23b6d1b3b665cdc7b7496fd59911122b.ppt

- Количество слайдов: 79

Organisation for Economic Co-operation and Development AUDITING SMALL AND MEDIUM SIZED ENTERPRISES 15. AUDIT TOOLS AND TECHNIQUES Korea 20 – 24 October 2008 Centre for Tax Policy and Administration

Organisation for Economic Co-operation and Development AUDITING SMALL AND MEDIUM SIZED ENTERPRISES 15. AUDIT TOOLS AND TECHNIQUES Korea 20 – 24 October 2008 Centre for Tax Policy and Administration

Types of businesses § To know how to run a business is to know how to audit a business § § § Businesses can be divided into standard types This typology is based on the internal controls and correlations It will also suggest the tools and techniques that might be used to audit the revenues of the company It is just a general framework: knowledge of the business at hand will lead to a concrete audit programme, depending on facts and circumstances So the initial interview with the taxpayer is important to get to know the business Even if this information is available on the internet or from an earlier audit it is necessary to have this interview: to update and to discuss any particular points § § § 2

Types of businesses § To know how to run a business is to know how to audit a business § § § Businesses can be divided into standard types This typology is based on the internal controls and correlations It will also suggest the tools and techniques that might be used to audit the revenues of the company It is just a general framework: knowledge of the business at hand will lead to a concrete audit programme, depending on facts and circumstances So the initial interview with the taxpayer is important to get to know the business Even if this information is available on the internet or from an earlier audit it is necessary to have this interview: to update and to discuss any particular points § § § 2

Direct and indirect methods to establish the taxable income § The direct method: the total of all direct information - wages/salary - interests - rents from immovable property - sales of shares - deductible expenses - profits and losses § As this information is delivered by the tax payer or reliable third parties it will be used as correct information, there is a burden on the taxpayer to proof incorrectness Regarding expenses: the onus of proving that these are incorrect lies with the Tax Authority § 3

Direct and indirect methods to establish the taxable income § The direct method: the total of all direct information - wages/salary - interests - rents from immovable property - sales of shares - deductible expenses - profits and losses § As this information is delivered by the tax payer or reliable third parties it will be used as correct information, there is a burden on the taxpayer to proof incorrectness Regarding expenses: the onus of proving that these are incorrect lies with the Tax Authority § 3

Indirect methods § § § 4 All these methods are used to establish the taxable income from secondary or linked information Often used by the Tax Authority, so burden of proof on them The use of estimates makes it necessary to use different indirect methods in the same audit

Indirect methods § § § 4 All these methods are used to establish the taxable income from secondary or linked information Often used by the Tax Authority, so burden of proof on them The use of estimates makes it necessary to use different indirect methods in the same audit

Indirect methods § § Bank deposit method Source and application of funds method Net worth method Capital comparison method § § Percentage of mark-up method Unit and volume method Negative cash balance method Chi-square test 5

Indirect methods § § Bank deposit method Source and application of funds method Net worth method Capital comparison method § § Percentage of mark-up method Unit and volume method Negative cash balance method Chi-square test 5

Auditing Small and Medium Size Enterprises 16. An EDP Audit case 6

Auditing Small and Medium Size Enterprises 16. An EDP Audit case 6

Electronic Data processing (EDP) - audit § § 7 Rapid development - paper books, records and documents will be replaced by data transmitted electronically These changes mean that it is necessary to make adjustments to examination methods A different approach also opens up new opportunities Number of specialists needed will increase

Electronic Data processing (EDP) - audit § § 7 Rapid development - paper books, records and documents will be replaced by data transmitted electronically These changes mean that it is necessary to make adjustments to examination methods A different approach also opens up new opportunities Number of specialists needed will increase

Products of EDP auditing 1. Preliminary investigation - taking stock of the information technology applied by the taxpayer in order to determine how information technology and the internal controls of the taxpayer interact 2. The relationship between risks analysis and the quality of the information technology - the advice of the tax auditor can be supplemented by a system audit by the EDP auditor 8

Products of EDP auditing 1. Preliminary investigation - taking stock of the information technology applied by the taxpayer in order to determine how information technology and the internal controls of the taxpayer interact 2. The relationship between risks analysis and the quality of the information technology - the advice of the tax auditor can be supplemented by a system audit by the EDP auditor 8

Products of EDP auditing (continued) 3. System audit of standard software - this standard software includes applications developed by software companies that are used by a lot of taxpayers 4. Data gathering and data conversion – in the preliminary investigation it has been established which electronic data of the taxpayer can be used in the EDP audit 5. Data analysis – which data to analyse and how, also follows from the planning stage 9

Products of EDP auditing (continued) 3. System audit of standard software - this standard software includes applications developed by software companies that are used by a lot of taxpayers 4. Data gathering and data conversion – in the preliminary investigation it has been established which electronic data of the taxpayer can be used in the EDP audit 5. Data analysis – which data to analyse and how, also follows from the planning stage 9

Products of EDP auditing (continued) 6. Sharing information gained while carrying out an audit (which may include the evaluation of this knowledge) via computer records – EDP auditing has an innovative and supporting role with the objective to transfer knowledge 7. Specific support of tax audits – making internal data available is part of this class of instruments and services 10

Products of EDP auditing (continued) 6. Sharing information gained while carrying out an audit (which may include the evaluation of this knowledge) via computer records – EDP auditing has an innovative and supporting role with the objective to transfer knowledge 7. Specific support of tax audits – making internal data available is part of this class of instruments and services 10

IT and EDP-auditing § § § 11 GTCBAS stands for “Guidance on Tax Compliance for Business and Accounting Software”. This Guidance will show all features to be built into software packages to get reliable accounting software. SAF-T stands for the Guidance for the “Standard Audit File for Tax Purposes” The SAF-T will show to add export features to accounting packages to ensure that data can be easily extracted from these systems for testing purposes Ready made audit packages for testing are available at the market (e. g. clair)

IT and EDP-auditing § § § 11 GTCBAS stands for “Guidance on Tax Compliance for Business and Accounting Software”. This Guidance will show all features to be built into software packages to get reliable accounting software. SAF-T stands for the Guidance for the “Standard Audit File for Tax Purposes” The SAF-T will show to add export features to accounting packages to ensure that data can be easily extracted from these systems for testing purposes Ready made audit packages for testing are available at the market (e. g. clair)

IT and EDP-auditing § § § 12 Via the GTCBAS Tax Authorities are encouraged to develop a regulatory framework regarding an automated accounting system Auditors - not being an EDP-auditor - should have some basic knowledge of automated systems They should be able to - work with Word, Excel, Power. Point and special developed tax software - read computerized output - translate their audit questions into queries for EDP-auditors When planning an audit it will be useful to consult the EDP-auditor Special attention should be paid to tables with fixed data ( like VAT rates, inter company prices, etceteras )

IT and EDP-auditing § § § 12 Via the GTCBAS Tax Authorities are encouraged to develop a regulatory framework regarding an automated accounting system Auditors - not being an EDP-auditor - should have some basic knowledge of automated systems They should be able to - work with Word, Excel, Power. Point and special developed tax software - read computerized output - translate their audit questions into queries for EDP-auditors When planning an audit it will be useful to consult the EDP-auditor Special attention should be paid to tables with fixed data ( like VAT rates, inter company prices, etceteras )

EDP AUDIT Practice example using Audit Software in reviewing a wholesale trade company in the hotel, café and catering industry 13

EDP AUDIT Practice example using Audit Software in reviewing a wholesale trade company in the hotel, café and catering industry 13

Issue The company is issuing anonymous invoices to customers, thereby creating a substantial amount of off record sales and resulting loss of tax income 14

Issue The company is issuing anonymous invoices to customers, thereby creating a substantial amount of off record sales and resulting loss of tax income 14

Topics § § Data analysis of Cash&Carry records Data analysis of Deliveries made over a 2 year period § By use of ACL ON: – information given in invoice headings – information given in the body of the invoice – information on regular customers – regularly sold items 15

Topics § § Data analysis of Cash&Carry records Data analysis of Deliveries made over a 2 year period § By use of ACL ON: – information given in invoice headings – information given in the body of the invoice – information on regular customers – regularly sold items 15

Cash & Carry How can we identify how many “anonymous” sales have been made, and for how much? 16

Cash & Carry How can we identify how many “anonymous” sales have been made, and for how much? 16

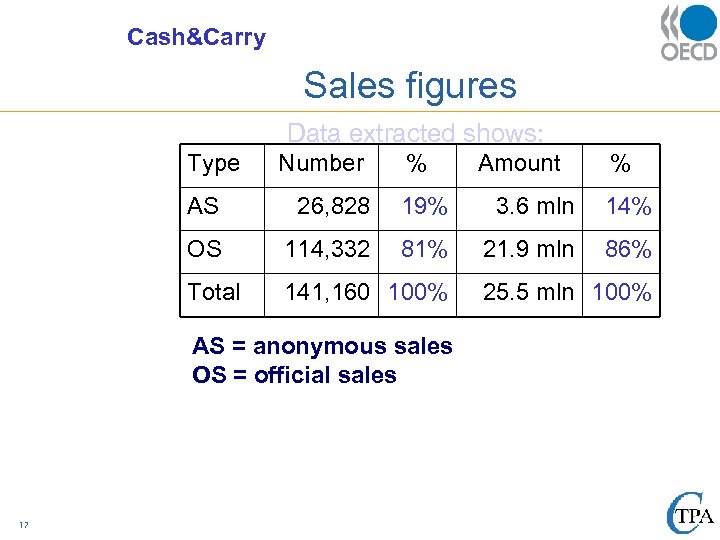

Cash&Carry Sales figures Type Data extracted shows: Number % Amount % AS 26, 828 19% 3. 6 mln 14% OS 114, 332 81% 21. 9 mln 86% Total 141, 160 100% AS = anonymous sales OS = official sales 17 25. 5 mln 100%

Cash&Carry Sales figures Type Data extracted shows: Number % Amount % AS 26, 828 19% 3. 6 mln 14% OS 114, 332 81% 21. 9 mln 86% Total 141, 160 100% AS = anonymous sales OS = official sales 17 25. 5 mln 100%

Cash & Carry § How can we identify the customers that the anonymous sales invoices refer to § By using the information given in the invoice headings 18

Cash & Carry § How can we identify the customers that the anonymous sales invoices refer to § By using the information given in the invoice headings 18

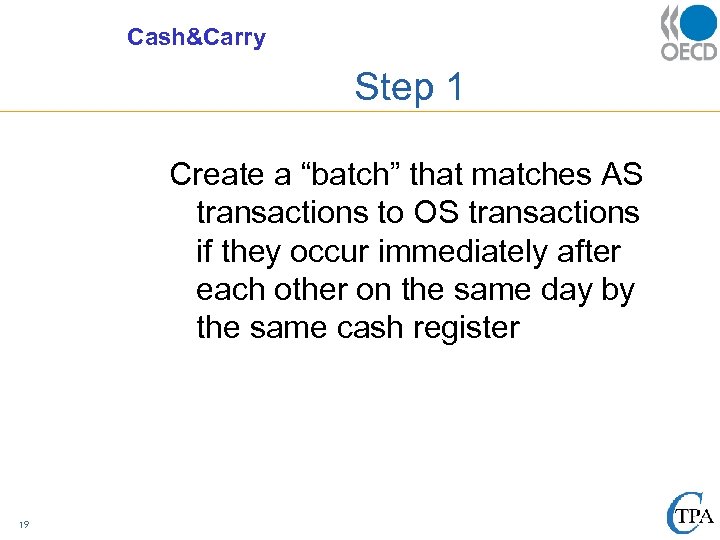

Cash&Carry Step 1 Create a “batch” that matches AS transactions to OS transactions if they occur immediately after each other on the same day by the same cash register 19

Cash&Carry Step 1 Create a “batch” that matches AS transactions to OS transactions if they occur immediately after each other on the same day by the same cash register 19

Cash & Carry § 20 We now have a file (CC_COMBINATION) that contains the matched transactions

Cash & Carry § 20 We now have a file (CC_COMBINATION) that contains the matched transactions

Cash&Carry Step 2 Analyse the list of customers where anonymous sales have matched up with official sales. Are there any that stand out? Review these in greater depth Same question: Is there a group of customers that are regulary matched to AS? 21

Cash&Carry Step 2 Analyse the list of customers where anonymous sales have matched up with official sales. Are there any that stand out? Review these in greater depth Same question: Is there a group of customers that are regulary matched to AS? 21

Cash&Carry Step 2 continued § Analyse the number of times AS and OS have matched for each customer. Extract the data by filtering and export the selection to a new file § In this example there are 20 or more matches 22

Cash&Carry Step 2 continued § Analyse the number of times AS and OS have matched for each customer. Extract the data by filtering and export the selection to a new file § In this example there are 20 or more matches 22

Cash&Carry After step 2 We have a file (MATCHED_ 20_TIMES_OR_MORE) that contains the first selection of customers (398) 23

Cash&Carry After step 2 We have a file (MATCHED_ 20_TIMES_OR_MORE) that contains the first selection of customers (398) 23

Cash&Carry Step 3 § Look for a a pattern in the articles bought through AS that are matched to the OS of the selected customers § Same question: Is there a consistency in the items purchased? 24

Cash&Carry Step 3 § Look for a a pattern in the articles bought through AS that are matched to the OS of the selected customers § Same question: Is there a consistency in the items purchased? 24

Cash&Carry Step 3 continued § Here we will be looking at the AS invoices. We want to identify the matched AS customer and invoice numbers by creating computed fields CUSTOMER and AS_INVOICE 25

Cash&Carry Step 3 continued § Here we will be looking at the AS invoices. We want to identify the matched AS customer and invoice numbers by creating computed fields CUSTOMER and AS_INVOICE 25

Cash&Carry Step 3 continued § Export the resulting data to a new file (MATCHED_AS_INV_NRS) § Use INV_LINES file and relate with MATCHED_AS_INV_NRS file for the line data § Extract these lines (by using a filter) and export to a new file (FIRST_SELECTION_INV_LINES) 26

Cash&Carry Step 3 continued § Export the resulting data to a new file (MATCHED_AS_INV_NRS) § Use INV_LINES file and relate with MATCHED_AS_INV_NRS file for the line data § Extract these lines (by using a filter) and export to a new file (FIRST_SELECTION_INV_LINES) 26

Cash&Carry Step 3 continued § § 27 From this file summarise CUSTOMER and ARTICLE and export to a new file: AS_ARTICLES_ FIRST_SELECTION To find the most interesting items we can analyse the information again, this time looking for the number of times the items are purchased

Cash&Carry Step 3 continued § § 27 From this file summarise CUSTOMER and ARTICLE and export to a new file: AS_ARTICLES_ FIRST_SELECTION To find the most interesting items we can analyse the information again, this time looking for the number of times the items are purchased

Cash&Carry Step 3 continued § § 28 After we have done this , we can develop a filter; for this example, we want one that will filter items that have been purchased 10 or more times To see which customers are ‘responsible’ for this we summarise this by exporting CUSTOMER to a new file SECOND_SELECTION_CUSTOMERS (191)

Cash&Carry Step 3 continued § § 28 After we have done this , we can develop a filter; for this example, we want one that will filter items that have been purchased 10 or more times To see which customers are ‘responsible’ for this we summarise this by exporting CUSTOMER to a new file SECOND_SELECTION_CUSTOMERS (191)

Cash&Carry Step 3 continued § To decrease the risk of a ‘mismatch’ we can now select those customers that have more than one article linked by filter and export the data to THIRD_SELECTION_OF_ CUSTOMERS (110) 29

Cash&Carry Step 3 continued § To decrease the risk of a ‘mismatch’ we can now select those customers that have more than one article linked by filter and export the data to THIRD_SELECTION_OF_ CUSTOMERS (110) 29

Cash&Carry Step 4 Now that we have selected an interesting group of customers, we have to identify the matched transactions. 30

Cash&Carry Step 4 Now that we have selected an interesting group of customers, we have to identify the matched transactions. 30

Cash&Carry Step 4 continued Connect the third selection of customers to CC_COMBINATION in order to identify the relevant transaction ID’s and related invoice numbers 31

Cash&Carry Step 4 continued Connect the third selection of customers to CC_COMBINATION in order to identify the relevant transaction ID’s and related invoice numbers 31

Cash&Carry Step 4 continued § In order to select the relevant invoice lines we will merge the INV_LINES file with the invoice numbers within CC_COMBINATION in 2 steps! § (There a number of invoices matched more than once) 32

Cash&Carry Step 4 continued § In order to select the relevant invoice lines we will merge the INV_LINES file with the invoice numbers within CC_COMBINATION in 2 steps! § (There a number of invoices matched more than once) 32

Cash&Carry Step 4 continued § From CC_COMBINATION (filter THIRD_SELECTION_INBVNRS) first sort using AS INVOICE and then OS INVOICE. § Then merge CC_INV_LINES with these two files form a new file : RESULT_COMBINATION 33

Cash&Carry Step 4 continued § From CC_COMBINATION (filter THIRD_SELECTION_INBVNRS) first sort using AS INVOICE and then OS INVOICE. § Then merge CC_INV_LINES with these two files form a new file : RESULT_COMBINATION 33

Cash&Carry Step 4 continued § In order to get other relevant information relate this file to CUSTOMER, ARTICLE and CC_INV_HEAD and sort on custommer to SORT RESULT_COMBINATION 34

Cash&Carry Step 4 continued § In order to get other relevant information relate this file to CUSTOMER, ARTICLE and CC_INV_HEAD and sort on custommer to SORT RESULT_COMBINATION 34

Cash&Carry Step 5 Analyse each transaction and you will see that there are some interesting combinations 35

Cash&Carry Step 5 Analyse each transaction and you will see that there are some interesting combinations 35

Auditing Small and Medium Size Enterprises 17. Capital Comparison 36

Auditing Small and Medium Size Enterprises 17. Capital Comparison 36

Capital comparison method § Capital at start plus § Reported income minus § Capital at end minus § Known private expenditures for major investments should be enough to spend on § 37 Household

Capital comparison method § Capital at start plus § Reported income minus § Capital at end minus § Known private expenditures for major investments should be enough to spend on § 37 Household

Capital comparison method § Capital at the start is all the taxpayer’s assets minus his liabilities ( bank deposits, shares, cars, immovable property minus loans, etc. ) § Reported income stated in the tax return § Known private expenditures ( television, courses ) § Household money spent on food, clothes, sport, leisure, etc. ) 38

Capital comparison method § Capital at the start is all the taxpayer’s assets minus his liabilities ( bank deposits, shares, cars, immovable property minus loans, etc. ) § Reported income stated in the tax return § Known private expenditures ( television, courses ) § Household money spent on food, clothes, sport, leisure, etc. ) 38

Capital comparison method § If the amount for household is negative there must have been some unreported income to support this expenditure § This will also be the case if the amount for household is too low compared to families in the same economic and social position § An adjustment should be made up to a level where the amount for household is equal to that of families in the same economic and social position 39

Capital comparison method § If the amount for household is negative there must have been some unreported income to support this expenditure § This will also be the case if the amount for household is too low compared to families in the same economic and social position § An adjustment should be made up to a level where the amount for household is equal to that of families in the same economic and social position 39

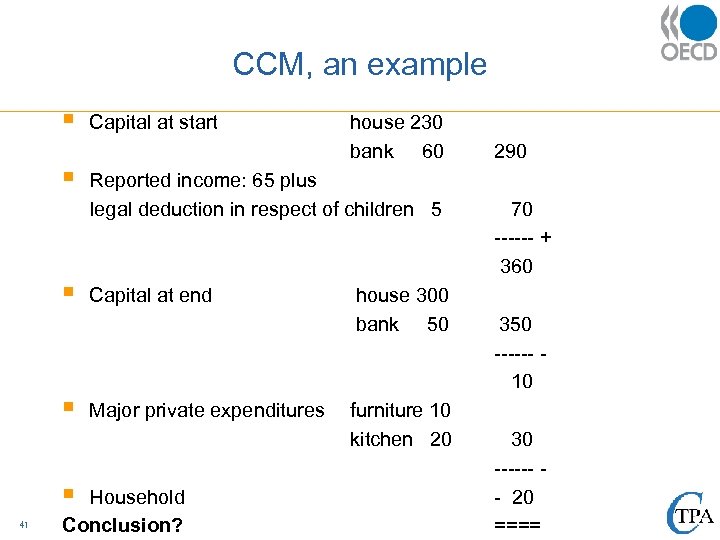

CCM, an example § § § 40 At the end of 2003 Mr. Bond owns a house he bought for $ 300, 000 and there is still $ 50, 000 in his bank account. He sold his old dwelling for $ 230, 000, which was also the value at 1 -1. His reported income was $ 65, 000 after a fictitious legal deduction of $ 5, 000 for 3 children. His bank account showed a deposit of $60, 000 at the beginning of the year. In his bank statements we also found expenditures for a new kitchen ($ 20, 000). The furniture in his new house looked rather new and during an interview he volunteered the information that he had paid $ 10, 000 for it.

CCM, an example § § § 40 At the end of 2003 Mr. Bond owns a house he bought for $ 300, 000 and there is still $ 50, 000 in his bank account. He sold his old dwelling for $ 230, 000, which was also the value at 1 -1. His reported income was $ 65, 000 after a fictitious legal deduction of $ 5, 000 for 3 children. His bank account showed a deposit of $60, 000 at the beginning of the year. In his bank statements we also found expenditures for a new kitchen ($ 20, 000). The furniture in his new house looked rather new and during an interview he volunteered the information that he had paid $ 10, 000 for it.

CCM, an example § 41 Capital at start house 230 bank 60 290 § Reported income: 65 plus legal deduction in respect of children 5 70 ------ + 360 § Capital at end house 300 bank 50 350 ------ 10 § Major private expenditures furniture 10 kitchen 20 30 ------ § Household - 20 Conclusion? ====

CCM, an example § 41 Capital at start house 230 bank 60 290 § Reported income: 65 plus legal deduction in respect of children 5 70 ------ + 360 § Capital at end house 300 bank 50 350 ------ 10 § Major private expenditures furniture 10 kitchen 20 30 ------ § Household - 20 Conclusion? ====

More on the Capital Comparison Method § § This method is in practice more complicated: It is an art to gather information that ’s not so obvious § 3 rd party information? Any investment abroad? Does tp travel a lot to the same place? Any reason to look into taxpayer ’s file at the bank ( any legal opposition? ) Look around at the premises ( who owns the boat, car, camper van, that you see? ) § § 42

More on the Capital Comparison Method § § This method is in practice more complicated: It is an art to gather information that ’s not so obvious § 3 rd party information? Any investment abroad? Does tp travel a lot to the same place? Any reason to look into taxpayer ’s file at the bank ( any legal opposition? ) Look around at the premises ( who owns the boat, car, camper van, that you see? ) § § 42

More on the Capital Comparison Method § Do you find any hints in the books or correspondence indicating large expenditure: such as a letter from a notary, a lawyer, insurance premium? § You might also find indications for the standard of living; just a set of golf clubs might indicate that the taxpayer likes the game, which will bring along a $ 10, 000 member fee and other sport investments § When interviewing the taxpayer he might tell you a lot about his lifestyle and in particular things he is proud of. ( large garden: who is doing all the work? ) 43

More on the Capital Comparison Method § Do you find any hints in the books or correspondence indicating large expenditure: such as a letter from a notary, a lawyer, insurance premium? § You might also find indications for the standard of living; just a set of golf clubs might indicate that the taxpayer likes the game, which will bring along a $ 10, 000 member fee and other sport investments § When interviewing the taxpayer he might tell you a lot about his lifestyle and in particular things he is proud of. ( large garden: who is doing all the work? ) 43

More on the Capital Comparison Method § You might find other sources of income § Are they liable to taxes under your national legislation? § E. g. transactions at the stock-market § Depending on taxable or not taxable: adjust the comparison ( a win at the lottery ) § Some amounts in the taxpayer ’s return might not reflect a cash or bank income. ( amounts fixed by law or something of that kind: an adjustment has to be made ). 44

More on the Capital Comparison Method § You might find other sources of income § Are they liable to taxes under your national legislation? § E. g. transactions at the stock-market § Depending on taxable or not taxable: adjust the comparison ( a win at the lottery ) § Some amounts in the taxpayer ’s return might not reflect a cash or bank income. ( amounts fixed by law or something of that kind: an adjustment has to be made ). 44

Existence checks § - 45 Stock-taking: based on the taxpayer’s organisation of stock-taking on site observation if the recorded goods/cash/ equipment exists as the aim of a tax audit for assets seeks to find more goods than recorded ( completeness ) this technique is not that useful However: if an asset can’t be found, it might have been sold and you have to account for the profit

Existence checks § - 45 Stock-taking: based on the taxpayer’s organisation of stock-taking on site observation if the recorded goods/cash/ equipment exists as the aim of a tax audit for assets seeks to find more goods than recorded ( completeness ) this technique is not that useful However: if an asset can’t be found, it might have been sold and you have to account for the profit

Existence checks § Expiration checks: - on accounts payable: if they are paid after balance date, their existence at balance date is very likely - on accounts payable : if they are not paid: 3 possibilities: 1 they never existed> try to establish how they came on the balance sheet 2 they were paid before balance date>delete and adjust 3 the value is too high, as the taxpayer doesn’t want to pay or just a part of it ( perhaps he doesn’t agree with the price or quality) 46

Existence checks § Expiration checks: - on accounts payable: if they are paid after balance date, their existence at balance date is very likely - on accounts payable : if they are not paid: 3 possibilities: 1 they never existed> try to establish how they came on the balance sheet 2 they were paid before balance date>delete and adjust 3 the value is too high, as the taxpayer doesn’t want to pay or just a part of it ( perhaps he doesn’t agree with the price or quality) 46

Completeness § § § Auditing for completeness is difficult Completeness of revenues/sales will be discussed elsewhere Completeness of receivables: check payments and invoices in the year after balance sheet date: invoice or delivery of last year should be in the balance sheet § Completeness of stocks and/or other assets: - Invoices from suppliers in the year after balance date: if the date of delivery is before balance date, the goods should be in stock or (partly) sold before balance date - Look around in the accounts and at the premises: any goods forgotten? One might even discover goods (not mentioned in the selection of the business) that never have been recorded, not even the sales of these goods 47

Completeness § § § Auditing for completeness is difficult Completeness of revenues/sales will be discussed elsewhere Completeness of receivables: check payments and invoices in the year after balance sheet date: invoice or delivery of last year should be in the balance sheet § Completeness of stocks and/or other assets: - Invoices from suppliers in the year after balance date: if the date of delivery is before balance date, the goods should be in stock or (partly) sold before balance date - Look around in the accounts and at the premises: any goods forgotten? One might even discover goods (not mentioned in the selection of the business) that never have been recorded, not even the sales of these goods 47

Auditing Small and Medium Size Enterprises 18. Negative Cash Balance method 48

Auditing Small and Medium Size Enterprises 18. Negative Cash Balance method 48

Negative cash balance method § § § 49 This method is based on the fact that the cash balance should always indicate a positive amount If the taxpayer’s cashbook shows a negative amount he registered a non existing expense or he did not register for some sales So the object is to audit the original cashbook The auditor might check on any date if the cash balance is still positive The auditor may have to put the cash book entries into the correct date order, so that he can check the cash flow

Negative cash balance method § § § 49 This method is based on the fact that the cash balance should always indicate a positive amount If the taxpayer’s cashbook shows a negative amount he registered a non existing expense or he did not register for some sales So the object is to audit the original cashbook The auditor might check on any date if the cash balance is still positive The auditor may have to put the cash book entries into the correct date order, so that he can check the cash flow

Chi-square test § § § § 50 Proves that there are fictitious entries in the cashbook Based on statistical procedures Also based on psychology: everyone has a preference for certain digits When producing an artificial list of numbers the preference numbers will appear more often than in a random made list Statistical calculations will underpin the outcomes The auditor need sufficient numbers ( minimum: 50 ) This method will stand in court in some jurisdictions as an extra proof for unreliable records

Chi-square test § § § § 50 Proves that there are fictitious entries in the cashbook Based on statistical procedures Also based on psychology: everyone has a preference for certain digits When producing an artificial list of numbers the preference numbers will appear more often than in a random made list Statistical calculations will underpin the outcomes The auditor need sufficient numbers ( minimum: 50 ) This method will stand in court in some jurisdictions as an extra proof for unreliable records

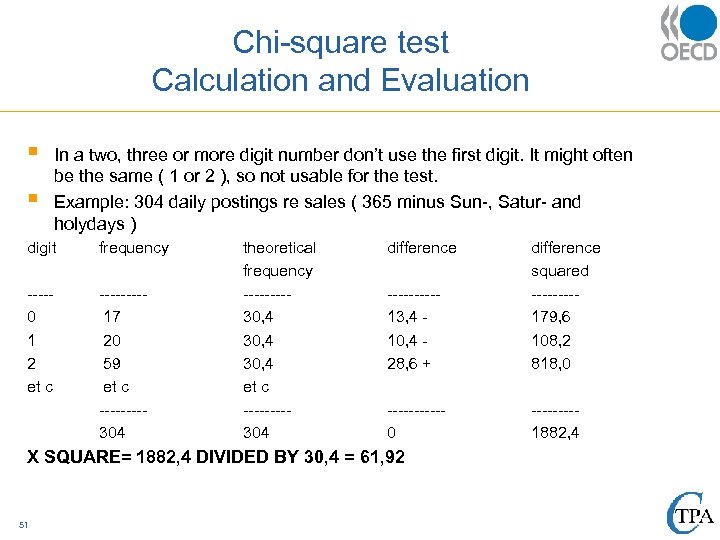

Chi-square test Calculation and Evaluation § § In a two, three or more digit number don’t use the first digit. It might often be the same ( 1 or 2 ), so not usable for the test. Example: 304 daily postings re sales ( 365 minus Sun-, Satur- and holydays ) digit frequency ----0 1 2 et c ---- 17 20 59 et c ----304 theoretical frequency ----30, 4 et c ----304 difference -----13, 4 10, 4 28, 6 + difference squared ----179, 6 108, 2 818, 0 -----0 ----1882, 4 X SQUARE= 1882, 4 DIVIDED BY 30, 4 = 61, 92 51

Chi-square test Calculation and Evaluation § § In a two, three or more digit number don’t use the first digit. It might often be the same ( 1 or 2 ), so not usable for the test. Example: 304 daily postings re sales ( 365 minus Sun-, Satur- and holydays ) digit frequency ----0 1 2 et c ---- 17 20 59 et c ----304 theoretical frequency ----30, 4 et c ----304 difference -----13, 4 10, 4 28, 6 + difference squared ----179, 6 108, 2 818, 0 -----0 ----1882, 4 X SQUARE= 1882, 4 DIVIDED BY 30, 4 = 61, 92 51

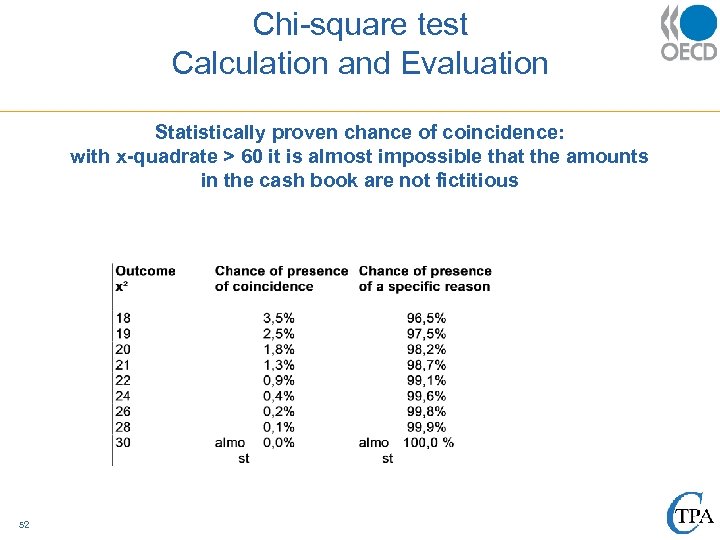

Chi-square test Calculation and Evaluation Statistically proven chance of coincidence: with x-quadrate > 60 it is almost impossible that the amounts in the cash book are not fictitious 52

Chi-square test Calculation and Evaluation Statistically proven chance of coincidence: with x-quadrate > 60 it is almost impossible that the amounts in the cash book are not fictitious 52

Case study § 53 Discussions on the next cases dealing with the capital comparison and the negative cash balance in the cashbook

Case study § 53 Discussions on the next cases dealing with the capital comparison and the negative cash balance in the cashbook

Auditing Small and Medium Size Enterprises 19. Mark up methods 54

Auditing Small and Medium Size Enterprises 19. Mark up methods 54

Percentage mark-up method § § § § § 55 Also known as the Gross margin method Used for trading companies and other businesses with a flow of goods ( restaurants, bars ) Margins have to be fixed for a certain period of time Can be applied to the total of sales/ product groups/ one product Apply before going to the Unit and Volume Method Most annual accounts and tax returns will show gross margins Comparing Gross Margins is a very useful tool when looking at a large number of businesses as apart of a risk profile ( or mapping ) exercise In quite a few OECD countries a standard profit and loss account is a legal obligation This standard p&l should show gross margins

Percentage mark-up method § § § § § 55 Also known as the Gross margin method Used for trading companies and other businesses with a flow of goods ( restaurants, bars ) Margins have to be fixed for a certain period of time Can be applied to the total of sales/ product groups/ one product Apply before going to the Unit and Volume Method Most annual accounts and tax returns will show gross margins Comparing Gross Margins is a very useful tool when looking at a large number of businesses as apart of a risk profile ( or mapping ) exercise In quite a few OECD countries a standard profit and loss account is a legal obligation This standard p&l should show gross margins

Percentage mark-up method § The gross margin should be tested against general/ objective standards § In practice these norms may not be strictly true for the taxpayer under review § Published norms will show a rough average figure or a minimum and maximum position § Obvious that tp’s under or near the minimum need special attention § Adjust the general norm for specific circumstances. The taxpayer might inform you about these specific circumstances. The auditor will also make his own observations 56

Percentage mark-up method § The gross margin should be tested against general/ objective standards § In practice these norms may not be strictly true for the taxpayer under review § Published norms will show a rough average figure or a minimum and maximum position § Obvious that tp’s under or near the minimum need special attention § Adjust the general norm for specific circumstances. The taxpayer might inform you about these specific circumstances. The auditor will also make his own observations 56

Percentage mark-up method Circumstances that might influence a general norm § § § § 57 the business location (highway, outlet centre, trendy centre) clientele (truck drivers, captains of industry) special events (prices might raise at carnival or fall for a wedding) seasonal or other sales particular losses: perishables, out of fashion promotional items for regular customers etceteras

Percentage mark-up method Circumstances that might influence a general norm § § § § 57 the business location (highway, outlet centre, trendy centre) clientele (truck drivers, captains of industry) special events (prices might raise at carnival or fall for a wedding) seasonal or other sales particular losses: perishables, out of fashion promotional items for regular customers etceteras

Percentage mark-up method § Where to find norms? • • 58 Public information: gathered by banks, by organisations in the same line of business, by Chambers of Commerce Internal information: some Revenue Authorities run their own intelligence service The taxpayer’s own manual (booklet or digital) or just ask him. Invoices will indicate purchase price, one might find sales prices in menus (restaurants) or price lists The shop-window might reveal prices ( they are likely to be up to date and correct, so note them for a next audit ) If these are not available just look for copies of the sales invoices If the copies are not readily available the auditor might find this information at the premises of some of the regular customers

Percentage mark-up method § Where to find norms? • • 58 Public information: gathered by banks, by organisations in the same line of business, by Chambers of Commerce Internal information: some Revenue Authorities run their own intelligence service The taxpayer’s own manual (booklet or digital) or just ask him. Invoices will indicate purchase price, one might find sales prices in menus (restaurants) or price lists The shop-window might reveal prices ( they are likely to be up to date and correct, so note them for a next audit ) If these are not available just look for copies of the sales invoices If the copies are not readily available the auditor might find this information at the premises of some of the regular customers

Percentage mark-up method § A proposal for adjustment based on a doubtful gross-margin can best be supported by other proposals ( audit mix! ) § A negative outcome of the capital comparison method § Fraud invoices, chi-square test revealed fictitious numbers § In general: as the burden of proof has been shifted to the taxpayer (failures in the bookkeeping system ; national legislation and court law will set out guidelines for this) § If the gross-margin is around the minimum norm the auditor might use the unit and volume method (time consuming) 59

Percentage mark-up method § A proposal for adjustment based on a doubtful gross-margin can best be supported by other proposals ( audit mix! ) § A negative outcome of the capital comparison method § Fraud invoices, chi-square test revealed fictitious numbers § In general: as the burden of proof has been shifted to the taxpayer (failures in the bookkeeping system ; national legislation and court law will set out guidelines for this) § If the gross-margin is around the minimum norm the auditor might use the unit and volume method (time consuming) 59

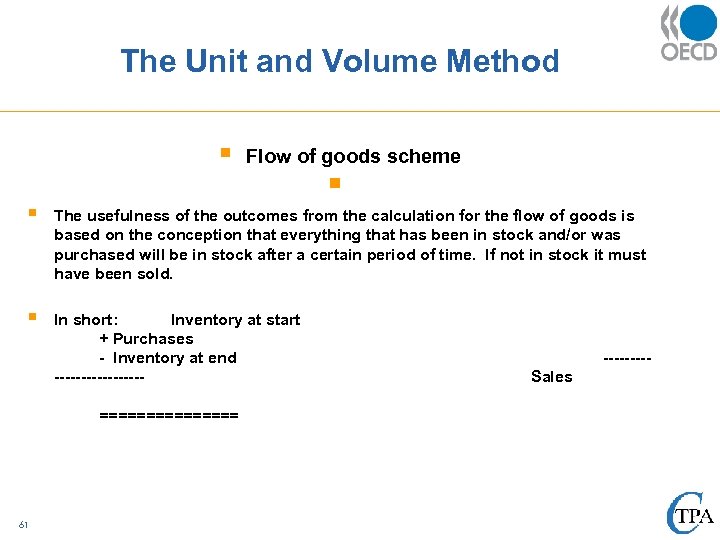

The Unit and Volume Method § Used at in depth audits when gross-margin is low or hard to find § The “flow of goods” calculation will be applied for this method at each product or just at some major products § The bookkeeping system might show aggregated figures per product § If not the total of purchases of each product has to be taken from invoices § A practical support: use of prepared spreadsheets 60

The Unit and Volume Method § Used at in depth audits when gross-margin is low or hard to find § The “flow of goods” calculation will be applied for this method at each product or just at some major products § The bookkeeping system might show aggregated figures per product § If not the total of purchases of each product has to be taken from invoices § A practical support: use of prepared spreadsheets 60

The Unit and Volume Method § Flow of goods scheme § § The usefulness of the outcomes from the calculation for the flow of goods is based on the conception that everything that has been in stock and/or was purchased will be in stock after a certain period of time. If not in stock it must have been sold. § In short: Inventory at start + Purchases - Inventory at end --------======== 61 ----Sales

The Unit and Volume Method § Flow of goods scheme § § The usefulness of the outcomes from the calculation for the flow of goods is based on the conception that everything that has been in stock and/or was purchased will be in stock after a certain period of time. If not in stock it must have been sold. § In short: Inventory at start + Purchases - Inventory at end --------======== 61 ----Sales

Audit direction Consider: § What is in taxpayer’s interest? § In what direction would he change figures? § Establish this in respect of each important item of the profit and loss account and the balance sheet. § Determine the direction of your audit. - positive : figure too high? - negative: figure too low? 62

Audit direction Consider: § What is in taxpayer’s interest? § In what direction would he change figures? § Establish this in respect of each important item of the profit and loss account and the balance sheet. § Determine the direction of your audit. - positive : figure too high? - negative: figure too low? 62

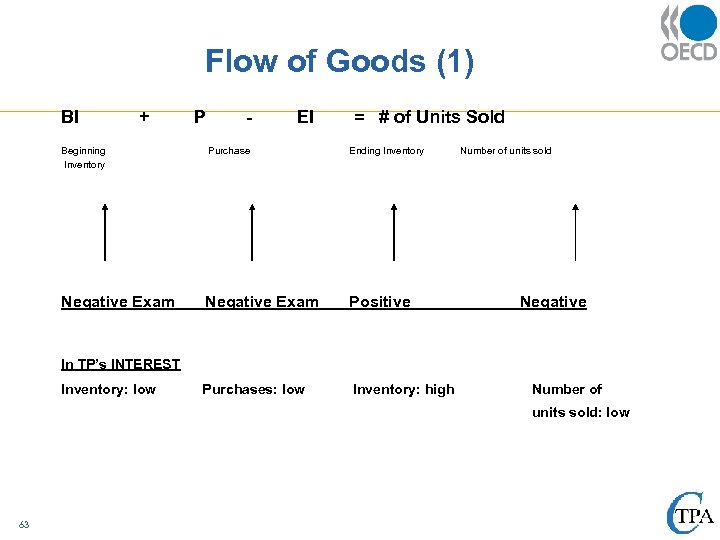

Flow of Goods (1) BI Beginning Inventory + Negative Exam P - EI = # of Units Sold Purchase Ending Inventory Number of units sold Negative Exam Positive Purchases: low Inventory: high Negative In TP’s INTEREST Inventory: low Number of units sold: low 63

Flow of Goods (1) BI Beginning Inventory + Negative Exam P - EI = # of Units Sold Purchase Ending Inventory Number of units sold Negative Exam Positive Purchases: low Inventory: high Negative In TP’s INTEREST Inventory: low Number of units sold: low 63

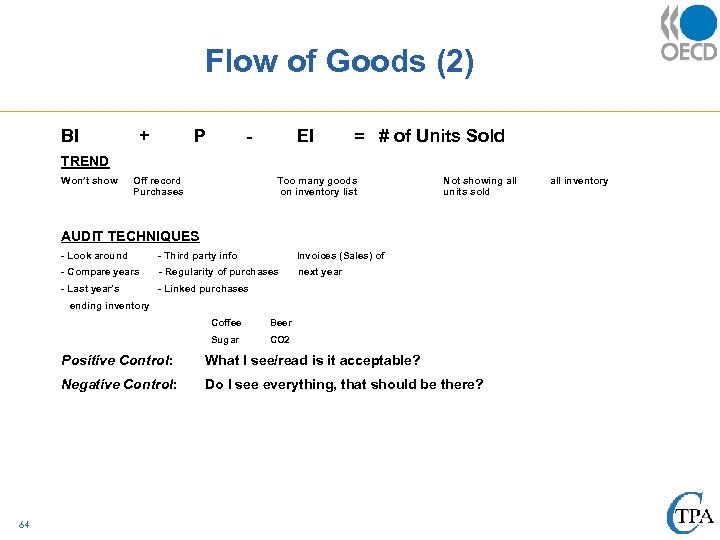

Flow of Goods (2) BI + P - EI = # of Units Sold TREND Won’t show Off record Purchases Too many goods on inventory list Not showing all units sold AUDIT TECHNIQUES - Look around - Third party info Invoices (Sales) of - Compare years - Regularity of purchases next year - Last year’s - Linked purchases ending inventory Coffee Beer Sugar CO 2 Positive Control: Negative Control: 64 What I see/read is it acceptable? Do I see everything, that should be there? all inventory

Flow of Goods (2) BI + P - EI = # of Units Sold TREND Won’t show Off record Purchases Too many goods on inventory list Not showing all units sold AUDIT TECHNIQUES - Look around - Third party info Invoices (Sales) of - Compare years - Regularity of purchases next year - Last year’s - Linked purchases ending inventory Coffee Beer Sugar CO 2 Positive Control: Negative Control: 64 What I see/read is it acceptable? Do I see everything, that should be there? all inventory

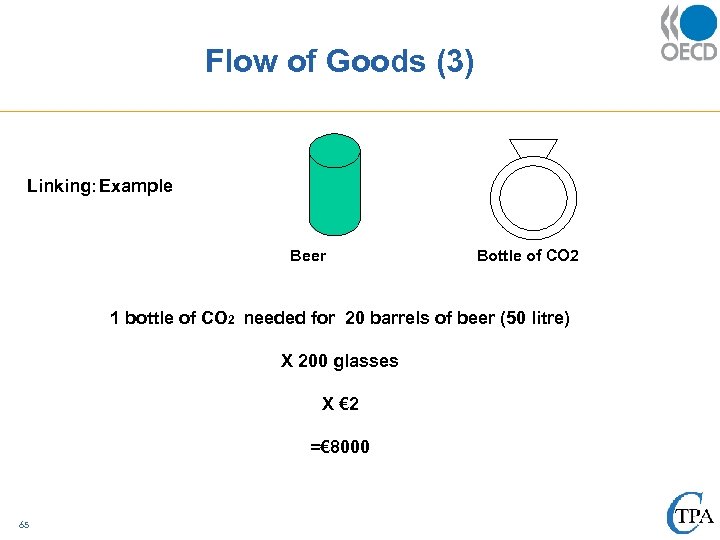

Flow of Goods (3) Linking: Example Beer Bottle of CO 2 1 bottle of CO 2 needed for 20 barrels of beer (50 litre) X 200 glasses X € 2 =€ 8000 65

Flow of Goods (3) Linking: Example Beer Bottle of CO 2 1 bottle of CO 2 needed for 20 barrels of beer (50 litre) X 200 glasses X € 2 =€ 8000 65

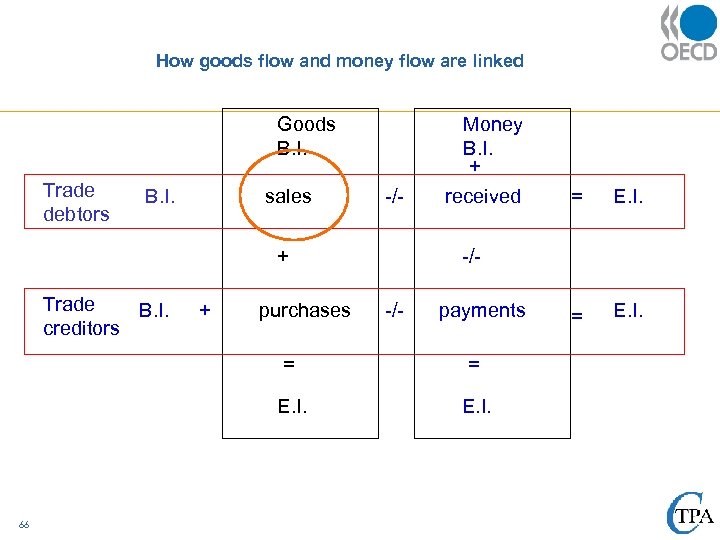

How goods flow and money flow are linked Trade debtors B. I. + Goods B. I. -/sales -/- + Trade B. I. creditors + purchases Money B. I. . + received E. I. = E. I. -/-/- payments = = E. I. 66 = E. I.

How goods flow and money flow are linked Trade debtors B. I. + Goods B. I. -/sales -/- + Trade B. I. creditors + purchases Money B. I. . + received E. I. = E. I. -/-/- payments = = E. I. 66 = E. I.

Completeness of purchases § Neither the mark-up nor the unit and volume method will guarantee the completeness of sales § The completeness of the purchases being a crucial condition § More than one preventive measure might assure the completeness (a sound internal control system, the invoice obligation, etc. ) § How to get hold of the completeness of purchases? 67

Completeness of purchases § Neither the mark-up nor the unit and volume method will guarantee the completeness of sales § The completeness of the purchases being a crucial condition § More than one preventive measure might assure the completeness (a sound internal control system, the invoice obligation, etc. ) § How to get hold of the completeness of purchases? 67

Completeness of purchases § § § Demands knowledge of the business and creative thinking Third party information (active/ passive) On site observation (if legally allowed; e. g. barrels of beer brought into a bar) Frequency of deliveries with particular regard to perishables Linked evidence - a currant loaf needs currants - beer needs CO 2 - oil to make fish and chips packing material premiums - - insurance 68

Completeness of purchases § § § Demands knowledge of the business and creative thinking Third party information (active/ passive) On site observation (if legally allowed; e. g. barrels of beer brought into a bar) Frequency of deliveries with particular regard to perishables Linked evidence - a currant loaf needs currants - beer needs CO 2 - oil to make fish and chips packing material premiums - - insurance 68

Production companies Key relationship: flow of goods (whilst changing their nature or the construction of a new product) Particular aspects regarding the audit of production companies: § § § 69 raw materials and labour coming in, finished goods going out the goods flow chart can be used, with prescription or construction norms added sometimes just use one part of the product for the goods flow chart ( e. g. every wheelbarrow has one tyre)

Production companies Key relationship: flow of goods (whilst changing their nature or the construction of a new product) Particular aspects regarding the audit of production companies: § § § 69 raw materials and labour coming in, finished goods going out the goods flow chart can be used, with prescription or construction norms added sometimes just use one part of the product for the goods flow chart ( e. g. every wheelbarrow has one tyre)

Production companies continued § Internal calculation schemes, cost price calculations § Production standards and prescriptions § Most production companies do account for differences regarding prices and quantities § Focus on these differences, wastage, production losses, etceteras 70

Production companies continued § Internal calculation schemes, cost price calculations § Production standards and prescriptions § Most production companies do account for differences regarding prices and quantities § Focus on these differences, wastage, production losses, etceteras 70

Production companies continued § Internal production reports and analyses will be useful § Some products are more suitable for unaccounted sales than others (compare alcoholic drinks to industrial gas) § Rejected products, B-quality, waste products, etceteras are often sold for cash, even by large companies. A flow of goods chart for this might be useful as well. 71

Production companies continued § Internal production reports and analyses will be useful § Some products are more suitable for unaccounted sales than others (compare alcoholic drinks to industrial gas) § Rejected products, B-quality, waste products, etceteras are often sold for cash, even by large companies. A flow of goods chart for this might be useful as well. 71

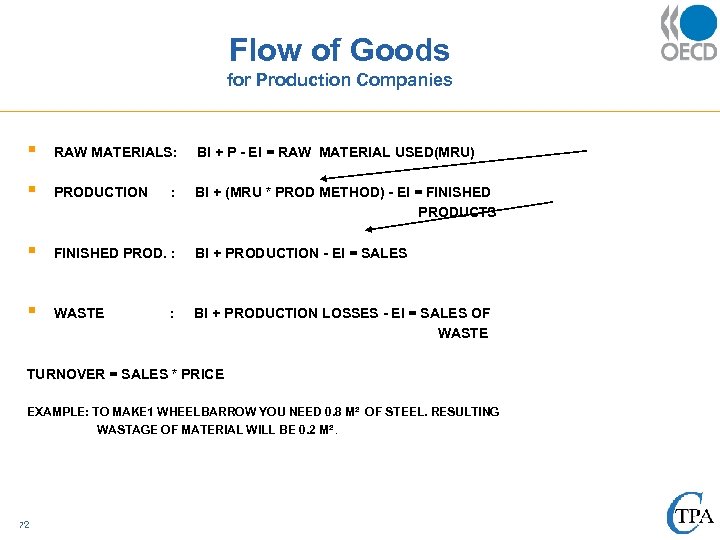

Flow of Goods for Production Companies § RAW MATERIALS: BI + P - EI = RAW MATERIAL USED(MRU) § PRODUCTION BI + (MRU * PROD METHOD) - EI = FINISHED PRODUCTS § FINISHED PROD. : BI + PRODUCTION - EI = SALES § WASTE BI + PRODUCTION LOSSES - EI = SALES OF WASTE : : TURNOVER = SALES * PRICE EXAMPLE: TO MAKE 1 WHEELBARROW YOU NEED 0. 8 M² OF STEEL. RESULTING WASTAGE OF MATERIAL WILL BE 0. 2 M². 72

Flow of Goods for Production Companies § RAW MATERIALS: BI + P - EI = RAW MATERIAL USED(MRU) § PRODUCTION BI + (MRU * PROD METHOD) - EI = FINISHED PRODUCTS § FINISHED PROD. : BI + PRODUCTION - EI = SALES § WASTE BI + PRODUCTION LOSSES - EI = SALES OF WASTE : : TURNOVER = SALES * PRICE EXAMPLE: TO MAKE 1 WHEELBARROW YOU NEED 0. 8 M² OF STEEL. RESULTING WASTAGE OF MATERIAL WILL BE 0. 2 M². 72

Flow of Goods for Production Companies THE REGRESSIVE METHOD § § § § 73 Useful when there are 2 almost similar products, using the same raw materials, but without a relation in the selling price (e. g. current bread and Christmas bread). Here you don’t know how much of the raw material has to go to each product. Start with the registered sales and assume for the moment that the turnover is all right. SALES A = BI + PRODUCED GOODS A - EI SALES B = BI + PRODUCED GOODS B - EI PRODUCED GOODS A = BI + (RMU*PRODUCTION METHOD) - EI PRODUCED GOODS B = BI + (RMU*PRODUCTION METHOD) - EI ADD RMU A to B ( Q ) Compare total RMU (Q) with: BI + P - EI = RAW MATERIALS USED IF Q < RAW MATERIALS USED, THEN SALES MIGHT BE OMITTED Calculate the omitted sales charging the extra raw materials used at THE HIGHEST SALES PRICE.

Flow of Goods for Production Companies THE REGRESSIVE METHOD § § § § 73 Useful when there are 2 almost similar products, using the same raw materials, but without a relation in the selling price (e. g. current bread and Christmas bread). Here you don’t know how much of the raw material has to go to each product. Start with the registered sales and assume for the moment that the turnover is all right. SALES A = BI + PRODUCED GOODS A - EI SALES B = BI + PRODUCED GOODS B - EI PRODUCED GOODS A = BI + (RMU*PRODUCTION METHOD) - EI PRODUCED GOODS B = BI + (RMU*PRODUCTION METHOD) - EI ADD RMU A to B ( Q ) Compare total RMU (Q) with: BI + P - EI = RAW MATERIALS USED IF Q < RAW MATERIALS USED, THEN SALES MIGHT BE OMITTED Calculate the omitted sales charging the extra raw materials used at THE HIGHEST SALES PRICE.

Discussions § § 74 Discuss different types of businesses and the linked evidence you might use to get hold of all sales. Discuss the legal possibilities you have for on site observations. Will taxpayer’s behaviour change when this technique is used?

Discussions § § 74 Discuss different types of businesses and the linked evidence you might use to get hold of all sales. Discuss the legal possibilities you have for on site observations. Will taxpayer’s behaviour change when this technique is used?

Auditing Small and Medium Size Enterprises 20. Typology of Business 75

Auditing Small and Medium Size Enterprises 20. Typology of Business 75

Typology of businesses § To know how to run a business is to know how to audit a business § Businesses can be divided into standard types § This typology is based on the internal controls and correlations regarding the cycle of values within the business § It will also suggest the tools and techniques that might be used to audit the revenues of the company 76

Typology of businesses § To know how to run a business is to know how to audit a business § Businesses can be divided into standard types § This typology is based on the internal controls and correlations regarding the cycle of values within the business § It will also suggest the tools and techniques that might be used to audit the revenues of the company 76

Typology of businesses § It is just a general framework: the business under review will lead to a solid audit programme, depending on facts and circumstances § The initial interview with the taxpayer is therefore important to get to know about the business § Even if this information is available on the internet or from an earlier audit it is necessary to have this interview: to update information and confirm detail 77

Typology of businesses § It is just a general framework: the business under review will lead to a solid audit programme, depending on facts and circumstances § The initial interview with the taxpayer is therefore important to get to know about the business § Even if this information is available on the internet or from an earlier audit it is necessary to have this interview: to update information and confirm detail 77

Types of businesses § § 78 Businesses that extract products from land or sea (farmers) Businesses that extract products from the earth ( mining company) Trading companies delivering goods to consumers (shops, supermarkets, mail-order firm) Trading companies delivering goods to other traders ( wholesaler, exporter)

Types of businesses § § 78 Businesses that extract products from land or sea (farmers) Businesses that extract products from the earth ( mining company) Trading companies delivering goods to consumers (shops, supermarkets, mail-order firm) Trading companies delivering goods to other traders ( wholesaler, exporter)

Percentage mark-up method § Where to find norms? • • 79 Public information: gathered by banks, by organisations in the same line of business, by Chambers of Commerce Internal information: some Revenue Authorities run their own intelligence service The taxpayer’s own manual (booklet or digital) or just ask him. Invoices will indicate purchase price, one might find sales prices in menus (restaurants) or price lists The shop-window might reveal prices ( they are likely to be up to date and correct, so note them for a next audit ) If these are not available just look for copies of the sales invoices If the copies are not readily available the auditor might find this information at the premises of some of the regular customers

Percentage mark-up method § Where to find norms? • • 79 Public information: gathered by banks, by organisations in the same line of business, by Chambers of Commerce Internal information: some Revenue Authorities run their own intelligence service The taxpayer’s own manual (booklet or digital) or just ask him. Invoices will indicate purchase price, one might find sales prices in menus (restaurants) or price lists The shop-window might reveal prices ( they are likely to be up to date and correct, so note them for a next audit ) If these are not available just look for copies of the sales invoices If the copies are not readily available the auditor might find this information at the premises of some of the regular customers