ac593fd2a1bd283a71df06fc85d33f38.ppt

- Количество слайдов: 60

OVERVIEW OF GST LAW

OVERVIEW OF GST LAW

Presentation Plan Introduction: GST A Game Changer Benefits and Salient Features of GST IGST Mechanism Registration and Returns Role of Technology 2

Presentation Plan Introduction: GST A Game Changer Benefits and Salient Features of GST IGST Mechanism Registration and Returns Role of Technology 2

What is GST? One Tax For Manufacturing Trading Services ONE NATION: ONE TAX

What is GST? One Tax For Manufacturing Trading Services ONE NATION: ONE TAX

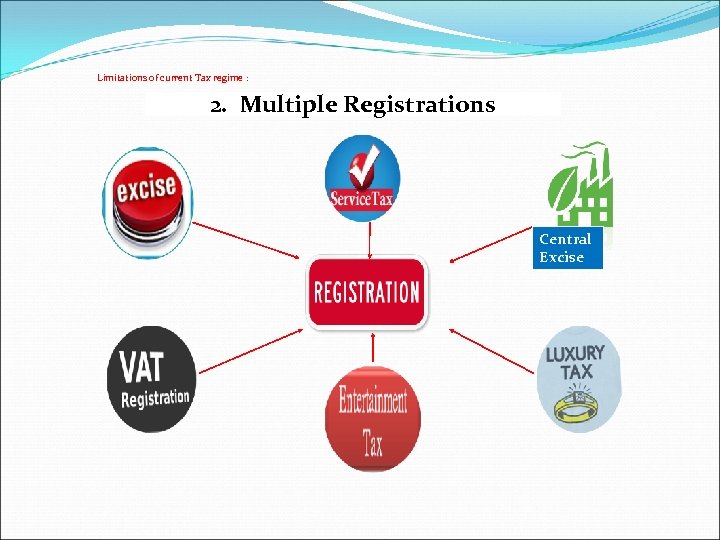

Limitations of current Tax regime : 2. Multiple Registrations Central Excise

Limitations of current Tax regime : 2. Multiple Registrations Central Excise

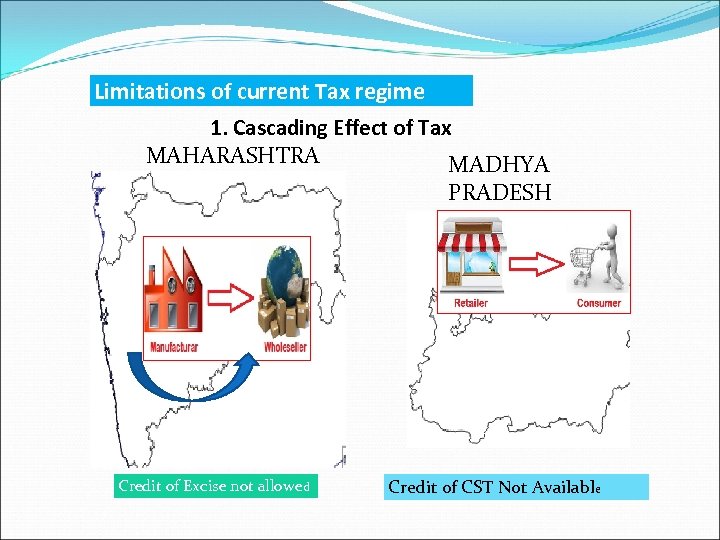

Limitations of current Tax regime 1. Cascading Effect of Tax MAHARASHTRA MADHYA PRADESH Credit of Excise not allowed Credit of CST Not Available

Limitations of current Tax regime 1. Cascading Effect of Tax MAHARASHTRA MADHYA PRADESH Credit of Excise not allowed Credit of CST Not Available

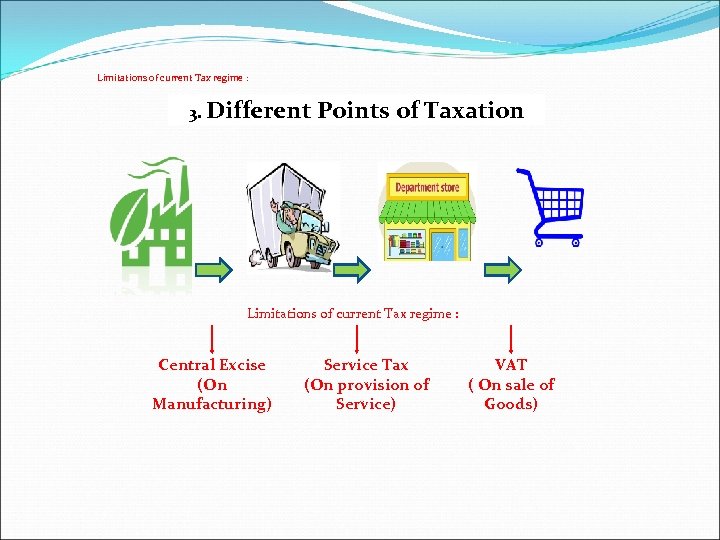

Limitations of current Tax regime : 3. Different Points of Taxation Limitations of current Tax regime : Central Excise (On Manufacturing) Service Tax (On provision of Service) VAT ( On sale of Goods)

Limitations of current Tax regime : 3. Different Points of Taxation Limitations of current Tax regime : Central Excise (On Manufacturing) Service Tax (On provision of Service) VAT ( On sale of Goods)

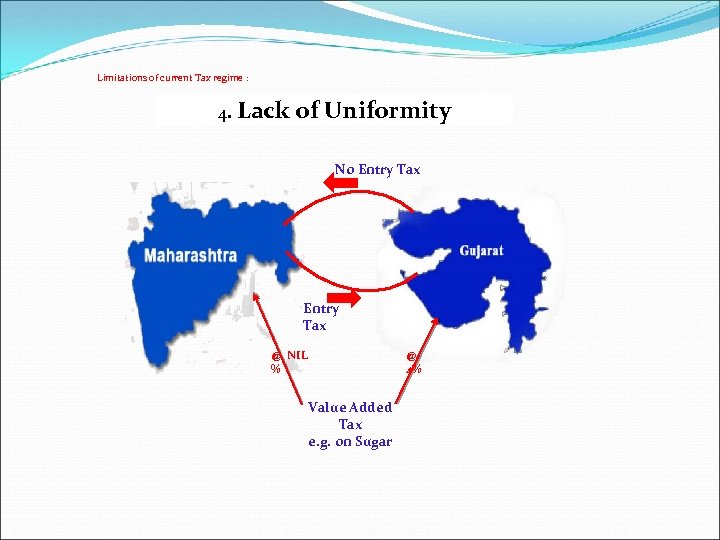

Limitations of current Tax regime : 4. Lack of Uniformity No Entry Tax @ NIL % Value Added Tax e. g. on Sugar @ 4%

Limitations of current Tax regime : 4. Lack of Uniformity No Entry Tax @ NIL % Value Added Tax e. g. on Sugar @ 4%

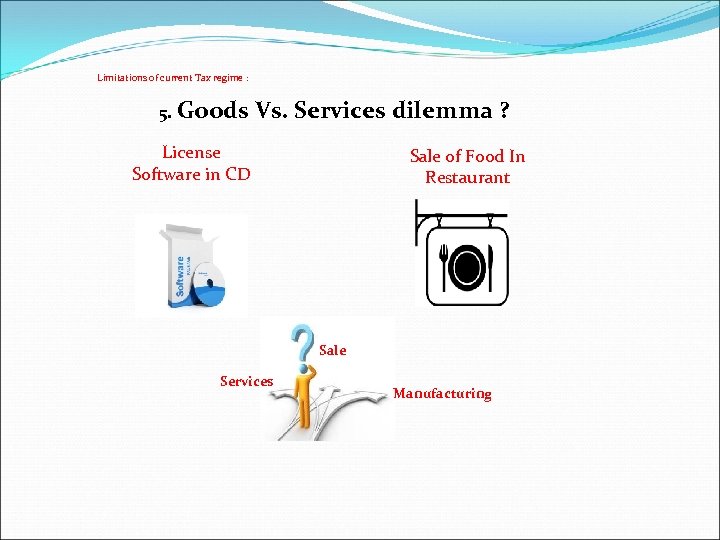

Limitations of current Tax regime : 5. Goods Vs. Services dilemma ? License Software in CD Sale of Food In Restaurant Sale Services Manufacturing

Limitations of current Tax regime : 5. Goods Vs. Services dilemma ? License Software in CD Sale of Food In Restaurant Sale Services Manufacturing

What are Goods ? ? ? “goods” means every kind of movable property Goods does not include money and securities Goods includes: actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply; Almost similar to VAT But some goods are deemed to be service in GST Leasing of goods is service Temporary transfer etc of copyright, trademark, patent is service Sec. 2(52) 9

What are Goods ? ? ? “goods” means every kind of movable property Goods does not include money and securities Goods includes: actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply; Almost similar to VAT But some goods are deemed to be service in GST Leasing of goods is service Temporary transfer etc of copyright, trademark, patent is service Sec. 2(52) 9

What is Services means anything other than goods, money and securities Service includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged Section 2(102) Try to understand the emphasis on “anything other than goods Some goods in VAT become service Sec. 7 10

What is Services means anything other than goods, money and securities Service includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged Section 2(102) Try to understand the emphasis on “anything other than goods Some goods in VAT become service Sec. 7 10

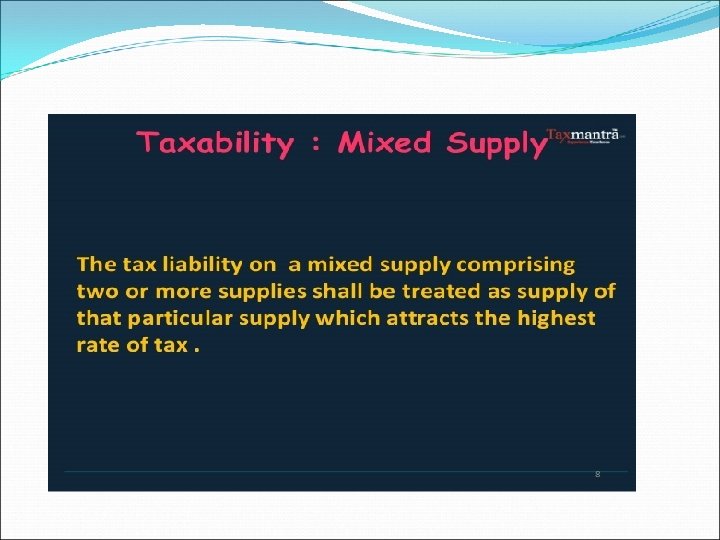

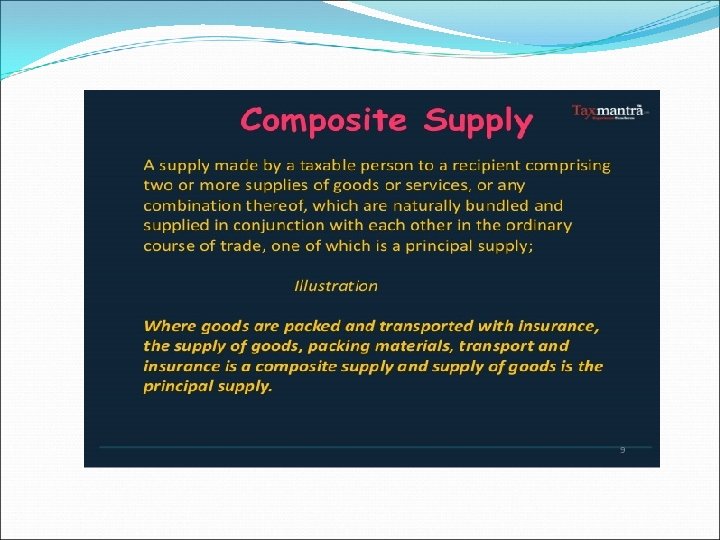

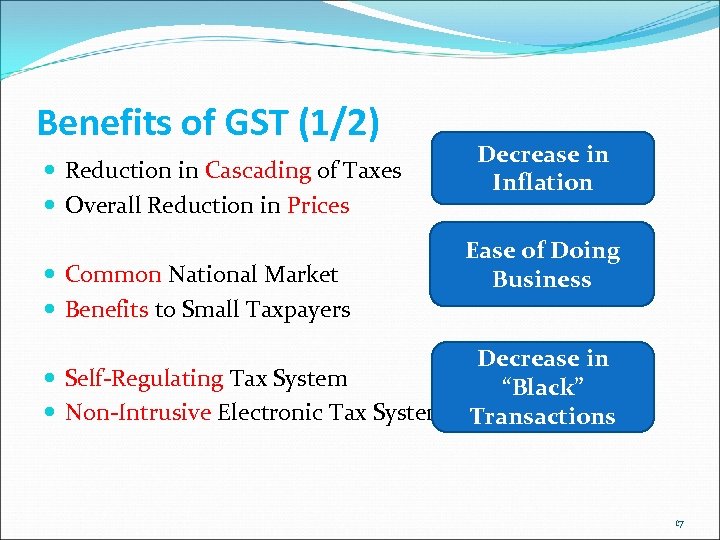

Benefits of GST (1/2) Reduction in Cascading of Taxes Overall Reduction in Prices Common National Market Benefits to Small Taxpayers Decrease in Inflation Ease of Doing Business Decrease in Self-Regulating Tax System “Black” Non-Intrusive Electronic Tax System Transactions 17

Benefits of GST (1/2) Reduction in Cascading of Taxes Overall Reduction in Prices Common National Market Benefits to Small Taxpayers Decrease in Inflation Ease of Doing Business Decrease in Self-Regulating Tax System “Black” Non-Intrusive Electronic Tax System Transactions 17

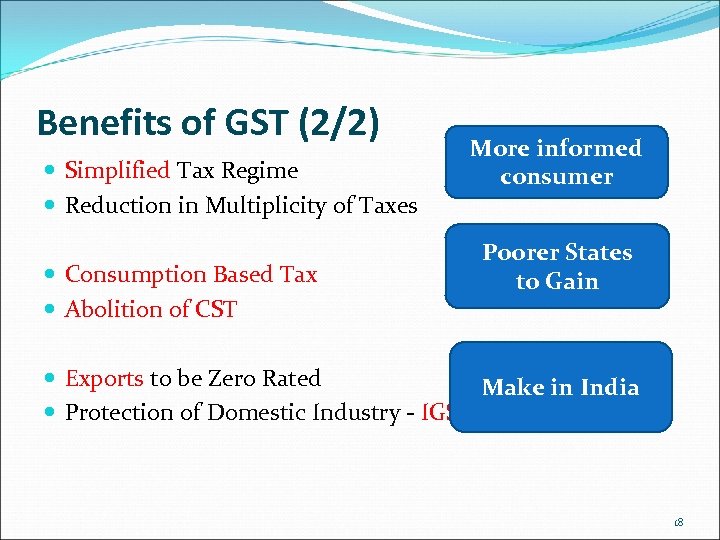

Benefits of GST (2/2) Simplified Tax Regime Reduction in Multiplicity of Taxes Consumption Based Tax Abolition of CST More informed consumer Poorer States to Gain Exports to be Zero Rated Make in India Protection of Domestic Industry - IGST 18

Benefits of GST (2/2) Simplified Tax Regime Reduction in Multiplicity of Taxes Consumption Based Tax Abolition of CST More informed consumer Poorer States to Gain Exports to be Zero Rated Make in India Protection of Domestic Industry - IGST 18

Salient features of GST The GST would be applicable on the supply of goods or services. It would be a single GST on any item out of which 50% will go to Central Govt and 50% will go to State Govt / Union Territory. Ø Central tax (CGST) and State tax (SGST) / Union territory tax (UTGST). The GST would apply on all goods or services or both other than alcoholic liquor for human consumption and five petroleum products. 19

Salient features of GST The GST would be applicable on the supply of goods or services. It would be a single GST on any item out of which 50% will go to Central Govt and 50% will go to State Govt / Union Territory. Ø Central tax (CGST) and State tax (SGST) / Union territory tax (UTGST). The GST would apply on all goods or services or both other than alcoholic liquor for human consumption and five petroleum products. 19

Salient features of GST. . . (contd. ) Destination based consumption tax Ø The tax would accrue to the State which has jurisdiction over the place of consumption which is also termed as place of supply. Ø Levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff. Ø In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer. Ø Exports would be tax-free and imports taxed at the same rate as integrated tax (IGST) levied on inter-State supply of like domestic products 20

Salient features of GST. . . (contd. ) Destination based consumption tax Ø The tax would accrue to the State which has jurisdiction over the place of consumption which is also termed as place of supply. Ø Levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff. Ø In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer. Ø Exports would be tax-free and imports taxed at the same rate as integrated tax (IGST) levied on inter-State supply of like domestic products 20

Salient features of GST. . . (contd. ) Tax payers with an aggregate turnover in a financial year up to Rs. 20 lakhs would be exempt from tax. Ø For special category states specified in Article 279 A, the threshold exemption shall be Rs. 10 lakhs. Ø Tax payers making inter-State supplies or paying tax on reverse charge basis shall not be eligible for threshold exemption. Small taxpayers with an aggregate turnover in a financial year up to Rs. 75 lakhs shall be eligible for composition levy. 21

Salient features of GST. . . (contd. ) Tax payers with an aggregate turnover in a financial year up to Rs. 20 lakhs would be exempt from tax. Ø For special category states specified in Article 279 A, the threshold exemption shall be Rs. 10 lakhs. Ø Tax payers making inter-State supplies or paying tax on reverse charge basis shall not be eligible for threshold exemption. Small taxpayers with an aggregate turnover in a financial year up to Rs. 75 lakhs shall be eligible for composition levy. 21

Salient features of GST. . . (contd. ) An Integrated GST (IGST) would be levied and collected by the Centre on inter-State supply of goods and services. HSN code shall be used for classifying the goods under the GST regime. Taxpayers whose turnover is above Rs. 1. 5 crores but below Rs. 5 crores shall use 2 -digit code and the taxpayers whose turnover is Rs. 5 crores and above shall use 4 -digit code. For Services, Service Accounting Codes (SAC) shall be used 22

Salient features of GST. . . (contd. ) An Integrated GST (IGST) would be levied and collected by the Centre on inter-State supply of goods and services. HSN code shall be used for classifying the goods under the GST regime. Taxpayers whose turnover is above Rs. 1. 5 crores but below Rs. 5 crores shall use 2 -digit code and the taxpayers whose turnover is Rs. 5 crores and above shall use 4 -digit code. For Services, Service Accounting Codes (SAC) shall be used 22

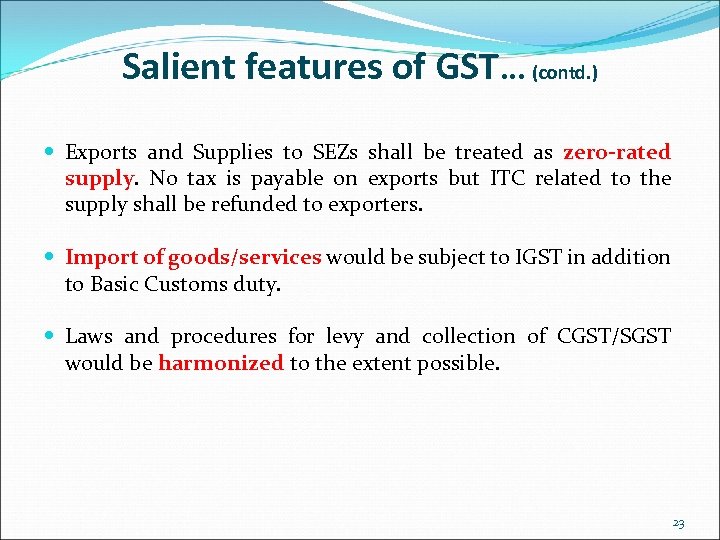

Salient features of GST. . . (contd. ) Exports and Supplies to SEZs shall be treated as zero-rated supply. No tax is payable on exports but ITC related to the supply shall be refunded to exporters. Import of goods/services would be subject to IGST in addition to Basic Customs duty. Laws and procedures for levy and collection of CGST/SGST would be harmonized to the extent possible. 23

Salient features of GST. . . (contd. ) Exports and Supplies to SEZs shall be treated as zero-rated supply. No tax is payable on exports but ITC related to the supply shall be refunded to exporters. Import of goods/services would be subject to IGST in addition to Basic Customs duty. Laws and procedures for levy and collection of CGST/SGST would be harmonized to the extent possible. 23

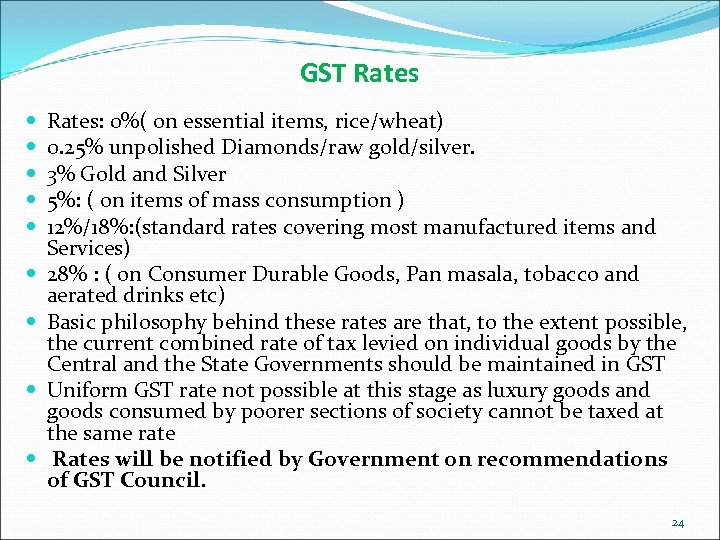

GST Rates Rates: 0%( on essential items, rice/wheat) 0. 25% unpolished Diamonds/raw gold/silver. 3% Gold and Silver 5%: ( on items of mass consumption ) 12%/18%: (standard rates covering most manufactured items and Services) 28% : ( on Consumer Durable Goods, Pan masala, tobacco and aerated drinks etc) Basic philosophy behind these rates are that, to the extent possible, the current combined rate of tax levied on individual goods by the Central and the State Governments should be maintained in GST Uniform GST rate not possible at this stage as luxury goods and goods consumed by poorer sections of society cannot be taxed at the same rate Rates will be notified by Government on recommendations of GST Council. 24

GST Rates Rates: 0%( on essential items, rice/wheat) 0. 25% unpolished Diamonds/raw gold/silver. 3% Gold and Silver 5%: ( on items of mass consumption ) 12%/18%: (standard rates covering most manufactured items and Services) 28% : ( on Consumer Durable Goods, Pan masala, tobacco and aerated drinks etc) Basic philosophy behind these rates are that, to the extent possible, the current combined rate of tax levied on individual goods by the Central and the State Governments should be maintained in GST Uniform GST rate not possible at this stage as luxury goods and goods consumed by poorer sections of society cannot be taxed at the same rate Rates will be notified by Government on recommendations of GST Council. 24

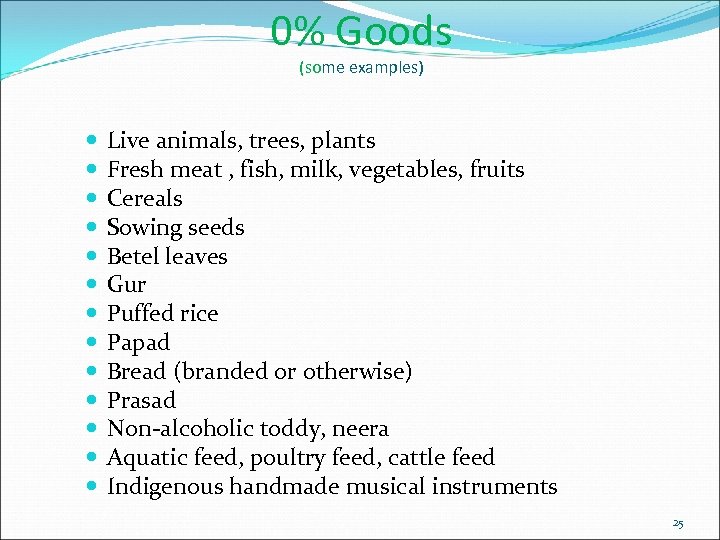

0% Goods (some examples) Live animals, trees, plants Fresh meat , fish, milk, vegetables, fruits Cereals Sowing seeds Betel leaves Gur Puffed rice Papad Bread (branded or otherwise) Prasad Non-alcoholic toddy, neera Aquatic feed, poultry feed, cattle feed Indigenous handmade musical instruments 25

0% Goods (some examples) Live animals, trees, plants Fresh meat , fish, milk, vegetables, fruits Cereals Sowing seeds Betel leaves Gur Puffed rice Papad Bread (branded or otherwise) Prasad Non-alcoholic toddy, neera Aquatic feed, poultry feed, cattle feed Indigenous handmade musical instruments 25

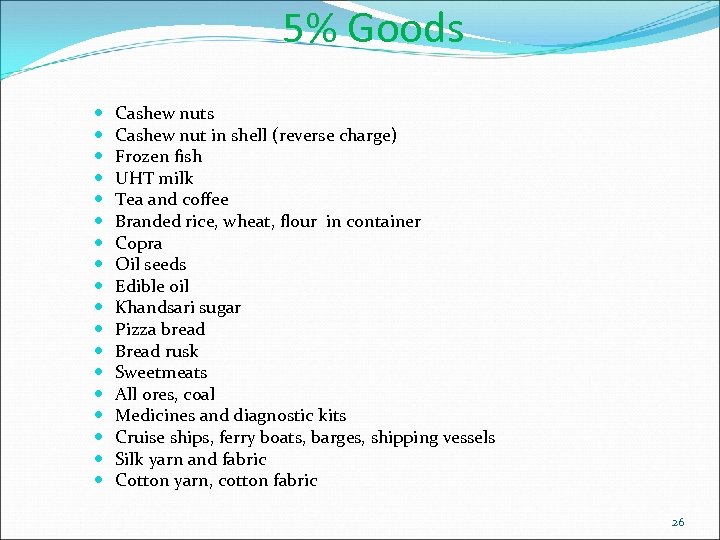

5% Goods Cashew nuts Cashew nut in shell (reverse charge) Frozen fish UHT milk Tea and coffee Branded rice, wheat, flour in container Copra Oil seeds Edible oil Khandsari sugar Pizza bread Bread rusk Sweetmeats All ores, coal Medicines and diagnostic kits Cruise ships, ferry boats, barges, shipping vessels Silk yarn and fabric Cotton yarn, cotton fabric 26

5% Goods Cashew nuts Cashew nut in shell (reverse charge) Frozen fish UHT milk Tea and coffee Branded rice, wheat, flour in container Copra Oil seeds Edible oil Khandsari sugar Pizza bread Bread rusk Sweetmeats All ores, coal Medicines and diagnostic kits Cruise ships, ferry boats, barges, shipping vessels Silk yarn and fabric Cotton yarn, cotton fabric 26

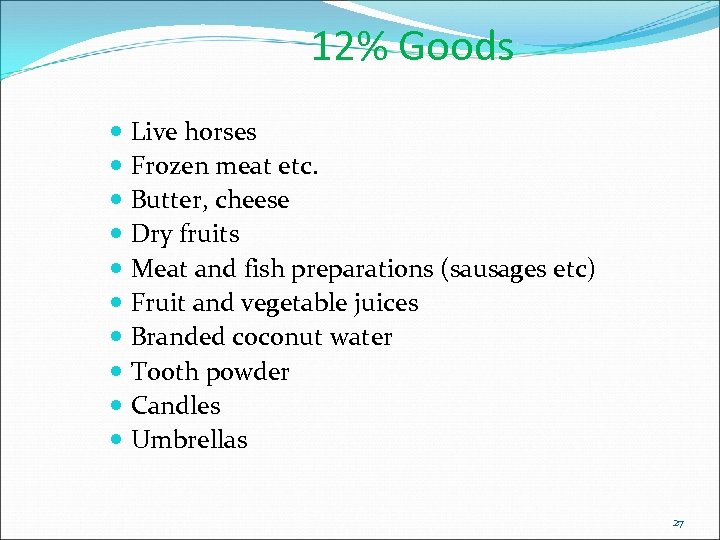

12% Goods Live horses Frozen meat etc. Butter, cheese Dry fruits Meat and fish preparations (sausages etc) Fruit and vegetable juices Branded coconut water Tooth powder Candles Umbrellas 27

12% Goods Live horses Frozen meat etc. Butter, cheese Dry fruits Meat and fish preparations (sausages etc) Fruit and vegetable juices Branded coconut water Tooth powder Candles Umbrellas 27

18% Goods Condensed milk Indian katha Margarine Sugar confectionery Pasta, cornflakes Cake Sauces Ice cream Mineral water Aerated water without sugar Hair oil 28

18% Goods Condensed milk Indian katha Margarine Sugar confectionery Pasta, cornflakes Cake Sauces Ice cream Mineral water Aerated water without sugar Hair oil 28

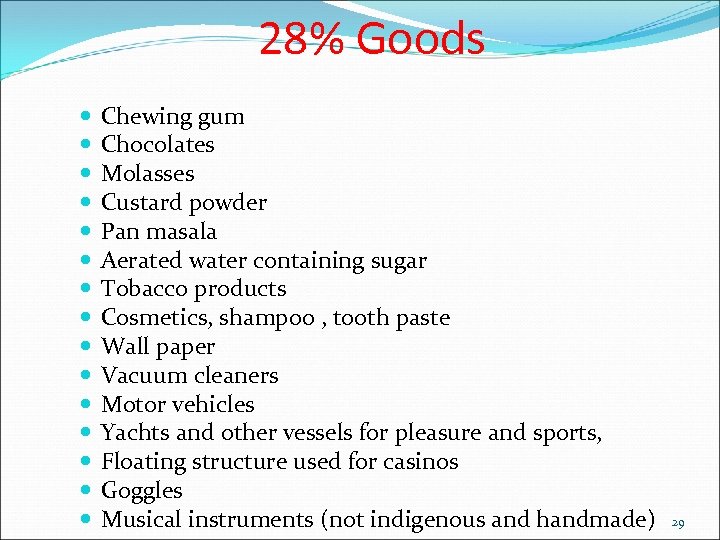

28% Goods Chewing gum Chocolates Molasses Custard powder Pan masala Aerated water containing sugar Tobacco products Cosmetics, shampoo , tooth paste Wall paper Vacuum cleaners Motor vehicles Yachts and other vessels for pleasure and sports, Floating structure used for casinos Goggles Musical instruments (not indigenous and handmade) 29

28% Goods Chewing gum Chocolates Molasses Custard powder Pan masala Aerated water containing sugar Tobacco products Cosmetics, shampoo , tooth paste Wall paper Vacuum cleaners Motor vehicles Yachts and other vessels for pleasure and sports, Floating structure used for casinos Goggles Musical instruments (not indigenous and handmade) 29

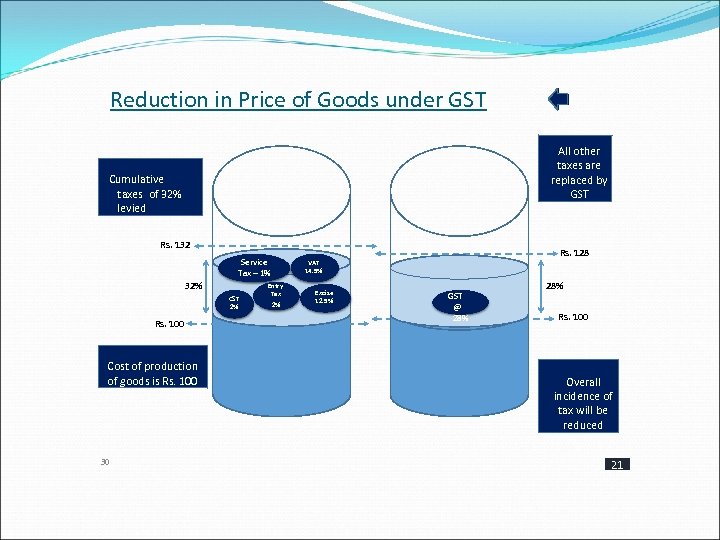

Reduction in Price of Goods under GST All other taxes are replaced by GST Cumulative taxes of 32% levied Rs. 132 Service Tax – 1% 32% CST 2% Rs. 100 Cost of production of goods is Rs. 100 30 Rs. 128 VAT 14. 5% Entry Tax 2% Excise 12. 5% GST @ 28% Rs. 100 Overall incidence of tax will be reduced 21

Reduction in Price of Goods under GST All other taxes are replaced by GST Cumulative taxes of 32% levied Rs. 132 Service Tax – 1% 32% CST 2% Rs. 100 Cost of production of goods is Rs. 100 30 Rs. 128 VAT 14. 5% Entry Tax 2% Excise 12. 5% GST @ 28% Rs. 100 Overall incidence of tax will be reduced 21

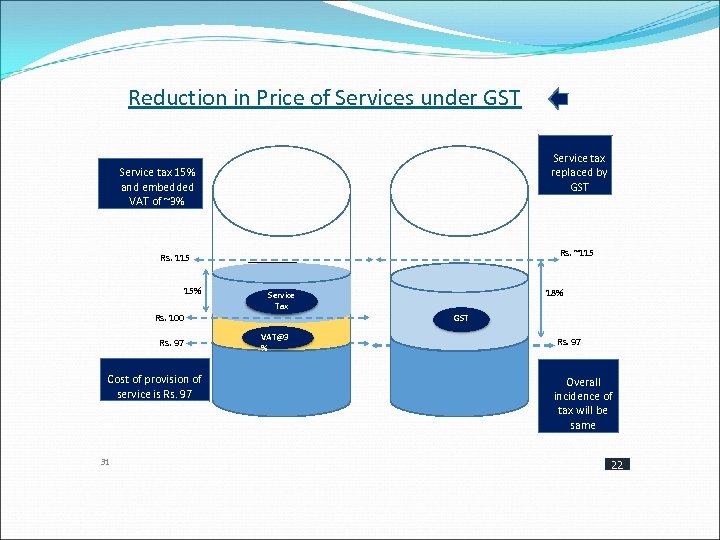

Reduction in Price of Services under GST Service tax replaced by GST Service tax 15% and embedded VAT of ~3% Rs. ~115 Rs. 115 15% Rs. 100 Rs. 97 Cost of provision of service is Rs. 97 31 18% Service Tax GST VAT@3 % Rs. 97 Overall incidence of tax will be same 22

Reduction in Price of Services under GST Service tax replaced by GST Service tax 15% and embedded VAT of ~3% Rs. ~115 Rs. 115 15% Rs. 100 Rs. 97 Cost of provision of service is Rs. 97 31 18% Service Tax GST VAT@3 % Rs. 97 Overall incidence of tax will be same 22

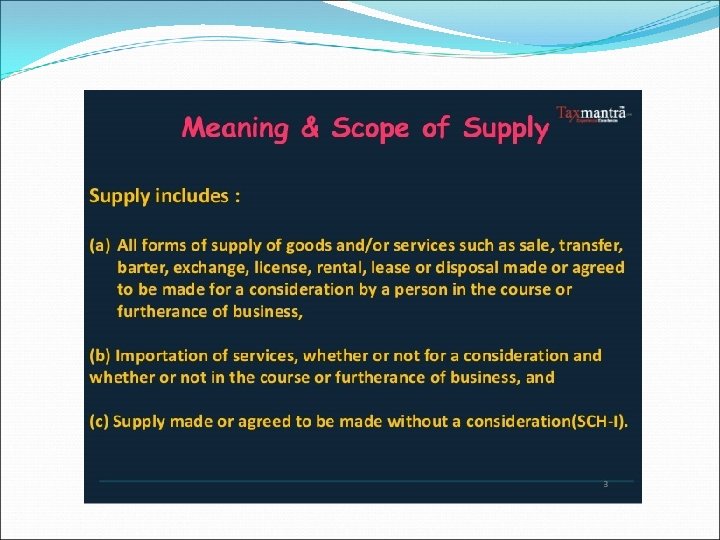

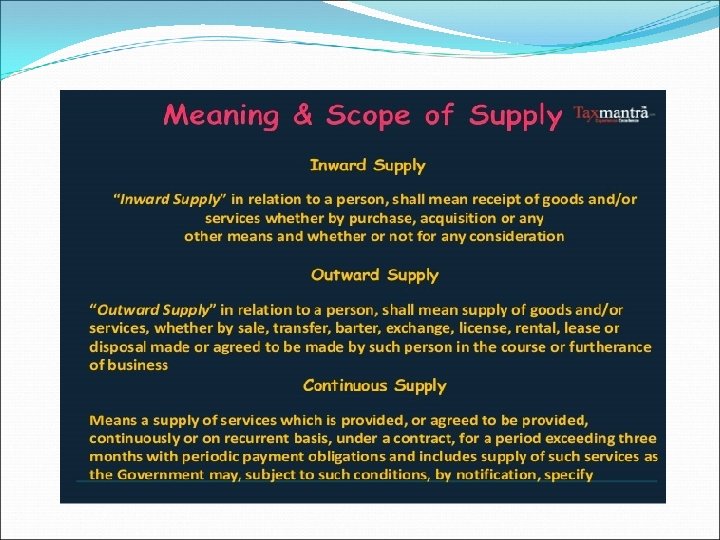

Neither Goods nor Services !!! The following would not constitute supply of Goods or Services (Schedule –III of the Act) Ø by an employee to employer Ø Services by any Court or Tribunal Ø Functions performed by Members of Parliament/ State legislature/Panchayats/ Municipalities/ other local authorities. Ø Duties performed by Constitutional functionary. Ø Duties performed by Chairperson/Member /Director in a body of CG/SG/local authority, who is not deemed to be an employee before commencement of this clause. 32

Neither Goods nor Services !!! The following would not constitute supply of Goods or Services (Schedule –III of the Act) Ø by an employee to employer Ø Services by any Court or Tribunal Ø Functions performed by Members of Parliament/ State legislature/Panchayats/ Municipalities/ other local authorities. Ø Duties performed by Constitutional functionary. Ø Duties performed by Chairperson/Member /Director in a body of CG/SG/local authority, who is not deemed to be an employee before commencement of this clause. 32

Neither Goods nor Services !!! (Contd. ) Ø Funeral, burial, crematorium/mortuary service, including transportation of deceased Ø Sale of land Ø Sale of building[ subject to clause (b) of paragraph 5 of Schedule II) Ø Actionable claims, other than lottery, betting and gambling 33

Neither Goods nor Services !!! (Contd. ) Ø Funeral, burial, crematorium/mortuary service, including transportation of deceased Ø Sale of land Ø Sale of building[ subject to clause (b) of paragraph 5 of Schedule II) Ø Actionable claims, other than lottery, betting and gambling 33

Activities which are supply of Goods/services (Schedule II) Works Contract -- service Renting/leasing of land or building -- service Job Work – treatment/process --- service 34

Activities which are supply of Goods/services (Schedule II) Works Contract -- service Renting/leasing of land or building -- service Job Work – treatment/process --- service 34

Why IGST? Need for a mechanism to levy and apportion GST on interstate supplies to destination states What are Inter-state supplies? 35

Why IGST? Need for a mechanism to levy and apportion GST on interstate supplies to destination states What are Inter-state supplies? 35

Inter-state supplies? A supply of goods or services or both in the course of inter-State trade or commerce means any supply where the location of the supplier and the place of supply are in different States. (Section 7(1) and 7(2) of the IGST Act) Exports/ Imports/ Supplies to & by SEZs-Deemed Why IGST? Advantages? 36

Inter-state supplies? A supply of goods or services or both in the course of inter-State trade or commerce means any supply where the location of the supplier and the place of supply are in different States. (Section 7(1) and 7(2) of the IGST Act) Exports/ Imports/ Supplies to & by SEZs-Deemed Why IGST? Advantages? 36

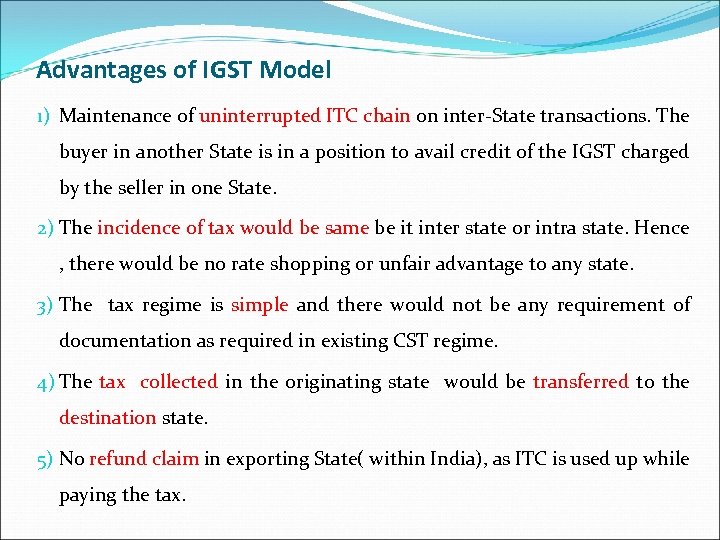

Advantages of IGST Model 1) Maintenance of uninterrupted ITC chain on inter-State transactions. The buyer in another State is in a position to avail credit of the IGST charged by the seller in one State. 2) The incidence of tax would be same be it inter state or intra state. Hence , there would be no rate shopping or unfair advantage to any state. 3) The tax regime is simple and there would not be any requirement of documentation as required in existing CST regime. 4) The tax collected in the originating state would be transferred to the destination state. 5) No refund claim in exporting State( within India), as ITC is used up while paying the tax.

Advantages of IGST Model 1) Maintenance of uninterrupted ITC chain on inter-State transactions. The buyer in another State is in a position to avail credit of the IGST charged by the seller in one State. 2) The incidence of tax would be same be it inter state or intra state. Hence , there would be no rate shopping or unfair advantage to any state. 3) The tax regime is simple and there would not be any requirement of documentation as required in existing CST regime. 4) The tax collected in the originating state would be transferred to the destination state. 5) No refund claim in exporting State( within India), as ITC is used up while paying the tax.

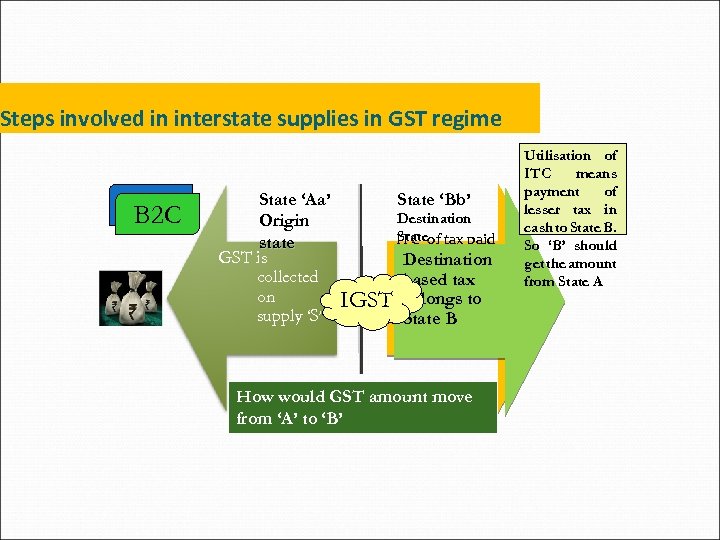

Steps involved in interstate supplies in GST regime B 2 B B 2 C State ‘Aa’ Origin state GST is collected on supply ‘S’ State ‘Bb’ IGST Destination State ITC of tax paid on ‘S’ Destination is used for based tax payment of belongs to GST on further State B supplies How would GST amount move from ‘A’ to ‘B’ Utilisation of ITC means payment of lesser tax in cash to State B. So ‘B’ should get the amount from State A

Steps involved in interstate supplies in GST regime B 2 B B 2 C State ‘Aa’ Origin state GST is collected on supply ‘S’ State ‘Bb’ IGST Destination State ITC of tax paid on ‘S’ Destination is used for based tax payment of belongs to GST on further State B supplies How would GST amount move from ‘A’ to ‘B’ Utilisation of ITC means payment of lesser tax in cash to State B. So ‘B’ should get the amount from State A

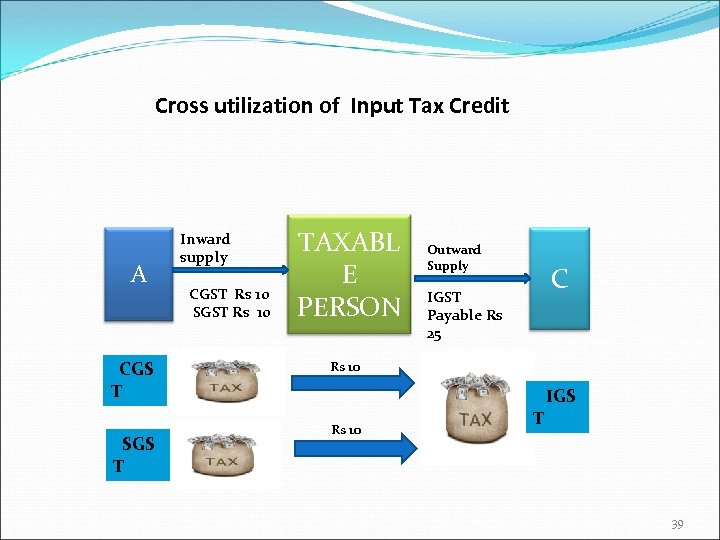

Cross utilization of Input Tax Credit A CGS T SGS T Inward supply CGST Rs 10 SGST Rs 10 TAXABL E PERSON Outward Supply IGST Payable Rs 25 C Rs 10 IGS T 39

Cross utilization of Input Tax Credit A CGS T SGS T Inward supply CGST Rs 10 SGST Rs 10 TAXABL E PERSON Outward Supply IGST Payable Rs 25 C Rs 10 IGS T 39

Place of Supply - Significance Determining Ø whether supplies are intra-state or inter-state /inter-national Ø which tax to pay – CGST & SGST or IGST Achieving the objective of destination based taxation Ø Tax is paid at the point of origin. However, it has to reach consumption point • ITC of IGST allowed to buying taxpayer in destination State 40

Place of Supply - Significance Determining Ø whether supplies are intra-state or inter-state /inter-national Ø which tax to pay – CGST & SGST or IGST Achieving the objective of destination based taxation Ø Tax is paid at the point of origin. However, it has to reach consumption point • ITC of IGST allowed to buying taxpayer in destination State 40

41

41

Transitional Provisions Ø GENERAL PROVISIONS Ø MIGRATION OF EXISTING TAX PAYERS Ø Eligibility to claim CENVAT/VAT CREDIT & INPUT CREDIT ON STOCK 42

Transitional Provisions Ø GENERAL PROVISIONS Ø MIGRATION OF EXISTING TAX PAYERS Ø Eligibility to claim CENVAT/VAT CREDIT & INPUT CREDIT ON STOCK 42

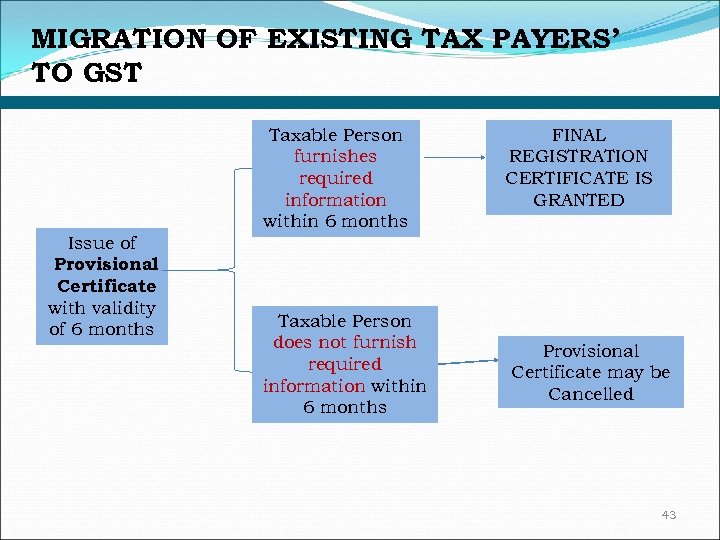

MIGRATION OF EXISTING TAX PAYERS’ TO GST Taxable Person furnishes required information within 6 months Issue of Provisional Certificate with validity of 6 months Taxable Person does not furnish required information within 6 months FINAL REGISTRATION CERTIFICATE IS GRANTED Provisional Certificate may be Cancelled 43

MIGRATION OF EXISTING TAX PAYERS’ TO GST Taxable Person furnishes required information within 6 months Issue of Provisional Certificate with validity of 6 months Taxable Person does not furnish required information within 6 months FINAL REGISTRATION CERTIFICATE IS GRANTED Provisional Certificate may be Cancelled 43

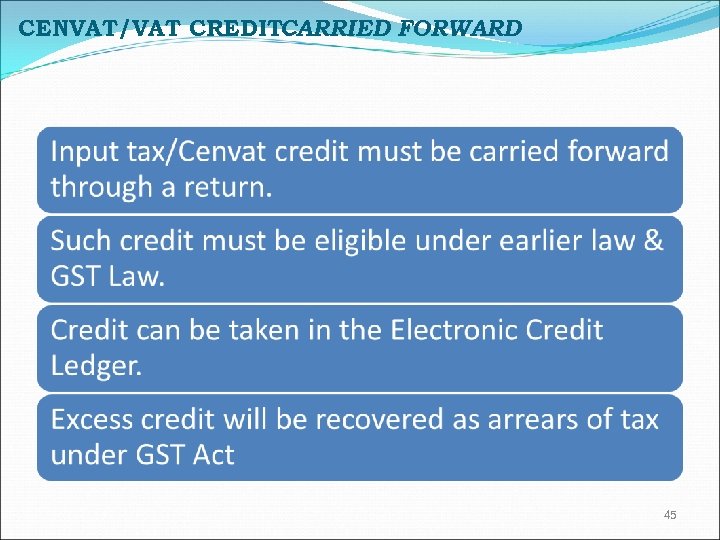

CENVAT/VAT CREDITCARRIED FORWARD CREDIT AVAILABLE IN GST Ø CENVAT/VAT CREDIT CARRIED FORWARD Ø UNAVAILED CENVAT/VAT CREDIT ON CAPITAL GOODS NOT CARRIED FORWARD

CENVAT/VAT CREDITCARRIED FORWARD CREDIT AVAILABLE IN GST Ø CENVAT/VAT CREDIT CARRIED FORWARD Ø UNAVAILED CENVAT/VAT CREDIT ON CAPITAL GOODS NOT CARRIED FORWARD

CENVAT/VAT CREDITCARRIED FORWARD 45

CENVAT/VAT CREDITCARRIED FORWARD 45

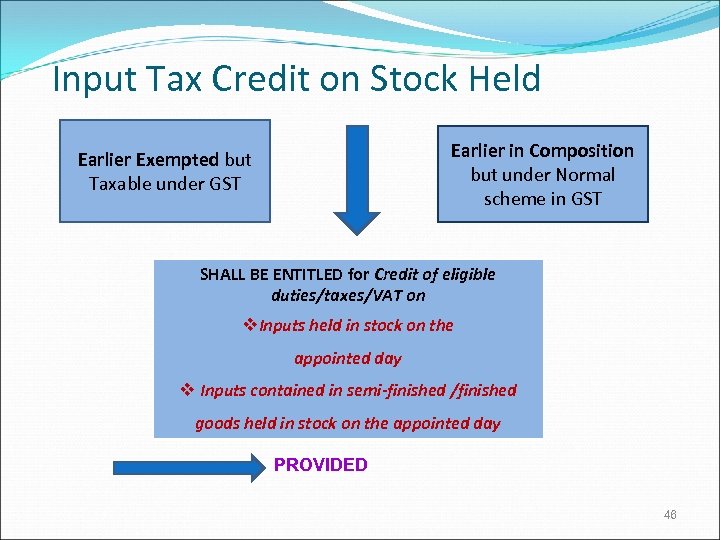

Input Tax Credit on Stock Held Earlier in Composition but under Normal scheme in GST Earlier Exempted but Taxable under GST SHALL BE ENTITLED for Credit of eligible duties/taxes/VAT on v. Inputs held in stock on the appointed day v Inputs contained in semi-finished /finished goods held in stock on the appointed day PROVIDED 46

Input Tax Credit on Stock Held Earlier in Composition but under Normal scheme in GST Earlier Exempted but Taxable under GST SHALL BE ENTITLED for Credit of eligible duties/taxes/VAT on v. Inputs held in stock on the appointed day v Inputs contained in semi-finished /finished goods held in stock on the appointed day PROVIDED 46

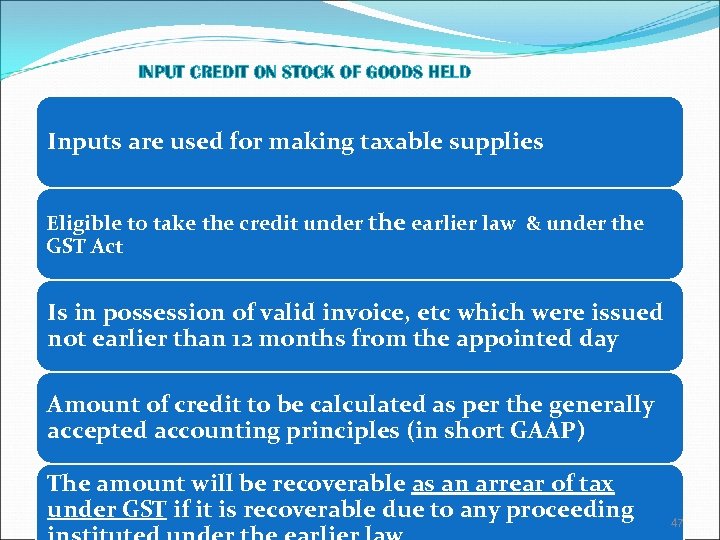

INPUT CREDIT ON STOCK OF GOODS HELD Inputs are used for making taxable supplies Eligible to take the credit under the earlier law & under the GST Act Is in possession of valid invoice, etc which were issued not earlier than 12 months from the appointed day Amount of credit to be calculated as per the generally accepted accounting principles (in short GAAP) The amount will be recoverable as an arrear of tax under GST if it is recoverable due to any proceeding 47

INPUT CREDIT ON STOCK OF GOODS HELD Inputs are used for making taxable supplies Eligible to take the credit under the earlier law & under the GST Act Is in possession of valid invoice, etc which were issued not earlier than 12 months from the appointed day Amount of credit to be calculated as per the generally accepted accounting principles (in short GAAP) The amount will be recoverable as an arrear of tax under GST if it is recoverable due to any proceeding 47

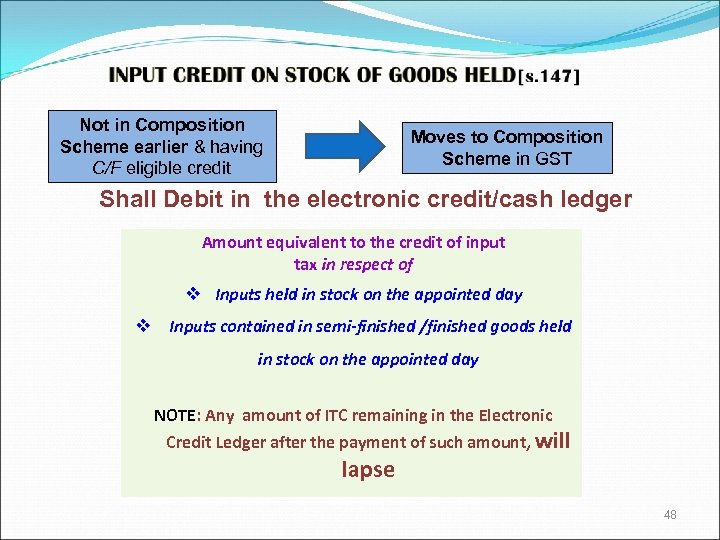

Not in Composition Scheme earlier & having C/F eligible credit Moves to Composition Scheme in GST Shall Debit in the electronic credit/cash ledger Amount equivalent to the credit of input tax in respect of v Inputs held in stock on the appointed day v Inputs contained in semi-finished /finished goods held in stock on the appointed day NOTE: Any amount of ITC remaining in the Electronic Credit Ledger after the payment of such amount, will lapse 48

Not in Composition Scheme earlier & having C/F eligible credit Moves to Composition Scheme in GST Shall Debit in the electronic credit/cash ledger Amount equivalent to the credit of input tax in respect of v Inputs held in stock on the appointed day v Inputs contained in semi-finished /finished goods held in stock on the appointed day NOTE: Any amount of ITC remaining in the Electronic Credit Ledger after the payment of such amount, will lapse 48

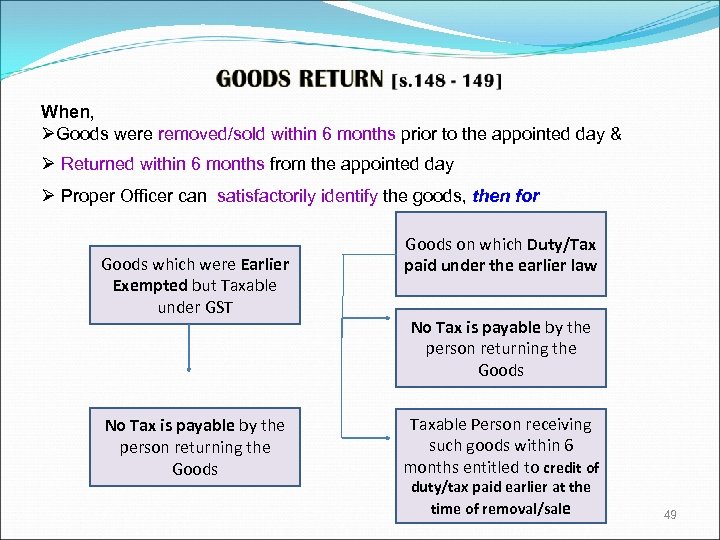

When, ØGoods were removed/sold within 6 months prior to the appointed day & Ø Returned within 6 months from the appointed day Ø Proper Officer can satisfactorily identify the goods, then for Goods which were Earlier Exempted but Taxable under GST No Tax is payable by the person returning the Goods on which Duty/Tax paid under the earlier law No Tax is payable by the person returning the Goods Taxable Person receiving such goods within 6 months entitled to credit of duty/tax paid earlier at the time of removal/sale 49

When, ØGoods were removed/sold within 6 months prior to the appointed day & Ø Returned within 6 months from the appointed day Ø Proper Officer can satisfactorily identify the goods, then for Goods which were Earlier Exempted but Taxable under GST No Tax is payable by the person returning the Goods on which Duty/Tax paid under the earlier law No Tax is payable by the person returning the Goods Taxable Person receiving such goods within 6 months entitled to credit of duty/tax paid earlier at the time of removal/sale 49

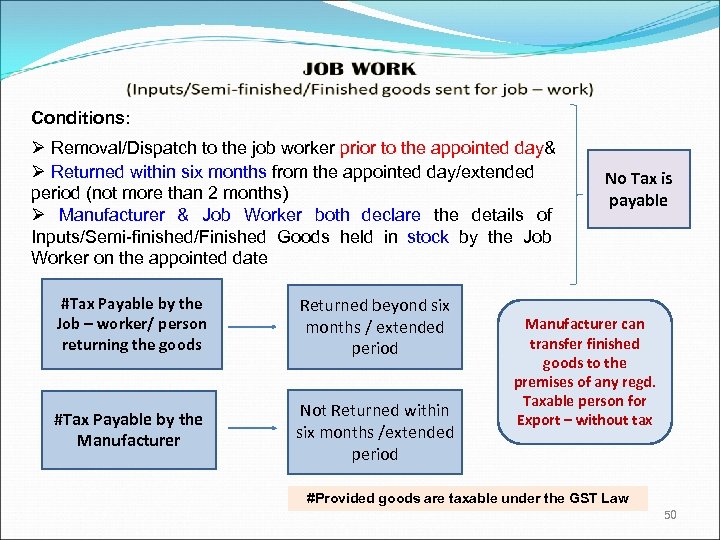

Conditions: Ø Removal/Dispatch to the job worker prior to the appointed day& Ø Returned within six months from the appointed day/extended period (not more than 2 months) Ø Manufacturer & Job Worker both declare the details of Inputs/Semi-finished/Finished Goods held in stock by the Job Worker on the appointed date #Tax Payable by the Job – worker/ person returning the goods Returned beyond six months / extended period #Tax Payable by the Manufacturer Not Returned within six months /extended period No Tax is payable Manufacturer can transfer finished goods to the premises of any regd. Taxable person for Export – without tax #Provided goods are taxable under the GST Law 50

Conditions: Ø Removal/Dispatch to the job worker prior to the appointed day& Ø Returned within six months from the appointed day/extended period (not more than 2 months) Ø Manufacturer & Job Worker both declare the details of Inputs/Semi-finished/Finished Goods held in stock by the Job Worker on the appointed date #Tax Payable by the Job – worker/ person returning the goods Returned beyond six months / extended period #Tax Payable by the Manufacturer Not Returned within six months /extended period No Tax is payable Manufacturer can transfer finished goods to the premises of any regd. Taxable person for Export – without tax #Provided goods are taxable under the GST Law 50

![REFUND/RECOVERY [s. 154 - 158] Assessment/Adjudication Proceeding as per Earlier Laws(any tax/penalty/interest) CENVAT/VAT Credit REFUND/RECOVERY [s. 154 - 158] Assessment/Adjudication Proceeding as per Earlier Laws(any tax/penalty/interest) CENVAT/VAT Credit](https://present5.com/presentation/ac593fd2a1bd283a71df06fc85d33f38/image-51.jpg) REFUND/RECOVERY [s. 154 - 158] Assessment/Adjudication Proceeding as per Earlier Laws(any tax/penalty/interest) CENVAT/VAT Credit as per Earlier Law Proceeding of appeal, revision, review or reference initiated before the appointed day to be disposed of as per the earlier law Liability of Output Duty/ Tax as per Earlier Law Refund/ Recovery Revision of return as per Earlier Law PENDING REFUND CLAIMS FILED BEFORE THE APPOINTED DAY to be disposed of as per the provisions of earlier law 51

REFUND/RECOVERY [s. 154 - 158] Assessment/Adjudication Proceeding as per Earlier Laws(any tax/penalty/interest) CENVAT/VAT Credit as per Earlier Law Proceeding of appeal, revision, review or reference initiated before the appointed day to be disposed of as per the earlier law Liability of Output Duty/ Tax as per Earlier Law Refund/ Recovery Revision of return as per Earlier Law PENDING REFUND CLAIMS FILED BEFORE THE APPOINTED DAY to be disposed of as per the provisions of earlier law 51

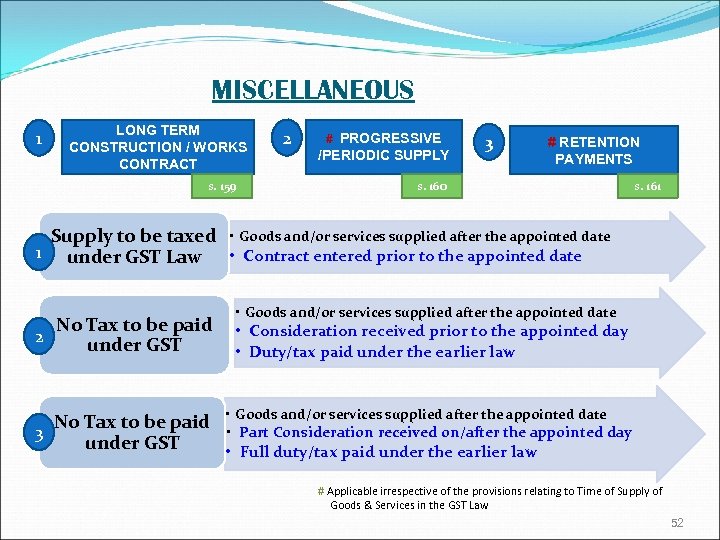

MISCELLANEOUS 1 LONG TERM CONSTRUCTION / WORKS CONTRACT s. 159 2 # PROGRESSIVE /PERIODIC SUPPLY 3 # RETENTION PAYMENTS s. 160 s. 161 Supply to be taxed • Goods and/or services supplied after the appointed date 1 under GST Law • Contract entered prior to the appointed date • Goods and/or services supplied after the appointed date No Tax to be paid • Consideration received prior to the appointed day 2 under GST • Duty/tax paid under the earlier law • Goods and/or services supplied after the appointed date No Tax to be paid • Part Consideration received on/after the appointed day 3 under GST • Full duty/tax paid under the earlier law # Applicable irrespective of the provisions relating to Time of Supply of Goods & Services in the GST Law 52

MISCELLANEOUS 1 LONG TERM CONSTRUCTION / WORKS CONTRACT s. 159 2 # PROGRESSIVE /PERIODIC SUPPLY 3 # RETENTION PAYMENTS s. 160 s. 161 Supply to be taxed • Goods and/or services supplied after the appointed date 1 under GST Law • Contract entered prior to the appointed date • Goods and/or services supplied after the appointed date No Tax to be paid • Consideration received prior to the appointed day 2 under GST • Duty/tax paid under the earlier law • Goods and/or services supplied after the appointed date No Tax to be paid • Part Consideration received on/after the appointed day 3 under GST • Full duty/tax paid under the earlier law # Applicable irrespective of the provisions relating to Time of Supply of Goods & Services in the GST Law 52

GSTN : Goods & Services Tax Network

GSTN : Goods & Services Tax Network

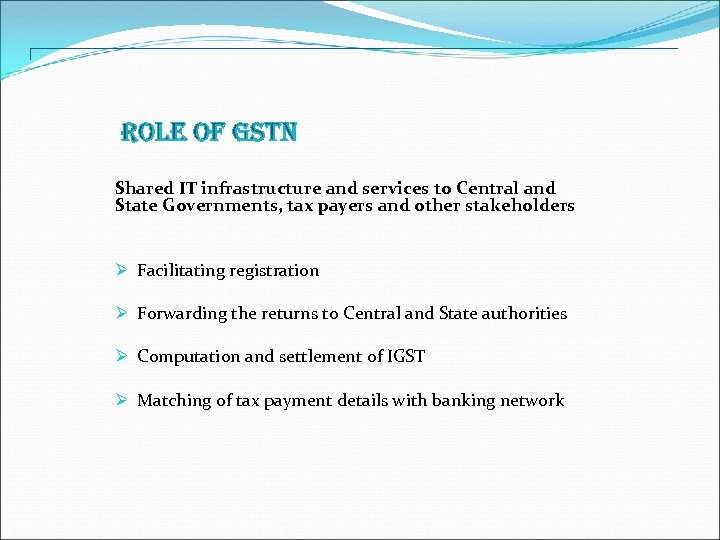

Role of Gst. N Shared IT infrastructure and services to Central and State Governments, tax payers and other stakeholders Ø Facilitating registration Ø Forwarding the returns to Central and State authorities Ø Computation and settlement of IGST Ø Matching of tax payment details with banking network

Role of Gst. N Shared IT infrastructure and services to Central and State Governments, tax payers and other stakeholders Ø Facilitating registration Ø Forwarding the returns to Central and State authorities Ø Computation and settlement of IGST Ø Matching of tax payment details with banking network

Role of Gst. N Ø Providing various MIS reports to the Central and the State Governments based on the tax payer return information Ø Providing analysis of tax payers’ profile; and Ø Running the matching engine for matching, reversal and reclaim of input tax credit

Role of Gst. N Ø Providing various MIS reports to the Central and the State Governments based on the tax payer return information Ø Providing analysis of tax payers’ profile; and Ø Running the matching engine for matching, reversal and reclaim of input tax credit

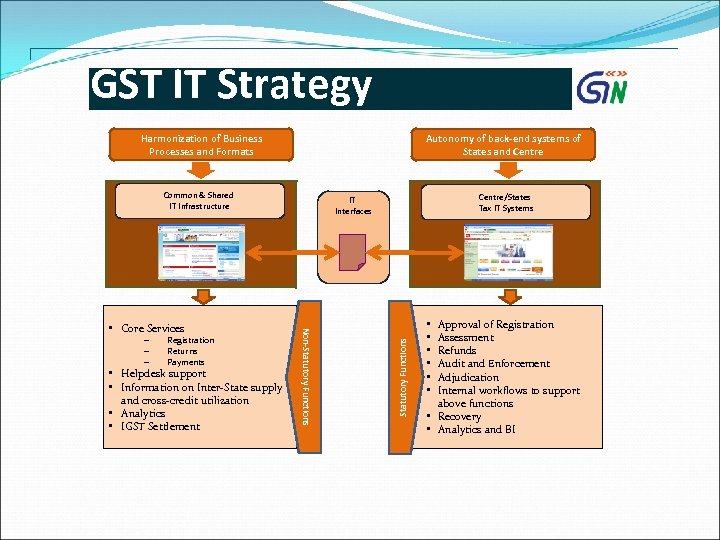

GST IT Strategy Harmonization of Business Processes and Formats Autonomy of back-end systems of States and Centre Common & Shared IT Infrastructure Registration Returns Payments • Helpdesk support • Information on Inter-State supply and cross-credit utilization • Analytics • IGST Settlement Statutory Functions – – – Non-Statutory Functions • Core Services Centre/States Tax IT Systems IT Interfaces Approval of Registration Assessment Refunds Audit and Enforcement Adjudication Internal workflows to support above functions • Recovery • Analytics and BI • • •

GST IT Strategy Harmonization of Business Processes and Formats Autonomy of back-end systems of States and Centre Common & Shared IT Infrastructure Registration Returns Payments • Helpdesk support • Information on Inter-State supply and cross-credit utilization • Analytics • IGST Settlement Statutory Functions – – – Non-Statutory Functions • Core Services Centre/States Tax IT Systems IT Interfaces Approval of Registration Assessment Refunds Audit and Enforcement Adjudication Internal workflows to support above functions • Recovery • Analytics and BI • • •

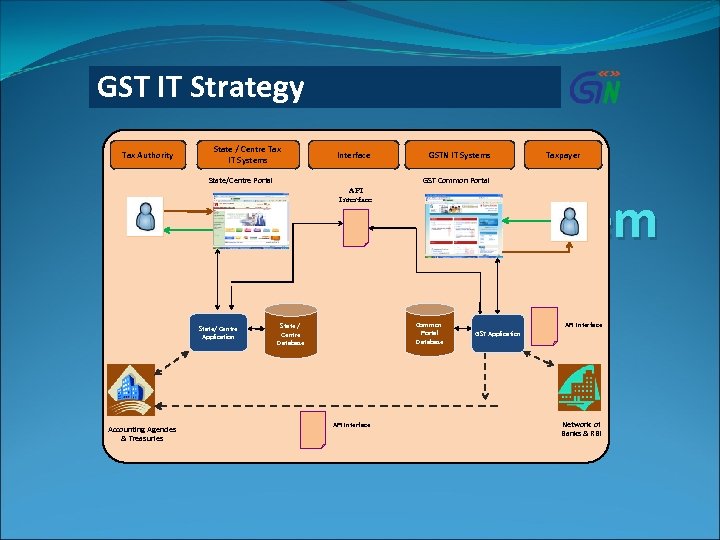

GST IT Strategy Tax Authority State / Centre Tax IT Systems State/Centre Portal Interface GSTN IT Systems Taxpayer GST Common Portal GST Ecosystem API Interface State/ Centre Application Accounting Agencies & Treasuries Common Portal Database State / Centre Database API Interface GST Application API Interface Network of Banks & RBI

GST IT Strategy Tax Authority State / Centre Tax IT Systems State/Centre Portal Interface GSTN IT Systems Taxpayer GST Common Portal GST Ecosystem API Interface State/ Centre Application Accounting Agencies & Treasuries Common Portal Database State / Centre Database API Interface GST Application API Interface Network of Banks & RBI

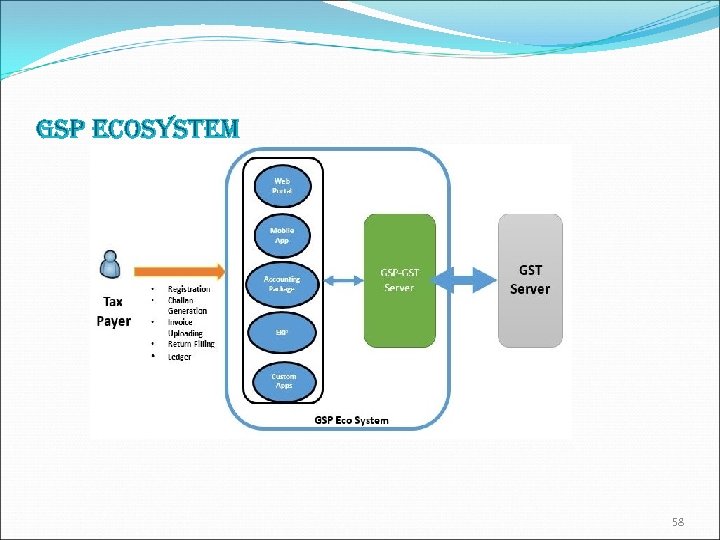

Gs. P ecosystem 58

Gs. P ecosystem 58

QUESTIONS AND ANSWERS

QUESTIONS AND ANSWERS