ce82e4f4d4b8a87f5a99306eacb47e47.ppt

- Количество слайдов: 12

Outlook of the Nigerian Pension Sector by M. K. Ahmad Director General National Pension Commission (Pen. Com) Abuja – Nigeria 16/05/2007 Medium Term Outlook for Nigeria

Agenda ¨Highlights of the Nigerian Pension Scheme ¨Implementation Breakthroughs ¨Impact of the Scheme on the Nigerian Economy ¨Outlook of the Nigerian Pension System ¨Conclusions 16/05/2007 Medium Term Outlook for Nigeria 1

Highlights of the Nigerian Pension Scheme ¨ Contributory Pension Scheme was established by Pension Reform Act 2004, which came into effect in June 2004 ¨ Rationale for the Reforms Ø Ø Ø Most schemes were under or unfunded Unsustainable outstanding pension liabilities Weak and inefficient administration Demographic shifts and aging made defined benefit scheme unsustainable Most workers in the Private Sector not covered by any form of retirement benefit arrangements Private sector schemes that existed were “resignation” rather than retirement schemes 16/05/2007 Medium Term Outlook for Nigeria 2

Highlights of the Nigerian Pension Scheme ¨Nature of the scheme — Contributory Ø Contributions by both employer and employee — Individual Accounts Ø Nature of the account, portability and withdrawals (Lump sum, Annuity & Programmed withdrawal) — Privately Managed — Life Insurance Cover — Coverage and Exemptions — Strictly regulated and supervised - Pen. Com 16/05/2007 Medium Term Outlook for Nigeria 3

Implementation Breakthroughs ¨ Total membership of the scheme 2. 2 million as at April 2007 Ø Ø ¨ 73. 16% from Public Sector 26. 84% from Private Sector ¨ Ø 3. 52 million public Sector of which 48. 8% have registered Ø 4. 7 million formal private sector of which 11. 5% have registered Ø 40. 8 million informal sector, of which none has registered yet 16/05/2007 20 state governments are at various levels of implementation ¨ Resulted in formal recognition of accrued pension rights of employees of the Federal Government ¨ Federal Government is funding a sinking fund to meet this liability Total estimated workforce in Nigeria as at December 2006 was 49. 0 million Ø Implementation of the scheme by state governments has commenced Medium Term Outlook for Nigeria 4

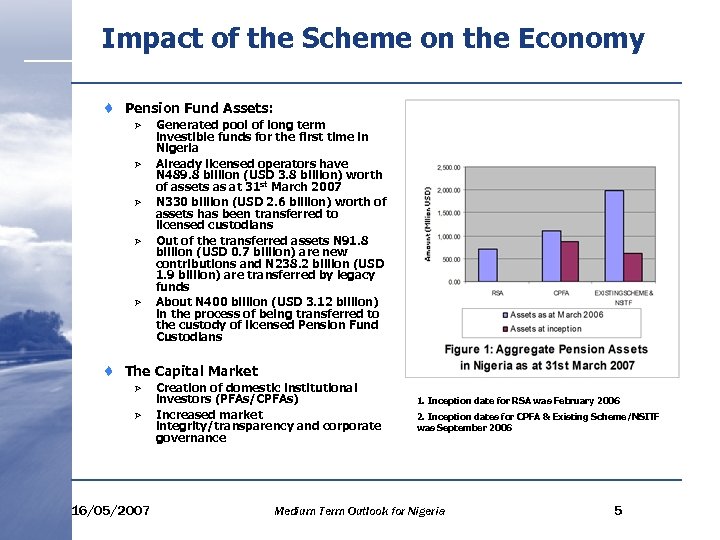

Impact of the Scheme on the Economy ¨ Pension Fund Assets: Ø Ø Ø ¨ Generated pool of long term investible funds for the first time in Nigeria Already licensed operators have N 489. 8 billion (USD 3. 8 billion) worth of assets as at 31 st March 2007 N 330 billion (USD 2. 6 billion) worth of assets has been transferred to licensed custodians Out of the transferred assets N 91. 8 billion (USD 0. 7 billion) are new contributions and N 238. 2 billion (USD 1. 9 billion) are transferred by legacy funds About N 400 billion (USD 3. 12 billion) in the process of being transferred to the custody of licensed Pension Fund Custodians The Capital Market Ø Ø 16/05/2007 Creation of domestic institutional investors (PFAs/CPFAs) Increased market integrity/transparency and corporate governance 1. Inception date for RSA was February 2006 2. Inception dates for CPFA & Existing Scheme/NSITF was September 2006 Medium Term Outlook for Nigeria 5

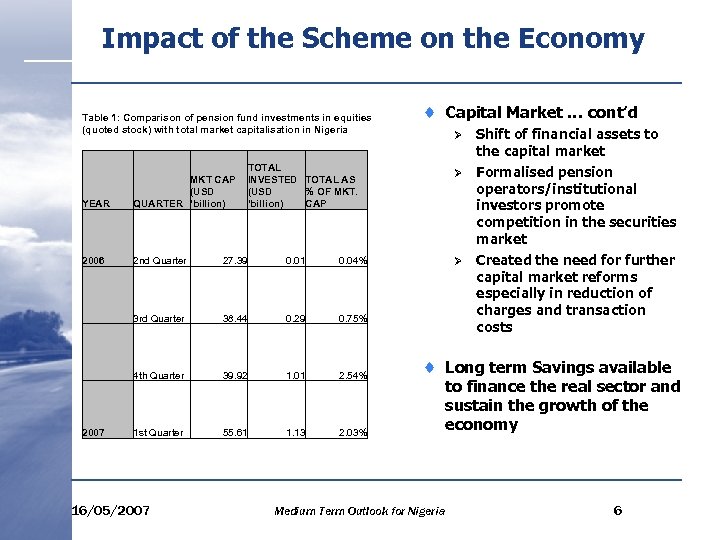

Impact of the Scheme on the Economy Table 1: Comparison of pension fund investments in equities (quoted stock) with total market capitalisation in Nigeria ¨ Capital Market … cont’d Ø Ø YEAR TOTAL MKT CAP INVESTED TOTAL AS (USD % OF MKT. QUARTER ‘billion) CAP 2006 2 nd Quarter 27. 39 0. 01 0. 04% Ø 3 rd Quarter 38. 44 0. 29 0. 75% 4 th Quarter 39. 92 1. 01 2. 54% 2007 1 st Quarter 55. 61 1. 13 2. 03% 16/05/2007 ¨ Medium Term Outlook for Nigeria Shift of financial assets to the capital market Formalised pension operators/institutional investors promote competition in the securities market Created the need for further capital market reforms especially in reduction of charges and transaction costs Long term Savings available to finance the real sector and sustain the growth of the economy 6

Impact of the Scheme on the Economy ¨ Created employment opportunities Ø Ø 16/05/2007 So far about 3, 000 Nigerians have been directly employed into the Pensions Industry Created opportunities for many third party service providers Medium Term Outlook for Nigeria 7

Outlook of the Nigerian Pension System ¨ Key Assumptions Ø Ø ¨ Continuation of Economic Reforms Macroeconomic Stability Major Improvement on Infrastructure Single Digit Inflation Rate Generation of pool of long term investible funds Ø Ø Will trigger the development of new long term instruments (REITs, Infrastructural Bonds, etc) Provide local counterpart funding for financing developments in the power, telecommunication sectors, etc o Will promote foreign direct investment in financing infrastructural developments ¨ Gradual move towards issuance of corporate bonds to reduce the volatility of the exposure in the overall equities investment ¨ Development of multiple funds ¨ Portion of funds to be invested offshore Ø Ø 16/05/2007 To diversify the risk of undue concentration of assets in domestic market To ensure higher returns on investment Medium Term Outlook for Nigeria 8

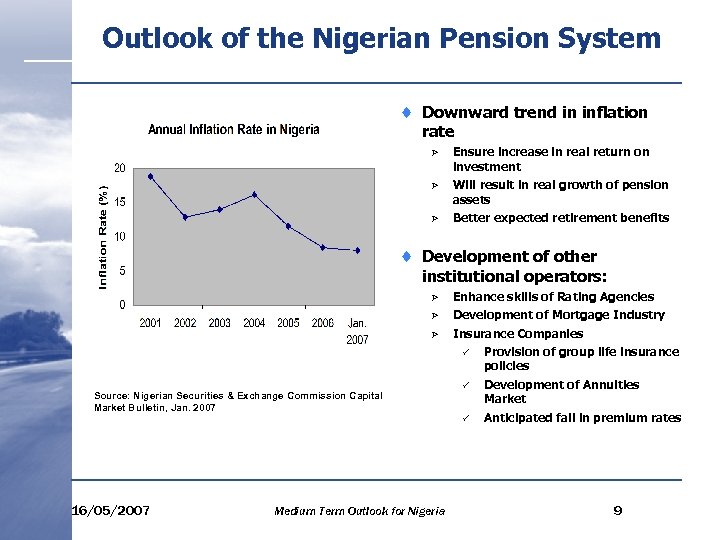

Outlook of the Nigerian Pension System ¨ Downward trend in inflation rate Ø Ø Will result in real growth of pension assets Ø ¨ Ensure increase in real return on investment Better expected retirement benefits Development of other institutional operators: Ø Enhance skills of Rating Agencies Ø Development of Mortgage Industry Ø Insurance Companies ü 16/05/2007 Medium Term Outlook for Nigeria ü Development of Annuities Market ü Source: Nigerian Securities & Exchange Commission Capital Market Bulletin, Jan. 2007 Provision of group life insurance policies Anticipated fall in premium rates 9

Outlook of the Nigerian Pension System ¨ Development of skills in the Industry Ø To continue working with World Bank, DFID and other relevant organisations in capacity building and skills acquisition for the industry in the areas of risk management, risk based supervision, corporate governance, information technology ¨ Enforcement of implementation in the private sector employers ¨ Secure buy-in by states yet to start implementation and the informal sector into the scheme ¨ Develop robust IT structure for identification, processing and storage of information ¨ Development of IT based system for the payment of accrued pension rights of Federal Government employees ¨ Benefits for the Nigerian worker Ø Ø 16/05/2007 Guaranteed Retirement Benefits Improved savings culture Introduction of multiple funds will allow the worker the choice of fund that met his/her risk appetite To benefit from developments in other sectors such as mortgage industry in acquiring affordable housing, etc Medium Term Outlook for Nigeria 10

Thank You! National Pension Commission Plot 174, Adetokunbo Ademola Crescent Wuse II, Abuja - Nigeria 09 – 4138736 – 40 info@pencom. gov. ng www. pencom. gov. ng 16/05/2007 Medium Term Outlook for Nigeria 11

ce82e4f4d4b8a87f5a99306eacb47e47.ppt