e3e5f1f2f6a4c11f93bc85edc1e81934.ppt

- Количество слайдов: 12

Opportunities from around the world? John Modd Director, Mail Triangle Management Services

Opportunities from around the world? John Modd Director, Mail Triangle Management Services

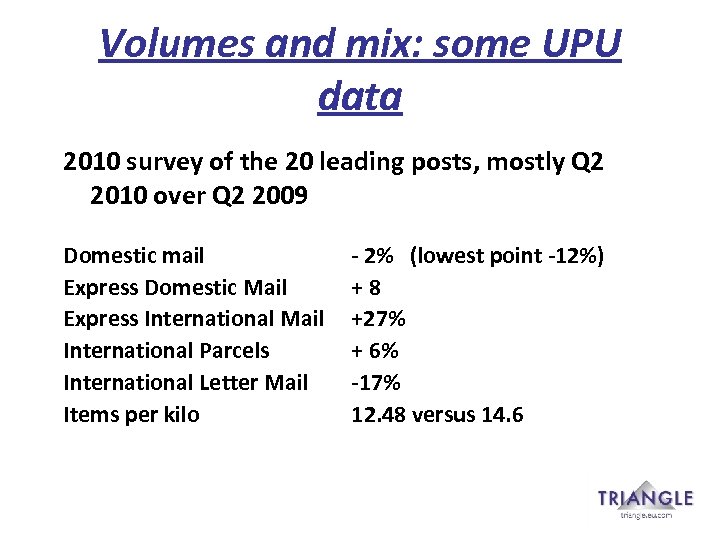

Volumes and mix: some UPU data 2010 survey of the 20 leading posts, mostly Q 2 2010 over Q 2 2009 Domestic mail Express Domestic Mail Express International Mail International Parcels International Letter Mail Items per kilo - 2% (lowest point -12%) + 8 +27% + 6% -17% 12. 48 versus 14. 6

Volumes and mix: some UPU data 2010 survey of the 20 leading posts, mostly Q 2 2010 over Q 2 2009 Domestic mail Express Domestic Mail Express International Mail International Parcels International Letter Mail Items per kilo - 2% (lowest point -12%) + 8 +27% + 6% -17% 12. 48 versus 14. 6

Contrasting data USPS • volumes down from 213 bn pieces per annum 2006 to 150 bn by 2020 Singapore Post • Mail volumes June-November 2010 up 30% year on year • Parcels volumes November 2010 on November 2009 up 90% • Ceased Saturday collection and delivery Royal Mail trials to improve delivery flexibility • Trial of mail order/e commerce evening delivery • Later opening hours for delivery offices (8. 00 pm Wednesdays)

Contrasting data USPS • volumes down from 213 bn pieces per annum 2006 to 150 bn by 2020 Singapore Post • Mail volumes June-November 2010 up 30% year on year • Parcels volumes November 2010 on November 2009 up 90% • Ceased Saturday collection and delivery Royal Mail trials to improve delivery flexibility • Trial of mail order/e commerce evening delivery • Later opening hours for delivery offices (8. 00 pm Wednesdays)

Ownerships and relationships • • TNT separation Royal Mail privatisation China Post express flotation and joint ventures Japan Post reversal La Poste new status Austria Post/Swiss Post international JV Poste Italiane co-operation with Russia Post

Ownerships and relationships • • TNT separation Royal Mail privatisation China Post express flotation and joint ventures Japan Post reversal La Poste new status Austria Post/Swiss Post international JV Poste Italiane co-operation with Russia Post

Direct Mail • Over 30% of B 2 B mailers in Europe and the US are using Transpromo • Hong Kong extends its reach into Mainland China • USPS offers Summer Sales and Simplified Addressing

Direct Mail • Over 30% of B 2 B mailers in Europe and the US are using Transpromo • Hong Kong extends its reach into Mainland China • USPS offers Summer Sales and Simplified Addressing

Digital developments (1) Digital platforms • Secure Pay (Australia) • Comparison Shopper Retail Website (Canada) • nugg. ad (Germany) • Local Information Services (New Zealand) • E-commerce fulfilment (Royal Mail)

Digital developments (1) Digital platforms • Secure Pay (Australia) • Comparison Shopper Retail Website (Canada) • nugg. ad (Germany) • Local Information Services (New Zealand) • E-commerce fulfilment (Royal Mail)

Digital developments (2) Email security • • . post from the UPU Net Posti from Itella E-Postbrief from Deutsche Post Swiss ID from Swiss Post

Digital developments (2) Email security • • . post from the UPU Net Posti from Itella E-Postbrief from Deutsche Post Swiss ID from Swiss Post

Digital developments (3) • Apps. Ø tracking Ø postcodes Ø post office locations Ø prices • Digital Postage • Personalisation Ø Greetings Cards Ø Indicia

Digital developments (3) • Apps. Ø tracking Ø postcodes Ø post office locations Ø prices • Digital Postage • Personalisation Ø Greetings Cards Ø Indicia

The wider digital world (1) Social Media • • Explosive growth in social media Impact on brand communication (good and bad) Increasingly regarded as an alternative to e mail Need for integration: brand evangelist “. . as social media grows, email will become less interesting or more of an inconvenience than a Twitter update…”

The wider digital world (1) Social Media • • Explosive growth in social media Impact on brand communication (good and bad) Increasingly regarded as an alternative to e mail Need for integration: brand evangelist “. . as social media grows, email will become less interesting or more of an inconvenience than a Twitter update…”

The wider digital world (2) Mobile telephony • 5 m mobile phones for a global population of 7 bn • One third of Facebook users are focused on mobile: 200 m people • Accessing e mails ‘on the go’ via mobile rather than laptop or PC: apps. and mobile friendly websites. • Messages must be crisper and less content heavy • Huge increase in mobile marketing: e. Bay sold $1. 5 bn worth of goods through mobile commerce in 2010 • Supports localisation of marketing messages • Google quoted as putting “mobile first” in all its product developments “…we have to rethink how we use images and not have content-heavy email campaigns…” with the risk of “consumers being overwhelmed by information overload…. ”

The wider digital world (2) Mobile telephony • 5 m mobile phones for a global population of 7 bn • One third of Facebook users are focused on mobile: 200 m people • Accessing e mails ‘on the go’ via mobile rather than laptop or PC: apps. and mobile friendly websites. • Messages must be crisper and less content heavy • Huge increase in mobile marketing: e. Bay sold $1. 5 bn worth of goods through mobile commerce in 2010 • Supports localisation of marketing messages • Google quoted as putting “mobile first” in all its product developments “…we have to rethink how we use images and not have content-heavy email campaigns…” with the risk of “consumers being overwhelmed by information overload…. ”

The wider digital world (3) Mobile retailing • Ocado: 5% of orders via transactional mobile services. “By launching an app. we let users update their shopping lists when they are travelling in places like the Tube. ” • M&S went to transactional mobile to attract a younger clientele • Tesco includes a barcode scanner in its App. enabling users to scan the barcodes of products they have just run out of to add to shopping lists. (Thanks to Marketing Week for the information contained in these three slides. )

The wider digital world (3) Mobile retailing • Ocado: 5% of orders via transactional mobile services. “By launching an app. we let users update their shopping lists when they are travelling in places like the Tube. ” • M&S went to transactional mobile to attract a younger clientele • Tesco includes a barcode scanner in its App. enabling users to scan the barcodes of products they have just run out of to add to shopping lists. (Thanks to Marketing Week for the information contained in these three slides. )

Conclusions • Mail survives and parcels thrive • Posts continue to search for new ownership and partnership models • Most innovation is in areas related to the internet • Is the marketing world moving beyond direct mail once and for all?

Conclusions • Mail survives and parcels thrive • Posts continue to search for new ownership and partnership models • Most innovation is in areas related to the internet • Is the marketing world moving beyond direct mail once and for all?