49e4f59768f93545f247d70460d4be1a.ppt

- Количество слайдов: 14

Overview: Investments Investment Process Taxonomy of Financial Assets Players and Vehicles Market Microstructure Recent Trends

Overview: Investments Investment Process Taxonomy of Financial Assets Players and Vehicles Market Microstructure Recent Trends

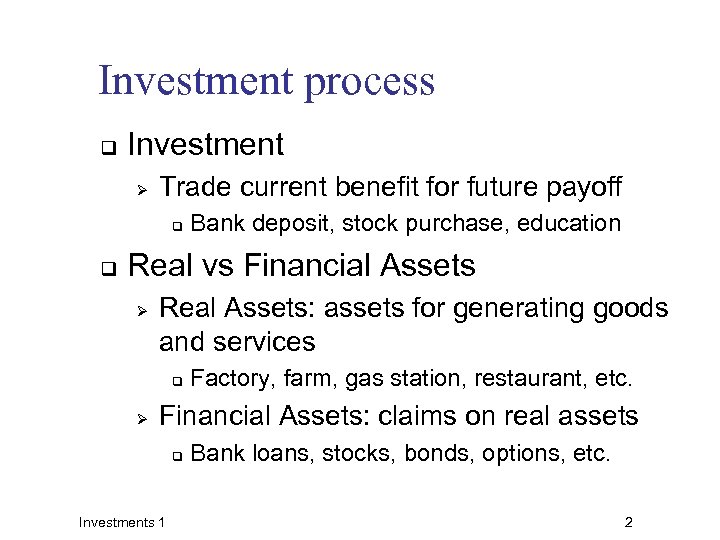

Investment process q Investment Ø Trade current benefit for future payoff q q Bank deposit, stock purchase, education Real vs Financial Assets Ø Real Assets: assets for generating goods and services q Ø Factory, farm, gas station, restaurant, etc. Financial Assets: claims on real assets q Investments 1 Bank loans, stocks, bonds, options, etc. 2

Investment process q Investment Ø Trade current benefit for future payoff q q Bank deposit, stock purchase, education Real vs Financial Assets Ø Real Assets: assets for generating goods and services q Ø Factory, farm, gas station, restaurant, etc. Financial Assets: claims on real assets q Investments 1 Bank loans, stocks, bonds, options, etc. 2

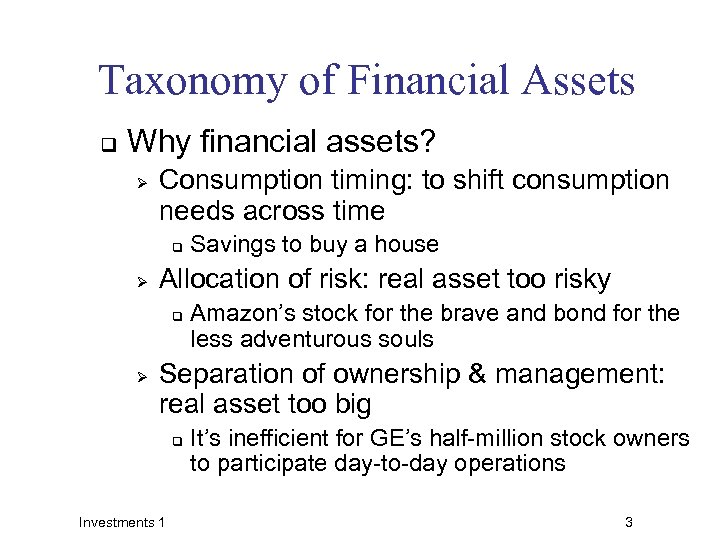

Taxonomy of Financial Assets q Why financial assets? Ø Consumption timing: to shift consumption needs across time q Ø Allocation of risk: real asset too risky q Ø Savings to buy a house Amazon’s stock for the brave and bond for the less adventurous souls Separation of ownership & management: real asset too big q Investments 1 It’s inefficient for GE’s half-million stock owners to participate day-to-day operations 3

Taxonomy of Financial Assets q Why financial assets? Ø Consumption timing: to shift consumption needs across time q Ø Allocation of risk: real asset too risky q Ø Savings to buy a house Amazon’s stock for the brave and bond for the less adventurous souls Separation of ownership & management: real asset too big q Investments 1 It’s inefficient for GE’s half-million stock owners to participate day-to-day operations 3

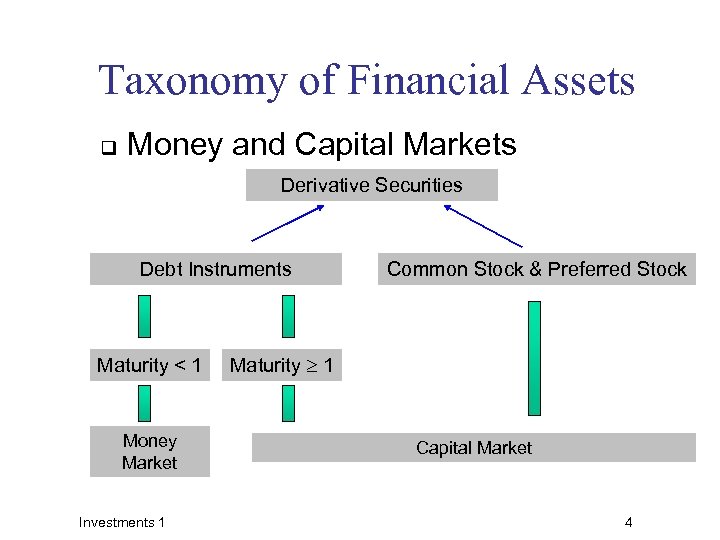

Taxonomy of Financial Assets q Money and Capital Markets Derivative Securities Debt Instruments Maturity < 1 Money Market Investments 1 Common Stock & Preferred Stock Maturity 1 Capital Market 4

Taxonomy of Financial Assets q Money and Capital Markets Derivative Securities Debt Instruments Maturity < 1 Money Market Investments 1 Common Stock & Preferred Stock Maturity 1 Capital Market 4

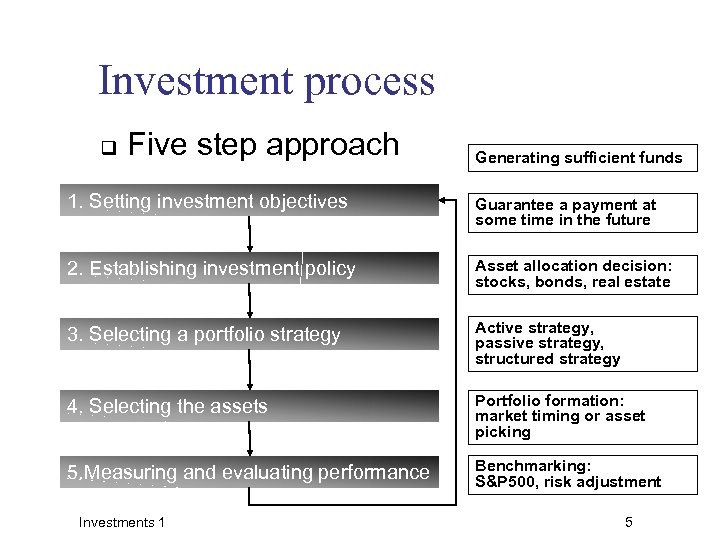

Investment process q Five step approach Generating sufficient funds 1. Setting investment objectives Guarantee a payment at some time in the future 2. Establishing investment policy Asset allocation decision: stocks, bonds, real estate 3. Selecting a portfolio strategy Active strategy, passive strategy, structured strategy 4. Selecting the assets Portfolio formation: market timing or asset picking 5. Measuring and evaluating performance Benchmarking: S&P 500, risk adjustment Investments 1 5

Investment process q Five step approach Generating sufficient funds 1. Setting investment objectives Guarantee a payment at some time in the future 2. Establishing investment policy Asset allocation decision: stocks, bonds, real estate 3. Selecting a portfolio strategy Active strategy, passive strategy, structured strategy 4. Selecting the assets Portfolio formation: market timing or asset picking 5. Measuring and evaluating performance Benchmarking: S&P 500, risk adjustment Investments 1 5

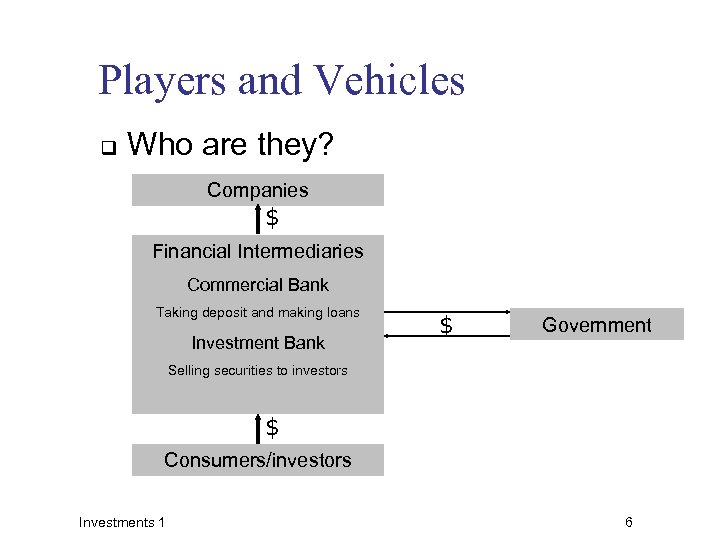

Players and Vehicles q Who are they? Companies $ Financial Intermediaries Commercial Bank Taking deposit and making loans Investment Bank $ Government Selling securities to investors $ Consumers/investors Investments 1 6

Players and Vehicles q Who are they? Companies $ Financial Intermediaries Commercial Bank Taking deposit and making loans Investment Bank $ Government Selling securities to investors $ Consumers/investors Investments 1 6

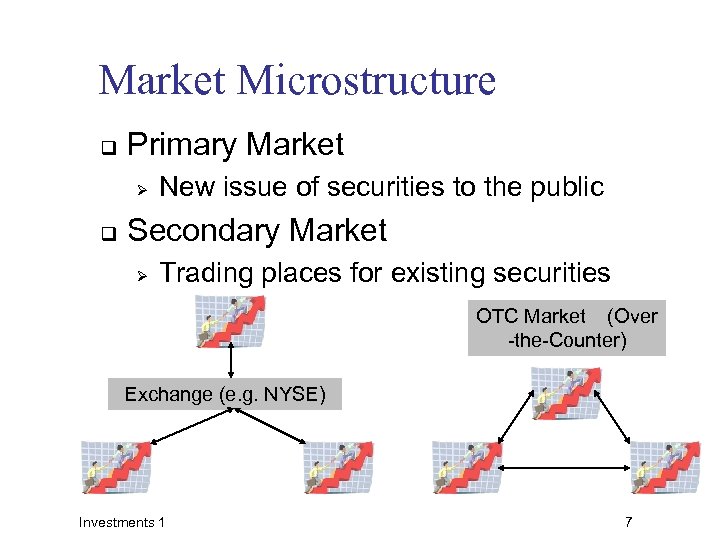

Market Microstructure q Primary Market Ø q New issue of securities to the public Secondary Market Ø Trading places for existing securities OTC Market (Over -the-Counter) Exchange (e. g. NYSE) Investments 1 7

Market Microstructure q Primary Market Ø q New issue of securities to the public Secondary Market Ø Trading places for existing securities OTC Market (Over -the-Counter) Exchange (e. g. NYSE) Investments 1 7

Market Microstructure q Direct Search Market Ø q Brokered Market Ø Ø q Brokers search buyers/sellers for sellers/buyers Moderate trading activity, e. g. , real estate, IPO Dealer Market Ø Ø q Buyers/sellers search each other directly Dealers buy/sell for their own accounts Active trading, e. g. , OTC, NASDAQ Auction Market Ø Ø Players buy/sell in one centralized place Active trading, e. g. , NYSE Investments 1 8

Market Microstructure q Direct Search Market Ø q Brokered Market Ø Ø q Brokers search buyers/sellers for sellers/buyers Moderate trading activity, e. g. , real estate, IPO Dealer Market Ø Ø q Buyers/sellers search each other directly Dealers buy/sell for their own accounts Active trading, e. g. , OTC, NASDAQ Auction Market Ø Ø Players buy/sell in one centralized place Active trading, e. g. , NYSE Investments 1 8

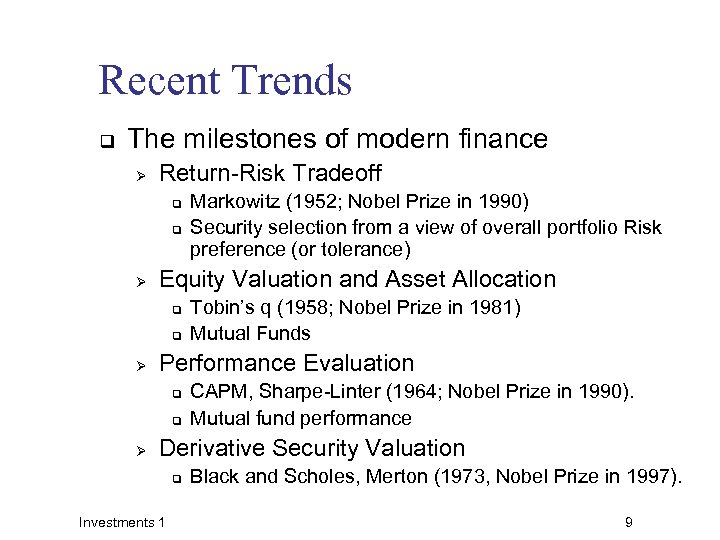

Recent Trends q The milestones of modern finance Ø Return-Risk Tradeoff q q Ø Equity Valuation and Asset Allocation q q Ø Tobin’s q (1958; Nobel Prize in 1981) Mutual Funds Performance Evaluation q q Ø Markowitz (1952; Nobel Prize in 1990) Security selection from a view of overall portfolio Risk preference (or tolerance) CAPM, Sharpe-Linter (1964; Nobel Prize in 1990). Mutual fund performance Derivative Security Valuation q Investments 1 Black and Scholes, Merton (1973, Nobel Prize in 1997). 9

Recent Trends q The milestones of modern finance Ø Return-Risk Tradeoff q q Ø Equity Valuation and Asset Allocation q q Ø Tobin’s q (1958; Nobel Prize in 1981) Mutual Funds Performance Evaluation q q Ø Markowitz (1952; Nobel Prize in 1990) Security selection from a view of overall portfolio Risk preference (or tolerance) CAPM, Sharpe-Linter (1964; Nobel Prize in 1990). Mutual fund performance Derivative Security Valuation q Investments 1 Black and Scholes, Merton (1973, Nobel Prize in 1997). 9

Recent Trends q Globalization Ø Ø An Integration of worldwide economic environment and national capital markets Major Activities q International diversification Ø q Cross border trading Ø q Local stocks, ADRs, mutual funds, WEBS (World Equity Benchmark Shares) – now part of i. Shares, etc. Foreign exchange risk Ø Investments 1 US market down, Asia markets up, average out Exchange rate fluctuation affects foreign stock returns 10

Recent Trends q Globalization Ø Ø An Integration of worldwide economic environment and national capital markets Major Activities q International diversification Ø q Cross border trading Ø q Local stocks, ADRs, mutual funds, WEBS (World Equity Benchmark Shares) – now part of i. Shares, etc. Foreign exchange risk Ø Investments 1 US market down, Asia markets up, average out Exchange rate fluctuation affects foreign stock returns 10

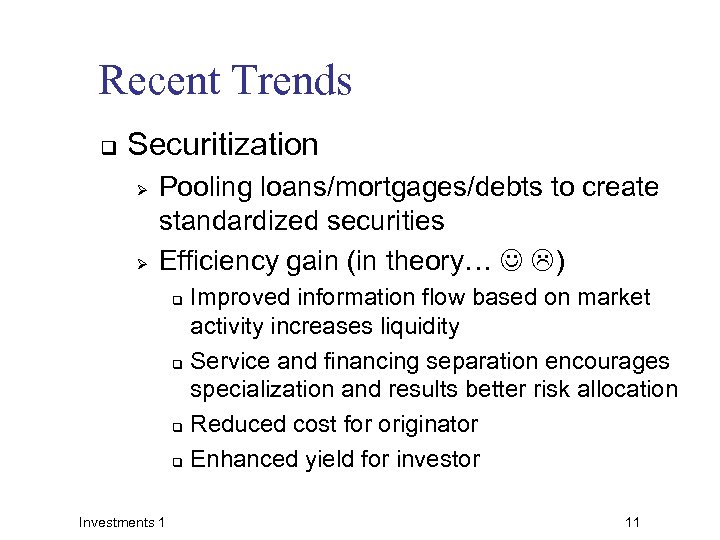

Recent Trends q Securitization Ø Ø Pooling loans/mortgages/debts to create standardized securities Efficiency gain (in theory… ) Improved information flow based on market activity increases liquidity q Service and financing separation encourages specialization and results better risk allocation q Reduced cost for originator q Enhanced yield for investor q Investments 1 11

Recent Trends q Securitization Ø Ø Pooling loans/mortgages/debts to create standardized securities Efficiency gain (in theory… ) Improved information flow based on market activity increases liquidity q Service and financing separation encourages specialization and results better risk allocation q Reduced cost for originator q Enhanced yield for investor q Investments 1 11

Recent Trends q Financial Engineering Ø Ø The process of creating customized securities tailored to investor’s need Bundling Combining cash flows together q Straight bond+call option=convertible bond q Ø Unbundling Slicing and dicing cash flow of an asset to several classes q CMO to mortgage pass-through tranches and treasury strips. q Investments 1 12

Recent Trends q Financial Engineering Ø Ø The process of creating customized securities tailored to investor’s need Bundling Combining cash flows together q Straight bond+call option=convertible bond q Ø Unbundling Slicing and dicing cash flow of an asset to several classes q CMO to mortgage pass-through tranches and treasury strips. q Investments 1 12

Recent Debacles q Subprime mortgage meltdown q Credit and liquidity crunch q What went wrong? Ø Video (from Britain) Investments 1 13

Recent Debacles q Subprime mortgage meltdown q Credit and liquidity crunch q What went wrong? Ø Video (from Britain) Investments 1 13

Wrap-up What is investment? q What are the differences between financial and real assets? q What’s hot? q What’s not? q Investments 1 14

Wrap-up What is investment? q What are the differences between financial and real assets? q What’s hot? q What’s not? q Investments 1 14