13b2cc9376ed8466cac75c10ddeeb8ab.ppt

- Количество слайдов: 29

Options and Speculative Markets 2004 -2005 Introduction Professor André Farber Solvay Business School Université Libre de Bruxelles OMS 01 Introduction

Options and Speculative Markets 2004 -2005 Introduction Professor André Farber Solvay Business School Université Libre de Bruxelles OMS 01 Introduction

1. Introduction • Outline of this session 1. Course outline 2. Derivatives 3. Forward contracts 4. Options contracts 5. The derivatives markets 6. Futures contracts August 23, 2004 OMS 01 Introduction 2

1. Introduction • Outline of this session 1. Course outline 2. Derivatives 3. Forward contracts 4. Options contracts 5. The derivatives markets 6. Futures contracts August 23, 2004 OMS 01 Introduction 2

• Reference: John HULL Options, Futures and Other Derivatives, Fifth edition, Prentice Hall 2003 • Copies of my slides will be available on my website: www. ulb. ac. be/cours/solvay/farber • Grades: – Cases: 20% – Final exam: 80% August 23, 2004 OMS 01 Introduction 3

• Reference: John HULL Options, Futures and Other Derivatives, Fifth edition, Prentice Hall 2003 • Copies of my slides will be available on my website: www. ulb. ac. be/cours/solvay/farber • Grades: – Cases: 20% – Final exam: 80% August 23, 2004 OMS 01 Introduction 3

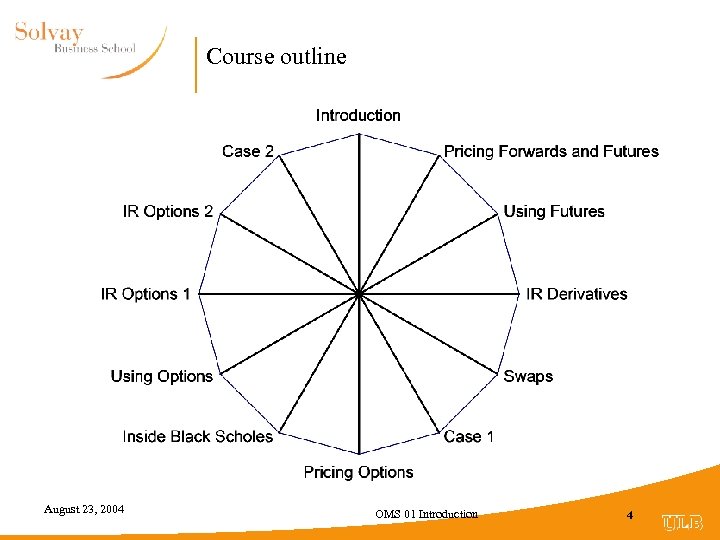

Course outline August 23, 2004 OMS 01 Introduction 4

Course outline August 23, 2004 OMS 01 Introduction 4

Derivatives • A derivative is an instrument whose value depends on the value of other more basic underlying variables • 2 main families: • Forward, Futures, Swaps • Options • = DERIVATIVE INSTRUMENTS • value depends on some underlying asset August 23, 2004 OMS 01 Introduction 5

Derivatives • A derivative is an instrument whose value depends on the value of other more basic underlying variables • 2 main families: • Forward, Futures, Swaps • Options • = DERIVATIVE INSTRUMENTS • value depends on some underlying asset August 23, 2004 OMS 01 Introduction 5

Forward contract: Definition • Contract whereby parties are committed: – to buy (sell) – an underlying asset – at some future date (maturity) – at a delivery price (forward price) set in advance • • The forward price for a contract is the delivery price that would be applicable to the contract if were negotiated today (i. e. , it is the delivery price that would make the contract worth exactly zero) The forward price may be different for contracts of different maturities • • Buying forward = "LONG" position Selling forward = "SHORT" position When contract initiated: No cash flow Obligation to transact August 23, 2004 OMS 01 Introduction 6

Forward contract: Definition • Contract whereby parties are committed: – to buy (sell) – an underlying asset – at some future date (maturity) – at a delivery price (forward price) set in advance • • The forward price for a contract is the delivery price that would be applicable to the contract if were negotiated today (i. e. , it is the delivery price that would make the contract worth exactly zero) The forward price may be different for contracts of different maturities • • Buying forward = "LONG" position Selling forward = "SHORT" position When contract initiated: No cash flow Obligation to transact August 23, 2004 OMS 01 Introduction 6

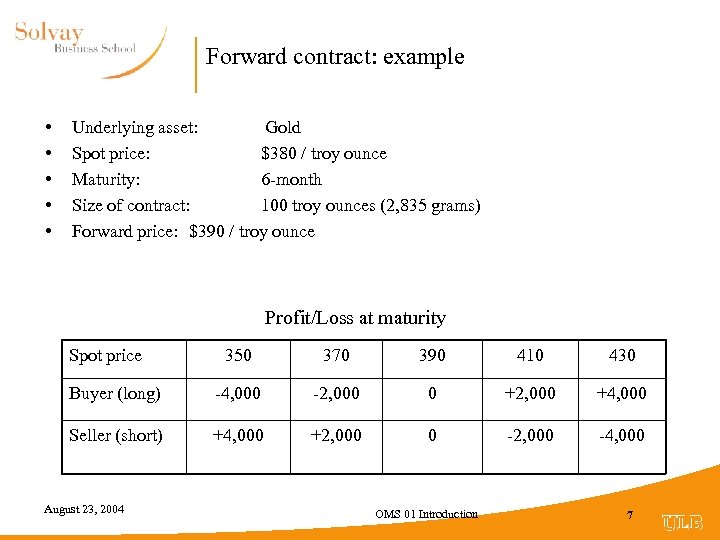

Forward contract: example • • • Underlying asset: Gold Spot price: $380 / troy ounce Maturity: 6 -month Size of contract: 100 troy ounces (2, 835 grams) Forward price: $390 / troy ounce Profit/Loss at maturity Spot price 350 370 390 410 430 Buyer (long) -4, 000 -2, 000 0 +2, 000 +4, 000 Seller (short) +4, 000 +2, 000 0 -2, 000 -4, 000 August 23, 2004 OMS 01 Introduction 7

Forward contract: example • • • Underlying asset: Gold Spot price: $380 / troy ounce Maturity: 6 -month Size of contract: 100 troy ounces (2, 835 grams) Forward price: $390 / troy ounce Profit/Loss at maturity Spot price 350 370 390 410 430 Buyer (long) -4, 000 -2, 000 0 +2, 000 +4, 000 Seller (short) +4, 000 +2, 000 0 -2, 000 -4, 000 August 23, 2004 OMS 01 Introduction 7

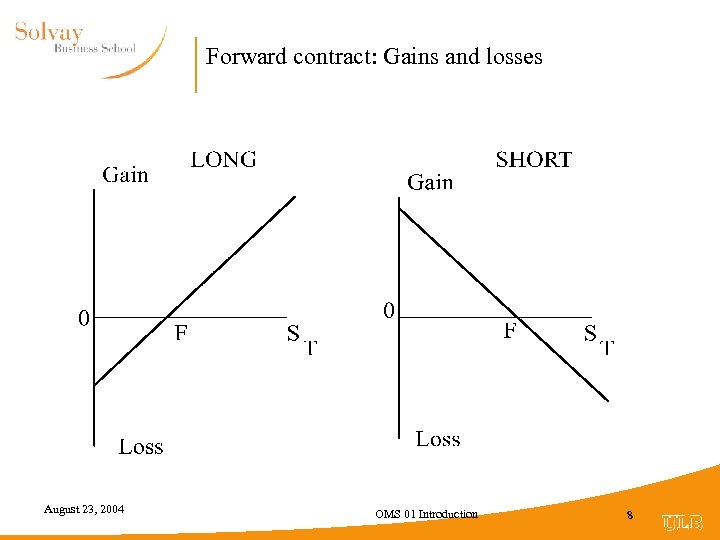

Forward contract: Gains and losses August 23, 2004 OMS 01 Introduction 8

Forward contract: Gains and losses August 23, 2004 OMS 01 Introduction 8

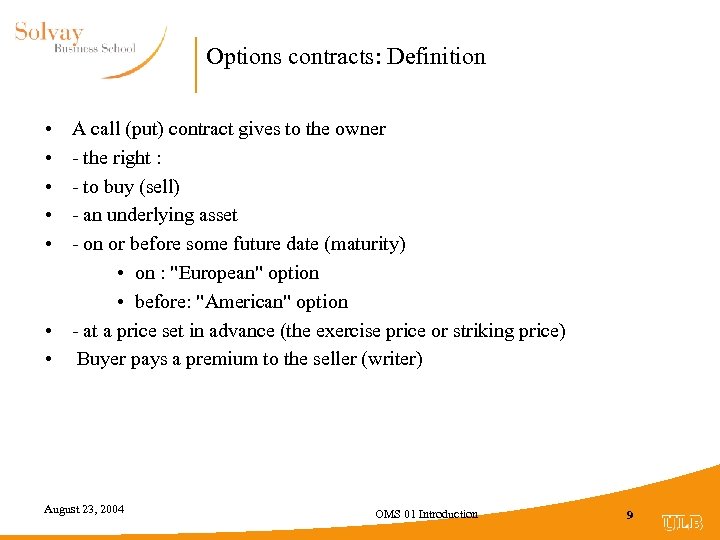

Options contracts: Definition • • • A call (put) contract gives to the owner - the right : - to buy (sell) - an underlying asset - on or before some future date (maturity) • on : "European" option • before: "American" option • - at a price set in advance (the exercise price or striking price) • Buyer pays a premium to the seller (writer) August 23, 2004 OMS 01 Introduction 9

Options contracts: Definition • • • A call (put) contract gives to the owner - the right : - to buy (sell) - an underlying asset - on or before some future date (maturity) • on : "European" option • before: "American" option • - at a price set in advance (the exercise price or striking price) • Buyer pays a premium to the seller (writer) August 23, 2004 OMS 01 Introduction 9

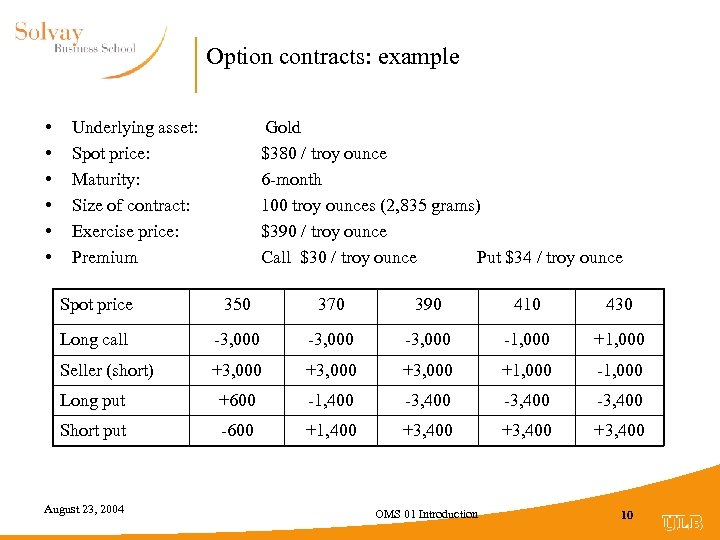

Option contracts: example • • • Underlying asset: Spot price: Maturity: Size of contract: Exercise price: Premium Gold $380 / troy ounce 6 -month 100 troy ounces (2, 835 grams) $390 / troy ounce Call $30 / troy ounce Put $34 / troy ounce Spot price 350 370 390 410 430 Long call -3, 000 -1, 000 +1, 000 Seller (short) +3, 000 +1, 000 -1, 000 Long put +600 -1, 400 -3, 400 Short put -600 +1, 400 +3, 400 August 23, 2004 OMS 01 Introduction 10

Option contracts: example • • • Underlying asset: Spot price: Maturity: Size of contract: Exercise price: Premium Gold $380 / troy ounce 6 -month 100 troy ounces (2, 835 grams) $390 / troy ounce Call $30 / troy ounce Put $34 / troy ounce Spot price 350 370 390 410 430 Long call -3, 000 -1, 000 +1, 000 Seller (short) +3, 000 +1, 000 -1, 000 Long put +600 -1, 400 -3, 400 Short put -600 +1, 400 +3, 400 August 23, 2004 OMS 01 Introduction 10

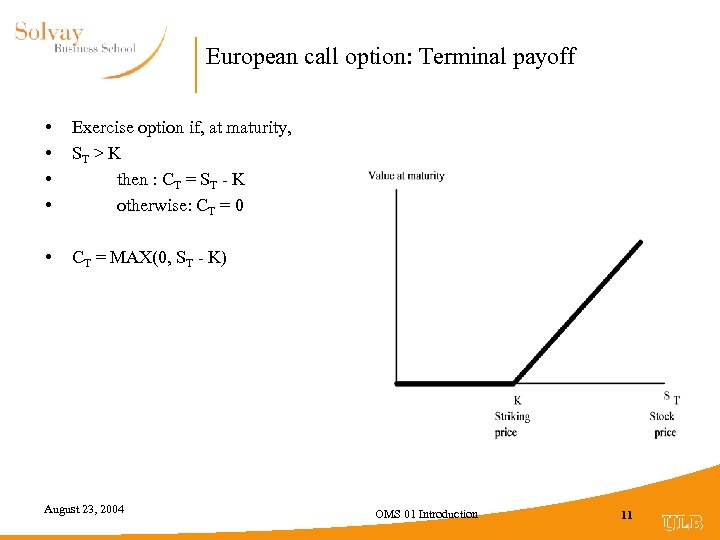

European call option: Terminal payoff • • Exercise option if, at maturity, ST > K then : CT = ST - K otherwise: CT = 0 • CT = MAX(0, ST - K) August 23, 2004 OMS 01 Introduction 11

European call option: Terminal payoff • • Exercise option if, at maturity, ST > K then : CT = ST - K otherwise: CT = 0 • CT = MAX(0, ST - K) August 23, 2004 OMS 01 Introduction 11

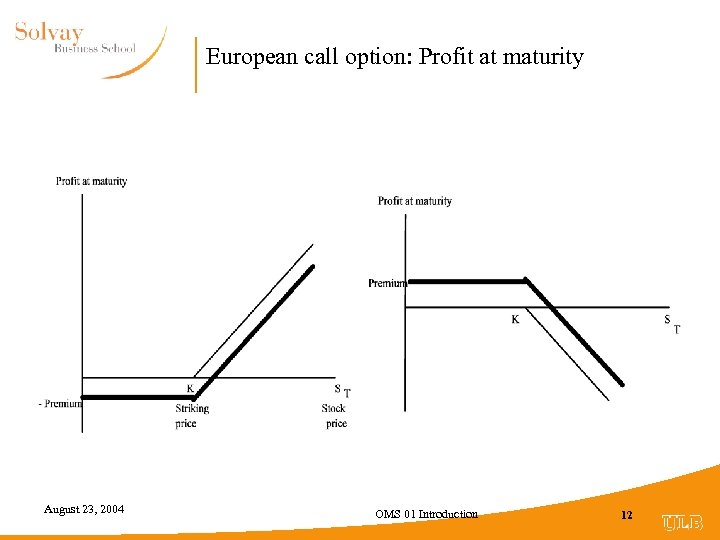

European call option: Profit at maturity August 23, 2004 OMS 01 Introduction 12

European call option: Profit at maturity August 23, 2004 OMS 01 Introduction 12

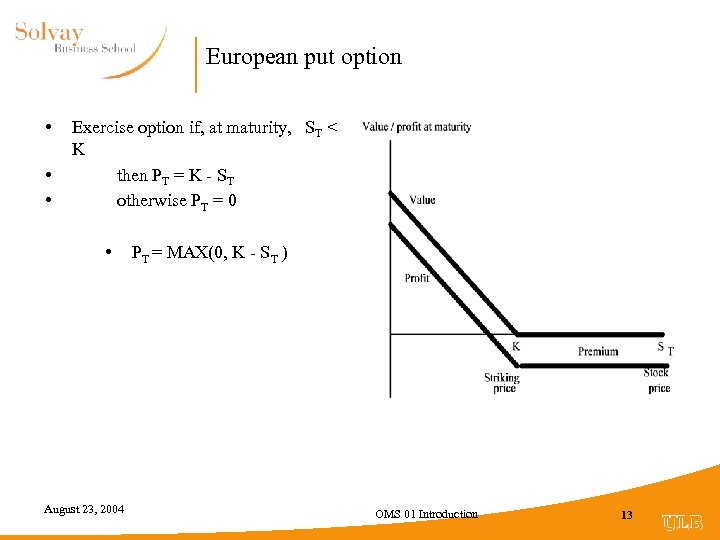

European put option • • • Exercise option if, at maturity, ST < K then PT = K - ST otherwise PT = 0 • August 23, 2004 PT = MAX(0, K - ST ) OMS 01 Introduction 13

European put option • • • Exercise option if, at maturity, ST < K then PT = K - ST otherwise PT = 0 • August 23, 2004 PT = MAX(0, K - ST ) OMS 01 Introduction 13

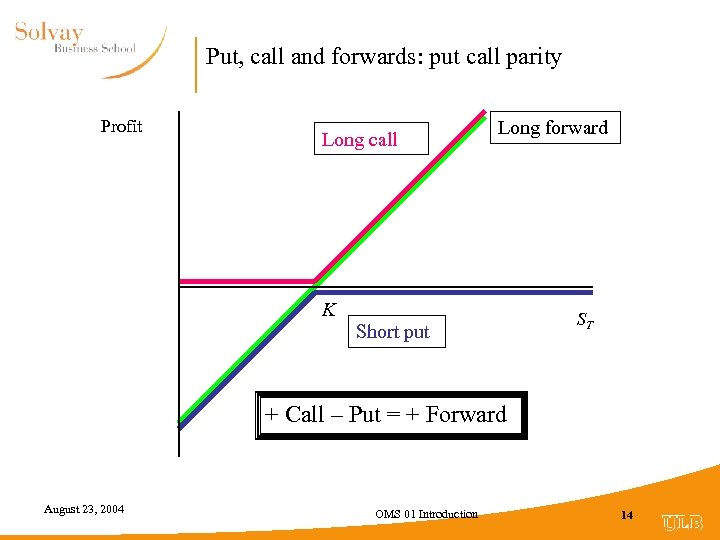

Put, call and forwards: put call parity Profit Long call Long forward K Short put ST + Call – Put = + Forward August 23, 2004 OMS 01 Introduction 14

Put, call and forwards: put call parity Profit Long call Long forward K Short put ST + Call – Put = + Forward August 23, 2004 OMS 01 Introduction 14

Derivatives Markets • Exchange traded – Traditionally exchanges have used the open-outcry system, but increasingly they are switching to electronic trading – Contracts are standard there is virtually no credit risk • Over-the-counter (OTC) – A computer- and telephone-linked network of dealers at financial institutions, corporations, and fund managers – Contracts can be non-standard and there is some small amount of credit risk August 23, 2004 OMS 01 Introduction 15

Derivatives Markets • Exchange traded – Traditionally exchanges have used the open-outcry system, but increasingly they are switching to electronic trading – Contracts are standard there is virtually no credit risk • Over-the-counter (OTC) – A computer- and telephone-linked network of dealers at financial institutions, corporations, and fund managers – Contracts can be non-standard and there is some small amount of credit risk August 23, 2004 OMS 01 Introduction 15

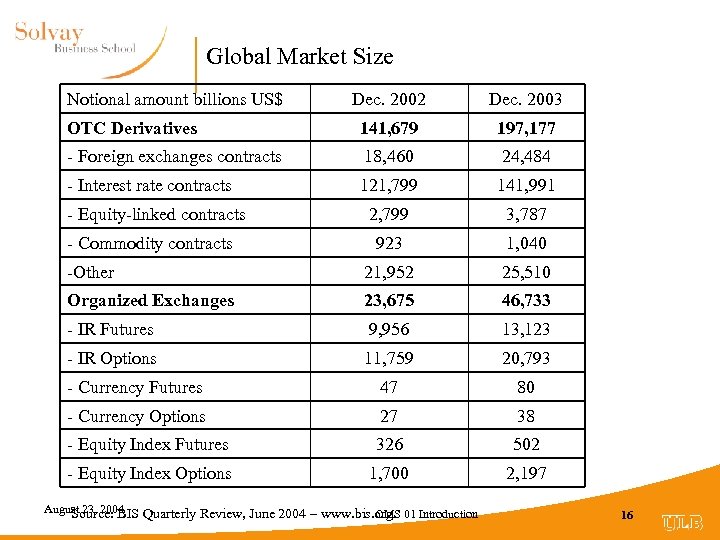

Global Market Size Notional amount billions US$ Dec. 2002 Dec. 2003 OTC Derivatives 141, 679 197, 177 - Foreign exchanges contracts 18, 460 24, 484 - Interest rate contracts 121, 799 141, 991 2, 799 3, 787 923 1, 040 -Other 21, 952 25, 510 Organized Exchanges 23, 675 46, 733 - IR Futures 9, 956 13, 123 - IR Options 11, 759 20, 793 - Currency Futures 47 80 - Currency Options 27 38 - Equity Index Futures 326 502 - Equity Index Options 1, 700 2, 197 - Equity-linked contracts - Commodity contracts August 23, 2004 Source: BIS Quarterly Review, June 2004 – www. bis. org 01 Introduction OMS 16

Global Market Size Notional amount billions US$ Dec. 2002 Dec. 2003 OTC Derivatives 141, 679 197, 177 - Foreign exchanges contracts 18, 460 24, 484 - Interest rate contracts 121, 799 141, 991 2, 799 3, 787 923 1, 040 -Other 21, 952 25, 510 Organized Exchanges 23, 675 46, 733 - IR Futures 9, 956 13, 123 - IR Options 11, 759 20, 793 - Currency Futures 47 80 - Currency Options 27 38 - Equity Index Futures 326 502 - Equity Index Options 1, 700 2, 197 - Equity-linked contracts - Commodity contracts August 23, 2004 Source: BIS Quarterly Review, June 2004 – www. bis. org 01 Introduction OMS 16

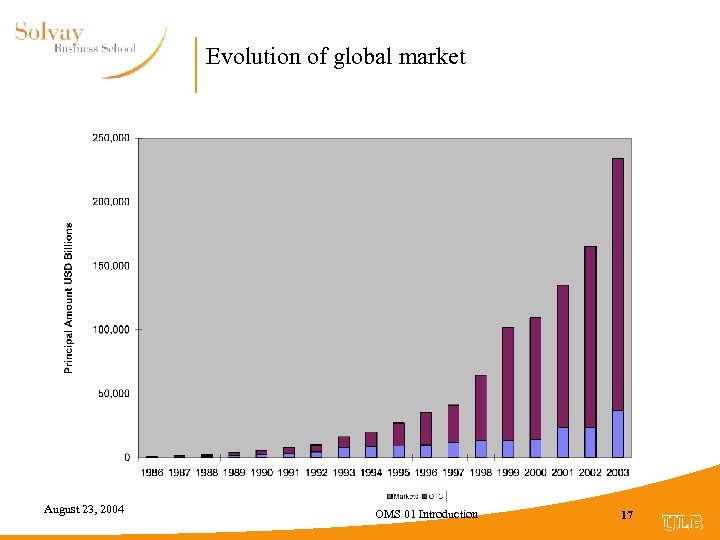

Evolution of global market August 23, 2004 OMS 01 Introduction 17

Evolution of global market August 23, 2004 OMS 01 Introduction 17

Main Derivative markets • Europe • United States Eurex: http: //www. eurexchange. com/ Liffe: http: //www. liffe. com Matif : http: //www. matif. fr Chicago Board of Tradehttp: //www. cbot. com August 23, 2004 OMS 01 Introduction 18

Main Derivative markets • Europe • United States Eurex: http: //www. eurexchange. com/ Liffe: http: //www. liffe. com Matif : http: //www. matif. fr Chicago Board of Tradehttp: //www. cbot. com August 23, 2004 OMS 01 Introduction 18

Why use derivatives? • • • To hedge risks To speculate (take a view on the future direction of the market) To lock in an arbitrage profit To change the nature of a liability To change the nature of an investment without incurring the costs of selling one portfolio and buying another August 23, 2004 OMS 01 Introduction 19

Why use derivatives? • • • To hedge risks To speculate (take a view on the future direction of the market) To lock in an arbitrage profit To change the nature of a liability To change the nature of an investment without incurring the costs of selling one portfolio and buying another August 23, 2004 OMS 01 Introduction 19

Forward contract: Cash flows • Notations ST Price of underlying asset at maturity Ft Forward price (delivery price) set at time t

Forward contract: Cash flows • Notations ST Price of underlying asset at maturity Ft Forward price (delivery price) set at time t

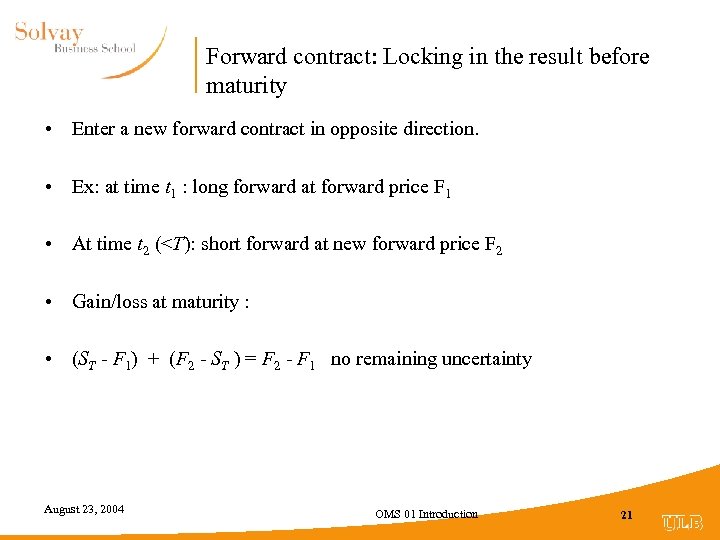

Forward contract: Locking in the result before maturity • Enter a new forward contract in opposite direction. • Ex: at time t 1 : long forward at forward price F 1 • At time t 2 (

Forward contract: Locking in the result before maturity • Enter a new forward contract in opposite direction. • Ex: at time t 1 : long forward at forward price F 1 • At time t 2 (

Futures contract: Definition • Institutionalized forward contract with daily settlement of gains and losses • Forward contract – Buy long sell short • Standardized – Maturity, Face value of contract • Traded on an organized exchange – Clearing house • Daily settlement of gains and losses (Marked to market) August 23, 2004 OMS 01 Introduction 22

Futures contract: Definition • Institutionalized forward contract with daily settlement of gains and losses • Forward contract – Buy long sell short • Standardized – Maturity, Face value of contract • Traded on an organized exchange – Clearing house • Daily settlement of gains and losses (Marked to market) August 23, 2004 OMS 01 Introduction 22

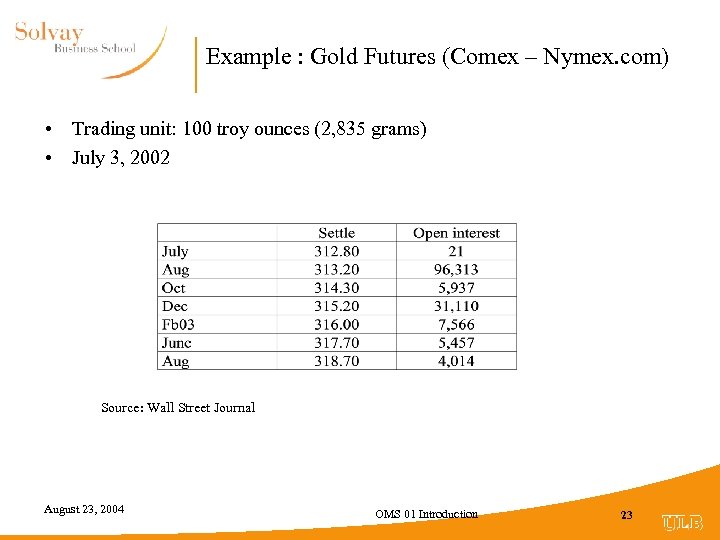

Example : Gold Futures (Comex – Nymex. com) • Trading unit: 100 troy ounces (2, 835 grams) • July 3, 2002 Source: Wall Street Journal August 23, 2004 OMS 01 Introduction 23

Example : Gold Futures (Comex – Nymex. com) • Trading unit: 100 troy ounces (2, 835 grams) • July 3, 2002 Source: Wall Street Journal August 23, 2004 OMS 01 Introduction 23

Gold futures: contract specifications • Trading Months Futures: Trading is conducted for delivery during the current calendar month, the next two calendar months, any February, April, August, and October thereafter falling within a 23 -month period, and any June and December falling within a 60 month period beginning with the current month. Options: The nearest six of the following contract months: February, April, June, August, October, and December. Additional contract months - January, March, May, July, September, and November - will be listed for trading for a period of two months. A 24 -month option is added on a June/December cycle. The options are American-style and can be exercised at any time up to expiration. On the first day of trading for any options contract month, there will be 13 strike prices each for puts and calls. Price Quotation Futures and Options: Dollars and cents per troy ounce. For example: $301. 70 per troy ounce. Minimum Price Fluctuation Futures and Options: Price changes are registered in multiples of 10¢ ($0. 10) per troy ounce, equivalent to $10 per contract. A fluctuation of $1 is, therefore, equivalent to $100 per contract. Maximum Daily Price Fluctuation Futures: Initial price limit, based upon the preceding day’s settlement price is $75 per ounce. Two minutes after either of the two most active months trades at the limit, trades in all months of futures and options will cease for a 15 -minute period. Trading will also cease if either of the two active months is bid at the upper limit or offered at the lower limit for two minutes without trading. Trading will not cease if the limit is reached during the final 20 minutes of a day’s trading. If the limit is reached during the final half hour of trading, trading will resume no later than 10 minutes before the normal closing time. When trading resumes after a cessation of trading, the price limits will be expanded by increments of 100%. Options: No price limits. Last Trading Day Futures: Trading terminates at the close of business on the third to last business day of the maturing delivery month. Options: Expiration occurs on the second Friday of the month prior to the delivery month of the underlying futures contract. August 23, 2004 OMS 01 Introduction 24

Gold futures: contract specifications • Trading Months Futures: Trading is conducted for delivery during the current calendar month, the next two calendar months, any February, April, August, and October thereafter falling within a 23 -month period, and any June and December falling within a 60 month period beginning with the current month. Options: The nearest six of the following contract months: February, April, June, August, October, and December. Additional contract months - January, March, May, July, September, and November - will be listed for trading for a period of two months. A 24 -month option is added on a June/December cycle. The options are American-style and can be exercised at any time up to expiration. On the first day of trading for any options contract month, there will be 13 strike prices each for puts and calls. Price Quotation Futures and Options: Dollars and cents per troy ounce. For example: $301. 70 per troy ounce. Minimum Price Fluctuation Futures and Options: Price changes are registered in multiples of 10¢ ($0. 10) per troy ounce, equivalent to $10 per contract. A fluctuation of $1 is, therefore, equivalent to $100 per contract. Maximum Daily Price Fluctuation Futures: Initial price limit, based upon the preceding day’s settlement price is $75 per ounce. Two minutes after either of the two most active months trades at the limit, trades in all months of futures and options will cease for a 15 -minute period. Trading will also cease if either of the two active months is bid at the upper limit or offered at the lower limit for two minutes without trading. Trading will not cease if the limit is reached during the final 20 minutes of a day’s trading. If the limit is reached during the final half hour of trading, trading will resume no later than 10 minutes before the normal closing time. When trading resumes after a cessation of trading, the price limits will be expanded by increments of 100%. Options: No price limits. Last Trading Day Futures: Trading terminates at the close of business on the third to last business day of the maturing delivery month. Options: Expiration occurs on the second Friday of the month prior to the delivery month of the underlying futures contract. August 23, 2004 OMS 01 Introduction 24

Futures: Daily settlement and the clearing house • In a forward contract: – Buyer and seller face each other during the life of the contract – Gains and losses are realized when the contract expires – Credit risk BUYER SELLER • In a futures contract – Gains and losses are realized daily (Marking to market) – The clearinghouse garantees contract performance : steps in to take a position opposite each party BUYER CH SELLER August 23, 2004 OMS 01 Introduction 25

Futures: Daily settlement and the clearing house • In a forward contract: – Buyer and seller face each other during the life of the contract – Gains and losses are realized when the contract expires – Credit risk BUYER SELLER • In a futures contract – Gains and losses are realized daily (Marking to market) – The clearinghouse garantees contract performance : steps in to take a position opposite each party BUYER CH SELLER August 23, 2004 OMS 01 Introduction 25

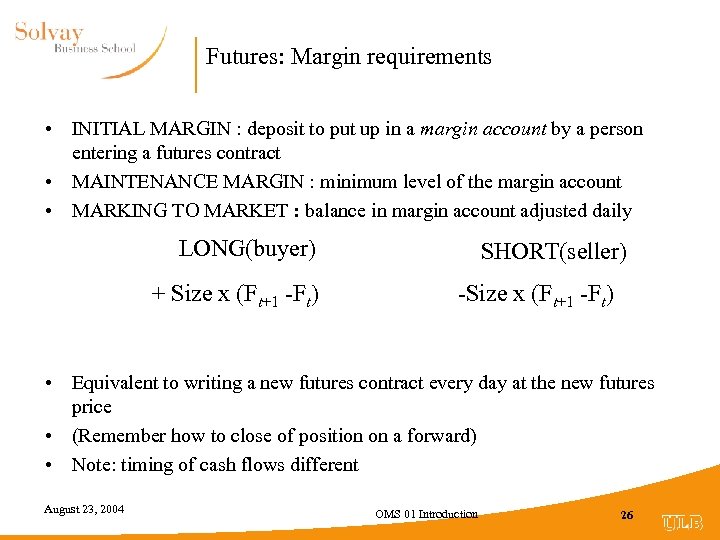

Futures: Margin requirements • INITIAL MARGIN : deposit to put up in a margin account by a person entering a futures contract • MAINTENANCE MARGIN : minimum level of the margin account • MARKING TO MARKET : balance in margin account adjusted daily LONG(buyer) + Size x (Ft+1 -Ft) SHORT(seller) -Size x (Ft+1 -Ft) • Equivalent to writing a new futures contract every day at the new futures price • (Remember how to close of position on a forward) • Note: timing of cash flows different August 23, 2004 OMS 01 Introduction 26

Futures: Margin requirements • INITIAL MARGIN : deposit to put up in a margin account by a person entering a futures contract • MAINTENANCE MARGIN : minimum level of the margin account • MARKING TO MARKET : balance in margin account adjusted daily LONG(buyer) + Size x (Ft+1 -Ft) SHORT(seller) -Size x (Ft+1 -Ft) • Equivalent to writing a new futures contract every day at the new futures price • (Remember how to close of position on a forward) • Note: timing of cash flows different August 23, 2004 OMS 01 Introduction 26

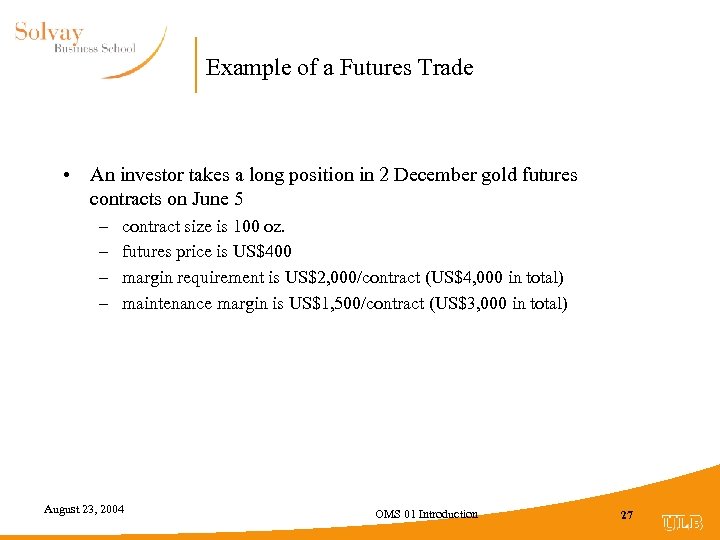

Example of a Futures Trade • An investor takes a long position in 2 December gold futures contracts on June 5 – – contract size is 100 oz. futures price is US$400 margin requirement is US$2, 000/contract (US$4, 000 in total) maintenance margin is US$1, 500/contract (US$3, 000 in total) August 23, 2004 OMS 01 Introduction 27

Example of a Futures Trade • An investor takes a long position in 2 December gold futures contracts on June 5 – – contract size is 100 oz. futures price is US$400 margin requirement is US$2, 000/contract (US$4, 000 in total) maintenance margin is US$1, 500/contract (US$3, 000 in total) August 23, 2004 OMS 01 Introduction 27

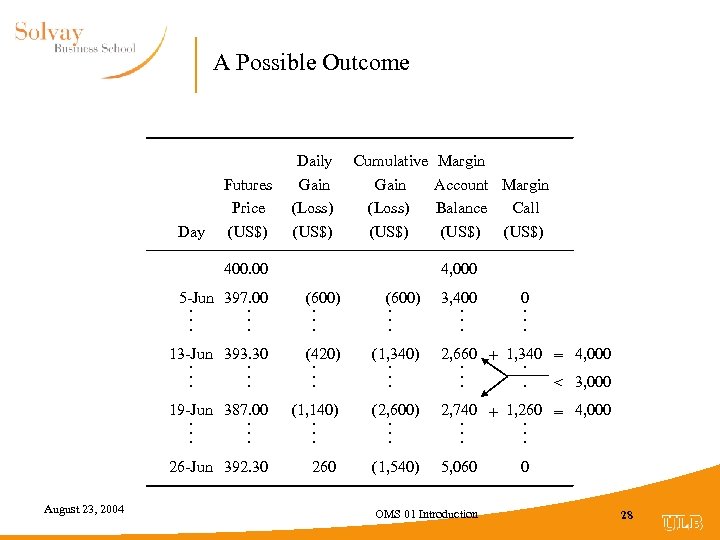

A Possible Outcome Day Futures Price (US$) Daily Gain (Loss) (US$) Cumulative Gain (Loss) (US$) 400. 00 Margin Account Margin Balance Call (US$) 4, 000 5 -Jun 397. 00. . . (600). . . 13 -Jun 393. 30. . . (420). . . (1, 340). . . 2, 660 + 1, 340 = 4, 000. . . < 3, 000 19 -Jun 387. 00. . . (1, 140). . . (2, 600). . . 2, 740 + 1, 260 = 4, 000. . . 26 -Jun 392. 30 August 23, 2004 (600). . . 3, 400. . . 260 (1, 540) 5, 060 OMS 01 Introduction 0. . . 0 28

A Possible Outcome Day Futures Price (US$) Daily Gain (Loss) (US$) Cumulative Gain (Loss) (US$) 400. 00 Margin Account Margin Balance Call (US$) 4, 000 5 -Jun 397. 00. . . (600). . . 13 -Jun 393. 30. . . (420). . . (1, 340). . . 2, 660 + 1, 340 = 4, 000. . . < 3, 000 19 -Jun 387. 00. . . (1, 140). . . (2, 600). . . 2, 740 + 1, 260 = 4, 000. . . 26 -Jun 392. 30 August 23, 2004 (600). . . 3, 400. . . 260 (1, 540) 5, 060 OMS 01 Introduction 0. . . 0 28

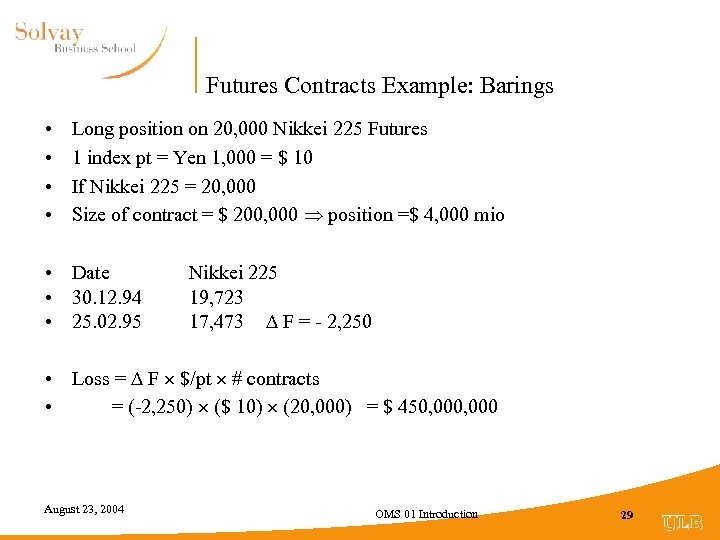

Futures Contracts Example: Barings • • Long position on 20, 000 Nikkei 225 Futures 1 index pt = Yen 1, 000 = $ 10 If Nikkei 225 = 20, 000 Size of contract = $ 200, 000 position =$ 4, 000 mio • Date • 30. 12. 94 • 25. 02. 95 Nikkei 225 19, 723 17, 473 F = - 2, 250 • Loss = F $/pt # contracts • = (-2, 250) ($ 10) (20, 000) = $ 450, 000 August 23, 2004 OMS 01 Introduction 29

Futures Contracts Example: Barings • • Long position on 20, 000 Nikkei 225 Futures 1 index pt = Yen 1, 000 = $ 10 If Nikkei 225 = 20, 000 Size of contract = $ 200, 000 position =$ 4, 000 mio • Date • 30. 12. 94 • 25. 02. 95 Nikkei 225 19, 723 17, 473 F = - 2, 250 • Loss = F $/pt # contracts • = (-2, 250) ($ 10) (20, 000) = $ 450, 000 August 23, 2004 OMS 01 Introduction 29