511c63d9d1efc04b5f282e7fb1386d4f.ppt

- Количество слайдов: 19

Opportunities in Quantitative Finance A/P Ng Kah Hwa, Ph. D (Columbia) Director, Quantitative Finance Programme Director, Centre for Financial Engineering 12 March 2005 Slide 1

Opportunities in Quantitative Finance A/P Ng Kah Hwa, Ph. D (Columbia) Director, Quantitative Finance Programme Director, Centre for Financial Engineering 12 March 2005 Slide 1

Introduction and Background • In 1973 Black and Scholes developed the option pricing models based on advanced mathematics • Today the financial practice has become very quantitative • Sophisticated mathematical models are used to support investment decisions, to develop and price new financial products or to manage risk 12 March 2005 Slide 2

Introduction and Background • In 1973 Black and Scholes developed the option pricing models based on advanced mathematics • Today the financial practice has become very quantitative • Sophisticated mathematical models are used to support investment decisions, to develop and price new financial products or to manage risk 12 March 2005 Slide 2

What is Quantitative Finance ? ü Multidisciplinary programme that combines Mathematics, Finance and Computing with a practical orientation that is designed for high-caliber students who wish to become professionals in the finance industry. ü Covers the following areas • • • Mathematical Theory and Tools Statistical Methods Computing Theory and Techniques Financial Theory and Principles Core Financial Product Knowledge ü Plays an increasingly important role in the financial services industry and the economy. 12 March 2005 Slide 3

What is Quantitative Finance ? ü Multidisciplinary programme that combines Mathematics, Finance and Computing with a practical orientation that is designed for high-caliber students who wish to become professionals in the finance industry. ü Covers the following areas • • • Mathematical Theory and Tools Statistical Methods Computing Theory and Techniques Financial Theory and Principles Core Financial Product Knowledge ü Plays an increasingly important role in the financial services industry and the economy. 12 March 2005 Slide 3

Examples Risk Management • Banks in the course of their business take on risk ? • How do we measure the risk that the bank is exposed to ? • How do we hedge and mange the risk? 12 March 2005 Slide 4

Examples Risk Management • Banks in the course of their business take on risk ? • How do we measure the risk that the bank is exposed to ? • How do we hedge and mange the risk? 12 March 2005 Slide 4

Examples (continued) Tools • Linear Algebra and Calculus • Advanced probability and statistics • Time Series Analysis • Simulation Methodologies 12 March 2005 Slide 5

Examples (continued) Tools • Linear Algebra and Calculus • Advanced probability and statistics • Time Series Analysis • Simulation Methodologies 12 March 2005 Slide 5

Examples Derivatives Trading Pricing and Hedging of Complex Derivatives Tools • Advanced Stochastic Processes • Numerical solutions to partial differential equations 12 March 2005 Slide 6

Examples Derivatives Trading Pricing and Hedging of Complex Derivatives Tools • Advanced Stochastic Processes • Numerical solutions to partial differential equations 12 March 2005 Slide 6

Career Opportunities Potential Employers • Banks • Investment Companies • Securities Firms • Insurance Companies • Multinationals Increase in demand for graduates with high level of quantitative and analytical skills 12 March 2005 Slide 7

Career Opportunities Potential Employers • Banks • Investment Companies • Securities Firms • Insurance Companies • Multinationals Increase in demand for graduates with high level of quantitative and analytical skills 12 March 2005 Slide 7

Career Opportunities Jobs • Financial Product Development and pricing (Structured Deposits, Derivatives etc. ) • Risk Management • Investment decision making and fund management • Wealth Management 12 March 2005 Slide 8

Career Opportunities Jobs • Financial Product Development and pricing (Structured Deposits, Derivatives etc. ) • Risk Management • Investment decision making and fund management • Wealth Management 12 March 2005 Slide 8

Skills Required for Quantitative Analysts/Risk Managers • Basic Quantitative Skills - Mathematics (Linear Algebra, Calculus) - Probability - Statistics • Computer programming - Excel, VBA, C/C++, SAS • Knowledge of Derivatives and Fixed Income 12 March 2005 Slide 9

Skills Required for Quantitative Analysts/Risk Managers • Basic Quantitative Skills - Mathematics (Linear Algebra, Calculus) - Probability - Statistics • Computer programming - Excel, VBA, C/C++, SAS • Knowledge of Derivatives and Fixed Income 12 March 2005 Slide 9

Objective ü To equip graduates for the finance industry with: • Technical knowledge and skills in quantitative finance and risk management Strong quantitative modeling skills Analytical mind • • ü This programme is uniquely positioned to meet the increasing demand for graduates with quantitative modeling and risk management skills. 12 March 2005 Slide 10

Objective ü To equip graduates for the finance industry with: • Technical knowledge and skills in quantitative finance and risk management Strong quantitative modeling skills Analytical mind • • ü This programme is uniquely positioned to meet the increasing demand for graduates with quantitative modeling and risk management skills. 12 March 2005 Slide 10

Introduction üKey features: • Multi-disciplinary • • curriculum integrating mathematical methods and statistical tools, computing techniques with applications to finance Use of quantitative tools with state-of-the-art financial systems in the computing laboratory Projects with financial engineering applications Current programme committee: • A/P Ng Kah Hwa (Programme Director) • A/P Tan Hwee Huat (Deputy Director) 12 March 2005 Slide 11

Introduction üKey features: • Multi-disciplinary • • curriculum integrating mathematical methods and statistical tools, computing techniques with applications to finance Use of quantitative tools with state-of-the-art financial systems in the computing laboratory Projects with financial engineering applications Current programme committee: • A/P Ng Kah Hwa (Programme Director) • A/P Tan Hwee Huat (Deputy Director) 12 March 2005 Slide 11

The Honours-Track programme ü Students are only admitted to QF Major after two semesters of studies in the Science Faculty. ü Students admitted to QF major are placed in the honours track leading to a B. Sc (Hons) degree upon completing the course work requirement (given later). ü A student may, however, for various reasons, opt to exit earlier with a B. Sc upon completing the corresponding course work requirement (given next slide). ü Typically, a student will require 3 and 4 years to complete the requirement for B. Sc and B. Sc (Hons) respectively. A shorter timeframe is possible for some. 12 March 2005 Slide 12

The Honours-Track programme ü Students are only admitted to QF Major after two semesters of studies in the Science Faculty. ü Students admitted to QF major are placed in the honours track leading to a B. Sc (Hons) degree upon completing the course work requirement (given later). ü A student may, however, for various reasons, opt to exit earlier with a B. Sc upon completing the corresponding course work requirement (given next slide). ü Typically, a student will require 3 and 4 years to complete the requirement for B. Sc and B. Sc (Hons) respectively. A shorter timeframe is possible for some. 12 March 2005 Slide 12

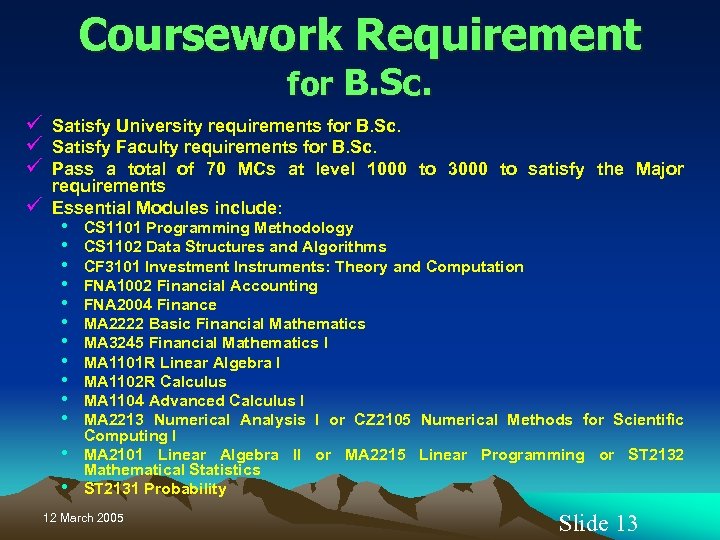

Coursework Requirement for B. Sc. ü ü Satisfy University requirements for B. Sc. Satisfy Faculty requirements for B. Sc. Pass a total of 70 MCs at level 1000 to 3000 to satisfy the Major requirements Essential Modules include: • • • • CS 1101 Programming Methodology CS 1102 Data Structures and Algorithms CF 3101 Investment Instruments: Theory and Computation FNA 1002 Financial Accounting FNA 2004 Finance MA 2222 Basic Financial Mathematics MA 3245 Financial Mathematics I MA 1101 R Linear Algebra I MA 1102 R Calculus MA 1104 Advanced Calculus I MA 2213 Numerical Analysis I or CZ 2105 Numerical Methods for Scientific Computing I MA 2101 Linear Algebra II or MA 2215 Linear Programming or ST 2132 Mathematical Statistics ST 2131 Probability 12 March 2005 Slide 13

Coursework Requirement for B. Sc. ü ü Satisfy University requirements for B. Sc. Satisfy Faculty requirements for B. Sc. Pass a total of 70 MCs at level 1000 to 3000 to satisfy the Major requirements Essential Modules include: • • • • CS 1101 Programming Methodology CS 1102 Data Structures and Algorithms CF 3101 Investment Instruments: Theory and Computation FNA 1002 Financial Accounting FNA 2004 Finance MA 2222 Basic Financial Mathematics MA 3245 Financial Mathematics I MA 1101 R Linear Algebra I MA 1102 R Calculus MA 1104 Advanced Calculus I MA 2213 Numerical Analysis I or CZ 2105 Numerical Methods for Scientific Computing I MA 2101 Linear Algebra II or MA 2215 Linear Programming or ST 2132 Mathematical Statistics ST 2131 Probability 12 March 2005 Slide 13

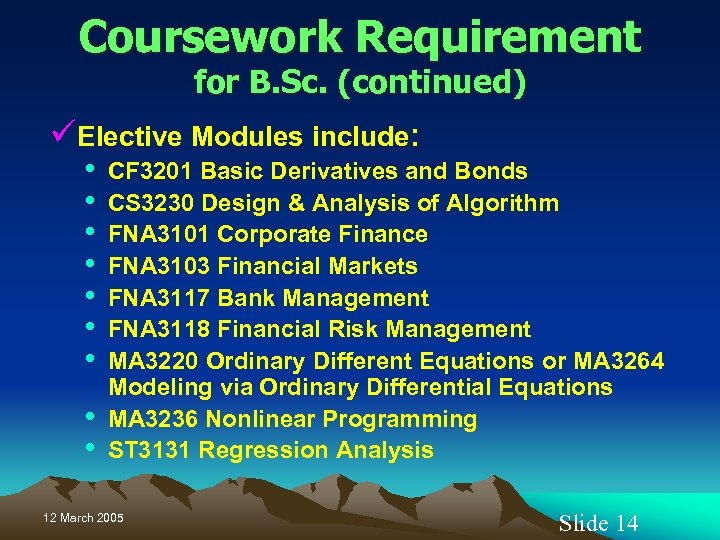

Coursework Requirement for B. Sc. (continued) üElective Modules include: • • • CF 3201 Basic Derivatives and Bonds CS 3230 Design & Analysis of Algorithm FNA 3101 Corporate Finance FNA 3103 Financial Markets FNA 3117 Bank Management FNA 3118 Financial Risk Management MA 3220 Ordinary Different Equations or MA 3264 Modeling via Ordinary Differential Equations MA 3236 Nonlinear Programming ST 3131 Regression Analysis 12 March 2005 Slide 14

Coursework Requirement for B. Sc. (continued) üElective Modules include: • • • CF 3201 Basic Derivatives and Bonds CS 3230 Design & Analysis of Algorithm FNA 3101 Corporate Finance FNA 3103 Financial Markets FNA 3117 Bank Management FNA 3118 Financial Risk Management MA 3220 Ordinary Different Equations or MA 3264 Modeling via Ordinary Differential Equations MA 3236 Nonlinear Programming ST 3131 Regression Analysis 12 March 2005 Slide 14

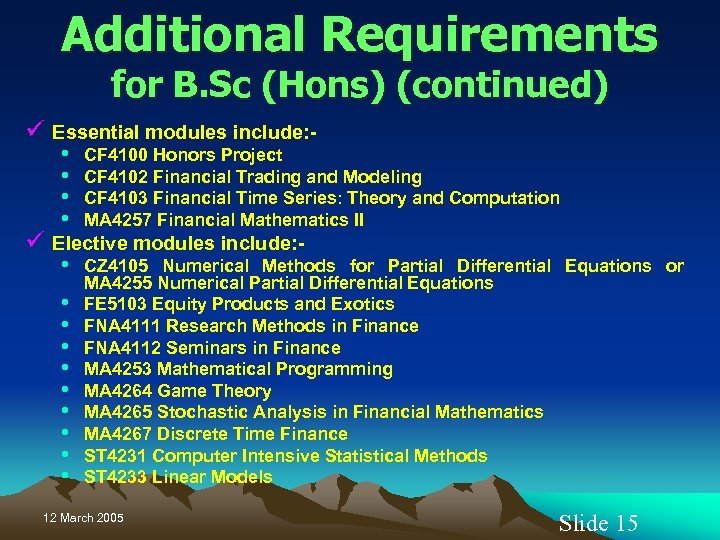

Additional Requirements for B. Sc (Hons) (continued) ü Essential modules include: • • CF 4100 Honors Project CF 4102 Financial Trading and Modeling CF 4103 Financial Time Series: Theory and Computation MA 4257 Financial Mathematics II • CZ 4105 Numerical Methods for Partial Differential Equations or MA 4255 Numerical Partial Differential Equations FE 5103 Equity Products and Exotics FNA 4111 Research Methods in Finance FNA 4112 Seminars in Finance MA 4253 Mathematical Programming MA 4264 Game Theory MA 4265 Stochastic Analysis in Financial Mathematics MA 4267 Discrete Time Finance ST 4231 Computer Intensive Statistical Methods ST 4233 Linear Models ü Elective modules include: • • • 12 March 2005 Slide 15

Additional Requirements for B. Sc (Hons) (continued) ü Essential modules include: • • CF 4100 Honors Project CF 4102 Financial Trading and Modeling CF 4103 Financial Time Series: Theory and Computation MA 4257 Financial Mathematics II • CZ 4105 Numerical Methods for Partial Differential Equations or MA 4255 Numerical Partial Differential Equations FE 5103 Equity Products and Exotics FNA 4111 Research Methods in Finance FNA 4112 Seminars in Finance MA 4253 Mathematical Programming MA 4264 Game Theory MA 4265 Stochastic Analysis in Financial Mathematics MA 4267 Discrete Time Finance ST 4231 Computer Intensive Statistical Methods ST 4233 Linear Models ü Elective modules include: • • • 12 March 2005 Slide 15

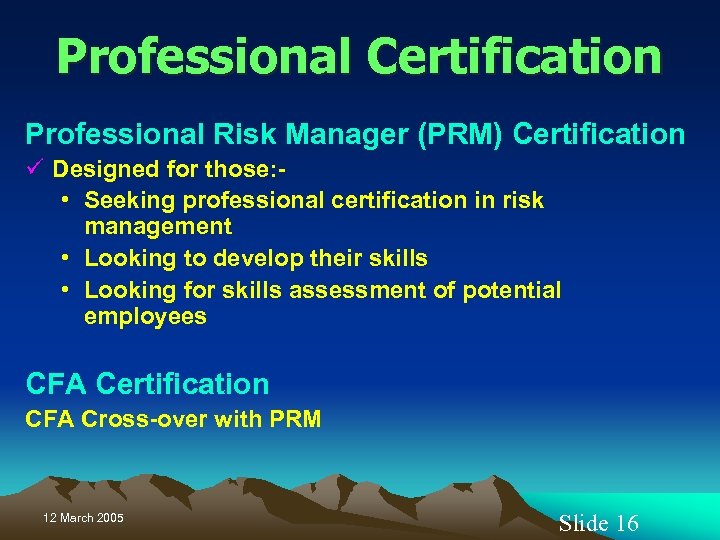

Professional Certification Professional Risk Manager (PRM) Certification ü Designed for those: • Seeking professional certification in risk management • Looking to develop their skills • Looking for skills assessment of potential employees CFA Certification CFA Cross-over with PRM 12 March 2005 Slide 16

Professional Certification Professional Risk Manager (PRM) Certification ü Designed for those: • Seeking professional certification in risk management • Looking to develop their skills • Looking for skills assessment of potential employees CFA Certification CFA Cross-over with PRM 12 March 2005 Slide 16

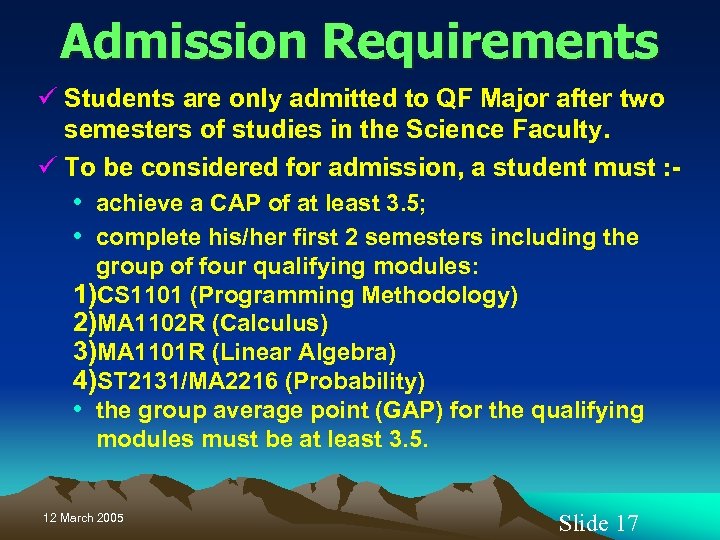

Admission Requirements ü Students are only admitted to QF Major after two semesters of studies in the Science Faculty. ü To be considered for admission, a student must : • achieve a CAP of at least 3. 5; • complete his/her first 2 semesters including the group of four qualifying modules: 1)CS 1101 (Programming Methodology) 2)MA 1102 R (Calculus) 3)MA 1101 R (Linear Algebra) 4)ST 2131/MA 2216 (Probability) • the group average point (GAP) for the qualifying modules must be at least 3. 5. 12 March 2005 Slide 17

Admission Requirements ü Students are only admitted to QF Major after two semesters of studies in the Science Faculty. ü To be considered for admission, a student must : • achieve a CAP of at least 3. 5; • complete his/her first 2 semesters including the group of four qualifying modules: 1)CS 1101 (Programming Methodology) 2)MA 1102 R (Calculus) 3)MA 1101 R (Linear Algebra) 4)ST 2131/MA 2216 (Probability) • the group average point (GAP) for the qualifying modules must be at least 3. 5. 12 March 2005 Slide 17

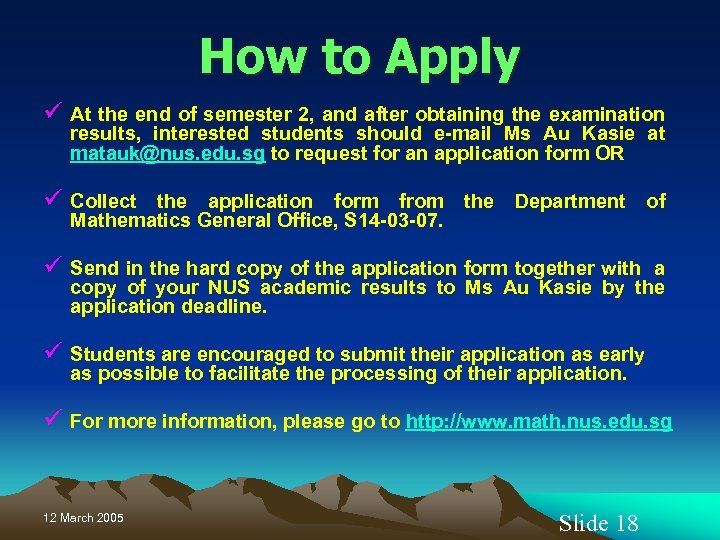

How to Apply ü At the end of semester 2, and after obtaining the examination results, interested students should e-mail Ms Au Kasie at matauk@nus. edu. sg to request for an application form OR ü Collect the application form from Mathematics General Office, S 14 -03 -07. the Department of ü Send in the hard copy of the application form together with a copy of your NUS academic results to Ms Au Kasie by the application deadline. ü Students are encouraged to submit their application as early as possible to facilitate the processing of their application. ü For more information, please go to http: //www. math. nus. edu. sg 12 March 2005 Slide 18

How to Apply ü At the end of semester 2, and after obtaining the examination results, interested students should e-mail Ms Au Kasie at matauk@nus. edu. sg to request for an application form OR ü Collect the application form from Mathematics General Office, S 14 -03 -07. the Department of ü Send in the hard copy of the application form together with a copy of your NUS academic results to Ms Au Kasie by the application deadline. ü Students are encouraged to submit their application as early as possible to facilitate the processing of their application. ü For more information, please go to http: //www. math. nus. edu. sg 12 March 2005 Slide 18

12 March 2005 Slide 19

12 March 2005 Slide 19