0078bf4057e0fb2d0614cc8995db41b5.ppt

- Количество слайдов: 64

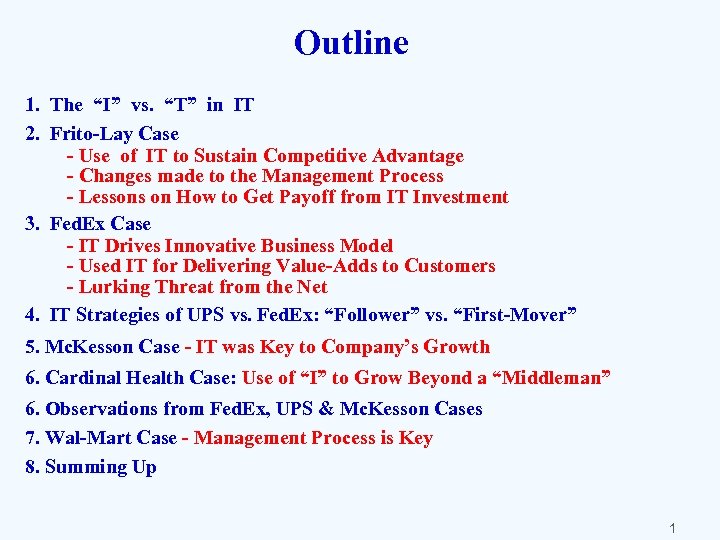

Outline 1. The “I” vs. “T” in IT 2. Frito-Lay Case - Use of IT to Sustain Competitive Advantage - Changes made to the Management Process - Lessons on How to Get Payoff from IT Investment 3. Fed. Ex Case - IT Drives Innovative Business Model - Used IT for Delivering Value-Adds to Customers - Lurking Threat from the Net 4. IT Strategies of UPS vs. Fed. Ex: “Follower” vs. “First-Mover” 5. Mc. Kesson Case - IT was Key to Company’s Growth 6. Cardinal Health Case: Use of “I” to Grow Beyond a “Middleman” 6. Observations from Fed. Ex, UPS & Mc. Kesson Cases 7. Wal-Mart Case - Management Process is Key 8. Summing Up 1

Outline 1. The “I” vs. “T” in IT 2. Frito-Lay Case - Use of IT to Sustain Competitive Advantage - Changes made to the Management Process - Lessons on How to Get Payoff from IT Investment 3. Fed. Ex Case - IT Drives Innovative Business Model - Used IT for Delivering Value-Adds to Customers - Lurking Threat from the Net 4. IT Strategies of UPS vs. Fed. Ex: “Follower” vs. “First-Mover” 5. Mc. Kesson Case - IT was Key to Company’s Growth 6. Cardinal Health Case: Use of “I” to Grow Beyond a “Middleman” 6. Observations from Fed. Ex, UPS & Mc. Kesson Cases 7. Wal-Mart Case - Management Process is Key 8. Summing Up 1

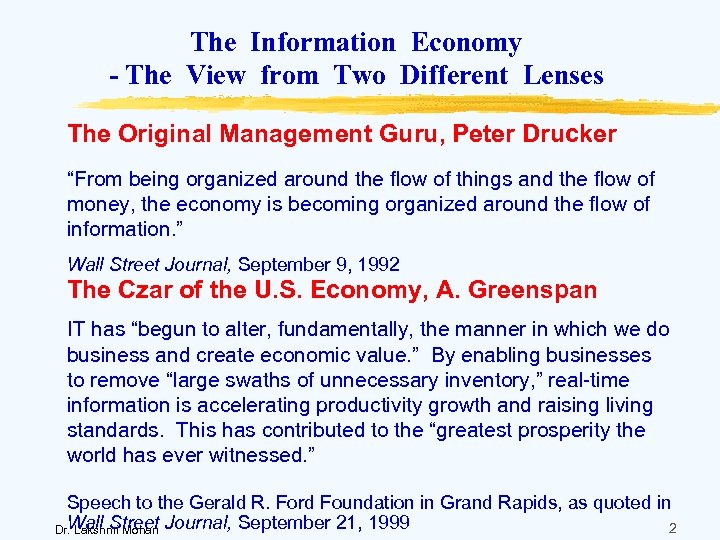

The Information Economy - The View from Two Different Lenses The Original Management Guru, Peter Drucker “From being organized around the flow of things and the flow of money, the economy is becoming organized around the flow of information. ” Wall Street Journal, September 9, 1992 The Czar of the U. S. Economy, A. Greenspan IT has “begun to alter, fundamentally, the manner in which we do business and create economic value. ” By enabling businesses to remove “large swaths of unnecessary inventory, ” real-time information is accelerating productivity growth and raising living standards. This has contributed to the “greatest prosperity the world has ever witnessed. ” Speech to the Gerald R. Ford Foundation in Grand Rapids, as quoted in Wall Street 2 Dr. Lakshmi Mohan Journal, September 21, 1999

The Information Economy - The View from Two Different Lenses The Original Management Guru, Peter Drucker “From being organized around the flow of things and the flow of money, the economy is becoming organized around the flow of information. ” Wall Street Journal, September 9, 1992 The Czar of the U. S. Economy, A. Greenspan IT has “begun to alter, fundamentally, the manner in which we do business and create economic value. ” By enabling businesses to remove “large swaths of unnecessary inventory, ” real-time information is accelerating productivity growth and raising living standards. This has contributed to the “greatest prosperity the world has ever witnessed. ” Speech to the Gerald R. Ford Foundation in Grand Rapids, as quoted in Wall Street 2 Dr. Lakshmi Mohan Journal, September 21, 1999

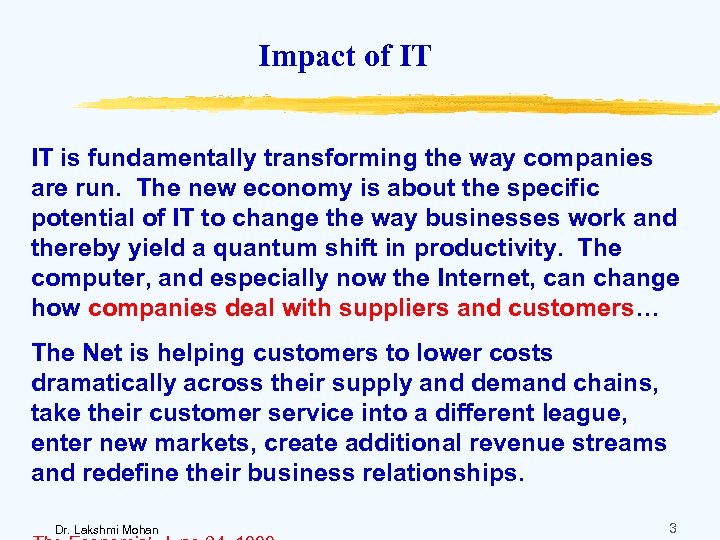

Impact of IT IT is fundamentally transforming the way companies are run. The new economy is about the specific potential of IT to change the way businesses work and thereby yield a quantum shift in productivity. The computer, and especially now the Internet, can change how companies deal with suppliers and customers… The Net is helping customers to lower costs dramatically across their supply and demand chains, take their customer service into a different league, enter new markets, create additional revenue streams and redefine their business relationships. Dr. Lakshmi Mohan 3

Impact of IT IT is fundamentally transforming the way companies are run. The new economy is about the specific potential of IT to change the way businesses work and thereby yield a quantum shift in productivity. The computer, and especially now the Internet, can change how companies deal with suppliers and customers… The Net is helping customers to lower costs dramatically across their supply and demand chains, take their customer service into a different league, enter new markets, create additional revenue streams and redefine their business relationships. Dr. Lakshmi Mohan 3

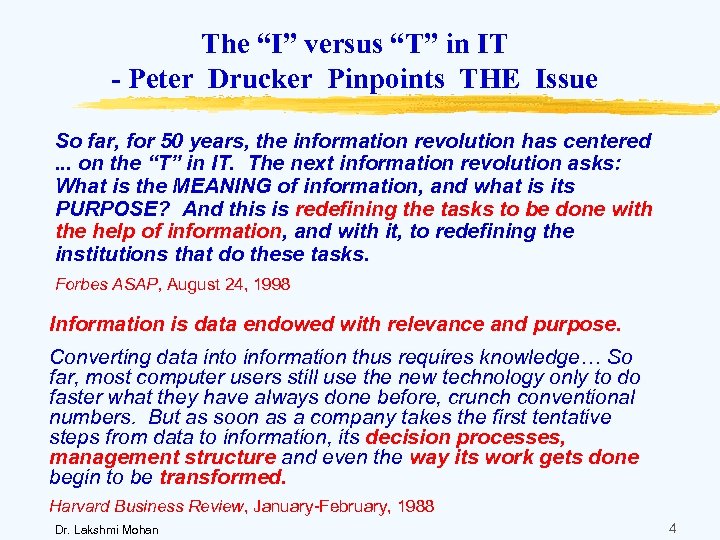

The “I” versus “T” in IT - Peter Drucker Pinpoints THE Issue So far, for 50 years, the information revolution has centered. . . on the “T” in IT. The next information revolution asks: What is the MEANING of information, and what is its PURPOSE? And this is redefining the tasks to be done with the help of information, and with it, to redefining the institutions that do these tasks. Forbes ASAP, August 24, 1998 Information is data endowed with relevance and purpose. Converting data into information thus requires knowledge… So far, most computer users still use the new technology only to do faster what they have always done before, crunch conventional numbers. But as soon as a company takes the first tentative steps from data to information, its decision processes, management structure and even the way its work gets done begin to be transformed. Harvard Business Review, January-February, 1988 Dr. Lakshmi Mohan 4

The “I” versus “T” in IT - Peter Drucker Pinpoints THE Issue So far, for 50 years, the information revolution has centered. . . on the “T” in IT. The next information revolution asks: What is the MEANING of information, and what is its PURPOSE? And this is redefining the tasks to be done with the help of information, and with it, to redefining the institutions that do these tasks. Forbes ASAP, August 24, 1998 Information is data endowed with relevance and purpose. Converting data into information thus requires knowledge… So far, most computer users still use the new technology only to do faster what they have always done before, crunch conventional numbers. But as soon as a company takes the first tentative steps from data to information, its decision processes, management structure and even the way its work gets done begin to be transformed. Harvard Business Review, January-February, 1988 Dr. Lakshmi Mohan 4

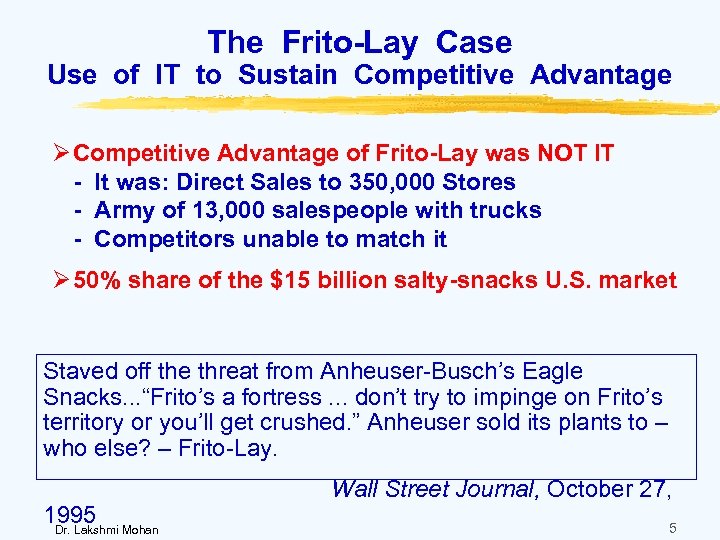

The Frito-Lay Case Use of IT to Sustain Competitive Advantage Ø Competitive Advantage of Frito-Lay was NOT IT - It was: Direct Sales to 350, 000 Stores - Army of 13, 000 salespeople with trucks - Competitors unable to match it Ø 50% share of the $15 billion salty-snacks U. S. market Staved off the threat from Anheuser-Busch’s Eagle Snacks. . . “Frito’s a fortress. . . don’t try to impinge on Frito’s territory or you’ll get crushed. ” Anheuser sold its plants to – who else? – Frito-Lay. 1995 Dr. Lakshmi Mohan Wall Street Journal, October 27, 5

The Frito-Lay Case Use of IT to Sustain Competitive Advantage Ø Competitive Advantage of Frito-Lay was NOT IT - It was: Direct Sales to 350, 000 Stores - Army of 13, 000 salespeople with trucks - Competitors unable to match it Ø 50% share of the $15 billion salty-snacks U. S. market Staved off the threat from Anheuser-Busch’s Eagle Snacks. . . “Frito’s a fortress. . . don’t try to impinge on Frito’s territory or you’ll get crushed. ” Anheuser sold its plants to – who else? – Frito-Lay. 1995 Dr. Lakshmi Mohan Wall Street Journal, October 27, 5

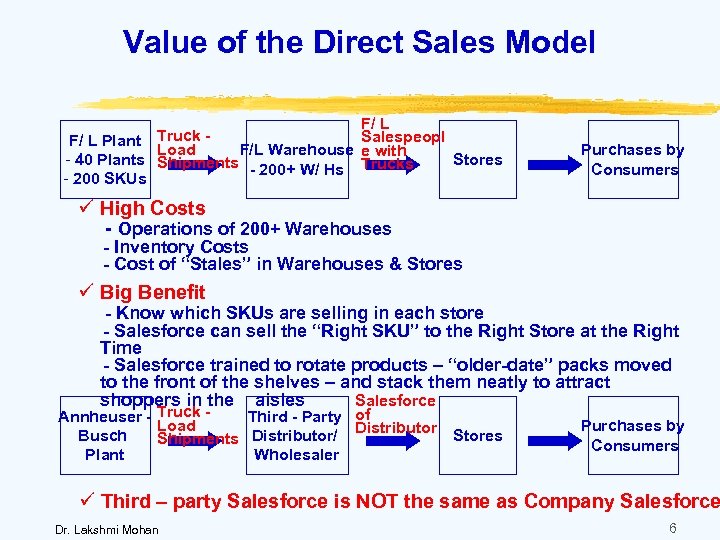

Value of the Direct Sales Model F/ L Truck Salespeopl F/ L Plant Load F/L Warehouse e with - 40 Plants Shipments Stores - 200+ W/ Hs Trucks - 200 SKUs Purchases by Consumers ü High Costs - Operations of 200+ Warehouses - Inventory Costs - Cost of “Stales” in Warehouses & Stores ü Big Benefit - Know which SKUs are selling in each store - Salesforce can sell the “Right SKU” to the Right Store at the Right Time - Salesforce trained to rotate products – “older-date” packs moved to the front of the shelves – and stack them neatly to attract shoppers in the aisles Salesforce Annheuser - Truck Third - Party of Load Distributor Busch Shipments Distributor/ Plant Wholesaler Stores Purchases by Consumers ü Third – party Salesforce is NOT the same as Company Salesforce Dr. Lakshmi Mohan 6

Value of the Direct Sales Model F/ L Truck Salespeopl F/ L Plant Load F/L Warehouse e with - 40 Plants Shipments Stores - 200+ W/ Hs Trucks - 200 SKUs Purchases by Consumers ü High Costs - Operations of 200+ Warehouses - Inventory Costs - Cost of “Stales” in Warehouses & Stores ü Big Benefit - Know which SKUs are selling in each store - Salesforce can sell the “Right SKU” to the Right Store at the Right Time - Salesforce trained to rotate products – “older-date” packs moved to the front of the shelves – and stack them neatly to attract shoppers in the aisles Salesforce Annheuser - Truck Third - Party of Load Distributor Busch Shipments Distributor/ Plant Wholesaler Stores Purchases by Consumers ü Third – party Salesforce is NOT the same as Company Salesforce Dr. Lakshmi Mohan 6

IT Target - SUSTAIN the Competitive Advantage FOCUS ON: - Revenue Drivers to Increase Revenues - Cost Drivers to Reduce Costs ü Improve Salesforce Productivity - Expand coverage by adding new stores without increasing the salesforce ü Reduce “Stales” - Timely information on sales and inventory from stores can trigger corrective action to reduce stales ü Micromarketing - Promote the “Right SKU in the Right Store at the Right Time” - Get more bang for the promotional dollars ! Dr. Lakshmi Mohan 7

IT Target - SUSTAIN the Competitive Advantage FOCUS ON: - Revenue Drivers to Increase Revenues - Cost Drivers to Reduce Costs ü Improve Salesforce Productivity - Expand coverage by adding new stores without increasing the salesforce ü Reduce “Stales” - Timely information on sales and inventory from stores can trigger corrective action to reduce stales ü Micromarketing - Promote the “Right SKU in the Right Store at the Right Time” - Get more bang for the promotional dollars ! Dr. Lakshmi Mohan 7

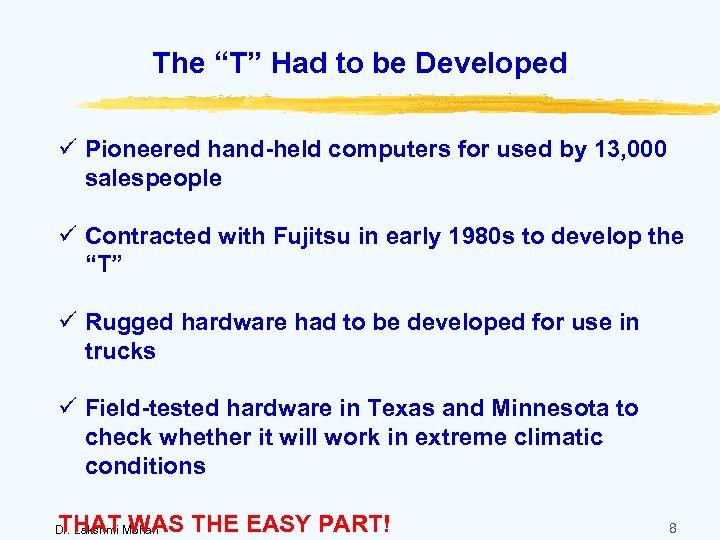

The “T” Had to be Developed ü Pioneered hand-held computers for used by 13, 000 salespeople ü Contracted with Fujitsu in early 1980 s to develop the “T” ü Rugged hardware had to be developed for use in trucks ü Field-tested hardware in Texas and Minnesota to check whether it will work in extreme climatic conditions THAT WAS THE EASY PART! Dr. Lakshmi Mohan 8

The “T” Had to be Developed ü Pioneered hand-held computers for used by 13, 000 salespeople ü Contracted with Fujitsu in early 1980 s to develop the “T” ü Rugged hardware had to be developed for use in trucks ü Field-tested hardware in Texas and Minnesota to check whether it will work in extreme climatic conditions THAT WAS THE EASY PART! Dr. Lakshmi Mohan 8

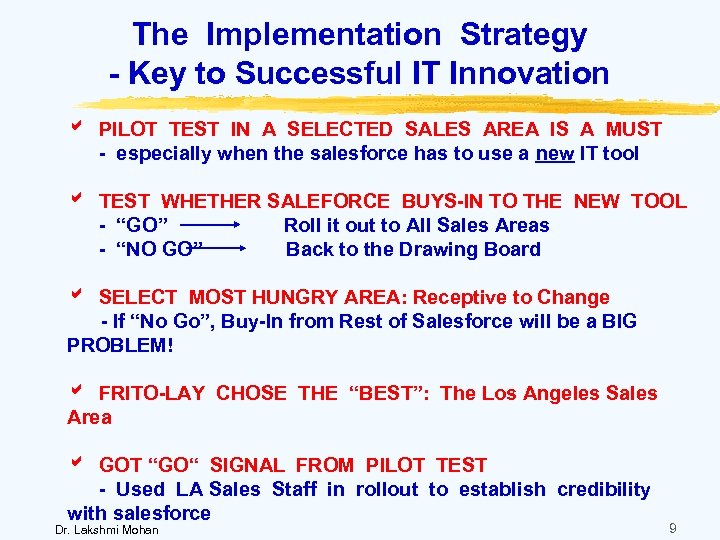

The Implementation Strategy - Key to Successful IT Innovation PILOT TEST IN A SELECTED SALES AREA IS A MUST - especially when the salesforce has to use a new IT tool TEST WHETHER SALEFORCE BUYS-IN TO THE NEW TOOL - “GO” Roll it out to All Sales Areas - “NO GO” Back to the Drawing Board SELECT MOST HUNGRY AREA: Receptive to Change - If “No Go”, Buy-In from Rest of Salesforce will be a BIG PROBLEM! FRITO-LAY CHOSE THE “BEST”: The Los Angeles Sales Area GOT “GO“ SIGNAL FROM PILOT TEST - Used LA Sales Staff in rollout to establish credibility with salesforce Dr. Lakshmi Mohan 9

The Implementation Strategy - Key to Successful IT Innovation PILOT TEST IN A SELECTED SALES AREA IS A MUST - especially when the salesforce has to use a new IT tool TEST WHETHER SALEFORCE BUYS-IN TO THE NEW TOOL - “GO” Roll it out to All Sales Areas - “NO GO” Back to the Drawing Board SELECT MOST HUNGRY AREA: Receptive to Change - If “No Go”, Buy-In from Rest of Salesforce will be a BIG PROBLEM! FRITO-LAY CHOSE THE “BEST”: The Los Angeles Sales Area GOT “GO“ SIGNAL FROM PILOT TEST - Used LA Sales Staff in rollout to establish credibility with salesforce Dr. Lakshmi Mohan 9

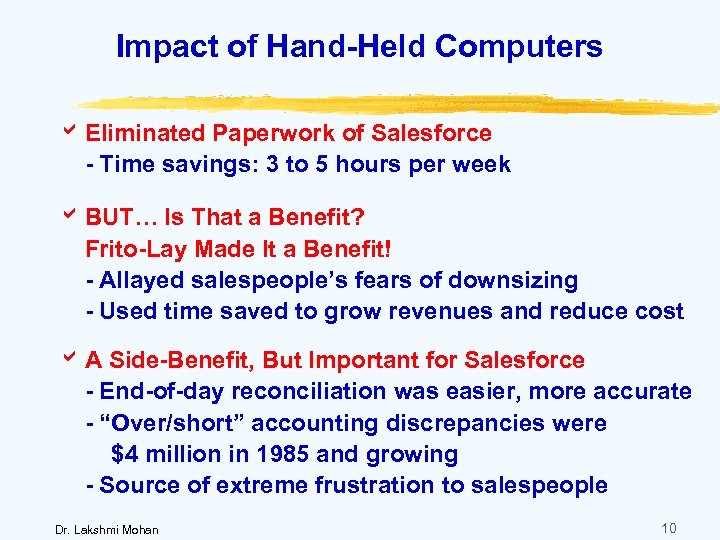

Impact of Hand-Held Computers a Eliminated Paperwork of Salesforce - Time savings: 3 to 5 hours per week a BUT… Is That a Benefit? Frito-Lay Made It a Benefit! - Allayed salespeople’s fears of downsizing - Used time saved to grow revenues and reduce cost a A Side-Benefit, But Important for Salesforce - End-of-day reconciliation was easier, more accurate - “Over/short” accounting discrepancies were $4 million in 1985 and growing - Source of extreme frustration to salespeople Dr. Lakshmi Mohan 10

Impact of Hand-Held Computers a Eliminated Paperwork of Salesforce - Time savings: 3 to 5 hours per week a BUT… Is That a Benefit? Frito-Lay Made It a Benefit! - Allayed salespeople’s fears of downsizing - Used time saved to grow revenues and reduce cost a A Side-Benefit, But Important for Salesforce - End-of-day reconciliation was easier, more accurate - “Over/short” accounting discrepancies were $4 million in 1985 and growing - Source of extreme frustration to salespeople Dr. Lakshmi Mohan 10

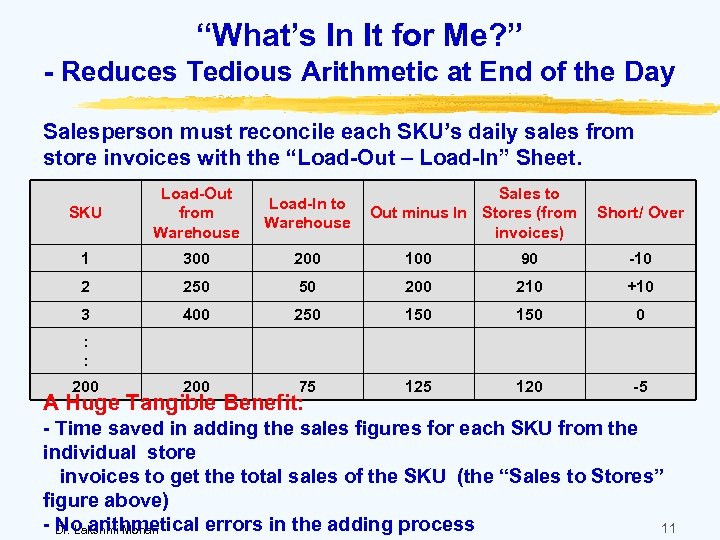

“What’s In It for Me? ” - Reduces Tedious Arithmetic at End of the Day Salesperson must reconcile each SKU’s daily sales from store invoices with the “Load-Out – Load-In” Sheet. SKU Load-Out from Warehouse Load-In to Warehouse Sales to Out minus In Stores (from invoices) 1 300 200 100 90 -10 2 250 50 200 210 +10 3 400 250 150 0 200 75 120 -5 Short/ Over : : 200 A Huge Tangible Benefit: - Time saved in adding the sales figures for each SKU from the individual store invoices to get the total sales of the SKU (the “Sales to Stores” figure above) - No arithmetical errors in the adding process 11 Dr. Lakshmi Mohan

“What’s In It for Me? ” - Reduces Tedious Arithmetic at End of the Day Salesperson must reconcile each SKU’s daily sales from store invoices with the “Load-Out – Load-In” Sheet. SKU Load-Out from Warehouse Load-In to Warehouse Sales to Out minus In Stores (from invoices) 1 300 200 100 90 -10 2 250 50 200 210 +10 3 400 250 150 0 200 75 120 -5 Short/ Over : : 200 A Huge Tangible Benefit: - Time saved in adding the sales figures for each SKU from the individual store invoices to get the total sales of the SKU (the “Sales to Stores” figure above) - No arithmetical errors in the adding process 11 Dr. Lakshmi Mohan

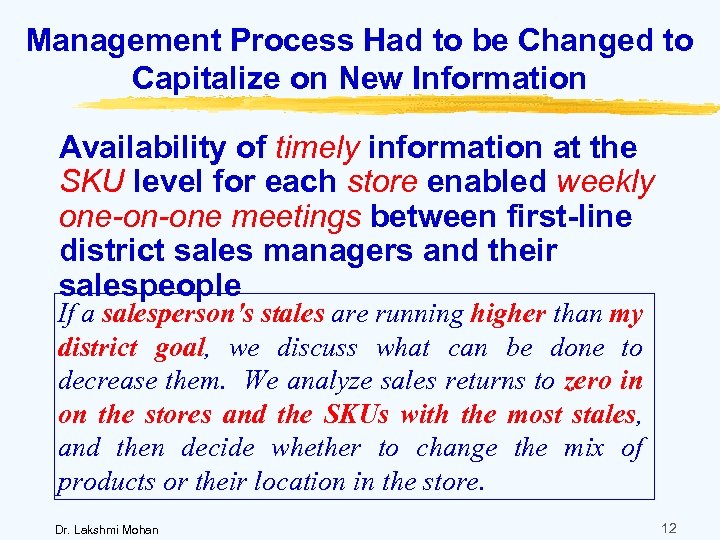

Management Process Had to be Changed to Capitalize on New Information Availability of timely information at the SKU level for each store enabled weekly one-on-one meetings between first-line district sales managers and their salespeople If a salesperson's stales are running higher than my district goal, we discuss what can be done to decrease them. We analyze sales returns to zero in on the stores and the SKUs with the most stales, and then decide whether to change the mix of products or their location in the store. Dr. Lakshmi Mohan 12

Management Process Had to be Changed to Capitalize on New Information Availability of timely information at the SKU level for each store enabled weekly one-on-one meetings between first-line district sales managers and their salespeople If a salesperson's stales are running higher than my district goal, we discuss what can be done to decrease them. We analyze sales returns to zero in on the stores and the SKUs with the most stales, and then decide whether to change the mix of products or their location in the store. Dr. Lakshmi Mohan 12

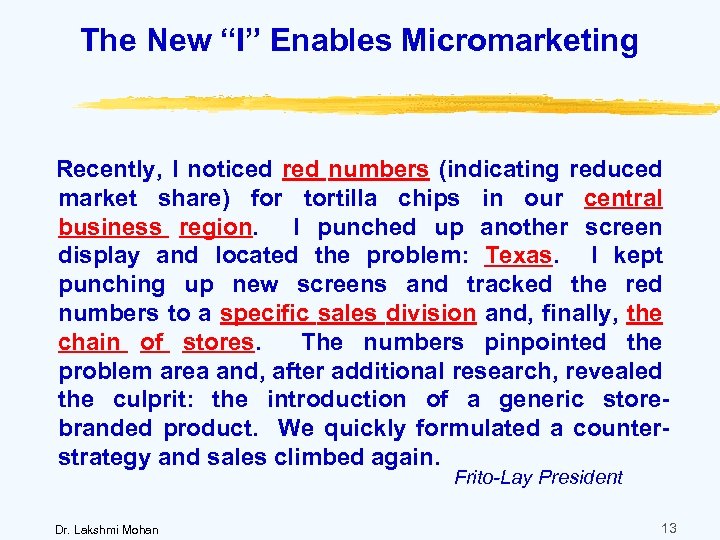

The New “I” Enables Micromarketing Recently, I noticed red numbers (indicating reduced market share) for tortilla chips in our central business region. I punched up another screen display and located the problem: Texas. I kept punching up new screens and tracked the red numbers to a specific sales division and, finally, the chain of stores. The numbers pinpointed the problem area and, after additional research, revealed the culprit: the introduction of a generic storebranded product. We quickly formulated a counterstrategy and sales climbed again. Frito-Lay President Dr. Lakshmi Mohan 13

The New “I” Enables Micromarketing Recently, I noticed red numbers (indicating reduced market share) for tortilla chips in our central business region. I punched up another screen display and located the problem: Texas. I kept punching up new screens and tracked the red numbers to a specific sales division and, finally, the chain of stores. The numbers pinpointed the problem area and, after additional research, revealed the culprit: the introduction of a generic storebranded product. We quickly formulated a counterstrategy and sales climbed again. Frito-Lay President Dr. Lakshmi Mohan 13

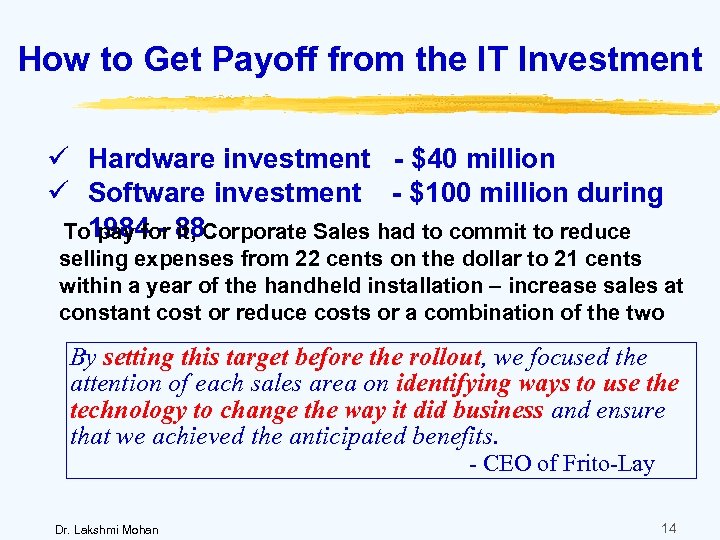

How to Get Payoff from the IT Investment ü Hardware investment - $40 million ü Software investment - $100 million during To 1984 - 88 Corporate Sales had to commit to reduce pay for it, selling expenses from 22 cents on the dollar to 21 cents within a year of the handheld installation – increase sales at constant cost or reduce costs or a combination of the two By setting this target before the rollout, we focused the attention of each sales area on identifying ways to use the technology to change the way it did business and ensure that we achieved the anticipated benefits. - CEO of Frito-Lay Dr. Lakshmi Mohan 14

How to Get Payoff from the IT Investment ü Hardware investment - $40 million ü Software investment - $100 million during To 1984 - 88 Corporate Sales had to commit to reduce pay for it, selling expenses from 22 cents on the dollar to 21 cents within a year of the handheld installation – increase sales at constant cost or reduce costs or a combination of the two By setting this target before the rollout, we focused the attention of each sales area on identifying ways to use the technology to change the way it did business and ensure that we achieved the anticipated benefits. - CEO of Frito-Lay Dr. Lakshmi Mohan 14

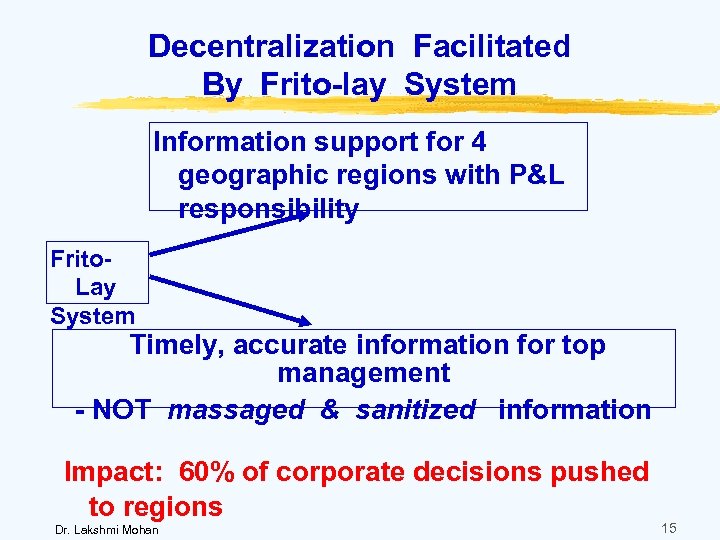

Decentralization Facilitated By Frito-lay System Information support for 4 geographic regions with P&L responsibility Frito. Lay System Timely, accurate information for top management - NOT massaged & sanitized information Impact: 60% of corporate decisions pushed to regions Dr. Lakshmi Mohan 15

Decentralization Facilitated By Frito-lay System Information support for 4 geographic regions with P&L responsibility Frito. Lay System Timely, accurate information for top management - NOT massaged & sanitized information Impact: 60% of corporate decisions pushed to regions Dr. Lakshmi Mohan 15

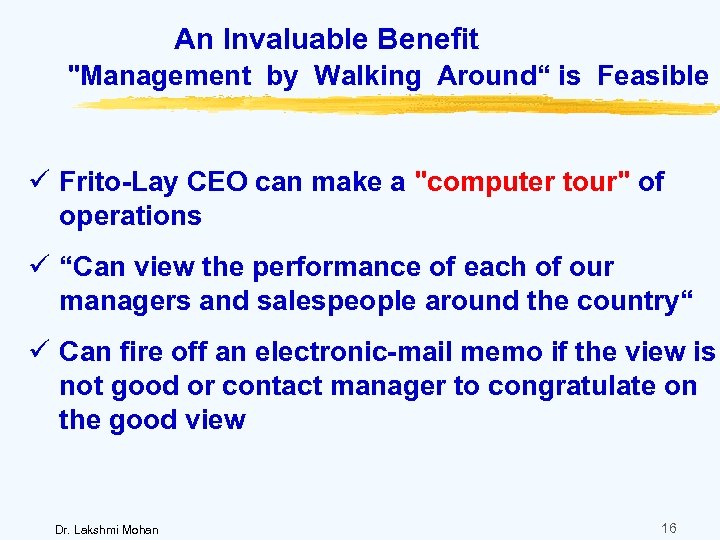

An Invaluable Benefit "Management by Walking Around“ is Feasible ü Frito-Lay CEO can make a "computer tour" of operations ü “Can view the performance of each of our managers and salespeople around the country“ ü Can fire off an electronic-mail memo if the view is not good or contact manager to congratulate on the good view Dr. Lakshmi Mohan 16

An Invaluable Benefit "Management by Walking Around“ is Feasible ü Frito-Lay CEO can make a "computer tour" of operations ü “Can view the performance of each of our managers and salespeople around the country“ ü Can fire off an electronic-mail memo if the view is not good or contact manager to congratulate on the good view Dr. Lakshmi Mohan 16

The Frito-Lay System - An Integrated Everyone’s Information System Delivers timely and consistent information to ALL levels of management and ALL functions: • A sales support system for field personnel • An Executive Information System for the top 200 executives • A market analysis and profitability reporting system for corporate staff • Additional support systems for key functions: purchasing, manufacturing and logistics Dr. Lakshmi Mohan 17

The Frito-Lay System - An Integrated Everyone’s Information System Delivers timely and consistent information to ALL levels of management and ALL functions: • A sales support system for field personnel • An Executive Information System for the top 200 executives • A market analysis and profitability reporting system for corporate staff • Additional support systems for key functions: purchasing, manufacturing and logistics Dr. Lakshmi Mohan 17

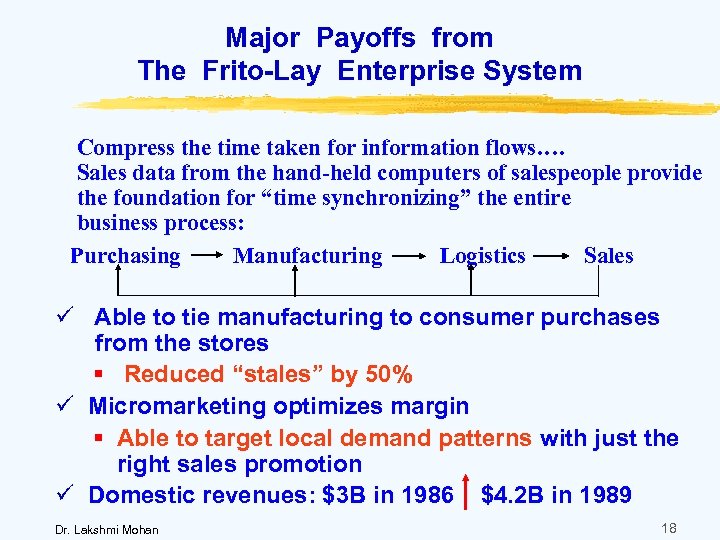

Major Payoffs from The Frito-Lay Enterprise System Compress the time taken for information flows…. Sales data from the hand-held computers of salespeople provide the foundation for “time synchronizing” the entire business process: Purchasing Manufacturing Logistics Sales ü Able to tie manufacturing to consumer purchases from the stores § Reduced “stales” by 50% ü Micromarketing optimizes margin § Able to target local demand patterns with just the right sales promotion ü Domestic revenues: $3 B in 1986 $4. 2 B in 1989 Dr. Lakshmi Mohan 18

Major Payoffs from The Frito-Lay Enterprise System Compress the time taken for information flows…. Sales data from the hand-held computers of salespeople provide the foundation for “time synchronizing” the entire business process: Purchasing Manufacturing Logistics Sales ü Able to tie manufacturing to consumer purchases from the stores § Reduced “stales” by 50% ü Micromarketing optimizes margin § Able to target local demand patterns with just the right sales promotion ü Domestic revenues: $3 B in 1986 $4. 2 B in 1989 Dr. Lakshmi Mohan 18

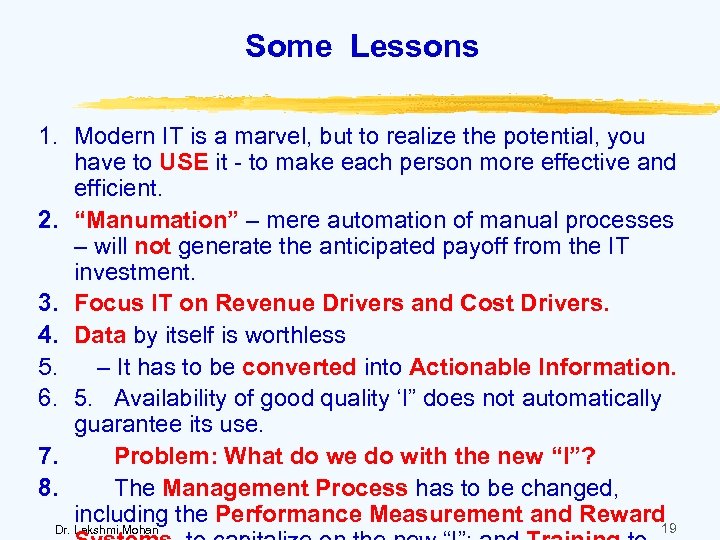

Some Lessons 1. Modern IT is a marvel, but to realize the potential, you have to USE it - to make each person more effective and efficient. 2. “Manumation” – mere automation of manual processes – will not generate the anticipated payoff from the IT investment. 3. Focus IT on Revenue Drivers and Cost Drivers. 4. Data by itself is worthless 5. – It has to be converted into Actionable Information. 6. 5. Availability of good quality ‘I” does not automatically guarantee its use. 7. Problem: What do we do with the new “I”? 8. The Management Process has to be changed, including the Performance Measurement and Reward 19 Dr. Lakshmi Mohan

Some Lessons 1. Modern IT is a marvel, but to realize the potential, you have to USE it - to make each person more effective and efficient. 2. “Manumation” – mere automation of manual processes – will not generate the anticipated payoff from the IT investment. 3. Focus IT on Revenue Drivers and Cost Drivers. 4. Data by itself is worthless 5. – It has to be converted into Actionable Information. 6. 5. Availability of good quality ‘I” does not automatically guarantee its use. 7. Problem: What do we do with the new “I”? 8. The Management Process has to be changed, including the Performance Measurement and Reward 19 Dr. Lakshmi Mohan

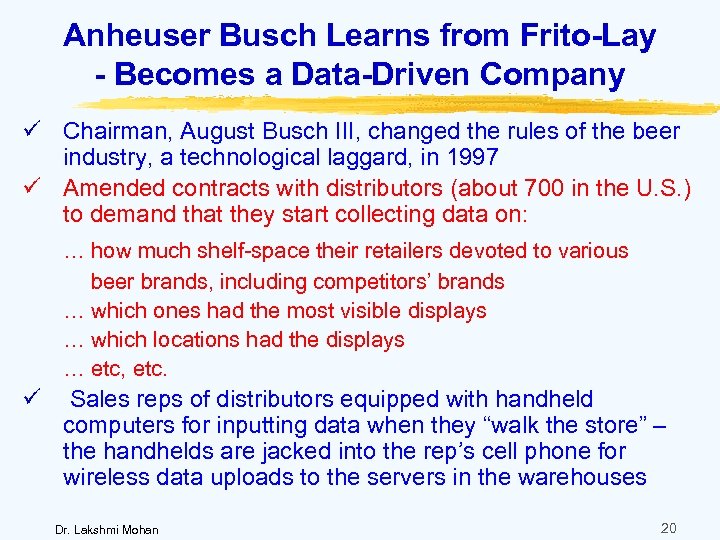

Anheuser Busch Learns from Frito-Lay - Becomes a Data-Driven Company ü Chairman, August Busch III, changed the rules of the beer industry, a technological laggard, in 1997 ü Amended contracts with distributors (about 700 in the U. S. ) to demand that they start collecting data on: … how much shelf-space their retailers devoted to various beer brands, including competitors’ brands … which ones had the most visible displays … which locations had the displays … etc, etc. ü Sales reps of distributors equipped with handheld computers for inputting data when they “walk the store” – the handhelds are jacked into the rep’s cell phone for wireless data uploads to the servers in the warehouses Dr. Lakshmi Mohan 20

Anheuser Busch Learns from Frito-Lay - Becomes a Data-Driven Company ü Chairman, August Busch III, changed the rules of the beer industry, a technological laggard, in 1997 ü Amended contracts with distributors (about 700 in the U. S. ) to demand that they start collecting data on: … how much shelf-space their retailers devoted to various beer brands, including competitors’ brands … which ones had the most visible displays … which locations had the displays … etc, etc. ü Sales reps of distributors equipped with handheld computers for inputting data when they “walk the store” – the handhelds are jacked into the rep’s cell phone for wireless data uploads to the servers in the warehouses Dr. Lakshmi Mohan 20

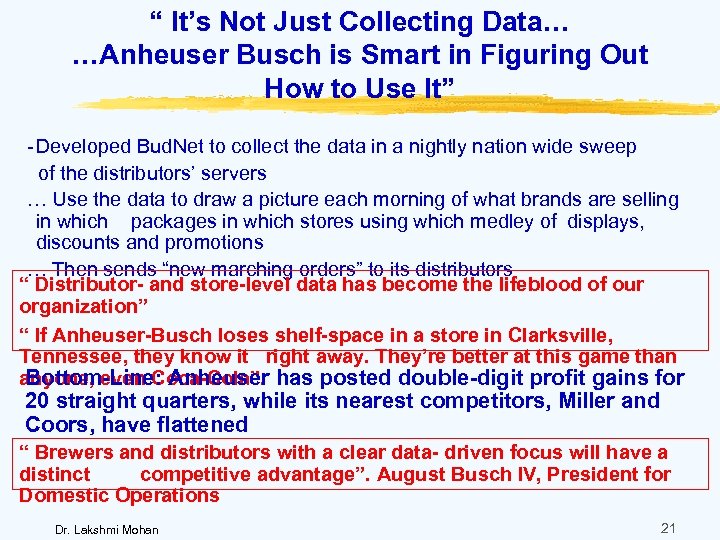

“ It’s Not Just Collecting Data… …Anheuser Busch is Smart in Figuring Out How to Use It” - Developed Bud. Net to collect the data in a nightly nation wide sweep of the distributors’ servers … Use the data to draw a picture each morning of what brands are selling in which packages in which stores using which medley of displays, discounts and promotions … Then sends “new marching orders” to its distributors “ Distributor- and store-level data has become the lifeblood of our organization” “ If Anheuser-Busch loses shelf-space in a store in Clarksville, Tennessee, they know it right away. They’re better at this game than Bottom-Line: Anheuser anyone, even Coca-Cola”. has posted double-digit profit gains for 20 straight quarters, while its nearest competitors, Miller and Coors, have flattened “ Brewers and distributors with a clear data- driven focus will have a distinct competitive advantage”. August Busch IV, President for Domestic Operations Dr. Lakshmi Mohan 21

“ It’s Not Just Collecting Data… …Anheuser Busch is Smart in Figuring Out How to Use It” - Developed Bud. Net to collect the data in a nightly nation wide sweep of the distributors’ servers … Use the data to draw a picture each morning of what brands are selling in which packages in which stores using which medley of displays, discounts and promotions … Then sends “new marching orders” to its distributors “ Distributor- and store-level data has become the lifeblood of our organization” “ If Anheuser-Busch loses shelf-space in a store in Clarksville, Tennessee, they know it right away. They’re better at this game than Bottom-Line: Anheuser anyone, even Coca-Cola”. has posted double-digit profit gains for 20 straight quarters, while its nearest competitors, Miller and Coors, have flattened “ Brewers and distributors with a clear data- driven focus will have a distinct competitive advantage”. August Busch IV, President for Domestic Operations Dr. Lakshmi Mohan 21

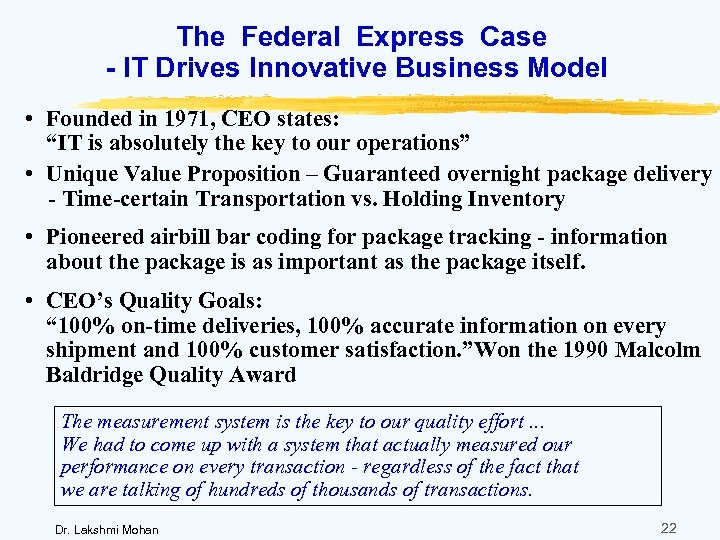

The Federal Express Case - IT Drives Innovative Business Model • Founded in 1971, CEO states: “IT is absolutely the key to our operations” • Unique Value Proposition – Guaranteed overnight package delivery - Time-certain Transportation vs. Holding Inventory • Pioneered airbill bar coding for package tracking - information about the package is as important as the package itself. • CEO’s Quality Goals: “ 100% on-time deliveries, 100% accurate information on every shipment and 100% customer satisfaction. ”Won the 1990 Malcolm Baldridge Quality Award The measurement system is the key to our quality effort. . . We had to come up with a system that actually measured our performance on every transaction - regardless of the fact that we are talking of hundreds of thousands of transactions. Dr. Lakshmi Mohan 22

The Federal Express Case - IT Drives Innovative Business Model • Founded in 1971, CEO states: “IT is absolutely the key to our operations” • Unique Value Proposition – Guaranteed overnight package delivery - Time-certain Transportation vs. Holding Inventory • Pioneered airbill bar coding for package tracking - information about the package is as important as the package itself. • CEO’s Quality Goals: “ 100% on-time deliveries, 100% accurate information on every shipment and 100% customer satisfaction. ”Won the 1990 Malcolm Baldridge Quality Award The measurement system is the key to our quality effort. . . We had to come up with a system that actually measured our performance on every transaction - regardless of the fact that we are talking of hundreds of thousands of transactions. Dr. Lakshmi Mohan 22

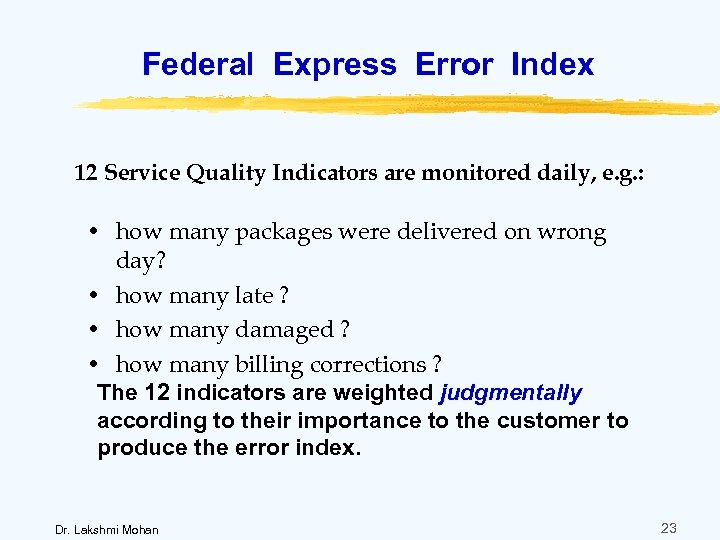

Federal Express Error Index 12 Service Quality Indicators are monitored daily, e. g. : • how many packages were delivered on wrong day? • how many late ? • how many damaged ? • how many billing corrections ? The 12 indicators are weighted judgmentally according to their importance to the customer to produce the error index. Dr. Lakshmi Mohan 23

Federal Express Error Index 12 Service Quality Indicators are monitored daily, e. g. : • how many packages were delivered on wrong day? • how many late ? • how many damaged ? • how many billing corrections ? The 12 indicators are weighted judgmentally according to their importance to the customer to produce the error index. Dr. Lakshmi Mohan 23

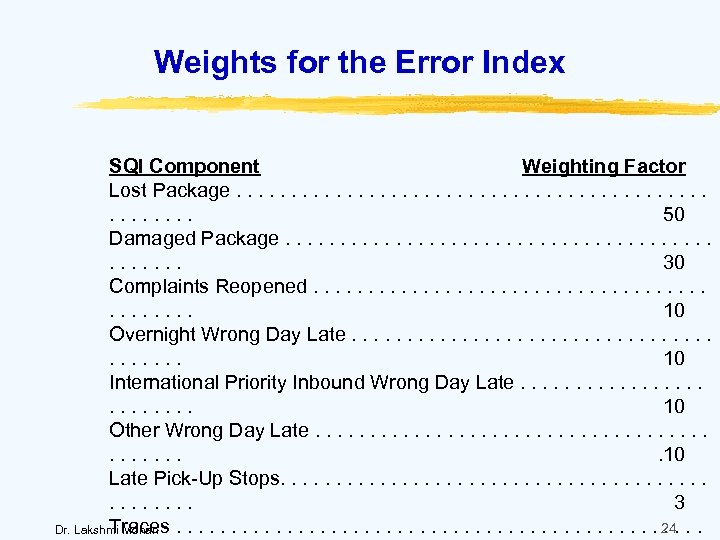

Weights for the Error Index SQI Component Weighting Factor Lost Package. . . . 50 Damaged Package. . . 30 Complaints Reopened. . . 10 Overnight Wrong Day Late. . . . . 10 International Priority Inbound Wrong Day Late. . . 10 Other Wrong Day Late. . . 10 Late Pick-Up Stops. . . 3 Traces. . . 24 Dr. Lakshmi Mohan

Weights for the Error Index SQI Component Weighting Factor Lost Package. . . . 50 Damaged Package. . . 30 Complaints Reopened. . . 10 Overnight Wrong Day Late. . . . . 10 International Priority Inbound Wrong Day Late. . . 10 Other Wrong Day Late. . . 10 Late Pick-Up Stops. . . 3 Traces. . . 24 Dr. Lakshmi Mohan

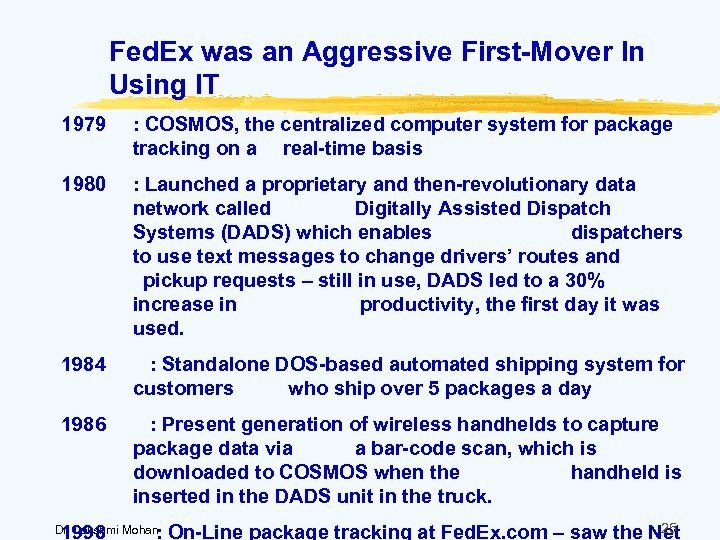

Fed. Ex was an Aggressive First-Mover In Using IT 1979 : COSMOS, the centralized computer system for package tracking on a real-time basis 1980 : Launched a proprietary and then-revolutionary data network called Digitally Assisted Dispatch Systems (DADS) which enables dispatchers to use text messages to change drivers’ routes and pickup requests – still in use, DADS led to a 30% increase in productivity, the first day it was used. 1984 : Standalone DOS-based automated shipping system for customers who ship over 5 packages a day 1986 : Present generation of wireless handhelds to capture package data via a bar-code scan, which is downloaded to COSMOS when the handheld is inserted in the DADS unit in the truck. 1998 25 : On-Line package tracking at Fed. Ex. com – saw the Net Dr. Lakshmi Mohan

Fed. Ex was an Aggressive First-Mover In Using IT 1979 : COSMOS, the centralized computer system for package tracking on a real-time basis 1980 : Launched a proprietary and then-revolutionary data network called Digitally Assisted Dispatch Systems (DADS) which enables dispatchers to use text messages to change drivers’ routes and pickup requests – still in use, DADS led to a 30% increase in productivity, the first day it was used. 1984 : Standalone DOS-based automated shipping system for customers who ship over 5 packages a day 1986 : Present generation of wireless handhelds to capture package data via a bar-code scan, which is downloaded to COSMOS when the handheld is inserted in the DADS unit in the truck. 1998 25 : On-Line package tracking at Fed. Ex. com – saw the Net Dr. Lakshmi Mohan

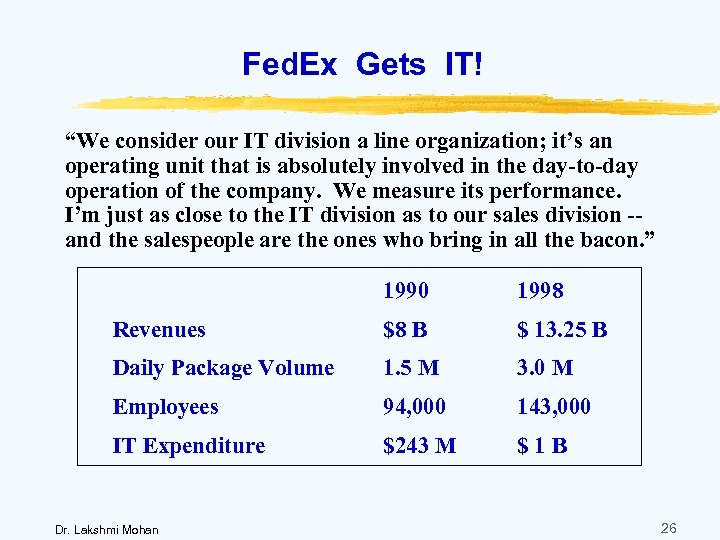

Fed. Ex Gets IT! “We consider our IT division a line organization; it’s an operating unit that is absolutely involved in the day-to-day operation of the company. We measure its performance. I’m just as close to the IT division as to our sales division -and the salespeople are the ones who bring in all the bacon. ” 1990 1998 Revenues $8 B $ 13. 25 B Daily Package Volume 1. 5 M 3. 0 M Employees 94, 000 143, 000 IT Expenditure $243 M $1 B Dr. Lakshmi Mohan 26

Fed. Ex Gets IT! “We consider our IT division a line organization; it’s an operating unit that is absolutely involved in the day-to-day operation of the company. We measure its performance. I’m just as close to the IT division as to our sales division -and the salespeople are the ones who bring in all the bacon. ” 1990 1998 Revenues $8 B $ 13. 25 B Daily Package Volume 1. 5 M 3. 0 M Employees 94, 000 143, 000 IT Expenditure $243 M $1 B Dr. Lakshmi Mohan 26

Fed. Ex Used IT to Expand its Core Competence From Moving Boxes to Bytes All major transportation and delivery companies from United Parcel Service to Ryder System are betting big on IT. The U. S. Postal Service has just announced a partnership with DHL for express deliveries from 11 cities in the U. S. to Europe. The package tracking information capabilities pioneered by Fed. Ex have become industry norms rather than a competitive advantage. Fed. Ex shifted to new pastures - Used IT to provide logistics services, for big manufacturers and retailers around the world Dr. Lakshmi Mohan 27

Fed. Ex Used IT to Expand its Core Competence From Moving Boxes to Bytes All major transportation and delivery companies from United Parcel Service to Ryder System are betting big on IT. The U. S. Postal Service has just announced a partnership with DHL for express deliveries from 11 cities in the U. S. to Europe. The package tracking information capabilities pioneered by Fed. Ex have become industry norms rather than a competitive advantage. Fed. Ex shifted to new pastures - Used IT to provide logistics services, for big manufacturers and retailers around the world Dr. Lakshmi Mohan 27

A Win-Win Tie-up with National Semi-Conductor Nat Semi’s products from 3 factories and 3 subcontractors in Asia are shipped to a Fed. Ex distribution warehouse in Singapore. Nat Semi’s order-processing system on an IBM mainframe in Santa Clara, California, sends a daily batch of orders over a dedicated line directly to Fed. Ex’s inventory management system running on a Tandem machine in Memphis. Fed. Ex essentially takes over and fulfills the order from the Singapore warehouse, and sends an execution record to Nat Semi. Dr. Lakshmi Mohan 28

A Win-Win Tie-up with National Semi-Conductor Nat Semi’s products from 3 factories and 3 subcontractors in Asia are shipped to a Fed. Ex distribution warehouse in Singapore. Nat Semi’s order-processing system on an IBM mainframe in Santa Clara, California, sends a daily batch of orders over a dedicated line directly to Fed. Ex’s inventory management system running on a Tandem machine in Memphis. Fed. Ex essentially takes over and fulfills the order from the Singapore warehouse, and sends an execution record to Nat Semi. Dr. Lakshmi Mohan 28

The Value-Add for Nat Semi National Semi-Conductor reduced. . . Average Customer Delivery Cycle from 4 weeks to 7 days. . . Distribution costs from 2. 9% of sales to 1. 2% National Semi-Conductor eliminated. . . 7 regional warehouses in the U. S. , Europe and Asia Fed. Ex has helped us prove that quicker cycle times and reduced costs are not mutually exclusive. It’s been five years of hard work and a painful change process, but we’ve succeeded. We used to have to deal with so many different nodes in the process -- freight forwarders, customs agents, handling companies, delivery companies, airlines. Now Fed. Ex is our one-stop shop. Dr. Lakshmi Mohan 29

The Value-Add for Nat Semi National Semi-Conductor reduced. . . Average Customer Delivery Cycle from 4 weeks to 7 days. . . Distribution costs from 2. 9% of sales to 1. 2% National Semi-Conductor eliminated. . . 7 regional warehouses in the U. S. , Europe and Asia Fed. Ex has helped us prove that quicker cycle times and reduced costs are not mutually exclusive. It’s been five years of hard work and a painful change process, but we’ve succeeded. We used to have to deal with so many different nodes in the process -- freight forwarders, customs agents, handling companies, delivery companies, airlines. Now Fed. Ex is our one-stop shop. Dr. Lakshmi Mohan 29

A Lurking Threat for Fed. Ex … From the Net! ü Overnight Delivery: 50% of Fed. Ex revenues - 25% of this business: Letter-size envelopes - Additional 15%: Paper documents such as contracts, legal briefs, etc. ü Alternative: Digital Delivery - Transmit documents electronically, or - Post them online; download when needed “For now, the impact on Fed. Ex is less than catastrophic. But online security is improving. And businesses are starting to adopt contractual devices such as digital signatures. As these technologies mature, the electronic transit of everything from real-estate closings to legal settlements is poised to explode – at the expense of shipping” Dr. Lakshmi Mohan Source: Business Week, May 21, 2001, pp. 67 -68 30

A Lurking Threat for Fed. Ex … From the Net! ü Overnight Delivery: 50% of Fed. Ex revenues - 25% of this business: Letter-size envelopes - Additional 15%: Paper documents such as contracts, legal briefs, etc. ü Alternative: Digital Delivery - Transmit documents electronically, or - Post them online; download when needed “For now, the impact on Fed. Ex is less than catastrophic. But online security is improving. And businesses are starting to adopt contractual devices such as digital signatures. As these technologies mature, the electronic transit of everything from real-estate closings to legal settlements is poised to explode – at the expense of shipping” Dr. Lakshmi Mohan Source: Business Week, May 21, 2001, pp. 67 -68 30

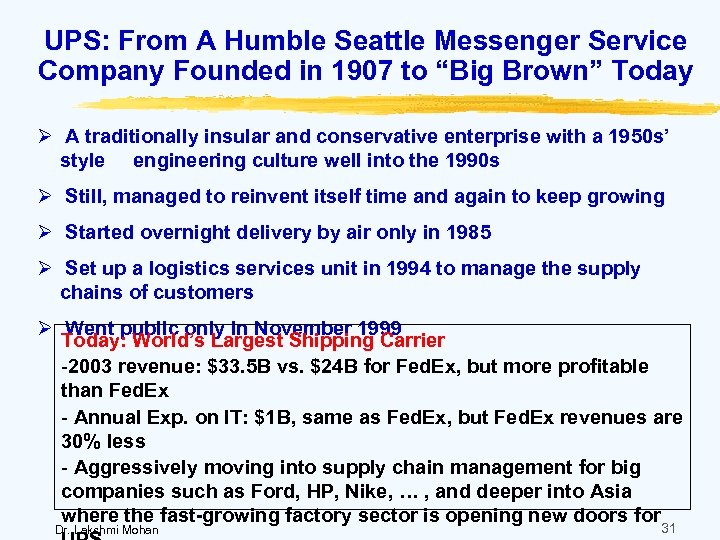

UPS: From A Humble Seattle Messenger Service Company Founded in 1907 to “Big Brown” Today Ø A traditionally insular and conservative enterprise with a 1950 s’ style engineering culture well into the 1990 s Ø Still, managed to reinvent itself time and again to keep growing Ø Started overnight delivery by air only in 1985 Ø Set up a logistics services unit in 1994 to manage the supply chains of customers Ø Went public only in November 1999 Today: World’s Largest Shipping Carrier -2003 revenue: $33. 5 B vs. $24 B for Fed. Ex, but more profitable than Fed. Ex - Annual Exp. on IT: $1 B, same as Fed. Ex, but Fed. Ex revenues are 30% less - Aggressively moving into supply chain management for big companies such as Ford, HP, Nike, … , and deeper into Asia where the fast-growing factory sector is opening new doors for Dr. Lakshmi Mohan 31

UPS: From A Humble Seattle Messenger Service Company Founded in 1907 to “Big Brown” Today Ø A traditionally insular and conservative enterprise with a 1950 s’ style engineering culture well into the 1990 s Ø Still, managed to reinvent itself time and again to keep growing Ø Started overnight delivery by air only in 1985 Ø Set up a logistics services unit in 1994 to manage the supply chains of customers Ø Went public only in November 1999 Today: World’s Largest Shipping Carrier -2003 revenue: $33. 5 B vs. $24 B for Fed. Ex, but more profitable than Fed. Ex - Annual Exp. on IT: $1 B, same as Fed. Ex, but Fed. Ex revenues are 30% less - Aggressively moving into supply chain management for big companies such as Ford, HP, Nike, … , and deeper into Asia where the fast-growing factory sector is opening new doors for Dr. Lakshmi Mohan 31

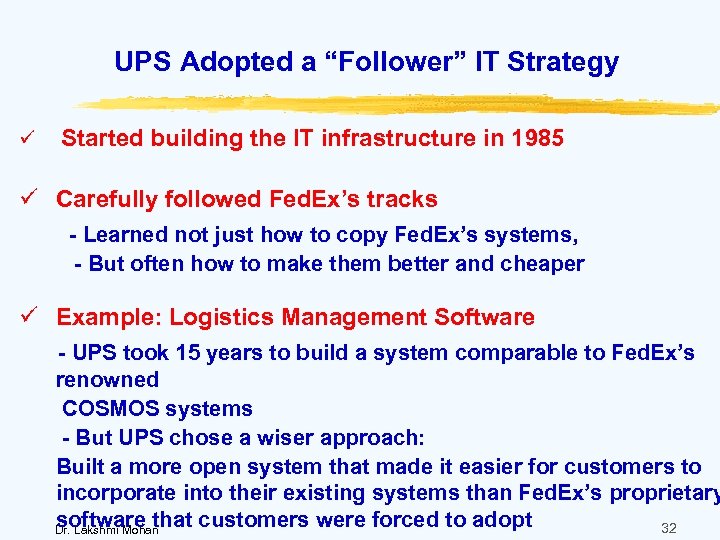

UPS Adopted a “Follower” IT Strategy ü Started building the IT infrastructure in 1985 ü Carefully followed Fed. Ex’s tracks - Learned not just how to copy Fed. Ex’s systems, - But often how to make them better and cheaper ü Example: Logistics Management Software - UPS took 15 years to build a system comparable to Fed. Ex’s renowned COSMOS systems - But UPS chose a wiser approach: Built a more open system that made it easier for customers to incorporate into their existing systems than Fed. Ex’s proprietary software that customers were forced to adopt 32 Dr. Lakshmi Mohan

UPS Adopted a “Follower” IT Strategy ü Started building the IT infrastructure in 1985 ü Carefully followed Fed. Ex’s tracks - Learned not just how to copy Fed. Ex’s systems, - But often how to make them better and cheaper ü Example: Logistics Management Software - UPS took 15 years to build a system comparable to Fed. Ex’s renowned COSMOS systems - But UPS chose a wiser approach: Built a more open system that made it easier for customers to incorporate into their existing systems than Fed. Ex’s proprietary software that customers were forced to adopt 32 Dr. Lakshmi Mohan

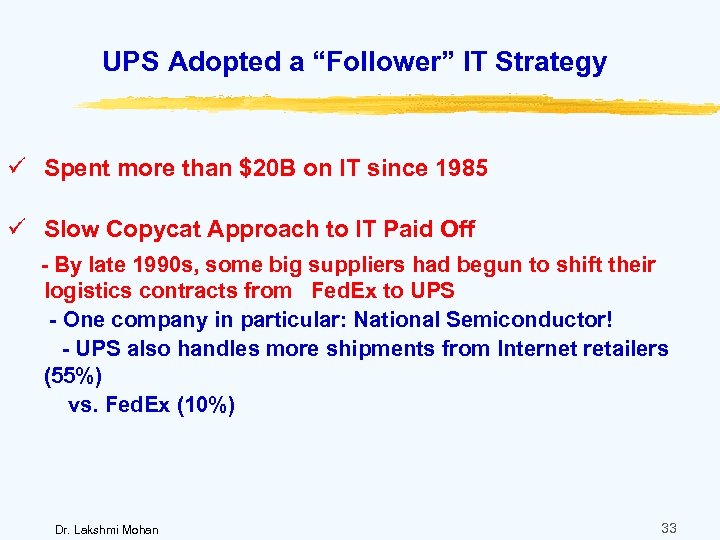

UPS Adopted a “Follower” IT Strategy ü Spent more than $20 B on IT since 1985 ü Slow Copycat Approach to IT Paid Off - By late 1990 s, some big suppliers had begun to shift their logistics contracts from Fed. Ex to UPS - One company in particular: National Semiconductor! - UPS also handles more shipments from Internet retailers (55%) vs. Fed. Ex (10%) Dr. Lakshmi Mohan 33

UPS Adopted a “Follower” IT Strategy ü Spent more than $20 B on IT since 1985 ü Slow Copycat Approach to IT Paid Off - By late 1990 s, some big suppliers had begun to shift their logistics contracts from Fed. Ex to UPS - One company in particular: National Semiconductor! - UPS also handles more shipments from Internet retailers (55%) vs. Fed. Ex (10%) Dr. Lakshmi Mohan 33

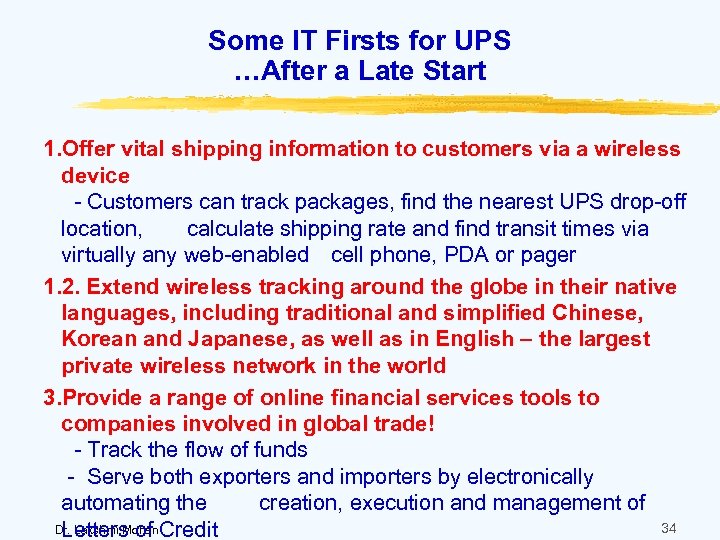

Some IT Firsts for UPS …After a Late Start 1. Offer vital shipping information to customers via a wireless device - Customers can track packages, find the nearest UPS drop-off location, calculate shipping rate and find transit times via virtually any web-enabled cell phone, PDA or pager 1. 2. Extend wireless tracking around the globe in their native languages, including traditional and simplified Chinese, Korean and Japanese, as well as in English – the largest private wireless network in the world 3. Provide a range of online financial services tools to companies involved in global trade! - Track the flow of funds - Serve both exporters and importers by electronically automating the creation, execution and management of 34 Dr. Lakshmi Mohan Letters of Credit

Some IT Firsts for UPS …After a Late Start 1. Offer vital shipping information to customers via a wireless device - Customers can track packages, find the nearest UPS drop-off location, calculate shipping rate and find transit times via virtually any web-enabled cell phone, PDA or pager 1. 2. Extend wireless tracking around the globe in their native languages, including traditional and simplified Chinese, Korean and Japanese, as well as in English – the largest private wireless network in the world 3. Provide a range of online financial services tools to companies involved in global trade! - Track the flow of funds - Serve both exporters and importers by electronically automating the creation, execution and management of 34 Dr. Lakshmi Mohan Letters of Credit

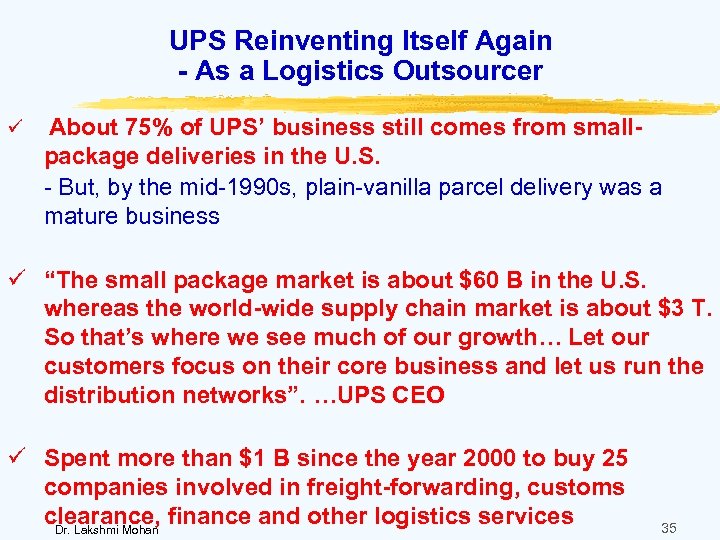

UPS Reinventing Itself Again - As a Logistics Outsourcer ü About 75% of UPS’ business still comes from smallpackage deliveries in the U. S. - But, by the mid-1990 s, plain-vanilla parcel delivery was a mature business ü “The small package market is about $60 B in the U. S. whereas the world-wide supply chain market is about $3 T. So that’s where we see much of our growth… Let our customers focus on their core business and let us run the distribution networks”. …UPS CEO ü Spent more than $1 B since the year 2000 to buy 25 companies involved in freight-forwarding, customs clearance, finance and other logistics services Dr. Lakshmi Mohan 35

UPS Reinventing Itself Again - As a Logistics Outsourcer ü About 75% of UPS’ business still comes from smallpackage deliveries in the U. S. - But, by the mid-1990 s, plain-vanilla parcel delivery was a mature business ü “The small package market is about $60 B in the U. S. whereas the world-wide supply chain market is about $3 T. So that’s where we see much of our growth… Let our customers focus on their core business and let us run the distribution networks”. …UPS CEO ü Spent more than $1 B since the year 2000 to buy 25 companies involved in freight-forwarding, customs clearance, finance and other logistics services Dr. Lakshmi Mohan 35

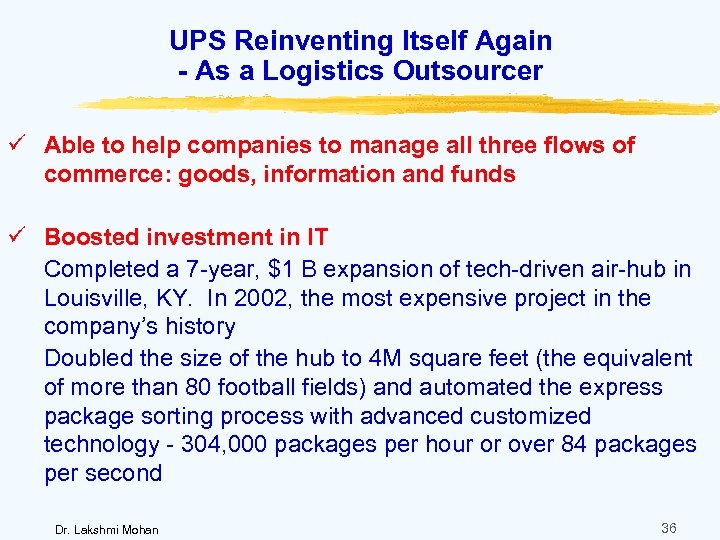

UPS Reinventing Itself Again - As a Logistics Outsourcer ü Able to help companies to manage all three flows of commerce: goods, information and funds ü Boosted investment in IT Completed a 7 -year, $1 B expansion of tech-driven air-hub in Louisville, KY. In 2002, the most expensive project in the company’s history Doubled the size of the hub to 4 M square feet (the equivalent of more than 80 football fields) and automated the express package sorting process with advanced customized technology - 304, 000 packages per hour or over 84 packages per second Dr. Lakshmi Mohan 36

UPS Reinventing Itself Again - As a Logistics Outsourcer ü Able to help companies to manage all three flows of commerce: goods, information and funds ü Boosted investment in IT Completed a 7 -year, $1 B expansion of tech-driven air-hub in Louisville, KY. In 2002, the most expensive project in the company’s history Doubled the size of the hub to 4 M square feet (the equivalent of more than 80 football fields) and automated the express package sorting process with advanced customized technology - 304, 000 packages per hour or over 84 packages per second Dr. Lakshmi Mohan 36

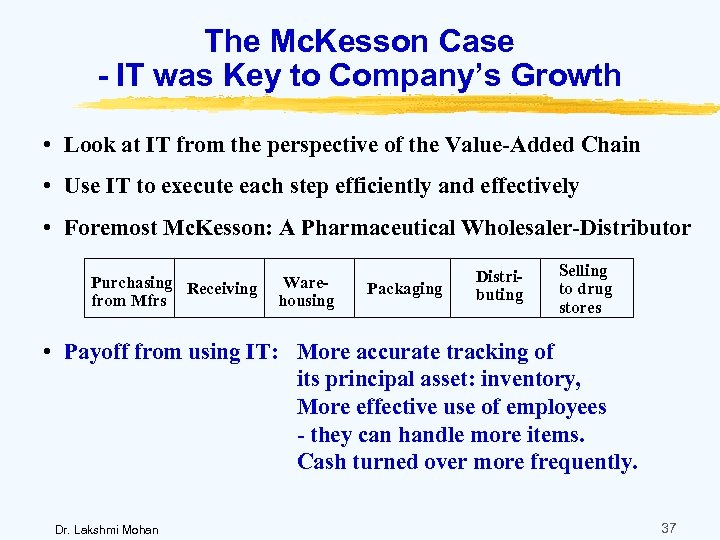

The Mc. Kesson Case - IT was Key to Company’s Growth • Look at IT from the perspective of the Value-Added Chain • Use IT to execute each step efficiently and effectively • Foremost Mc. Kesson: A Pharmaceutical Wholesaler-Distributor Purchasing Receiving from Mfrs Warehousing Packaging Distributing Selling to drug stores • Payoff from using IT: More accurate tracking of its principal asset: inventory, More effective use of employees - they can handle more items. Cash turned over more frequently. Dr. Lakshmi Mohan 37

The Mc. Kesson Case - IT was Key to Company’s Growth • Look at IT from the perspective of the Value-Added Chain • Use IT to execute each step efficiently and effectively • Foremost Mc. Kesson: A Pharmaceutical Wholesaler-Distributor Purchasing Receiving from Mfrs Warehousing Packaging Distributing Selling to drug stores • Payoff from using IT: More accurate tracking of its principal asset: inventory, More effective use of employees - they can handle more items. Cash turned over more frequently. Dr. Lakshmi Mohan 37

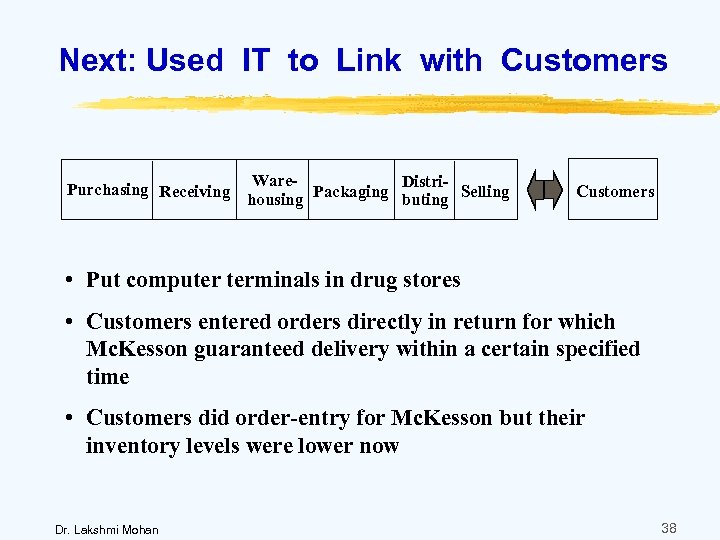

Next: Used IT to Link with Customers Ware. Distri. Purchasing Receiving Packaging housing buting Selling Customers • Put computer terminals in drug stores • Customers entered orders directly in return for which Mc. Kesson guaranteed delivery within a certain specified time • Customers did order-entry for Mc. Kesson but their inventory levels were lower now Dr. Lakshmi Mohan 38

Next: Used IT to Link with Customers Ware. Distri. Purchasing Receiving Packaging housing buting Selling Customers • Put computer terminals in drug stores • Customers entered orders directly in return for which Mc. Kesson guaranteed delivery within a certain specified time • Customers did order-entry for Mc. Kesson but their inventory levels were lower now Dr. Lakshmi Mohan 38

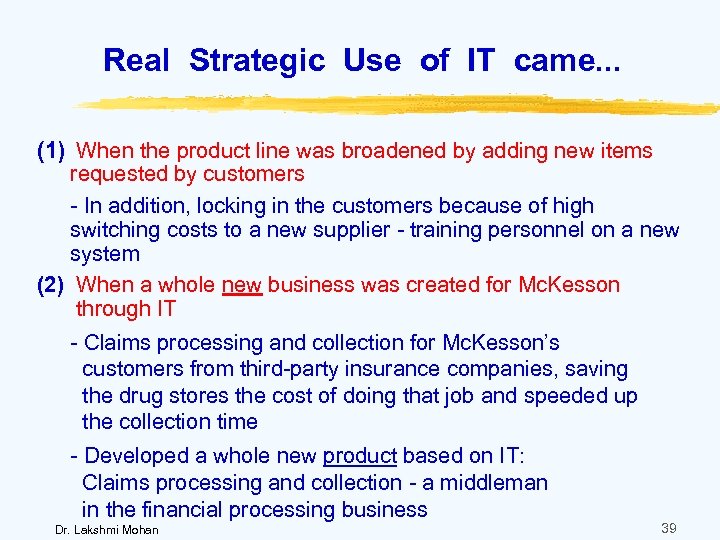

Real Strategic Use of IT came. . . (1) When the product line was broadened by adding new items requested by customers - In addition, locking in the customers because of high switching costs to a new supplier - training personnel on a new system (2) When a whole new business was created for Mc. Kesson through IT - Claims processing and collection for Mc. Kesson’s customers from third-party insurance companies, saving the drug stores the cost of doing that job and speeded up the collection time - Developed a whole new product based on IT: Claims processing and collection - a middleman in the financial processing business Dr. Lakshmi Mohan 39

Real Strategic Use of IT came. . . (1) When the product line was broadened by adding new items requested by customers - In addition, locking in the customers because of high switching costs to a new supplier - training personnel on a new system (2) When a whole new business was created for Mc. Kesson through IT - Claims processing and collection for Mc. Kesson’s customers from third-party insurance companies, saving the drug stores the cost of doing that job and speeded up the collection time - Developed a whole new product based on IT: Claims processing and collection - a middleman in the financial processing business Dr. Lakshmi Mohan 39

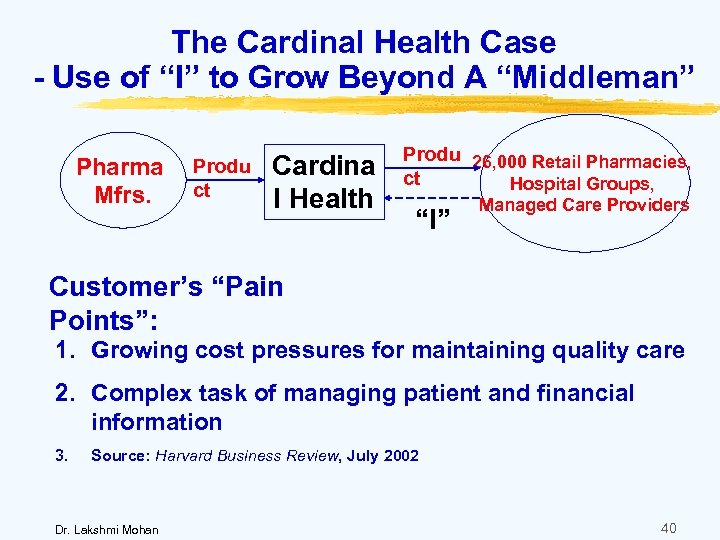

The Cardinal Health Case - Use of “I” to Grow Beyond A “Middleman” Pharma Mfrs. Produ ct Cardina l Health Produ 26, 000 Retail Pharmacies, ct Hospital Groups, “I” Managed Care Providers Customer’s “Pain Points”: 1. Growing cost pressures for maintaining quality care 2. Complex task of managing patient and financial information 3. Source: Harvard Business Review, July 2002 Dr. Lakshmi Mohan 40

The Cardinal Health Case - Use of “I” to Grow Beyond A “Middleman” Pharma Mfrs. Produ ct Cardina l Health Produ 26, 000 Retail Pharmacies, ct Hospital Groups, “I” Managed Care Providers Customer’s “Pain Points”: 1. Growing cost pressures for maintaining quality care 2. Complex task of managing patient and financial information 3. Source: Harvard Business Review, July 2002 Dr. Lakshmi Mohan 40

New Businesses Developed by Cardinal - To Meet Customer Needs 1. Hosted Information Systems for Hospital Pharmacies 1. - Used its expertise in inventory management and procurement 2. Automated Transaction Systems for ordering and dispensing medications, and distributing them to hospital patients 1. - Reduced loss and theft, improved accuracy and captured 2. valuable operational data 3. Moved into Hospital Pharmacy Management Services - Staffing, Consulting, Outsourcing of the Pharmaceutical Functions 4. Introduced a “Franchise” option for Independent Retail Pharmacists 41 Dr. Lakshmi Mohan - Offered them Information Systems, Marketing Resources,

New Businesses Developed by Cardinal - To Meet Customer Needs 1. Hosted Information Systems for Hospital Pharmacies 1. - Used its expertise in inventory management and procurement 2. Automated Transaction Systems for ordering and dispensing medications, and distributing them to hospital patients 1. - Reduced loss and theft, improved accuracy and captured 2. valuable operational data 3. Moved into Hospital Pharmacy Management Services - Staffing, Consulting, Outsourcing of the Pharmaceutical Functions 4. Introduced a “Franchise” option for Independent Retail Pharmacists 41 Dr. Lakshmi Mohan - Offered them Information Systems, Marketing Resources,

New Businesses Developed by Cardinal - To Meet Supplier Needs 1. Design and Produce Customized Packaging for Drugs - Used the “I” about the market - Reduced manufacturing and distribution costs by linking the two costs for JIT replenishment and smaller inventories 2. Aggregated Demand for Less Common Dosage Forms from Multiple Pharma Companies 1. - Achieved scale production advantages for products like freeze-dried tablets 3. Produced Custom Packaging of Certain Drugs for Hospitals - A need that pharma companies could not meet with their siloed manufacturing operations Dr. Lakshmi Mohan 42

New Businesses Developed by Cardinal - To Meet Supplier Needs 1. Design and Produce Customized Packaging for Drugs - Used the “I” about the market - Reduced manufacturing and distribution costs by linking the two costs for JIT replenishment and smaller inventories 2. Aggregated Demand for Less Common Dosage Forms from Multiple Pharma Companies 1. - Achieved scale production advantages for products like freeze-dried tablets 3. Produced Custom Packaging of Certain Drugs for Hospitals - A need that pharma companies could not meet with their siloed manufacturing operations Dr. Lakshmi Mohan 42

Created a New “I” Product To package and sell real-time information about wholesale and retail sales to pharmaceutical marketers - A byproduct of its distribution and pharmacy management services A Huge opportunity for Companies to Leverage their “I” Asset … Although information systems are expensive and time-consuming to build, once the software has been developed and the information has been captured, they can be reused at very low marginal cost Dr. Lakshmi Mohan 43

Created a New “I” Product To package and sell real-time information about wholesale and retail sales to pharmaceutical marketers - A byproduct of its distribution and pharmacy management services A Huge opportunity for Companies to Leverage their “I” Asset … Although information systems are expensive and time-consuming to build, once the software has been developed and the information has been captured, they can be reused at very low marginal cost Dr. Lakshmi Mohan 43

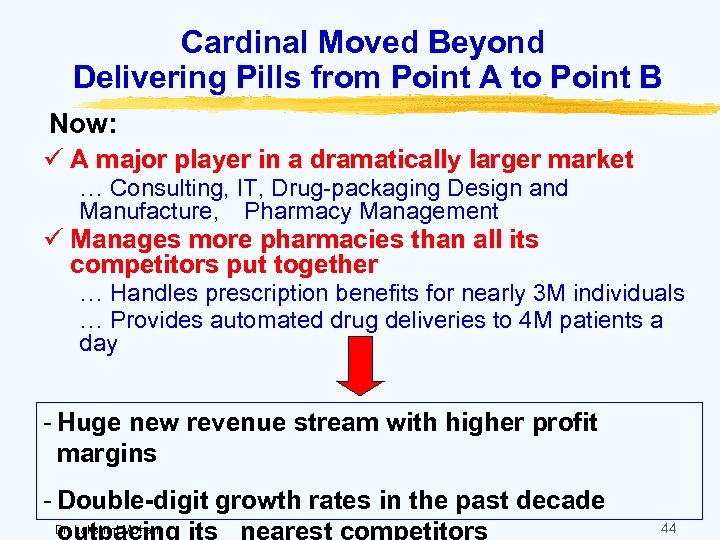

Cardinal Moved Beyond Delivering Pills from Point A to Point B Now: ü A major player in a dramatically larger market … Consulting, IT, Drug-packaging Design and Manufacture, Pharmacy Management ü Manages more pharmacies than all its competitors put together … Handles prescription benefits for nearly 3 M individuals … Provides automated drug deliveries to 4 M patients a day - Huge new revenue stream with higher profit margins - Double-digit growth rates in the past decade Dr. Lakshmi Mohan 44

Cardinal Moved Beyond Delivering Pills from Point A to Point B Now: ü A major player in a dramatically larger market … Consulting, IT, Drug-packaging Design and Manufacture, Pharmacy Management ü Manages more pharmacies than all its competitors put together … Handles prescription benefits for nearly 3 M individuals … Provides automated drug deliveries to 4 M patients a day - Huge new revenue stream with higher profit margins - Double-digit growth rates in the past decade Dr. Lakshmi Mohan 44

Food for Thought 1. IT Innovation is NOT Just About Technology - It must deliver a significant “value-add” to customers. 1. 2. First-Mover Advantage on IT Innovation - Does not last long since competitors will catch up. 3. IT Innovation is a Continuous Process - Capitalize on IT opportunities for reducing pain points of customers and becoming a one-stop shop. 4. Using IT to Lock Customers In - High switching costs deters customers from switching to competitors - Should be wary though of competitors trying to steal customers with irresistible value-adds 5. A “Follower” Strategy May Be Better - Can learn from the successes and mistakes of early movers - Not only can unnecessary costs be avoided but the learning may enable building of better systems 45 Dr. Lakshmi Mohan

Food for Thought 1. IT Innovation is NOT Just About Technology - It must deliver a significant “value-add” to customers. 1. 2. First-Mover Advantage on IT Innovation - Does not last long since competitors will catch up. 3. IT Innovation is a Continuous Process - Capitalize on IT opportunities for reducing pain points of customers and becoming a one-stop shop. 4. Using IT to Lock Customers In - High switching costs deters customers from switching to competitors - Should be wary though of competitors trying to steal customers with irresistible value-adds 5. A “Follower” Strategy May Be Better - Can learn from the successes and mistakes of early movers - Not only can unnecessary costs be avoided but the learning may enable building of better systems 45 Dr. Lakshmi Mohan

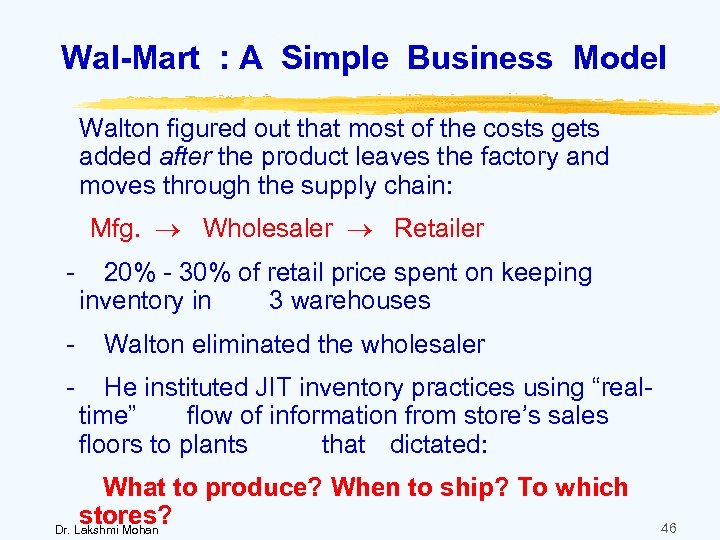

Wal-Mart : A Simple Business Model Walton figured out that most of the costs gets added after the product leaves the factory and moves through the supply chain: Mfg. Wholesaler Retailer - 20% - 30% of retail price spent on keeping inventory in 3 warehouses - Walton eliminated the wholesaler - He instituted JIT inventory practices using “realtime” flow of information from store’s sales floors to plants that dictated: What to produce? When to ship? To which stores? Dr. Lakshmi Mohan 46

Wal-Mart : A Simple Business Model Walton figured out that most of the costs gets added after the product leaves the factory and moves through the supply chain: Mfg. Wholesaler Retailer - 20% - 30% of retail price spent on keeping inventory in 3 warehouses - Walton eliminated the wholesaler - He instituted JIT inventory practices using “realtime” flow of information from store’s sales floors to plants that dictated: What to produce? When to ship? To which stores? Dr. Lakshmi Mohan 46

Wal-Mart after 40 years ……. Lord of the Things • Annual 2001 sales: $220 billion …. . More than all other general-merchandise retailers combined • #1 Food Retailer in the U. S. : $56 billion in 2001 …. . Opened since 1985 over 1000 massive dept. /grocery supercenters, at 200, 000 sq. ft. bigger than 4 football fields • # of employees worldwide: 1. 28 million …. . More than the US Postal service ; # in China : 4, 000 • # of Suppliers : 30, 000 …. . In every continent but Antarctica • Value of 100 shares bought in 1970 @ $16. 50 per share: $11. 5 million • Wal-Mart’s % of P&G's $40 billion in annual sales : 15% • Terabytes of data in data warehouse in Bentonville: 500 - Terabytes in the data warehouse of the U. S. Internal Revenue Service: 40 • Typical starting hourly wage: $6. 50 Dr. Lakshmi Mohan 47

Wal-Mart after 40 years ……. Lord of the Things • Annual 2001 sales: $220 billion …. . More than all other general-merchandise retailers combined • #1 Food Retailer in the U. S. : $56 billion in 2001 …. . Opened since 1985 over 1000 massive dept. /grocery supercenters, at 200, 000 sq. ft. bigger than 4 football fields • # of employees worldwide: 1. 28 million …. . More than the US Postal service ; # in China : 4, 000 • # of Suppliers : 30, 000 …. . In every continent but Antarctica • Value of 100 shares bought in 1970 @ $16. 50 per share: $11. 5 million • Wal-Mart’s % of P&G's $40 billion in annual sales : 15% • Terabytes of data in data warehouse in Bentonville: 500 - Terabytes in the data warehouse of the U. S. Internal Revenue Service: 40 • Typical starting hourly wage: $6. 50 Dr. Lakshmi Mohan 47

IT is Critical for Wal-Mart’s “Everyday Low Price” Strategy Invested in most of the waves of retail IT systems earlier and more aggressively than its competitors - Set industry standards in IT 1969 : Used computers to track store inventory 1980 : Adopted bar codes 1985 : Electronic Data Interchange (EDI) with suppliers Late 80’s : Wireless scanning guns 2003 : Mandated its 100 largest suppliers to place RFID (Radio Frequency Identification) tags on the boxes and pallets shipped to Wal-mart stores by January 2005 Focus of IT Investments: Applications that directly enhanced its core value proposition – EDLP – and increasing sales through micromerchandising Dr. Lakshmi Mohan 48

IT is Critical for Wal-Mart’s “Everyday Low Price” Strategy Invested in most of the waves of retail IT systems earlier and more aggressively than its competitors - Set industry standards in IT 1969 : Used computers to track store inventory 1980 : Adopted bar codes 1985 : Electronic Data Interchange (EDI) with suppliers Late 80’s : Wireless scanning guns 2003 : Mandated its 100 largest suppliers to place RFID (Radio Frequency Identification) tags on the boxes and pallets shipped to Wal-mart stores by January 2005 Focus of IT Investments: Applications that directly enhanced its core value proposition – EDLP – and increasing sales through micromerchandising Dr. Lakshmi Mohan 48

Wal-Mart’s Data Warehouse Current Level of Storage Capacity – Second only to the U. S. Government’s – Several times the level of Sears BUT ALL THAT DATA IS USELESS UNLESS IT IS USED Information is shared with its own buyers AND suppliers – 100, 000 queries a week on purchase patterns or checking on a product Dr. Lakshmi Mohan 49

Wal-Mart’s Data Warehouse Current Level of Storage Capacity – Second only to the U. S. Government’s – Several times the level of Sears BUT ALL THAT DATA IS USELESS UNLESS IT IS USED Information is shared with its own buyers AND suppliers – 100, 000 queries a week on purchase patterns or checking on a product Dr. Lakshmi Mohan 49

Value of the Data Warehouse Wal-Mart’s Buyers ü Help to time merchandise deliveries so that its shelves stay stocked, but NOT overstocked ü Keep inventory levels leaner and turning faster – a MUST for retailers of perishable products and predictable fashion Suppliers ü Vast and detailed data on sales, profit margins and inventory exceeds what many manufacturers know about their own products ü Wal-Mart opened its data vault in January 1999 to its suppliers – Cements Wal-Mart’s power over them Dr. Lakshmi Mohan 50

Value of the Data Warehouse Wal-Mart’s Buyers ü Help to time merchandise deliveries so that its shelves stay stocked, but NOT overstocked ü Keep inventory levels leaner and turning faster – a MUST for retailers of perishable products and predictable fashion Suppliers ü Vast and detailed data on sales, profit margins and inventory exceeds what many manufacturers know about their own products ü Wal-Mart opened its data vault in January 1999 to its suppliers – Cements Wal-Mart’s power over them Dr. Lakshmi Mohan 50

All That Data Is Mined! - Doing it since 1990 Analysis of its 90 million shopping cart transactions per week - To see how the purchases of the different items are related. - Company can then better identify different items to market together. Obvious examples: - Charcoal and tongs go alongside the barbecue grills - Tiny baggies next to the pretzel boxes so Mom can pack snacks for the kids A not so obvious example! - Customers who buy Barbie dolls (it sells one every 20 seconds) have a 60% likelihood of buying one of three 51 Dr. Lakshmi Mohan types of candy bars

All That Data Is Mined! - Doing it since 1990 Analysis of its 90 million shopping cart transactions per week - To see how the purchases of the different items are related. - Company can then better identify different items to market together. Obvious examples: - Charcoal and tongs go alongside the barbecue grills - Tiny baggies next to the pretzel boxes so Mom can pack snacks for the kids A not so obvious example! - Customers who buy Barbie dolls (it sells one every 20 seconds) have a 60% likelihood of buying one of three 51 Dr. Lakshmi Mohan types of candy bars

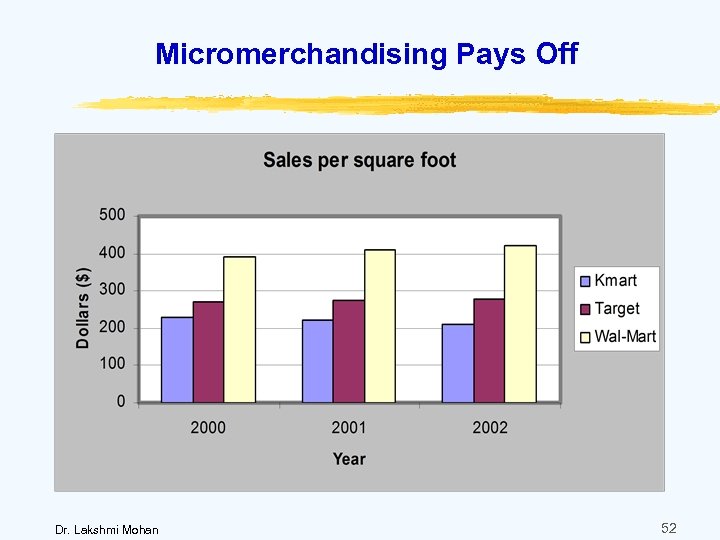

Micromerchandising Pays Off Dr. Lakshmi Mohan 52

Micromerchandising Pays Off Dr. Lakshmi Mohan 52

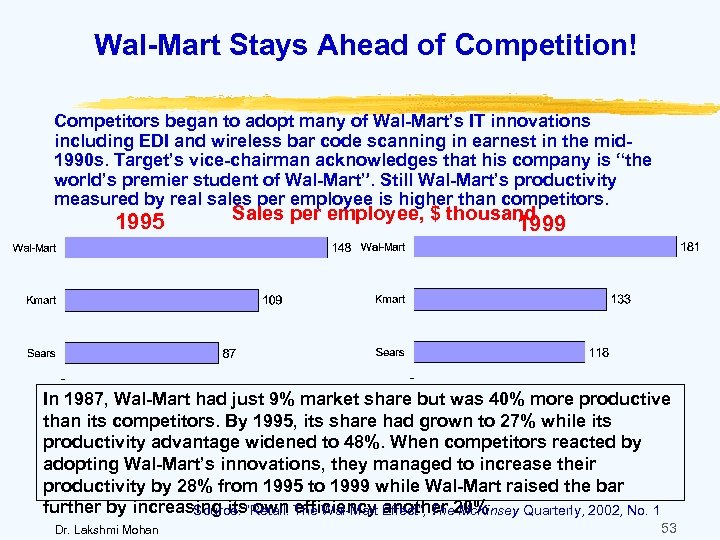

Wal-Mart Stays Ahead of Competition! Competitors began to adopt many of Wal-Mart’s IT innovations including EDI and wireless bar code scanning in earnest in the mid 1990 s. Target’s vice-chairman acknowledges that his company is “the world’s premier student of Wal-Mart”. Still Wal-Mart’s productivity measured by real sales per employee is higher than competitors. 1995 Sales per employee, $ thousand 1999 In 1987, Wal-Mart had just 9% market share but was 40% more productive than its competitors. By 1995, its share had grown to 27% while its productivity advantage widened to 48%. When competitors reacted by adopting Wal-Mart’s innovations, they managed to increase their productivity by 28% from 1995 to 1999 while Wal-Mart raised the bar further by increasing its own efficiency another 20% Source: “Retail: The Wal-Mart Effect”, The Mc. Kinsey Quarterly, 2002, No. 1 Dr. Lakshmi Mohan 53

Wal-Mart Stays Ahead of Competition! Competitors began to adopt many of Wal-Mart’s IT innovations including EDI and wireless bar code scanning in earnest in the mid 1990 s. Target’s vice-chairman acknowledges that his company is “the world’s premier student of Wal-Mart”. Still Wal-Mart’s productivity measured by real sales per employee is higher than competitors. 1995 Sales per employee, $ thousand 1999 In 1987, Wal-Mart had just 9% market share but was 40% more productive than its competitors. By 1995, its share had grown to 27% while its productivity advantage widened to 48%. When competitors reacted by adopting Wal-Mart’s innovations, they managed to increase their productivity by 28% from 1995 to 1999 while Wal-Mart raised the bar further by increasing its own efficiency another 20% Source: “Retail: The Wal-Mart Effect”, The Mc. Kinsey Quarterly, 2002, No. 1 Dr. Lakshmi Mohan 53

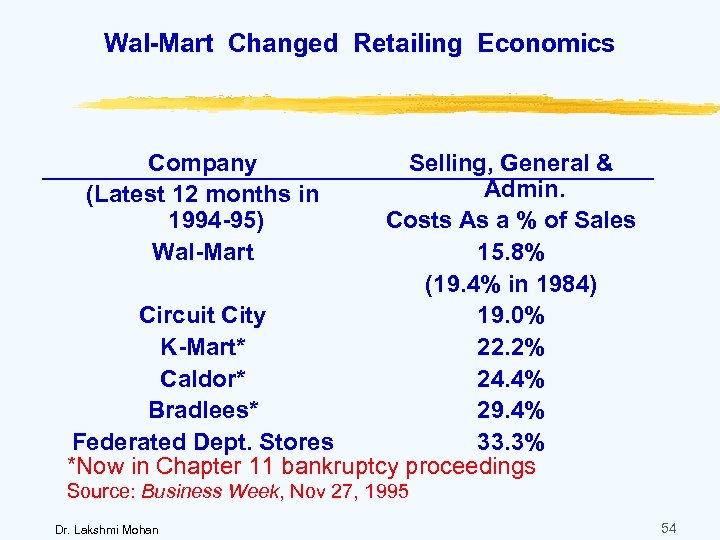

Wal-Mart Changed Retailing Economics Company (Latest 12 months in 1994 -95) Wal-Mart Selling, General & Admin. Costs As a % of Sales 15. 8% (19. 4% in 1984) Circuit City 19. 0% K-Mart* 22. 2% Caldor* 24. 4% Bradlees* 29. 4% Federated Dept. Stores 33. 3% *Now in Chapter 11 bankruptcy proceedings Source: Business Week, Nov 27, 1995 Dr. Lakshmi Mohan 54

Wal-Mart Changed Retailing Economics Company (Latest 12 months in 1994 -95) Wal-Mart Selling, General & Admin. Costs As a % of Sales 15. 8% (19. 4% in 1984) Circuit City 19. 0% K-Mart* 22. 2% Caldor* 24. 4% Bradlees* 29. 4% Federated Dept. Stores 33. 3% *Now in Chapter 11 bankruptcy proceedings Source: Business Week, Nov 27, 1995 Dr. Lakshmi Mohan 54

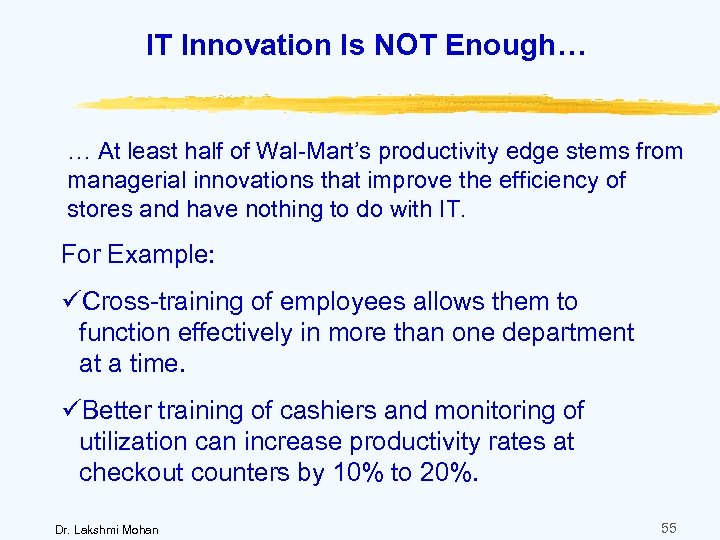

IT Innovation Is NOT Enough… … At least half of Wal-Mart’s productivity edge stems from managerial innovations that improve the efficiency of stores and have nothing to do with IT. For Example: üCross-training of employees allows them to function effectively in more than one department at a time. üBetter training of cashiers and monitoring of utilization can increase productivity rates at checkout counters by 10% to 20%. Dr. Lakshmi Mohan 55

IT Innovation Is NOT Enough… … At least half of Wal-Mart’s productivity edge stems from managerial innovations that improve the efficiency of stores and have nothing to do with IT. For Example: üCross-training of employees allows them to function effectively in more than one department at a time. üBetter training of cashiers and monitoring of utilization can increase productivity rates at checkout counters by 10% to 20%. Dr. Lakshmi Mohan 55

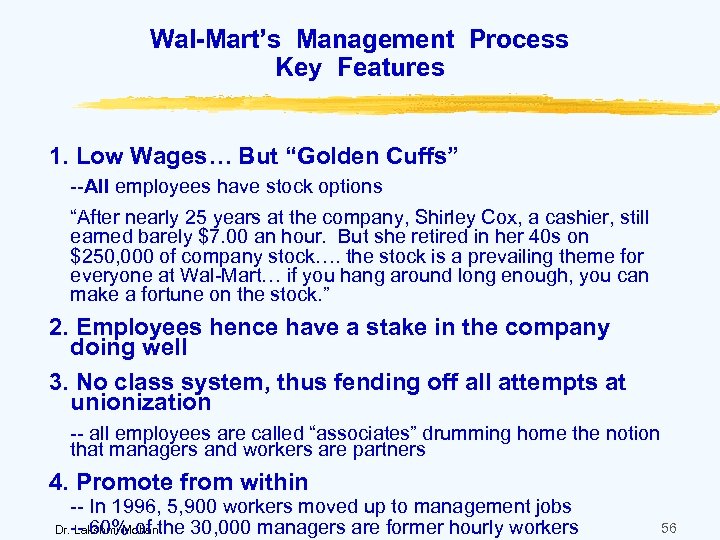

Wal-Mart’s Management Process Key Features 1. Low Wages… But “Golden Cuffs” --All employees have stock options “After nearly 25 years at the company, Shirley Cox, a cashier, still earned barely $7. 00 an hour. But she retired in her 40 s on $250, 000 of company stock…. the stock is a prevailing theme for everyone at Wal-Mart… if you hang around long enough, you can make a fortune on the stock. ” 2. Employees hence have a stake in the company doing well 3. No class system, thus fending off all attempts at unionization -- all employees are called “associates” drumming home the notion that managers and workers are partners 4. Promote from within -- In 1996, 5, 900 workers moved up to management jobs Dr. Lakshmi Mohan -- 60% of the 30, 000 managers are former hourly workers 56

Wal-Mart’s Management Process Key Features 1. Low Wages… But “Golden Cuffs” --All employees have stock options “After nearly 25 years at the company, Shirley Cox, a cashier, still earned barely $7. 00 an hour. But she retired in her 40 s on $250, 000 of company stock…. the stock is a prevailing theme for everyone at Wal-Mart… if you hang around long enough, you can make a fortune on the stock. ” 2. Employees hence have a stake in the company doing well 3. No class system, thus fending off all attempts at unionization -- all employees are called “associates” drumming home the notion that managers and workers are partners 4. Promote from within -- In 1996, 5, 900 workers moved up to management jobs Dr. Lakshmi Mohan -- 60% of the 30, 000 managers are former hourly workers 56

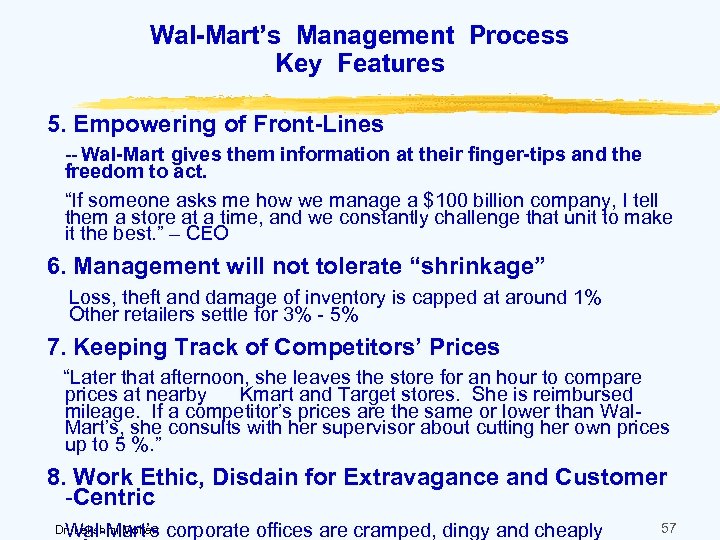

Wal-Mart’s Management Process Key Features 5. Empowering of Front-Lines -- Wal-Mart gives them information at their finger-tips and the freedom to act. “If someone asks me how we manage a $100 billion company, I tell them a store at a time, and we constantly challenge that unit to make it the best. ” – CEO 6. Management will not tolerate “shrinkage” Loss, theft and damage of inventory is capped at around 1% Other retailers settle for 3% - 5% 7. Keeping Track of Competitors’ Prices “Later that afternoon, she leaves the store for an hour to compare prices at nearby Kmart and Target stores. She is reimbursed mileage. If a competitor’s prices are the same or lower than Wal. Mart’s, she consults with her supervisor about cutting her own prices up to 5 %. ” 8. Work Ethic, Disdain for Extravagance and Customer -Centric Wal-Mart’s corporate offices are cramped, dingy and cheaply Dr. Lakshmi Mohan 57

Wal-Mart’s Management Process Key Features 5. Empowering of Front-Lines -- Wal-Mart gives them information at their finger-tips and the freedom to act. “If someone asks me how we manage a $100 billion company, I tell them a store at a time, and we constantly challenge that unit to make it the best. ” – CEO 6. Management will not tolerate “shrinkage” Loss, theft and damage of inventory is capped at around 1% Other retailers settle for 3% - 5% 7. Keeping Track of Competitors’ Prices “Later that afternoon, she leaves the store for an hour to compare prices at nearby Kmart and Target stores. She is reimbursed mileage. If a competitor’s prices are the same or lower than Wal. Mart’s, she consults with her supervisor about cutting her own prices up to 5 %. ” 8. Work Ethic, Disdain for Extravagance and Customer -Centric Wal-Mart’s corporate offices are cramped, dingy and cheaply Dr. Lakshmi Mohan 57

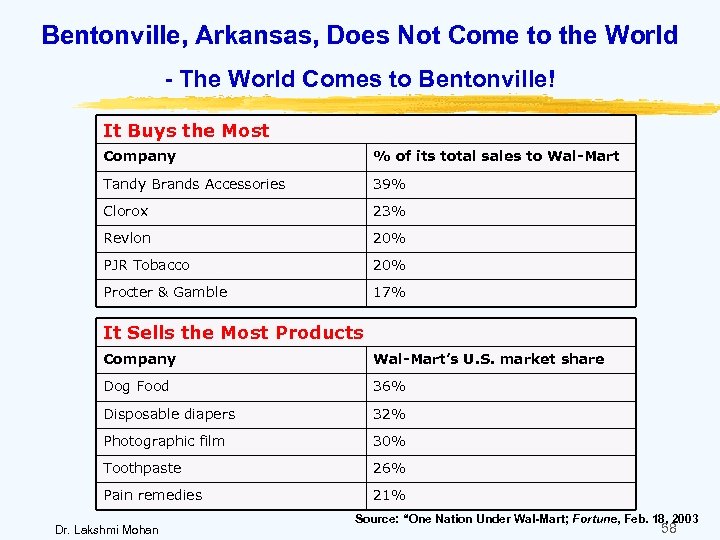

Bentonville, Arkansas, Does Not Come to the World - The World Comes to Bentonville! It Buys the Most Company % of its total sales to Wal-Mart Tandy Brands Accessories 39% Clorox 23% Revlon 20% PJR Tobacco 20% Procter & Gamble 17% It Sells the Most Products Company Wal-Mart’s U. S. market share Dog Food 36% Disposable diapers 32% Photographic film 30% Toothpaste 26% Pain remedies 21% Dr. Lakshmi Mohan Source: “One Nation Under Wal-Mart; Fortune, Feb. 18, 2003 58

Bentonville, Arkansas, Does Not Come to the World - The World Comes to Bentonville! It Buys the Most Company % of its total sales to Wal-Mart Tandy Brands Accessories 39% Clorox 23% Revlon 20% PJR Tobacco 20% Procter & Gamble 17% It Sells the Most Products Company Wal-Mart’s U. S. market share Dog Food 36% Disposable diapers 32% Photographic film 30% Toothpaste 26% Pain remedies 21% Dr. Lakshmi Mohan Source: “One Nation Under Wal-Mart; Fortune, Feb. 18, 2003 58

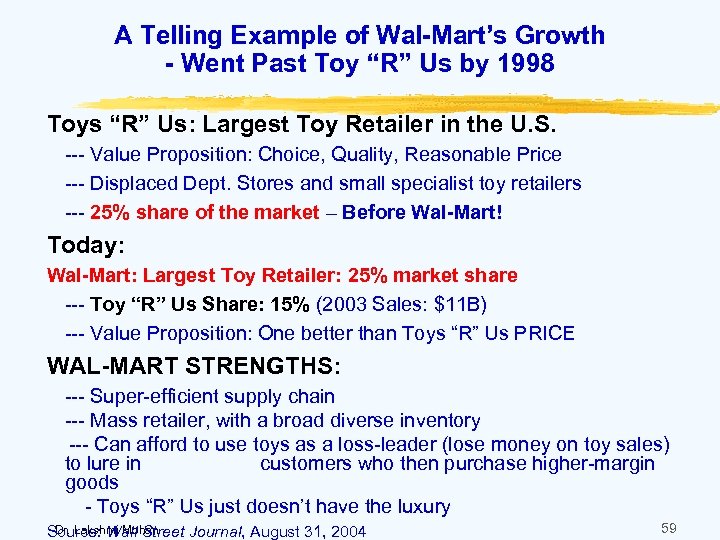

A Telling Example of Wal-Mart’s Growth - Went Past Toy “R” Us by 1998 Toys “R” Us: Largest Toy Retailer in the U. S. --- Value Proposition: Choice, Quality, Reasonable Price --- Displaced Dept. Stores and small specialist toy retailers --- 25% share of the market – Before Wal-Mart! Today: Wal-Mart: Largest Toy Retailer: 25% market share --- Toy “R” Us Share: 15% (2003 Sales: $11 B) --- Value Proposition: One better than Toys “R” Us PRICE WAL-MART STRENGTHS: --- Super-efficient supply chain --- Mass retailer, with a broad diverse inventory --- Can afford to use toys as a loss-leader (lose money on toy sales) to lure in customers who then purchase higher-margin goods - Toys “R” Us just doesn’t have the luxury Dr. Lakshmi Mohan Source: Wall Street Journal, August 31, 2004 59

A Telling Example of Wal-Mart’s Growth - Went Past Toy “R” Us by 1998 Toys “R” Us: Largest Toy Retailer in the U. S. --- Value Proposition: Choice, Quality, Reasonable Price --- Displaced Dept. Stores and small specialist toy retailers --- 25% share of the market – Before Wal-Mart! Today: Wal-Mart: Largest Toy Retailer: 25% market share --- Toy “R” Us Share: 15% (2003 Sales: $11 B) --- Value Proposition: One better than Toys “R” Us PRICE WAL-MART STRENGTHS: --- Super-efficient supply chain --- Mass retailer, with a broad diverse inventory --- Can afford to use toys as a loss-leader (lose money on toy sales) to lure in customers who then purchase higher-margin goods - Toys “R” Us just doesn’t have the luxury Dr. Lakshmi Mohan Source: Wall Street Journal, August 31, 2004 59

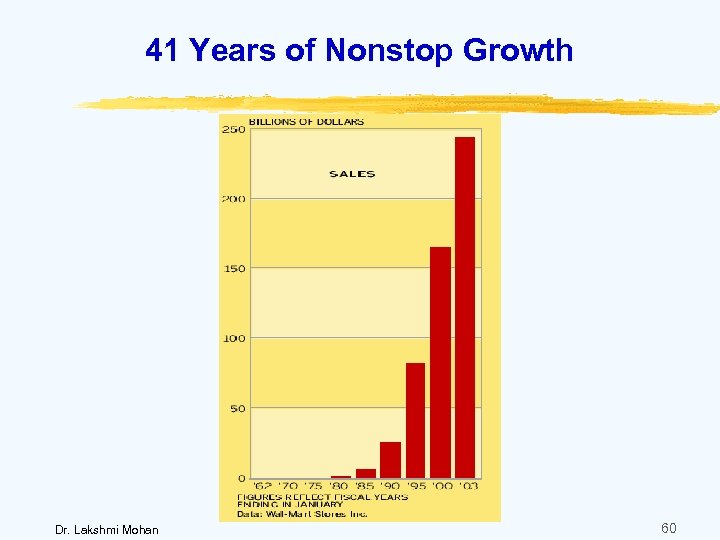

41 Years of Nonstop Growth Dr. Lakshmi Mohan 60

41 Years of Nonstop Growth Dr. Lakshmi Mohan 60

“Sense & Respond” Management Process of Wal-Mart : Why They are Unbeatable Disappointing sales on Friday, Nov 26, 2004 (the day after Thanksgiving), Traditionally the biggest shopping day of the year - Wal-Mart knows it literally at the end of the day Because of their state-of-the-art information system Dr. Lakshmi Mohan 61

“Sense & Respond” Management Process of Wal-Mart : Why They are Unbeatable Disappointing sales on Friday, Nov 26, 2004 (the day after Thanksgiving), Traditionally the biggest shopping day of the year - Wal-Mart knows it literally at the end of the day Because of their state-of-the-art information system Dr. Lakshmi Mohan 61

How did Wal-Mart Management respond to it? 1. Within a couple of hours, Michael Duke, the president of Wal-Mart, had gotten messages on his Blackberry that sales were off at stores around the country. 2. He brainstormed with execs and store managers about which products to mark down. 3. A team met over the weekend to finalize the list and contact suppliers. 4. On Tuesday, stores nationwide offered the new prices. Dr. Lakshmi Mohan 62

How did Wal-Mart Management respond to it? 1. Within a couple of hours, Michael Duke, the president of Wal-Mart, had gotten messages on his Blackberry that sales were off at stores around the country. 2. He brainstormed with execs and store managers about which products to mark down. 3. A team met over the weekend to finalize the list and contact suppliers. 4. On Tuesday, stores nationwide offered the new prices. Dr. Lakshmi Mohan 62

How did Wal-Mart Management respond to it? 5. On Thursday, Wal-Mart broadcast a video for its stores suggesting new displays. 6. The next day, the displays were up, and a new ad campaign was underway. 7. On Saturday, the company conducted a meeting with 500 employees asking for more ideas -- and acted on 21 of their recommendations. The result? The retailer expects December sales to be up three percent. Although it's not the holiday season it had initially hoped for, it represents a heck of a comeback. Source: www. fastcompany. com Dr. Lakshmi Mohan 63

How did Wal-Mart Management respond to it? 5. On Thursday, Wal-Mart broadcast a video for its stores suggesting new displays. 6. The next day, the displays were up, and a new ad campaign was underway. 7. On Saturday, the company conducted a meeting with 500 employees asking for more ideas -- and acted on 21 of their recommendations. The result? The retailer expects December sales to be up three percent. Although it's not the holiday season it had initially hoped for, it represents a heck of a comeback. Source: www. fastcompany. com Dr. Lakshmi Mohan 63

At the End of the Day… It’s How We Use IT That Counts IT is a Means to Executing a Smart Strategy 1. Simply following IT trends can backfire. 2. Smart companies analyze their economics carefully and spend aggressively on IT applications targeted at those levers that have the greatest impact on productivity 2. A prerequisite for getting returns from IT investments is managerial innovation. Business managers should lead the way, reshaping their companies’ processes and practices so that the full benefits of new information systems could be realized 3. Focus on value-adds for the customer 4. “There is only one valid definition of a business purpose: to create a satisfied customer”. Peter Drucker, The Practice of Management, 1954 64 Dr. Lakshmi Mohan

At the End of the Day… It’s How We Use IT That Counts IT is a Means to Executing a Smart Strategy 1. Simply following IT trends can backfire. 2. Smart companies analyze their economics carefully and spend aggressively on IT applications targeted at those levers that have the greatest impact on productivity 2. A prerequisite for getting returns from IT investments is managerial innovation. Business managers should lead the way, reshaping their companies’ processes and practices so that the full benefits of new information systems could be realized 3. Focus on value-adds for the customer 4. “There is only one valid definition of a business purpose: to create a satisfied customer”. Peter Drucker, The Practice of Management, 1954 64 Dr. Lakshmi Mohan