f3d70b954a1b87f1aa69a2a68bf6593d.ppt

- Количество слайдов: 28

Outsourcing and firm performance in the Italian manufacturing industry Pinuccia Calia, Silvia Pacei Dipartimento di Scienze Statistiche Università di Bologna L’analisi dei dati di impresa per la conoscenza del sistema produttivo italiano: il ruolo della statistica ufficiale 21 -22 novembre 2011 Istat - Roma

Outsourcing and firm performance in the Italian manufacturing industry Pinuccia Calia, Silvia Pacei Dipartimento di Scienze Statistiche Università di Bologna L’analisi dei dati di impresa per la conoscenza del sistema produttivo italiano: il ruolo della statistica ufficiale 21 -22 novembre 2011 Istat - Roma

Motivation (1) Fragmentation of production has increased without precedent in the last two decades, boosted by: - diffusion on ICT that made it possible to perform activities in any location (Grossman and Helpman 2005); - continuous decline of transportation costs that has facilitated the worldwide flows of goods (Hummels 2007). The fragmentation of production has more and more often gone beyond the boundaries of the firm, so as to involve other independent firms. In this case we can speak about “outsourcing”. If the outside supplier is an offshore company we speak about international outsourcing or off-shoring

Motivation (1) Fragmentation of production has increased without precedent in the last two decades, boosted by: - diffusion on ICT that made it possible to perform activities in any location (Grossman and Helpman 2005); - continuous decline of transportation costs that has facilitated the worldwide flows of goods (Hummels 2007). The fragmentation of production has more and more often gone beyond the boundaries of the firm, so as to involve other independent firms. In this case we can speak about “outsourcing”. If the outside supplier is an offshore company we speak about international outsourcing or off-shoring

Motivation (2) The scope of outsourcing is : - to take advantage of specialization and scale economies in production tasks by specialized suppliers ; - to gain flexibility to respond to demand changes quickly. As a consequence, firms may specialize in those activities where they have a competitive edge seeking to improve production efficiency, and consequently, their competitiveness (Dìaz-Mora, 2008). The fundamental question is whether outsourcing is value enhancing and, in particular, whether firms undertaking outsourcing benefit higher productivity and profitability.

Motivation (2) The scope of outsourcing is : - to take advantage of specialization and scale economies in production tasks by specialized suppliers ; - to gain flexibility to respond to demand changes quickly. As a consequence, firms may specialize in those activities where they have a competitive edge seeking to improve production efficiency, and consequently, their competitiveness (Dìaz-Mora, 2008). The fundamental question is whether outsourcing is value enhancing and, in particular, whether firms undertaking outsourcing benefit higher productivity and profitability.

Theoretical framework Grossman and Helpman (2002) provide a comprehensive analysis of firms’ outsourcing decision, building on transaction cost theory (Williamson 1975, 1985) and property right theory (Grossman and Hart, 1986). Outsourcing entails a variety of transaction costs that arise from the need of asset specific investment and the specification, monitoring and enforcement of contracts. On the contrary, outsourcing increases the flexibility in the production process as well as it allows to benefit from provider cost advantages derived from specialization, experience, economies of scale and location. Outsourcing is attractive only when transaction costs incurring from asset specificity, incomplete contracting and search efforts are lower than the production costs advantage.

Theoretical framework Grossman and Helpman (2002) provide a comprehensive analysis of firms’ outsourcing decision, building on transaction cost theory (Williamson 1975, 1985) and property right theory (Grossman and Hart, 1986). Outsourcing entails a variety of transaction costs that arise from the need of asset specific investment and the specification, monitoring and enforcement of contracts. On the contrary, outsourcing increases the flexibility in the production process as well as it allows to benefit from provider cost advantages derived from specialization, experience, economies of scale and location. Outsourcing is attractive only when transaction costs incurring from asset specificity, incomplete contracting and search efforts are lower than the production costs advantage.

Benefits of outsourcing Outsourcing allows access to better, cheaper and more varied (final and intermediate) inputs, because goods and services may be more efficiently produced by other firms and bought at a lower prices. The benefits of outsourcing on productivity and profitability derives principally form savings resources in terms of both labor costs and capital However it is an unresolved empirical issue whether outsourcing actually has a positive influence on a firm’s performance as is expected a priori.

Benefits of outsourcing Outsourcing allows access to better, cheaper and more varied (final and intermediate) inputs, because goods and services may be more efficiently produced by other firms and bought at a lower prices. The benefits of outsourcing on productivity and profitability derives principally form savings resources in terms of both labor costs and capital However it is an unresolved empirical issue whether outsourcing actually has a positive influence on a firm’s performance as is expected a priori.

Data Firm-level panel that put together data collected in different surveys and administrative archives (SCI, PMI, balance sheets archives) Years 1998 -2007 Target population: enterprises in industry and service sectors with twenty or more employees. Catch-up prospective panel: starting from firms surveyed in 1998 and then locating firms in the present by subsequent observation. New firms entering after 1998 are not included. Only firms which, after 1998, are survey respondent or are present in the BS archives at least for 4 years are included. We select manufacturing firms: 8, 235 in 1998, 5, 862 in 2007 with complete information.

Data Firm-level panel that put together data collected in different surveys and administrative archives (SCI, PMI, balance sheets archives) Years 1998 -2007 Target population: enterprises in industry and service sectors with twenty or more employees. Catch-up prospective panel: starting from firms surveyed in 1998 and then locating firms in the present by subsequent observation. New firms entering after 1998 are not included. Only firms which, after 1998, are survey respondent or are present in the BS archives at least for 4 years are included. We select manufacturing firms: 8, 235 in 1998, 5, 862 in 2007 with complete information.

Measures of outsourcing We measure outsourcing by “works contracted out to third parties on raw materials supplied to them” which refers to tasks which being a part of the own production process are carried out by other firms. Neither external services nor purchases of raw materials and supplies (office materials or fuel, ) are included. Subcontracts are included within this concept. This measure overcome the shortages implied by outsourcing measured as the value of material intermediate inputs: - it includes raw material purchases and arms-length purchases of standardized components in the market (Diaz-Mora, 2008). - it does not capture the outsourcing of the final production stage, the assembly or specific production tasks.

Measures of outsourcing We measure outsourcing by “works contracted out to third parties on raw materials supplied to them” which refers to tasks which being a part of the own production process are carried out by other firms. Neither external services nor purchases of raw materials and supplies (office materials or fuel, ) are included. Subcontracts are included within this concept. This measure overcome the shortages implied by outsourcing measured as the value of material intermediate inputs: - it includes raw material purchases and arms-length purchases of standardized components in the market (Diaz-Mora, 2008). - it does not capture the outsourcing of the final production stage, the assembly or specific production tasks.

Indicators of outsourcing intensity 1) The ratio of the value of outsourcing to the number of employees of the firm; 2) The ratio of the value of outsourcing to the total wage bill of the firm. Outsourcing can be seen as a substitute for inhouse production and hence may, in the short run, lead to a reduction in the total wage bill: the cost of outsourcing may be seen as the opportunity wage that would have occurred to in-house employees if these services had not been contracted out (Girma and Gorg, 2004). The two are related by a factor equal to the wage rate.

Indicators of outsourcing intensity 1) The ratio of the value of outsourcing to the number of employees of the firm; 2) The ratio of the value of outsourcing to the total wage bill of the firm. Outsourcing can be seen as a substitute for inhouse production and hence may, in the short run, lead to a reduction in the total wage bill: the cost of outsourcing may be seen as the opportunity wage that would have occurred to in-house employees if these services had not been contracted out (Girma and Gorg, 2004). The two are related by a factor equal to the wage rate.

Measures of performance Productivity indicator: labor productivity - ratio of operational value added to the number of employees. Profitability indicator: “per capita gross earnings before taxation” - ratio of EBITDA (the difference between value added and labor costs) to the number of employees (Görzig and Stephan, 2002; Giannelle and Tattara, 2009).

Measures of performance Productivity indicator: labor productivity - ratio of operational value added to the number of employees. Profitability indicator: “per capita gross earnings before taxation” - ratio of EBITDA (the difference between value added and labor costs) to the number of employees (Görzig and Stephan, 2002; Giannelle and Tattara, 2009).

Some summary statistics (1) The percentage of firms which outsource range between 70% and 74% across years. Neither all the firms that start to outsource continue in the next years nor the outsourcing firms are the same every year Considering the pure panel (60% of all the firms in 1998): - 23% of firms outsource every year - 19% outsource almost all the years but one. - 3% of firms never outsource, - 54% follows all the other patterns of behaviour

Some summary statistics (1) The percentage of firms which outsource range between 70% and 74% across years. Neither all the firms that start to outsource continue in the next years nor the outsourcing firms are the same every year Considering the pure panel (60% of all the firms in 1998): - 23% of firms outsource every year - 19% outsource almost all the years but one. - 3% of firms never outsource, - 54% follows all the other patterns of behaviour

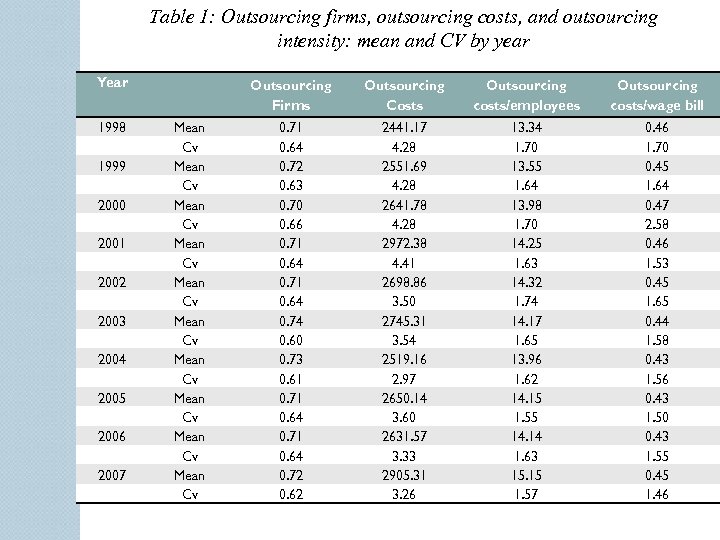

Table 1: Outsourcing firms, outsourcing costs, and outsourcing intensity: mean and CV by year Year 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Mean Cv Mean Cv Mean Cv Outsourcing Firms Outsourcing Costs Outsourcing costs/employees Outsourcing costs/wage bill 0. 71 0. 64 0. 72 0. 63 0. 70 0. 66 0. 71 0. 64 0. 74 0. 60 0. 73 0. 61 0. 71 0. 64 0. 72 0. 62 2441. 17 4. 28 2551. 69 4. 28 2641. 78 4. 28 2972. 38 4. 41 2698. 86 3. 50 2745. 31 3. 54 2519. 16 2. 97 2650. 14 3. 60 2631. 57 3. 33 2905. 31 3. 26 13. 34 1. 70 13. 55 1. 64 13. 98 1. 70 14. 25 1. 63 14. 32 1. 74 14. 17 1. 65 13. 96 1. 62 14. 15 1. 55 14. 14 1. 63 15. 15 1. 57 0. 46 1. 70 0. 45 1. 64 0. 47 2. 58 0. 46 1. 53 0. 45 1. 65 0. 44 1. 58 0. 43 1. 56 0. 43 1. 50 0. 43 1. 55 0. 45 1. 46

Table 1: Outsourcing firms, outsourcing costs, and outsourcing intensity: mean and CV by year Year 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Mean Cv Mean Cv Mean Cv Outsourcing Firms Outsourcing Costs Outsourcing costs/employees Outsourcing costs/wage bill 0. 71 0. 64 0. 72 0. 63 0. 70 0. 66 0. 71 0. 64 0. 74 0. 60 0. 73 0. 61 0. 71 0. 64 0. 72 0. 62 2441. 17 4. 28 2551. 69 4. 28 2641. 78 4. 28 2972. 38 4. 41 2698. 86 3. 50 2745. 31 3. 54 2519. 16 2. 97 2650. 14 3. 60 2631. 57 3. 33 2905. 31 3. 26 13. 34 1. 70 13. 55 1. 64 13. 98 1. 70 14. 25 1. 63 14. 32 1. 74 14. 17 1. 65 13. 96 1. 62 14. 15 1. 55 14. 14 1. 63 15. 15 1. 57 0. 46 1. 70 0. 45 1. 64 0. 47 2. 58 0. 46 1. 53 0. 45 1. 65 0. 44 1. 58 0. 43 1. 56 0. 43 1. 50 0. 43 1. 55 0. 45 1. 46

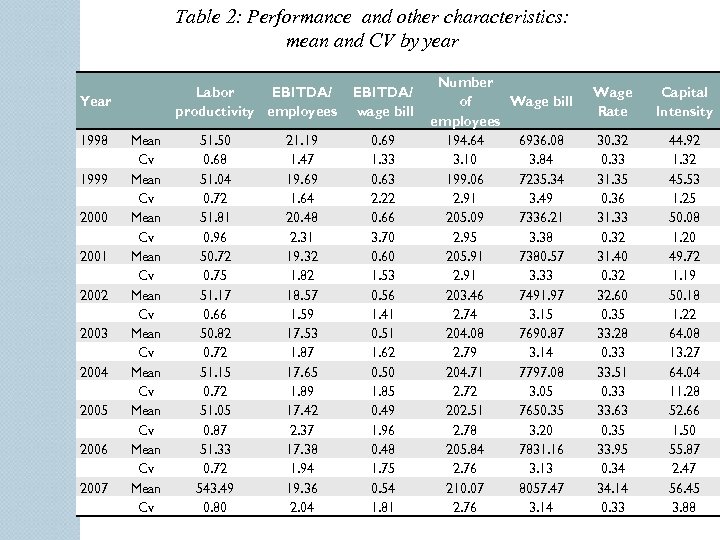

Some summary statistics (2) Outsourcing/employees increases slightly every year Outsourcing/wage bill remains almost constant and decreases a bit after 2002. The number of employees tends to remain almost stable across years while the wage bill increases steadily, due to the increase in wage rate EBITDA /employee stays more or less constant EBITDA /wage bill declines steadily till the last year considered. Labor productivity, on the contrary, is constant through the period

Some summary statistics (2) Outsourcing/employees increases slightly every year Outsourcing/wage bill remains almost constant and decreases a bit after 2002. The number of employees tends to remain almost stable across years while the wage bill increases steadily, due to the increase in wage rate EBITDA /employee stays more or less constant EBITDA /wage bill declines steadily till the last year considered. Labor productivity, on the contrary, is constant through the period

Table 2: Performance and other characteristics: mean and CV by year Labor EBITDA/ productivity employees Year 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Mean Cv Mean Cv Mean Cv 51. 50 0. 68 51. 04 0. 72 51. 81 0. 96 50. 72 0. 75 51. 17 0. 66 50. 82 0. 72 51. 15 0. 72 51. 05 0. 87 51. 33 0. 72 543. 49 0. 80 21. 19 1. 47 19. 69 1. 64 20. 48 2. 31 19. 32 1. 82 18. 57 1. 59 17. 53 1. 87 17. 65 1. 89 17. 42 2. 37 17. 38 1. 94 19. 36 2. 04 EBITDA/ wage bill 0. 69 1. 33 0. 63 2. 22 0. 66 3. 70 0. 60 1. 53 0. 56 1. 41 0. 51 1. 62 0. 50 1. 85 0. 49 1. 96 0. 48 1. 75 0. 54 1. 81 Number Wage bill of employees 194. 64 6936. 08 3. 10 3. 84 199. 06 7235. 34 2. 91 3. 49 205. 09 7336. 21 2. 95 3. 38 205. 91 7380. 57 2. 91 3. 33 203. 46 7491. 97 2. 74 3. 15 204. 08 7690. 87 2. 79 3. 14 204. 71 7797. 08 2. 72 3. 05 202. 51 7650. 35 2. 78 3. 20 205. 84 7831. 16 2. 76 3. 13 210. 07 8057. 47 2. 76 3. 14 Wage Rate Capital Intensity 30. 32 0. 33 31. 35 0. 36 31. 33 0. 32 31. 40 0. 32 32. 60 0. 35 33. 28 0. 33 33. 51 0. 33 33. 63 0. 35 33. 95 0. 34 34. 14 0. 33 44. 92 1. 32 45. 53 1. 25 50. 08 1. 20 49. 72 1. 19 50. 18 1. 22 64. 08 13. 27 64. 04 11. 28 52. 66 1. 50 55. 87 2. 47 56. 45 3. 88

Table 2: Performance and other characteristics: mean and CV by year Labor EBITDA/ productivity employees Year 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Mean Cv Mean Cv Mean Cv 51. 50 0. 68 51. 04 0. 72 51. 81 0. 96 50. 72 0. 75 51. 17 0. 66 50. 82 0. 72 51. 15 0. 72 51. 05 0. 87 51. 33 0. 72 543. 49 0. 80 21. 19 1. 47 19. 69 1. 64 20. 48 2. 31 19. 32 1. 82 18. 57 1. 59 17. 53 1. 87 17. 65 1. 89 17. 42 2. 37 17. 38 1. 94 19. 36 2. 04 EBITDA/ wage bill 0. 69 1. 33 0. 63 2. 22 0. 66 3. 70 0. 60 1. 53 0. 56 1. 41 0. 51 1. 62 0. 50 1. 85 0. 49 1. 96 0. 48 1. 75 0. 54 1. 81 Number Wage bill of employees 194. 64 6936. 08 3. 10 3. 84 199. 06 7235. 34 2. 91 3. 49 205. 09 7336. 21 2. 95 3. 38 205. 91 7380. 57 2. 91 3. 33 203. 46 7491. 97 2. 74 3. 15 204. 08 7690. 87 2. 79 3. 14 204. 71 7797. 08 2. 72 3. 05 202. 51 7650. 35 2. 78 3. 20 205. 84 7831. 16 2. 76 3. 13 210. 07 8057. 47 2. 76 3. 14 Wage Rate Capital Intensity 30. 32 0. 33 31. 35 0. 36 31. 33 0. 32 31. 40 0. 32 32. 60 0. 35 33. 28 0. 33 33. 51 0. 33 33. 63 0. 35 33. 95 0. 34 34. 14 0. 33 44. 92 1. 32 45. 53 1. 25 50. 08 1. 20 49. 72 1. 19 50. 18 1. 22 64. 08 13. 27 64. 04 11. 28 52. 66 1. 50 55. 87 2. 47 56. 45 3. 88

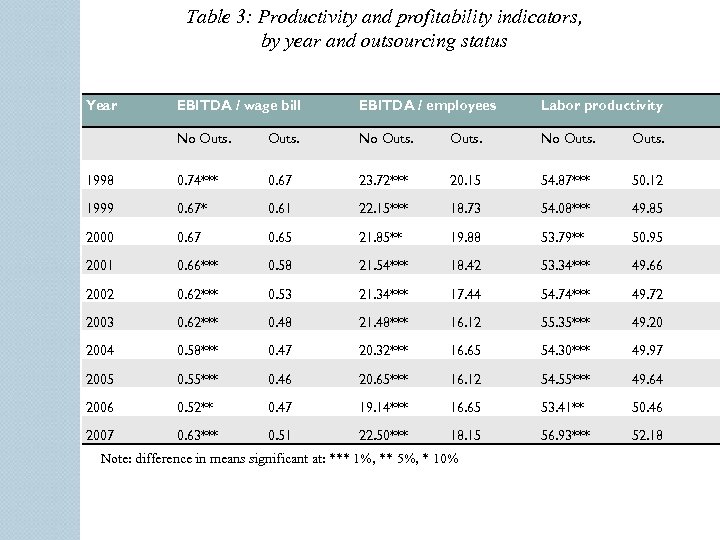

Table 3: Productivity and profitability indicators, by year and outsourcing status Year EBITDA / wage bill EBITDA / employees Labor productivity No Outs. 1998 0. 74*** 0. 67 23. 72*** 20. 15 54. 87*** 50. 12 1999 0. 67* 0. 61 22. 15*** 18. 73 54. 08*** 49. 85 2000 0. 67 0. 65 21. 85** 19. 88 53. 79** 50. 95 2001 0. 66*** 0. 58 21. 54*** 18. 42 53. 34*** 49. 66 2002 0. 62*** 0. 53 21. 34*** 17. 44 54. 74*** 49. 72 2003 0. 62*** 0. 48 21. 48*** 16. 12 55. 35*** 49. 20 2004 0. 58*** 0. 47 20. 32*** 16. 65 54. 30*** 49. 97 2005 0. 55*** 0. 46 20. 65*** 16. 12 54. 55*** 49. 64 2006 0. 52** 0. 47 19. 14*** 16. 65 53. 41** 50. 46 2007 0. 63*** 0. 51 22. 50*** 18. 15 56. 93*** 52. 18 Note: difference in means significant at: *** 1%, ** 5%, * 10%

Table 3: Productivity and profitability indicators, by year and outsourcing status Year EBITDA / wage bill EBITDA / employees Labor productivity No Outs. 1998 0. 74*** 0. 67 23. 72*** 20. 15 54. 87*** 50. 12 1999 0. 67* 0. 61 22. 15*** 18. 73 54. 08*** 49. 85 2000 0. 67 0. 65 21. 85** 19. 88 53. 79** 50. 95 2001 0. 66*** 0. 58 21. 54*** 18. 42 53. 34*** 49. 66 2002 0. 62*** 0. 53 21. 34*** 17. 44 54. 74*** 49. 72 2003 0. 62*** 0. 48 21. 48*** 16. 12 55. 35*** 49. 20 2004 0. 58*** 0. 47 20. 32*** 16. 65 54. 30*** 49. 97 2005 0. 55*** 0. 46 20. 65*** 16. 12 54. 55*** 49. 64 2006 0. 52** 0. 47 19. 14*** 16. 65 53. 41** 50. 46 2007 0. 63*** 0. 51 22. 50*** 18. 15 56. 93*** 52. 18 Note: difference in means significant at: *** 1%, ** 5%, * 10%

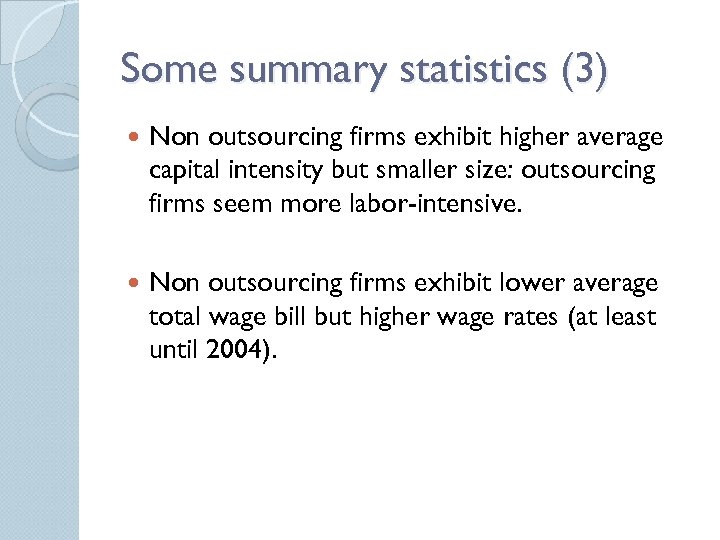

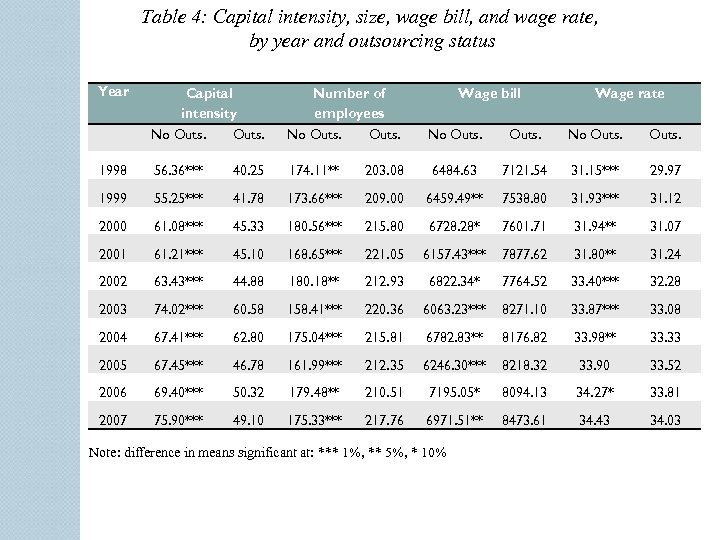

Some summary statistics (3) Non outsourcing firms exhibit higher average capital intensity but smaller size: outsourcing firms seem more labor-intensive. Non outsourcing firms exhibit lower average total wage bill but higher wage rates (at least until 2004).

Some summary statistics (3) Non outsourcing firms exhibit higher average capital intensity but smaller size: outsourcing firms seem more labor-intensive. Non outsourcing firms exhibit lower average total wage bill but higher wage rates (at least until 2004).

Table 4: Capital intensity, size, wage bill, and wage rate, by year and outsourcing status Year Capital intensity Number of employees Wage bill Wage rate No Outs. 1998 56. 36*** 40. 25 174. 11** 203. 08 6484. 63 7121. 54 31. 15*** 29. 97 1999 55. 25*** 41. 78 173. 66*** 209. 00 6459. 49** 7538. 80 31. 93*** 31. 12 2000 61. 08*** 45. 33 180. 56*** 215. 80 6728. 28* 7601. 71 31. 94** 31. 07 2001 61. 21*** 45. 10 168. 65*** 221. 05 6157. 43*** 7877. 62 31. 80** 31. 24 2002 63. 43*** 44. 88 180. 18** 212. 93 6822. 34* 7764. 52 33. 40*** 32. 28 2003 74. 02*** 60. 58 158. 41*** 220. 36 6063. 23*** 8271. 10 33. 87*** 33. 08 2004 67. 41*** 62. 80 175. 04*** 215. 81 6782. 83** 8176. 82 33. 98** 33. 33 2005 67. 45*** 46. 78 161. 99*** 212. 35 6246. 30*** 8218. 32 33. 90 33. 52 2006 69. 40*** 50. 32 179. 48** 210. 51 7195. 05* 8094. 13 34. 27* 33. 81 2007 75. 90*** 49. 10 175. 33*** 217. 76 6971. 51** 8473. 61 34. 43 34. 03 Note: difference in means significant at: *** 1%, ** 5%, * 10%

Table 4: Capital intensity, size, wage bill, and wage rate, by year and outsourcing status Year Capital intensity Number of employees Wage bill Wage rate No Outs. 1998 56. 36*** 40. 25 174. 11** 203. 08 6484. 63 7121. 54 31. 15*** 29. 97 1999 55. 25*** 41. 78 173. 66*** 209. 00 6459. 49** 7538. 80 31. 93*** 31. 12 2000 61. 08*** 45. 33 180. 56*** 215. 80 6728. 28* 7601. 71 31. 94** 31. 07 2001 61. 21*** 45. 10 168. 65*** 221. 05 6157. 43*** 7877. 62 31. 80** 31. 24 2002 63. 43*** 44. 88 180. 18** 212. 93 6822. 34* 7764. 52 33. 40*** 32. 28 2003 74. 02*** 60. 58 158. 41*** 220. 36 6063. 23*** 8271. 10 33. 87*** 33. 08 2004 67. 41*** 62. 80 175. 04*** 215. 81 6782. 83** 8176. 82 33. 98** 33. 33 2005 67. 45*** 46. 78 161. 99*** 212. 35 6246. 30*** 8218. 32 33. 90 33. 52 2006 69. 40*** 50. 32 179. 48** 210. 51 7195. 05* 8094. 13 34. 27* 33. 81 2007 75. 90*** 49. 10 175. 33*** 217. 76 6971. 51** 8473. 61 34. 43 34. 03 Note: difference in means significant at: *** 1%, ** 5%, * 10%

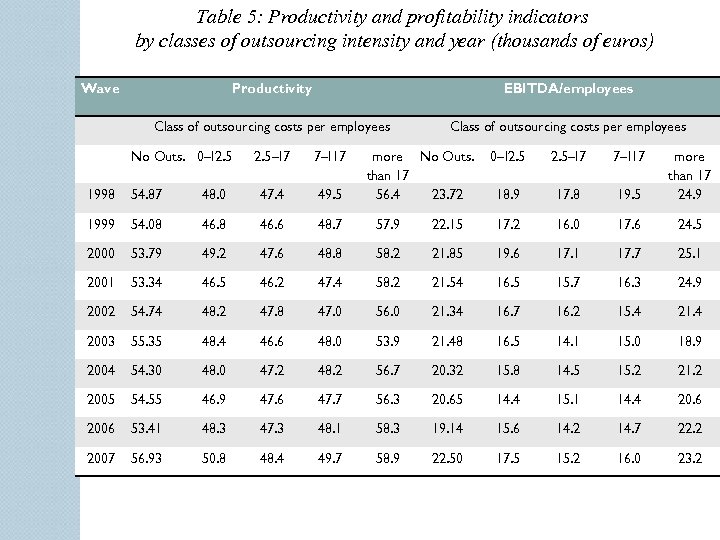

Table 5: Productivity and profitability indicators by classes of outsourcing intensity and year (thousands of euros) Wave Productivity EBITDA/employees Class of outsourcing costs per employees No Outs. 0 ǀ2. 5 ǀ7 7 ǀ17 Class of outsourcing costs per employees more No Outs. than 17 56. 4 23. 72 0 ǀ2. 5 ǀ7 7 ǀ17 18. 9 17. 8 19. 5 more than 17 24. 9 1998 54. 87 48. 0 47. 4 49. 5 1999 54. 08 46. 6 48. 7 57. 9 22. 15 17. 2 16. 0 17. 6 24. 5 2000 53. 79 49. 2 47. 6 48. 8 58. 2 21. 85 19. 6 17. 1 17. 7 25. 1 2001 53. 34 46. 5 46. 2 47. 4 58. 2 21. 54 16. 5 15. 7 16. 3 24. 9 2002 54. 74 48. 2 47. 8 47. 0 56. 0 21. 34 16. 7 16. 2 15. 4 21. 4 2003 55. 35 48. 4 46. 6 48. 0 53. 9 21. 48 16. 5 14. 1 15. 0 18. 9 2004 54. 30 48. 0 47. 2 48. 2 56. 7 20. 32 15. 8 14. 5 15. 2 21. 2 2005 54. 55 46. 9 47. 6 47. 7 56. 3 20. 65 14. 4 15. 1 14. 4 20. 6 2006 53. 41 48. 3 47. 3 48. 1 58. 3 19. 14 15. 6 14. 2 14. 7 22. 2 2007 56. 93 50. 8 48. 4 49. 7 58. 9 22. 50 17. 5 15. 2 16. 0 23. 2

Table 5: Productivity and profitability indicators by classes of outsourcing intensity and year (thousands of euros) Wave Productivity EBITDA/employees Class of outsourcing costs per employees No Outs. 0 ǀ2. 5 ǀ7 7 ǀ17 Class of outsourcing costs per employees more No Outs. than 17 56. 4 23. 72 0 ǀ2. 5 ǀ7 7 ǀ17 18. 9 17. 8 19. 5 more than 17 24. 9 1998 54. 87 48. 0 47. 4 49. 5 1999 54. 08 46. 6 48. 7 57. 9 22. 15 17. 2 16. 0 17. 6 24. 5 2000 53. 79 49. 2 47. 6 48. 8 58. 2 21. 85 19. 6 17. 1 17. 7 25. 1 2001 53. 34 46. 5 46. 2 47. 4 58. 2 21. 54 16. 5 15. 7 16. 3 24. 9 2002 54. 74 48. 2 47. 8 47. 0 56. 0 21. 34 16. 7 16. 2 15. 4 21. 4 2003 55. 35 48. 4 46. 6 48. 0 53. 9 21. 48 16. 5 14. 1 15. 0 18. 9 2004 54. 30 48. 0 47. 2 48. 2 56. 7 20. 32 15. 8 14. 5 15. 2 21. 2 2005 54. 55 46. 9 47. 6 47. 7 56. 3 20. 65 14. 4 15. 1 14. 4 20. 6 2006 53. 41 48. 3 47. 3 48. 1 58. 3 19. 14 15. 6 14. 2 14. 7 22. 2 2007 56. 93 50. 8 48. 4 49. 7 58. 9 22. 50 17. 5 15. 2 16. 0 23. 2

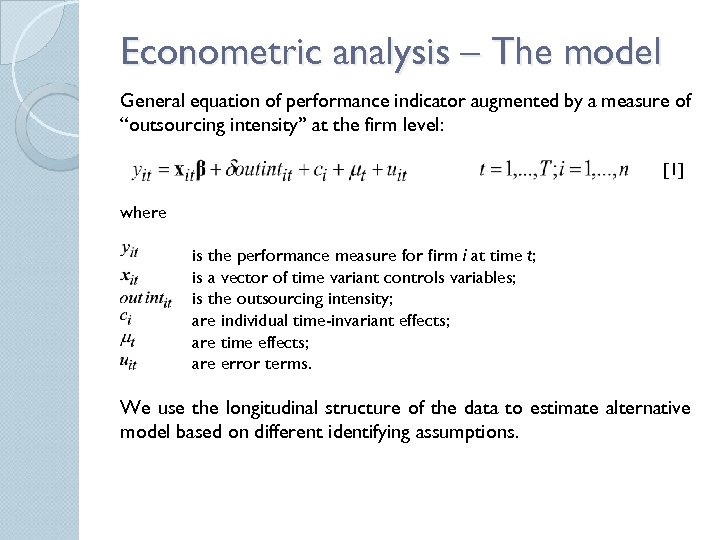

Econometric analysis – The model General equation of performance indicator augmented by a measure of “outsourcing intensity” at the firm level: [1] where is the performance measure for firm i at time t; is a vector of time variant controls variables; is the outsourcing intensity; are individual time-invariant effects; are time effects; are error terms. We use the longitudinal structure of the data to estimate alternative model based on different identifying assumptions.

Econometric analysis – The model General equation of performance indicator augmented by a measure of “outsourcing intensity” at the firm level: [1] where is the performance measure for firm i at time t; is a vector of time variant controls variables; is the outsourcing intensity; are individual time-invariant effects; are time effects; are error terms. We use the longitudinal structure of the data to estimate alternative model based on different identifying assumptions.

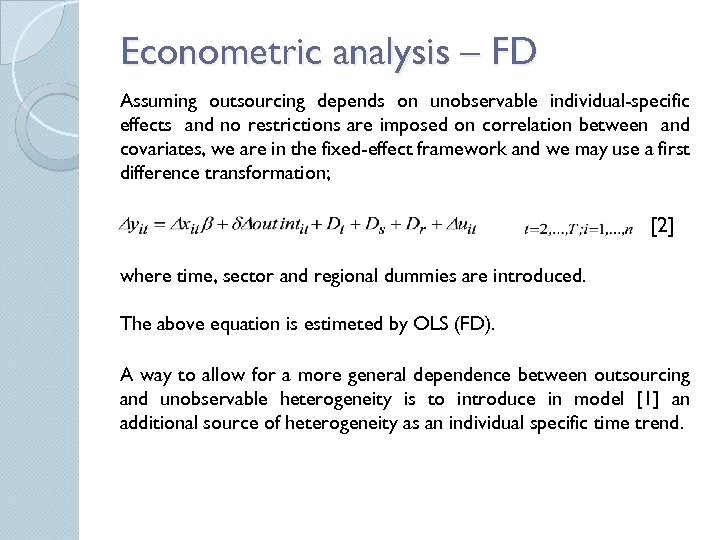

Econometric analysis – FD Assuming outsourcing depends on unobservable individual-specific effects and no restrictions are imposed on correlation between and covariates, we are in the fixed-effect framework and we may use a first difference transformation; [2] where time, sector and regional dummies are introduced. The above equation is estimeted by OLS (FD). A way to allow for a more general dependence between outsourcing and unobservable heterogeneity is to introduce in model [1] an additional source of heterogeneity as an individual specific time trend.

Econometric analysis – FD Assuming outsourcing depends on unobservable individual-specific effects and no restrictions are imposed on correlation between and covariates, we are in the fixed-effect framework and we may use a first difference transformation; [2] where time, sector and regional dummies are introduced. The above equation is estimeted by OLS (FD). A way to allow for a more general dependence between outsourcing and unobservable heterogeneity is to introduce in model [1] an additional source of heterogeneity as an individual specific time trend.

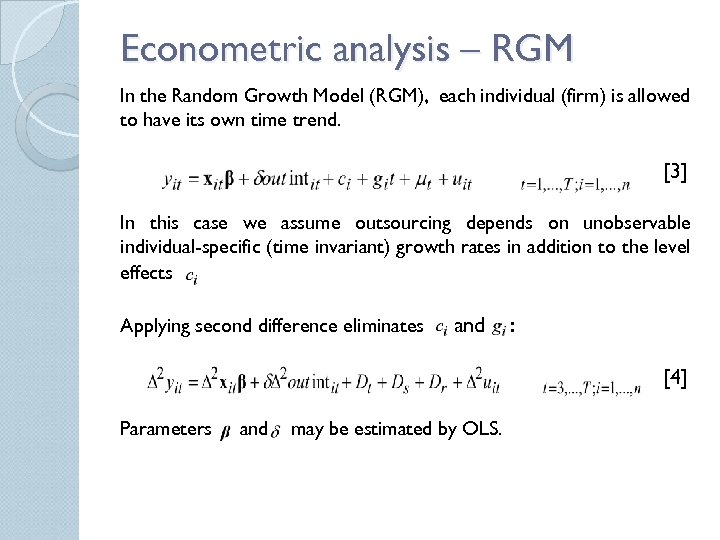

Econometric analysis – RGM In the Random Growth Model (RGM), each individual (firm) is allowed to have its own time trend. [3] In this case we assume outsourcing depends on unobservable individual-specific (time invariant) growth rates in addition to the level effects Applying second difference eliminates and : [4] Parameters and may be estimated by OLS.

Econometric analysis – RGM In the Random Growth Model (RGM), each individual (firm) is allowed to have its own time trend. [3] In this case we assume outsourcing depends on unobservable individual-specific (time invariant) growth rates in addition to the level effects Applying second difference eliminates and : [4] Parameters and may be estimated by OLS.

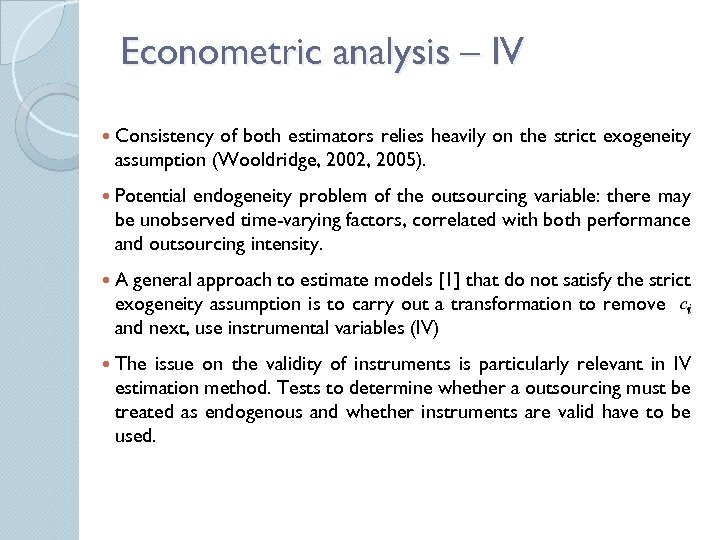

Econometric analysis – IV Consistency of both estimators relies heavily on the strict exogeneity assumption (Wooldridge, 2002, 2005). Potential endogeneity problem of the outsourcing variable: there may be unobserved time-varying factors, correlated with both performance and outsourcing intensity. A general approach to estimate models [1] that do not satisfy the strict exogeneity assumption is to carry out a transformation to remove , and next, use instrumental variables (IV) The issue on the validity of instruments is particularly relevant in IV estimation method. Tests to determine whether a outsourcing must be treated as endogenous and whether instruments are valid have to be used.

Econometric analysis – IV Consistency of both estimators relies heavily on the strict exogeneity assumption (Wooldridge, 2002, 2005). Potential endogeneity problem of the outsourcing variable: there may be unobserved time-varying factors, correlated with both performance and outsourcing intensity. A general approach to estimate models [1] that do not satisfy the strict exogeneity assumption is to carry out a transformation to remove , and next, use instrumental variables (IV) The issue on the validity of instruments is particularly relevant in IV estimation method. Tests to determine whether a outsourcing must be treated as endogenous and whether instruments are valid have to be used.

Econometric analysis – IV We choose instruments for outsourcing intensity among the following variables (in logarithm) - skilled and unskilled wages rates - white collar ratio, either calculated as second differences and lagged differences We consider the three above estimation strategies: FD, RGM and IV. All models are estimated using a robust methods for standard errors to allow for heteroskedasticity as well as an unspecified correlation within but not across firm’s error terms.

Econometric analysis – IV We choose instruments for outsourcing intensity among the following variables (in logarithm) - skilled and unskilled wages rates - white collar ratio, either calculated as second differences and lagged differences We consider the three above estimation strategies: FD, RGM and IV. All models are estimated using a robust methods for standard errors to allow for heteroskedasticity as well as an unspecified correlation within but not across firm’s error terms.

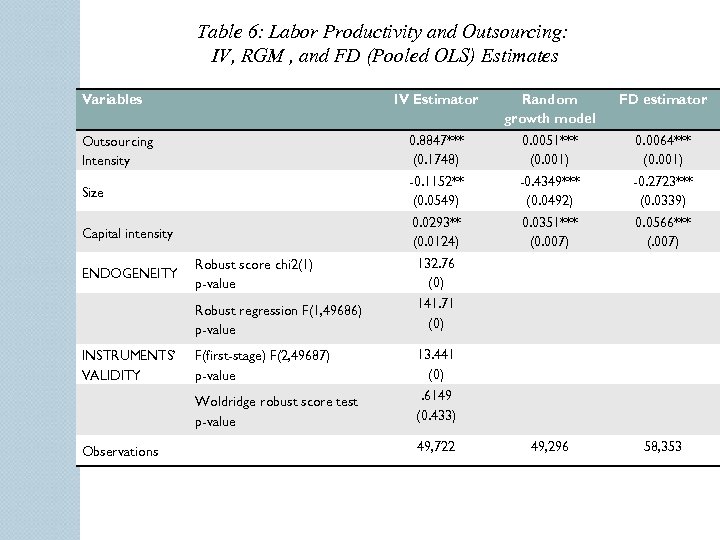

Results - Productivity Dependent variable: log of labor productivity. Covariates: log of capital intensity; log of size; log of outsourcing per employees; time, sector and territorial repartition dummies. Instruments for outsourcing: second difference of the log of wage rate for skilled and unskilled workers. IV Estimates results: all coefficients are significant. The elasticity of labor productivity with respect to outsourcing is 0. 88%. FD and RGM results: same sign observed for IV but much smaller values. Similar results between FD and RGM.

Results - Productivity Dependent variable: log of labor productivity. Covariates: log of capital intensity; log of size; log of outsourcing per employees; time, sector and territorial repartition dummies. Instruments for outsourcing: second difference of the log of wage rate for skilled and unskilled workers. IV Estimates results: all coefficients are significant. The elasticity of labor productivity with respect to outsourcing is 0. 88%. FD and RGM results: same sign observed for IV but much smaller values. Similar results between FD and RGM.

Table 6: Labor Productivity and Outsourcing: IV, RGM , and FD (Pooled OLS) Estimates Variables IV Estimator Random growth model FD estimator Outsourcing Intensity 0. 8847*** (0. 1748) 0. 0051*** (0. 001) 0. 0064*** (0. 001) Size -0. 1152** (0. 0549) -0. 4349*** (0. 0492) -0. 2723*** (0. 0339) Capital intensity 0. 0293** (0. 0124) 0. 0351*** (0. 007) 0. 0566*** (. 007) 49, 296 58, 353 Observations 132. 76 (0) 141. 71 (0) F(first-stage) F(2, 49687) p-value 13. 441 (0) Woldridge robust score test p-value INSTRUMENTS’ VALIDITY Robust score chi 2(1) p-value Robust regression F(1, 49686) p-value ENDOGENEITY . 6149 (0. 433) 49, 722

Table 6: Labor Productivity and Outsourcing: IV, RGM , and FD (Pooled OLS) Estimates Variables IV Estimator Random growth model FD estimator Outsourcing Intensity 0. 8847*** (0. 1748) 0. 0051*** (0. 001) 0. 0064*** (0. 001) Size -0. 1152** (0. 0549) -0. 4349*** (0. 0492) -0. 2723*** (0. 0339) Capital intensity 0. 0293** (0. 0124) 0. 0351*** (0. 007) 0. 0566*** (. 007) 49, 296 58, 353 Observations 132. 76 (0) 141. 71 (0) F(first-stage) F(2, 49687) p-value 13. 441 (0) Woldridge robust score test p-value INSTRUMENTS’ VALIDITY Robust score chi 2(1) p-value Robust regression F(1, 49686) p-value ENDOGENEITY . 6149 (0. 433) 49, 722

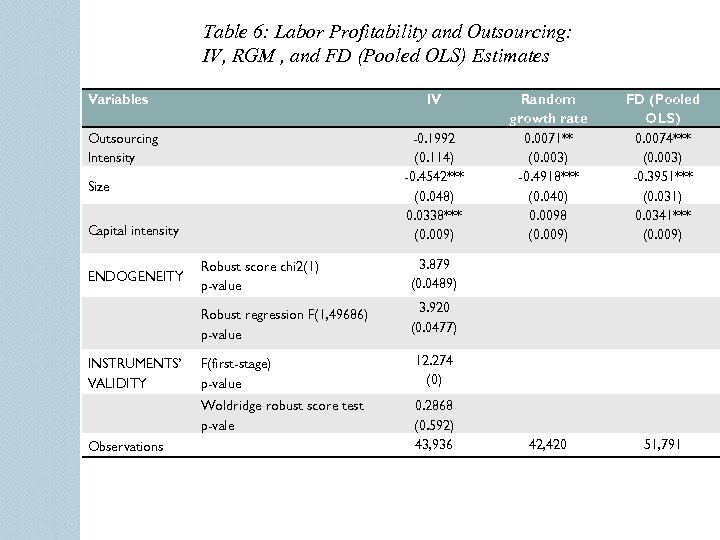

Results - Profitability Dependent variable: log of EBITDA per employees. Covariates: log of capital intensity; log of size; log of outsourcing per employees; time, sector and territorial repartition dummies. Instruments for outsourcing: second difference of -log of wage rate for skilled workers -log of white collar ratio. IV Estimates results: The outsourcing intensity has a negative but not significant effect on profitability. Between the two components of the value added (EBITDA and labor costs) outsourcing affects mainly the labor costs per employee. FD and RGM results: effect of outsourcing is positive (even if very small) and significant. Similar results between FD and RGM.

Results - Profitability Dependent variable: log of EBITDA per employees. Covariates: log of capital intensity; log of size; log of outsourcing per employees; time, sector and territorial repartition dummies. Instruments for outsourcing: second difference of -log of wage rate for skilled workers -log of white collar ratio. IV Estimates results: The outsourcing intensity has a negative but not significant effect on profitability. Between the two components of the value added (EBITDA and labor costs) outsourcing affects mainly the labor costs per employee. FD and RGM results: effect of outsourcing is positive (even if very small) and significant. Similar results between FD and RGM.

Table 6: Labor Profitability and Outsourcing: IV, RGM , and FD (Pooled OLS) Estimates Variables IV Outsourcing Intensity -0. 1992 (0. 114) -0. 4542*** (0. 048) 0. 0338*** (0. 009) Size Capital intensity Robust score chi 2(1) p-value Observations 42, 420 51, 791 3. 920 (0. 0477) F(first-stage) p-value 12. 274 (0) Woldridge robust score test p-vale INSTRUMENTS’ VALIDITY FD (Pooled OLS) 0. 0074*** (0. 003) -0. 3951*** (0. 031) 0. 0341*** (0. 009) 3. 879 (0. 0489) Robust regression F(1, 49686) p-value ENDOGENEITY Random growth rate 0. 0071** (0. 003) -0. 4918*** (0. 040) 0. 0098 (0. 009) 0. 2868 (0. 592) 43, 936

Table 6: Labor Profitability and Outsourcing: IV, RGM , and FD (Pooled OLS) Estimates Variables IV Outsourcing Intensity -0. 1992 (0. 114) -0. 4542*** (0. 048) 0. 0338*** (0. 009) Size Capital intensity Robust score chi 2(1) p-value Observations 42, 420 51, 791 3. 920 (0. 0477) F(first-stage) p-value 12. 274 (0) Woldridge robust score test p-vale INSTRUMENTS’ VALIDITY FD (Pooled OLS) 0. 0074*** (0. 003) -0. 3951*** (0. 031) 0. 0341*** (0. 009) 3. 879 (0. 0489) Robust regression F(1, 49686) p-value ENDOGENEITY Random growth rate 0. 0071** (0. 003) -0. 4918*** (0. 040) 0. 0098 (0. 009) 0. 2868 (0. 592) 43, 936

Conclusions Importance of longitudinal data at firm level: - to take account of firm’s heterogeneity - to treat endogeneity in estimating the effect of outsourcing This preliminary analysis produces results that need to be further investigated (better model specification, separate analysis by industry). In particular, at the moment we neglect the analysis of dynamics of outsourcing and its effect on firms’ performance, i. e. whether outsourcing firms gets a better performance after the decision to outsource.

Conclusions Importance of longitudinal data at firm level: - to take account of firm’s heterogeneity - to treat endogeneity in estimating the effect of outsourcing This preliminary analysis produces results that need to be further investigated (better model specification, separate analysis by industry). In particular, at the moment we neglect the analysis of dynamics of outsourcing and its effect on firms’ performance, i. e. whether outsourcing firms gets a better performance after the decision to outsource.

Some references Díaz-Mora, C. (2008) “What factors determine the outsourcing intensity? A dynamic panel data approach for manufacturing industries”. Applied Economics, vol. 40, 2509– 2521. Gianelle, C. , & Tattara, G. (2009). Manufacturing abroad while making profits at home: the Veneto footwear and clothing industry. In M. Morroni (ed. ), Corporate Governance, Organization and the Firm. Co-operation and Outsourcing in the Global Economy, Cheltenham, UK: Edward Elgar. Girma, S. and Gorg, H. (2004) Outsourcing, foreign ownership and productivity: evidence from UK establishment level data, Review of International Economics, 12, 817– 32. Görzig, B. , & Stephan, A. (2002). Outsourcing and Firm-Level Performance. German Institute for Economic Research, Discussion Paper 309. Grossman, G. M. , & Helpman, E. (2005). Ousourcing in a Global Economy. Review of Economic Studies, 72(250), 135 -159. Hummels, D. (2007). Transportation Costs and International Trade in the Second Era of Globalization. Journal of Economic Perspectives, 21(3), 131– 154. Williamson, O. (1975) Markets and Hierarchies: Analysis and Antitrust Implications, Macmillan, New York. Wooldridge J. M. (2002), Econometric Analysis of Cross Section and Panel Data, The MIT Press: London.

Some references Díaz-Mora, C. (2008) “What factors determine the outsourcing intensity? A dynamic panel data approach for manufacturing industries”. Applied Economics, vol. 40, 2509– 2521. Gianelle, C. , & Tattara, G. (2009). Manufacturing abroad while making profits at home: the Veneto footwear and clothing industry. In M. Morroni (ed. ), Corporate Governance, Organization and the Firm. Co-operation and Outsourcing in the Global Economy, Cheltenham, UK: Edward Elgar. Girma, S. and Gorg, H. (2004) Outsourcing, foreign ownership and productivity: evidence from UK establishment level data, Review of International Economics, 12, 817– 32. Görzig, B. , & Stephan, A. (2002). Outsourcing and Firm-Level Performance. German Institute for Economic Research, Discussion Paper 309. Grossman, G. M. , & Helpman, E. (2005). Ousourcing in a Global Economy. Review of Economic Studies, 72(250), 135 -159. Hummels, D. (2007). Transportation Costs and International Trade in the Second Era of Globalization. Journal of Economic Perspectives, 21(3), 131– 154. Williamson, O. (1975) Markets and Hierarchies: Analysis and Antitrust Implications, Macmillan, New York. Wooldridge J. M. (2002), Econometric Analysis of Cross Section and Panel Data, The MIT Press: London.