk weight (45% or LTV method) only if the house which is the mortgage of the loan is for personal use, otherwise it will be risk weighted at 100%. • In order to control concentration risk, FSC has closely been monitoring the banks with excessive exposrure to mortgage loans and required the relevant banks to diversify credit asset and reserve sufficient capital to absorb loss. 40

4. Sound Supervision of Financial Business (Cont’d) (7) Establishing the domestic foreign currency denominated bills market : Increase fund-raising channels for domestic enterprises easily accessing to the short-term foreign capital, and expand size of bills market. 41

4. Sound Supervision of Financial Business (Cont’d) (8) Enhancing communication channel with financial institutions • To establish a long-term communication channel between the FSC and domestic banks, and to discuss about banking business and lending market situation, the FSC has held periodically meeting with chairmen of domestic banks. • To establish the platform for two-way communication, FSC hold regular meetings with foreign banks. These meetings are not only help foreign banks fully understand the local policies but also enhance the FSC developing sound financial system. • Financial institutions are invited irregularly to the Bureau to exchange views on the development and the compliance of regulations. 42

4. Sound Supervision of Financial Business (Cont’d) (9) Enhancing supervisory regulations regarding to information systems of domestic banks FSC has amended the “Regulations Governing Internal Operating Systems and Procedures for the Outsourcing of Financial Institution Operation", disallowing domestic banks to outsource their information operation overseas and requiring them to establish independent information systems within our territory. 43

VI. Future Plan 1. Maintaining Financial Stability (1)Formulating and review of financial laws and regulations ‧Amending the Regulations Governing Authorization and Administration of Service Enterprises Engaged in Interbank Credit Information Processing and Exchange ‧Amending the Financial Institutions Merger Act ‧ Amending the Rogulations Governing The Establishment Criteria and Administration of The Industrial Bank (2)Enhancing capital adequacy of banks (3)Enhancing liquidity risk management of banks 44

2. Enhancing Protection and Education of Consumer and Investor (1)Continue to strengthen the credit card business and better protect the interest of cardholders. (2)Continue to promote financial education, enhance protection for consumer/investor rights and interests 45

3. Financial Interactions across the Strait (1)To continue the systematic mechanism of the periodic meetings of “the Cross-Strait Banking Supervisory Cooperation Platform”, which are intended to enhance the supervisory information exchanges and communications across the strait in order to promote the healthy management of the cross-strait banking industry, and to maintain the stability of financial market. (2)In accordance with timetable of service trade negotiation under ECFA. The bureau will expedite the further negotiation on financial service sector to gain favorable treatment of market access and business expansion for Taiwanese banks. (3)This bureau will continue to exercise prudential supervision of the operational risks and financial soundness of financial institutions with respect to their investments and cross-strait business activities. 46

4. Sound Supervision of Financial Business .Enhanced prudential use of JCIC information .Strengthened self-discipline for members of the Trust Association .Prudential supervision of foreign bank subsidiaries in Taiwan .Foreign investors’ participation in Taiwan’s financial market .Closer supervisory cooperation with foreign regulatory authorities .Participation in the international arena 47

The End 48

77598299a2455336369deae41b76275d.ppt