1d5267171d3d624ec79a42b272ae22c5.ppt

- Количество слайдов: 47

Orange Juice Stimulus Plan Presented to the Florida Citrus Commission January 21, 2009

Orange Juice Stimulus Plan Presented to the Florida Citrus Commission January 21, 2009

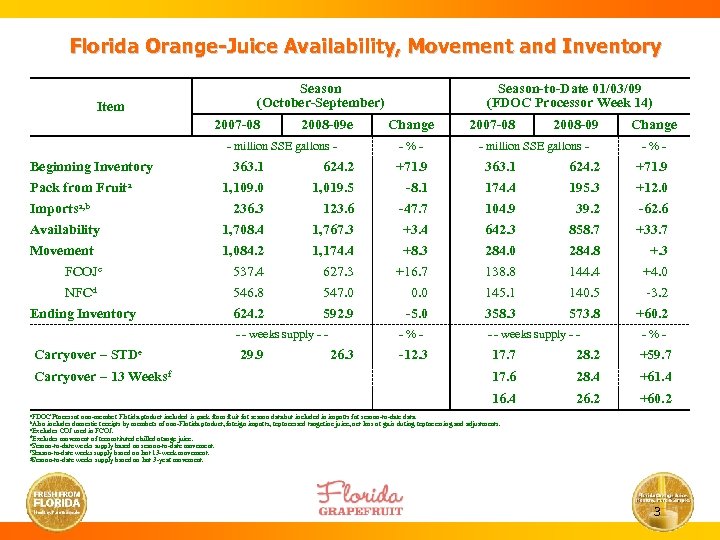

Florida Orange-Juice Availability, Movement and Inventory Item Season (October-September) 2007 -08 2008 -09 e - million SSE gallons - Season-to-Date 01/03/09 (FDOC Processor Week 14) Change -%- 2007 -08 2008 -09 - million SSE gallons - Change -%- Beginning Inventory Pack from Fruita Importsa, b 363. 1 1, 109. 0 236. 3 624. 2 1, 019. 5 123. 6 +71. 9 -8. 1 -47. 7 363. 1 174. 4 104. 9 624. 2 195. 3 39. 2 +71. 9 +12. 0 -62. 6 Availability Movement FCOJc NFCd Ending Inventory 1, 708. 4 1, 084. 2 537. 4 546. 8 624. 2 1, 767. 3 1, 174. 4 627. 3 547. 0 592. 9 +3. 4 +8. 3 +16. 7 0. 0 -5. 0 642. 3 284. 0 138. 8 145. 1 358. 3 858. 7 284. 8 144. 4 140. 5 573. 8 +33. 7 +. 3 +4. 0 -3. 2 +60. 2 -%- - - weeks supply - - Carryover – STDe 26. 3 -12. 3 17. 7 28. 2 +59. 7 17. 6 28. 4 +61. 4 16. 4 Carryover – 13 Weeksf 29. 9 -%- 26. 2 +60. 2 a. FDOC Processor non-member Florida product included in pack from fruit for season data but included in imports for season-to-date data. includes domestic receipts by members of non-Florida product, foreign imports, reprocessed tangerine juice, net loss or gain during reprocessing and adjustments. COJ used in FCOJ. d. Excludes movement of reconstituted chilled orange juice. e. Season-to-date weeks supply based on season-to-date movement. f. Season-to-date weeks supply based on last 13 -week movement. g. Season-to-date weeks supply based on last 3 -year movement. b. Also c. Excludes 3

Florida Orange-Juice Availability, Movement and Inventory Item Season (October-September) 2007 -08 2008 -09 e - million SSE gallons - Season-to-Date 01/03/09 (FDOC Processor Week 14) Change -%- 2007 -08 2008 -09 - million SSE gallons - Change -%- Beginning Inventory Pack from Fruita Importsa, b 363. 1 1, 109. 0 236. 3 624. 2 1, 019. 5 123. 6 +71. 9 -8. 1 -47. 7 363. 1 174. 4 104. 9 624. 2 195. 3 39. 2 +71. 9 +12. 0 -62. 6 Availability Movement FCOJc NFCd Ending Inventory 1, 708. 4 1, 084. 2 537. 4 546. 8 624. 2 1, 767. 3 1, 174. 4 627. 3 547. 0 592. 9 +3. 4 +8. 3 +16. 7 0. 0 -5. 0 642. 3 284. 0 138. 8 145. 1 358. 3 858. 7 284. 8 144. 4 140. 5 573. 8 +33. 7 +. 3 +4. 0 -3. 2 +60. 2 -%- - - weeks supply - - Carryover – STDe 26. 3 -12. 3 17. 7 28. 2 +59. 7 17. 6 28. 4 +61. 4 16. 4 Carryover – 13 Weeksf 29. 9 -%- 26. 2 +60. 2 a. FDOC Processor non-member Florida product included in pack from fruit for season data but included in imports for season-to-date data. includes domestic receipts by members of non-Florida product, foreign imports, reprocessed tangerine juice, net loss or gain during reprocessing and adjustments. COJ used in FCOJ. d. Excludes movement of reconstituted chilled orange juice. e. Season-to-date weeks supply based on season-to-date movement. f. Season-to-date weeks supply based on last 13 -week movement. g. Season-to-date weeks supply based on last 3 -year movement. b. Also c. Excludes 3

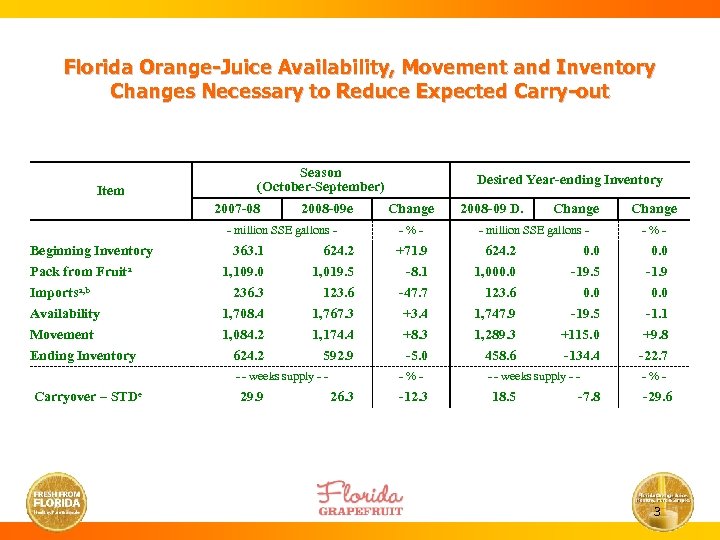

Florida Orange-Juice Availability, Movement and Inventory Changes Necessary to Reduce Expected Carry-out Item Season (October-September) 2007 -08 2008 -09 e - million SSE gallons - Desired Year-ending Inventory Change -%- 2008 -09 D. Change - million SSE gallons - Change -%- Beginning Inventory Pack from Fruita Importsa, b 363. 1 1, 109. 0 236. 3 624. 2 1, 019. 5 123. 6 +71. 9 -8. 1 -47. 7 624. 2 1, 000. 0 123. 6 0. 0 -19. 5 0. 0 -1. 9 0. 0 Availability Movement Ending Inventory 1, 708. 4 1, 084. 2 624. 2 1, 767. 3 1, 174. 4 592. 9 +3. 4 +8. 3 -5. 0 1, 747. 9 1, 289. 3 458. 6 -19. 5 +115. 0 -134. 4 -1. 1 +9. 8 -22. 7 -%- - - weeks supply - - Carryover – STDe 29. 9 26. 3 -12. 3 - - weeks supply - - 18. 5 -7. 8 -%- -29. 6 3

Florida Orange-Juice Availability, Movement and Inventory Changes Necessary to Reduce Expected Carry-out Item Season (October-September) 2007 -08 2008 -09 e - million SSE gallons - Desired Year-ending Inventory Change -%- 2008 -09 D. Change - million SSE gallons - Change -%- Beginning Inventory Pack from Fruita Importsa, b 363. 1 1, 109. 0 236. 3 624. 2 1, 019. 5 123. 6 +71. 9 -8. 1 -47. 7 624. 2 1, 000. 0 123. 6 0. 0 -19. 5 0. 0 -1. 9 0. 0 Availability Movement Ending Inventory 1, 708. 4 1, 084. 2 624. 2 1, 767. 3 1, 174. 4 592. 9 +3. 4 +8. 3 -5. 0 1, 747. 9 1, 289. 3 458. 6 -19. 5 +115. 0 -134. 4 -1. 1 +9. 8 -22. 7 -%- - - weeks supply - - Carryover – STDe 29. 9 26. 3 -12. 3 - - weeks supply - - 18. 5 -7. 8 -%- -29. 6 3

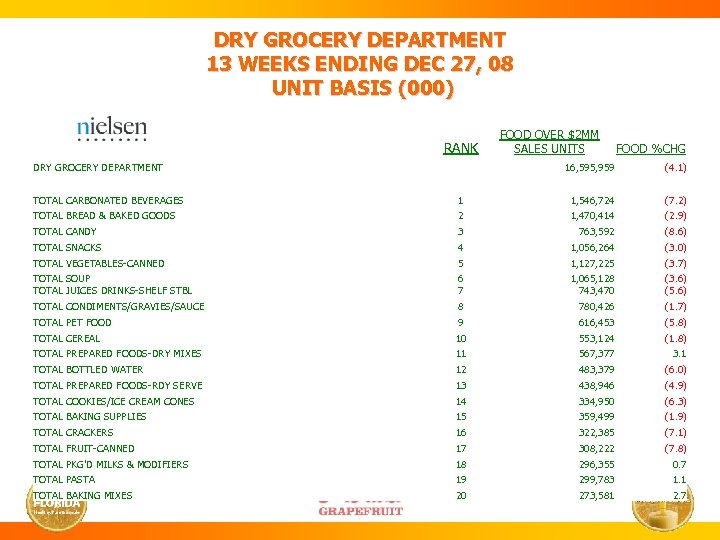

DRY GROCERY DEPARTMENT 13 WEEKS ENDING DEC 27, 08 UNIT BASIS (000) RANK FOOD OVER $2 MM SALES UNITS FOOD %CHG DRY GROCERY DEPARTMENT 16, 595, 959 (4. 1) TOTAL CARBONATED BEVERAGES 1 1, 546, 724 (7. 2) TOTAL BREAD & BAKED GOODS 2 1, 470, 414 (2. 9) TOTAL CANDY 3 763, 592 (8. 6) TOTAL SNACKS 4 1, 056, 264 (3. 0) TOTAL VEGETABLES-CANNED 5 1, 127, 225 (3. 7) TOTAL SOUP TOTAL JUICES DRINKS-SHELF STBL 6 7 1, 065, 128 743, 470 (3. 6) (5. 6) TOTAL CONDIMENTS/GRAVIES/SAUCE 8 780, 426 (1. 7) TOTAL PET FOOD 9 616, 453 (5. 8) TOTAL CEREAL 10 553, 124 (1. 8) TOTAL PREPARED FOODS-DRY MIXES 11 567, 377 TOTAL BOTTLED WATER 12 483, 379 (6. 0) TOTAL PREPARED FOODS-RDY SERVE 13 438, 946 (4. 9) TOTAL COOKIES/ICE CREAM CONES 14 334, 950 (6. 3) TOTAL BAKING SUPPLIES 15 359, 499 (1. 9) TOTAL CRACKERS 16 322, 385 (7. 1) TOTAL FRUIT-CANNED 17 308, 222 (7. 8) TOTAL PKG'D MILKS & MODIFIERS 18 296, 355 0. 7 TOTAL PASTA 19 299, 783 1. 1 TOTAL BAKING MIXES 20 273, 581 2. 7 3. 1

DRY GROCERY DEPARTMENT 13 WEEKS ENDING DEC 27, 08 UNIT BASIS (000) RANK FOOD OVER $2 MM SALES UNITS FOOD %CHG DRY GROCERY DEPARTMENT 16, 595, 959 (4. 1) TOTAL CARBONATED BEVERAGES 1 1, 546, 724 (7. 2) TOTAL BREAD & BAKED GOODS 2 1, 470, 414 (2. 9) TOTAL CANDY 3 763, 592 (8. 6) TOTAL SNACKS 4 1, 056, 264 (3. 0) TOTAL VEGETABLES-CANNED 5 1, 127, 225 (3. 7) TOTAL SOUP TOTAL JUICES DRINKS-SHELF STBL 6 7 1, 065, 128 743, 470 (3. 6) (5. 6) TOTAL CONDIMENTS/GRAVIES/SAUCE 8 780, 426 (1. 7) TOTAL PET FOOD 9 616, 453 (5. 8) TOTAL CEREAL 10 553, 124 (1. 8) TOTAL PREPARED FOODS-DRY MIXES 11 567, 377 TOTAL BOTTLED WATER 12 483, 379 (6. 0) TOTAL PREPARED FOODS-RDY SERVE 13 438, 946 (4. 9) TOTAL COOKIES/ICE CREAM CONES 14 334, 950 (6. 3) TOTAL BAKING SUPPLIES 15 359, 499 (1. 9) TOTAL CRACKERS 16 322, 385 (7. 1) TOTAL FRUIT-CANNED 17 308, 222 (7. 8) TOTAL PKG'D MILKS & MODIFIERS 18 296, 355 0. 7 TOTAL PASTA 19 299, 783 1. 1 TOTAL BAKING MIXES 20 273, 581 2. 7 3. 1

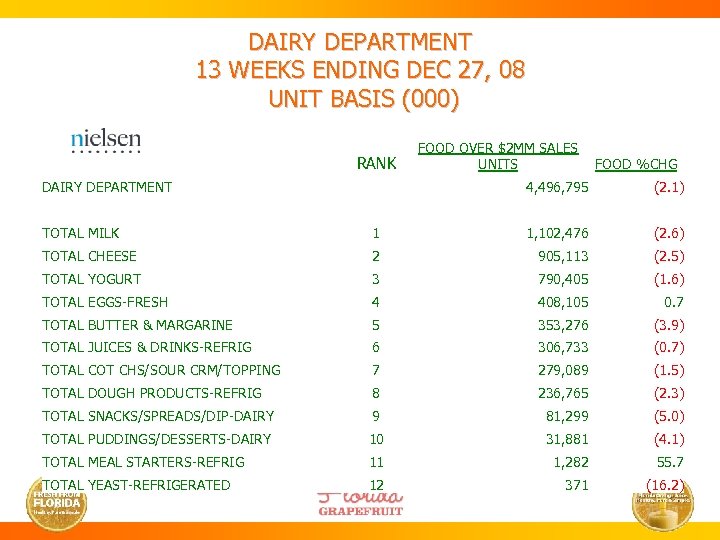

DAIRY DEPARTMENT 13 WEEKS ENDING DEC 27, 08 UNIT BASIS (000) RANK FOOD OVER $2 MM SALES FOOD %CHG UNITS DAIRY DEPARTMENT 4, 496, 795 (2. 1) TOTAL MILK 1 1, 102, 476 (2. 6) TOTAL CHEESE 2 905, 113 (2. 5) TOTAL YOGURT 3 790, 405 (1. 6) TOTAL EGGS-FRESH 4 408, 105 TOTAL BUTTER & MARGARINE 5 353, 276 (3. 9) TOTAL JUICES & DRINKS-REFRIG 6 306, 733 (0. 7) TOTAL COT CHS/SOUR CRM/TOPPING 7 279, 089 (1. 5) TOTAL DOUGH PRODUCTS-REFRIG 8 236, 765 (2. 3) TOTAL SNACKS/SPREADS/DIP-DAIRY 9 81, 299 (5. 0) TOTAL PUDDINGS/DESSERTS-DAIRY 10 31, 881 (4. 1) TOTAL MEAL STARTERS-REFRIG 11 1, 282 55. 7 TOTAL YEAST-REFRIGERATED 12 371 0. 7 (16. 2)

DAIRY DEPARTMENT 13 WEEKS ENDING DEC 27, 08 UNIT BASIS (000) RANK FOOD OVER $2 MM SALES FOOD %CHG UNITS DAIRY DEPARTMENT 4, 496, 795 (2. 1) TOTAL MILK 1 1, 102, 476 (2. 6) TOTAL CHEESE 2 905, 113 (2. 5) TOTAL YOGURT 3 790, 405 (1. 6) TOTAL EGGS-FRESH 4 408, 105 TOTAL BUTTER & MARGARINE 5 353, 276 (3. 9) TOTAL JUICES & DRINKS-REFRIG 6 306, 733 (0. 7) TOTAL COT CHS/SOUR CRM/TOPPING 7 279, 089 (1. 5) TOTAL DOUGH PRODUCTS-REFRIG 8 236, 765 (2. 3) TOTAL SNACKS/SPREADS/DIP-DAIRY 9 81, 299 (5. 0) TOTAL PUDDINGS/DESSERTS-DAIRY 10 31, 881 (4. 1) TOTAL MEAL STARTERS-REFRIG 11 1, 282 55. 7 TOTAL YEAST-REFRIGERATED 12 371 0. 7 (16. 2)

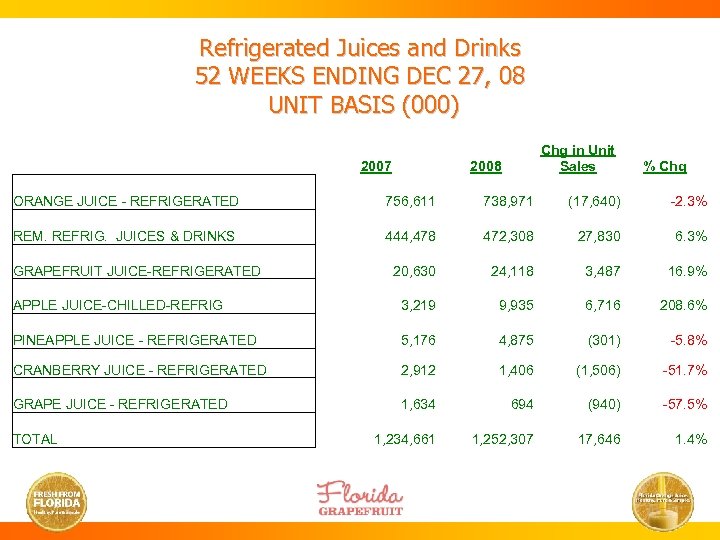

Refrigerated Juices and Drinks 52 WEEKS ENDING DEC 27, 08 UNIT BASIS (000) 2007 Chg in Unit Sales 2008 % Chg ORANGE JUICE - REFRIGERATED 756, 611 738, 971 (17, 640) -2. 3% REM. REFRIG. JUICES & DRINKS 444, 478 472, 308 27, 830 6. 3% 20, 630 24, 118 3, 487 16. 9% APPLE JUICE-CHILLED-REFRIG 3, 219 9, 935 6, 716 208. 6% PINEAPPLE JUICE - REFRIGERATED 5, 176 4, 875 (301) -5. 8% CRANBERRY JUICE - REFRIGERATED 2, 912 1, 406 (1, 506) -51. 7% GRAPE JUICE - REFRIGERATED 1, 634 694 (940) -57. 5% 1, 234, 661 1, 252, 307 17, 646 1. 4% GRAPEFRUIT JUICE-REFRIGERATED TOTAL

Refrigerated Juices and Drinks 52 WEEKS ENDING DEC 27, 08 UNIT BASIS (000) 2007 Chg in Unit Sales 2008 % Chg ORANGE JUICE - REFRIGERATED 756, 611 738, 971 (17, 640) -2. 3% REM. REFRIG. JUICES & DRINKS 444, 478 472, 308 27, 830 6. 3% 20, 630 24, 118 3, 487 16. 9% APPLE JUICE-CHILLED-REFRIG 3, 219 9, 935 6, 716 208. 6% PINEAPPLE JUICE - REFRIGERATED 5, 176 4, 875 (301) -5. 8% CRANBERRY JUICE - REFRIGERATED 2, 912 1, 406 (1, 506) -51. 7% GRAPE JUICE - REFRIGERATED 1, 634 694 (940) -57. 5% 1, 234, 661 1, 252, 307 17, 646 1. 4% GRAPEFRUIT JUICE-REFRIGERATED TOTAL

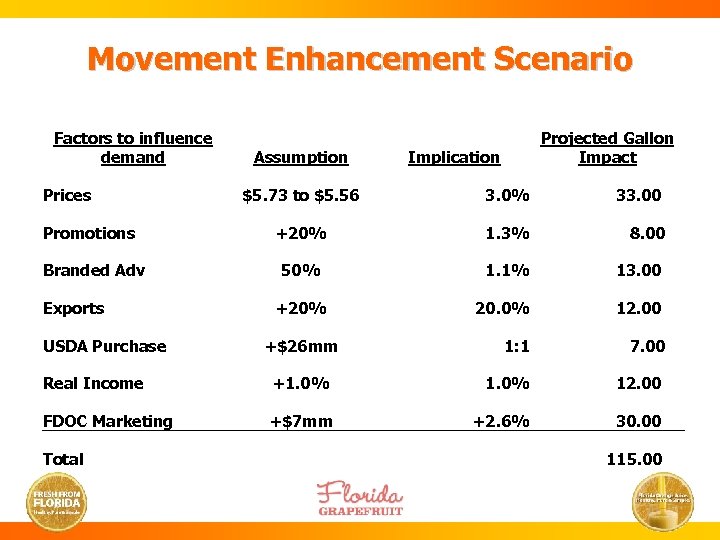

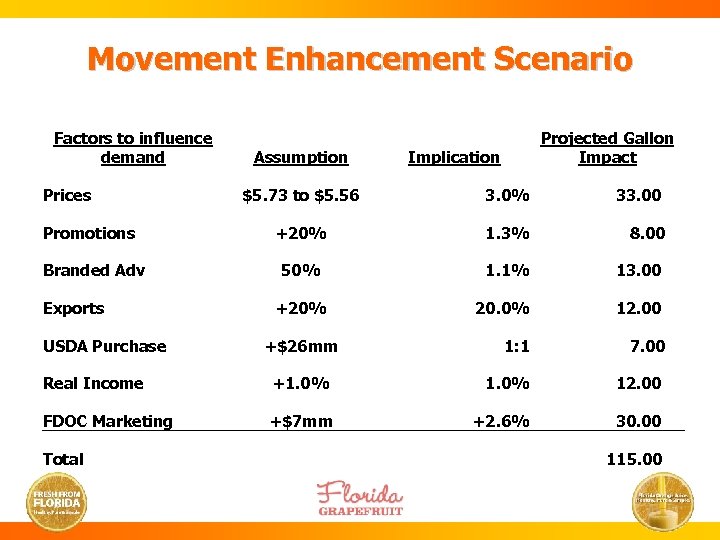

Movement Enhancement Scenario Factors to influence demand Prices Promotions Branded Adv Exports USDA Purchase Assumption Projected Gallon Impact Implication $5. 73 to $5. 56 3. 0% 33. 00 +20% 1. 3% 8. 00 50% 1. 1% 13. 00 20. 0% 12. 00 1: 1 7. 00 +20% +$26 mm Real Income +1. 0% 12. 00 FDOC Marketing +$7 mm +2. 6% 30. 00 Total 115. 00

Movement Enhancement Scenario Factors to influence demand Prices Promotions Branded Adv Exports USDA Purchase Assumption Projected Gallon Impact Implication $5. 73 to $5. 56 3. 0% 33. 00 +20% 1. 3% 8. 00 50% 1. 1% 13. 00 20. 0% 12. 00 1: 1 7. 00 +20% +$26 mm Real Income +1. 0% 12. 00 FDOC Marketing +$7 mm +2. 6% 30. 00 Total 115. 00

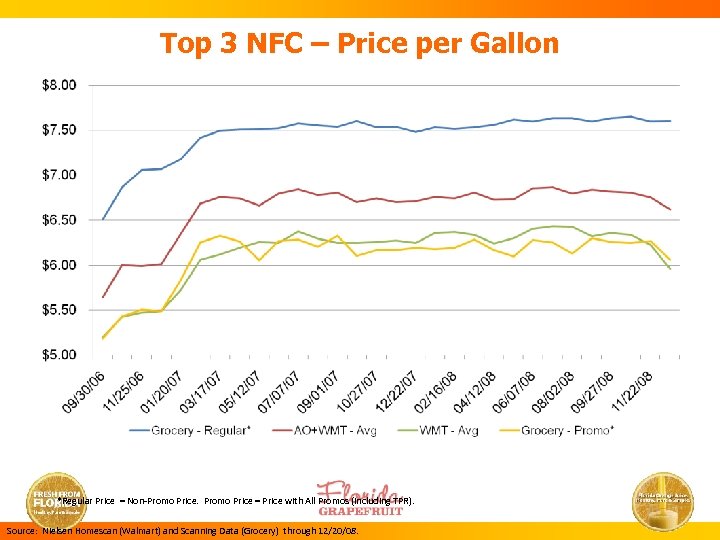

Top 3 NFC – Price per Gallon *Regular Price = Non-Promo Price = Price with All Promos (including TPR). Source: Nielsen Homescan (Walmart) and Scanning Data (Grocery) through 12/20/08.

Top 3 NFC – Price per Gallon *Regular Price = Non-Promo Price = Price with All Promos (including TPR). Source: Nielsen Homescan (Walmart) and Scanning Data (Grocery) through 12/20/08.

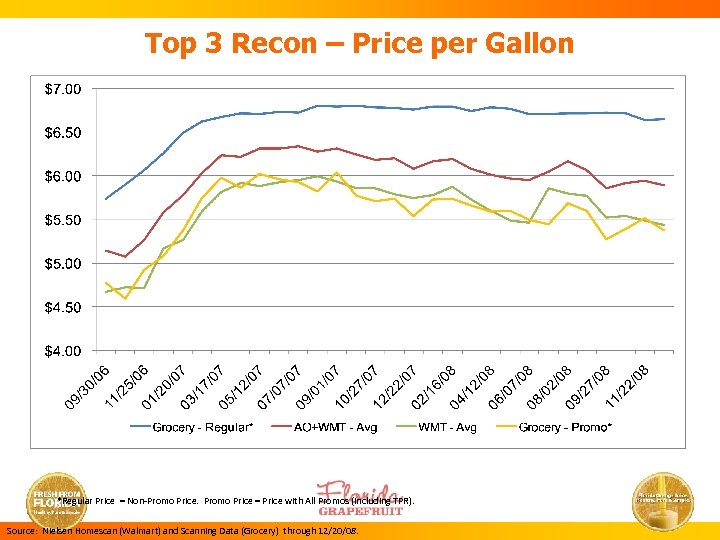

Top 3 Recon – Price per Gallon *Regular Price = Non-Promo Price = Price with All Promos (including TPR). Source: Nielsen Homescan (Walmart) and Scanning Data (Grocery) through 12/20/08.

Top 3 Recon – Price per Gallon *Regular Price = Non-Promo Price = Price with All Promos (including TPR). Source: Nielsen Homescan (Walmart) and Scanning Data (Grocery) through 12/20/08.

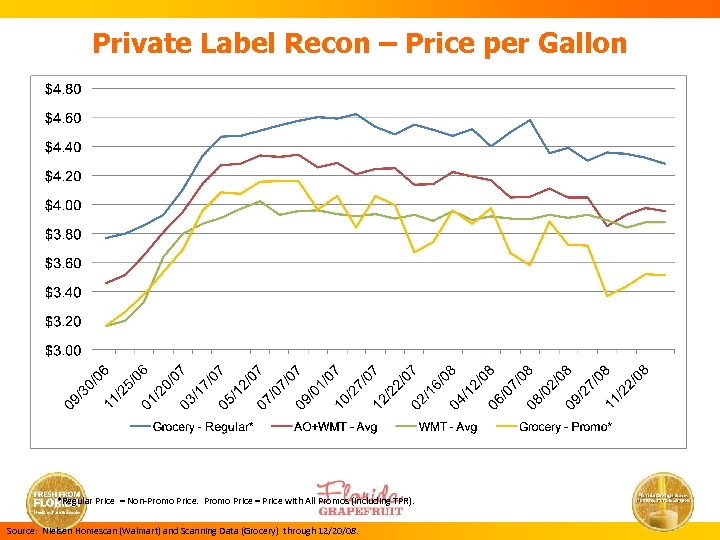

Private Label Recon – Price per Gallon *Regular Price = Non-Promo Price = Price with All Promos (including TPR). Source: Nielsen Homescan (Walmart) and Scanning Data (Grocery) through 12/20/08.

Private Label Recon – Price per Gallon *Regular Price = Non-Promo Price = Price with All Promos (including TPR). Source: Nielsen Homescan (Walmart) and Scanning Data (Grocery) through 12/20/08.

% Sold on Promo % Change Total OJ Trends All Outlets + Walmart

% Sold on Promo % Change Total OJ Trends All Outlets + Walmart

Movement Enhancement Scenario Factors to influence demand Prices Promotions Branded Adv Exports USDA Purchase Assumption Projected Gallon Impact Implication $5. 73 to $5. 56 3. 0% 33. 00 +20% 1. 3% 8. 00 50% 1. 1% 13. 00 20. 0% 12. 00 1: 1 7. 00 +20% +$26 mm Real Income +1. 0% 12. 00 FDOC Marketing +$7 mm +2. 6% 30. 00 Total 115. 00

Movement Enhancement Scenario Factors to influence demand Prices Promotions Branded Adv Exports USDA Purchase Assumption Projected Gallon Impact Implication $5. 73 to $5. 56 3. 0% 33. 00 +20% 1. 3% 8. 00 50% 1. 1% 13. 00 20. 0% 12. 00 1: 1 7. 00 +20% +$26 mm Real Income +1. 0% 12. 00 FDOC Marketing +$7 mm +2. 6% 30. 00 Total 115. 00

Trend Report: Consumer Awareness/Attitudes Regarding Orange Juice Pricing Presented to the Florida Citrus Commission January 21, 2009

Trend Report: Consumer Awareness/Attitudes Regarding Orange Juice Pricing Presented to the Florida Citrus Commission January 21, 2009

Background • Research Objective – FDOC Staff/Agencies implemented research study to • Measure economic affect on purchase behavior • Gauge value perception of orange juice

Background • Research Objective – FDOC Staff/Agencies implemented research study to • Measure economic affect on purchase behavior • Gauge value perception of orange juice

Background • Methodology – – National quantitative Via Opinion Dynamics Sample (N) = 500 Timing – Dec 08/Jan 09

Background • Methodology – – National quantitative Via Opinion Dynamics Sample (N) = 500 Timing – Dec 08/Jan 09

Summary of Findings

Summary of Findings

Awareness of Price Changes • Awareness of Food Prices – 90% of respondents noticed an increase in food prices at grocery • Awareness of Citrus Prices – Aided, only 47% of respondents noticed an increase in orange juice prices

Awareness of Price Changes • Awareness of Food Prices – 90% of respondents noticed an increase in food prices at grocery • Awareness of Citrus Prices – Aided, only 47% of respondents noticed an increase in orange juice prices

Awareness of Price Changes • Awareness of Food Prices – 90% of respondents noticed an increase in food prices at grocery • Awareness of Citrus Prices – Aided, only 47% of respondents noticed an increase in orange juice prices • Key Takeaways – Consumer perception of orange juice prices may be affected by overall food increases

Awareness of Price Changes • Awareness of Food Prices – 90% of respondents noticed an increase in food prices at grocery • Awareness of Citrus Prices – Aided, only 47% of respondents noticed an increase in orange juice prices • Key Takeaways – Consumer perception of orange juice prices may be affected by overall food increases

Impact of Price Changes • Behavioral Changes – The 47% who noticed an increase in the price of orange juice are taking steps to deal with it

Impact of Price Changes • Behavioral Changes – The 47% who noticed an increase in the price of orange juice are taking steps to deal with it

Impact of Price Changes • Behavioral Changes – The 47% who noticed an increase in the price of orange juice are taking steps to deal with it • • I am looking for store deals/promotions I am buying store brands I am buying less orange juice I am shopping at super centers 27% 16% 14% 10%

Impact of Price Changes • Behavioral Changes – The 47% who noticed an increase in the price of orange juice are taking steps to deal with it • • I am looking for store deals/promotions I am buying store brands I am buying less orange juice I am shopping at super centers 27% 16% 14% 10%

Impact of Price Changes • Behavioral Changes – The 47% who have noticed an increase in the price of OJ are taking steps to deal with it • • I am looking for store deals/promotions I am buying store brands I am buying less orange juice I am shopping at super centers 27% 16% 14% 10% • Key Takeaways – Sustaining promotional activity is critical – Retailers and consumers alike have a renewed focus on private label

Impact of Price Changes • Behavioral Changes – The 47% who have noticed an increase in the price of OJ are taking steps to deal with it • • I am looking for store deals/promotions I am buying store brands I am buying less orange juice I am shopping at super centers 27% 16% 14% 10% • Key Takeaways – Sustaining promotional activity is critical – Retailers and consumers alike have a renewed focus on private label

Impact on Purchase Intent • Impact of economy on orange juice purchase – 69% report no change • Maintaining buying rate

Impact on Purchase Intent • Impact of economy on orange juice purchase – 69% report no change • Maintaining buying rate

Impact on Purchase Intent • Impact of economy on orange juice purchase – 69% report no change • Maintaining buying rate • Key reasons for continuing to buy orange juice – – Nutritious and healthy beverage One simple thing to stay healthy Refreshing Good for quick energy 38% 19% 10% 02%

Impact on Purchase Intent • Impact of economy on orange juice purchase – 69% report no change • Maintaining buying rate • Key reasons for continuing to buy orange juice – – Nutritious and healthy beverage One simple thing to stay healthy Refreshing Good for quick energy 38% 19% 10% 02%

Impact on Purchase Intent • Impact of economy on orange juice purchase – 69% report no change • Maintaining buying rate • Key reasons for continuing to buy orange juice – – Nutritious and healthy beverage One simple thing to stay healthy Refreshing Good for quick energy 38% 19% 10% 02% 57% • Top two drivers are key elements of the DOC message strategy

Impact on Purchase Intent • Impact of economy on orange juice purchase – 69% report no change • Maintaining buying rate • Key reasons for continuing to buy orange juice – – Nutritious and healthy beverage One simple thing to stay healthy Refreshing Good for quick energy 38% 19% 10% 02% 57% • Top two drivers are key elements of the DOC message strategy

Perceived Value • Which one of the following beverages do you feel is the best value for the money? – Orange juice noted as the best value for the money – Apple followed orange juice – Cranberry and Grape were third and fourth, respectively

Perceived Value • Which one of the following beverages do you feel is the best value for the money? – Orange juice noted as the best value for the money – Apple followed orange juice – Cranberry and Grape were third and fourth, respectively

Next Steps • Continue to track actual/perceived impact of price and the economic environment on consumer buying behavior • Leverage integrated marketing programs to underscore the value of OJ

Next Steps • Continue to track actual/perceived impact of price and the economic environment on consumer buying behavior • Leverage integrated marketing programs to underscore the value of OJ

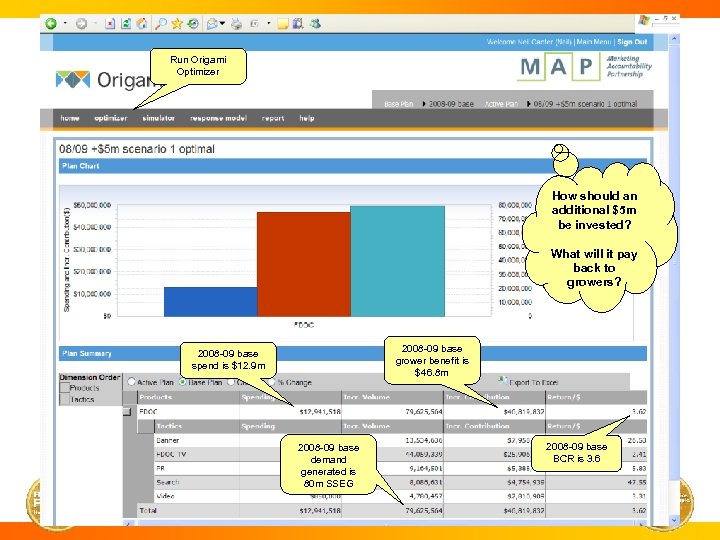

Run Origami Optimizer How should an additional $5 m be invested? What will it pay back to growers? 2008 -09 base grower benefit is $46. 8 m 2008 -09 base spend is $12. 9 m 2008 -09 base demand generated is 80 m SSEG 2008 -09 base BCR is 3. 6

Run Origami Optimizer How should an additional $5 m be invested? What will it pay back to growers? 2008 -09 base grower benefit is $46. 8 m 2008 -09 base spend is $12. 9 m 2008 -09 base demand generated is 80 m SSEG 2008 -09 base BCR is 3. 6

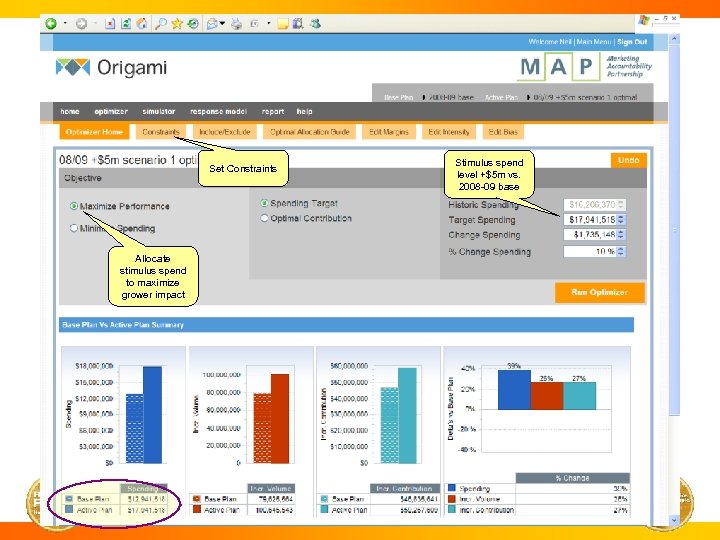

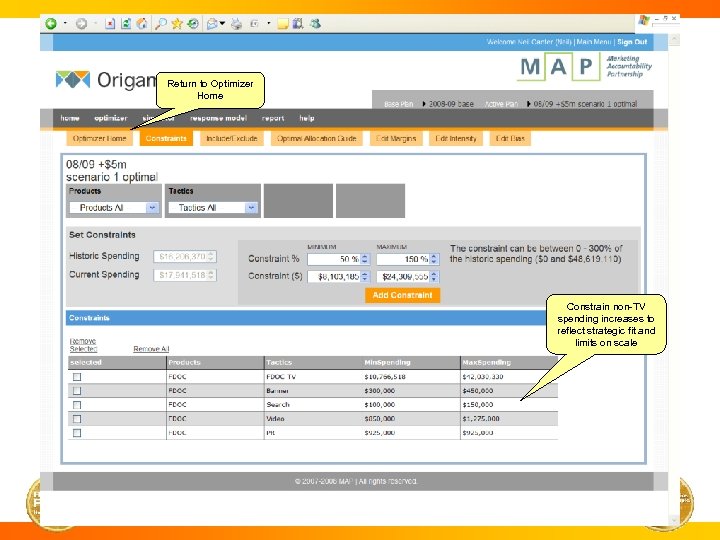

Set Constraints Allocate stimulus spend to maximize grower impact Stimulus spend level +$5 m vs. 2008 -09 base

Set Constraints Allocate stimulus spend to maximize grower impact Stimulus spend level +$5 m vs. 2008 -09 base

Return to Optimizer Home Constrain non-TV spending increases to reflect strategic fit and limits on scale

Return to Optimizer Home Constrain non-TV spending increases to reflect strategic fit and limits on scale

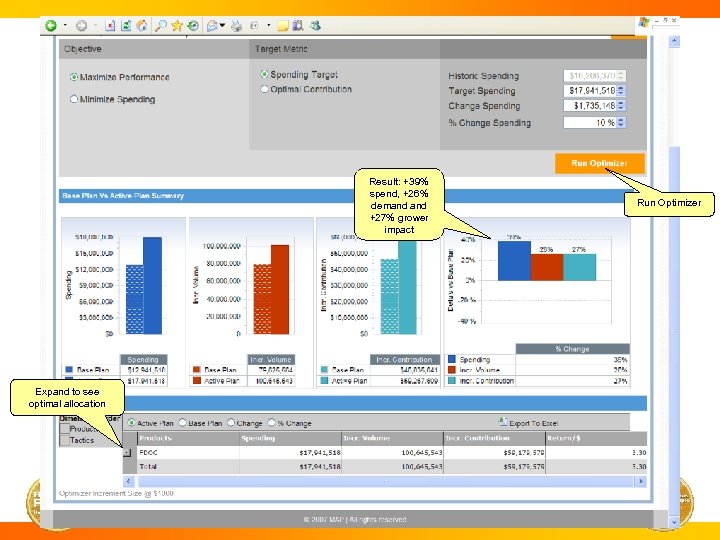

Result: +39% spend, +26% demand +27% grower impact Expand to see optimal allocation Run Optimizer

Result: +39% spend, +26% demand +27% grower impact Expand to see optimal allocation Run Optimizer

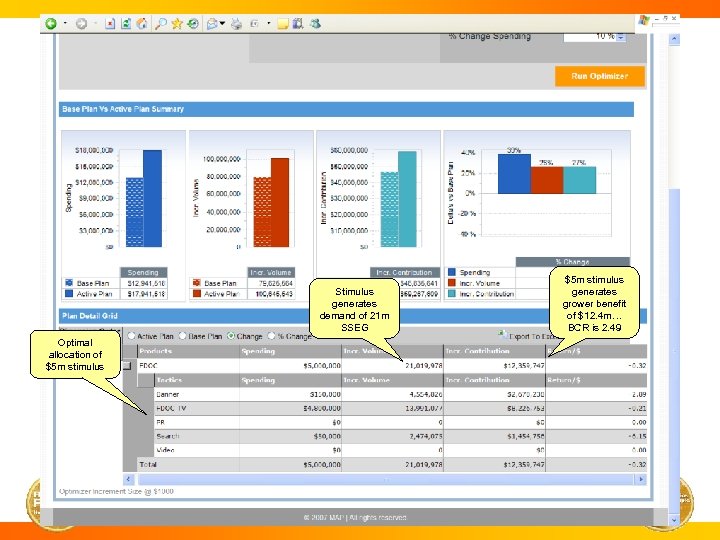

Stimulus generates demand of 21 m SSEG Optimal allocation of $5 m stimulus generates grower benefit of $12. 4 m… BCR is 2. 49

Stimulus generates demand of 21 m SSEG Optimal allocation of $5 m stimulus generates grower benefit of $12. 4 m… BCR is 2. 49

Orange Juice Stimulus Plan Program Recommendation “The most successful people are those who are good at Plan B. " James Yorke Domestic Marketing Team

Orange Juice Stimulus Plan Program Recommendation “The most successful people are those who are good at Plan B. " James Yorke Domestic Marketing Team

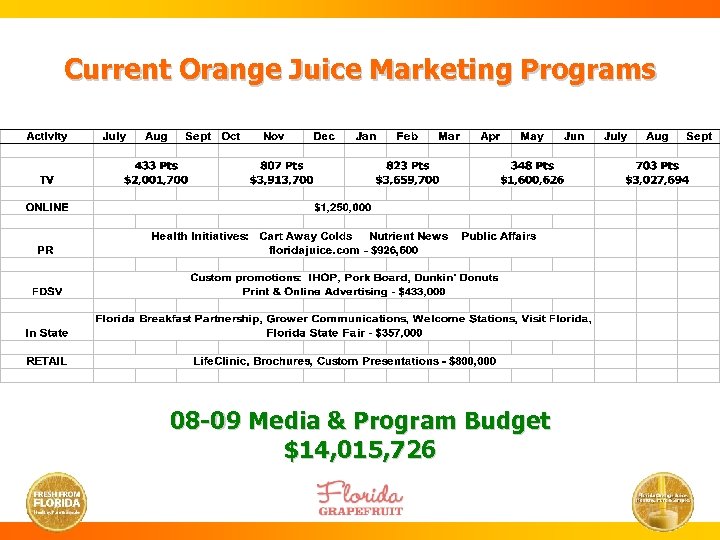

Current Orange Juice Marketing Programs 08 -09 Media & Program Budget $14, 015, 726

Current Orange Juice Marketing Programs 08 -09 Media & Program Budget $14, 015, 726

Orange Juice Stimulus Plan • Objective – Accelerate orange juice movement to relieve excess inventory • Priorities – Immediate focus on April – September – Television • Restore April/May/June • Strengthen July/August/September – Increase presence at retail • Flexibility – ‘Back end’ of the plan – Approximately $2 million • Budget – Approximately $7, 000

Orange Juice Stimulus Plan • Objective – Accelerate orange juice movement to relieve excess inventory • Priorities – Immediate focus on April – September – Television • Restore April/May/June • Strengthen July/August/September – Increase presence at retail • Flexibility – ‘Back end’ of the plan – Approximately $2 million • Budget – Approximately $7, 000

Considerations • • • Shelf. Vision Shelf. Talk Shelf Take. One Freezer Shelf. Talk Floor. Talk Carts Cinema Television Public Relations FSI • Sunday magazines – Parade, American Profile • • Coupons Walmart. com Walmart TV In store radio Life. Clinic Brochures PR/retail joint programs Online

Considerations • • • Shelf. Vision Shelf. Talk Shelf Take. One Freezer Shelf. Talk Floor. Talk Carts Cinema Television Public Relations FSI • Sunday magazines – Parade, American Profile • • Coupons Walmart. com Walmart TV In store radio Life. Clinic Brochures PR/retail joint programs Online

Recommendations

Recommendations

Television • AMJ – Commit additional $2, 785, 124 – Incremental/Total TRPs: 465/813 – New Reach & Frequency: 80%/10. 2 x • JAS – Commit additional $765, 000 – Incremental/New Total TRPs: 145/848 – Reach & Frequency: 80%/10. 6 x • Near historic levels – Real stimulus, weights not scene since 04 -05 • National buy

Television • AMJ – Commit additional $2, 785, 124 – Incremental/Total TRPs: 465/813 – New Reach & Frequency: 80%/10. 2 x • JAS – Commit additional $765, 000 – Incremental/New Total TRPs: 145/848 – Reach & Frequency: 80%/10. 6 x • Near historic levels – Real stimulus, weights not scene since 04 -05 • National buy

Walmart Television Targeted Retail • All WMSC stores – 2450 – Nielsen monitored • 2 flights – March and August – Spring holidays – Back to school • 12 -15 flatscreen televisions per store – Dairy/Produce • One hour loop – 5 - : 30 s or 10 - : 15 s – Modify current spot. Use Selleck voiceover. • Impressions: 71 million/month

Walmart Television Targeted Retail • All WMSC stores – 2450 – Nielsen monitored • 2 flights – March and August – Spring holidays – Back to school • 12 -15 flatscreen televisions per store – Dairy/Produce • One hour loop – 5 - : 30 s or 10 - : 15 s – Modify current spot. Use Selleck voiceover. • Impressions: 71 million/month

Walmart. com Targeted Retail • Lots of traffic – 35/40 million visitors/month • April - September • AMJ – Banner ads over entire site – Product page content (integrate with key messages) • JAS – – Banner ads Product page content Video Walmart Wire – Push email newsletter • 9, 000 distribution • Custom content

Walmart. com Targeted Retail • Lots of traffic – 35/40 million visitors/month • April - September • AMJ – Banner ads over entire site – Product page content (integrate with key messages) • JAS – – Banner ads Product page content Video Walmart Wire – Push email newsletter • 9, 000 distribution • Custom content

In Store Radio Targeted Retail • 2 flights – March and August – Spring holidays – Back to school • 11, 000 stores – A&P, Pathmark, Kroger, Safeway, Winn Dixie, Meijer, Albertsons, Ingles, Sweet. Bay, Wegmanns, Shoprite, etc. – Expands retailer reach • 2 – : 30 s per hour • Selleck voiceover • Impressions: 720 million/month

In Store Radio Targeted Retail • 2 flights – March and August – Spring holidays – Back to school • 11, 000 stores – A&P, Pathmark, Kroger, Safeway, Winn Dixie, Meijer, Albertsons, Ingles, Sweet. Bay, Wegmanns, Shoprite, etc. – Expands retailer reach • 2 – : 30 s per hour • Selleck voiceover • Impressions: 720 million/month

Life. Clinic Targeted Retail • Blood pressure machines • Tested and proven – WMSC test v control = +28% lift • 4 flights – April thru August • 6, 400 stores – All WMSC, all current FDOC call list • Secondary location in pharmacy • Custom message – Panel plus take ones with orange juice message – Refresh look and messages • Complements FDOC brochures in dairy/refrigerated areas

Life. Clinic Targeted Retail • Blood pressure machines • Tested and proven – WMSC test v control = +28% lift • 4 flights – April thru August • 6, 400 stores – All WMSC, all current FDOC call list • Secondary location in pharmacy • Custom message – Panel plus take ones with orange juice message – Refresh look and messages • Complements FDOC brochures in dairy/refrigerated areas

Orange Juice Brochures Targeted Retail • 4 flights – April thru August • Complements blood pressure machines in pharmacy • Custom messages – Cold & flu, heart health, general health – Refresh look and messages • Target 6, 400 stores – All WMSC, all current FDOC call list

Orange Juice Brochures Targeted Retail • 4 flights – April thru August • Complements blood pressure machines in pharmacy • Custom messages – Cold & flu, heart health, general health – Refresh look and messages • Target 6, 400 stores – All WMSC, all current FDOC call list

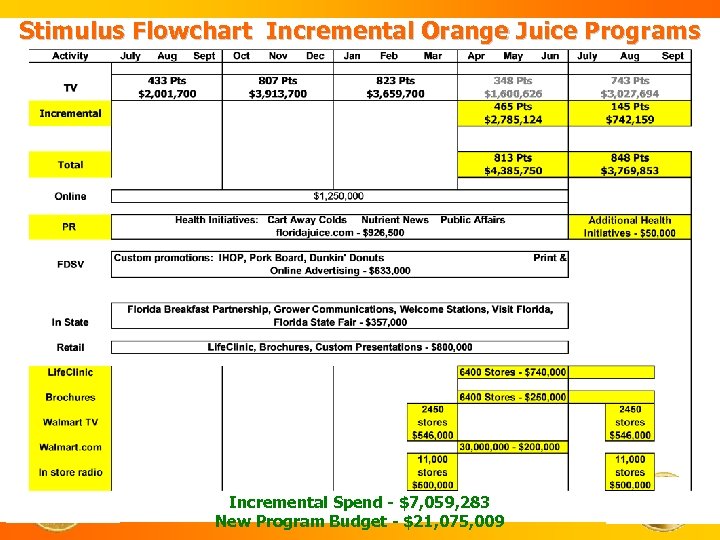

Stimulus Flowchart Incremental Orange Juice Programs Incremental Spend - $7, 059, 283 New Program Budget - $21, 075, 009

Stimulus Flowchart Incremental Orange Juice Programs Incremental Spend - $7, 059, 283 New Program Budget - $21, 075, 009

Millward Brown

Millward Brown

Next Steps • Complete message testing – Identify top performing health and wellness copy points using all elements of the marketing mix • Importance, believability and motivation • Results in January 2009 • Script development in February 2009

Next Steps • Complete message testing – Identify top performing health and wellness copy points using all elements of the marketing mix • Importance, believability and motivation • Results in January 2009 • Script development in February 2009

Request Approval to Proceed

Request Approval to Proceed