2194343ba86fc29f1b3869c477f9530b.ppt

- Количество слайдов: 53

OVERVIEW: CDM FINANCING DENR Training Course November 4 -6, 2003 Climate Change Information Center Manila Observatory Ateneo de Manila University

Contents 1. 2. 3. 4. Basics of CDM Financing CDM Transaction Costs Risks in CDM Financing State of the Carbon Market

1. Basics of CDM Financing

Starting Point: Viable Project • A potential CDM Project is a feasible project § Technologically feasible § Financially sound • A potential CDM Project is a project which has an Environmental Compliance Certificate (ECC)

Total Project Costs and Sources of Finance Total Project Cost Estimates • Investment costs, including development costs, up to commissioning of project Sources of Finance to be Sought or Already Identified • • • Critical to identify other debt and/or equity finance Typical sources of funding: international development banks, government funding, private financing, supplier credit CDM contribution = typically 5 -15% of total project costs

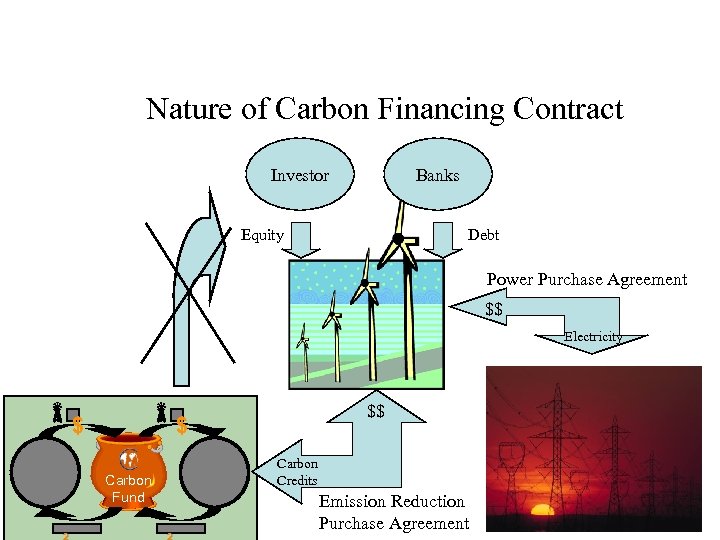

Financing Options in a CDM Project Emission Reductions Purchase Agreement • Annex I investor agrees to buy CERs as they are produced by the project

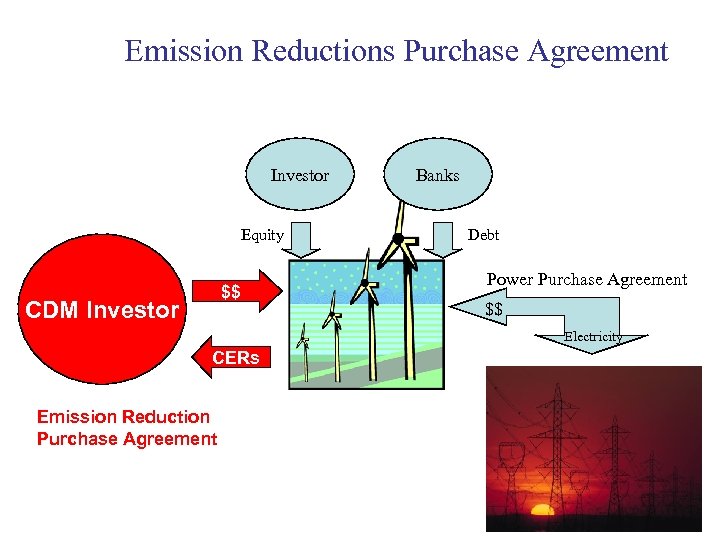

Emission Reductions Purchase Agreement Investor Equity $$ CDM Investor Banks Debt Power Purchase Agreement $$ Electricity CERs Emission Reduction Purchase Agreement

Emission Reduction Purchase Agreement • Will improve IRRs • Forward contract – Payment upon delivery of verified ERs – Upfront payments are rare • Will provide a hard currency revenue • Helps secure financing and reduce project risk – Future ER payments as collateral for project loans – Can be paid into an escrow account, protecting lenders from currency convertibility and transfer risks

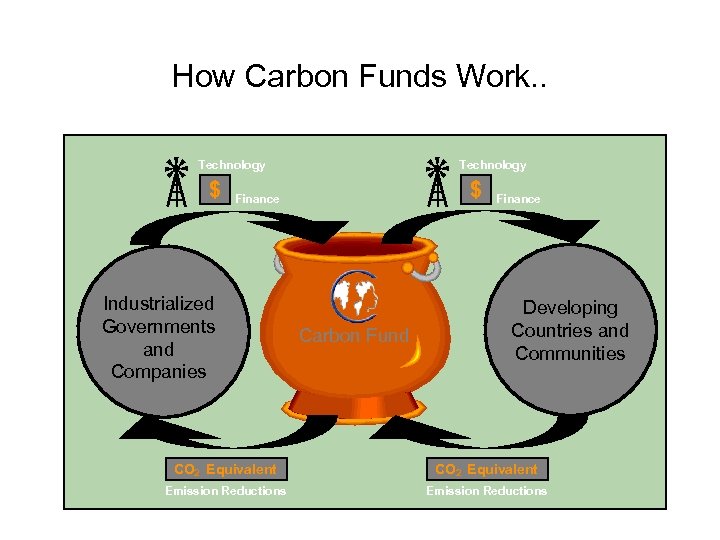

Financing Options in a CDM Project Carbon Funds • Annex I investors contribute to a mutual fund • Mutual fund agrees to buy CERs as they are produced by the project • Examples – WB Prototype Carbon Fund – Netherland’s CERUPT

How Carbon Funds Work. . Technology $ Finance Industrialized Governments and Companies Carbon Fund Finance Developing Countries and Communities CO 2 Equivalent Emission Reductions

Nature of Carbon Financing Contract Investor Banks Equity Debt Power Purchase Agreement $$ Electricity $ $ Carbon Credits Carbon Fund 2 $$ 2 Emission Reduction Purchase Agreement

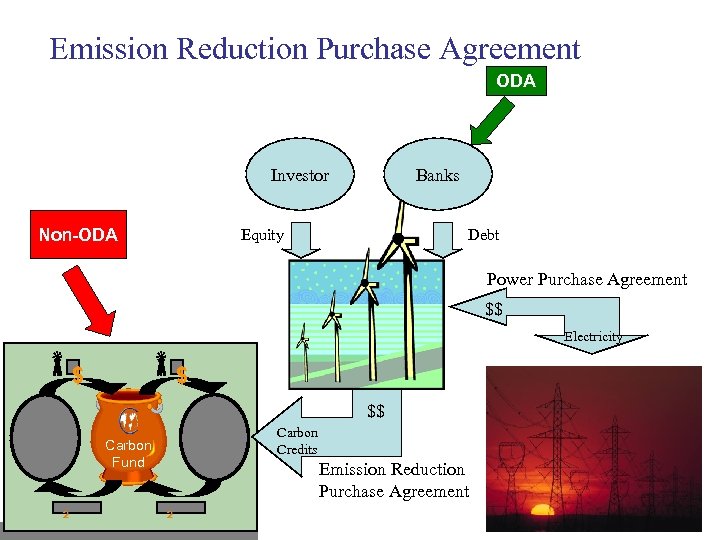

Emission Reduction Purchase Agreement ODA Investor Non-ODA Banks Equity Debt Power Purchase Agreement $$ Electricity $ $ $$ Carbon Credits Carbon Fund 2 Emission Reduction Purchase Agreement 2

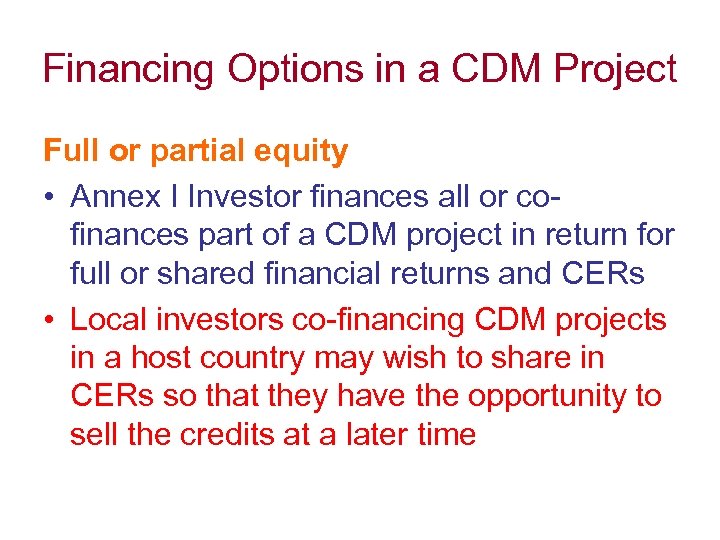

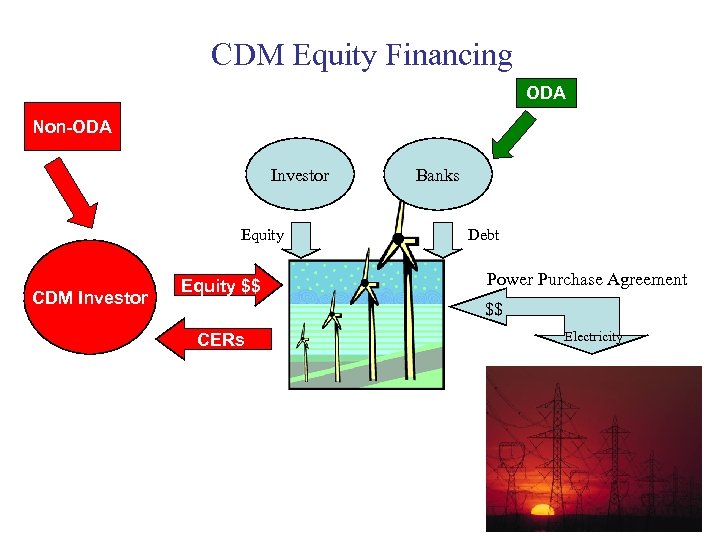

Financing Options in a CDM Project Full or partial equity • Annex I Investor finances all or cofinances part of a CDM project in return for full or shared financial returns and CERs • Local investors co-financing CDM projects in a host country may wish to share in CERs so that they have the opportunity to sell the credits at a later time

CDM Equity Financing ODA Non-ODA Investor Equity CDM Investor Equity $$ Banks Debt Power Purchase Agreement $$ CERs Electricity

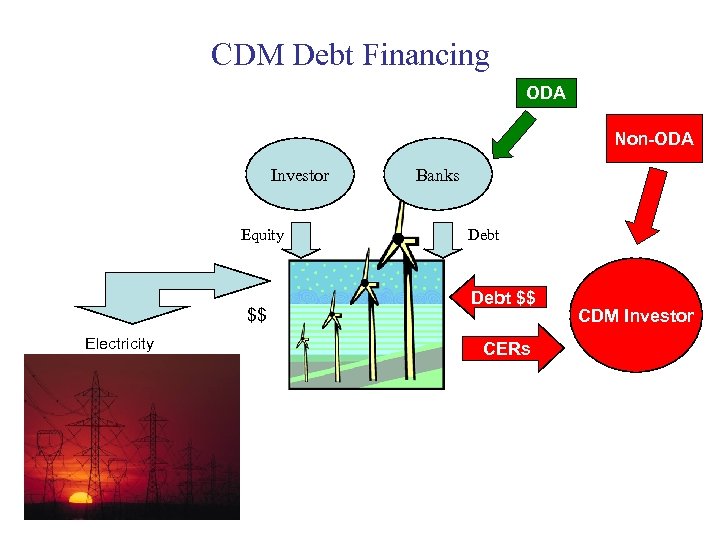

Financing Options in a CDM Project Loan • Annex I Investor provides loan or lease financing at concessional rates in return for CERs

CDM Debt Financing ODA Non-ODA Investor Equity $$ Electricity Banks Debt $$ CERs CDM Investor

2. CDM Transaction Costs

Pre-implementation costs • Search costs • Negotiation costs • Baseline determination costs • Approval costs • Validation costs • Review costs • Registration costs

Implementation costs • Monitoring costs • Verification costs • Review costs • Certification costs • Enforcement costs

Trading costs • Transfer costs • Registration costs

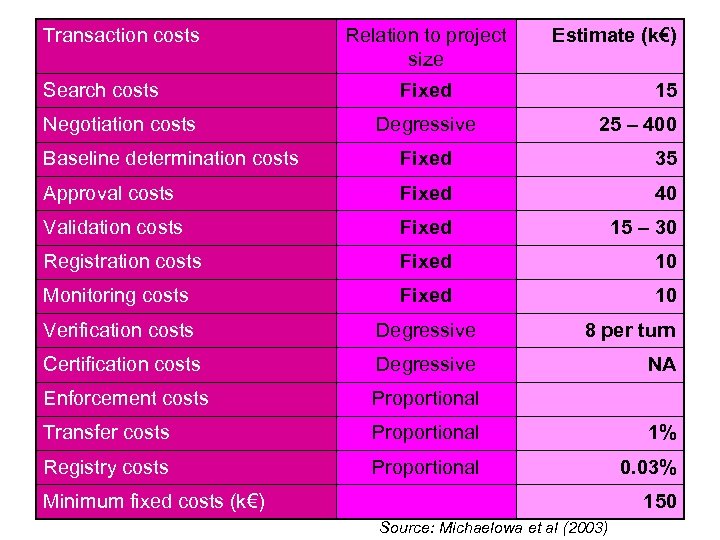

Transaction costs Search costs Negotiation costs Relation to project size Estimate (k€) Fixed Degressive 15 25 – 400 Baseline determination costs Fixed 35 Approval costs Fixed 40 Validation costs Fixed 15 – 30 Registration costs Fixed 10 Monitoring costs Fixed 10 Verification costs Degressive 8 per turn Certification costs Degressive NA Enforcement costs Proportional Transfer costs Proportional 1% Registry costs Proportional 0. 03% Minimum fixed costs (k€) 150 Source: Michaelowa et al (2003)

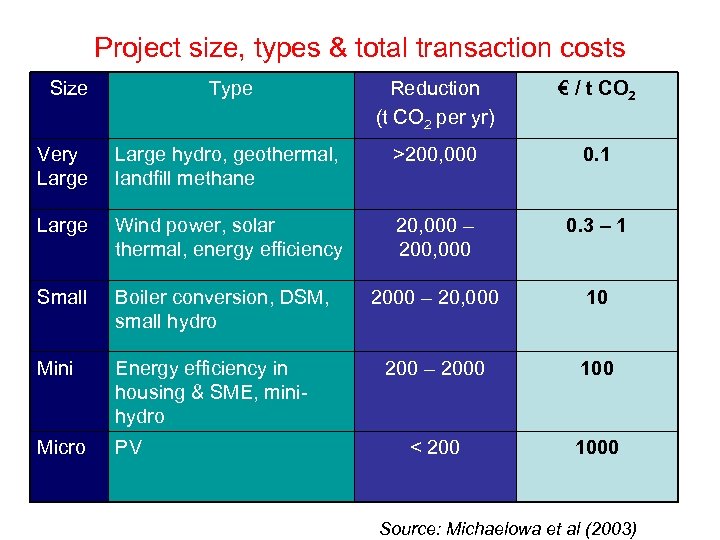

Project size, types & total transaction costs Size Type Reduction (t CO 2 per yr) € / t CO 2 Very Large hydro, geothermal, landfill methane >200, 000 0. 1 Large Wind power, solar thermal, energy efficiency 20, 000 – 200, 000 0. 3 – 1 Small Boiler conversion, DSM, small hydro 2000 – 20, 000 10 Mini Energy efficiency in housing & SME, minihydro 200 – 2000 100 Micro PV < 200 1000 Source: Michaelowa et al (2003)

Project size thresholds • PCF considers any project with a volume below 3 million € greenhouse gas benefits would not be attractive due to transaction costs § Threshold of about 50, 000 t CO 2 per year for a 20–year project • Transaction costs should not be more than 25% of proceeds of CER sales to make a project viable (Shell, 2001) • Cost threshold of about 1 € / t CO 2

Viability of CDM Projects • Given CER market price estimates of 1 – 5 € pet t CO 2 (Jotzo and Michaelowa, 2001) • Given PCF transactions priced at 3 – 4 € per t CO 2 ØOnly projects classified as large and very large are viable ØMany small-scale projects would not be viable

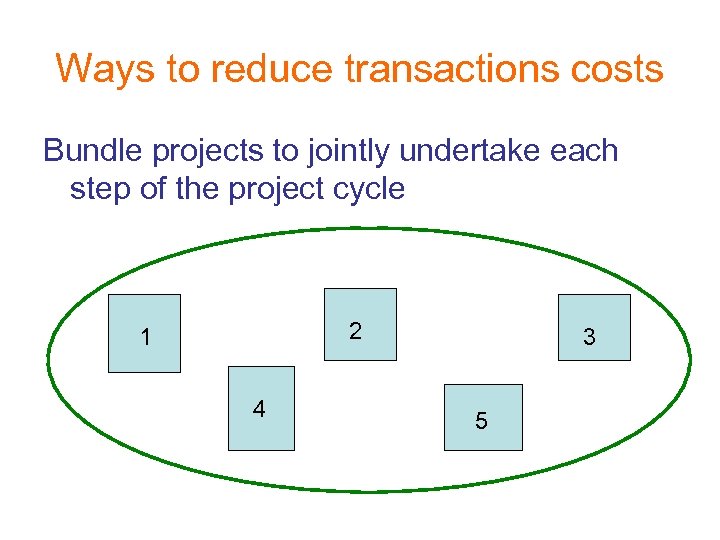

Ways to reduce transactions costs Bundle projects to jointly undertake each step of the project cycle 2 1 4 3 5

Ways to reduce transactions costs • Do verification and certification not annually but at long intervals • Exempt projects from one or more steps of the project cycle • Streamline the information needs on each step of the project cycle • Standardization of parameters Source: Michaelowa et al (2003)

Ways to reduce transactions costs • Do unilateral CDM projects that reduce search and negotiation costs • Registration and certification fees proportional to the size of the project • Validation and verification fees proportional to the size of the project Source: Michaelowa et al (2003)

3. Risks in CDM Financing

Risks in CDM Financing • Renewable energy projects are considered risky by financing institutions • Multitude of risks could reduce the value of the project to zero • Measures are needed to mitigate risks at different stages of the project

“Normal” Project Risks • Political/Country Risks • Sponsor Risks • Construction Risks • Technical Risks • Fuel Risks • Environmental Risks • Financial Risks • Legal Risks • Operation Risks

CDM-Specific Risks • Market/Price Risk – Will there be a market for project-based ERs? – Will contract price exceed market price? • Policy/Compliance Risk – What if no Kyoto Protocol? – What if host country does not ratify or comply? – What if host country does not approve project? ð Market and Policy Risk are closely linked

CDM-Specific Risks • Baseline Risks – Eligibility--will ERs be Kyoto-compliant? – Will project be validated and registered? – Will ERs be verified and certified? – Baseline design--is the baseline robust? Will its assumptions remain valid over time? – Performance--actual performance will determine level of ERs generated

4. Emerging Trends in the Carbon Market

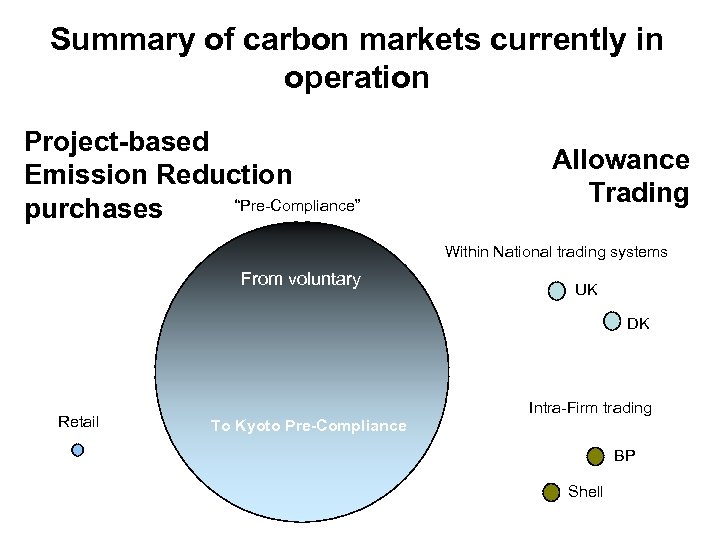

Summary of carbon markets currently in operation Project-based Emission Reduction “Pre-Compliance” purchases Allowance Trading Within National trading systems From voluntary UK DK Retail Intra-Firm trading To Kyoto Pre-Compliance BP Shell

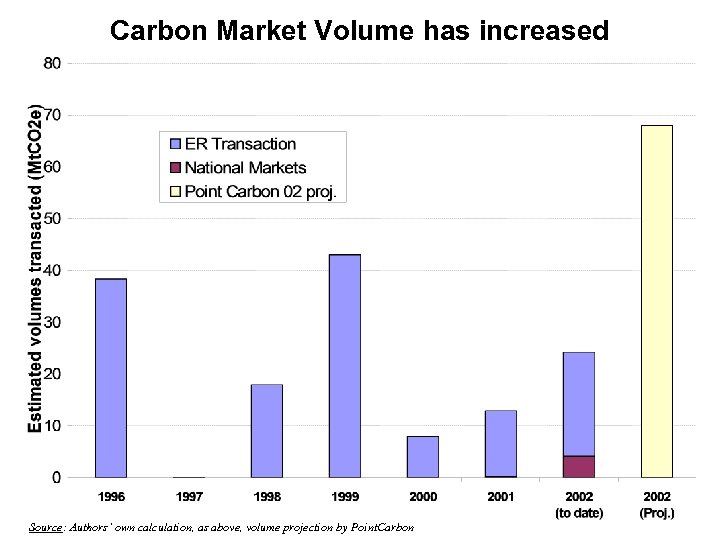

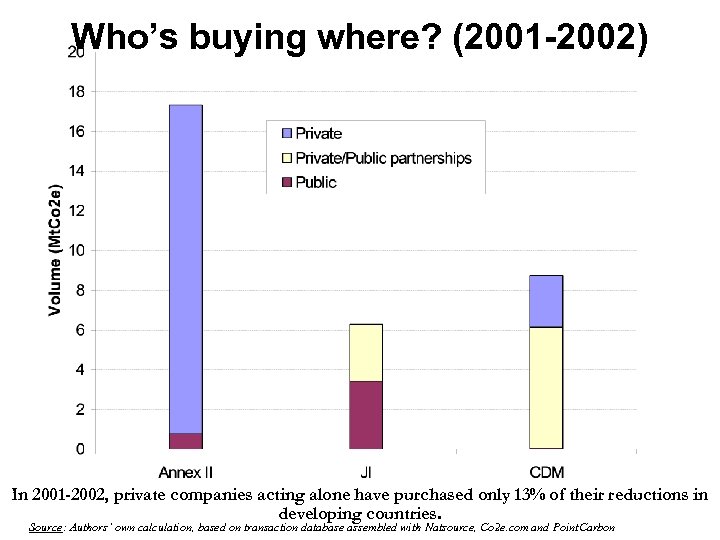

Market Intelligence: “Few Countries Benefiting, Little Private Sector Buying” • Market: cumulative 200 million tonnes CO 2 traded ($500 million) since 1996 • Five-fold increase between 2001 and 2002 • Only 43% of all carbon transactions made in CDM/JI (2001 -2002), dominated by Dutch and PCF • Only 13% of the private sector’s purchases were in CDM (2001 -2002) • African countries, smaller countries and smallscale projects are largely bypassed

Carbon Market Volume has increased Source: Authors’ own calculation, as above, volume projection by Point. Carbon

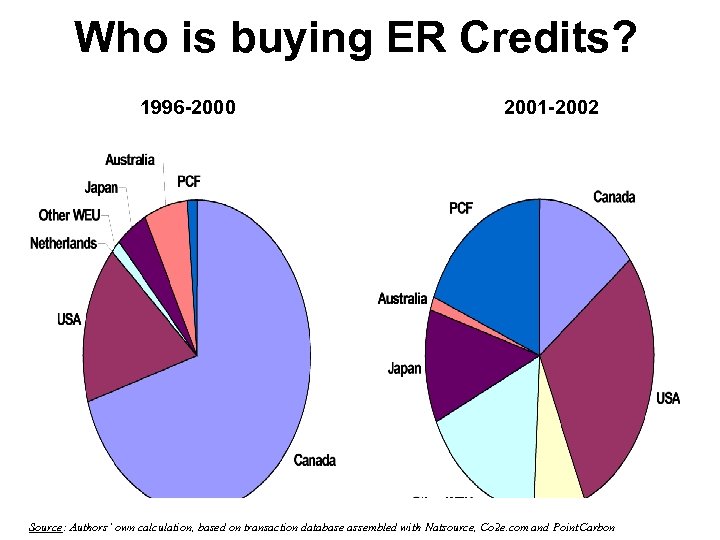

Who is buying ER Credits? 1996 -2000 2001 -2002 Source: Authors’ own calculation, based on transaction database assembled with Natsource, Co 2 e. com and Point. Carbon

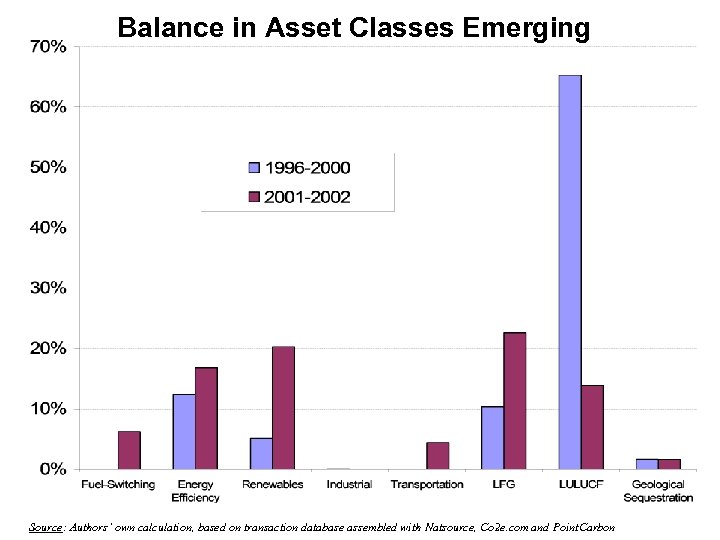

Balance in Asset Classes Emerging Source: Authors’ own calculation, based on transaction database assembled with Natsource, Co 2 e. com and Point. Carbon

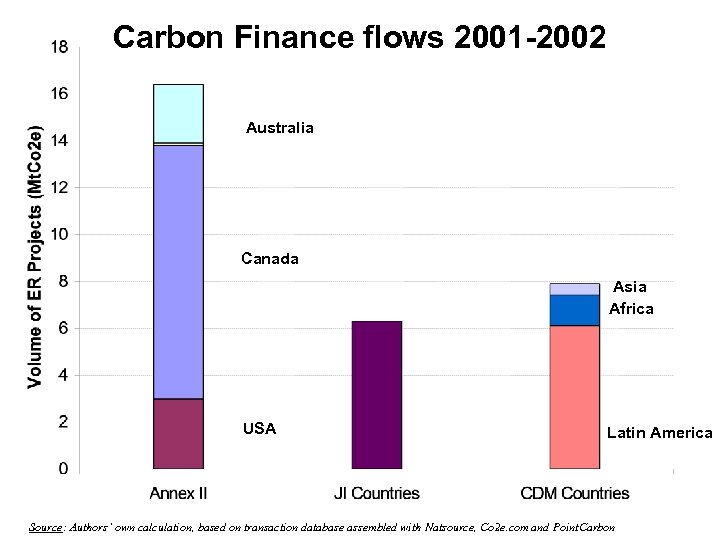

Carbon Finance flows 2001 -2002 Australia Canada Asia Africa USA Latin America Source: Authors’ own calculation, based on transaction database assembled with Natsource, Co 2 e. com and Point. Carbon

Who’s buying where? (2001 -2002) In 2001 -2002, private companies acting alone have purchased only 13% of their reductions in developing countries. Source: Authors’ own calculation, based on transaction database assembled with Natsource, Co 2 e. com and Point. Carbon

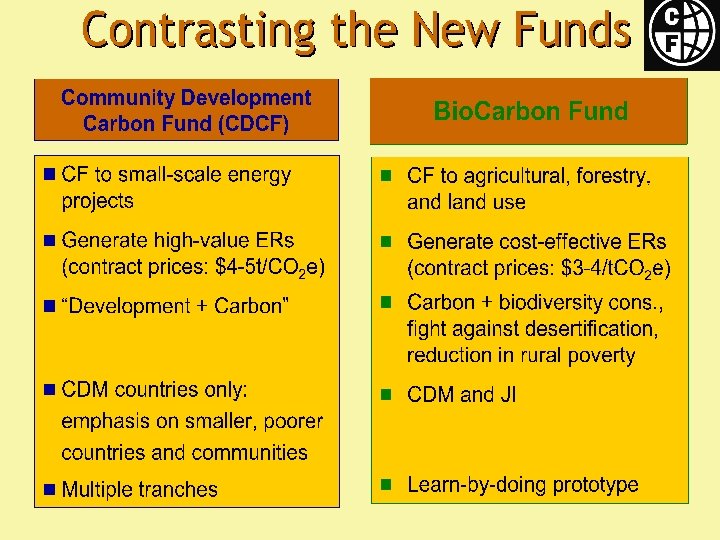

World Bank Carbon Finance Vehicles Netherlands CDM Facility Italian Carbon Fund Bio Carbon Fund

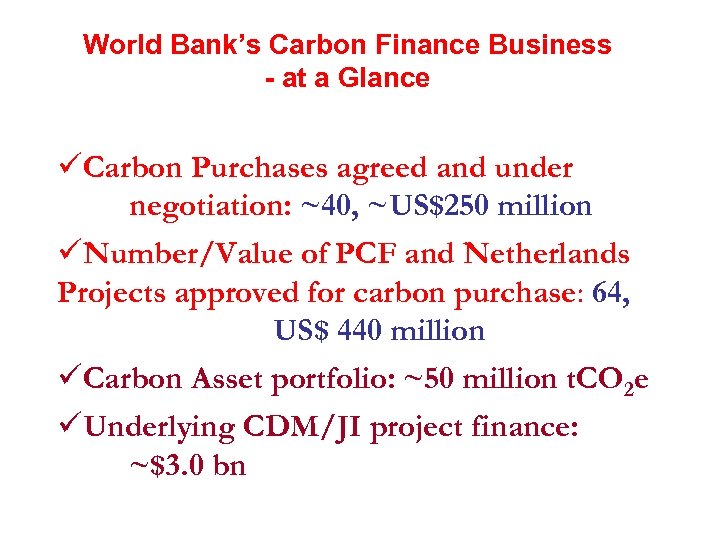

World Bank’s Carbon Finance Business - at a Glance üCarbon Purchases agreed and under negotiation: ~40, ~US$250 million üNumber/Value of PCF and Netherlands Projects approved for carbon purchase: 64, US$ 440 million üCarbon Asset portfolio: ~50 million t. CO 2 e üUnderlying CDM/JI project finance: ~$3. 0 bn

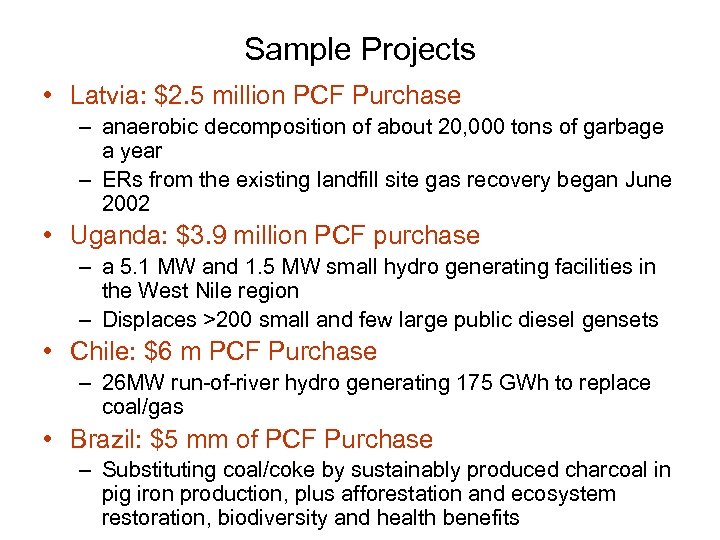

Sample Projects • Latvia: $2. 5 million PCF Purchase – anaerobic decomposition of about 20, 000 tons of garbage a year – ERs from the existing landfill site gas recovery began June 2002 • Uganda: $3. 9 million PCF purchase – a 5. 1 MW and 1. 5 MW small hydro generating facilities in the West Nile region – Displaces >200 small and few large public diesel gensets • Chile: $6 m PCF Purchase – 26 MW run-of-river hydro generating 175 GWh to replace coal/gas • Brazil: $5 mm of PCF Purchase – Substituting coal/coke by sustainably produced charcoal in pig iron production, plus afforestation and ecosystem restoration, biodiversity and health benefits

![Buyers of Carbon Credits [Mt. Ce/yr] (Source: Grubb, March 2003) Historical Emissions Low Surplus Buyers of Carbon Credits [Mt. Ce/yr] (Source: Grubb, March 2003) Historical Emissions Low Surplus](https://present5.com/presentation/2194343ba86fc29f1b3869c477f9530b/image-47.jpg)

Buyers of Carbon Credits [Mt. Ce/yr] (Source: Grubb, March 2003) Historical Emissions Low Surplus (High Demand, Low Supply) High Surplus (Low Demand, High Supply) 1990 2000 % change 2000 -2010 Carbon Balance 220 53 EU Carbon 911. 4 895. 5 7% 120 -3% 30 Japan Carbon 305. 3 313. 7 10% 58 -3% 17 Canada Carbon 128. 6 158. 0 15% 61 0% 37 + Net other GHGs (+5, -5%) 12 -2 - Managed forest allowance -30 GROSS DEMAND

![Sellers of Carbon Credits [Mt. Ceq/yr] (Grubb, March 2003) Historical Emissions Low Surplus (High Sellers of Carbon Credits [Mt. Ceq/yr] (Grubb, March 2003) Historical Emissions Low Surplus (High](https://present5.com/presentation/2194343ba86fc29f1b3869c477f9530b/image-48.jpg)

Sellers of Carbon Credits [Mt. Ceq/yr] (Grubb, March 2003) Historical Emissions Low Surplus (High Demand, Low Supply) High Surplus (Low Demand, High Supply) 1990 2000 % change 2000 -2010 Carbon Balance 331 587 647 450. 7 20% 106 0% 196 Ukraine Carbon 191. 9 104. 5 20% 67 0% 87 Accession 10 Carbon 245. 2 146. 6 25% 45 5% 75 Other EITs 87. 8 45. 4 25% 24 0% 36 Other GHGs (10, 20%) 24 79 + Managed forest allowance 40 40 SUPPLY Russia Carbon CDM 15 50

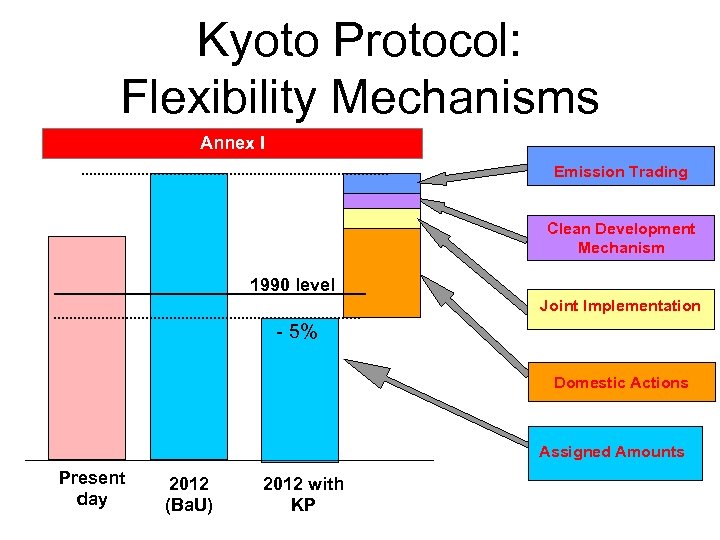

Kyoto Protocol: Flexibility Mechanisms Annex I Emission Trading Clean Development Mechanism 1990 level Joint Implementation - 5% Domestic Actions Assigned Amounts Present day 2012 (Ba. U) 2012 with KP

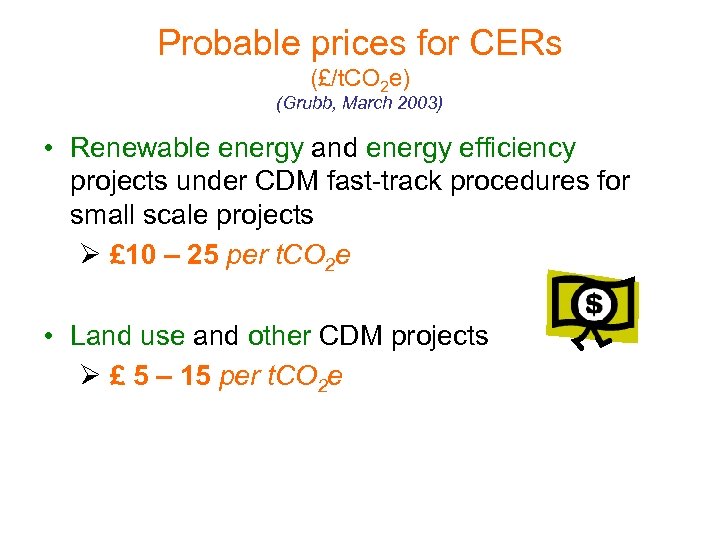

Probable prices for CERs (£/t. CO 2 e) (Grubb, March 2003) • Renewable energy and energy efficiency projects under CDM fast-track procedures for small scale projects Ø £ 10 – 25 per t. CO 2 e • Land use and other CDM projects Ø £ 5 – 15 per t. CO 2 e

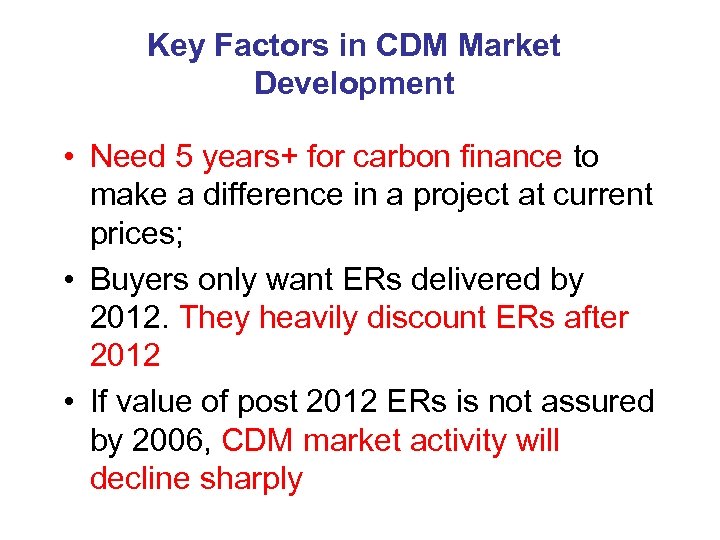

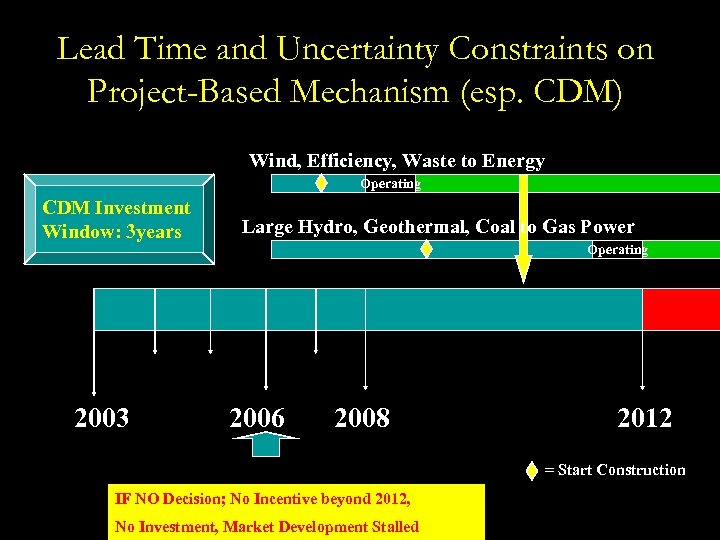

Key Factors in CDM Market Development • Need 5 years+ for carbon finance to make a difference in a project at current prices; • Buyers only want ERs delivered by 2012. They heavily discount ERs after 2012 • If value of post 2012 ERs is not assured by 2006, CDM market activity will decline sharply

Lead Time and Uncertainty Constraints on Project-Based Mechanism (esp. CDM) Wind, Efficiency, Waste to Energy Operating CDM Investment Window: 3 years 2003 Large Hydro, Geothermal, Coal to Gas Power Operating 2006 2008 2012 = Start Construction IF NO Decision; No Incentive beyond 2012, No Investment, Market Development Stalled

Roberto C. Yap, S. J. , Ph. D. Environmental Economist Climate Change Information Center Manila Observatory Ateneo de Manila University Tel +63 2 426 -6144 Fax +63 2 426 -6070 rcyap@ateneo. edu

2194343ba86fc29f1b3869c477f9530b.ppt