3323979e6d0beb13548ef3ba4b640284.ppt

- Количество слайдов: 21

ORGANISTION OF SOUTHERN AND EAST AFRICA INSURERS TECHNICAL TRAINING SEMINAR LIFE UNDERWRITING TRENDS AND OPPORTUNITIES 10 -12 NOVEMBER 2015 BY JUSTUS M MUTIGA 1

ORGANISTION OF SOUTHERN AND EAST AFRICA INSURERS TECHNICAL TRAINING SEMINAR LIFE UNDERWRITING TRENDS AND OPPORTUNITIES 10 -12 NOVEMBER 2015 BY JUSTUS M MUTIGA 1

WHAT IS UNDERWRITING – (BACK TO BASICS) The process of determining the level of risk presented by the applicant and deciding whether to accept the proposal, and if so, at what terms and at what premium/price 2

WHAT IS UNDERWRITING – (BACK TO BASICS) The process of determining the level of risk presented by the applicant and deciding whether to accept the proposal, and if so, at what terms and at what premium/price 2

TERMS OF ACCEPTANCE (BACK TO BASICS) l Standard Rates l Increased Premium throughout the term l Increased Premium for a limited term l Debt on the Sum Assured l Exclusion Clause l Deferred for stated period l Decline 3

TERMS OF ACCEPTANCE (BACK TO BASICS) l Standard Rates l Increased Premium throughout the term l Increased Premium for a limited term l Debt on the Sum Assured l Exclusion Clause l Deferred for stated period l Decline 3

ROLE OF UNDERWRITING l Risk Management l Distribution Management l Expenses Management 4

ROLE OF UNDERWRITING l Risk Management l Distribution Management l Expenses Management 4

LIFE UNDERWRITING CHALLENGES l Disclosures l Underwriting Skills l Processing Hurdles 5

LIFE UNDERWRITING CHALLENGES l Disclosures l Underwriting Skills l Processing Hurdles 5

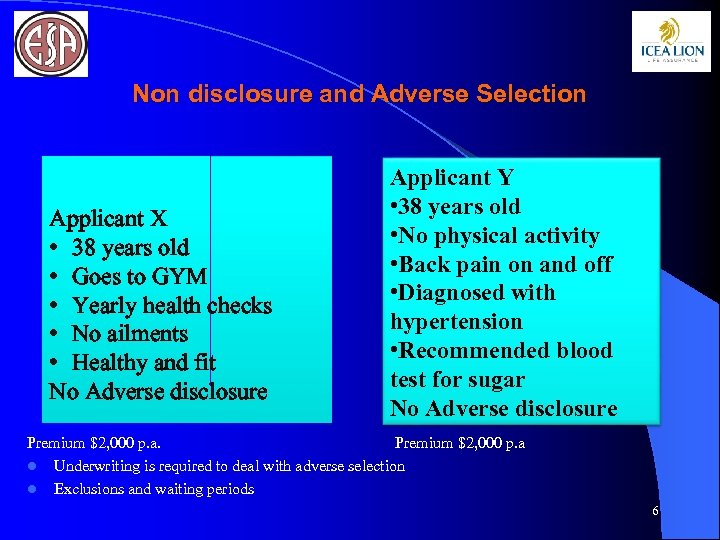

Non disclosure and Adverse Selection Applicant X • 38 years old • Goes to GYM • Yearly health checks • No ailments • Healthy and fit No Adverse disclosure Applicant Y • 38 years old • No physical activity • Back pain on and off • Diagnosed with hypertension • Recommended blood test for sugar No Adverse disclosure Premium $2, 000 p. a l Underwriting is required to deal with adverse selection l Exclusions and waiting periods 6

Non disclosure and Adverse Selection Applicant X • 38 years old • Goes to GYM • Yearly health checks • No ailments • Healthy and fit No Adverse disclosure Applicant Y • 38 years old • No physical activity • Back pain on and off • Diagnosed with hypertension • Recommended blood test for sugar No Adverse disclosure Premium $2, 000 p. a l Underwriting is required to deal with adverse selection l Exclusions and waiting periods 6

DISCLOSURES IMPACT l Low Non Medical Limits l Increase in Expenses l Claims Repudiation l Extreme Customer discomfort l Asymmetrical portfolio 7

DISCLOSURES IMPACT l Low Non Medical Limits l Increase in Expenses l Claims Repudiation l Extreme Customer discomfort l Asymmetrical portfolio 7

UNDERWRITING SKILLS l Training of underwriters is expensive and time consuming l Skilled life underwriters are not always available l Reassurers provide manuals l Computerized systems for underwriting l Underwriting is about judgment 8

UNDERWRITING SKILLS l Training of underwriters is expensive and time consuming l Skilled life underwriters are not always available l Reassurers provide manuals l Computerized systems for underwriting l Underwriting is about judgment 8

IMPACT OF LACK OF UNDERWRITING SKILLS l Inappropriate inconsistent decisions l Loss of credibility l Increased medical evidence l Higher declinature rate l Loss of business 9

IMPACT OF LACK OF UNDERWRITING SKILLS l Inappropriate inconsistent decisions l Loss of credibility l Increased medical evidence l Higher declinature rate l Loss of business 9

PROCESSING HURDLES l Processing efficiently requires robust systems l Automated underwriting systems are useful but expensive. l Sound decisions are important 10

PROCESSING HURDLES l Processing efficiently requires robust systems l Automated underwriting systems are useful but expensive. l Sound decisions are important 10

THE IMPACT OF PROCESSING HUDLES l Delay in Issuance l Dissatisfied customers, and sales force l Customer cools off l Reduced Business Volumes 11

THE IMPACT OF PROCESSING HUDLES l Delay in Issuance l Dissatisfied customers, and sales force l Customer cools off l Reduced Business Volumes 11

WHAT CAN BE DONE l Adopt a new approach because sound decisions have to be made. l Tel underwriting l Automated Expert underwriting 12

WHAT CAN BE DONE l Adopt a new approach because sound decisions have to be made. l Tel underwriting l Automated Expert underwriting 12

TEL-UNDERWRITING l Basic underwriting data is gathered by Tel. Interviewer l Information sent to Underwriting l Decision is communicated off-line, or l Use automated “expert” Underwriting systems 13

TEL-UNDERWRITING l Basic underwriting data is gathered by Tel. Interviewer l Information sent to Underwriting l Decision is communicated off-line, or l Use automated “expert” Underwriting systems 13

TEL UNDERWRITING l Decision provided instantly l Interviews are done by skilled underwriters l “Skilled” personal not required if expert engines are used. 14

TEL UNDERWRITING l Decision provided instantly l Interviews are done by skilled underwriters l “Skilled” personal not required if expert engines are used. 14

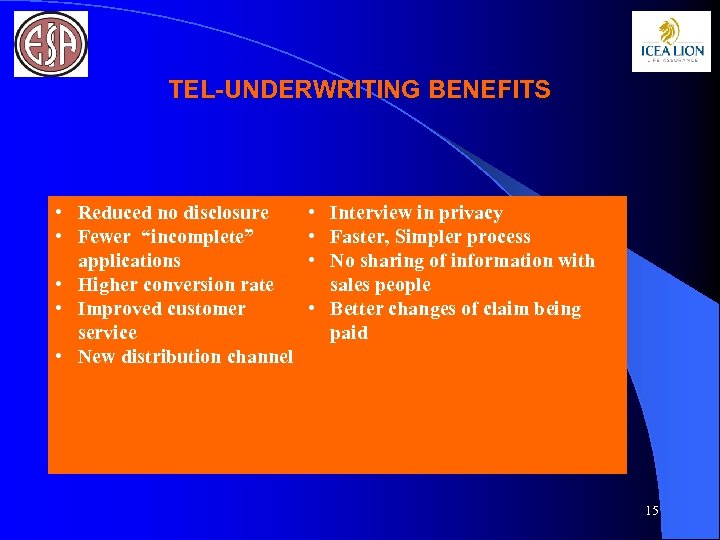

TEL-UNDERWRITING BENEFITS • Reduced no disclosure • Fewer “incomplete” applications • Higher conversion rate • Improved customer service • New distribution channel • Interview in privacy • Faster, Simpler process • No sharing of information with sales people • Better changes of claim being paid 15

TEL-UNDERWRITING BENEFITS • Reduced no disclosure • Fewer “incomplete” applications • Higher conversion rate • Improved customer service • New distribution channel • Interview in privacy • Faster, Simpler process • No sharing of information with sales people • Better changes of claim being paid 15

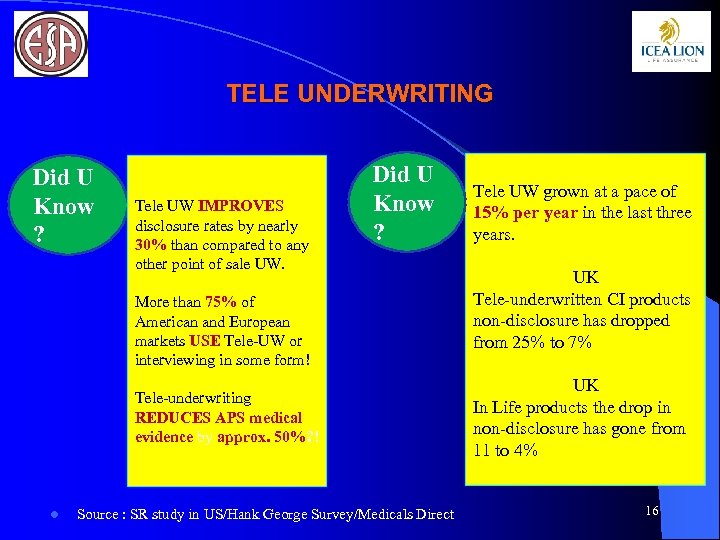

TELE UNDERWRITING Did U Know ? Tele UW IMPROVES disclosure rates by nearly 30% than compared to any other point of sale UW. Did U Know ? More than 75% of American and European markets USE Tele-UW or interviewing in some form! Tele-underwriting REDUCES APS medical evidence by approx. 50%? ! l Source : SR study in US/Hank George Survey/Medicals Direct Tele UW grown at a pace of 15% per year in the last three years. UK Tele-underwritten CI products non-disclosure has dropped from 25% to 7% UK In Life products the drop in non-disclosure has gone from 11 to 4% 16

TELE UNDERWRITING Did U Know ? Tele UW IMPROVES disclosure rates by nearly 30% than compared to any other point of sale UW. Did U Know ? More than 75% of American and European markets USE Tele-UW or interviewing in some form! Tele-underwriting REDUCES APS medical evidence by approx. 50%? ! l Source : SR study in US/Hank George Survey/Medicals Direct Tele UW grown at a pace of 15% per year in the last three years. UK Tele-underwritten CI products non-disclosure has dropped from 25% to 7% UK In Life products the drop in non-disclosure has gone from 11 to 4% 16

AUTOMATED U/W SYSTEM l Most automated system available do some of the following: l Identify Yes/No questions l Refer applications with non standard disclosures l Calculate BMI l Use logic based “Rules” l Capable of identifying “medical conditions” 17

AUTOMATED U/W SYSTEM l Most automated system available do some of the following: l Identify Yes/No questions l Refer applications with non standard disclosures l Calculate BMI l Use logic based “Rules” l Capable of identifying “medical conditions” 17

EXPERT U/W SYSTEMS - BENEFITS l Faster “turnaround” l Saving in hiring and training costs l Improved business turn-over l Accurate decisions and l Consistent decisions 18

EXPERT U/W SYSTEMS - BENEFITS l Faster “turnaround” l Saving in hiring and training costs l Improved business turn-over l Accurate decisions and l Consistent decisions 18

CREATING AN UNDERWRING PROFESSIONAL l Attract the Talent l Nurture the Talent • In-house • Reassurers • Diploma in life underwriting • Retain Talent 19

CREATING AN UNDERWRING PROFESSIONAL l Attract the Talent l Nurture the Talent • In-house • Reassurers • Diploma in life underwriting • Retain Talent 19

WHAT ARE THE OPPORTUNITIES OF NEW TRENDS l Shortened Proposal Forms l Technology and big data l Business from elderly l Future Insurability l Forward Underwriting l Field Underwriting 20

WHAT ARE THE OPPORTUNITIES OF NEW TRENDS l Shortened Proposal Forms l Technology and big data l Business from elderly l Future Insurability l Forward Underwriting l Field Underwriting 20

l QUESTIONS • THANK YOU 21

l QUESTIONS • THANK YOU 21