8b5cf8408bbdb82af42c5e9e0b201eeb.ppt

- Количество слайдов: 37

ORANGE COUNTY TREASURER-TAX COLLECTOR EFFECTIVE & EFFICIENT CONSTITUENT SERVICE Chriss W. Street, Treasurer-Tax Collector

ORANGE COUNTY TREASURER-TAX COLLECTOR EFFECTIVE & EFFICIENT CONSTITUENT SERVICE Chriss W. Street, Treasurer-Tax Collector

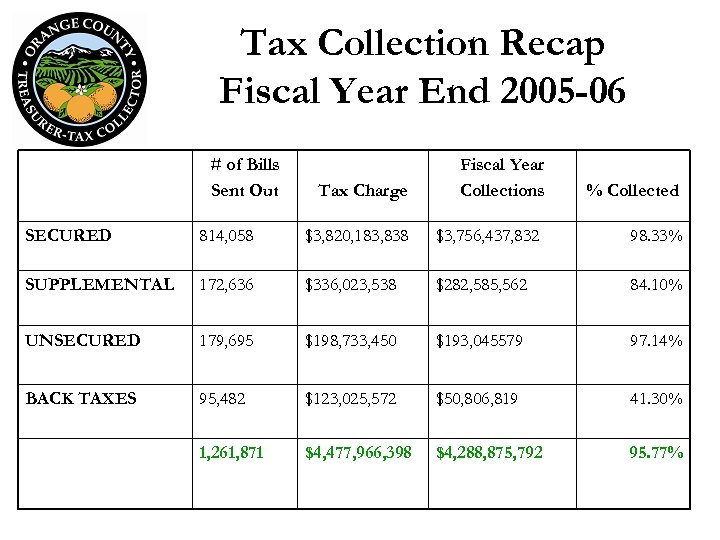

Tax Collection Recap Fiscal Year End 2005 -06 # of Bills Sent Out Tax Charge Fiscal Year Collections % Collected SECURED 814, 058 $3, 820, 183, 838 $3, 756, 437, 832 98. 33% SUPPLEMENTAL 172, 636 $336, 023, 538 $282, 585, 562 84. 10% UNSECURED 179, 695 $198, 733, 450 $193, 045579 97. 14% BACK TAXES 95, 482 $123, 025, 572 $50, 806, 819 41. 30% 1, 261, 871 $4, 477, 966, 398 $4, 288, 875, 792 95. 77%

Tax Collection Recap Fiscal Year End 2005 -06 # of Bills Sent Out Tax Charge Fiscal Year Collections % Collected SECURED 814, 058 $3, 820, 183, 838 $3, 756, 437, 832 98. 33% SUPPLEMENTAL 172, 636 $336, 023, 538 $282, 585, 562 84. 10% UNSECURED 179, 695 $198, 733, 450 $193, 045579 97. 14% BACK TAXES 95, 482 $123, 025, 572 $50, 806, 819 41. 30% 1, 261, 871 $4, 477, 966, 398 $4, 288, 875, 792 95. 77%

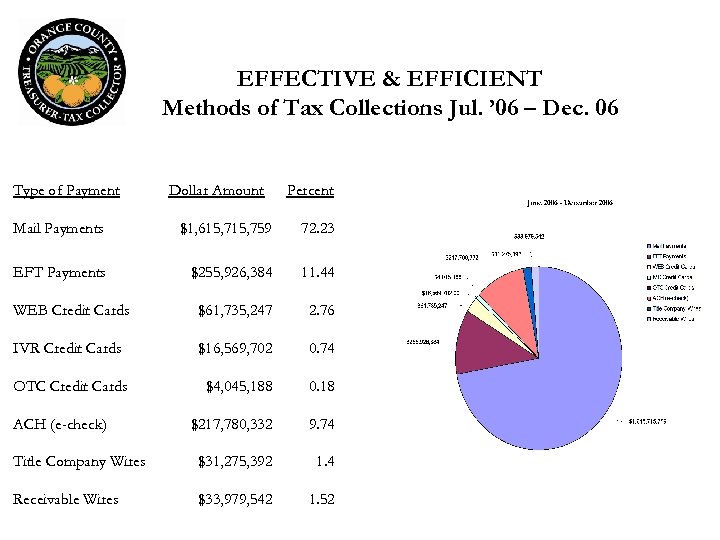

EFFECTIVE & EFFICIENT Methods of Tax Collections Jul. ’ 06 – Dec. 06 Type of Payment Dollar Amount Percent Mail Payments $1, 615, 759 72. 23 EFT Payments $255, 926, 384 11. 44 WEB Credit Cards $61, 735, 247 2. 76 IVR Credit Cards $16, 569, 702 0. 74 OTC Credit Cards $4, 045, 188 0. 18 $217, 780, 332 9. 74 Title Company Wires $31, 275, 392 1. 4 Receivable Wires $33, 979, 542 1. 52 ACH (e-check)

EFFECTIVE & EFFICIENT Methods of Tax Collections Jul. ’ 06 – Dec. 06 Type of Payment Dollar Amount Percent Mail Payments $1, 615, 759 72. 23 EFT Payments $255, 926, 384 11. 44 WEB Credit Cards $61, 735, 247 2. 76 IVR Credit Cards $16, 569, 702 0. 74 OTC Credit Cards $4, 045, 188 0. 18 $217, 780, 332 9. 74 Title Company Wires $31, 275, 392 1. 4 Receivable Wires $33, 979, 542 1. 52 ACH (e-check)

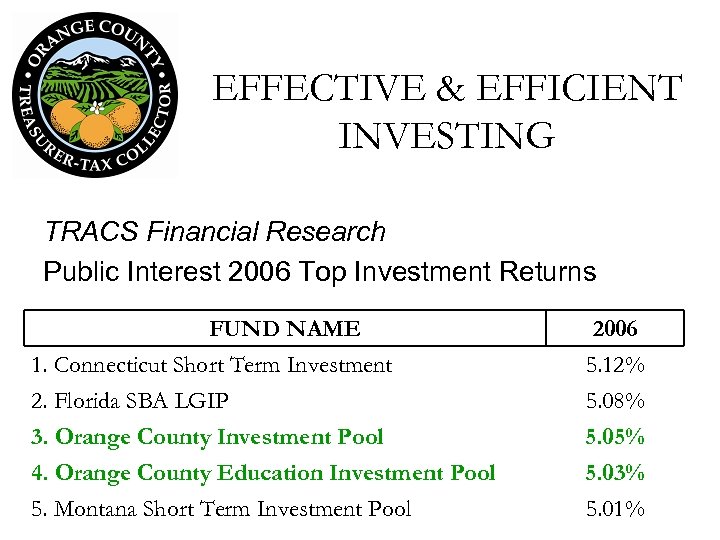

EFFECTIVE & EFFICIENT INVESTING TRACS Financial Research Public Interest 2006 Top Investment Returns FUND NAME 1. Connecticut Short Term Investment 2. Florida SBA LGIP 3. Orange County Investment Pool 2006 5. 12% 5. 08% 5. 05% 4. Orange County Education Investment Pool 5. Montana Short Term Investment Pool 5. 03% 5. 01%

EFFECTIVE & EFFICIENT INVESTING TRACS Financial Research Public Interest 2006 Top Investment Returns FUND NAME 1. Connecticut Short Term Investment 2. Florida SBA LGIP 3. Orange County Investment Pool 2006 5. 12% 5. 08% 5. 05% 4. Orange County Education Investment Pool 5. Montana Short Term Investment Pool 5. 03% 5. 01%

EFFECTIVE & EFFICIENT Constituent Service over the INTERNET 2004 - Pay Taxes Online 2005 - Supplemental Tax Calculators; Pay Multiple Online & Simultaneously 2006 - Email Reminder Subscription; Prior Year Refund Interest; Escheatment List

EFFECTIVE & EFFICIENT Constituent Service over the INTERNET 2004 - Pay Taxes Online 2005 - Supplemental Tax Calculators; Pay Multiple Online & Simultaneously 2006 - Email Reminder Subscription; Prior Year Refund Interest; Escheatment List

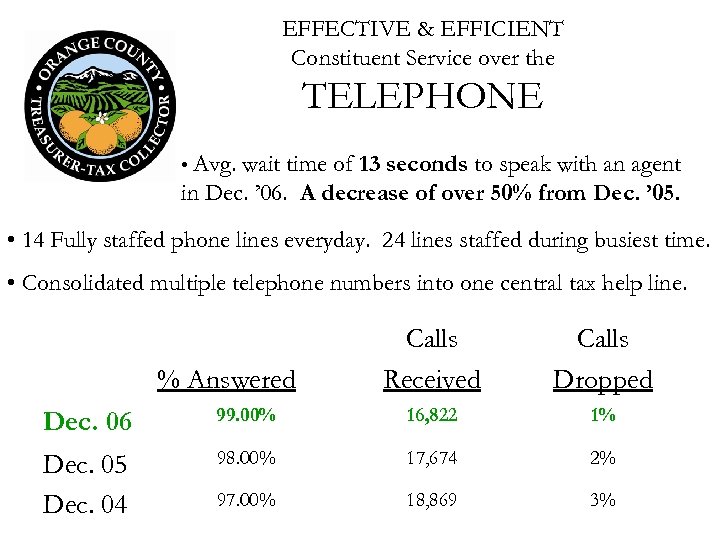

EFFECTIVE & EFFICIENT Constituent Service over the TELEPHONE • Avg. wait time of 13 seconds to speak with an agent in Dec. ’ 06. A decrease of over 50% from Dec. ’ 05. • 14 Fully staffed phone lines everyday. 24 lines staffed during busiest time. • Consolidated multiple telephone numbers into one central tax help line. % Answered Calls Received Calls Dropped Dec. 06 99. 00% 16, 822 1% Dec. 05 Dec. 04 98. 00% 17, 674 2% 97. 00% 18, 869 3%

EFFECTIVE & EFFICIENT Constituent Service over the TELEPHONE • Avg. wait time of 13 seconds to speak with an agent in Dec. ’ 06. A decrease of over 50% from Dec. ’ 05. • 14 Fully staffed phone lines everyday. 24 lines staffed during busiest time. • Consolidated multiple telephone numbers into one central tax help line. % Answered Calls Received Calls Dropped Dec. 06 99. 00% 16, 822 1% Dec. 05 Dec. 04 98. 00% 17, 674 2% 97. 00% 18, 869 3%

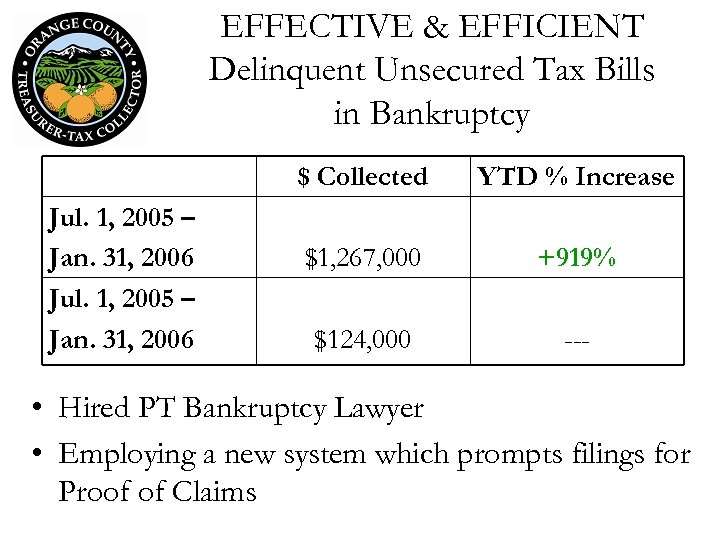

EFFECTIVE & EFFICIENT Delinquent Unsecured Tax Bills in Bankruptcy $ Collected Jul. 1, 2005 – Jan. 31, 2006 YTD % Increase $1, 267, 000 +919% $124, 000 --- • Hired PT Bankruptcy Lawyer • Employing a new system which prompts filings for Proof of Claims

EFFECTIVE & EFFICIENT Delinquent Unsecured Tax Bills in Bankruptcy $ Collected Jul. 1, 2005 – Jan. 31, 2006 YTD % Increase $1, 267, 000 +919% $124, 000 --- • Hired PT Bankruptcy Lawyer • Employing a new system which prompts filings for Proof of Claims

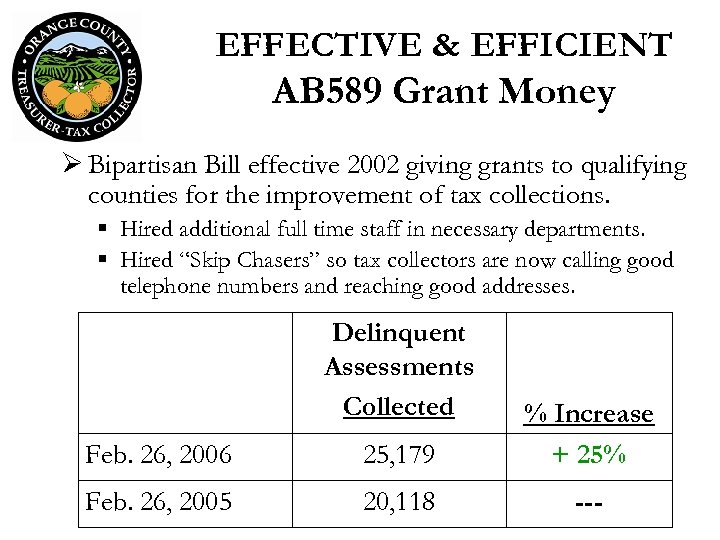

EFFECTIVE & EFFICIENT AB 589 Grant Money Ø Bipartisan Bill effective 2002 giving grants to qualifying counties for the improvement of tax collections. § Hired additional full time staff in necessary departments. § Hired “Skip Chasers” so tax collectors are now calling good telephone numbers and reaching good addresses. Delinquent Assessments Collected Feb. 26, 2006 25, 179 % Increase + 25% Feb. 26, 2005 20, 118 ---

EFFECTIVE & EFFICIENT AB 589 Grant Money Ø Bipartisan Bill effective 2002 giving grants to qualifying counties for the improvement of tax collections. § Hired additional full time staff in necessary departments. § Hired “Skip Chasers” so tax collectors are now calling good telephone numbers and reaching good addresses. Delinquent Assessments Collected Feb. 26, 2006 25, 179 % Increase + 25% Feb. 26, 2005 20, 118 ---

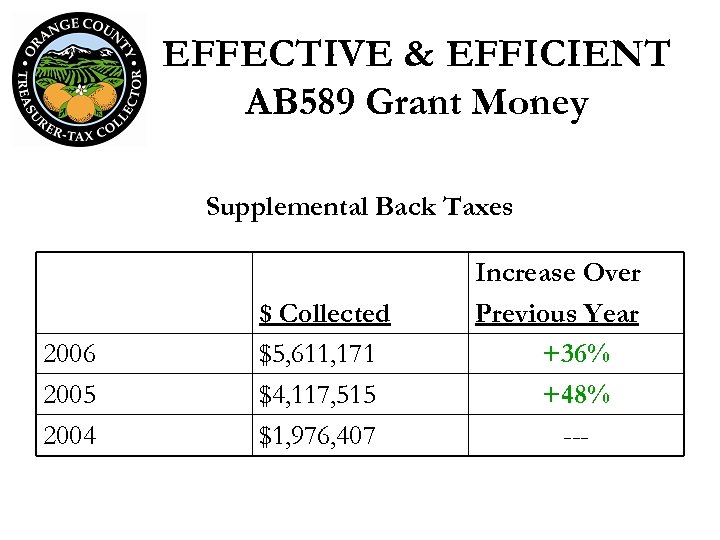

EFFECTIVE & EFFICIENT AB 589 Grant Money Supplemental Back Taxes 2006 2005 2004 $ Collected $5, 611, 171 $4, 117, 515 $1, 976, 407 Increase Over Previous Year +36% +48% ---

EFFECTIVE & EFFICIENT AB 589 Grant Money Supplemental Back Taxes 2006 2005 2004 $ Collected $5, 611, 171 $4, 117, 515 $1, 976, 407 Increase Over Previous Year +36% +48% ---

Chriss W. Street Treasurer-Tax Collector Office of the Treasurer-Tax Collector County of Orange Hall of Finance & Records 12 Civic Center Plaza, Suite G 76 Post Office Box 4515 Santa Ana, CA 92701 www. ttc. ocgov. com For Additional Information Contact Susan Czech Director of External Affairs Email: sczech@ttc. ocgov. com Phone: 714. 834. 5279

Chriss W. Street Treasurer-Tax Collector Office of the Treasurer-Tax Collector County of Orange Hall of Finance & Records 12 Civic Center Plaza, Suite G 76 Post Office Box 4515 Santa Ana, CA 92701 www. ttc. ocgov. com For Additional Information Contact Susan Czech Director of External Affairs Email: sczech@ttc. ocgov. com Phone: 714. 834. 5279

ORANGE COUNTY TREASURER-TAX COLLECTOR CONSOLIDATED SERVICES Brett R. Barbre, Chief Assistant Treasurer - Tax Collector

ORANGE COUNTY TREASURER-TAX COLLECTOR CONSOLIDATED SERVICES Brett R. Barbre, Chief Assistant Treasurer - Tax Collector

EFFECTIVE & EFFICENT Consolidated Services at TTC

EFFECTIVE & EFFICENT Consolidated Services at TTC

ORANGE COUNTY TREASURER-TAX COLLECTOR TAX REFUND PROCESS OVERVIEW Walter Daniels Assistant Treasurer – Tax Collector, Tax Collection Rogelia Martinez, Chief Deputy Tax Collector

ORANGE COUNTY TREASURER-TAX COLLECTOR TAX REFUND PROCESS OVERVIEW Walter Daniels Assistant Treasurer – Tax Collector, Tax Collection Rogelia Martinez, Chief Deputy Tax Collector

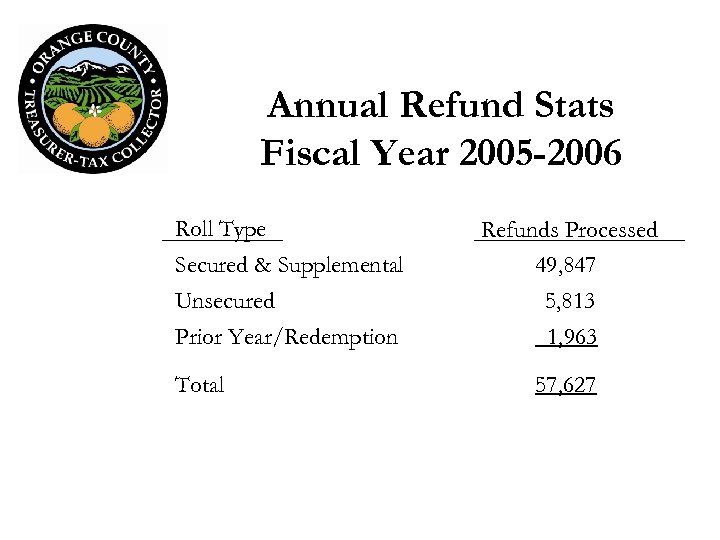

Annual Refund Stats Fiscal Year 2005 -2006 Roll Type Secured & Supplemental Refunds Processed 49, 847 Unsecured Prior Year/Redemption 5, 813 1, 963 Total 57, 627

Annual Refund Stats Fiscal Year 2005 -2006 Roll Type Secured & Supplemental Refunds Processed 49, 847 Unsecured Prior Year/Redemption 5, 813 1, 963 Total 57, 627

Reasons for Refunds Duplicate/Double Payments • Taxpayers • Title Companies • Mortgage Companies Over Payments • Penalty Overpayments • Transposition Errors Mismatched/Short Payments • Payments received late • Transposition Errors

Reasons for Refunds Duplicate/Double Payments • Taxpayers • Title Companies • Mortgage Companies Over Payments • Penalty Overpayments • Transposition Errors Mismatched/Short Payments • Payments received late • Transposition Errors

Other Inflows to Refund Stream Assessment Appeal Board Decisions (AAB) Assessment Roll Corrections (ARC) Negative Supplemental Tax Bills

Other Inflows to Refund Stream Assessment Appeal Board Decisions (AAB) Assessment Roll Corrections (ARC) Negative Supplemental Tax Bills

Refund Processing Timeline 3 – 4 Weeks Mismatched/Short Payments AAB and ARC refunds under $2, 500 Automatically refunded by the system provided there was no change of assessee within that fiscal year. Negative Supplemental Assessments 6 – 7 Weeks Duplicate and Overpayments AAB and ARC greater than $2, 500 Due to the fact that the “who paid” information must be determined before issuing these refunds.

Refund Processing Timeline 3 – 4 Weeks Mismatched/Short Payments AAB and ARC refunds under $2, 500 Automatically refunded by the system provided there was no change of assessee within that fiscal year. Negative Supplemental Assessments 6 – 7 Weeks Duplicate and Overpayments AAB and ARC greater than $2, 500 Due to the fact that the “who paid” information must be determined before issuing these refunds.

Methods of Refunds Ø Refunds are processed and approved through the Assessment Tax System (ATS) and the checks are issued by the Auditor-Controller. Ø Occasionally Manual/Trust Fund refunds are processed for those items that cannot be processed through the ATS and the completed refund form are forwarded to the Auditor-Controller for issue of checks. Ø Refunds for payments received by Electronic Funds Transfer (EFT), Credit Cards, ACH Debit (e-check) and wires are processed in normal manner through the ATS and the checks are issued by the Auditor. Controller. Ø Credit card payments that are accidentally paid twice for the same parcel on the same day (duplicated) may be reversed by using reversal method. This will credit the taxpayers’ credit card account and the Tax Collector will not see it on the daily report or the bank statement.

Methods of Refunds Ø Refunds are processed and approved through the Assessment Tax System (ATS) and the checks are issued by the Auditor-Controller. Ø Occasionally Manual/Trust Fund refunds are processed for those items that cannot be processed through the ATS and the completed refund form are forwarded to the Auditor-Controller for issue of checks. Ø Refunds for payments received by Electronic Funds Transfer (EFT), Credit Cards, ACH Debit (e-check) and wires are processed in normal manner through the ATS and the checks are issued by the Auditor. Controller. Ø Credit card payments that are accidentally paid twice for the same parcel on the same day (duplicated) may be reversed by using reversal method. This will credit the taxpayers’ credit card account and the Tax Collector will not see it on the daily report or the bank statement.

Issues of Security & Control in the refund process Only selected employees are given access to the refund releasing program. Once the refunds are released to the system, a weekly approval report is produced the following Monday. (The system will not release refunds for those payments made within the past 14 working days. This is a built-in safeguard against ‘bad checks’). Next Monday the final report is printed. This report is verified by the Supervisors and approved by the Managers prior to being delivered to the Auditor-Controller’s office for final processing. The Auditor-Controller runs the refund job every Friday. The refund checks are mailed the following Monday.

Issues of Security & Control in the refund process Only selected employees are given access to the refund releasing program. Once the refunds are released to the system, a weekly approval report is produced the following Monday. (The system will not release refunds for those payments made within the past 14 working days. This is a built-in safeguard against ‘bad checks’). Next Monday the final report is printed. This report is verified by the Supervisors and approved by the Managers prior to being delivered to the Auditor-Controller’s office for final processing. The Auditor-Controller runs the refund job every Friday. The refund checks are mailed the following Monday.

Additional Refund Information For any information concerning refunds, please contact: (714) 834 -3411 THE END Thank you for your Attention

Additional Refund Information For any information concerning refunds, please contact: (714) 834 -3411 THE END Thank you for your Attention

ORANGE COUNTY TREASURER-TAX COLLECTOR METHODS OF PAYMENT Kim Hansen, Cash Manager

ORANGE COUNTY TREASURER-TAX COLLECTOR METHODS OF PAYMENT Kim Hansen, Cash Manager

EFFECTIVE & EFFICIENT Methods of Payment REMITTANCE PROCESSING ENHANCEMENTS ØUpgrading existing machines with new software ØInstalling a new 3 rd machine ØCharacter recognition has improved ØFewer items sent for data correction ØVery reliable system with same day processing

EFFECTIVE & EFFICIENT Methods of Payment REMITTANCE PROCESSING ENHANCEMENTS ØUpgrading existing machines with new software ØInstalling a new 3 rd machine ØCharacter recognition has improved ØFewer items sent for data correction ØVery reliable system with same day processing

EFFECTIVE & EFFICIENT Methods of Payment TITLE AND ESCROW COMPANY PAYMENTS - HISTORY ØPrior to electronic payments, payments were made by check ØChecks didn’t include a payment stub ØTTC staff made a payment stub for each payment ØIn 2005, TTC requested title and escrow companies to pay electronically ØToday, most companies are paying via wire transfer

EFFECTIVE & EFFICIENT Methods of Payment TITLE AND ESCROW COMPANY PAYMENTS - HISTORY ØPrior to electronic payments, payments were made by check ØChecks didn’t include a payment stub ØTTC staff made a payment stub for each payment ØIn 2005, TTC requested title and escrow companies to pay electronically ØToday, most companies are paying via wire transfer

EFFECTIVE & EFFICIENT Methods of Payment TITLE AND ESCROW COMPANY PAYMENTS - EFT ØBack office processing is a labor intensive manual process ØThere is no standard format within wires for parcel/bill number information ØPayment information and actual payment often are not received simultaneously ØStaff time for research and refunding has increased significantly

EFFECTIVE & EFFICIENT Methods of Payment TITLE AND ESCROW COMPANY PAYMENTS - EFT ØBack office processing is a labor intensive manual process ØThere is no standard format within wires for parcel/bill number information ØPayment information and actual payment often are not received simultaneously ØStaff time for research and refunding has increased significantly

EFFECTIVE & EFFICIENT Methods of Payment TITLE AND ESCROW COMPANY PAYMENTS - EFT • Cost of a wire is much higher than ACH or check ($6. 00) • The bank fees have increased dramatically due to high volume of wires • Processing time for EFT payments takes up to 2 weeks • Overall, EFT payments are not working! • A change is necessary

EFFECTIVE & EFFICIENT Methods of Payment TITLE AND ESCROW COMPANY PAYMENTS - EFT • Cost of a wire is much higher than ACH or check ($6. 00) • The bank fees have increased dramatically due to high volume of wires • Processing time for EFT payments takes up to 2 weeks • Overall, EFT payments are not working! • A change is necessary

EFFECTIVE & EFFICIENT Methods of Payment PAYMENT OPTIONS FOR ALL TAXPAYERS TTC has many payment options: üCash üCheck üCredit Card via telephone üCredit Card via web üACH Debit via web üACH Credit üWire Transfer

EFFECTIVE & EFFICIENT Methods of Payment PAYMENT OPTIONS FOR ALL TAXPAYERS TTC has many payment options: üCash üCheck üCredit Card via telephone üCredit Card via web üACH Debit via web üACH Credit üWire Transfer

EFFECTIVE & EFFICIENT Methods of Payment PAYMENT OPTIONS FOR TITLE AND ESCROW COMPANIES Currently, title and escrow companies have these options: üCheck üACH Debit via web üACH Credit üWire Transfer

EFFECTIVE & EFFICIENT Methods of Payment PAYMENT OPTIONS FOR TITLE AND ESCROW COMPANIES Currently, title and escrow companies have these options: üCheck üACH Debit via web üACH Credit üWire Transfer

EFFECTIVE & EFFICIENT Methods of Payment PAYMENTS ØThe Treasurer-Tax Collector strongly recommends that title and escrow companies no longer use ACH Credit or Wire Transfer payments. ØToday, our preferred payment methods are: üCheck üACH Debit via web

EFFECTIVE & EFFICIENT Methods of Payment PAYMENTS ØThe Treasurer-Tax Collector strongly recommends that title and escrow companies no longer use ACH Credit or Wire Transfer payments. ØToday, our preferred payment methods are: üCheck üACH Debit via web

EFFECTIVE & EFFICIENT Methods of Payment CHECK PAYMENTS ØTTC will revert back to creating payment stubs for each payment ØGuaranteed same day processing with next day visibility ØIf title and escrow companies include the reference or escrow number on the check, it will be included on any refund!

EFFECTIVE & EFFICIENT Methods of Payment CHECK PAYMENTS ØTTC will revert back to creating payment stubs for each payment ØGuaranteed same day processing with next day visibility ØIf title and escrow companies include the reference or escrow number on the check, it will be included on any refund!

EFFECTIVE & EFFICIENT Methods of Payment ACH DEBIT VIA WEB ØSafety and security controls available today mitigate most of the risk previously associated with ACH debit ØDealing with a known partner ØDebit filters on your bank account ØTTC website can process single or multiple payments ØPayment window stays open/active for 8 hours

EFFECTIVE & EFFICIENT Methods of Payment ACH DEBIT VIA WEB ØSafety and security controls available today mitigate most of the risk previously associated with ACH debit ØDealing with a known partner ØDebit filters on your bank account ØTTC website can process single or multiple payments ØPayment window stays open/active for 8 hours

EFFECTIVE & EFFICIENT Methods of Payment FUTURE PAYMENT OPTIONS ØTTC will continue to work with title and escrow companies to develop efficiencies for both sides ØElectronic payments continue to grow and develop ØACH Credit could be utilized with some standardization of addenda information

EFFECTIVE & EFFICIENT Methods of Payment FUTURE PAYMENT OPTIONS ØTTC will continue to work with title and escrow companies to develop efficiencies for both sides ØElectronic payments continue to grow and develop ØACH Credit could be utilized with some standardization of addenda information

EFFECTIVE & EFFICIENT Methods of Payment PAYMENT METHODS ØTalk to your treasury/finance group ØLet TTC help educate them ØQuestions? ?

EFFECTIVE & EFFICIENT Methods of Payment PAYMENT METHODS ØTalk to your treasury/finance group ØLet TTC help educate them ØQuestions? ?

ORANGE COUNTY TREASURER-TAX COLLECTOR DATA DELIVERY ENHANCEMENTS Clarissa Adriano-Ceres Assistant Treasurer-Tax Collector, Information Tech.

ORANGE COUNTY TREASURER-TAX COLLECTOR DATA DELIVERY ENHANCEMENTS Clarissa Adriano-Ceres Assistant Treasurer-Tax Collector, Information Tech.

EFFECTIVE & EFFICIENT Enhancements to Data Delivery Methods Before After Data files are copied to tapes Data files will be made readily available through the County FTP server Tapes are physically delivered or picked up Data accessed anywhere through your browser Takes days before data gets to destination Data is retrievable anytime

EFFECTIVE & EFFICIENT Enhancements to Data Delivery Methods Before After Data files are copied to tapes Data files will be made readily available through the County FTP server Tapes are physically delivered or picked up Data accessed anywhere through your browser Takes days before data gets to destination Data is retrievable anytime

Chriss W. Street Treasurer-Tax Collector Don’t forget to drop your business card in the drop box in the foyer if you want to receive periodic email updates as to future enhancements at the TTC. Thank you for your time and the opportunity to serve you going forth. We look forward to your questions and feedback at the conclusion of today’s presentation.

Chriss W. Street Treasurer-Tax Collector Don’t forget to drop your business card in the drop box in the foyer if you want to receive periodic email updates as to future enhancements at the TTC. Thank you for your time and the opportunity to serve you going forth. We look forward to your questions and feedback at the conclusion of today’s presentation.