c74fc31f1c40b555a084d093aab3afe0.ppt

- Количество слайдов: 67

Opportunities for Green Investment 17 th November 2008

The State of Responsible Business in 2008 Bob Gordon 17 th November 2008 © EIRIS

Contents • EIRIS • The Principles for Responsible Investment (PRI) • The Report • Results: Environment & Climate Change • Recommendations © EIRIS

EIRIS • Independent Research Provider • Operating for 25 years • Research c. 3, 000 companies worldwide • Covering over 60 areas • Robust methodology – assessing risk, identifying opportunity • Policy, systems, reporting, performance © EIRIS

The Principles for Responsible Investment • A framework for incorporating ESG • Complements and promotes the UN Global Compact • Provides support Principle 1: Principle 2: To be active owners and incorporate ESG issues into ownership policies and practices. Principle 3: © EIRIS To incorporate ESG issues into investment analysis and decision-making processes. To seek appropriate disclosure on ESG issues by the companies invested in.

The State of Responsible Business • Objectives of the report • Response and reporting results • • • FTSE All World Developed Index Addresses UN Global Compact issues Explores risk exposure and corporate response • Convention Watch • EIRIS PRI Toolkit © EIRIS

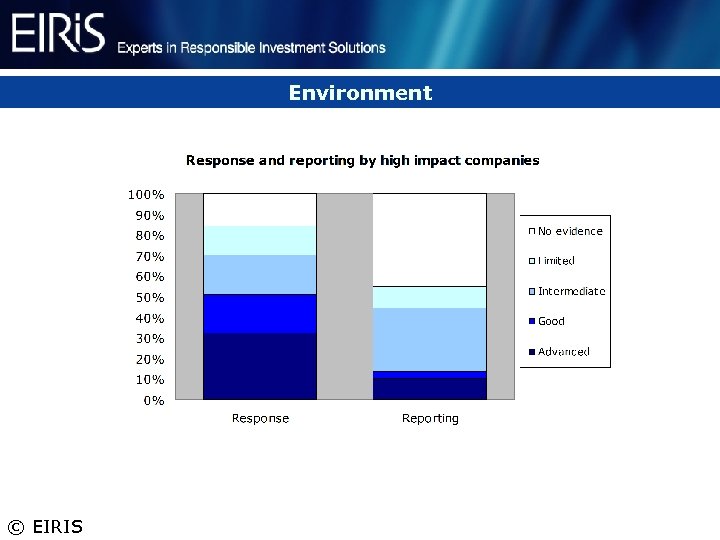

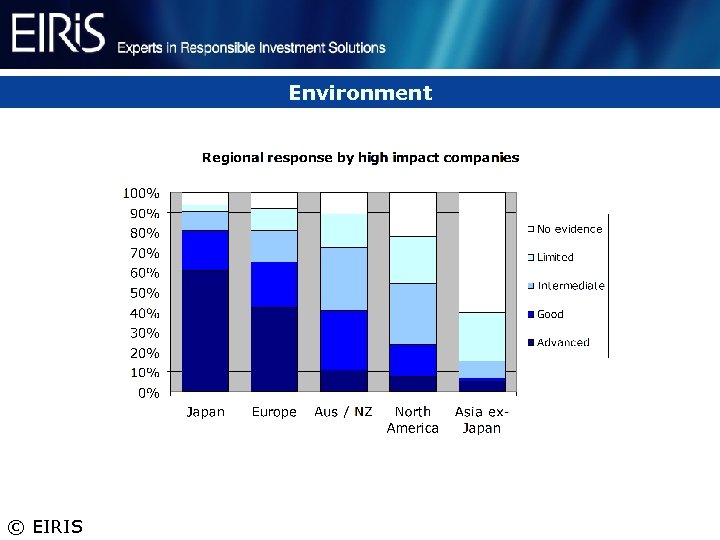

Environment © EIRIS

Environment © EIRIS

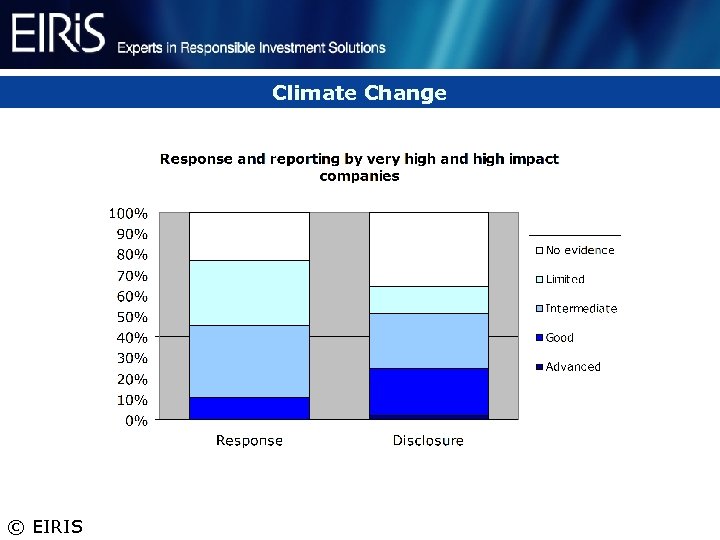

Climate Change © EIRIS

Recommendations Ø Integrate ESG risk into your investment strategy Ø Engage to improve company performance Ø Seek better corporate disclosure Ø Support the PRI © EIRIS

Opportunities for Green Investment Jo Allen Head of SEE Engagement & Research 17 th November 2008

Summary • The Co-operative Asset Management • Why incorporate environment into investment analysis • Our Approach: Investment Philosophy and Analysis Process • Sustainable Leaders Trust • Good Companies Guide • Case Studies: Drax and Scottish & Southern Energy • Engagement on Environmental Issues • Investment Performance 12

The Co-operative Asset Management • The Co-operative Asset Management carry out the fund management activities of The Co-operative Financial Services and is part of The Co-operative Group. • 300, 000 investors in unit trust range approx £ 20 billion AUM. • Co-operative ownership structure & longstanding socially responsible tradition. • Fully integrate ESG issues throughout the investment process. • Ethical Engagement Policy launched following customer consultation in 2005, applied to all funds under management. 13

Why incorporate environmental issues into investment decisions? • ESG issues are material – robust evidence that ESG affects shareholder value in both the short and long term • Identification of potentially overlooked risks reduces portfolio risk • Engagement on environmental issues delivers more decision-useful information • Enhances fundamental company analysis • Enhances fund performance 14

Investment Philosophy We believe that by looking over a longer time horizon and using a broader perspective than the market, we can identify mispriced stocks and build focused portfolios to deliver sustainable performance. It is fundamental to our view of responsible investment to promote good governance and reflect our investors’ values. 15

Our analysis process Theme • Identify and quantify macroeconomic, social and political trends • Investigate long-term thematic changes with senior management at company meetings • Medium to long term trends tend to be underestimated • Industry • Awareness of global industry changes and their interactions between industries • Industry lifecyles can be more important than economic cycles • Understanding the change in industry dynamics, particularly competitive behaviour • Company • Identify good businesses - cash generative, well capitalised, generating above WACC returns • Focus on changing situations, e. g. new managements or transformational M&A • House view on a stock derived from agreement between equity analysts, ESG and fixed income Quantify change and incorporate to valuations

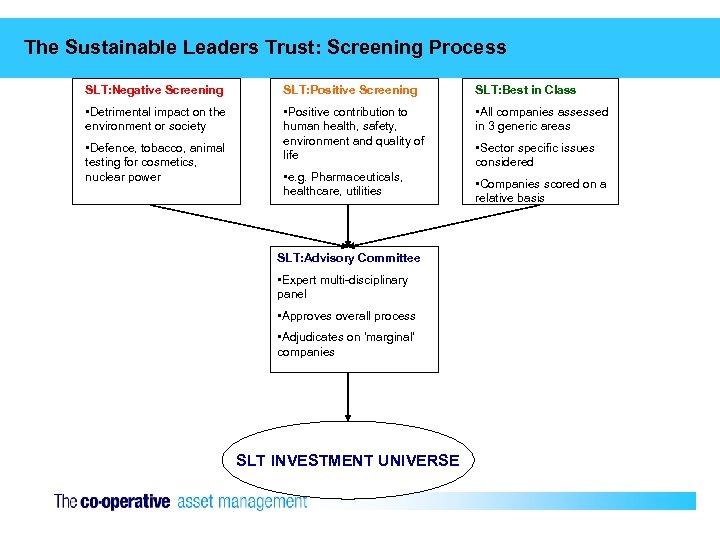

The Sustainable Leaders Trust: Screening Process SLT: Negative Screening SLT: Positive Screening SLT: Best in Class • Detrimental impact on the environment or society • Positive contribution to human health, safety, environment and quality of life • All companies assessed in 3 generic areas • Defence, tobacco, animal testing for cosmetics, nuclear power • e. g. Pharmaceuticals, healthcare, utilities SLT: Advisory Committee • Expert multi-disciplinary panel • Approves overall process • Adjudicates on ‘marginal’ companies SLT INVESTMENT UNIVERSE • Sector specific issues considered • Companies scored on a relative basis

Sustainable Leaders Trust: Investment Universe What does the investment universe look like? • Key underweights: Oil, mining, tobacco, defence • Key overweights: Healthcare, utilities, housebuilders, business services • Companies approved: Focused fund: invests in 40 -50 companies (170 approved for investment = 52%of FTSE All-share) plus AIM and some overseas. High quality • Positive structural drivers: increasing demand for healthcare, environmental and H&S regulation, sustainability 18

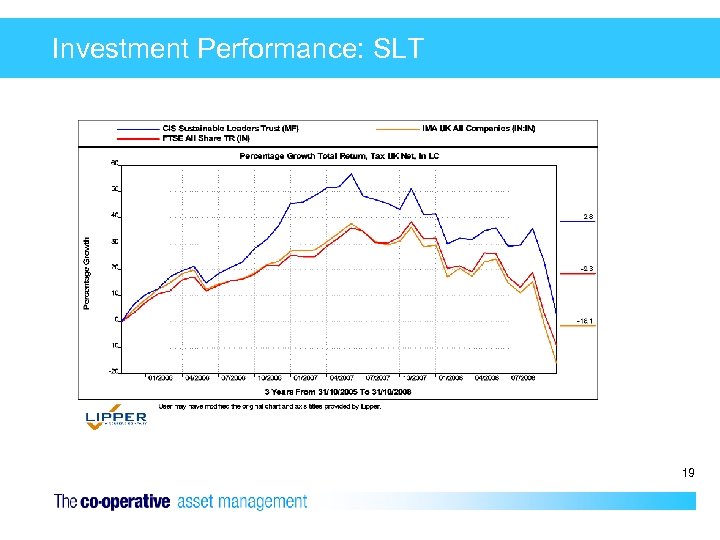

Investment Performance: SLT 19

Key ethical peers Performance Data up to 31/07/08 Performance 3 months % 1 year % 3 years % TCAM Sustainable Leaders -3. 9 -11. 8 28. 0 Aegon Ethical -6. 1 -10. 9 33. 8 F&C Stewardship Growth -12. 2 -24. 6 0. 6 Jupiter Ecology -3. 1 -9. 0 39. 9 NU Sustainable Future -7. 3 -19. 5 11. 4 Source Lipper • Consistent, competitive performance

Our Approach: The Good Companies Guide • A guide to help individual investors wanting to put their money into companies making a positive contribution to society • Highlight issues commonly considered as part of our investment approach • Investor transparency: UNPRI • Naming and shaming? Unavoidable. But also congratulating! 21

“The Good Companies Guide”: what we measured • Risk Management & Reporting • Environmental: control of impacts and management of risk (e. g. arising from climate change). • Social: management of stakeholder relationships and workplace relations and the risks these pose to business • Governance: independent oversight; board effectiveness; audit; directors’ remuneration; shareholder alignment. • Sector-specific: e. g. , food retailers – responsible sourcing; planning and competition; labelling and marketing; product sustainability. 22

Drax: squaring the circle? SRI analysis identified: • Single-asset coal plant proscribed by EU ETS • Limited headroom for reducing absolute emissions • Drax will suffer when Phase 2 of ETS corrects over-allocation • Significant costs (c. £ 160 m p. a. assuming $20 carbon price) 'til 2012, after which permits are likely to be 100% auctioned Integration in practice: • This contributed to case for reducing exposure to Drax and a bearish houseview • Fund managers and SRI analysts working together on what Drax's new 'Project Willow' to build 3 biomass plants from 2015 means for our previous analysis.

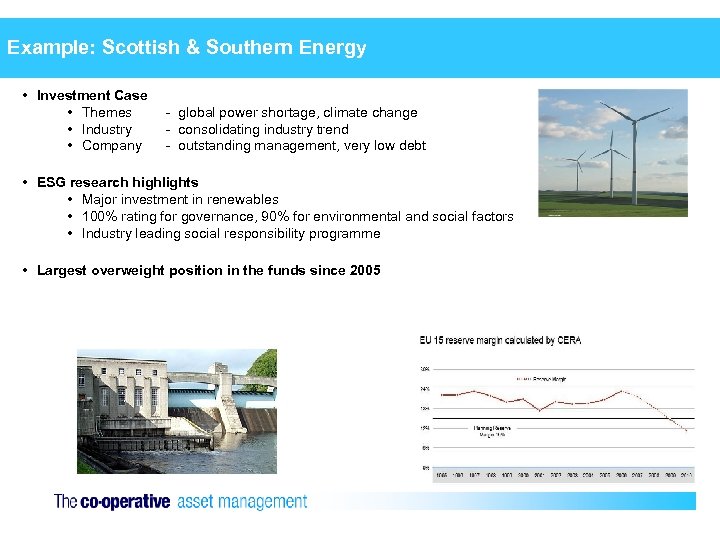

Example: Scottish & Southern Energy • Investment Case • Themes • Industry • Company - global power shortage, climate change - consolidating industry trend - outstanding management, very low debt • ESG research highlights • Major investment in renewables • 100% rating for governance, 90% for environmental and social factors • Industry leading social responsibility programme • Largest overweight position in the funds since 2005

Engaging on the Environment • Tar Sands “Unconventional Oil: Scraping the Bottom of the Barrel”: commercialisation of unconventional fossil fuels. Intensively climate hostile sources of energy. Called on companies to report on the risks associated with the env & soc liabilities of oil sands operations. Halt further expansion. • Biofuels: report on the sustainability risks and opportunities surrounding biofuels, including the impact on food prices. • HSBC Samling: investment in a Malaysian logging company was at odds with HSBC commitment to the Equator Principles. • Severn Trent: failures in governance since 2002. Fined £ 36 m by OFWAT for submitting to false customer satisfaction data, used to justify increases in customer tariffs. • UNPRI: Engagement clearinghouse 25

Jo Allen Head of SEE Research & Engagement The Co-operative Asset Management 22 nd Floor, Miller Street Manchester M 60 0 AL t: (0)161 9034014 m: (0)7912162963 e: jo. allen@cfs. coop 26

Disclaimer This document is provided to you for your information and discussion only. It is not a solicitation or an offer to buy or sell any security or other financial instrument. Any analytical information provided is for information purposes only and is not an impartial assessment of the value or the prospects of its subject matter. Nothing in this document constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your or your clients' individual circumstances, or otherwise constitutes a personal recommendation to you or your clients. Any information in this document (including facts, opinions or quotations) may be condensed or summarised and are expressed as of the date of writing. The information may change without notice and The Co-operative Asset Management is under no obligation to ensure that such updates are brought to your attention. The price and value of investments mentioned any income that might accrue could fall or rise or fluctuate, and investors may get back less than they invest. Past performance is not a guide to future performance. This document has been prepared from sources The Co-operative Asset Management believes to be reliable but we do not guarantee its accuracy or completeness and do not accept liability for any loss arising from its use (including as a result of any acts or omissions based on the information). The Co-operative Asset Management, its affiliates and/or their employees may have a position or holding, or other material interest or effect transactions in any securities mentioned or options thereon, or other investments related thereto and from time to time may add to or dispose of such investments. This document is intended only for the person to whom it is issued by The Co-operative Asset Management. It may not be reproduced or distributed either in whole, or in part, without our written permission. The distribution of this document and the offer and sale of the investment in certain jurisdictions may be forbidden or restricted by law or regulation. For the purposes of this document The Co-operative Asset Management means Co-operative Insurance Society Limited and or its subsidiary company CIS Unit Managers Limited. Both companies are authorised and regulated by the Financial Services Authority. The registered address is CIS Tower, Miller Street, Manchester, M 60 OAL (CIS registered no: IP 3615 R, CIS Unit Managers Limited registered number: 02369965).

Opportunities for Green Investment Presentation to charity advisors and investors 17 th November 2008 Pagasus House, 37 -43 Sackville Street, London, W 1 S 3 EH, UK Tel: +44 (0)20 7434 1122 Fax: +44 (0)20 7437 1245 Impax Asset Management Limited is authorised & regulated by the Financial Services Authority

Agenda • Introduction to Impax Asset Management • Background on environmental investing • Different approaches to environmental investing

Introduction to Impax Asset Management

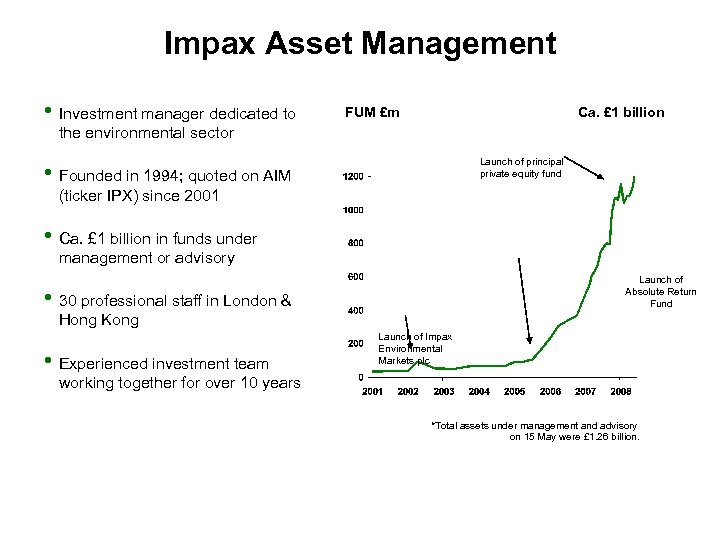

Impax Asset Management • Investment manager dedicated to FUM £m Ca. £ 1 billion the environmental sector Launch of principal private equity fund • Founded in 1994; quoted on AIM (ticker IPX) since 2001 • Ca. £ 1 billion in funds under management or advisory Launch of Absolute Return Fund • 30 professional staff in London & Hong Kong • Experienced investment team Launch of Impax Environmental Markets plc working together for over 10 years *Total assets under management and advisory on 15 May were £ 1. 26 billion.

Background on environmental investing

What is environmental investing? Environmental investing: “Investing in companies which provide, utilise, implement or advise upon technology-based systems, products or services in environmental markets, particularly those of alternative energy and energy efficiency, water treatment and pollution control, and waste technology and resource management. ” Environmental Investing differs from mainstream SRI by: • Investing only in environment-related sectors • Applying no ethical screens • Focusing on returns only

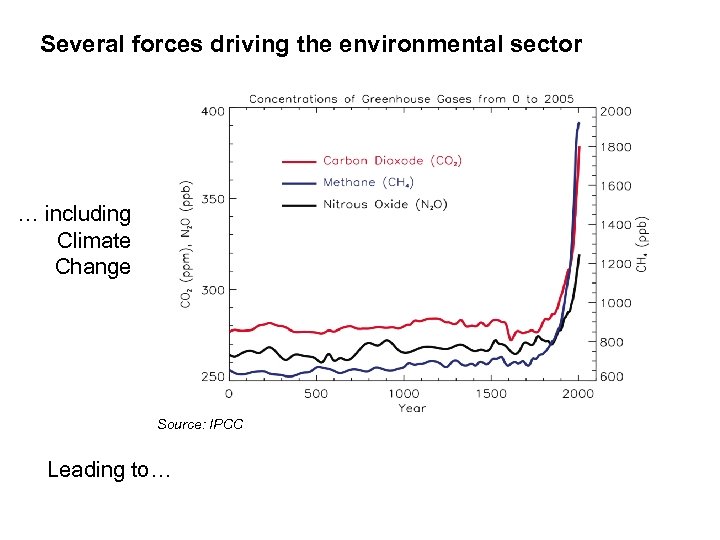

Several forces driving the environmental sector … including Climate Change Source: IPCC Leading to…

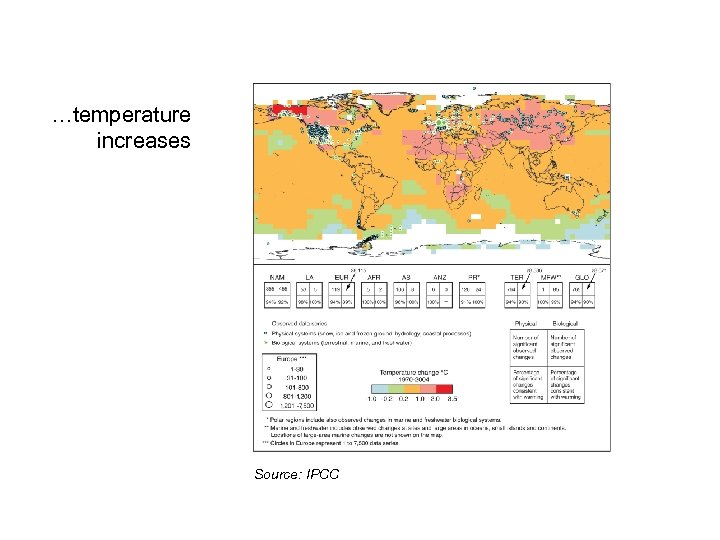

…temperature increases Source: IPCC

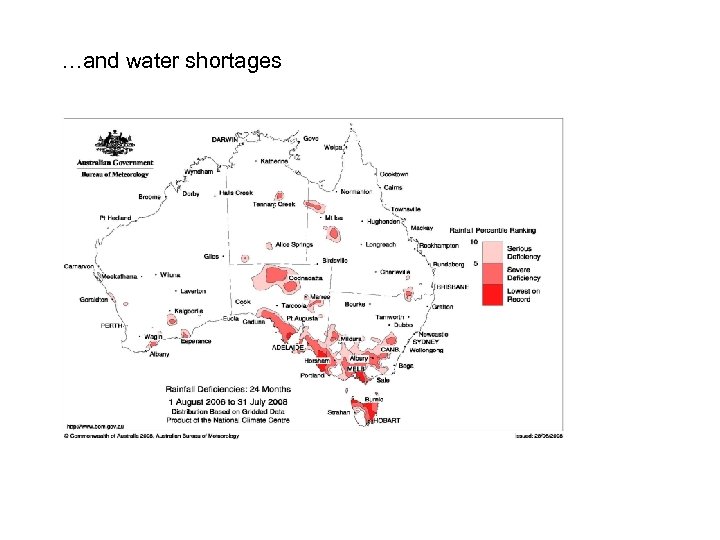

…and water shortages

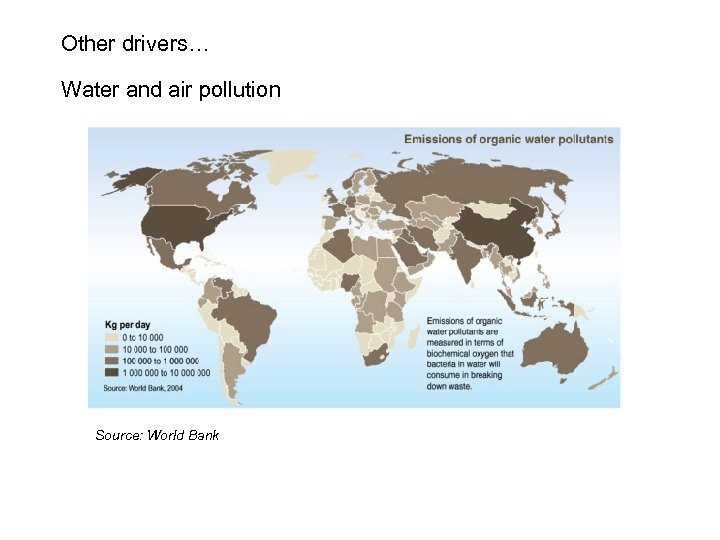

Other drivers… Water and air pollution Source: World Bank

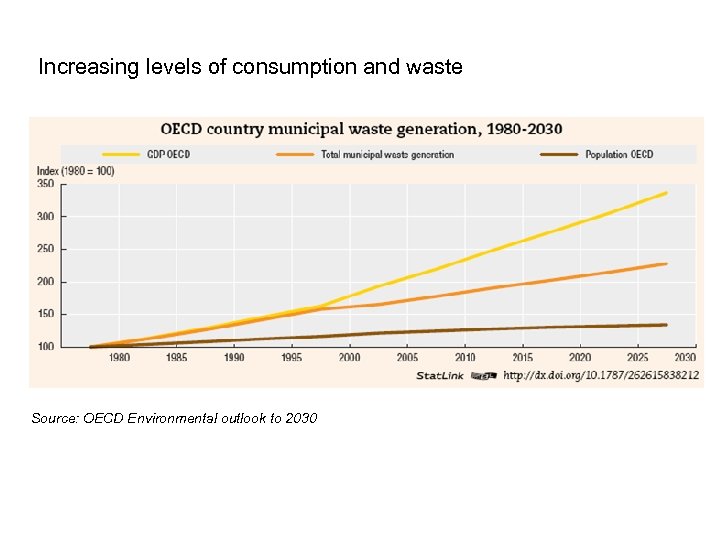

Increasing levels of consumption and waste Source: OECD Environmental outlook to 2030

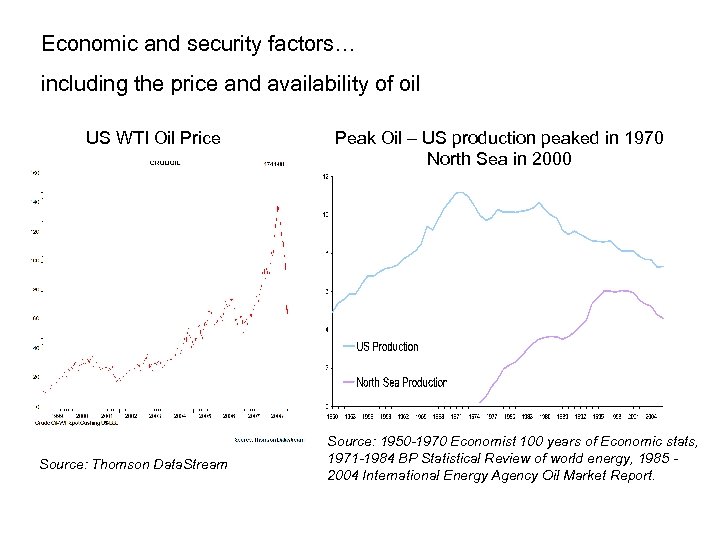

Economic and security factors… including the price and availability of oil US WTI Oil Price Source: Thomson Data. Stream Peak Oil – US production peaked in 1970 North Sea in 2000 Source: 1950 -1970 Economist 100 years of Economic stats, 1971 -1984 BP Statistical Review of world energy, 1985 2004 International Energy Agency Oil Market Report.

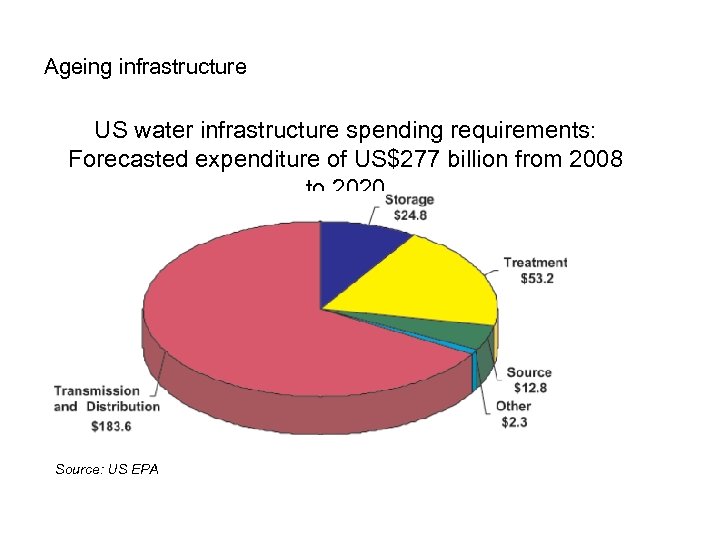

Ageing infrastructure US water infrastructure spending requirements: Forecasted expenditure of US$277 billion from 2008 to 2020 Source: US EPA

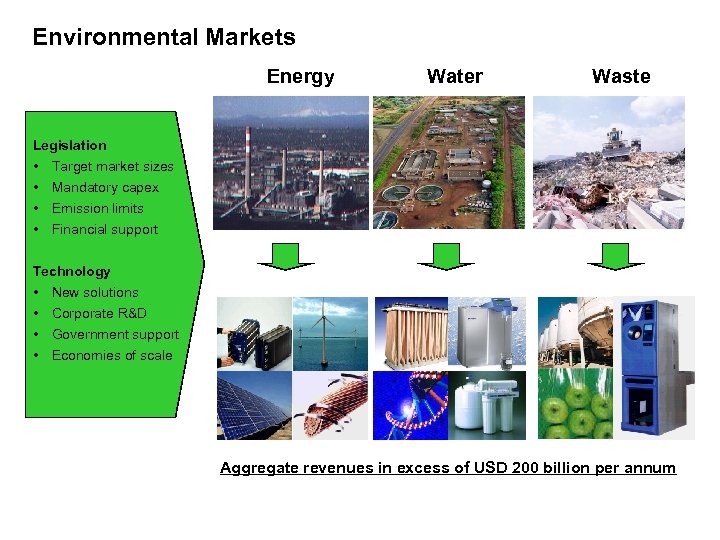

Environmental Markets Energy Water Waste Legislation • • Target market sizes Mandatory capex Emission limits Financial support Technology • • New solutions Corporate R&D Government support Economies of scale Aggregate revenues in excess of USD 200 billion per annum

Different approaches to environmental investing

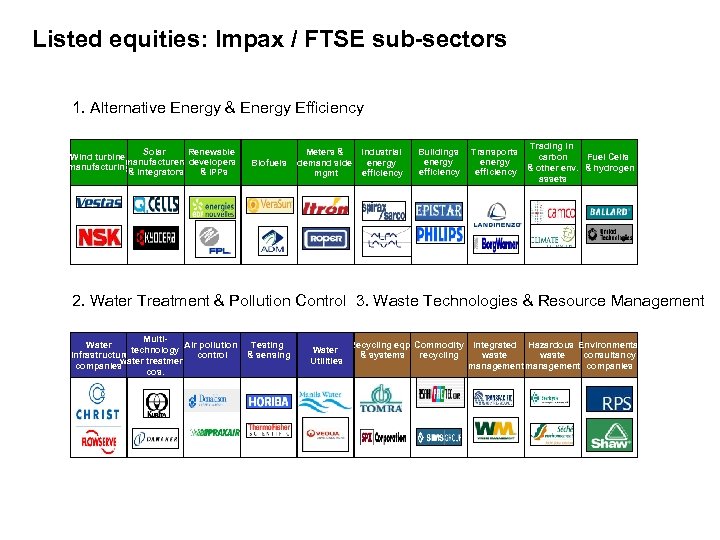

Listed equities: Impax / FTSE sub-sectors 1. Alternative Energy & Energy Efficiency Renewable Solar Wind turbine manufacturers developers manufacturing & IPPs & integrators Biofuels Meters & demand side mgmt Industrial energy efficiency Buildings energy efficiency Trading in Transports carbon Fuel Cells energy efficiency & other env. & hydrogen assets 2. Water Treatment & Pollution Control 3. Waste Technologies & Resource Management Multi. Water Air pollution technology infrastructure control water treatment companies cos. Testing & sensing Water Utilities Recycling eqpt. Commodity & systems recycling Integrated Hazardous Environmental waste consultancy management companies

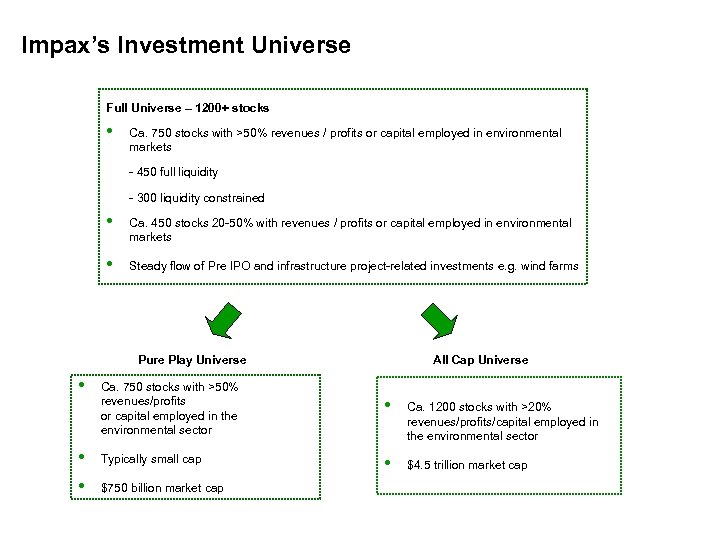

Impax’s Investment Universe Full Universe – 1200+ stocks • Ca. 750 stocks with >50% revenues / profits or capital employed in environmental markets - 450 full liquidity - 300 liquidity constrained • Ca. 450 stocks 20 -50% with revenues / profits or capital employed in environmental markets • Steady flow of Pre IPO and infrastructure project-related investments e. g. wind farms Pure Play Universe • All Cap Universe Ca. 750 stocks with >50% revenues/profits or capital employed in the environmental sector • Ca. 1200 stocks with >20% revenues/profits/capital employed in the environmental sector • Typically small cap • $4. 5 trillion market cap • $750 billion market cap

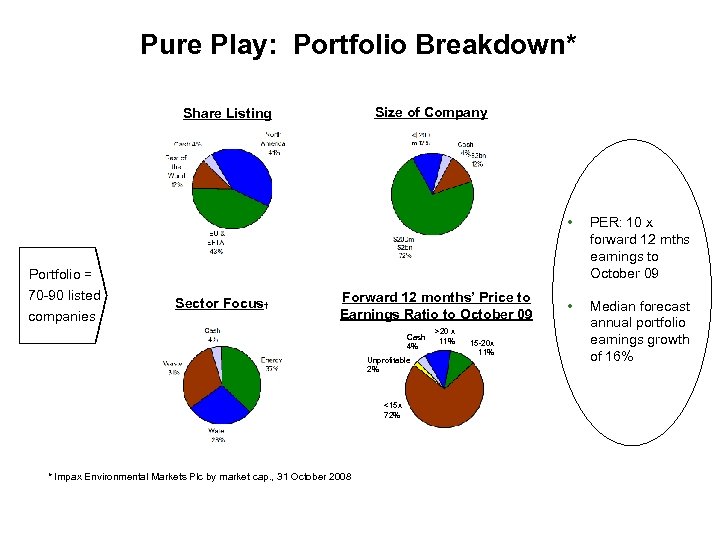

Pure Play: Portfolio Breakdown* Size of Company Share Listing • PER: 10 x forward 12 mths earnings to October 09 • Median forecast annual portfolio earnings growth of 16% Portfolio = 70 -90 listed companies Sector Focus† Forward 12 months’ Price to Earnings Ratio to October 09 Cash 4% Unprofitable 2% <15 x 72% * Impax Environmental Markets Plc by market cap. , 31 October 2008 >20 x 11% 15 -20 x 11%

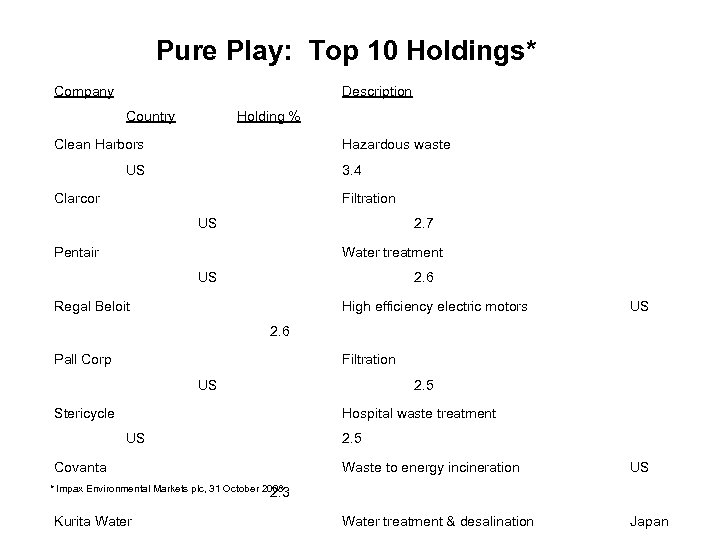

Pure Play: Top 10 Holdings* Company Description Country Holding % Clean Harbors Hazardous waste US 3. 4 Clarcor Filtration US 2. 7 Pentair Water treatment US 2. 6 Regal Beloit High efficiency electric motors US 2. 6 Pall Corp Filtration US 2. 5 Stericycle Hospital waste treatment US 2. 5 Covanta Waste to energy incineration US Water treatment & desalination Japan * Impax Environmental Markets plc, 31 October 2008 2. 3 Kurita Water

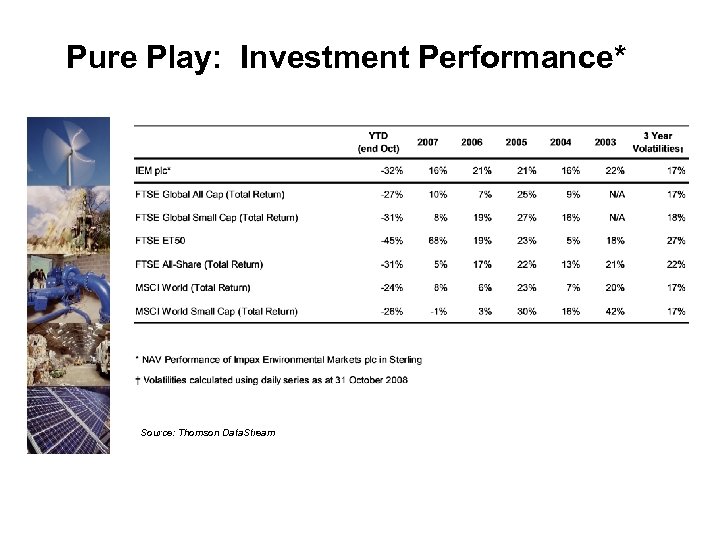

Pure Play: Investment Performance* Source: Thomson Data. Stream

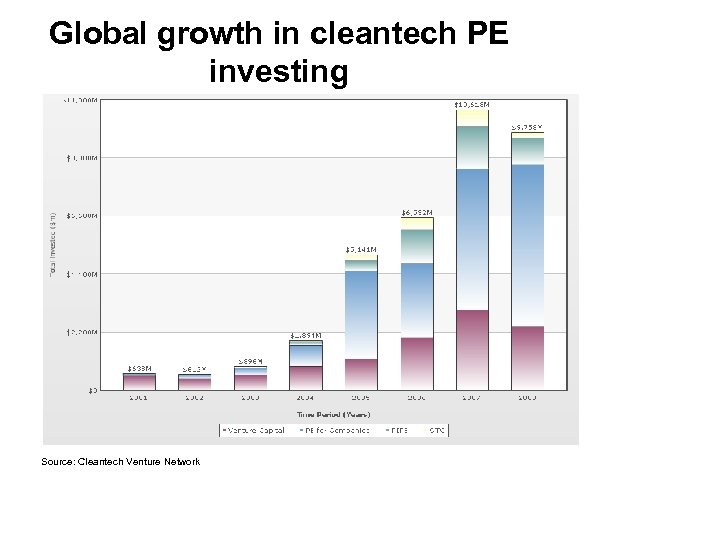

Global growth in cleantech PE investing Source: Cleantech Venture Network

Example PE investment • • Innovate design of fuel cells fork-lift trucks • Fast recharging and consistent performance beat the traditional battery alternative • • Sold to Plug Power in March 2007 Focussed on distribution hub application – indoor, clean-air demand Impax investment return with 70%+ IRR

Infrastructure investing • Sector has scale and is growing rapidly • Individual projects offer low technology risk & attractive economics • Sponsors can partner with a specialist fund or sell out to a utility • Fund can add value e. g. by arranging debt, overseeing construction, repackaging assets • Early movers (funds) can leverage expertise and relationships • Projected fund IRRs > 20%

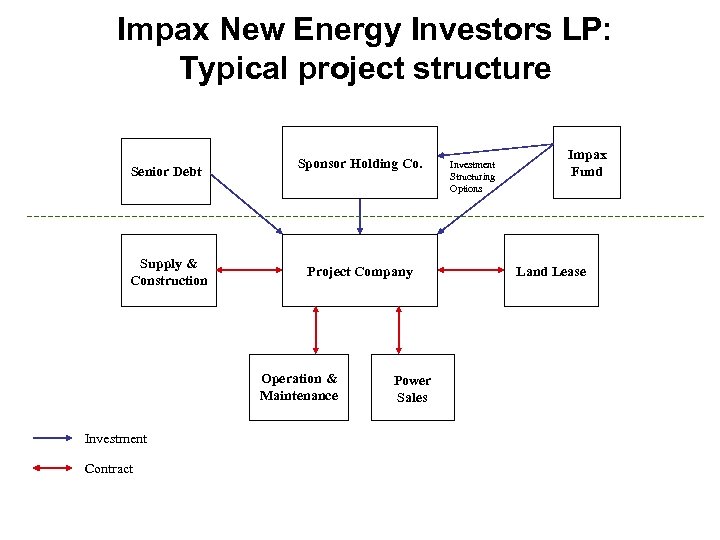

Impax New Energy Investors LP: Typical project structure Senior Debt Supply & Construction Sponsor Holding Co. Project Company Operation & Maintenance Investment Contract Power Sales Investment Structuring Options Impax Fund Land Lease

Conclusio ns • • • Strong market drivers leading to superior expected growth rates • Venture investments likely to perform well but exits dependent on favourable markets • Project-related investments well suited to “infrastructure” asset class Continuing government support for environmental sector Well-chosen, diversified portfolios of listed stocks should outperform global markets

Contact Details Adrian Cornwall Tel: +44 20 7432 2609 a. cornwall@impax. co. uk Disclaimer This document has been prepared by Impax Asset Management Limited (Impax, authorized and regulated by the Financial Services Authority). The information and any opinions contained in this document have been compiled in good faith, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Impax, its officers, employees, representatives and agents expressly advise that they shall not be liable in any respect whatsoever for any loss or damage, whether direct, indirect, consequential or otherwise however arising (whether in negligence or otherwise) out of or in connection with the contents of or any omissions from this document. This document does not constitute an offer to sell, purchase, subscribe for or otherwise invest in units or shares of any fund managed by Impax. It may not be relied upon as constituting any form of investment advice and prospective investors are advised to ensure that they obtain appropriate independent professional advice before making any investment in any such Fund. Any offering is made only pursuant to the relevant offering document and the relevant subscription application, all of which must be read in their entirety. Prospective investors should review the offering memorandum, including the risk factors in the offering memorandum, before making a decision to invest. Past performance of a fund is no guarantee as to its performance in the future. This presentation is not an advertisement and is not intended for public use or distribution.

Les Jones Ethical and Socially Responsible Investment in Practice

Ethical and Socially Responsible Investment What is it: • Ethical – interpreted frequently as negative – avoid certain companies • Socially responsible investment – interpreted frequently as positive – focus on positive companies • The two get mixed • I believe a sound policy should have elements of both • Integrates values and social concerns with investment decisions • Considers both the charity’s investment needs and the impact they will have on society/the environment etc.

Ethical and Socially Responsible Investment The Charity Commission’s views • The governing document • Trustees decide on any policy • Case law (Bishop of Oxford) trustees must seek to make returns on their investments but they can avoid companies whose activities interfere with their objectives • A view that companies which act in a socially responsible way deliver the best long term returns • Trustees are free to adopt a policy they reasonably believe provides the best balance of risk and reward

Ethical and Socially Responsible Investment Why charities must consider a policy • Exceptions to the primary responsibility to maximise the return – Where the activities of the company are clearly in conflict with the charity’s aims – Investing in a particular company or sector may hamper the work of the charity e. g. reputational risk – donors – Trustees may take a more personal moral stance if this does not risk “significant financial detriment” – If a policy exists it must be disclosed – SORP 2005 – If it doesn’t?

WWF – A Case Study • • 1996 a principles statement 1996 first challenge – Jonathon Porritt 1997 a new policy 1999 policy made more positive with more engagements • 2000 policy used as basis of WWF/NPI investment fund – Economist – Times – Daily Mail • 2000 policy extended to include all relationships with business and industry • Subsequently - More positive - More engagement

WWF Socially Responsible Investment Policy • Overall objectives • Primary objective: to maximise the value of its investments by way of a diversified portfolio • No investment will be permitted in companies whose business operations conflict with or detract from the objects of the charity • Investments should promote the principles of socially responsible investment • This means investing in companies whose operations enhance the environment for the benefit of present and future generations • The concept of “inherent sustainability”

WWF Socially Responsible Investment Policy The three tests: • Invest in positively sustainable companies • The exclusion test – – Armaments/offensive weapons Tobacco Trade in cites appendix 1 listed flora and/or fauna Animal testing for cosmetic or other non-medical products or medical testing on endangered species – Nuclear power The 10% test

WWF Socially Responsible Investment Policy The third test – extreme caution • Investing in these sectors will shift the core business on to a more sustainable basis e. g: – – – – Genetic engineering Pesticides and agro chemicals Oil Fossil fuels Intensive farming Mining Environmentally insensitive tourism • Best in sector • The decisions are informed by the Ethical Investment research Service (EIRIS)

WWF Socially Responsible Investment Policy Engagement. • Dialogue with companies we invest in • Influence performance and attitudes to the environment • Research matrix • Company questionnaires • The policy to be disclosed in the annual report and accounts • Influence WWF International and the national organisations

WWF Socially Responsible Investment Policy Other factors: • Campaigning engagement – – BP shareholders motion Portfolio share holding Investment advisors Animal testing etc. • The business and industry policy – – Based on investment policy Who we take money from Who we partner Confrontation • The business and industry group – Cross departmental – Considers relationships – Knows what is in portfolio

Ethical and Socially Responsible Investment Other charity involvement • Animal charity – – Animal testing Human health The laboratories The environment • Medical charity – Smoking ? – Airlines – Insurance companies.

Ethical and Socially Responsible Investment Getting involved • He WWF-UK/NPI fund – – – Joint fund Some of the proceeds to WWF-UK Joint committee Well received Amp takeover • The Living Planet fund – – – Owned by WWF International A “world” fund Delegate investment management $50 million Not yet marketed in the uk • The future – Morale hazard

Ethical and Socially Responsible Investment Conclusion • All charities need a socially responsible/ethical policy/statement – irrespective of money or size • Charities should set an example • It needs to be realistic and balanced • Trustees need to be involved • Charities should engage

Opportunities for Green Investment www. charitysri. org

c74fc31f1c40b555a084d093aab3afe0.ppt