3b6405e17fda7d64596397c3d470dba2.ppt

- Количество слайдов: 33

OVERVIEW OF BUSINESS ORGANIZATIONS

• Sole Proprietorship • Partnerships Introduction – General Partnership – Limited Liability Partnership • Corporation – Close Corporation – Publicly Held Corporation – S Corporation • Limited Liability Company

Factors to Consider in Choosing Forms of Business Organizations • • Creation Control Limited liability Taxation Duration Ability to raise capital Advantages Disadvantages

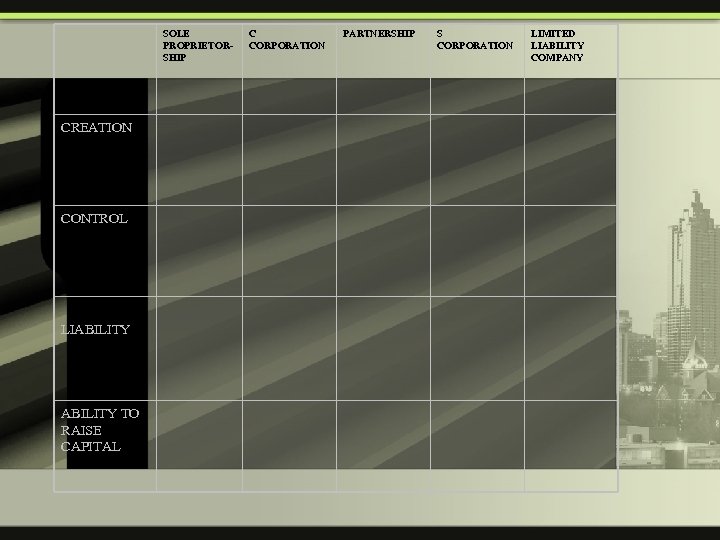

SOLE PROPRIETORSHIP CREATION CONTROL LIABILITY TO RAISE CAPITAL C CORPORATION PARTNERSHIP S CORPORATION LIMITED LIABILITY COMPANY

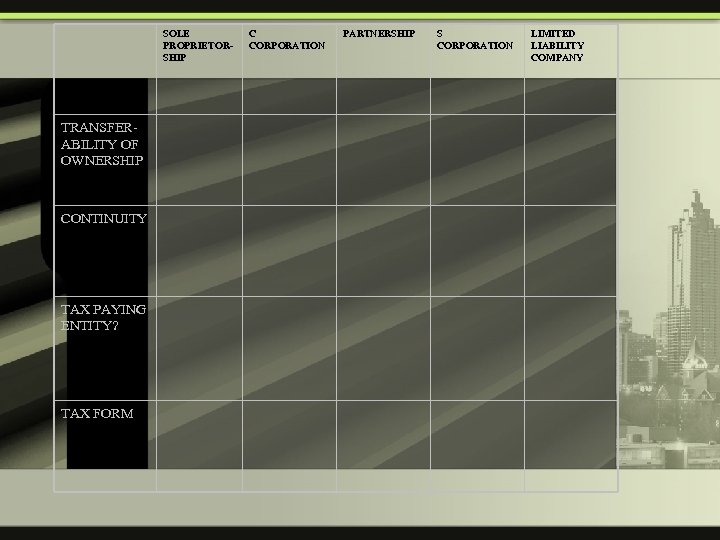

SOLE PROPRIETORSHIP TRANSFERABILITY OF OWNERSHIP CONTINUITY TAX PAYING ENTITY? TAX FORM C CORPORATION PARTNERSHIP S CORPORATION LIMITED LIABILITY COMPANY

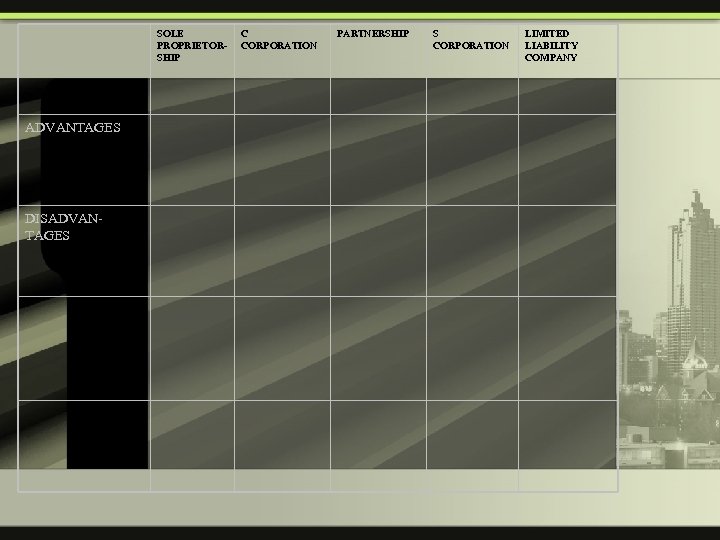

SOLE PROPRIETORSHIP ADVANTAGES DISADVANTAGES C CORPORATION PARTNERSHIP S CORPORATION LIMITED LIABILITY COMPANY

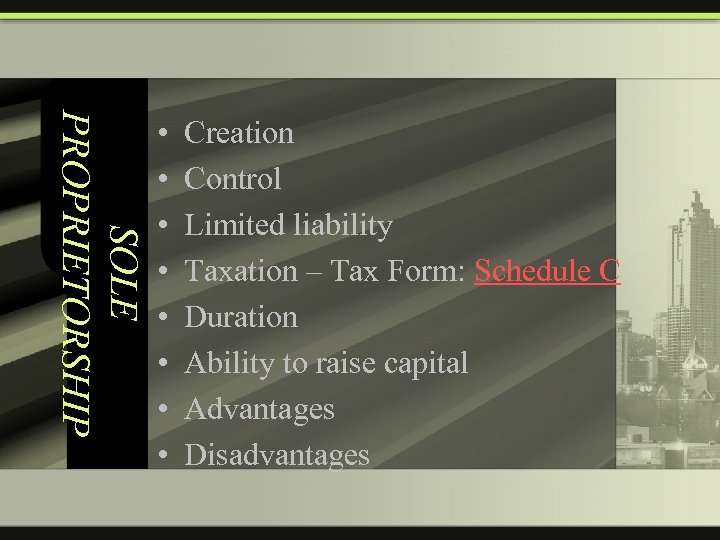

SOLE PROPRIETORSHIP • • Creation Control Limited liability Taxation – Tax Form: Schedule C Duration Ability to raise capital Advantages Disadvantages

PARTNERSHIPS

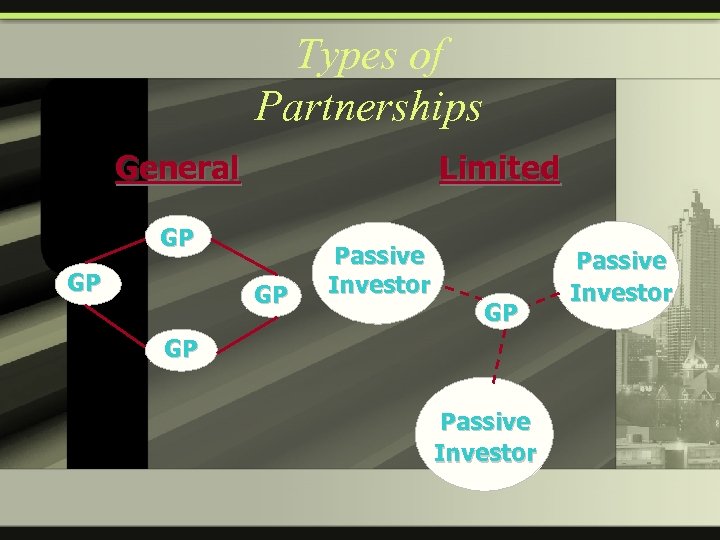

Types of Partnerships General Limited GP GP GP Passive Investor

GENERAL PARTNERSHIPS

The UNIFORM PARTNERSHIP ACT defines a partnership as: • • an association of 2 or more persons carrying on a business as co-owners for profit

GENERAL PARTNERSHIP • • • CREATION: CONTROL: LIABILITY: TAXATION: Form 1065 DURATION: ABILITY TO RAISE CAPITAL: • ADVANTAGES: • DISADVANTAGES:

LIMITED PARTNERSHIPS Georgia Filing Procedures

LIMITED PARTNERSHIP • • • CREATION: CONTROL: LIABILITY: TAXATION: DURATION: ABILITY TO RAISE CAPITAL: • ADVANTAGES: • DISADVANTAGES:

Corporations

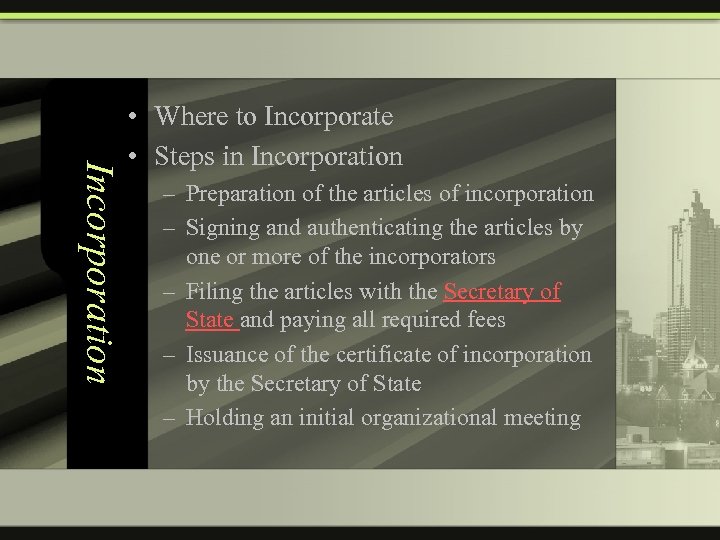

Incorporation • Where to Incorporate • Steps in Incorporation – Preparation of the articles of incorporation – Signing and authenticating the articles by one or more of the incorporators – Filing the articles with the Secretary of State and paying all required fees – Issuance of the certificate of incorporation by the Secretary of State – Holding an initial organizational meeting

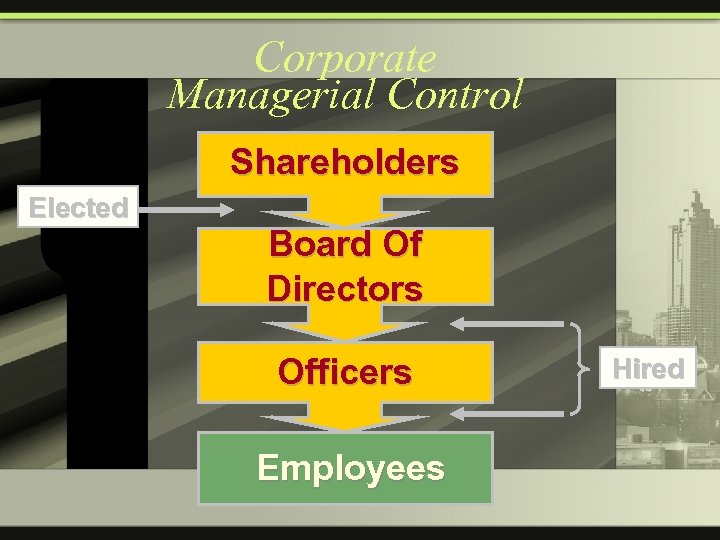

Corporate Managerial Control Shareholders Elected Board Of Directors Officers Employees Hired

Duties of Directors and Officers • Duty to Act within Authority – Ratification • Duty of Due Care and Diligence – Prudent Person Standard – Business Judgment Rule – The Business Judgment Rule in the Takeover Context – Deal Protection Devices – Legislative Responses to Increased Director Liability • Charter Option Statutes • Self-executing Statutes • Cap on Monetary Damages Statute

Duties of Directors and Officers • Duty of Loyalty and Good Faith – Self-Dealing – Usurping Corporate Opportunities – Freeze-Outs, Oppression, and Bad Faith – Trading on Inside Information • Director’s Right to Dissent

Corporate Taxation • Business Profit Tax Form 1120 (or Form 1120 -A) • Shareholder/Dividend Distribution Tax • Avoiding Double Tax – – – Closely Held- Reasonable Officer Salary Employee/Shareholder Expense Account Capital Structure- Equity v. Debt Accumulate Earnings- No Dividend File Subchapter S

Corporate Characteristics • LIABILITY – Limited for investors (unless corporation is a sham. ) – Officers & directors may have some liability • DURATION/CONTINUITY – Can outlive its creators/owners – Ownership can be sold subject to security laws & shareholder agreements

Corporate Characteristics • ADVANTAGES – Practical means of bringing large number of investors together. – Limited liability for investors – Perpetual existence – Shareholders can also be employees

Corporate Characteristics • DISADVANTAGES – Cost of forming & maintaining – License fees & franchise taxes – Double taxation – Must be qualified in all states where it is doing business – More government regulation

Organizational Form Hybrids • S Corporations – Legal Characteristics Of Corporation – Can Elect To Be Taxed As Partnership • Limited Liability Company – Nontaxable Entity – More Flexible Than S Corp. – Shareholders = “Members”

S Corporation • Domestic • Not a member of affiliated group • Shareholders can be individuals, estate, & certain trusts • 100 or fewer shareholders • Only one class of stock • No nonresident aliens

• Tax Form 1120 s S Corporation

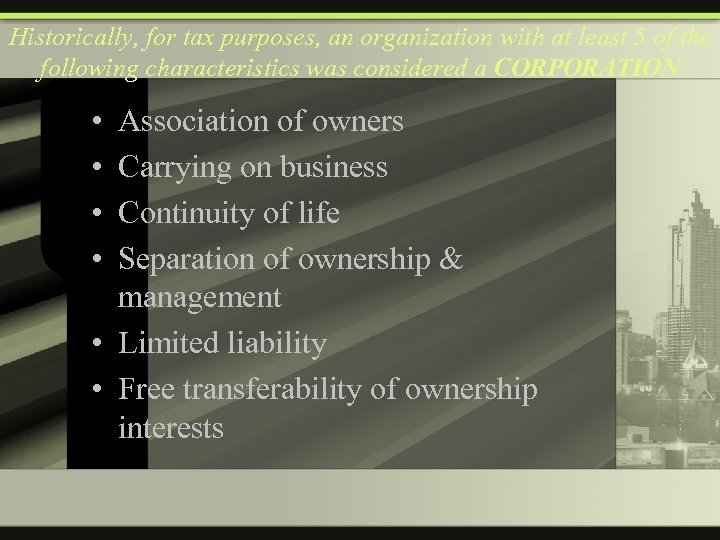

Historically, for tax purposes, an organization with at least 5 of the following characteristics was considered a CORPORATION • • Association of owners Carrying on business Continuity of life Separation of ownership & management • Limited liability • Free transferability of ownership interests

• Starting in 1997, “check the box” rules became effective.

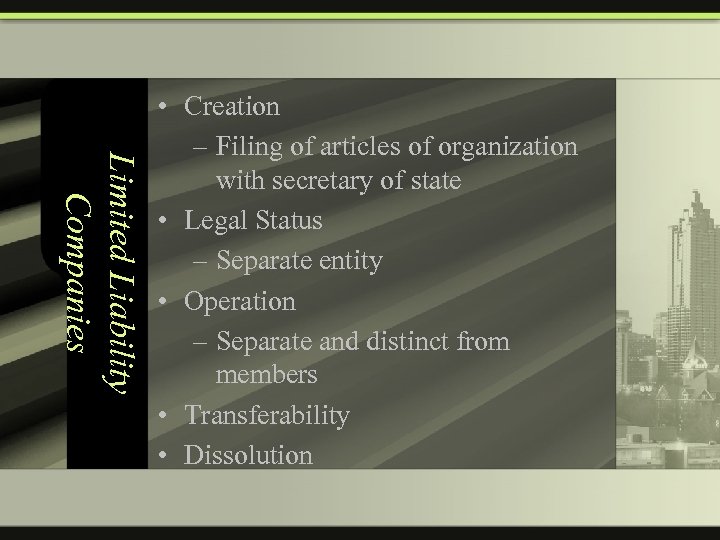

Limited Liability Companies • Creation – Filing of articles of organization with secretary of state • Legal Status – Separate entity • Operation – Separate and distinct from members • Transferability • Dissolution

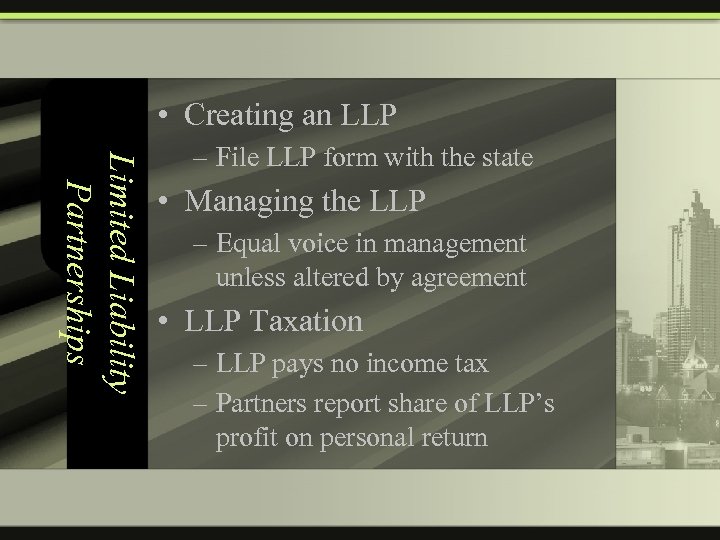

• Creating an LLP Limited Liability Partnerships – File LLP form with the state • Managing the LLP – Equal voice in management unless altered by agreement • LLP Taxation – LLP pays no income tax – Partners report share of LLP’s profit on personal return

Which form of business organization should they use? • Adam, Bonnie, and Carl want to open a Thai restaurant. – Adam has no money to invest, but he has a bartender’s license and was an assistant manager at a restaurant for 10 years. – Bonnie is a dentist who is looking for an investment.

Which form of business organization should they use? – Carl has $20, 000 in savings. He can invest some, but needs the rest to send his daughter to cosmetology school. He has tried several business ventures in the past, but they have all been failures. He hopes this one will make it and he is counting on his best friend, Adam, to help him.

Which form of business organization should they use? • Before forming their business, Adam and Carl learn that Bonnie has been performing some unauthorized procedures while her patients are anesthetized. She is now being hit with dozens of lawsuits. Should they consider different form of business entity?

3b6405e17fda7d64596397c3d470dba2.ppt