816f352a9e5be63eb63951761a1e7720.ppt

- Количество слайдов: 16

OTP Bank 1 Q 2002. Performance Dr. Zoltán Spéder Vice-Chairman, Deputy CEO, CFO BSE Roadshow – 2002

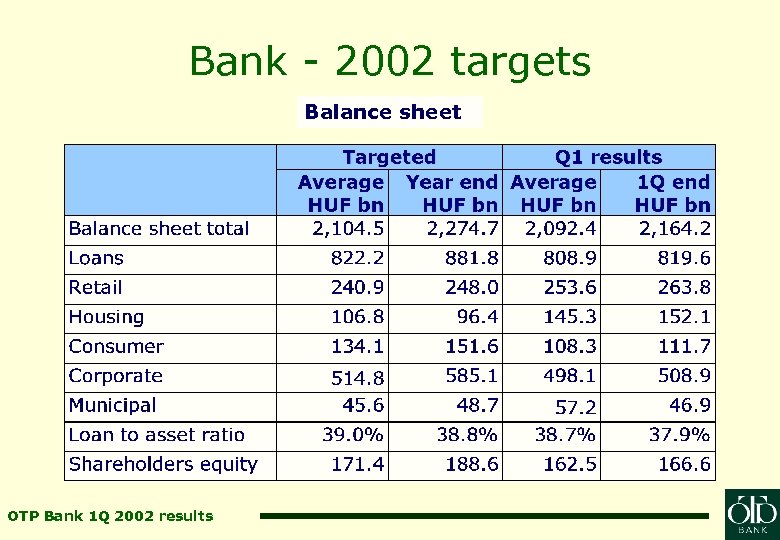

Bank - 2002 targets Balance sheet OTP Bank 1 Q 2002 results

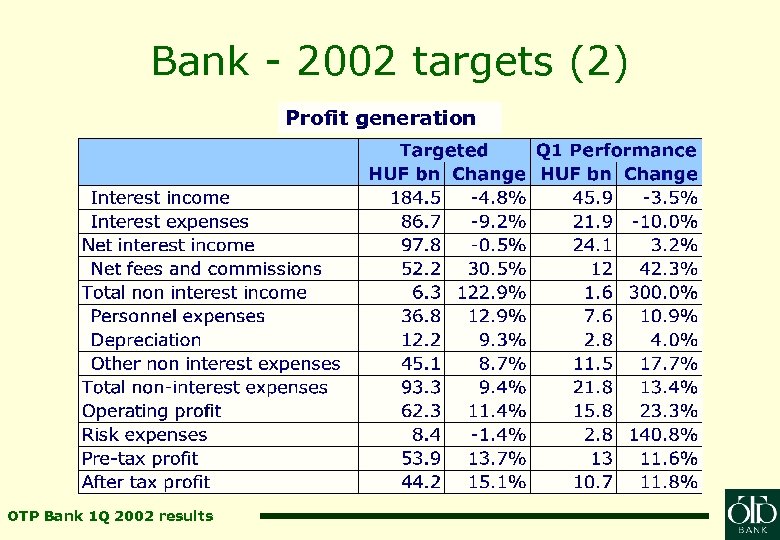

Bank - 2002 targets (2) Profit generation OTP Bank 1 Q 2002 results

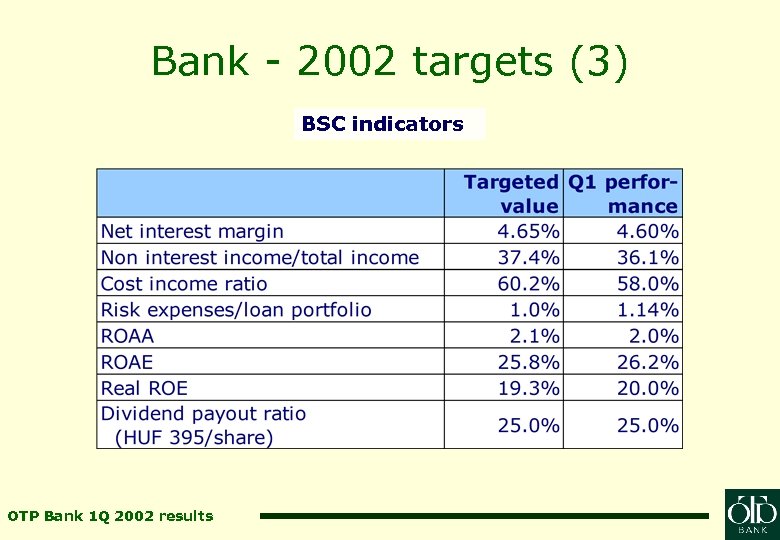

Bank - 2002 targets (3) BSC indicators OTP Bank 1 Q 2002 results

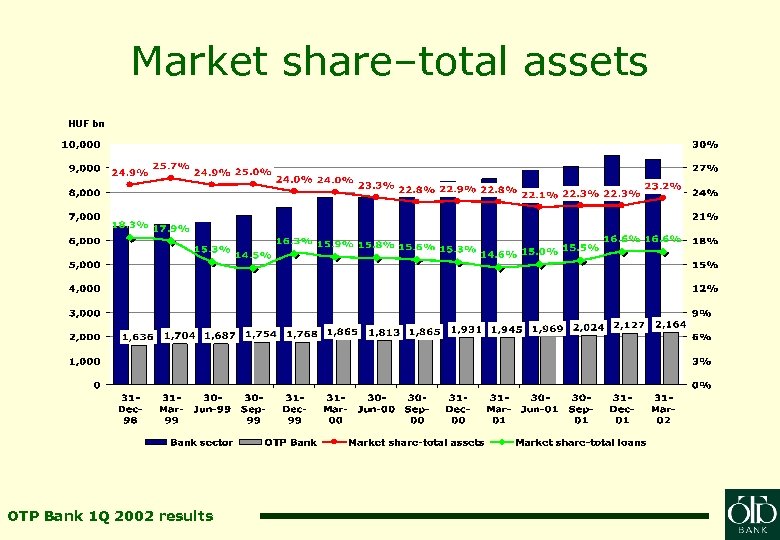

Market share–total assets HUF bn OTP Bank 1 Q 2002 results

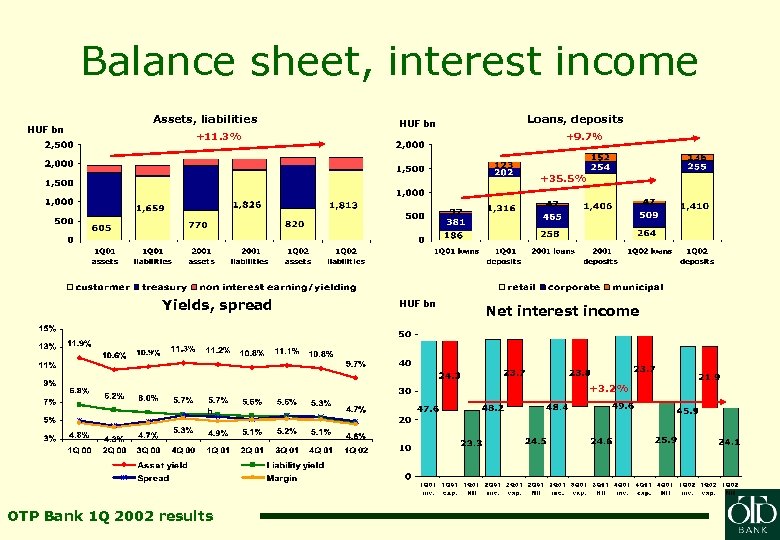

Balance sheet, interest income HUF bn Assets, liabilities HUF bn +11. 3% Loans, deposits +9. 7% +35. 5% Yields, spread HUF bn Net interest income +3. 2% OTP Bank 1 Q 2002 results

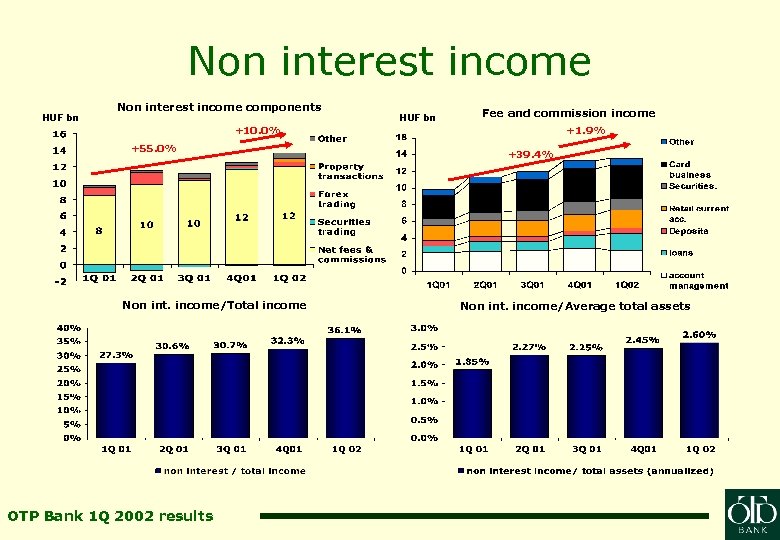

Non interest income HUF bn Non interest income components HUF bn Fee and commission income +10. 0% +55. 0% Non int. income/Total income OTP Bank 1 Q 2002 results +1. 9% +39. 4% Non int. income/Average total assets

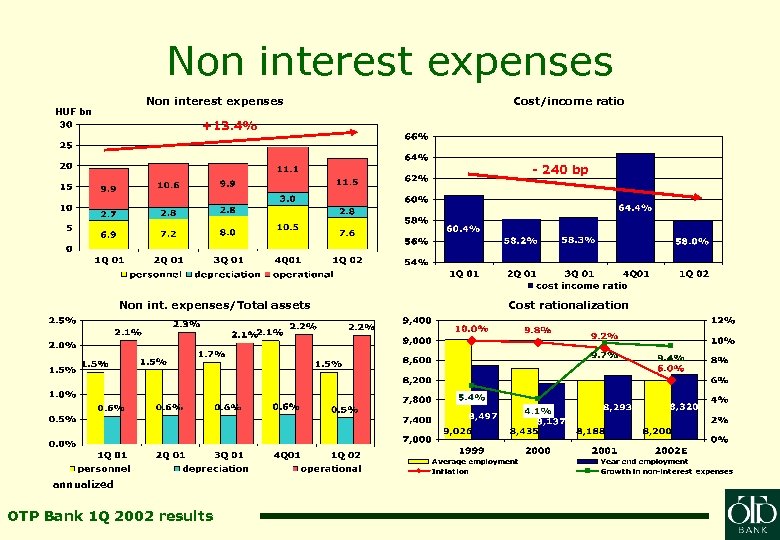

Non interest expenses HUF bn Non interest expenses Cost/income ratio +13. 4% - 240 bp Non int. expenses/Total assets annualized OTP Bank 1 Q 2002 results Cost rationalization

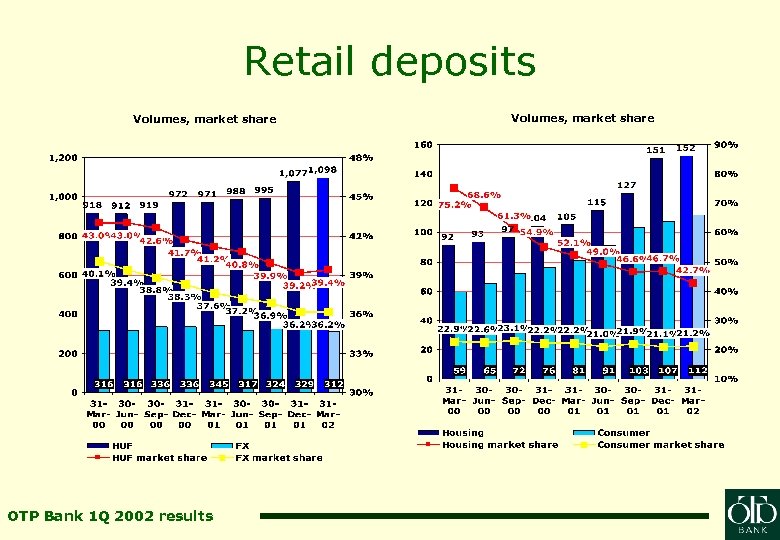

Retail deposits Volumes, market share OTP Bank 1 Q 2002 results Volumes, market share

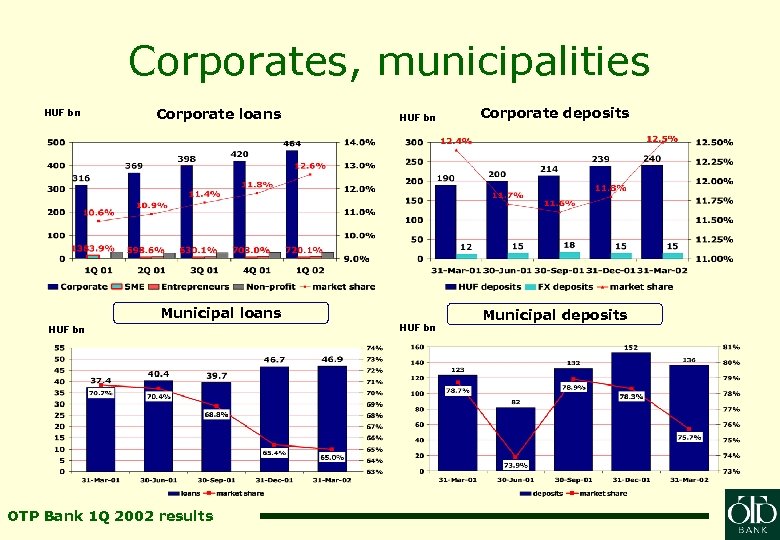

Corporates, municipalities HUF bn Corporate loans HUF bn Municipal loans HUF bn OTP Bank 1 Q 2002 results HUF bn Corporate deposits Municipal deposits

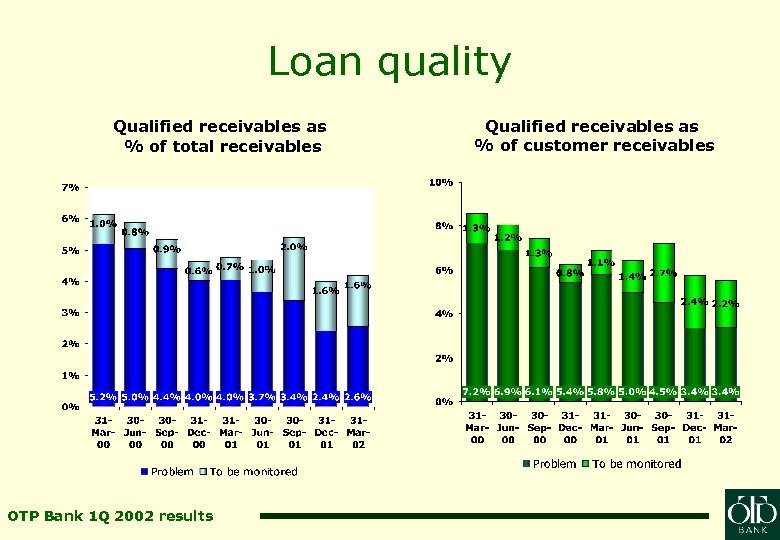

Loan quality Qualified receivables as % of total receivables OTP Bank 1 Q 2002 results Qualified receivables as % of customer receivables

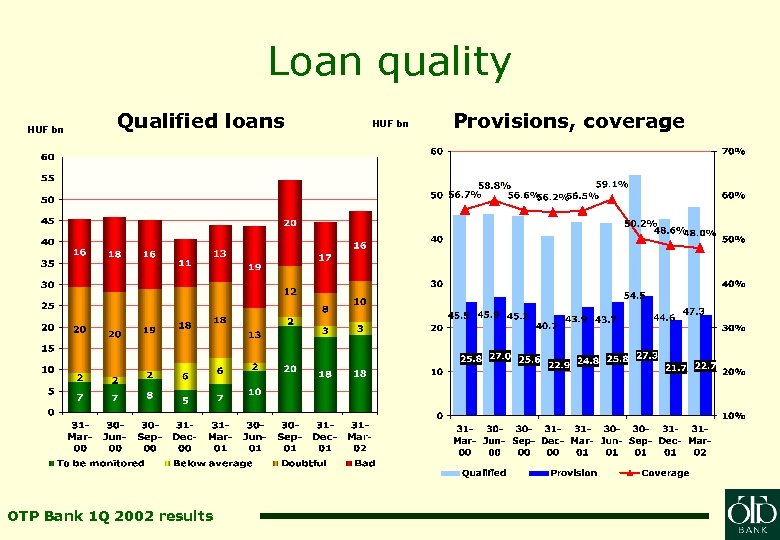

Loan quality HUF bn Qualified loans OTP Bank 1 Q 2002 results HUF bn Provisions, coverage

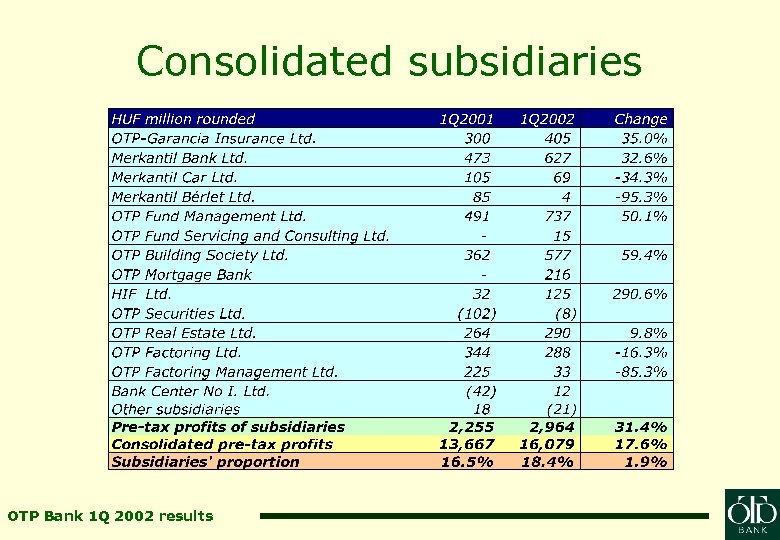

Consolidated subsidiaries OTP Bank 1 Q 2002 results

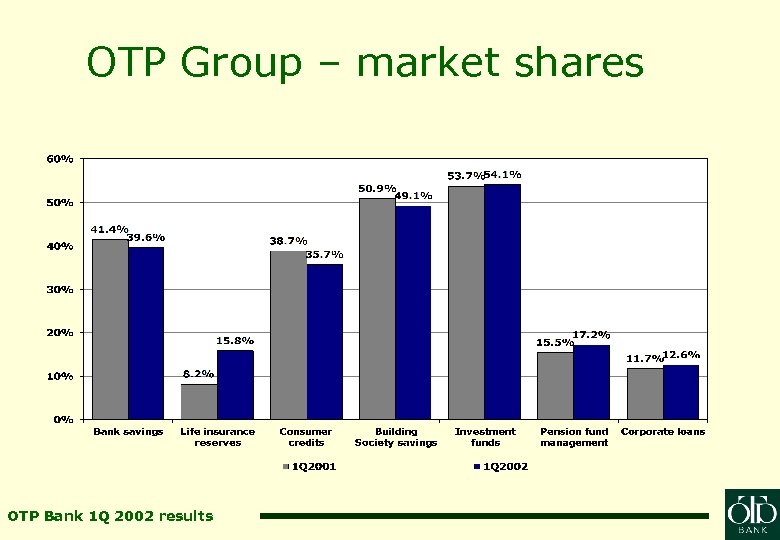

OTP Group – market shares OTP Bank 1 Q 2002 results

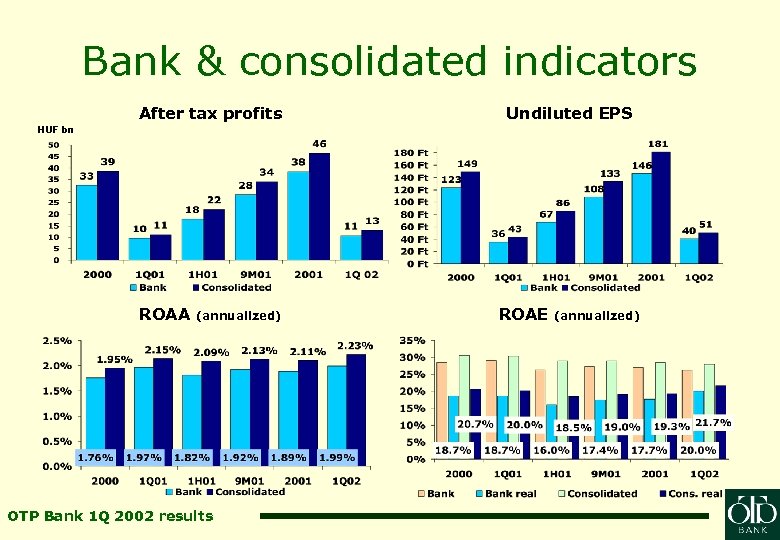

Bank & consolidated indicators After tax profits Undiluted EPS HUF bn ROAA (annualized) OTP Bank 1 Q 2002 results ROAE (annualized)

For further information please contact: Dr. Zoltán Spéder, Vice-Chairman, CFO spederz@otpbank. hu George Fenyõ Managing Director, IR fenyog@otpbank. hu Phone: +36 1 269 1693 OTP Bank 1 Q 2002 results

816f352a9e5be63eb63951761a1e7720.ppt