bebc9f26a814b48b5b254945eb6c5f76.ppt

- Количество слайдов: 41

Operations Management Introduction A. A. Elimam

Operations Management Introduction A. A. Elimam

Operations Management ACTIVITIES THAT RELATE TO THE CREATION OF GOODS AND SERVICES THROUGH THE TRANSFORMATION OF INPUTS INTO OUTPUTS

Operations Management ACTIVITIES THAT RELATE TO THE CREATION OF GOODS AND SERVICES THROUGH THE TRANSFORMATION OF INPUTS INTO OUTPUTS

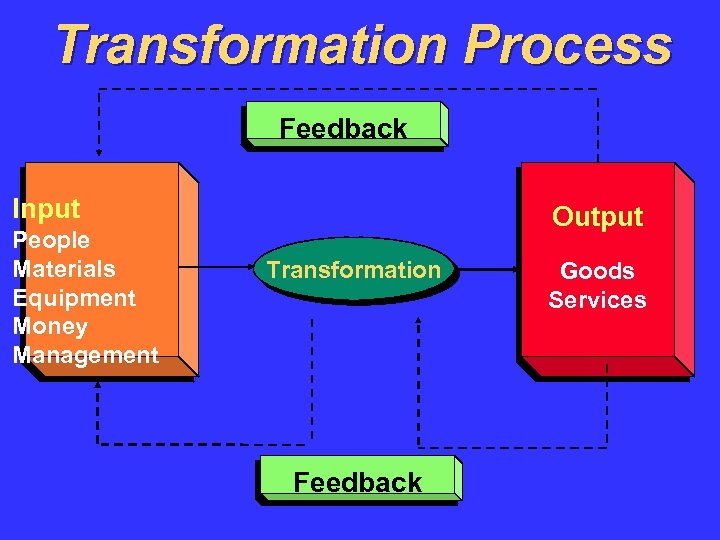

Transformation Process Feedback Input People Materials Equipment Money Management Output Transformation Feedback Goods Services

Transformation Process Feedback Input People Materials Equipment Money Management Output Transformation Feedback Goods Services

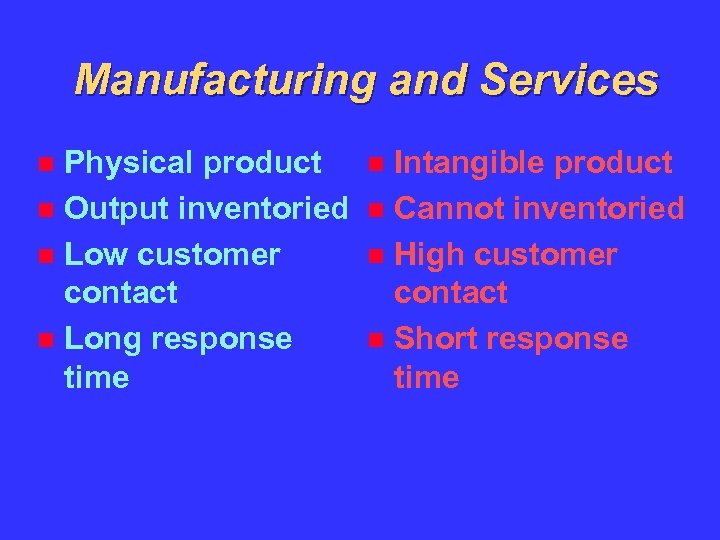

Manufacturing and Services Physical product Output inventoried Low customer contact Long response time Intangible product Cannot inventoried High customer contact Short response time

Manufacturing and Services Physical product Output inventoried Low customer contact Long response time Intangible product Cannot inventoried High customer contact Short response time

Manufacturing and Services World markets Large facilities Capital intensive Quality easily measured Local markets Small facilities Labor intensive Quality not easily measured

Manufacturing and Services World markets Large facilities Capital intensive Quality easily measured Local markets Small facilities Labor intensive Quality not easily measured

MAJOR CHALLENGES TO OPERATIONS MANAGERS Increase the VALUE of output relative to the COST of input. Increase PRODUCTIVITY = OUTPUT INPUT

MAJOR CHALLENGES TO OPERATIONS MANAGERS Increase the VALUE of output relative to the COST of input. Increase PRODUCTIVITY = OUTPUT INPUT

PRODUCTIVITY Productivity is the quotient obtained by dividing output by one of the factors of production. One can speak of productivity of capital, labor, raw materials, etc.

PRODUCTIVITY Productivity is the quotient obtained by dividing output by one of the factors of production. One can speak of productivity of capital, labor, raw materials, etc.

WAYS TO IMPROVE PRODUCTIVITY REDUCE INPUTS INCREASE OUTPUT MINIMIZE DEFECTS IMPROVE QUALITY ELIMINATE WASTE FEWER HOURS LOWER ENERGY IMPROVE QUALITY

WAYS TO IMPROVE PRODUCTIVITY REDUCE INPUTS INCREASE OUTPUT MINIMIZE DEFECTS IMPROVE QUALITY ELIMINATE WASTE FEWER HOURS LOWER ENERGY IMPROVE QUALITY

Example : Productivity Example: Output = $1000 Inputs: human = $300 material = $200 capital = $300 energy = $100 other exp. = $50 Human Productivity = 1000 / 300 = $ / $ 3. 33 Total Productivity = 1000 / 950 = $ / $ 1. 053

Example : Productivity Example: Output = $1000 Inputs: human = $300 material = $200 capital = $300 energy = $100 other exp. = $50 Human Productivity = 1000 / 300 = $ / $ 3. 33 Total Productivity = 1000 / 950 = $ / $ 1. 053

Example : Productivity Output = 600 insurance policies Inputs: human = 3 employees working 8 hours / day for 5 days Labor Productivity = 600 / (3)(5)(8) = 5 policies / hour

Example : Productivity Output = 600 insurance policies Inputs: human = 3 employees working 8 hours / day for 5 days Labor Productivity = 600 / (3)(5)(8) = 5 policies / hour

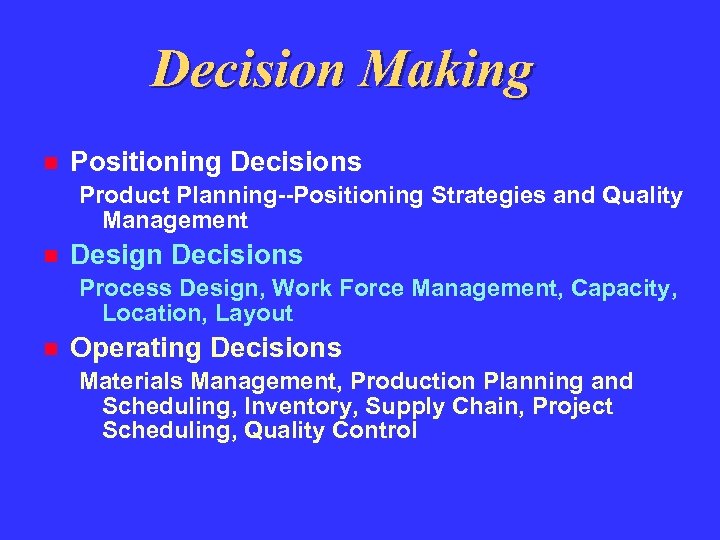

Decision Making Positioning Decisions Product Planning--Positioning Strategies and Quality Management Design Decisions Process Design, Work Force Management, Capacity, Location, Layout Operating Decisions Materials Management, Production Planning and Scheduling, Inventory, Supply Chain, Project Scheduling, Quality Control

Decision Making Positioning Decisions Product Planning--Positioning Strategies and Quality Management Design Decisions Process Design, Work Force Management, Capacity, Location, Layout Operating Decisions Materials Management, Production Planning and Scheduling, Inventory, Supply Chain, Project Scheduling, Quality Control

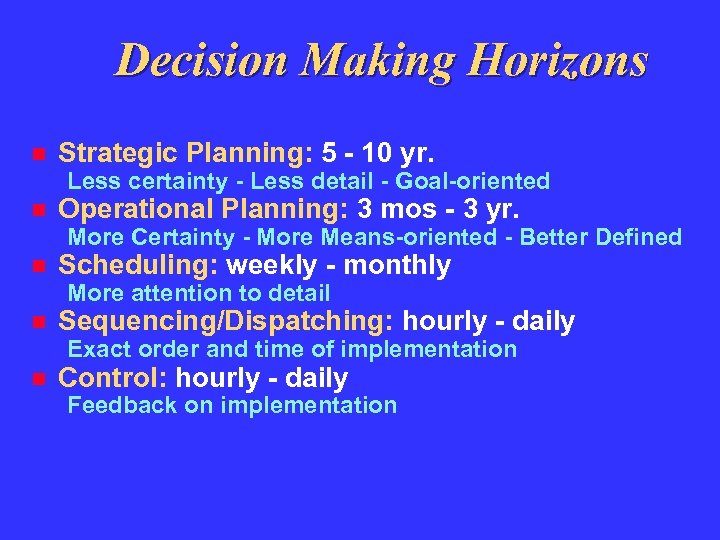

Decision Making Horizons Strategic Planning: 5 - 10 yr. Less certainty - Less detail - Goal-oriented Operational Planning: 3 mos - 3 yr. More Certainty - More Means-oriented - Better Defined Scheduling: weekly - monthly More attention to detail Sequencing/Dispatching: hourly - daily Exact order and time of implementation Control: hourly - daily Feedback on implementation

Decision Making Horizons Strategic Planning: 5 - 10 yr. Less certainty - Less detail - Goal-oriented Operational Planning: 3 mos - 3 yr. More Certainty - More Means-oriented - Better Defined Scheduling: weekly - monthly More attention to detail Sequencing/Dispatching: hourly - daily Exact order and time of implementation Control: hourly - daily Feedback on implementation

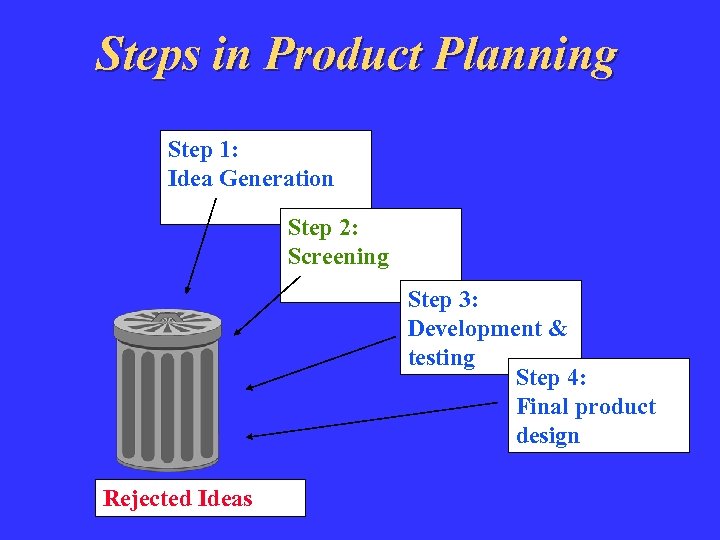

Steps in Product Planning Step 1: Idea Generation Step 2: Screening Step 3: Development & testing Step 4: Final product design Rejected Ideas

Steps in Product Planning Step 1: Idea Generation Step 2: Screening Step 3: Development & testing Step 4: Final product design Rejected Ideas

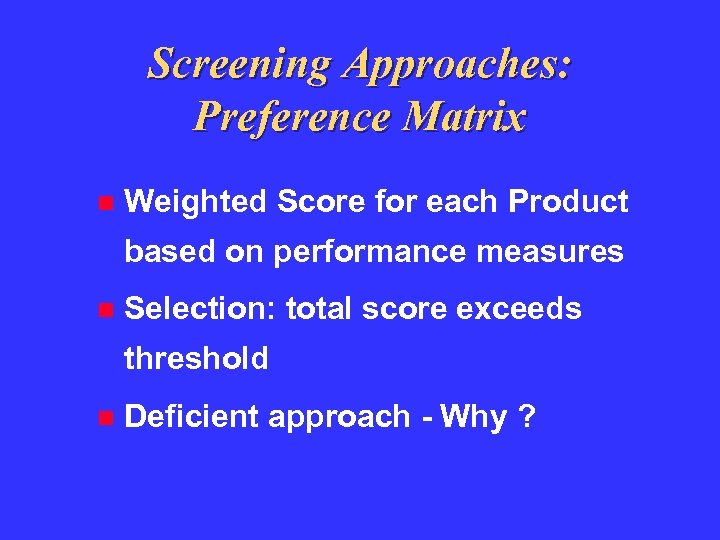

Screening Approaches: Preference Matrix Weighted Score for each Product based on performance measures Selection: total score exceeds threshold Deficient approach - Why ?

Screening Approaches: Preference Matrix Weighted Score for each Product based on performance measures Selection: total score exceeds threshold Deficient approach - Why ?

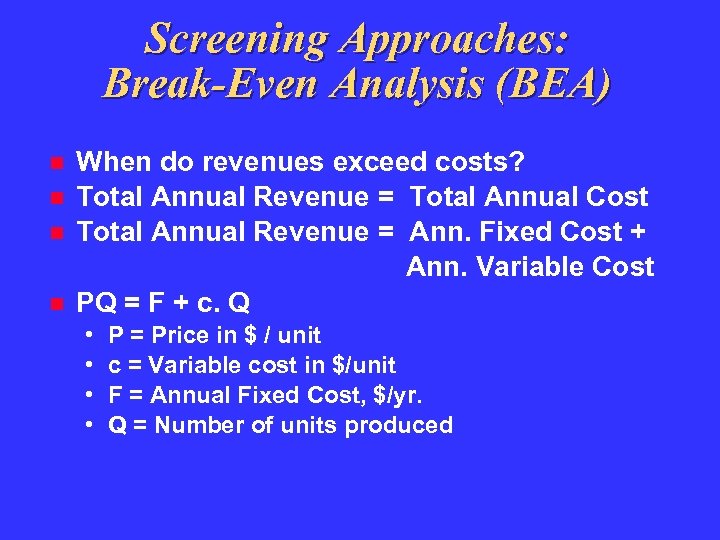

Screening Approaches: Break-Even Analysis (BEA) When do revenues exceed costs? Total Annual Revenue = Total Annual Cost Total Annual Revenue = Ann. Fixed Cost + Ann. Variable Cost PQ = F + c. Q • • P = Price in $ / unit c = Variable cost in $/unit F = Annual Fixed Cost, $/yr. Q = Number of units produced

Screening Approaches: Break-Even Analysis (BEA) When do revenues exceed costs? Total Annual Revenue = Total Annual Cost Total Annual Revenue = Ann. Fixed Cost + Ann. Variable Cost PQ = F + c. Q • • P = Price in $ / unit c = Variable cost in $/unit F = Annual Fixed Cost, $/yr. Q = Number of units produced

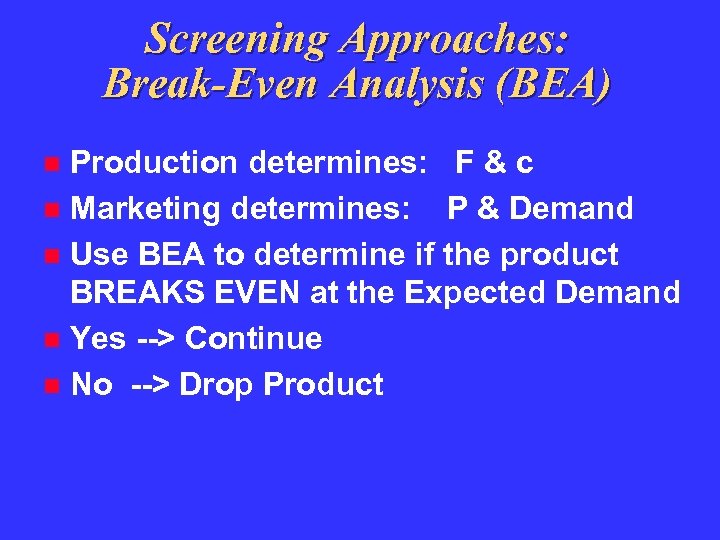

Screening Approaches: Break-Even Analysis (BEA) Production determines: F & c Marketing determines: P & Demand Use BEA to determine if the product BREAKS EVEN at the Expected Demand Yes --> Continue No --> Drop Product

Screening Approaches: Break-Even Analysis (BEA) Production determines: F & c Marketing determines: P & Demand Use BEA to determine if the product BREAKS EVEN at the Expected Demand Yes --> Continue No --> Drop Product

Graphical Approach to BEA Given: p= $ 20/unit c=$10/unit F= $100, 000

Graphical Approach to BEA Given: p= $ 20/unit c=$10/unit F= $100, 000

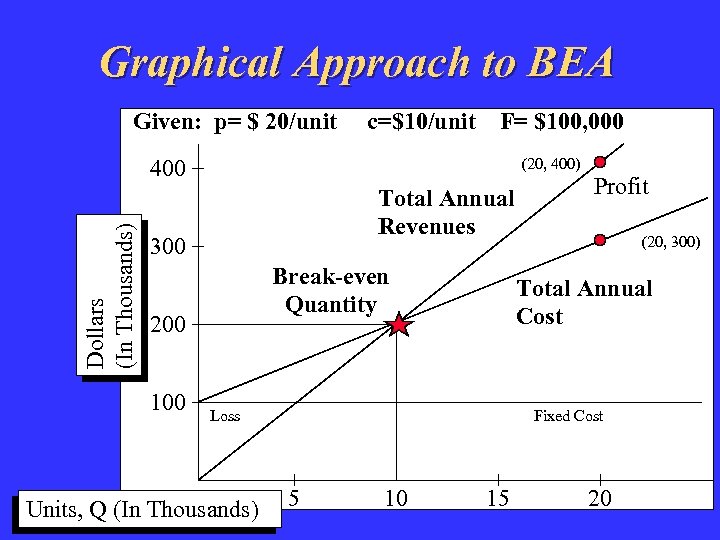

Graphical Approach to BEA Given: p= $ 20/unit c=$10/unit F= $100, 000 Dollars (In Thousands) 400 (20, 400) Total Annual Revenues 300 Break-even Quantity 200 100 (20, 300) Total Annual Cost Loss Units, Q (In Thousands) Profit Fixed Cost 5 10 15 20

Graphical Approach to BEA Given: p= $ 20/unit c=$10/unit F= $100, 000 Dollars (In Thousands) 400 (20, 400) Total Annual Revenues 300 Break-even Quantity 200 100 (20, 300) Total Annual Cost Loss Units, Q (In Thousands) Profit Fixed Cost 5 10 15 20

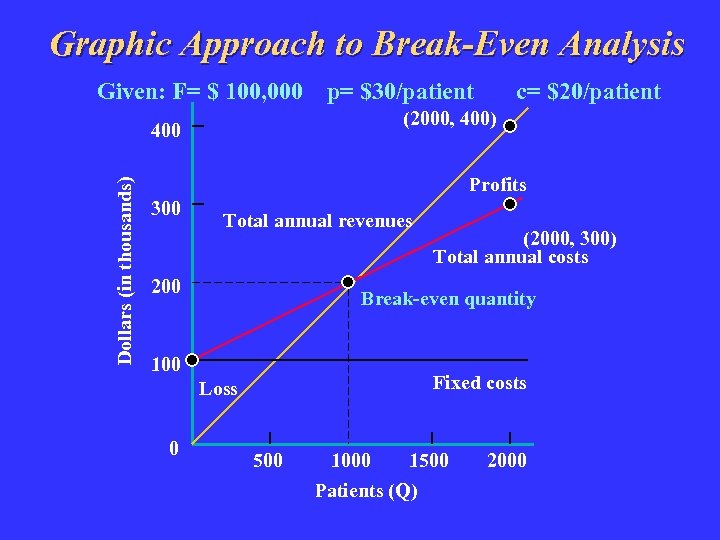

Graphic Approach to Break-Even Analysis Given: F= $ 100, 000 p= $30/patient c= $20/patient

Graphic Approach to Break-Even Analysis Given: F= $ 100, 000 p= $30/patient c= $20/patient

Graphic Approach to Break-Even Analysis Given: F= $ 100, 000 c= $20/patient (2000, 400) 400 Dollars (in thousands) p= $30/patient Profits 300 Total annual revenues 200 Break-even quantity 100 Fixed costs Loss 0 (2000, 300) Total annual costs 500 1000 1500 Patients (Q) 2000

Graphic Approach to Break-Even Analysis Given: F= $ 100, 000 c= $20/patient (2000, 400) 400 Dollars (in thousands) p= $30/patient Profits 300 Total annual revenues 200 Break-even quantity 100 Fixed costs Loss 0 (2000, 300) Total annual costs 500 1000 1500 Patients (Q) 2000

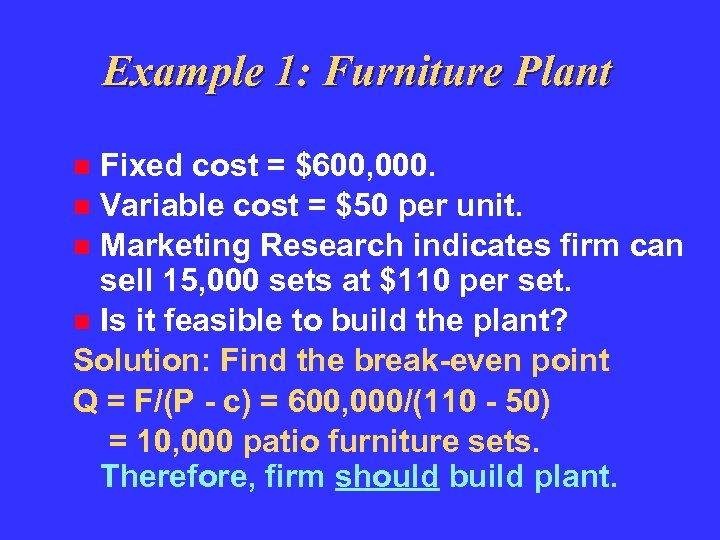

Example 1: Furniture Plant Fixed cost = $600, 000. Variable cost = $50 per unit. Marketing Research indicates firm can sell 15, 000 sets at $110 per set. Is it feasible to build the plant? Solution: Find the break-even point Q = F/(P - c) = 600, 000/(110 - 50) = 10, 000 patio furniture sets. Therefore, firm should build plant.

Example 1: Furniture Plant Fixed cost = $600, 000. Variable cost = $50 per unit. Marketing Research indicates firm can sell 15, 000 sets at $110 per set. Is it feasible to build the plant? Solution: Find the break-even point Q = F/(P - c) = 600, 000/(110 - 50) = 10, 000 patio furniture sets. Therefore, firm should build plant.

Example 2: Luxor Inc. Began producing cheese in 1993 output reached 20, 000 lb. at total cost of $40, 000 1994 output increased to 30, 000 lb. at total cost of $50, 000

Example 2: Luxor Inc. Began producing cheese in 1993 output reached 20, 000 lb. at total cost of $40, 000 1994 output increased to 30, 000 lb. at total cost of $50, 000

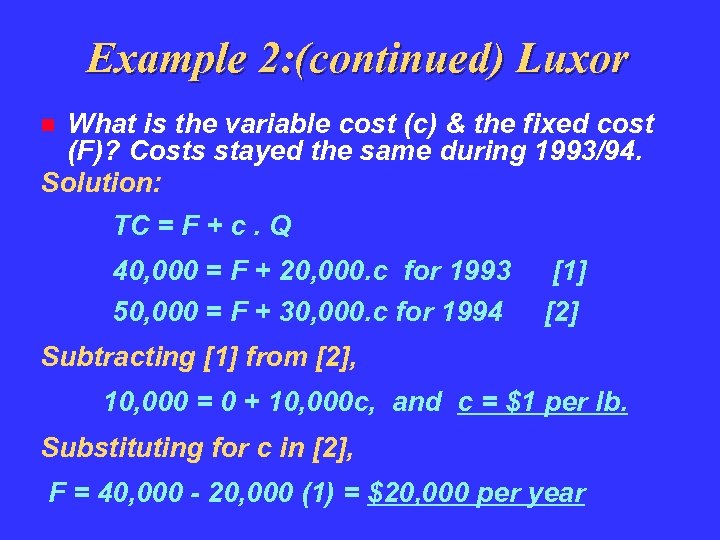

Example 2: (continued) Luxor What is the variable cost (c) & the fixed cost (F)? Costs stayed the same during 1993/94. Solution: TC = F + c. Q 40, 000 = F + 20, 000. c for 1993 50, 000 = F + 30, 000. c for 1994 [1] [2] Subtracting [1] from [2], 10, 000 = 0 + 10, 000 c, and c = $1 per lb. Substituting for c in [2], F = 40, 000 - 20, 000 (1) = $20, 000 per year

Example 2: (continued) Luxor What is the variable cost (c) & the fixed cost (F)? Costs stayed the same during 1993/94. Solution: TC = F + c. Q 40, 000 = F + 20, 000. c for 1993 50, 000 = F + 30, 000. c for 1994 [1] [2] Subtracting [1] from [2], 10, 000 = 0 + 10, 000 c, and c = $1 per lb. Substituting for c in [2], F = 40, 000 - 20, 000 (1) = $20, 000 per year

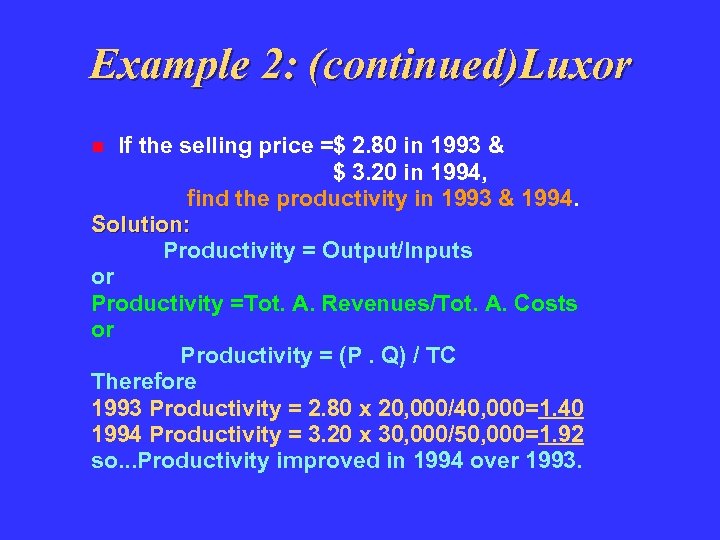

Example 2: (continued)Luxor If the selling price =$ 2. 80 in 1993 & $ 3. 20 in 1994, find the productivity in 1993 & 1994. Solution: Productivity = Output/Inputs or Productivity =Tot. A. Revenues/Tot. A. Costs or Productivity = (P. Q) / TC Therefore 1993 Productivity = 2. 80 x 20, 000/40, 000=1. 40 1994 Productivity = 3. 20 x 30, 000/50, 000=1. 92 so. . . Productivity improved in 1994 over 1993.

Example 2: (continued)Luxor If the selling price =$ 2. 80 in 1993 & $ 3. 20 in 1994, find the productivity in 1993 & 1994. Solution: Productivity = Output/Inputs or Productivity =Tot. A. Revenues/Tot. A. Costs or Productivity = (P. Q) / TC Therefore 1993 Productivity = 2. 80 x 20, 000/40, 000=1. 40 1994 Productivity = 3. 20 x 30, 000/50, 000=1. 92 so. . . Productivity improved in 1994 over 1993.

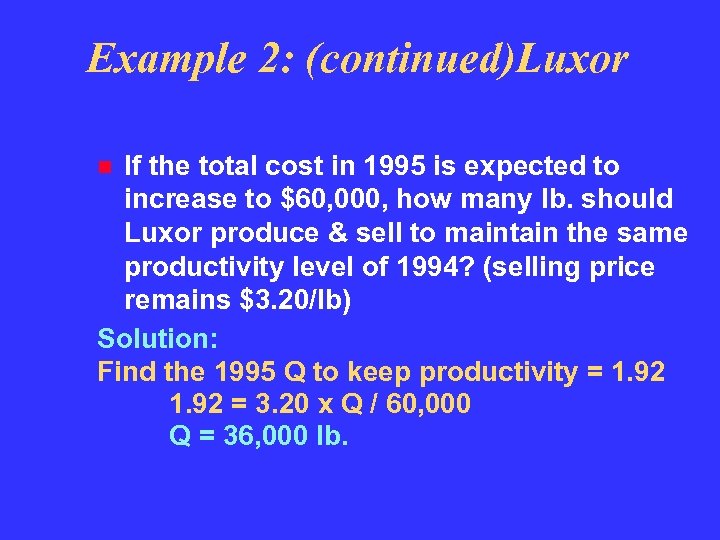

Example 2: (continued)Luxor If the total cost in 1995 is expected to increase to $60, 000, how many lb. should Luxor produce & sell to maintain the same productivity level of 1994? (selling price remains $3. 20/lb) Solution: Find the 1995 Q to keep productivity = 1. 92 = 3. 20 x Q / 60, 000 Q = 36, 000 lb.

Example 2: (continued)Luxor If the total cost in 1995 is expected to increase to $60, 000, how many lb. should Luxor produce & sell to maintain the same productivity level of 1994? (selling price remains $3. 20/lb) Solution: Find the 1995 Q to keep productivity = 1. 92 = 3. 20 x Q / 60, 000 Q = 36, 000 lb.

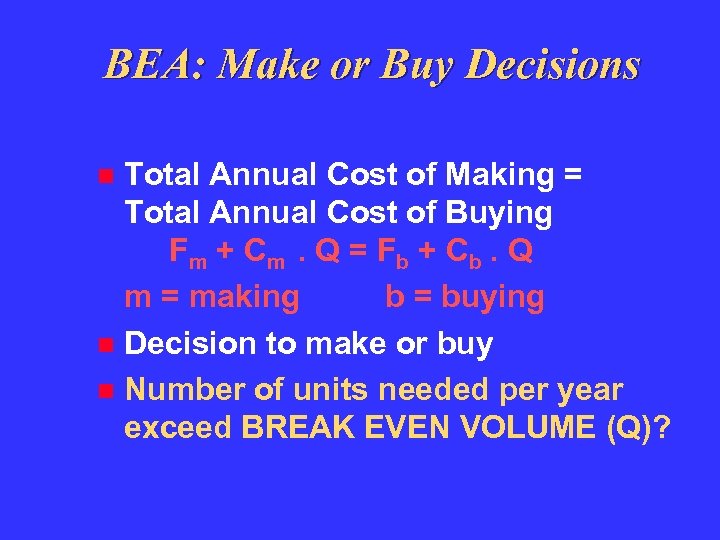

BEA: Make or Buy Decisions Total Annual Cost of Making = Total Annual Cost of Buying F m + C m. Q = F b + Cb. Q m = making b = buying Decision to make or buy Number of units needed per year exceed BREAK EVEN VOLUME (Q)?

BEA: Make or Buy Decisions Total Annual Cost of Making = Total Annual Cost of Buying F m + C m. Q = F b + Cb. Q m = making b = buying Decision to make or buy Number of units needed per year exceed BREAK EVEN VOLUME (Q)?

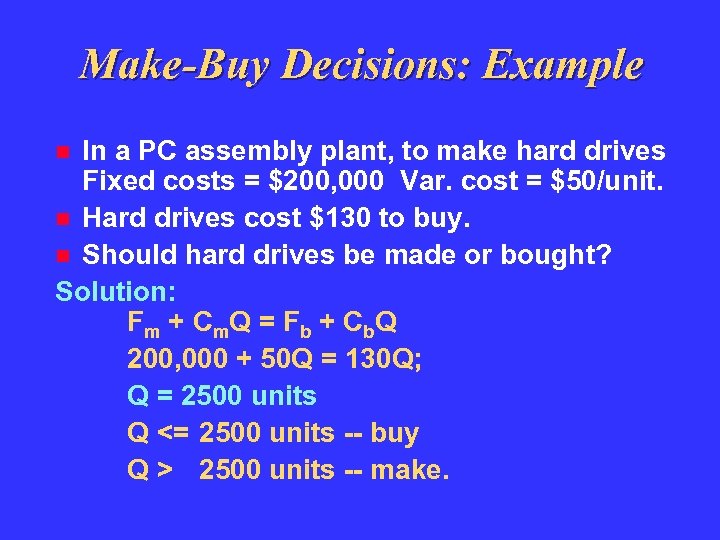

Make-Buy Decisions: Example In a PC assembly plant, to make hard drives Fixed costs = $200, 000 Var. cost = $50/unit. Hard drives cost $130 to buy. Should hard drives be made or bought? Solution: F m + C m. Q = F b + C b Q 200, 000 + 50 Q = 130 Q; Q = 2500 units Q <= 2500 units -- buy Q > 2500 units -- make.

Make-Buy Decisions: Example In a PC assembly plant, to make hard drives Fixed costs = $200, 000 Var. cost = $50/unit. Hard drives cost $130 to buy. Should hard drives be made or bought? Solution: F m + C m. Q = F b + C b Q 200, 000 + 50 Q = 130 Q; Q = 2500 units Q <= 2500 units -- buy Q > 2500 units -- make.

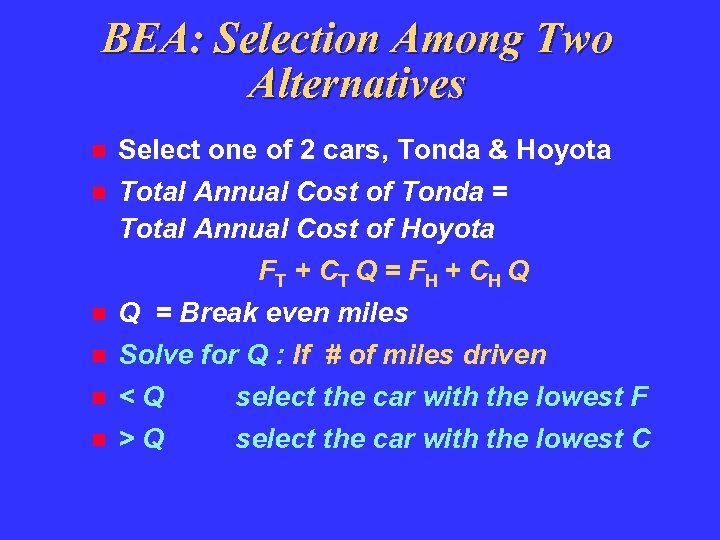

BEA: Selection Among Two Alternatives Select one of 2 cars, Tonda & Hoyota Total Annual Cost of Tonda = Total Annual Cost of Hoyota FT + C T Q = F H + C H Q Q = Break even miles Solve for Q : If # of miles driven

BEA: Selection Among Two Alternatives Select one of 2 cars, Tonda & Hoyota Total Annual Cost of Tonda = Total Annual Cost of Hoyota FT + C T Q = F H + C H Q Q = Break even miles Solve for Q : If # of miles driven Q select the car with the lowest F select the car with the lowest C

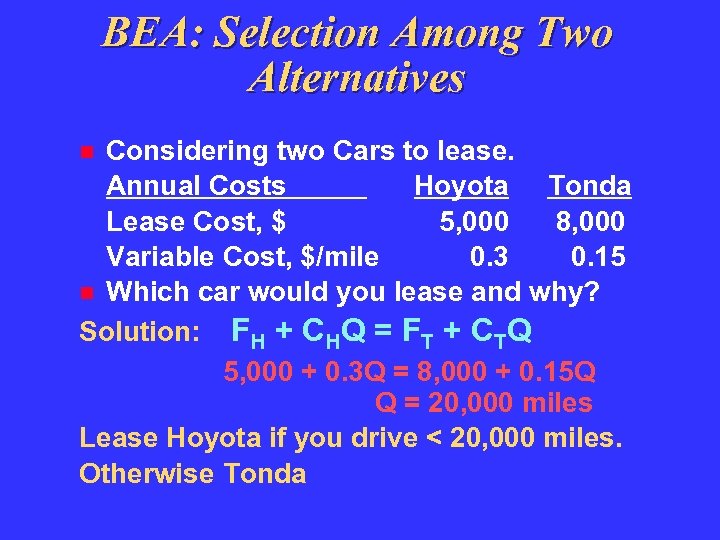

BEA: Selection Among Two Alternatives Considering two Cars to lease. Annual Costs Hoyota Tonda Lease Cost, $ 5, 000 8, 000 Variable Cost, $/mile 0. 3 0. 15 Which car would you lease and why? Solution: FH + CHQ = FT + CTQ 5, 000 + 0. 3 Q = 8, 000 + 0. 15 Q Q = 20, 000 miles Lease Hoyota if you drive < 20, 000 miles. Otherwise Tonda

BEA: Selection Among Two Alternatives Considering two Cars to lease. Annual Costs Hoyota Tonda Lease Cost, $ 5, 000 8, 000 Variable Cost, $/mile 0. 3 0. 15 Which car would you lease and why? Solution: FH + CHQ = FT + CTQ 5, 000 + 0. 3 Q = 8, 000 + 0. 15 Q Q = 20, 000 miles Lease Hoyota if you drive < 20, 000 miles. Otherwise Tonda

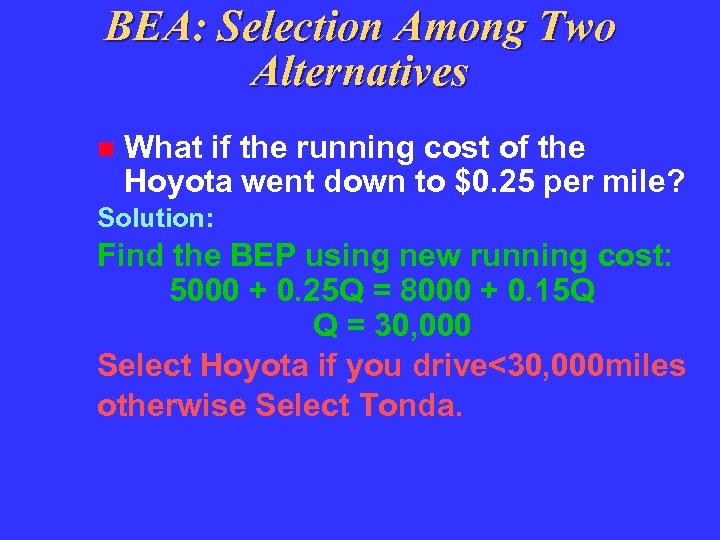

BEA: Selection Among Two Alternatives What if the running cost of the Hoyota went down to $0. 25 per mile? Solution: Find the BEP using new running cost: 5000 + 0. 25 Q = 8000 + 0. 15 Q Q = 30, 000 Select Hoyota if you drive<30, 000 miles otherwise Select Tonda.

BEA: Selection Among Two Alternatives What if the running cost of the Hoyota went down to $0. 25 per mile? Solution: Find the BEP using new running cost: 5000 + 0. 25 Q = 8000 + 0. 15 Q Q = 30, 000 Select Hoyota if you drive<30, 000 miles otherwise Select Tonda.

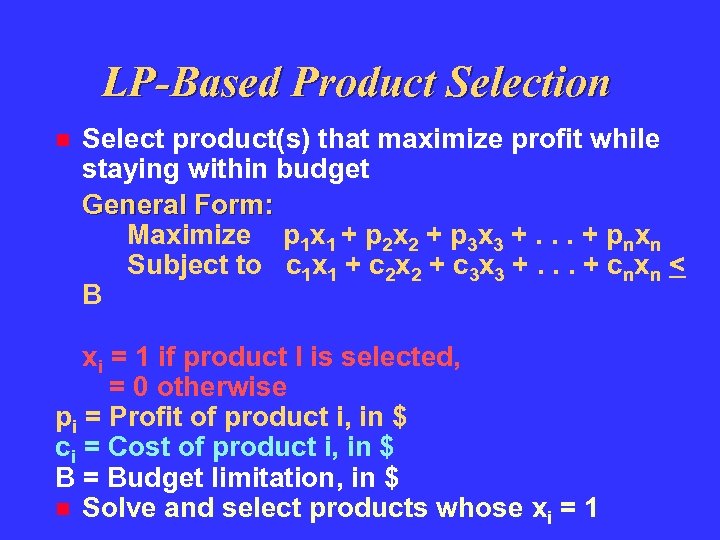

LP-Based Product Selection Select product(s) that maximize profit while staying within budget General Form: Maximize p 1 x 1 + p 2 x 2 + p 3 x 3 +. . . + pnxn Subject to c 1 x 1 + c 2 x 2 + c 3 x 3 +. . . + cnxn < B xi = 1 if product I is selected, = 0 otherwise pi = Profit of product i, in $ ci = Cost of product i, in $ B = Budget limitation, in $ Solve and select products whose xi = 1

LP-Based Product Selection Select product(s) that maximize profit while staying within budget General Form: Maximize p 1 x 1 + p 2 x 2 + p 3 x 3 +. . . + pnxn Subject to c 1 x 1 + c 2 x 2 + c 3 x 3 +. . . + cnxn < B xi = 1 if product I is selected, = 0 otherwise pi = Profit of product i, in $ ci = Cost of product i, in $ B = Budget limitation, in $ Solve and select products whose xi = 1

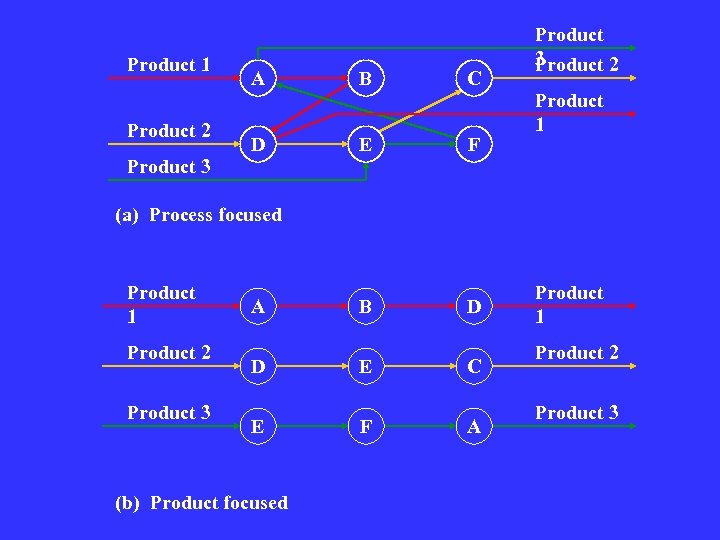

Product 1 Product 2 Product 3 A B C D E F Product 3 Product 2 Product 1 (a) Process focused Product 1 Product 2 Product 3 A D E (b) Product focused B E F D C A Product 1 Product 2 Product 3

Product 1 Product 2 Product 3 A B C D E F Product 3 Product 2 Product 1 (a) Process focused Product 1 Product 2 Product 3 A D E (b) Product focused B E F D C A Product 1 Product 2 Product 3

Process-Focused Strategy Resources set around similar processes One center/resource type-no duplication Products compete for resources Products move in jumbled (Job Shop) flow Highly skilled manual operations Used for low volume customized products Intensive, frequent customer interaction Example: Aircraft, Building, Interior Design

Process-Focused Strategy Resources set around similar processes One center/resource type-no duplication Products compete for resources Products move in jumbled (Job Shop) flow Highly skilled manual operations Used for low volume customized products Intensive, frequent customer interaction Example: Aircraft, Building, Interior Design

Product-Focused Strategy Resources organized around product Duplicate operations for different products Products do not compete for resources Products move in line flow (Flow Shop) Highly automated/expensive facilities Product-specialized and efficient Used in high volume standard products Little or no customer interaction Example: Paper Clips, Tires, Floppy Disks

Product-Focused Strategy Resources organized around product Duplicate operations for different products Products do not compete for resources Products move in line flow (Flow Shop) Highly automated/expensive facilities Product-specialized and efficient Used in high volume standard products Little or no customer interaction Example: Paper Clips, Tires, Floppy Disks

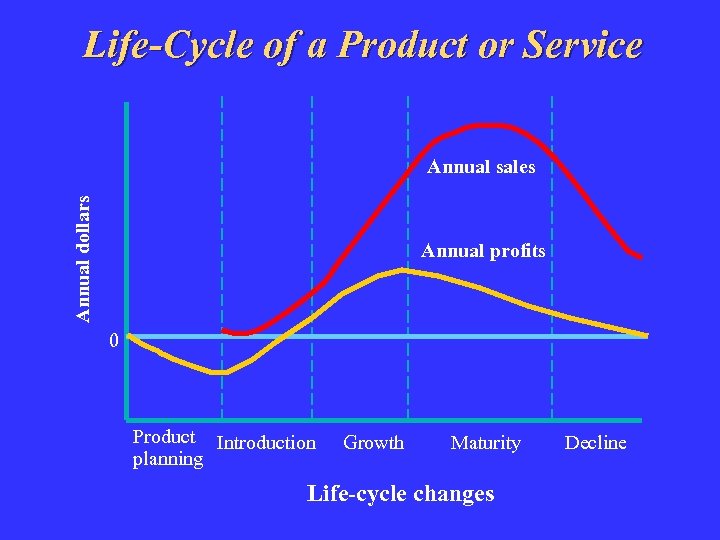

Five Stages Product Planning Introduction Growth Maturity Decline

Five Stages Product Planning Introduction Growth Maturity Decline

Life-Cycle of a Product or Service Annual dollars Annual sales Annual profits 0 Product Introduction planning Growth Maturity Life-cycle changes Decline

Life-Cycle of a Product or Service Annual dollars Annual sales Annual profits 0 Product Introduction planning Growth Maturity Life-cycle changes Decline

Life Cycle Audit Identify stage of product, based on changes in sales/profits Decide when to drop, revitalize or introduce new products Cycles vary from product to product

Life Cycle Audit Identify stage of product, based on changes in sales/profits Decide when to drop, revitalize or introduce new products Cycles vary from product to product

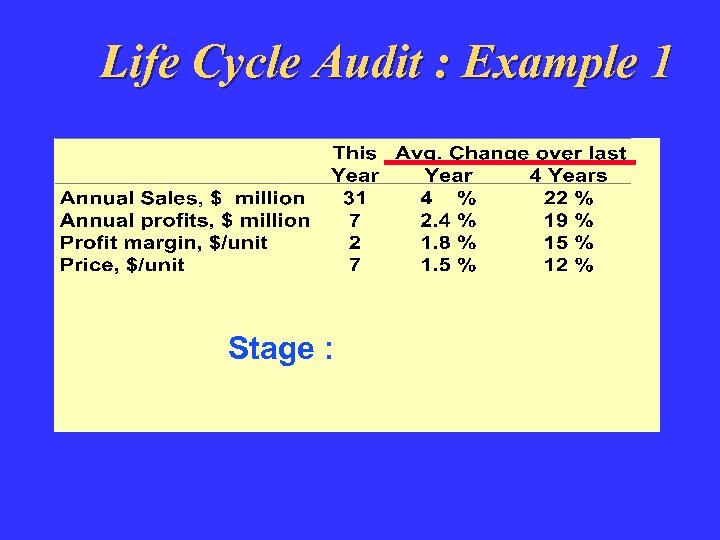

Life Cycle Audit : Example 1 Stage :

Life Cycle Audit : Example 1 Stage :

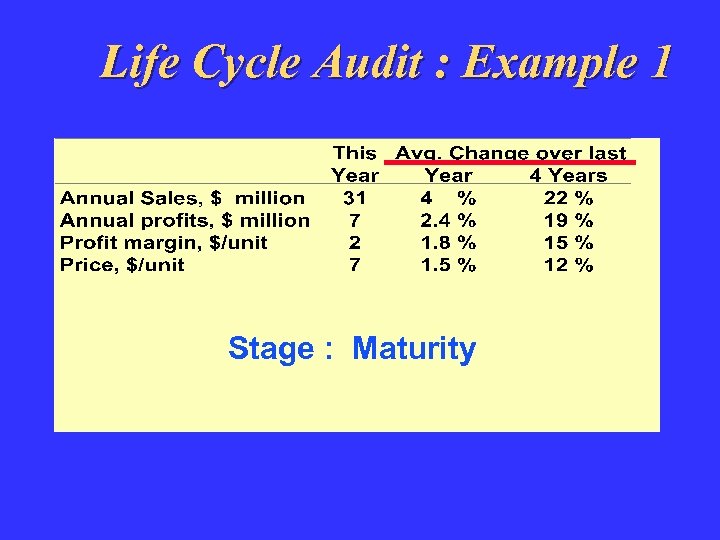

Life Cycle Audit : Example 1 Stage : Maturity

Life Cycle Audit : Example 1 Stage : Maturity

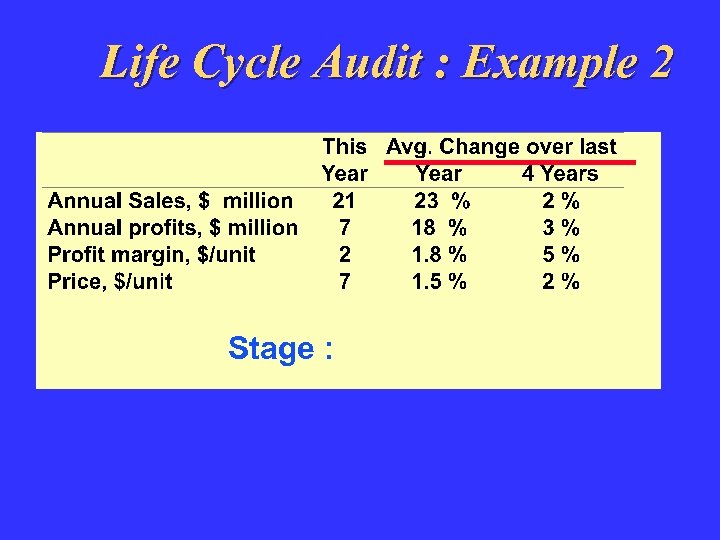

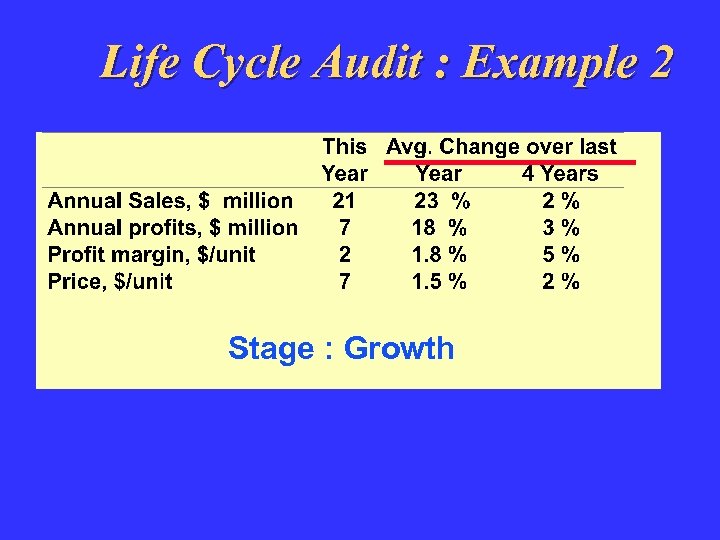

Life Cycle Audit : Example 2 Stage :

Life Cycle Audit : Example 2 Stage :

Life Cycle Audit : Example 2 Stage : Growth

Life Cycle Audit : Example 2 Stage : Growth