c2b4ce506fa72d2f7e9f22f63a74ff81.ppt

- Количество слайдов: 21

Options An Introduction to Derivative Securities

Options An Introduction to Derivative Securities

Introduction o As the name is meant to imply, derivative securities are financial instruments that derive their value from an “underlying” asset. o In this sense they can be seen as “side bets” between two investors as to what will happen to the value of the underlying asset. n The characterization of them as a bet implies pure speculation on the part of the investors. The main use of derivatives, however is actually in reducing or “hedging” risk. o Being side bets, they are in “zero net supply. ”

Introduction o As the name is meant to imply, derivative securities are financial instruments that derive their value from an “underlying” asset. o In this sense they can be seen as “side bets” between two investors as to what will happen to the value of the underlying asset. n The characterization of them as a bet implies pure speculation on the part of the investors. The main use of derivatives, however is actually in reducing or “hedging” risk. o Being side bets, they are in “zero net supply. ”

Options o While there are many types of derivative securities, our concentration in this introduction will be on option contracts, in particular call option contracts. o Option contracts are financial contracts that give their owner the right (not the obligation) to buy (call) or sell (put) the underlying asset (commonly a stock or a bond) either on (European) or on or before (American) a specific date (expiration date) for a fixed price (exercise price).

Options o While there are many types of derivative securities, our concentration in this introduction will be on option contracts, in particular call option contracts. o Option contracts are financial contracts that give their owner the right (not the obligation) to buy (call) or sell (put) the underlying asset (commonly a stock or a bond) either on (European) or on or before (American) a specific date (expiration date) for a fixed price (exercise price).

Call Options o A call option gives the owner the right to buy an asset at a fixed price on (or before) a given date. o Definitions n n n Call price Stock price (current and at maturity) Exercise price Time to expiration American versus European In/out of/at the money

Call Options o A call option gives the owner the right to buy an asset at a fixed price on (or before) a given date. o Definitions n n n Call price Stock price (current and at maturity) Exercise price Time to expiration American versus European In/out of/at the money

Long Position in a Call o Suppose that a particular call option can be exercised 6 months from now at the exercise price of $20. What will be the value of a long position in (ownership of) the call at expiration if: n n n The call is in the money – e. g. ST = $40? It is out of the money – e. g. ST = $15? Under what condition would we say the call is at the money?

Long Position in a Call o Suppose that a particular call option can be exercised 6 months from now at the exercise price of $20. What will be the value of a long position in (ownership of) the call at expiration if: n n n The call is in the money – e. g. ST = $40? It is out of the money – e. g. ST = $15? Under what condition would we say the call is at the money?

Put Options o Ownership of a put option on an underlying asset provides the right to sell that asset for a fixed price on (or before) the expiration date. o Suppose a particular put option can be exercised one year from now at the exercise price of $15. What is the value of the put at expiration if: n n The put is in the money – e. g. ST = $8? It is out of the money – e. g. ST = $35?

Put Options o Ownership of a put option on an underlying asset provides the right to sell that asset for a fixed price on (or before) the expiration date. o Suppose a particular put option can be exercised one year from now at the exercise price of $15. What is the value of the put at expiration if: n n The put is in the money – e. g. ST = $8? It is out of the money – e. g. ST = $35?

Short Positions in Options o For every buyer there is a seller. o An investor who writes a call on common stock promises to deliver shares of that stock if the option is exercised by the option holder. The seller is obligated to do so. n What are the possible payoffs at expiration? o An investor who writes a put agrees to purchase shares of that stock if the put holder should so request (exercise). n What are the possible payoffs at expiration?

Short Positions in Options o For every buyer there is a seller. o An investor who writes a call on common stock promises to deliver shares of that stock if the option is exercised by the option holder. The seller is obligated to do so. n What are the possible payoffs at expiration? o An investor who writes a put agrees to purchase shares of that stock if the put holder should so request (exercise). n What are the possible payoffs at expiration?

Combinations of Options o “Betting on volatility. ” n What if you don’t disagree with the market on the current price but you think it is more volatile than other investors. Can you take a position that will provide positive returns if you are right? n Can you bet against volatility? n There exist a myriad of other possibilities, let’s look at a particular relationship of great interest.

Combinations of Options o “Betting on volatility. ” n What if you don’t disagree with the market on the current price but you think it is more volatile than other investors. Can you take a position that will provide positive returns if you are right? n Can you bet against volatility? n There exist a myriad of other possibilities, let’s look at a particular relationship of great interest.

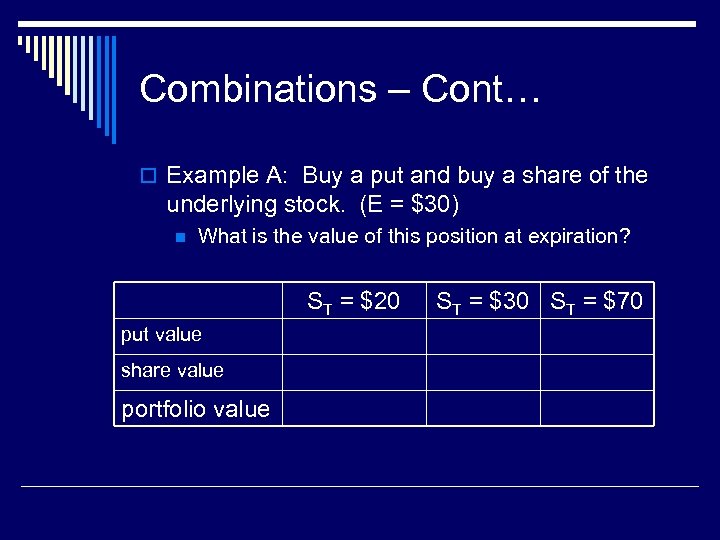

Combinations – Cont… o Example A: Buy a put and buy a share of the underlying stock. (E = $30) n What is the value of this position at expiration? ST = $20 put value share value portfolio value ST = $30 ST = $70

Combinations – Cont… o Example A: Buy a put and buy a share of the underlying stock. (E = $30) n What is the value of this position at expiration? ST = $20 put value share value portfolio value ST = $30 ST = $70

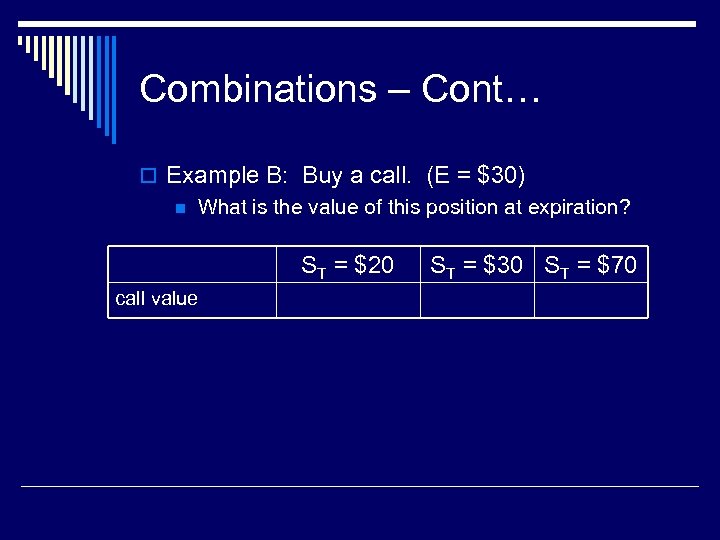

Combinations – Cont… o Example B: Buy a call. (E = $30) n What is the value of this position at expiration? ST = $20 call value ST = $30 ST = $70

Combinations – Cont… o Example B: Buy a call. (E = $30) n What is the value of this position at expiration? ST = $20 call value ST = $30 ST = $70

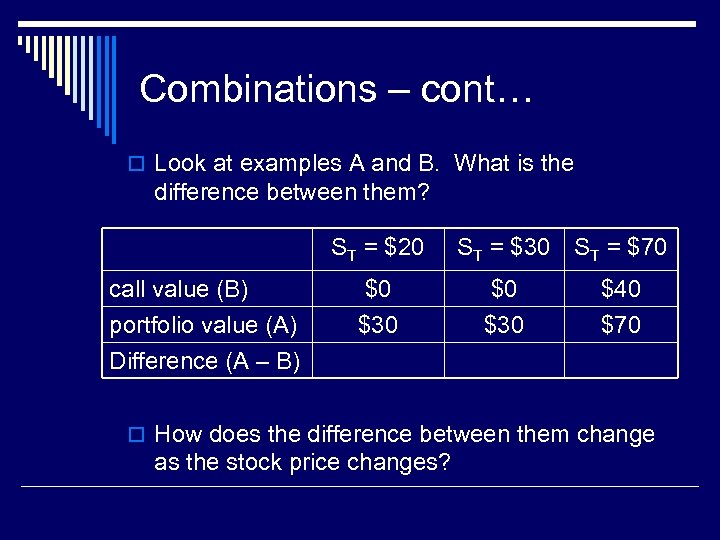

Combinations – cont… o Look at examples A and B. What is the difference between them? ST = $20 call value (B) portfolio value (A) Difference (A – B) $0 $30 ST = $70 $0 $30 $40 $70 o How does the difference between them change as the stock price changes?

Combinations – cont… o Look at examples A and B. What is the difference between them? ST = $20 call value (B) portfolio value (A) Difference (A – B) $0 $30 ST = $70 $0 $30 $40 $70 o How does the difference between them change as the stock price changes?

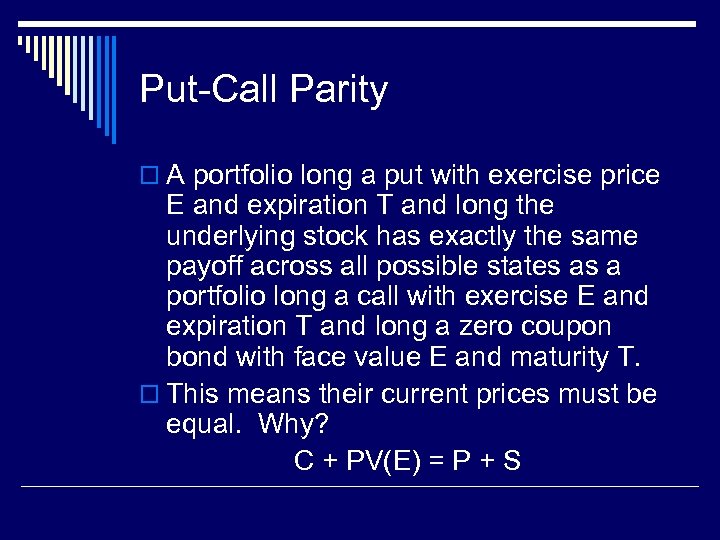

Put-Call Parity o A portfolio long a put with exercise price E and expiration T and long the underlying stock has exactly the same payoff across all possible states as a portfolio long a call with exercise E and expiration T and long a zero coupon bond with face value E and maturity T. o This means their current prices must be equal. Why? C + PV(E) = P + S

Put-Call Parity o A portfolio long a put with exercise price E and expiration T and long the underlying stock has exactly the same payoff across all possible states as a portfolio long a call with exercise E and expiration T and long a zero coupon bond with face value E and maturity T. o This means their current prices must be equal. Why? C + PV(E) = P + S

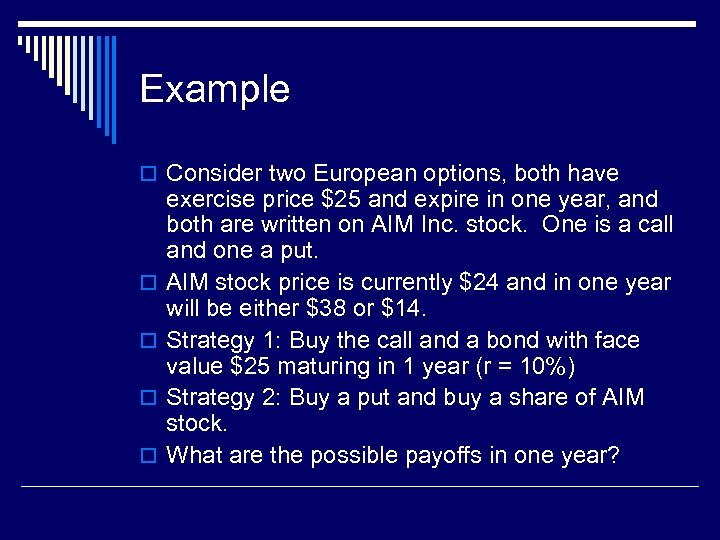

Example o Consider two European options, both have o o exercise price $25 and expire in one year, and both are written on AIM Inc. stock. One is a call and one a put. AIM stock price is currently $24 and in one year will be either $38 or $14. Strategy 1: Buy the call and a bond with face value $25 maturing in 1 year (r = 10%) Strategy 2: Buy a put and buy a share of AIM stock. What are the possible payoffs in one year?

Example o Consider two European options, both have o o exercise price $25 and expire in one year, and both are written on AIM Inc. stock. One is a call and one a put. AIM stock price is currently $24 and in one year will be either $38 or $14. Strategy 1: Buy the call and a bond with face value $25 maturing in 1 year (r = 10%) Strategy 2: Buy a put and buy a share of AIM stock. What are the possible payoffs in one year?

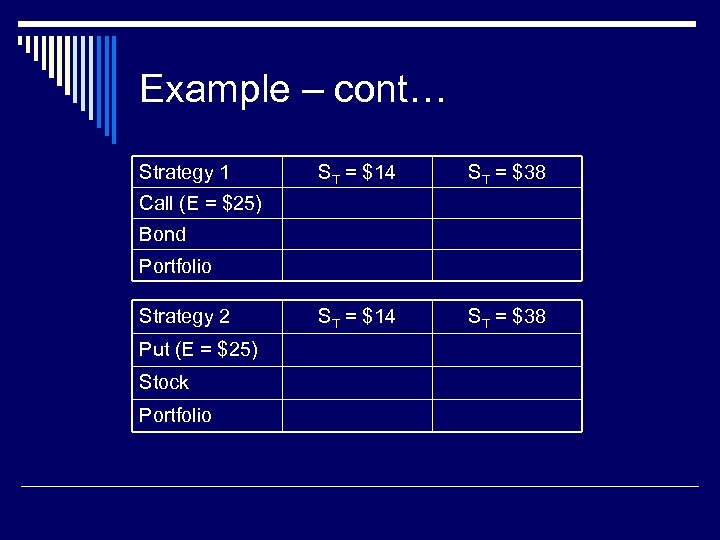

Example – cont… Strategy 1 ST = $14 ST = $38 Call (E = $25) Bond Portfolio Strategy 2 Put (E = $25) Stock Portfolio

Example – cont… Strategy 1 ST = $14 ST = $38 Call (E = $25) Bond Portfolio Strategy 2 Put (E = $25) Stock Portfolio

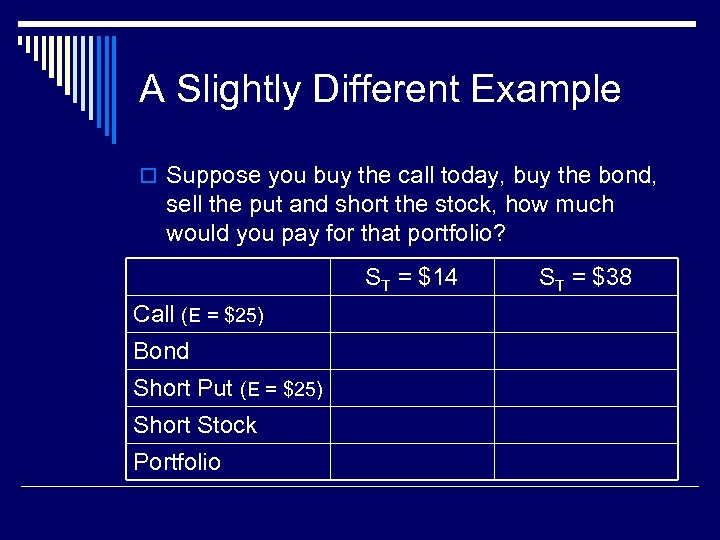

A Slightly Different Example o Suppose you buy the call today, buy the bond, sell the put and short the stock, how much would you pay for that portfolio? ST = $14 Call (E = $25) Bond Short Put (E = $25) Short Stock Portfolio ST = $38

A Slightly Different Example o Suppose you buy the call today, buy the bond, sell the put and short the stock, how much would you pay for that portfolio? ST = $14 Call (E = $25) Bond Short Put (E = $25) Short Stock Portfolio ST = $38

A Final Example o Suppose you desperately want to buy a put option on AIM Inc. but there is no one who wants to write a put? Is there a way you can satisfy your cravings?

A Final Example o Suppose you desperately want to buy a put option on AIM Inc. but there is no one who wants to write a put? Is there a way you can satisfy your cravings?

Binomial Option Pricing Model o Can we find the correct price of a one year call o o on AIM Inc. stock? Use the same approach as in deriving the putcall parity relation. If we can find a portfolio of AIM stock and a risk free bond that mimics the payoff on the call we can price the call. (Assume rf = 10%. ) That portfolio and the call must have the same price. Why? We can price the portfolio since we know the current price of the stock and the bond.

Binomial Option Pricing Model o Can we find the correct price of a one year call o o on AIM Inc. stock? Use the same approach as in deriving the putcall parity relation. If we can find a portfolio of AIM stock and a risk free bond that mimics the payoff on the call we can price the call. (Assume rf = 10%. ) That portfolio and the call must have the same price. Why? We can price the portfolio since we know the current price of the stock and the bond.

Binomial Model o Recall the payoff at expiration on the call option is $0 if the stock price goes down to $14 and is $13 if the stock price rises to $38. n This is a change of $13 from “bad” to “good” outcome. o One share of stock however has a change of $24 across outcomes. o What if we buy 13/24 ths of a share? n n n The payoff on this position is $7. 58 if the stock price goes down and $20. 58 it goes up. The position costs $13. The number 13/24 is called the “hedge ratio” or “delta” of this option.

Binomial Model o Recall the payoff at expiration on the call option is $0 if the stock price goes down to $14 and is $13 if the stock price rises to $38. n This is a change of $13 from “bad” to “good” outcome. o One share of stock however has a change of $24 across outcomes. o What if we buy 13/24 ths of a share? n n n The payoff on this position is $7. 58 if the stock price goes down and $20. 58 it goes up. The position costs $13. The number 13/24 is called the “hedge ratio” or “delta” of this option.

Binomial Model o Notice that the value of our position now changes by $13 for an up versus a down move in stock price. o The only problem is that the payoff does not exactly match the call payoff. o This is easily corrected however if we could subtract $7. 58 from each outcome on our position in the stock. o We can do that by borrowing so we have to repay exactly $7. 58 at the expiration of the call.

Binomial Model o Notice that the value of our position now changes by $13 for an up versus a down move in stock price. o The only problem is that the payoff does not exactly match the call payoff. o This is easily corrected however if we could subtract $7. 58 from each outcome on our position in the stock. o We can do that by borrowing so we have to repay exactly $7. 58 at the expiration of the call.

Binomial Model o A portfolio that is long 13/24 ths of a share of stock and borrows $6. 89 ($7. 58/(1. 1)) has a payoff of $0 ($7. 58 - $7. 58) if the stock price falls to $14 and a payoff of $13 ($20. 58 - $7. 58) if the stock price rises. This perfectly mimics the call. o The cost (price) of this portfolio must be exactly the same as the price of the call. o C = $13(13/24 $24) – $6. 89($7. 58/(1. 1)) C = $6. 11

Binomial Model o A portfolio that is long 13/24 ths of a share of stock and borrows $6. 89 ($7. 58/(1. 1)) has a payoff of $0 ($7. 58 - $7. 58) if the stock price falls to $14 and a payoff of $13 ($20. 58 - $7. 58) if the stock price rises. This perfectly mimics the call. o The cost (price) of this portfolio must be exactly the same as the price of the call. o C = $13(13/24 $24) – $6. 89($7. 58/(1. 1)) C = $6. 11

Binomial Model o This model, while very simple, captures the essence of most option pricing models. o The famous Black Scholes option pricing model follows from exactly this same logic, the main difference is that rather than a binomial model to capture stock prices we use a geometric Brownian motion (a continuous time stochastic process). o There have been various extensions of the simple option pricing model, allowing random “jumps” in the stock price, changing volatility, etc. , many of which rely on the simple replicating portfolio argument presented in these notes. o Understanding options and the basics of option pricing can help in a variety of situation.

Binomial Model o This model, while very simple, captures the essence of most option pricing models. o The famous Black Scholes option pricing model follows from exactly this same logic, the main difference is that rather than a binomial model to capture stock prices we use a geometric Brownian motion (a continuous time stochastic process). o There have been various extensions of the simple option pricing model, allowing random “jumps” in the stock price, changing volatility, etc. , many of which rely on the simple replicating portfolio argument presented in these notes. o Understanding options and the basics of option pricing can help in a variety of situation.