247eb3df0ea66f569a51700b1040ad17.ppt

- Количество слайдов: 42

Overcoming the Challenges of Modernizing Core Banking Systems Banking Vietnam, an IDG event Anselm De Souza Vice-President, Asia Pacific Sales System Access Limited, Singapore 17 -19 th May 2006, Melia, Hanoi, Vietnam

Agenda • Introduction • Key Questions – Why Change – Selection Criteria • Overcoming the challenges – Key Success Factors – Case Study – the Vietnam International Bank

Introduction

Key Questions • Why were Vietnamese banks taking extended period to roll-out their core systems • What were/are the challenges Vietnamese Banks faced when modernizing core systems? • Is this situation specific to Vietnam? • How can we do it better?

Questions to ask • Should we change? Why? • How do we choose? What are the criteria? • How do we prepare for change?

Should we change? Why?

Vietnam Banking Environment Overview

Vietnamese Banking Environment Overview • Vietnam economy grew 8. 4% in 2005 • State’s 10 -year Development Plan for the Banking Industry – Adopt international banking and business best practices – Better corporate governance – Market-based monetary management – Modernization of common systems – Promote Public Trust in the banking system

Vietnamese Banking Environment Overview • The World Bank’s initiative to modernize the Vietnam Banking Industry • Vietnam is still largely unbanked – 45% of money in cash – >50% of local business transactions done outside the banking system – Only 1. 3 Million Bank Accounts

Rationale for Acquiring New Core Banking Systems

Rationale for Replacement of Legacy CBS • • • Entry of foreign competition Increase Customer Sophistication Adoption of international best practices Delivery of international banking products Faster go to market More stringent regulatory requirements

Rationale for Replacement of Legacy CBS ÜTime is of the Essence! Opportunities for growth in the banking sector are so big that “local speculation in banking shares is running hot and heavy here on expectations that big foreign banks will buy into smaller local state-owned commercial banks toward the end of the year. ” -- Asia Times Online, April 19, 2006

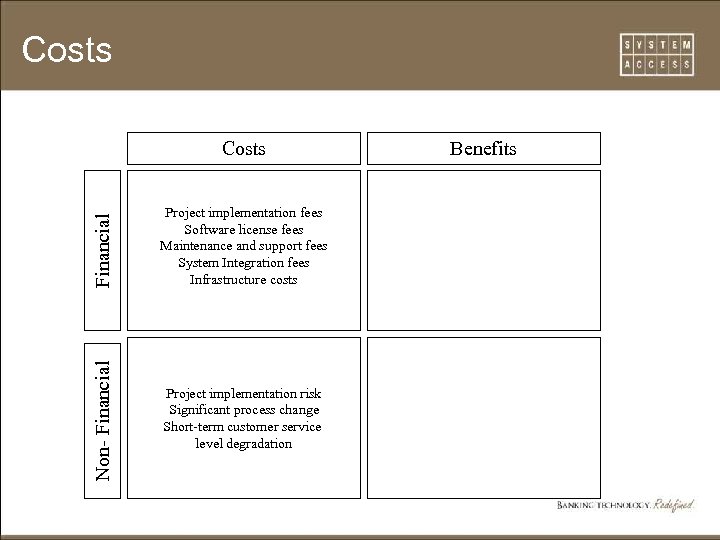

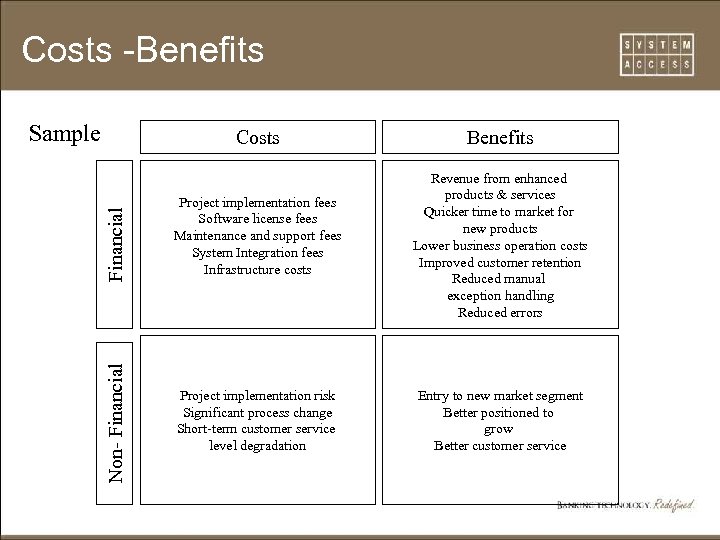

Costs Financial Project implementation fees Software license fees Maintenance and support fees System Integration fees Infrastructure costs Non- Financial Costs Project implementation risk Significant process change Short-term customer service level degradation Benefits

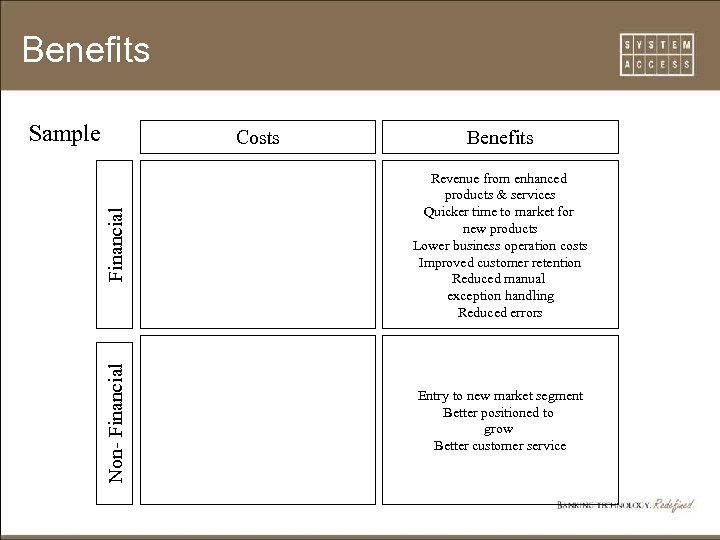

Benefits Sample Financial Benefits Revenue from enhanced products & services Quicker time to market for new products Lower business operation costs Improved customer retention Reduced manual exception handling Reduced errors Non- Financial Costs Entry to new market segment Better positioned to grow Better customer service

Costs -Benefits Sample Non- Financial Costs Project implementation fees Software license fees Maintenance and support fees System Integration fees Infrastructure costs Project implementation risk Significant process change Short-term customer service level degradation Benefits Revenue from enhanced products & services Quicker time to market for new products Lower business operation costs Improved customer retention Reduced manual exception handling Reduced errors Entry to new market segment Better positioned to grow Better customer service

How do we choose? Criteria for Selection of Core Banking Solutions

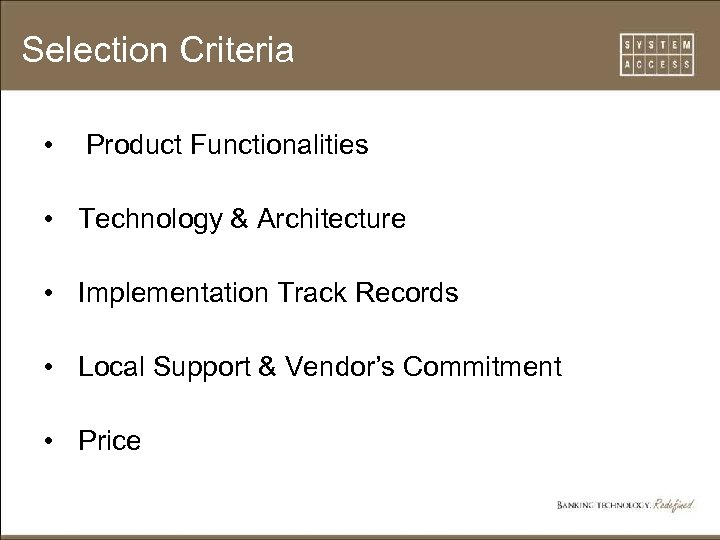

Selection Criteria • Product Functionalities • Technology & Architecture • Implementation Track Records • Local Support & Vendor’s Commitment • Price

Selection Criteria • Product Functionalities – Sufficient Functionality Coverage • Technology & Architecture – – – Scalability Flexibility Ease of Integration Interoperability with existing systems Security

Selection Criteria • Implementation Track Record – Global expertise and domain knowledge – Local project implementation experience

Selection Criteria • Local Support & Vendor’s Commitment – Tried and tested post-implementation support strategy – Local Product Support – Local Office

Selection Criteria • Price – Minimal Customizations on International CBS product – Short Implementation Time

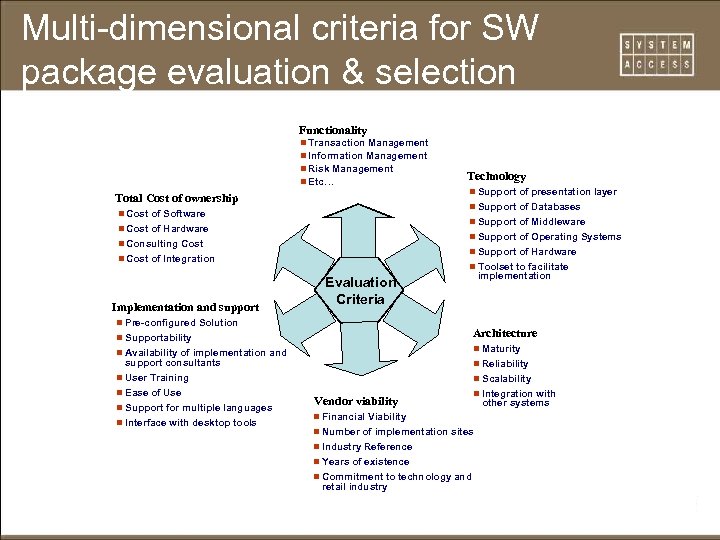

Multi-dimensional criteria for SW package evaluation & selection Functionality n Transaction Management n Information Management n Risk Management n Etc… Total Cost of ownership n Support of presentation layer n Support of Databases n Cost of Software n Support of Middleware n Cost of Hardware n Support of Operating Systems n Consulting Cost n Support of Hardware n Cost of Integration Implementation and support Technology n Toolset to facilitate implementation Evaluation Criteria n Pre-configured Solution Architecture n Supportability n Availability of implementation and n Maturity n User Training n Scalability support consultants n Ease of Use n Support for multiple languages n Interface with desktop tools n Reliability Vendor viability n Integration with n Financial Viability n Number of implementation sites n Industry Reference n Years of existence n Commitment to technology and retail industry other systems

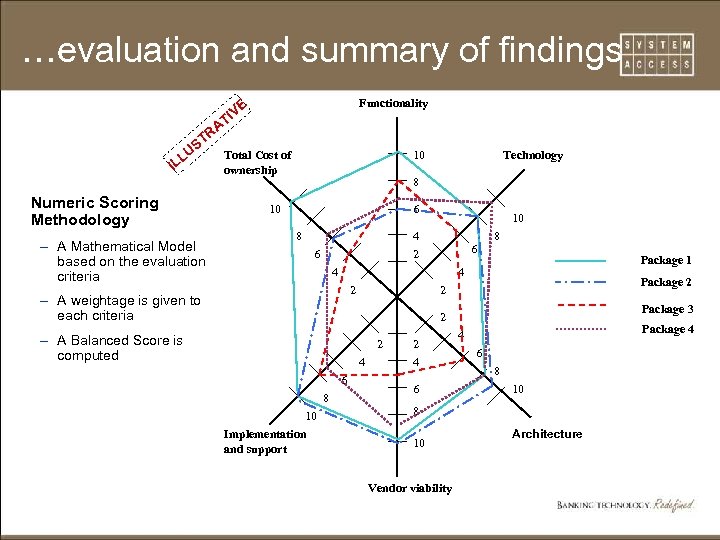

…evaluation and summary of findings Functionality E V TI A LU IL R ST Numeric Scoring Methodology – A Mathematical Model based on the evaluation criteria Total Cost of ownership 10 Technology 8 10 6 8 10 4 2 6 6 4 8 Package 1 4 2 – A weightage is given to each criteria Package 2 2 Package 3 2 – A Balanced Score is computed 2 4 6 8 10 Implementation and support 2 4 6 Package 4 4 6 8 10 Vendor viability Architecture

How to over come these challenges?

Challenges • To reduce evaluation process – more time to implement • To implement clear & objective evaluation scoring system • Look beyond the typical focus – Product Fit • Technical • Functional – Project • Timeline – Price

Note on Pricing “Project delays are very costly. The opportunity costs of any delays usually erode any benefits of the initially competitive financial proposition and more. -- Mr. Trinh Van Tuan, VIB Chairman

Key success factors 1. Internal Commitment – – Top down support Adequate Resourcing • – Strategic HR changes • • • – 20 -30 staff typically involved in project implementation whilst managing day to day activities Talent spotting Change management Redesigning jobs & roles Business Process Re-engineering

Key success factors • Vendor management – Management commitment – Adequate resourcing & project management – Partner strategy (one team, one goal) • • Bank staff & Vendor integration Culture and language

Case Study: Vietnam International Bank

About VIB Ü Vietnam International Bank (VIB) Ü Started in September 18, 1996 with an initial paid-up capital of 50 billion VNDs Ü At the beginning of 2005, chartered capital had amounted to 325 billion VNDs Ü 5 th Largest Joint Stock Bank in Vietnam Ü Goal to achieve very challenging growth targets for the next 10 years “Our bank has set out a plan to expand the current branch network of 34 branches, grow total assets, grow the number of customers, and widen range of products and services. This plan will ensure VIB attains a balanced portfolio of assets to strengthen the banks financial stability, a diversified sources of income as it achieves its growth targets”. -- Mr. Trinh Van Tuan, VIB Chairman

The Major Objectives • Rigid & Short Implementation Time Frame • “Big Bang”, simultaneous Live sites

VIB Selection Criteria • Legacy Core Banking System – Aging technology that cannot sustain growth • VIB’s Stringent Selection Criteria – – – Rich Functionality and Flexibility Robust Technical Specifications Operational Compatibility Technical Scalability Professional Service Standards and Management Support

Other Key Issues Faced Partner Issues Product Issues Ü Choosing the right solutions partner Ü Language and cultural barriers Ü Coordinating Team members separated geographically Ü Support international banking product offering and also local practices and processes Ü Local language support Ü Rapid implementation

How the eventual vendor was chosen • Selected from among several international banking vendors including the Top 5 global solution providers • Track record of successful project delivery On-Time and On-Budget. • Domain Knowledge and Understanding of VIB’s business

What VIB looked for in a partner “We are a bank, and project delays are very costly. The opportunity costs of any delays usually erode any benefits of the initially competitive financial proposition and more. We want a partner who will deliver on their promise. After thorough reference checks and site visits, the VIB team found that customers of System Access spoke highly of the company’s immense desire to work closely with the bank and deliver in the given timeline. ” -- Mr. Trinh Van Tuan, VIB Chairman

Project Approach • Both parties agreed on “Bank in a box” Approach – Vietnamese Localizations – Minimal Customization – International best practices & business process – Thorough training (knowledge transfer) – Introduction of Factory Acceptance Test – Full onsite support

How Partner rose to the occasion • Domain knowledge and Expertise to provide a Localized International CBS product – Flexibility of the product that is a readily customizable international product suitable for Vietnam banks – Complete understanding of the issues and challenges that arose – Hurdled the cultural and language barriers – Solid Project management

Successful Live Operations! • On 14 th April 2006, SYMBOLS went LIVE at VIB. • In only 10 months, VIB is now serving months – More than 70, 000 customers – Network of 34 branches, and – Covering more than 2000 KM throughout Vietnam using SYMBOLS CBS. • VIB is now set to Expand Acquire an even Bigger Domestic Customer Market share. • VIB is now ready to compete aggressively against bigger foreign banks when they enter Vietnam.

About Speaker

Anselm de Souza • Vice President, Sales Asia Pacific – 22 working experience in Financial Services Industry – Senior Regional Positions in: • • • Callatay & Wouters (Core & Private banking) Cash. Tech (Cash management) S 1 (E-Banking solutions) FICS (Corporate Banking Solutions) Dow Jones Marshalls Money Brokers

System Access At A Glance Ü Incorporated in 1983 – Focus on Banking Software Development & Implementation Ü 300+ staff across 13 Regional Offices in Bangkok, Beijing, Shanghai, Hanoi, Tokyo, Kuala Lumpur(x 2), Bangladesh, Bratislava, Dubai, Manila, Prague, and Karachi Ü 150+ banks in more than 25 countries across Asia Pacific, Middle East, Africa and Europe. Ü Major Shareholders – Management, IDA, Warburg Pincus & Private Investors Ü Listed in the Singapore Stock Exchange

247eb3df0ea66f569a51700b1040ad17.ppt