6815f84f7d3400d95ce767ad96b2226f.ppt

- Количество слайдов: 26

Options Markets CHAPTER 14 Mc. Graw-Hill/Irwin © 2007 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Options Markets CHAPTER 14 Mc. Graw-Hill/Irwin © 2007 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Option Terminology • • • Buy - Long Sell - Short Call Put Key Elements – Exercise or Strike Price – Premium or Price – Maturity or Expiration 14 -2

Option Terminology • • • Buy - Long Sell - Short Call Put Key Elements – Exercise or Strike Price – Premium or Price – Maturity or Expiration 14 -2

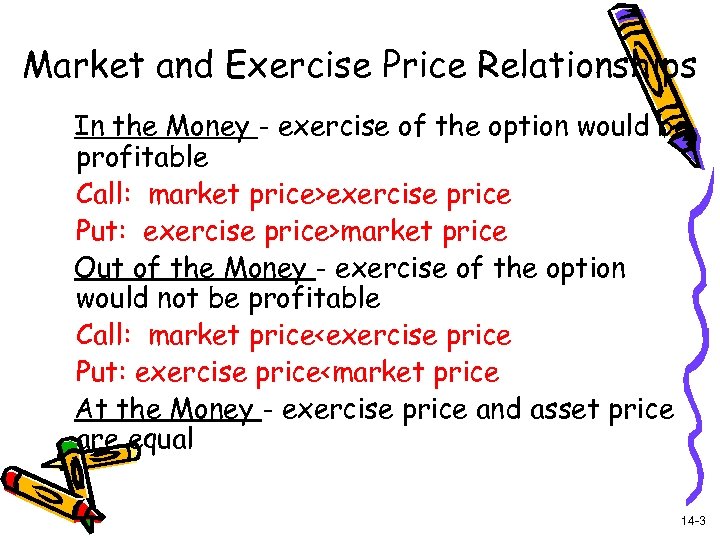

Market and Exercise Price Relationships In the Money - exercise of the option would be profitable Call: market price>exercise price Put: exercise price>market price Out of the Money - exercise of the option would not be profitable Call: market price

Market and Exercise Price Relationships In the Money - exercise of the option would be profitable Call: market price>exercise price Put: exercise price>market price Out of the Money - exercise of the option would not be profitable Call: market price

American vs European Options American - the option can be exercised at any time before expiration or maturity European - the option can only be exercised on the expiration or maturity date 14 -4

American vs European Options American - the option can be exercised at any time before expiration or maturity European - the option can only be exercised on the expiration or maturity date 14 -4

Different Types of Options • • • Stock Options Index Options Futures Options Foreign Currency Options Interest Rate Options 14 -5

Different Types of Options • • • Stock Options Index Options Futures Options Foreign Currency Options Interest Rate Options 14 -5

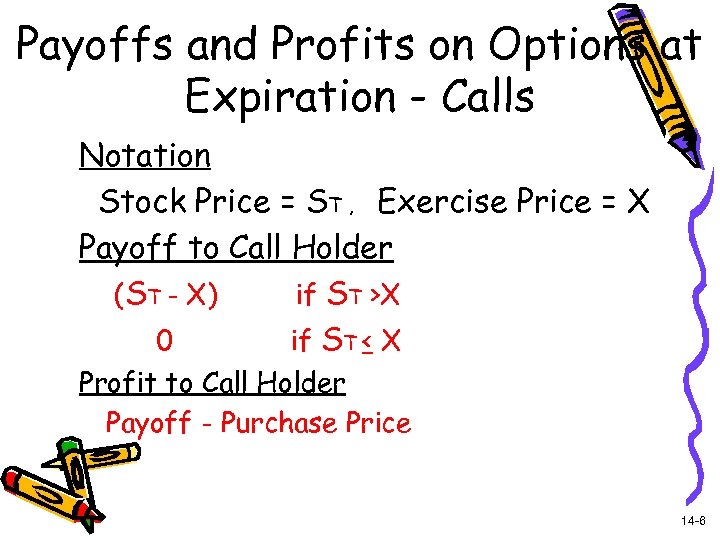

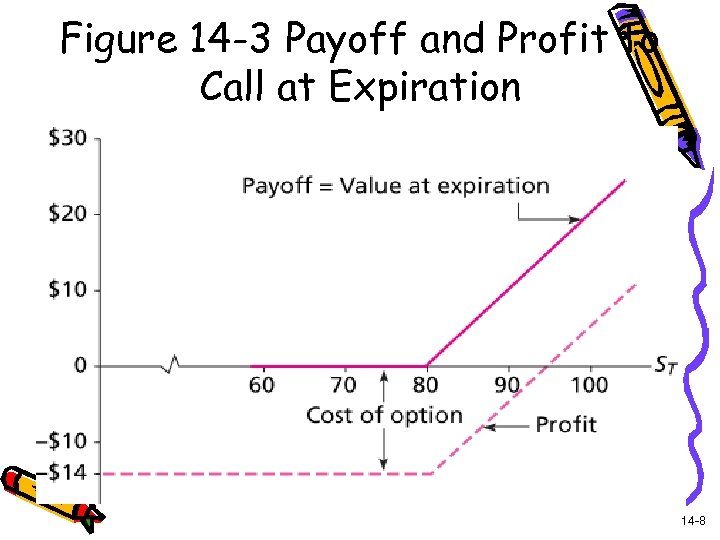

Payoffs and Profits on Options at Expiration - Calls Notation Stock Price = ST , Exercise Price = X Payoff to Call Holder (ST - X) if ST >X 0 if ST < X Profit to Call Holder Payoff - Purchase Price 14 -6

Payoffs and Profits on Options at Expiration - Calls Notation Stock Price = ST , Exercise Price = X Payoff to Call Holder (ST - X) if ST >X 0 if ST < X Profit to Call Holder Payoff - Purchase Price 14 -6

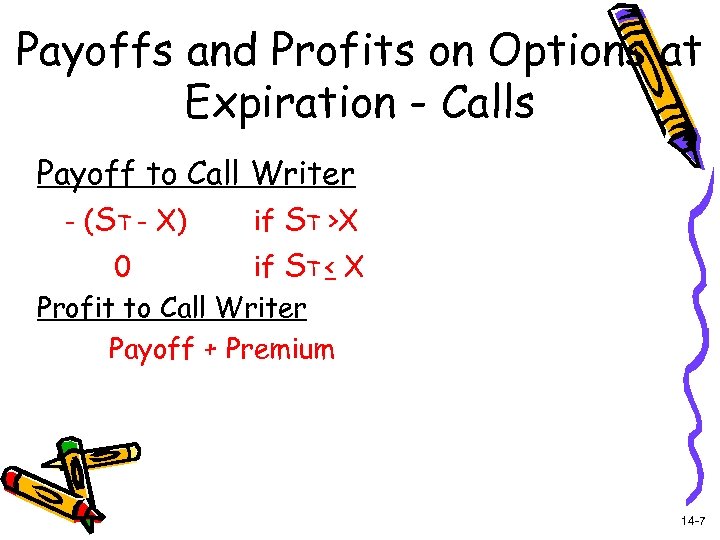

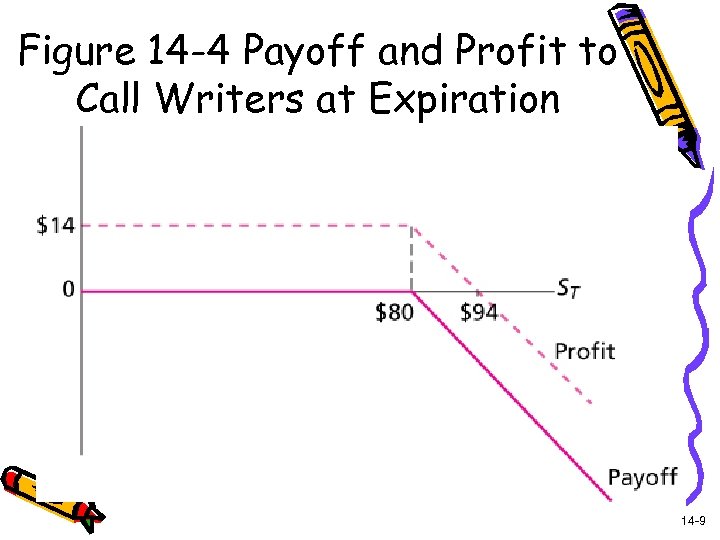

Payoffs and Profits on Options at Expiration - Calls Payoff to Call Writer - (ST - X) if ST >X 0 if ST < X Profit to Call Writer Payoff + Premium 14 -7

Payoffs and Profits on Options at Expiration - Calls Payoff to Call Writer - (ST - X) if ST >X 0 if ST < X Profit to Call Writer Payoff + Premium 14 -7

Figure 14 -3 Payoff and Profit to Call at Expiration 14 -8

Figure 14 -3 Payoff and Profit to Call at Expiration 14 -8

Figure 14 -4 Payoff and Profit to Call Writers at Expiration 14 -9

Figure 14 -4 Payoff and Profit to Call Writers at Expiration 14 -9

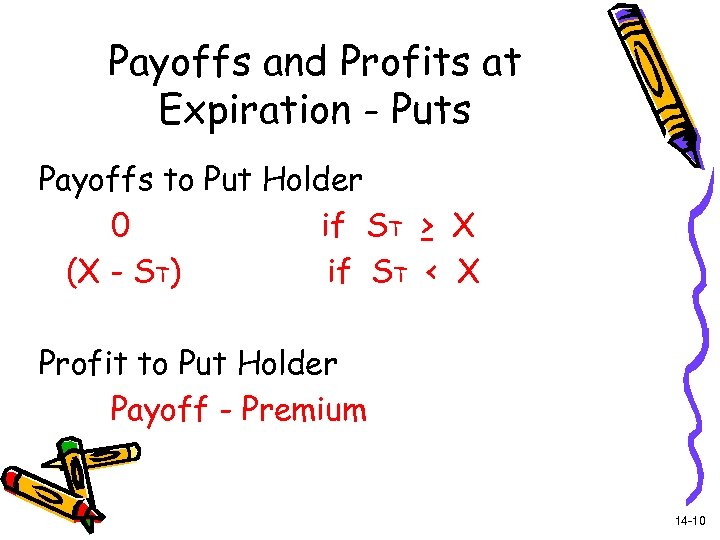

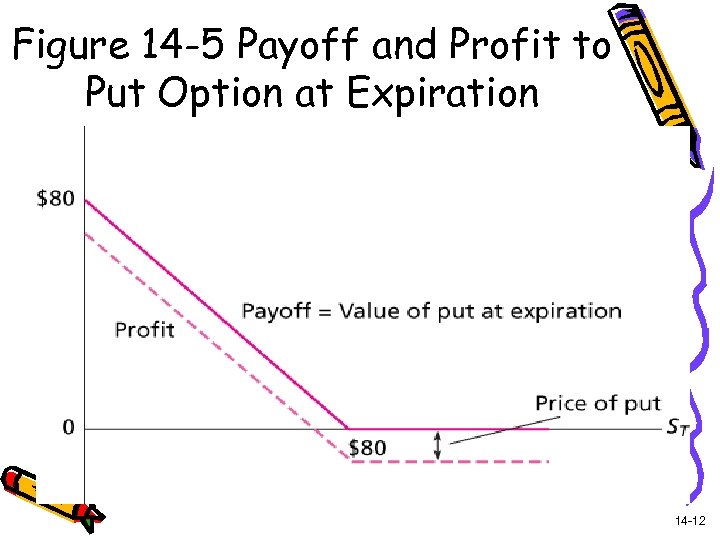

Payoffs and Profits at Expiration - Puts Payoffs to Put Holder 0 if ST > X (X - ST) if ST < X Profit to Put Holder Payoff - Premium 14 -10

Payoffs and Profits at Expiration - Puts Payoffs to Put Holder 0 if ST > X (X - ST) if ST < X Profit to Put Holder Payoff - Premium 14 -10

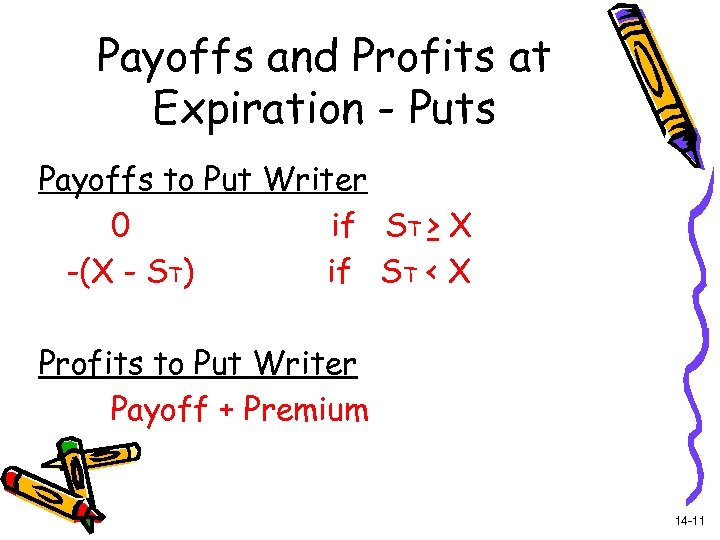

Payoffs and Profits at Expiration - Puts Payoffs to Put Writer 0 if ST > X -(X - ST) if ST < X Profits to Put Writer Payoff + Premium 14 -11

Payoffs and Profits at Expiration - Puts Payoffs to Put Writer 0 if ST > X -(X - ST) if ST < X Profits to Put Writer Payoff + Premium 14 -11

Figure 14 -5 Payoff and Profit to Put Option at Expiration 14 -12

Figure 14 -5 Payoff and Profit to Put Option at Expiration 14 -12

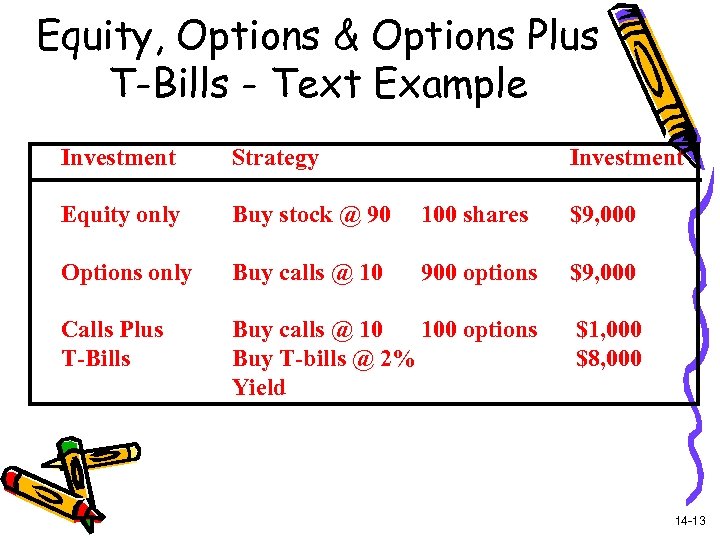

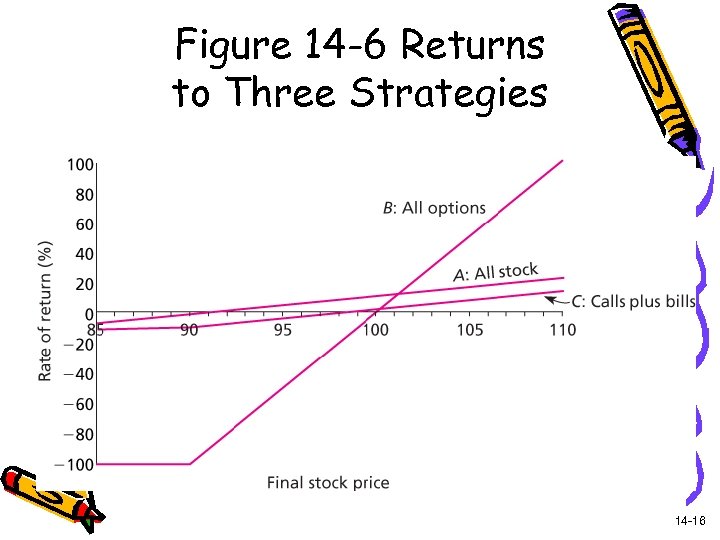

Equity, Options & Options Plus T-Bills - Text Example Investment Strategy Investment Equity only Buy stock @ 90 100 shares $9, 000 Options only Buy calls @ 10 900 options $9, 000 Calls Plus T-Bills Buy calls @ 10 100 options Buy T-bills @ 2% Yield $1, 000 $8, 000 14 -13

Equity, Options & Options Plus T-Bills - Text Example Investment Strategy Investment Equity only Buy stock @ 90 100 shares $9, 000 Options only Buy calls @ 10 900 options $9, 000 Calls Plus T-Bills Buy calls @ 10 100 options Buy T-bills @ 2% Yield $1, 000 $8, 000 14 -13

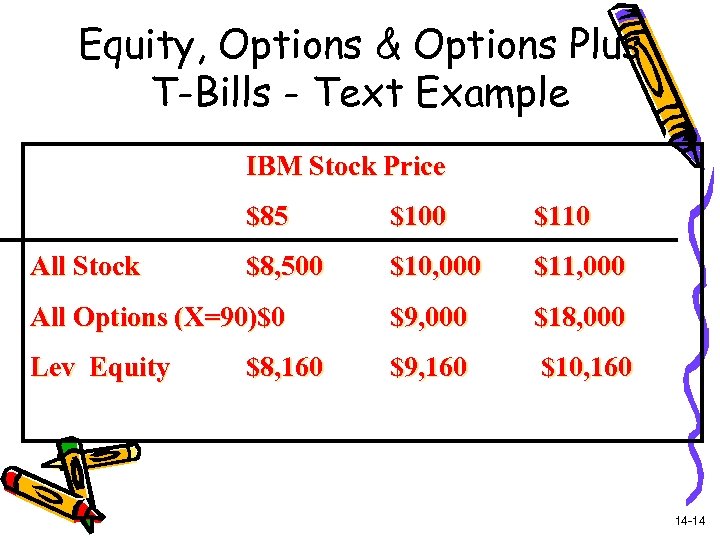

Equity, Options & Options Plus T-Bills - Text Example IBM Stock Price $85 $100 $110 $8, 500 $10, 000 $11, 000 All Options (X=90)$0 $9, 000 $18, 000 Lev Equity $9, 160 $10, 160 All Stock $8, 160 14 -14

Equity, Options & Options Plus T-Bills - Text Example IBM Stock Price $85 $100 $110 $8, 500 $10, 000 $11, 000 All Options (X=90)$0 $9, 000 $18, 000 Lev Equity $9, 160 $10, 160 All Stock $8, 160 14 -14

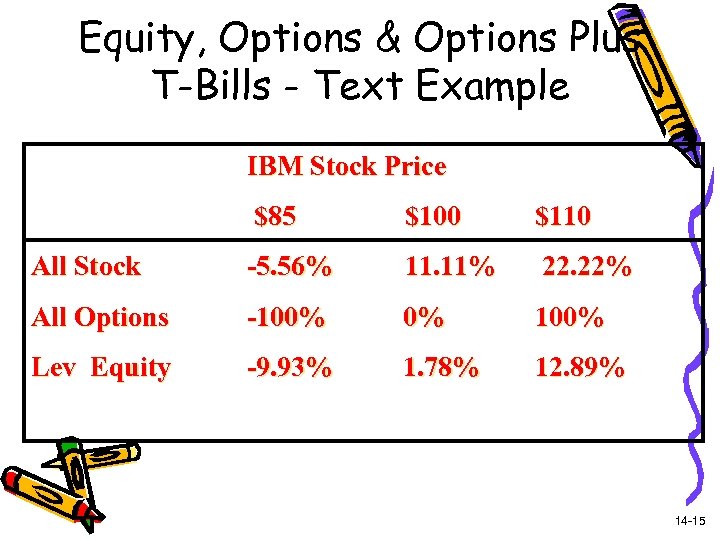

Equity, Options & Options Plus T-Bills - Text Example IBM Stock Price $85 $100 $110 All Stock -5. 56% 11. 11% 22. 22% All Options -100% 0% 100% Lev Equity -9. 93% 1. 78% 12. 89% 14 -15

Equity, Options & Options Plus T-Bills - Text Example IBM Stock Price $85 $100 $110 All Stock -5. 56% 11. 11% 22. 22% All Options -100% 0% 100% Lev Equity -9. 93% 1. 78% 12. 89% 14 -15

Figure 14 -6 Returns to Three Strategies 14 -16

Figure 14 -6 Returns to Three Strategies 14 -16

Option Strategies Protective Put Long Stock Long Put Straddle Long Call Long Put Covered Call Long Stock Short Call Bullish Spread Long Call Low Ex. Short Call High Ex. 14 -17

Option Strategies Protective Put Long Stock Long Put Straddle Long Call Long Put Covered Call Long Stock Short Call Bullish Spread Long Call Low Ex. Short Call High Ex. 14 -17

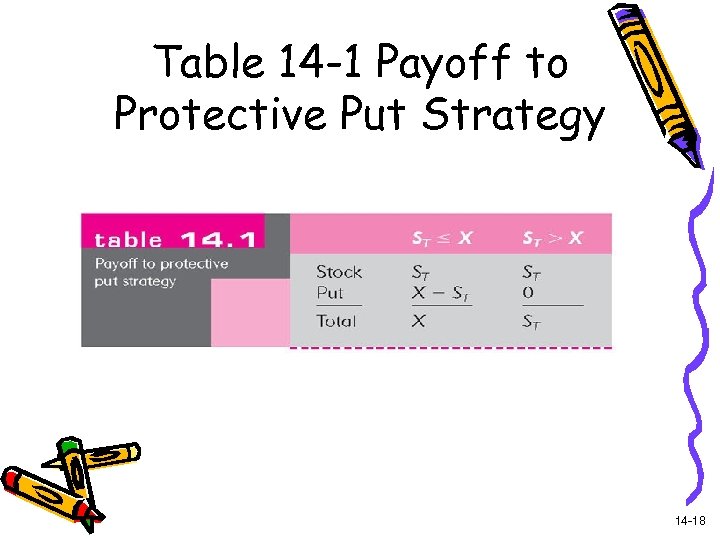

Table 14 -1 Payoff to Protective Put Strategy 14 -18

Table 14 -1 Payoff to Protective Put Strategy 14 -18

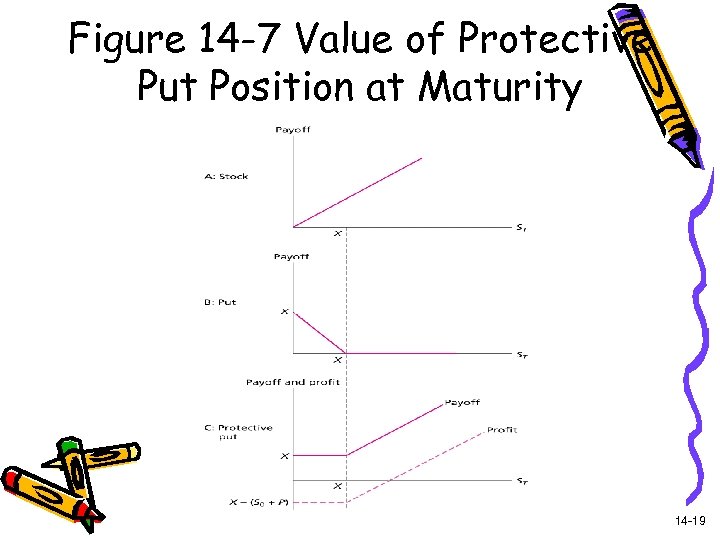

Figure 14 -7 Value of Protective Put Position at Maturity 14 -19

Figure 14 -7 Value of Protective Put Position at Maturity 14 -19

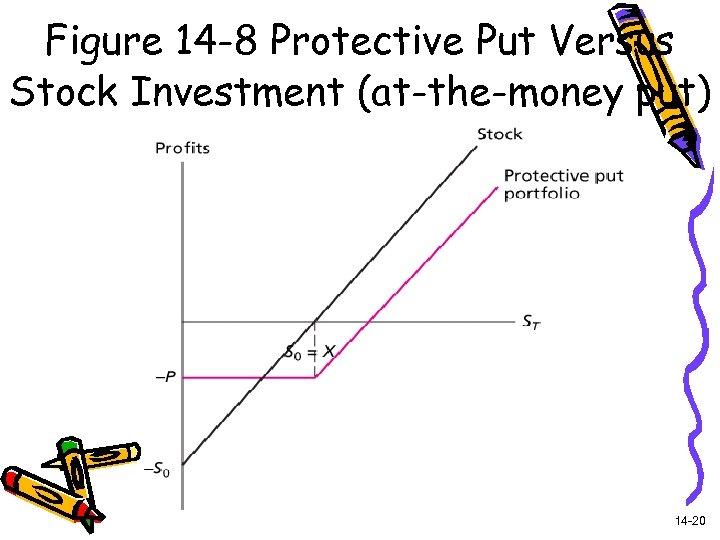

Figure 14 -8 Protective Put Versus Stock Investment (at-the-money put) 14 -20

Figure 14 -8 Protective Put Versus Stock Investment (at-the-money put) 14 -20

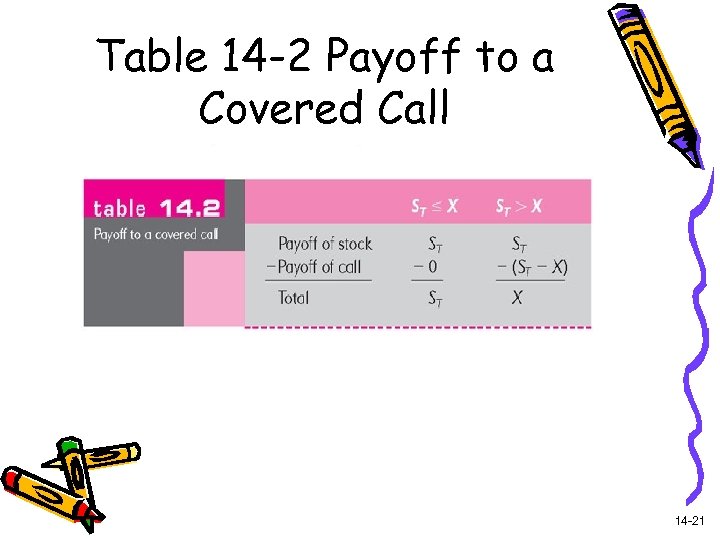

Table 14 -2 Payoff to a Covered Call 14 -21

Table 14 -2 Payoff to a Covered Call 14 -21

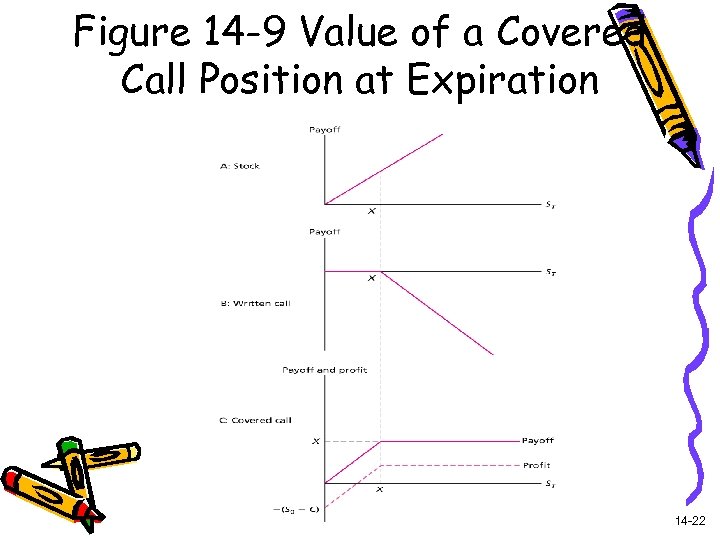

Figure 14 -9 Value of a Covered Call Position at Expiration 14 -22

Figure 14 -9 Value of a Covered Call Position at Expiration 14 -22

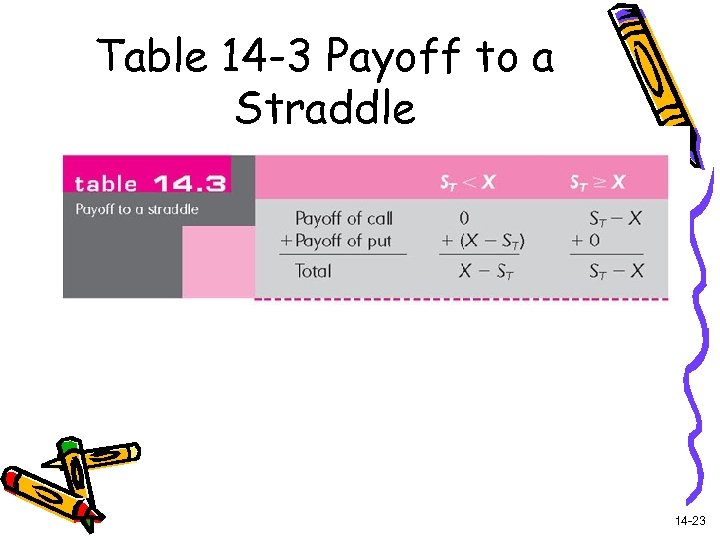

Table 14 -3 Payoff to a Straddle 14 -23

Table 14 -3 Payoff to a Straddle 14 -23

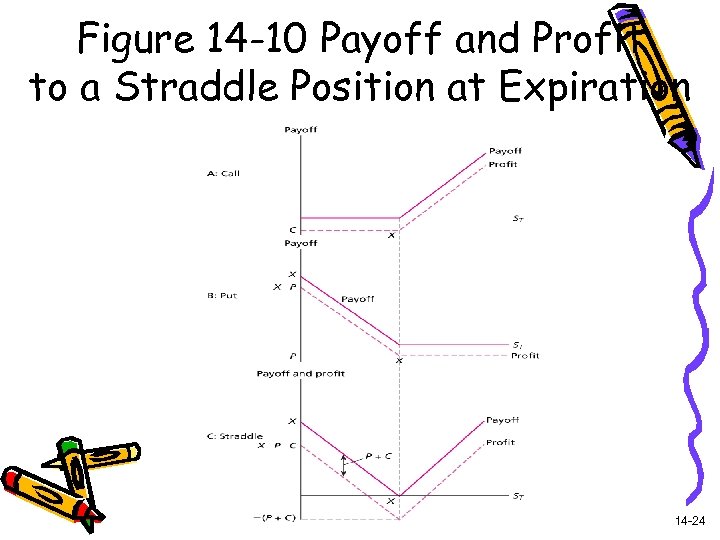

Figure 14 -10 Payoff and Profit to a Straddle Position at Expiration 14 -24

Figure 14 -10 Payoff and Profit to a Straddle Position at Expiration 14 -24

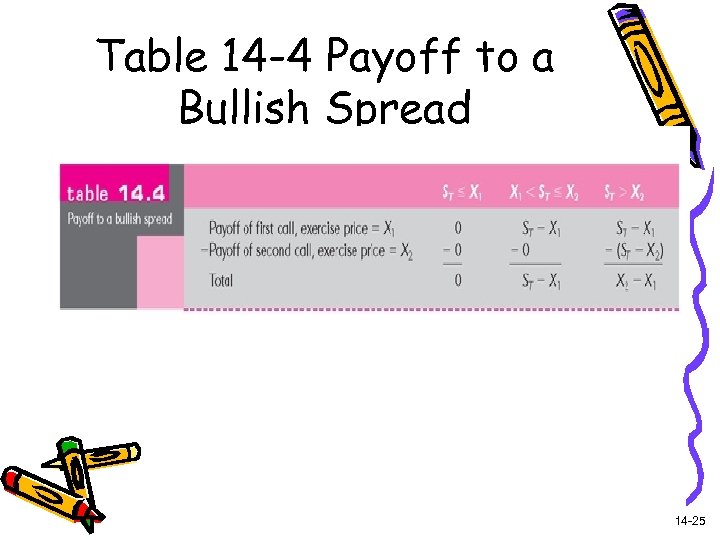

Table 14 -4 Payoff to a Bullish Spread 14 -25

Table 14 -4 Payoff to a Bullish Spread 14 -25

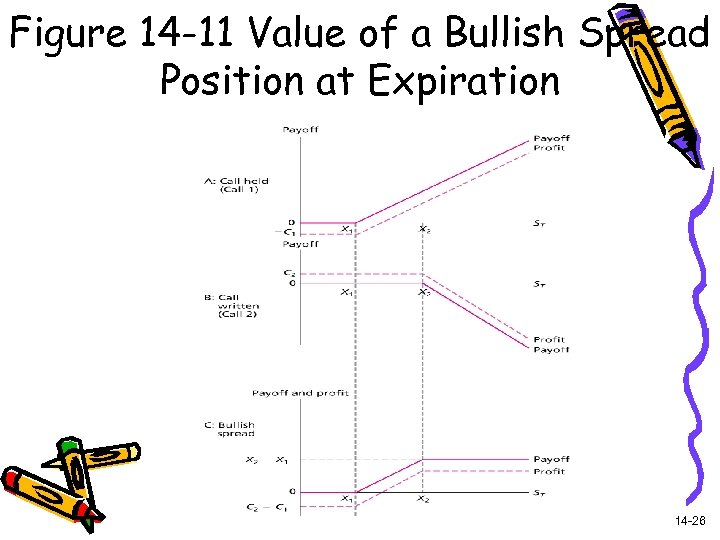

Figure 14 -11 Value of a Bullish Spread Position at Expiration 14 -26

Figure 14 -11 Value of a Bullish Spread Position at Expiration 14 -26