69e1d938e053c8a580c4fac9fd37bf8b.ppt

- Количество слайдов: 95

Organizational Theory, Structure & Design Books to be read ® 1. Understanding theory & design of organizations- Richard L Daft ® 2. Organization Theory- Stephen Robbins ® 3. Organizations- structures, processes & outcomes- Richard H. Hall ® 4. Organizational Theory- Gareth Jones ® 5. Organization Structure and Design. Mirza Saiyadain & Poornima Gupta ®

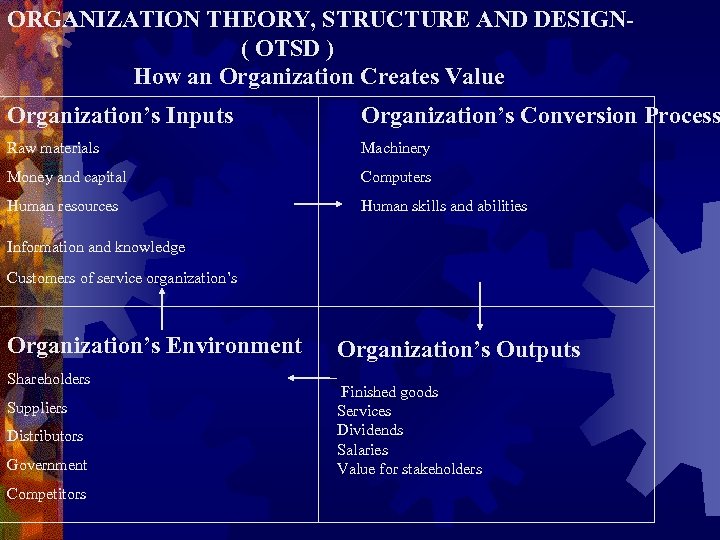

ORGANIZATION THEORY, STRUCTURE AND DESIGN( OTSD ) How an Organization Creates Value Organization’s Inputs Organization’s Conversion Process Raw materials Machinery Money and capital Computers Human resources Human skills and abilities Information and knowledge Customers of service organization’s Organization’s Environment Shareholders Suppliers Distributors Government Competitors Organization’s Outputs Finished goods Services Dividends Salaries Value for stakeholders

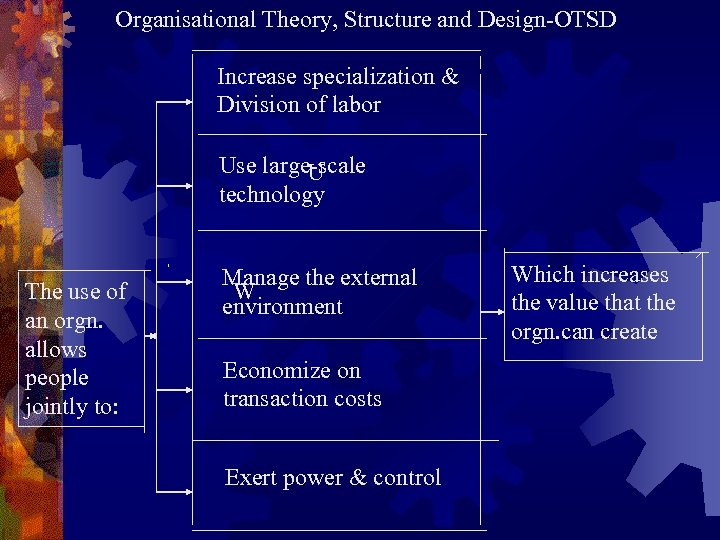

Organisational Theory, Structure and Design-OTSD Increase specialization & Division of labor Use large-scale U technology The use of an orgn. allows people jointly to: Manage the external W environment Economize on transaction costs Exert power & control Which increases the value that the orgn. can create

OTSDOrganizational Theory is a study of how organizations function and how they affect and are affected by the environment in which they operate. O T consists of three parts viz: Organization Structure Organisational Design Organisational Culture

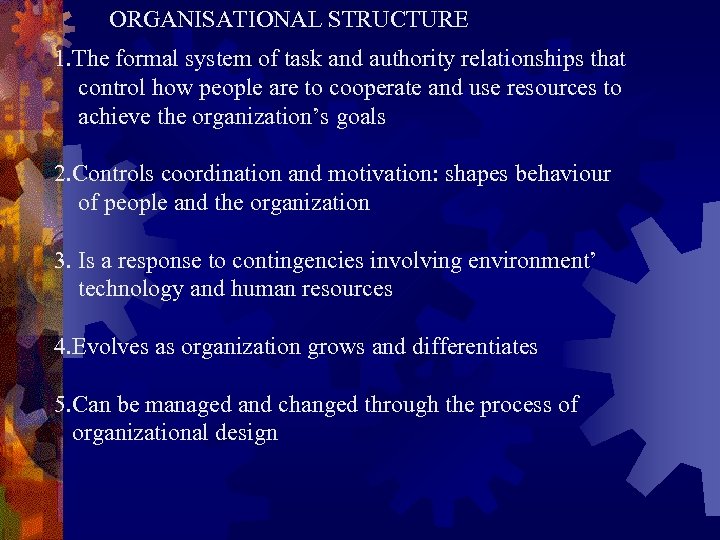

ORGANISATIONAL STRUCTURE 1. The formal system of task and authority relationships that control how people are to cooperate and use resources to achieve the organization’s goals 2. Controls coordination and motivation: shapes behaviour of people and the organization 3. Is a response to contingencies involving environment’ technology and human resources 4. Evolves as organization grows and differentiates 5. Can be managed and changed through the process of organizational design

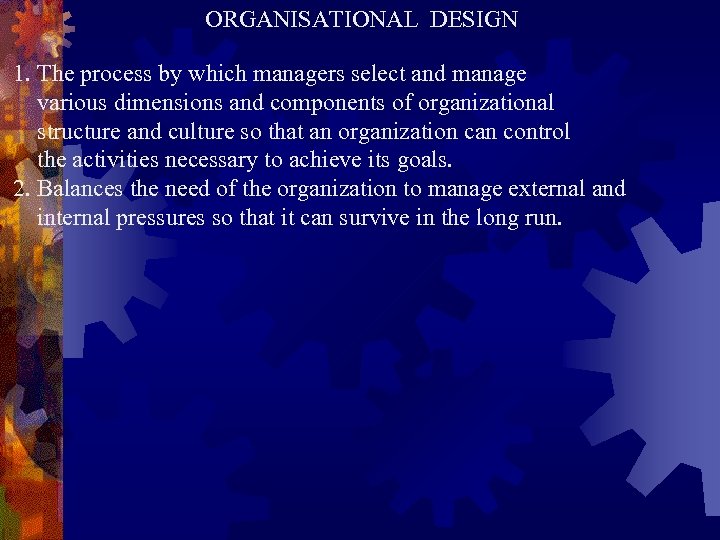

ORGANISATIONAL DESIGN 1. The process by which managers select and manage various dimensions and components of organizational structure and culture so that an organization can control the activities necessary to achieve its goals. 2. Balances the need of the organization to manage external and internal pressures so that it can survive in the long run.

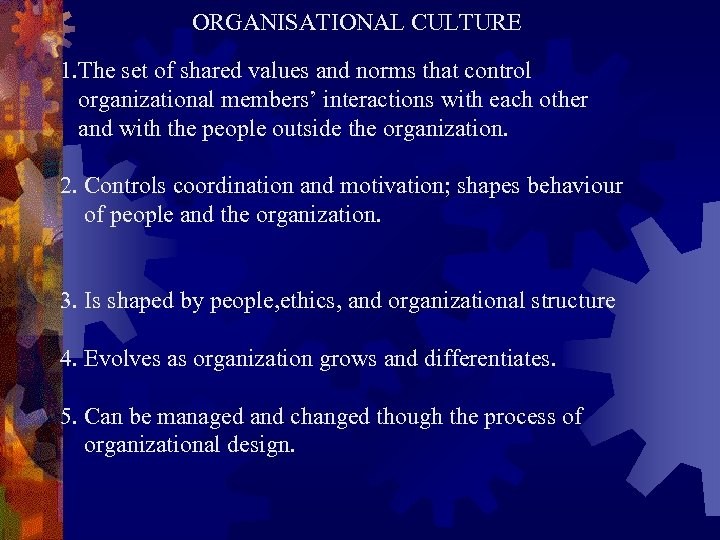

ORGANISATIONAL CULTURE 1. The set of shared values and norms that control organizational members’ interactions with each other and with the people outside the organization. 2. Controls coordination and motivation; shapes behaviour of people and the organization. 3. Is shaped by people, ethics, and organizational structure 4. Evolves as organization grows and differentiates. 5. Can be managed and changed though the process of organizational design.

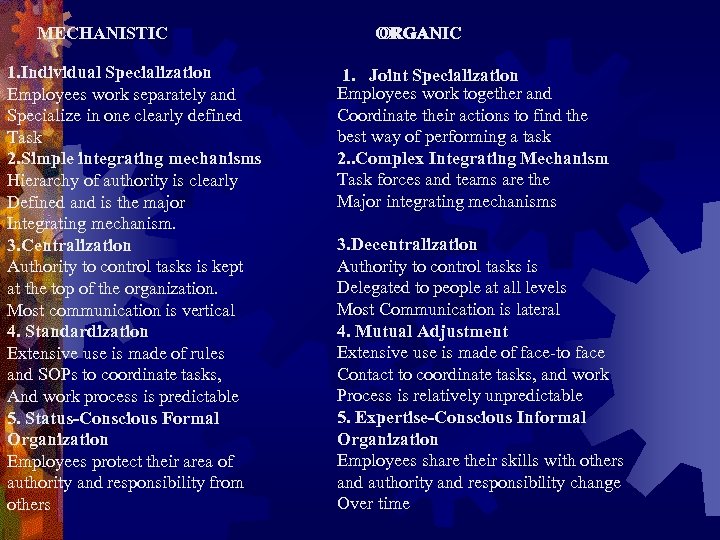

MECHANISTIC 1. Individual Specialization Employees work separately and Specialize in one clearly defined Task 2. Simple integrating mechanisms Hierarchy of authority is clearly Defined and is the major Integrating mechanism. 3. Centralization Authority to control tasks is kept at the top of the organization. Most communication is vertical 4. Standardization Extensive use is made of rules and SOPs to coordinate tasks, And work process is predictable 5. Status-Conscious Formal Organization Employees protect their area of authority and responsibility from others ORGANIC 1. Joint Specialization Employees work together and Coordinate their actions to find the best way of performing a task 2. . Complex Integrating Mechanism Task forces and teams are the Major integrating mechanisms 3. Decentralization Authority to control tasks is Delegated to people at all levels Most Communication is lateral 4. Mutual Adjustment Extensive use is made of face-to face Contact to coordinate tasks, and work Process is relatively unpredictable 5. Expertise-Conscious Informal Organization Employees share their skills with others and authority and responsibility change Over time

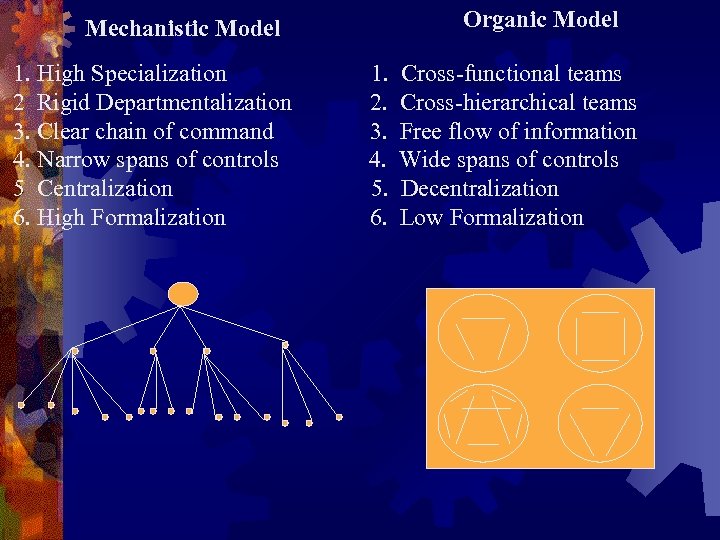

Organic Model Mechanistic Model 1. High Specialization 2 Rigid Departmentalization 3. Clear chain of command 4. Narrow spans of controls 5 Centralization 6. High Formalization 1. 2. 3. 4. 5. 6. Cross-functional teams Cross-hierarchical teams Free flow of information Wide spans of controls Decentralization Low Formalization

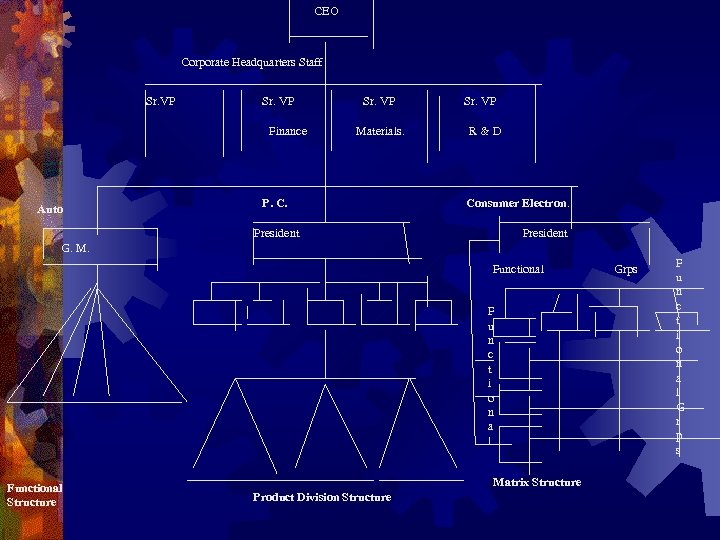

CEO Corporate Headquarters Staff Sr. VP Finance Auto Sr. VP Materials. P. C. Sr. VP R&D Consumer Electron. President G. M. Functional F u n c t i o n a l Functional Structure Matrix Structure Product Division Structure Grps F u n c t i o n a l G r p s

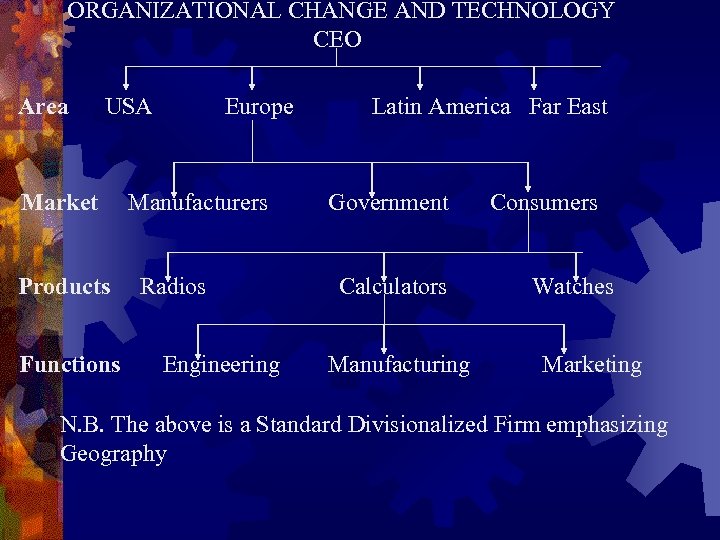

ORGANIZATIONAL CHANGE AND TECHNOLOGY CEO Area USA Market Products Functions Europe Manufacturers Radios Engineering Latin America Far East Government Calculators Manufacturing Consumers Watches Marketing N. B. The above is a Standard Divisionalized Firm emphasizing Geography

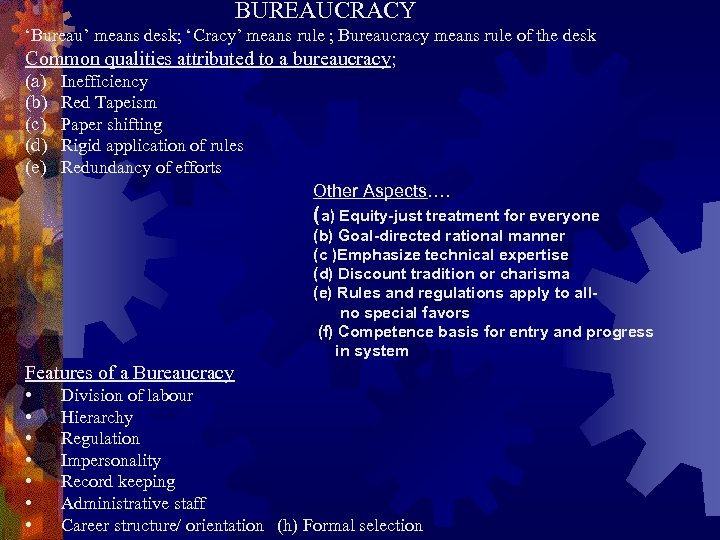

BUREAUCRACY ‘Bureau’ means desk; ‘Cracy’ means rule ; Bureaucracy means rule of the desk Common qualities attributed to a bureaucracy; (a) (b) (c) (d) (e) Inefficiency Red Tapeism Paper shifting Rigid application of rules Redundancy of efforts Other Aspects…. ( a) Equity-just treatment for everyone (b) Goal-directed rational manner (c )Emphasize technical expertise (d) Discount tradition or charisma (e) Rules and regulations apply to allno special favors (f) Competence basis for entry and progress in system Features of a Bureaucracy • • Division of labour Hierarchy Regulation Impersonality Record keeping Administrative staff Career structure/ orientation (h) Formal selection

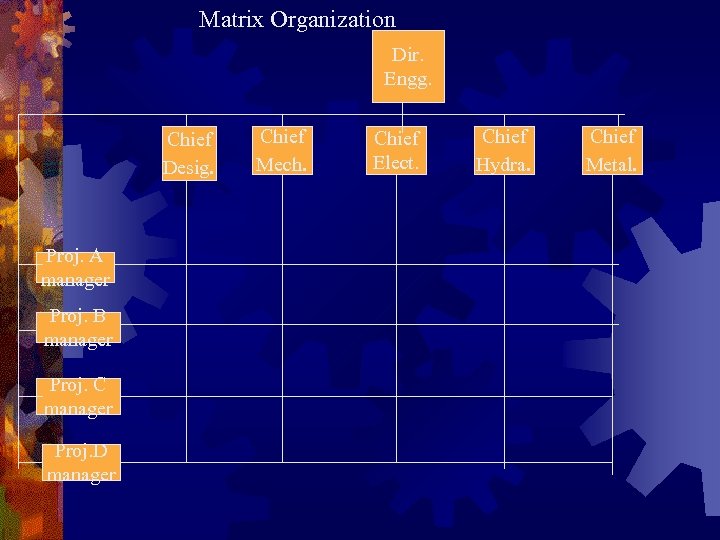

Matrix Organization Dir. Engg. Chief Desig. Proj. A manager Proj. B manager Proj. C manager Proj. D manager Chief Mech. Chief Elect. Chief Hydra. Chief Metal.

MATRIX ORGANIZATION ADVANTAGES 1. Is oriented towards end results 2. Professional identity is maintained 3. Pin-points product-profit relationship DISADVANTAGES 1. Conflict in organization authority exists 2. Possibility of disunity of command exists 3. Requires manager effective in human relations

MATRIX ORGANIZATON Problems with Matrix Organizations 1. State of conflict between functional and project managers 2. Role conflict, role ambiguity, role overload leading to stress 3. Imbalance in power-functional(more)-delay in projects: project(more)- inefficiencies-functional managers have to change priorities as per demands of project 4. Managers try to protect themselves from blame by putting everything in writing thereby increasing administrative costs 5. Matrix orgn. has many time-consuming meetings Making Matrix Orgn. Effective 1. Define objectives clearly 2. Clarify roles. Authority and responsibilities of managers and team members 3. Influence based on knowledge & information and not on rank 4. Balance power of project and functional managers 5. Provide an experienced manager to head project-leadership 6. Install cost , time, quality controls-deviations 7. Reward project managers team members fairly

Organization Design Aspects 1. Mechanistic vs. Organic 2. Classical form of Bureaucracies- Basis of Legal Authority, Logic and Order 3. Centralization vs. Decentralization 4. Chain of Command Span of Control 5. Formalization-written rules, regulations, policies and procedures 6, Specialization 7. Standardization 8. Stratification- inhibits free flow of superior-subordinates interaction 9. Tall and Flat structures 10. Line and Staff functions 11. Departmentalization 12. Functional, Product and Matrix Structures 13. Hybrid Structures

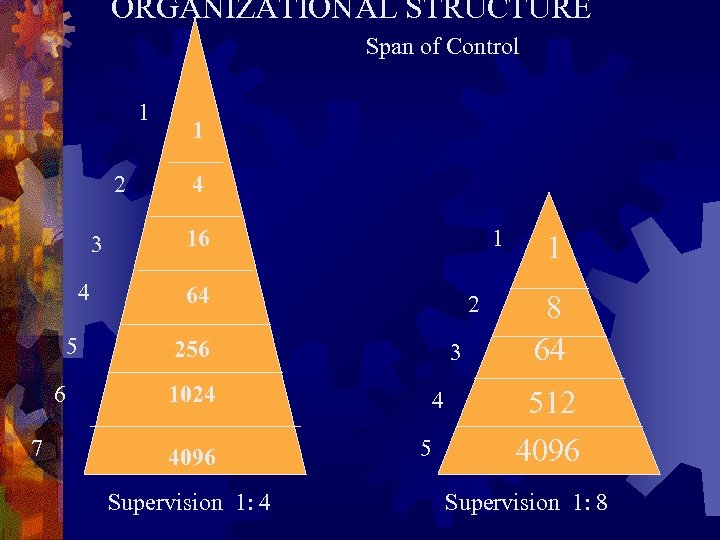

ORGANIZATIONAL STRUCTURE Span of Control 1 2 3 4 5 6 7 1 4 16 1 64 2 256 3 1024 4096 Supervision 1: 4 4 5 1 8 64 512 4096 Supervision 1: 8

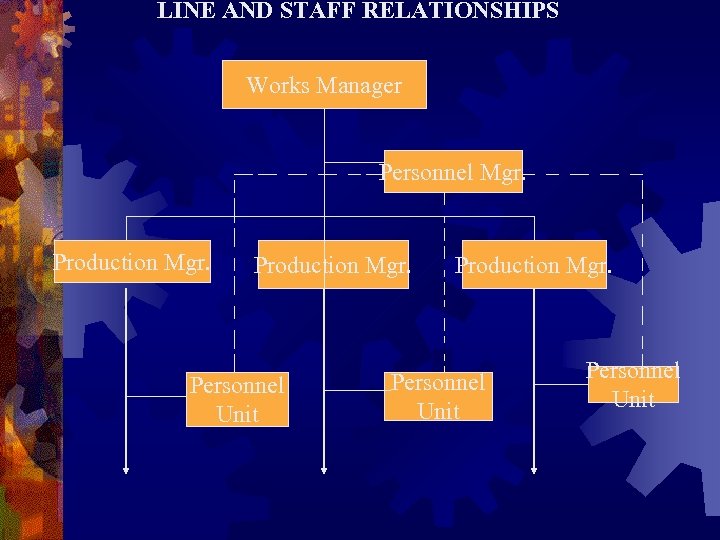

LINE AND STAFF RELATIONSHIPS Works Manager Personnel Mgr. Production Mgr. Personnel Unit

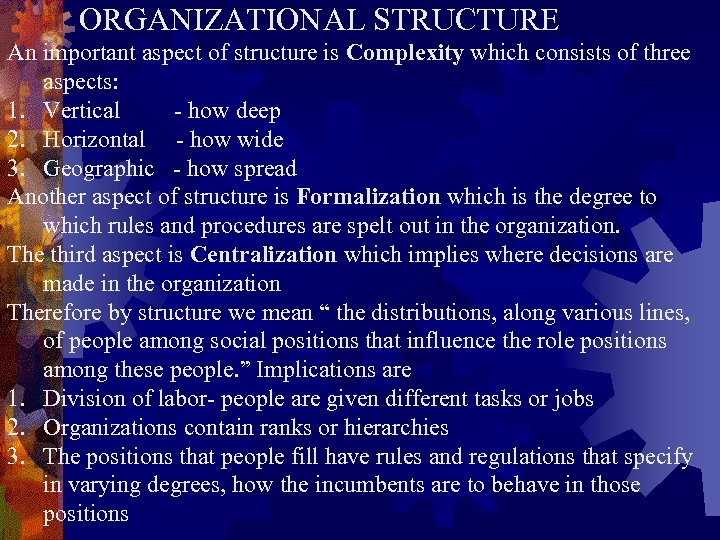

ORGANIZATIONAL STRUCTURE An important aspect of structure is Complexity which consists of three aspects: 1. Vertical - how deep 2. Horizontal - how wide 3. Geographic - how spread Another aspect of structure is Formalization which is the degree to which rules and procedures are spelt out in the organization. The third aspect is Centralization which implies where decisions are made in the organization Therefore by structure we mean “ the distributions, along various lines, of people among social positions that influence the role positions among these people. ” Implications are 1. Division of labor- people are given different tasks or jobs 2. Organizations contain ranks or hierarchies 3. The positions that people fill have rules and regulations that specify in varying degrees, how the incumbents are to behave in those positions

ORGANIZATION STRUCTURE Comments on structure: 1. “ Structures shape people’s practices, but it is also people’s practices that constitute(and reproduce) structure. ” Sewell-1992 2. Structure does not yield total conformity, but it is intended to prevent random behaviour 3. “Structure is a juxtaposition of technological solutions, political exchanges, and social interpretation in and around organizations, which results in modes of structuring, and that there is a dialectical unfolding of relations among organizational actors. This results in consequences for organizational forms. ” ( Fombrum, 1986). Structure is thus continually emergent. 4. Organizational structures serve three basic functions (a) Produce organizational outputs to achieve organizational goals (b) To minimize or at least regulate the influence of individual variations on the organization. This is done to ensure that individuals conform to requirements of the organization and not vice versa (c ) Structures are the settings in which power is exercised( structures also set or determine which positions have power in the first place

FACTORS WHICH AFFECT STRUCTURE 1. STRATEGY 2. ORGANISATION SIZE 3. TECHNOLOGY 4. ENVIRONMENT Strategy is a process that results in an outcome which is the basis for organizational decisions and actions. There are three strategy dimensions A. Innovation Strategy B. Cost Minimization Strategy C. Imitation Strategy Innovation Strategy emphasizes the introduction of major New products and services. Cost Minimization Strategy emphasizes tight cost controls, Avoidance of unnecessary innovation or marketing expenses, And price cutting. Imitation Strategy seeks to move into new products or new Markets only after their viability has already been proven.

IMPACT OF STRATEGY ON STRUCTURE Strategy can be defined as the determination of the basic long-term goals and objectives of the enterprise, and the adoption of courses of action and allocation of resources necessary for carrying out the goals. Decisions involve: (a) Expanding the volume of activities (b) Setting up distant plants and offices (c) Moving into new economic functions (d) Diversifying into many lines of business involving defining new basic goals The above has to be done in response to: (a) Shifting demands (b) Changing sources of supply (c) Fluctuating economic conditions (d) New technological developments (e) Actions of competitors As Peter Drucker puts it “ Structure is a means for attaining the goals and objectives of an institution. Any work on structure must therefore start with objectives and strategy. ”

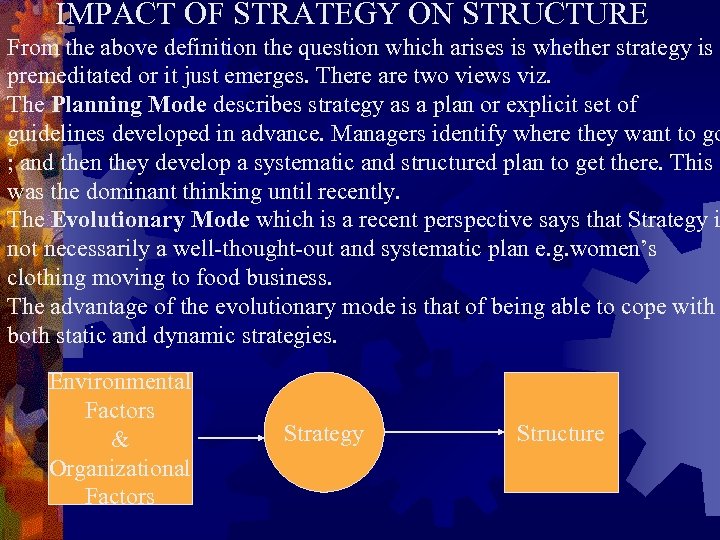

IMPACT OF STRATEGY ON STRUCTURE From the above definition the question which arises is whether strategy is premeditated or it just emerges. There are two views viz. The Planning Mode describes strategy as a plan or explicit set of guidelines developed in advance. Managers identify where they want to go ; and then they develop a systematic and structured plan to get there. This was the dominant thinking until recently. The Evolutionary Mode which is a recent perspective says that Strategy i not necessarily a well-thought-out and systematic plan e. g. women’s clothing moving to food business. The advantage of the evolutionary mode is that of being able to cope with both static and dynamic strategies. Environmental Factors & Organizational Factors Strategy Structure

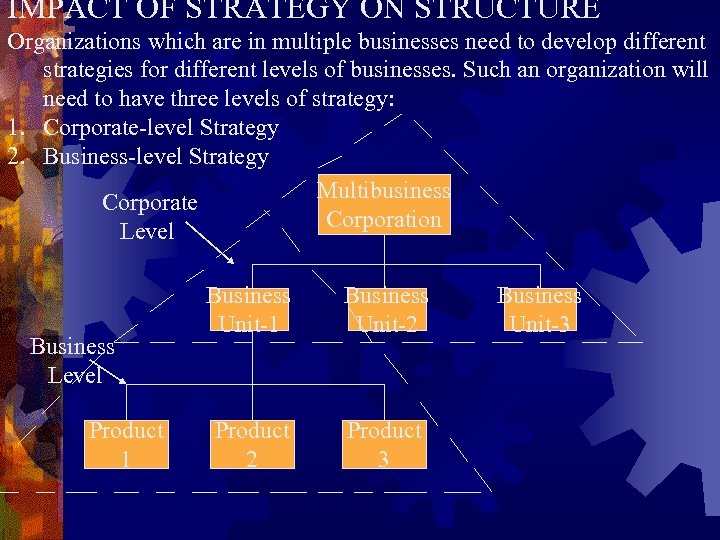

IMPACT OF STRATEGY ON STRUCTURE Organizations which are in multiple businesses need to develop different strategies for different levels of businesses. Such an organization will need to have three levels of strategy: 1. Corporate-level Strategy 2. Business-level Strategy Multibusiness Corporate Corporation Level Business Level Product 1 Business Unit-2 Product 3 Business Unit-3

IMPACT of STRATEGY ON STRUCTURE There are four dimensions to Strategy 1. Innovation: it means that strategy does not mean merely simple and cosmetic changes but meaningful and unique innovations e. g. 3 M OR Apple Computers 2. Market Differentiation: strives to create customer loyalty and uniquel meeting a particular need e. g. designer apparel or MERC 3. Breadth: the scope of the market the business caters to in terms of geographical range and number of products 4. Cost Control: considers tightly controlled costs, refrains from unnecessary expenses and cuts prices e. g. Walmart

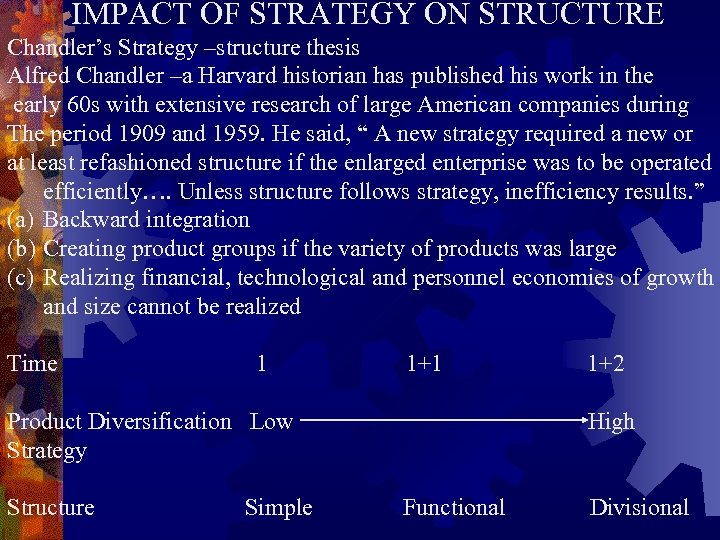

IMPACT OF STRATEGY ON STRUCTURE Chandler’s Strategy –structure thesis Alfred Chandler –a Harvard historian has published his work in the early 60 s with extensive research of large American companies during The period 1909 and 1959. He said, “ A new strategy required a new or at least refashioned structure if the enlarged enterprise was to be operated efficiently…. Unless structure follows strategy, inefficiency results. ” (a) Backward integration (b) Creating product groups if the variety of products was large (c) Realizing financial, technological and personnel economies of growth and size cannot be realized Time 1 1+1 Product Diversification Low Strategy Structure Simple 1+2 High Functional Divisional

IMPACT OF SIZE ON ORGANIZATIONAL STRUCTURE As an organization grows there is bound to be an impact on its structure. Generally, large organizations- those employing 2000 or more employees tend to be : (a) More Specialized (b) More Departmentalized (c) Have more vertical levels (d) More rules and regulations when compared to smaller organizations. Furthermore, size affects structure at a decreasing rate for e. g. an organization of 2000 employees is as it is fairly mechanistic and an addition of another 500 employees will not have any impact. But an organization of 300 employees if it adds another 500 employees will have a substantial impact in terms of developing a more mechanistic structure

IMPACT OF SIZE ON ORGANIZATIONAL STRUCTURE Increased Size Greater Div. Of Labour (Job Spln. Within units) Greater Differentiation Between Units Less need for Intraunit Coordination Larger Unit Size More Levels in the Hierarchy More need for Interunit Coordination More Formalisation of Behaviour Structure more Bureaucratic (Unskilled variety) More use of Planning Control Systems

IMPACT OF TECHNOLOGY ON STRUCTURE One of the most pervasive factors in the environment is Technology. Science provides the knowledge and Technology uses it. “Technology is the sum total off the knowledge we have of doing things. It includes inventions, it includes techniques, and it includes the vast store of organized knowledge and everything from aerodynamics to zoology. But its main influence is on the ways of doing things, on how we design, produce, distribute, andsell goods as well as services, ” Technology is the principal means adopted by nations seeking developmental progress and higher standards of human life. Technology involves many elements including engineering, organizational know-how, and economic, societal and managerial factors-internal(cultural) and external( technical) factors. Technology is a set of specialized knowledge applied to achieving a practical purpose. Hard T – plant, machinery and equipment Soft T- training, know-how and more efficient means of organizing existing factors of production including goods and services

Impact of Technology on Structure Other definitions of Technology: “Technology is any tool or technique, or any product or process, any physical equipment or method of doing or making, by which human capacity is extended. ” UNCTAD- 1979 (UN Conference on Trade and Development) “Technology means a process or the rendering of a service, including any integrally associated, managerial and marketing techniques. ” Categories of Technological Change: 1. Increased ability to manage Time and Distance 2. Increased ability to generate , store , transport and distribute energy, electricity etc. 3. Increased ability to design new materials and change properties of others 4. Mechanization or automation of physical resources 5. Mechanization or automation of mental resources 6. Extension of human ability to sense things 7. Increased understanding of individual/ group behaviour 8. Increased ability to understand diseases and their treatment

IMPACT OF TECHNOLOGY ON STRUCTURE Features of Technology-George Kozmetsky (1990) Five factors which are related to its nature and its commercialization in the modern economy. 1. Technology is a constantly replenishable national resource 2. Technology generates wealth, which in turn is the key to power(economic, social and political) 3. Technology is the prime factor in domestic productivity and international competitiveness 4. Technology is the driver of new alliances among academia, business and government 5. Technology requires new managerial philosophy and practice Benefits of Technology Problems of Technology (a) Greater productivity (a)Traffic jams (b) Higher living standards (b) Pollution of air & water (c) More leisure time (c ) Energy shortages (d) Greater variety of products (d) Loss of privacy N. B. There is need for a balanced approach to Technology introduction

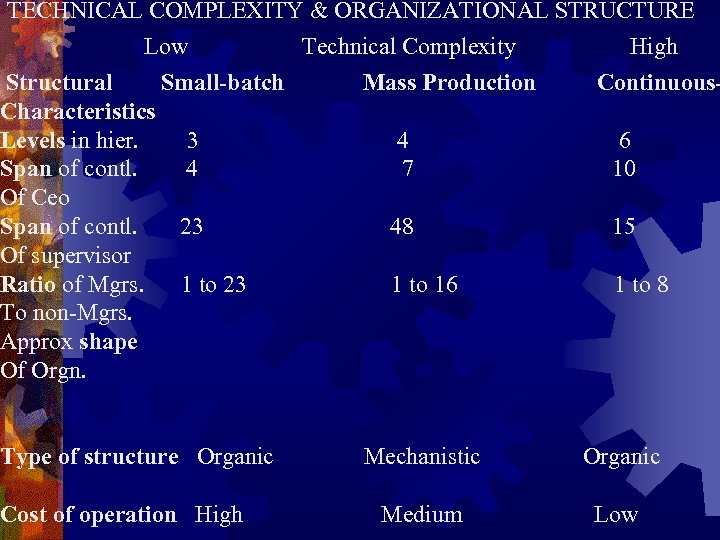

TECHNICAL COMPLEXITY & ORGANIZATIONAL STRUCTURE Low Technical Complexity High Structural Small-batch Characteristics Levels in hier. 3 Span of contl. 4 Of Ceo Span of contl. 23 Of supervisor Ratio of Mgrs. 1 to 23 To non-Mgrs. Approx shape Of Orgn. Mass Production Type of structure Organic Mechanistic Organic Medium Low Cost of operation High Continuous- 4 7 6 10 48 15 1 to 16 1 to 8

WHY AND HOW ORGANIZATIONAL STRUCTURES CHANGE? Competition has forced firms to go in for rapid and revolutionary change in the PRODUCT and PROCESS technologies and increase the extent of capital investment in them. Product Life Cycles have been reduced to between 3 -5 years. Trend towards more centrally directed and controlled technological development efforts-e. g. (a) Computerization eliminating clerical staff (b) Automation-cnc machines reducing unskilled/semi-skilled workmen (c) Automated painting (d) Filling, packing etc. automated in Pharmaceutical plants (e) Atomic energy instead of electrical power (f) Flat organizational structures- reducing levels and costs (g) BPR and Re-engineering (h) Virtual Organizations

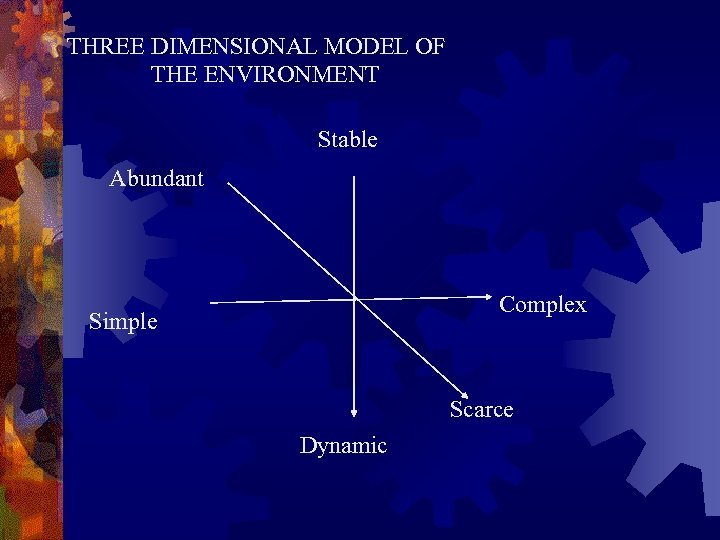

THREE DIMENSIONAL MODEL OF THE ENVIRONMENT Stable Abundant Complex Simple Scarce Dynamic

ENVIRONMENTAL CHARACTERISTICS An organization is affected by the environment and this Environment is UNCERTAIN. There could be a number of factors which could affect the Organization and these could be: 1. New competitors 2. New technological breakthroughs 3. Difficulty in acquiring raw materials 4. Changing product preferences of customers 5. Activities of public pressure groups One way to reduce environmental uncertainty is through Adjustments in the organizational structure. There are three dimensions of the environment viz, a) Capacity - abundance or scarcity of resources b) Volatility - degree of unpredictable change c) Complexity- homogeneity, heterogeneity or concentration, dispersion

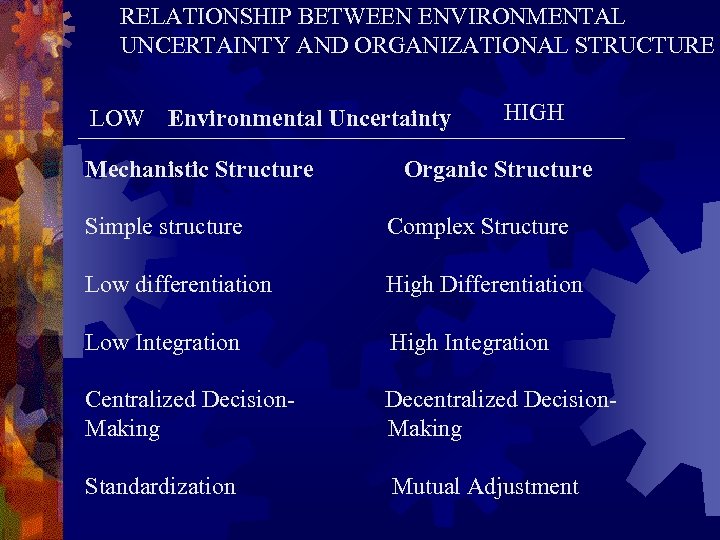

RELATIONSHIP BETWEEN ENVIRONMENTAL UNCERTAINTY AND ORGANIZATIONAL STRUCTURE LOW Environmental Uncertainty Mechanistic Structure HIGH Organic Structure Simple structure Complex Structure Low differentiation High Differentiation Low Integration High Integration Centralized Decision. Making Decentralized Decision. Making Standardization Mutual Adjustment

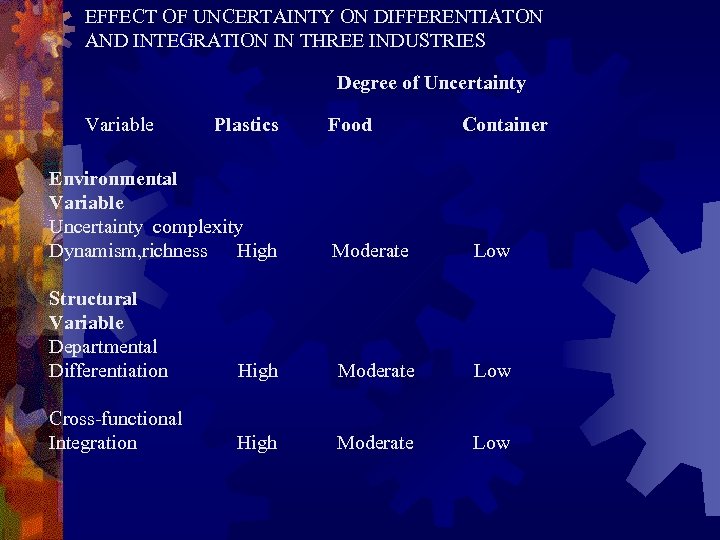

EFFECT OF UNCERTAINTY ON DIFFERENTIATON AND INTEGRATION IN THREE INDUSTRIES Degree of Uncertainty Variable Plastics Food Container Environmental Variable Uncertainty complexity Dynamism, richness High Moderate Low Structural Variable Departmental Differentiation High Moderate Low Cross-functional Integration High Moderate Low

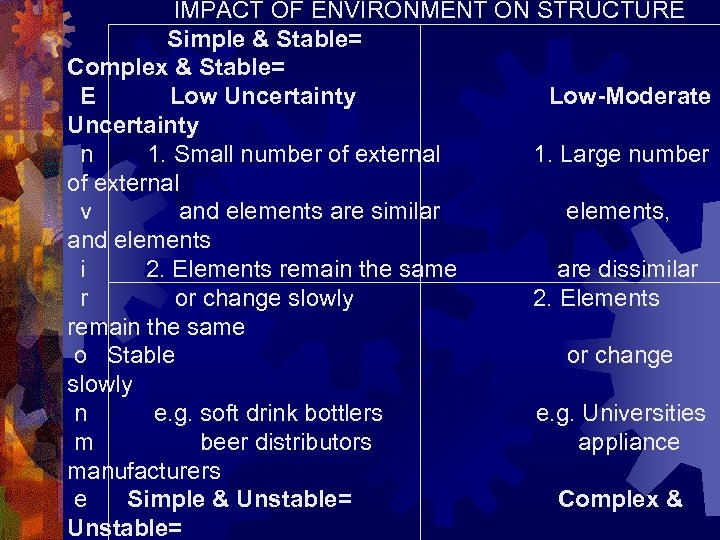

IMPACT OF ENVIRONMENT ON STRUCTURE Simple & Stable= Complex & Stable= E Low Uncertainty Low-Moderate Uncertainty n 1. Small number of external 1. Large number of external v and elements are similar elements, and elements i 2. Elements remain the same are dissimilar r or change slowly 2. Elements remain the same o Stable or change slowly n e. g. soft drink bottlers e. g. Universities m beer distributors appliance manufacturers e Simple & Unstable= Complex & Unstable=

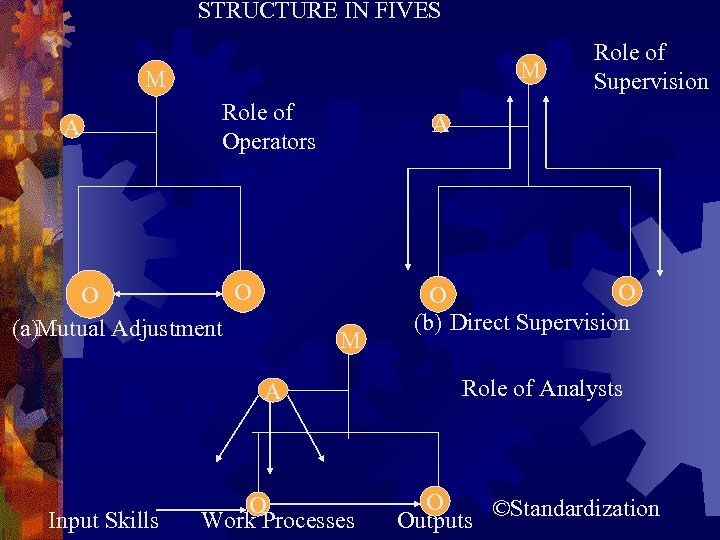

STRUCTURE IN FIVES M M A Role of Operators O O (a)Mutual Adjustment A M A Input Skills Role of Supervision O Work Processes O O (b) Direct Supervision Role of Analysts O Outputs ©Standardization

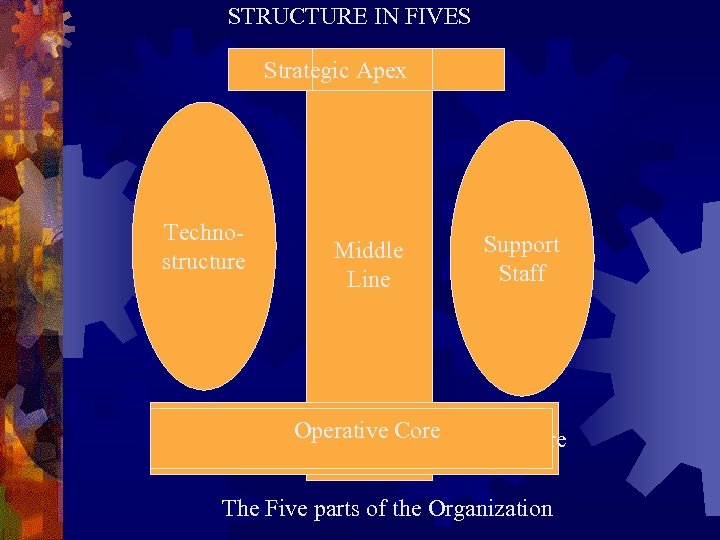

STRUCTURE IN FIVES Strategic Apex Technostructure Middle Line Support Staff Operative Core Operating Core The Five parts of the Organization

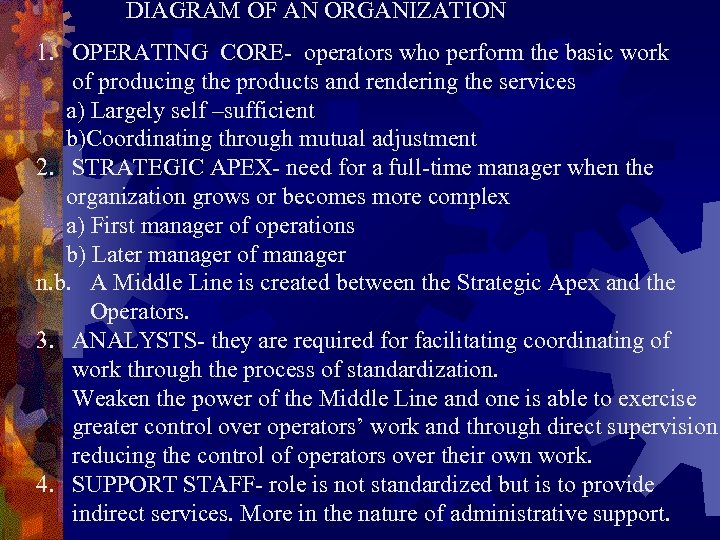

DIAGRAM OF AN ORGANIZATION 1. OPERATING CORE- operators who perform the basic work of producing the products and rendering the services a) Largely self –sufficient b)Coordinating through mutual adjustment 2. STRATEGIC APEX- need for a full-time manager when the organization grows or becomes more complex a) First manager of operations b) Later manager of manager n. b. A Middle Line is created between the Strategic Apex and the Operators. 3. ANALYSTS- they are required for facilitating coordinating of work through the process of standardization. Weaken the power of the Middle Line and one is able to exercise greater control over operators’ work and through direct supervision reducing the control of operators over their own work. 4. SUPPORT STAFF- role is not standardized but is to provide indirect services. More in the nature of administrative support.

(5) MIDDLE LINE- connecting the Strategic Apex with the Operating Core. The chain runs from first-line supervision to senior managers. The synthesis achieved through the following: 1. Simple Structure: based on Direct Supervision in which the Strategic Apex is the key part 2. Machine Bureaucracy based on standardization of work processes in which Technostructure is the key part. 3. Professional Bureaucracy has the standardization of skills in which the Operating Core is the key point. 4. Divisionalized Form based on standardized output, in which the Middle Line is the key part. 5 Adhocracy based on Mutual Adjustment in which Support Staff (sometimes with the Operating Core) is the key part.

OTSD- STRUCTURE IN FIVES-Henry Mintzberg A) Five coordinating mechanisms 1. Mutual Adjustment- process of informal communication 2. Direct Supervision- responsibility 3. Stdn. of work processes- contents & programmed 4. Stdn. Of work outputs- dimensions of product/ performance 5 Stdn. Of worker skills- knowledge and skills As the organization work becomes more complicated, the favoured means of coordination seems to shift from mutual adjustment to direct supervision to standardization, preferably of work processes, otherwise of outputs, or else of skills, finally reverting back to mutual adjustment.

OTSD- STRUCTURE IN FIVES Behaviour Formalization- Three ways 1. By the position, specifications being attached to the job itself, as in a job description 2. By the work flow, specifications being attached to the work, as in the case of a printing order docket. 3. By rules, specifications being issued in general, as in the various regulations- everything from dress to the use of forms- contained in the policy manuals. n. b. In all three cases, the worker’s behaviour is regulated Why formalize behaviour? To reduce its variability, ultimately to predict and control it. Also to coordinate activities Most efficient procedures- no favoritism

STRUCTURE IN FIVES ( contd. ) A)Job Specialization-breadth or scope -jack of all trades -Highly specialized task B) Job Specialization- depth -merely does the job -controls every aspect of it, including doing it Horizontal Job Specialization( Division of Labour)or Job Enlargement where more tasks are performed Vertical Job Specialization or Job Enrichment where More tasks are performed with more control over it. Job Enlargement pays to the extent that the gains from better motivated workers in a particular job offset the losses from less than optimal technical specialization Some workers prefer narrowly specialized repetitive jobs

Structure in Fives- Manufacturing Firm Board of Directors President (SA) Executive Committee President’s staff Strategic Planning. Legal Counsel Controller Public Relations VPs Personnel Training Industrial Relations Oper & Mktg. Operations Research (TNS) Research & Devlpt. Production Scheduling Plant Mgrs RSMs(SS) Pricing Foremen RSMs Works Study Payroll Technocratic clerical (ML) Reception staff Mailroom Cafeteria Purchasing Agents Assemblers Machine Operators (OC) Salespersons Shippers

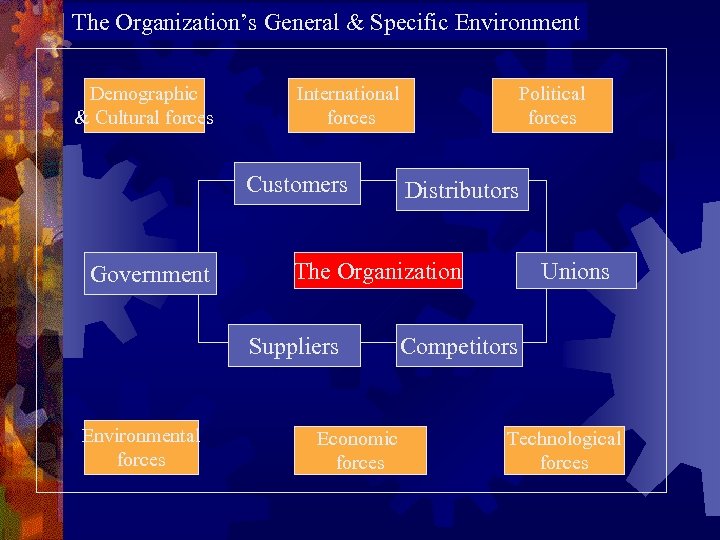

The Organization’s General & Specific Environment Demographic & Cultural forces International forces Customers Government Distributors The Organization Suppliers Environmental forces Political forces Economic forces Unions Competitors Technological forces

ORGANISATIONAL THEORIES 1. CONTINGENCY THEORY 2. RESOURCE DEPENDENCE THEORY 3. TRANSACTION COST THEORY Contingency Theory states that in order to manage its environment effectively an organization should design its structure to fit with the environment. The external environment is a contingency which has to be planned for. A poor fit between structure and environment leads to failure; a close fit leads to success. The strength and complexity of the forces in the general and specific environments have a direct effect on the differentiation inside an organization. e. g. two sets of two circles each; functional depts. to meet specific needs of the environment

CRITICISM OF CONTINGENCY THEORY 1. Emphasis on the environment as the factor determining organizational structure. 2. Strategic choices made by the manager directly influence the organizational environment 3. Enacted Environment is the one managers respond to which is created out of their own perceptions. 4. Managers who face the same set of forces in the specific or general environments may respond very differently. 5 An organization may merge with a competitor and make the environment richer. 6. Tailoring the fit is not a one-way process but a one way one as stated in the Contingency Theory. e. g. The Pharmaceutical Industry had taken powerful measures to influence the environment: a) Successfully lobbied with the Govt. for protecting their brands b) Developed close ties with doctors to prescribe their products. c) With their resources employ lawyers and lobbyists to influence.

RESOURCE DEPENDENCE THEORY Organizations are dependent on their environment for the resources they need to survive and grow. The supply of resources is dependent on the following: 1. Complexity 2. Dynamism 3. Richness An environment becomes poorer when a) Important customers are lost b) New competitors enter the market c) Resources are likely to become scarcer and more valuable d) Uncertainty is likely to increase The Resource Dependence Theory states that the goal of the organization is to minimize its dependence on other organizations for the supply of scarce resources in its environment and to find ways of influencing them to make resources available.

There are two aspects which must be managed: 1) It must exert influence over other organizations so that it can obtain resources 2) It must respond to the needs and demands of the other organizations in the environment The extent of dependence on other organizations is dependent on two factors which are a) How vital the resource is to the organization’s survival? e. g. scarce and valuable resource-components and raw materials, customers and distribution outlets b) The extent to which the resource is controlled by other organizations e. g. Can Industry is controlled by Alcoa, an aluminium manufacturing monopoly company with the dependent companies involved being Crown Cork and Seal. e. g. Personal Computers Industry with Compaq, Packard and Bell dependent on Intel for the micro chips. The question is to balance its need to reduce dependence against the loss of autonomy.

RESOURCE DEPENDENCY THEORY(Contd. ) Reputation: A state in which an organization is held in high esteem and trusted by other parties because of its fair and honest business Practices. e. g. paying bills on time; providing quality goods e. g. De Beers diamond cartel uses its trust and reputation to manage its linkages with its customers which are its mechanisms for managing symbiotic interdependencies. But it must be understood that acting honestly does not rule out active bargaining and negotiating over the price and quality of the inputs and outputs. Cooptation: A strategy that manages symbiotic interdependenciesby neutralizing problematic forces in the environment. e. g. Pharma Cos. Influencing Govt. , Doctors about their cause. Cooptation is an important political tool. All types of organizations use this tool to influence the stakeholders e. g. schools with PTAs and parents on school boards. Interlocking Directorate-linkage when one Dir. of one CO. sits on the Board of another.

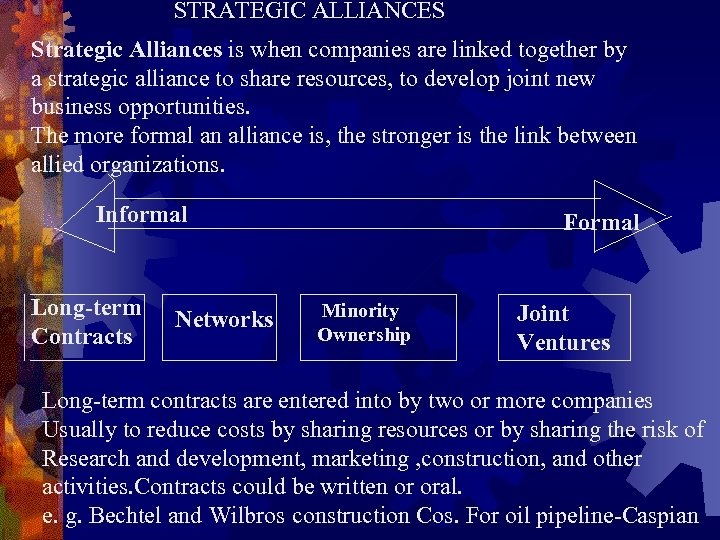

STRATEGIC ALLIANCES Strategic Alliances is when companies are linked together by a strategic alliance to share resources, to develop joint new business opportunities. The more formal an alliance is, the stronger is the link between allied organizations. Informal Long-term Contracts Networks Formal Minority Ownership Joint Ventures Long-term contracts are entered into by two or more companies Usually to reduce costs by sharing resources or by sharing the risk of Research and development, marketing , construction, and other activities. Contracts could be written or oral. e. g. Bechtel and Wilbros construction Cos. For oil pipeline-Caspian

Networks-are a cluster of different organizations whose actions are coordinated by contracts and agreements rather than through a formal authority. Members of a network closely to support and complement one another’s activities. It also prevents the core organization from becoming too large and too bureaucratic. e. g. Nike establishes similar networks with its Customers. Distributors and Suppliers. Minority Ownership- a more formal alliance emerges when organizations buy minority stake in each other. Minority Ownership makes organizations more interdependent and forges strong cooperative bonds. e. g. Toyota with its Suppliers with a 49% stake resulting in discovering new ways to improve Quality and reduce the Cost of Components. There are two types of Keiretsu viz. capital keiretsu i. e are used to manage input and output linkages and financial keiretsu-linkages of diverse companies are done through with a bank in the centre.

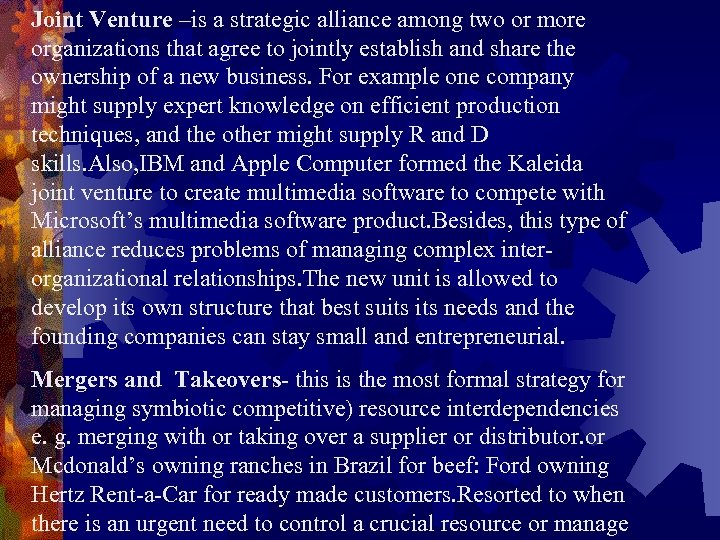

Joint Venture –is a strategic alliance among two or more organizations that agree to jointly establish and share the ownership of a new business. For example one company might supply expert knowledge on efficient production techniques, and the other might supply R and D skills. Also, IBM and Apple Computer formed the Kaleida joint venture to create multimedia software to compete with Microsoft’s multimedia software product. Besides, this type of alliance reduces problems of managing complex interorganizational relationships. The new unit is allowed to develop its own structure that best suits needs and the founding companies can stay small and entrepreneurial. Mergers and Takeovers- this is the most formal strategy for managing symbiotic competitive) resource interdependencies e. g. merging with or taking over a supplier or distributor. or Mcdonald’s owning ranches in Brazil for beef: Ford owning Hertz Rent-a-Car for ready made customers. Resorted to when there is an urgent need to control a crucial resource or manage

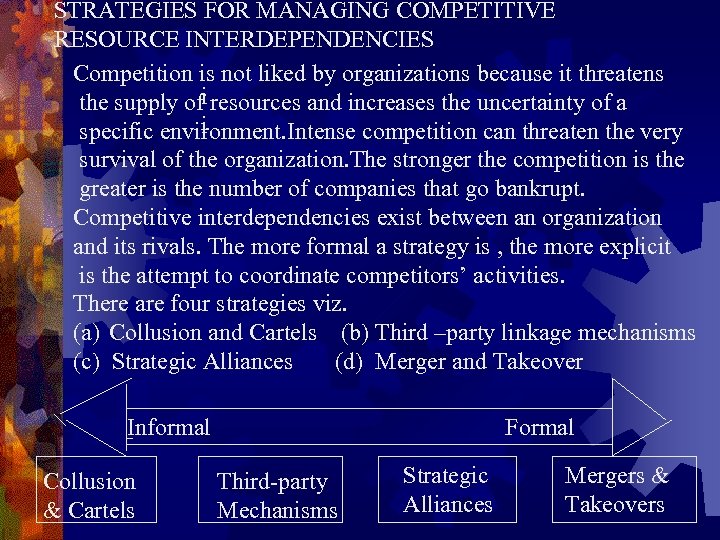

STRATEGIES FOR MANAGING COMPETITIVE RESOURCE INTERDEPENDENCIES Competition is not liked by organizations because it threatens the supply ofi resources and increases the uncertainty of a i specific environment. Intense competition can threaten the very survival of the organization. The stronger the competition is the greater is the number of companies that go bankrupt. Competitive interdependencies exist between an organization and its rivals. The more formal a strategy is , the more explicit is the attempt to coordinate competitors’ activities. There are four strategies viz. (a) Collusion and Cartels (b) Third –party linkage mechanisms (c) Strategic Alliances (d) Merger and Takeover Informal Collusion & Cartels Formal Third-party Mechanisms Strategic Alliances Mergers & Takeovers

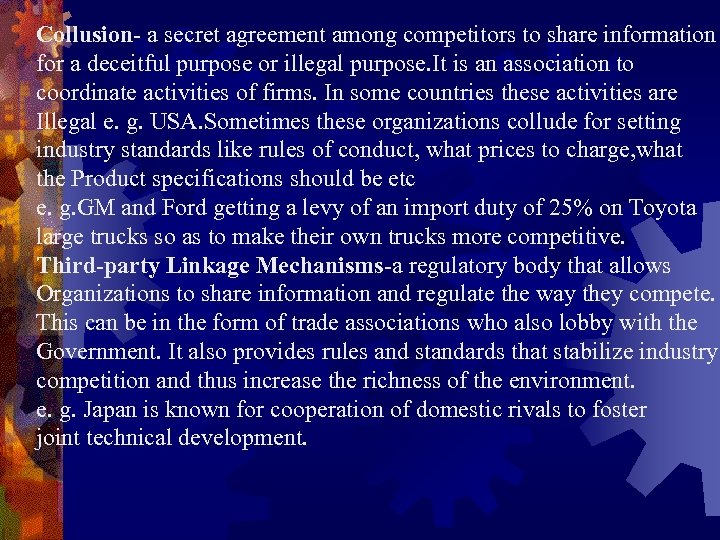

Collusion- a secret agreement among competitors to share information for a deceitful purpose or illegal purpose. It is an association to coordinate activities of firms. In some countries these activities are Illegal e. g. USA. Sometimes these organizations collude for setting industry standards like rules of conduct, what prices to charge, what the Product specifications should be etc e. g. GM and Ford getting a levy of an import duty of 25% on Toyota large trucks so as to make their own trucks more competitive. Third-party Linkage Mechanisms-a regulatory body that allows Organizations to share information and regulate the way they compete. This can be in the form of trade associations who also lobby with the Government. It also provides rules and standards that stabilize industry competition and thus increase the richness of the environment. e. g. Japan is known for cooperation of domestic rivals to foster joint technical development.

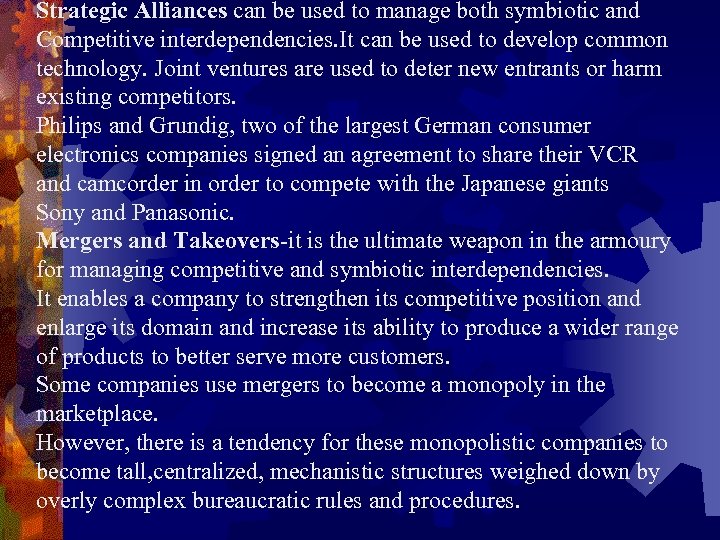

Strategic Alliances can be used to manage both symbiotic and Competitive interdependencies. It can be used to develop common technology. Joint ventures are used to deter new entrants or harm existing competitors. Philips and Grundig, two of the largest German consumer electronics companies signed an agreement to share their VCR and camcorder in order to compete with the Japanese giants Sony and Panasonic. Mergers and Takeovers-it is the ultimate weapon in the armoury for managing competitive and symbiotic interdependencies. It enables a company to strengthen its competitive position and enlarge its domain and increase its ability to produce a wider range of products to better serve more customers. Some companies use mergers to become a monopoly in the marketplace. However, there is a tendency for these monopolistic companies to become tall, centralized, mechanistic structures weighed down by overly complex bureaucratic rules and procedures.

MANAGING SYMBIOTIC RESOURCES INTERDEPENDENCIES Symbiotic interdependencies generally exist between an organization and its suppliers and distributors. The more formal a strategy is the greater is the cooperation between organizations. The strategies are: 1. Reputation 2. Cooptation 3. Strategic Alliances 4. Mergers and Takeovers Informal Reputation Formal Cooptation Strategic Alliances Mergers Takeovers

TRANSACTION COST THEORY The transaction costs are costs of negotiating, monitoring, and governing exchanges between people. Transaction Cost Theory states that the goal of an organization is to minimize the costs of exchanging resources in the environment and the costs of managing exchanges inside the Organization. e. g. In the USA it is estimated that 40% of the Health Care Budget Is spent in handling exchanges( such as bills and insurance claims) Between doctors , hospitals government insurance companies and other parties. )This resulted in the formation of HMOs i. e. Health Maintenance Organizations. Transaction costs result from a combination of human and environmental factors. The environment is characterized by considerable uncertainty and complexity. People, however have only a limited ability to process information and to understand the Environment surrounding them.

TRANSACTION COST THEORY( Contd. ) Because of the limited ability, or bounded rationality, the higher the uncertainty is in the environment the greater is the difficulty of managing transactions between organizations. e. g. Company A wants to license a technology developed by Company B but because of the uncertainty involved in signing a contract together with the uncertainty of possible use of the new products and their use as well as the transaction costs involved and Bounded Rationality Company B may decide to go it alone. However , Company B may also decide to go in for a more formal linkage mechanism like a strategic alliance or minority ownership or a merger perhaps which could lower transaction costs. Opportunism and small numbers-suppliers exploit customers by supplying inferior goods but charging higher prices. This reduces their costs and increases their profit. The US government spends millions to protect itself from defense contractors who tend to exploit the Govt.

Risks and Specific Assets are Investments- in skills, machinery, knowledge and information-that create value in one exchange relationship but have no value in any other relationship. e. g. Company investing Rs. 100 m. for making microchips for IBM Transaction Costs and Linkage Mechanism : Organizations base their choice of inter-organizational linkage mechanism on the level of transaction costs involved in the exchange relationship. Transaction costs are low when these conditions exist: 1. Organizations are exchanging nonspecific goods and services 2. Uncertainty is low 3. There are many possible exchange partners n. b. It is easy to negotiate and monitor in this low cost environment and relatively informal linkage mechanisms like reputation and unwritten, word-of mouth contracts are used.

TRANSACTON COSTS THEORY(Contd. ) Transaction costs increase when these conditions exist: 1. Organizations begin to exchange more specific goods and services 2. Uncertainty increases 3. The number of possible exchange partners falls n. b. In this kind of environment, an organization will begin to feel that it cannot afford to trust organizations, and will start to monitor and use more formal linkages, such as long-contracts to govern its exchanges. High-transaction-cost situation as per this theory requires a more formal linkage mechanism to manage exchanges as transaction costs increase. Formal mechanisms include Strategic Alliances (joint ventures), mergers and takeovers

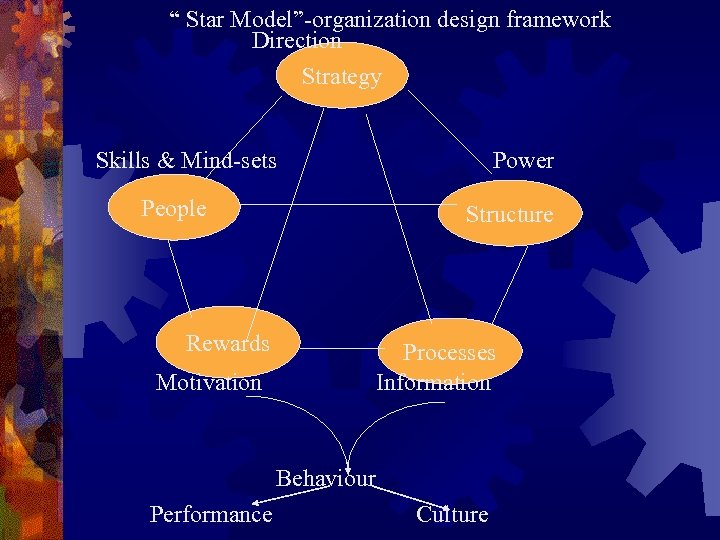

“ Star Model”-organization design framework Direction Strategy Skills & Mind-sets People Power Structure Rewards Processes Information Motivation Behaviour Performance Culture

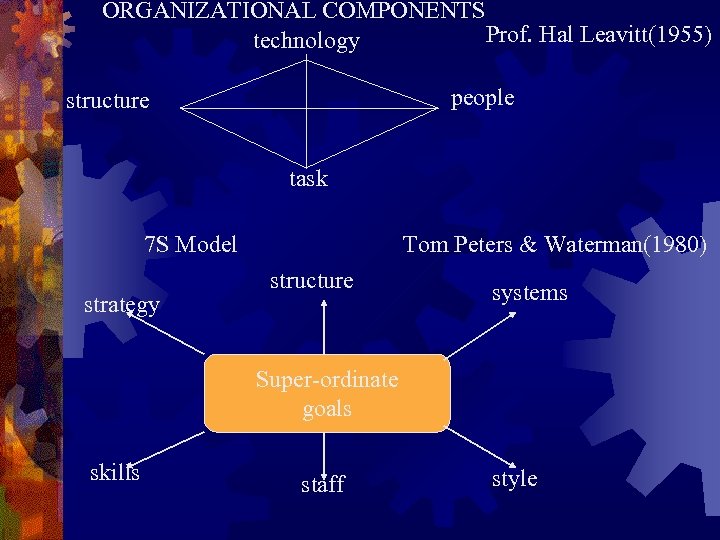

ORGANIZATIONAL COMPONENTS Prof. Hal Leavitt(1955) technology people structure task 7 S Model strategy Tom Peters & Waterman(1980) structure systems Super-ordinate goals skills staff style

OTSD-Designing Orgns. -6 Immutable forces shaping today’s Orgns. 1. Buyer Power-competition has shifted the power to buyers and OS are designed around customers and initiatives are launched to please customers and as a result they too shape organizations 2. Variety and Solutions-as a result of buyer power the number of products and services are on the increase. More information is to be collected and more decisions taken. Besides, customers do not just want an increase in the products but their integration. Customer wants cross product coordination in addition to individual quality 3. The Internet- the Website becomes the central or single face to the customer and all other interactions e. g. sales force, service personnel call centres have to align their actions to the Internet. 4. Multiple Dimensions- today’s companies are organized along multiple dimensions- product, functions, markets, geography etc. This requires complex OS across countries and businesses. 5. Change-the combination of variety, multiple dimensions, and change causes the company to take still more decisions more frequently. Decentralization adds to more people taking decisions. 6. Speed-customers want quick execution of orders and so do orgns.

1. (a) (b) (c) (d) (e) 2. (a) (b) (c) (d) 3. (a) (b) (c) (d) (e) (f) CHOOSING STRUCTURES Functional Structure Small-size, single product line Undifferentiated market Scale or expertise within the function Long product development and life-cycles Common standards Product Structure Product focus Multiple products for separate customers Short product development and life-cycle Minimum efficient scale for functions or outsourcing Market Structure Important market segments Product or service unique to segment Buyer strength Customer knowledge advantage Rapid customer service and product cycles Minimum efficient scale in functions or outsourcing

CHOOSING STRUCTURES (contd. ) 4. Geographical Structure (a)Low value-to-transport cost ratio (b)Service delivery on site (c )Closeness to customer for delivery or support (d)Perception of the organization as local (e)Geographical market segments needed 5. Process Structure (a)Best seen as an alternative to the functional structure (b)Potential for new processes and radical change to processes (c )Reduced working capital (d)Need for reducing cycle times N. B. Before one finalizes on one or the other structure one needs to analyze the advantages and disadvantages of each structure and how it fits with the business strategy.

OTSD-Schedule of Lectures 1. What is an Organization and how it creates Value 15/1 2. Definitions of Structure, Design and Culture 3. Mechanistic and Organic forms of Organization 4. Types of Structure- Functional, Product and Matrix 5. Bureaucratic Form of Organization Factors affecting Structure (a) Strategy (b) Organization Size (c )Technology (d) Environment 7. ‘Structure in Fives’ 8. Organizational Theories (a) Contingency Theory (b) Resource Dependence Theory (c) Transaction Cost Theory 9. Case Study on Organization Structure (Richman) 10. Presentation on Organization Structure 11. Strategies for managing (a) Competitive Resource Interdependencies (b) Symbiotic Resource Interdependencies (c )Transaction Theory 12. Choosing structures and current trends 13/4 13. Assignment on Merger of Air-India and Indian

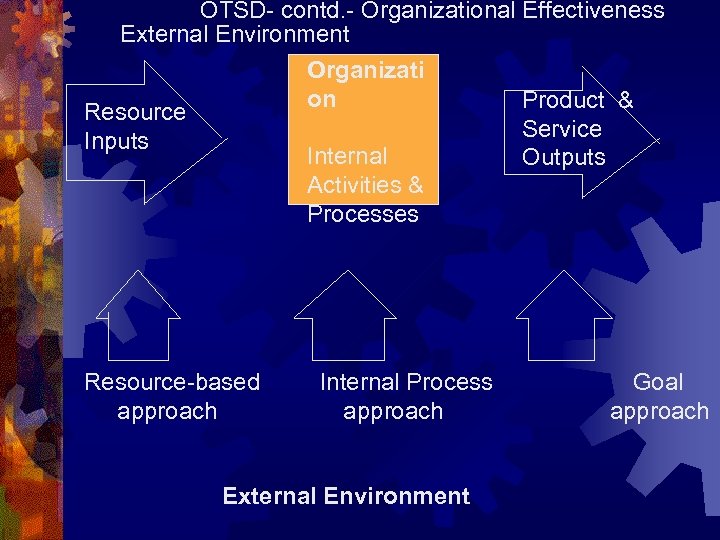

OTSD-Contd- Organizational Effectiveness Organizational effectiveness is the degree to which an organization realizes its goals. Effectiveness is a broad concept and is concerned with organizational and departmental levels and with multiple goals- official and operative. On the other hand, Efficiency is limited to the ratio of outputs to inputs or the amount of resources required to produce an unit of output. There a variety of approaches to Organizational effectiveness which are as under: 1. The Goal approach 2. The Resource-based approach 3. The Internal process approach The above contingency approaches are based on which part of the organization managers consider most important to measure. .

OTSD contd. - Organizational Effectiveness Main points of the Resource-based Approach This approach is defined as the ability of the organization, in absolute or relative terms, to obtain scarce and valuable resources and successfully integrate and manage them. 1. Bargaining position- the ability of the organization to obtain from the environment scarce and valuable resources, including financial resources, raw materials, human resources, knowledge and technology 2. The abilities of the organization decision-makers to perceive and correctly interpret the real properties of the external environment 3. The abilities of the managers to use tangible (e. g. supplies, people) and intangible (e. g. knowledge, corporate culture ) resources in day-to-day organizational activities to achieve superior performance 4. The ability of the organization to respond to changes in the environment

OTSD-contd. - Organizational Effectiveness Main points of the Goal Approach 1. Identification of an organization’s output goals and assessing how effectively the organization has attained those goals 2. Goals could be certain levels of output, profit and client satisfaction 3. Official goals tend to be abstract and difficult to measure whereas operative goals reflect the activities the organization is actually performing

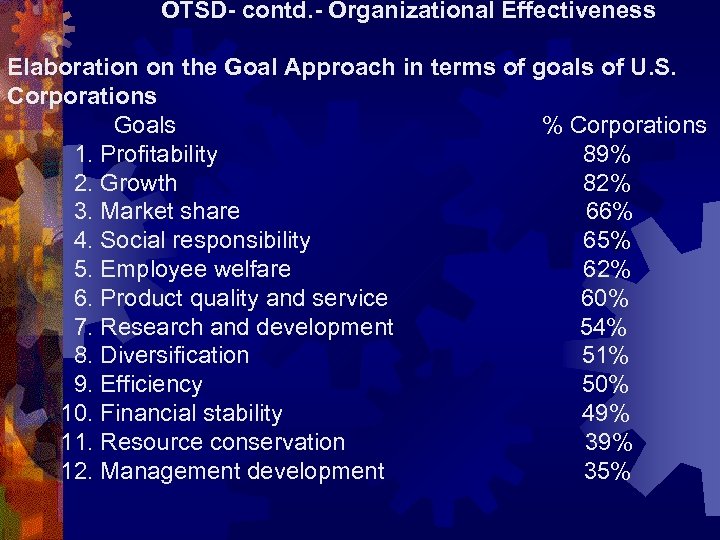

OTSD- contd. - Organizational Effectiveness Elaboration on the Goal Approach in terms of goals of U. S. Corporations Goals % Corporations 1. Profitability 89% 2. Growth 82% 3. Market share 66% 4. Social responsibility 65% 5. Employee welfare 62% 6. Product quality and service 60% 7. Research and development 54% 8. Diversification 51% 9. Efficiency 50% 10. Financial stability 49% 11. Resource conservation 39% 12. Management development 35%

OTSD-contd. -Organizational Effectiveness 1. 2. 3. 4. 5. 6. 7. Main points of the Internal Process Approach Strong corporate culture and positive work climate Team spirit, group loyalty and teamwork Confidence, trust, and communication between management and workers Decision-making near the sources of information, regardless of where those sources are on the organization chart Undistorted horizontal and vertical communication; sharing of relevant facts and feelings Rewards to managers for performance, growth, and development of subordinates and for creating an effective work group Interaction between the organization and its parts, with conflict that occurs over projects resolved in the interest of the organization.

OTSD- contd. - Organizational Effectiveness External Environment Organizati on Product & Resource Service Inputs Internal Outputs Activities & Processes Resource-based approach Internal Process approach External Environment Goal approach

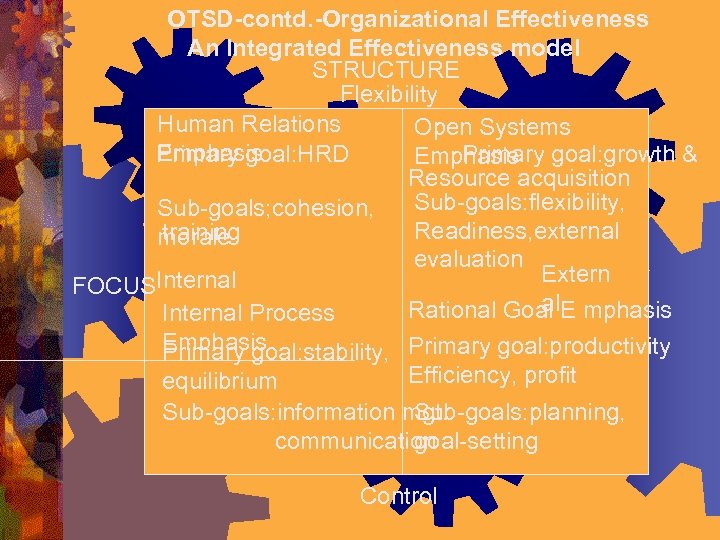

OTSD-contd. -Organizational Effectiveness An Integrated Effectiveness model STRUCTURE Flexibility Human Relations Open Systems Emphasis Primary goal: HRD Primary Emphasis goal: growth & Resource acquisition Sub-goals: flexibility, Sub-goals; cohesion, Readiness, external training morale evaluation Extern FOCUSInternal al Rational Goal E mphasis Internal Process Emphasis Primary goal: stability, Primary goal: productivity Efficiency, profit equilibrium Sub-goals: information mgt. Sub-goals: planning, communication goal-setting Control

OTSD-contd. –Mergers and Acquisitions (M & A) What are the motives behind international mergers and acquisitions? 1. Growth 2. Technology 3. Product advantages 4. Government policy 5. Rate of exchange 6. Political and economic stability 7. Differential labour costs and productivity 8. To follow clients 9. Diversification 10. To assure a source of raw material Reasons for failure of Ms and As 1. Reality gap 2. Culture clash (a) Employee retention (b) Organizational design (c )Forging a new corporate culture

OTSD-contd. - M & A The number of and sizes of M and As being completed continue to grow exponentially. It is clear that As have become one of the most important corporate-level strategies in the new millennium. But many Ms and As fail or fail to reach their potential. Thirty largest deals in the last 5 years have underperformed: 1. Acquisition of MCI by Worldcom for $ 37 b 2. Acquisition of Traudler’s Ground by Citicorp FOR $77 b 3. Mobil by Exxon for $79 b 4. SBC and Amartech for $61. 8 b 5. National Bank Corp. and Ban American Corp valued at $60 b 6. Telecommunications by A T & T valued at $43 b 7. Chrysler and Daimler Benz valued at $45. 4 b n. b. Serial no. 1 took place in ’ 97 while the rest in ’ 98 In ’ 99 the merger of MCI Worldcom with Sprat was disallowed

OTSD-contd. Ms & As Results of Ms and As 1. Shareholders of acquired firms get above average returns whereas those of the acquiring firms earn on an average zero returns 2. Only 23% of the As were successful 3. 30 -45% of the As were later sold at a loss on the investment 4. Acquired companies were spun off into separate companies e. g. Boeing-Mcdonnel Douglas have eliminated unprofitable lines and shut down 27 m sq. ft. of production line by 2003 In the 1980 s, the emphasis was on (a) Restructuring (b) Focus on core and related businesses (b) In the 1990 s, the emphasis was on (c) Desire to achieve economies and market power so as to increase competitiveness in the global markets (b) Preparing for the future due to technological

OTSD-contd. - Ms & As Unintended consequence of Ms and As has been reduced Innovation because of : (a) Overemphasize financial controls (b) Become more risk averse (c) Integrate new firms in the system and thereby reduce/ discourage innovation (d) New products are essential for growth and survival and to compete in fast-changing and unpredictable markets and demands of customers (e) Potential for management hubris (f) 1) Preclude proper analysis of firm (g) 2) Substantial premiums are paid (h) 3) Personal battles (f) Two large , complex firms having different cultures, structures and cultures and operating systems (g) e. g. Union Pacific acquisition of Southern Pacificintegrate, cut costs, lay-offs resulted in substantial railroad congestion and many problems- $1. 3 b. of lost

OTSD-contd. –Ms and As Top executives must make effective decisions and implement effective procedures throughout the acquisition process to enjoy the benefits of successful acquisitions Requirements of Success: 1. Exercising due diligence 2. (a) Careful and deliberate selection of target firms and conduct the negotiations so that one gets best complementary assets and the highest potential synergies (b) Avoid inappropriate premium which if paid leads to inadequate financial performance Investment bankers do play a role. Management brokers give a feeling of over-confidence in one’s abilities, characteristics, processes and outcomes • Financing an Acquisition Through debt, or stock or cash. Other aspects include tax implications, accounting treatments, managerial

OTSD-contd. Ms and As 3. Searching for Complementary Resources Assets/ resources of a complementary nature that are supportive and generate synergy e. g. in 1997 Morgan Stanley and Dean Wilter Discovey Co. - one was a provider and the other a distributor of financial resources. Thus additional product and distribution lines could be be established. Moreover , to develop synergy was a challenge to the management too. 4. Seeking a friendly and Cooperative Merger There also hostile takeovers- underperforming firms by outperforming firms. A hostile culture is when there is no synergy and integration- there is conflict between the management and professionals of both firms. Friendly takeovers lead to success. Hostile bids leads to resistance which raises the premium price and affects the benefits of investment. 5. Achieving Integration and Synergy is creation of value e. g. KPMG Peat Marwick

OTSD-contd. -Ms and As e. g. Entrepreneurial vs risk averse clients- Smith Kline Beecham plc and Glaxo Welcome plc- market was positive on the merger- scientific acumen but marketing process aversion to Glaxo’s hostile takeover of Welcome 6. Learning from Experience Acquire new skills and knowledge for acquired firm. Flexibility should promote post acquiring integration 7. Deciding How and When to acquire Innovation Healthy investment in R and D Maintain innovative culture Search for partners of similar culture 8. Hazards of Diversification Relatedness helps economies of scope and synergy. Sometimes with unrelated businesses

OTSD- contd. –Ms and As Effect of Ms and As on Organizational Structure: 1. Synergy 2. (a) Vertical Integration 3. (b) Horizontal Integration 2. Rationalization of the workforce 3. Skills Analysis- technical, marketing. R and D skills, production skills 4. Entrepreneurial skills and operational skills 5. Requirements- Foundations 1. Strategic Fit- matching of strategic organizational capabilities 2. Organizational Fit- similar management processes, culture, systems and structures 3. Management Actions 4. (a) Helping others (b) Leadership Team (c )Sense of Purpose 5. (d) Modeling behaviour

New Forms of Organization Learning Organization A learning organization is one that has developed the continuous capacity to adapt and change. “ All organizations learn, whether they consciously chose or not- it is a fundamental requirement fo their sustained existence. ” Single-loop learning is when errors are detected, the corrections process relies on past routines and present policies. Double-loop learning is when an error is detected, its corrected in ways that involve the modification of the organization’s objectives, policies, and standard routines. Double-loop learning challenges deep-rooted assumptions and norms within the organization. There are five basic characteristics of a learning organization viz. 1. There exists a shared vision which everyone agrees on 2. People discard their old ways of thinking and the

New Forms OF Organization Learning Organization contd. 4. People openly communicate with each other( across vertical and horizontal boundaries) without fear of criticism or punishment 5. People sublimate their personal self-interests and fragmented departmental interests to work together to achieve the organization’s vision ( Senge- The Fifth Discipline) The proponents of the Learning Organization have a remedy for three fundamental inherent in traditional organizations: Fragmentation: based on specialization creates “walls” and “chimneys” that separate different functions into independent and often warring fiefdoms Competition: is over emphasized which undermines collaboration. Members want to show who is right. who knows more etc. rather than sharing knowledge and cooperating with each other

Self-Directed Teams The terms self-managed teams and self-directed teams are used synonymously. They are sometimes called empowered teams. However, some authors draw a distinction between the two as under: Self- managed team- is a group of people working together in their own ways towards a common goal which is defined outside the team e. g there could be a team manufacturing special chairs as defined by executive leadership. But the team does its own scheduling, training, rewards and recognition etc. Self-directed team- is a group of people working together intheir own ways towards a common goal which the team defines. e. g a team which handles compensation and discipline and acts as a profit centre by defining its own future. The above type of teams have been formed or have evolved as part of the empowerment process and the prevalence of

Self-directed team-contd. These teams have some particular problems including(a) Team members unwillingness to give up past practices or set aside power and position (b) Not all team members possess the abilty, knowledge, or skill to contribute to the group which slows functioning (c) As team members, workers often face conflicts or challenges to their personal benefit. What works for one group may not work for the other

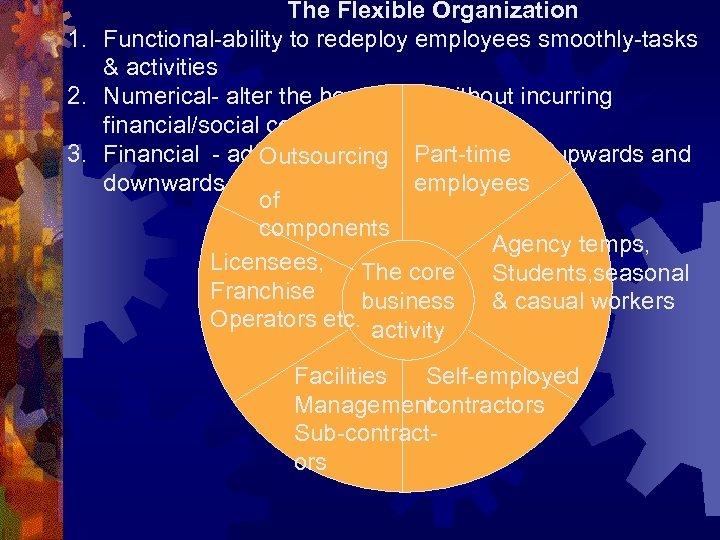

The Flexible Organization 1. Functional-ability to redeploy employees smoothly-tasks & activities 2. Numerical- alter the headcount without incurring financial/social costs 3. Financial - adjust wages and. Part-time Outsourcing salary costs upwards and downwards employees of components Agency temps, Licensees, The core Students, seasonal Franchise business & casual workers Operators etc. activity Facilities Self-employed Management contractors Sub-contractors

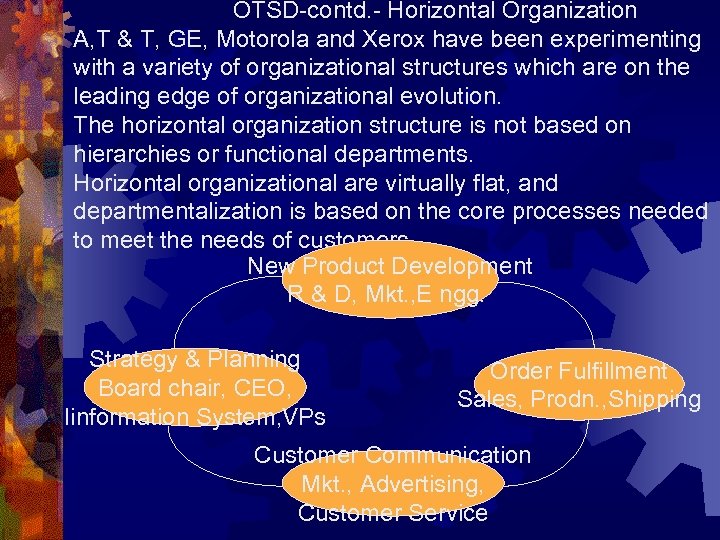

OTSD-contd. - Horizontal Organization A, T & T, GE, Motorola and Xerox have been experimenting with a variety of organizational structures which are on the leading edge of organizational evolution. The horizontal organization structure is not based on hierarchies or functional departments. Horizontal organizational are virtually flat, and departmentalization is based on the core processes needed to meet the needs of customers. New Product Development R & D, Mkt. , E ngg. Strategy & Planning Board chair, CEO, Iinformation System, VPs Order Fulfillment Sales, Prodn. , Shipping Customer Communication Mkt. , Advertising, Customer Service

OTSD- contd. - Horizontal Organization There are 7 differentiation features of the horizontal organization viz. 1. The organization is divided into core processes and each core process has a manager or team leader who takes ownership for the accomplishment of the process 2. The organization is flat because functions that do not add value to the process are eliminated 3. Teams are used almost exclusively 4. Performance is measured and rewarded by customer satisfaction rather than completion of narrow functional tasks 5. Team effort and success earn team rewards 6. The customer, rather than the internal workings of the functional departments, is the central focus of everyone 7. An open book management system is used so that all employees have access to all information the firm has in order to enable them to complete the process and serve the customer

OTSD-contd. -Boundaryless Organization This type of organization was created by GE Chairman, Jack Welch. He wanted GE to be a ‘ family grocery store’ inspite of its monstrous size-$150 billion and amongst the top 10 companies in the USA. He wanted to eliminate vertical and horizontal boundaries within GE and its customers and suppliers. The boundaryless organization seeks to eliminate the chain of command, and have limitless spans of control, and replace departments with empowered teams. Since these teams are heavily information technology based they are called T-form or technology-based organization. GE has not yet reached the boundaryless state and probably never reach it, other organizations like Hewlett Packard, Motorola and Oticon are experimenting with the same. By removing vertical boundaries, management flattens the hierarchy. Status and rank are minimized. Crosshierarchical teams( which include top executives, middle

OTSD-contd. -Boundary less Organization Functional departments create horizontal boundaries which stifle interaction between functions, products lines and units e. g. budgeting is done not on functional basis but on processes. There are thus lateral transfers, job rotation etc. The approach is to turn specialists into generalists. When fully operational this organization will break down barriers to external constituents( suppliers, , customers, regulators, etc)and barriers created by geography. Globalization, strategic alliances, customer-organization links and telecommunicating are all examples of practices breaking down external barriers. Increasingly, boundaryless organizations are using technology e. g Walmart has networked with its suppliers for monitoring its inventory levels in its various stores so also do Procter and Gamble and Levi Strauss.

Bureaucracy- is it dead? Dsyfunctional aspects Robert Miewald 1. Goal Displacement 1. B can adapt to environment 2. Inappropriate application 2. Forces of B have never been 3. of rules stronger 3. Employee Alienation 3. Machine B replaced by Profess 4. Concentration of Power ional B 5. Non-member Frustration 4. B should be eliminated vs B Warren Bennis changing with the times • Rapid and unexpected change 5. Bs are everywhere • Growth in Size 6. Bs are the most efficient forms • Increasing Diversity • Change in Mgt. Behaviour

OTSD Assignment for MHRDM-Semester-4 (20 marks) 1. Briefly describe your existing organization ( enclose Organization Chart ) 2. Your organization has to: (a) Increase its turnover by 33% (b) Increase its profits by 15% (c )Reduce manpower by 20% n. b. The above is to be achieved within a period of 3 years 3. What strategy would be most successful considering the competition 4. Groups of 6 are to be formed who will have to make a 15 minute presentation followed by Q and A

69e1d938e053c8a580c4fac9fd37bf8b.ppt