412e8374afc6410de803d5bdbd14150a.ppt

- Количество слайдов: 84

Overview of social security systems in Asia with a focus on developing countries in East Asia 18 June 2009 Maastricht University Hiroshi Yamabana Social Security Actuary ILO Social Security Department, Geneva E-mails: yamabana@ilo. org hiroshi. yamabana@gmail. com 1

Overview of social security systems in Asia with a focus on developing countries in East Asia 18 June 2009 Maastricht University Hiroshi Yamabana Social Security Actuary ILO Social Security Department, Geneva E-mails: yamabana@ilo. org hiroshi. yamabana@gmail. com 1

Structure of the presentation 1. Social and economic context 2. Rough classifications of social security systems in Asia 3. Design of social security pensions 4. Pensions: Country examples 5. Remarks on pensions 6. Health care as a core component of social security 7. Employment injury insurance (EII) 8. (Un) employment insurance (U(E)I) 2

Structure of the presentation 1. Social and economic context 2. Rough classifications of social security systems in Asia 3. Design of social security pensions 4. Pensions: Country examples 5. Remarks on pensions 6. Health care as a core component of social security 7. Employment injury insurance (EII) 8. (Un) employment insurance (U(E)I) 2

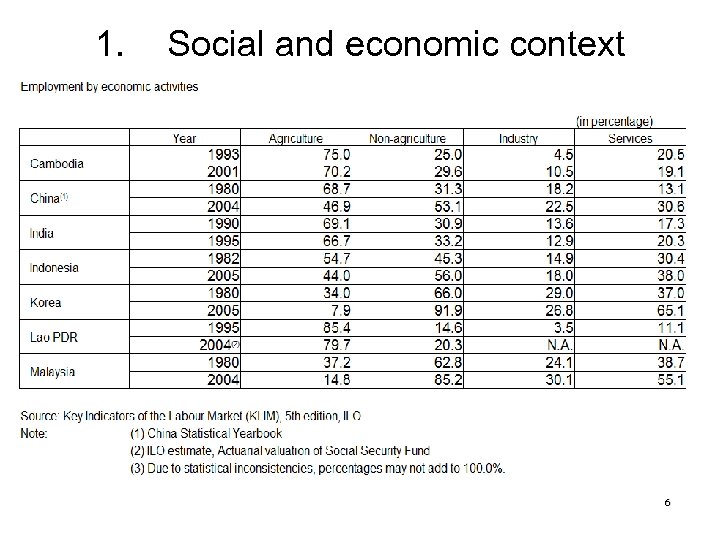

1. 1. Social and economic context Diversity Different level of economic and social development Different industrial structure Different GDP per capita, productivity, wages, price level Different employment structure e. g. wage-earners/non-wage earners (formal / informal), employment share in different economic sectors Different demographic structure e. g. age structure, fertility, mortality Different level of urbanization 3

1. 1. Social and economic context Diversity Different level of economic and social development Different industrial structure Different GDP per capita, productivity, wages, price level Different employment structure e. g. wage-earners/non-wage earners (formal / informal), employment share in different economic sectors Different demographic structure e. g. age structure, fertility, mortality Different level of urbanization 3

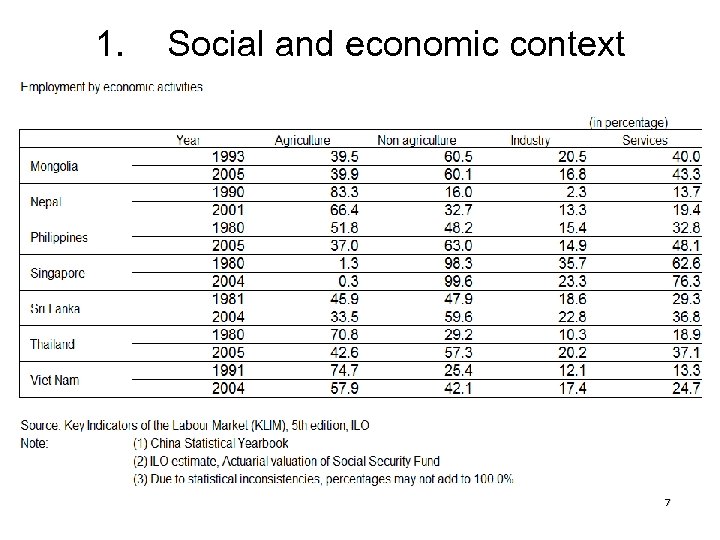

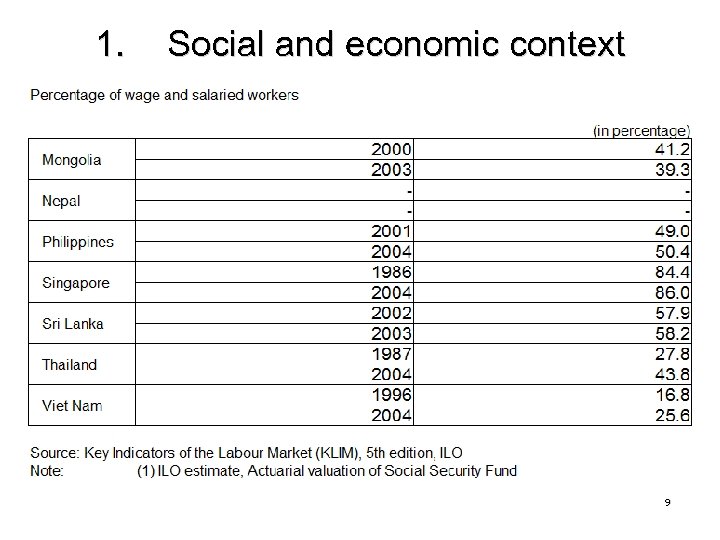

1. 2. Social and economic context Rapid changes - Economic development as a whole Increase in GDP per capita, productivity, wages, price level Changes in industrial structure (From primary to secondary/tertiary) Changes in employment structure i. e. wage-earners / non-wage earners (formal / informal): not necessarily uniform, even with increase in urban informal economy Employment share in different economic sectors 4

1. 2. Social and economic context Rapid changes - Economic development as a whole Increase in GDP per capita, productivity, wages, price level Changes in industrial structure (From primary to secondary/tertiary) Changes in employment structure i. e. wage-earners / non-wage earners (formal / informal): not necessarily uniform, even with increase in urban informal economy Employment share in different economic sectors 4

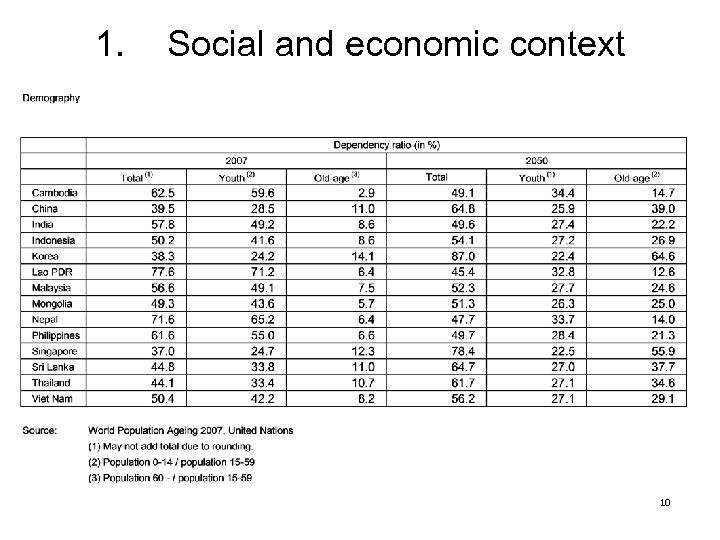

1. - Social and economic context Rapid changes in demographic structure i. e. age structure, fertility, mortality Rapid urbanization (internal migration) Increasing international migration => All have substantial impacts on present / future of social security systems and pose challenges 5

1. - Social and economic context Rapid changes in demographic structure i. e. age structure, fertility, mortality Rapid urbanization (internal migration) Increasing international migration => All have substantial impacts on present / future of social security systems and pose challenges 5

1. Social and economic context 6

1. Social and economic context 6

1. Social and economic context 7

1. Social and economic context 7

1. Social and economic context 8

1. Social and economic context 8

1. Social and economic context 9

1. Social and economic context 9

1. Social and economic context 10

1. Social and economic context 10

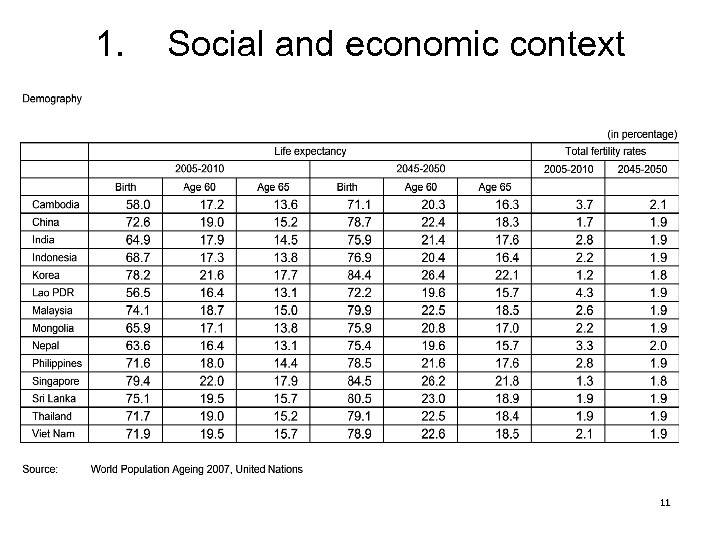

1. Social and economic context 11

1. Social and economic context 11

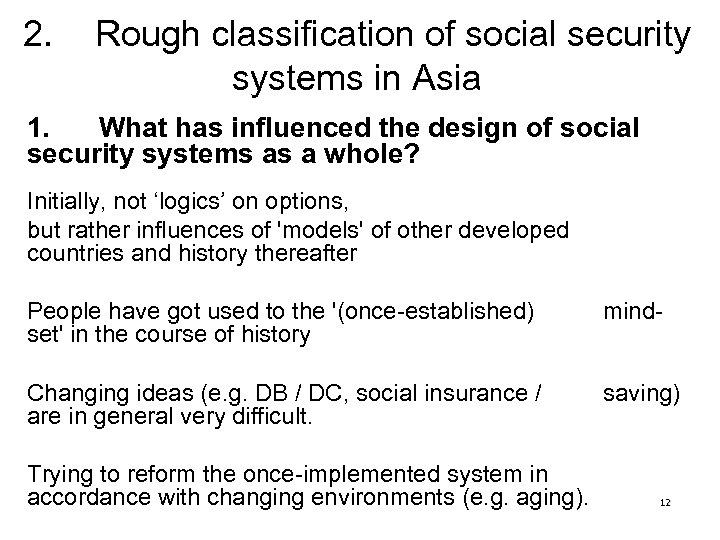

2. Rough classification of social security systems in Asia 1. What has influenced the design of social security systems as a whole? Initially, not ‘logics’ on options, but rather influences of 'models' of other developed countries and history thereafter People have got used to the '(once-established) set' in the course of history mind- Changing ideas (e. g. DB / DC, social insurance / are in general very difficult. saving) Trying to reform the once-implemented system in accordance with changing environments (e. g. aging). 12

2. Rough classification of social security systems in Asia 1. What has influenced the design of social security systems as a whole? Initially, not ‘logics’ on options, but rather influences of 'models' of other developed countries and history thereafter People have got used to the '(once-established) set' in the course of history mind- Changing ideas (e. g. DB / DC, social insurance / are in general very difficult. saving) Trying to reform the once-implemented system in accordance with changing environments (e. g. aging). 12

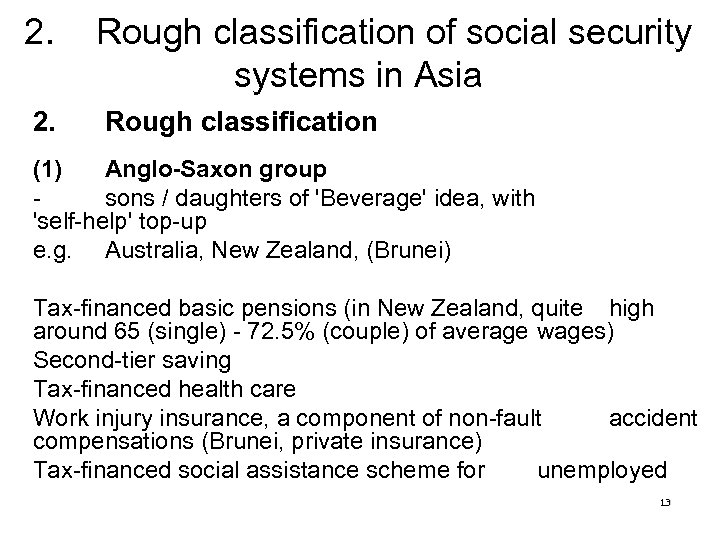

2. Rough classification of social security systems in Asia 2. Rough classification (1) Anglo-Saxon group sons / daughters of 'Beverage' idea, with 'self-help' top-up e. g. Australia, New Zealand, (Brunei) Tax-financed basic pensions (in New Zealand, quite high around 65 (single) - 72. 5% (couple) of average wages) Second-tier saving Tax-financed health care Work injury insurance, a component of non-fault accident compensations (Brunei, private insurance) Tax-financed social assistance scheme for unemployed 13

2. Rough classification of social security systems in Asia 2. Rough classification (1) Anglo-Saxon group sons / daughters of 'Beverage' idea, with 'self-help' top-up e. g. Australia, New Zealand, (Brunei) Tax-financed basic pensions (in New Zealand, quite high around 65 (single) - 72. 5% (couple) of average wages) Second-tier saving Tax-financed health care Work injury insurance, a component of non-fault accident compensations (Brunei, private insurance) Tax-financed social assistance scheme for unemployed 13

2. (2) Rough classification of social security systems in Asia North East Asia 'Bismarck' group sons / daughters of 'Bismarck' idea, classical insurance based on solidarity e. g. Korea, Chinese Taipei, Japan 'Universal' pension insurance 'Universal' health insurance Work-injury insurance Unemployment insurance Maternity / sickness insurance Social assistance as the last resort (very restricted) 14

2. (2) Rough classification of social security systems in Asia North East Asia 'Bismarck' group sons / daughters of 'Bismarck' idea, classical insurance based on solidarity e. g. Korea, Chinese Taipei, Japan 'Universal' pension insurance 'Universal' health insurance Work-injury insurance Unemployment insurance Maternity / sickness insurance Social assistance as the last resort (very restricted) 14

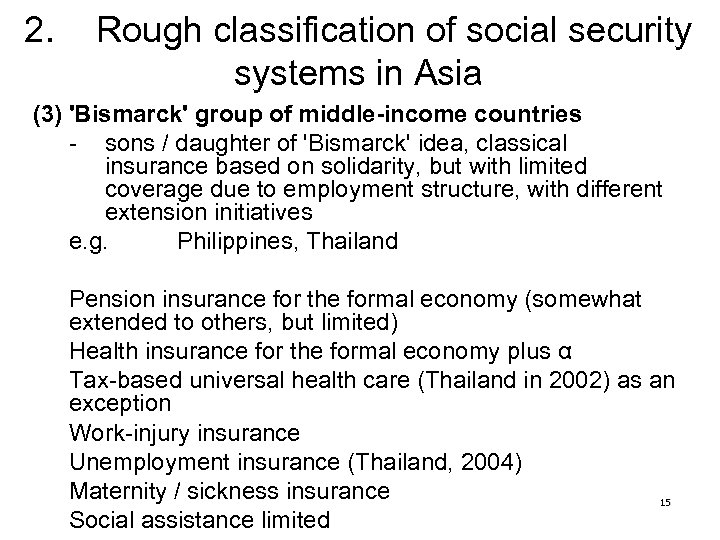

2. Rough classification of social security systems in Asia (3) 'Bismarck' group of middle-income countries - sons / daughter of 'Bismarck' idea, classical insurance based on solidarity, but with limited coverage due to employment structure, with different extension initiatives e. g. Philippines, Thailand Pension insurance for the formal economy (somewhat extended to others, but limited) Health insurance for the formal economy plus α Tax-based universal health care (Thailand in 2002) as an exception Work-injury insurance Unemployment insurance (Thailand, 2004) Maternity / sickness insurance 15 Social assistance limited

2. Rough classification of social security systems in Asia (3) 'Bismarck' group of middle-income countries - sons / daughter of 'Bismarck' idea, classical insurance based on solidarity, but with limited coverage due to employment structure, with different extension initiatives e. g. Philippines, Thailand Pension insurance for the formal economy (somewhat extended to others, but limited) Health insurance for the formal economy plus α Tax-based universal health care (Thailand in 2002) as an exception Work-injury insurance Unemployment insurance (Thailand, 2004) Maternity / sickness insurance 15 Social assistance limited

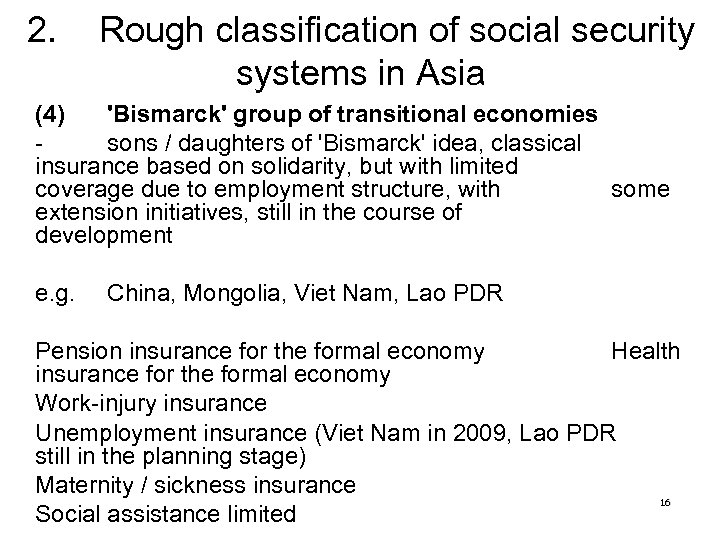

2. Rough classification of social security systems in Asia (4) 'Bismarck' group of transitional economies sons / daughters of 'Bismarck' idea, classical insurance based on solidarity, but with limited coverage due to employment structure, with some extension initiatives, still in the course of development e. g. China, Mongolia, Viet Nam, Lao PDR Pension insurance for the formal economy Health insurance for the formal economy Work-injury insurance Unemployment insurance (Viet Nam in 2009, Lao PDR still in the planning stage) Maternity / sickness insurance 16 Social assistance limited

2. Rough classification of social security systems in Asia (4) 'Bismarck' group of transitional economies sons / daughters of 'Bismarck' idea, classical insurance based on solidarity, but with limited coverage due to employment structure, with some extension initiatives, still in the course of development e. g. China, Mongolia, Viet Nam, Lao PDR Pension insurance for the formal economy Health insurance for the formal economy Work-injury insurance Unemployment insurance (Viet Nam in 2009, Lao PDR still in the planning stage) Maternity / sickness insurance 16 Social assistance limited

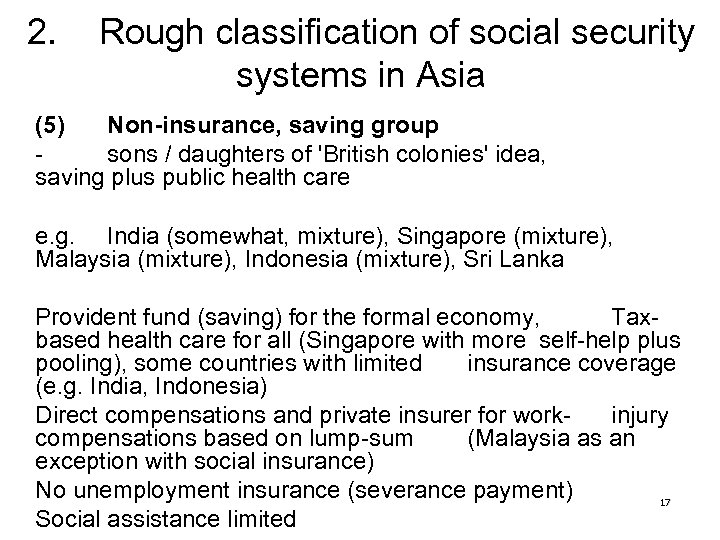

2. Rough classification of social security systems in Asia (5) Non-insurance, saving group sons / daughters of 'British colonies' idea, saving plus public health care e. g. India (somewhat, mixture), Singapore (mixture), Malaysia (mixture), Indonesia (mixture), Sri Lanka Provident fund (saving) for the formal economy, Taxbased health care for all (Singapore with more self-help plus pooling), some countries with limited insurance coverage (e. g. India, Indonesia) Direct compensations and private insurer for workinjury compensations based on lump-sum (Malaysia as an exception with social insurance) No unemployment insurance (severance payment) 17 Social assistance limited

2. Rough classification of social security systems in Asia (5) Non-insurance, saving group sons / daughters of 'British colonies' idea, saving plus public health care e. g. India (somewhat, mixture), Singapore (mixture), Malaysia (mixture), Indonesia (mixture), Sri Lanka Provident fund (saving) for the formal economy, Taxbased health care for all (Singapore with more self-help plus pooling), some countries with limited insurance coverage (e. g. India, Indonesia) Direct compensations and private insurer for workinjury compensations based on lump-sum (Malaysia as an exception with social insurance) No unemployment insurance (severance payment) 17 Social assistance limited

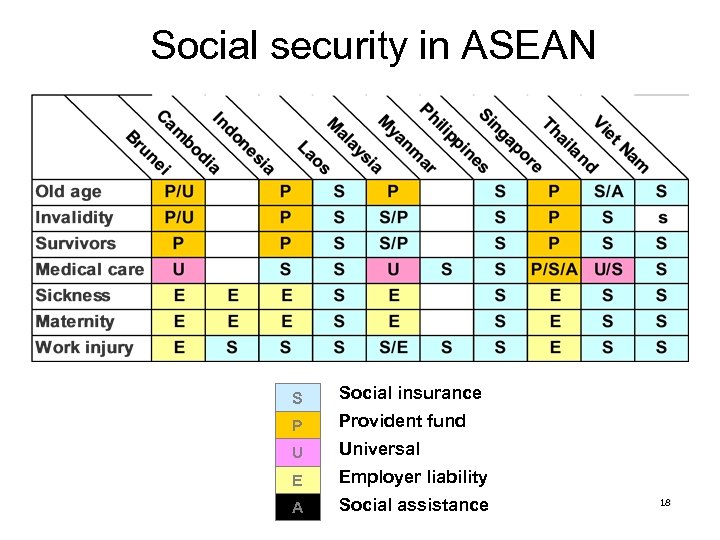

Social security in ASEAN S Social insurance P Provident fund U Universal E Employer liability A Social assistance 18

Social security in ASEAN S Social insurance P Provident fund U Universal E Employer liability A Social assistance 18

3. 1. Design of social security pensions Roles of social security pensions Roughly speaking, there are two major roles; (1) Basic income security for all Providing basic means of living to all residents => Way of poverty alleviation (2) Income replacement role for income earners Smoothening the transition before / after retirement Providing a partial replacement of income for the retirement lives of income earners and their families 19

3. 1. Design of social security pensions Roles of social security pensions Roughly speaking, there are two major roles; (1) Basic income security for all Providing basic means of living to all residents => Way of poverty alleviation (2) Income replacement role for income earners Smoothening the transition before / after retirement Providing a partial replacement of income for the retirement lives of income earners and their families 19

3. Design of social security pensions 1. Roles of social security pensions - Everyone admits (1) as the most basic role, but, historically, (2) has developed, firstly, for civil servants as 'salary continuation' or 'rewards for their royalty', followed by insurance schemes for private-sector workers and cannot be easily extended to self- employed, rural farmers etc. , mainly due to low affordability of insurance contributions and administrative difficulties. In Asia, many countries end up with 'singletier' income-related security pension schemes either through insurance (DB) or saving (DC). 20

3. Design of social security pensions 1. Roles of social security pensions - Everyone admits (1) as the most basic role, but, historically, (2) has developed, firstly, for civil servants as 'salary continuation' or 'rewards for their royalty', followed by insurance schemes for private-sector workers and cannot be easily extended to self- employed, rural farmers etc. , mainly due to low affordability of insurance contributions and administrative difficulties. In Asia, many countries end up with 'singletier' income-related security pension schemes either through insurance (DB) or saving (DC). 20

3. 2. Design of social security pensions Basic income security role To be measured as 'absolute‘ level, sometimes connected to social assistance level, minimum wages, poverty level etc. based on a basket of goods comprising of food, clothing, housing, energy, water etc. Countries satisfying (partially) this role through providing 'pensions for all' (universal coverage) Taxation group Australia (around 67% of the elderly receive means-tested pensions), New Zealand, Brunei Insurance group Korea, Japan, Taiwan No developing countries 21

3. 2. Design of social security pensions Basic income security role To be measured as 'absolute‘ level, sometimes connected to social assistance level, minimum wages, poverty level etc. based on a basket of goods comprising of food, clothing, housing, energy, water etc. Countries satisfying (partially) this role through providing 'pensions for all' (universal coverage) Taxation group Australia (around 67% of the elderly receive means-tested pensions), New Zealand, Brunei Insurance group Korea, Japan, Taiwan No developing countries 21

3. 2. Design of social security pensions Basic income security role Social Pensions (such as those in Australia, Brunei, New Zealand) In many developing countries, it is difficult for insurance schemes to cover substantial percentage of population because of the large informal economy, especially rural farmers and increasing informal workers in urban areas. Tax-based non-contributory social pensions become more popular in low- and middle-income countries. 22

3. 2. Design of social security pensions Basic income security role Social Pensions (such as those in Australia, Brunei, New Zealand) In many developing countries, it is difficult for insurance schemes to cover substantial percentage of population because of the large informal economy, especially rural farmers and increasing informal workers in urban areas. Tax-based non-contributory social pensions become more popular in low- and middle-income countries. 22

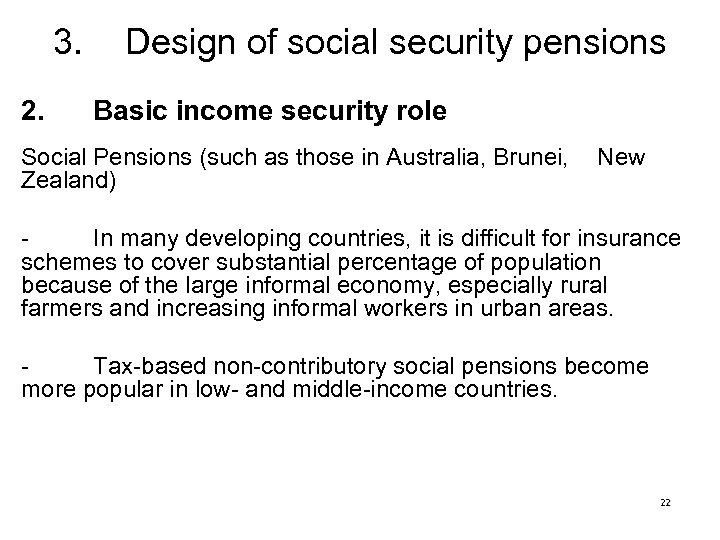

3. Design of social security pensions Non-contributory pensions 23

3. Design of social security pensions Non-contributory pensions 23

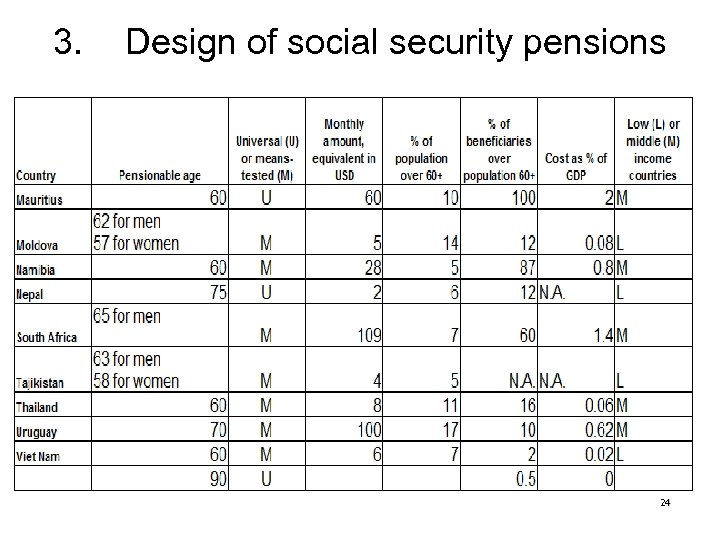

3. Design of social security pensions 24

3. Design of social security pensions 24

Basic social security in developing countries ILO Definition • Universal affordable access to basic health benefits – provided through a public health service funded by taxes, social and private insurance and micro-insurance systems linked together into one system. • Income security for all children – provided through family/child benefits aimed to facilitate access to basic social services: education, health and housing. • Income security for older persons and persons with disabilities – provided through basic universal non-contributory pensions. • Social security to working poor and unemployed in active age groups – provided through social assistance and employment guarantees. 25

Basic social security in developing countries ILO Definition • Universal affordable access to basic health benefits – provided through a public health service funded by taxes, social and private insurance and micro-insurance systems linked together into one system. • Income security for all children – provided through family/child benefits aimed to facilitate access to basic social services: education, health and housing. • Income security for older persons and persons with disabilities – provided through basic universal non-contributory pensions. • Social security to working poor and unemployed in active age groups – provided through social assistance and employment guarantees. 25

Affordability of basic social security Assumptions for calculations • Benefit package (1) Universal pension benefit 30 per cent of GDP per capita, capped at US$ 1 (PPP) a day, indexed with inflation For all the elderly 65 years of age and above and the disabled assumed as 1% of working age population. (2) Basic health care Cost measured based on ratio of 300 medical staff to 100, 000 population Medical staff wages indexed in line with GDP per capita growth Health staff wages assumed at a minimum of three times GDP per capita Overhead costs of 67 per cent of staff costs. (3) Child benefit 15 per cent of GDP per capita, capped at US$ 0. 50 (PPP) a day, indexed with inflation Provided to up to two children in the age bracket of 0 -14 per woman. (4) Income support to targeted poor and unemployed in active age group 30 per cent of GDP per capita, capped at US$ 1 (PPP) a day, indexed with inflation 10 per cent of the working age population for 100 days per year, only to those in households not benefiting from any other form of cash transfer (i. e. child benefit, pensions). • Administration costs for delivering cash benefits 15 % of cash benefit expenditure 26

Affordability of basic social security Assumptions for calculations • Benefit package (1) Universal pension benefit 30 per cent of GDP per capita, capped at US$ 1 (PPP) a day, indexed with inflation For all the elderly 65 years of age and above and the disabled assumed as 1% of working age population. (2) Basic health care Cost measured based on ratio of 300 medical staff to 100, 000 population Medical staff wages indexed in line with GDP per capita growth Health staff wages assumed at a minimum of three times GDP per capita Overhead costs of 67 per cent of staff costs. (3) Child benefit 15 per cent of GDP per capita, capped at US$ 0. 50 (PPP) a day, indexed with inflation Provided to up to two children in the age bracket of 0 -14 per woman. (4) Income support to targeted poor and unemployed in active age group 30 per cent of GDP per capita, capped at US$ 1 (PPP) a day, indexed with inflation 10 per cent of the working age population for 100 days per year, only to those in households not benefiting from any other form of cash transfer (i. e. child benefit, pensions). • Administration costs for delivering cash benefits 15 % of cash benefit expenditure 26

Affordability of basic social security Assumptions for calculations (2) • Real GDP growth Working age population growth plus 3% (India) Working age pop growth plus 2% (Ethiopia, Tanzania and Viet Nam) Working age pop growth plus 1% (Other countries). • Total Government expenditure Increased by 50 per cent of their current level by the year 2034, with a maximum of 30 per cent of GDP. • Total Government revenue (excluding grants) To reach the projected expenditure level by 2014 in order to reach a balanced budget. • Government budget allocation Option 1 (Status quo) Governments will not increase the proportion of resources allocated to social protection as in 2003. Option 2 (Policy change) 20% of Government expenditure allocated to the financing of basic social protection. 27

Affordability of basic social security Assumptions for calculations (2) • Real GDP growth Working age population growth plus 3% (India) Working age pop growth plus 2% (Ethiopia, Tanzania and Viet Nam) Working age pop growth plus 1% (Other countries). • Total Government expenditure Increased by 50 per cent of their current level by the year 2034, with a maximum of 30 per cent of GDP. • Total Government revenue (excluding grants) To reach the projected expenditure level by 2014 in order to reach a balanced budget. • Government budget allocation Option 1 (Status quo) Governments will not increase the proportion of resources allocated to social protection as in 2003. Option 2 (Policy change) 20% of Government expenditure allocated to the financing of basic social protection. 27

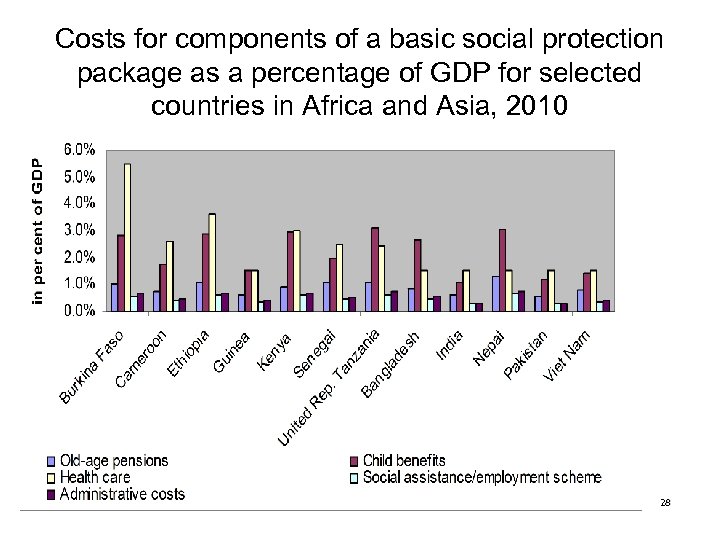

Costs for components of a basic social protection package as a percentage of GDP for selected countries in Africa and Asia, 2010 28

Costs for components of a basic social protection package as a percentage of GDP for selected countries in Africa and Asia, 2010 28

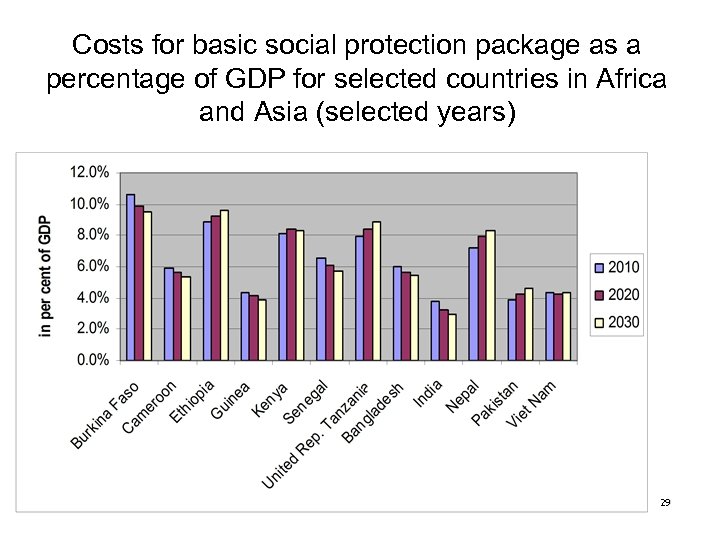

Costs for basic social protection package as a percentage of GDP for selected countries in Africa and Asia (selected years) 29

Costs for basic social protection package as a percentage of GDP for selected countries in Africa and Asia (selected years) 29

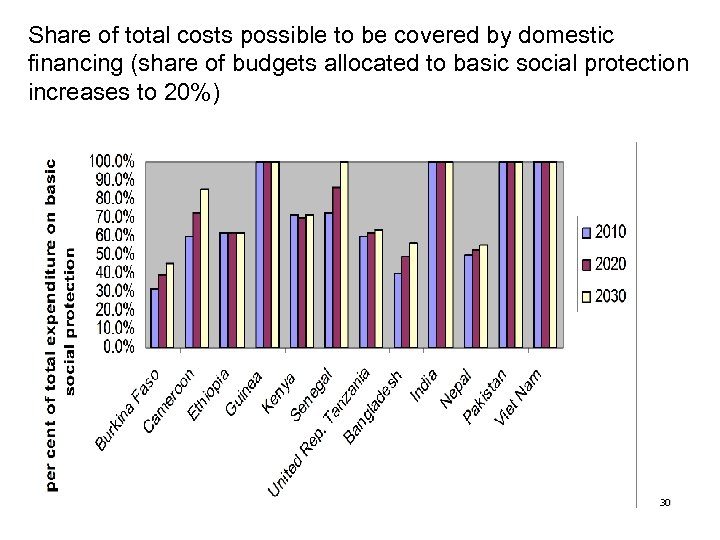

Share of total costs possible to be covered by domestic financing (share of budgets allocated to basic social protection increases to 20%) 30

Share of total costs possible to be covered by domestic financing (share of budgets allocated to basic social protection increases to 20%) 30

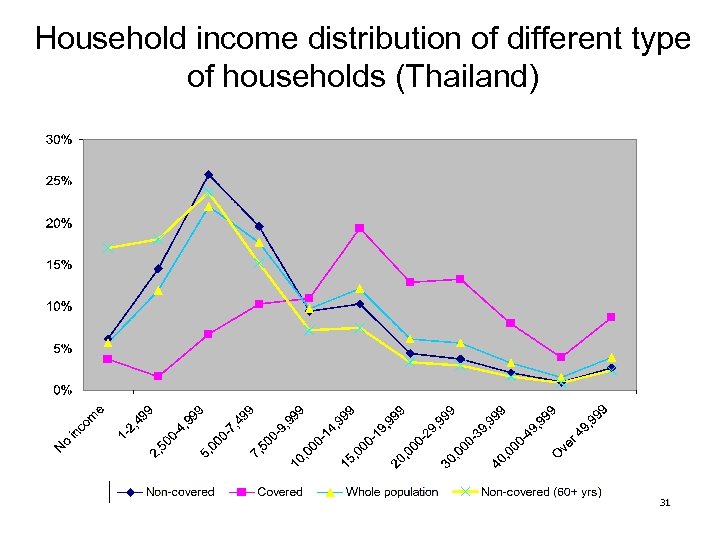

Household income distribution of different type of households (Thailand) 31

Household income distribution of different type of households (Thailand) 31

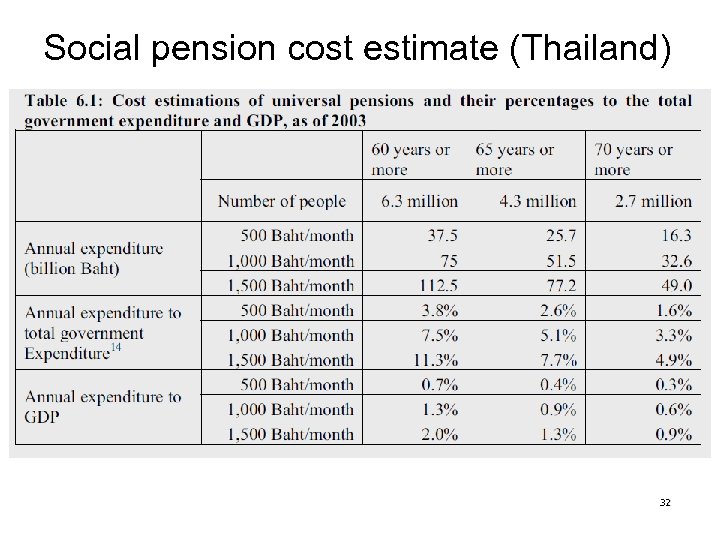

Social pension cost estimate (Thailand) 32

Social pension cost estimate (Thailand) 32

International comparison of government expenditure on pensions • Thailand A= 1, 500 Baht person/month to people over 60 years old (2. 0% in the figure) • Thailand B=500 Baht person/month to people over 70 years old (0. 3% in the figure) • Each 0. 8% for Thailand A and B is GPF expenditure • Thailand (2003), Japan (1995), France (1994), Sweden, Germany, England (1993), USA (1992) 33

International comparison of government expenditure on pensions • Thailand A= 1, 500 Baht person/month to people over 60 years old (2. 0% in the figure) • Thailand B=500 Baht person/month to people over 70 years old (0. 3% in the figure) • Each 0. 8% for Thailand A and B is GPF expenditure • Thailand (2003), Japan (1995), France (1994), Sweden, Germany, England (1993), USA (1992) 33

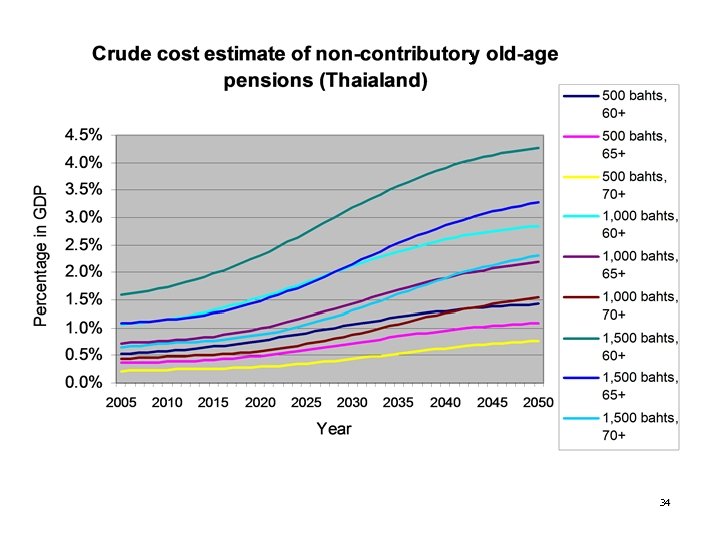

34

34

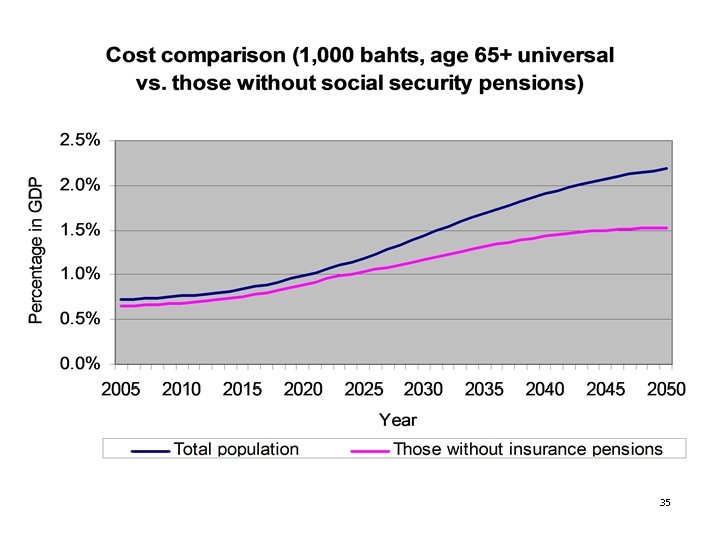

35

35

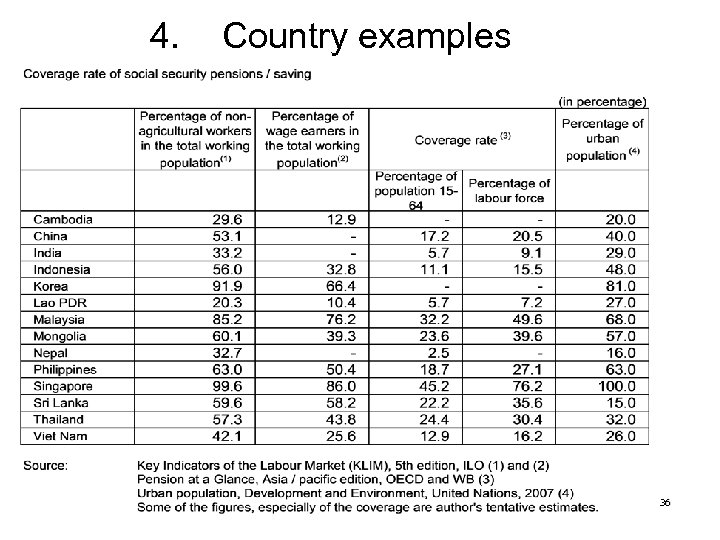

4. Country examples 36

4. Country examples 36

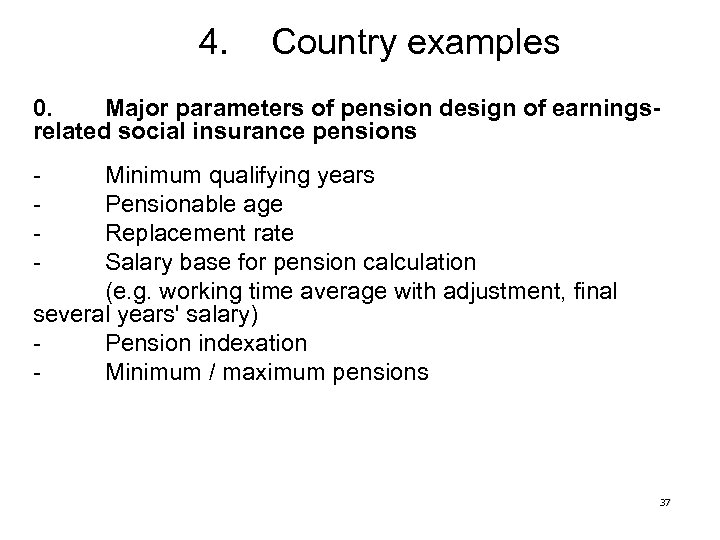

4. Country examples 0. Major parameters of pension design of earningsrelated social insurance pensions - Minimum qualifying years Pensionable age Replacement rate Salary base for pension calculation (e. g. working time average with adjustment, final several years' salary) Pension indexation Minimum / maximum pensions 37

4. Country examples 0. Major parameters of pension design of earningsrelated social insurance pensions - Minimum qualifying years Pensionable age Replacement rate Salary base for pension calculation (e. g. working time average with adjustment, final several years' salary) Pension indexation Minimum / maximum pensions 37

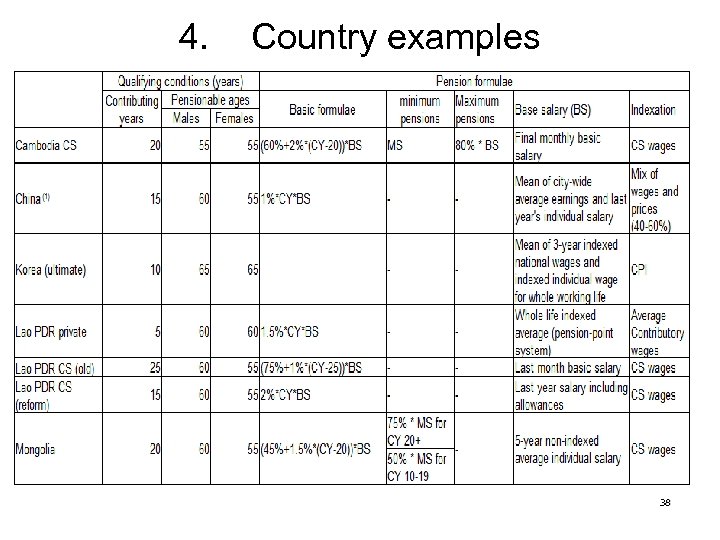

4. Country examples 38

4. Country examples 38

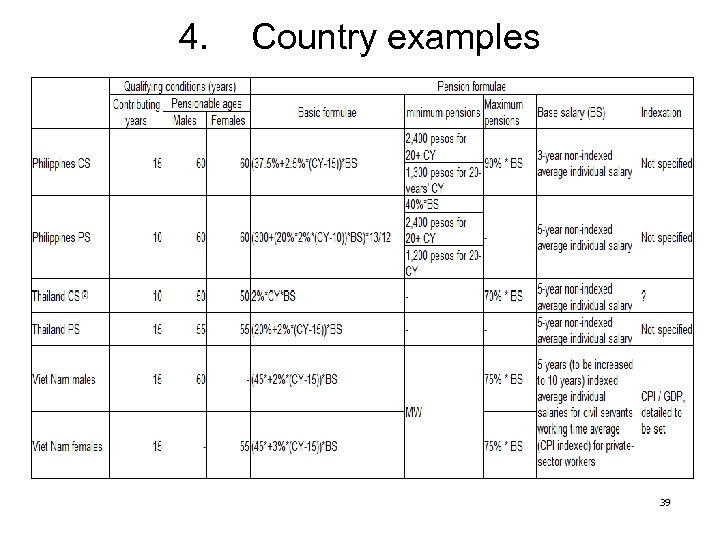

4. Country examples 39

4. Country examples 39

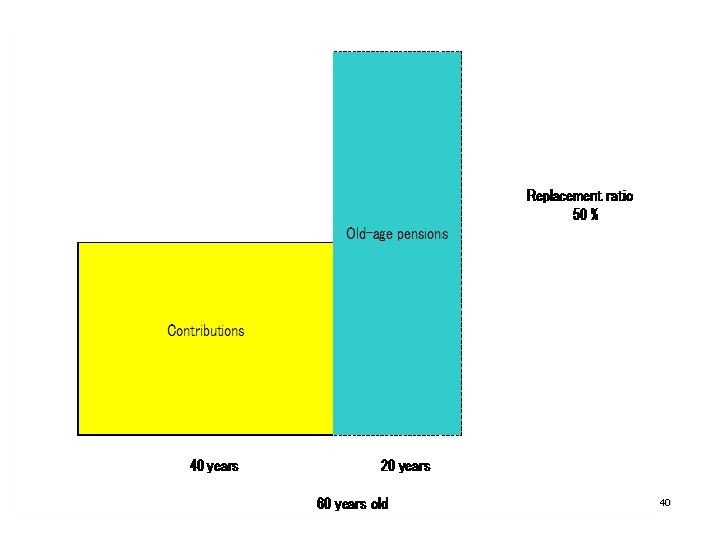

40

40

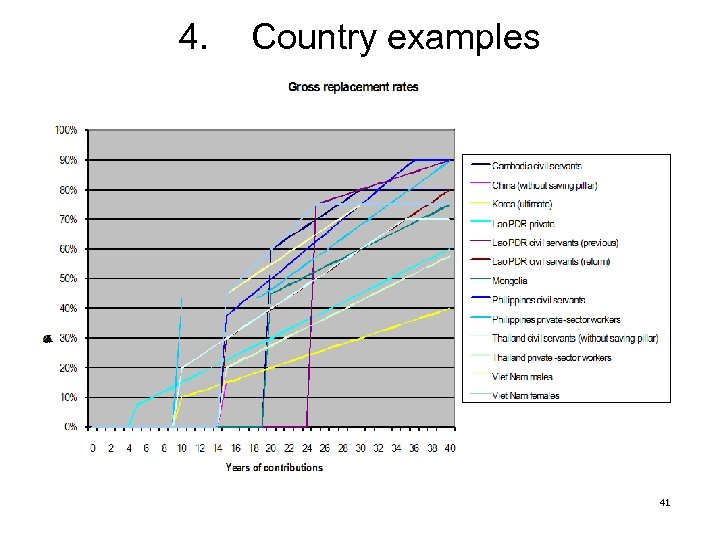

4. Country examples 41

4. Country examples 41

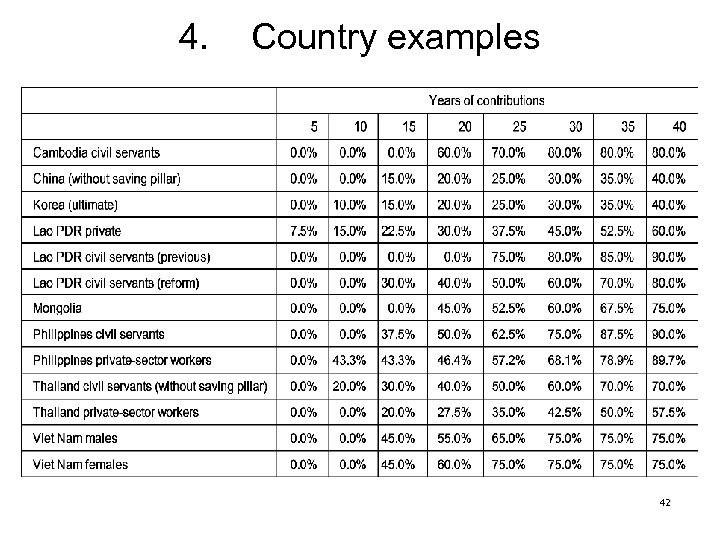

4. Country examples 42

4. Country examples 42

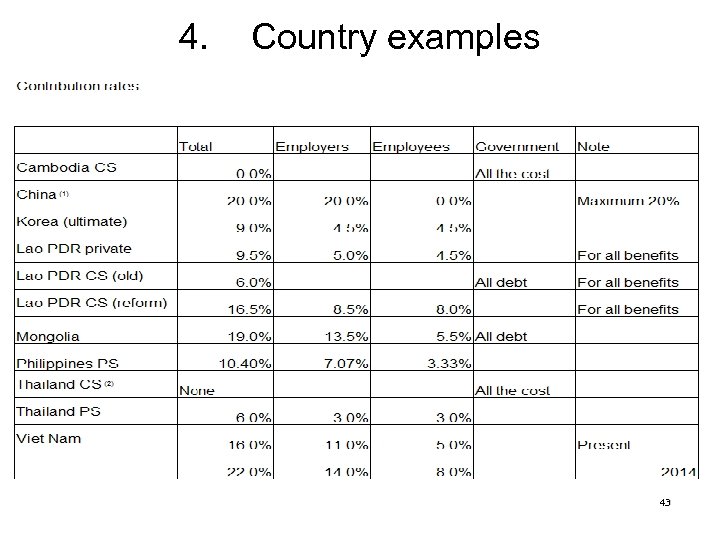

4. Country examples 43

4. Country examples 43

4. 1. Country examples Korea, Japan Challenges: (1) How to cater for ‘coverage gaps' of insurance (2) How to make existing systems financially sustainable in the super-aging society, with a broad consensus of the adequacy of social security pensions, expressed mainly as the replacement level and the contribution rate / cost on tax-financing Korea: Direct reduction of replacement level accepted in society (to 40% ultimate)? Future increase in the contribution rate, pensionable age? 44

4. 1. Country examples Korea, Japan Challenges: (1) How to cater for ‘coverage gaps' of insurance (2) How to make existing systems financially sustainable in the super-aging society, with a broad consensus of the adequacy of social security pensions, expressed mainly as the replacement level and the contribution rate / cost on tax-financing Korea: Direct reduction of replacement level accepted in society (to 40% ultimate)? Future increase in the contribution rate, pensionable age? 44

4. 2. Country examples Thailand, Philippines Coverage: still to be improved Civil servants' pensions: Too generous in replacement level, pensionable too low ages Private-sector workers' pensions Philippines: too generous Thailand: modest, low retirement age Final 5 -wage calculation to be reformed Contribution rate to be gradually increased 46

4. 2. Country examples Thailand, Philippines Coverage: still to be improved Civil servants' pensions: Too generous in replacement level, pensionable too low ages Private-sector workers' pensions Philippines: too generous Thailand: modest, low retirement age Final 5 -wage calculation to be reformed Contribution rate to be gradually increased 46

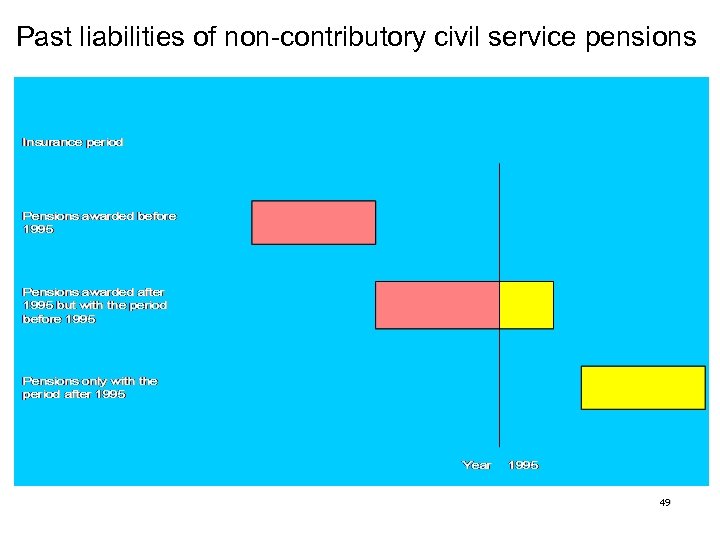

4. 2. Country examples Transition countries (Mongolia, Viet Nam, Lao PDR) Coverage: Still to be improved, especially stronger enforcements necessary to private-sector workers Earnings-related pensions for both civil servants and private-sector workers (Mongolia, Viet Nam): Normal retirement ages to be increased, equalized between men and women. Early retirement to be gradually abolished. Structurally high replacement level to be rationalized. Past liabilities (before 1995) to be sorted out by taxation revenues. Contribution rates to be rationalized with the reform of past liabilities. 47

4. 2. Country examples Transition countries (Mongolia, Viet Nam, Lao PDR) Coverage: Still to be improved, especially stronger enforcements necessary to private-sector workers Earnings-related pensions for both civil servants and private-sector workers (Mongolia, Viet Nam): Normal retirement ages to be increased, equalized between men and women. Early retirement to be gradually abolished. Structurally high replacement level to be rationalized. Past liabilities (before 1995) to be sorted out by taxation revenues. Contribution rates to be rationalized with the reform of past liabilities. 47

4. 2. Country examples Transition countries (Mongolia, Viet Nam, Lao PDR) The range of wage for contribution to be wider, with compliance. Realistic phasing-in of NDC in Mongolia (for those after 1960) to be considered and established. Lao PDR: Extension of coverage of private-sector scheme to PDR (now only in three Provinces) Gradual and continuous reform of civil servants; (like Vietnam and Mongolia) better born all Lao scheme 48

4. 2. Country examples Transition countries (Mongolia, Viet Nam, Lao PDR) The range of wage for contribution to be wider, with compliance. Realistic phasing-in of NDC in Mongolia (for those after 1960) to be considered and established. Lao PDR: Extension of coverage of private-sector scheme to PDR (now only in three Provinces) Gradual and continuous reform of civil servants; (like Vietnam and Mongolia) better born all Lao scheme 48

Past liabilities of non-contributory civil service pensions 49

Past liabilities of non-contributory civil service pensions 49

4. Country examples 3. Countries with provident funds (Indonesia, Singapore, Malaysia) Improvements of compliance, especially Indonesia 47% of wage earners covered). (only Fundamental problems of benefit adequacy (mainly lumpsum payments), especially without basic-tier pensions even for wage earners. Premature withdrawals prevalent for housing and education (some measures are being taken for preventing early withdrawals, e. g. Singapore / Malaysia). 50

4. Country examples 3. Countries with provident funds (Indonesia, Singapore, Malaysia) Improvements of compliance, especially Indonesia 47% of wage earners covered). (only Fundamental problems of benefit adequacy (mainly lumpsum payments), especially without basic-tier pensions even for wage earners. Premature withdrawals prevalent for housing and education (some measures are being taken for preventing early withdrawals, e. g. Singapore / Malaysia). 50

5. Remarks on pensions 1. Basic-tier pensions is lacking in developing countries in Asia and this needs urgent attentions and remedies (social pensions? ). 2. Earnings-related pensions need future gradual reforms of key system parameters, seen as in many developed countries. 3. Governance issues are also important, such as more strict compliance measures to be taken and the abolishment of early retirement provisions. 4. Transition issues such as the past liabilities for civil servants need special attentions of schemes of transitional countries (e. g. Viet Nam, Lao PDR). 51

5. Remarks on pensions 1. Basic-tier pensions is lacking in developing countries in Asia and this needs urgent attentions and remedies (social pensions? ). 2. Earnings-related pensions need future gradual reforms of key system parameters, seen as in many developed countries. 3. Governance issues are also important, such as more strict compliance measures to be taken and the abolishment of early retirement provisions. 4. Transition issues such as the past liabilities for civil servants need special attentions of schemes of transitional countries (e. g. Viet Nam, Lao PDR). 51

5. Remarks on pensions 5. Provident funds need strengthened measures of preventing early withdrawals and of facilitating annuitization. 6. Other social security provisions, such as health care, invalidity and survivors‘ pensions (and elderly care finally) should be also taken into account from both angles of adequacies of benefits for the elderly including old-age pensions and the cost of the overall packages. 7. No drastic changes seem to take place on the fundamental structure of existing (earnings-related) schemes (e. g. DB / DC of earnings-related tier. ). Gradual reforms will be the demands of developing countries and developed countries can contribute by sharing experiences and provide support / advice. 52

5. Remarks on pensions 5. Provident funds need strengthened measures of preventing early withdrawals and of facilitating annuitization. 6. Other social security provisions, such as health care, invalidity and survivors‘ pensions (and elderly care finally) should be also taken into account from both angles of adequacies of benefits for the elderly including old-age pensions and the cost of the overall packages. 7. No drastic changes seem to take place on the fundamental structure of existing (earnings-related) schemes (e. g. DB / DC of earnings-related tier. ). Gradual reforms will be the demands of developing countries and developed countries can contribute by sharing experiences and provide support / advice. 52

6. Health care as a core component of social security 1. Poverty and health • • • 20% of the world population lives in abject poverty. 80% of the world population does not have access to adequate social protection, most of them live in social insecurity. Every year 100 million people globally are forced into poverty by health care costs. Worldwide, 178 million people are exposed to catastrophic health costs. => Notorious vicious circle of poverty and health 2. People’s high demands in health 3. Large segment of workers still non- labour wage earners, low affordability of non-covered population and difficulties of administration of self-employed persons and farmers => limitations of voluntary insurance coverage, roles of tax-financing 53 essential. • •

6. Health care as a core component of social security 1. Poverty and health • • • 20% of the world population lives in abject poverty. 80% of the world population does not have access to adequate social protection, most of them live in social insecurity. Every year 100 million people globally are forced into poverty by health care costs. Worldwide, 178 million people are exposed to catastrophic health costs. => Notorious vicious circle of poverty and health 2. People’s high demands in health 3. Large segment of workers still non- labour wage earners, low affordability of non-covered population and difficulties of administration of self-employed persons and farmers => limitations of voluntary insurance coverage, roles of tax-financing 53 essential. • •

54

54

55

55

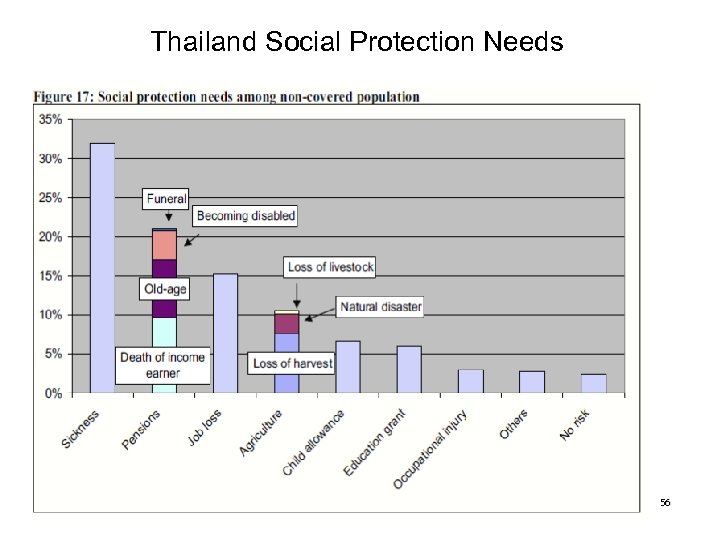

Thailand Social Protection Needs 56

Thailand Social Protection Needs 56

Thailand household income distribution 57

Thailand household income distribution 57

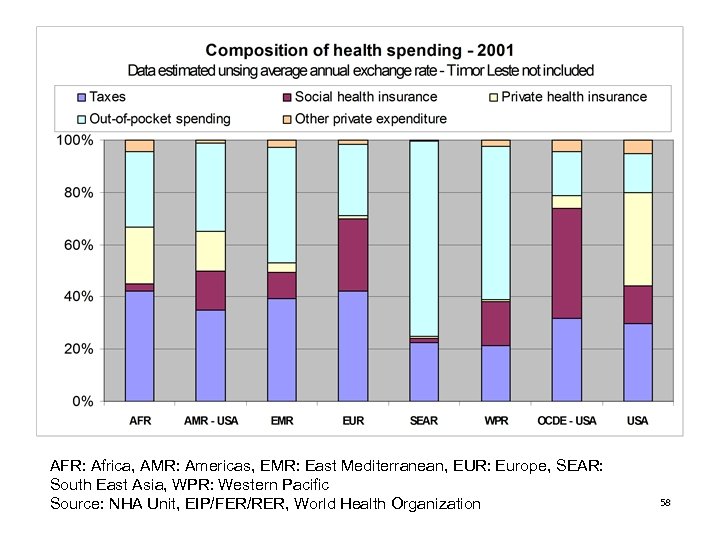

AFR: Africa, AMR: Americas, EMR: East Mediterranean, EUR: Europe, SEAR: South East Asia, WPR: Western Pacific Source: NHA Unit, EIP/FER/RER, World Health Organization 58

AFR: Africa, AMR: Americas, EMR: East Mediterranean, EUR: Europe, SEAR: South East Asia, WPR: Western Pacific Source: NHA Unit, EIP/FER/RER, World Health Organization 58

Experience of Social Health Protection of Asia-Pacific Successfully in achieving (quasi-)universal coverage Poor and informal economy not covered Australia New Zealand Japan South Korea Malaysia Thailand Mongolia Sri Lanka China India Indonesia Cambodia Lao PDR 59

Experience of Social Health Protection of Asia-Pacific Successfully in achieving (quasi-)universal coverage Poor and informal economy not covered Australia New Zealand Japan South Korea Malaysia Thailand Mongolia Sri Lanka China India Indonesia Cambodia Lao PDR 59

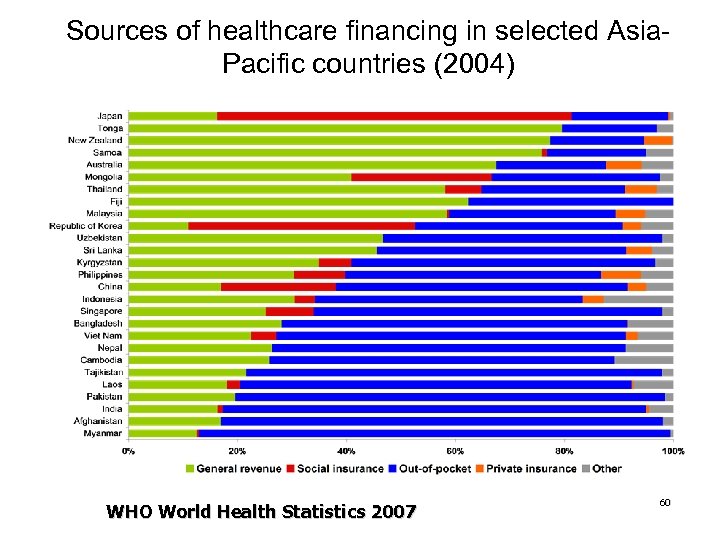

Sources of healthcare financing in selected Asia. Pacific countries (2004) WHO World Health Statistics 2007 60

Sources of healthcare financing in selected Asia. Pacific countries (2004) WHO World Health Statistics 2007 60

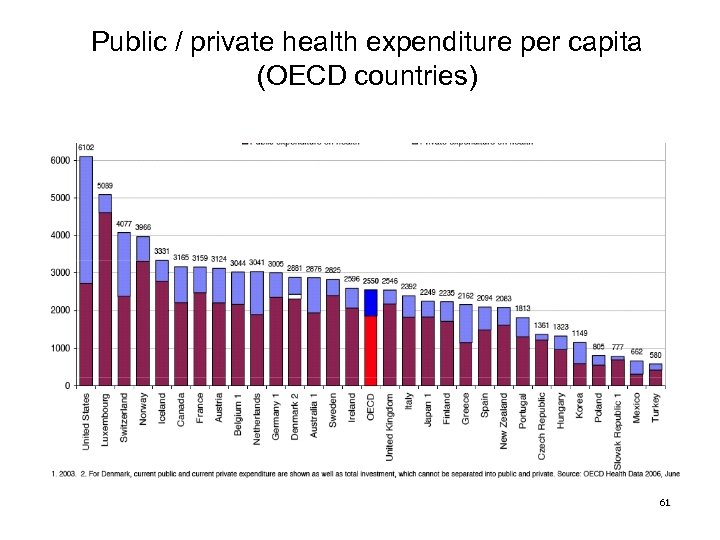

Public / private health expenditure per capita (OECD countries) 61

Public / private health expenditure per capita (OECD countries) 61

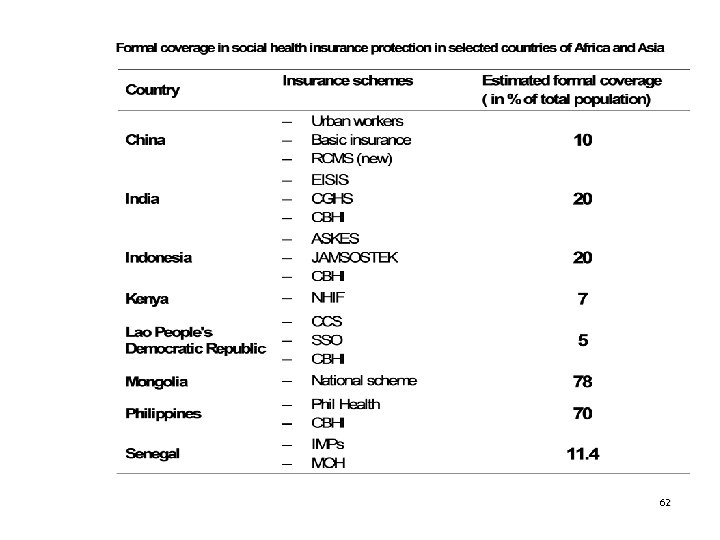

62

62

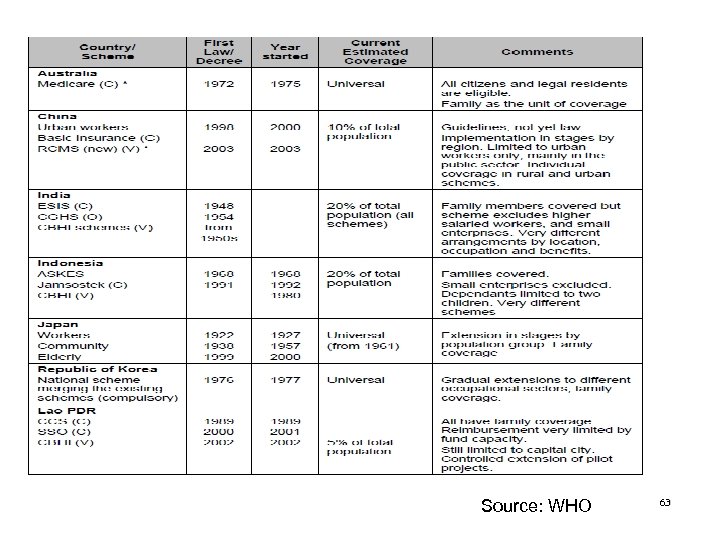

Source: WHO 63

Source: WHO 63

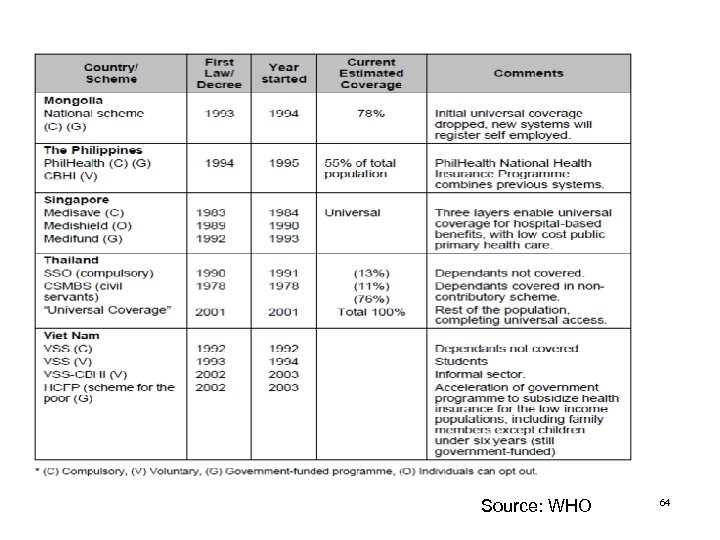

Source: WHO 64

Source: WHO 64

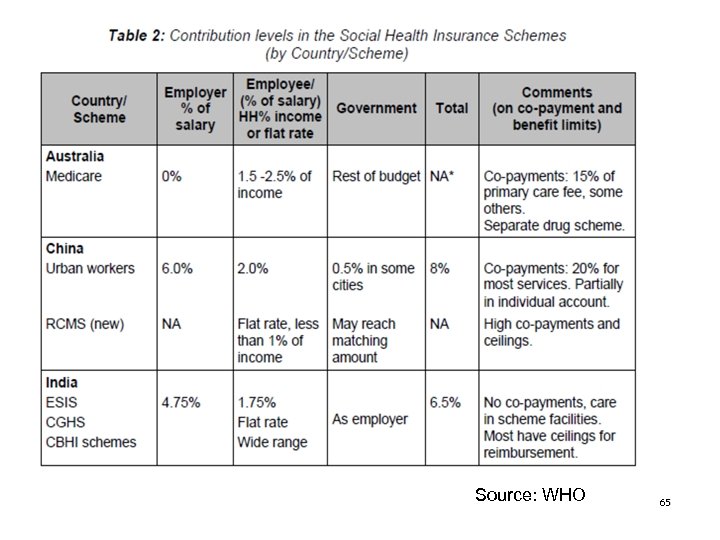

Source: WHO 65

Source: WHO 65

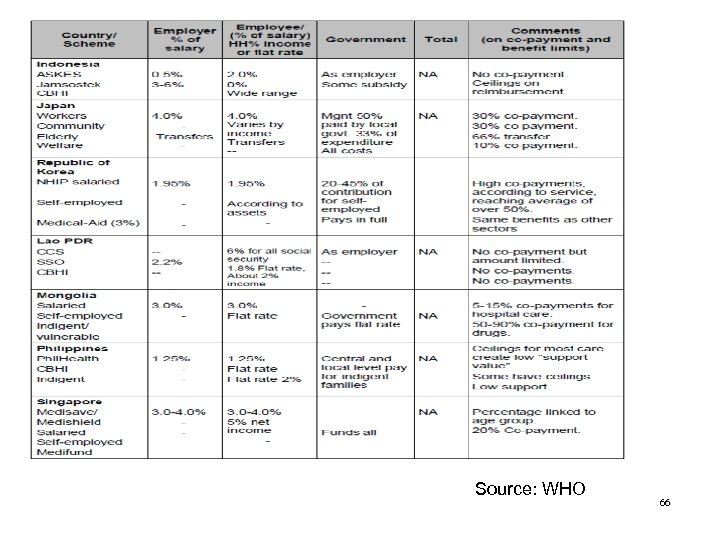

Source: WHO 66

Source: WHO 66

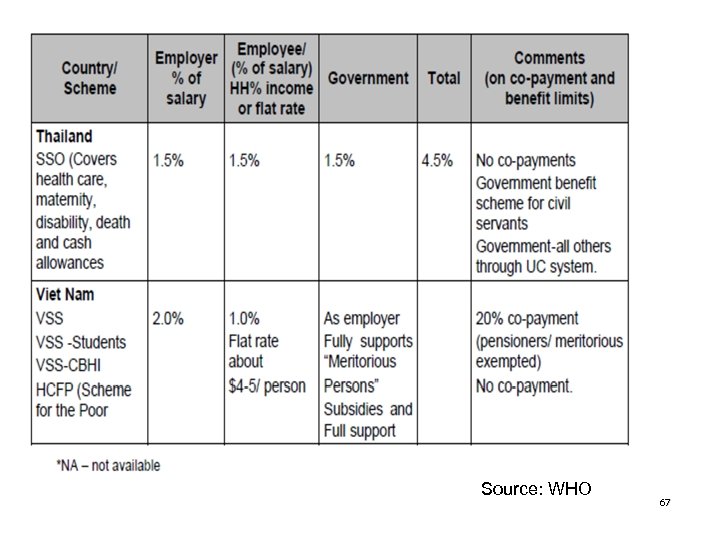

Source: WHO 67

Source: WHO 67

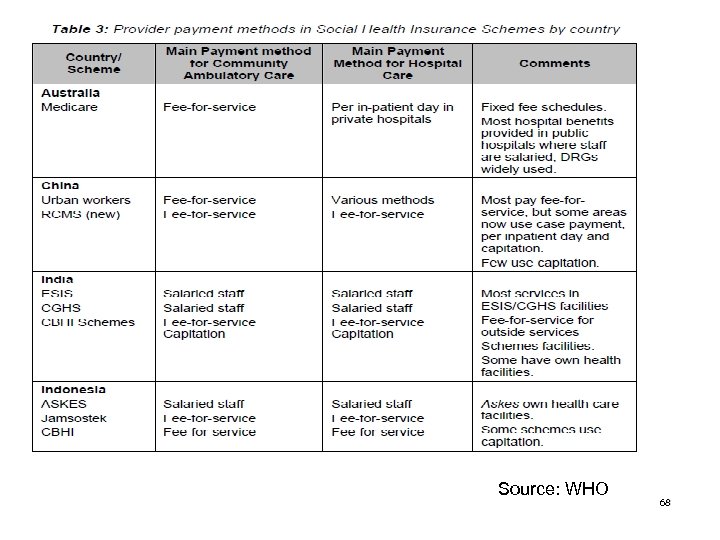

Source: WHO 68

Source: WHO 68

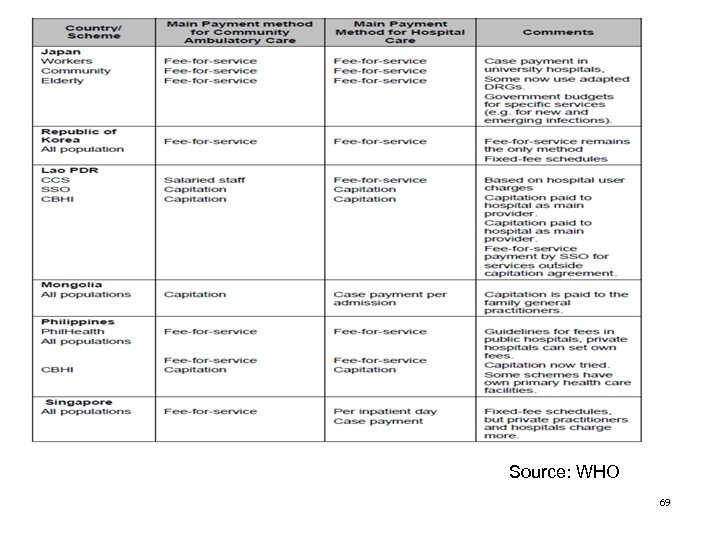

Source: WHO 69

Source: WHO 69

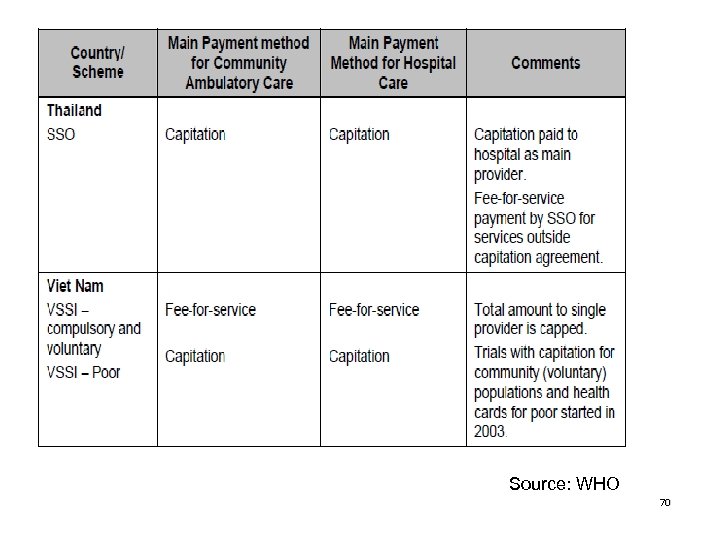

Source: WHO 70

Source: WHO 70

6. Health care as a core component of social security - Basic health care, basic education, basic income protections are public goods and hence Governments have a responsibility for financing and controlling. - Public spending (social insurance / taxation) is majority for countries with high levels of coverage. - Taxation / compulsory insurance coverage are the only ultimate ways of achieving universal coverage with adequate redistribution to make health care affordable for poorer segment of the population. - Tax spending plays a major role even in countries with social insurance, especially, to cover selfemployed, farmers (substantial subsidies) and the poor / social assistance groups (fully paid). 71

6. Health care as a core component of social security - Basic health care, basic education, basic income protections are public goods and hence Governments have a responsibility for financing and controlling. - Public spending (social insurance / taxation) is majority for countries with high levels of coverage. - Taxation / compulsory insurance coverage are the only ultimate ways of achieving universal coverage with adequate redistribution to make health care affordable for poorer segment of the population. - Tax spending plays a major role even in countries with social insurance, especially, to cover selfemployed, farmers (substantial subsidies) and the poor / social assistance groups (fully paid). 71

6. Health care as a core component of social security - Social insurance, even though covering only wage earners, can free up the tax resources for poorer segment of the population (Thailand UC). - In the process of extension / improvement, voluntary insurance coverage / donor assistance can play roles, but not permanent / significant in the future. => Do we have credible / realistic ‘exit’ strategies for specific low-income countries? - Private medical providers can play roles in providing health care under social insurance schemes (Japan, Korea) / tax-financed schemes (Thailand), but needs strong Government controls on fees / pricing / provider payments. 72

6. Health care as a core component of social security - Social insurance, even though covering only wage earners, can free up the tax resources for poorer segment of the population (Thailand UC). - In the process of extension / improvement, voluntary insurance coverage / donor assistance can play roles, but not permanent / significant in the future. => Do we have credible / realistic ‘exit’ strategies for specific low-income countries? - Private medical providers can play roles in providing health care under social insurance schemes (Japan, Korea) / tax-financed schemes (Thailand), but needs strong Government controls on fees / pricing / provider payments. 72

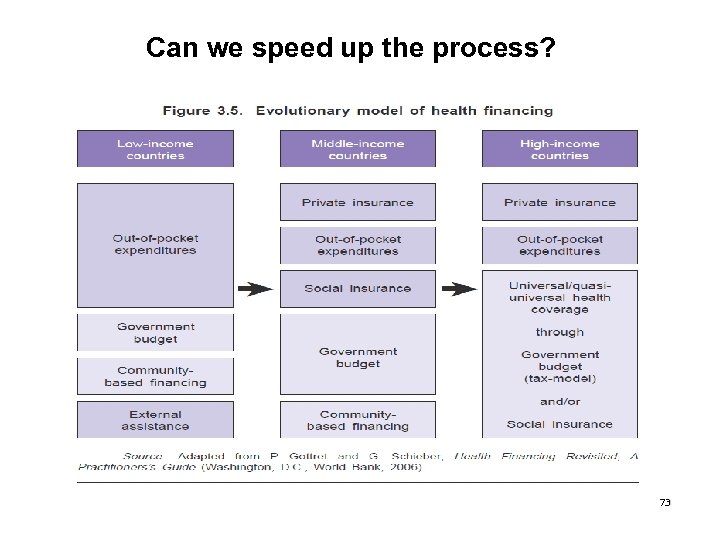

Can we speed up the process? 73

Can we speed up the process? 73

7. Employment injury insurance (EII) - Many insurance-group countries as well as ‘Anglo-Saxon’ group (e. g. Australia, New Zealand) have EII to provide cash compensations (disability / survivors pensions) as well as medical care in case of occupational accidents / diseases. - Indonesia has an insurance scheme, but cash compensations are still in the forms of lump-sum, not pensions. - Many ex-British colonies (e. g. Pacific countries) rely on direct compensations / voluntary insurance companies, often leading to non-payments in case companies cannot pay or non-coverage in case private insurance companies are not willing to cover them (high-risk industries). - Malaysia has a fairly advanced scheme regardless of their ‘grouping’. - Better linkages of preventions / compensations / 74 rehabilitations are still challenges.

7. Employment injury insurance (EII) - Many insurance-group countries as well as ‘Anglo-Saxon’ group (e. g. Australia, New Zealand) have EII to provide cash compensations (disability / survivors pensions) as well as medical care in case of occupational accidents / diseases. - Indonesia has an insurance scheme, but cash compensations are still in the forms of lump-sum, not pensions. - Many ex-British colonies (e. g. Pacific countries) rely on direct compensations / voluntary insurance companies, often leading to non-payments in case companies cannot pay or non-coverage in case private insurance companies are not willing to cover them (high-risk industries). - Malaysia has a fairly advanced scheme regardless of their ‘grouping’. - Better linkages of preventions / compensations / 74 rehabilitations are still challenges.

7. Employment injury insurance (EII) - Contribution rate maximum 1 -2% on average. - Many countries cover commuting accidents. 75

7. Employment injury insurance (EII) - Contribution rate maximum 1 -2% on average. - Many countries cover commuting accidents. 75

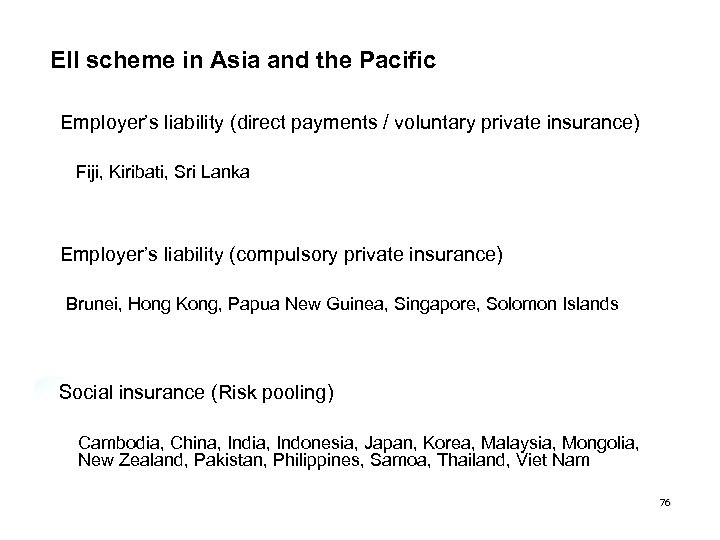

EII scheme in Asia and the Pacific Employer’s liability (direct payments / voluntary private insurance) Fiji, Kiribati, Sri Lanka Employer’s liability (compulsory private insurance) Brunei, Hong Kong, Papua New Guinea, Singapore, Solomon Islands Social insurance (Risk pooling) Cambodia, China, India, Indonesia, Japan, Korea, Malaysia, Mongolia, New Zealand, Pakistan, Philippines, Samoa, Thailand, Viet Nam 76

EII scheme in Asia and the Pacific Employer’s liability (direct payments / voluntary private insurance) Fiji, Kiribati, Sri Lanka Employer’s liability (compulsory private insurance) Brunei, Hong Kong, Papua New Guinea, Singapore, Solomon Islands Social insurance (Risk pooling) Cambodia, China, India, Indonesia, Japan, Korea, Malaysia, Mongolia, New Zealand, Pakistan, Philippines, Samoa, Thailand, Viet Nam 76

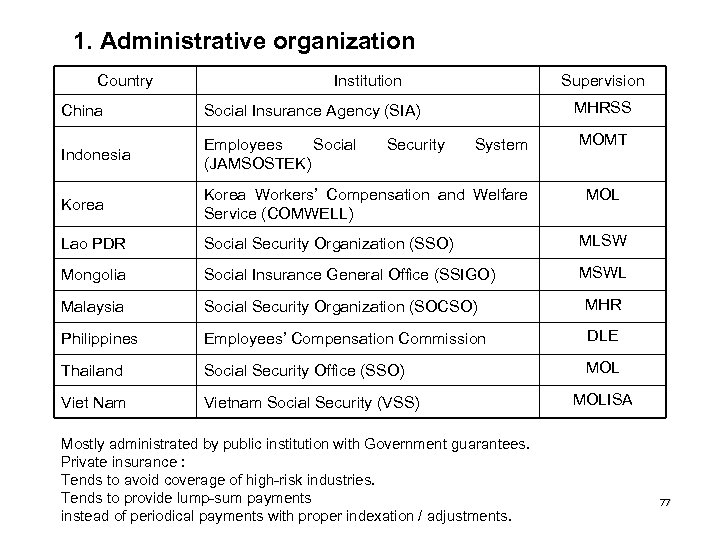

1. Administrative organization Country Institution Supervision MHRSS China Social Insurance Agency (SIA) Indonesia Employees Social (JAMSOSTEK) Korea Workers’ Compensation and Welfare Service (COMWELL) Lao PDR Social Security Organization (SSO) MLSW Mongolia Social Insurance General Office (SSIGO) MSWL Malaysia Social Security Organization (SOCSO) MHR Philippines Employees’ Compensation Commission DLE Thailand Social Security Office (SSO) MOL Viet Nam Vietnam Social Security (VSS) Security System Mostly administrated by public institution with Government guarantees. Private insurance : Tends to avoid coverage of high-risk industries. Tends to provide lump-sum payments instead of periodical payments with proper indexation / adjustments. MOMT MOLISA 77

1. Administrative organization Country Institution Supervision MHRSS China Social Insurance Agency (SIA) Indonesia Employees Social (JAMSOSTEK) Korea Workers’ Compensation and Welfare Service (COMWELL) Lao PDR Social Security Organization (SSO) MLSW Mongolia Social Insurance General Office (SSIGO) MSWL Malaysia Social Security Organization (SOCSO) MHR Philippines Employees’ Compensation Commission DLE Thailand Social Security Office (SSO) MOL Viet Nam Vietnam Social Security (VSS) Security System Mostly administrated by public institution with Government guarantees. Private insurance : Tends to avoid coverage of high-risk industries. Tends to provide lump-sum payments instead of periodical payments with proper indexation / adjustments. MOMT MOLISA 77

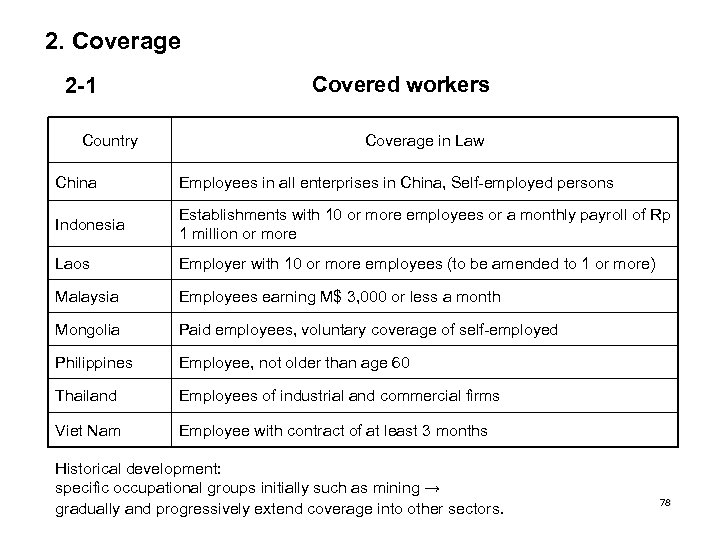

2. Coverage 2 -1 Country Covered workers Coverage in Law China Employees in all enterprises in China, Self-employed persons Indonesia Establishments with 10 or more employees or a monthly payroll of Rp 1 million or more Laos Employer with 10 or more employees (to be amended to 1 or more) Malaysia Employees earning M$ 3, 000 or less a month Mongolia Paid employees, voluntary coverage of self-employed Philippines Employee, not older than age 60 Thailand Employees of industrial and commercial firms Viet Nam Employee with contract of at least 3 months Historical development: specific occupational groups initially such as mining → gradually and progressively extend coverage into other sectors. 78

2. Coverage 2 -1 Country Covered workers Coverage in Law China Employees in all enterprises in China, Self-employed persons Indonesia Establishments with 10 or more employees or a monthly payroll of Rp 1 million or more Laos Employer with 10 or more employees (to be amended to 1 or more) Malaysia Employees earning M$ 3, 000 or less a month Mongolia Paid employees, voluntary coverage of self-employed Philippines Employee, not older than age 60 Thailand Employees of industrial and commercial firms Viet Nam Employee with contract of at least 3 months Historical development: specific occupational groups initially such as mining → gradually and progressively extend coverage into other sectors. 78

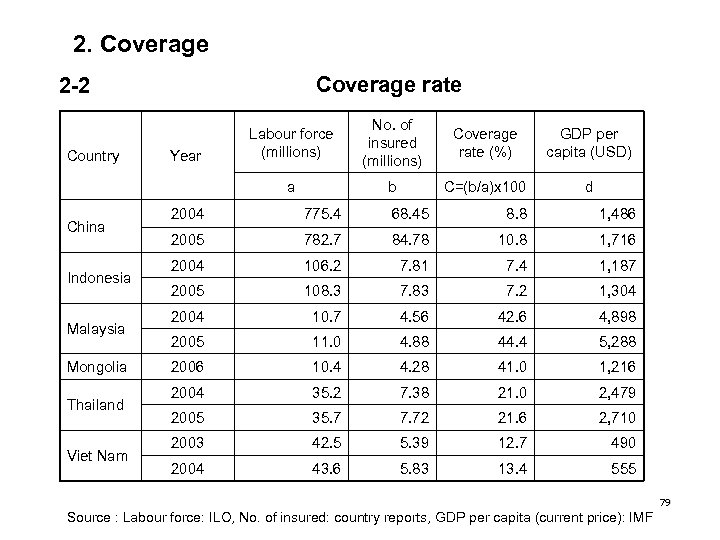

2. Coverage rate 2 -2 China Indonesia Malaysia Mongolia Thailand Viet Nam Year No. of insured (millions) Coverage rate (%) GDP per capita (USD) a Country Labour force (millions) b C=(b/a)x 100 d 2004 775. 4 68. 45 8. 8 1, 486 2005 782. 7 84. 78 10. 8 1, 716 2004 106. 2 7. 81 7. 4 1, 187 2005 108. 3 7. 83 7. 2 1, 304 2004 10. 7 4. 56 42. 6 4, 898 2005 11. 0 4. 88 44. 4 5, 288 2006 10. 4 4. 28 41. 0 1, 216 2004 35. 2 7. 38 21. 0 2, 479 2005 35. 7 7. 72 21. 6 2, 710 2003 42. 5 5. 39 12. 7 490 2004 43. 6 5. 83 13. 4 555 79 Source : Labour force: ILO, No. of insured: country reports, GDP per capita (current price): IMF

2. Coverage rate 2 -2 China Indonesia Malaysia Mongolia Thailand Viet Nam Year No. of insured (millions) Coverage rate (%) GDP per capita (USD) a Country Labour force (millions) b C=(b/a)x 100 d 2004 775. 4 68. 45 8. 8 1, 486 2005 782. 7 84. 78 10. 8 1, 716 2004 106. 2 7. 81 7. 4 1, 187 2005 108. 3 7. 83 7. 2 1, 304 2004 10. 7 4. 56 42. 6 4, 898 2005 11. 0 4. 88 44. 4 5, 288 2006 10. 4 4. 28 41. 0 1, 216 2004 35. 2 7. 38 21. 0 2, 479 2005 35. 7 7. 72 21. 6 2, 710 2003 42. 5 5. 39 12. 7 490 2004 43. 6 5. 83 13. 4 555 79 Source : Labour force: ILO, No. of insured: country reports, GDP per capita (current price): IMF

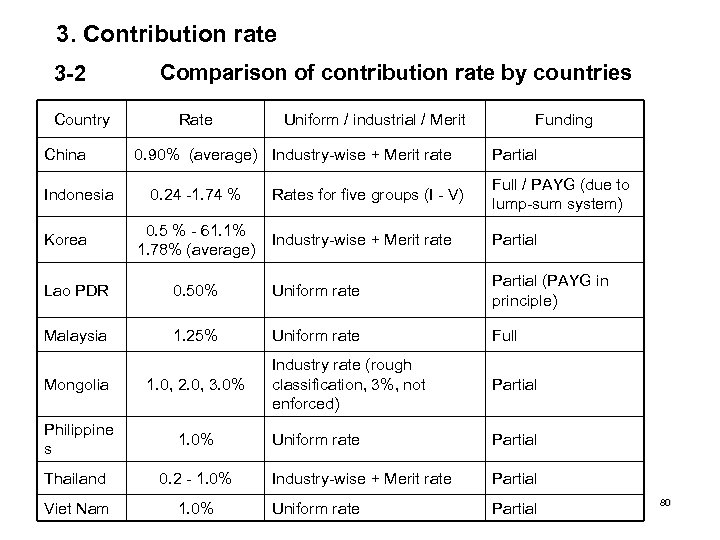

3. Contribution rate 3 -2 Country China Indonesia Korea Comparison of contribution rate by countries Rate Uniform / industrial / Merit 0. 90% (average) Industry-wise + Merit rate 0. 24 -1. 74 % 0. 5 % - 61. 1% 1. 78% (average) Funding Partial Rates for five groups (I - V) Full / PAYG (due to lump-sum system) Industry-wise + Merit rate Partial Lao PDR 0. 50% Uniform rate Partial (PAYG in principle) Malaysia 1. 25% Uniform rate Full Industry rate (rough classification, 3%, not enforced) Partial Uniform rate Partial Industry-wise + Merit rate Partial Uniform rate Partial Mongolia 1. 0, 2. 0, 3. 0% Philippine s 1. 0% Thailand 0. 2 - 1. 0% Viet Nam 1. 0% 80

3. Contribution rate 3 -2 Country China Indonesia Korea Comparison of contribution rate by countries Rate Uniform / industrial / Merit 0. 90% (average) Industry-wise + Merit rate 0. 24 -1. 74 % 0. 5 % - 61. 1% 1. 78% (average) Funding Partial Rates for five groups (I - V) Full / PAYG (due to lump-sum system) Industry-wise + Merit rate Partial Lao PDR 0. 50% Uniform rate Partial (PAYG in principle) Malaysia 1. 25% Uniform rate Full Industry rate (rough classification, 3%, not enforced) Partial Uniform rate Partial Industry-wise + Merit rate Partial Uniform rate Partial Mongolia 1. 0, 2. 0, 3. 0% Philippine s 1. 0% Thailand 0. 2 - 1. 0% Viet Nam 1. 0% 80

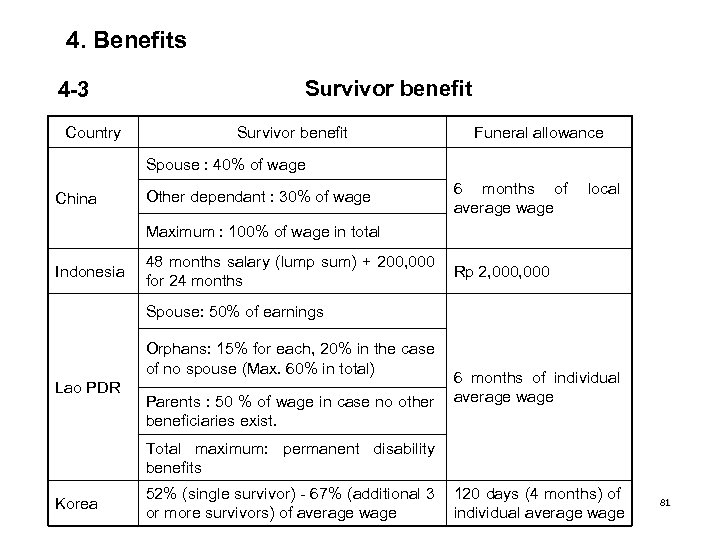

4. Benefits 4 -3 Country Survivor benefit Funeral allowance Spouse : 40% of wage China Other dependant : 30% of wage 6 months of local average wage Maximum : 100% of wage in total Indonesia 48 months salary (lump sum) + 200, 000 Rp 2, 000 for 24 months Spouse: 50% of earnings Orphans: 15% for each, 20% in the case of no spouse (Max. 60% in total) Lao PDR 6 months of individual Parents : 50 % of wage in case no other average wage beneficiaries exist. Total maximum: permanent disability benefits Korea 52% (single survivor) - 67% (additional 3 120 days (4 months) of or more survivors) of average wage individual average wage 81

4. Benefits 4 -3 Country Survivor benefit Funeral allowance Spouse : 40% of wage China Other dependant : 30% of wage 6 months of local average wage Maximum : 100% of wage in total Indonesia 48 months salary (lump sum) + 200, 000 Rp 2, 000 for 24 months Spouse: 50% of earnings Orphans: 15% for each, 20% in the case of no spouse (Max. 60% in total) Lao PDR 6 months of individual Parents : 50 % of wage in case no other average wage beneficiaries exist. Total maximum: permanent disability benefits Korea 52% (single survivor) - 67% (additional 3 120 days (4 months) of or more survivors) of average wage individual average wage 81

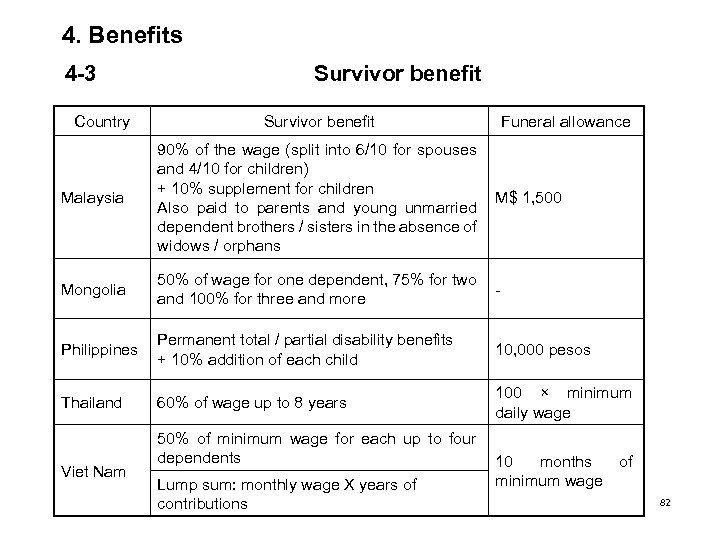

4. Benefits 4 -3 Country Survivor benefit Funeral allowance Malaysia 90% of the wage (split into 6/10 for spouses and 4/10 for children) + 10% supplement for children M$ 1, 500 Also paid to parents and young unmarried dependent brothers / sisters in the absence of widows / orphans Mongolia 50% of wage for one dependent, 75% for two and 100% for three and more Philippines Permanent total / partial disability benefits + 10% addition of each child 10, 000 pesos Thailand 60% of wage up to 8 years 100 × minimum daily wage Viet Nam 50% of minimum wage for each up to four dependents 10 months of minimum wage Lump sum: monthly wage X years of contributions 82

4. Benefits 4 -3 Country Survivor benefit Funeral allowance Malaysia 90% of the wage (split into 6/10 for spouses and 4/10 for children) + 10% supplement for children M$ 1, 500 Also paid to parents and young unmarried dependent brothers / sisters in the absence of widows / orphans Mongolia 50% of wage for one dependent, 75% for two and 100% for three and more Philippines Permanent total / partial disability benefits + 10% addition of each child 10, 000 pesos Thailand 60% of wage up to 8 years 100 × minimum daily wage Viet Nam 50% of minimum wage for each up to four dependents 10 months of minimum wage Lump sum: monthly wage X years of contributions 82

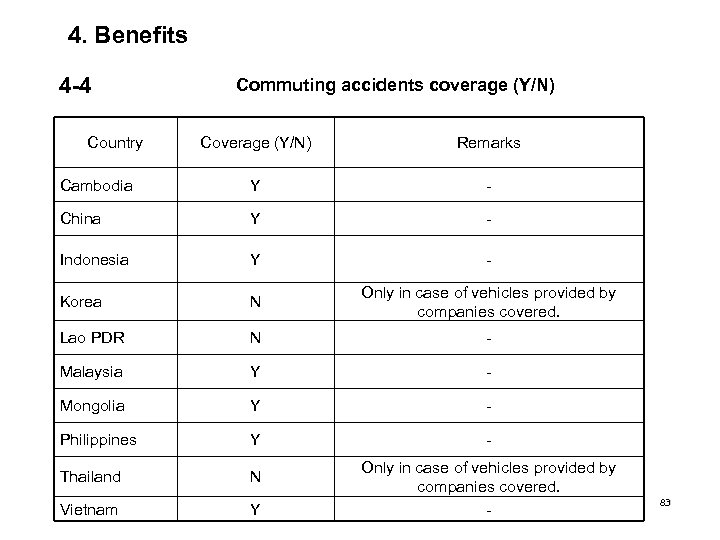

4. Benefits 4 -4 Country Commuting accidents coverage (Y/N) Coverage (Y/N) Remarks Cambodia Y - China Y - Indonesia Y - Korea N Only in case of vehicles provided by companies covered. Lao PDR N - Malaysia Y - Mongolia Y - Philippines Y - Thailand N Vietnam Y Only in case of vehicles provided by companies covered. - 83

4. Benefits 4 -4 Country Commuting accidents coverage (Y/N) Coverage (Y/N) Remarks Cambodia Y - China Y - Indonesia Y - Korea N Only in case of vehicles provided by companies covered. Lao PDR N - Malaysia Y - Mongolia Y - Philippines Y - Thailand N Vietnam Y Only in case of vehicles provided by companies covered. - 83

8. (Un) employment insurance (U(E)I) - Schemes are still limited to developed countries and socialist countries. - Japan, Korea: advanced EI, linking cash compensations with job services and vocational trainings (active labour market policies) - Australia, New Zealand: tax-based social assistance type of EI (relatively low benefits with means test, back to work policies) - China, Mongolia, Viet Nam (introduced in 2009): EI with some linkages of compensations with job services and vocational trainings - Other countries still rely on severance payments, unreliable in case of economic downturns with bankruptcies / insolvencies of companies - Linkage between compensations and active labour 84 market policies important.

8. (Un) employment insurance (U(E)I) - Schemes are still limited to developed countries and socialist countries. - Japan, Korea: advanced EI, linking cash compensations with job services and vocational trainings (active labour market policies) - Australia, New Zealand: tax-based social assistance type of EI (relatively low benefits with means test, back to work policies) - China, Mongolia, Viet Nam (introduced in 2009): EI with some linkages of compensations with job services and vocational trainings - Other countries still rely on severance payments, unreliable in case of economic downturns with bankruptcies / insolvencies of companies - Linkage between compensations and active labour 84 market policies important.

9. Concluding remarks (1) Toward universal coverage of basic social security In many developing countries, the basic-tier income /health security is lacking and needs consideration, including modest-level tax-based non-contributory systems. (2) Reform of present systems In developing countries, present systems are mainly targeting the formal sector, except for public health care provisions seen in ex-British colonies and Thailand Universal health care and some initiatives of tax-based pensions / health care for the poor. Tendencies of not doing drastic reforms of existing schemes in Asia. With regards to existing systems, realistic movements would be gradually reforming existing systems into a better shape. (3) Mutual exchanges toward better social security systems In both aspects, mutual exchanges and also learning the history of developed nationals will become more important. 85

9. Concluding remarks (1) Toward universal coverage of basic social security In many developing countries, the basic-tier income /health security is lacking and needs consideration, including modest-level tax-based non-contributory systems. (2) Reform of present systems In developing countries, present systems are mainly targeting the formal sector, except for public health care provisions seen in ex-British colonies and Thailand Universal health care and some initiatives of tax-based pensions / health care for the poor. Tendencies of not doing drastic reforms of existing schemes in Asia. With regards to existing systems, realistic movements would be gradually reforming existing systems into a better shape. (3) Mutual exchanges toward better social security systems In both aspects, mutual exchanges and also learning the history of developed nationals will become more important. 85