c6ffdd2f177fb5898426e800ff4060c4.ppt

- Количество слайдов: 29

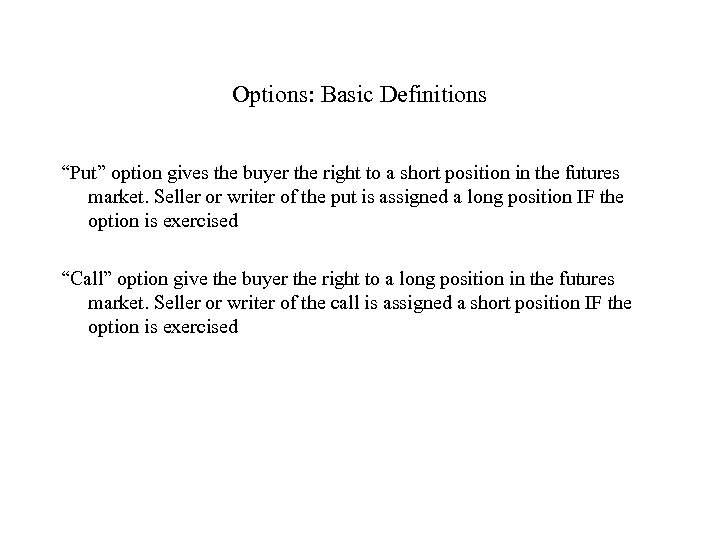

Options: Basic Definitions “Put” option gives the buyer the right to a short position in the futures market. Seller or writer of the put is assigned a long position IF the option is exercised “Call” option give the buyer the right to a long position in the futures market. Seller or writer of the call is assigned a short position IF the option is exercised

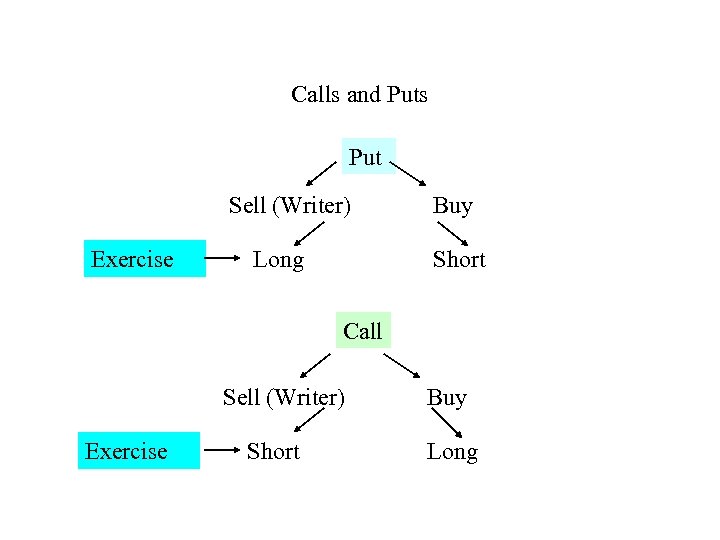

Calls and Puts Put Sell (Writer) Exercise Long Buy Short Call Sell (Writer) Exercise Short Buy Long

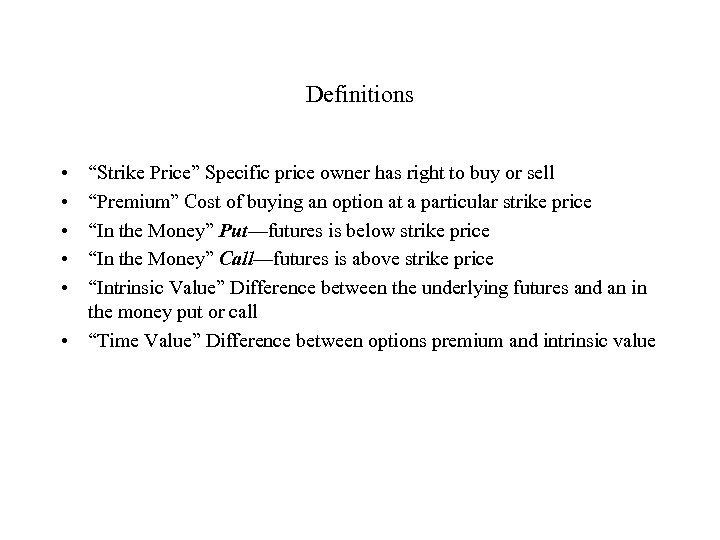

Definitions • • • “Strike Price” Specific price owner has right to buy or sell “Premium” Cost of buying an option at a particular strike price “In the Money” Put—futures is below strike price “In the Money” Call—futures is above strike price “Intrinsic Value” Difference between the underlying futures and an in the money put or call • “Time Value” Difference between options premium and intrinsic value

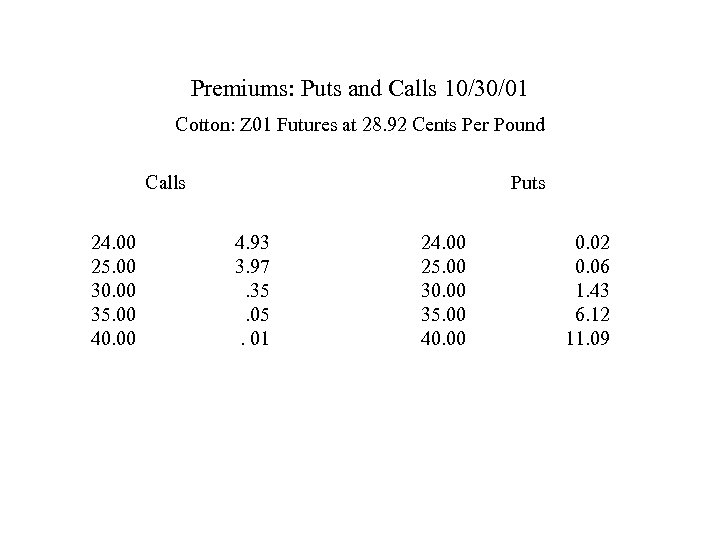

Premiums: Puts and Calls 10/30/01 Cotton: Z 01 Futures at 28. 92 Cents Per Pound Calls 24. 00 25. 00 30. 00 35. 00 40. 00 Puts 4. 93 3. 97. 35. 01 24. 00 25. 00 30. 00 35. 00 40. 00 0. 02 0. 06 1. 43 6. 12 11. 09

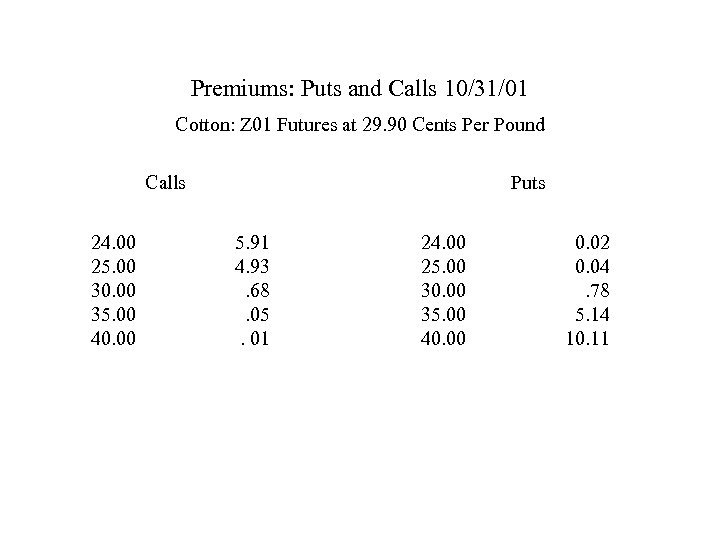

Premiums: Puts and Calls 10/31/01 Cotton: Z 01 Futures at 29. 90 Cents Per Pound Calls 24. 00 25. 00 30. 00 35. 00 40. 00 Puts 5. 91 4. 93. 68. 05. 01 24. 00 25. 00 30. 00 35. 00 40. 00 0. 02 0. 04. 78 5. 14 10. 11

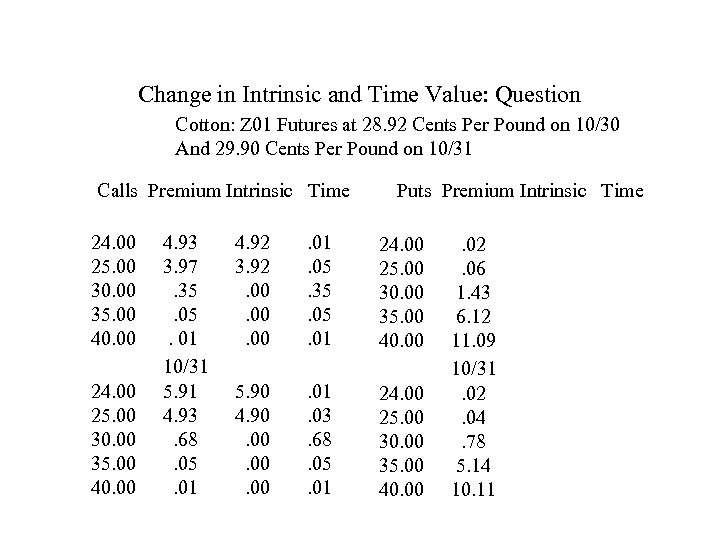

Change in Intrinsic and Time Value: Question Cotton: Z 01 Futures at 28. 92 Cents Per Pound on 10/30 And 29. 90 Cents Per Pound on 10/31 Calls Premium Intrinsic Time 24. 00 25. 00 30. 00 35. 00 40. 00 4. 93 3. 97. 35. 01 10/31 5. 91 4. 93. 68. 05. 01 Puts Premium Intrinsic Time 4. 92 3. 92. 00. 00 . 01. 05. 35. 01 24. 00 25. 00 30. 00 35. 00 40. 00 5. 90 4. 90. 00. 00 . 01. 03. 68. 05. 01 24. 00 25. 00 30. 00 35. 00 40. 00 . 02. 06 1. 43 6. 12 11. 09 10/31. 02. 04. 78 5. 14 10. 11

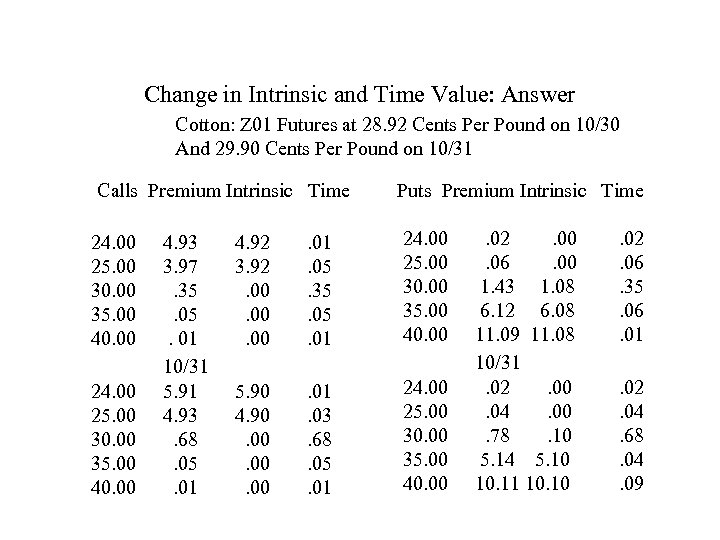

Change in Intrinsic and Time Value: Answer Cotton: Z 01 Futures at 28. 92 Cents Per Pound on 10/30 And 29. 90 Cents Per Pound on 10/31 Calls Premium Intrinsic Time Puts Premium Intrinsic Time 24. 00 25. 00 30. 00 35. 00 40. 00 4. 93 3. 97. 35. 01 10/31 5. 91 4. 93. 68. 05. 01 4. 92 3. 92. 00. 00 . 01. 05. 35. 01 24. 00 25. 00 30. 00 35. 00 40. 00 5. 90 4. 90. 00. 00 . 01. 03. 68. 05. 01 24. 00 25. 00 30. 00 35. 00 40. 00 . 02. 00. 06. 00 1. 43 1. 08 6. 12 6. 08 11. 09 11. 08 10/31. 02. 00. 04. 00. 78. 10 5. 14 5. 10 10. 11 10. 10 . 02. 06. 35. 06. 01. 02. 04. 68. 04. 09

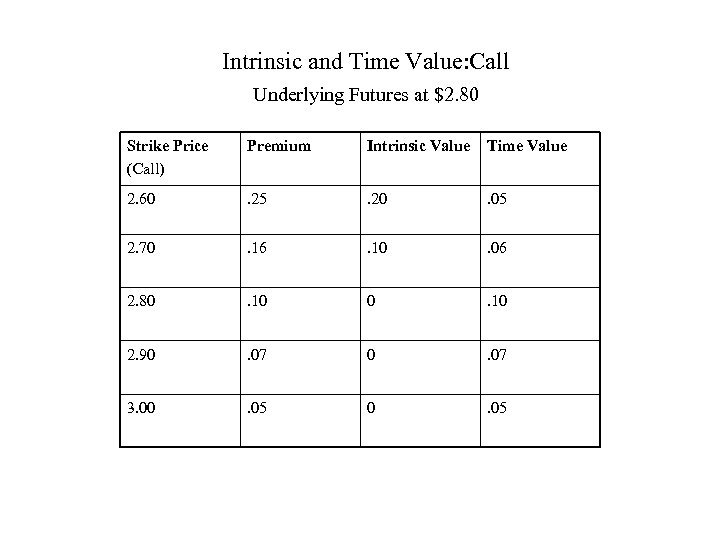

Intrinsic and Time Value: Call Underlying Futures at $2. 80 Strike Price (Call) Premium Intrinsic Value Time Value 2. 60 . 25 . 20 . 05 2. 70 . 16 . 10 . 06 2. 80 . 10 2. 90 . 07 3. 00 . 05

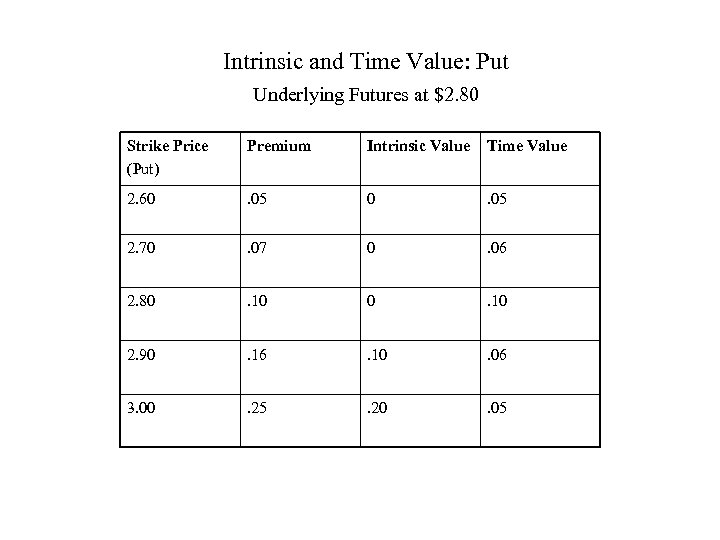

Intrinsic and Time Value: Put Underlying Futures at $2. 80 Strike Price (Put) Premium Intrinsic Value Time Value 2. 60 . 05 2. 70 . 07 0 . 06 2. 80 . 10 2. 90 . 16 . 10 . 06 3. 00 . 25 . 20 . 05

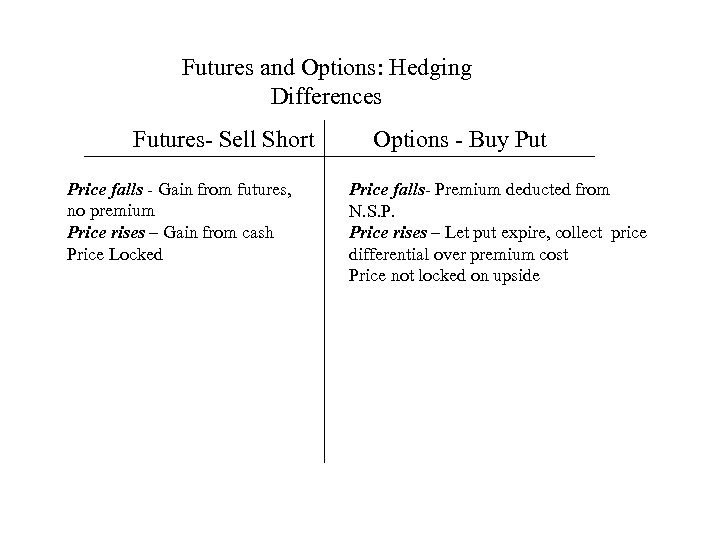

Futures and Options: Hedging Differences Futures- Sell Short Price falls - Gain from futures, no premium Price rises – Gain from cash Price Locked Options - Buy Put Price falls- Premium deducted from N. S. P. Price rises – Let put expire, collect price differential over premium cost Price not locked on upside

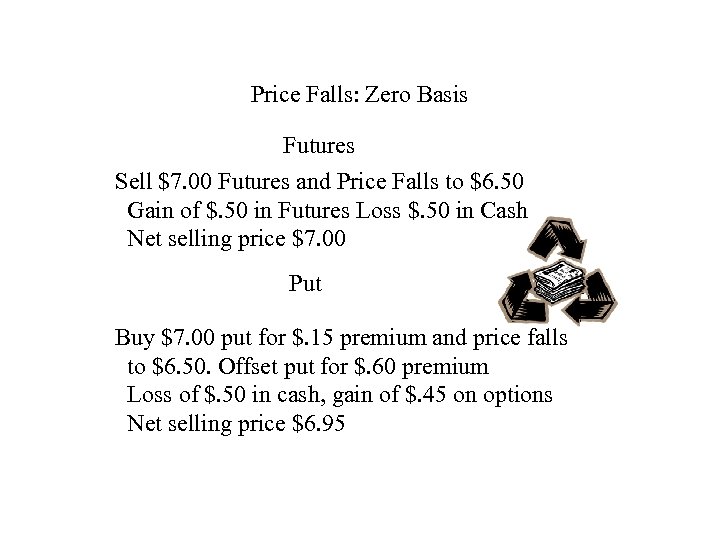

Price Falls: Zero Basis Futures Sell $7. 00 Futures and Price Falls to $6. 50 Gain of $. 50 in Futures Loss $. 50 in Cash Net selling price $7. 00 Put Buy $7. 00 put for $. 15 premium and price falls to $6. 50. Offset put for $. 60 premium Loss of $. 50 in cash, gain of $. 45 on options Net selling price $6. 95

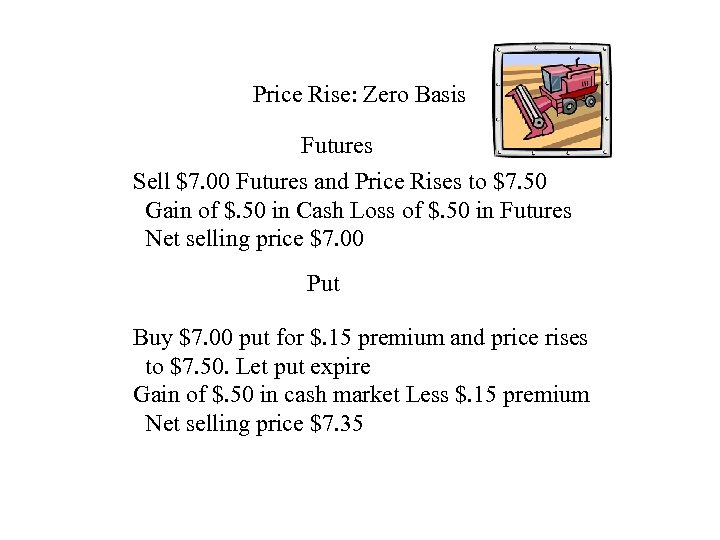

Price Rise: Zero Basis Futures Sell $7. 00 Futures and Price Rises to $7. 50 Gain of $. 50 in Cash Loss of $. 50 in Futures Net selling price $7. 00 Put Buy $7. 00 put for $. 15 premium and price rises to $7. 50. Let put expire Gain of $. 50 in cash market Less $. 15 premium Net selling price $7. 35

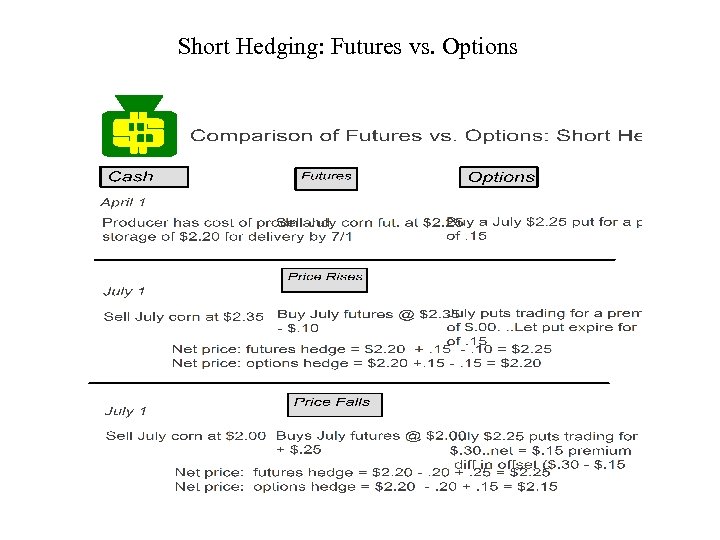

Short Hedging: Futures vs. Options

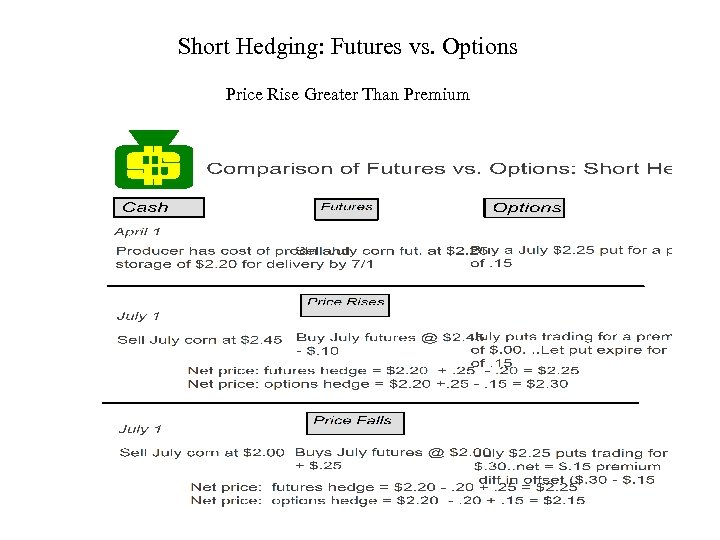

Short Hedging: Futures vs. Options Price Rise Greater Than Premium

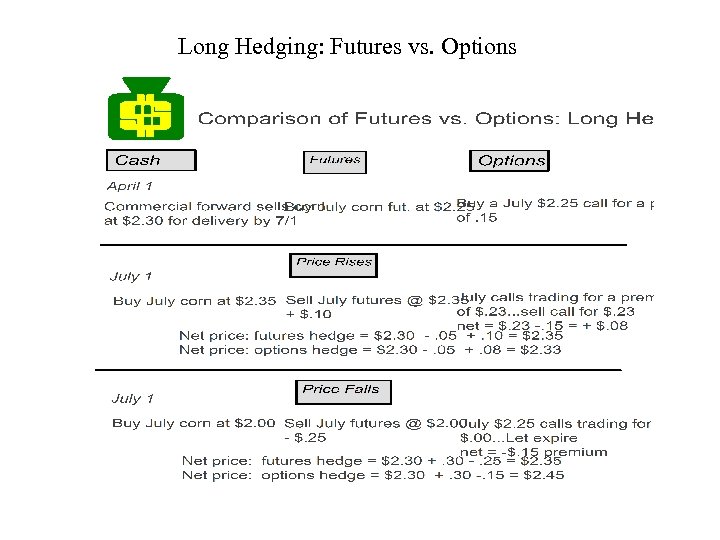

Long Hedging: Futures vs. Options

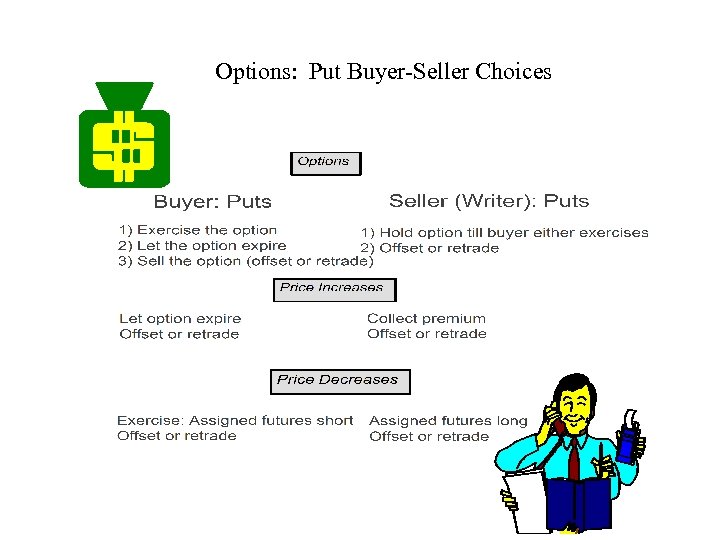

Options: Put Buyer-Seller Choices

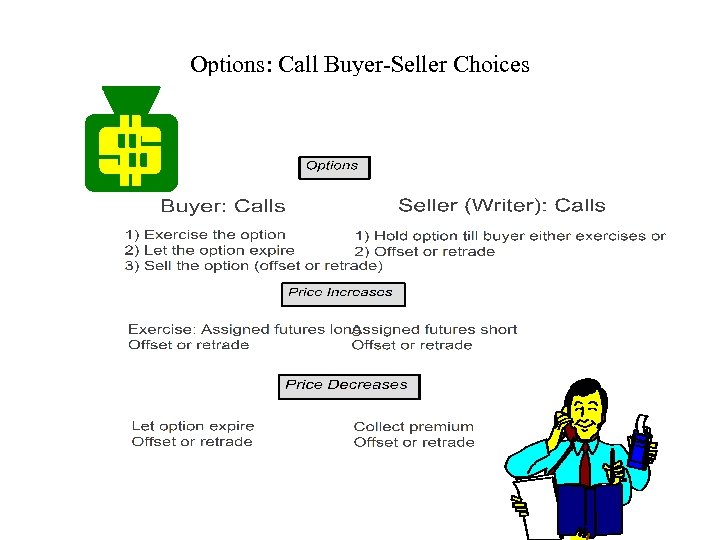

Options: Call Buyer-Seller Choices

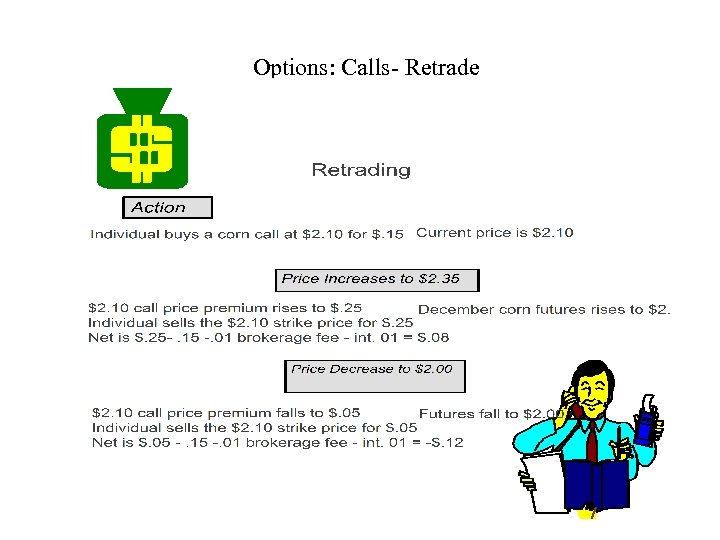

Options: Calls- Retrade

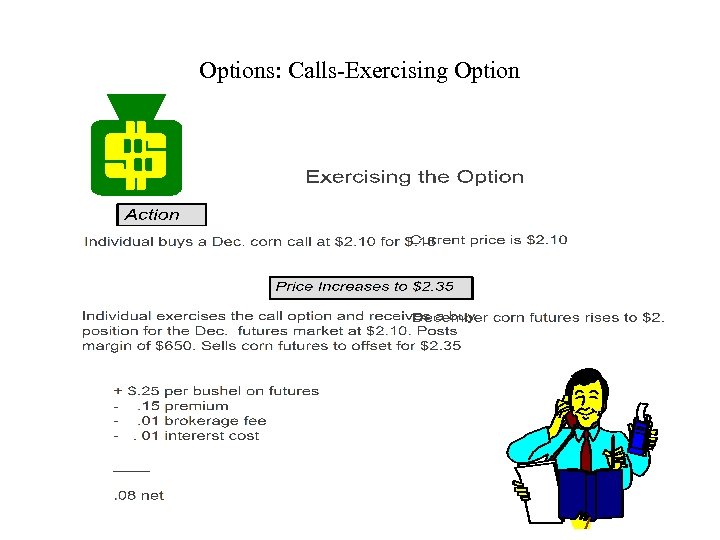

Options: Calls-Exercising Option

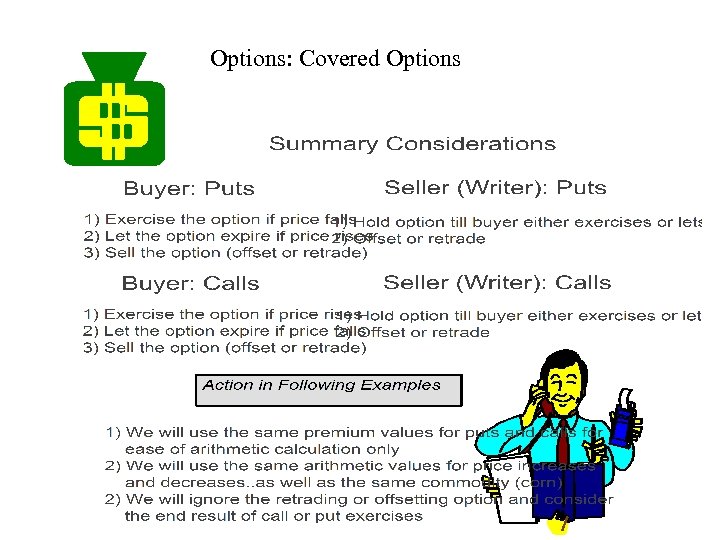

Options: Covered Options

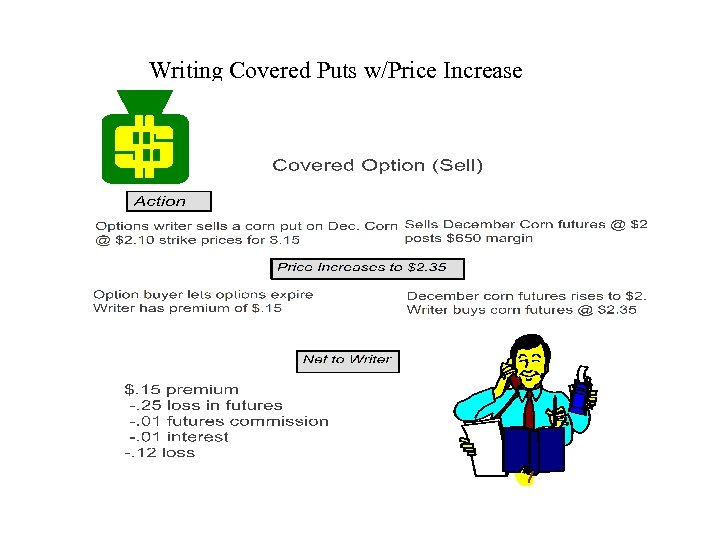

Writing Covered Puts w/Price Increase

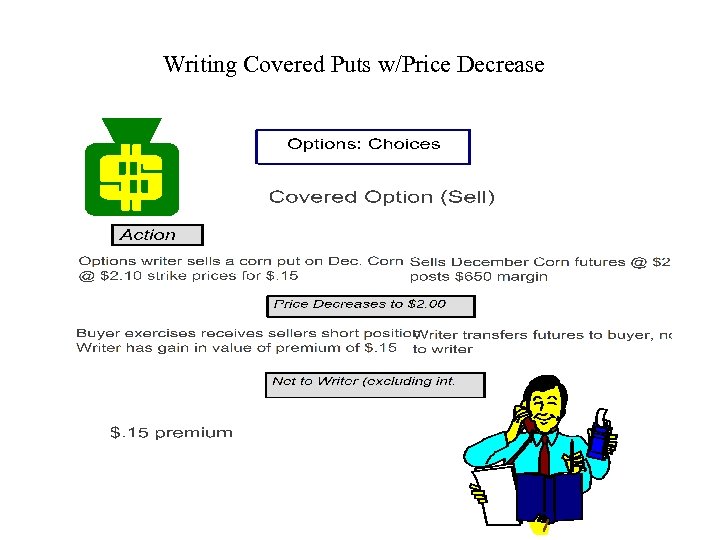

Writing Covered Puts w/Price Decrease

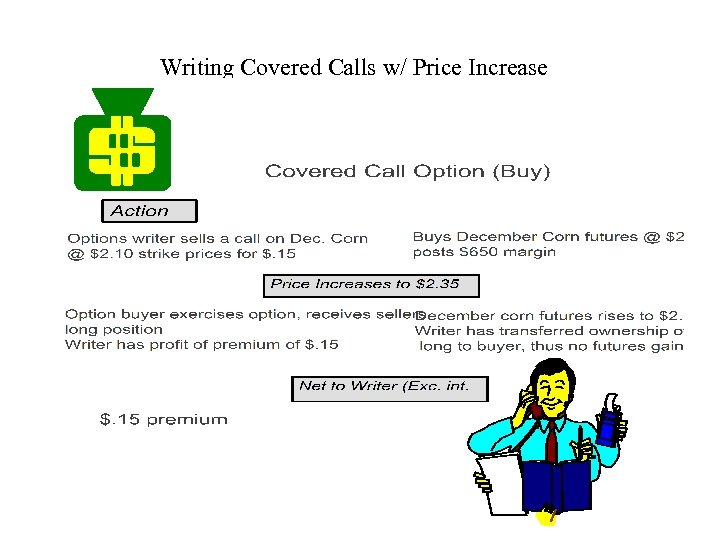

Writing Covered Calls w/ Price Increase

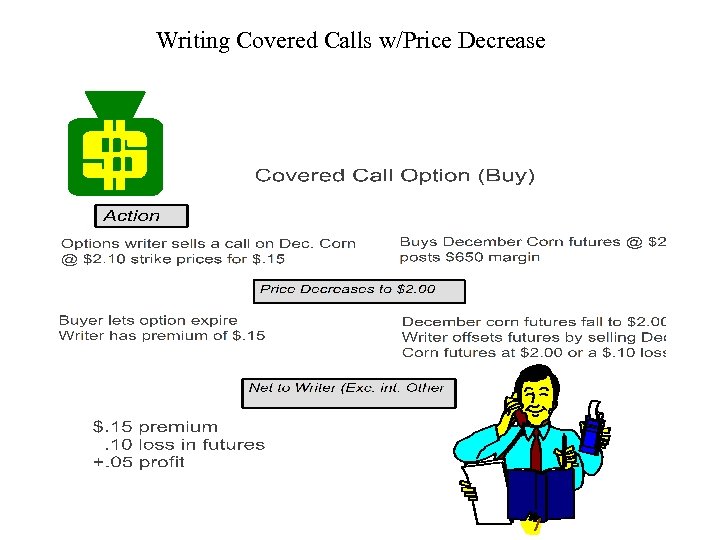

Writing Covered Calls w/Price Decrease

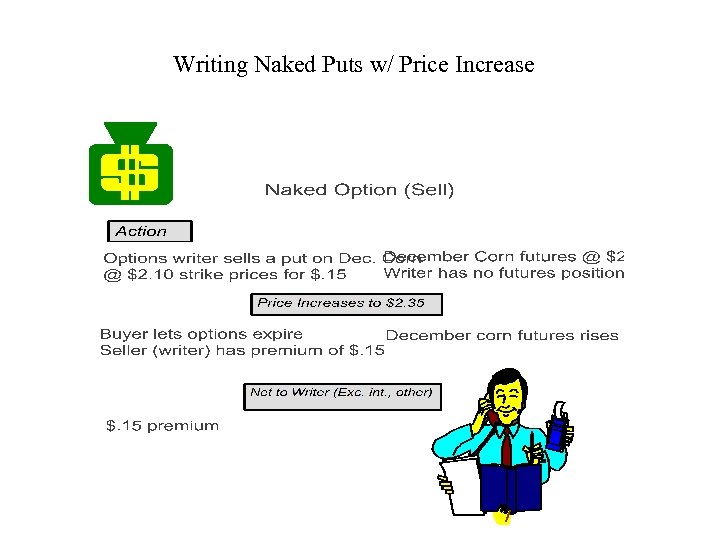

Writing Naked Puts w/ Price Increase

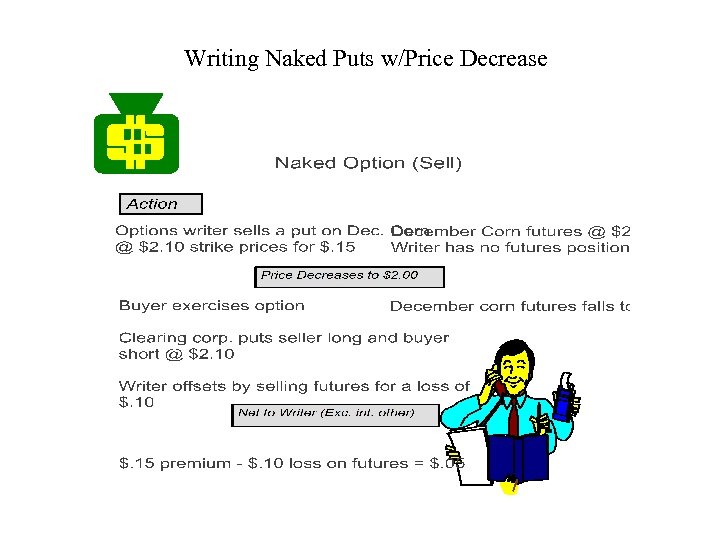

Writing Naked Puts w/Price Decrease

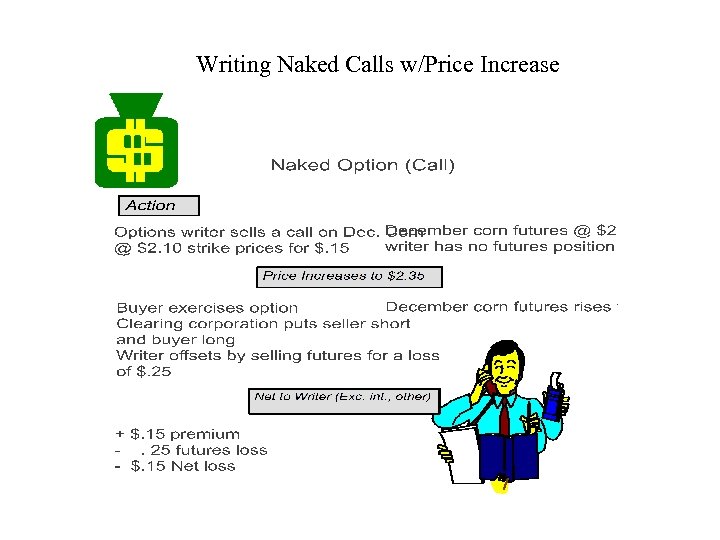

Writing Naked Calls w/Price Increase

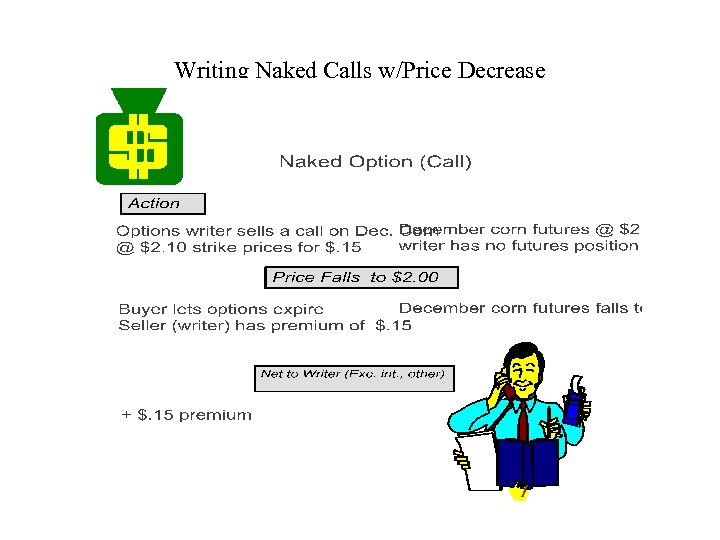

Writing Naked Calls w/Price Decrease

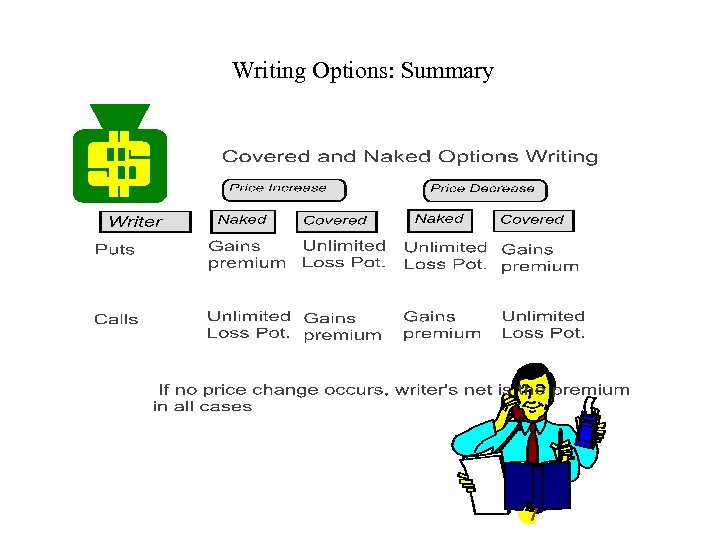

Writing Options: Summary

c6ffdd2f177fb5898426e800ff4060c4.ppt