6b46fa5290fdaa124b9b874d6d4adc49.ppt

- Количество слайдов: 82

Organisation for Economic Co-operation and Development Auditing Small and Medium Sized Enterprises Korea, 20 - 24 October 2008 Centre for Tax Policy and Administration

Organisation for Economic Co-operation and Development Auditing Small and Medium Sized Enterprises Korea, 20 - 24 October 2008 Centre for Tax Policy and Administration

Your presenters and helpers § Matthijs Alink ( OECD Centre for Tax Policy and Administration) § Brendan Kelly(Australia) § Hiroaki Ogawa (Japan) 2

Your presenters and helpers § Matthijs Alink ( OECD Centre for Tax Policy and Administration) § Brendan Kelly(Australia) § Hiroaki Ogawa (Japan) 2

Objectives for the seminar § To increase understanding of international practices and developments in the area of Tax Administration and in particular in the area of Auditing SMEs § To promote discussion among officials. § To identify new ideas for improving Tax Administration § To encourage officials to consider improvements to their administration based on their assessment of international practices and Tax Administration needs. § To answer specific issues raised by participants. 3

Objectives for the seminar § To increase understanding of international practices and developments in the area of Tax Administration and in particular in the area of Auditing SMEs § To promote discussion among officials. § To identify new ideas for improving Tax Administration § To encourage officials to consider improvements to their administration based on their assessment of international practices and Tax Administration needs. § To answer specific issues raised by participants. 3

Our approach to your interests and concerns *** During the course of the seminar, we will aim to answer any questions raised by participants. *** Language differences/ translation may complicate your understanding of what is being presented or we don’t fully cover issues of interest to you – please to ask questions!!!! *** Practices from country to country vary significantly due to political, legal, historical, cultural and economic factors. 4

Our approach to your interests and concerns *** During the course of the seminar, we will aim to answer any questions raised by participants. *** Language differences/ translation may complicate your understanding of what is being presented or we don’t fully cover issues of interest to you – please to ask questions!!!! *** Practices from country to country vary significantly due to political, legal, historical, cultural and economic factors. 4

Structure of course (1) § Introduction § OECD Work on Taxation § General Introduction on Tax Administration § Primary Processes § Compliance Risk Management § General Principles and Approaches of Audit § Audit Theory § Falsification / fraud cases § The Audit process 5

Structure of course (1) § Introduction § OECD Work on Taxation § General Introduction on Tax Administration § Primary Processes § Compliance Risk Management § General Principles and Approaches of Audit § Audit Theory § Falsification / fraud cases § The Audit process 5

Structure of Course (2) § § § § § 6 Importance of Small and Medium Sized Enterprises Cash economy Audit Tools and Techniques EDP audit Capital Comparison method Negative Cash Balance method Mark up methods / Regressive methods Typology of business Performance measurement Course Review, questions and summary

Structure of Course (2) § § § § § 6 Importance of Small and Medium Sized Enterprises Cash economy Audit Tools and Techniques EDP audit Capital Comparison method Negative Cash Balance method Mark up methods / Regressive methods Typology of business Performance measurement Course Review, questions and summary

Structure of course(3) § § § 7 Lectures Workshops Discussions

Structure of course(3) § § § 7 Lectures Workshops Discussions

Tax Administration 2. OECD Work on Taxation 8

Tax Administration 2. OECD Work on Taxation 8

OECD Work on Taxation § OECD work on taxation is directed by the Committee on Fiscal Affairs (CFA), supported by the Centre for Tax Policy and Administration (CTPA). § The CFA sets standards and exchanges views in the tax area on international and domestic policy and administration issues. § Activities to promote its standards and views include its Outreach Program delivered for non-members. § Its role is to promote an environment supporting effective fiscal sovereignty of countries over the design and implementation of tax systems, which reflect each country’s social, economic, & political preferences. 9

OECD Work on Taxation § OECD work on taxation is directed by the Committee on Fiscal Affairs (CFA), supported by the Centre for Tax Policy and Administration (CTPA). § The CFA sets standards and exchanges views in the tax area on international and domestic policy and administration issues. § Activities to promote its standards and views include its Outreach Program delivered for non-members. § Its role is to promote an environment supporting effective fiscal sovereignty of countries over the design and implementation of tax systems, which reflect each country’s social, economic, & political preferences. 9

OECD Work on Taxation- Current Key Topics § Dispute resolution: Improvements to mutual agreement procedures (MAP) in tax treaties § Improved exchanges of information between countries § Consumption taxes: Trade in international services, etc § Removing tax obstacles to foreign direct investment § Transfer pricing guidelines and profits attribution for PE’s § Strategies for curbing harmful tax practices § Publications on comparative tax information § Improving tax administration: Better compliance risk management & use of technology for service delivery 10

OECD Work on Taxation- Current Key Topics § Dispute resolution: Improvements to mutual agreement procedures (MAP) in tax treaties § Improved exchanges of information between countries § Consumption taxes: Trade in international services, etc § Removing tax obstacles to foreign direct investment § Transfer pricing guidelines and profits attribution for PE’s § Strategies for curbing harmful tax practices § Publications on comparative tax information § Improving tax administration: Better compliance risk management & use of technology for service delivery 10

Our Mission To maintain our position as the organisation of first choice for countries - OECD and non-OECD – to work together to develop international tax standards and identify ways to improve the design and operation of tax systems. 11

Our Mission To maintain our position as the organisation of first choice for countries - OECD and non-OECD – to work together to develop international tax standards and identify ways to improve the design and operation of tax systems. 11

Tax Systems Operate in a Rapidly Changing Environment § Financial liberalisation, increased regional integration and new communication technologies have enabled taxpayers to plan and operate on a global basis. § Capital, labour and consumption have become much more mobile. § Competitive pressures have encouraged enterprises to restructure their business to minimise costs, including tax costs. § Economic activity is shifting away from manufacturing to services. 12

Tax Systems Operate in a Rapidly Changing Environment § Financial liberalisation, increased regional integration and new communication technologies have enabled taxpayers to plan and operate on a global basis. § Capital, labour and consumption have become much more mobile. § Competitive pressures have encouraged enterprises to restructure their business to minimise costs, including tax costs. § Economic activity is shifting away from manufacturing to services. 12

The OECD Tax World: The Structure and Work of the Committee on Fiscal Affairs (CFA) § The focal point for the OECD’s tax work is the CFA, serviced by the Centre for Tax Policy and Administration (CTPA). § Seven Subsidiary Bodies: Tax treaty issues and related questions Tax policy analysis and for statistical work Taxation of multinational enterprises International tax evasion & avoidance, & the tax-related aspects of bribery Consumption taxes The Forum on Harmful Tax Practices The Forum on Tax Administration § What does the CFA do? Sets international tax standards for the global economy; monitor their implementation; provide mechanisms to resolve tax disputes. Provides the analytical and statistical basis for good tax policy Identifies best practices and relevant comparative data for revenue bodies. Delivers large program of Outreach events. 13 • • •

The OECD Tax World: The Structure and Work of the Committee on Fiscal Affairs (CFA) § The focal point for the OECD’s tax work is the CFA, serviced by the Centre for Tax Policy and Administration (CTPA). § Seven Subsidiary Bodies: Tax treaty issues and related questions Tax policy analysis and for statistical work Taxation of multinational enterprises International tax evasion & avoidance, & the tax-related aspects of bribery Consumption taxes The Forum on Harmful Tax Practices The Forum on Tax Administration § What does the CFA do? Sets international tax standards for the global economy; monitor their implementation; provide mechanisms to resolve tax disputes. Provides the analytical and statistical basis for good tax policy Identifies best practices and relevant comparative data for revenue bodies. Delivers large program of Outreach events. 13 • • •

The Work of the Committee on Fiscal Affairs (CFA) § The work falls into three output groups: 1. International Taxation: Tax Policies & International Standards 2. International Taxation: International Co-operation 3. Tax Administration 14

The Work of the Committee on Fiscal Affairs (CFA) § The work falls into three output groups: 1. International Taxation: Tax Policies & International Standards 2. International Taxation: International Co-operation 3. Tax Administration 14

OECD has proven that it is well placed to help governments respond to these challenges § § § 15 Providing the analytical & statistical underpinnings for tax reforms. Adapting international tax arrangements to the new global environment. Counteracting the spread of tax havens. Examining the impacts of taxes on competitiveness & growth. Linking the Tax and Aid Development Agenda. Providing guidance & comparative information for tax administrations.

OECD has proven that it is well placed to help governments respond to these challenges § § § 15 Providing the analytical & statistical underpinnings for tax reforms. Adapting international tax arrangements to the new global environment. Counteracting the spread of tax havens. Examining the impacts of taxes on competitiveness & growth. Linking the Tax and Aid Development Agenda. Providing guidance & comparative information for tax administrations.

Engaging Non-OECD Economies (NOE’s) is Central to our Mission § § § 16 Extending observership (current observers: Argentina, Chile, China, India, Russian Federation, & South Africa). Enlargement (accession candidates: Chile, Estonia, Israel, Russia, and Slovenia) Enhanced relationship candidates: China, Brazil, India, Indonesia, and South Africa Developing partnerships with key countries in each region. Creating a global network of multilateral tax centers (e. g. Ankara, Budapest, Korea, Mexico and Vienna). Developing joint initiatives (e. g. ITD) with other international organizations.

Engaging Non-OECD Economies (NOE’s) is Central to our Mission § § § 16 Extending observership (current observers: Argentina, Chile, China, India, Russian Federation, & South Africa). Enlargement (accession candidates: Chile, Estonia, Israel, Russia, and Slovenia) Enhanced relationship candidates: China, Brazil, India, Indonesia, and South Africa Developing partnerships with key countries in each region. Creating a global network of multilateral tax centers (e. g. Ankara, Budapest, Korea, Mexico and Vienna). Developing joint initiatives (e. g. ITD) with other international organizations.

International Tax Dialogue The International Tax Dialogue (ITD) is a collaborative arrangement involving the IDB, IMF, OECD, UN and World Bank to encourage and facilitate discussion of tax matters among national tax officials, international organisations, and a range of other key stakeholders. increase cooperation share good practice, knowledge and experience improve tax policies and administration 17

International Tax Dialogue The International Tax Dialogue (ITD) is a collaborative arrangement involving the IDB, IMF, OECD, UN and World Bank to encourage and facilitate discussion of tax matters among national tax officials, international organisations, and a range of other key stakeholders. increase cooperation share good practice, knowledge and experience improve tax policies and administration 17

International Tax Dialogue Activities have focussed on creating dialogue opportunities through: § § § 18 Online resources Conferences and forums Shared technical assistance information

International Tax Dialogue Activities have focussed on creating dialogue opportunities through: § § § 18 Online resources Conferences and forums Shared technical assistance information

Online resources § 19 www. itdweb. org is a free, multilingual, multinational internet site operated by the ITD. The site provides a mechanism for countries and organisations to share knowledge and experience with each other, quickly, easily and globally

Online resources § 19 www. itdweb. org is a free, multilingual, multinational internet site operated by the ITD. The site provides a mechanism for countries and organisations to share knowledge and experience with each other, quickly, easily and globally

www. itdweb. org § A broad range of both administration and policy topics are covered: § § § 20 Tax policy Personal & corporate income tax VAT/GST & sales tax Other taxes Domestic tax avoidance &evasion

www. itdweb. org § A broad range of both administration and policy topics are covered: § § § 20 Tax policy Personal & corporate income tax VAT/GST & sales tax Other taxes Domestic tax avoidance &evasion

www. itdweb. org § A broad range of both administration and policy topics are covered: § § § 21 Taxation of multinationals Treaties Other international issues Tax procedure Organisation and management of tax administration Service delivery & community relationships

www. itdweb. org § A broad range of both administration and policy topics are covered: § § § 21 Taxation of multinationals Treaties Other international issues Tax procedure Organisation and management of tax administration Service delivery & community relationships

www. itdweb. org § § Over 2700 documents from a range countries and organisations are currently available with more added everyday Documents can be accessed through a tax topic structure, by keyword, country, date, language, etc § § 22 Information is available in 8 languages: English, Dutch, French, German, Japanese, Norwegian, Spanish and Russian. Online translation facilities are provided. Other resources include: news, events calendar, extensive range of links and contact information for more than 100 countries

www. itdweb. org § § Over 2700 documents from a range countries and organisations are currently available with more added everyday Documents can be accessed through a tax topic structure, by keyword, country, date, language, etc § § 22 Information is available in 8 languages: English, Dutch, French, German, Japanese, Norwegian, Spanish and Russian. Online translation facilities are provided. Other resources include: news, events calendar, extensive range of links and contact information for more than 100 countries

23

23

www. itdweb. org § Success lies in the knowledge and experience national tax organisations share with one another § All countries are encouraged to share their § 24 own information using the site Adding documents is very quick and easy and can be done from anywhere in the world

www. itdweb. org § Success lies in the knowledge and experience national tax organisations share with one another § All countries are encouraged to share their § 24 own information using the site Adding documents is very quick and easy and can be done from anywhere in the world

ITD Conferences and forums § § 25 The first global conference was held in March 2005, in Rome, on Value Added Tax (VAT) topics 240 participants from 97 countries and organisations attended The second conference was held in October 2007 in Buenos Aires considering Taxation of Small and Medium Sized Enterprises. Around 250 participants from 73 countries and 9 organizations attended

ITD Conferences and forums § § 25 The first global conference was held in March 2005, in Rome, on Value Added Tax (VAT) topics 240 participants from 97 countries and organisations attended The second conference was held in October 2007 in Buenos Aires considering Taxation of Small and Medium Sized Enterprises. Around 250 participants from 73 countries and 9 organizations attended

Tax Administration: Key Areas of Work in 2007/ 2008 § Organisational risk management (incl. note on ‘state of the art’ compliance measurement indicators & methodologies). § § Selected key issues in tax debt collection. § Developments with ‘joined up/whole of government’ service delivery and use of technology in service delivery. § Comparative information series (3 rd edition). 26 Approaches to large taxpayers’ compliance management. VAT abuses: update on countermeasures and their impacts. Developments with pre-filled tax return systems.

Tax Administration: Key Areas of Work in 2007/ 2008 § Organisational risk management (incl. note on ‘state of the art’ compliance measurement indicators & methodologies). § § Selected key issues in tax debt collection. § Developments with ‘joined up/whole of government’ service delivery and use of technology in service delivery. § Comparative information series (3 rd edition). 26 Approaches to large taxpayers’ compliance management. VAT abuses: update on countermeasures and their impacts. Developments with pre-filled tax return systems.

Comparative Information Series (2006) § A unique series of tax administration related information on 45 countries, including: - 27 organizational design features (incl. office networks) taxes collected and non-tax functions; service delivery standards tax return and payment system features; use of tax withholding; service delivery standards; relative tax burden data; audit and debt collection performance information; staffing and relative costs of administration; progress with electronic service delivery; TIN system features; and key administrative powers and sanctions.

Comparative Information Series (2006) § A unique series of tax administration related information on 45 countries, including: - 27 organizational design features (incl. office networks) taxes collected and non-tax functions; service delivery standards tax return and payment system features; use of tax withholding; service delivery standards; relative tax burden data; audit and debt collection performance information; staffing and relative costs of administration; progress with electronic service delivery; TIN system features; and key administrative powers and sanctions.

Seoul Declaration September 2006 § § 28 Further developing a directory of aggressive taxplanning schemes Examining the role of tax intermediaries in relation to non compliance Greater attention to the linkage between tax and corporate governance Improving the training of tax officials on international tax issues, including the secondment of staff from one administration to another

Seoul Declaration September 2006 § § 28 Further developing a directory of aggressive taxplanning schemes Examining the role of tax intermediaries in relation to non compliance Greater attention to the linkage between tax and corporate governance Improving the training of tax officials on international tax issues, including the secondment of staff from one administration to another

Cape Town Communiqué January 2008 § § § 29 Follow up Seoul Declaration: Achieving an enhanced relationship Focus on the role of tax intermediaries in aggressive tax planning has evolved by broadening its focus into a wider review of the tripartite relationship between tax administrations, taxpayers and intermediaries. Report focused on large corporate taxpayers and those providing them with tax advice.

Cape Town Communiqué January 2008 § § § 29 Follow up Seoul Declaration: Achieving an enhanced relationship Focus on the role of tax intermediaries in aggressive tax planning has evolved by broadening its focus into a wider review of the tripartite relationship between tax administrations, taxpayers and intermediaries. Report focused on large corporate taxpayers and those providing them with tax advice.

Enhanced relationship Main conclusions report (1) § § § 30 Tax intermediaries play a vital role by helping taxpayers understand comply with their tax obligations However some are also designers and promoters of aggressive tax planning Taxpayers are the ones who decide whether to adopt particular planning opportunities Risk management is an essential tool for tax administrations Relationship between tax administrations and taxpayers would be based upon early disclosure of potential tax issues and transparency

Enhanced relationship Main conclusions report (1) § § § 30 Tax intermediaries play a vital role by helping taxpayers understand comply with their tax obligations However some are also designers and promoters of aggressive tax planning Taxpayers are the ones who decide whether to adopt particular planning opportunities Risk management is an essential tool for tax administrations Relationship between tax administrations and taxpayers would be based upon early disclosure of potential tax issues and transparency

Enhanced relationship Main conclusions report (2) § § § 31 Tax Administrations should base their relationship with taxpayers and intermediaries upon 5 fundamental attributes: Understanding based on commercial awareness Impartiality Proportionality Openness Responsiveness Large corporate taxpayers would then be more likely to engage in a relationship with tax administrations based on cooperation and trust

Enhanced relationship Main conclusions report (2) § § § 31 Tax Administrations should base their relationship with taxpayers and intermediaries upon 5 fundamental attributes: Understanding based on commercial awareness Impartiality Proportionality Openness Responsiveness Large corporate taxpayers would then be more likely to engage in a relationship with tax administrations based on cooperation and trust

Organisation for Economic Co-operation and Development Auditing SME 3. General Introduction on Tax Administration Centre for Tax Policy and Administration

Organisation for Economic Co-operation and Development Auditing SME 3. General Introduction on Tax Administration Centre for Tax Policy and Administration

What is a Tax Administration? § 33 Core activities of a Tax Administration are centered around the implementation and enforcement of tax legislation and tax regulations

What is a Tax Administration? § 33 Core activities of a Tax Administration are centered around the implementation and enforcement of tax legislation and tax regulations

Purpose of Taxation Contribution to society: § § 34 Financing public expenditures Redistribution of income Instrument of fiscal policy (budget policy) Instrument of social-economic policy (stimulate and disencourage investments / behaviour)

Purpose of Taxation Contribution to society: § § 34 Financing public expenditures Redistribution of income Instrument of fiscal policy (budget policy) Instrument of social-economic policy (stimulate and disencourage investments / behaviour)

Principles of Taxation § § 35 Equality: contribution in proportion to ability / revenue Certainty: time of payment, manner of payment, quantity to be paid clear Convenient timing for the taxpayer Efficient collection: lowest cost for taxpayer and revenue body

Principles of Taxation § § 35 Equality: contribution in proportion to ability / revenue Certainty: time of payment, manner of payment, quantity to be paid clear Convenient timing for the taxpayer Efficient collection: lowest cost for taxpayer and revenue body

External Trends § § § 36 Globalization Technological evolution Social factors Harmonization of tax issues required by economic integration processes Aggressive tax planning

External Trends § § § 36 Globalization Technological evolution Social factors Harmonization of tax issues required by economic integration processes Aggressive tax planning

Organizational trends § § § § § 37 Autonomy Outsourcing / privatization Decentralization Merge with customs Merge with social security contributions Growing interdependence between tax policy, tax legislation and administration Attention for administrative and compliance costs Cooperation with other (governmental) bodies International cooperation

Organizational trends § § § § § 37 Autonomy Outsourcing / privatization Decentralization Merge with customs Merge with social security contributions Growing interdependence between tax policy, tax legislation and administration Attention for administrative and compliance costs Cooperation with other (governmental) bodies International cooperation

Core activities § § § § 38 Identifying and registering taxpayers Assessing, collecting and auditing taxes Preventing and combating fraud Surveillance (by customs) of goods imported and exported to collect duties and to protect the quality of society Assessing and collecting social security contributions Other assessment and collection Payment of (social) benefits

Core activities § § § § 38 Identifying and registering taxpayers Assessing, collecting and auditing taxes Preventing and combating fraud Surveillance (by customs) of goods imported and exported to collect duties and to protect the quality of society Assessing and collecting social security contributions Other assessment and collection Payment of (social) benefits

Core Activities(2) Information is key § § 39 Collecting information from taxpayers Collecting information from third parties Providing information to taxpayers Providing information to third parties

Core Activities(2) Information is key § § 39 Collecting information from taxpayers Collecting information from third parties Providing information to taxpayers Providing information to third parties

Administering tax laws should serve the public interest § § § 40 The agency and its employees must have the confidence of the public they serve Collect the proper amount of tax due to the law at the least possible cost Public confidence in the efficiency, effectiveness and fairness of the agency Consistent and equal treatment Good value for money

Administering tax laws should serve the public interest § § § 40 The agency and its employees must have the confidence of the public they serve Collect the proper amount of tax due to the law at the least possible cost Public confidence in the efficiency, effectiveness and fairness of the agency Consistent and equal treatment Good value for money

Voluntary compliance Critical factors: § § § 41 Public perception of the fairness of the tax system Public perception of the fairness of the public expenditure policy and practice Public perception of the fairness and performance of the tax administration

Voluntary compliance Critical factors: § § § 41 Public perception of the fairness of the tax system Public perception of the fairness of the public expenditure policy and practice Public perception of the fairness and performance of the tax administration

OECD’s policy brief of January 2007 Cutting Red Tape: National Strategies § § 42 Cutting red tape is a priority on the political agenda Business spend to much time to activities such as filing out forms, applying for permits and licences, reporting business information, notifying changes This is particularly burdensome to smaller business, and may even discourage people from starting up a new business WB Doing Business annual report includes administrative burdens as a key variable in competitiveness

OECD’s policy brief of January 2007 Cutting Red Tape: National Strategies § § 42 Cutting red tape is a priority on the political agenda Business spend to much time to activities such as filing out forms, applying for permits and licences, reporting business information, notifying changes This is particularly burdensome to smaller business, and may even discourage people from starting up a new business WB Doing Business annual report includes administrative burdens as a key variable in competitiveness

The field of taxation places a significant administrative (compliance) burden on business § § 43 At the Forum on Tax Administration (FTA) meeting held in Seoul 2006 both the Netherlands and UK tax commissioners noted the significant efforts underway to reduce administrative burdens on business The OECD Secretariat has prepared a report for the FTA Taxpayer Services Subgroup to identify details of the key strategies of revenue bodies and of their impacts.

The field of taxation places a significant administrative (compliance) burden on business § § 43 At the Forum on Tax Administration (FTA) meeting held in Seoul 2006 both the Netherlands and UK tax commissioners noted the significant efforts underway to reduce administrative burdens on business The OECD Secretariat has prepared a report for the FTA Taxpayer Services Subgroup to identify details of the key strategies of revenue bodies and of their impacts.

Challenge to seek the minimum necessary information for effective control § § § 44 What are the major burdens that taxpayers face in complying with the tax system, and how large are they? What strategies have been most effective in reducing the compliance burden (simplifying tax legislation, improving forms and procedures, streamlining processes, intergovernmental co-operation) What role can information technology play in reducing the compliance burden

Challenge to seek the minimum necessary information for effective control § § § 44 What are the major burdens that taxpayers face in complying with the tax system, and how large are they? What strategies have been most effective in reducing the compliance burden (simplifying tax legislation, improving forms and procedures, streamlining processes, intergovernmental co-operation) What role can information technology play in reducing the compliance burden

Measures taken by governments § § § 45 Harmonizing/standardisation of definitions and language in (tax) legislation Use of single (Tax) Identification Number across government (Electronic) single business information point delivering government wide information Reuse of information Standardisation of electronic information (processes, architecture, infrastructure

Measures taken by governments § § § 45 Harmonizing/standardisation of definitions and language in (tax) legislation Use of single (Tax) Identification Number across government (Electronic) single business information point delivering government wide information Reuse of information Standardisation of electronic information (processes, architecture, infrastructure

Voluntary compliance § The objective of Tax administrations is to achieve the highest possible level of voluntary compliance with the laws, at minimal cost. § Why “voluntary” compliance? - Tax administrations cannot enforce compliance from each & every taxpayer; they don’t have the resources. - Governments will not provide more resources, which are both costly and intrusive. - Voluntary compliance is the cheapest & most efficient means of administering a tax system. 46

Voluntary compliance § The objective of Tax administrations is to achieve the highest possible level of voluntary compliance with the laws, at minimal cost. § Why “voluntary” compliance? - Tax administrations cannot enforce compliance from each & every taxpayer; they don’t have the resources. - Governments will not provide more resources, which are both costly and intrusive. - Voluntary compliance is the cheapest & most efficient means of administering a tax system. 46

Barriers to achieving voluntary compliance § There are many barriers to achieving voluntary compliance: tell - Taxpayers’ ignorance of the law- I did not know! You did not me what I needed to do! - Tax laws are often complex – I made an error! - Tax laws & rules may put a high compliance burden on taxpayers- Its too costly/ difficult to comply! - Some taxpayers have poor/ no records –They don’t know how to keep good records or can’t be bothered. - Some citizens and business are not prepared to comply. They deliberately don’t comply & are prepared to take a risk of being caught. 47

Barriers to achieving voluntary compliance § There are many barriers to achieving voluntary compliance: tell - Taxpayers’ ignorance of the law- I did not know! You did not me what I needed to do! - Tax laws are often complex – I made an error! - Tax laws & rules may put a high compliance burden on taxpayers- Its too costly/ difficult to comply! - Some taxpayers have poor/ no records –They don’t know how to keep good records or can’t be bothered. - Some citizens and business are not prepared to comply. They deliberately don’t comply & are prepared to take a risk of being caught. 47

Taxpayer services § Effective taxpayer services help achieve voluntary compliance by: - Improving taxpayers’ understanding of the law - Making it easier and less costly to comply - Informing taxpayers on what they need to do to properly comply - Discouraging taxpayers from non-compliance 48

Taxpayer services § Effective taxpayer services help achieve voluntary compliance by: - Improving taxpayers’ understanding of the law - Making it easier and less costly to comply - Informing taxpayers on what they need to do to properly comply - Discouraging taxpayers from non-compliance 48

Complexity of (non-)compliant behaviour Academic research………. § Academic research over last two decades has led to increased awareness of the complexity of tax compliant and non-compliant behaviour. § The research has largely shifted from the “persuasion versus punishment” (or service versus enforcement) debate to what is the right mix of the two. SERVICE + ENFORCEMENT = COMPLIANCE § 49 Emphasis on a regulatory model: Attempting co-operation remains the best first choice for achieving compliance in most situations.

Complexity of (non-)compliant behaviour Academic research………. § Academic research over last two decades has led to increased awareness of the complexity of tax compliant and non-compliant behaviour. § The research has largely shifted from the “persuasion versus punishment” (or service versus enforcement) debate to what is the right mix of the two. SERVICE + ENFORCEMENT = COMPLIANCE § 49 Emphasis on a regulatory model: Attempting co-operation remains the best first choice for achieving compliance in most situations.

Classification of determinants of tax compliance § § Political perspective (fiscal policy) Tax system (complexity, tax rates, etc) Social psychological perspective Mental (social) representations Tax knowledge and mental concepts Attitudes: beliefs and evaluations Norms: Personal norms Social norms and identity Societal norms 50

Classification of determinants of tax compliance § § Political perspective (fiscal policy) Tax system (complexity, tax rates, etc) Social psychological perspective Mental (social) representations Tax knowledge and mental concepts Attitudes: beliefs and evaluations Norms: Personal norms Social norms and identity Societal norms 50

Classification of determinants of tax compliance (2) § 51 Mental (social) representations (2) Perceived opportunity to evade Fairness perceptions: Distributive fairness Procedural fairness Retributive fairness Motivation to comply Motivational postures Tax morale

Classification of determinants of tax compliance (2) § 51 Mental (social) representations (2) Perceived opportunity to evade Fairness perceptions: Distributive fairness Procedural fairness Retributive fairness Motivation to comply Motivational postures Tax morale

Classification of determinants of tax compliance § § § Decision making perspective Rational decision making Audit probability, fines, tax rate and income Psychological aspects of decision making Sequence of audits: learning processes Heuristics, biases, frames Withholding phenomena Self-employment (paying out of pocket) Interaction between tax authorities and taxpayers (Cops against robbers versus service for clients perspective) 52

Classification of determinants of tax compliance § § § Decision making perspective Rational decision making Audit probability, fines, tax rate and income Psychological aspects of decision making Sequence of audits: learning processes Heuristics, biases, frames Withholding phenomena Self-employment (paying out of pocket) Interaction between tax authorities and taxpayers (Cops against robbers versus service for clients perspective) 52

Interaction with taxpayers the crucial variable that determines tax climate § Tax authorities who perceive taxpayers as robbers rather then as clients are likely to establish a command control climate with taxpayers engaging in escaping the authorities by taking extensive (rational) decisions. Tax behaviour depends on audit probability and fines § Tax authorities who perceive taxpayers as clients and governments committed to responsive regulation are likely to establish a climate of cooperation and trust. Voluntary compliance depends on the taxpayers’ social representations of taxation. 53

Interaction with taxpayers the crucial variable that determines tax climate § Tax authorities who perceive taxpayers as robbers rather then as clients are likely to establish a command control climate with taxpayers engaging in escaping the authorities by taking extensive (rational) decisions. Tax behaviour depends on audit probability and fines § Tax authorities who perceive taxpayers as clients and governments committed to responsive regulation are likely to establish a climate of cooperation and trust. Voluntary compliance depends on the taxpayers’ social representations of taxation. 53

Improvement of compliance § § § § § 54 Simple and understandable legislation Transparent and clear procedures Fast efficient processes Low compliance costs Treatment of the taxpayer as a client Taxpayer service (assistance, information) Visible supervision and fraud detection Use of third party information (banks etc. ) Enforcement communication

Improvement of compliance § § § § § 54 Simple and understandable legislation Transparent and clear procedures Fast efficient processes Low compliance costs Treatment of the taxpayer as a client Taxpayer service (assistance, information) Visible supervision and fraud detection Use of third party information (banks etc. ) Enforcement communication

Public confidence § § § § 55 Rights and obligations of the taxpayers Clear guidance in dealing with the Tax Administration Ethical standards and rules of conduct Confidentiality of information Professional staff Feedback from stakeholders Performance measurement

Public confidence § § § § 55 Rights and obligations of the taxpayers Clear guidance in dealing with the Tax Administration Ethical standards and rules of conduct Confidentiality of information Professional staff Feedback from stakeholders Performance measurement

Taxpayer rights and obligations § § § 56 Explanation and protection of rights Explanation why information is asked Disclosure of information only on legal basis Professional service Representation Payment of only the correct amount of Tax

Taxpayer rights and obligations § § § 56 Explanation and protection of rights Explanation why information is asked Disclosure of information only on legal basis Professional service Representation Payment of only the correct amount of Tax

Emergence of ‘Taxpayers’ Rights Increasing acknowledgment that taxpayers have rights, as well as obligations. § Examples of (basic) rights: - to be informed, heard, and assisted; § - to pay no more than the correct amount of tax due; - to appeal decisions of the tax body; and - to have certainty, privacy, and confidentiality § Examples of (advanced) “rights” - Services are comprehensive, easily accessible, low cost to taxpayer, & timely. 57

Emergence of ‘Taxpayers’ Rights Increasing acknowledgment that taxpayers have rights, as well as obligations. § Examples of (basic) rights: - to be informed, heard, and assisted; § - to pay no more than the correct amount of tax due; - to appeal decisions of the tax body; and - to have certainty, privacy, and confidentiality § Examples of (advanced) “rights” - Services are comprehensive, easily accessible, low cost to taxpayer, & timely. 57

Taxpayers’ Rights § Basic rights may be stated in countries legislation § Many revenue bodies set out taxpayers’ rights in formal charters/ statements that are made public. § Charters reflect revenue body’s vision for service delivery (e. g. services are comprehensive, accessible, fair, & timely). § Many revenue bodies set service performance standards with time-bound objectives that are made public 58

Taxpayers’ Rights § Basic rights may be stated in countries legislation § Many revenue bodies set out taxpayers’ rights in formal charters/ statements that are made public. § Charters reflect revenue body’s vision for service delivery (e. g. services are comprehensive, accessible, fair, & timely). § Many revenue bodies set service performance standards with time-bound objectives that are made public 58

3. Workshop 1. What are the core tasks of your Tax Administration? What type of taxes do you collect. Has the Tax Administration been merged with customs or social security. Future plans? 2. Do you have a system of stakeholders’ feedback? Describe the system and the main results. If not, how to design such a system? 3. Describe the interaction with taxpayers in your country. Does your Tax Administration see taxpayers mainly as robbers or as clients? Explain your answer. 59

3. Workshop 1. What are the core tasks of your Tax Administration? What type of taxes do you collect. Has the Tax Administration been merged with customs or social security. Future plans? 2. Do you have a system of stakeholders’ feedback? Describe the system and the main results. If not, how to design such a system? 3. Describe the interaction with taxpayers in your country. Does your Tax Administration see taxpayers mainly as robbers or as clients? Explain your answer. 59

Roles, responsibilities and accountability in a Tax Administration Traditional vision Top-level: vision and policy making, leadership Operational (middle) level: leading and controlling implementation Lower level: implementation and maintenance of programs instructed by upper management 60

Roles, responsibilities and accountability in a Tax Administration Traditional vision Top-level: vision and policy making, leadership Operational (middle) level: leading and controlling implementation Lower level: implementation and maintenance of programs instructed by upper management 60

Mission § What does a Tax Administration? Definition of the Core business § How does the Administration fulfill its task, how does it perform? Organizational philosophy, strategic planning, risk management, performance management (targets, indicators, results) § What is the strategic direction of the organization? In what direction should the organization develop? Mission statement 61

Mission § What does a Tax Administration? Definition of the Core business § How does the Administration fulfill its task, how does it perform? Organizational philosophy, strategic planning, risk management, performance management (targets, indicators, results) § What is the strategic direction of the organization? In what direction should the organization develop? Mission statement 61

Mission statement Tax Administration Mission statements describe the strategic direction of the organization, common elements in mission statements include: § § § § § 62 Improving (voluntary) compliance Service providing in accordance with compliance goals Strengthen public’s confidence in Tax Administration’s integrity and fairness Ensuring fairness, equity and equality Improving productivity and quality Optimal prevention of fraud in society Motivated, competent and well-trained staff Efficient and proper use of resources Reducing the tax gap

Mission statement Tax Administration Mission statements describe the strategic direction of the organization, common elements in mission statements include: § § § § § 62 Improving (voluntary) compliance Service providing in accordance with compliance goals Strengthen public’s confidence in Tax Administration’s integrity and fairness Ensuring fairness, equity and equality Improving productivity and quality Optimal prevention of fraud in society Motivated, competent and well-trained staff Efficient and proper use of resources Reducing the tax gap

Overall Tax Gap The total amount of tax not collected resulting from all forms of non-compliance for all taxes administered by a revenue body 63

Overall Tax Gap The total amount of tax not collected resulting from all forms of non-compliance for all taxes administered by a revenue body 63

More useful approach (reflected in tax administration work at the OECD) § § § 64 Well-developed compliance risk management processes for the identification, assessment and treatment of major compliance risks for each of the major groupings of taxpayers Risk assessment approach entails an element of estimating the revenue potential of a particular risk ( e. g. undeclared business income of self-employed persons, over claimed employee work-related expenses) Once the major risk areas are assessed and prioritized, treatment strategies are developed

More useful approach (reflected in tax administration work at the OECD) § § § 64 Well-developed compliance risk management processes for the identification, assessment and treatment of major compliance risks for each of the major groupings of taxpayers Risk assessment approach entails an element of estimating the revenue potential of a particular risk ( e. g. undeclared business income of self-employed persons, over claimed employee work-related expenses) Once the major risk areas are assessed and prioritized, treatment strategies are developed

Autonomy § § § 65 Budgetary autonomy Autonomy in defining the objectives Autonomy in management of material resources (IT investments) Autonomy in management of human resources (recruitment, promotion) Autonomy in incentives policy Autonomy in (individual) case handling

Autonomy § § § 65 Budgetary autonomy Autonomy in defining the objectives Autonomy in management of material resources (IT investments) Autonomy in management of human resources (recruitment, promotion) Autonomy in incentives policy Autonomy in (individual) case handling

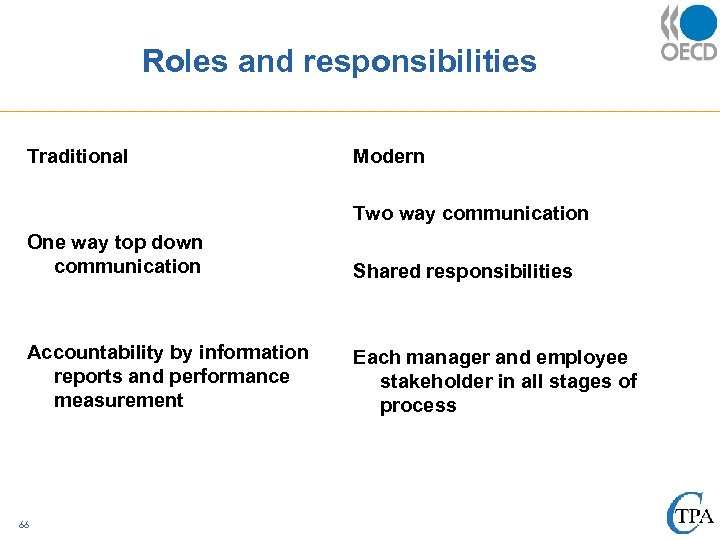

Roles and responsibilities Traditional Modern Two way communication One way top down communication Shared responsibilities Accountability by information reports and performance measurement Each manager and employee stakeholder in all stages of process 66

Roles and responsibilities Traditional Modern Two way communication One way top down communication Shared responsibilities Accountability by information reports and performance measurement Each manager and employee stakeholder in all stages of process 66

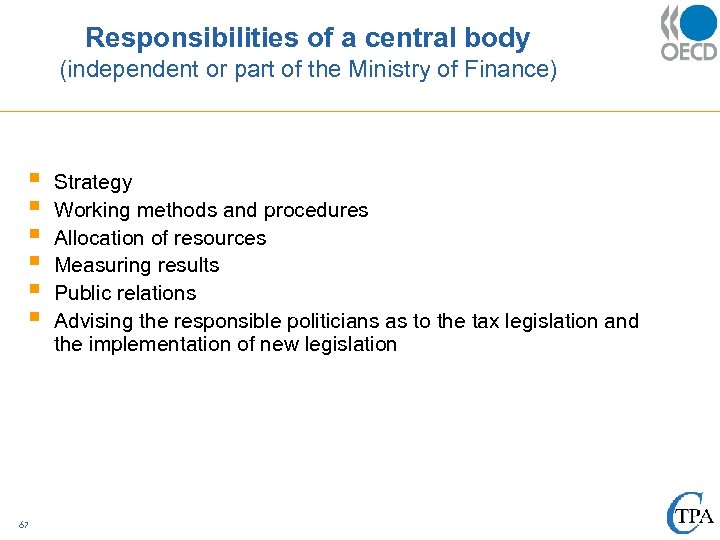

Responsibilities of a central body (independent or part of the Ministry of Finance) § § § 67 Strategy Working methods and procedures Allocation of resources Measuring results Public relations Advising the responsible politicians as to the tax legislation and the implementation of new legislation

Responsibilities of a central body (independent or part of the Ministry of Finance) § § § 67 Strategy Working methods and procedures Allocation of resources Measuring results Public relations Advising the responsible politicians as to the tax legislation and the implementation of new legislation

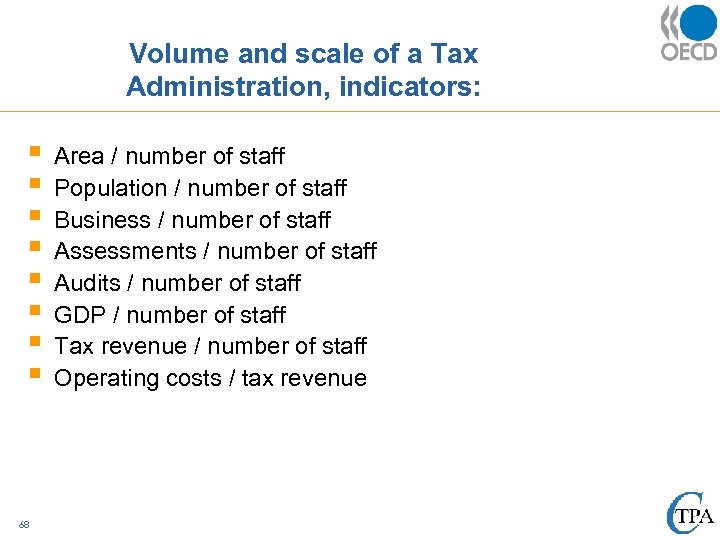

Volume and scale of a Tax Administration, indicators: § § § § 68 Area / number of staff Population / number of staff Business / number of staff Assessments / number of staff Audits / number of staff GDP / number of staff Tax revenue / number of staff Operating costs / tax revenue

Volume and scale of a Tax Administration, indicators: § § § § 68 Area / number of staff Population / number of staff Business / number of staff Assessments / number of staff Audits / number of staff GDP / number of staff Tax revenue / number of staff Operating costs / tax revenue

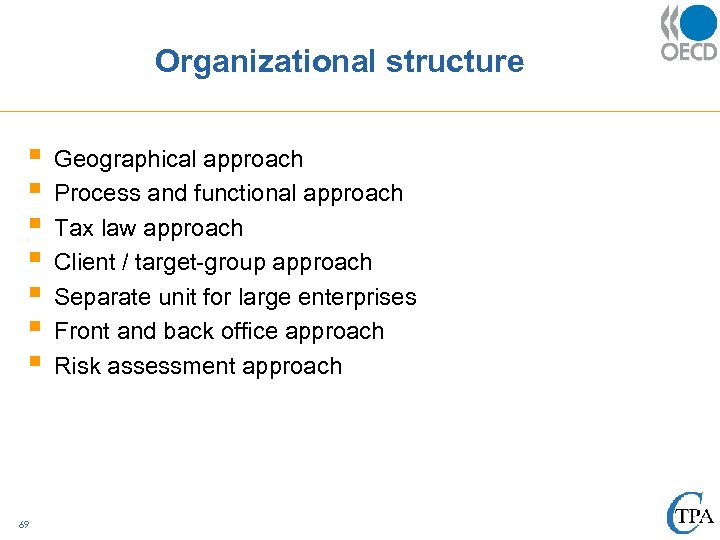

Organizational structure § § § § 69 Geographical approach Process and functional approach Tax law approach Client / target-group approach Separate unit for large enterprises Front and back office approach Risk assessment approach

Organizational structure § § § § 69 Geographical approach Process and functional approach Tax law approach Client / target-group approach Separate unit for large enterprises Front and back office approach Risk assessment approach

Geographical approach § § § 70 Similar offices in different places Most common form Combination with other forms Large countries Rural policy to keep villages alive

Geographical approach § § § 70 Similar offices in different places Most common form Combination with other forms Large countries Rural policy to keep villages alive

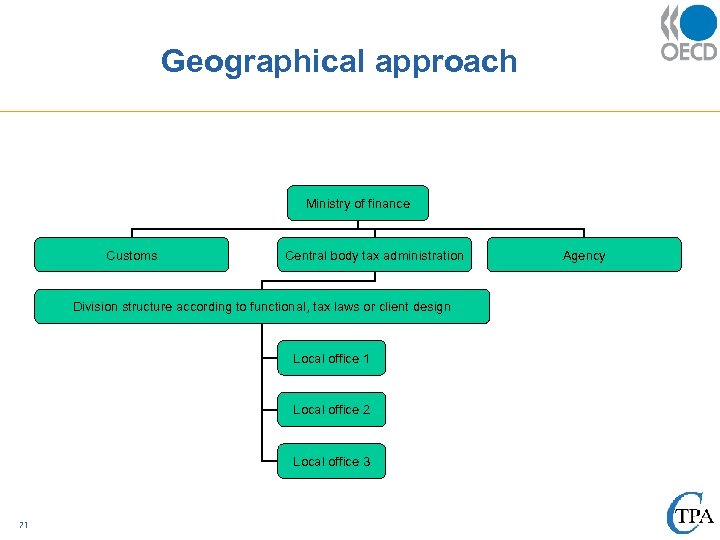

Geographical approach Ministry of finance Customs Central body tax administration Division structure according to functional, tax laws or client design Local office 1 Local office 2 Local office 3 71 Agency

Geographical approach Ministry of finance Customs Central body tax administration Division structure according to functional, tax laws or client design Local office 1 Local office 2 Local office 3 71 Agency

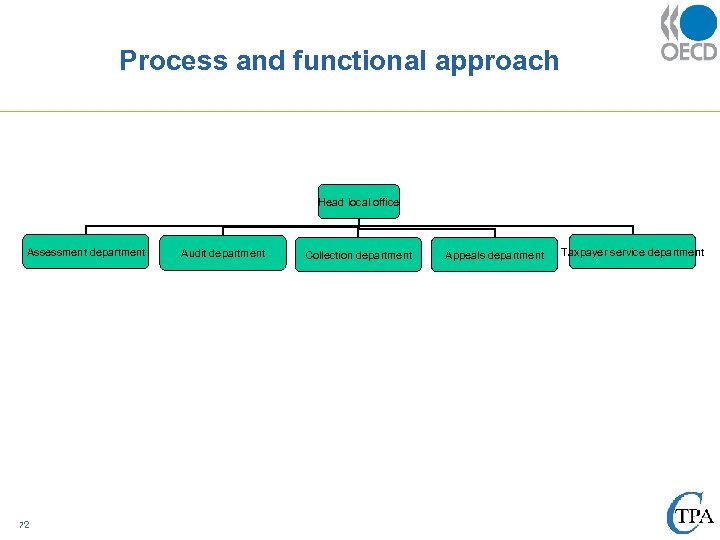

Process and functional approach Head local office Assessment department 72 Audit department Collection department Appeals department Taxpayer service department

Process and functional approach Head local office Assessment department 72 Audit department Collection department Appeals department Taxpayer service department

Process and functional approach § § § 73 Approach can be used for the Tax Administration as a whole with process and functional offices, within one office with specialized units (chart) or just for some specific functions (collection, auditing, fiscal investigation) Advantage: specialization/professionalization Risk: lack of coordination

Process and functional approach § § § 73 Approach can be used for the Tax Administration as a whole with process and functional offices, within one office with specialized units (chart) or just for some specific functions (collection, auditing, fiscal investigation) Advantage: specialization/professionalization Risk: lack of coordination

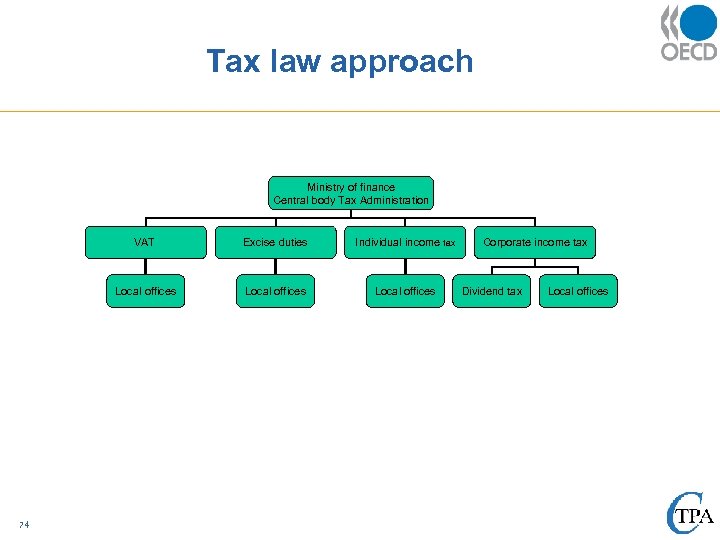

Tax law approach Ministry of finance Central body Tax Administration VAT Individual income tax Local offices 74 Excise duties Local offices Corporate income tax Dividend tax Local offices

Tax law approach Ministry of finance Central body Tax Administration VAT Individual income tax Local offices 74 Excise duties Local offices Corporate income tax Dividend tax Local offices

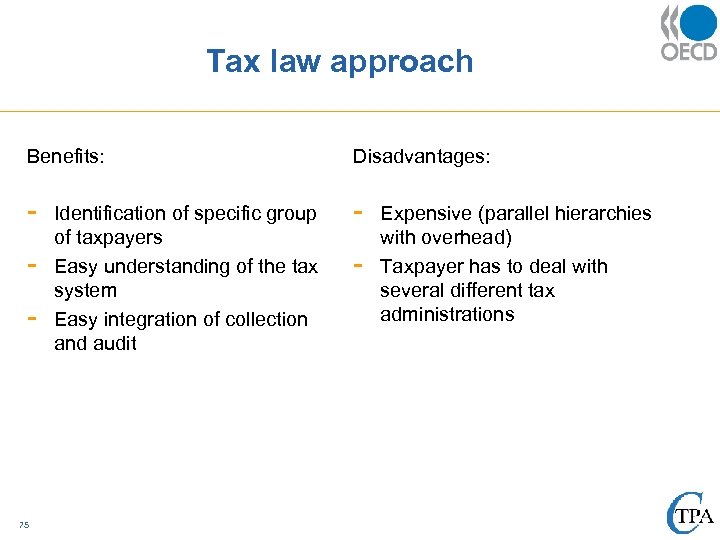

Tax law approach Benefits: Disadvantages: - - - 75 Identification of specific group of taxpayers Easy understanding of the tax system Easy integration of collection and audit - Expensive (parallel hierarchies with overhead) Taxpayer has to deal with several different tax administrations

Tax law approach Benefits: Disadvantages: - - - 75 Identification of specific group of taxpayers Easy understanding of the tax system Easy integration of collection and audit - Expensive (parallel hierarchies with overhead) Taxpayer has to deal with several different tax administrations

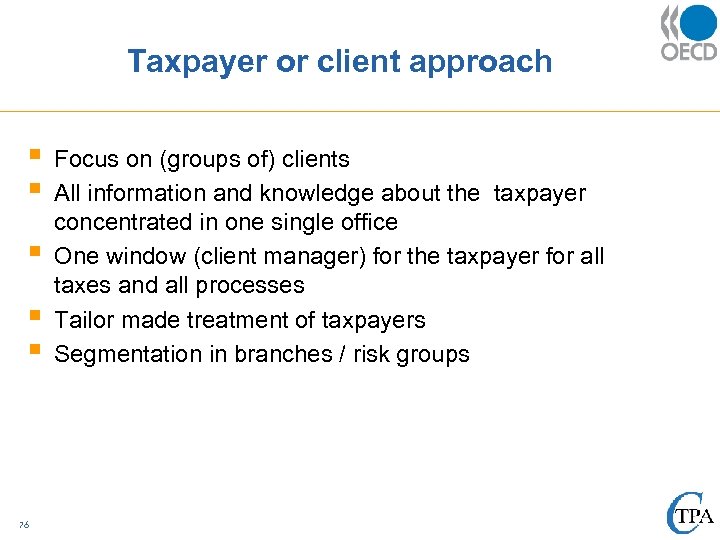

Taxpayer or client approach § § § 76 Focus on (groups of) clients All information and knowledge about the taxpayer concentrated in one single office One window (client manager) for the taxpayer for all taxes and all processes Tailor made treatment of taxpayers Segmentation in branches / risk groups

Taxpayer or client approach § § § 76 Focus on (groups of) clients All information and knowledge about the taxpayer concentrated in one single office One window (client manager) for the taxpayer for all taxes and all processes Tailor made treatment of taxpayers Segmentation in branches / risk groups

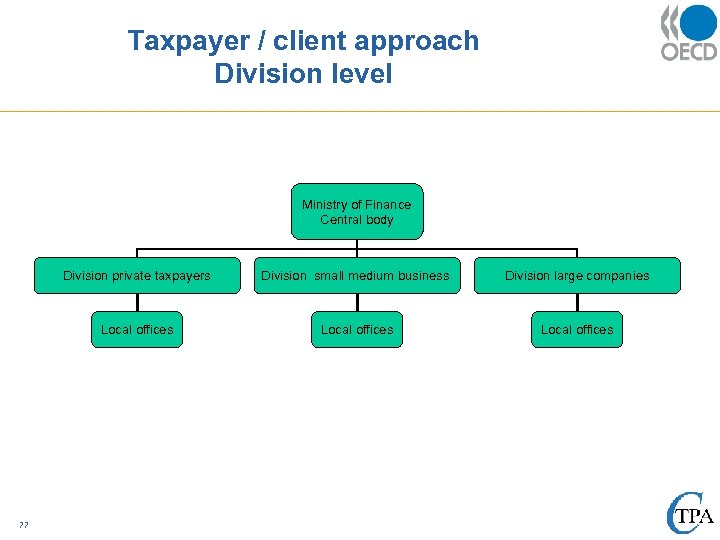

Taxpayer / client approach Division level Ministry of Finance Central body Division private taxpayers Division large companies Local offices 77 Division small medium business Local offices

Taxpayer / client approach Division level Ministry of Finance Central body Division private taxpayers Division large companies Local offices 77 Division small medium business Local offices

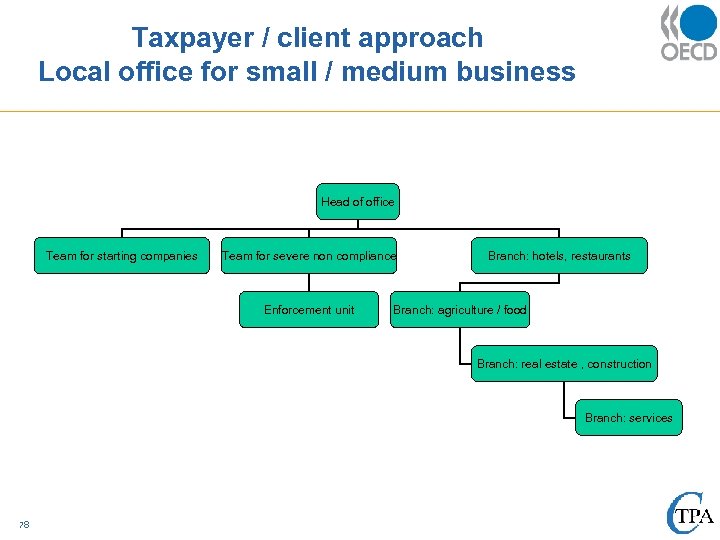

Taxpayer / client approach Local office for small / medium business Head of office Team for starting companies Team for severe non compliance Enforcement unit Branch: hotels, restaurants Branch: agriculture / food Branch: real estate , construction Branch: services 78

Taxpayer / client approach Local office for small / medium business Head of office Team for starting companies Team for severe non compliance Enforcement unit Branch: hotels, restaurants Branch: agriculture / food Branch: real estate , construction Branch: services 78

Importance of large taxpayers § § § 79 Large companies represent up to 80% of tax revenue Economic importance Use of high skilled professional tax advisors International scope of multinationals Aggressive avoidance schemes

Importance of large taxpayers § § § 79 Large companies represent up to 80% of tax revenue Economic importance Use of high skilled professional tax advisors International scope of multinationals Aggressive avoidance schemes

Front and back office approach § § 80 Front office is the part of the organization where taxpayers and tax officials have contacts. Both physical and non physical. Back office is the part of the organization without client contacts. Examples are automation centers for massive processes

Front and back office approach § § 80 Front office is the part of the organization where taxpayers and tax officials have contacts. Both physical and non physical. Back office is the part of the organization without client contacts. Examples are automation centers for massive processes

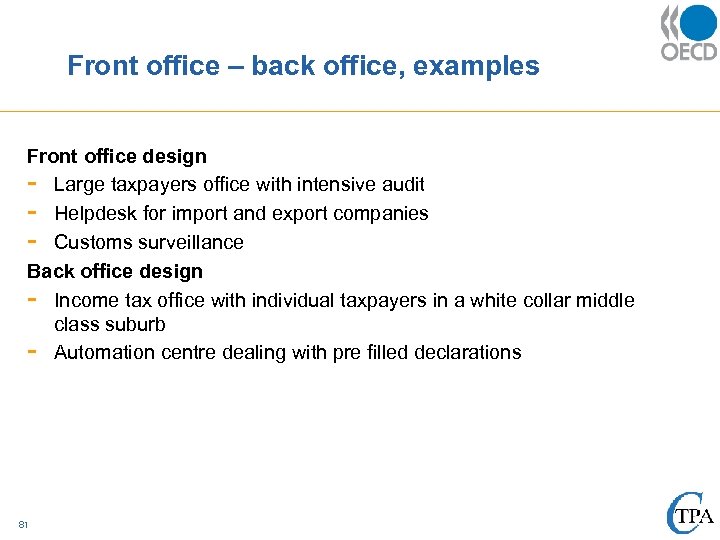

Front office – back office, examples Front office design - Large taxpayers office with intensive audit - Helpdesk for import and export companies - Customs surveillance Back office design - Income tax office with individual taxpayers in a white collar middle class suburb - Automation centre dealing with pre filled declarations 81

Front office – back office, examples Front office design - Large taxpayers office with intensive audit - Helpdesk for import and export companies - Customs surveillance Back office design - Income tax office with individual taxpayers in a white collar middle class suburb - Automation centre dealing with pre filled declarations 81

4. Workshop 1. 2. 3. 4. 5. 6. 82 Do you have a system of stakeholders’ feedback? Describe the system and the main results. If not, how to design such a system? Describe the interaction with taxpayers in your country. Does your Tax Administration see taxpayers mainly as robbers or as clients? Explain your answer. Describe the structure of your tax administration. What coordination mechanism do you recognize? Do you have a separate body dealing with large taxpayers? And also for SMEs? Describe the autonomy of your administration (different aspects) What is the mission statement of your administration. What is common and what not. Formulate a mission statement with your group.

4. Workshop 1. 2. 3. 4. 5. 6. 82 Do you have a system of stakeholders’ feedback? Describe the system and the main results. If not, how to design such a system? Describe the interaction with taxpayers in your country. Does your Tax Administration see taxpayers mainly as robbers or as clients? Explain your answer. Describe the structure of your tax administration. What coordination mechanism do you recognize? Do you have a separate body dealing with large taxpayers? And also for SMEs? Describe the autonomy of your administration (different aspects) What is the mission statement of your administration. What is common and what not. Formulate a mission statement with your group.