Options-2.pptx

- Количество слайдов: 29

Options A contract in which the writer (seller) promises that the contract buyer has the right, but not the obligation, to buy or sell a certain security at a certain price (the Strike price) on or before a certain expiration date, or exercise date. Option Holder – the buyer of Option contract Option Writer – the Seller of Option contract. The purchaser of a contract is known to “go long” the contract. A seller is referred to as “going short” the contract Strike Price – The price at which an Option holder has the right to buy or sell an underlying commodity and/or financial derivative. Expiration date (exercise date) – The last day the Option may be exercised.

Options A contract in which the writer (seller) promises that the contract buyer has the right, but not the obligation, to buy or sell a certain security at a certain price (the Strike price) on or before a certain expiration date, or exercise date. Option Holder – the buyer of Option contract Option Writer – the Seller of Option contract. The purchaser of a contract is known to “go long” the contract. A seller is referred to as “going short” the contract Strike Price – The price at which an Option holder has the right to buy or sell an underlying commodity and/or financial derivative. Expiration date (exercise date) – The last day the Option may be exercised.

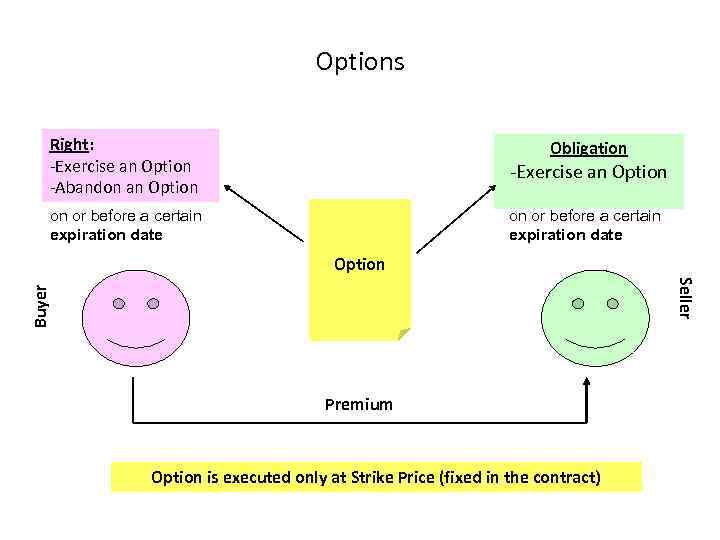

Options Right: -Exercise an Option -Abandon an Option -Exercise an Option on or before a certain expiration date Obligation Option Buyer Seller Premium Option is executed only at Strike Price (fixed in the contract)

Options Right: -Exercise an Option -Abandon an Option -Exercise an Option on or before a certain expiration date Obligation Option Buyer Seller Premium Option is executed only at Strike Price (fixed in the contract)

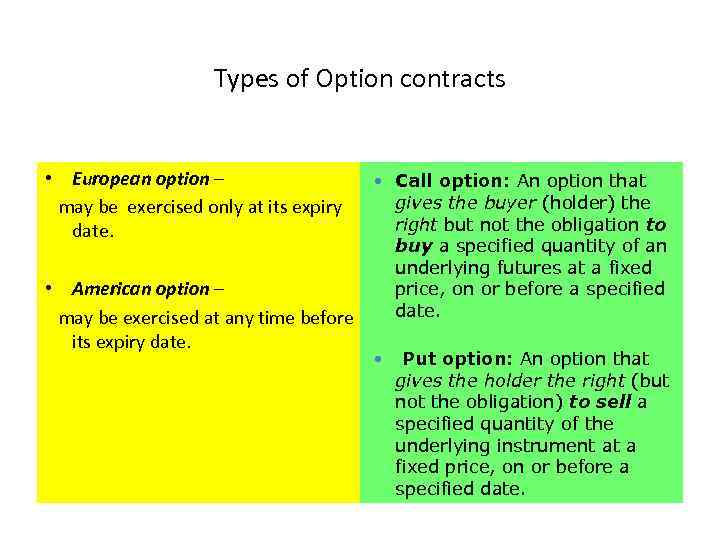

Types of Option contracts • European option – may be exercised only at its expiry date. • American option – may be exercised at any time before its expiry date. Call option: An option that gives the buyer (holder) the right but not the obligation to buy a specified quantity of an underlying futures at a fixed price, on or before a specified date. Put option: An option that gives the holder the right (but not the obligation) to sell a specified quantity of the underlying instrument at a fixed price, on or before a specified date.

Types of Option contracts • European option – may be exercised only at its expiry date. • American option – may be exercised at any time before its expiry date. Call option: An option that gives the buyer (holder) the right but not the obligation to buy a specified quantity of an underlying futures at a fixed price, on or before a specified date. Put option: An option that gives the holder the right (but not the obligation) to sell a specified quantity of the underlying instrument at a fixed price, on or before a specified date.

2 stages of Option Deal 1) The Option Buyer obtains the right to exercise or not to exercise the contract. 2) The Option Buyer realizes this right (or not realizes).

2 stages of Option Deal 1) The Option Buyer obtains the right to exercise or not to exercise the contract. 2) The Option Buyer realizes this right (or not realizes).

Call options • Call options give the right, but not an obligation, to the buyer to buy a commodity at a predetermined price by the expiration date. • Buyer has the right to buy the commodity at the strike price. • Seller has an obligation to sell the commodity at the strike price. • The buyer pays a premium for the right to buy the commodity at the strike price. • The premium compensates the option seller, who has to sell the commodity at a known price, which could be below the actual price on the sale date.

Call options • Call options give the right, but not an obligation, to the buyer to buy a commodity at a predetermined price by the expiration date. • Buyer has the right to buy the commodity at the strike price. • Seller has an obligation to sell the commodity at the strike price. • The buyer pays a premium for the right to buy the commodity at the strike price. • The premium compensates the option seller, who has to sell the commodity at a known price, which could be below the actual price on the sale date.

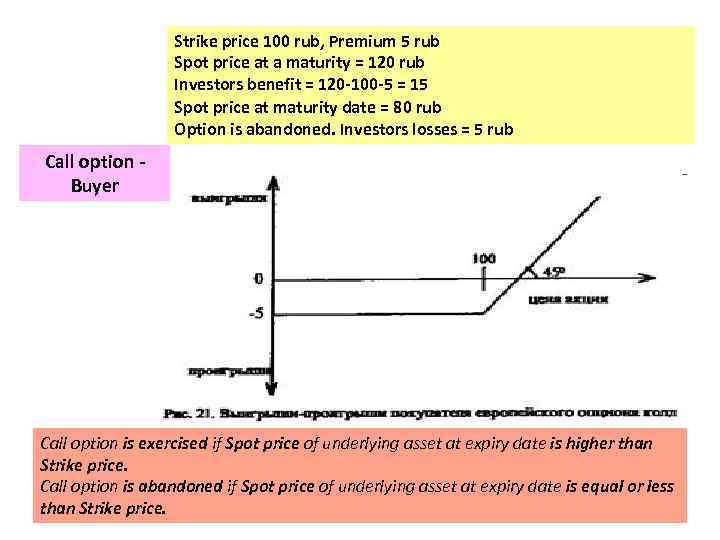

Strike price 100 rub, Premium 5 rub Spot price at a maturity = 120 rub Investors benefit = 120 -100 -5 = 15 Spot price at maturity date = 80 rub Option is abandoned. Investors losses = 5 rub Call option Buyer Call option is exercised if Spot price of underlying asset at expiry date is higher than Strike price. Call option is abandoned if Spot price of underlying asset at expiry date is equal or less than Strike price.

Strike price 100 rub, Premium 5 rub Spot price at a maturity = 120 rub Investors benefit = 120 -100 -5 = 15 Spot price at maturity date = 80 rub Option is abandoned. Investors losses = 5 rub Call option Buyer Call option is exercised if Spot price of underlying asset at expiry date is higher than Strike price. Call option is abandoned if Spot price of underlying asset at expiry date is equal or less than Strike price.

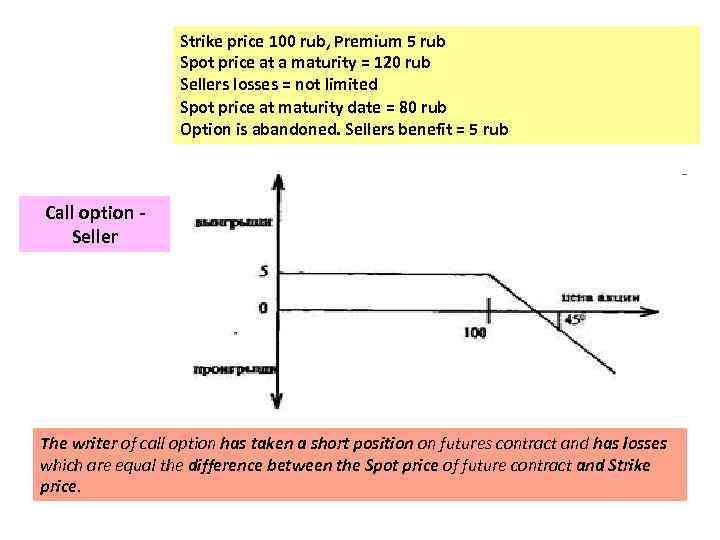

Strike price 100 rub, Premium 5 rub Spot price at a maturity = 120 rub Sellers losses = not limited Spot price at maturity date = 80 rub Option is abandoned. Sellers benefit = 5 rub Call option Seller The writer of call option has taken a short position on futures contract and has losses which are equal the difference between the Spot price of future contract and Strike price.

Strike price 100 rub, Premium 5 rub Spot price at a maturity = 120 rub Sellers losses = not limited Spot price at maturity date = 80 rub Option is abandoned. Sellers benefit = 5 rub Call option Seller The writer of call option has taken a short position on futures contract and has losses which are equal the difference between the Spot price of future contract and Strike price.

Put options • Put options give the right, but not an obligation, to the buyer to sell a commodity at a predetermined price by the expiration date. • Buyer has the right to sell the commodity at the strike price. • Seller has an obligation to buy the commodity at the strike price. • The buyer pays a premium for the right to sell the commodity at the strike price. • The premium compensates the option seller, who has to buy the commodity at a known price, which could be higher than the actual price on the buying date.

Put options • Put options give the right, but not an obligation, to the buyer to sell a commodity at a predetermined price by the expiration date. • Buyer has the right to sell the commodity at the strike price. • Seller has an obligation to buy the commodity at the strike price. • The buyer pays a premium for the right to sell the commodity at the strike price. • The premium compensates the option seller, who has to buy the commodity at a known price, which could be higher than the actual price on the buying date.

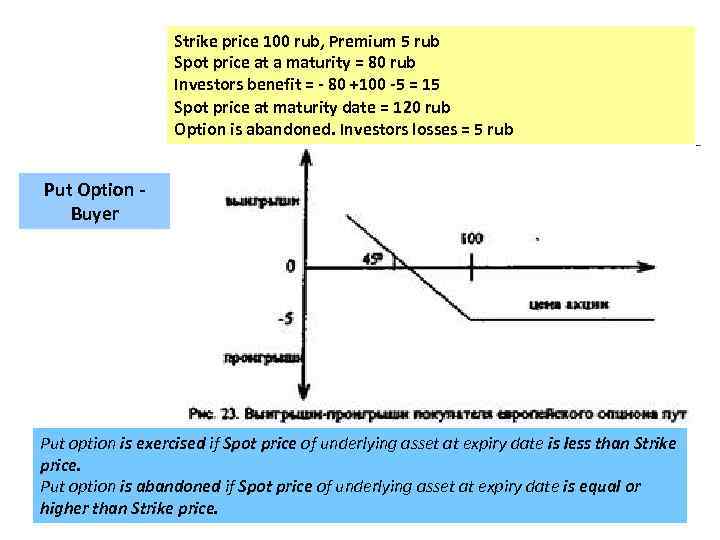

Strike price 100 rub, Premium 5 rub Spot price at a maturity = 80 rub Investors benefit = - 80 +100 -5 = 15 Spot price at maturity date = 120 rub Option is abandoned. Investors losses = 5 rub Put Option Buyer Put option is exercised if Spot price of underlying asset at expiry date is less than Strike price. Put option is abandoned if Spot price of underlying asset at expiry date is equal or higher than Strike price.

Strike price 100 rub, Premium 5 rub Spot price at a maturity = 80 rub Investors benefit = - 80 +100 -5 = 15 Spot price at maturity date = 120 rub Option is abandoned. Investors losses = 5 rub Put Option Buyer Put option is exercised if Spot price of underlying asset at expiry date is less than Strike price. Put option is abandoned if Spot price of underlying asset at expiry date is equal or higher than Strike price.

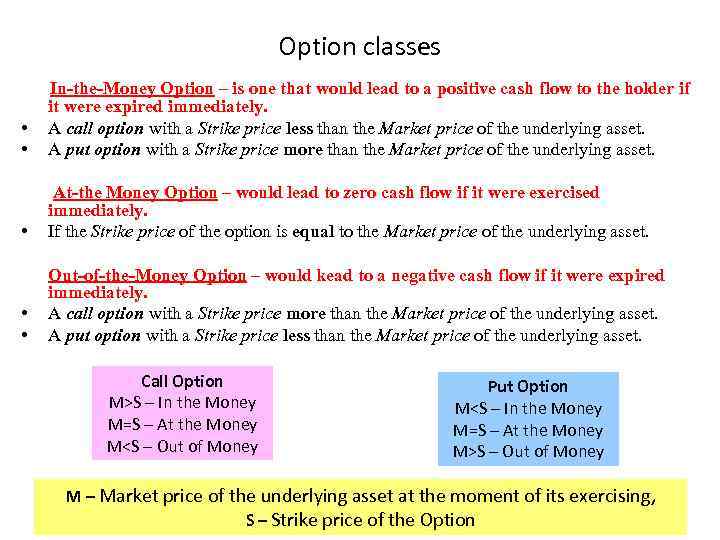

Option classes • • In-the-Money Option – is one that would lead to a positive cash flow to the holder if it were expired immediately. A call option with a Strike price less than the Market price of the underlying asset. A put option with a Strike price more than the Market price of the underlying asset. At-the Money Option – would lead to zero cash flow if it were exercised immediately. • If the Strike price of the option is equal to the Market price of the underlying asset. Out-of-the-Money Option – would kead to a negative cash flow if it were expired immediately. • A call option with a Strike price more than the Market price of the underlying asset. • A put option with a Strike price less than the Market price of the underlying asset. Call Option M>S – In the Money M=S – At the Money M

Option classes • • In-the-Money Option – is one that would lead to a positive cash flow to the holder if it were expired immediately. A call option with a Strike price less than the Market price of the underlying asset. A put option with a Strike price more than the Market price of the underlying asset. At-the Money Option – would lead to zero cash flow if it were exercised immediately. • If the Strike price of the option is equal to the Market price of the underlying asset. Out-of-the-Money Option – would kead to a negative cash flow if it were expired immediately. • A call option with a Strike price more than the Market price of the underlying asset. • A put option with a Strike price less than the Market price of the underlying asset. Call Option M>S – In the Money M=S – At the Money MS – Out of Money M – Market price of the underlying asset at the moment of its exercising , S – Strike price of the Option

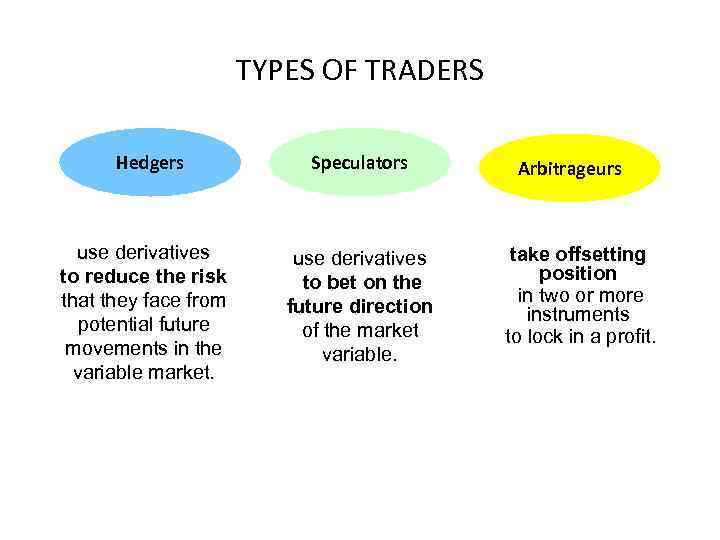

TYPES OF TRADERS Hedgers use derivatives to reduce the risk that they face from potential future movements in the variable market. Speculators use derivatives to bet on the future direction of the market variable. Arbitrageurs take offsetting position in two or more instruments to lock in a profit.

TYPES OF TRADERS Hedgers use derivatives to reduce the risk that they face from potential future movements in the variable market. Speculators use derivatives to bet on the future direction of the market variable. Arbitrageurs take offsetting position in two or more instruments to lock in a profit.

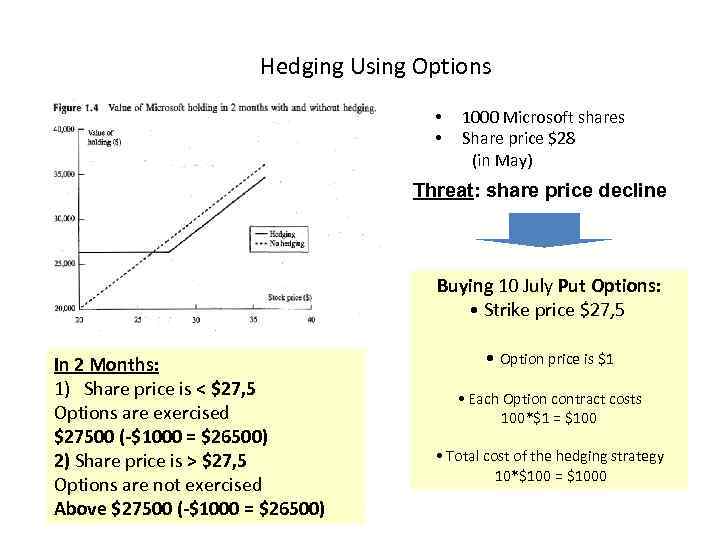

Hedging Using Options • 1000 Microsoft shares • Share price $28 (in May) Threat: share price decline Buying 10 July Put Options: • Strike price $27, 5 In 2 Months: 1) Share price is < $27, 5 Options are exercised $27500 (-$1000 = $26500) 2) Share price is > $27, 5 Options are not exercised Above $27500 (-$1000 = $26500) • Option price is $1 • Each Option contract costs 100*$1 = $100 • Total cost of the hedging strategy 10*$100 = $1000

Hedging Using Options • 1000 Microsoft shares • Share price $28 (in May) Threat: share price decline Buying 10 July Put Options: • Strike price $27, 5 In 2 Months: 1) Share price is < $27, 5 Options are exercised $27500 (-$1000 = $26500) 2) Share price is > $27, 5 Options are not exercised Above $27500 (-$1000 = $26500) • Option price is $1 • Each Option contract costs 100*$1 = $100 • Total cost of the hedging strategy 10*$100 = $1000

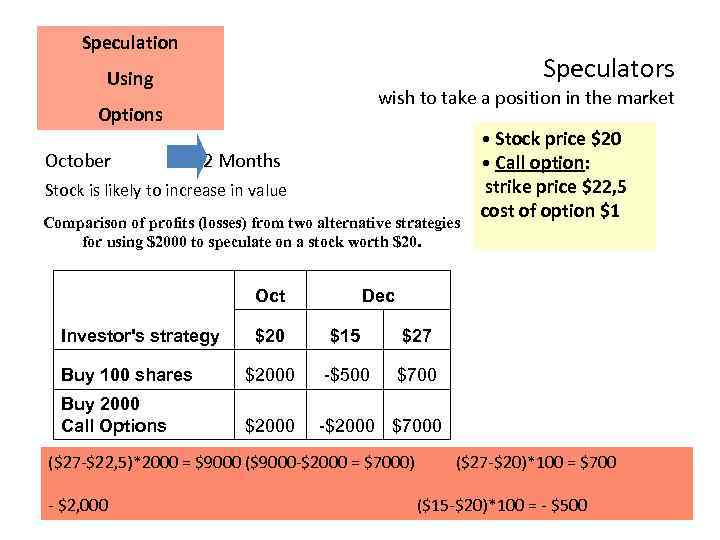

Speculation Speculators Using wish to take a position in the market Options October in 2 Months Stock is likely to increase in value Comparison of profits (losses) from two alternative strategies for using $2000 to speculate on a stock worth $20. Oct • Stock price $20 • Call option: strike price $22, 5 cost of option $1 Dec $20 $15 $27 Buy 100 shares $2000 -$500 $700 Buy 2000 Call Options $2000 -$2000 $7000 Investor's strategy ($27 -$22, 5)*2000 = $9000 ($9000 -$2000 = $7000) ($27 -$20)*100 = $700 - $2, 000 ($15 -$20)*100 = - $500

Speculation Speculators Using wish to take a position in the market Options October in 2 Months Stock is likely to increase in value Comparison of profits (losses) from two alternative strategies for using $2000 to speculate on a stock worth $20. Oct • Stock price $20 • Call option: strike price $22, 5 cost of option $1 Dec $20 $15 $27 Buy 100 shares $2000 -$500 $700 Buy 2000 Call Options $2000 -$2000 $7000 Investor's strategy ($27 -$22, 5)*2000 = $9000 ($9000 -$2000 = $7000) ($27 -$20)*100 = $700 - $2, 000 ($15 -$20)*100 = - $500

• The option strategy is 10 times more profitable than directly buying the stock. • Options like Futures provide a form of leverage. Difference Forward: The Speculators potential gain and loss are very large. Option: The Speculators potential loss is limited to the amount paid for the options.

• The option strategy is 10 times more profitable than directly buying the stock. • Options like Futures provide a form of leverage. Difference Forward: The Speculators potential gain and loss are very large. Option: The Speculators potential loss is limited to the amount paid for the options.

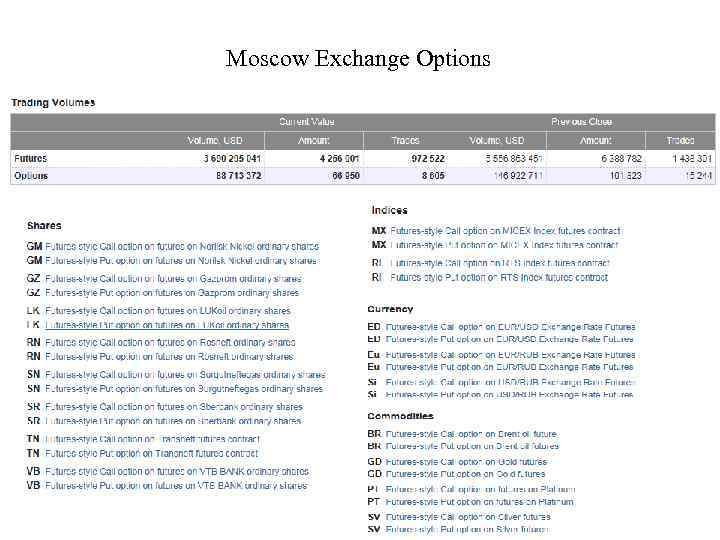

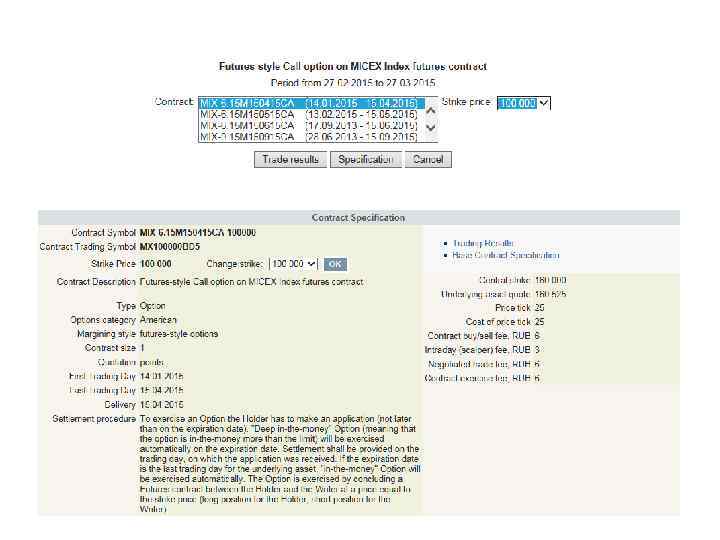

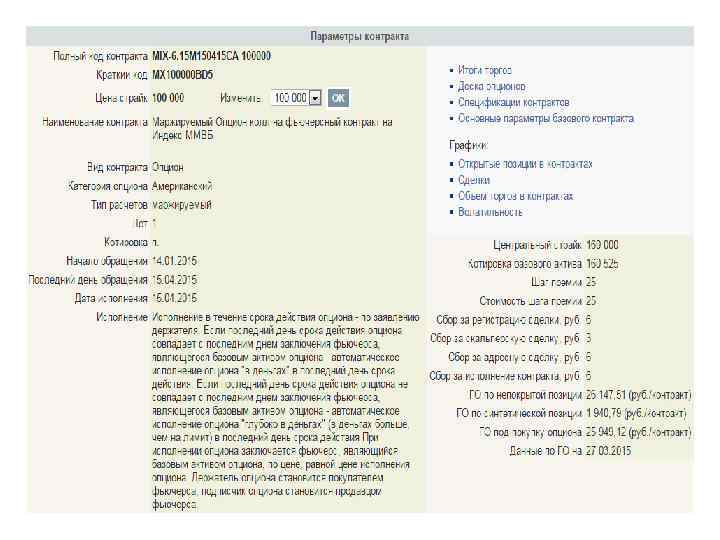

Moscow Exchange Options

Moscow Exchange Options

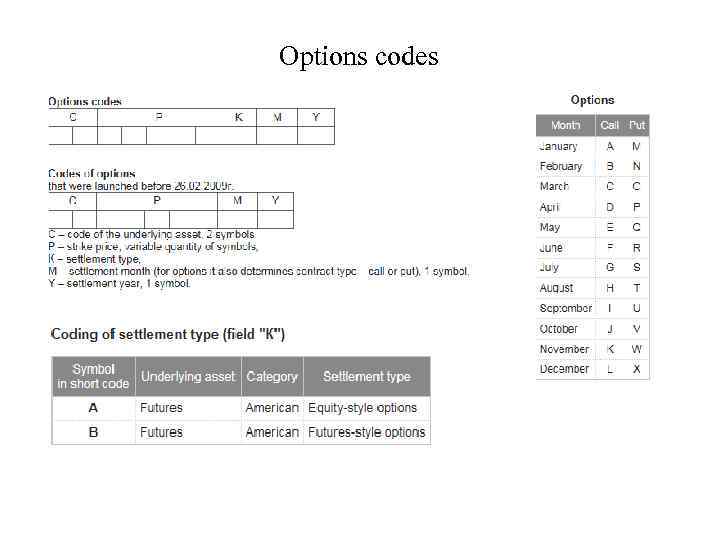

Options codes

Options codes

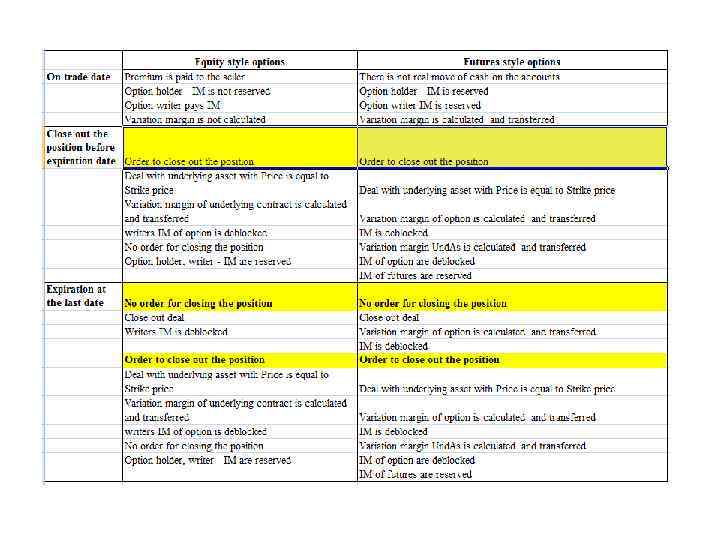

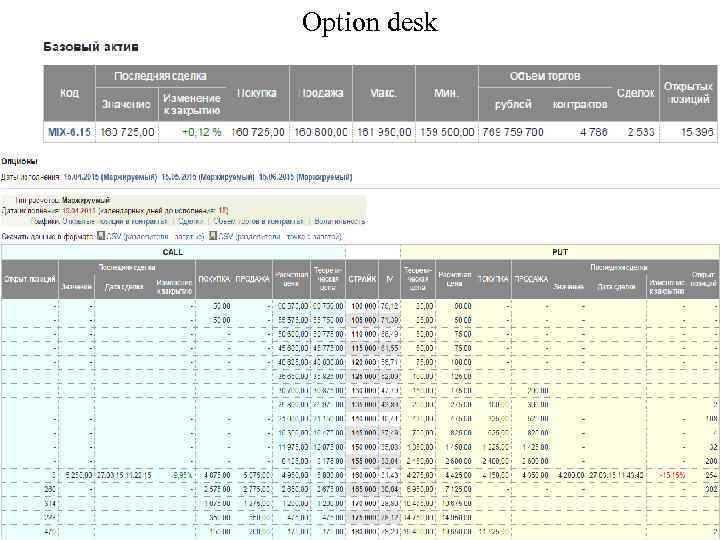

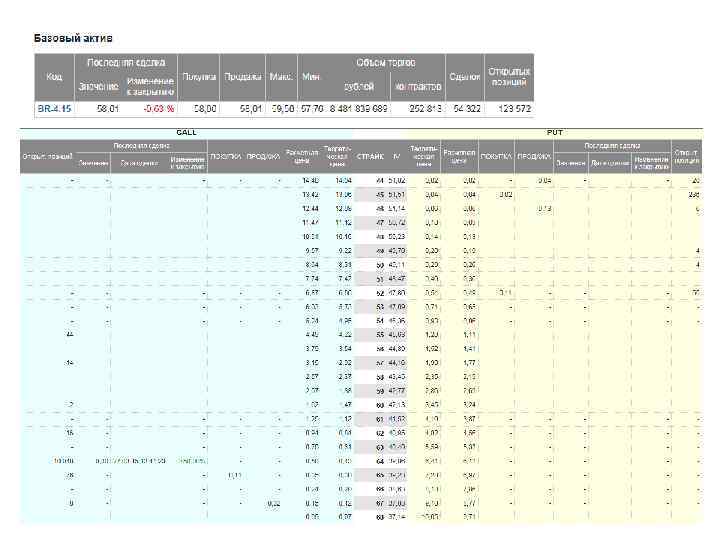

Option desk

Option desk

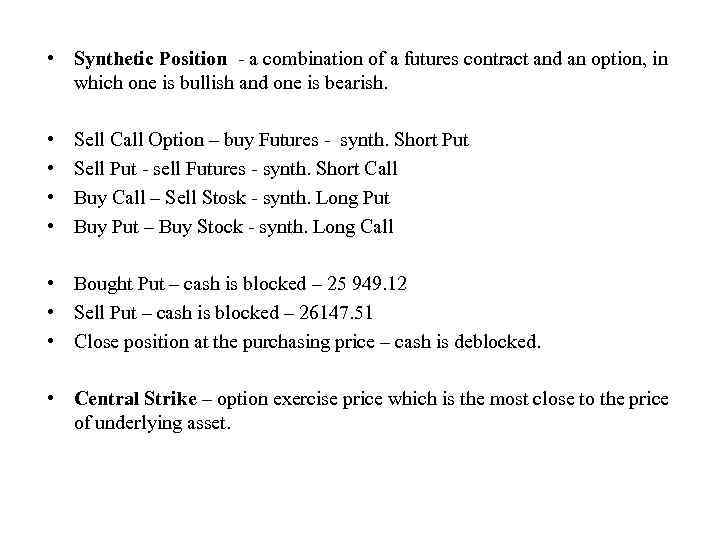

• Synthetic Position - a combination of a futures contract and an option, in which one is bullish and one is bearish. • • Sell Call Option – buy Futures - synth. Short Put Sell Put - sell Futures - synth. Short Call Buy Call – Sell Stosk - synth. Long Put Buy Put – Buy Stock - synth. Long Call • Bought Put – cash is blocked – 25 949. 12 • Sell Put – cash is blocked – 26147. 51 • Close position at the purchasing price – cash is deblocked. • Central Strike – option exercise price which is the most close to the price of underlying asset.

• Synthetic Position - a combination of a futures contract and an option, in which one is bullish and one is bearish. • • Sell Call Option – buy Futures - synth. Short Put Sell Put - sell Futures - synth. Short Call Buy Call – Sell Stosk - synth. Long Put Buy Put – Buy Stock - synth. Long Call • Bought Put – cash is blocked – 25 949. 12 • Sell Put – cash is blocked – 26147. 51 • Close position at the purchasing price – cash is deblocked. • Central Strike – option exercise price which is the most close to the price of underlying asset.

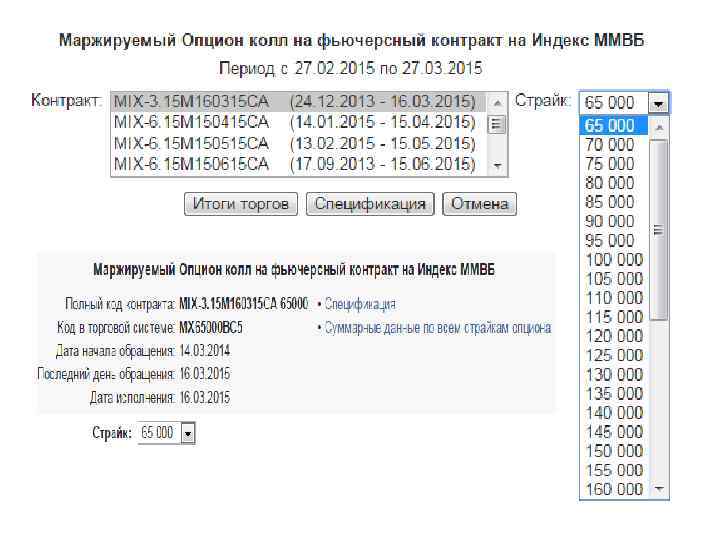

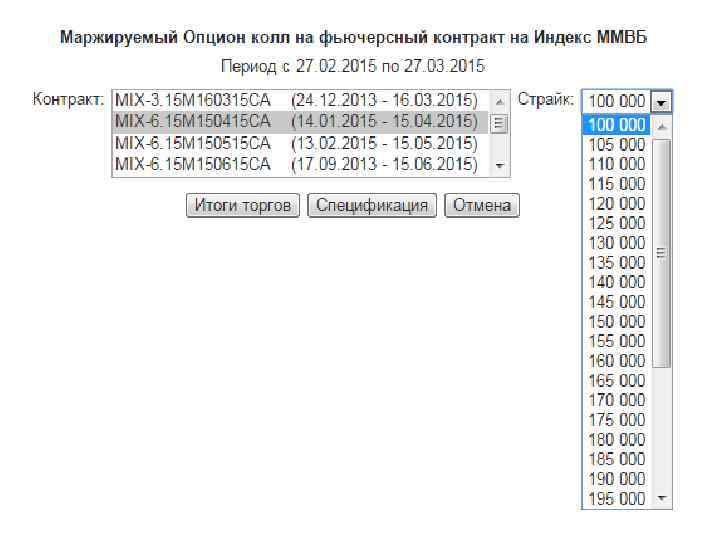

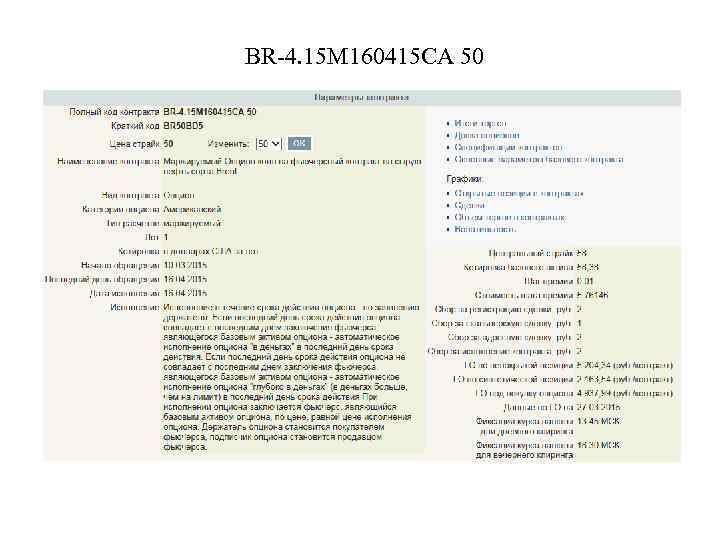

BR-4. 15 M 160415 CA 50

BR-4. 15 M 160415 CA 50

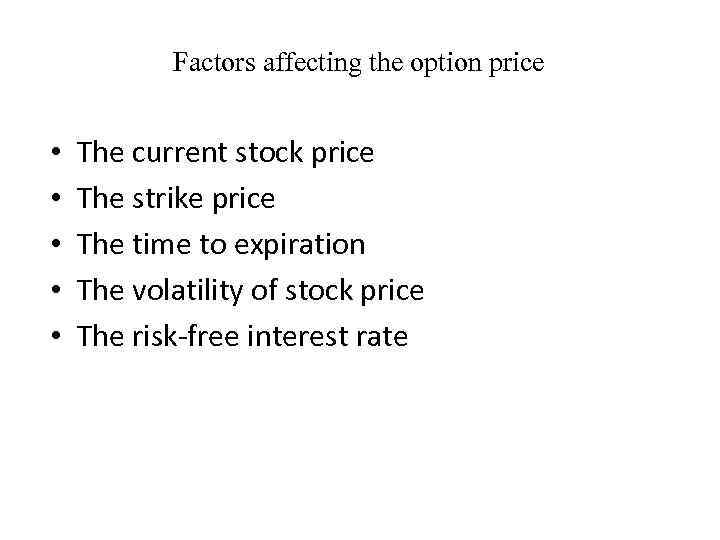

Factors affecting the option price • • • The current stock price The strike price The time to expiration The volatility of stock price The risk-free interest rate

Factors affecting the option price • • • The current stock price The strike price The time to expiration The volatility of stock price The risk-free interest rate

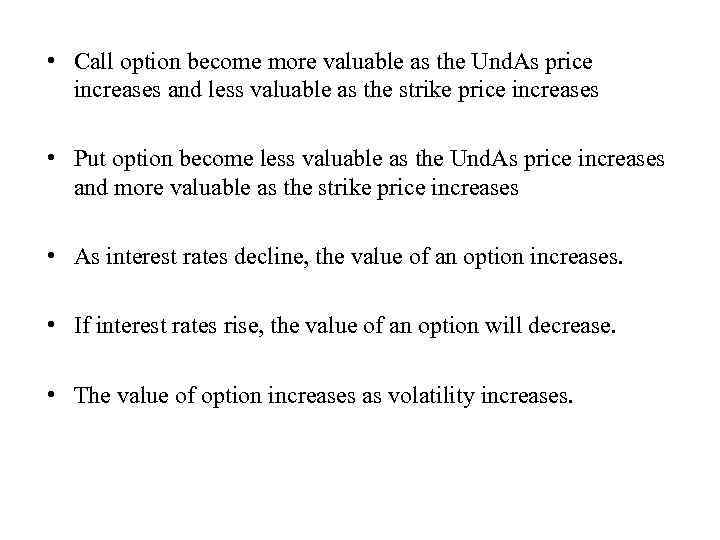

• Call option become more valuable as the Und. As price increases and less valuable as the strike price increases • Put option become less valuable as the Und. As price increases and more valuable as the strike price increases • As interest rates decline, the value of an option increases. • If interest rates rise, the value of an option will decrease. • The value of option increases as volatility increases.

• Call option become more valuable as the Und. As price increases and less valuable as the strike price increases • Put option become less valuable as the Und. As price increases and more valuable as the strike price increases • As interest rates decline, the value of an option increases. • If interest rates rise, the value of an option will decrease. • The value of option increases as volatility increases.

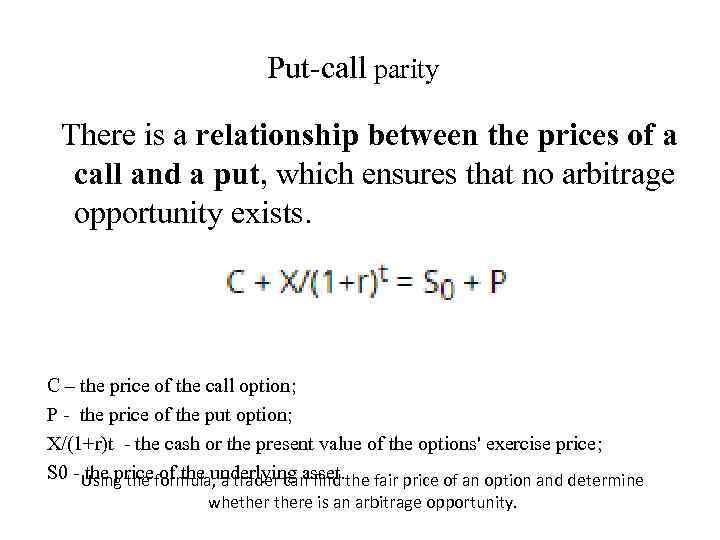

Put-call parity There is a relationship between the prices of a call and a put, which ensures that no arbitrage opportunity exists. C – the price of the call option; P - the price of the put option; X/(1+r)t - the cash or the present value of the options' exercise price; S 0 - the price of the underlying asset. Using the formula, a trader can find the fair price of an option and determine whethere is an arbitrage opportunity.

Put-call parity There is a relationship between the prices of a call and a put, which ensures that no arbitrage opportunity exists. C – the price of the call option; P - the price of the put option; X/(1+r)t - the cash or the present value of the options' exercise price; S 0 - the price of the underlying asset. Using the formula, a trader can find the fair price of an option and determine whethere is an arbitrage opportunity.

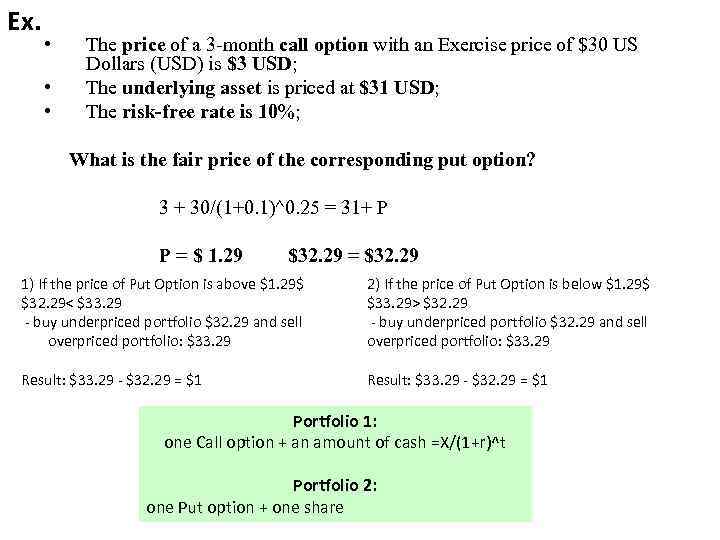

Ex. • • • The price of a 3 -month call option with an Exercise price of $30 US Dollars (USD) is $3 USD; The underlying asset is priced at $31 USD; The risk-free rate is 10%; What is the fair price of the corresponding put option? 3 + 30/(1+0. 1)^0. 25 = 31+ P P = $ 1. 29 $32. 29 = $32. 29 1) If the price of Put Option is above $1. 29$ $32. 29< $33. 29 - buy underpriced portfolio $32. 29 and sell overpriced portfolio: $33. 29 2) If the price of Put Option is below $1. 29$ $33. 29> $32. 29 - buy underpriced portfolio $32. 29 and sell overpriced portfolio: $33. 29 Result: $33. 29 - $32. 29 = $1 Portfolio 1: one Call option + an amount of cash =X/(1+r)^t Portfolio 2: one Put option + one share

Ex. • • • The price of a 3 -month call option with an Exercise price of $30 US Dollars (USD) is $3 USD; The underlying asset is priced at $31 USD; The risk-free rate is 10%; What is the fair price of the corresponding put option? 3 + 30/(1+0. 1)^0. 25 = 31+ P P = $ 1. 29 $32. 29 = $32. 29 1) If the price of Put Option is above $1. 29$ $32. 29< $33. 29 - buy underpriced portfolio $32. 29 and sell overpriced portfolio: $33. 29 2) If the price of Put Option is below $1. 29$ $33. 29> $32. 29 - buy underpriced portfolio $32. 29 and sell overpriced portfolio: $33. 29 Result: $33. 29 - $32. 29 = $1 Portfolio 1: one Call option + an amount of cash =X/(1+r)^t Portfolio 2: one Put option + one share