520766c663ca9a432223af81d90f0fb3.ppt

- Количество слайдов: 35

Operations Management Session 25: Supply Chain Coordination

Operations Management Session 25: Supply Chain Coordination

Today’s Lecture w How information and incentives impact the performance? w Supply Chain Coordination w Vertical Integration Session 25 Operations Management 2

Today’s Lecture w How information and incentives impact the performance? w Supply Chain Coordination w Vertical Integration Session 25 Operations Management 2

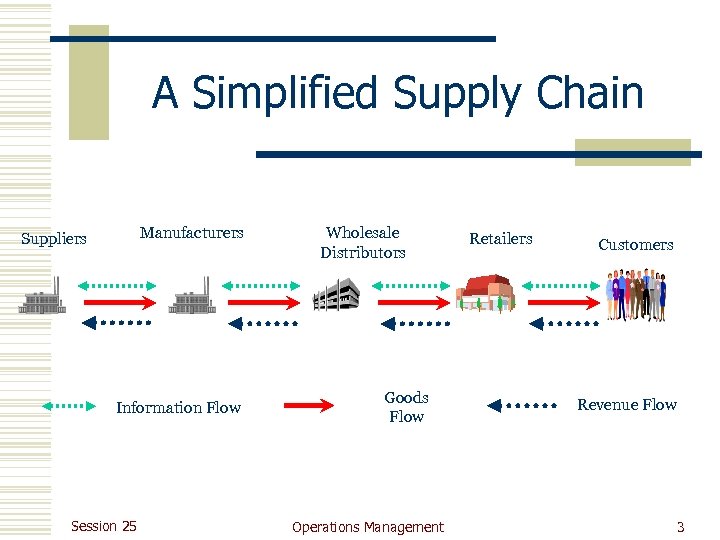

A Simplified Supply Chain Manufacturers Suppliers Information Flow Session 25 Wholesale Distributors Goods Flow Operations Management Retailers Customers Revenue Flow 3

A Simplified Supply Chain Manufacturers Suppliers Information Flow Session 25 Wholesale Distributors Goods Flow Operations Management Retailers Customers Revenue Flow 3

Supply Chain Management (SCM) w Supply Chain Management (SCM) concerns the coordination and optimization of all supply, manufacturing, distribution and logistics activities from raw materials to finished goods to the customer. w SCM strives to use the supply chain as a mutually beneficial competitive tool. Session 25 Operations Management 4

Supply Chain Management (SCM) w Supply Chain Management (SCM) concerns the coordination and optimization of all supply, manufacturing, distribution and logistics activities from raw materials to finished goods to the customer. w SCM strives to use the supply chain as a mutually beneficial competitive tool. Session 25 Operations Management 4

Multiple Perspectives w Raw Materials Suppliers w Component Manufacturer w Systems Integrator w Assembler w Integrated Manufacturer w Logistics Provider w Distributor w Customer Session 25 Operations Management 5

Multiple Perspectives w Raw Materials Suppliers w Component Manufacturer w Systems Integrator w Assembler w Integrated Manufacturer w Logistics Provider w Distributor w Customer Session 25 Operations Management 5

SCM Goals w Maximize profits of all supply chain partners w How to do it? n Get the right product, in the right quantity, to the right customer at the right time with minimum cost, proper documentation and financial reconciliation w Difficulty: Each partner has its own goal Session 25 Operations Management 6

SCM Goals w Maximize profits of all supply chain partners w How to do it? n Get the right product, in the right quantity, to the right customer at the right time with minimum cost, proper documentation and financial reconciliation w Difficulty: Each partner has its own goal Session 25 Operations Management 6

Channel Coordination w What are the objectives? n What is channel coordination? n Why are channels not coordinated? n How can we coordinate channels? Session 25 Operations Management 7

Channel Coordination w What are the objectives? n What is channel coordination? n Why are channels not coordinated? n How can we coordinate channels? Session 25 Operations Management 7

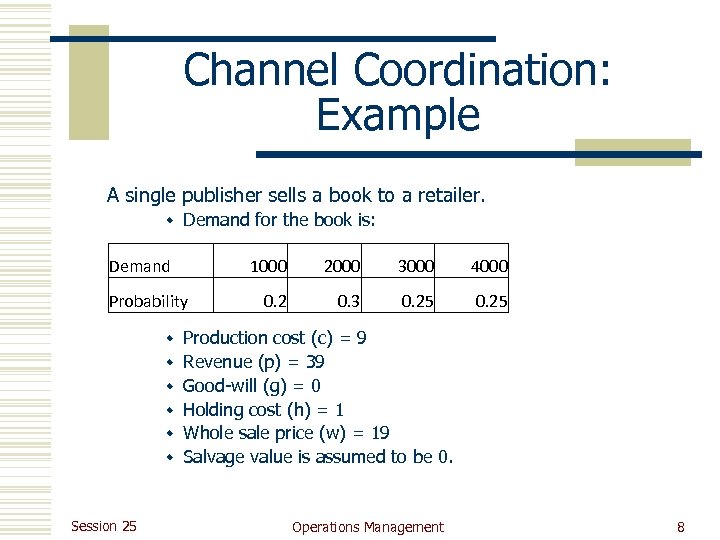

Channel Coordination: Example A single publisher sells a book to a retailer. w Demand for the book is: Demand Probability 1000 2000 3000 4000 0. 2 0. 3 0. 25 w Production cost (c) = 9 w Revenue (p) = 39 w Good-will (g) = 0 w Holding cost (h) = 1 w Whole sale price (w) = 19 w Salvage value is assumed to be 0. Session 25 Operations Management 8

Channel Coordination: Example A single publisher sells a book to a retailer. w Demand for the book is: Demand Probability 1000 2000 3000 4000 0. 2 0. 3 0. 25 w Production cost (c) = 9 w Revenue (p) = 39 w Good-will (g) = 0 w Holding cost (h) = 1 w Whole sale price (w) = 19 w Salvage value is assumed to be 0. Session 25 Operations Management 8

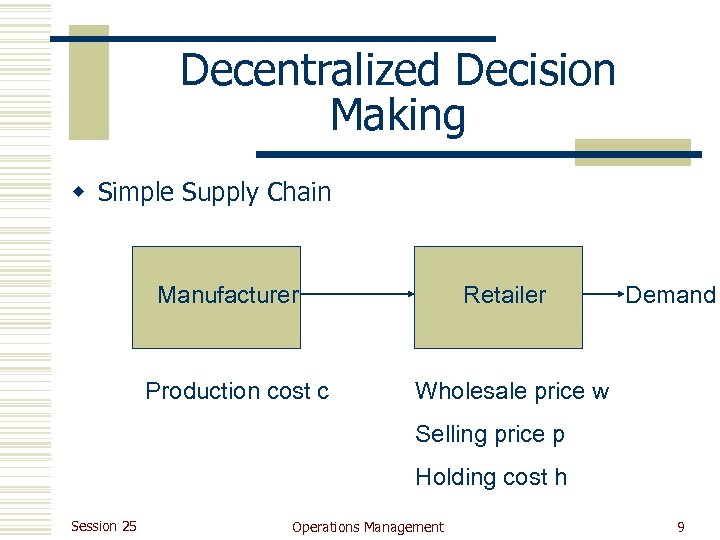

Decentralized Decision Making w Simple Supply Chain Manufacturer Production cost c Retailer Demand Wholesale price w Selling price p Holding cost h Session 25 Operations Management 9

Decentralized Decision Making w Simple Supply Chain Manufacturer Production cost c Retailer Demand Wholesale price w Selling price p Holding cost h Session 25 Operations Management 9

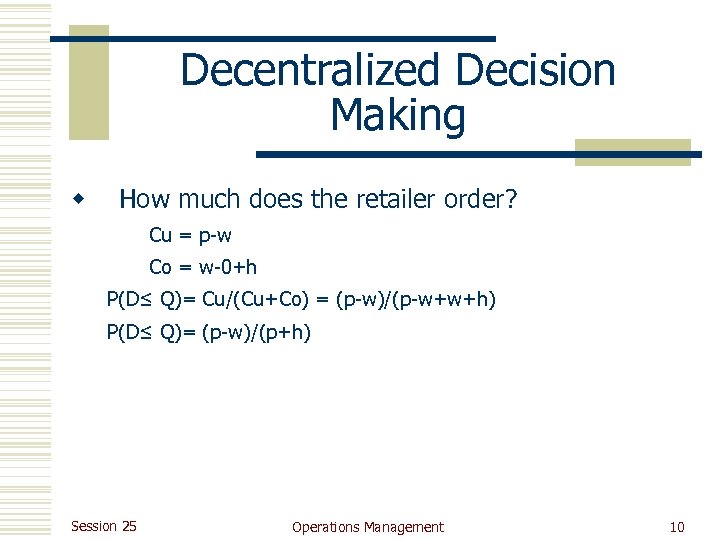

Decentralized Decision Making w How much does the retailer order? Cu = p-w Co = w-0+h P(D≤ Q)= Cu/(Cu+Co) = (p-w)/(p-w+w+h) P(D≤ Q)= (p-w)/(p+h) Session 25 Operations Management 10

Decentralized Decision Making w How much does the retailer order? Cu = p-w Co = w-0+h P(D≤ Q)= Cu/(Cu+Co) = (p-w)/(p-w+w+h) P(D≤ Q)= (p-w)/(p+h) Session 25 Operations Management 10

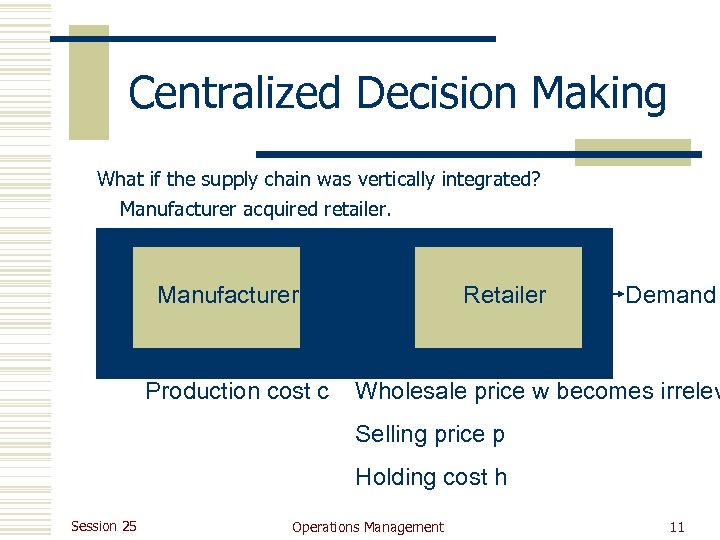

Centralized Decision Making What if the supply chain was vertically integrated? Manufacturer acquired retailer. Manufacturer Production cost c Retailer Demand Wholesale price w becomes irrelev Selling price p Holding cost h Session 25 Operations Management 11

Centralized Decision Making What if the supply chain was vertically integrated? Manufacturer acquired retailer. Manufacturer Production cost c Retailer Demand Wholesale price w becomes irrelev Selling price p Holding cost h Session 25 Operations Management 11

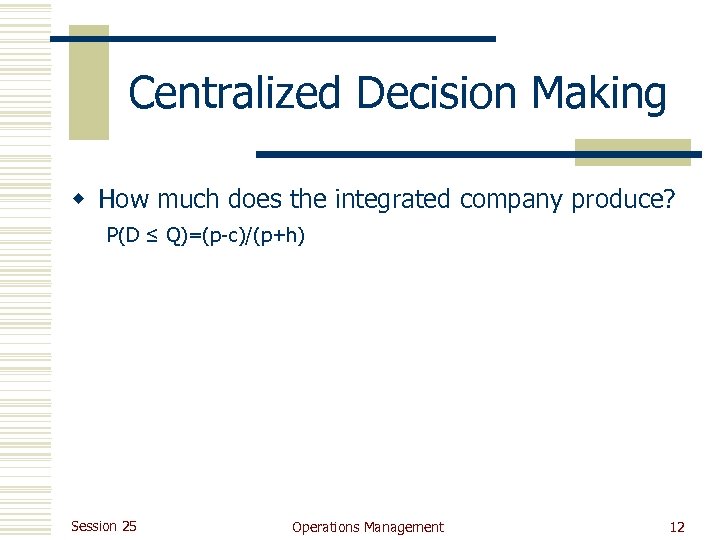

Centralized Decision Making w How much does the integrated company produce? P(D ≤ Q)=(p-c)/(p+h) Session 25 Operations Management 12

Centralized Decision Making w How much does the integrated company produce? P(D ≤ Q)=(p-c)/(p+h) Session 25 Operations Management 12

Question is… w Which supply chain is better? n Decentralized decision making n Centralized decision making Session 25 Operations Management 13

Question is… w Which supply chain is better? n Decentralized decision making n Centralized decision making Session 25 Operations Management 13

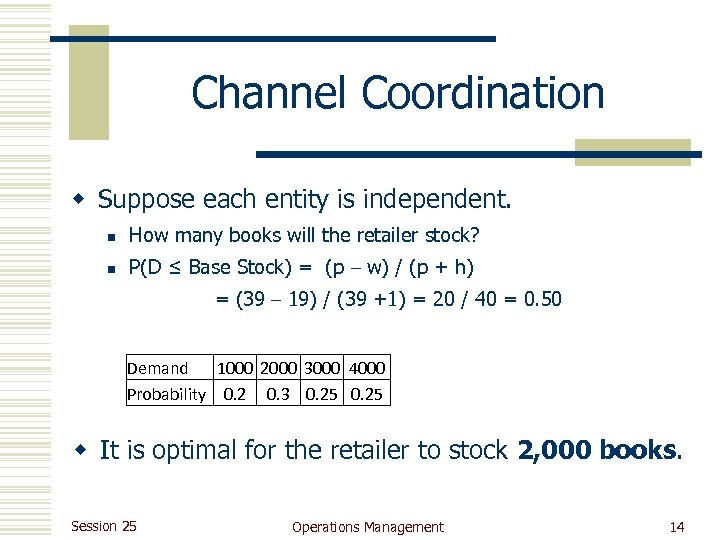

Channel Coordination w Suppose each entity is independent. n How many books will the retailer stock? n P(D ≤ Base Stock) = (p – w) / (p + h) = (39 – 19) / (39 +1) = 20 / 40 = 0. 50 Demand 1000 2000 3000 4000 Probability 0. 2 0. 3 0. 25 w It is optimal for the retailer to stock 2, 000 books. Session 25 Operations Management 14

Channel Coordination w Suppose each entity is independent. n How many books will the retailer stock? n P(D ≤ Base Stock) = (p – w) / (p + h) = (39 – 19) / (39 +1) = 20 / 40 = 0. 50 Demand 1000 2000 3000 4000 Probability 0. 2 0. 3 0. 25 w It is optimal for the retailer to stock 2, 000 books. Session 25 Operations Management 14

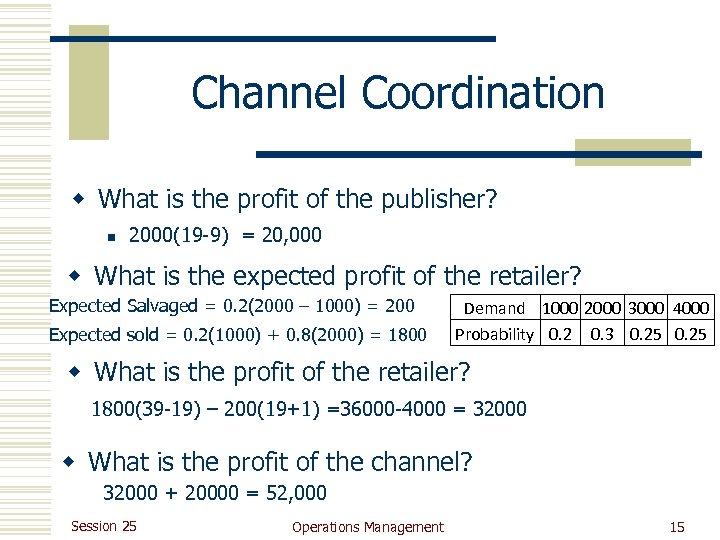

Channel Coordination w What is the profit of the publisher? n 2000(19 -9) = 20, 000 w What is the expected profit of the retailer? Expected Salvaged = 0. 2(2000 – 1000) = 200 Expected sold = 0. 2(1000) + 0. 8(2000) = 1800 Demand 1000 2000 3000 4000 Probability 0. 2 0. 3 0. 25 w What is the profit of the retailer? 1800(39 -19) – 200(19+1) =36000 -4000 = 32000 w What is the profit of the channel? 32000 + 20000 = 52, 000 Session 25 Operations Management 15

Channel Coordination w What is the profit of the publisher? n 2000(19 -9) = 20, 000 w What is the expected profit of the retailer? Expected Salvaged = 0. 2(2000 – 1000) = 200 Expected sold = 0. 2(1000) + 0. 8(2000) = 1800 Demand 1000 2000 3000 4000 Probability 0. 2 0. 3 0. 25 w What is the profit of the retailer? 1800(39 -19) – 200(19+1) =36000 -4000 = 32000 w What is the profit of the channel? 32000 + 20000 = 52, 000 Session 25 Operations Management 15

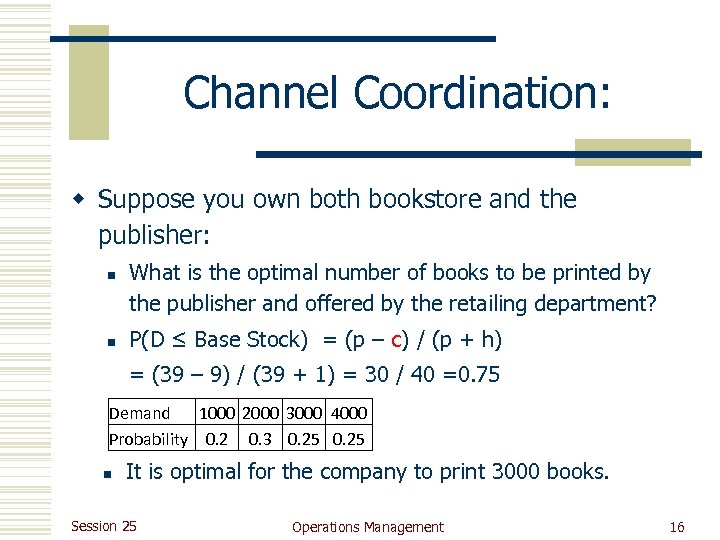

Channel Coordination: w Suppose you own both bookstore and the publisher: n n What is the optimal number of books to be printed by the publisher and offered by the retailing department? P(D ≤ Base Stock) = (p – c) / (p + h) = (39 – 9) / (39 + 1) = 30 / 40 =0. 75 Demand 1000 2000 3000 4000 Probability 0. 2 0. 3 0. 25 n It is optimal for the company to print 3000 books. Session 25 Operations Management 16

Channel Coordination: w Suppose you own both bookstore and the publisher: n n What is the optimal number of books to be printed by the publisher and offered by the retailing department? P(D ≤ Base Stock) = (p – c) / (p + h) = (39 – 9) / (39 + 1) = 30 / 40 =0. 75 Demand 1000 2000 3000 4000 Probability 0. 2 0. 3 0. 25 n It is optimal for the company to print 3000 books. Session 25 Operations Management 16

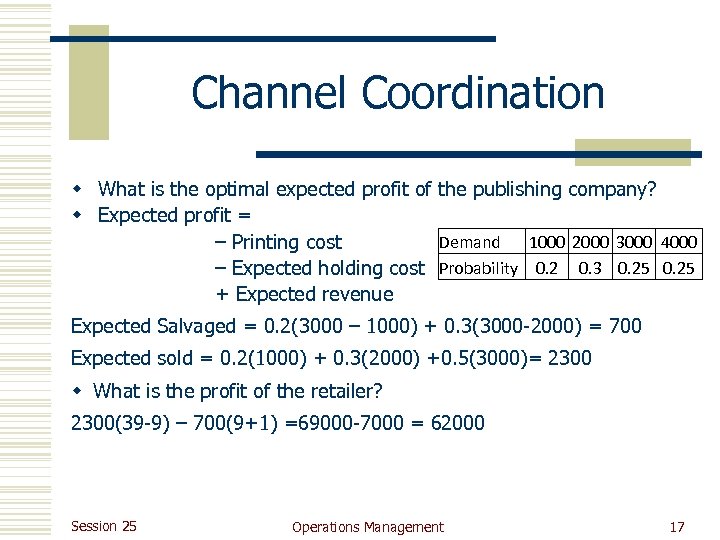

Channel Coordination w What is the optimal expected profit of the publishing company? w Expected profit = Demand 1000 2000 3000 4000 – Printing cost – Expected holding cost Probability 0. 2 0. 3 0. 25 + Expected revenue Expected Salvaged = 0. 2(3000 – 1000) + 0. 3(3000 -2000) = 700 Expected sold = 0. 2(1000) + 0. 3(2000) +0. 5(3000)= 2300 w What is the profit of the retailer? 2300(39 -9) – 700(9+1) =69000 -7000 = 62000 Session 25 Operations Management 17

Channel Coordination w What is the optimal expected profit of the publishing company? w Expected profit = Demand 1000 2000 3000 4000 – Printing cost – Expected holding cost Probability 0. 2 0. 3 0. 25 + Expected revenue Expected Salvaged = 0. 2(3000 – 1000) + 0. 3(3000 -2000) = 700 Expected sold = 0. 2(1000) + 0. 3(2000) +0. 5(3000)= 2300 w What is the profit of the retailer? 2300(39 -9) – 700(9+1) =69000 -7000 = 62000 Session 25 Operations Management 17

Question w Notice: The profit in the integrated company is $62, 000 w The profit in the disintegrated company is only $52, 000 w Why are they leaving some money on the table? n Double marginalization Session 25 Operations Management 18

Question w Notice: The profit in the integrated company is $62, 000 w The profit in the disintegrated company is only $52, 000 w Why are they leaving some money on the table? n Double marginalization Session 25 Operations Management 18

Double Marginalization w What can be done to increase: n The channel profit n The publisher profit n The retailer profit n Recall that there is $10, 000 on the table. Session 25 Operations Management 19

Double Marginalization w What can be done to increase: n The channel profit n The publisher profit n The retailer profit n Recall that there is $10, 000 on the table. Session 25 Operations Management 19

Channel Coordination: Solutions w Type of channel coordination solutions n Buy back n Revenue Sharing n Vendor Managed Inventory (VMI) n Consignment n Options Session 25 Operations Management 20

Channel Coordination: Solutions w Type of channel coordination solutions n Buy back n Revenue Sharing n Vendor Managed Inventory (VMI) n Consignment n Options Session 25 Operations Management 20

Double Marginalization: The Solution w Suppose the publisher is willing to purchase back all the excess inventory w In return for this service, he might change the wholesale price Session 25 Operations Management 21

Double Marginalization: The Solution w Suppose the publisher is willing to purchase back all the excess inventory w In return for this service, he might change the wholesale price Session 25 Operations Management 21

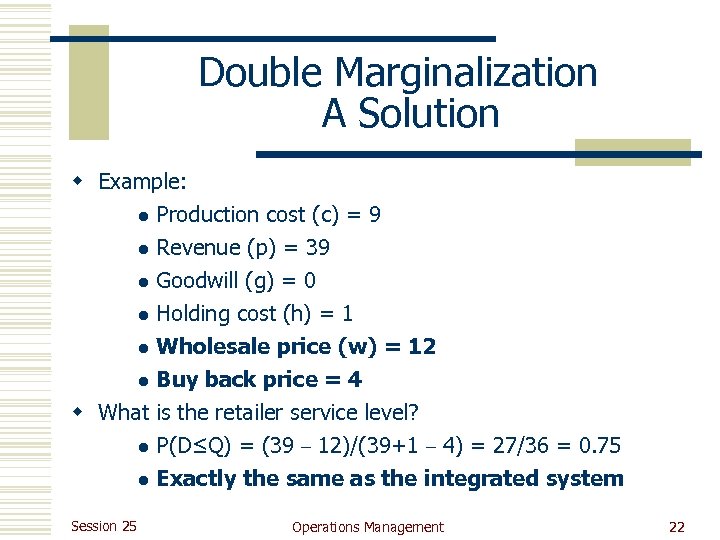

Double Marginalization A Solution w Example: l Production cost (c) = 9 l Revenue (p) = 39 l Goodwill (g) = 0 l Holding cost (h) = 1 l Wholesale price (w) = 12 l Buy back price = 4 w What is the retailer service level? l P(D≤Q) = (39 – 12)/(39+1 – 4) = 27/36 = 0. 75 l Exactly the same as the integrated system Session 25 Operations Management 22

Double Marginalization A Solution w Example: l Production cost (c) = 9 l Revenue (p) = 39 l Goodwill (g) = 0 l Holding cost (h) = 1 l Wholesale price (w) = 12 l Buy back price = 4 w What is the retailer service level? l P(D≤Q) = (39 – 12)/(39+1 – 4) = 27/36 = 0. 75 l Exactly the same as the integrated system Session 25 Operations Management 22

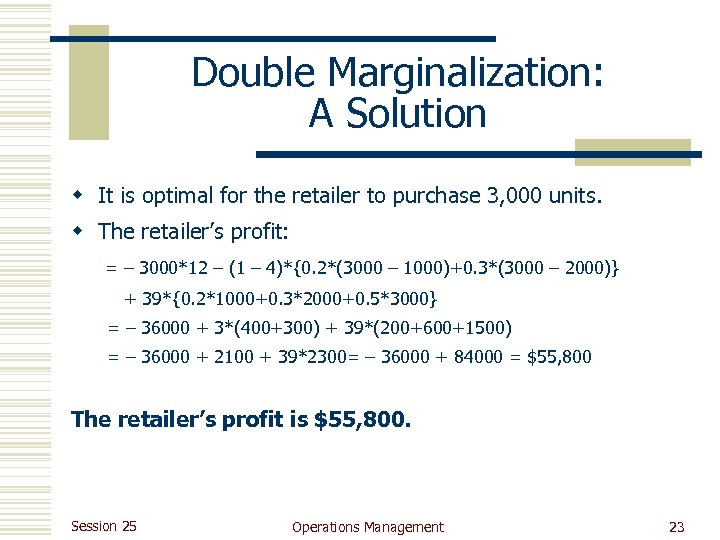

Double Marginalization: A Solution w It is optimal for the retailer to purchase 3, 000 units. w The retailer’s profit: = – 3000*12 – (1 – 4)*{0. 2*(3000 – 1000)+0. 3*(3000 – 2000)} + 39*{0. 2*1000+0. 3*2000+0. 5*3000} = – 36000 + 3*(400+300) + 39*(200+600+1500) = – 36000 + 2100 + 39*2300= – 36000 + 84000 = $55, 800 The retailer’s profit is $55, 800. Session 25 Operations Management 23

Double Marginalization: A Solution w It is optimal for the retailer to purchase 3, 000 units. w The retailer’s profit: = – 3000*12 – (1 – 4)*{0. 2*(3000 – 1000)+0. 3*(3000 – 2000)} + 39*{0. 2*1000+0. 3*2000+0. 5*3000} = – 36000 + 3*(400+300) + 39*(200+600+1500) = – 36000 + 2100 + 39*2300= – 36000 + 84000 = $55, 800 The retailer’s profit is $55, 800. Session 25 Operations Management 23

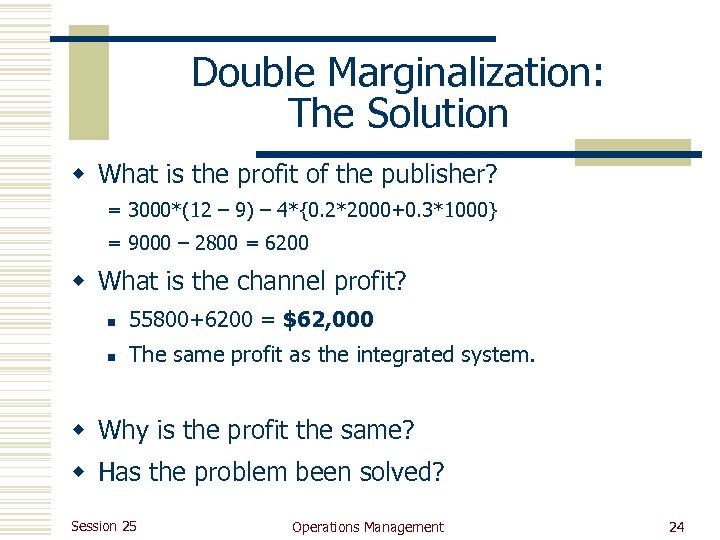

Double Marginalization: The Solution w What is the profit of the publisher? = 3000*(12 – 9) – 4*{0. 2*2000+0. 3*1000} = 9000 – 2800 = 6200 w What is the channel profit? n 55800+6200 = $62, 000 n The same profit as the integrated system. w Why is the profit the same? w Has the problem been solved? Session 25 Operations Management 24

Double Marginalization: The Solution w What is the profit of the publisher? = 3000*(12 – 9) – 4*{0. 2*2000+0. 3*1000} = 9000 – 2800 = 6200 w What is the channel profit? n 55800+6200 = $62, 000 n The same profit as the integrated system. w Why is the profit the same? w Has the problem been solved? Session 25 Operations Management 24

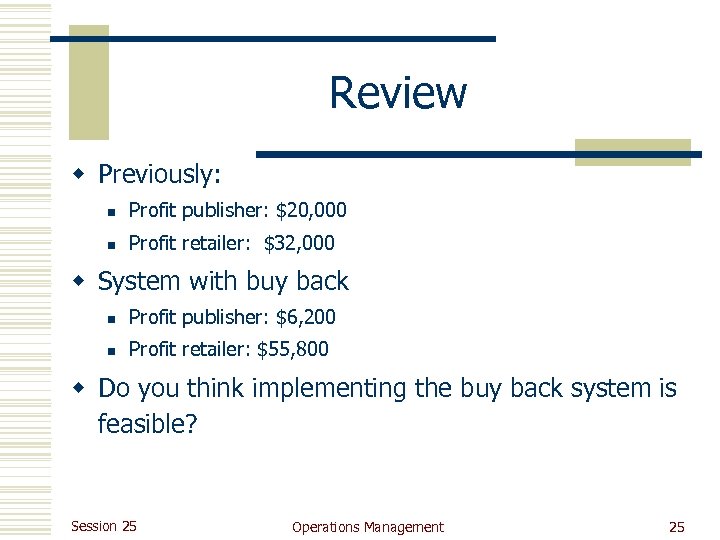

Review w Previously: n Profit publisher: $20, 000 n Profit retailer: $32, 000 w System with buy back n Profit publisher: $6, 200 n Profit retailer: $55, 800 w Do you think implementing the buy back system is feasible? Session 25 Operations Management 25

Review w Previously: n Profit publisher: $20, 000 n Profit retailer: $32, 000 w System with buy back n Profit publisher: $6, 200 n Profit retailer: $55, 800 w Do you think implementing the buy back system is feasible? Session 25 Operations Management 25

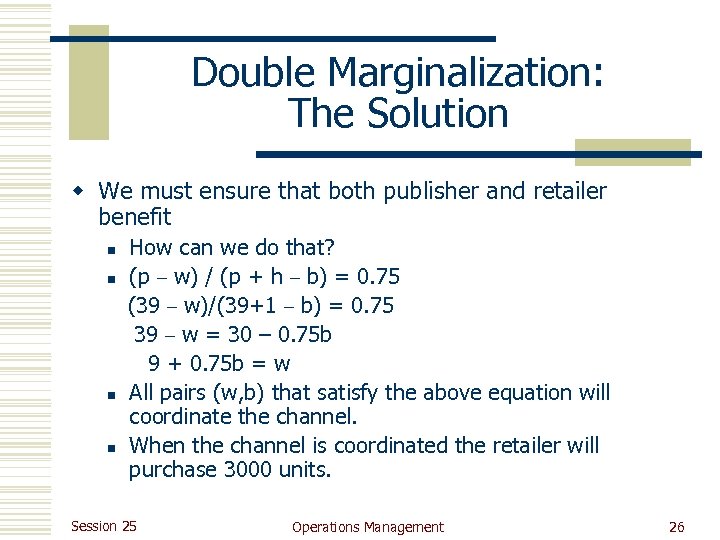

Double Marginalization: The Solution w We must ensure that both publisher and retailer benefit n n How can we do that? (p – w) / (p + h – b) = 0. 75 (39 – w)/(39+1 – b) = 0. 75 39 – w = 30 – 0. 75 b 9 + 0. 75 b = w All pairs (w, b) that satisfy the above equation will coordinate the channel. When the channel is coordinated the retailer will purchase 3000 units. Session 25 Operations Management 26

Double Marginalization: The Solution w We must ensure that both publisher and retailer benefit n n How can we do that? (p – w) / (p + h – b) = 0. 75 (39 – w)/(39+1 – b) = 0. 75 39 – w = 30 – 0. 75 b 9 + 0. 75 b = w All pairs (w, b) that satisfy the above equation will coordinate the channel. When the channel is coordinated the retailer will purchase 3000 units. Session 25 Operations Management 26

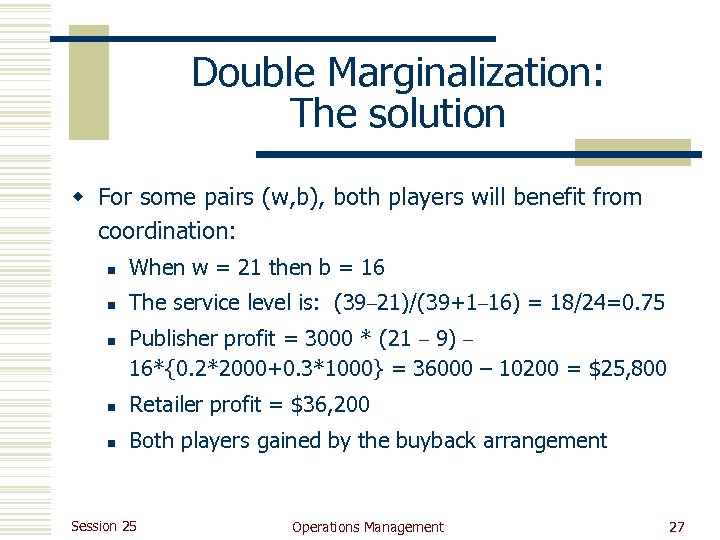

Double Marginalization: The solution w For some pairs (w, b), both players will benefit from coordination: n When w = 21 then b = 16 n The service level is: (39– 21)/(39+1– 16) = 18/24=0. 75 n Publisher profit = 3000 * (21 – 9) – 16*{0. 2*2000+0. 3*1000} = 36000 – 10200 = $25, 800 n Retailer profit = $36, 200 n Both players gained by the buyback arrangement Session 25 Operations Management 27

Double Marginalization: The solution w For some pairs (w, b), both players will benefit from coordination: n When w = 21 then b = 16 n The service level is: (39– 21)/(39+1– 16) = 18/24=0. 75 n Publisher profit = 3000 * (21 – 9) – 16*{0. 2*2000+0. 3*1000} = 36000 – 10200 = $25, 800 n Retailer profit = $36, 200 n Both players gained by the buyback arrangement Session 25 Operations Management 27

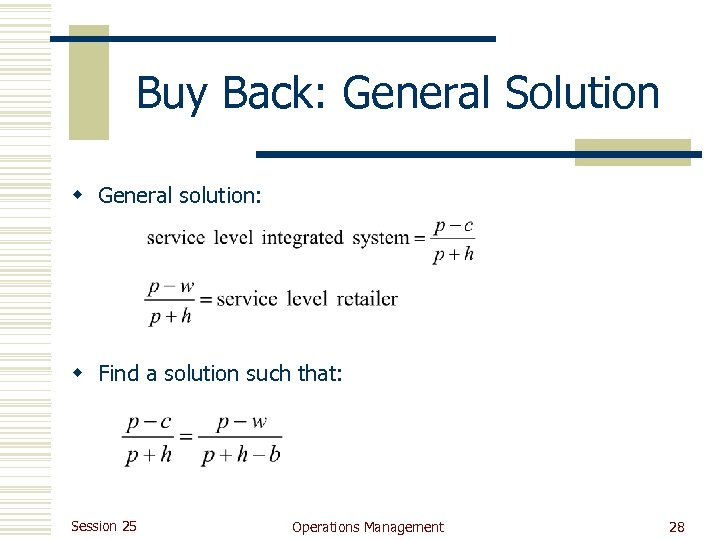

Buy Back: General Solution w General solution: w Find a solution such that: Session 25 Operations Management 28

Buy Back: General Solution w General solution: w Find a solution such that: Session 25 Operations Management 28

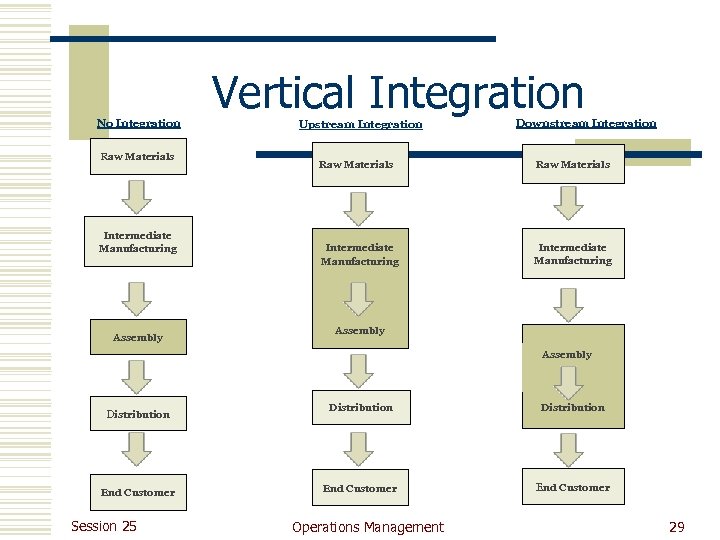

Vertical Integration No Integration Raw Materials Intermediate Manufacturing Assembly Upstream Integration Downstream Integration Raw Materials Intermediate Manufacturing Assembly Distribution End Customer Session 25 Distribution End Customer Operations Management 29

Vertical Integration No Integration Raw Materials Intermediate Manufacturing Assembly Upstream Integration Downstream Integration Raw Materials Intermediate Manufacturing Assembly Distribution End Customer Session 25 Distribution End Customer Operations Management 29

Article Reading w "Back to the Future: Benetton Transforms it’s Global network" MIT Sloan management Review, Fall 2001. Session 25 Operations Management 30

Article Reading w "Back to the Future: Benetton Transforms it’s Global network" MIT Sloan management Review, Fall 2001. Session 25 Operations Management 30

Benetton w Factors contributing to success n Delayed dyeing n Network organization for manufacturing n Network organization for distribution w Benetton’s strategy in supply chain management n Product design (customized by region) n Supply and production (strong upstream vertical integration) n Retail network (mixed downstream vertical integration) w Diversifying into sports Session 25 Operations Management 31

Benetton w Factors contributing to success n Delayed dyeing n Network organization for manufacturing n Network organization for distribution w Benetton’s strategy in supply chain management n Product design (customized by region) n Supply and production (strong upstream vertical integration) n Retail network (mixed downstream vertical integration) w Diversifying into sports Session 25 Operations Management 31

Vertical Integration w To decide whether to vertically integrate, consider: n n n Session 25 Cost: Cost of market transactions between firms vs. cost of administering the same activities internally within a single firm Control: Impact of asset control, which can impact barriers to entry and which can assure cooperation of key value-adding players. Coordination/Information Sharing Operations Management 32

Vertical Integration w To decide whether to vertically integrate, consider: n n n Session 25 Cost: Cost of market transactions between firms vs. cost of administering the same activities internally within a single firm Control: Impact of asset control, which can impact barriers to entry and which can assure cooperation of key value-adding players. Coordination/Information Sharing Operations Management 32

Vertical Integration: Drawbacks w Capacity balancing issues n For example, the firm may need to build excess upstream capacity to ensure that its downstream operations have sufficient supply under all demand conditions. w Potentially higher costs n n Due to low efficiencies resulting from lack of supplier competition. Economy of scale/risking pooling from outsourcing Session 25 Operations Management 33

Vertical Integration: Drawbacks w Capacity balancing issues n For example, the firm may need to build excess upstream capacity to ensure that its downstream operations have sufficient supply under all demand conditions. w Potentially higher costs n n Due to low efficiencies resulting from lack of supplier competition. Economy of scale/risking pooling from outsourcing Session 25 Operations Management 33

Factors against Vertical Integration w The vertically adjacent activities are in very different types of industries. For example, manufacturing is very different from retailing. w The addition of the new activity places the firm in competition with another player with which it needs to cooperate. The firm then may be viewed as a competitor rather than a partner. Session 25 Operations Management 34

Factors against Vertical Integration w The vertically adjacent activities are in very different types of industries. For example, manufacturing is very different from retailing. w The addition of the new activity places the firm in competition with another player with which it needs to cooperate. The firm then may be viewed as a competitor rather than a partner. Session 25 Operations Management 34

Alternatives to Vertical Integration w Long-term explicit contracts w Franchise agreements w Joint ventures w Co-location of facilities w Implicit contracts (relying on firms' reputation) Session 25 Operations Management 35

Alternatives to Vertical Integration w Long-term explicit contracts w Franchise agreements w Joint ventures w Co-location of facilities w Implicit contracts (relying on firms' reputation) Session 25 Operations Management 35