03ec6d38d85d2d3585658adb1798217e.ppt

- Количество слайдов: 10

Options Professor Brooks BA 444 01/09/08

The First Known Option Trader n Philosopher Thales of Milesian. n Used the stars to determine the olive crop would be large that year. n Paid a deposit on all the olive presses in the area for use in the harvest season n Olive crop harvest large n Presses in high demand n Rented presses out a rate higher than he had secured with his deposit…made $$$$$

Types of Options n Only Two n Call – Right but not the obligation to buy the underlying asset on or before a set date at a pre-set price (strike or exercise price) n Put – Right but not the obligation to sell the underlying asset on or before a certain date at a pre-set price (strike or exercise price)

Categories of Options n American vs. European n Underlying Asset n Equity Option – Stock n Index Option – Financial Index n Futures Option – Futures Contract n FX Option – Foreign Exchange n Interest Rate Option – Treasury Bond

Standardized Option Contract Traded on an Exchange n ISE, CBOE, AMEX, Philly, PSE n Set Size of Underlying Asset n Equities are 100 shares of stock n Futures are the size of futures contract n Specific Expiration Date (Third Friday) n Specific Strike Price (Exercise Price) n Price of Option is current selling/buying price of the financial asset. n

Options Basics n A basketball ticket… Owner of the ticket has the right to n Attend the game n Sell the ticket to someone else n “Eat” the ticket, not use or sell the ticket n Original seller must provide the “seats” for the game if exercised by either original buyer or subsequent buyer of the ticket n Price of the ticket will vary through time based on the performance of the teams and the time left before tipoff n

Four Positions in Options & Risk n Buy a Call – Risk is cost of option n Sell a Call – Risk is rising prices n Buy a Put – Risk is cost of option n Sell a Put – Risk is falling prices n Diagrams of four positions n Hockey Sticks of Options n Reveals potential gains and losses

Trading Options n Option Ticker Symbols n Page 23… n Example at ISE, http: //www. ise. com/ n Bid Prices and Ask Prices n Bid, price at which one is willing to buy n Ask, price at which one is willing to sell n Market vs. Limit n Order Book Official (Limit order book) n Preference to price and time

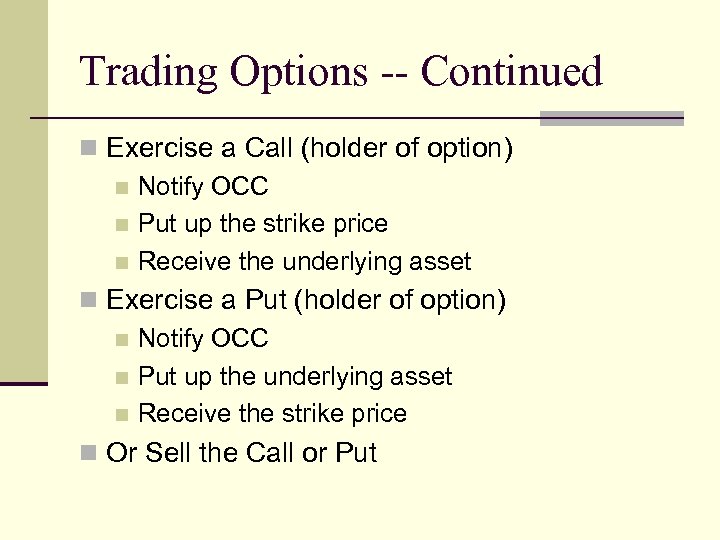

Trading Options -- Continued n Exercise a Call (holder of option) n Notify OCC n Put up the strike price n Receive the underlying asset n Exercise a Put (holder of option) n Notify OCC n Put up the underlying asset n Receive the strike price n Or Sell the Call or Put

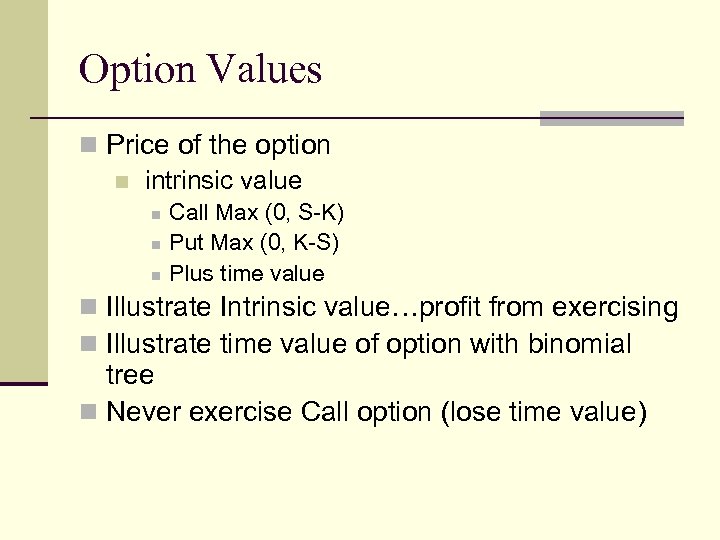

Option Values n Price of the option n intrinsic value n n n Call Max (0, S-K) Put Max (0, K-S) Plus time value n Illustrate Intrinsic value…profit from exercising n Illustrate time value of option with binomial tree n Never exercise Call option (lose time value)

03ec6d38d85d2d3585658adb1798217e.ppt