Optimal Trading of a Mean-Reverting Process MS&E 444, Spring 2008 Shih-Arng (Tony) Pan, Wei Wang, Chen Tze Wee, Ren Fung Yu

Optimal Trading of a Mean-Reverting Process MS&E 444, Spring 2008 Shih-Arng (Tony) Pan, Wei Wang, Chen Tze Wee, Ren Fung Yu

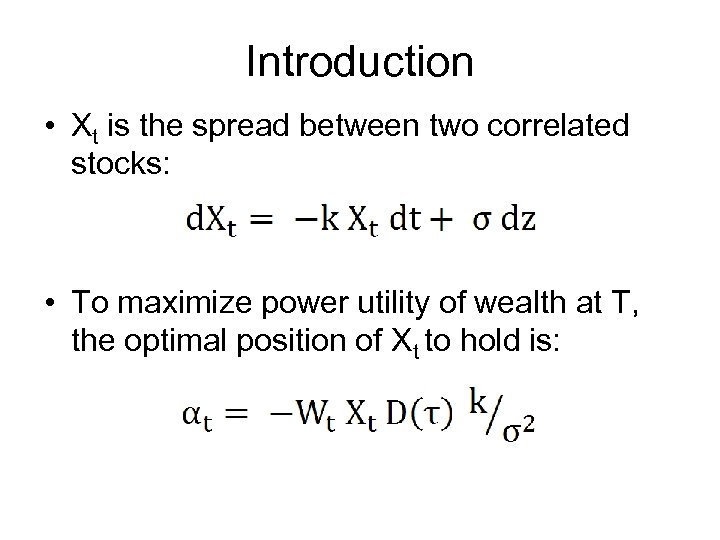

Introduction • Xt is the spread between two correlated stocks: • To maximize power utility of wealth at T, the optimal position of Xt to hold is:

Introduction • Xt is the spread between two correlated stocks: • To maximize power utility of wealth at T, the optimal position of Xt to hold is:

Choosing correlated stocks • Stocks were chosen from the S&P 100 index • Chose stock pairs with the highest correlation of daily returns (>0. 75). • Examples: – International Paper/Weyerhauser – Merrill Lynch/Morgan Stanley – Chevron/Exxon Mobil – Baker Hughes/Schlumberger

Choosing correlated stocks • Stocks were chosen from the S&P 100 index • Chose stock pairs with the highest correlation of daily returns (>0. 75). • Examples: – International Paper/Weyerhauser – Merrill Lynch/Morgan Stanley – Chevron/Exxon Mobil – Baker Hughes/Schlumberger

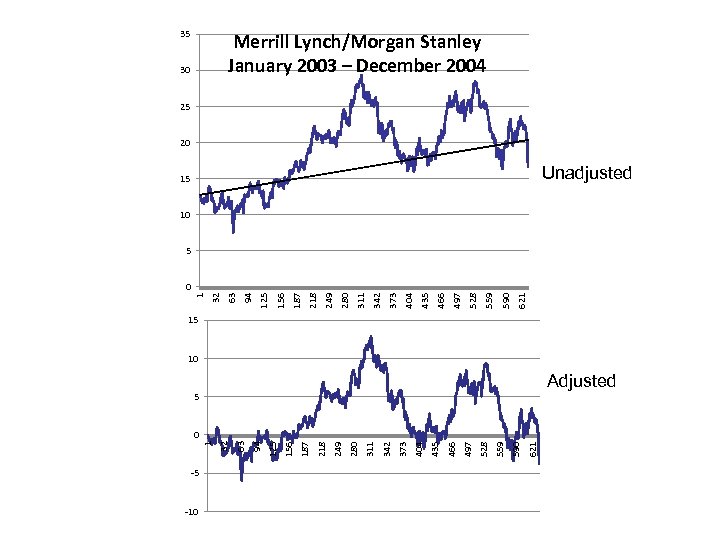

-5 -10 621 590 559 528 497 466 435 404 373 342 311 280 249 218 187 156 125 94 63 32 1 30 63 32 1 35 Merrill Lynch/Morgan Stanley January 2003 – December 2004 25 20 15 Unadjusted 10 5 0 15 10 5 Adjusted 0

-5 -10 621 590 559 528 497 466 435 404 373 342 311 280 249 218 187 156 125 94 63 32 1 30 63 32 1 35 Merrill Lynch/Morgan Stanley January 2003 – December 2004 25 20 15 Unadjusted 10 5 0 15 10 5 Adjusted 0

Parameters • Parameters k and σ were estimated using MLE using January 2003 to December 2004 data. • The strategy was implemented after January 2005, out of sample. • Power Utility parameter: γ= -0. 1 • Transaction cost: 0. 15% of initial wealth (constant)

Parameters • Parameters k and σ were estimated using MLE using January 2003 to December 2004 data. • The strategy was implemented after January 2005, out of sample. • Power Utility parameter: γ= -0. 1 • Transaction cost: 0. 15% of initial wealth (constant)

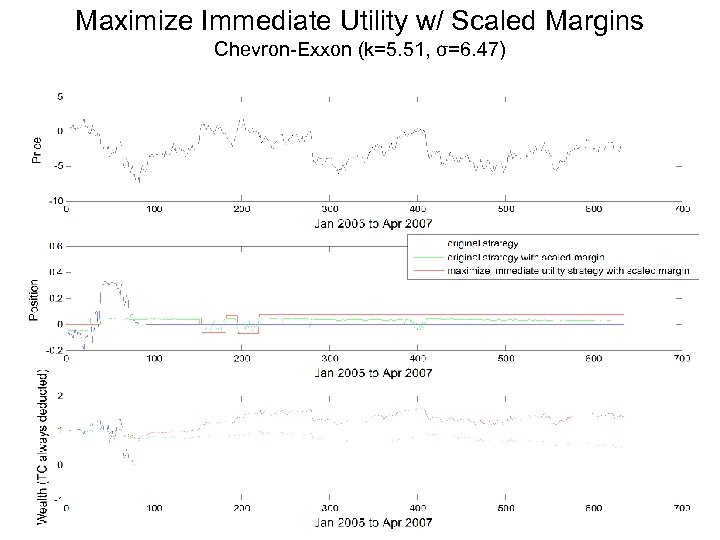

Maximize Immediate Utility w/ Scaled Margins Chevron-Exxon (k=5. 51, σ=6. 47)

Maximize Immediate Utility w/ Scaled Margins Chevron-Exxon (k=5. 51, σ=6. 47)

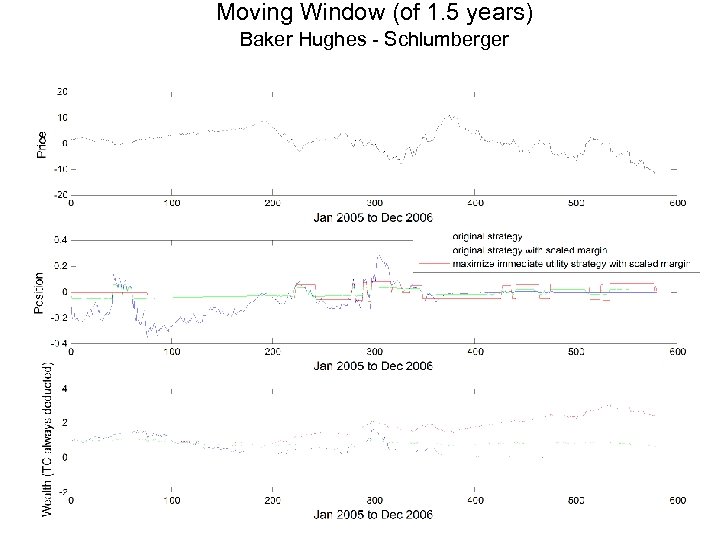

Moving Window (of 1. 5 years) Baker Hughes - Schlumberger

Moving Window (of 1. 5 years) Baker Hughes - Schlumberger

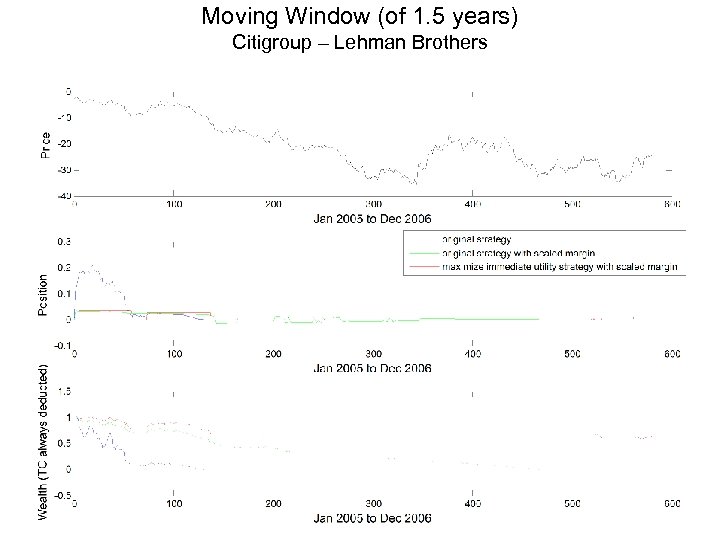

Moving Window (of 1. 5 years) Citigroup – Lehman Brothers

Moving Window (of 1. 5 years) Citigroup – Lehman Brothers

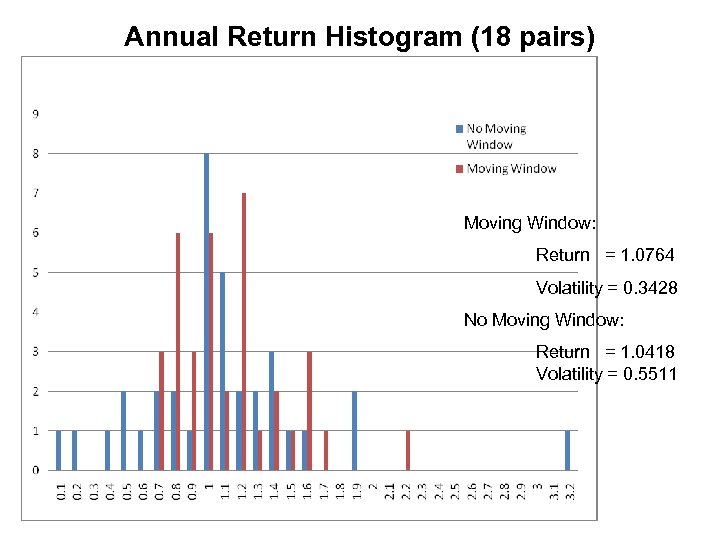

Annual Return Histogram (18 pairs) Moving Window: Return = 1. 0764 Volatility = 0. 3428 No Moving Window: Return = 1. 0418 Volatility = 0. 5511

Annual Return Histogram (18 pairs) Moving Window: Return = 1. 0764 Volatility = 0. 3428 No Moving Window: Return = 1. 0418 Volatility = 0. 5511

Conclusion • Theoretical strategy too risky for market conditions. • Maximizing immediate utility w/ scaled margin strategy shows promise. • Moving Window parameter estimation improves returns, but not enough to beat market. • Better stock pairs, or a process with even more memory is required.

Conclusion • Theoretical strategy too risky for market conditions. • Maximizing immediate utility w/ scaled margin strategy shows promise. • Moving Window parameter estimation improves returns, but not enough to beat market. • Better stock pairs, or a process with even more memory is required.